The SoCal market is not as hot as you think it is: Inventory at 2 year highs for Los Angeles and Pasadena. Inventory for Irvine at 3 year highs.

As we dig deeper into the summer selling season it is becoming more apparent that this summer is going to be a dud for Southern California. From Compton and Inglewoodto San Marino and Arcadia the insanity has reached another apex. Inventory is growing, price gains are stalling out, and sales volume has certainly fallen. Aspirations are certainly different from what your budget can afford. Whenever I see comments about “people are always willing to buy†I tend to agree. People are willing to buy a $700,000 McMansion while making minimum wage as we witnessed in the last housing bubble. Give buyers enough credit and they’ll go hog wild. When it comes to housing, #YoLo seems to be the motto. The will to own a home will make people do some seriously ridiculous decisions. Need we remind you that 7,000,000 people rolled the housing dice and actually lost their homes via foreclosure just in the last decade?  You don’t get any cable airtime for “This Failed Flip†or “Stretching our Budget for a Crap Shack.†Who would you get as a sponsor? Maybe Fancy Feast for the baby boomers lounging in their granite countertop gold plated sarcophagus. The housing market is turning in SoCal yet again. But real estate cycles turn with the speed of a sloth. Will we see a minor correction or something bigger?

Looking at inventory

Current prices are too juicy for some sellers to ignore. Since banks have the option of ignoring mark-to-market, you are now starting to see organic sellers cashing in on those million dollar housing lottery tickets. Not a bad option. Even if you own a $1 million glorified tent in Pasadena, you still have to pay taxes, insurance, and maintenance. In the end, you are not generating any cash flow simply by owning a home. Sure, you can tap out equity or go with a reverse mortgage but then you are handing the place back to the bank. Not exactly the best retirement strategy unless your goal is to enter your grave with zero assets and leave a bag of stale Doritos to your heirs (which by the way, is the end game for many renters as well). And this strategy of tapping out equity or selling might be harder to employ when you have grown children coming back home with mountains of debt and crawling back into their Superman and My Little Pony themed rooms.

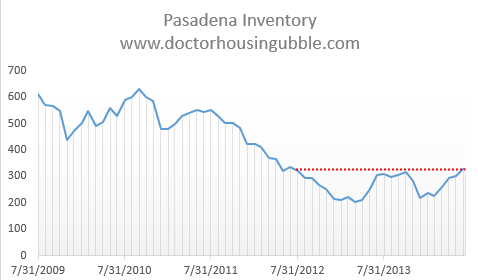

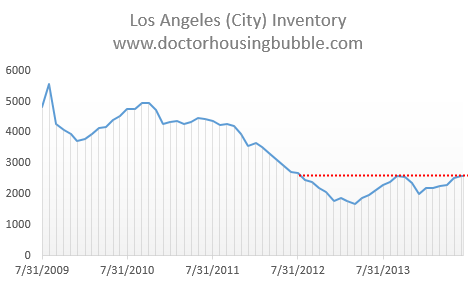

Inventory is rising because sales have plunged. This is happening during the typically hot summer selling season. Let us take a look at inventory for a few locations:

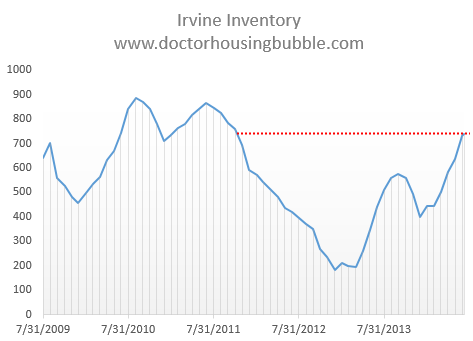

Pasadena has seen inventory levels rise to their highest level in two years. The same can be said for the L.A. City market. Even prime areas in Orange County are seeing inventory grow:

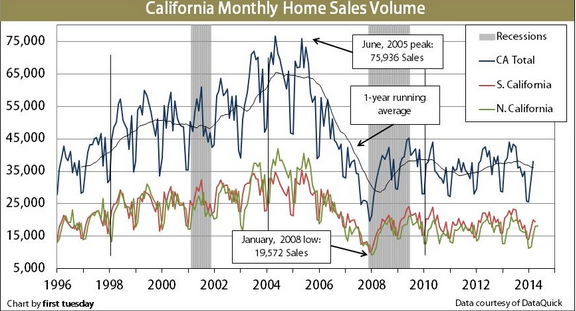

Irvine now has a three year high when it comes to inventory. This change has of course calmed the markets from the hordes of delusional buyers ready to ink away $700,000 for what amounts to a beat up Great Depression built property and essentially begging sellers to take their money. Prices are being driven by mania and this notion that because we are now verifying income and people are buying, that somehow this trend will simply continue. First of all, cash buying is still the dominant force here. We are already seeing investors pullback in many markets. This is why you are seeing sales volume being very low:

From 1998 to 2008 the 1-year running average of California sales hovered above 45,000. Sales in May crawled along to 37,734. Not exactly a booming market when you look at current prices. Current prices are simply a reflection of the low inventory over the past few years and insatiable investor demand.

Let us look at an example of current inventory right now in Pasadena:

3810 Canfield Rd, Pasadena, CA 91107 Â Â Â

3 beds, 2 baths, 1,785 square feet

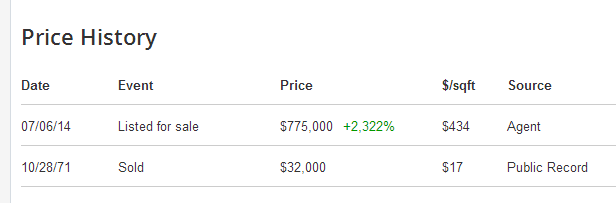

Well first of all, we at least get two bathrooms here. This place is a nice example of someone cashing in on their lottery ticket:

Current list price of $775,000. This home was purchased back in 1971 for $32,000. Before saying “see, housing is the best investment ever!†if you would have stuck that $32,000 into the boring S&P 500 you would now have $2.4 million. You can buy this house and have a cool $1.6 million left to avoid eating Purina Dog Chow into retirement. But Californians of course are hormonally charged to purchase real estate and they fail to run the numbers for alternative investment options.

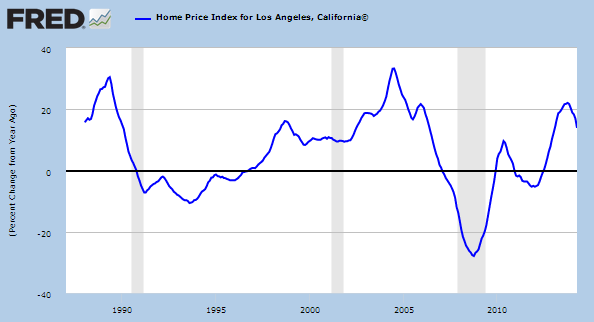

And this is why the LA/OC market is destined for booms and busts:

We just had a very nice boom. Going back to the 1980s, this pattern has held steady. So what comes after the boom? Or is it truly different this time because of large investor buying and the continuing gentrification of California into a renter state?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

124 Responses to “The SoCal market is not as hot as you think it is: Inventory at 2 year highs for Los Angeles and Pasadena. Inventory for Irvine at 3 year highs.”

This is the same story in Northern California as well. Specifically, the Sierra Nevada foothills. Houses are sitting on the market. Prices are dropping. I just saw three major drops within the last week. $90k, $50k and $40k…

I’ll wait…

Yep… Eastern Sac suburbs/foothills is my area: 3 price drops? I get over 10 emails per day for my zip code updating price reductions.

