Southern California housing market update: Slowest January for home sales in three years. Median home price back to June 2013 levels.

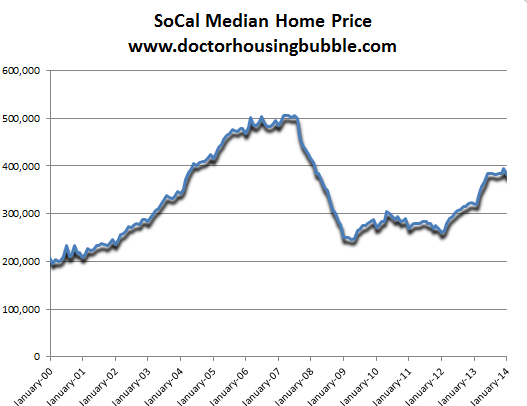

The latest housing data highlights a stagnant market in Southern California. January home sales came in at a three year low logging in 14,471 sales. With a low number of foreclosure resales now making up the pool of total sold homes, there is little reason to use the excuse that foreclosures are depressing home prices on aggregate. Home prices retreated back to levels last seen in June primarily because investors are having a tougher find picking out good low priced properties and modestly higher rates are still hurting the market with cash strapped buyers. The market is caught in a Catch-22; if the stock market goes up this adds fuel for the Fed to retreat from QE and this will likely push rates higher. If the stock market pulls back, the Fed is likely to dive back in and interest rates are likely to stagnate or fall but investor activity is likely to take a hit. Yet there is little action to be had overall with such an artificially low amount of inventory and crowding out regular buyers with investors is still common. It is more likely that we have a month in 2014 with a negative year-over-year median price versus a repeat of 2013.

An analysis of SoCal real estate

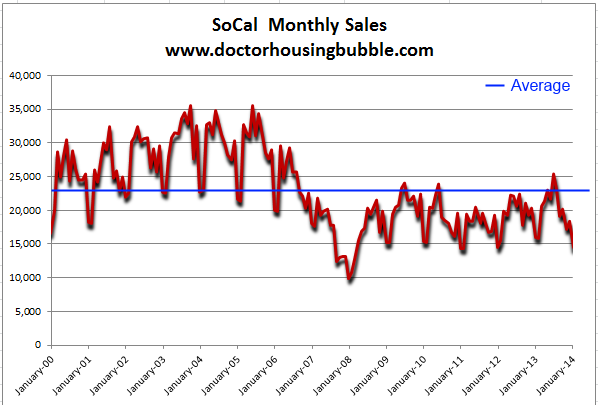

I went back and dug through monthly housing data for SoCal dating back to January of 2000. There is a serious seasonal pattern to home sales. January and February data always reflects the slowdown from buyers and sellers during the November and December holiday months. Escrow and closing could add 30 to 60 days of a delay on data reporting. This data also reflects a seriously manic market.

From 2000 to 2006 a month of 30,000 to 35,000 home sales was not uncommon. Then you will see the collapse that occurred starting in 2006 as sales collapsed first, then home prices. Let us look at this data carefully:

This is very telling of the current market. Since 2007, we have struggled to pullout a month of sales over 25,000. This happened last year during the investor driven mania. Homes sales took a big dip in January recording the slowest January in three years. Keep in mind this is occurring on the back of a year of near record breaking annual price increases.

One thing is certain from the chart above and that is volume has been cut dramatically from the bubble days. It is almost as if two housing markets exist in the same area. Keep in mind this data is reflecting an area where population grew slightly so you would expect higher volume but not when many young Californians are cash strapped or living at home. The number of investors buying homes is still high at 27.5 percent.

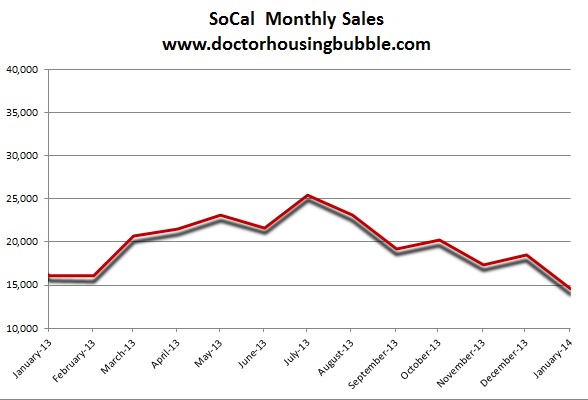

Let us look at the last year of home sales data:

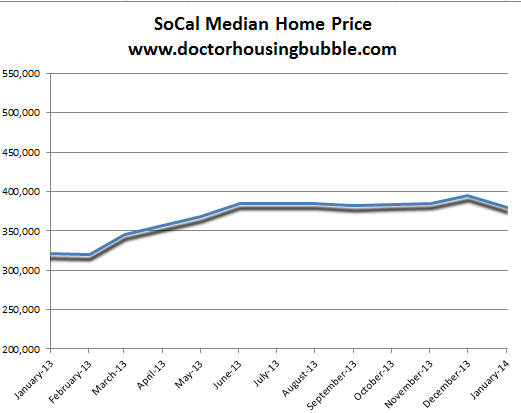

You can see the peak hitting in July right before higher rates put the brakes on the market. Home price increases have also come to a screeching halt in SoCal:

Home prices have stalled out for the last year. The current median home price in SoCal is $380,000 down from $395,000 in December. Since last summer, gains have been muted:

The current median home price is back to where it was in June. While the median home price is up 18.4 percent year-over-year for SoCal, home sales are down 9.9 percent year-over-year. The press doesn’t know what to make of this because they can’t come out and say that Fed and banking policy over the years has created a U.S.S.R. like housing market worthy of a gold medal in Sochi. So they mention that low inventory is an issue. Why? Because banks are circumventing accounting standards but you also have 13.2 percent of home owners in LA and OC underwater in spite of the big jump in prices. Next, you have many near negative equity and others looking for bubble like prices. Early last year, this was pulling in the masses with people foregoing home inspections and bidding wars were once again common. This year is not starting out on the same footing. Put those PowerPoint presentations of the family back onto the cloud and keep your sleeping bags for the mountains since it is unlikely you will need to camp out at an open house to get the seller to pay attention to you.

Most are forecasting home gains for 2014. I think it is more likely that we have a negative year-over-year median price for SoCal. What I find amazing is how quickly people are assuming their area is somehow untouchable. There is little doubt that areas like Beverly Hills, Santa Monica, Pacific Palisades, Newport Coast, or Malibu are clearly prime markets. If a home drops from $10 million to $8 million how many people can bounce on this move? But some people think Torrance is now in this category! Well not the entire city but a pizza slice portion of the area. I was surprised to see what cities folks now think will be the new gentrification spot where hipsters will move in and slowly outgrow the blight, low incomes, and crime. Much of this rhetoric existed in 2005, 2006, and even 2007. What has changed? Lower inventory? Sure. Manipulated policy leading to homes being sold to banks? Sure. Yet the elusive income question remains. We do have 4,000,000 Californians on food stamps a 50+ percent jump since the recession ended.

