Social Distancing Out of California – What Does the Migration out of California Mean for the future of Real Estate.

As we embark on a New Year, we can now look back on 2020 and conduct an analysis on what is happening on the ground here in California. Overall real estate prices nationwide did amazingly well amid the pandemic. Even though sales volume was low, record low interest rates, mortgage forbearance, and people being stuck in place, real estate overall did great. Although in places like California, we saw a record number of young people living at home with parents from an already high number. Yet we saw some high profile moves out of California including Tesla, Oracle, and Joe Rogan and they all started singing a similar song: high taxes, NIMBYism mentality, and ultimately a place that is getting too expensive for most working-class residents. And while home prices went up, if you look below the headlines there is a major shift happening.

Where are California Sellers Going?

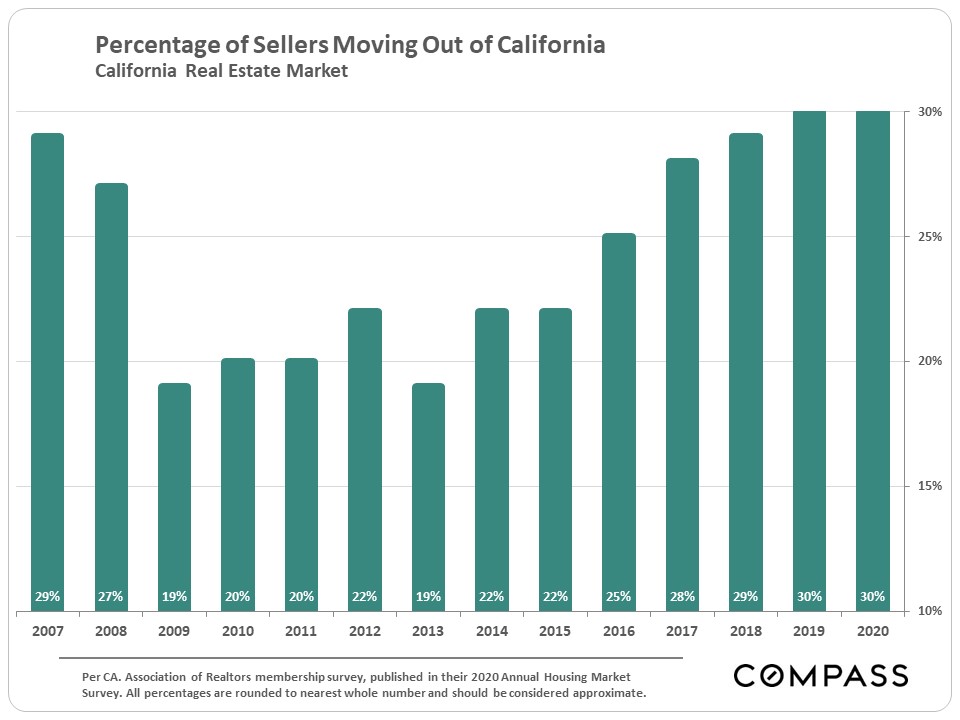

A record number of people selling California homes left California:

A stunning 30% of sellers of California homes left the state per a survey conducted by the California Association of Realtors (CAR). If you look at this chart, this is an ongoing trend that merely was accelerated by the pandemic. You have places like Los Angeles with $1 million crap shacks for Taco Tuesday Baby Boomers and then a short distance away, you have working-class areas of essential workers living like sardines (so is it any wonder the virus is exploding in LA even though we have some of the toughest lockdown restrictions?). All of this is predictable since telling people to stay in place yet not replacing their income is not going to help. People are going to opt to feed their families even if it means risking their health.

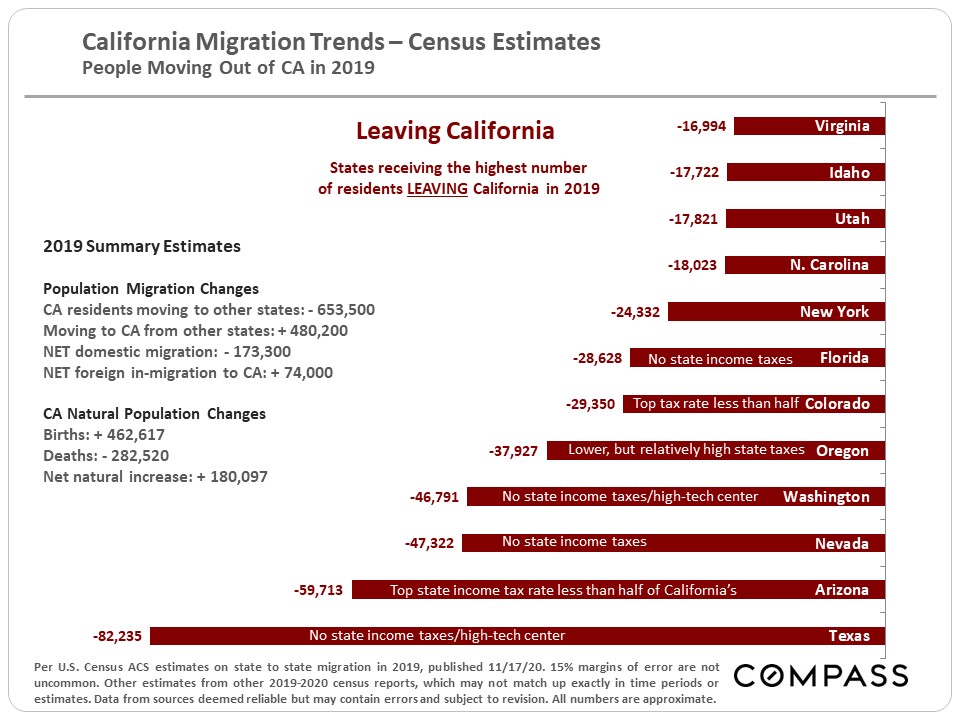

It is too early to get a full scope of what states people are going to for 2020 but Texas is a big winner here so far:

This chart is worth exploring for 2019. You had 653,500 California residents leave the state in 2019. 480,200 moved in from other US states. Net domestic migration was -173,300. You then had 74,000 in-migration from foreigners but that number is going to plummet for 2020 because of Covid-19.

Look where people are going. Texas is the big winner because they have no state income tax and actually have growing metro areas in Dallas, Austin, and San Antonio to name a few with affordable housing. When it comes to weather, Californians for the most part like the sun (other top states are Arizona and Nevada). I imagine if we broke the data down further, we would find SoCal folks going to Texas, Arizona, and Nevada and NorCal people going to places like Washington and Oregon for the most part.

Overall this trend is likely to continue into 2021 as people realize that if you want space and want to raise your family in a home without paying inflated prices for cramped quarters, then looking at another state may be an option. Millennials are becoming bolder in their moves since they now have a taste of the experience of working from home and older boomers realize that the office theatrics are not necessary in the 5-day 8-5 work week. Look at the companies that won this year (Amazon, Microsoft, Tesla, etc.).

But maybe international buyers can save California?

International Buyers

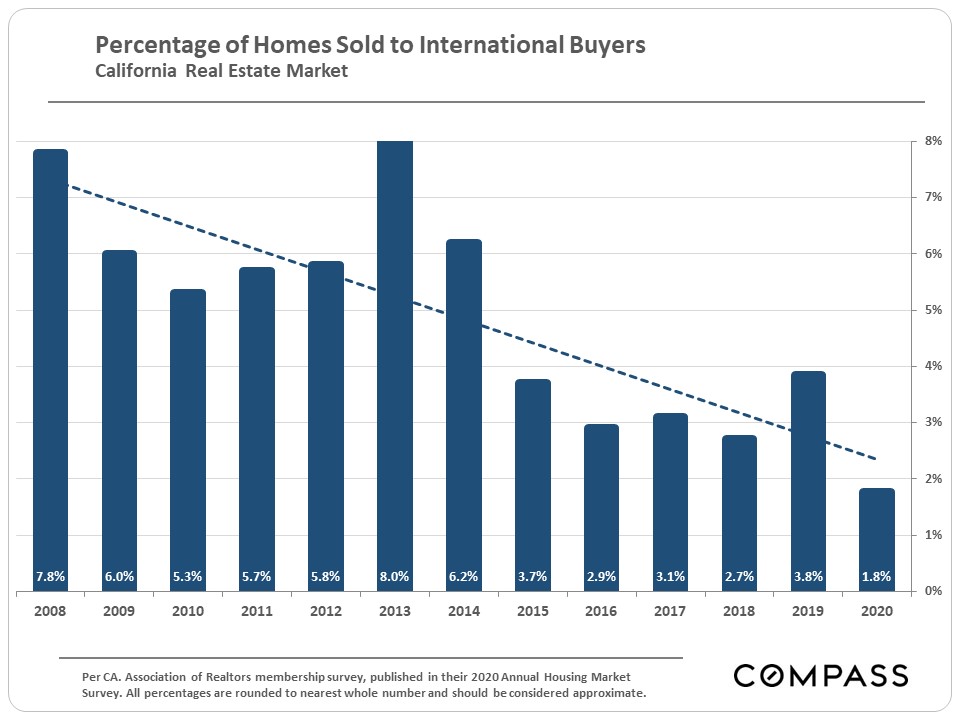

It is unlikely that international buyers will save the market in the long-term:

You already see that home buying by international buyers was going down even before the pandemic hit. It hit a near record low recently and you need to keep in mind that in California, most of the international home buying came from China. Given the recent politics and our current outbreak here in LA, some of the shine of California has certainly been washed away.

