Southern California Shadow Inventory: Born on October 2008. Foreclosures Still Exploding but MLS Down from 160,000 to 69,000 in Southern California Since September 2007. Renting the next Bailout?

The last time we examined shadow inventory we arrived at a conclusion that there were 40,000 homes hidden off the MLS in Southern California. I believe this estimate is underscoring the massive amount of shadow inventory hidden on the dark balance sheets of many banks throughout the country. Yet trying to get an accurate figure is a challenge in itself. As we examined the lower end of the housing market and the higher end of the housing market we start understanding the dynamics of volatile Southern California real estate. I wanted to get a more accurate figure of when the shadow inventory started taking off.

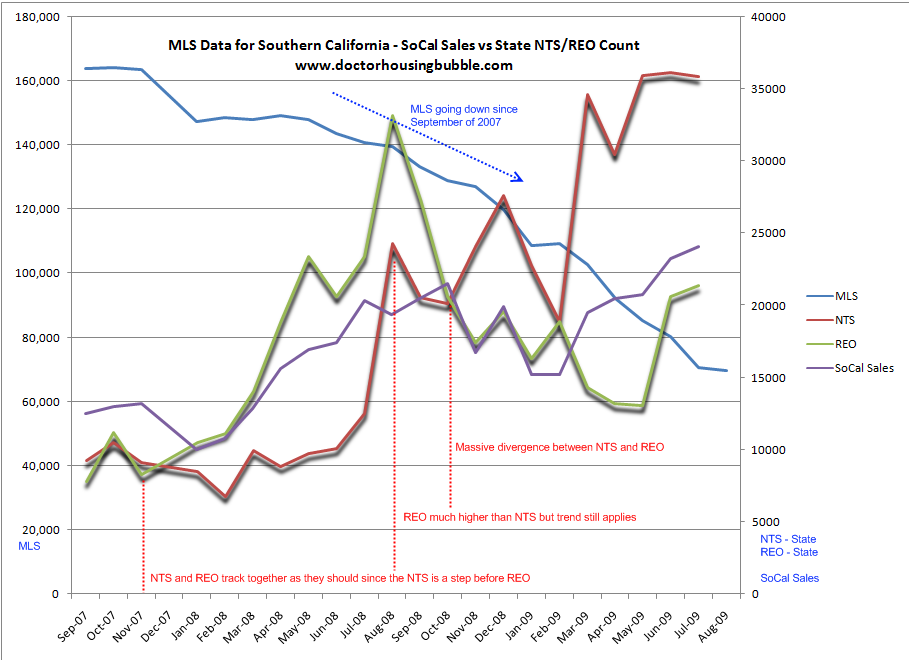

If you want to think about the peak of the housing bubble, for Southern California it popped in the summer of 2007 when it reached its pinnacle in terms of price. From that point on, it has fallen roughly 50 percent in terms of the median price. I started tracking the MLS data at that time and since that time, the public inventory has dwindled from 160,000 in September of 2007 to our current low level of 69,000. This of course does not tell the entire story. I decided to put together various sources in one chart to try to help us discover the birth of the shadow inventory in Southern California:

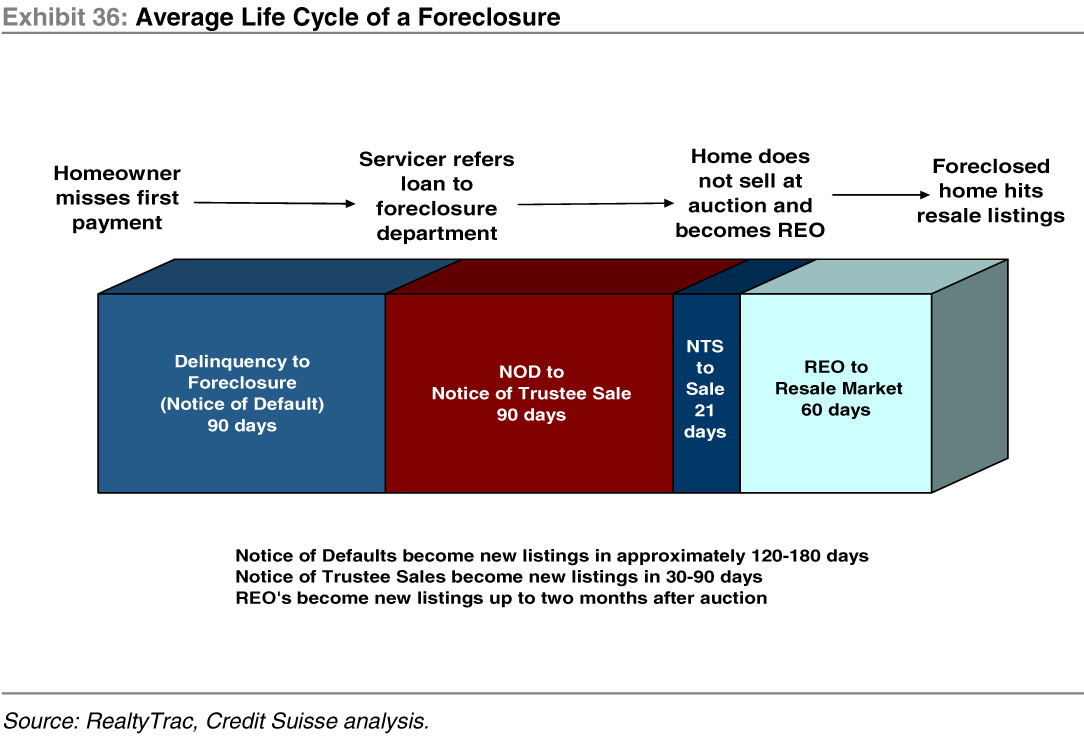

I’ve put the MLS data on one axis and the NTS/REO and Southern California sales data on another. First thing you’ll notice is the MLS trend has been perfectly heading lower. In fact, the MLS data has gone down by a stunning 62 percent since September of 2007! This of course has come in large part to the massive price cuts and the large sale in distressed properties making up nearly 50 percent of all sales throughout this time. But the other data helps us pinpoint the start of the shadow inventory. If you notice in the beginning, the NTS and REO data tracks up until December of 2007. This should be no surprise. This is a typical foreclosure process:

The NTS stage is the last stage before a home becomes a bank owned (REO) property. Given that few homes sold at auction during the early phase of the bubble burst, many of these homes simply went back to the bank. In the early stages, it was nearly a 1:1 ratio. After December 2007 you’ll notice that the REO count is actually higher than the NTS count. This pattern holds until October of 2008. But you’ll also notice that the trend still holds. At this point, we start getting some shadow inventory building up but not much. In this stage, these are your large disconnect prices where a bank probably wouldn’t waste any time trying to auction a home that it knows it will have to move quicker and also reflects the moratoriums. This is the likely explanation for this jump since it skips the NTS stage in the process above. But come October of 2008 is when the real shadow inventory starts taking hold in California.

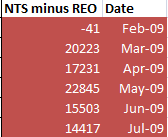

At this point, you’ll notice that the NTS and REO numbers meet up once again as would be expected since most homes that reach the NTS stage do end up bank owned. But starting early this year the NTS data completely disconnects from REO data. In fact, for a few months they move in opposite directions! Now there can be a couple of explanations here. One, many homes are being sold at auctions. But if this is the case, what are investors doing with the homes? Think about the discrepancy here. Let us run the numbers for the last few months for the state:

Now that is the crux of the issue. Assuming all these homes are being sold at auctions (doubtful) then they are not making it back on to the MLS. This is obvious just by looking at the decline in the data since September of 2007. But look at the difference above? In only 5 months, there is a discrepancy of 90,219 NTS properties and REOs. One thing is certain and that is the shadow inventory is mounting but to what end?

