Southern California home sales collapse by 21 percent year over year. Real estate tanks simultaneously with ending of government artificial market intervention.

As would be expected, home sales in Southern California have collapsed in near synchronization with the ending of tax credits and tighter lending guidelines. The July sales figures fell on a year over year basis by 21.4 percent. This is a significant drop in a summer month that usually has solid home sales. This is the proof that the market is merely being held up by massive government intervention and incredibly expensive tax credits that serve really no purpose except to provide a short term sugar high for the market. The size of the decline resembles the declines we saw during the inflection point of the bubble bursting. As you will see in the next chart, home sales always collapse first and then prices follow. This is how the market reacts to imbalances and many cities in Southern California are still largely in housing bubbles. The market is essentially saying that home prices are too expensive without government subsidies. It is also the case that the job market is incredibly weak even after all the bailouts and stimulus that have been injected. Let us examine the Southern California sales pattern first.

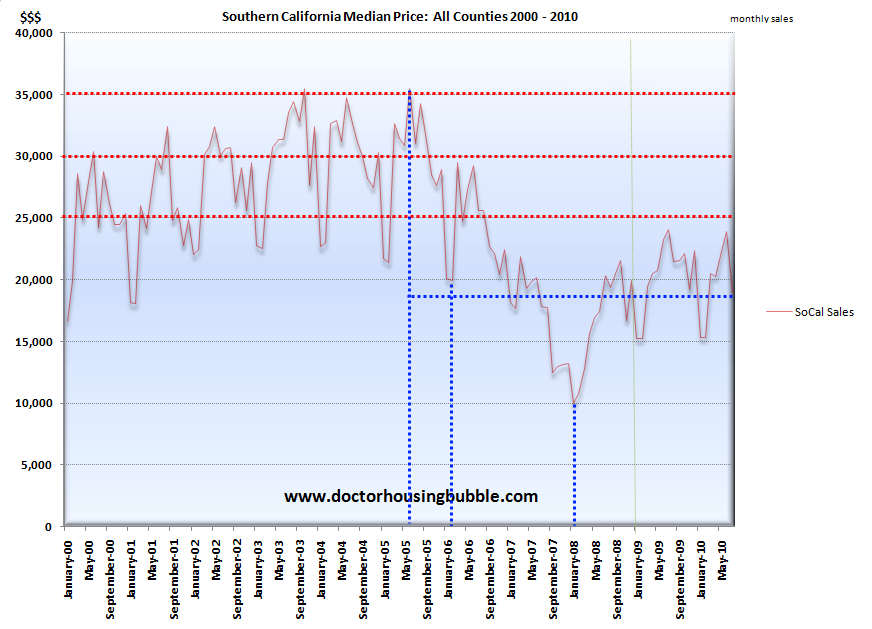

The below chart looks at home sales in Southern California:

The first thing you’ll notice is we have never come close to reaching the peak sales months of the bubble. Two months over the last decade had 35,000+ sales! The best month we’ve had since the crisis started in 2007 didn’t even reach 25,000 sales. In July 18,946 homes sold in Southern California. The average for July is 26,000 dating back to 1988 so the latest July sales figures are off by 27 percent. Keep in mind July typically is a hot sales month. If you examine the chart closely above, you can see the seasonal pattern play out each year. The dips always occur during the fall and winters. The higher sales months from 2000 to 2007 were all driven by the exotic financing days of the bubble. This recent drop is troubling for a couple of reasons:

-1. It shows that recent jump in homes sales was completely driven by government stimulus.

-2. Home sales collapsing during a peak month shows that the market is still overpriced. People would buy without stimulus or government tax breaks if prices actually made sense. The market is trying to find this level but banks and policy makers are doing everything they can to keep the bubble inflated. It isn’t working.

-3. There is a cost to all this stimulus and focus on housing. Jobs are still not here even after all the bailouts and the price tag is astronomical. So we have to examine where the bulk of funding went. Typically this was to the big banking sector on Wall Street.

So now we are left with the reality that the only way to even keep home sales looking “normal†is with giant sums of government money and policies directly targeted at housing. Yet in order to achieve this, you shift focus from other more vital sectors of the economy. It was our obsession in housing that led us to the worst crisis since the Great Depression and the primary government and Wall Street focus is still on housing.