And a TON of new listing daily also. Only the real cheap ones/absolute lowest end of the market, are selling relatively fast ie: 2 wks to pending sale.

I get monthly sales data emailed to me and inventory is up 112% from this time last year, the price per sq. ft is down $9 and days on market has nearly tripled.

Also, new listings vs. sold and pending are showing ever widening gaps on the charts.

This was bound to happen. I mean, how many Sacramentans have all this money to buy these overpriced homes? Sacramento has high unemployment, high state workers (hardly wealthy) and lots of people on welfare.

I was at the hair salon waiting for my appointment last week and picked up a copy of the “Luxury Homes for Sale” magazine. 80 pages of local homes $900k and up. One after another. I thought “why are they selling now”? I mean do all these people really need to sell to move? Or are they just pitching a last desperate attempt to cash in before housing goes to sh$t?

Me? I have my cash stashed away and are patiently waiting for the time when I can pick up a decent house for 30+% LESS than today’s prices.

I just read “The Housing Trap” by Patrick Killelea. Best and most amusing read I’ve had all year. I highly recommend it.

Maybe our friend Jim Taylor was right all along!! Time will tell.

Those were the 3 most drastic price drops. Like you, I get multiple emails PER DAY from Redfin with $5k – $15k drops.

It’s funny reading all the B.S. statistics. I don’t need anything other than my own two eyes to see what’s happening. My B.S. detector is pegging right now…

“high state workers”

They’re high, that’s for sure!

By the way, what’s the latest on the landlord looking to sell?

Echo that for Roseville through to Auburn. Prices seem to be leveling off a bit and the mania has died down visually at open houses.

Quick fun fact … Bloomberg ranks Sacramento 8th riskiest place in the nation to buy a home. Sierra foothills, depending on where you are at can be an extension of that market. Very speculative because of bay area proximity. Also got hit the hardest during the recession. Buyer be cautious of hype

http://www.bloomberg.com/news/2014-06-25/the-riskiest-housing-markets-in-the-u-s-.html

GenYSac:

I’ve moved multiple times over the past 10 years for school and career. 4 of the 10 places I’ve lived are on the list. Riverside, Sacramento/Roseville, San Diego, Los Angeles. This makes sense why I’ve been cynical regarding housing because it’s frustrating living in cities where your not buying a home, but rather spinning a roulette wheel.

CaliGirl: prices will decline if people are compelled to sell at those lower level. But if you have an “all cash phenomena”, like I’ve seen in Sac than you won’t see price declines because those sellers are completely solvent. While I’m not buying now, I think these price levels are going to be the new norm unless larger macroeconomic factors come into play.

Sacramento Housing in June: Total sales down 4% and active inventory increases 91%

http://www.calculatedriskblog.com/2014/07/sacramento-housing-in-june-total-sales.html#yCXU8s6HFIJZrxqV.99

Cranky CPA wrote “CaliGirl: prices will decline if people are compelled to sell at those lower level. But if you have an “all cash phenomenaâ€, like I’ve seen in Sac than you won’t see price declines because those sellers are completely solvent. While I’m not buying now, I think these price levels are going to be the new norm unless larger macroeconomic factors come into play.”

_____

When all cash buyers run out, even if the majority of owners are completely solvent, their homes are worth what similar houses are selling at the margin.

Don’t you understand this basic market principle??????? You might have a row of 20 houses worth $2m each, and 19 of the owners may own outright. Completely solvent.

However 1 owner may be deep in debt, or may just want to sell and get out with a good price. If he lowers to $1.5m for a quick sale, and accepts an offer of $1.3m, then all the other houses owned by “completely solvent” people fall in value to around the same value too. This is why so many owners are complacent… be afraid.

Elliottwave: “Conversely, for prices of assets to fall, it takes only one seller and one buyer who agree that the former value of an asset was too high. If no other bids are competing with that buyer’s, then the value of the asset falls, and it falls for everyone who owns it. If a million other people own it, then their net worth goes down even though they did nothing. Two investors made it happen by transacting, and the rest of the investors made it happen by choosing not to disagree with their price. “

California is not England. CA Dept of Real Estate book: “It is also the appraiser’s responsibility to keep the appraisals timely in a changing market.

It is no longer prudent to rely solely on past sales of comparable property. The appraiser must use all pertinent data and appraisal methods to insure the appraised value is, in fact, the closest estimate of the price the property would bring if freely offered on the open market.

Recent world events has resulted in property appreciation spirals to historic highs, along with creative financing approaches to generate sales This has been followed by a collapse in property values and extraordinary levels of foreclosure and bankruptcy. Such times required exceptional appraiser sensitivity to the true market forces. Market Value under California law is found in the Code of Civil Procedure, Section 1263.320, as follows:

“The fair market value of the property taken is the highest price on the date of valuation that would be agreed to by a seller, being willing to sell but under no particular or urgent necessity for so doing, nor obliged to sell, and a buyer, being ready, willing, and able to buy but under no particular necessity for so doing,”

Forced sales are not used in the valuation. One sale by itself that is unusual is not counted. Many appraisers look at transactions that are 12 months old and do not get caught up with these “animal spirits”, as evidenced by bank appraisals and how much they will loan. The banks know that the air will come out of the balloon.

As far as appraisers are concerned, it only matters to the extent that the purchases are mortgaged.

Not really sure what California not being England has to do with much. Seems like a bit of a “this place is different” attitude which foregoes that a lot in life and finance is universal. If anything, there could be less resistance to margin pressure in the states due to the larger land area and more available opportunity to move between relatively attractive markets.

“because those sellers are completely solvent”

I thought this was an interesting claim. Are they solvent by and large? How can anyone possibly know for sure? Who’s to say that there aren’t bets riding elsewhere in the system by which the asset is exposed. Some guy loses big and needs to liquidate the asset to cure debts made elsewhere. What if far more folks in these cash deals of the past few years than can be imagined have that level of risk exposure? It’s mostly for this exact unknown that I’ve been skeptical of the idea that Chinese buyers are making a long play on U.S. RE.

Another note: I’ve noticed all of the recent sales in my area I have been watching are NOT being reported on Zillow….

Don’t want to push those “Zestimates” down to reality, do they?

BS: Haven’t heard a peep. Nearly a month now. Nobody has contacted me to inspect the house, do repairs, take pics. Nada.

I’m guessing they realized they can’t get within $60,000 of their break even point, even without paying realtors and doing FSBO. We’ll see….

But Doc, “it IS different here.” This place IS different. Everyone DOES want to live here.

Especially over in Culver City, which is why this place has been a sittin’ since December 18th. Over 200 days. No bites.

http://www.redfin.com/CA/Culver-City/5021-Purdue-Ave-90230/home/8136377

Houses in Culver City do sell but in this case it is way overpriced and your front yard is a freeway wall (see google street view in 180 deg mode). All the houses along Purdue have horrible freeway noise and all the other features we hear about: pollution, dust, soot and even particles of rubber from car tires. Many streets alongside freeways also get the truckers parking to get some sleep. terrible location.

You’re absolutely right and this is a great example of how fundamentals do matter but get ignored in areas where folks think a new paradigm based on location and time has been reached. History has shown that a proportional correction follows.

Actually, this is not Culver City but the Del Rey neighborhood of Los Angeles. The area is serviced by the Culver City post office but is Los Angeles city property. What this means is if a prospective buyer has school age children, their kids will be going to Los Angeles Unified School District not Culver City Unified.

