Southern California takes the trophy for most overvalued real estate in the nation: Austin Texas now home to inflated real estate as well.

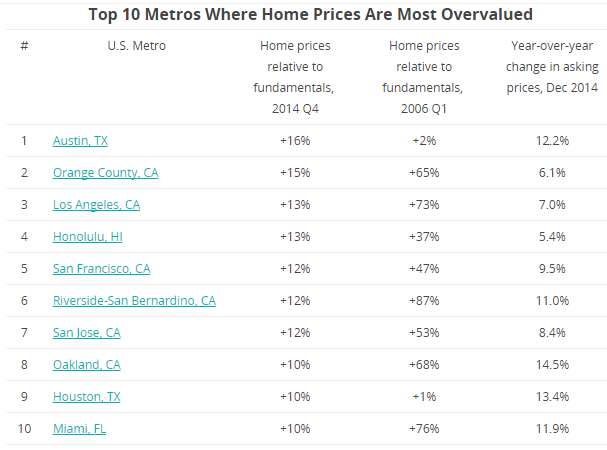

You might think that the Bay Area is home to the most inflated real estate in the US but being “over priced†is also relative to local area incomes. The army of tech professionals in the Bay Area earning healthy household incomes is expansive. Sure, having a household earning $150,000 a year might make it tight to purchase a $1 million crap shack but that is the situation. So it should come as no surprise that in the land of “All Hat and no Cattle†that we have the most overpriced real estate. According to a report by Trulia the most overpriced areas come in as Austin (Texas), Orange County, and Los Angeles. Why? Incomes are detached from the rise of home prices. Of course in some areas foreign money and investors with deep pockets have pushed prices to stratospheric levels. In many parts of the US home prices are within reasonable ranges thanks to the Fed’s ridiculously low interest rate fury road policy. Yet Millennials are not buying in mass because many are deep in debt and incomes are just not keeping up with home prices. If home prices are overvalued, how much are they overvalued by? If everyone thought home prices were within reason there really wouldn’t be all this interest and analysis on the subject.

The bubbliest market of them all

The LA/OC market also has the most inflated rents across the country and that is why we are seeing a massive trend of people taking on roommates or grown adults living with their parents. The rent is too damn high in SoCal. Apparently some think that the trend to living like human sardines is fantastic and needing to eat Top Ramen every other night to pay the mortgage makes sense.

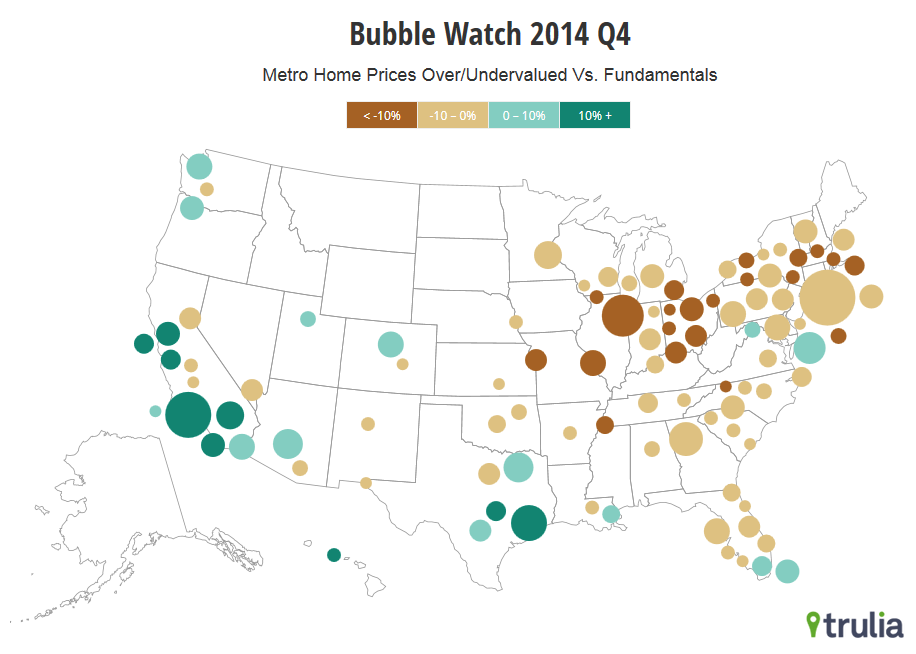

Trulia has a bubble watch report and as you would expect, many California areas make the list:

First note is that according to the report nationwide home values are undervalued by 2 percent. Now this data is up to Q4 2014 so things might have changed since then (values are probably close to being within fundamentals on a nationwide basis). But just look at the most overvalued market on the map above. Our drought ridden and beautiful Southern California tops the list! However, the most overvalued city according to the list is Austin Texas:

What methodology is used here?

“To answer that question, we assess whether home prices are overvalued or undervalued relative to their fundamental value by comparing prices today with historical prices, incomes, and rents. Incomes determine how much people can pay for housing, and price increases aren’t sustainable if they push prices too high relative to incomes. Rents reflect how much people value housing even if they won’t benefit from price appreciation (as renters don’t, but owners do); the price-to-rent ratio is like the price-earnings (P/E) ratio for stocks. Using data from multiple sources (see footnote), we create several measures of fundamental value and combine them in order to calculate how overvalued or undervalued home prices are relative to fundamentals.â€

Seems like a reasonable method but of course you are going to get the meme that incomes don’t matter but everyone that wants to buy is going to pay their mortgage/rent via earned income. Need we remind you that a mortgage is for 30 years? And taking on a $700,000 crap shack mortgage is no tiny commitment.

Is Southern California in a real estate bubble?  Well if you define a bubble as prices going beyond economic fundamentals then yes, prices seem to be frothy today. However it is good to know that we are not the only area going down the real estate fury road of bubbles.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

107 Responses to “Southern California takes the trophy for most overvalued real estate in the nation: Austin Texas now home to inflated real estate as well.”

Lot of folks who bought 2010-2013 are looking to cash out, asking prices are around 2007-2009 price points. Possibly seeing what they can get to cash out before market dips. It’s as if buyers don’t have access to the internet to check MLS sales history.

if people have been trying to cash out then we’d see a glut of inventory

but we don’t see that and thats one of the reason for high prices.. low inventory

Inventory is up YOY in all of these counties. OC and Riverside up more than 30%, LA up 11%.