Sales are leading indicators at least in free markets

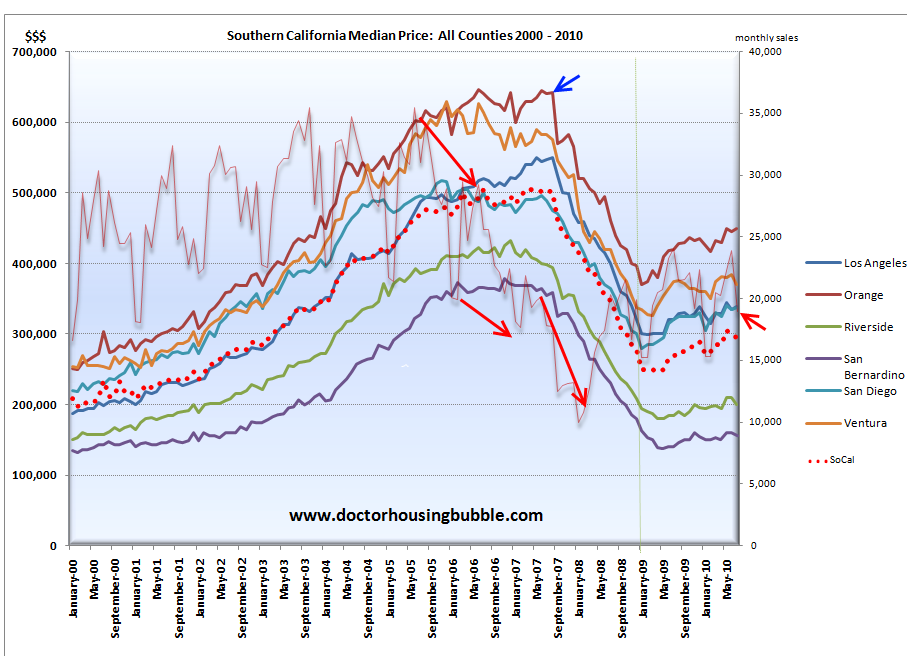

When home sales drop or move off seasonal patterns, the market is saying something. Typically it is that prices are too high or too low. In the boom days, sales blasted up first before prices started following. Given that anyone with a desire to buy could buy in California during the bubble, you suddenly had a giant new pool of potential buyers. This pushed prices up for years and of course led us to the bust. On the below chart, you’ll notice that sales collapse first before prices follow:

Sales started breaking out of their pattern in 2005 and 2006 yet prices didn’t peak until 2007. So the lag is roughly 12 to 18 months before prices actually started moving quickly lower. The recent collapse signifies a similar trend. Yet the market is so mired with artificial programs and shadow inventory that it is really hard to get a sense of what a free market in housing actually looks like. So last month, the median price in SoCal actually fell in tandem with the collapse in sales. Now this is an interesting observation because historically this is normally not the case. But then again, there is nothing typical about our current housing market except that it is royally screwed up.

Now I’ve gotten a few e-mails about out of country investors buying up real estate in the state. This in fact is happening. Yet it is important to clear up some details of this. Sure, you might have a rich foreign investor buying up a home in a prime location but that is the exception. Last month 26 percent of all SoCal home purchases were done with all cash. The median sales price? How about $218,250. In other words the bulk is coming from actual investors seeking out low hanging fruit. And Southern California always has a large number of all cash buyers (historical 22 year average is 14.2 percent).

Shift in psychology

It is interesting to see that banks were betting on typical Americans being naïve and honoring their debts while they were able to work out special deals with our government for massive transfers of bailout funds. Banks assumed that it would be okay for them to renege on their promise and loyalty to customers while struggling Americans would not only bail them out, but also continue paying on debt that was secured by assets that were inflated from the bubble. The psychology didn’t hold up and in fact, many Americans are taking their lead from banks and are acting just as calculating. Extend and pretend seems to be the new paradigm:

“(New York Times) I am not going to be a slave to the bank,†said Shawn Schlegel, a real estate agent who is in default on a $94,873 home equity loan. His lender obtained a court order garnishing his wages, but that was 18 months ago. Mr. Schlegel, 38, has not heard from the lender since. “The case is sitting stagnant,†he said. “Maybe it will just go away.â€

Mr. Schlegel’s tale is similar to many others who got caught up in the boom: He came to Arizona in 2003 and quickly accumulated three houses and some land. Each deal financed the next. “I was taught in real estate that you use your leverage to grow. I never dreamed the properties would go from $265,000 to $65,000.â€

And that is only one of tens of thousands of cases. Here in California, one third of all mortgage holders are underwater. Even from speaking with people, it is interesting how things have shifted from 2007 to 2008. Back then, I would talk with people and it was still talk about how prices would go up. No one brought up foreclosures or short sales. Now, the stigma is gone and even at some gatherings in higher end areas people brag about their walking away or how they’ll stop paying.  No way are they going to change their lifestyle to pay for the mortgage they say!

The take away from the collapse in sales? Without the government there is no market but of course you can’t call it a “market†when it is pure artificial growth. Keep in mind we don’t have the money as a nation to be doing all of this so we are well into a debt spiral. The question is, will the public do anything about it? The system is broke so going through the same channels will do nothing. Makes you wonder if the next stimulus program will involve giveaway housing?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

52 Responses to “Southern California home sales collapse by 21 percent year over year. Real estate tanks simultaneously with ending of government artificial market intervention.”

That’s a significant decline in one of the hottest months of the year. Prices are dropping and continue to drop in So. Cal, even in the high end areas. There is absolutely little pressure, if any, to buy now. With people getting smart and not throwing any more money down an underwater mortgage hole, the banks are actually making things worse for themselves. More defaults, foreclosures etc… Gov’t officials are now scared sh#$less, that nothing has/is going to work.

Prices dropping in all zip codes now.

http://www.westsideremeltdown.blogspot.com

God, this is going to sound stupid, but…

I’ve come to the conclusion that I want to buy now.

So I put in the work to find a house in a decent neighborhood that isn’t tremendously overpriced (though by my calculations will probably lose 20-25% of its value). Whatever. I’ve come to terms with the loss. I accept it. The choice is to rent for a year (month-to-month is sky-high, twice what the equivalent mortgage payment is), buy a house, or continue living with roommates, which is guaranteed to drive my husband insane in short order.

