Southern California housing market indicators update for the end of September 2010 – MLS inventory up, NODs sharply up, and rumors of banks taking more action on foreclosures.

I wanted to examine the current state of the Southern California real estate market from three different angles. First, I wanted to look at changes in the distressed market inventory. Next, we will look at trends in prices and home sales. Finally we will look at changes in the actual MLS inventory count. The toxic mortgages are being worked through the system. As reluctant as banks are to recognize the reality that home prices will not come close to bubble level prices, many are now moving on inventory. I have heard on multiple accounts from those who either buy homes as investors or work inside banks that many financial institutions are now starting to gear up on moving out their shadow inventory. From looking at key indicators this seems to be the case.

Let us examine changes in distressed inventory over the last two months for Southern California:

Distressed market indicators

8/4/2010 to 9/25/2010

Notice of defaults filed:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â +4,518

Scheduled auctions:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â -5,315

Bank owned homes:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â +352

For many months notice of defaults steadily declined as banks held off on the foreclosure process. But over the last two months notice of defaults have spiked by 10 percent. Does this mean that the shadow inventory is now working its way through? Maybe. It is too early to tell. Scheduled auctions have fallen and these usually track with bank owned homes. It is safe to assume that many at this stage were either sold through short sales or were place on modifications. Yet the fact that NODs have recently spiked tells us auctions should bounce up in the next few months.

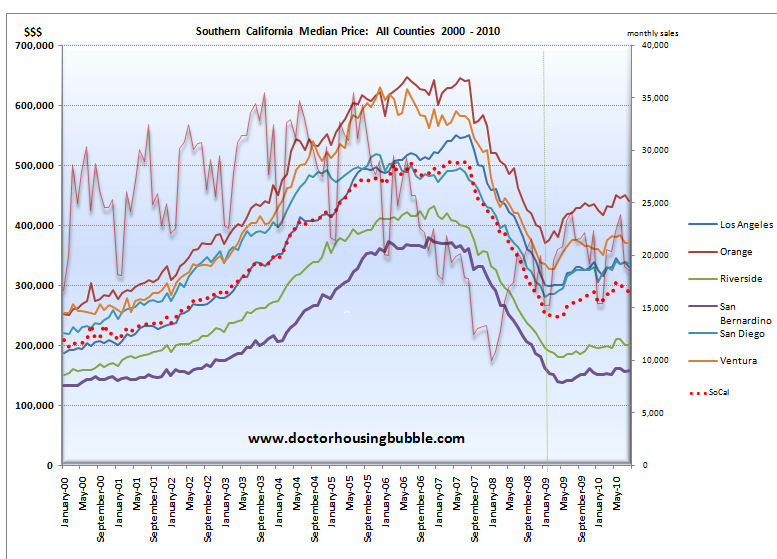

Sales trend:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â year-over-year down -13.80%

Median price trend:Â Â Â Â Â Â Â year-over-year up 4.7% (down $7,000 from last month)

Median home prices in Southern California have now fallen for three consecutive months. After reaching a median of $305,000 in May the median is now back down to $288,000 (a decline of 5.5% over three months). The real big change is with home sales. Year over year homes sales have fallen by approximately 14%. If past trends are any indicators, this means prices have added pressure on the downside.

9/5/2010 to 9/25/2010

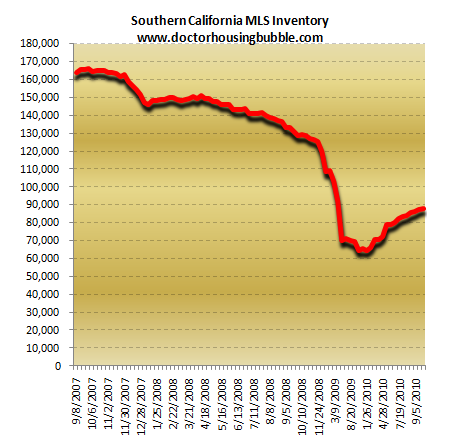

Southern California MLS inventory indicator:Â Â Â Â Â Â +2,011

If banks are really moving on shadow inventory then it should be no surprise that MLS inventory added 2,000 homes over the last 20 days. Most “organic sellers†do not sell in fall so it is safe to say much of this is coming from the distressed pipeline.