The Del Rey neighborhood is basically a Mexican/Hispanic barrio loaded with Cholos (Mexican gang members). The Del Rey neighborhood and Venice High School is not a desirable location for White or Asian parents with school age children.

The Mar Vista Gardens housing project is located a short distance away.

No wonder, this house has San Diego Freeway literally in the back yard.

2 stories high new buildings on the other side too: Not a place anyone would want to live unless it’s really cheap and seller thinks it’s worth 700 grands?

This plce is awseome: http://www.redfin.com/CA/Culver-City/5021-Purdue-Ave-90230/home/8136377

The 405 is in your actual backyard! You can wave to the people as they race by and you get black lung from their exhaust. This will only cost three quarters of a million dollars. I love LA!

“Race by”? On the 405 North? Hardly. You’ll be able to power walk Purdue faster than the commuters on the freeway there at many hours of any given day…

>> This will only cost three quarters of a million dollars. <<

Not anymore. Today they dropped the price by nearly $100,000.

It’s almost back to its original list of $625K on 12/18. Interesting how Redfin masks the values whereas they can still be found on Zillow. The previous sale notes and photos are there too. Makes for an interesting before and after comparison.

http://www.zillow.com/homedetails/5021-Purdue-Ave-Culver-City-CA-90230/63090883_zpid/

Anyways… this is a great example of how price discovery in RE has been disconnected from the real economy. That’s the price of taking on risk and it’s fantastic to see some folks are being held to learn this lesson because last time I checked, hard money lenders and flippers weren’t given a direct facility by the Fed to cushion their losses from bad bets.

For the price they are asking, one is better off going to Redondo Beach or the areas of Torrance that are adjacent to Redondo Beach.

Irvine inventory. They are in the process of building thousands of homes.

But the Chinese are coming with suitcases full of cash!!! 🙂

you bet: http://www.latimes.com/business/la-fi-foreign-home-buyers–20140709-story.html

@Calgirl67, you are absolutely correct! There are at least 500 Million Chinese nationals lined up in tour buses waiting to buy in Irvine. Soon the average starter home in Irvine will be $75 Million dollars, all cash!!!!!!!!

These Chinese nationals better close the deal before the Red Chinese government speeds up their anti-corruption campaign and strips them of their suitcases of graft-based booty.

Looks like the Chinese party is coming to an end soon.

http://www.zerohedge.com/news/2014-07-10/did-china-just-crush-us-housing-market

@PointDotDohh

that article ought to be required reading.

My favorite Irvine development is the one with the lovely shoe boxes (I mean “apartment homes”) nestled between the 405 and the sewage treatment plant (I mean “water recycling facility and bird sanctuary”). Those name changes add like a hundred grand to the price, right?

We have a new development near us with SFH selling from $450 -$700k. Thi is in Sacramento, NOT OC. $4,000 a year in mello roos alone. HOA fees also.

It’s nestled between an industrial park and the local sewerage treatment plant. They have done everything to divert attention away from the sewerage plant, even putting in another road and signing it as the main entrance so people won’t (hopefully) see the open sewer ponds. You can smell it however.

They call it something like “water storage center”. My son calls it THE STINKY FARM.

The 1971 buyers most likely put 20% down which is $6,400 making it a much better investment than the S&P. Also the buyers did not face any monthly payment increases unless they refinanced. If the refinanced, they took advantage of further leveraging the equity of the house. This is not possible with stock investments.

Doc’s scenario involved a one time buy and hold on the index. Even a mediocre timed high sell low buy back-in on the major swings would have netted an even greater return. Just paying attention and not being greedy would have been all that was needed – sort of like with housing.

“Also the buyers did not face any monthly payment increases unless they refinanced.”

The statement is somewhat confusing since most folks refinance to a lower rate for a lower cost of loan service.

I’m willing to bet the owners did face increased taxes and insurance costs over the years. I’m also willing to bet the owners have dished out for maintenance and repair.

“they took advantage of further leveraging the equity of the house.”

An often overlooked part of the home equity loan argument is that most folks leverage home equity for consumption.

“This is not possible with stock investments.”

Margin – http://www.schwab.com/public/schwab/nn/articles/Margin-How-Does-It-Work

Tired of the BS,

A cash out refi will usually increase the monthly payment.

CA Prop 13 allows very minimal property tax increases.

Renters also pay insurance.

When you buy on margin, a dip in the stock price will take you out the game.

I was using the same house purchase to S&P comparison that the doc used. The house got a much higher ROI. Also with the sale of that house, 500k of the profit will be tax free. Can’t beat that!

“A cash out refi will usually increase the monthly payment.”

True, although I thought we were looking at ways for the homeowner to increase their share of the equity. The borrowed money has a cost factor.

“CA Prop 13 allows very minimal property tax increases.”

Beginning in 1978 and not all components were in place for a few years.

“Renters also pay insurance.”

Not only do they pay a fraction of homeowners, it’s overwhelmingly optional as it mostly covers contents. The landlord’s homeowners policy covers the big stuff. There’s a huge difference.

“When you buy on margin, a dip in the stock price will take you out the game.”

Sort of reminds me of cash out refis ending in foreclosure.

“I was using the same house purchase to S&P comparison that the doc used. The house got a much higher ROI. Also with the sale of that house, 500k of the profit will be tax free. Can’t beat that!”

There’s a reason why the “profit” is not taxed on primary residences. Because hardly anyone doesn’t buy another house upon the sale. Therefore, it keeps getting rolled forward.

Again, there’s no free ride or lunch waiting at the end of any available path.

Check out this “jewel” in Valley Village.

Not only is it a fugly abomination, but the current owners are looking to double their money in a year.

The price history is one of those that closely tracks the roller coaster of boom and bust over the years. Oh, how in L.A. we can so easily come across some of these properties where the ghosts of housing busts past reside.

http://www.redfin.com/CA/Valley-Village/12525-Miranda-St-91607/home/5176122

Fugly is right. What the hell is that thing on the roof? Looks like a UFO landed.

Nearly a million bucks…. insane

How desirable is Valley Village? I hear that, in the Valley, it’s best to stay south of the 101. Even better south of Ventura Boulevard.

I think Valley Village is a fancy term for ‘eastern Van Nuys’ 🙂

Sherman Oaks, Encino, Studio City, Toluca Lake. I remember meeting a woman and when I asked her where she was from she said ‘West Toluca Lake’ I laughed in her face when she said that. Then she asked me what was so funny and I said “WESTERN Toluca Lake?” she said it is a well described part of Toluca Lake (where the excrete meet?) later in the conversation she asked me where I was from and I said WESTERN Santa Monica.

Valley Village is desirable enough to have many houses sell in the 1-2M+ range. This one is just north of Burbank so technically not in the boundary of Valley Village, but still a nice area. Guessing it will get sold for around 900K.

Notice how it’s still sitting months later. People get offended by that 400,000 price increase. To answer the people below…Valley Village generally isn’t desirable. It’s not as desirable as Studio City, Sherman Oaks, or Toluca Lake. However the valley is odd. You have great streets and literally a street over is not so great. If it’s Valley Village right next to Studio City say right at Riverside Drive it’s not too bad. The further north you go past Ventura Blvd will ALWAYS be less desirable unless it’s the pockets of Studio City. I have lived in Studio City for 12 years off and on 6 of them straight and three years were in the late 90’s so I am good judge. 🙂

I watch pretty closely the trend of sale closing and still on the market. Closings continue to be grossly under water houses and buyers who think they got the big get. Short sales and bank owned arev now history, Good clean homes not in trouble and priced right continue to sit. Lousy houses always drive down the overall picture at any pricevthey are dogs in the RE industry.