These trends while accelerated by the pandemic, were already baked in given that in California nearly half of renters’ income goes to rent. And given California is a renting state, most people basically work to pay the rent or the mortgage on a crap shack. So the choice is clear for many working-class residents of California and given most were stuck at home for most of the year, they realize weather doesn’t matter much if you are stuck in your home office needing to work – might as well get a nicer and bigger place for the family.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

154 Responses to “Social Distancing Out of California – What Does the Migration out of California Mean for the future of Real Estate.”

Home purchases declined for the third month in a row, California is swirl the bowl ladies and gentlemen

https://yhoo.it/3pu3v1M

If you purchased in the last 24 months? you’re fucked

People from Cali have always been smug. this rocks

Nearly all of the people that left California are broke and could never afford a home in California anyway. So what.

A few wealthy ones left, but even more wealthy people moved in. No big deal.

jt

You are not entirely off base. There is a group of older Californians who did poorly in the crash of 2008, who either have since gotten an inheritance, or still have some home equity who are forced by circumstances to move to cheaper real estate markets. I know several myself, including one family planning a move to the prairie for economic reasons. Unfortunately, a lot of the top destination states have gone up in price this last year, so more of them will have to move to “flyover” country where prices are still low enough. Look at prices in Bend, OR vs prices in the prairie states. Those states aren’t showing up in the Bloomberg data I posted or the Dr’s destination list, so they are still not the majority of movers.

I agree, California is a tough place to live, but many are successful. Put a For Sale sign in your yard and your house will sell quickly.

I paid $7,000 in state income tax last year, BFD, if you’re leaving California because of this, you must be struggling.

If you paid $7K in state taxes you made shit money for California. No way you could buy a house in California on that income alone……not possible.

Nearly all the homeowners in CA are broke too. 😛

Here in Woodland Hills houses are selling for $50K-$200K over asking. It’s bringing wealthier people. Also the homeless well cleared out by judge order I’m sure it will eventually pay dividends economically. Not everyone is broke people.

I said nearly everyone, and was being facetious.

A family in Alabama has more disposable income these days.

No es bueno.

I see a lot of equity rich Californians but they are cash poor and house rich. The industries in Silicon Valley, Silicon Beach, Pharma in OC and San Diego has bubbled home prices. People in other jobs cannot earn $200k+ each year just to afford a shack. They can move to TX, NV,AZ,CO, or FL and dramatically improve their financial situation.

Apart from the nice weather we used to have year round and views near the coast, what is so great about California?

Diversity, Int’l food, outdoors activities, shopping, entertainment can all be found in cities of the states I mentioned above. Your living situation improves along with being able to invest more. Many of them see the light. Its not all $10–20$/hour people moving out.

there’s more wildfires, crime, traffic hell, and extremely out of touch political leaders . There are better alternatives and they found it.

Probably true. In fact the electric car company Rivian which does engineering in Irvine force some workers from much cheaper Plymouth Michigan to move to Irvine they were pissed.

Lol! You dont get rich by spending more money Einstein. Especially, when the state is so poorly ran that the only way to keep the state afloat is by taxing on top of taxes.

This article lists the states Californians are moving to:

https://www.bloomberg.com/opinion/articles/2020-01-09/where-people-leaving-new-york-california-and-illinois-are-going

I noted that Oregon is #4 on the list. I have been thinking of upgrading my rental house in Oregon and selling it to finance a real estate purchase elsewhere. It is not near Portland, which isn’t necessarily good. Portland suburbs have had a phenomenal run-up in rent costs and sales. In fact it is rural, 25 miles out of town. But it does have internet and cheap electricity thanks to the Co-Op which gets hydro power. With tele-commuting, who knows who would want to live with bears and beavers as neighbors?

The link I provided is similar to the graph presented by the good Dr, but is more long term data. Oregon does have very low sales tax, and relatively low property taxes. There is a Prop 13 like limit on RE tax increases. The income taxes are similar to California, but if you are retired and depend heavily on SSA payments, you are way ahead there. Like CA, OR doesn’t tax Social Security income.

“Oregon does have very low sales tax”

I thought that there is no sales tax in OR; am I mistaken?

No sales tax at the register, but there are a few hidden sales taxes on certain products and local taxes.

“Oregon is one of five states with no statewide sales tax, but Oregon law still allows municipalities or cities to enact their own local sales taxes at their discretion. Ashland, for example, has a 5% local sales tax on the sale of prepared food.

Oregon has no sales tax, it’s sneaked in as a tax on business who of course pass it on. But the taxes in Oregon are lower than Cali, my wife and I are buying a place in So Cal asap. But out in the desert where the p tax is lower.

Oregon passed a property tax law similar to Cali, but instead of 1 1/2% they made it 3% and they have mass ways to cheat around it as they have done to us. In some cases our actual tax increased 30% in one year.

ttim,

My assessed value in Oregon is less than half of what the County says is the real market value. I have owned the property for a long time. My tax this year was 8.6% higher than last year. The year before, then increase was 2.3%. So Oregon taxes are going up faster than California on a percent basis. It takes about three month’s rental income to pay the taxes and insurance. I assume that if I bought in Oregon now my taxes would be more than double, kind of like California.

What’s the point of living in California if you’re in the desert?

There are more reasonable desert states to live in.

Bob: “My Republican friends seem to think more foreign aid is bad. However, they think we should have military bases in these same countries. Such a paradox.”

I: SOL gave you already a good rebuttal. No point for me to reply to all your comments.

As you know there is a big difference between conservatives and republicans. For example, Romney and McCain is/was republican, but none of them is conservative.

I have conservative friends and all are against foreign wars and imperialism – the corporations win and the middle class disappears.

McConnell is a republican and a globalist. Ron Paul is a conservative. The difference between the two is like day and night. Romney is more like McConnell – a globalist. Like I said before, I don’t like globalists, period; it doesn’t matter to me if they have R or D after their name.

I really enjoy reading your comments Flyover, you know exactly what your talking about and I 100% agree with you. Globalism is an absolute cancer to a country like the US. Wealth is like thermodynamics or osmosis, it flows from high concentrations to low concentrations until an equilibrium is achieved. The US a very wealthy country and heavily involved in global affairs. In a globalist world, our wealth will flow out of our country. We, as Americans, will never benefit from globalism. This is one of the main reasons why this “bubble†is not a bubble at all. This is globalism in the making and like it or not, our new normal. One of the reasons CA is more expensive is because it’s pretty ahead in what globalism will inevitably do to the rest of the nation.

So there will eventually be $1M crap shacks in Austin too?

I’m sure there are already $1M crap shacks in Austin if the location is perfect. Land value and rezoning is what gives birth to $1M crap shacks. Before you judge that crap shack, try to understand where the value comes from. Sometimes that dingy old 200 year old house that’s been abandoned for 30 years demands a 7 figure sales price because it’s located in the “Fifth Avenue†of its respective major ritzy part of downtown financial and commercial hub. Zoning probably allows a 4 story mid rise building and if one were to follow thru with the demolition and build, they’ll be sitting on a gold mine that they got for a steal. But people have a hard time looking past the building and not seeing the vision that plot of land can manifest into.