It is also fascinating to see the shift in psychology. Those claiming massive paper gains probably realize that the only way you unlock those gains is by actually selling the home. Some are those cat food eating golden handcuffed baby boomers. Will they leave California? Unlikely. They will sit idly by and watch new neighbors move in, probably a new younger wealthier demographic of two working professionals, and let them pay 10 times the amount of taxes for a similar property courtesy of Prop 13. It is also odd that those that feel they missed the boat don’t bother on buying today. So you missed a one year window and it is game over for you? Why not buy now? Do you mean you are…speculating? Heck, you can even go in with a low rate interest only loan. What these people don’t want to admit is that the housing market is one giant speculation scheme fully hitched to Fed policy and they are merely speculators in the cause. Housing across the nation is actually fairly priced but look at the boom and bust data for SoCal just since 2000 above.

Before people begin saying that SoCal is the next London or Tokyo they may want to look at the median price and sales figures and realize that manias come and go in SoCal. They should also realize that SoCal is one massive region. This is probably why some people get a halo effect and somehow think their property in “X†city is the next Laguna Beach or San Marino.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

99 Responses to “Southern California housing market update: Slowest January for home sales in three years. Median home price back to June 2013 levels.”

Dear Doctor:

You make very good fundamental points arguing the case for a bear market in real estate. I used to be in that camp. But now I am not. We do not have a free market in our country. It is manipulated by the politicians, The Fed and the Big Banks. They not only own the marbles, but the entire playground. They make the rules and they will do everything they can to make sure the real estate market does not collapse like it did back in 2006. Besides, the American public thinks higher home prices is good for the economy.

Remember, the market can stay irrational longer than you can stay solvent. Also, with record amounts of debt held by our federal government, states and municipalities and even the large corporations, the only way out is via money printing and inflation.

In other words, this time is different because it’s all rigged and TPTB are going to save housing? All of those down markets in the past they just let it go but this time the politicians are going to save it. This time is different. Sure.

I have seen three major Real Estate downturns in the California market,

each many years apart — they are all the same, no difference except one;

the Banks have been forced to delay foreclosures due to Government legislation

and pressure from the Obama administration — this will NOT last long and the Gov’t

will have to give in and allow these foreclosures to come to open market and the

Home Prices will DROP$$$ in a big way. (Yes even in the luxury Zip Codes.).

I remember stories ( in the early 1990’s) of “caravans of Japanese buyers”

touring the Rancho Palos Verdes estates and buying homes at one-half the last sold price.

Surprisingly even those “investors” lost money paying prices at 50% discounts.

Back then Orange County filed the largest municipal bankruptcy … a sign of those times.

This time the inventory of defaulted homes is much larger and the artificial

increase in prices cannot last. When the most current bubble happened (2004-2008),

it was based on “LIAR Loans” and phony appraisals … so the majority of new

loans in the pre-bubble-burst period were based on “not-credible” values.

HOW is it possible now that the homes values in 2013-2014 price escalation- which are approaching the 2006-to-2008 bubble period, can also be “credible”. Especially since the

majority of defaulted homes are still yet to come to open market.

The math just does not add up here.

It’s promising to see other news content (from Truthdig) supporting DHB. Maybe not tanking hard, but creeping down and down, fueled by trying to unload before the other. A 10k price reduction here, a 10k price reduction there.

http://www.truthdig.com/report/item/foreclosure_filings_jump_as_investors_eye_exits_20140215

Weather is great….can’t blame it on weather.

We have one of the best home shopping weather in a generation and sharply rising inventory means this isn’t a “supply problem”

“Pending Sales Biggest Collapse Since May 2010″

The Western region crashed 40% MoM and 14%

YoY. The largest by a wide margin and an ‘HISTORICAL LOW FOR ANY MONTH”.

The West has seen the best house shopping weather in a generation, so where are the buyers?????? Moreover, supply out there is rising sharply meaning it couldn’t be a “supply problem”.

This is the best home looking/buying winter weather, ever. Not too hot and not too cold. Certainly, the abnormally dry weather in the busy Western region should outweigh the abnormally cold weather in the slow Northeast. First, they blamed the back-half ’13 demand destruction on the rate surge. Then, on the Gov’t shut down. Of course, “low inventory” is always blamed. But now, rates have normalized higher, the Gov’t is back to work, and New Home inventory back to 6 months. Yet, demand is still dropping sharply. It simply can’t be a “lack of supply” as supply is rising and demand falling. Once the last excuse card is played…the weather…we can move on to call this what it really is. Housing Bubble 2.0 blowing up in a real time.

Get your popcorn and watch the show. It will be a fascinating thing to watch 🙂

To be answered with bailout 5.0? I am cynical that we will ever have a housing market that is not ballooned by the money printing monetarist and the banksters and Dimons who own their sorry sycophantic covered arses.

But Doctor, housing prices in “prime” areas of the giant S-hole known as the LA basin can only go up because it is “prime”. We all know S-hole “prime” areas like Culver City, Palms, Mar Vista, West Chester, Torrance, Blah, Blah, Blah will never go down because they are “prime” and “prime” areas never go down… What a bunch of BS. I am 4th gen LA and I can tell you all areas can go down and the areas mentioned above have all gone down in the past. These were all gang infested s-holes where no one in their right mind would live on purpose. Just because some NY transplant opens a trendy restaurant in the neighborhood does not mean that the area is now impervious to busts…

I have spent quite some time in other areas of the state and country and I am not convinced that LA is the place to be. I moved out of the toilet bowl and am fine. I am still in California and don’t miss LA in the least. I go visit my friends there once in a while and every time I am reminded why I left. LA is overpriced, overrated and overrun… The NY transplants can have it…

BTW NYC is another big flying S-hole. I never understood the love affair with that f’ed up place. I love Chicago, Boston, San Francisco, etc so it is not that I hate cities just LA and NYC.

What, who claimed that prime areas will never go down? It certainly wasn’t me. I have stated MANY times that prime areas will weather the next storm much better than non prime areas for obvious reasons. The areas you mentioned are all undergoing gentrification (some more than others), go drive down to any of these areas and see for yourself. LA County, OC, IE has close to 20M residents. There are only so many super prime properties available (Malibu, Newport, Santa Monica, etc.). These properties haven’t been affordable to the commoner for a long time. The commoner (upper middle class) is looking for the next wrung of the ladder…and that is Redondo, Torrance, Culver City, Irvine, etc.

You even claim you don’t live in LA. If you don’t live here, you don’t understand the ever changing dynamics of the housing market in this city. By the way, I think most of LA is toilet too. But if you can afford the nice areas, it sure is tough to beat. Middle of winter, 70 degrees and sunny at the beach. Life is good!

LB – I may not live there now but I have spent the majority of my life in the area. The good news is that I understand much better than you think what is going on. Like I said I do visit and have many friends still in the area.

BTW this is not the first time “gentrification” has occurred. Most of the areas you mention were open fields when my family first arrived in the 1800’s. The first land speculators in the area were agriculture and oil. The further you moved up the coast the bigger mining played a part. Hard to believe that speculating was going on in California before most families even reached the US. Like I said before nothing really all that new here same old shit different ass…

As a former native Chicago who fled to the West where I made my fortune and relatives who still reside there in their 60’s and 70’s with a chain link fence, and weeds in the grass, and a tree, They dream of our lives out West but never had the guts to do it.