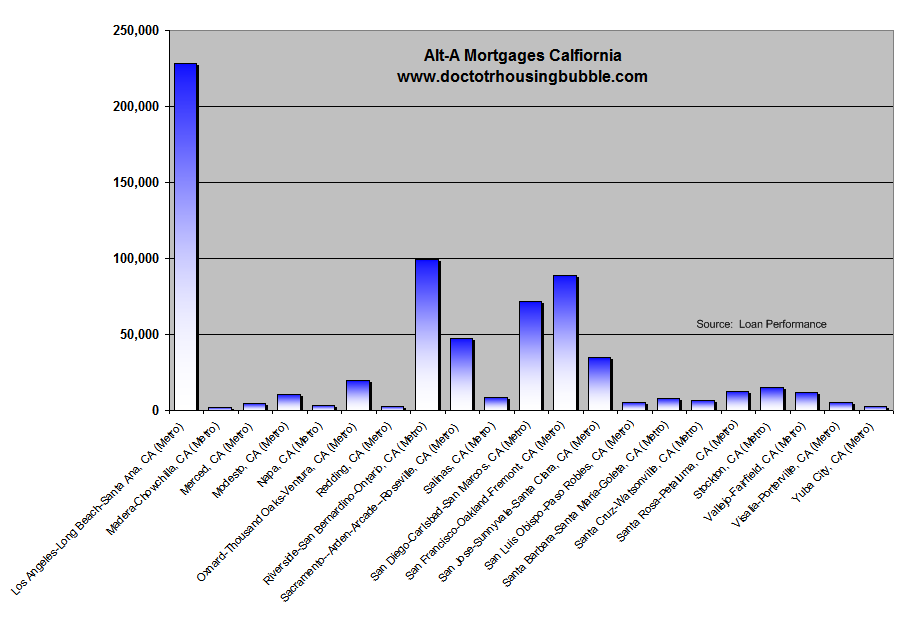

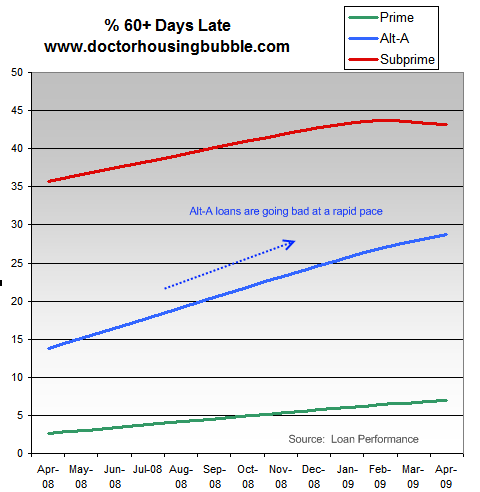

We know that most Alt-A and option ARM loans are tragic products just waiting to enter distress. These loans are junk and we’ve broken out where most of these loans sit. A large number of these loans sit in Southern California (approximately 400,000):

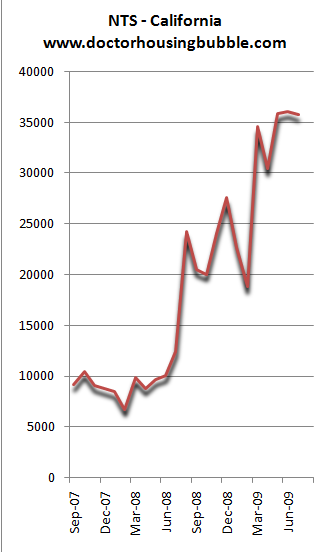

The above chart shows active loans in the state. How much of these will default? A large number and the shadow inventory indicator now seems to be the NTS line which is now off the charts:

The trend is obvious. The Alt-A and option ARM loans including prime loans are now defaulting in the second wave:

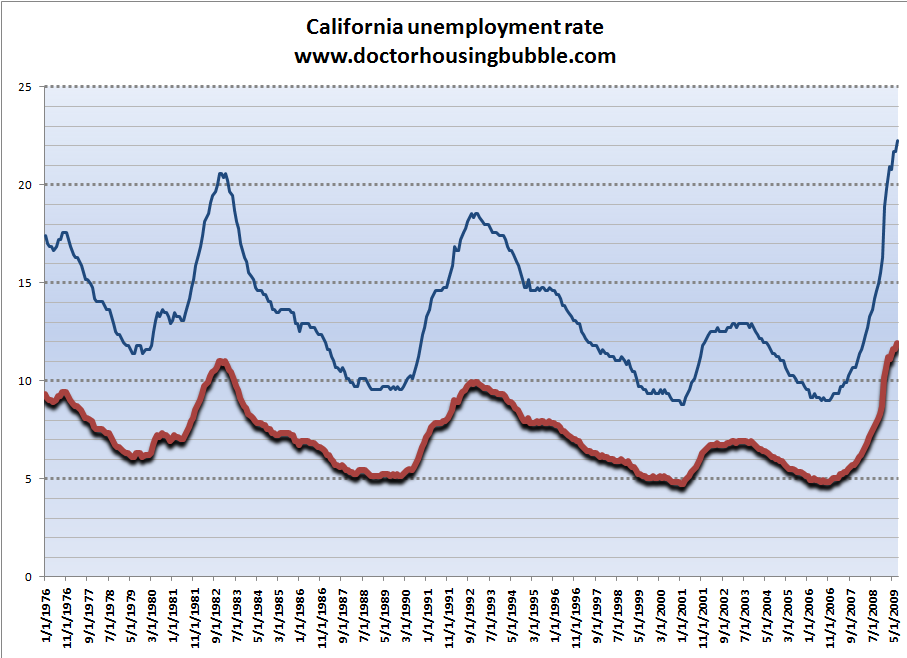

The question however still remains, where are these properties going? One thing is certain, if someone is buying to rent homes out, this may not be the right time:

Rental Vacancy Rate – West

Q2 2008 -Â Â Â Â Â Â Â Â Â Â Â Â 6.9%

Q2 2009 -Â Â Â Â Â Â Â Â Â Â Â Â 8.9%

And the biggest sense of irony here is that it would appear that some banks are looking to go down this route:

Seamless short sales:

“(WaPo) Here’s how the process works: First, the bank agrees to sell the property short to a private investor, just as it often does now. In the seamless version, however, the investor is contractually bound to lease back the house on a “triple net” basis — the tenants pay taxes, insurance and utilities — for two to three years.

The former owners only qualify if they have sufficient income to afford a fair market rent and can handle the other expenses, including maintaining the property. The deal comes with a preset buyout price after the lease-back period. That price is higher than the short-sale price paid by the investor, but lower than the original price of the house paid by the foreclosed owners.

Hackman and Huerta already are doing seamless short-sale transactions. Here is one moving toward escrow: A family purchased a house for $725,000 with 20 percent down in 2005, then made substantial improvements with the help of an equity line of $72,500. The house now is valued around $500,000, but is saddled with $625,000 in mortgage debts.

Enter the seamless short sale: Hackman has brought in a private investor who is willing to buy the house at current value, all cash. As part of the deal, the investor has agreed to lease back the house at $25,000 a year, triple net. In three years, assuming they’ve been good tenants, the original owners have the option to buy back the property for $550,000.

Hackman says the internal rate of return to investors can be raised or lowered based on rents and the buyback price, but typically are in the 8 percent to 10 percent range.”

After the real estate industry berated the notion of renting and mocking those that leased, one solution to the problem is, renting! Bwahahaha! This is classic. So the above situation to break it down goes as follows:

Family bought home in 2005 for $725,000

Down payment:Â $145,000

Mortgage:Â Â Â Â Â Â Â Â Â Â $580,000

Went to the home ATM for:Â Â Â Â Â Â $72,500

Current mortgage debt:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $625,000 (my calculation would put the debt closer to $650k)

Home currently worth:Â $500,000

Underwater by:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $125,000

Okay, so this owner is way over their head now. They can’t sell unless they want to put down $125,000 of their own money (on top of the $145,000 down payment). Think of that for a second! To sell in this current market they would lose in real dollars $270,000 which includes the down payment and current cash. Real estate can cause real and deep cuts to your net worth. Clearly they are not going this path. So with this new lease-buy option (this is what it is basically) an investor will rent the house back for $25,000 a year for three years with an option to buy back at $550,000. The investor buys the home at market for $500,000. Are you following this crap? This is the logic of the banking industry but let us run the numbers.