Orange County

http://i.imgur.com/r9EAbgT.png

Los Angeles County

http://i.imgur.com/WP7IUVN.png

Riverside County

http://i.imgur.com/Rvkd5BP.png

Condos in 92103 up 100 percent in 5 months, houses 20 percent.

NOT PRICES, INVENTORY

Inventory has spiked up drastically within the past few months. Not sure what’s going on but something has seriously changed in regard to inventory and the past few years of low inventory is no longer the case. Then again we constantly get remarks in here from people who aren’t paying attention to what’s going on at the ground level so no surprise you still think the low inventory story still applies.

The ” Inventory ” might be higher – but these are houses that are NOT desirable because these were Repo’ed Houses that were refurbished and put back on market; however these homes have issues like BAD LOCATION … in a tough city, near a freeway or other factors. The NICER properties that ARE DESIRABLE are VERY HIGH PRICED …. SO WHO WANTS TO PAY OUTRAGEOUS PRICES IN EITHER CASE … Only NAIVE BUYERS WILL TAKE THAT RISK.

*** THEREFORE “INVENTORY” OF DESIRABLE AND PURCHASABLE HOMES ARE LOW ***

That doesn’t square with what I’m observing Paul, the inventory creep is happening in both desirable and low-end neighborhoods and homes.

This time it’s different.

When you say “Housing”

I say “Tank Hard”

“Housing!”

“Tank Hard!”

“Housing!”

“Tank Hard!”

Gone from predicting to cheering/hoping I see.

poop in one hand and wish/hope in the other….see which hand fills up first

One of my fav quotes

Some more evidence of apples to apples price declines:

Hacienda Heights 680K 7-5-14

https://www.redfin.com/CA/Hacienda-Heights/2709-Fragancia-Ave-91745/home/7845588

Hacienda Heights comp 632K 4-8-15

https://www.redfin.com/CA/Hacienda-Heights/15727-Pintura-Dr-91745/home/7845684

Of course these are only 2 properties, but I’m seeing these types of comp YOY sales price reductions here and there. This, along with increased inventory and sales volume trending lower in a few areas could be seen as the canary in the coal mine.

Personally I’m leaning toward a foreclosure auction if my Buy Option Lease proposal fails. Knowing that I narrowly missed on an estate auction property in 2012 still irks me. I’m thinking going to the county steps with private financing could allow me to front run some of the downward price action. I doubt foreclosures are getting overbid as flip headroom is minimal. Buying a foreclosure to live in as opposed to flipping makes the math easier than for the specuvestor competition. Anybody else ever went to the court steps for the auctions? It’s an interesting experience. Some of the specuvestors and flippers will chat with you if you approach them well. Something everyone whose taken an interest in SoCal RE should do once.

You have helped me the last few months so I need to help you now. I got beat on 2 properties and actually backed out on 1 in 2012 myself and am still kicking myself. But now is not the time to buy esecially on the steps. Too much wreckless big money there. Way too risky if you ask me to buy that way. Just wait it out another 3 months and I think you will see the price declines accelerate, which should help you wait another 1 – 2 years to scoop something up at 50% declines from present levels. Of if you don’t want to wait that long you could still score 25% below within another 12 months most likely.

Keep the faith, the fundamentals do not support these prices and the FED cannot continue its charity much longer. Down we go soon!!!

Thanks Jim. I don’t necessarily think 50% off is in the cards, but 36% gets us back to 2012 pre-Bubble 2.0 prices. As for the steps, there’s a couple of pre-foreclosure I’m tracking in Hacienda Heights and West Corina. The math would have to makes sense though. I have to factor in opportunity cost as the excellent private financing I have available now is not guaranteed to be their later. Anyone with half a brain buying on the county steps is looking for 25% off on this environment. No momentum to sell into means they need some wiggle room. If it’s a property I REALLY like and I can get it 25% off current market I’d have to consider it. As optimistic as we are we can’t say for certain what the time and extent of the correction will be. Keeping my options open, but I’m in no way in a rush. Despite our adversaries assertions, this thing is wholly unsustainable. There’s going to be a rate raise in September and the bond market is going to start eating itself as sovereign and corporate debt starts to go belly up. Our debate opponents here will see how UN-DETACHED housing is from the real economy at that time. And in case nobody noticed Greek debt is about to turn Deutsche Bank into Lehman Brothers 2.0 and the Chinese stock exchange dropped 16%. But, you know everything is bullish for SoCal housing 🙂

Understandable. I hope that works out for you. Let us know either way. I will sure miss your support to keep me patient through all this, but if you find a good place I will be happy for you 🙂

@ Jim Taylor

Like I’ll stop going to Real estate BLOGs just because I buy a house LOL 😉 I’ve been frequenting BLOGs since the halcyon days of Housing Bubble 1.0. Spent hours Patrick.net and Housing Panic reading bullish commenters on “The New Normal”. They were wrong then and they are wrong now. If I feel the need to pursue a forclosure because I feel my financing option may not be availiable in 2017, I’ll proceed with care and only go for a house that makes sense should I experience problems. If nothing meets that criteria I’m supremely confident I’ll find the house that’s right for me in 2017, or as late as 2020. What I will NOT be doing is blowing my nest egg, to buy a house for OVER rental parity!

What cannot continue will not. Never in the roller coaster history of SoCal RE has a run-up of this magnitude not been followed by a correction. The macro economic factors I mentioned in my last comment assure it.

Patience brother. We will have our time…

You guys are delusional thinking prices will correct by 50% or even 36%. Even bears like myself find that ridiculous. Keep telling yourself that and you will sit on the fence the rest of your life. Don’t want to buy above rental parity or pay redonk prices? Get out of socal.

Sometimes the bearishness of this blog and community tries to push the sentiment buying is a bad idea. Since 2013, people have been predicting crashes and corrections.

@FresnoResident

“The Market Can Remain Irrational Longer Than You Can Remain Solvent”. Heard that RE could never go down prior to the last crash too. Bears didn’t participate in the equity “gains” either. But they didn’t lose their shirts when the day of reckoning arrived.

@FresnoResident

I think I’ll follow the advice of my broker friend with 30 years in the industry over an anonymous internet douche nozzle. They are planning there business strategies based on a correction picking up steam over the next year and a half. Bears were wrong from 2005-2007, but being right is 2008 sure saved them from some catastrophic losses. You’re tone reeks of realtard/homedebtor bias as well as the desperation of someone intellectually bereft of sound argument.