But for the life of me, I don’t understand why the bank won’t call my agent back. We’ve basically been told we’re the highest offer (though we don’t know the cash percentage on the other offer they have), and it’s been two weeks, and nothing. I can’t understand it.

Granted, in the mean time, houses are coming on the market in my price range that I’ve never even been able to look at before. I get it – waiting even a few months is probably going to get me a better house. But the agent/bank not even having the decency to look at our offer is something I don’t understand.

Are you renting a mansion? You said your rent is twice as much as an equivalent mortgage. If you know that chances are very high that you will likely lose money by buying today…why don’t you get a cheaper rental and wait out the storm for another year or two. The nesting instinct can be very strong…that instinct financially wiped out a good population of the thirty somethings of who wanted to buy a house and start a family in the last 5 or so years.

Here’s some unsolicited advice from a stranger (and hence, likely not worth the paper it’s written on):

Look at however much you’re willing to spend right now month-to-month on your mortgage. Go to mortgagecalculator.org or some similar site and enter your specifics for down payment, interest rate, PMI, etc., and assume a 4.25% rate as is the currently typical. Take note of the monthly payment. Now double the interest rate. 8.5% is fairly typical, historically speaking, and is reasonable to expect in a healthy economy. Adjust the price and down payment down to where the payment matches what your currently comfortable payment is. You will find that the value of the house needs to come down 30-40%. In other words, at a reasonable equilibrium and assuming a 20% down payment, you will be out not only your down payment but an additional 50-100% of that amount in negative equity. And it won’t just reappear overnight. You’ll be underwater for years. And that’s completely neglecting the likelihood that the pendulum will swing well past the equilibirium point on mortgages, which is certainly quite strong with the current fiscal and spending policies of every level of government. What if we end up with rates mirroring the late 70’s? I think my parents first mortgage was around 12.5% and I remember hearing stories of others reaching up into the 15-20% range. What is the likelihood that unemployment and wages will rise before mortgage rates do? Probably not high.

Now here’s the magic… suppose the rates do go up to 12 and prices plummet to match. Buy with the high rate and low price with roughly the same payment and as the rates come back down, prices rise and all of a sudden, you have equity.

Really, what sounds better? Buy now, end up deep underwater in the near term, about even in the mid term, eventually breaking even in another decade or more as you finish paying off the interest on the mortgage? Or sucking it up, accepting a rental for another year or two, buying when the the economy REALLY sucks and then having a nice lump equity as your kids start choosing a college?

And regarding the rental situation… just sign the annual lease. If you need to sublet the place, that shouldn’t be difficult. And as long as you’re there more than six months, even if you move out and the apartment goes vacant, it would have been cheaper than spending twice as much on a monthly rental. But chances are strong that it’ll take more than 6 months for buying to become a wise prospect.

I don’t disagree, but my question is “how long?” How long will I have to wait for rates to go up, and for prices to fall as a result? I’ve been renting for well over a decade since college, and now I’ve been married for 3 years. We chose to postpone jumping into the market in 2006, and it turned out to be the right decision. Now, some “reasonable looking” houses are starting to come within the range we can afford. Prices could still come down further, but with government intervention, the drop could be dragged out for years and years like Japan. Life is short, and my wife and I are starting to get sick of the waiting game. I’m not saying we’re going to buy a house tomorrow, just saying I understand why some would choose not to wait any longer.

Beautifully written and perfectly acurate. I pray for rising interest rates to accelerate price depreciation so I can buy at better prices and hope to pay it off sooner. For now, I continue to sit on the fence, watching all the nonsense go by.

Who is to say that historical interest rates are likely to come back? With the debtload of the average american, this would really wipe out the economy. Fewer businesses would be borrowing, so unemployment would shoot up further. Governments will either default on their debts or cause hyperinflation due to far more spending than collecting in taxes.

There is no real market for interest rates, as we have seen over the last 15 years or more. Japan has kept their borrowing rates extremely low for a long time now, and will probably continue since most other countries are doing the same. It’s probably more likely than not that we will continue to see low borrowing rates because our presidents and congressmen will keep the pressure on the Feds to keep them low, and we still have GSE’s that are providing the majority of loans (at taxpayer expense when the losses come in).

That doesn’t mean that I think that housing is out of the woods. The collapse itself is still sorting itself out, and real incomes are still on the downhill. However, I just don’t believe that we’ll be seeing mortgage rates above 8% for a long time, and probably not even above 7%.

If you are really spending twice on rent that it would cost to buy a similar house…..what are you waiting for?

Places like Phoenix and Vegas, I know for a fact, renting is 2 to 3 times rent. I am sure there are some inland areas of ca. in the same situation.

If you are in Modesto or Stockton or a similar place, prices are probably close to the bottom, it is safe to buy, at least below 500K.

On the other hand, the markets the Dr. usually talks about are still in bubbles and I have never heard of rent being more than the mortgage unless you are talking about a studio or something.

I’ve come to the conclusion that I want to buy now.

Not the site to saying that, Susie Q.

Suzanne Researched This

Good Luck.