Tell me what you like about old outdated cities with narrow minds, outdated ballparks that the owners tell you it is history, toll roads, taxes, lousy weather can I gone on of course.?

Right now I’m brushing the pool overlooking a canyon, with mountains that songs are made of and you like Boston and Chicago?

The return of little “r”. You can have the s-hole my friend. Enjoy the traffic, smog, crowds where every a-holes thinks they are a producer. Yea it is really fun driving in circles for 30 minutes looking for a parking space. I love planning my day around traffic. The funny thing was that I seemed to do more outdoor activities when I spent time with the narrow minds in Boston than in the perpetual sunshine of So-Cal. Yes the weather is great but I enjoy where I am now way more than I did when I was in LA. I think the most narrow minds of all would believe that LA is the only place on earth worth living in. Most of my friends couldn’t wait to get out and the ones still there complain about all the newcomer a-holes like yourself… Enjoy!

My business is here in Pasadena. I grew up in Southwestern Connecticut, so I will tell you what I miss:

A) People able to speak English.

B) Many more millionaires per capita than CA, ranked 12 of 50 in median income. Sorry, NJ, MD, CT and VA is where it’s at income-wise.

C) Public schools that you could actually go to.

D) Not having to clean a thick layer of smut off everything every two weeks. Imagine what that does to the lungs.

E) Cops that actually work for you, not who menace you.

F) I forked over 21K to Jerry Brown this week and am getting little for it. This is just income tax and doesn’t include the 9% sales tax.

G) Kind of frustrating to live somewhere where half the population is on the government dole. 25% of Californians are on Medi-Caid, a program for the “poor.”

H) Your view is in the minority apparently since CA has a net population loss despite immigrants constantly coming in.

I) Outside of Caltech, Berkley and Stanford, very few schools that are acknowledged to be top-tier outside of CA. Try to get a Wall Street job with a UC-Riverside degree. Clearly, this is not fair and accurate, but that’s the way it is.

I can go on and on. There ain’t nothing special about California except the weather and that’s not everything.

Brushing a pool while commenting on blog? That’s some feat. Point is, instead of enjoying those mountains songs are made of (good grief, really?), you’re here telling us about it.

AK, so, one of your gripes is not enough millionnaires per capita? Wow, ok.

And as another 4th gen Californian and a UCLA grad, I’m asking what you mean by Top tier? Top 20 in America is top tier, dude. Your LA hate knows no bounds!

Go Bruins!

ak, seems like you generalizing quite a bit. Most of the issues you have with CA don’t exist in the desirable areas; hence, the premium you pay. I’m sure the same goes for CT, NJ, NY, MD, VA…you aren’t living the charmed life unless you have money. The weather counts for quite a substantial premium. Ask anybody back east how they are enjoying their nice mild winter.

We don’t need anymore people here, it’s crowded enough. If there are so many things wrong with this place…leave or don’t come here. It’s that simple.

DFresh – you would be the first Californian that I have heard that thinks LA is still a great place. I know of no one who was born in LA county that thinks LA is a great place especially if you are over 30. Have you ever been outside of the basin? Are you a young frog in the slow boil that hasn’t noticed any heat?

I understand all the transplants thinking it is the greatest thing since sliced bread because of the dreams created by watching too much TV. Most of these folks wake up and realize it was really a nightmare and leave. I guess some folks never wake and live a life of walking sleep…

Sorry,

I have a degree from UCLA also. They don’t consier it top 20 on the East Coast. Again, it’s unfair bias, but it’s the way it is.

California is great. But hearing people here, you think it’s magical. It ain’t.

What? Huge qualifier….born in Fresno, so argument can be made for transplant status.

DeFresh – WOW!!! I am sorry to hear that… I guess any place is heaven compared to Fresno. I would have to be classified as a transplant.

What a sad story. Has anyone ever been to Fresno? I wouldn’t wish that on my worst enemy… And to think we have people commenting on how awful it would be to live in Chicago or Boston. 🙂

Robert, you’re quite a multitasker. How do you type with that pool brush in hand?

While I’m no fan of robert’s smug triumphalism I have to say that most of the replies to his comment have the tang of bitter rationalization: I failed to get the house I wanted so I’m going to hate California now since it’s easier than hating myself.

As someone who commutes on the 405 I fully recognize the disadvantages of SoCal, but I grew up in the NYC area and the rush hour traffic was just about as bad, the beaches were dirty and crowded, the “mountains” all would barely qualify as hills out here, and I always seemed to have a perpetual cold 6 months out of the year.

While I wish do wish that housing prices were (a lot) lower, I live a 2 minute walk of extensive hiking trails, an easy 20 minute drive to the beach and a half hour from mountains twice as large as anything where I grew up. SoCal is no paradise, but I genuinely do enjoy the outdoor recreation it offers.

There are plenty of nice places to live in the USA, but to deny that SoCal can be one of them just sounds like sour grapes.

And I really do wish that the good doctor would allow for editing of blog entries after submission. I have a bad habit of typing quickly and hitting “Submit Comment” without proofreading, and as a result often end up sounding quasi-literate at best.

I grew up in NJ, live in NYC for 10 years, lived in Florida for 4 years, LA for 6 years. I also spent time in England. There are things that I love about all of the places I lived. The common thread has been great people. Everywhere I have lived I have met people that are great. Spiritual, kind, positive, healthy, adventurous, and fun.

ap – I choose to rent. I could easily purchase a house with my income and savings. I could actually pay cash. I am a finance guy and for me it does not make financial sense to buy. At this point I can live in a beach house for half of what it would cost me to own and sock away the other half. So there are absolutely no sour grapes from me.

I think little “r” is a clown and a shrill/shill to boot.

I am probably the only native of LA that comments on this blog and I believe that LA had jumped the shark many years ago. It has now become a caricature of itself. It is so goofy at this point that I am embarrassed for all the pretending clowns that fill the streets. I was there for Christmas and walking on the promenade was really painful. You wouldn’t understand if I have to explain…

The majority of folks flocking there now are deranged latecomers. I believe that there is quite a bit of myth chasing at this point. Surf and ski in the same day. That was true in my day because the surf wasn’t completely zoo’ed, the traffic to Big Bear was actually pretty quick and you could get a full day with minimal waits on the lifts. All of that no longer exists. It is just a mythical statement repeated by the latest NY transplant. I actually have no desire to live in LA. God bless all the greater fools who do…

@What, there’s plenty of sour grape cases on this blog if you haven’t noticed. It’s nothing more than frustration. People want a decent house in a decent part of town for what they think is a decent price. This is obviously not happening and likely won’t for some time so it feels good to bash LA and socal. If housing prices were reasonable, this would be proclaimed the greatest spot on earth. This is a free country, you are free to go wherever you please. If LA sucks so much, there are plenty of other places that will likely fill the bill. Imagine if I went on Chicago, NY or Austin housing blogs and bashed those areas claiming LA was so much better. I’m sure I’d getting plenty of flack from the locals too. To each their own but the whole “socal sucks so much” gets old quick.