Posts like yours only strengthen my thesis. If twats like you believe in the forever bull market, it must be a complete impossibility. True stupidity has never accurately forecast a market.

@ Prince Of Heck “The Market Can Remain Irrational Longer Than You Can Remain Solventâ€. Heard that RE could never go down prior to the last crash too. Bears didn’t participate in the equity “gains†either. But they didn’t lose their shirts when the day of reckoning arrived.

I agree, but as my renting pal likes to tell me; “Markets can remain irrational longer than you can remain sane.”

We don’t need entire market to fall by 36% or 50%. There should be occasional opportunity for value of such magnitude, for the well placed home-buyer, into the correction – even if wider indices don’t ever reflect it.

I believe NZ’s, your own and my sanity is narrowly within acceptable deviations, for now. 😉 Except we need something soon. “She cannae take any more, Captain. Berny and Yellen been giving the market all they’ve got.”

@NihilistZero

It was first amusing to read you guys circle jerk one another with your pipe dreams but it gets obnoxious. I’m a housing bear and, despite recently buying, am hoping for a dip in prices when hopefully interest rates rise. But your 50% pipe dream wreaks of someone in denial about missing the last RE bottom and being profoundly wrong the past 2 years. An impressionable bloke might read this community and tell themselves that these SoCal nuts are right.

@Galaxy Brain

First, excellent quote on deflation further down the thread. I copied that for future use 🙂 Now as far as holding my sanity, I’ve always found patience the greatest of virtues. Unlike so many of our fellows who strictly live in the now, we are taking a holistic approach to the time we will spend on this rock. In my mind sacrificing a few years out of the (hopefully) many I will spend on this rock to insure my financial stability and well being is a no brainer. What so many Boomers achieved by accident of birth, we are trying to achieve through prudent and decisive action. When we achieve our goal of land ownership at a stable and sustainable price, hopefully to be paid off long before the 30 year amortization table, we’ll have done it facing headwinds they did not. SoCal having transformed into the great sprawl of an international city. An incredibly challenging and dynamic employment environment. Rising cost of everything through unimaginable monetary debasement.

I keep my sanity by knowing that as a child of the 80’s I was born into the raping of the American working class. I will not move from SoCal. I will not waver in my resolve that perma-bull runs are always an unsustainable fantasy. We will have our time brother. May our celebration be great! 🙂

@FresnoResident

So beyond being a douche-nozzle you’re also illiterate. I disagreed with Jim on the 50% downturn. I prognosticated -36% and even then I’m speaking to the more inland areas. That would erase the post 2012 gains but would mean a higher monthly nut as mortgage rates will be elevated. So in other words I’m predicting housing to be MORE expensive than 2012 after the correction.

To fact, we’ve seen this already in 2009-2010. the home buyer credits created a spike in activity and prices, then the market took a mini-dive as soon as those supports were removed. The greater SoCal RE market does not exist in a vacuum and if all it took was monied immigrants to sustain elevated prices, we never would have had the first crash and we CERTAINLY wouldn’t have had the post home buyer credit dip. I’m unsure to the extent of the correction and I’m sure Jt is as well, precisely because this is the most manipulated worldwide financial market in human history! To discuss a correction of extreme severity the unwinding of the QE’tard FED’s policies and 30 plus years of debt expansion will possible cause is not a circle-jerk, it’s merely being prudent. Much as not buying a house you can rent for several hundred dollars less a month is as well.

And with so many people waiting in the wings to strike so quickly, how will prices even have enough time to go down?

PRICES are STILL CHEAP for property … OUTSIDE MAJOR METRO AREA or MAJOR EMPLOYMENT AREAS.

IT IS POSSIBLE TO BUY A 3500 Sq.ft home in Riverside for less than $400-K,

and that’s with a big yard … But Riverside is a long drive to Los Angeles or Orange County.

@Sabbie “And with so many people waiting in the wings to strike so quickly, how will prices even have enough time to go down?”

Define “So many people? JT, me and Galaxy Brain and our ilk hardly represent a huge demographic. Even less so when you combine are desire to buy plus being financially savvy enough to be prudent in the decision. Your argument isn’t supported by math.

@Paul – ( not a Realtor )

A house for 400K in Riverside is overpriced lest it is a 3500SQFT plus McMansion. Even then it is questionable. The low sales volume and listings sitting on the market at below last years comps tells you the market is overvalue in the IE as well. If it wasn’t, those houses would be moving. Perhaps your definition of “cheap” means only $600 over rental parity as opposed to $1000…

“I’m a housing bear and, despite recently buying”

Read no further. Bought at the top in direct contradiction to the self-labeling.

@FresnoResident wrote: “…You guys are delusional thinking prices will correct by 50% or even 36%…”

It’s happened before.

In 1997 I bought a 1 bedroom condo in Culver City for $75K. The previous buyer (who was foreclosed on) had paid $180K in 1992. Adjusted for inflation, $180K in 1992 is equivalent to $305K in 2015 dollars, which is what Culver City 1 bedroom condos are selling for today.

History may not repeat, but it certainly does rhyme.

I do not expect places like Lancaster to correct because median home prices to median household income there is about 4:1, Culver City is about 12:1 so Culver City is in nosebleed territory. Santa Clarita at 7:1 may see a modest correction. Anaheim is at 7:1. Manhattan Beach is at 17:1 so I expect a major correction in Manhattan Beach. Temecula is about 4:1 so no correction in Temecula. West Covina is 7:1 so maybe a modest correction there. Barstow is at 2:1 so no correction in Barstow. Heck, Fresno with a 5:1 ratio will probably no major price correction.

Short answer: I expect anywhere with home price to income ratios of 10:1 to get hammered. There are many places in SoCal that are well below this ratio so I would think those areas are safe from any downward price movement.

Good luck NZ. I’d admire your focus.

I expected better from Paul – ( not a Realtor ) that ‘$400K Riverside cheap houses’ – given he bought his house cheap in a real house price crash early 90s.

Reading the news.. nationally houses near 2006 peak. Home sales booming. I’d like to see some evidence of this supposed pickup in inventory.

Jim, I hope you get your house. But a 50% decline in the next year or two is simply not in the cards. For that to happen we would need the mother of all recessions and other unprecedented events to unfold. If you are that confident in the decline, they have ultra high leverage short positions available in the stock market. Be careful when playing with fire like that!