LOL Tyrone, I saw that video very early when it was first posted back in late ’06 or ’07 or so, and I *STILL* play it every few weeks, just to get a good laugh and remind myself of what a cluster f— our society created for itself.

Okay, okay, I’ll come clean.

I’ve run the math on this one. Based in the price range I’ve decided to buy in, the interest rate I currently qualify for, and the cost of rent (even if I rent for a year instead of month-to-month, and even if I’m renting a significantly crappier house or apartment), if my potential interest rate goes up 2% within the next 3 years, and based on my projection of a 20-25% decline in value, I actually am out pretty close to the same amount of money whether I buy now or I rent for a year and then attempt to buy.

So yes, a gamble, but a rational gamble that I’m prepared for because I actually want to live in the house. But no one will sell me a goddamned house. Something about this is “off”. There’s something going on, and I’d like to know what it is, because I’d like to know what regulations I need to support to get some transparency into this process.

Where are you? I find it difficult to believe renting costs twice as much as a mortgage. For the past ten years it has been the exact opposite. My rent is less than half what everyone I know pays for their mortgage. You should look for a better rental and follow DangerMike’s advice. It is better to buy a low priced home with a large interest rate than to buy an overpriced home with a low interest rate.

It’s actually not renting in general that costs twice as much – it’s renting month-to-month. Month-to-month rentals are in extremely short supply, so I’m finding that a rental that might go for say $1500 on a year-long lease is offered at $2500 month-to-month. In fact, looking at month-to-month rentals, it’s difficult to even find a studio or one-bedroom month-to-month for under $2000. And those that are tend to be in incredibly unsafe neighborhoods. Comparatively, the house range I’m looking in has a monthly payment that hovers around $2000, probably rents for around $1500 on a year-long lease, and has twice as much square footage as rentals in that price range (though the same number of bedrooms).

SusieQ, I was of the same opinion some years ago, and I let emotion over reasoning take over my decision. I now sit in a home that is worth less than 50% what I owe. I now need to move to another area due to school districts, etc. My wife wants to buy because she cannot see us “throwing away” rent money to pay someone else’s mortgage. But I have learned my lesson…I am OK with renting. My wife and kids want a bigger home in a nicer area, and that is fine…I will rent one, even having the capital for downpayment and income to make the monthly payments, I just won’t make the same mistake again…not the time to be buying in Southern Cal right now. Trust me, I’ve shown the numbers to my wife, and it is tough to swallow because of the stigma maybe of her wanting to be in her own house and not renting…but at the end of the day..who cares?

I would rather take that down payment money and buy smaller units in markets that make sense. In fact, I just closed today on a small single-family home in Atlanta. Very nice and newer little home. I have a tenant moving in already with a 1-year lease and positive cash flow. That’s an asset with cash coming in. The alternative use of my money for a down payment for another home in Southern Cal would simply be a liability.

By the way, I am looking at renting for probably about the same monthly payment that a new mortgage would cost me. So there is the lost benefit of tax write-off of your interests, but heck, start a home-based business, and you can write-off a whole bunch of other expenses, even while you’re renting.

Good luck.

SF

Same is happening to me. I am trying to put an aggressive offer together for a condo in a “C” area but the bank and its listing agents totally refuse to work with me. Even though the market is ready for a new collapse and the condo has been sitting forever they are dellusional and trying to holdout for some mythical “cash-buyer” who will pay too much. Now the bank is threatening that the property will go to “auction” … which is likely wont. Very frustrating but I’m not going to pay more. Be patient and things will come down. As long as the gov’t stops trying to prop up wallstreet, which I hope it will STOP doing.

Just thinking out loud here, but maybe besides hoping for someone else to happen upon the scene with more money, they think that by stonewalling you, at least for a while, they’ll get you to increase your offer.

Maybe you should put the pressure on them?

What if, instead of you being their fallback position, you suddenly present them with your offer and tell them that if they don’t accept within two days, your offer will still be on the table but minus $10,000 for each additional day that passes?

Just a thought.

You are a real estate agent or loan company plant. You are not telling the truth about yourself or your situation.

Except for one thing: if hyper inflation strikes while you’re renting you could lose your downpayment. I’m in exactly that situation with 60k in the bank. I’d rather be underwater in shelter I own than renting and suddenly find my downpayment gone.

Simple.

Put 25% of that money into Gold or silver. If inflation takes off Gold and Silver will become very over valued, basically making up for what you lost on the other 75%.

I know no one likes to guess like that with their life savings but our Federal Government has chosen to go to war against anyone who is responsible and prudent.

Silver at only 30% of its 1980 peak price is not in a bubble and Gold at 30% above 1980 peak price, it is not in a bubble.

For perspective the stock market is 10 times 1980 peak price and housing is about 10 times 1980 peak price so I really get a kick out of those who claim gold and silver are in bubbles when they are below or just above 1980 peak pricing.

Dangermike, thanks for your advice. Hopefully, I too will suck it up. Last year my wife and I both lost our jobs. We were in IT for many years and our jobs were offshored or onshored (India Visas). Anyway, I am in escrow on my house in Palos Verdes and I moved to Olympia (wife to follow soon). I bought my house in PV in 1994. Now, I will rent a 2 bedroom apartment up here and some storage. The economy up here in Olympia is not as much a high-flyer environment of So. Cal. I just felt that it was time to cash out my chips. I bought the house as a foreclosure when the aerospace industry hit some bad times. I do not have the stomach to take a hit of $7XX to $4xx that occured for the sellers of my house in 1994.