We’ll keep an eye on these indicators since the next few months will show how much Southern California home prices will correct.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

26 Responses to “Southern California housing market indicators update for the end of September 2010 – MLS inventory up, NODs sharply up, and rumors of banks taking more action on foreclosures.”

Last week I was in Malibu-Zuma and there were a lot of for sale signs on PCH. It looks like the rich people are starting to fold. The rich are the last to fold. The middle class folks went first, now the rich are throwing in the towel, so may be the end is in sight, oh, maybe the light is a train coming through the tunnel……?

I vote the latter…

Even with all this price correction–and more to come–the proportion of household income eaten up by mortgage interest continues to grow as income/wages decrease. This is one of the untold stories since the 1970s, when real wages started declining. The housing boom–and with it the debt boom–represents a huge shift of already eroding wages directly into the pockets of banksters.

That’s the piece that rarely gets calculated or highlighted in discussing housing debt. Mortgage interest is front end loaded. This is why it makes sense to make a solid down payment and pay ahead if possible (without penalty): to get out from under the interest portion of the debt. To rocket ahead if possible into a situation where the borrower is putting that money into principal rather than interest.

Visualize this as a curve starting high on a chart, at the left margin, and going downward. The first 17 or so years of a 30-year loan, the bank gets the bulk of the total monthly payment as interest (the area under that line).

Each time a mortgage holder refinances, the interest is reset to the fattest part of the curve–Month One and on. This is obviously what the lenders like. And why lenders encouraged nonsense like Option ARMs and Interest Only Mortgages: the longer they can keep people in the first few years of a loan (through adjustment of loan terms), or paying only interest, the more interest they skim. Why shouldn’t they discourage the paydown of principal, since the more the borrower owes, and the more often the borrower has to finance, the more interest the lender gets?

Thus in the first X years of a mortgage, a huge proportion of a household’s income is going right into the lender’s pockets. Not into more productive pursuits.

People obsess on the “value” of their house going down. Even though the “value” is set at point of sale and really doesn’t exist before then.

But somehow they overlook that as WAGES and INCOME go down, and JOBLESSNESS goes up, the proportion of indentured servitude represented by their mortgage interest payments skyrockets. And now the banks have borrowers coming and going. Not only do they siphon off wages in the form of interest, which is fatter earlier and reset to Month One with each refi, now they’re also eroding the principal people have paid on their homes, if any.

DHB, I’d love to see you compare some estimate of the interest portion of housing indebtedness, over say the past 30 years, to median incomes in that time. I’d be willing to bet that the overall proportion of household income paid to interest has gone up hugely in that time.

It isn’t just that houses are too expensive (principal). Debt is too expensive as well (interest, no matter how low the percentage). Housing “values” could go down another 15 or 20 or whatever percent, but the lenders will still structure loans so they get that lifeline of interest (and fees) to which they have become accustomed.

rose

Rose,

Closing cost are already increasing.

Statistically, the national average for closing costs seems to have soared in 2010, up 37% to $3,741 from just $2,732 in 2009.

But that’s probably deceiving. What’s new this year is that a revised government-mandated good faith estimate took effect and it requires all projected expenses be accurate within 10%. That way, there are no big surprises at closing.

http://nocrealestateblog.blogspot.com/2010/09/closing-costs-soaring-nationwide.html

OilCan, you are in my experience exactly correct. And that increase in closing costs–$1,000–is a big nut percentage-wise when a family’s income is eroded in all the ways that have been applied systematically to wages since the ’70s. And that are still being applied today (corporate profits celebrated when all they result from is slashing jobs).

But people have been taught to think, “Oh, $1,000 isn’t so much! Why in 2006, this house sold for 80 gajillion! So I’m saving well over 79 gajillion!” They aren’t taught to think about what percentage of their monthly income will go to paying that $1K plus the interest on it. Particularly how it will hit their pockets in the initial months of the loan.

To put it another way, Wall St. and the banksters have succeeded in convincing everyone that in order to win on Wall St. and with the banks, you have to play Monopoly like Wall St. and the banksters do. Problem is, the little guys simply cannot win, because our scale and computers are too small.