Of course you still have $1M crap shacks that literally can’t justify half the sticker price under current or future zoning. I’m bullish on RE but not THAT bullish. LA is one market I just stay away from. I’ll never understand that market nor do I care enough to. Money can be made literally 40 miles in any direction from that hellhole.

I think Flyover and myself were separated at birth and Ron Paul is our biological father, haha.

All joking aside, this is 100% spot on. I thought in 2008 people would start to awaken, but sadly it’s gone the other direction. We as a society are dumber than ever…

The cash holders are the biggest losers.

Check out cryptos….Bitcoin over 30k now!! move your cash into Stocks, RE and Bitcoin…..

To cash holders waiting for a crash….sry guys….its going to be painful to watch asset classes explode in value in 2021.

I’m with you on this one. I’m literally throwing cash at assets faster than it comes in. I’m extremely cash poor. And I wouldn’t have it any other way.

The question isn’t where to put cash, it’s what is the cash for.

I have no idea what you’re asking but just buy RE or gold. Some people just like things they can see and touch so those are two great assets right there. Never go wrong with that if you’re not comfortable with non-tangible assets.

Turtle, if one would have put that 1200 stimulus check into bitcoin back in April 2020 you would have made 411% as of Jan 5th 2021. Cryptos are going nuts this year with all those institutional bitcoin buying. Put at least a few percent of your net worth in crypto.

I didn’t get a stimulus check and I don’t have a crystal ball.

Scared money don’t make money. Holding cash is a losing position, just keep that in mind.

Being scared of inflation causes people to gamble their cash intended for near future purchases into Bitcoin and stocks. Stocks are for the long-term and I contribute the right amount each month for retirement. Most of my assets are in stocks, bonds and real estate. Only a fool (or someone scared) gambles money they plan on spending in the near future. That’s why I said the question is not where to put cash, but what is it for.

Doesn’t matter – plenty more lined up to buy those CA homes. Houses in my area of Sacramento Eastern subs are selling $30k over asking, with 10-30 bids. It’s true home sales have dropped… because there is NO inventory!

You’re buying into the “No inventory†half truth and I say half truth because it’s not the dominant driver in price appreciation. We’ve had low inventory for years why the sudden jump now? Obviously it’s not affecting price movement as people make it out to be. You just said Sacramento which if prices were to double would still be a steal to Silicon Valley tech nerds that are permanently working remotely. You have entire droves of cash hoarding professionals that hit every suburb in NorCal like a tsunami catalyzed by low interest rates and what does that get you? Exactly what you’re seeing. Everything makes a lot more sense when you look at things for what they really are and not just some talking point you see on contrarian blogs that have been dead wrong for years now.

OMG….

Cg vs NA….

Supply Side vs Demand Side economics!!

What about supply & demand?

I’ll carry over my reply to Bob from the last thread.

Bob, you are all over the map, and full of contradictions.

Bob: Trump has been the biggest … Isolationist since Hoover (or Mussolini) …

Huh?

Isolationism means NOT getting involved in foreign wars. A GOOD thing.

Mussolini invaded Ethiopia. How can you call Mussolini an Isolationist?

Bob: the Republicans … favor … more for foreign governments. Trump … wants to maintain their military bases.

Foreign aid and military bases are NOT Isolationist. If you think Trump supports these, then how can you call Trump an Isolationist?

If you oppose foreign aid and military bases, YOU are an Isolationist … which you condemn. A paradox.

Bob: My Republican friends seem to think more foreign aid is bad. However, they think we should have military bases in these same countries. Such a paradox.

So do you oppose both? (I do.) If so, congratulations, YOU are an Isolationist.

Bob: Are you an Isolationist? I’m sure you know, under Presidents Harding, Coolidge and Hoover in the 1920’s, this led to the rise of Communist Russia and Nazi Germany.

So you oppose Isolationism? But you also oppose overseas U.S. military bases? How do you propose to stop the “Communist Russia and Nazi Germany†of tomorrow without overseas military bases?

I am an Isolationist. America First. No foreign aid. No overseas military bases. No interference in foreign wars. Foreign dictatorships are not our problem. Let’s just make sure we have a strong enough defense for ourselves.

I am consistent.

You, however, are confused and all over the map. You attack Isolationism, yet want us to stop foreign dictatorships, yet also oppose overseas military bases.

But if you oppose Isolationism, don’t worry — Biden and Harris will provide MASSIVE amounts of foreign aid, EXPAND overseas military bases, and USE them for a war or two.

If you love war, and hate Isolationism, you’ll love the expensive, globalist wars that Biden and Harris have in store for you.

“Bob, you are all over the map, and full of contradictions.”

Please re-read my post. I am not full of contradictions. I am commenting on the current policies and state of affairs with this administration. That is a steaming mess of contradictions.

If you want my opinion, it lines up mostly with the incoming administration.

1) Not isolationist. We need a presence in the world both with military and aid.

Otherwise, there will be many more people like Flyover who are forced out of their countries to the US by ruthless autocrats. This responsibility must be shared with the rest of the world to be effective, so a strong UN.

2) Pro 1950’s MAGA tax structure. America was great in the 1950’s under this structure. Sorry 400K+ earners, you might have to pay more to narrow the wealth disparity.

3) A living wage. This will drive more capitalist spending and drive up home prices.

4) Pro fair global capitalism. Tariffs have been proven not to work many times.

5) Pro infrastructure improvements.

6) Pro law and order. People violating laws should be punished.

7) Pro Constitution. Politicians who encourage violating the Constitution should be severely punished. I really don’t care if someone kneels or even burns a flag. It is part of the First Amendment. I don’t care if someone owns 100 AR’s as long as they are trained on storage, security, and usage and severely punished if they infringe on anyone’s right to life. That is the Second Amendment.

Just my opinion.

Bob: “Pro 1950’s MAGA tax structure. America was great in the 1950’s under this structure. Sorry 400K+ earners, you might have to pay more to narrow the wealth disparity.”

Correlation is not causation!…Very important!…

What is the real cause for the fast US development after WWII? It was the only advanced economy standing selling to the whole world at monopoly prices with almost no competition. High taxes were not the cause of growth. High taxes are anti-growth. The reason for the high taxes were to mop the liquidity from the market to avoid mass inflation (all the money in the world were coming to US).

The opposite is true today. All policy makers are afraid of deflation. Increasing taxes mops the liquidity from the market and you have even a greater deflation. That is the reason why taxes and interest were coming down in the last few decades – DEFLATION.

Today US is competing with the whole world and lots of advanced economies with lower labor cost than in US. The only way to increase wages under these conditions is to decrease the purchasing power of the US dollars (exactly what you see in the markets today) – massive deficits and printing of money, coupled to helicopter money. Yes, wages will increase but the standard of living will decrease for most people regardless of who is in power. Trump was just slowing the trend. Biden will accelerate it. Biden is a catalyst for change, in worse. You’ll live and see.

” Pro law and order. People violating laws should be punished.”

The whole Summer, while ANTIFA and BLM were burning our cities, I never heard you condemning them or express your indignation in any shape or form. Why a sudden change of heart?

You say, “Texas is the big winner.” What makes you think it is a “win” to have a higher population? And beyond that, more Californians?

Real estate owners in Texas see the most price appreciation in the country. That’s why it’s good, their wealth grows the most and the fastest YoY compared to other states.

TX.does indeed have no personal income tax, but does have corporate income tax. Also has very steep property taxes.

OTHO, Texas is a “homestead state,” offering strong protections (including from property taxes) for the house you live in: https://lonestarlandlaw.com/homestead-protections-in-texas/

The amount of property tax actually paid in TX is not any worse than in California because the homes are valued at 1/2 to 1/3 less in Texas. It’s only the RATE that is higher.

The RATE, people!

Not to mention retired and disabled people don’t have to pay any property tax whatsoever until they’re dead, if they so choose.

Turtle,

Californian in Texas

BTW, I’ve owned three companies in Texas and never paid a dime in Franchise tax (don’t even need a business license from my city). Franchise tax in TX doesn’t hit businesses with revenue under $1,000,000 (great for small businesses and solopreneurs). California actually taxes companies that have a loss – and let’s not even talk about income tax. California hates businesses and I am insane for planning to move back.

