Enter in the fall housing market: Shopping in Santa Monica with a $900,000 budget. Expectations running high before the fall season hits.

You can smell the end of the summer real estate season as some drunk sellers are pulling properties off the market since they are unable to obtain their ridiculous prices. Funny how expectations work. Some sellers drink the Kool-Aid and suddenly think their home is worth some optimistic appraisal or what a manic market will pay. You even see this in the real estate ads where sellers try to throw in their best curveball on what otherwise is a glorified closet. But hey, prices will only go up so buy with all the confidence in the world and never mind the carrying costs, opportunity costs, or other factors that make buying a more intricate process. The fall housing market always slows down. Now, with foreclosures making a smaller portion of sales, we should expect to see a bit more seasonal changes. However, I just love seeing some of the old neighborhoods where old properties are being sold as if they were newly built quality homes. We are seeing this in places like Pasadena for example. Let us go shopping in Santa Monica and see what we can get with $900,000.

The Republic of Santa Monica and L.A. County

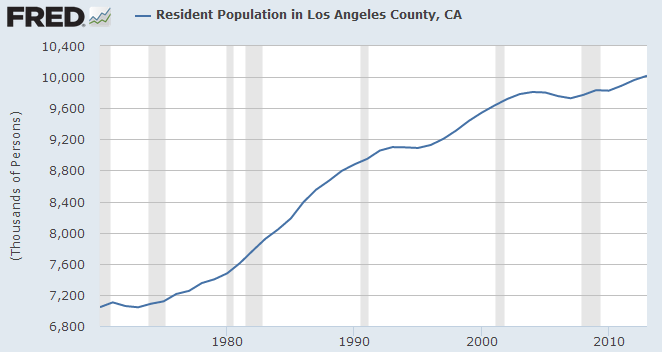

L.A. County is the most populated county in the state of California. More than 10,000,000 people call this area home. The majority of households rent. Yes, that other four letter word. And this trend has only grown since the housing bubble popped. If you want to buy in today’s market, expect to find tight inventory and sellers high on believing that real estate is somehow some golden ticket to prosperity. Even with inventory rising and prices stalling out, people are still on the real estate meth of 2013. The 1,000,000 foreclosures since the crisis hit in the state seem to now be a distant memory. Flippers are out in fashion and cable producers are trying each and every way to figure out how they can repackage the idea of selling a piece of shelter. These aren’t people creating ground breaking companies, scientific breakthroughs, or reshaping our economy. No, basically handing over a home which is essentially shelter to another person and skimming cash off in the process. That is probably why the allure remains for real estate. Everyone can understand it. Everyone can understand the process of prices going up. It doesn’t take a genius to understand a house has a roof, bathrooms, rooms, kitchen, and living room. With a few cable shows under your belt, you suddenly are an expert on recessed lighting, hardwood floors, granite countertops, and stainless steel appliances. You learn about staging, the plastic surgery of home sales. In other words, real estate is the bread and circus for the public. Good luck trying to get the public to understand derivatives, options, high frequency trading, or how the bond market works. For a public that doesn’t know Ben Bernanke from Ben Hur, it is understandable how people can get swept up in the winds of mania. Real estate is tangible and not complicated. Yet to make it seem like a no brainer (which it was for a couple of generations) is now out the window especially in high priced markets.

L.A. County continues to grow but at a much slower pace:

Things are slowing down and most of the recent household growth has been in the form of renters. You also have adult kids moving in with their Taco Tuesday loving baby boomer parents since they don’t have the money to pay higher rents, let alone venture out to purchase a home. Mom and dad brought you up in Santa Monica so now you want to live there. You want something modest and something that allows you to be as “successful†as your parents since they bought in Santa Monica as well. Take a look at this beauty:

727 Marine St, Santa Monica, CA 90405

2 beds, 1 bath, 730 square feet

730 square feet with 2 beds, and 1 bath. Sure, it might be a bit cramped but you’ll be living in Santa Monica! Let us look at the ad:

“Adorable Santa Monica Bungalow located south of Lincoln Blvd offers a comfortable charming desert scape garden and wooden patio/deck. The home has wooden floors throughout, some new appliances and original detailed cabinets, Perfect for a professional or couple. Home also features a 1 car detached Garage with Laundry area. Recent extensive Sewer Main to the Street repairs with 15 year Warranty with RotoRooter, receipt upon request for successful bidder. Limited showings, Tenant Occupied. Please do not disturb occupant.â€

First, this place is currently rented. Hey! A renter in a prime area, what a stunner. The Zestimate rent on this place is $3,427. What is the current selling price?

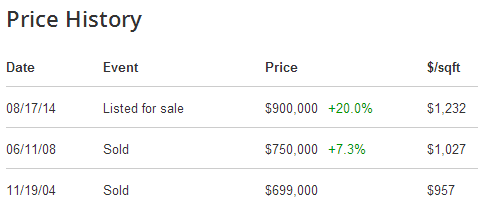

$900,000. Yup, $900,000 for 730 square feet. Feel free to make your bid and commit yourself to 30 years of mortgage payments for this place. The cap rate on this place makes no sense as an investment property. Do you see a professional or couple living in this place for a long time? That is another problem people make because they run the numbers over 30 years. Well in house lusting California people are lucky to last 10 years in a home before they want to “upgrade†into a larger and more expensive home keeping you forever on the property ladder treadmill. Mortgage burning parties are a relic of the past. People love being in debt in SoCal. That is why you have a flood of Purina Dog Chow living baby boomers complaining about Prop 13 or other things as if they were poor yet sit in a million dollar sarcophagus. House rich, cash poor. Yet a home doesn’t throw off cash until you sell! Yet people have a hard time giving up the California lifestyle. It is interesting to get e-mails form young professionals that are happy renting in areas with good school districts versus buying in a potentially upcoming neighborhood with crappy schools.