@LB You are not a local. You are and always will be a transplant. It was because of all the transplants f’ing up my home town that made me leave. I lived in MA for 9 years and never claimed to be a New Englander or a local. I am a Californian regardless where I live. I live in Santa Cruz and would never consider myself a Santa Cruz local even when the other transplants call me a local. My cousin lives in Texas and he will never be a Texan. Here in lies the real problem with LA. Some clown rolls into town and day one thinks they are locals and want to tell my about my home town. LA is now a sea of transplants and you can have it as far as I am concerned. I couldn’t care less about the house prices in LA. I have no desire to move back to my home town. If you read my comments you would see that I am more interested in the economics of the housing bubble. This site just happens to be based in So-Cal (my home town). I would still read and follow this site if it was based in FL, AZ or NV. The only sour grapes I may have are about all the transplants. Enjoy my home town…

@What. Dude, sounds like you have a major case of sour grapes. I have lived in socal for over three decades. So yes, I will consider myself a local. Do you need to be born here and have a special certificate proclaiming “socal native and local?” The reason for all the transplants is because socal is desirable in form or another to many; hence, the high home prices. Sorry we effed up “your” city!

LB you will never be a local and it goes without saying that you will never be a native. I can understand the confusion over “local” but you actually think you are a native?

The definition of Native: “a person born in a specified place or associated with a place by birth, whether subsequently resident there or not.”

What, you need to learn the definitions of local and native for the context we are dealing with.

No, I’m not a native because I wasn’t born here.

Yes, I am a local because this locale is where I currently reside.

It’s really not that hard. You can make a great batch of whine with those sour grapes you have!

LB – Move to Hawaii and paddle out at the “local” surf spot, tell the Hawaiians that you are a local because you now live there and tell me how that works out for you…

Yow! I usually like What’s posts here, so the nativist rant is a little bit shocking. Last I looked we’re ALL transplants here. It’s the nature of being an Anglo in California. My wife’s family came over with the 49ers and I’m sure all the Californios thought (rightly) that they were interlopers too. And I’m sure the Chumash et al (the few that survived) thought the Spaniards interlopers.

It’s the nature of the place: Our desire to make a home here gives us all just as much right to define California as anyone else – wherever we were born

ap – with that logic eucalyptus and palm trees would have to be considered native plants… I wonder why my comment about the definition of native is hitting so many nerves on this blog…

It’s not your definition of native that rankles, but your implication that your status as a native somehow gives your opinion greater weight , and renders that of mere “transplants” (like myself who’ve lived here for 35+ years) invalid.

You’re entitled to make up lies about how overtaxed California is compared to, um, New Jersey, but you’re not entitled to make up population loss. California has been growing at roughly 3% per annum since the 2010 census, which is in the middle of the pack along with states like Georgia. California does NOT have net population loss occurring. Sorry, folks, it IS getting more crowded.

I really agree with your basic assessment of LA & NYC. There is no way I would live in either place. NYC actually rations sunshine. LA you can enjoy all the sunshine you want in your car.

I also agree that SF and Chicago are nice cities. I’ve only been to Boston once but it also seemed very nice. My problem is I can’t take being cold for long — chills me to the bone. SF is actually too cold in the city itself. I like San Jose which is warmer and has turned into a city but does not compare of course.

Any suggestions? I’d love to kick Cali to the curb!

Chicago? Really?

I’ve only heard bad things about today’s Chicago. A city so rife with political corruption, gang infestation, and economic problems, it makes L.A. look squeaky clean and prosperous.

Have you actually ever been there? Being a So Cal native and having spent most of my youth west of the 405 I had the same impression. I did a lot of traveling when I got a Job with a large management consulting firm after college. I would hear people talk about Chicago in positive terms and I would say “Chicago, really?” Eventually, I was assigned to a project for a year in Chicago and was very unhappy with the idea. I guess I was expecting Detroit but got something very different. The city was actually very clean and the people were very friendly especially for a city. The food was great and there was great music. They actually have really good Mexican food which was a complete shock to a So-Cal Mexican food snob. It is a very diverse city that seems to work. It is true that they get that awful white stuff in winter but have you ever been to an outdoor concert in fall in Chicago? Some of this may have been low expectations but when I spent two years in NYC which I expected a dirty cold city. And guess what? NYC is a cold dirty city in more ways than one. I hear a lot of negative news on Chicago but I can tell you that the bad parts are somewhat isolated from the good parts and the crime does not really spill over like it does in another big city which shall remain nameless…

That’s an interesting case of the pot calling the kettle black. Our nation’s three largest cities have those things in common (corruption, gangs, and economic problems) like nothing else.

@son of a landlord, I was in Chicago last year (two week business trip). The northern suburbs of Chicago are immaculate. The north side make Beverly Hills look pedestrian, and Manhattan Beach look like a ghetto.

Why would anyone live in Chicago?

Why would anyone buy a condo on the North Side of Chicago, which has a murder rate lower than most small towns (3.3 per 100,000 pop.), incredible ethnic diversity (57 languages spoken in my area), beautiful architecture, friendly people, good public transit, retail and entertainment within an easy walk from my 5 room 2 bed 1200 sq ft vintage condo for which I just paid less than $100,000 (last year) and that has beautiful architecture, lovely vintage details, and is reasonably well-appointed?

Why would anyone live in a town like Chicago, with its vast array of top cultural and civic amenities, its lakefront and beaches, its walkable neighborhoods? Why does Chicago rank #3 on Huff Post’s list of the top 10 cities people are moving to in 2014?

“If it bleeds, it leads”, the journalists say, and that’s why you hear so much about the gangland murders here, which take place in the far south and west reaches of the city, in 6 neighborhoods you and I are most unlikely to have any business in. It’s not difficult to avoid nabes like Grand Crossing, Garfield Park, and Pullman. Those areas are 25 miles from where I live, and while my general area has a couple of nasty little pockets, overall it is one of the safest, cleanest, and most pleasant places to live of any city or town I have lived in.

And it’s a neighborhood in which you can buy a great house for $400-$600K, and a perfectly lovely little 3-2 brick bungalow for under $300K.

You want a “prime” neighborhood closer to downtown? You can buy a fine house in Lakeview for about $500K to $700K, and in Lincoln Park, which is REALLY prime, for $800K up.

But you don’t have to live in these “hot” neighborhoods for beautiful housing and a high degree of safety and comfort. The north side includes such great neighborhoods as Ravenswood (Rahm Emanual’s home), Old Irving, Edgewater Glen, Lakewood-Balmoral, Jefferson Park, Saganash Park, Portage Park, North Park, West Ridge-W Rogers Park, which last is my home and is affordable, beautiful, ethnically diverse, convenient, interesting, and safe.

Ernst, if Chicago had Manhattan Beach’s weather then it certainly would be the center of the universe. I haven’t looked at the weather reports, but I’m sure it’s been “quite a while” since Chicago has seen a nice sunny 70 degree day. Weather is a key ingredient that drives prices here…

@Lord Blankfein, you should read @Laura Louzader’s post. Chicago is world class. SoCal is not. Now if only I could convince the execs at my company to allow me relocate from the 310 area code to Chicago’s north side my life would be perfect…

Ah, the Northside of Chicago is NICE, except when it’s cold. 🙂

Glencoe, Wilmette, Highland Park, Lake Forest, nice leafy areas, in the spring, summer and fall.