Turtle,

Misses family

Arizona passed Prop 208 so now, our top tax rate for individuals earning over $250k and couples earning over $500k will pay an additional 3.5% income tax rate. Teachers union Red for Ed held the state hostage to walk out strikes. Even now, with the measure passing, they are threatening walk outs over Covid. The previous income tax rate topped out at 4.5% so now, will be one of the highest marginal tax rates in the country. We also have high sales tax rates and in some areas, property tax is high. Welcome to Arizona.

That’s too bad. AZ will lose some high earning California exiles to Nevada and Texas.

Still, not nearly as bad as CA’s top tax rate. Holy cow. It’s so shocking to see a state destroy itself with one bad decision after another.

We’re seriously reconsidering ours plans to move back to CA.

Virginia is on the list. Virginia has food taxes, real estate taxes, personal property taxes, you name it. If VA could tax the air you breathe they would. However, taxes are somewhat lower in Southwestern part of the state and real estate is cheaper there, too. Internet is NOT high speed and health care access can be a pain unless you are in one of the cities. Northern Virginia is very, very expensive and crowded/

We are moving the east side of TN for 6.5 months a year, no income tax on earned income, 6% on “passive”, “everything” you consume (ok not really everything, but electricity and gasoline) is half the price it is in SoCal. Keeping the house in CA until we are too old to come back and forth or it looks like they will pass this crap:

Dec 18, 2020 — California’s Legislature is considering a wealth tax on residents, … “Hotel California†lyric: “You can check out any time you like, but you can … If Bill Gates spent 60 days a year in his Palm Desert home, for each … Here’s Why.

We’re already tired of Oldsome and his antics.

It’s not that easy escaping California taxes, even if you live here for less than 6 months a year: https://www.palmspringstaxandtrustlawyers.com/the-part-time-resident-tax-trap/

I was, for many years, a part-year resident of both California and New York. One’s tax situation becomes … complicated. That’s why I’ve always relied on accountants.

You’re still gonna have to pay CA income tax for 4.5 months a year. When you combine that with the cost of maintaining two homes (two lives, really), is it worth it? We looked at doing something similar by staying in Texas while spending the hot months in a condo in San Diego, but it doesn’t add up in terms of added cost and effort. California really wants people all in or all out. They’re nasty with those snowbirds in Rancho Mirage.

TN is awesome for taxes on all fronts. Truly one of the most free states.

TN, in my opinion is the best administered state in the union, even with the disadvantage of being landlocked and high humidity – the smartest politicians and the least corrupt (comparative to other politicians). Nashville, like all democrat bastions, is the worst city in TN and the most corrupt.

I think that ID is the second in terms of administration, but drier. The winters are also colder than TN. Still, stay away from Ada County and Boise.

San Ramon, CA Housing Prices Crater 33% YOY As Tech Layoffs Expand Across Northern California

https://www.movoto.com/san-ramon-ca/market-trends/

As one Bay area broker shared, “smart money liquidated months ago. There’s nothing left but the crying…. and falling prices.â€

Look out below, oopppsss, just tripped over a homeless guy

Who will pay the rental income missing for 12 months now? Renters will not pay that money back and just leave. The landlord is 30,000 dollars in the hole. Who picks up that tab?

Who picks up the tab?

Sometimes the landlord and sometimes a combination of landlord equity and taxpayers money. The politicians use the landlord’s equity to further their political careers by buying votes with someone else money.

If the landlord leaves the key to the banks, FannieMae and FrediMac (aka taxpayers) foot the bill. Indirectly, everybody pays in lower standard of living, the dollar buying less and less because of Trillions and trillions printed to bail out everything in sight.

If the landlord had the property paid in full, the eviction could not be stopped. The executive order applied only to the properties with a mortgage.

With the new change in political landscape, prepare for even more trillions to be printed till you’ll buy a loaf of bread with a $100. Remember, government does not create wealth and money are not wealth. They create currencies which are a medium of exchange, but there is not too much to exchange it for with the coming lockdowns (Biden said so, not me).

Two things could happen:

1. Democrats keep their promises and you see massive inflation.

2. Increase taxes a lot for the average person to control inflation. Remember this – taxes are for personal control and inflation control. The government does not need your money and mine. As they showed this past year they can create as many trillions as they like.

In both situations, you’ll lose in purchasing power and standard of living which is exactly what they want – more natural resources for them and their children and less for you. That is all you need to know about global warming and lockdowns.

We need a massive inflation decade in order to get things under control in the US. Park your money outside of USD. Good luck.

The stimulus bill contains $25 billion in rental assistance for back rent and utilities. It covers 12 months of rent/utilities paid directly to the landlord or utility company. You can get an additional 3 months if there’s money left over.

If I had tenants who qualified, I’d be helping them fill out the forms so I could get paid.

Crypto is skyrocketing.

Bitcoin 40k

Ethereum almost at its previous all time high. Once Ethereum exceeds its previous all time high it will Be moon time.

M, you’ve been calling it! I own a small percentage of a bitcoin, and a few Ethereum coins. I’m all in on crypto, if my wife let me. She’s a non-believer I’d love to hear your strategy and predictions.

Your Ethereum will do extremely well.

I dollar cost avg. institutional fomo is still strong and grayscale for instance buys more bitcoin daily than newly mined bitcoins! Ethereum will outperform bitcoin though. The gains will be life changing money.

Not only in real estate but BitCorn- a fool and his money are soon parted, lmao

BTC price eyes 30% correction: 5 things to watch in Bitcoin this week

https://cointelegraph.com/news/btc-price-eyes-30-correction-5-things-to-watch-in-bitcoin-this-week?utm_source=Telegram&utm_medium=social

Crypto Carnage Erases Over $200 Billion In Market Cap

https://www.zerohedge.com/crypto/crypto-carnage-erases-over-200-billion-market-cap?fbclid=IwAR2n0pQnQ1njB_IxcfIoqHOEfs51JqWlvfkNTBc2ZWP5UA4kWFExx2dDRXg

Life’s Hard, But It’s Harder If You’re Stupid- John Wayne

After increasing several X you need to backtest support levels.

The crypto market cap reached 1T for the first time and Bitcoin is over 30k. Previous all time high was 20k.

Invest in it and you should have no problem coming up with a downpayment.

Columnist Lansner of the OC Register has a headline article on Calexodus (my term. not his).He says a recent poll showed 26% of residents were thinking about leaving. From 2017-2019, 3% actually left. He then goes on to list the states with the best affordability by category:

Housing: Mississippi

Services: Alabama, Mississippi and Tennessee (tie)

Goods: Nevada

On the other side of the economic equation:

For income: Massachusetts is #1.

Lowest Unemployment: North Dakota

Lowest taxes: Alaska

He then went on and calculated take home by figuring in unemployment and taxes and Massachusetts was still #1.

Then he formed a buying power index and the order was:

1 Massachusetts

2 Connecticut

3 Washington

4 North Dakota

5 California

He concluded the political climate, desire to work remotely and retirement were probably more important than economic issues. For the last two, a lower cost of living is a big driving force for moves. You take your California wages or retirement income and move somewhere that costs a lot less. He thinks that the #1 destination (Texas ) wins on a number of levels.

I know someone who lives in one of the top 5 buying power index states (but not in California) who is considering a job where he will work remotely, except for one week a month where he will be on site in a town 500 miles away. He’s strongly considering it.

Buying index dont mean much.

The majority of Ex-Cals migrate as follows

So-Calrs go to Texas, Arizona and Nevada in that order

Nor-Calrs go to Oregon and Washington.

(others go elsewhere of course)

I would tend to agree with this considering that in September I moved from San Diego to Dallas.

The average disposable household income in Alabama is higher than in California these days thanks to the cost of housing. Most people not affluent that didn’t buy in 2012 or 1980-something must be thinking of leaving.

Huntsville Alabama has the job market. Mazda=Toyota, Jeff Bezos’s Blue Origin engine facility. Its called the rocket city. In fact the space command is switching from Colorado Springs to Huntsville. If you are interested in Ohio, Franklin-Delaware Counties, most of the finance jobs in Ohio are there. Delaware median income is higher than LA at 100,000.

I am not a mortgage industry insider, and I currently have no mortgages. I tried to do a search on the proportion of 15 mortgages being written. i found one article from two years ago that stated that 87% of mortgages were 30 year-repayment option mortgages. The author was anti-30 year mortgage. He stated:

“Americans are socialized to think that buying a house and getting a mortgage means being a “homeowner,†but the more debt you have and the less means you have to service your debt, the more it’s just way to be a highly leveraged real estate speculator.”