Also, many don’t have kids or plan on having kids so who cares about schools. This current first time home buyer demographic has different wants and needs than real estate horny older generations. I’m sure many kids are seeing their parents in prime homes yet living on a tight budget because they failed to plan outside of housing. All money is funneled into real estate via mortgage payments, taxes, insurance, and upgrades at the expense of other financial goals. This is why economist love housing for GDP growth because people buying homes causes a whirlwind of spending in other areas. You have 2.3 million young adults living at home getting a front row seat of the action. You even get advice to save giant sums of money just for the down payment at the expense of saving for retirement. Take this Santa Monica home of 730 square feet and built in 1953. A 20 percent down payment comes to $180,000. And you will still have a $720,000 mortgage for 30 years. Even when this place is paid off, you still have taxes and insurance (and it would be wise to get earthquake insurance as well since many in California seem to forget that we get these).

Los Angeles County is an interesting place. A world with a tinge of Hollywood, good weather, and diverse foods and culture. I view this as a great positive. But you also have many of the new jobs hitting the market coming in with lower wages and less financial security. To pay $900,000 for 730 square feet is crazy but those in the Bay Area might find this a bargain.

If you think this is a good deal, how would you run the numbers? Are you being too optimistic on price appreciation for this place and being negative on the stock market? Compare the rise in prices of real estate and stocks since the Great Recession hit. This place certainly is not a good deal as a rental. So that leaves you with someone buying it for a flip or actually moving in. Good times in SoCal real estate!

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

99 Responses to “Enter in the fall housing market: Shopping in Santa Monica with a $900,000 budget. Expectations running high before the fall season hits.”

I’m not the only one using the “T” word now: http://investmentresearchdynamics.com/july-new-home-sales-tank/

TANK TANK TANK

Housing to Tank Hard in 2014!!!!

It’s not tanking everywhere, Jim.

This Pasadena house was listed for $625,000 — and sold for $801,000: https://www.redfin.com/CA/Pasadena/1210-N-Chester-Ave-91104/home/7200087

And here’s a Pasadena house that was listed for $579,000 and sold for $620,000: https://www.redfin.com/CA/Pasadena/1420-Valencia-Ave-91104/home/7265038

It does seem that houses “priced right” are selling, and even being bid up.

Whereas recent purchases by flippers, with huge markups, are sitting.

This Woodland Hills house has sat for 50 days. It was last sold in December 2013 for $415,000. They’re now asking for $799,900 (they had been asking $829,900): https://www.redfin.com/CA/Woodland-Hills/5232-Marmol-Dr-91364/home/4174146

And here’s a Pasadena house that was listed for $579,000 and sold for $620,000: https://www.redfin.com/CA/Pasadena/1420-Valencia-Ave-91104/home/7265038

That’s actually a very cute house. I love that kitchen and bathrooms are largely original and intact, not gutted and granite-ized. A modest and nice place, I would live there.

But not for $620,000.

“House – flipping collapses in San Francisco losses spread”

Oh oh? Maybe some of you “experts” here can explain that surely?!

Home sales down , check Retail sales down, check Auto sales down check

Movie goers down, check =

Recession in 3 2 1 check and housing to tank check!

According to Case Shiller, which is generally considered the most reliable real estate tracker, house prices fell from April 2014 to May 2014 by .2 percent, then prices fell from May to June by the same .2 percent. Who cares about price increases from a year ago. Prices are falling month-to-month.

I saw this house during one of the open houses and it’s a smallish house and DARK and GLOOMY otherwise it’s kind of nice, but no where near 800k sheesh. Idiots who love to pay high property taxes for sub par schools. Hope they remember to lock their windows at night and turn on the security alarm and never mind the constant buzz from helicopters all night..

This article is worth reading. Dick Bove, a leading banking analyst, predicts a housing and mortgage crisis by this winter. As the government phases out their monthly purchases of mortgage-back securities, the cost and difficulty of getting mortgage financing will rise considerably.

I know there are a lot of real estate professionals, flippers and investors who are feeling very confident now. Remember, nothing lasts forever —

http://www.cnbc.com/id/101963571

Jim, keep your meme consistent with our viewpoint. Remember it’s…

Housing IS Tanking Hard in 2014!!!! LOL 😉

Anecdotal story… Afriend of mine’s father has a decent shack in north Upland. A long time ago I Told him I’d be his neighbor someday when Bubble 2.0 pops. I was told how the neighborhood was selling in the 600K range. I told him only 2 sales closed in the last 3 years near 600k and that was during the mania of the last year or so. I also pointed out how there were 5 per-foreclosure shacks in his vicinity (thank you Zillow :-). Not what he wanted to hear as he’s an older fellow and has burned equity on failed businesses. Considering a fixer upper on his block sold for a little below 400k in 2011 before the mania picked up, I told him I’d take my chances “timing” the market. He of course thinks this is impossible and dangerous. I’ll say this for sure this old man home debtor sounded a lot more scared than me at the prospects for SoCal Real Estate.

And to further frame the position this baby boomer Regan voter, he recently got cancer care under the pre-existing conditions exemption of Obamacare. He also bragged to me about his $1500 a year prop 13 tax payment. this is why I shed no tears for these entitled assholes when they lose their homes. GenX and the Millenials will have the last laugh. the math is on our side.

@nihilist0 “gen x and millenials will have the last laugh”

Guessing from your comments you were born around 2009.