I always hated Monopoly.

Well then, it would make sense that the repeal of that also be added to the “contract with America”!

Agree Rose. Last time I checked, 9% on 100,000 is still less than 5% on 400,000…

And, MT, $3,500 in closing costs and $150K in interest is a much larger proportion of a $18K Wal-Mart greeter salary in a household, or of X months of unemployment benefits, or nothin’ at all, than it was of two productive “Old Economy” median salaries.

This nation is in desperate need of remedial arithmetic for all.

You Nailed it!!!

Brilliant. And where do the banks get all the money to lend to us and charge us outrageous interest on outrageous terms (front loaded mortgages)? Why it is mostly created for them out of thin air!

Oh so that’s how the economy really works and why the banking industry gets richer and richer and the average person does not (well that and bailouts). It has nothing to do with the operation of the free market and the allocation of productive wealth.

I saw a documentary called “Maxed Out” released in 2005 that featured a heavy dose of Elizabeth Warren and some ex-bankers.

Basically, the banks make most of their money off of the stupid and broke, thus they have every incentive to keep people as stupid and broke as possible. They like those who have recently declared bankruptcy the most because they can’t declare it again for quite awhile.

Since no one in the US has a monthly budget or can do basic math, it makes it real easy for the banksters to scam us. If you’re often looking at your monthly budget and monthly income and paying attention to how much things are costing, it makes it much easier to say “No” to credit.

It’s time for a return to heavy usury protections (and 9th grade math).

The banks are between a rock and a hard place (ie – a brick wall). If they “take more action” on foreclosures and flood the market with repossessed homes, it will be like a 10 megaton bomb going off – it will kill the housing market and the banks along with it. If they do nothing, the banks die a slow death, like that of leprosy or cancer, from worthless home loans and lack of funds. Damned if you do, and damned if you do otherwise.

There’s no pretty end to this boys and girls.

Disagree,

The recession was over 19 months ago, according to the Bureau of AccuStatistics and Truth-tellers. In fact, I’m pretty sure all those non-matching 401k and employer defferred raises will be retroactively instated, with interest. As Donald Fagen himself once said, “Don’t think I’ve been taken in by stories I have heard. I just read the daily news and swear by every word.” Everything’s OK now, it was just an accounting mistake.

Wow, a three month decline of 5.5%. That’s pretty fast for housing.

Raising the inventory going into the slow season?! That’s not too smart.

Loans that are over $600K are probably where banks will feel the most pain on their balance sheets from losses. Perhaps you could pick a town or zip code with homes that are in the $1M range and see how many are now not paying their mortgages?

It has been unusually quiet here on the Westside, since home sales fell of a cliff in August, once the government juice disappeared. The calm before the storm. A spattering of sales, probably due to all cash buyers looking to hedge their bets. However th overall market is DEAD. With 4 % rates and gobs of inventory, the market should be going wild. Instead ,you have banks and the government, acting like deers in the headlights. But, as long as the government is able to print, loan at .25% and pay 2.5% through treasuries to banks, the market will stay flatlined…………………………..

http://www.westsideremeltdown.blogspot.com

The patient (Real Estate) is suffering from terminal cancer. We have used chemotherapy for years (fighting fire with fire) to battle this terrible disease. The government needs to stop wasting time with injections and let the patient die.

Think of it as a mountain fire, everything dies and comes back many years later much stronger than before. Why did our previous administrations let this develop? Who was asleep at the wheel? Now we have to fix America one house at a time…

I think in the relatively near future government will work out some kind of amnesty for the student loan mania that is still alive and well. An entire generation suckered into the pretense that a college degree guarantees a high-income profession for life. Just worked with a fellow with a rather impressive medical technology degree saying he took a job at our company making 10% of what he was making before he was laid off over a year ago. As Doc indicated recently, young professionals already have a mortgage–student loans that they cannot walk away from. I don’t know how many RHG’s a bunch of drywall hangers and survey stake holders are going to buy. Couple of other bubbles getting ready to crash?:

Gold-all time high? P Hilton seems to be at an all-time high too…

Apple-done amazing things last few years. Dell used to be growing 40% a year.

