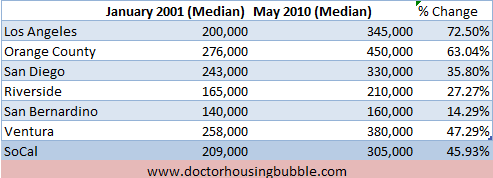

Southern California housing largely in a housing bubble – California CPI up 31 percent for the decade home prices in SoCal up 45 percent. Los Angeles County up 72 percent and Orange County up 63 percent.

The dynamics of the housing market for the past year show very little resemblance to a normal market. The government has stepped in and has artificially stimulated the market with a monetary taser. It is hard to get a handle on where things are heading but one thing is certain; overall Southern California is still in a housing bubble. Now this might seem odd given the massive drop in prices already faced in California. Keep in mind that the drop was not universal. Prices fell because of the way data is gathered. For the past year the bulk of home sales came from distressed properties and the volume was pushed by lower priced home sales. Now, we are seeing a better mix of home sales and higher priced areas although lower, are selling more and this has pushed the overall median price up.

Yet Southern California, a region with over 20 million people is still largely in a housing bubble. If we look at housing prices on a historical basis, they normally keep pace with inflation. So we can first use inflation over the past decade to measure the housing bubble:

California CPI

2000 = 172

2010 = 227

Increase of 32 percent

Source:Â CA Dept. of Industrial Relations

Over the decade the Consumer Price Index (CPI) for the state has gone up nearly 32 percent. This includes rent and also the owner’s equivalent of rent figures. This is the measure that is often used to examine inflation. It may be flawed since it understated the housing bubble going up and does not capture the crash with home prices going down. Yet this is the figure often used in government studies and also to base monetary decisions taken by the Federal Reserve. How did home prices in Southern California perform over the last decade?

This is where you can see the housing bubble clearly. In areas like Riverside and San Bernardino (the Inland Empire) home prices have actually come under the overall rate of inflation. In fact, San Bernardino is seeing prices like those back in the early part of the decade. So the housing market is not uniform across the spectrum even in a regionally close area like Southern California. The three areas that are largely in bubbles are Los Angeles, Orange, and Ventura counties and the data above shows why.

In Los Angeles County home prices are up 72 percent over the decade and this is where half of SoCal lives (approximately 10 million people).  This is twice the overall rate of inflation. If we were to use the 32 percent rate, home prices would be closer to:

$200,000 x 1.32 =Â Â Â Â Â Â Â Â Â Â Â Â $264,000

That would mean an overall price decline of 23 percent from the current level for the county. Is this feasible? Keep in mind that prices can adjust in two ways. They can nominally correct as they have been or they can be inflated away through inflation (what the Federal Reserve is hoping happens). Yet without wage inflation and a weak state economy, there is little that can be done here even with gigantic tax credits and historically low interest rates. So it is very likely prices will adjust lower in these areas. The amount of the price drop will depend on the rate of inflation and also how well the economy does in the next few years.

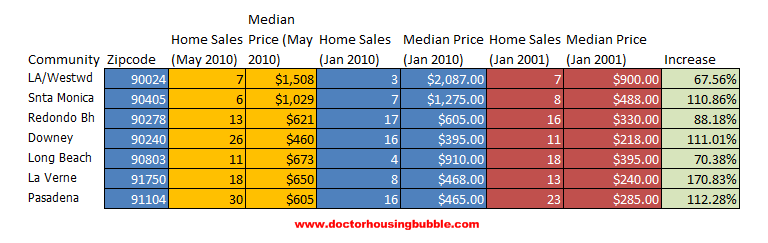

Let us dig a little deeper into some cities in the region:

I track various markets closely because this is the only way you will get a better sense of market dynamics. All the above areas are largely in housing bubbles as measured by their price increases (if we go by income and inflation data). But if we look at a more recent trend we can see what is happening. In very high priced areas like Westwood and Santa Monica, we see prices declining in the first half of 2010. In the 90024 zip code, home sales doubled but the median price fell by $500,000 for these sold homes. In Santa Monica (90405) the median price fell by $250,000 with the same number of homes moving. In the 90803 zip code of Long Beach the median price fell by $240,000 over this time. The higher priced regions are seeing similar trends.