Gen x and millenials are born slaves to the massive financial ponzy that this government created. You built nothing and made nothing you work and you consume! Enjoy your future it’ll be a interesting one.

NihilistZerO: …this is why I shed no tears for these entitled assholes when they lose their homes. GenX and the Millenials will have the last laugh. the math is on our side.

_____

Many similar stories here. The question I struggle with, is whether political authorities can or will switch from all the nicey-nicey “helping the economy” in their selecting winners and losers. Whether that in itself is actually wrong footing many vested-interests as velocity of money plunges.

In the UK in the early 90s, into a recession and throughout it, political authorities took a hard-line. Prime Minister John Major repeatedly said, “If it’s not hurting, it’s not working.” (We had a big house price crash during that time, and I know loads of families who were so so so happy, as they finally had the chace to trade up to a family home… with 60-80 year olds who had been hogging such homes, downsizing and accepting lower price.).

Also it broke up companies that had overexpanded; including one guy who thought he was a hero because in the boom. During the 1980s, he’d expanded into the boom, and bought 3 more franchises.. so into the 90s he didn’t just have his original Honda franchise, but had added a Suzuki franchise, a Yamaha franchise and finally a BMW franchise, with more business premises. His attitude, along with other VI had coursened entitlement. He bought a new Bentley every 3 years, he had a mansion (bought cheap in 1970s recession from some other over-expanded person), a private plane, racehorses, groom, live-in butler and staff. He was furious when the party ended, blaming everyone but himself. However in the final reckoning, lots of other younger entrants bought parts of his business cheap, so you had 8 new businesses out of it… instead of one guy living the ultra high life. Also a neurosurgeon bought his mansion cheap from the bank as a repo… which to me is good money replacing bad/entitled/greedy, and why rebalancing is required.

There must have been similar political parallels for the US in that recession, and previous ones, with hardened political will to see through necessary economic rebalancing and correction. It seems like the early 2000s, with super political correctness and “forever boom – aren’t we all the best” and other ingrained niceities…. authorities have either forgotten, or do not wish to be (for their own VI)… HARD.

I still hold out for the possibility they will become hard, and that such a switch will be a huge shock to other VI who have grown accustomed to being cuddled and protected, despite already having enjoyed decades of prosperity… homes owned outright, big pension etc…. bringing the real pain down on those who’ve been reckless, and clearing the way for young sensible generations to get a stake in society at much lower prices/lower borrowing.

RE: Brain

The thing I find most comical about the entrenched beneficiaries of the system is the total cognitive dissonance when it comes to empirical data. Every statistical argument is countered with Unicorns and Rainbows bullshit. I’ll accept any argument that points out that growing income disparity and Prime L.A. status as an “international city” straining affordability for the foreseeable future (though interest rates will factor here as well). This does not portend every home within an hour drive of Los Angeles becoming unaffordable via local incomes. There must/will be a correction. The boom always follows the bust. Inflation is naggingly consistent over long timelines. The up swings are always followed by the down and it all averages out to a few percentage points a year. Residential RE up 30% in two years is begging for a correction. One that has already started.

The moguls of today are often the paupers of tomorrow. You Car Dealer example is a good one.

@NihilistZerO,

I do agree with you on Generation X and Millennials if one uses a long term projection. The SoCal population growth appears to be slowing to zero. The oldest of the Baby Boomers will be turning 70 next year, and the pre-Baby Boomer generation will be cashing out and tossing in the towel if home prices continue their plateauing. This process will take about 4 to 7 years.

RE: blofeld

If 4 years gets us to 2010 trough prices minus 5-10% to make up for the higher interest rates, I’ll take that. 2010 was the least manipulated market since 2000 in my opinion. Outside of the Federal tax incentives you pretty much had a functional housing market based on solid underwriting standards, organic demand and nothing extreme in the flipping game. Realtards make this seem like ancient history but NOTHING that has happened in the last 4 years but economic contraction among the working classes. Sure prime areas have seen an influx of buyers that should make those areas (South Bay, South OC, Westside, etc) fairly sticky. But even there you have to question how many are directly drawing income from the ponzi? Many of these high income earners get short term interest only loans because they can. There living in multi-million dollar cribs for 5K a month before taxes just because they can get financing we can’t. The curtain is going to get pulled back rather soon…

Nope, no Tank on the horizon. The prices are still higher on YOY basis. Houses sit for longer period on the market, but I see no tank around here. The inventory is still short, the rents are still high, so, no tank in 2014.

Last I checked, the Case SHILLer index was up around 8% YOY in Los Angeles for properly prices listings. Of course, anyone can cherry pick the drastic price drops on overprices homes and claim that hosing is tanking.

I will agree with @QE abyss. Even though I believe 100% of the housing is overpriced, at least 20%, in my area (i am not familiar with SoCal that much), some homes are way-way overpriced, like 40-50%. So, if those way-way overpriced (40-50%) just become overpriced (20-30%), the prices decline, but they still “decline” to the higher level than a year ago. If, say, someone bought a home a couple of years ago for $500K and now tries to sell it for $800K, even if the asking price drops $100K, which is 12.5%, it will be still selling at 40% markup over two years. So, the price drop on its own doesn’t reflect anything. The prices should drop on YoY basis, only then we would start seeing “Tanks” to develop. As I said, no tank in here, not even on the horizon…

Go try and sell one of those jewels at 8% YOY. Just numbers. It’s the selling that matters, agreed? Spurious feelings of security and superiority. House priced near or above a million will sell. But the bulk of business should come in the 350-500K range for evidence of a truly healthy economy and those are not moving. 50 properties on watch and 5 have sold in 3 months. Anyone can cherry pick houses that went over list. Those houses are charismatic and or priced low by and agent to ignite bidding.