U.S. household debt rises above pre-pandemic levels due to mortgages

https://www.reuters.com/article/us-usa-fed-debt/u-s-household-debt-rises-above-pre-pandemic-levels-due-to-mortgages-idUSKBN27X27B

“Total household debt increased by $87 billion to $14.35 trillion in the three months ending Sept. 30, the New York Fed’s Quarterly Report on Household Debt and Credit found.”

“Mortgage balances increased by $85 billion to $9.86 trillion, driven by a combination of refinancing and home purchases. The $1.05 trillion in mortgage originations was the highest since a refinance boom in the third quarter of 2003.”

“Households reduced their credit card balances for the third straight quarter, but the $10 billion decline during the third quarter was only a fraction of the $76 billion drop in the second quarter. Altogether, consumers shed $120 billion in credit card debt in the first three quarters of 2020, cutting debt by 13% from the end of 2019.”

Mortgage refinancing is hot, but using your home as an ATM is not

https://www.cnbc.com/2020/12/02/mortgage-refinancing-is-hot-but-using-your-home-as-an-atm-is-not.html

“Credit card debt is at an all-time high. Many with equity in their homes that can (and should) tap into that equity at a lower fixed rate are electing not to do so.â€

According to an old CS Monitor article, refinance loans for 15 year terms went from 8.5% to 35% of loans issued between 2007 and 2012. That makes sense. Refi loans in a falling rate market should also reduce the term of the loan (if the borrower has any money sense!). That’s what someone in my family did recently. But first time buyers probably are looking more at getting the house they want, and less at building equity. Is there anyone with 2020 data on shorter term refi and new house loans out there?

Not only in real estate but BitCorn- a fool and his money are soon parted, lmao

BTC price eyes 30% correction: 5 things to watch in Bitcoin this week

https://cointelegraph.com/news/btc-price-eyes-30-correction-5-things-to-watch-in-bitcoin-this-week?utm_source=Telegram&utm_medium=social

Crypto Carnage Erases Over $200 Billion In Market Cap

https://www.zerohedge.com/crypto/crypto-carnage-erases-over-200-billion-market-cap?fbclid=IwAR2n0pQnQ1njB_IxcfIoqHOEfs51JqWlvfkNTBc2ZWP5UA4kWFExx2dDRXg

Life’s Hard, But It’s Harder If You’re Stupid- John Wayne

Head and shoulders pattern completing on bitcoin

BS

H&S was invalidated. A dip in a bitcoin bull market has been a buying opportunity since 12 years now. Bitcoin is going to 100k this year.

A 15 yr refi yields a better interest rate and less interest pmts over time.

However if you’re looking for a lower monthly pmt then you’ll go for the

30 yr.. Generally, in Cali’s expensive market most buyers are forced to

stretch their financing and the 30 yr. is the only available option. The thinking

is that over time the lost interest money is more than made up by the

higher appreciation you’ll get here or in other growth markets. A bit riskier,

but historically has proven out. In a long term sense, that is. You’re betting

that appreciation will be greater than monthly equity build up. I don’t agree that

the 30 yr. is just a herd mentality. There’s some logic behind it. If there were a

50 yr. or 100 yr. multigenerational refi. you’d see borrowers navigating to those

also. In fact, don’t some other countries have that ?

For me, at these low rates, the 30 year makes sense. Depends on your situation.

I just wish they would offer a 30 year on multifamily buildings. Generally I’ve only

seen up to 10 yr. financing amortized for 30 yrs. with a rollover. I think the lenders

know low rates won’t go on forever and they opt to get that future higher rate knowing

that rents increase over time to cover the pmts.. They don’t occupy those big downtown

buildings for nothing.

Best to pretend 15 years is the only option. Do the math and be horrified.

Britain’s financial watchdog issued a dire warning to cryptocurrency traders Monday as Bitcoin took investors on another wild ride.

The UK’s Financial Conduct Authority said consumers who invest in the red-hot cryptocurrency market “should be prepared to lose all their money†because there are so many risks involved.

“should be prepared to lose all their moneyâ€

Firms promoting crypto investments may overstate the returns that traders will reap and understate the risks of the market, and investors who buy in are unlikely to have access to consumer protections if something goes wrong, regulators said.

“Consumers should be aware of the risks and fully consider whether investing in high-return investments based on cryptoassets is appropriate for them,†the agency, known as the FCA, said in the warning. “They should check and carefully consider the cryptoasset business involved.â€

Stupid is as stupid does, enjoy that weather.

What will happen in 2021?

Ken McElroy throws down on some important indicators

https://www.youtube.com/watch?v=n59SdRCyLG4&inf_contact_key=356d43971f801a32f30a9e598000b92b680f8914173f9191b1c0223e68310bb1

What will happen in 2021? We will see crypto values skyrocket.

Bitcoin 100-150k. Ethereum 25-30k

After the peak at $42k, it lost 25% down to $30k. It will be headed back to about $15k before people line up to ride the roller coaster again. When the chart is nearly vertical, rational investors recognize the pyramid scheme and cash out.

Your post is funny! Especially by looking at the charts/price right now 🙂

You think we will see 15k ever again! Good luck 🙂 btw., check out Elon musks Twitter profile. 🙂

Crypto to me sounds like the old Wild Wild West during the gold rush. You could

make a fortune or lose a fortune – and quickly. Appears like it’s all in the timing.

And I’ve always sucked at timing, even in the stock market. Good luck. Just

don’t go into it with eyes wide shut, and don’t bet the farm.

Crypto moves in 4 year cycles (see Bitcoin halving).

After each halving event the price increases exponentially due to the halving of new supply (mining rewards). If you would have bought the previous top at each market cycle you would be very rich by now. It’s not a rich quick kinda game. It’s about the willingness to explore a new asset class and about putting in the time to understand the market. Dumb money always comes in at the end. Smart money is still buying (I consider the institutional money as smart money). I am still accumulating as well. Dollar cost avg is your friend. If you buy, don’t panic sell. Buy the dips in a bull market.

Don’t feel bad, nobody can time the stock market. Those experts sending out newsletters do worse on average than your average Boglehead sitting back and doing next to nothing with their index funds – in the long term (which is all that matters with the stock market).

Hysteria has arrived, people.

Hey M, are you close to being able to turn a profit if you were to sell?

Hey Turtle, my house appreciated quite a bit. The next phases saw price increases and the models are priced a lot higher than what I paid. However, with 6% of the price going to realtors and other fees I would nit really make money on a sale yet.

I don’t think I will ever sell this home though. Just refinance and put a renter in.

Rates are so low, 2.5% for a 30y

https://www.cnbc.com/2021/01/19/biden-looks-to-give-a-big-boost-to-homebuyers-and-builders.html

Biden is proposing a $15,000 first-time homebuyer tax credit, which could be accessed immediately by the buyer, thereby serving as down payment assistance. … First-time buyers, defined as those who have not purchased a home in at least three years …

Hah, that’s like 2% down on the median priced home in CA.

“First-time buyers, defined as those who have not purchased a home in at least three years”

Serious? That’s hilarious.

15,000 tax credit if you haven’t purchased a home in 3 years?

I’ve purchased/sold 4 homes in my lifetime and I seem to qualify as a first-time buyer.

I wouldn’t have called it a first-time buyer incentive but it should stabilize housing prices when Biden raises mortgage rates to a rational level. I believe interest rates are going up and this will be enacted to stabilize housing.

I think it applies to most of us. Except M, who has to wait another 2 years. Well within the Biden first term. 2 years is nothing for an investment.

This seems like really poor timing for this kind of incentive. Like pouring gasoline on a fire. Some of his other proposals, like incentivizing local governments to rezone for more density make a lot more sense considering the main problem is lack of supply and ridiculously high prices. I think I’m gonna sit this market out for a while and see what happens. My best guess is all this spending will finally cause interest rates to rise.

@Sheetrockero I feel much the same, but imagine they can keep interest rates low for at least a couple years. They’re kicking the can down the road in a major way and thus making the problems even bigger. It’s unnatural. This all necessitates a bigger correction.