Chicago is a great city, one of my favorites, but I like LA (live in Pasadena, work in Westwood), Boston, Seattle, Tokyo and London too. But for raising a family Chicago is one of the best places. Now being single with a good paying Job, then well, LA is probably better. For a family LA stinks.

@What –

You come across as a very angry, bitter person. I used to actually enjoy reading some of your posts. I feel a lot differently after seeing the tone and content of your responses this weekend to LB and others.

“@LB You are not a local. You are and always will be a transplant. It was because of all the transplants f’ing up my home town that made me leave.”

Yah, right. The “transplants” were the ones who f’d it up and “made” YOU leave. Pushing aside the issue of you blaming others for your own actions — or that maybe perhaps people like you also helped to f’k up LA – the simple fact is that LA has had very severe crime, blight and air for decades. Remember, the Watts riots took place in the 1960’s, the Russians commented on the traffic jams during their visit in the 1950’s, and it is a well-documented fact that both smog and gangs have been a huge problem since just after WWII. It was a toilet in the 1970’s and 1980’s, too. Them’s the facts. Stop making out LA to be some kind of place that was wonderful when you were younger but turned horrible when all of the “transplants” suddenly arrived. After the 1980’s You’re not fooling anyone.

LA is going downhill long-term due to long-term economic reasons. The decline in entertainment and aerospace industry in the area, combined with the increasing costs of urban sprawl, has led to a long-term decline. The City like others could even face bankruptcy due to a declining Prop 13 tax base and unfunded pensions. I would never buy a house in LA at current prices for these reasons.

“What a sad story. Has anyone ever been to Fresno? I wouldn’t wish that on my worst enemy…”

OH. Well, then, if you have never been to Fresno, how would you ever know anything about it to opine in that manner?

“I lived in MA for 9 years and never claimed to be a New Englander or a local. I am a Californian regardless where I live. I live in Santa Cruz and would never consider myself a Santa Cruz local even when the other transplants call me a local.”

Wrong, Mr. “What (is love and happiness because those things are lacking in my life)”. HOME IS WHERE THE HEART IS. You can keep chasing all of your anger and running away from all of your insecurity but you are NEVER going to feel at home anywhere in any community until you come to terms with your fears, your materialism, your dishonesty and your hating and your bitterness. Now I realize probably you may not “get it”, but others are reading and hence maybe someone will smile because they understand what I am talking about.

Santa Cruz is a laid-back hippy town that I love very much. I feel VERY sorry for the locals there who have had to put up with an influx of uptight angry assholes from Silicon Valley and LA. You state you left LA because you were unhappy and yet the way you go on and on it’s very clear you are equally miserable in Santa Cruz. You can change your geographic location, but that isn’t going to change the angry monster that still resides inside “What?”

“I am a finance guy and for me it does not make financial sense to buy.”

In other words, a BMW sports car driver — the only kind in Santa Cruz who actually drive such cars. But your car doesn’t change the size of your manhood, either.

I think you misunderstand my discontent with my home town. LA has become so crowded and pretentious that it is no longer the place I grew up. Everyone thinks they are a producer and are more important than everyone else. You talk about San Jose pretension. I assure you there is no more pretension in San Jose than in the city you love so dearly.

My mother was a school teacher in Watts during the riots. So yes I am aware that LA was never perfect but now it is just a crowded zoo.

As for Santa Cruz, I love this place. The “locals†(what ever that means to you) are fine with me including my family from the area.

I have been happy everywhere I lived. This is really a “who moved my cheese†moment. The place changed and I made a change. Most of my friends made the same change for similar reasons. Is it sad to lose your home town? Yes, but I have no regrets. Do transplants get under my skin from time to time? Yes! But hey I think it is healthy to morn the loss of a loved one. So I am not sure who is the bitter man here. Like I said the transplants can have it.

The Fresno comment was supposed to be light humor. Fresno has a reputation in the bay area and I was just making the obligatory joke. It is like Bakersfield to LA.

The most entertaining comment would have to be “In other words, a BMW sports car driver — the only kind in Santa Cruz who actually drive such cars. But your car doesn’t change the size of your manhood, either.â€

You really have me wrong my friend. Could I afford a BMW? Yes! Just about everyone that reports to me or is at an equal or lower pay grade on my team drives a BMW, Mercedes, Audi, Acura, etc. Actually the car I drive would not impress anyone. I am not really trying to impress anyone because I am cool with myself.

BTW – why are you not offended with SOL’s comment “why would anyone want to live in Chicago� This is from someone who never even visited the place… I think I may have hit a nerve with my transplant comment. Maybe that is why I am getting so much flack. Just a thought.

BWAHAHAHAHA

Yes, the new normal is the sales volume of the last 5 years or so. Prices are the factor that is being manipulated by X,Y, and Z(put the names of your own personal villains here) We notice that it is only the coastal cities that seem to be prime. More coast land is not being manufactured. Is Oxnard(coastal) going to be the new Newport Coast? SoCal is manic-depressive, just like the people that live there. Riverside-San Bernardino counties are not even players in this market. Housing in California is an investment and much of it is speculation, the same as investing in the S&P 500. Both appear to be near the top and not a good investment at this time.

There are rumors that the steel as well as the riveting are flawed. Well no worries, we are still unsinkable. The fact that the life boats are only for show proves it…

“Housing across the nation is actually fairly priced…” Not outside of small towns wiht not jobs and run-down neighborhoods. It’s just not as overpriced as SolCal. If home prices has stayed hitched to incomes like they (mostly) did prior to 1994, the average home in the U.S. would only cost around $100K.

If home prices had stayed hitched to average prospective household incomes 20 years out from the purchase date as they (mostly) did prior to 1970, the cost of the average home in the U.S. would actually be declining toward $50K.

Interesting article and graph:

http://www.zerohedge.com/contributed/2014-02-13/%E2%80%9Cforeclosure-rebound-pattern%E2%80%9D-foreclosure-starts-suddenly-jump-57-california-

Foreclosure process starts up 57% is good, this means more inventory coming online. The banks are managing their problem loans better now. The banks see that house prices are going up, so now they can unload these properties for no loss. Or may be they think that the real estate price run up may stop soon, so time to get out now, like those rats abandoning a sinking liner(crew first, of course). When prices were down, the banks were not eager to start foreclosures, because they really did not want the costs of maintaining the property and etc.

@Edward J. Smith, why are foreclosures up? Could it be that Congress has chosen not to extend unemployment benefits and voted to cut food stamp (EBT/SNAP) benefits? Think about it….

It is full steam ahead captain. This ship has no reverse. White Star expects us to make land in record time…

there is not enough time for those items to show up. those pople on unemployment and food stamps are not players in this market. The Capt is correct, but not on that night . Capt, please don’t go out to sea again.

Doc,

We do have a shadow inventory still don’t we? I have a central question.