Yet look at the mid-tier market. This is where you see many fence sitters moving off the sidelines and jumping back into the market. All these loans qualify under the FHA insured guidelines whereas the other top areas need jumbo loans and a hefty down payment. For these areas home sales have jumped and so have home prices. Take a look at the 91104 zip code in Pasadena. Back in January 16 homes sold for a median price of $465,000. In May, 30 homes sold for $605,000. These are reminiscent trends of the housing bubble days. Or take a look at La Verne. In January there were 8 home sales at a median price of $465,000. In May, there were 18 sold homes at a median price of $650,000.

What can we gather from the above? The higher jumbo market end is adjusting rather drastically. This market requires high down payments and cash to purchase. The starter home markets and nicer area markets that qualify for government loans are showing bubble like jumps as many of those sitting on the fence jumped in to capitalize on the government tax credit and have pushed prices up. With the tax credit and a low down payment it isn’t that hard to jump in.

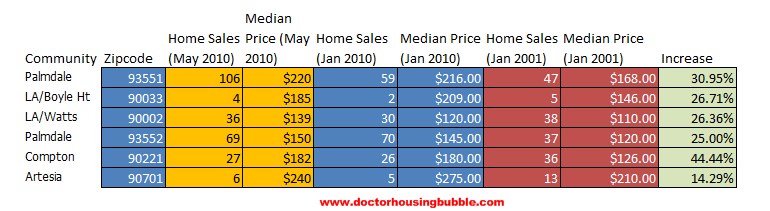

What is happening in lower priced areas of Southern California? Let us examine that market as well:

First look at the decade long price increase column. Interesting how each of these areas falls close or very close to the overall inflation rate (aside from Compton). What happened in the first half of 2010? Not much in terms of price. The only area that saw a nice jump in home sales is the 93551 zip code in Palmdale but prices remained largely at the same level. You’ll also notice that the amount of home sales in these regions is much higher than the previous chart. And this isn’t all based on population:

93551 (Palmdale):           est. pop              41,462

91104 (Pasadena):          est. pop              40,882

The Pasadena zip code had 30 home sales and the Palmdale zip code had 106 home sales in the same month. Clearly something is pushing a three time higher sales rate in an area that has nearly the same population. For the above lower priced regions, a large part of the home buyer base comes from investors. But this momentum is stalling out. With rents declining and a glut of housing on the market, many investors are finding it harder to flip in these regions. Good luck trying to find steady renters in these markets that are facing challenging economic situations. Housing can only remain healthy if the overall economy is healthy.

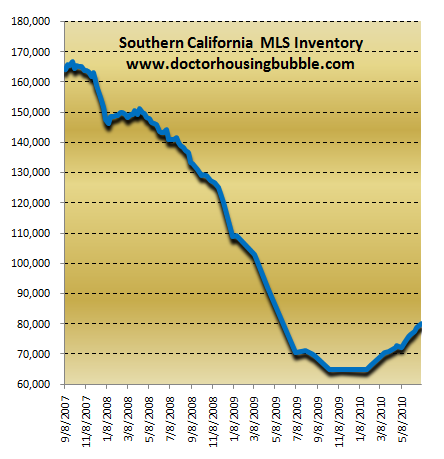

The overall amount of housing making its way onto the market is slowly increasing on a day to day basis:

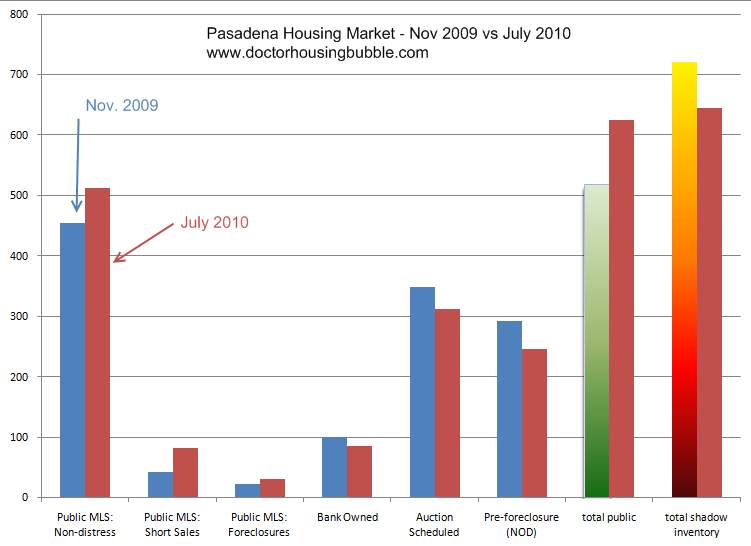

Since the low MLS inventory figure of October of 2009, MLS inventory for Southern California has increased 23 percent. The trend shows no signs of stopping. Much of this is probably due to many Real Homes of Genius and regular homes now entering into the public view as banks move more inventory. Let us look at Pasadena for example:

What we see is the public MLS inventory moving up while distressed properties move lower. The amount of shadow inventory has moved slightly lower while MLS inventory has slightly moved up. In fact, if we add MLS + distressed inventory there has been little change from November of 2009 to our data today in July of 2010; 1,239 for Nov. 2009 and 1,264 for July of 2010. Keep in mind this trend was made completely possible by government bailouts and intervention.  The question will be whether prices can stand on their own now that every imaginable gimmick has been thrown onto the housing market. It is also the case that distressed figures are kept lower as banks prolong the first step in foreclosure.

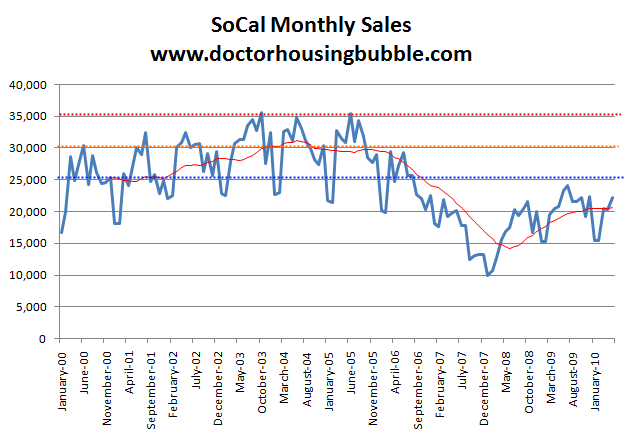

Even with the large amount of home sales from lower priced areas home sales for the region are far from peak levels seen in the bubble:

This gives you a good perspective of where we are at. We have yet to have a 25,000 sales month since mid-2006. We are nowhere close to a 30,000 sales month or the insane months of 35,000. And keep in mind that at certain points over the last year 50 percent of sales were foreclosure resales in the market. The previous peaks were all done with grade-A bubble herd buying (little distressed to be had). We are still working through large amounts of toxic mortgages so it will be two years before we have any semblance of a normal market.

What can we conclude from the above? Large parts of Southern California are still very much in housing bubbles. It looks like starter home areas have seen a strong jump in price as people rush to suck up government intervention. Prime markets like Santa Monica and Westwood have seen prices fall but are still high relative to local area incomes. Lower priced regions seem to have steady sales and prices. So the bubble is now in the hands of middle class home buyers that moved off the fence and were sold by the government easy money parade. Yet will this hold going forward? That is the next trend to follow in the second half of 2010.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

19 Responses to “Southern California housing largely in a housing bubble – California CPI up 31 percent for the decade home prices in SoCal up 45 percent. Los Angeles County up 72 percent and Orange County up 63 percent.”

This is an election year, now only about 4 months away. BOTH parties can be expected to pass more tax cuts,or other benefits, for housing purchases, to keep things going until AFTER the elections.