Thanks for your advice to tell us to ‘suck it up’…

@mymini

I sympathsize with you on the onshoring thing. In my neighborhood, it is chock full of Indians on visas working for HP thru an Indian company (thank you Mark Hurd!). It is not like they are not making decent wages either, so the benefits for HP appear to me more associated with having the flexibiity in the labor force. We are not necessarily them as neighbors as they are relatively insular, and even when interacting, kind of obnoxious talking about how great India is (please go back then).

Have you been there? It’s actually quite nice and the people are too. Your frustration would be better directed towards the companies that pit workers around the globe against one another.

Thanks Dangermike.

Your analysis is right in tune with the good DR.

It’s been interesting to watch the arc of this real estate madness. There was an article several years ago talking about the social stigma of being foreclosed upon. And then about a year ago, it suddenly became socially acceptable to talk about ‘losing your house, And who would judge? So many people were underwater and in trouble, that people had a common foe, the banks, and they developed victim mentalities. Soi sending your keys, (jingle mail) back to the lender was getting easier and easier to do. And now today, many are heralding the defaulters, saying they are doing the right and moral thing, by not being enslaved to their homes or enriching the banksters. Not to mention the added perks of living rent free for up to two years, saving money and bundling it away, or spending it freely, because it was now discretionary income. I wish I could predict how this will end up, without the thought of a Mad Max scenario continually coming to mind…

Yeah, can’t wait for those prices to keep falling. Still see SOOO many houses that are so stinkin’ overpriced, but…even those homes are starting to creep down. What cracks me up is when you see a house – it’s been on the market for a while and it’s a POS and then you see the realtard has upped the price by 10 grand or so. What’s the point people? Still so much delusion out there!

My suggestion is to look for houses that must be sold because of divorce or death. Put in a low offer on a house and if its not accepted put in another low offer on another house. Soon enough you will own a house for a lot less than the asking price. You want what I refer to as a ‘dispassionate seller’. They want to clear the books and the sooner the better. So figure out what a low offer is and knock off 10% and then make the offer.

Thanks again Dr. HB, for doing a damn fine job of shining a spotlight in the sewer that is the RE market, Washington, and Wall Street.

BTW, did you all check out the PBS News Hour report on strategic defaults? The estimate is much higher than the banks/Wall Street/government want people to believe (for obvious reasons) – ONE THIRD of all defaults are strategic now!

http://www.pbs.org/newshour/bb/business/jan-june10​/mortgage_04-20.html

Hi there. In brief: I’m 30 years old living in SoCal. Household income is about 90k a year. My wife and I recently decided to test how far our money could go in terms of a house; needless to say, it was an emotionally humiliating experience. We are not willing to live in an unsafe environment or stretch ourselves thin to live in a two bedroom condo that could hardly fit a sofa. Now we are considering moving back east, to Tennessee, where our down payment would go a lot further and housing prices seem less psychotic, if not necessarily completely sane. Still, we would like to buy at the right time. As I understand it, suppressed interest rates are supporting (if barely) the presently artificially-inflated value of housing. What I’m not clear on is when interest rates will rise; apparently that seems to happen when an economy recovers. But does it really make sense for housing prices to come DOWN when an economy is recovering? Is it a possibility that housing prices will go into freefall despite the low interest rates because the affordability gap eventually must hit a breaking point and therefore there will be a sweet spot for bystanders who can leap on low interest rates and reasonable prices? I’m sorry if this all sounds naive.

Hey Steve, yeah it’s not a good time to buy when interest rates are low AND home prices continue to drop because when interest rates rise, the value of the asset drops. 90K is a lot even in SoCal believe it or not – home prices do not reflect the local incomes. Sure, there’s movie stars and so forth but SoCal jobs are underpaid relative to other areas. You also have to take into account how high rents are in SoCal – this prevents a lot of people from saving for a downpayment. There is probably very little demand in SoCal right now but sellers are still holding onto unreasonable pricing because they want to pass the mistake onto someone else.

The economy is not recovering. Unemployment is through the roof in CA – that’s the bigger picture. Look at any UE stats and CA is one of the worst states. UE only begets more UE. There is no net creator of jobs, especially the types of jobs that will allow someone to buy a $2 million house. There’s no dot.com bubble, housing bubble, China bubble to do that. My parents, some relatives and parents of some of my friends got hit really hard back in early 90’s recession and they are still feeling the effects to this day. As long as you are employed, have a roof over your head and food on the table, wait it out and be happy. Don’t make a huge financial mistake because it is very hard to come back after one especially in a time like now where things are so precarious.

Same thing here. Our household income is near 190k. We were looking areas like Arcadia and South Pasadena with good school district. However, even with our income, we cannot afford any house that is in good condition (so we don’t have to spend $ to fix stuff) and in around 2000 sqft. (They are at least around 750k-850k in that area).

We don’t want to borrow too much money in case one of us lose job the other can still afford the mortgage. We don’t want to borrow to much money because we don’t want a house that brings down our living quality, after all, all of us want a house to have better quality of life. We don’t want to because mortgage slaves. We still want annual vacation, raise kids right, save money, and even invest.