Monthly Rent (3 years):Â $2,083

$550,000 PITI After 3 years to buy

Assume 10% down (another $50,000 out of the owners wallet)

$500,000 mortgage at 6% for 30 years fixed

PITI:Â Â $3,569

Kicking the can down the road again! Think about this. If they can’t afford the current payment how are they going to deal with a monthly nut payment jump of 71 percent! This is your typical Alt-A and option ARM scenario here. So banks are going to kick the can down the road further. Any homeowner will probably take the option, rent the place for sub-market prices subsidized by the trillions in government bailouts and will default a few years later. Come on now. At a certain point someone is going to need to realize the losses. For those who think banks will simply rent homes out the market for rents in California is weak and prices are dropping because of this:

But leave it to banks to come up with more can kicking ideas just like the pathetic loan modification programs (notice how Attorney General Jerry Brown is cracking down on them?). They are a joke especially in California. We’ve traced the birth of the shadow inventory and we know it is growing. Clearly it isn’t making it to the MLS but that doesn’t mean it is not there. If we start seeing rental signs popping up with the too big to fail bank logos, we know that we’ve entered stage two of can kicking.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

39 Responses to “Southern California Shadow Inventory: Born on October 2008. Foreclosures Still Exploding but MLS Down from 160,000 to 69,000 in Southern California Since September 2007. Renting the next Bailout?”

Overall I agree with your fundamentals here, Doc. I also observe that systematic deflation may be engineered to deflate these losses.

~

In other words, since so many people got themselves into debt problems–including the very financial uberlords themselves–the game is no longer being played for things like sound fundamentals and returns that make sense. It’s a game of catch as catch can. Snap up whatever you can, ignore the losses, make other spay for them…and hope to be one of the last people to be holding cards when everybody else folds.

~

Even a shit hand can win the game, if you’re lucky. Another form of lottery.

~

😐

~

rose

PS–Sorry, UPS man came and I added my comment before finishing.

~

The second part of the deflate-the-debt policy scheme is to let prices re-inflate after the power players get their debt shrinky-dinked down and own all the assets once again.

~

rose

DHB,

I’m confused.

In the scenario discussed, the bank(s) holding the 1st and the HELOC have to be willing to take a $125k-$150k loss, if they sell the notes to the 3rd party investor for $500k. Maybe they are, since a 20% discount on a nonperforming loan isn’t that bad in the scheme of things. But if that’s the case, why wouldn’t the bank holding the 1st simply force the house to the trustee sale, wipe out the HELOC and the homeowner, then turn around and sell the house for $500k? Then they only take a 9% loss, maybe 10-11% when they include a discounted agent’s fee.

I think the simpler explanation for the shadow inventory is that the NOD to NTS stage has now been allowed by lenders to become a 6 month process, and once they file the NTS, it is not unusual to continually postpone the Trustee Sale for as much as a year, making the NTS stage a 9-12 month process, so your whole foreclosure process now is lengthened to 18-21 months from when the homeonwer stops paying.

Why are lenders doing that? Because the carrying cost is almost nothing with FedFunds rate at 0% and because the elimination of mark to market accounting requirements on the loans makes nonperforming loans more valuable on a balance sheet than the deflated asset backing the loan.

As I noted in in my comment on the prior thread, this seems to be what happened to me on my last bid here in San Jose. Made a generous offer on a short sale, owner accepted, but then the bank came back and said they were taking it off the market. It already had renters in it so there was some cash flow.

Of course, I’m going FHA and someone would have to reconvert the garage back to a garage but that’s only about $3k and I would have picked that up on my nickel.

You are finally coming around to the disturbing reality – there is no tsunami coming. Why not? If the banks dump, they recognize huge losses, if they recognize huge losses, they are out of covenant, if they are out of covenant, the FDIC comes in and they DIE.