So buyers are running out of in trouble folks who must sell, buyers don’t want want nice homes priced right because they perceive they didn’t steal it, and nobody but first time low quaifying folks look at bad property.

Something has to give, buyers, in the end good houses priced right and yes I see them everyday must now be on your radar or forever be a renter?

OMG,

Put down the crack pipe. There was a huge housing bubble, it didn’t deflate all the way. Prices in SoCal are still 25-30% too high vs. history and here you are, unable to tell what was the ceiling and what was the floor of the housing bubble.

Housing not based on real rise in income is a Ponzi scheme which will inevitably collapse. There is 40% less first time buyers than usual. The bottom rung of the Ponzi scheme has disappeared. How long before the pyramid collapses?

And here you are, imagining people paying whatever for a house despite the fact that they don’t have any money.

BINGO !!!! ak, that is it in a nutshell. Anyone wanna spin the FED casino wheel? Jump right in. The deck is stacked.

http://www.westsideremeltdown.blogspot.com

Robert: >> buyers don’t want want nice homes priced right because they perceive they didn’t steal it, <<

You're implying that only buyers "steal"?

You don't think sellers want to steal buyers' money with over-priced homes?

You imagine that all those nice homes sitting on the market are "priced right"?

We’ve been down this road before with Robert on the whole “stealing” business. He has this notion that somehow homeowners are to be absolved of risk exposure on the sell side.

“Priced Right” + Don’t Sell = Priced Wrong. Markets change. Sellers need to deal with it if they actually want to sell instead of just advertise how expensive they think their house should be.

Robert: “Good clean homes not in trouble and priced right continue to sit.”

_____

Priced right in your mind, perhaps. To younger people, perhaps chronically over-valued.

This is a market Robert, and I fear many property Vested-Interests are utterly complacent about what is fair value. Markets also move at the margin.

“You don’t get any cable airtime for “This Failed Flip†or “Stretching our Budget for a Crap Shack.†Who would you get as a sponsor?”

Now see, I would would watch “This Failed Flip” before I’d watch any a flipping show where the guy makes 90K by the end of said show. That only depresses me. Of course I’d follow the programming with, “This Failed Marriage.” and finally “This Old Suicide.” It’s the future of cable programming, trust me.

There is a show titled “Flip or Flop” which puts on the kid gloves and follows dumb, rookie, wanna be RE moguls on their flips. As for the $90K “profit”, when all is said and done with ALL costs from the hard money lenders which are often used to building material/supply cost overruns, labor, endless hidden problems etc., many flips are EXTREMELY lucky if they actually turn a profit.

As for the show lineup you describe, here’s the teaser trailer for the full line up, a wonderful blast from the past and one of our favorites:

https://www.youtube.com/watch?v=20n-cD8ERgs

Watching that video was disturbing on so many levels.

Firstly, I noticed it was released in 2007 – height of the BUBBLE. Talking that stupid spineless “man” into an overpriced house, most likely financed by a NINJA ARM loan.

Secondly, listening to that realt-whore pressuring the poor fool into it. “Suzanne’s researched this” The only thing the realtard researched was the size of her commission check.

And lastly, I would not stay with a wimp of an excuse of a man like that. I have no respect for such a spineless, easily manipulated pushover like the idiot portrayed in that video.

I live my life according to Suzanne’s teachings…

What heirs…? heeheehee!

That guy who bought that house in 1971 for $32k did not have $32k to invest. Let’s be realistic doc… He maybe had 20% or $6400 to invest.. Meaning compounded at 10.34% annual returns he would make $440k roughly on that house money. So yes, real estate is a better investment. Cause he didn’t pay rent either.

Not to take a side one way or another but equities are also levered (i.e. debt used) as the equity in a company is paid after debt service and almost every company has debt.

The reality is that he was just making a simple analogy but one would need to consider taxes, repair/update/depreciation, and all kinds of things including the cost of paying rent and such savings as an alternative. Most of these (outside of alternative rent) are factored into the income statement or other financials of the companies in which you are investing.

I would not at all discount the risk side either. Viewing a primarily home as an investment offers virtually zero liquidity, no cash flow (dividends), and zero diversification as you are betting on a single property in a single location. Similar to one company, in one industry, selling to one locale being A LOT more risky than investing in a number of non-homogeneous companies. Hell, invest in MSFT, GOOG, Intel, or whatever and you crush any house on the planet but that’s cherry picking – then again so is a SoCal home from 1970 forward compared to most of the nation.

Making an apples to apples is going to be nearly impossible but it’s at least worth thinking about as very few people consider alternative use of funds.

BTW, in addition to the demographic impacts what really drove real estate 1980 forward was declining interest rates. Given that equities are also levered, there was a similar impact here too both on the side of #1 – cheaper debt in the capital stack under the equity (i.e. just stay in business, refinance more cheaply, and drive the equity value up and #2 – equities are valued as a series of future free cash flows (like real estate earning rent) which are discounted, lower interest rates drive the discount rate and this is an unbelievably powerful mechanism.

Stuff to think about anyway.

Another home of genius: http://www.redfin.com/CA/Culver-City/4205-Irving-Pl-90232/home/6722266

Located in Culver City, built in 1923, 780 sq ft, 2/1, for nearly $800,000 (specifically, 799k)

Lot size is only 3,200 sq ft — but look at the map. Seems the original lot was subdivided to fit 3 houses. Most of the houses on this block sit on lots THREE TIMES AS LARGE.

From the description: “This fully remodeled jewel box has it all … hardwood floors, remodeled kitchen with tiled counters, stainless steel appliances … front yard sits behind tall hedges and provides a great space for entertaining … private back deck is the perfect spot for morning coffee. Located in the awesome downtown Culver City …”

So it’s not a house. It’s a jewel box.

A quibble with your math. If you bought that house in cash, you paid 32K plus what, 1K per year in property taxes (thanks prop 13) and some upkeep. If you did not buy that house or any other, presumably you paid rent for the last 43 years, plus you’re likely paying around 250K in capital gains when you cash out, so you’re really not coming out $1.6M “ahead.”

There’s this thing call Roth IRA/401k. And 43 years of rent is still less than $1M, so the net from SP500 is well above the current price.

You’re still not $1.6M “ahead.”

Also there’s this thing called, 401Ks didn’t exist until 1978 and Roth IRAs didn’t exist until 1997.

You know what else didn’t exist prior to 1978?

Prop 13

Yep, and it rolled back the tax assessment to 1975 values. Which as you know, are a lot closer to 2014 values than 1971 values.

And this has to be in the House of Genius Top Ten: http://www.redfin.com/CA/Los-Angeles/2805-Pacific-View-Trl-90068/home/5313019

Located in the Hollywood Hills, this $759k crapbox looks like a decrepit trailer on stilts.

Do a Google Street view. Although the residents are probably mostly middle class whites, the neighborhood looks like one of those Haitian slums up in the hills.

Redfin Agent Alec Traub, who toured the place, says: “Has character & potential though needs updating throughout.”

Not enough “character & potential” to justify $759k.

Oh yes, there’s a “mini yard with lemon tree.” I suppose it’s behind those concrete cinder block walls.