With our income, we can only afford a nice looking “CONDO” in the area that we want. With California as one of the worst education in states, we just don’t see the point of spending all our saving to buy that CONDO.

So we’re planning to move to Texas where we’ve done some research. We can find an old house in a nice area cost less than 200k. Even though our salary might be lower than what we’re getting now, but not much lower if you consider no state income tax in Texas. The property tax in Texas is higher but hey, with 200k house how much will we pay? It’s still lower than just the state income tax we’re paying here in California.

Bye bye California, another smarter high-income couple is moving away from you.

Prices dropping while inventory is rising…all during the best season for sales? This is how a leg down starts.

i live in Highland Park and bought near the peak in June 2005. i have watched in the last year or so in my area as a couple of foreign investors have been snapping up foreclosures and flipping them, The house next door was bought at auction for 200k, he flipped it (quite beautifully I might add), put it on the market for 420k, and it overbid eventually going for $475k! it seems like in Highland Park, couples who have been sitting on the sidelines for so long are jumping in especially when the place is turnkey and would go for more in silverlake or echo park, and certainly in Pasadena..my question..how much will prices soften in silverlake and Pasadena?? It seems like they remain stubbornly high. the DR. seems convinced of this but we are waiting and waiting..any comments welcome

Buying a house is more than an ivestment. There are emotional considerations as well as what it means to your kids to have a solid foundation and the stability of a home. You can’t argue with the data here but most of the posters here are b itter because they cannot afford to buy without all the props we had in the past. Think of it this way, if you are paying rent, you are paying someones mortgage. They aren’t walking away and there is obviously some benefit to owning. Even if the price of your home declines for years you are still paying down what you owe and not what someone else owes. At some point you end up with an asset even if its not priced at what you paid for it vs. Throwing money out the window in rent. Don’t let the sheep fool you into thinking defaulting is the in thing to do now. These are the same people who leveraged themselves into foreclosure and now sing the merits of strategic default to rationalize their failure. There is no cut and dry answer here. Renting, buying, defaulting, all depend on not only your financial situation but the way you want to live your life. There are people here that would say that since I just purchased my second property I’m a fool but guess what? I’m happy my wife is happy my kids are happy and we have a great house in a great neighborhood that we got at discount throguh short sale. And we still own our first home which is rented out. The renter pays the mortgage. Think I care if price goes up or down? Of course but if the rental is worth 500k or 300k 15 years from now it will be a paid for asset. I default and invest the money elsewhere I don’t know it turns into that. Th e only way any of this is cut and dry if u are single investor and simply look at this from numbers standpoint. Many of this have other considerations though.

Mad equates to assumptive and stupid?

@alex

“the condo has been sitting forever they are dellusional and trying to holdout for some mythical “cash-buyer†who will pay too much. Now the bank is threatening that the property will go to “auction†… which is likely wont. Very frustrating but I’m not going to pay more.”

Let them wait. and if they find another buyer who is willing to pay more, let it go.

Don’t be emotionally attached to a single property. There will be thousands more coming on the market but there are still so many fools out there and that is what they are banking on. You will not have a problem finding another property and most

likely it will be a better deal.

@Steve

“Still, we would like to buy at the right time.”

The right tight varies so much from individual to individual, family to family.

It depends on your job situation, age, how long you plan to live in the house,

etc., etc.

I read the following in a book titled: “Home-Buying Tips for Christians” or something like that. People who followed these old fashioned guidelines

almost never foreclosed. Here they are:

How much of a house can you afford to buy? No more than 3.5 times your yearly

income. If you make $50K a year, that is $175K.

How much should you put down? Min 10% preferably 20%.

How much can you afford in monthly mortgage payments? No more than 28% of

your gross monthly income should go to and cover: mortgage/taxes/insurance

AND maintenance.

How do you know when you are paying too much for a house? Find out what that

house would cost to rent vs. the mortgage (including taxes and insurance) if the

mortage exceeds more than 25% of rent, the house would be too expensive

to buy.

I live in Encino, the rent on a house I’d like to buy is more than 50% cheaper

than owning it.

Your own will (and always has) costed more than renting but should not

exceed 25% from renting. But, they want you to factor in not only the

mortage but property taxes and insurance and maintenance, not only

the mortage.

Hope this helps answer some questions.

Susie Q: Bank is not allowing no one to purchase at this time because they already know many people will walk away…..not because they can’t pay but they know people now days mental thinking is ” I don’t give a fu*k” attitude……. So sadly enough, bank is happy and still earning with or without you or me. By the way, not the teller people but loan officer and top guys in the banking is laughing all the way to stair way to heaven while we folks getting kick out from gate keepers and feeling the pain as many still in denial…….