Just think about that every time you think “they have to dump – they cant do this for ever” – just remember this simple rule “they dump they die”, that simple.

So what are they going to do? Anything and everything short of a dump. The healthiest will dump and probably already have – the weakest will hide the ball over the next 5-10 years while they continue to drip drip drip REO onto the market. You say it wont last that long? Well thanks to the permanent changes to GAAP (not concincidentally made in Oct 2008) they can play this game forever.

I have a question for anyone who reads this and may have an answer.

If the banks are doing the “seamless short sales” do they have to realize the loss?

If they do then the same problem still exists for them which is the mark to market of the properties. This will lead to a mark down in the asset values on their balance sheet and the requirement for more reserve capital. Which will then in turn lead to credit destruction and the realization that they are insolvent. (This domino effect is what the banks the the gov’t are trying desperately to avoid).

If my thought process is correct the banks will only be able to do a certain number of these short sales before having to stop the process due to the balance sheet problems mentioned above.

OR are the banks still the legal owners and then taking the private investor money and creating another vehicle the binds the asset and the investment without actually selling the property? If this is the case they are playing three card monte all over again!

Any insight on this would be much appreciated.

Welcome to the new Rent-A-Center economy. This whole thing makes me sick. Atlas Shrugged is playing out in real life. This entire thing is a disgrace to what our nation was founded on… time to get our guns out and reform the banking industry… 1776 style…

Interesting article in The Business Insider headlined “The Coming Alt-A Mortgage Reset Bomb is a Myth”. The article was written by Bill Matz, president of California-based MastersTouch Mortgage Corporation. http://bit.ly/cRGDi. Definitely worth a read.

Hope that some of you who know WLA/CC area well can provide some color here. Who are these folks living in the 650k-700k 3/2 modest starter homes in CC/Mar Vista? Are there really that many tens of thousands of ppl who have a combined income of 200-250k who want to live in a very modest, middle class neighborhood? It is very hard for me to imagine a family making 200-250k+ settling for a modest starter home in Culver City. I know a couple who just bought a 700k condo in Brentwood, and when I asked whether they’d consider buying a house for that prices in CC, they asked me is CC safe? I know there are some fancy neighborhoods in CC, but I am not talking about those. I am more focused on the neighborhoods with the 650-700k modest starter homes. Look forward to hearing what you guys think.

Sean is right. The normal delinquent-mortgage resolution process has been completely replaced by an ever-evolving series of delaying gimmicks made possible only through fantasy bookkeeping. Many banks are “alive” only because of bogus accounting, and because they have been enabled by the availability of unlimited amounts of free money.

The HELOC loan valuations are particularly shady – many are worth exactly zero because the homeowners are severely underwater on the first mortgage, but banks are still carrying them on the books at 100% until the foreclosure auction is final. You can debate “mark to market” and “fair market value” all day, but at least with these loans, allowing banks to pretend they have billions in assets when they in fact have next to nothing is nothing short of permitting outright fraud.

Atlacat is also right up to a point. There may be no surge of actual REO/MLS listings because of these pacing tactics, but there will be a tsunami of default activity that will cause the banks to employ such tactics to a rapidly growing portfolio of problem loans on what would otherwise be distressed property resales.

According to new research from the University of Chicago’s Booth School of Business and Northwestern University’s Kellogg School of Management.

“26% of the record numbers of home mortgage defaults across the country are “strategic” — that is, calculated economic decisions to bail out of loans by owners who actually have the money to make the payments but can’t handle the negative equity they’re carrying caused by local property value declines.”

Nationwide, according to data from Zillow.com, 22% of all homeowners were underwater, with mortgage debts that exceeded their home values, in the first quarter of 2009.

In some parts of California and Nevada, more than half of all households have negative equity.

“In a few localities, the size of the equity deficit is staggering: In the Salinas, Calif., metropolitan area, for example, the median equity for people who bought their homes in 2006, near the peak of the boom, is now a negative $214,305, according to the study.”