Most states are going to have to cut government jobs,since unions refuse to consider across the board pay cuts. Local governments will have to fund millions more in pension benefits in the next 3 years.(see pensiontsunami.com)

Bottom line: We won’t see a true picture of the housing market until after the elections, when the reality of a falling economy can no longer be postponed by

“pretend and extend.”

You would have to be a fool to buy at this juncture.

The Median is skewed. Prices have not gone up. Inventory in the lower price ranges are being held back by an overwhelmed shadow inventory of lender owned foreclosures. This is why Median prices are never accurate when stating that prices are either going up or down. It depends on the inventory avialable. If you took price ranges and compared them or neighborhoods and compared them you would have a much more accurate snap shot of the true picture.

We are already at 13 trillion in debt and at some point there is going to be a crisis in confidence. The republicans plan is to change us in to a third world country. The democrats is to keep their head in the sand like an ostrich. So really the question is not if, but when the next crisis will hit. When it does and interest rates zoom up, it might finally hit bottom or maybe we end up like Japan with persistant mild deflation?

Laguna Niguel and Aliso Viejo currently show 99 homes avialable on the MLS up to $650,000 with at least 3 bedrooms. Of these homes, 48 have had at least one price reduction. Seven weeks ago there were only 69 homes available with the same criteria…quite the upward trendline in a very short period.

The 2 bedroom, 1.75 bath, 1,400 square foot home at 10217 Casanes Ave Downey, CA 90241 is typical of both Downey and Los Angeles: it sold for $351,000 and sold for $251 per square foot.

Yes, the sales in Palmdale are likely from investors. I wonder how many of these investors will move in and how many will be successful in renting (probably very few) and how many will default on their investment (likely the majority).

Thanks for your insightful posts, please keep up the good work.

Like caboy said: We are already at 13 trillion in debt and at some point there is going to be a crisis in confidence. That day is coming soon, and then the US Treasury will have no money and there will be a liquidity evaporation where investors likely will not be able to obtain their funds in brokerage accounts and money market accounts and Fannie Mae and Freddie Mac and FHA will not be lending. Yes there will be a seizure in lending. Credit will evaporate. Banks will not lend. Then financial institutions and the US Government will be melded together into one credit and monetary institution. Banks will not foreclose and start to lease their REO homes and real estate prices will collapse. The value of the Treasury ETFs IEF, TLT, and ZROZ will fall rapidly in value; and the Direxion 300% inverse of 30 year US Treasuries will zoom up in value.

Interesting numbers Doc, the white enclaves of Southern Calif such as Santa Monica, Pasadena, La Veme all share common racial and economic backgrounds. In Northern Calif its what I call the urban rural locations that are 98% white such as the City of Sonoma,parts of San Francisco are upper class Asian and of course the traditional Gay and white neighborhoods. Its the price deflation in the white middle/upper white areas that causes the phones to ring in D.C.and brings out the sense of panic in the media. Here in Sonoma its the 500K to 1.5K homes that are getting hit hard with a combination of slow sales and price reductions but similar to what you are saying about Southern Calif is certainly true in many parts of Northern Calif. The bubble lives !!

We are in for a lost decade, similar to Japan. I’m still renting and will be for a while, as housing prices in the area where I live, Walnut Creek, will be relatively flat or worse.

Oregon has just become ranked third for the state with the most foreclosures.

Just like Hawaii, Seattle, and Phoenix, many refuse to believe it, because

“everyone wants to live here”.

With minimum wage jobs, and dismal,rainy summer weather this year, now it is

“Do you want to move to Oregon? ”

Not so much.

Max, as it is, the Pacific Northwest (Oregon, Washington, Northern CA) has been known as a very difficult place to get a job and make a living, particularly if you are a new arrival.

Only high-tech workers with advanced skills need expect to get a foothold in that part of the country, let alone do really well. Even in good times, it is a daunting place to an outsider. You wouldn’t go there in search of a job.

“so it will be two years before we have any semblance of a normal market.”

Perfect, by 2012, the market will be normal- at the same time the world is ending. Perfect timing.

If you think market will be normal in 2012, you must be not understanding current situation. But then again, who knows….always the corruption & bail out so maybe it could be better…… On the other hand, Ca is out of money by then….. Look out current DMV employees, they be looking for job in 2011…..