@Galaxy Brain

Reading the news.. nationally houses near 2006 peak. Home sales booming. I’d like to see some evidence of this supposed pickup in inventory.

Those national numbers aren’t matching up to what’s happening in the SGV and the near IE. Rancho Cucamonga is at 523 listings on Zillow. West Covina is at 190. Median price number is incredibly unreliable indicator with such low volume and sales skewing toward the high end.

Once again I’m not saying the median will be down 36% in two years. I’m saying there will be properties available at such discounts when the downturn picks up. We’re 3 months away from either a FED raise, or if they blink a bond market revolt in the near future. You don’t need a financial apocalypse for such an adjustment. In hindsight the 2008 fiasco wasn’t really all that bad for working people as things never really recovered from the 2001 pop. Sure realtors, specuvestors and others directly tied to the REIC got burned. But in the end for a lot of people who didn’t own property or otherwise get caught u p in the mania, life just went on. If anything it was BETTER during the 2008-2012 period when housing costs were down. It’s not necessarily gonna take something huge for prices to fall back to 2012 levels. The FED inching rates up should be enough.

Not only is the second one about 7% less…but it’s nicer too.

Buying sight unseen is not for the faint of heart. OUr aution house was actually infested with rats. After cleaning that up and remodeling the place (55K). We sold for a bit of profit in 2010. Buyer incentives from the gov’t back then, a bit of a frenzy. The buyers are now back on the market 5 yrs later about 90K higher. Hope they get it, their family has outgrown the cute little place. Looks exactly the way we sold it in 2010.

There is risk to be sure, but that’s why your paying XX% less than retail. If you’ve carefully researched the market and are prepared to do some of the labor yourself it’s a risk worth taking. But only at the right price of course.

I’ve been trying to get a feel for the foreclosure market from a couple of my broker friends and I’m thinking of checking out the next auction at the Pomona Courthouse. If some of the properties are going for 25-30% off retail, I’ll figure the market is slow enough that jumping in the near future wouldn’t leave me in a bad position after a correction. That would also be a good indicator of where the smart money thinks prices are going as even the most basic lipstick on a pig remodel means putting the house back on the market during the not-so-hot back to school season. I’d expect even a slightly seasoned investor would want 1/4th to a 1/3rd below retail headroom.

If I make it to the courthouse I’ll be sure to let you guys know what the properties are going for. Should be an interesting trip.

NZerO whatever you do please don’t come back as a born again prime housing cheerleader like certain doucheholes here who shall remain nameless.

I fully expect that the house I buy could decline in value. Such is CA Real Estate. But unlike all the specuvestor assholes I plan to live in it. Would I rather it not decline? Of course. But if it does so in an environment where lower housing costs are actually spurring the consumer economy (ala the 90’s), I should come out ahead anyway as I should be making more money. Opportunity cost always plays a factor as well.

Rest assured if my place drops a few percentage points I’ll take my medicine. And if by some horrible tragedy we get another ridiculous uptick based on hopium financials soon after I buy, I’ll be here with Jim Taylor and others telling the restless buyers to be patient. The very fact that we’re reading this BLOG means we’re smarter than most. The wise will always get their opportunities…

By what virtue of supply/demand will housing fall 50% anytime soon? Do you think the foreign and stock option cash buyers and the hedge funds will be clamoring to sell at a loss vs ride it out? The last crash saw not just a massive sub prime emergency exit from housing, but also a huge portion of the job market itself was built around real estate, everyone was getting a piece of the pie. This latest “recovery” in contrast has benefited mainly the wealthy. There is way more skin in the game today, these are not the same distressed sellers of yesterday. Back then the rents were still low too, walking away from your house and renting for a while looked like a pretty good option, but not so much anymore. I think the recession circa 2001 will be a much better indicator of this next coming crash, housing did not tank very much. And who’s to say rates won’t drop to 3.25% and kick start a whole new bubble?

“I think the recession circa 2001 will be a much better indicator of this next coming crash, housing did not tank very much.”

2001 recession was solely equities based. To compare it to the current mega bubble in equities, bonds an RE is beyond naive.

“And who’s to say rates won’t drop to 3.25% and kick start a whole new bubble?”

Housing Bubble 2.0 is an echo bubble in which the correction from Bubble 1.0 was circumvented by extraordinary means which even if repeated are not likely to engineer the same result. Could another run happen quickly following a short trough (2011-2012 last time)? Possibly. An Jim Taylor, myself and others are surely preparing to strike quickly. That said the WORLD economy is teetering on a precipice, more so than 2001 or 2008. One of the things that could help it’s precarious balance is a lowering of fixed RE costs for consumers. This would enable an increase in consumer spending without an increase in wages. If you believe in even the most benign notions of TPTB working through the FED to protect their interests, a FED engineered pop of Housing Bubble 2.0 is a VERY reasonable prognostication. Fostering another RE bull run so soon after Housing Bubble 2.0’s demise wouldn’t really serve anyone’s interests.

You forgot about the wild card, non market forces. Esp. with an election coming up, the government will do everything in their power to prop us housing. Loan mods, principal mods, heck they’ll probably even offer zero down.

I have never seen so many for sale signs as I see now in Fremont, S.F. Bay Area.

It looks like bubble pop top to me, but the college educated, foreign born nationals are still buying.

Young famlies who are here for the long haul.

They don’t care if the market drops, as long as they have a job and a roof over their head.

Same in Sacramento eastern suburbs. Lots of inventory hitting the market but still lots of foreign born college educated tech workers buying them up – at any price.

BUT… I’ve heard multiple rumors that Intel Folsom is going to be starting some HUGE layoffs really soon. Since 90% of the staff at that campus are Indian HB-1 workers, perhaps I’ll see some inventory dumping towards the end of the year.

Locals have pretty much stopped buying in my area.

Still sitting pretty in my nice, affordable rental. I’ve come to like renting. Only drawback IMO is landlord stops paying mtg – the house you live in goes into foreclosure (happened in my last rental)… landlord decided to cash out, landlord decides to move back in.

Speaking of foreclosures – in my zip I’ve seen a huge increase in foreclosures coming onto RealtyTrac. I’ve also noticed lots of stores closing up, and near empty restaurants.

Interesting times.

Calgirl

What part of Sacramento are you in?

There’s a huge increase in foreclosures in the eastern suburbs of Sacramento? There are a few but not a huge number. For example, in Carmichael there are five foreclosures listed on Zillow.