Oh yea, by the way, banks don’t give fu*k about us. So fu*k Banks and mothur fu*kin mama…

Many of the posters to the good Doctor’s blog reveal the same problem

in their thinking regarding the SoCal market, especially as it relates to

the so called “stubborn neighborhoods”. This is August 2010. The top

was in the first quarter of 2007 for most of this area. The financial collapse

was triggered in August/September 2008. Hence, your anticipated horizon

for a significant drop in real estate prices is way too short, especially with the

government’s intervention attempts. If you want “price discovery” to work

its course, you must be willing to wait until mid-2014 before starting to look for

a home. If you buy then, be prepared to see no change in your nominal purchase price for another 6-10 more years. After that, if the economy starts to improve for reasons we can’t anticipate now, only expect to keep up with inflation going forward. This means that the 15% or so in appreciation that you’ll lose to even pultry returns in CDs during the same period will probably be gone forever. Buy today, and expect that permanent loss to eventually be in the range of at least 40% of purchase price. By Japanese standards, this is actually quite positive. They’re down an inflation-adjusted 70% in many prime areas after waiting twenty years for the market to return. Just remember, there is no return to the past. That’s why it’s now called a “housing bubble”.

Mad guru is…well…madly insane.

Steve,

If interest rates go up, housing prices will DIVE into the gutter.

The big unreported story which will severely affect mid to high end real estate In Southern California is the slowly evolving destruction of the private practice medical system . On again off again draconian cuts in Medicare reimbursements and sliding reimbursements from insurers are causing dramatic changes in the plans of doctors as their offices leases come due, with many deciding to retire, close their practice and become employees of larger systems, or opting out of Medicare and insurance and laying off employees. These changes will lead to physician demand for housing to collapse.

Fortunately we are in a depression and won’t be raising interest rates soon. Additionaly, CA will eventually lose the ability to play hide the hot dog with the budget and the gov’t will bail out the states. Notice how they sugar-coated the first state bailout: 26 Billion ‘education’ bailout. Like the lottery, anything education must be a good thing so it slides right through. Obviously, any funds are general funds, so whatever they are earmarked for can just be substituted for pork. I keep seeing ‘Recovery Act’ projects in all the states I drive through, just like they had in the 30’s. Still, we’re so addicted to sports all the communities that assumed perpetual growth will be stuck with half-full stadiums. Rays are #2 in baseball and can’t fill the park, because their bubble broke and they are still in decline in Tampa. When prices do get real, the end of the party days are over and the decline will accelerate. This ain’t your father’s recession–It’s grandpa’s depression, at best.

Hi

Does anyone know if the picture in the bay area (Berkeley way) is the same as being discussed here?

I was in much the same boat as Susie a year and a half ago. We were renting a 3 bedroom house for $2,500 a month, which when we got into it in 2006 was fairly low for the area (Knollwood, top of Balboa). Life happens – hubby got laid off last January (he’s still unemployed a year and a half later) and my salary is less than 1/4 what he made. We faced a choice: either find another house which I alone could afford and still pay the rest of our bills, or…well, there really wasn’t another choice, as rentals had not dropped under $1,700 a month for homes (still have not). I couldn’t swing $1,700 a month – or, technically I could, but then I would not be able to pay anything else, like food, water, gas and power – not to mention gasoline to get to work. Finding a house to purchase became my second job. I managed to do it. I had 20% down, as long as the price was not over 225k. I closed on a half acre horse property, 3 bedroom house with detached 2-car garage, barn and outbuildings in early April. Excellent area of Canyon Country, with awesome neighbors. Mind, it wasn’t remotely easy. I hunted daily; at work online with the blessing of my job, after work, weekends. It was all I did for over a year, in my spare time.

My mortgage is $940 a month. With insurance and property tax rolled in, $1,200. I pay an additional $200 against principal every month, and when the hubby is able to get a new job, we intend to double up on payments. Even without him having work, I can manage all our bills, still have enough left for extras and come in comfortably with my mortgage well under 1/3 of my take-home. Not many extras, granted, but it sure beats the alternative.

So, yes…one can actually find an excellent deal if they are prepared to bust ass to make it happen, and definitely have a mortgage payment less than half what one would pay for rent of a comparable place. **We agreed we couldn’t ever do an apartment; we have pets that are “part of the family”.

Bust ass? Finding a place it time based. Had you done the same day 1 would it be called busting ass. The one who constructed the property is the true ass buster.

I have two comments:

First, you relate: “So we have to examine where the bulk of funding went. Typically this was to the big banking sector on Wall Street.” This is true, the Federal Reserve facility of TARP transferred out 1.2Trillion in US Treasuries to the banks in exchange for distressed securities such as those in Fidelity Capitol and Income mutual fund FAGIX. This capitalized and saved the banks who turned the funding back to the Fed who placed in excess reserves where it resides in a liquidity trap unavailable to be used productively. What is really bad it integrated the banks into the Federal Government creating a behemoth of state corporatism, that is government banking rule. And it enable the savvy investor to go long the market and make a profit.

Secondly, IrvineRenter in Irvine Housing Bloguge price reductions are starting to appear now as sales are starting to fall off — the lack of buyers is finally starting a crack in pricing.

I belileve that soon there will be no sales, repeat no slaes when the global debt bubble bursts.