Oh, good old Pacific View Trail.

This is what I call a “bubble pop” street, because for a few months just past the top of the last bubble, the only new listings in Hollywood that weren’t $5mil were on a handful of streets – shacks on Pacific View Trail and Drive and Multiview Drive, and condos on Barham Blvd and Hillpark Drive.

Most have panoramic freeway views and innovative construction of plywood, duct-tape and hope, slowly disintegrating since the early 1950s!

Ordinarily, there aren’t a lot of listings here, because ordinarily, you wouldn’t be able to pay someone to take a shack in this location off your hands. An avalanche of listings on these streets is a pretty good sign of a mania gone by and decline straight ahead. Currently:

Pacific View Trail and Drive: 4 listings

Multiview Drive: 5 listings

Hillpark Drive: 7 listings

Barham Blvd: 8 listings

It’s like a time machine back to ’08.

Sounds like my kinda street!

BWAHAHAHA, the property description from the listing real-turd/real-tard/realt-whore is hilarious:

“Situated in tranquil, neighborhood of lovely neighbors!” It’s in a tranquil, COMMA, neighborhood full of lovely neighbors, doing lovely, neighborly things no doubt.

“mixed use floors, hardwood, parquet, tile, & carpeting” It also has mixed use floors – you can walk on them, crawl on them, roll around on them, even lie down on them.

That’s scary + the asking price super scary.

Oh… it’s 3 minutes drive from that house on stilts Riggs pulled down in Lethal Weapon 2.

Chinese money has stopped going to Irvine, hence the drop in sales and the increase in inventory.

http://www.zerohedge.com/news/2014-07-10/did-china-just-crush-us-housing-market

And here’s why.^^^^

This buttresses my earlier notions that Red Chinese money was a serious factor in California real estate — but ONLY when and where the hot money wanted a home.

(pun intended)

I totally agree with this post at ZeroHedge.

Red Chinese liquidity creation has been hyper-epic by any standard.

Instead of raising the general wage level (like Henry Ford, $5/ day, 1912) the CCP permitted its aparats to buy up the rest of the planet — at unworldly prices.

Because of the illegal / quasi-legal nature of these money flows, I contended that there could be no reflux back to Red China. These properties were going to be, in the main, buy and hold, core holdings. Normally, they’ve been purchased for their own extended families.

The next twenty-years must prove most interesting. Will Red China morph into a bigger version of Japan, Inc.? Or will it go rogue, like Imperial Germany, and destroy the China shop?

%%%

Scarcely mentioned: Red China is utterly dependent — not on oil — but on phosphate imports.

For reasons biological, there are VERY few phosphate deposits/ mines across the world.

(Biological processes destroy phosphate deposits unless certain geochemistry occurs.)

North America is in the catbird seat. Canada and Florida have magnum phosphate deposits.

Morocco has enough phosphate for Europe.

Red China, not so much. (Demand much larger than domestic supply.)

Tunisia and Iraq have a massive phosphate deposits. Interesting, no?

The money coming to US and Socal is sent to China by the SP500 companies, in exchange to the stuff you have in the check out lanes in many stores in the US. The Red China doesn’t print USD, and they only print Chinese Yuan. It is essentially the US money buying US properties.

@Yang, the Chinese government initiated their anti-corruption measures in earnest in 2013. So the tightening of Red hot (fraud based) Chinese money has only just begun. It will be interesting to see the effects of this in U.S. housing pricing by the year 2016, especially the San Gabriel Valley, Irvine and DTLA.

(Reuters) – China’s central bank is looking into allegations by a state broadcaster that Bank of China, the country’s fourth largest lender, has been laundering money offshore for clients, the official Xinhua news agency said on Friday.

While Beijing maintains a tight control over its capital account, limiting foreign currency transfers by individuals to $50,000 a year, wealthy Chinese, including corrupt government officials, have managed to move their money out to snap up overseas property and other assets.

The China Central Television (CCTV) aired what it said was an undercover investigation program on Wednesday that focused on a service offered by BOC called “You Hui Tong”, which is designed to help Chinese individuals take part in investment emigration programs in other countries to move cash offshore in amounts the exceed the annual cap.

I’ll beat Jim Taylor to the punch: Housing IS tanking in 2014!! Buy now if you enjoy catching falling knives.

@Bubble Pop,

The time to watch is middle of October. This is when the sales data for real estate transactions that closed in September are released. The reason this is important is that in June 2013 is when interest rates began their 100 basis point climb of about 3.25% to 4.25%. The first full month of home sales closing at the higher interest rates was September 2013. Since it takes about two months from offer to close of escrow that means that September 2013 would include real estate sales that were initiated as early as July 2013 (when interest rates moved 100 basis points up).

So September 2013 to September 2014 would be an honest apples-to-apples (interest rate) comparison of real estate.

This may be anecdotal, but my house in Temecula has dropped $25,000 from 390k to 365k according to zillow since January. I view this as a good thing as the market had increase 30%+ over the past 2 years and was pricing out middle income earners.

@DG, what you described is the standard way a real estate bubble deflates. The outer most regions (exburgs) deflate first, then the far suburbs, then the near suburbs and finally the the inner core. That is why peak-to-trough for a typical real estate bubble to 5 to 7 years.

If the Federal Reserve had not interfered with the 2007 real estate bubble bursting we’d be plowing along at the bottom right now. However since the Central Banks interfered with the normal cyclical deflation process what the Fed really did was extend the 2007 bubble through early this year. QE3 coming to and end in October will show who is really naked when the tide rolls out.

Worry not people the Fed has purchased 2 trillion! In mortgages since 2011 so I am sure they can spend another 2 trillion!

I have had the pleasure of traveling to many different countries. That said, I am amazed how high prices are in many European countries compared to So Cal. The average wages don’t justify the prices, but there they are. In comparison, USA real estate looks like a pretty good deal. Then you have Japanese real estate, that has pretty much deflated over the last 20 years. Why there?

My point being, I can not for the life of me figure out any reason why values stay sky high in one economy and slowly deflate in another.

While prices in CA may slowly decline 10%, maybe even 20% over the next few years, assuming the economy stays as it is today. In 30 years, I am sure prices will be 100% higher than they are today. Do any of you really believe that in the long term prices are going down like Japan? If no, then buying an affordable home (not $700k) somewhere and getting it paid off, is just a part of financial planning like your 401k savings. Just my 2 cents.

“Then you have Japanese real estate, that has pretty much deflated over the last 20 years. Why there?”

Somebody is not paying attention…

Hint; What was the cost of capitol in Japan in the 80’s versus the rest of the planet/galaxy/universe? They beat us to the punch bowl, got really smashed and were hungover before anyone else got to the party.

“While prices in CA may slowly decline 10%, maybe even 20% over the next few years, assuming the economy stays as it is today. In 30 years, I am sure prices will be 100% higher than they are today. Do any of you really believe that in the long term prices are going down like Japan? If no, then buying an affordable home (not $700k) somewhere and getting it paid off, is just a part of financial planning like your 401k savings. Just my 2 cents.”

I think you answered your own question.

So your equation is negative 10%/20% times “few†years to the power of 30 equals 100% of “X†not equal to $700k function 401k. Solving for “X†gives 2 cents. Yes! I believe the math works…

” Do any of you really believe that in the long term prices are going down like Japan?”

Yes.

The boomers are aging and dying, the middle class is not reproducing fast enough, those who are having kids are in a perpetual poverty cycle.

This means demand will slowly drop and prices will have to drop with it.