I am wondering whether it’s banks holding shadow inventory or individual sellers, how much of the current low inventory is from people not wanting to sell because house values were climbing astronomically.

I mean why sell your house today when you could sell it for 20% more a year from now? I think this was the big factor, not being underwater, for a lot of potential sellers. Now that prices have flattened out, I am curious if these very same owners will scramble to sell.

Another point overlooked was when the “Home Owners’ Bill of Rights” came online, there was an artificial and precipitous drop in foreclosures. These delinquent loans will come home to roost at some point.

Prices rose because there was a positive feedback loop cycle for buyers to jump in and for sellers to hold out for higher prices. We are hopefully reaching an inflection point where there will be a negative feedback loop as sellers jump in and buyers pull back given the uncertain outlook in future prices.

Homes don’t need to be linked to incomes. Homes are now tied to how much a fund manager has to invest. Long term the housing funds will do well if you have a 30 year horizon.

That said. Welcome to the SoCal renters chat forum. Everyone here who doesn’t own will most likely never pay the going rate for a SoCal home.

Oh please Sean. A lot of people here own. You’ve been around with your same sob story for years. Grow some confidence and buy a home then. I think people like Lord Blankfein and PapaNow bought homes and they seem happy and still post here. You are just a weak negative Nelly with no research to back up any of your positions. You would remain pathetic as a homeowner or a renter.

Wow Sarah, very insightful. Two people on the forum bought homes. Did you attend the housewarming to confirm? Didn’t think so.

Pathetic is actually believing future decisions of home ownership is based on the posts of this blog.

However, my post was not intended to be negative, it’s saying that most people here will rent because they are unwilling to pay the going rate driven by all market forces in price that are far beyond our control – and the banks – and big brother.

Ideally, posts here could provide some strategy on where to buy, what would be a good long term strategy, etc.. Don’t see many of those.

renters chat forum -or- potential home owners forum…

I think it can be summed up in the following way:

The desireable areas; such as Beverlywood, Culver City, WLA, Santa Monica, Venice, Marina Del Rey, Pasadena: you can find a frumpy house or decent house for about $700K. If you cant or wont sign off that level of home price, then you are left with $450K – $550K homes in areas that are less desirable but do hold potential (parts of Pasadena, Atwater, Los Feliz, Baldwin Hills). But by less desireable I dont mean ‘lousy’. For lousy, you could try SouthLA, or thereabouts for under $400K. And no one speaks of San Gabriel Valley (San Gabriel, Rosemead, Alhambra, Mandarin (Monterey) Park, perhaps because it is mostly Asian. In any case, home prices will fluctuate down, so maybe shave 15% off today’s prices for later this year. But like previous poster alluded to: If you cant afford now, it wont get suddenly affordable. In the mean time, the Inland Empire would be happy to have any of us.

Alhambra, South Pasadena, Pasadena, all very nice places. I have been looking in those areas and you are correct that you need about $700 to enter that market. I think a lot more people would be willing to buy a fixer if they could trust a contractor to renovate the home for a known cost. Those home shows make it look easy but a real renovation isn’t over in an hour.

Sean,

While South Pasadena, Pasadena and Alhambra border each other, they are actually very disparate places and very different markets. 700,000 will get you into Alhambra. 700,000 will also get you into a good part of Pasadena if you wait a while. The inventory in Pasadena is even lower than its surroundings right now. Hold out a bit and I bet this problem will mitigate. Also be warned that you are getting little for the prices in Pasadena as the school system sucks and there are a LOT of bad areas and a LOT of nice areas fairly close to each other.

South Pas is another market altogether. Unless you are looking for a condo, of which there are few, you can’t get sh!t for 700,000. And whatever you get is likely old and needs renovation.

I was curious what the cheapest and most expensive places on the L.A. market were at this time. So I few days ago, I checked Redfin for Compton and Bel Air, which are arguably the cheapest and most expensive areas, respectively.

The cheapest house in Compton is going for $110,000.

The most expensive estate in Bel Air is going for $30,000,000.

There may be cheaper or more expensive houses in other part of L.A. County. My method wasn’t 100% scientific, but I think it gives a good general idea.

There’s also a house in the L.A.’s Sawtelle area (which is just east of Santa Monica) which has been on the market for a while. It’s only $499,000. But it’s a small, boarded up shack. An authentic tear-down, perhaps already condemned.

Great article as usual, Doc!

Here are some added charts to make your point. http://confoundedinterest.wordpress.com/2014/02/14/something-wicked-southern-california-home-sales-worst-in-3-years-as-foreclosure-starts-skyrocket/

Things are getting very weird in the Canajo Valley. Realtors are getting extremely desperate. Sales have dried out but the banks are acting like it’s prime time. My wife just went to see a house that is about to be put on the market in Thousand Oaks. Bank sale(?) It’s a disaster. Cracked slab, rear yard is a disaster, driveway cracked from settling and lack of rebar, multiple homes in the vicinity with the same problem. How much does the bank want? $450k ($215/square foot). They are INSANE. The hole is probably worth $200k tops in the real world. The bank already turned down an offer for $305k. I’m going to be patient. I’m going to be renting for a while. These prices are totally off the charts.

John in Simi: couldn’t agree more on prices west of the 405, north of the 101. My wife and I moved from Huntington Beach and are seeing a similarity to Simi in that there’s no housing with character AND homes are all $450k plus. I agree with you that it’s better to wait out here, but I do know Simi has building ordinances to control the number of houses coming onto the market. For the new ones being built off N Sycamore… Track style nightmares starting at $700k but builders can’t cover costs for less so there’s a lack of inventory on multiple fronts.

Its frustrating making 100k+ and having to rent.

Cranky CPA: “Track style nightmares …”

It’s interesting how fashions change. What’s considered ugly today was once deemed stylish and desirable.

Today most people think tract houses are hideous. Yet some people still regard Tract houses as worthy of admiration and preservation: http://marvistatract.org/

Jim, where you at??

I’m in the trade and was horrified to watch prices in the “affordable” category go up 20% almost overnight last summer. Horrified. I actually had a problem with helping buyers buy… it was just too fast to accept. It happened here in two months — July and August. Prices have NOT retreated to June 2013 levels here. They’ve leveled off but they have NOT lost those gains and the spring season is already starting. It seems that even if only 5 people can afford these prices there will only be 1 house available to sell those 5 people and they will have a bidding war for it!

All these forces discussed affect this and they are powerful obviously. Think about entities that can drive prices up DOUBLE in the course of about 2 years, and then again up 20% in two months! Maybe I’m a bit defeatist … but what can an individual who wants to buy a house do about it? I mean if you have 3 or 4 kids and a dog renting can be a real pain if you WANT to stay in the same place for the next 10 years or so. At some level housing is a very basic good and “ownership” can be a preferable style of filling that need. So, its nice to be informed about all of this, but I don’t think it can really inform what an individual needs to do about their housing situation. These folks at the top “do what they please and they do it with ease.” If they decide tomorrow that your house will be worth a quarter… it will. If they decide it will be worth a million… it will. Instead of trying to be “smart” about a totally gamed system… maybe we should try to do something to change it? I know that’s crazy talk….because it doesn’t appear we have any control of this country.