Pharma-my generation isn’t in awe of drugs, except maybe Viagra-type stuff. The next generations are even less in awe. Demographic’s are baked in–but cracks are forming around the edges.

Media–everyone is still in love with any form of stimulation, but they have less and less the means and the willingness to overpay for the stuff. Blu-ray may have seen it’s day.

Insurance of all kinds–considering the advertising budgets, there must be huge profits in auto insurance. At some point, growth will stop because it too cannot grow faster than wages indefinitely.

Sports–Tampa Bay can’t afford the best team in baseball for much longer. The rest of the nation can’t support the growth indefinitely. How ’bout that billion-dollar stadium for 0-2 ‘boys?

Private transportation–much of green shoots is about building more roads, but this expensive infrastructure cannot continue to grow indefinately either. Each lane you add to a highway adds less flow/lane. It’s a dead end road.

Municipal and other bonds–Ben will copter in loot to keep states from defaulting, but don’t assume all bonds are backed by some FDIC. Credit default swaps–remember those? Not guaranteed, unless Goldman is a counterparty.

Derivatives–over a quadrillion out there now. Enough for earth and the entire solar system. Derivatives either grow or die, and when they die, it is very ugly.

It took over a year and a half to realize the recession ended? Bubble in dubious statistics too?

DARK AGES wrote:

Just worked with a fellow with a rather impressive medical technology degree saying he took a job at our company making 10% of what he was making before he was laid off over a year ago.

That story belongs in the urban legend book right along with kidney thieves and the Chuppacabra.

Making 10% of what he made at his last job? Huh?

As to the rest of the ramblings, what the hell does Apple, Tampa Bay’s baseball owners and Blue-Ray discs have to do with anything?

Yeah, the insurance business is very profitable. It’s the ultimate arbitrage play. You just realize this? But so are most if not all the other businesses that advertise on television.

News flash to all liberal bedwetters- America is a grand experiment in capitalism, not socialism. We have thse things called profits, sometimes losses, and what is supposed to be a darwinian model for business.

Don’t get your tights in a wad, Robin. It is germaine to the discussion in this measure: We have become accustomed to living beyond our means as a nation and do not consider the cost of things in our budgets. We buy shit we can’t afford and assume somehow it all will work out in the end. Business assumes they can squeeze the middle class indefinitely because they have been doing it for years. Gov assumes they can inflate away all our debts and kick the cans down the road forever. Apple is cool and probably has more cool stuff in the pipleline, but perpetual growth is a fool’s dream. If it’s grow or die, death is certain eventually.

The guy wasn’t bragging about it. The lead tech on the project asked him why he came over and he explained matter of fact. Not in a braggart way. My boss was director of Engineering, got outsted and I ran into him working at Staples: 115k to whatever the hell they pay at Staples to work the floor–I’m guessing less than 100k. (trophy wife went back to momma) Stock market’s up–American dream is down.

Nobody ever mentions what happens to government bonds when interest rates go up.

A couple of the ZIPs I watch are 92116 and 92103. Each of them have over 2 years MLS inventory on houses above 700K. This is going by the last three months of sales data.

You know, I am not asking too much. Given that 500K is what most people make in 10 years (after taxes), is it too much to ask that I get something other than a dump?

This might answer a few questions about those pocket areas that don’t seem to drop YET……………..http://www.dailyfinance.com/story/investing/a-tale-of-two-cities-real-estate-in-new-york-and-los-angeles/19646093/

I grew up in 92216. Only maybe 5-10% are home with a value of over $700.000. I had three different paper routes including a lot of the now $700,000 houses. I use to do monthly collections. Wish I could remember the inside architecture going insides and getting my money.

Meant 92116, not 92216. Sold my Mom’s house at the top of the market. She died in 2003. Kept the house empty. Put in on the market as soom as the general housing market topped. Had it sold in three months. Market for 92216 (Kensington) stayed up another a year before the market really hit the upper middle class in older areas.

Doctor,

I am looking forward to your posts on this subject in the coming months, i have heard similar stories but am skeptical about how much shadow inventory banks will release. Keep up the good work.

Leave a Reply