We have been and will continue in greater volume to import “middle class” from abroad, most notably from China and India. The demand for SoCal newish stucco box tract housing in great school districts is not going away. Our foreign friends value such areas highly. These are people who are moving in and staying in to get their kids an American education while they make mid-level dual incomes in the science and tech industries. Surely you can see that this is what is going on, it is happening throughout the West Coast aka Pacific Rim and has even expanded eastward. Nobody who is paying attention has missed this obvious demographic trajectory. It is not stopping, it is accelerating.

Falconator, I think you’re mistaken in treating the influx of foreign money-launderers which make up 40% of today’s market as “the new normal”.

It’s anything but normal and has nowhere to go but away. If it does not abate by natural forces, political forces already brewing in the coastal areas will prompt legislative action.

Having lived in Europe, I will tell you why houses to BUY are so expensive relative to incomes.

First, most European securities markets are corrupt to hell, and no one wants to invest in them.

Second, wages are very low in Europe. Essentially it’s like this because they are tied to their traditions which prevent creative destruction and new ideas entering their economies.

Third, combine the first 2 – nowhere to invest money & low wages – and you get people trying to live off their assets.

Fourth, these properties have all been paid off for decades if not centuries. When listed to sell, sellers list at wishing prices. Therefore, few transactions ever take place.

Fifth, transaction costs. Notaries in Europe cost 5-10 USD for the typical paperwork to buy a home. Not the agent or the bank fees, just the notary. Add in bank fees, taxes, agent costs and you get 40K US higher prices just off the bat.

I lived in a pretty expensive European city in a flat that would have cost 500K Euro to buy, but I paid 800 E/month in rent. In the US, a half million dollar property would have waaay pricier to rent. People there are also crazy about owning vs. renting. Doesn’t make sense since they have rent control and you can keep your rent cost the same indefinitely and you’re totally making out. It’s cultural more than anything.

Yeah, I’m thinking the cultural component has a lot to do with it. Two other things are that the U.S. has a stronger RE lobby at the government level and a hell of a lot more land per capita.

And then I just read this: http://www.forbes.com/sites/greatspeculations/2012/10/03/greatest-real-estate-bubble-in-modern-history-has-yet-to-really-burst/

So who really knows? Certainly not me.

Red China has injected an INSANE amount of liquidity into the world.

Most of that has been contained inside Red China.

However, there has been leakage, (quasi) officially sanctioned leakage.

Read ZeroHedge.

Their bubble is popping.

It’s this Red Chinese liquidity that has permitted mad money to buy, and buy, and buy… lest the CCP authorities claw the monies back.

(think criminal proceeds — as in kickbacks)

If you’re not aware, Red Chinese pay no property taxes. Instead, each municipality sustains its budget by being a property developer. (!)

Crazy, I know.

Now the way it works is that a commercial sale really amounts to a 40-year leasehold. During that ‘lease’ no payments are due. Everything was front loaded.

At the end of the term, everything reverts back to the municipality.

(We’ll see how that pans out when the first leaseholds expire many years from now. Expect more graft.)

Residential buyers end up with (don’t quote me) 60 year ‘leaseholds.’ Then everything reverts back to the municipality/ other governmental body.

These deals always get sticky when all of society is witnessing expiring leaseholds.

(c.f. the Hawaii panic of the 1980s when the wealthy saw their leaseholds blow up. They ran to the courts and the legislature. Everything was re-jiggered, of course. This battle went to the USSC, BTW.)

In any event, the CCP is riding a tiger and does not know how to dismount. If they shut down the inflation engine, the civil unrest will be the end of the CCP.

This is the reason that the CCP has decided to pick a fight with Japan, Taiwan and the US. No way can the possible oil deposits compensate for the economic drubbing that Beijing would suffer should the dogs of war be set loose.

&&&

More generally, Red China is an ISLAND power.

The fact that her island is contiguous with the rest of Asia is of no import.

ALL of her trade transits the USN ocean — and by tacit permission, too.

Beijing has no prospect under any circumstances of preventing the USN from preventing her from shipping to and fro to Europe or the Western Hemisphere.

Red China’s trade with Russia is trite, insignificant, even at this time. Her economic engine runs on trade with her geopolitical rivals if not out right enemies. Most of it would be shut down with phone calls and radiograms.

What purpose would oil imports be if all trade in manufactures shuts down?

Obviously the need would evaporate with the customers.

Red China would have to ENTIRELY eliminate the USN to gain access to Europe. As Germany and Japan could tell them, that’s a tall order.

Blert, I thoroughly enjoy reading on this topic as the “Red Chinese” are eating up the market in my area. It will prove to be most interesting indeed. They are also well known to buy and hold, as you stated. It’s not like all those Chinese buyers are suddenly going to turn around and start unloading their purchases. It does not fit their MO. There has been little to no slowdown in their pace of buying residential and commercial RE, at least in my neck of the woods.

Is your contention in line with the article on ZH that the Chinese gov will actually begin to enforce the $50K/yr max capital outflow? If so, why, and what effect do you believe it would have on China’s domestic economy? I look forward to an interesting rant.

“They are also well known to buy and hold, as you stated.”

How long has this been “well known” throughout history? We’ve had how many years of a more open China to assess probability how many years into the future?

Tired, we actually do have a model/history and it has proven that they (Japanese/Chinese) do cash out when things start to go bad(deflation) at home. But hey, we will pretend that it is different this time and that they will buy and hold forever!!! Reality has no place in today’s market…

CAB…

The serious money is flowing through the hands of CCP apparats; civilians can only dream.

1) The CCP found out the hard way that — as an entity — it can’t buy what it wants to buy overseas. No-one will sell to the CCP directly.

2) The Red Chinese government ( as against the CCP ) has also found out the hard way that its bids get turned down flat. Counter parties refuse to sell national assets to Beijing. (Union Oil Company, Peruvian copper lodes, etc.)

3) Yet the dollar balances just kept on coming. So it was resolved to let CCP members to buy overseas assets — at retail — on the down low.

? keeps conflating Tokyo with Beijing. China didn’t bomb Pearl Harbor.

During the Japanese mania Tokyo had no serious capital exchange controls.

During the Red Chinese mania, Beijing has serious capital exchange controls — unless you’re a CCP member. Their retail purchases of real estate are but a trivial fraction of their assets. They are bought without alien (non-Chinese) financing — as in all cash. Most of the properties are destined to house multi-generational Chinese families — which is the norm for the Chinese going back 3,000 years. Multi-generational families don’t move around the countryside — like American corporate apparats.

TBS

The Red Chinese/ Hong Kong track record goes back about forty-years. You might find old/ ancient Barrons articles on the phenomenon worth reading. The upshot is that the Chinese buy to hold… unless they’re full blown property developers. In which case they operate like Chinn Ho.

http://articles.latimes.com/1987-05-14/news/mn-9114_1_kidney-failure

http://www.hawaiimagazine.com/blogs/hawaii_today/2009/7/27/hawaii_five_o_ilikai_hotel

Chinn Ho was also behind Peacock Gap in Marin County — the last of its kind in that county.

The idea that Red Chinese real estate monies are going to flee into other assets is quite strange — and has no cultural basis at all.

The kicker is that such strained transactions warp the entire California real estate market. They’re blended in to the over all averages — when they really need to be set entirely apart, rather like Americans buying up Costa Rican properties.

This how NAR statistics generate false market signals.

Likewise, the collapse at the bottom of the market causes a statistical skew. It moves the averages up — even though the market is really in trouble.