Calgirl: BUT… I’ve heard multiple rumors that Intel Folsom is going to be starting some HUGE layoffs really soon. Since 90% of the staff at that campus are Indian HB-1 workers, perhaps I’ll see some inventory dumping towards the end of the year.

I made a mental-note of this. Turns out you were correct, Calgirl, with your HUMINT (Human Intelligence) (rumors) proving to have substance, but layoffs not too severe. Slower PC growth sales, and refocusing on growth markets, seems to be the official line.

_____

Intel Corporation To Layoffs 165 From Santa Clara, 152 From Folsom

June 26, 2015

Intel Corporation (NASDAQ:INTC) confirmed its layoff plans last week, and is now providing more details. By July 15th, the chip maker plans to lay off 152 employees from its Folsom campus, while 165 jobs are going to be trimmed from Intel’s headquarter in Santa Clara.

Over the past five years, Intel’s workforce at Folsom campus has remained almost constant at 6,000 employees, but that’s going to change now. The upcoming layoff represents a staff reduction of around 2.5%, says a report from Sacbee.

The tech giant, which has plants across the U.S. and globally, filed a notice on June 11 with the State Employment Development Department under the “WARN Act letter,†which require big businesses to give advance notice regarding mass layoffs and closures.

continues http://www.valuewalk.com/2015/06/intel-layoffs-165-santa-clara-152-folsom/

Lately, I find one thing more distressing than high housing prices: The belief that High Prices for houses is a GOOD thing. I’m always surprised that people I would otherwise consider to be reasonably bright, think that high house prices are a positive. I usually start with “Good for whom?” and then progress to “Money spent on Housing cannot be spent supporting other businesses” – I’d like to think that I’ve prompted some deep thoughts, but I doubt it. How did this belief come about? IT doesn’t stand up to any sort of critical thought!

Well it is a good thing for those who bought ages ago at mid-to-high end, at very low prices. I know I’d like to be sat on $1 Million house bought cheap ages ago (I’d sell it of course). Rising prices make them ever wealthier on paper and when they sell/or like QE Abyss.. planning to rent out a future inherited house at $5,000+pm.

So you get many in the market who push how great rising prices are, because they’re at the higher end, getting ever more asset wealthier as others pay ever higher prices. Also it’s not collective responsibility when markets fall. No one forced anyone to buy at silly high prices, or not to sell at very high prices before a big crash.

And of course you always get loads in the market chasing easy money, perpetuating how great rising prices are for easy wealth / or selling the idea (it’s up to individuals to make their own decisions about value) – with all sorts of excuses like everyone needs to live somewhere / growing population.

@Chris in Cali:

Google reports that the majority of people possess IQ’s ranging from 85 to 115. This might partially explain why many people think high house prices are beneficial.

Although I generally do not think high house prices are good (for various reasons, including those you mentioned), there are some limited circumstances in which high prices might be beneficial for a limited subset of people. For instance, if you have your house paid off and it has appreciated wildly, you can sell the house, move to a less expensive locale and pocket a sizeable amount of cash. Or sell, rent for a while, and rebuy when the bubble pops, which would also allow you to pocket cash. Alternatively, if you have your house paid off and your neighborhood has appreciated wildly, high prices are a great way to keep out the riff raff. Although people with money don’t always have class as has been previously discussed.

Other than the foregoing, I can’t really think of many circumstances in which high house prices are desirable.

My iq says When you can sell a house to finance your entire retirement, something is seriously out of whack And not likely to last

If someone overpays $100k for something, somebody else has a $100k windfall. Real estate purchases have a strong zero sum game aspect. Of course all kind of side effects make high real estate prices a bad thing for the population in general. Think of less money to spend when it is needed most for kids and household creation, and more money to spend when you don’t need it (at retirement). Make that: shouldn’t need it.

Istrilyin.

Your thinking is pre 2000

Way to go Jim…I am waiting as well…I have 100 k for down payment ,and I good job but dont want to pay for over priced houses, so lets wait, we might as well.

cool down payment, where are you gonna get the rest?

He said he has a good job. Thats where he’ll get the rest.

This past week, I’m seeing lots of inventory and lots of open houses in San Gabriel Valley and Inland Empire. This past week I don’t remember seeing such a horde of houses becoming available. I look at the price history for this house in Rancho Cucamonga that was bought in 2012 for $270,000 and now they just listed for $399,999.

I think like the previous post says, people are looking at this opportunity to cash out. Year over year inventory nearly doubled on most areas of SGV and IE.

And there in lies the potential for a rush-to-the-exits that many say isn’t possible. There are a group of sellers that will need to cash out their gains even if the market top has passed. Reasons could be impending retirement. Age, in other words they won’t live to see the next market top. Or something as simple and familiar as the unexpected financial downturns that befall so many everyday.

As I’ve said before you can have a drop in prices in a low inventory environment just as you can have an increase. The last semi-organic market was in 2011-12 inventory was pretty low and prices were STILL flat to trending down until the FED went QE’tard. Once the market psychology swings prices will move accordingly. I believe it has already begun in some areas.

@ NZ As I’ve said before you can have a drop in prices in a low inventory environment just as you can have an increase.

Or course; basic market theory. Values can shoot up to crazy heights, then crazier heights further in low value market. Yet they can also cascade quickly down in low volume/low inventory/low transaction market too. Cascade… don’t you just love that word. And the shocker for many on the owner side is the transactions taking place at lower prices brings value of their own homes right down.

Conversely, for prices of assets to fall, it takes only one seller and one buyer who agree that the former value of an asset was too high. If no other bids are competing with that buyer’s, then the value of the asset falls, and it falls for everyone who owns it.

If a million other people own it, then their net worth goes down even though they did nothing. Two investors made it happen by transacting, and the rest of the investors made it happen by choosing not to disagree with their price. Financial values can disappear through a decrease in prices for any type of investment asset, including bonds, stocks and land.

-Elliottwave; Deflation.

@SOCAL SCREWED, inventory is up and prices are stable in those areas due to the Chinese governments’ capital control crackdowns that started a few years ago. The hot money coming from Chinese nationals is down to a trickle.

SFR home prices in 5 of 8 Irvine zip codes, as well as parts of the San Gabriel Valley, are down year-over-year due to the Chinese government anti-fraud crackdown. The red hot Red Chinese national real estate money of 2013 and 2014 are now history.