Drowning in Unsold New Homes?

http://wolfstreet.com/2014/08/25/housing-bubble-2-drowning-in-unsold-new-homes/

This is one of the most hilariously incongruous listing descriptions I have ever read. It says the house is “in wonderful neighborhood of Los Angeles.”

But look at the first photo — BARS on the windows: https://www.redfin.com/CA/Los-Angeles/5418-Geer-St-90016/home/6887576

I didn’t know that houses in “wonderful neighborhoods” had bars on windows.

This 85-year-old stucco crapbox is also described as “Absolutely amazing” and “spectacular.”

The broker also forgot to mention ‘culver city adjacent’. : )

Actually as prices in SM, WLA, Culver City, Rancho Park and Beverlywood have risen dramatically since 2010, many young professionals are moving into the western ends of 90016.

That actually does look like it might have been nice enough if you like old houses like me…but the generic crappy flipper kitchen, bathroom, and flooring is even more jarring than usual in an older house. The flippers markup for spending a month raping this place is $130K, about the same as in northern Calif. But where is the bark landscaping??

The listing on the above Santa Monica house says: “Adorable Santa Monica Bungalow located south of Lincoln Blvd”

There is NO “south of Lincoln Blvd.” There is east of Lincoln, and west of Lincoln. But no north or south of Lincoln.

I’m guessing realtor meant that it’s near Lincoln, south of the 10 freeway.

Exactly!!! But it is North of the “new” Whole Paycheck! For those who did not grow up in the area, Lincoln and Rose is where all the hookers and pimps use to hang out. I think it was considered a no man’s land between South side SM and Ghost Town (the bad part of Venice).

I remember in high school in the mid 70’s when many of the houses along Venice Canals were broken down beach bungalows, lots of biker gangs and the canals were toxic dumps full of trash and car parts, etc.

@son of a landlord

Hey I noticed that too. There IS no south of Lincoln ! I would speculate the realtor is trying to say “West of Lincoln”, because that would be more desirable; closer to the ocean.

The thing about this property, and the reason in is arguably worth the asking price, is that the house could be torn down and rebuilt. In that way this property really does have potential

One word for why I would never buy in that area: liquefaction.

The doctor: “in house lusting California people are lucky to last 10 years in a home before they want to ‘upgrade’ into a larger and more expensive home”

I saw this only last week. I visited a house in Woodland Hills. The owners, a youngish couple, were there. They’d bought the house in 2012 and were already looking to sell it, asking for a $230,000 markup from what they’d paid.

They explained to me that they had “outgrown” the house and were planning to move to Calabasas.

As long as there are jobs there will be residents

You mean “Yobs” of course…

Now that mortgage rates are falling rapidly, get ready for yet another price jump in the beach cities. The mortgage rates are falling because of the ECB will be printing hundreds of billions shortly. And, they will be printing for a long time. Mortgage rates will continue to fall … perhaps lower than the 2013 spring level. The prices on small beach close homes will jump and jump again.

If mortgage rates start to fall lower again, it will inflict even more severe pain on the economy later. Besides, it will guarantee higher inflation. Got gold?

Who’s prosperity are we supporting with these recent gains?

If we don’t bear the pain now on savings and mortgage interest rates going higher then we are leaving the burden on our children and grandchildren instead of our selves. I think the interest rate hikes should not be feared.

@jt, low (and lower) mortgage rates are really bad for everyone a terrible Catch-22

1.) Lower rates causes asset inflation.

2.) Commercial lenders cannot issue mortgages at rates below 5%. If they did they would be out of business and bankrupt very quickly.

3.) The Federal Reserve is determined to keep rates artificially low to create #1 above. But when they do this they create #2 above.

The true cost of a mortgage is: the 10 year U.S. treasury yield (about 2.5%) plus a 25 to 50 basis point premium for not being a government backed security plus another 25 to 50 basic points for the cost of servicing the loan. Add in 200 basis points for inflation (using the governments’ fake CPI, not real inflation at 3% to 5%).

The sum of all this yields a minimum mortgage rate of 5% to 5.5%. Anything less, banks will go bankrupt. This also assumes 100% on time payments, no foreclosures, no short sales, no litigation and no decline in home prices.

As I’ve argued elsewhere, there’s no excuses left for people when prices are so high.

Can they really claim “forever house price inflation” against such asking prices and mostly stagnant incomes, and fierce conditions on wages going forwards. Those who choose to buy at such painfully high prices, make their own decisions. That bungalow. High frequency trading not worth learning anyway, against financial markets where volumes are so flat (August volume was one of the lowest in years).

Prices are insane, and now there’s a just a slight bit of global tightening (Don’t do the QE Draghi).

The Deputy Governor of the Bank of England, recently said, (tellingly in my opinion) that it’s no longer house prices they’re looking at, but their focus is now on mortgage volume transactions, “which today are very low.” I wonder how volume could be improved, and so allow banks to write millions of profitable mortgages….. my answer, at much lower house prices, and get the market moving again. It would not surprise me if US authorities, behind closed doors at Jackson’s Hole (and so few invites this year to the VI), leaning the same way.

Hold on to something… because we’re going into a massive house price crash in mid-to-upper prime (starting soon and ever more evident over the next 24 months), in my opinion, and the political authorities are going to switch around, and with a massive shakeup coming on the complacent Vested Interests in high house prices, who will suddenly find they are not as cuddled-and-kissed as they were before.

_____

It was over. The climax had been reached. It was done, destroyed, could be no more. It was not finished, but it was over. The game was over; couldn’t anybody see that? He looked despairingly around the faces of the officials, the spectators, the observers and Adjudicators. What was wrong with them all?