While the drunkards are gorging on Bitcoin and tech stocks, a few others have enough discipline to maintain dry powder and they will be the ones rewarded when reality hits. The gamblers can say all they want against CD’s and high-yield savings but nobody that’s well diversified is concerned about erosion when they have their eye on the target.

I mean, don’t people realize that Uncle Sam is inflating this bubble, at least in part, so that his wealthy cronies can swoop in and gobble things up at pennies on the dollar? Just remember that even the little guys can keep some dry powder and get a piece themselves.

DISCLAIMER: I’m just guessing like you! But, I think common sense is on my side. Certainly don’t listen to gamblers running on their emotions.

https://www.dailywire.com/news/biden-reveals-day-one-executive-orders

Biden’s first day executive orders to “extend the pause on student loan payments and continue current restrictions on foreclosures and evictions.”

Pretty soon everything will be free and nobody will have to work again. Utopia!

Extend and pretend, kick the can… I feel good, I feel great, I feel wonderful!

Stay diversified,

Turtle

There have been a lot of posts about crypto lately. I’m with Warren Buffet on this one. I just don’t see the value at this point, other than for gambling and making money laundering easier. The one thing Bitcoin and the others are supposed to do is act as a medium of exchange with a stable value. Considering the crazy volatility in the crypto market, crypto currencies are really bad at what they are supposed to do. I am a bit worried about all the government spending debasing our currency (USD), but it would be something like 3% per year at most. In contrast crypto currencies seem to be able to go up or down 10-20% in a single day! How could a (legitimate) business possibly feel comfortable writing contracts with that kind of volatility? Maybe there is a future for crypto once it grows up and stops being so volatile, but at the moment the only thing it is good for is speculation and transactions that you want to keep off the government radar.

Elon Musk has a company inside SpaceX called Starlink. This company’s terminals can access the internet virtually anywhere on earth once the network of satellites is up and functioning. There are other satellite internet ventures as well. Cryptocurrencies in reality exist only on the internet. So an internet outside the control of governments would be a big shot in the arm to crypto. Satellite internet can bypass governments in theory as long as independent governments can exist. Look for repressive governments to ban satellite internet terminals.

Crypto agencies located in tax havens connected to customers around the world by satellite internet is a sure thing. However, crypto transactions do not go unrecorded like handing gold coins or paper currency to someone in a dark alley. Crypto will only be truly useful when its value is as stable as physical exchange media (e.g. gold and silver). Paper currency in reality isn’t much more stable than crypto. The big difference there is that paper currency goes down in value over time while crypto goes up and down.

A lot of people talk about volatility when it comes to crypto. Never heard of stable coins that don’t move in price and are pegged to the dollar?

Bitcoin isn’t meant to be stable. The price per coins goes up over time tremendously. If you would have put your stimulus money into bitcoin you would have a good junk of your next house down payment. From its low of 3k, Bitcoin rallied to 42k. And it’s not done for this bull run.

Bitcoin is like digital gold. You hold it to hedge against inflation and to increase your value. It’s not meant to buy your daily coffee with it. It’s bit meant to replace the dollar.

Crypto agencies located in tax havens …

Many “tax havens” are militarily weak, and only exist because their “sovereignty” is permitted by some Great Power or other. All those Caribbean islands, Hong Kong, Leichtenstein, even Switzerland. For instance, should the Cayman Islands ever pass a tax law seriously harmful to British financial interests, that law will quickly be shut down from London.

The globalist oligarchs permit “sovereign” tax havens, because it benefits them. Crypto tax havens will be permitted only if its benefits, to the oligarchs, outweighs the harm.

SOL,

Whaaat? Tax havens exist? No way? Never heard that before.

What?? They always existed??? Have people put USD there before???

Next you will tell me that the US dollar has been used for illegal activities in the past and my head will explode and my view of the world will completely change.

I agree with both Joe and M.

Tax havens have existed forever for USD.

Just the fact that Trump only paid $700 in taxes last year despite earning multi-millions in income for housing his staff while charging US taxpayers screams tax haven. I’m pretty sure Trump is not a Bitcoin fanatic.

Bitcoin just makes shielding income easier without high-paid crooked accountants.

The Reddit people would like to know since they represent the rest of us who are not concerned with havenning billions.

However, there are many in the US who are working under-the table for cash and report no income from this. At least one is whining they can’t qualify for a loan because their tax returns don’t report enough income.

How exactly does bitcoin let me not pay taxes exactly? How do I not have my bitcoin gains not taxed? You guys realize that every bitcoin transaction is recorded and openly available? This is what a blockchain is. An open ledger.

My exchange transmits my statements to the iRS. Google “coinbase and IRSâ€. Not reporting my transactions doesn’t help me. It’s done automatically. Maybe you find a country that lets you sell your crypto to their local currency without submitting KYC documentation but then what? You will have to have a bank account in that country and wire the money to a US account or are you flying out to Azerbaijan and withdraw from a local bank and come back with suitcases of cash hoping to not get caught? Maybe you can buy gold watches and hope their aren’t fake. A lot can go wrong here and the chances of ending behind bars are pretty high. No idea why some people think it’s easy to not pay bitcoin taxes?!! I wanna know how?

Well, we bought in SCV in 2016 and can now sell and pay almost all cash for a huge house on river-front acreage in Tennessee, a naturally beautiful state that is fiscally sound. I’m now WFH and the wife soon will be. The only reason we are still here is because of extended family.

Here is a chart of the US Dollar Index VS GLD, the gold ETF:

https://bigcharts.marketwatch.com/advchart/frames/frames.asp?show=&insttype=Future&symb=US+DOLLAR+INDEX+FUTURES&time=100&startdate=4%2F1%2F2019&enddate=1%2F24%2F2021&freq=1&compidx=aaaaa%3A0&comptemptext=GLD&comp=GLD&ma=0&maval=9&uf=0&lf=1&lf2=0&lf3=0&type=64&style=320&size=4&x=36&y=15&timeFrameToggle=false&compareToToggle=false&indicatorsToggle=false&chartStyleToggle=false&state=13

Note the strong upward trend of gold, and the recent downward drift of the dollar.

Here is a chart for the same timeframe for a Bitcoin exchange vs then dollar:

https://bigcharts.marketwatch.com/advchart/frames/frames.asp?show=&insttype=Future&symb=US+DOLLAR+INDEX+FUTURES&time=100&startdate=4%2F1%2F2019&enddate=1%2F24%2F2021&freq=1&compidx=aaaaa%3A0&comptemptext=BTCSTD&comp=BTCSTD&ma=0&maval=9&uf=0&lf=1&lf2=0&lf3=0&type=64&style=320&size=4&x=49&y=18&timeFrameToggle=false&compareToToggle=false&indicatorsToggle=false&chartStyleToggle=false&state=13

The upward trend is undeniable, but the volatility is stupendous. If you want to ride the rollercoaster, don’t try to jump off before the ride ends. And don’t bet the farm. One thing you absolutely should NOT do is short Bitcoin. From Bitcoin.com:

“While bitcoin has crossed a new all-time price high in 2021, traders are leery toward shorting the crypto asset. Data from Bitfinex shows the number of short contracts has been extremely low in comparison to the total number of shorts in mid-March 2020. On Saturday, January 2, 2021, when the price of bitcoin surpassed $33k, over 100 million dollars in short positions were liquidated in a matter of minutes.”

Volatility is not a smart argument against holding Bitcoin.

I rather have volatility and my asset makes me 200% annually than an asset like gold which is making me 15%. Why should I be scared about volatility? Any dip is a buying opportunity.

Just look at the 10y chart of bitcoin. Bitcoin has outperformed any asset class.

“Shorting the market in a bull run is not something that I would do. Grayscale alone buys more Bitcoin daily than what is mined. You really think shorting BTC and betting against smart money (institutions) is a good idea? When has that ever worked.”

Well that’s something we agree on. See this article on Gamestop:

https://nypost.com/2021/01/25/gamestop-shares-spike-another-50-percent-amid-short-squeeze/

Robinhood traders trying and succeeding in punishing short selling hedge funds (aka the scum of the earth).

Shorting the market in a bull run is not something that I would do. Grayscale alone buys more Bitcoin daily than what is mined. You really think shorting BTC and betting against smart money (institutions) is a good idea? When has that ever worked.

M, you are betting that a single entity, GrayScale won’t change their mind at some point and drive Bitcoin to zero. That is gambling and in my humble opinion, Grayscale is manipulating the market.