Doug Noland of Prudent Bear writes on the Mother Of All Bubbles in his Prudent Bear August 20, 2010 article entitled Let’s Change The Debate stating: “I have posited that the 2008 bursting of the mortgage/Wall Street finance Bubble unleashed an even bigger “mother of all†bubble throughout global fixed-income marketplaces. I trace today’s Bubble back at least to the Greenspan Fed’s 1987 post-crash systemic reliquefication. Recent history of monetary disorder fueling serial boom and bust cycles is unequivocal. From my analytical perspective, we’re in the midst of history’s greatest and most perilous financial Bubble. And I am beside myself that nobody in a position of influence seems to care. We’ve witnessed momentous analytical and policy errors over the years – and these blunders are allowed to repeat themselves without thorough analysis and review. All this talk about fighting deflation and helping Main Street misses the point – and only feeds the Bubble. It is fundamental to our nation’s future that we stabilize the government debt Bubble and secure the integrity of our monetary system. The chorus of calls for larger deficits and greater Fed monetization is fueling distortions that risk financial calamityâ€.

As I look at the chart of the 20 to 30 year US Government Bonds, TLT, I see just part of the massive amount of debt, BND. And I believe we have blown the debt bubble so large, there is going to be a mad rush to the exit doors to sell, where there will not be enough buyers for sellers, resulting in a liquidity evaporation, and a liquidity crisis.

Out of the chaos, I believe that a Financial Regulator will be announced who will oversee lending and credit, as well as money market and brokerage accounts. He will be what I call a credit boss or credit seignior who funds economic operations with an emphasis on seeing that the strategic needs of the country are met and that monies for food stamps keeps flowing. I believe the government will become the first, last and only provider of liquidity and money.

I believe the Financial Regulator will exercise Discretionary Governance, and announce a Home Leasing Program administered by the banks on their REO properties and those of Freddie Mac, Fannie Mae and the US Federal Reserve. Mortgage lending and securitization of loans will cease, and leasing of homes will be a public private partnership cooperative endeavor. Companies that have created and serviced mortgage-backed securities, such as Anworth Mortgage Asset Corporation, ANH, and Annaly Capital Management, NLY, will quickly disappear from the economic landscape, as mortgage bond funds such as Goldman Sachs Mortgage Bonds, GSUAX, tumble in value.

And I envision that a continuing falling EUR/JPY will result in further stock deflation, and then a stock liquidity crisis will also emerge, where there will not be enough buyers for sellers of stocks as well as bonds, causing small business failures and banks to become sorely decapitalized, resulting in the president of the ECB arising to be an “Eurozone credit seignior†and provider of liquidity to Europe. I also believe that framework agreements will be announced in Europe providing for fiscal federalism giving a whole new meaning to the term European Economic Governance. Yes, I foresee a greater fiscal union. Fiscal federalism will result in the Eurozone evolving into a region of global governance where national sovereignty is a concept of a bygone era.

I’ve been reading Pulitzer author, UCLA’s Jared Diamond and he notes that one of our natural defenses from the pain we cannot bear is denial. Just like all the sellers denying the obvious that they are never going to sell their albatros at bubble prices, so they do not see the truth. The world all knows that as this giant debt bubble unwinds, there will be a deflationary depression of unimaginable size, perhaps even another Dark Ages as the entire system breaks down into chaos and WW III, but that is too horible to believe, so denial. I feel that at least discussing the possibility may help avoid it. Don’t know if Bernanke really thought that dropping money out of hellicopters would somehow put out the fire. Seems rather foolish now as it did then. Also Paulson’s Bazooka bit–seems more like a doomsday bomb in retrospect.

Still most folks here think housing will go down another 20% and everything will magically correct and they can resume California dreaming…So far Doc’s arguments have a lot more credibility than a bunch of happy cows…When we get a fair market, all hell will break loose.

I would think by now it should be obvious to the most casual observer that that fat is rising to the top and all the greasy stimulous is just fattening up Wall Street, as the middle class is discarded like whey. Fed target is at zero, which means the rugger is full over and we still can’t get this ship back on course. Why? The rudders not even in the water anymore. I you get the price you want for a house, it will be because the artificial stimulous has failed and prices and conditions will fall perilously. When the fed’s target of zero fails to keep mortgage rates artificially low, the last line of defense will be broken.

IMHO, what we need is like a ‘prenuptual’ agreement where if the market value of a home drops due to ambient conditions, the principal of the loan falls accordingly, like a hedge for both parties. If the value of the home goes back up, the mortgage follows. Sure, this is complex, but face it: a lot of people want to buy a home at a fair price and a hellofalotof homes need an owner, besides the bank. There’s got to be an algorithm to help both parties find a way to get the deal done.

A “price guarantee” would only solidify the bubble. The bubble was/is an anomaly that must go away.

I got into a rent controlled apartment in Santa Monica about a year ago. I think if you can find a decent place with rent control in LA or SM, that is the way to go. You get the security of capped increases in rent, its almost impossible for a landlord to get you to leave as long as you pay in a timely manner and you can wait out the market until you find something you like.

In September 2008, bought a 2 br/1 ba house with a separately metered granny unit for $118,000 and another 2 br/1 ba house down the street for $63,900. I probably put in $20k total to get them ready to rent. This is in Sacramento, just down the street from the UC Davis Medical Center. I’m currently bringing in more than twice the PITI. I got some cash together and am thinking of buying another one for $75k to $100k. I don’t really see the down side of this. If prices in Sac tank further, so what. My concern is will the economy tank so bad that I’ll lose renters.

Leave a Reply