The ultimate drain on real estate values is Big Government:

http://www.oftwominds.com/blogjuly14/tax-donkeys7-14.html\

This bleeding ^^^^ offsets the easy money of the Federal Reserve policy monkeys.

Stepwise, America is centralizing and socializing the economy and the culture. This can only end up in totally crashing the system… taking the rest of the planet with us.

The US dollar is the trading Sampson that is holding up / sustaining global trade.

Thanks for clarifying. FWIW I agree with your analysis of what has been transpiring.

Look what just hit ZH:

http://www.zerohedge.com/news/2014-07-10/did-china-just-crush-us-housing-market

China exporting its hot liquidity to the USA….

“It was as if millions of voices suddenly cried out in terror and then suddenly were silenced.”

I love you Doc but like some others have said above your math is misleading re the $32K home purchase in ’71. If a guy really did a cash deal, what he saved in mtg pmts could have gone into the market at about $185/mo. and today he would have close to $1.6 mil in the market plus the house free and clear (which if he sold, $500K profit = tax free) If he really had $32K and put $6K down and $26K into the market and let it ride, he would have about $1.9 mil plus the house free and clear, where he had $500K tax free sitting there.

Hey guys, don’t worry there are only 1.4 billion Chinese and 1.3 billion Indians. There is no way they will all end up over here. Maybe only the top 2% will be able to make it happen – that’s “only” 54 million people – hahahahaha!

News-flash for the “middle-class”, you have been and will continue to be priced out of really good neighborhoods in coastal SoCal. Same as in Bay area, NYC area, DC area, etc. You need to head out to the distant burbs or move to a 3rd/4th tier metro area.

I guess all we can do is hope that maybe only .002% want to move over here.

54 million? Lets get real, its more like 189,000 visas for Chinese nationals in 2012. Most of these will not stay. Lets see… thats .0140% per year.

http://usa.chinadaily.com.cn/epaper/2013-09/17/content_16975662.htm

Also remember international buyers from china only made up 24% of the dollar value of international sales that compose 7% of the market. Thus a significant but small slice.

The problem is the lack of demand for traditional buyers. The industry needs to find a way to build more cheaply or sellers will have to discount. The Fed has been very good to me, but has not been as good to traditional new home buyers. The lack of a wealth effect on an aging society should of been properly modeled (Japan), but we had lazy academics. Maybe they only live in half of our two-tiered society.

http://www.businessweek.com/articles/2013-05-09/as-home-prices-rise-consumer-wealth-effect-may-be-smaller

The Fed has done what they could for housing, they now have bigger concerns. Don’t expect super-duper infinity QE. They would quickly run out of Mortgage backed securities. I guess they could buy stocks outright or through a shell, but maybe they have already tried that. How high do stocks have to go before people loose confidence. Current planned wage hikes will just decimate public coffers and lead to reduced staffing. $30,000/year wage earners are not competing for SoCal houses and watch their gains get devoured by inflation.

Let it fall. A soup line is kinda like Disneyland just with a happier ending.

@Leaf Crusher, your rationality is hurting the financial recovery. Everyone knows there are 600 Million Chinese nationals, each of whom just happens to be a multi-zillionaire, just waiting with baited breath to buy in Irvine and San Marino. How those 600 Million Chinese multi-zillionaires will squeeze into those cities is unknown. But housing prices will go up by 30% a year, every year forever!!!!! Prices will never every go down. If you haven’t bought by now you have now priced out of the market forever!!!!! That cardboard box and the freeway underpass is the new home for non-homeowners.

Put another way, buy now or be priced out forever since boatloads of forieners with buckets of money will always want to live here because this place is different. The ever elusive crystal ball has spoken.

SoCal coastal is absolutely different. So is SF. So is NYC. So are London and Paris. The fact that some people refuse to accept that certain elite markets are in fact “different” boggles my mind.

Regarding Asian impact on SoCal housing, where do you see a requirement that a visa is necessary to purchase a home? Where is the requirement that an Asian remain permanently in the country to keep the home? That’s what I thought. In any event, Asian immigration has accelerated by nearly 1,000% over the past dozen years. Not just from China, but massive numbers from India, and don’t forget about S. Korea and other Pacific Rim countries.

Where are all these immigrants ending up? What is their state of choice? California of course, we lead the nation by far in Asian immigrants. How can anyone look at what has happened over the years in Cupertino, Milpitas, Irvine, San Gabriel Valley, San Marino, etc,. and not see that Asians are driving the market? .. How can anyone look at San Diego County in Carmel Valley, Penasquitos, West Rancho Bernardo and North Scripps Ranch and not see what is happening?

Asian immigration is ACCELERATING.

Falconator: “SoCal coastal is absolutely different. So is SF. So is NYC. So are London and Paris. The fact that some people refuse to accept that certain elite markets are in fact “different†boggles my mind.”

_____

The ‘elites’ have been buying properties and and leaving them empty in London. Bubble-bubble. Yet the VI talk like we had a crash in the first place. Just a bit of softening, then QE/base rate floored, and new peaks.

_____

March 2014: The “buy to leave†phenomenon —where super-rich overseas buyers purchase prime London property with little or no intention of using it as anything other than a growing investment — has become a distinctive feature of London’s post-crash story.“You can physically see the empty homes. You walk down any street in Chelsea and there are very often very few lights on.â€

http://www.standard.co.uk/lifestyle/london-life/the-ghost-town-of-the-superrich-kensington-and-chelseas-buytoleave-phenomenon-9207306.html

So yeah, buy now or be priced out forever. It’s different this time. My that’s a bright crystal ball.

So, for those of you waiting for the big bust, is the theory that after things drop 30% (or more) that people with enough money to buy NOW, won’t be interested in buying at those new low prices? and thus the prices will be low for you?

So much for inventory sitting around in Pasadena… that house is now “pending”.

six days on the market, I guess it was priced right.

This is a 2/1 house in Pasadena that listed for $699k and just sold for $752k.

It’s a nice house, and it’s south of the 210. But still, it’s a 2/1. And yet, there as a bidding war.

Oops, forgot to add the url: http://www.redfin.com/CA/Pasadena/265-S-Berkeley-Ave-91107/home/7014198

It may be a 2/1 but it’s 1200 sq ft SFR on a 7000 ft lot. Compared to what I see in Culver City / Mar Vista / Palms, that lot is an equestrian estate.

I am not a fan of overpriced real estate however Pasadena’s proximity to DTLA makes it a solid choice for shakers and movers with jobs in DTLA but want to live the suburban existence.

Welcome to LA, LA, LAnd where owners and renters are getting squeezed. Even when rents drop and home prices drop do you think it will significantly change the percentage figures shown below?

“LA Times June 25th, by Tim Logan.

More Angelenos spend a large portion of their income on housing than people anywhere else in the country, according to a new study out Thursday from Harvard University’s Joint Center for Housing Studies.

Fully half of the households in metro Los Angeles spend at least 30% of their income on rent or mortgage payments, the highest rate of 381 metropolitan areas in the U.S.

One in four households here spends at least half its income on housing.The report is the latest evidence of a growing affordability crunch in Southern California’s housing market.

Costs to both buy and rent homes have grown far faster than incomes in recent years, pushing more families to spend a greater share of their income to live here.

Seven of the 10 metros with the highest share of “cost-burdened” households are in California, including the Inland Empire, San Diego and Ventura County.