The Emperor had fallen for it, taken the bait, entered the run and followed it to be torn apart near the high stand, storms of splinters before the fire.

-Player of Games. – Iain M Banks.

A condo that I rented five years ago at $1100 is now listed for rent at $1900. It is ~73% increase over 5 years. Prices cannot grow forever at these rates, I agree, unless people’s income follow, but the prices can stay at unaffordable elevated level for prolong period of time, thanks to the funny money policies. I believe the prices will not grow at the level they used to, but they wont fall either, at least for the next couple of years.

Housing NOT to Tank hard at least till 2016!!!

Housing to Stay Flat in 2014!!!!

Hosing is already up in 2014. I think you and young Jim are both wrong!!! I am still in the renal market myself and have noticed that renals are up as well. Remember, you can’t taper a ponzi scheme…

When I said flat, I actually meant that even if the prices fall on M-o-M basis in 2014, they will still be either the same or up on Y-o-Y. Which means the housing will either grow or stay flat.

kinda hard to have fun anymore, ain’t it What?

A flat lining housing market will certainly reign in flipping and likely stall the whole market, which of course leads to price drops. Of course the sellers will take the approach of doing 1% drops over months to potentially lure people in. I doubt 10% drops will be across the board but will drip slowly.

” you can’t taper a ponzi scheme…”

Correct. Ponzi schemes are always sustainable.

You talk about economists loving this situation in light of rising (?) GDP. It is my understanding that GDP is not affected by the sale of an existing home, only when you buy a newly built home. Or do you mean the consequences of people being the crab shacks?

Actually, GDP is effected/affected by the sale of an existing house, just not for the full value of the exiting house. The fees and “upgrades” are supposedly included. But this is all your grandfather’s GDP/GNP. We have moves so far from GDP as gauge of economic activity and we now live in a world where GDP is manufactured in an underground lab in the Mohave using captured alien technology from the 1960’s. I suggest you start purchasing tin foil, rolls and rolls of tin foil…

Don’t yea just love it! LA Times last FRIDAY…..Folks all over the country are gett’in HELOC’s like crazy (Hee-Lock’s). The music is playing again, and almost everybody (me not included) is dancing. Did everybody forget what happened in 2008? The tide is gonna go out again and a lot of people are going to find out they don’t have any clothes on! I’ll be the first to laugh, and very loud. Happy Labor Day!!!!!!

“America is so over homeownership: Why the shift to a renting economy might actually be a good thing

Fewer Americans are buying houses than at any point in recent decades. Some fear this shift—but maybe we shouldn’t”

http://www.salon.com/2014/08/31/america_is_so_over_homeownership_why_the_shift_to_a_renting_economy_might_actually_be_a_good_thing/

Lower the f*king prices and people will start buying, problem solved!!!!

a guy from Seattle

Lower the f*king prices and people will start buying, problem solved!!!!

REPLY

They don’t want you to buy. Home prices are high by design…mastered by the Fed. They want home prices high so homeowners can feel good about spending. They want you spending your money, not saving it. Spending psychology…if you were under water but now your home and the stock market are going higher and higher, makes you feel very comfortable to spend. As for renters who have not bought because of high prices, they too continue to spend because they are not strapped with a huge down payments and high monthly mortgages. Renters keep renting and home owners keep feeling good about home ownership with rising prices. Renters and homeowners are free to spend and certainly saving your money won’t get you anywhere…spend away! They don’t care if renters can buy homes, they want everyone spending.

@Christie S, the “problem” I see it is that we won’t have any homeowners soon, only renters. Which is not a bad thing,I believe, but if the fed wants the folks to “feel” rich, since we have the lowest home ownership rate in 20+ something years, fewer and fewer people will “feel” rich because fewer people own homes. Isn’t it going to create the opposite of what the fed is trying to achieve? It is not that I think the fed has done anything right in more than 100 years, but they would just create the opposite of they are targeting…

The Fed does not care about new homeownership. They want current homeowners “happy” that home prices have risen to where they are not underwater. This provides previously underwater homeowners good psychology to spend. They want homeowners spending. They do not want us saving.

They don’t care that renters can’t buy homes. They want renters spending their money in the market place. If they want renters to be buyers they will loosen credit standards. They might make it easier to buy high priced crap, they will not raise interest rates which in turn will drop home prices and make it more affordable to buy. They want home prices high. The Fed want you buying at high prices. If interests rates rise it will be very minimal, not enough to lower home prices.

Investors have driven home prices up. The reason why they are buying is to diversify out of the stock market and with all the money printing many with assets fear a total collapse of the dollar where money will flea to tangible assets. We are in the beginning phases of a currency war.

Housing doesn’t matter without water….California water to crash hard in 2014…housing will follow the path of water….like the old days…

Every home is worthless without running water….

I don’t like to think about this one. But you are right. At some times Energy prices and Water are going to be so expensive housing prices could be free and it wont matter. What California has going for it is the climate so less demand on energy, but the water sure is and is far more critical!

Surely the Fed can print Energy and Water. That would be a mere pittance for the folks who can print prosperity!