Too dangerous for my conservative ethics. I don’t gamble. I invest.

Lol

That was one example.

Grayscale, micro strategies, PayPal, square bought or are buying bitcoin. The list goes on and on. Check out Elon musks Twitter profile. His bio just says #Bitcoin now.

Bitcoin will go to 100k per coin. It’s at 34k at the time of writing.

For all the Crypto traders out there or potential crypto traders this is a must read:

https://crypto-anonymous-2021.medium.com/the-bit-short-inside-cryptos-doomsday-machine-f8dcf78a64d3

I read it but I wish I hadn’t. This is the most boring article and almost put me back to sleep. The “tether FUD†comes up every year several times. Fud means fear, uncertainty and doubt. Go back to 2017 and you will see tether FUD.

Tether is a stable coin just like dozens of stable coins.

Tether gets audited several times a year.

End of story.

Dude wake up. You’re about to lose all of your pretend money, and likely your pretend house too. Bitcoin was/is a great concept, but it’s being manipulated by Tether big time. The scam is being exposed.

Why would I lose my house and money invested in crypto?

Maybe you have missed the news that there is a federally chartered crypto bank now and that hedge funds, banks, nasdaq listed companies and insurance companies are buying bitcoin? There is no scam here. Crypto is another investment class that is going to the moon. Instead of selling I am DCA in. This year will be massive for crypto! Mind-blowing massive!

Wow!

Robinhood has stopped its little guy traders from screwing with the hedge funds that were shorting GameStop, AMC and other such short seller targets. What did you expect would happen? This article explains how Robinhood works:

https://www.vice.com/en/article/qjpnz5/robinhoods-customers-are-hedge-funds-like-citadel-its-users-are-the-product

Here is a quote:

“If the service is free, you are the product. Robinhood users thought the service was accountable to them, but actually it exists to serve giant Wall Street institutions like Citadel and other market makers,†J.E. Karla, editor of the business newsletter Contention, told Motherboard. “They will suicide bomb their own business models to protect the real powers from the consequences of their internal contradictions. When a system approaches a terminal crisis, its institutions will break their own rules to suppress elements that threaten the system’s continued viability. That’s what’s happening here. This specific episode may be over in a week or two, but it’s a symptom of something very ominous.”

The billions that hedge funds gave to elect Biden mean that no one at SEC will give a rat’s ass for the anti-competitive move against small investors made by a fake “friend of the little guy”. Nobody in that business is your friend. That goes for “your friend in the mortgage business” too.

I agree.

If you don’t let a million little Robin Hoods compete, it is not a free market.

Got GOLD ? The Dollar’s Reserve Currency Status Won’t Last Forever

https://www.zerohedge.com/markets/dollars-reserve-currency-status-wont-last-forever

Crypo, Bitcorn, trade it, don’t own it.

HODL Bitcoin

I used to enjoy all the Real Estate discussion on this board. But lately, its just a bunch of people sniffing the stock market armpits and kissing Mr. Musk asshole. Let’s stay on topic and stop dreaming of all the shit you can’t take with you to the grave.

WB,

I have said before that economics is the real topic of this blog. The “eco” in economics comes from the greek work “oikos” which means house. All of this stock market and crypto talk is about people trying to get the jack to afford a California downpayment. There is now a TV show about lottery winners buying their dream home. Your odds look better with crypto or crushing a short seller than by winning a lottery, so why not go for it?

PS You can’t take a house with you to the grave, although some have tried. Ambrose Bierce called a Mausoleum the final and funniest folly of the rich. To quote the title of an old Country song: “Six feet of earth makes us all the same”.

The financial markets are all connected. Don’t live/think in a silo.

I agree. I will try to control myself.

I left the Housing Bubble blog since it turned into a Pro-Trump election fraud blog.

I hope that blog changes since he lost over half of his readers, including me, with his 50% wacky posts.

There is much evidence that Trump won by a landslide but the election was stolen.

* Affidavits are evidence.

* Eyewitness accounts are evidence.

* Circumstantial evidence, such as statistics and anomalies, are evidence.

These all meet the legal definition of evidence. You might not think the evidence is persuasive, but it is evidence. So when the media says “without evidence Trump claims” … then the media is lying. By definition.

Why is the media lying so much?

Nor did the courts, much less the Supreme Court, rule against Trump’s evidence. They refused to even examine the evidence, finding procedural excuses. Why? Either from bias or fear of Antifa rioting, or fear of the Deep State.

After a year of extreme Leftist terrorism, vandalism, and rioting, and Big Tech and Big Media promoting censorship, hatred and lies, Trump still won on election night. Only by stopping the count in five battleground states (where Trump was leading), and suddenly switching the results the next morning, was the Deep State able to steal the election.

So ironic, that Pelosi and Clinton promoted the “Russia stole the 2016 election” hoax for several years … and now they (and Big Tech, Big Media, and the Intelligence and National Security Community) claim that doubting Biden’s “win” is dangerous extremism.

SIAB,B,

To my friends I compared the choice of Trump vs Biden to eating a cow pie vs eating a toadstool sandwich. Seeing what Biden and his friends are doing to free speech and the economies of states that didn’t vote for him, as well as what will likely happen with taxes and regulation of the sharks on Wall Street (Robinhood, Citadel, Melvin, etc.), I truly wish that Trump had been re-elected and tied up with another real impeachment trial. This one is a sham because he’s out of office and the Chief Justice won’t preside as per the constitution.

SOL, you are 100% correct.

On the “bright side”, after BLM burned the US cities the whole Summer encouraged by Maxine and Pelosi, now they are proposed for the Peace Nobel Prize!….same like Obama. How many wars Obama started in 4 years?!!!…Trump did not start any in 4 years. Welcome the the New World Order and the Great Reset. I am sure at least Bob is happy!…

SB1079 = RealEstate DISSASTOR (Values Headed LOWER)

https://www.youtube.com/watch?v=brh0N6WWGnM

It’s a party, and you aint invited! So get outside and enjoy that weather :)))

I feel the need to comment on the Good Dr.’s excellent post and not be a lurker commenting on Bitcoin.

From the people I know and work with:

1) Some long-time home owners believe they have won the lottery with their home and are cashing in for millions and moving out of state. Many to live close to children who have left long ago.

2) Some long-time homeowners know they are millionaires but love CA for the climate and beaches (and many have family who stayed) so they are staying.

3) Some poorer renters are leaving for elsewhere due to high rent. Never be a long-term renter!

4) Some even poorer renters are piling in multiple families into an apartment with multiple income earners to pay the rent. They enjoy the higher pay and the jobs offered in CA. IMHO, quality of living and space seems to be less of a concern for them.

5) Some are moving to CA for high paying jobs. They can afford rent and a small house mortgage. I have 3 young co-workers who have just moved to CA from Flyover. The CA dream still exists but you need the correct job to live it.

Large companies pay a premium to move talented people to CA. We’ll see with WFH whether this continues. These people being paid large salaries can still live the CA dream.

Thank you, good Dr. for your excellent data and comments.

The first ten posts I made on this current discussion on leaving California were on out of state real estate and the movers, California real estate and mortgages. I post a balanced view of crypto to offset the fans and the doomsayers. I had a limited understanding of crypto prior to all the posts on this blog and I appreciate the discussion which prompted me to look into it more thoroughly. Lurker indeed!

Myth about Flyover. Delaware County Ohio has a median income of 100,000 while LA is only 72,000. Most jobs in LA are restraint and hotel jobs.. There are lots of high paying jobs in Ohio its not all rust belt. In fact many Midwest states pay 20,000 more for jobs than LA/OC or even more so than Riverside or San Berandino. In fact I read an article wher La county lost people due to low pay in the so-called Flyover country.

Cynthia’s right. Disposable income is what matters. California’s disposable income is pathetic compared to much of the South and Midwest.

California seems on its way to become something like a Mexican resort city. A thin strip of wealth along the coast with poverty for miles inland. Today’s middle class families in CA don’t have the same quality of life their parents did.

WHERE ARE ALL THE BEARS?? the only one left is “realist” but we cant take him seriously.

Where is “bigRecessionInSight”. He hasnt posted here for over 6 months. maybe he’s embarrassed about the terrible call he made.