However, you still have the issue of the Federal Reserve keeping the stock markets artificially pumped up via artificially low interest rates. This keeps Santa Monica, Brentwood, Beverly Hills, Holmby Hills, Bel Air, Manhattan Beach, Venice, West Los Angeles, Cheviot Hills and Playa Vista (as well as neighboring Palms, Mar Vista, Culver City and Westchester) artificially high.

One thing to consider when it comes to an inventory increase is how much of that inventory is overpriced. In my neck of the woods, there might be more inventory available but there are plenty of unrealistic sellers asking 10%+ above market value. Just because there is more inventory available and more price drops doesn’t mean the asking price is right to begin with.

Still it’s encouraging.. more inventory. And it only takes one or two sellers to lose their nerve and sell at lower prices, to have an effect on wider values / indices.

I’m enjoying reading the comments on this entry. There’s a slight flicker of hope.

Averages and means in income compared to averages and means in rent/house prices are really misleading.

The reason is LA county is a huge welfare magnet, millions of S-8 households, plus 2 mll illegal aliens (whose wages are cash and not even counted in the stats right?).

I’m not sure how to look at the stats city to city accurately. The whole ‘mix’ of housing plus the demographic issues are a lot to obfuscate things.

I you want to buy a condo in a high crime ghetto – it would look affordable on paper.

But you could go west a few mils in LA and the condo would cost 500-800k and be super pricey on paper, for a similar unit.

Renting in LA is really awful you either have corporate landlords raising rents yearly in large apt buildings poorly run OR you have a private landlord (will kick you out when he can flip his flop).

@HiMomItsMe, you got it.

SoCal is a welfare state. About 50% of population in San Bernadino are on government assistance too.

@ernst blofeld

I find the welfare recipients of South OC far more disturbing than San Bernardino. A whole class of people whose wealth is built on RE development and profits that can only be derived through FED fiat debasement. At least the San Bernardino crowd will admit they’re on welfare…

Actually, about 80 percent of the illegal immigrants worked in jobs that are taxed usually restaurants, maid jobs in hotels. lower skilled assembly worked in food processing even car washed jobs are less in the underground economy than 10 years. You can file taxes without a social security number. Lots of construction workers pay taxes too particularly if they are a plumber, carpenter and even some roofers or drywallers. The start ups economy has lower day labor by having Joe blow do car wash, ride share, cutting someone lawn as long as you have a smart phone. Uber is destroying foreign cab workers and even causing other industries to hire teenagers as indpt contractors. I predict illegal immirgrants will be limted to dishwashing, some cleaning work which is also encouraging more native born to do it as a second job, and most little skilled construcion in 10 years. Mexico is also becoming a car manufacture placed since all the Asian companies and German companies and American companies are producing cars there and Mexico is selling their oil off since it has had production problems. Oil production increases in Mexico about half the Juan and Juanita will not want to come to the US. Oil work tends to pay higher if Juan gets 5 per hour and up he will not come to LA/Oc to make 10 an hour with higher rent costs.

Overpriced? Sure. But on the chart it’s NOTHING like the housing bubble. Orange County is +15% now vs. +65% then – more than FOUR times as bad. The national chart shows some areas moderately overpriced, some areas moderately underpriced, and most areas pretty close to fair pricing (withing 10%). That sounds like normal market operations. It’s certainly not anything like 2006.

The Trulia article itself admits that their numbers are arbitrary. Quoting from the article, “Bubble watching is as much an art as a science because there’s no definitive measure of fundamental value.” Their May 2013 article is supposed to describe their methodology, and again, we find statements such as “it’s impossible to be sure whether price gains are justified by fundamentals until, if and when, a bubble bursts.”

In other words, if their predictions turn out to be completely, they’ve covered their butts: sure they were wrong, but you see, it’s impossible to predict bubbles, so nobody could have done it better. This type of thinking leads to intellectual laziness.

The May 2013 claims that their methodology is based in part on “the price-to-rent ratio (national only)”. See how it says “national only” in parentheses? Maybe they didn’t include that measure in the metro analysis because it helped them reach the conclusion they wanted to reach: home prices are not in a bubble.

As far as I can tell, in their methodology, prices were overvalued in 2005 because of the deviation from the trend. Today, however, prices in San Francisco don’t look so overvalued relative to the recent peak (2005-2007), so they are supposed to be reasonable. In Las Vegas, prices are still way below their levels from 2005-2007, so they claim in their 2013 report that it is the most undervalued market in the nation. Of course, looking at the prior trend is the exact mistake that led to Bernanke’s absurd statement that there is no housing bubble because home prices have never declined on a nationwide basis.

“In Las Vegas, prices are still way below their levels from 2005-2007, so they claim in their 2013 report that it is the most undervalued market in the nation.”

From my understanding of the bubble report, it has more to do with the fundamentals than what prices once were. In 2013, it was amazingly easy to find properties in Las Vegas that had a positive cash flow. In other words, mortgage payments that were less than paying rent for the same house. In 2013, I can’t remember being involved in any purchase that didn’t have at least a 7% cash on cash return using conservative calculations. That’s why Las Vegas was considered undervalued, not because of what the artificial values were back in 2006.

We’re approaching Bubble 1.0 prices. What fundamental change has occurred between 2008 and now to justify that?

OC Median Sale Price

http://i.imgur.com/5HNecZP.png

The peak in 2008 was 643k, and now it’s at 598k. The low in the middle there is 416k. So an even better question…what has happened in the last three years justify an increase of 43%?

A lot more demand for living space. Rents are way up, which means a given housing price is much more reasonable. For OC, and a few other places, there’s also been a shift in economics where development is no longer chasing the fringe but trying to be close to successful job centers (like OC). People no longer think buying in Riverside or even Victorville will result in you owning in the “next OC” in 30 years.

I look at the current prices, and they seem nuts, but when I ran the numbers for my mother-in-law up in the Bay Area (in a somewhat similar situation price-wise) renting actually didn’t seem better. It’s not like the last housing bubble at all.

@Fair Economist:

“A lot more demand for living space. Rents are way up, which means a given housing price is much more reasonable. For OC, and a few other places, there’s also been a shift in economics where development is no longer chasing the fringe but trying to be close to successful job centers (like OC). People no longer think buying in Riverside or even Victorville will result in you owning in the ‘next OC’ in 30 years.”

No need to recycle the gentrification and the population growth argument. Neither translate into qualifiable demand. Prices over the long course of RE history have barely stayed above inflation. Inflation has not climbed 43%, and wages have stagnated at best.