Even if you buy what you can afford today, the economy is so unstable that you may be out of a job or income reduced quickly. Its just a different world these days and the gloves are off when it comes to the average person. There is very little security for the middle class anymore… at every turn there is a pitfall designed to take you out. Health care, deflated home values, bad job market, inflated tuition costs, deflated 401ks, loss of benefits and incomes across the board, long term care… many foreseeable or likely life events have ben turned into bankrupting opportunities… and just a way to transfer wealth at our expense to the wealthy… you take the debt hit (after someone has to– the money after all is not really there and someone has to be accountable for it) … flame out and are financially destroyed and all the proceeds stay in the hands of those at the top.

The same strategy has always been here in our model … after all, in order to have winners you MUST have losers. (You want to piss off someone who already knows the game is stacked in their favor — refuse to play and watch them get irrationally irate about how unfair YOU are being — they will call you every name in the book. Lazy, welfare cheating, no good vagrant, coward, stupid, and of course the unimaginative go to — LOSER. Well yeah– LOL.) But this is the first time these strategies have been so systematically and effectively aimed at the middle class. Maybe we should have rooted out some of these practices when they were affecting mostly the poor? Just a thought. Now the consumer protections being put in place will probably prevent many middle class wannabes from “wealth” building through real estate during this season.

Now I know it is all a game… but for the most part we do have to play at least some of it. The folks on this forum seem to relish the fact that they are able to sit out a round on housing… but no one can completely not play this game. If you’re renting you are also participating. If you’re sitting on a paid for house you inherited and refusing to sell… you’re playing too. Unless you are living in a box on the street, you are playing this game.

I don’t know the answers, but I’m not sure this blog asks the right questions for an individual trying to decide to buy a house. It is useful to be informed… I just question how some of the people commenting are trying to apply the information.

Housing TO Tank Hard in 2014!!!@

Phew… I thought we lost you.

Thanks for checking in Jim.

January sales look similar the past 5 years. Only after spring will we know the true state of the market.

My Bev Hills adj 2/2 1770sf condo goes up in early March, so happy to report.

“Before people begin saying that SoCal is the next London or Tokyo..”

Read and weep: LA is #20 global tourist destination and #2 in America:

http://www.businessinsider.com/most-popular-tourist-destinations-2013-2013-6#1-bangkok-the-number-one-tourist-destination-this-year-1598-million-people-will-visit-bangkok-spending-upwards-of-143-billion-20

Read and weep: LA is #12 global “cities of opportunity” and #6 overall in innovation.

“This is probably why some people get a halo effect and somehow think their property in “X†city is the next Laguna Beach or San Marino.”

Bam! DHB’s favorite bubble target, Culver City, HAS become a recent, post-gentrified city. Game over.

http://www.citymayors.com/economics/top-cities.html

A great article from gloom and doom for all the soothsayers out there…

http://www.zerohedge.com/news/2014-02-14/certainty-complex-systems-and-unintended-consequences

The only people selling currently are those that HAVE TO SELL. Inventory is pathetically low.

Interesting article from of all places Breitbart on Dr. Housing Bubble’s California. Reader comments at the bottom are of subjects we hear on DHB routinely but sadly without Blert.

http://www.breitbart.com/Big-Government/2014/02/14/Blue-State-Blues-The-Joys-of-Aural-Sex

problem is there are tons of 400k plus houses (in “affordable” areas) but very few “starter range” properties

You got that right. That house is a teardown. On another note, a bank foreclosure came up in Westlake. The interesting thing is that the bank foreclosed in 2009, and people say shadow inventory is a myth….

In No. San Diego County, I’m finding that large homebuilders (38 acres) with pre-approval for 30 homes or so, (already ok’d septic, power and water lines to the land etc) are not building and in fact trying to sell the land. One owner of a building business is even in foreclosure on some of the property. There are two other large plots of land (6 acres, 15 acres) that are also ready with permits for building that are for sale.

It is understandable why it happens. Check with any supplier and they can confirm 100% increase in lumber prices in one year. All other materials and labor went way up. With the liberals pushing for higher minimum wage, all construction labor will increase, too. All this means protection for the big banks who own real estate as collateral.

The whole QE is about bank protection making everyone else poorer (same wage buying less and less).

I have not met a construction worker who makes less than minimum wage. and it is not true that all lumber has increased 100%. Con heart has increased less than 15%. I shop at Anawalt, Stock, Ganahl, and HD.HD con heart prices are the same as last year.

Andy,

What you say it’s true. However, between 2012 and 2013 lumber prices went up 100%. Then, some type of lumber came down a little bit, maybe 20%, but we no longer have the prices from 2012.

It is also true that workers in construction make more than minimum wage. However, to understand what happens when the min. is increased lets assume the minimum wage is $10/ hour. Then a skilled person would make $25/h. Now if the min. becomes 15/h, then the skilled person would ask $40/h because everything else he is buying now costs more. Everyone wants to preserve their purchasing power. You get the idea.

I am not saying if it is good or bad to raise the minimum. That is a totally different subject where we can debate for a long time. There is no correct answer – some benefit and some loose. Surprisingly, if you make an in depth analysis, you will realize the beneficiaries being different than what seems on the surface. For now and here I am just stating a fact. This fact you can not deny.

Here in Nor Cal The Real Estate market is hot! We have also seen a drop in homes sales but this is due to the fact that we only have 700 homes to sell in the entire county. The demand for homes is at all time highs and there are No homes to sell… What does that mean…. Less home sales!

The S&P500 is up about 20% from the time of the housing peak. Housing has not recovered to its peak. The stocks have recovered and pushed ahead, plus, stocks are liquid assets, unlike real estate. Better to be a renter for economic reasons. Being a man of the sea, I move around a lot. The salt air is calling me, especially with the new routes through the Artic due to the melting ice. Those bergs are real trouble.

Sorry captain but the course and speed has already been plotted. The metal and rivet technology has already been baked into the equation. The life boats are only for show. There will be only so many survivors. You may be the captain but you are really just a figurehead, a patsy chosen for your staunch demeanor to assure the passengers and crew that there is nothing to worry about and that we have everything under control as long as the band continues to play. So have another drink to calm your nerves and give the order, full steam ahead…

housing will continue to get juiced along with the $$ supply until the printing stops

with the underlying weakness in US and global economies, it may take 4-6 years for Fed to be tapped out and US debt to hit $20 trillion

then houses go on that long awaited 50% off sale

That’s a great story… How does it end?

From recent history, if you want to buy housing at a 50% off sale in certain parts of this country, you better have all cash or some serious connections. I hope you guys waiting for the big crash are preparing yourselves. And don’t forget you’ll be competing with people who already own RE who want to add more to their portfolio. I personally would love to own another South Bay beach city property if the price is right…trust me, I’ve been saving for another opportunity.

I was reading the following article and came to the belief that the QE sham is just that, a sham.

http://www.equities.com/editors-desk/investing-strategies/dividends-fixed-income/why-the-low-interest-rate-environment-isn-t-going-away-anytime-soon

I was a big believer that the Fed’s QE “printing money out of thin air†was going to cause massive inflation… Now I am starting to believe I took the bait along with the rest.