Those of you banking in selling your home to the next generation maybe in for a surprise. Each subsequent generation is less interested in owning and more interested in experiencing. They understand the game is rigged — if you’re not a 1%er — you’re someone’ s serf. To think you’re not is an illusion. One thing people don’t mention about home ownership today is how much of your (my?) life is consumed by worrying whether the precious little asset is going up or crashing. What would you be doing with your time if you weren’t constantly worrying about something that is supposed to make you feel secure. Those of you like Christie s who seem to be completely seduced by the material world — my multimillionaire business partners are evidence that a high standard of living does not equate to a high quality of life. You’re a slave to the seduction and will never own enough to feel secure. Little power brokers being controlled by the big power brokers. I doubt anyone is going to think while lying on their deathbed that they wished they did one more trade or flipped one last house. Younger people get this. Hence, “Is Owning Overrated? The Rental Economy Rises”, http://www.nytimes.com/2014/08/30/upshot/is-owning-overrated-the-rental-economy-rises.html?rref=opinion&module=Ribbon&version=context®ion=Header&action=click&contentCollection=Opinion&pgtype=article&abt=0002&abg=0

tolucatom

Those of you like Christie s who seem to be completely seduced by the material world — my multimillionaire business partners are evidence that a high standard of living does not equate to a high quality of life. You’re a slave to the seduction and will never own enough to feel secure. Little power brokers being controlled by the big power brokers. I doubt anyone is going to think while lying on their deathbed that they wished they did one more trade or flipped one last house. Younger people get this. Hence, “Is Owning Overrated? The Rental Economy Risesâ€,

Reply

I don’t know how you think I’m a slave to anyone or anything? I work for myself and make my own schedule. I don’t answer to anyone except myself. I own homes outright with no mortgage and own rentals with no mortgage. I don’t flip houses. I think I have the ideal life. I spend quality time raising my child and have the time and money to do so. I don’t live like a millionaire but I have the freedom from debt which I think is the greatest freedom. I do indulge and I can. I thoroughly enjoy the life I have now as opposed to when I worked for someone else enriching their life and lifestyle while I was struggling just to make it. Everything thing I have, I own. You would be so lucky to have my lifestyle. If anything I am seduced by financial freedom.

There is no such thing as a unrealistic asking price. You have to start somewhere. Macy’s wants $100 for a shirt. They are asking $100, this weekend it’s 50% off. If you have an extra coupon it’s $40. At some point the retailer and buyer agree on a price and the shirt is sold.

Same here…make an offer for what you feel is fair and quit complaining about the high price. If it sells you are both happy. If it goes for asking then there is someone else out there who is happy.

But unlike shirts, there is limited homes in Santa Monica. They are not making more land in Santa Monica and it’s not likely to go out of style any time soon.

I would like housing to tank so I can buy a home cheap. But I know that is not going to happen. SoCal is full of rich people with cash burning a hole in their pockets. And more keep coming.

Until the Midwest has Santa Monica weather and culture, forget about a huge price drop.

Also, the west side never corrected. That second leg we all waited for never happened. Instead they are higher than ever. But somehow it’s going to tank in 2014. LOL…no.

I’m not a realtor, I’m a realist.

Absolutely amazing†yes 900k for that house is amazing.

1) THE HOUSING MARKET NEAR ME.

We drove by an open house on a nice cul de sac in central Orange County today. It isn’t the first one they’ve held, so my Wife (who went to a previous one) offered to stop and show me the place. It’s about 2700 Sq Ft on a large lot, and in nice condition. My Wife says the $719K asking price is about $100K too much and if it doesn’t sell, we might want to offer on it for the lower figure and see what they say. It’s on the block our Grandkids are on. She says that it isn’t going to appeal to younger buyers with the hardwood flooring and kitchen it currently has. It looks nice from the outside, though.

2) WATER WATER EVERYWHERE

I’m not impressed with the so called water shortage. 1) The majority of California water goes to agriculture. In a free market, the farms would probably get outbid by cities who need water. Also, old-fashioned agriculture wastes water. My Brother works for one of America’s largest farm equipment companies, and they are working on technology to control irrigation based on imbedded sensors to give just the right amount of water to a crop. Israel already uses more advanced technology for crop watering than does California.

Water recycling is being used out in Orange County, and they also pump runoff water from storms into the aquifer. Someone finked on a “water waster” in my town and the water department told her that they didn’t have a problem so MYOB. Seems to me the biggest water waster in LA is the DWP and their antiquated equipment.

Other desert countries on salty seas use desalinization. It costs more, but the wealthy here can afford it so why not use it for people who can afford it?

U must be new to California. The 70’s and 80’s droughts were good, this one will be epic, it’s just starting. Ag in the central valley is already shifting down and plowing down trees, crops and failing, water rights control that and ground water is in very bad shape. No rain this year and Central valley economy collapses like dust bowl 2…

You live in a desert and most of the sheeple in Orange county think everything is given to them. Well, when it comes to water it will not be easy to get down in no longer orange but dry county. You get your water from the Colorado and the Sierras. Without water good luck. All I see is green lawns, medians, industrial buildings etc using water. A bunch of wasteful people hanging behind the orange curtain, where subprime was born……

You are discounting this drought like the pea head governor…it will not turn out good.

You must be new to California yourself. The politicians are the problem not the climate.

Born in Pasadena (not in Texas),

Joe R

“good school districts”? No such thing. Another Establishment con.

Our local builders started to offer “free” upgrades up to $50K on $500K houses. How about lowering the price by $50K without any upgrades?

People still fall for the old “Buy one, Get one FREE” schtick, so yeah.

The upgrades make the house. Everyone should demand them at little additional house. And no landscape? It’s much cheaper for the developer to build out the landscape. It’s like having a car with no AC.

I’m seeing more of these showing up. I don’t understand this. People buying in 2013 and willing to sell at a loss today? Why?

http://www.zillow.com/homedetails/5130-W-20th-St-Los-Angeles-CA-90016/20596350_zpid/

The prices shown in Zillow, or Trulia, Redfin can be inaccurate or not tell the whole historic picture. Of course someone could be selling at a loss, but best to have a friend who is in the real estate business to dig deeper and determine what the reasons behind the numbers.