According to Zillow my house appreciated in value 70k since Q1 2020. 🙂

Thats crazy but not unheard of of new construction. Especially if the model homes and later phases sell for significantly more.

Since I signed, interest rates have plummeted which boosted my equity. Thank you FED!!!!

WHERE ARE ALL THE BEARS??

Look in the mirror.

You’ve always been the loudest bull and the loudest bear.

M doesn’t see the irony.

He is mocking bears for changing their minds.

Yet M was King Bear, he of the infamous “55 to 70% crash” prediction.

Thus, in mocking bears for changing their minds, M is publicly mocking himself.

Indeed, as former King Bear, if M hopes to heap shame onto others, he must reserve a double helping for himself.

Yes, I changed my mind and I am glad a bought a nice house back in q1 2020. Crazy it’s already been a year. Interest rates went down since then and I can refinance and lower my payment while my house increased in value!!! Buying a house was the best thing ever! I am proud of myself that I had an open mind and were able to change my strategy.

I want to help other perma bears here but it seems they have all left. Or maybe they bought in the meantime. Good for them if they did (buy)!

M, the bears all left a while ago. After over a DECADE of being 100% completely wrong, you have a hard time convincing yourself “the big tank” is right around the corner. I’m glad you bought a home when you did. I would recommend holding onto it regardless. The writing has been on the wall in CA for a long time, you will Californication on a national level soon..it will happen rapidly. Owning assets is the only way to survive in this environment. This is not a hard game to play. Just look at what the politicians, Fed, PTB are telling you and make your decisions based on that.

You are so right Lord B!

I want to buy a rental but haven’t managed to get one yet. Owning more RE is def the way to go. Remaining in cash is the worst thing one can do IMO.

We bears are waiting. Waiting until sanity returns to basically all manner of asset classes. Waiting until stocks valuations revert back to fundamentals. Waiting until everybody and their mom doesn’t think they can afford a $1 million crap shack just because interest rates are low. I’m glad I waited until the dust settled to buy my first home in 2012 instead of overextending myself during the height of the last bubble. It appreciated and we sold last Summer due to a move. I can wait until market conditions change before buying another. It might take a couple of years. Who knows. Until then, I’ll let somebody else cut the grass.

I’m happy to see my mutual funds and home value go up wildly but common sense says this is not going to continue indefinitely. The government is not more powerful than reality, which has a way of always pulling things back to earth.

Long-term, I’m always a bear. Short-term, in this nutty environment with multiple artificial factors at play, I’m not optimistic.

I get the impression, M, that you’ve experienced most of your real adult life in a bear market. And frankly, receiving an inheritance at so young an age is almost an artificial factor itself in your life. First you were a major bear then you received an inheritance and became a huge bull while paying way beyond the trend line for a house. You said you’re living the dream in that house then announced you’re going to reside in Tennessee. You’ve been all over the place in little more than one year.

It appears your emotions are all over the map. I say stop acting on them to easily. Don’t mistake your confidence for a crystal ball and don’t imagine that past performance predicts future performance in any way whatsoever.

I hope I wasn’t unkind. I like you and think people’s abuse towards you is stupid. I’m not against changing one’s mind or receiving a gift. The first is often wise and the latter is a blessing. Also, I could be dead wrong about you and where the market is headed. I’m mostly just guessing like you and all the rest here.

Stay diversified,

Turtle

Long-term, I’m always a bull, that is (not a bear). Oy! 😉

Tennessee?? Nope.

Anyone can just post with my handle since there are no logins.

I never even thought of moving away from SoCal. As you said, living the dream here.

People who told me I bought the top in Q1 2020 have since been very quiet. My house appreciated 70k since then (Zillow). The model homes sold for a significant amount more than my house. Buying new construction is a no brainer. My next rental might be new construction if I get in in phase 1.

Buying a house was the best financial decision ever. I realize now: the beat time to buy a house was yesterday. The second best time is today.

Don’t listen to the bears that tell you the market will crash in 2016,2017,2018,2019,2020,2021,2022,…

M: People who told me I bought the top in Q1 2020 have since been very quiet.

Blatantly untrue.

People have criticized you for buying at the top.

Others have expressed doubt that you even bought a house.

So no, though you might dispute your critics’ claims, they have not been “very quiet.”

Do you even read posts other than your own?

For every Joe Rogan who moves to Texas, that is the equivalent to 1000 CA Median income earners, or 460 median family incomes. 50 high earners, in the highest tax brackets, who move to Florida or Texas is having a very large impact. I sold my Brentwood home to a wealthy foreign family who will use it for one of their children to live there. Replacing a high earner with a trust fund child does not bode well for LA or CA.

Not surprisingly, rents in my Texas metro are up 10% while in LA they’re down 10%.

I have been watching a high end spec home in the 90405 zip code priced at a record setting $6mil. It reportedly sold for just under the asking price to a Chinese national for his 27 year old son trustafarian to live in….

Chinese domination is coming…wake up world!

You still heading to Tennessee?

This of course was meant in reply to M up there. 😉

Not me. I am staying in SoCal. Not sure who that other M is. There is only one real M…..me

So there is Millennial, M and M (the troll) who posts as M but isn’t M. Real M used to be real Millennial and M (the troll) has never ben either. Will we see Millennial (troll) next?

Bizarre, the comments are nowhere to be found now – not the original, nor mine, neither the reply to mine in which someone was saying how fiscally sound TN is – unless I’m missing it. Doc? Anyhow, my apologies.

Ahh, there it is: http://www.doctorhousingbubble.com/social-distancing-out-of-california-what-does-the-migration-out-of-california-mean-for-the-future-of-real-estate/#comment-1102395

Not our M, I presume: https://www.seattletimes.com/seattle-news/need-a-boost-today-be-on-the-lookout-for-notes-of-kindness-in-seattle-from-a-mysterious-writer-named-m/

When will the crash come?

From some of the people I follow, it seems that the following will happen

– Biden will juice the economy with stimulus

– that stimulus will keep housing afloat through Q1 and Q2 and maybe Q3 of 2021 but expect the collapse to start in Q4 of this year.

In the meantime, here is Ken McElroys take

https://www.youtube.com/watch?v=t8GQ6d0ZwMA

Several commentators I have read have pointed out that large retail participation in rapidly rising stock markets precedes big market crashes. The housing crash was preceded by an epidemic of liar loans and RE speculation on credit. We are currently seeing the former but not so much the latter. Housing is selling but with tighter lending standards. So I expect that a stock market big correction will cause a slowdown in real estate, but not a deep crash like 2008. I’m moving my retirement into foreign stocks where PE multiples are not so high and value stocks, plus TIPS for parking cash. Some protection against the inflation Biden hopes to create. ( He wants inflation rather than deflation, and thinks he can control it.)

Kick that can!

Crypto is exploding!!! Ethereum was at 700 in dec. It’s at 1740 right now.

Link, Cardano (ADA), lite coin ….alt coins are on fire!

Tesla bought 1.5b dollars worth of bitcoin. And allows BTC as a payment soon.

https://www.cnbc.com/2021/02/08/tesla-buys-1point5-billion-in-bitcoin.html

Yep, there are still people taking an a$$ pounding on condo-tels.

‘the California Assn. of Realtors found that 21% of listings had a reduced price’

From The Eastsider LA in California. “A recent report by the California Assn. of Realtors found that 21% of listings had a reduced price. The highest priced Eastside home sale within about the past week was a 3-bedroom Franklin Hills contemporary that sold for $2,200,000 ($198,000 under asking); the lowest was a 2-bedroom Historic-Filipinotown condo that went for $460,000 ($37,888 under asking).â€

“Here are some examples, followed by a breakdown by neighborhood, of recent price cuts on homes, condos, apartments and other Eastside properties. Silver Lake condo: $10,000 slice on a 2-bedroom unit in gated complex with 2 bathrooms, fireplace, kitchen appliances and balcony. Now asking $759,000.â€

“Echo Park one-bedroom: $30,000 reduction on a Lilac Terraces unit with floor to ceiling windows, updated bathroom, new flooring, and in-unit laundry. Located near shops, restaurants, hikes, trails and Dodger Stadium. Now asking $399,000.â€

“Los Feliz Spanish: $200,000 chop on a 2-bedroom home in need of TLC. Includes fireplace in living room, long private driveway, and backyard. Now asking $990,000.â€

Enjoy that weather, LMAO

Leave a Reply