Republicans vs. Democrats? How about international central bankers vs. the free world? Republicans and Democrats are funded by the same corporations and they belong to the same thinktanks. As long people continue believing in the Republicans vs. Democrats paradigm, nothing will change.

The same people own nearly all of the central banks in 192 countries worldwide. These are privately-owned, for-profit banks that work in conjunction with the UN via the World Bank and the IMF. All economic misery is now planned, for a reason.

Think about that.

I am not sure if i see anything here, that makes any sense, we live in a new time , to use historical data does not seem to hold much water any longer in my view. If you can find a place you like and you can get a loan buy a house. think positive and good things will happen, there really are not many places left to build in Southern CA. My guess is that things will level out, they have to. As far the world ending and all this talk about democrats and republicans, that is all just hot air and feeding the fear bubble. We are Americans lets stop with all this what if thinking. we must break the fear bubble. if you can buy a house to live in do it .

JG must be a realtor… I think positive, and by renting I feel even better about my future!

JG, that has to be the most ridiculous reasoning I’ve ever heard for making the BIGGEST financial decision of one’s life….”just do it”…. you’d think he works for Nike…..we’re talking about a decision that, in turn, affects all other decisions finanicially, emotionally, relationship wise, etc……

I”ll tell you what, you go first and tell me how it went in a couple of years !

Re: 7/5. What Laura said. And even high tech workers can mostly expect to permatemp in the PNW. The big secret of Seattle is just how cold and closed it is…though there are good reasons for it, and it’s probably functional overall, though outsiders who are accustomed to taking whatever they want by storm chafe at the non-stormability of Fort Pugetopolis.

~

You see, we don’t cotton to being exploited by Californians who think they can perpetually export their model of gentrification/Third Worldism. How many Pension Millionaires have come up here, driven up housing prices, and expect workers back in CA to pay them to live higher on the hog than any of us? Forever. How many Silicon Valley whiz kids roll in, thinking they’ll control the world because they have addiction to iCrap and think everybody should?

~

Pugetopolis still has strong remnants of a culture where, them that works, eats…though the corporate and governmental welfare cultures are chipping away at that. Starting with a lot of union bashing and class war against working people. But the fact is, there’s one acid test in the vast PNW outside Seattle proper: if a big tree blows down and blocks a road, do you reach for your cell phone? Or your chain saw?

~

John is right. The big shakedown we’re facing isn’t the two phony US political parties, it’s the priests of money versus everyone else…just as it has been ever since this system was invented in Mesopotamia. If labor yields money, then money goes to those who make an effort and have skills, not those who set up mathematical formula money mills.

~

http://michael-hudson.com/2002/04/the-new-economic-archaeology-of-debt/

~

And also what Doc said. We watch things in SoCal and NoCal alike and are stymied by how friends can be listing 900 sf bungalows for $700K after moving to giant new places (“a bargain off the bubble!”). They are working some system that we apparently don’t partake in, since we loathe debt (i.e., interest servitude to banks).

~

But it’s clear there’s a lot of blood still to be wrung out of this carcass, and the FIRE vampires know it all too well. 2011-2012 will be a huge shakeout time. And the tail end will go on for a long time, with new exploiters rising to suck some more heme.

~

rose

JG, the bubble buyers from 05 can think positive 24/7 and nothing good is going to happen. Many factors need to be taken into account when buying a house, more so than ever today. We have never seen a bubble like this before, never seen a recession like this before and are in economic uncertain times to say the least. Most normal people don’t know if they will have a job in two years, the last thing they should do is mortgage themselves to the hilt with overpriced housing. It truly is different this time!

Yes, Max, you are correct. People, please do not move to the Northwest.

I think market data has always been screwy, but we are now witnessing the artifact of the internet. Greater and more instantaneous access to data being confused with new meaningfulness, Also partly explains the anger in society.

An analogy: Seafaring technology causing the white man to suddenly discover the New World. Hello, it was always there and known to some peoples.

Leave a Reply