First, we are at a debt level that completely stifles growth.

“Academic research has shown that a public and private debt to GDP ratio above the range of 260-275% has a depressing impact on economic growth.â€

“Based on the latest 2013 figures, total private and public debt amounted to $58.2 trillion or 344% of GDPâ€

Creating more debt/money will not increase economic activity it will actually stifle growth.

Second, the “printing†is not making it into the money supply.

“…the money multiplier, which reflects the conversion of bank reserves into deposits (money) by the banking system, fell to a new 100 year low of less than 3 in late December 2013.â€

“Since 1913, $1 of high-powered money has, on average, resulted in an increase of $8.20 of M2.â€

Third, what money is actually making it into the system is not increasing economic activity.

“With the money supply expanding at 5.6% in the latest year, it would be reasonable to expect the same growth rate in nominal GDP if V were stable. Unfortunately, since 1997 velocity has been falling, and in the last twelve months it has dropped by 3% to 1.57, the lowest level in six decade.â€

Fourth and most important is that the kind of debt matters. Debt for investment in future productivity is good debt because it can pay for itself. Debt for consumption can never pay for itself and is doomed.

“If debt generates an income stream that repays principal and interest and creates other activities, it will tend to expand economic activity and cause V to rise. Student, auto and other loans for consumption (which represent the bulk of the increase in consumer credit in 2013) do not meet the necessary criteria, so debt is merely an acceleration of future consumption. This will tend to inhibit the borrower’s ability to increase consumption in the future.â€

I recognize that the point of this article was to argue about why interest rates will not rise in the near future. However, I believe the failure of QE3 to actually impact economic activity or even money supply is even more startling.

I am starting to suspect that the Fed’s real plan is to get “investors†out of lower risk dollar denominated investments and into higher risk equities and hard assets. This way the banks are not holding the bag during the next crisis, you are. I think their plan worked pretty well if this was their real plan…

What: “Second, the “printing†is not making it into the money supply.”

But won’t the printing make it into the money supply … eventually?

I’d read a conspiracy theory a few years ago: Banks are withholding the new money from the economy to keep house prices low. This allows banks and big investors to buy houses cheaply. AFTER they’ve bought up a lot of houses, THEN they release the new money into the economy, creating hyperinflation and driving up the prices of their own houses.

Well, big investors did buy up a lot of houses these last few years. And when banks release all that money, home prices should go up, especially if loans become easy to get again.

In which case, so much for home prices tanking hard in 2014.

SOL – So, how do these banks “release all the money”? They would have to loan the money from their reserves. There will be no more new loans if housing goes any higher. I am not convinced that this plan will work. I am not saying it is not the plan but it sounds like a really bad plan to me… I think it make more sense to get the assets off their balance sheet and onto the publics balance sheet before the next crisis. That sounds like a much better plan to me… I am not saying that’s the plan but that would be my plan if I was an evil sociopath.

First off, I have to say that our backgrounds and conclusions are pretty similar–I also grew up in LA (South Bay) with a stop in the Santa Cruz area. I lament that the Southern California of the 80s and earlier is gone and isn’t coming back, and what has filled the void, so to speak, is fiscally unsustainable.

In any case, I think that the great money print of Bernanke hasn’t led to inflation (also my initial belief) because of the low velocity of the money supply right now. Shock: businesses aren’t investing. And now there’s this huge balance sheet. And yes, it was all about forcing folks out of “safe” long-term investments–I think that’s pretty indisputable.

But I also think that the Fed is trying to get out of the QE game and actually needs to raise rates. I don’t think Yellen has sufficiently prepared the market for this change, and that it’ll be necessary sooner rather than later. With the Taylor rule, we should already be at 1.5%. The credibility of the Fed is kinda at stake here now, and yes, I think they actually care. Vice Chair Fischer is a very well respected hawk, and I think Yellen and the other Board members will be listening to him.

So, So. Cal. will have a rising interest rate environment with stagnant wages in the private sector and less economic opportunity as the state’s war on business continues. Public funding will increasingly be for $200,000 firefighters and their pension packages. (Did you know that 92% of the San Diego Unified School District Budget goes towards salaries and benefits?) Potholes won’t be fixed and public services will continue to decline. The rich Chinese will grow tired of the charade and try to cash out and move into another investment now that they’ve fled the homeland. That 3% cap rate enjoyed by investors will look like peanuts, and the money will rotate back into the ten-year note. And then we’ll have the day where folks scratch their head about their $800k home in deeply inland Redondo Beach and wonder what the heck they’ve gotten themselves into.

“How I learned to love SoCal and forget the housing bubble” Doc, what does this mean and how have you done this?

Sigh. I guess nobody under 40 even remembers Dr. Strangelove anymore. I always thought DHB’s association of housing with Kubrick’s “nightmare comedy” rather apt. Weapons of financial mass destruction indeed.

Yes, I’m under 40 and not really into films. Thanks and now I have a movie to watch tonight.

I’ve been slowly dipping my toes in the San Diego market to buy, but these prices are outrageous. One complex in particular in Point Loma was just over $500,000 during the bubble for a 2 bed/2.5 bath 1300 sqf. condo with a two car garage and biking distance to the beach. Just a year ago the price was down near $350,000 for the same model, but is now back up to $440,000+ for similar models. I can’t believe the stratospheric rise back to nearly peak prices. I can’t begin to justify paying the newly inflated prices, so i’m planning on sitting this market out and waiting for the next correction. At 25 years old and with a 20%+ downpayment, i’m hoping that time is on my side.

Kristopher, I agree with what you’re seeing, I’m also looking at SD, but in North County. Prices are still high even with recent downturn in RE buying, retail off etc. But I’m also seeing houses fall out of escrow, then quickly sold again with 15K or so off the top so I’m hoping deals can be made when you get to that stage. I’ve gotta go out of L.A. this year and will just have to do the best I can and not go over my budget. I’m ready to lower my expectations and live down a bit just for the peace of mind. You have such good situation with your cash/age you can take some risk, but good to wait if you can. After all “housing to tank in 2014!” right?

Kristopher, you have all the time in the world so I wouldn’t lose any sleep at night. From the info you stated, there are a few things to note. Prices are still down over 10% from the peak. Compared to the bubble days, today’s interest rates are likely 1 or more percent lower. Today’s pricing in real terms is likely 20% lower compared to the peak. What do units in this complex rent for? Do the calculation and if you are at or near rental parity you might want to consider buying. In hindsight, buying a few years ago was an absolute no brainer based purely on the numbers.

Prices in many urban parts of soCal are over-valued if using price to rent and income ratios. The problem is that monetary and fiscal measures aimed at helping the housing market do so in an uneven way. Areas that needed support often got caught in battles between govt and lenders, whereas higher end homes that didn’t need bailing out, piggy-backed off the upward price momentum. In places like LA, this reinforced the myth that somehow the local market can absorb these inflated prices. In reality, imminent higher mortgage rates will smother demand, and if inventory gathers momentum, there could be a correction to 2012 prices.

Leave a Reply