Many economists peg 30% of income as a point at which housing costs start to become burdensome, crowding out other spending. At 50%, it becomes a “severe burden.” Of low-income households that spend at least that much on housing, 39% reported spending less on food and 65% cut spending on healthcare, the report said.

“Pretty much all other necessity spending is getting crowded out,” said Dan McCue, research manager at the Harvard Joint Center for Housing Studies. “Food, clothing, healthcare, you name it. There’s just less to go around.”

Renters are especially squeezed, with 6 in 10 renting households spending at least 30% on housing. Among homeowners in metro Los Angeles, 4 in 10 spend that much, the sixth-highest rate in the country.

The study’s findings echo a report issued in May by the Southern California Assn. of Nonprofit Housing, which found Los Angeles County has a shortfall of nearly 500,000 apartments that are affordable to low-income households. State and local funding for affordable housing has fallen in recent years, even as rents have climbed and demand for low-cost rentals has surged.

In Southern California, the challenge is one both of high housing costs and stagnant wages. Median household income, adjusted for inflation, has fallen 11% here since 2005, while rents have climbed.

And while the typical Southland household still earns more than the national average, incomes here lag behind those of other high-cost housing markets like San Francisco, New York and Washington, D.C. So, despite having less expensive housing than those cities, Los Angeles fares worse on measures of housing affordability.

“The basic cause of these high cost burdens is weak income growth,” McCue said.

More broadly, the Harvard study sees the housing market slowly healing nationwide, in step with the broader economy. But tight credit and high levels of student loan debt are keeping many young adults from buying homes, one of several factors holding back a stronger recovery.”

Racism at its best. I wonder if Italians or Germans or Irish were buying up everything for cash that some of you would be crying about it. Bet you would be the first in line to take their cash, run to the bank, and stop posting on housing bubble blogs?

Not racism at all, lil’ robert. Don’t be so shallow. The source of the foreign money pouring into SoCal is of interest because it gives a big heads up as to whats happening in their economy.

Seriously, the race card? That’s desperate.

Here’s a novel idea. Where is the insurance market to protect home buyers from substantial financial loss? think CDS and the protection banks bought to obtain full face value in event borrower defaults. I buy a $750k crap box, then I want protection from the lender and appraiser who are busy authorizing an inflated value to close the deal. Then if the crapbox value goes to hell, I call the note and file a claim. Forcing the NAR and MBA and scam RE agents to have skin in the game should curb the madness.

Just curious, how’s the inland empire affected at this time? Are prices still stable in Riverside County and adjoining areas? I saw some really high end homes in the 700K to 900K range. Just curious….

Curt…There are good buys such as Rancho Cuchamonga (Victoria) where nice homes can still be had in the $400k range. I understand this is a bash housing site, but look around in a place like CA. Many bargains still out there in decent areas.

And when rates inch up and the recovery is exposed for the illusion it is those same houses will dip below $400k. So how is blowing your down payment and being upside down in a year or 2 a good deal???

“I understand this is a bash housing site”

Thankfully it’s not so bashing in that one can spread the good word with sermons to the unenlightened innocents who happen upon these comment threads. It’s worth it if only one one soul is to be spared the devil’s scourge of renting.

@Robert, let’s see…buy a place in Rancho Cucamonga and spend 4 hours a day in traffic getting to and from your job on the Westside? Does that really make sense? Also, 400K requires a household income of about $80K per year @ 4.5% interest. Median household income in SoCal is in the $55K range. The numbers don’t work.

In California, the numbers don’t have to work. “Economic voodoo” takes care of everything.

Will everyone just stop talking so I can enjoy this recovery!!!

Robert and his ilk remind me of the “Too High Guy” at a drug party. You’re enjoying your roll, accepting the pleasure fantasy for what it is, and all of a sudden her comes Too High believing the hallucination is real and getting naked in front of your girl.

“Sure Robert, that stucco shack surrounded by 9 pre-forclosures really is worth a half a million dollars… now will you please put your penis away?”

Zero…Please paste and cut what stucco shack in CA. Is surrounded by 9 preforclosers?

I want to know so I can offer on them, in 2016 I will make another bundle.

Go to Zillow and look at Ontario or anywhere in the IE. Now sure they aren’t all on the same block, but they’re in the same market areas. And Zillow only shows NODs, how do you account for those just barely hanging on? I know you’re trolling because real RE investors don’t have the time or inclination to post on BLOGs. If they’re real big $ investors they’d also lack your hubris. I know a few people who’ve made $ during Bubble 2.0. They’d never insult my intelligence by calling this anything more than what it is, a bubble.

Folks be cautious in life, but don’t be fooled by folks who missed the boat in 2008-2009 and now want you to believe the real estate market in the largest ecomony in the world, the world’s currency,that this country of dreams and fortune will

I never have posted that anybody should buy overpriced turkey properties, what all my life I have done is look outside the doom and gloom and search for oppertunties, they exsist

This administrtion who will get the boot, much better fundamentals of business will arise in 2016.

Upside down in property? I love this , look you only lose when you sell in life, somebody wants what you have, investors don’t sit around for ten years waiting to steal your investment, they either get it now or move on.

You own your home, if you can afford the payment you are in the drivers seat, real estate and land in good locations is gold in your pocket, I should know I done it for a long time and it will pay off.

I remember well, my 1993 purchase of a $308k house, told it would go down to $200k in 95′, waited and sold it for $617k, today that property is worth $945k, even if the buyer of that home dumps it for $750k he still made out.

long term house renting is a losers bet, like leasing a car, we loved buyers who thought they beat the game of car deprecation .

See folks, that is how it works buy right, wait, and sell, the key again, “Buy Right”

or don’t buy.

PS That 400k house in Victora that a poster said would drop like a rock in two years???The house was sold at $ 744k in 2006, not a good buy anytime, but at 400k offer less 5% ($380k)and buy yourself (better then renting)a 2300 ft house in a well maintained location.If he thinks that house is going down to $150k in two years, then he thinks gas is going to $1.50 a gallon and the Cubs will win back to back World Series?

Hey Robert have you ever heard of the “Multiplier effect” ?

Housing prices don’t double in a healthy environment but they sure do in a manipulated one!

King….Run this by my again when you have a chance, can’t get a hold on it?

In a healthy sellers market prices don’t go up, is that the essence of your post, just curious.

_____

Housing still too expensive despite positive signs

Thursday, 10 Jul 2014

Mortgage rates are attractive. Home price gains are easing. Employment is improving. So why aren’t more people buying houses? Sales are rising slightly month-to-month but are still well below where they were last year. The answer is pretty simple: Too many people can’t afford to buy homes.

Where Asking Prices Rose Most Year-over-Year, June 2014

1. Riverside-San Bernardino, CA

Y-o-Y% asking price change, June 2014: 16.9%

Y-o-Y% change in wages per worker 2013 vs.2013

…Sellers, say real estate agents, are now completely out of touch with what buyers can stomach.

…As investors move out, the market is left to regular, owner-occupant, mortgage-dependent buyers. Mortgage applications to buy an existing home are down 10 percent from a year ago, and a report Thursday from the Mortgage Bankers Association finds loan applications to purchase a newly built home fell 5 percent in June from May.

While supplies of homes for sale may still be slim, sellers cannot claim the sky is the limit on price, especially with a tighter mortgage market standing in the way.

…buyers nationwide are walking away from bidding wars because homes are significantly less affordable and credit is still comparatively tight, according to Redfin.

In full: http://www.cnbc.com/id/101823538

Leave a Reply