Thanks QE. I plan on doing just that. This is the 3rd property in 2 weeks that was bought in 2013 and for sale now at a reduced price. They’re showing up in my listings. I’m curious as to whether this is a trend and a portend. I think many people got caught up in the 2013 frenzy and bought houses expecting to make money. Now that the tea leaves forecast as downturn, could it be they are trying to get out?

I quit searching for a house last year because I could see that they were being bid up well past the highest they had ever been. Didn’t make sense that they could go higher even though RE agents were all saying buy now. It’s so easy to get caught up on the emotionalism and frenzy and to bite off more than one can chew.

I took a bike ride through the $1MM neighborhoods — never seen so many houses for sale. Smart money trying to dump their houses while the getting is good? Heck if I know. But Zillowed a few and the one I looked at were reduced in price.

“…but best to have a friend who is in the real estate business to dig deeper and determine what the reasons behind the numbers…”

One of my acquaintances asked me a few months ago, she is a mortgage broker, why we are not buying, the interest rates are so low, etc, bla-bla-bla… I explained my arguments why u believe it is not good time to buy, but it was hard to convince her that the prices do not always go up…

More reason just to pack up and move out of this godforsaken state. My wife and I would love to buy a home in OC – and we need one because we have a growing family – but we can’t afford one unless we’re willing to live in a dumpy area. We could always rent a house, but it makes ZERO sense to throw away $2000 to $3000 every month on rent. It’s looking more and more like we’re going to pack the UHaul and get out of here for good.

Oh BTW, have you heard your gas prices might go up by $0.40 to a dollar or more per gallon on January 1? Yup, the new global warming legislation they passed a few years ago up in Sacramento is starting to kick in. Yet another reason to get out of this insane state. I’m tired of paying for the pet projects of nutcase legislators who are trying to save the planet.

“Oh BTW, have you heard your gas prices might go up by $0.40 to a dollar or more per gallon on January 1?”

– No, my dad hadn’t forwarded me that chain email yet. Scaremonger.

Now that the Spring/Summer buying season is over, I wonder if many unsold houses will be delisted?

Sellers might think they’d get a fresh shot at a good price if they wait till Spring 2015.

That fresh shot in 2015 likely will be more of the same. I’m in the camp that reads the data as higher mortgage rates and zero flipper activity next spring. My gut tells me a lot of the sheeple have dipped into equity during this run up just to get by and when they can’t sell… Well, I’ve said for a while 2015=2008 for housing. I think stocks might levitate a while longer as that market is so much more liquid and easy to manipulate. But the bill is coming due for Housing Bubble 2.0. I suspect the tank in prices is late 2015. Seattle dude thinks 2016. I’ll wait it out patiently either way 🙂

@Beware of ideas in march of 2016…

“…Seattle dude…”

Hey… Seattle guy, not dude…

I still like 2014, but I can deal with 2015 or 16 if that’s what it takes 😉

Home prices do not tank when a real estate bubble pops. Instead it’s like a tire with a slow leak. It takes 4 to 7 years and prices eventually revert to the mean.

RE: blofeld

I think 2008 qualified as a tank. Prices were 15% plus down in many areas. Sure they were 30% or more down by 2010. But that -15% is still a tank. Especially when 99% of buyers had no skin in the game. It all semms so familiar whenb you look around today, doesn’t it? 🙂

@NihilistZerO, yup, it looks familiar except the prices are up on Y-o-Y in 2014…

@Jim Tank, …I still like 2014, but I can deal with 2015 or 16 if that’s what it takes ;)…

So… I will take it a housing to tank hard in 2016. Common folks, look at the stock market, it is all up, the bonds are going back to 2013, the second quarter GDP is 4%+, we are in full “recovery”…entire 2014 was a momentum of 2013. The 2015 will be momentum of 2014 (or what is left of it) by the end of 2015 we will start seeing some cracks… 2016 is when the housing will start tanking… and another 2 years for it to settle to a new bottom. So, 2018 is about time to buy, got gold??!!!

RE:Seattle “yup, it looks familiar except the prices are up on Y-o-Y in 2014…”

Prices were up YoY in many markets through 2007, some into early 2008. More familiar than your mis-remebering 😉

Any comments regarding this scenario? Haven’t heard this angle.

‘Mortgage crisis’ is coming this winter: Bove

http://finance.yahoo.com/news/mortgage-crisis-coming-winter-bove-153341109.html

Read the same article this morning. I’m sure Democrate appointed Yellen won’t be so dovish on rates after the midterm elections tho November. Rates will go up and prices will come down. Use any online mortgage calculator and you’ll see how dramatically rates impact affordability.

Who cares about mortgages nowadays if we have Blackstones and Chinese with suitcases full of cash.

With interest rates on a 30 year mortgage in the 4% to 4.5%, no financial institution in their right mind is going to underwrite that kind of loan. Now if banks can get +6% on a 30 year mortgage that changes everything.

Most of the mortgages issued since 2008 are Fanny Mae, Freddy Mac, FHA, VA or hoovered up by the Federal Reserve. Private mortgage lending has disappeared since the Federal Reserve started ZIRP.

I’ve watched this home being built that is almost hanging over the 101 freeway in the busy Cahuenga pass. It is on a narrow mound of dust wedged between the frontage roads and is maybe 20 feet from the freeway with not a single tree in between. There is a back deck that offers a glorious up close view of 8 lanes of freeway traffic. All summer I’ve seen the progress on my drive to the office thinking that it surely was a commercial building and not residential. I then saw the signs go up and looked up the listing. It turns out it is indeed residential and there is a pool up there. I went looking to guess how much. I thought, 500k? 600k? It comes with one of the best descriptions I’ve read in awhile. I would imagine the deck would need to be hosed down every morning.