“I look at the current prices, and they seem nuts, but when I ran the numbers for my mother-in-law up in the Bay Area (in a somewhat similar situation price-wise) renting actually didn’t seem better. It’s not like the last housing bubble at all.”

The underlying thread is cheap debt all over again. Just as prior to the last recession, ZIRP has encouraged investors to pile into risky assets (startups and RE). So now the economy is experiencing simultaneous bubbles. When the money dries up, the effects will be felt throughout both the rental and RE markets.

I see people repeatedly saying here that homes are overpriced. Who’s to say a home is overvalued? Like anything else, a property is only worth what someone is willing to pay for it, nothing less…nothing more. And judging by the low inventory and short listing times , it seems to me there are plenty of people willing to pay at today’s prices.

Your rationale could be used to applied any other bubble. A .dot stock was only worth what someone was willing to pay for it. A house during 2004 was only worth what someone was willing to pay for it.

The underlying themes are the same now as they were prior to the last downturn. Too much easy money chasing too few resources. Only now, that easy money is in the hands of large firms taking on debt to buy properties and to establish investment funds.

Prices predictably rose exponentially faster than qualifiable organic demand could support because of over-speculation

If the shoe was on the other foot, and you actually owned property in S. Cali, you would be singing a different tune.

@Hunan

Nope. I’m realistic to know that RE is basically shelter that carries a lot of liabilities. It is a mass consumption product that fundamentally should be tied to local incomes. If I were to sell RE or a stock at 2x its true value, I would thank my lucky star that the buyer was willing to overpay. Just buying RE 20 years ago when RE wasn’t the speculative investment that it is now does not make an owner smarter than a first time home buyer.

@Prince Of Heck

“Nope. I’m realistic to know that RE is basically shelter that carries a lot of liabilities. It is a mass consumption product that fundamentally should be tied to local incomes.”

It’s easy to make statements like this when you have no skin in the game.

Prince of Heck,

I own multiple properties, some purchased years ago and two just recently. Being lucky had nothing to do with it. Making intelligent decisions is more like it. Maybe that is your problem?

@Hunan

“It’s easy to make statements like this when you have no skin in the game.”

It’s because I don’t have as much to lose in the market as you do that I can be objective. Who says that taxpayers have a duty to support real estate prices?

“I own multiple properties, some purchased years ago and two just recently. Being lucky had nothing to do with it. Making intelligent decisions is more like it. Maybe that is your problem?”

And you’re full of yourself in believing that Fed and government subsidizing RE is somehow being smart. You’d be smart if you bought under the expectation that ZIRP would fuel cheap debt, taxpayers would continue to flush money into Freddie and Fannie, and financial institutions would be allowed to keep their distressed RE inventory off the books.

My general observation:

People who have bought or already have real estate tend to believe that real estate in socal would not go down in general. Some of these people were bear during 2005-2007 and bought after 2009+

People who are waiting tend to believe that socal real estate would crash..

Not sure who is correct but history has shown us again and again that socal real estate has boom n bust cycle..

would it be different this time ?

I am in san diego and prices are crazy here.

The other board piggington.com members used to be bear but most of them bought few years back and now believe that socal prices would never go down. It is really amusing to see this 180 degree change in their views.

@John

I think it’s generally true for bulls who have all their eggs in one basket. There comes a time when common sense should tell you when economic fundamentals do not justify prices. Anybody who have observed the stock market would realize that over-speculation due to cheap debt will lead to booms and the inevitable busts. Diversification is key here — hence, spend as little for any asset class to manage risk.

Homes aren’t like items on ebay though. If artificially low interest rates, and investors buying up houses are the main drivers of that increase in value…then that “real value” is highly skewed. When those rates return to normal, investors find a better investment, or everyone stretched to the ultimate limit loses a job in an economic downturn….that sudden “real value” can drop very quickly.

It’s unbelievable how people rationalize being lucky in timing the market. As someone here stated previously, high prices can only be negative over the long run. A vibrant RE market needs first time organic buyers to thrive from top to bottom.

Wow @ Hunan.

It’s easy.. don’t have any skin in the game because I expect/want a HPC. I’m not here worrying about the owner/investor side at all, such as you buying another 2 properties, or QE Abyss rubbing his hands at prospect of inheriting a house and thinking demand high forever to maintain prices and can rent out for $5,000 per month.

Values in the wider market are set at the margin, between sellers and buyers. So sellers and buyers decide value. For prices to remain at these levels or push higher, you need sellers and buyers transacting at higher prices. For them to fall, we need sellers and buyers transacting at lower prices. It’s that simple.

Yellen: “Credit availability remains quite constrained for mortgages.†Those without pristine credit ratings find it quite difficult

Yellen: “housing “remains quite affordableâ€

4 charts here to show that Yellen and all Fed members desperately need to take a course in residential lending

http://loganmohtashami.com/2015/06/17/yellen-still-needs-a-course-in-residential-lending/

So Logan, would you expect the yellow line in the first graph, and the blue line in the second graph to come back to 2011 levels? That looks more like where they should be.

I live on a beautiful farm in Oregon BUT I am selling and moving to Long Beach CA. I lived in LA and for 20 yrs from the bottom to the top of the market. I’m in escrow on a property in LB at a price that I swore I would never pay(high) I have done very well on Ca real estate in the past. My farm is 10 min to 3 intel plants and 15 min to the Nike campus. I was going to stay and capture more gains from the tech growth here but have decided life is too short to wait. I can afford the new house and I want to move back to the nice weather. I get everyone’s point but sometimes you just need to move on.

I think we stopped having weather in SoCal. SSDD

Logan, looking at the above chart, there are plenty of areas in the east where prices are still soft, hence Yellen’s comments. Any area that is attractive to people in the top 20% earnings bucket, out west, is doing well though.

My area has homes from about $600k to $10M. Looking at homes on the market, it does appear that the cheap stuff still sells fast, but once you get to $2.5M, they properties are sitting unsold much longer that 12 months ago, so maybe even the people with big $$$ are starting to think the prices are crazy out here.

I bought in SF in 2011. In 2013 a similar house went on the market down the street for $500,000 more than I paid. I saw it on a Tuesday. The broker told me they were accepting bids on Saturday and it was off the market by Monday. The new owner put in new windows and painted the front door. Now it’s on the market for $500,000 more than they paid. It’s been two months and they’re still having open houses. It looks like the top has been reached. They’ll still probably make a bundle on it but it’s nowhere as easy as it was.

On another note, I went out last night to an event I’ve been attending for years. I left an hour earlier than usual. I barely found parking, couldn’t get a reservation at the place I usually eat and got the last table at my back up place. The demand for housing is obviously still there but I think the prices have reached the point where it’s just not reasonable to expect a family making 1/4 million a year to buy a poorly maintained house built 75 years ago for a working class family. Renting doesn’t look so bad when you see what you can afford to buy.

One of the major contributors to prices in California, i.e., a reason inventory remains low, is prop 13. There are likely still lot’s of people frozen in place. They can’t sell without giving up their preferential tax rates, and can’t afford to buy or rent anything else in California. Of course many of these people also aren’t very smart in my opinion. Unless you inherited a prop 13 house, chance are it’s paid for, so why not cash out … many would probably clear close to a million, and could live out their retirement years with in comfort!

Same going on in Culver City – usually there are very few houses on the market. Last few weeks quite a few coming online at prices way higher than the last bubble. Many are sitting, a few are selling – but few. There was one outlier that astounded me this year – over 2 mill.

https://www.redfin.com/CA/Culver-City/10770-Barman-Ave-90230/home/6724611

Flipper bought a typical CC bungalow and turned it into a giant Mar Vista-like modern box. It is so out of place in the area – visually and price-wise. Now someone is doing the same thing on the corner right across the street.

Find it all so baffling – ads will crow about the amazing CC schools (apparently amazing is a relative term) and the fact you can take a train to Santa Monica soon. And you can have all this for 1.5M dollars! Ugh.

@Vera, this is really not that shocking. You may blame the Federal Reserve for this.

Ultra low interest rates from the Federal Reserve encourages companies to buy back their stock via artificially low bond yields created by the Federal Reserve. These companies then use the stock buy backs in mergers and acquisitions of revenueless/incomeless Silicon Beach (Santa Monica/Marina Del Rey/Playa Vista) companies. The Silicon Beach companies with no earnings then issues stock grants to employees. Employees can’t buy in Santa Monica, Marina Del Rey or Venice as there is no inventory and they are priced out. So they go to the nearest areas that are not ghettos, i.e. Culver City, Mar Vista, Palms.

Only 15 SFR’s sold in Santa Monica in the month of May, and about 18 in Culver City. In a non-bubble era free of the Federal Reserve, you’d be looking at 50 to 60 sales not 15 to 18.

Big piece of the equation on the west side et al is the connection between the latest tech bubble and housing bubble. Priced out VC money from SV came looking for deals down south and others followed to form a crowd. I contend the Silicon Beach party is mostly based on overrated mal-investment. For each remote office we have of the Googles and Microsofts that can be shuttered in an instant, there seems to be two box of crap subscription startups. While the better ideas like recurring shipments of discounted disposable razor cartridges will probably end up being acquired and jobs moved away from high cost SoCal, most of these are basically fly by night skimming operations. Then there are the entertainment and media-based hanger ons of an industry whose core is slowly leaving the area. Buyer beware.

That house looks like the front end of an Edsel.

@Hunan

It’s because I don’t have as much to lose in the market as you do that I can be objective.

“all hat and no cattle”. Yes, it is crazy in Texas, of course , we old timers blame those “damn Yankees” or those crazy California folks. I hear(when I visit my winter home in Zuma) that it is the Chinese or those foreigners. I still keep a few head of cattle in Kerrville that Carlos(not that real estate shill in Oxnard) takes care of.

One of the dangers of home ownership. You go on a long vacation, and return to find yoru house occupied by squatters — and the law refuses to evict them: http://www.dailymail.co.uk/news/article-2182085/Its-just-nightmare-Family-evict-illegal-squatters-home-file-bankruptcy-exploit-legal-loophole.html

son of landlord, this article you linked completely kills any thought I might have of building myself a tiny experimental home in the woods somewhere. I have always been nervous about leaving my home alone for too long a period, and the thought of a 2nd property a distance away that I can’t watch every minute, already unnerved me. Now that I’ve read this, forgetaboutit.

Property ownership has become meaningless in this country. Really, worse than meaningless when you consider the following: Eminent domain, escalating property taxes, squatters who you can’t evict and who can still sue you for injuries they suffer on the property they stole by force, and endless liabilities for repairs, sidewalk maintenance, and anyone who feels like suing you for anything, PLUS the price risk, make it an unappealing option for many people these days.

We moved to Austin a year ago and closed a house at the end of the year. Based on what I’ve seen, I would say that the biggest problem with real estate prices in the region are the huge number of houses placed on the market without repairs after being trashed by 3.5% down “owners” over the last decade.

guys like NO and others who think they’ll see 2011 prices again are kidding themselves. Doesn’t mean you should buy in prime areas like SoCal (I wouldn’t) right now, but deluding yourself into believing you’ll see another huge dip is amusing just so you can feel about missing the boat on huge equity gains is amusing

@FresnoResident, I was told similar things about socal real estate in 2006. People told me that prices in socal would never drop significantly so it makes sense to buy not rent.

Maybe you should try making an argument to prove them wrong….?

where are the cogent arguments saying the massive dip is imminent?

Low inventory/high demand + low interest rates + specuvestor buying has a completely different landscape than the bubble 1.0. I’m a bear, but the crazy bears here lament another “crash” out of some emotional attachment to affordability. The country is not all LA and SF and NYC. Many residential units have been completely wiped from the inventory landscape for the forseeable future partly due to mass-scale investor buying and turning units into rentals and families not “moving up” in housing. Where there is strong rental parity, unlike prime areas, only an uptick in interest rates and a massive increase in supply will dip the market. And only a mass influx of foreclosures will create a “crash” like 1.0. Not gonna happen. I’m hoping prices will fall and level out, but 30%-50% off??? Don’t make me laugh. And don’t hold your breath.

Who cares what other people think prices might drop to. The skepticism on prices not dropping is what you’re up against. How about presenting some cogent arguments regarding that instead of presenting useless douchehole distractions?

L.A. has a year of water left at present (reduced) usage rates Baring some massive and continual tropical storms for the next few years, when the water runs out, what’s that going to do to your housing prices? After all, who wants to live someplace where you can’t even flush the toilet?

Just a thought.

VicB3

People on the Real estate business starts to sell just so they can get money out of their investment even though they are at loss.

Leave a Reply