Have a look. Be sure to have a look at the street view.

Listing…

http://takesunset.idxco.com/idx/5184/details.php?idxID=240&listingID=SR14184716

and the map…

https://www.google.com/maps/place/34%C2%B007%2722.0%22N+118%C2%B020%2725.9%22W/@34.1227695,-118.34053,15z/data=!3m1!4b1!4m2!3m1!1s0x0:0x0

Holy crapola. I gotta go check that out. That’s terrible.

Unbelievable.

That house belongs in the Real Homes of Genius category.

I like the lot size shown as 0.3 acres… most of it downhill!

Wow, the traffic noise would make it tough to enjoy that pool. Awful location.

Great commuter home!!! Easy freeway access!!! Only seconds from the 101 freeway!!! Great location!!!

All this house needs is its own on/off ramp to the 101…

More like 11-12 lanes (!!!) — I count six lanes just on the northbound; guessing as many southbound.

It’s also a sloped part of the freeway entering Hollywood so everyone is everyone is on the brakes coming down and heavy on the gas going up. A highway enthusiast’s dream home.

Strange, but I find myself rather liking this house. Maybe it’s because it is so different than what I live in, that it feels “edgy” and altogether alien. Why live in a decorative old condo on a street lined with leafy trees whose limbs meet each other over the street, for a tenth the money this place costs, when I could pay $1.3M for a house that makes me feel like I’m sleeping on the median strip in the middle of the highway? Is that not edgy, or what? Is there not something a little stimulating about sitting on your pool deck and imagining the slope above sliding into the pool and over the house in the famous Los Angeles monsoons…..or, for that matter, the whole structure sliding down the slope onto the highway below? Is there not something appealingly bizarre and surreal about all that concrete and asphalt and all those flat surfaces and right angles?

Alameda county. Saw (simple curiosity) 3/2 flip for 1.5M Very nice inside. No obvious problems of any kind. Personal tastes vary, but basically move-in condition. However, surrounded by high-rises. Sliver of a view. Every window, incl. bathrooms, visible by neighbors. Sold, not pending but sold, day after close (1 open house). $1.8M.

Not only have we seen no price decreases but rather huge price increases. 1 year ago, we saw houses listing at 650K selling for $850. Now it’s hard to find one w/ ask of less than $950K. Most recent? 2/2 for $960K.

Median is now around $1M and there still seem to be plenty of buyers. And when the owners sell, in 5 or 10 years, that 1M will be a floor. We’ve been using Zillow to look at neighborhoods. Where last year’s estimates were in the $600-$800 range, they’re now in the 900K plus range, based on comparable sales.

It would seem that real estate, like stocks, can lose value over the short term (and 6 years from crash isn’t that long), but over time it does go up … while wages for ordinary people stagnate.

Finally, the crash hurt a lot of owners, but did not much help buyers priced out of last boom because owners wouldn’t sell at a loss and foreclosures aren’t bought by ordinary buyers.

Nearly 3 mths after being informed by my landlord they are going to “cash out” and sell the rental I’ve leased for the past 2.5 yrs, they are finally going to put it on the market.

They’re doing FSBO. Priced it about $45,000 over what it would appraise for. Its at the lower end of the market for this area, so I bet most potential buyers will be just able to scrape up the down payment, let alone make up any difference between appraised price and agreed sale price.

Somehow I think they’ve missed the gravy train.

And it needs at least $30,000 worth of repairs made. New flooring, new appliances, no backyard landscaping or drainage just a slab of concrete and bare spotted bark. It totally floods in winter.

I had to set them straight today that they need to give me 24 hrs notice and showings can only be made during normal business hours. I also refused to give them a key, and informed them I will be there for every showing as I am not comfortable having god knows who stroll through my house accompanied by my wanna be realtor landlords.

Have an appointment to look at another rental 8 doors up around the corner, tomorrow. A little overpriced on the rent, but owner seems willing to negotiate, and I’m taking along my rental comps I’ve collected over the past 12 mths.

Ugh. Getting “evicted” when owners decide to sell really sucks. No matter how much you tell yourself that people are getting ripped off that are going to buy the place, etc. it really is stressful and frustrating to be forced to look for another place.

This is one of the big reasons that I bought a place. I vowed never to be at the mercy of a landlord. I sleep a lot better at night now.

Good luck with your search.

I’m definitely ready to buy, just not right now in this insane, over0inflated, unstable real estate market.

12 more months of renting for me, then (if my theory is correct) will be a good time to buy.

We’ve been following this 3 bedroom 2.5 bath home in a nice middle class neighborhood in Roseville which northeast of Sacramento. It has been been a rental since it was originally sold for $256K in 2002. The owners from the Bay Area put it on the market back in April for $357K. There were no offers so it was quickly reduced to $346K. No offers. The owners had the outside painted a hideous green color. Still no offers. The owners switched realtors and listed it for $337K. No offers. The owners re-painted the outside to a more neutral color. No offers. They reduced the price to $334K. Still no offers. The owners took the house off the market in August and decided to rent the house out again at $1,700 month & $75 for utilities.

http://www.zillow.com/homes/1872-granite-way,-roseville,-ca_rb/

” Good luck trying to get the public to understand derivatives, options, high frequency trading, or how the bond market works”

After the 60 minutes ep and the book “flash boys”, everyone knows how HFT works:

It’s front-running, now with silicon!

And just like recording radio.. suddenly everything changes with silicon..

oh wait.. it’s just corruption in the SEC.

Leave a Reply