Read More: http://www.housingnewslive.com

Subprime Lenders Head the Line for Federal Subsidies:

http://www.time.com/time/business/article/0,8599,1919184,00.html?xid=newsletter-daily

I really doubt this kick the can strategy proposed by Congress will gain much traction. Its a win-win for the current homeowner and for the bank, but its not a great deal from the viewpoint of the investor. Using the example from the article, the investor financing this arrangement would receive an IRR of slightly over 8% on their $500K investment. But the ROI to the investor is largely dependent on the price of the house in three years. If the price of the house doesn’t increase at all then the IRR drops to 3.4%, basically what you would currently earn on a 10Y Treasury note. Also, because the owner has an option to buy, the upside for the investor is limited to 8%. Whereas the downside risk for the investor is only limited by how low the housing market can go. If I’ve got $500K lying around, that doesn’t sound like a very good investment to me.

The banks can kick the can down the road for a while but the laws of gravity cannot be suspended. The question is when, not if, the shadow game will end. Do you let the air out of the bubble slowly (as we could be doing) or do we let the pressure build up until BOOOM! there is a catastrophic implosion (what we are doing)?

Gov bailouts, lack of enforcement, and accounting tricks are distorting the market. Everyone seems to be quite content in their delusion. Even Paul Krugman seems quite happy with a $9trillion deficit (Nobel Prizes just aren’t what they used to be). Typical smug Baby Boomer attitude towards responsibility and prudence.

Be brave Comrades!

The concept of “fairness” has vanished. There is no longer even a government pretense to rewarding the frugal and prudent and punishing the irresponsible, or even allowing them to bear the cost of their greed or foolishness. All that we have are desperate attempts to keep the banks’ balance sheets favorable, and pump up the economy–for a little while, at least. Whether millions of people who stayed out of the bubble will ever get the house they dreamed of at a fair price or not, is no concern of any entity which runs this country.

The example given by Dr. HB is appalling in that it is illustrative of a bubble buyer who now gets to rent a pretty good house at a price a good deal less than someone who would like to rent it but is not currently sitting in it due to falsifying their job or credit history, or stupidly or greedily thinking that the market would pleasantly continue to rise forever. Of course such a person will walk away from the inane “rent to buy” program in a few years, but he will have more money in the bank because of the low rent he paid during that time. Clearly the banks and the government would prefer to have this happening, than have the house go on the market and fetch lesser value. Or maybe they will let the person keep renting for half market price for another ten years. Maybe it’s much more about faking balance sheets and trying to get your stock to go up, than legitimate profit interests.

I certainly don’t take joy out of general economic misery, but I find myself so enraged and upset by the shell game that is being played, that I am very tempted to urge everyone who is solvent to stop spending discretionary income, and then let’s see what happens to the economy. 15% unemployment ought to have some salubrious effect on the housing market. It might sound selfish, but since every other player on the field has acted out of utter short-term self-indulgence, why should the responsible people keep being forced to bail them all out, while they chuckle at what they think is their continued good fortune?

I saw blog post about the Chinese buying up quite a bit of real estate quietly. http://thehousingbubbleblog.com/?p=5602

Do you think there is any truth to it? *IF* it were true, might they be scooping up the properties in auction before they go to REO? It could be an explanation about what is being done with them.

Not sure how much credit to put in this as I don’t normally read the site linked above, but it was linked to by a site I have been reading a lot lately.

Nemo

You were right about the commercial bust, doc:

http://realestate.aol.com/article/_a/10-cities-facing-the-next-bust/20090827001

My question, if I understand the above scenerio is – current buyer has a mortgage of $625 – $650 ( including $145K skin in game) but home is only worth (today) $500k. Current owner then would pay (almost) $2,100 a month + about $500 a month for property tax (which I ASSUME the all cash investor gets to write off?) + let’s say another $100 for insurance? So the current “owner/rentor/possible futer owner” gets to pay approx $2,700 rent (plus upkeep) for 3 years for the privilage of then purchasing the house back from the all cash investor for $50k more than it’s worth TODAY?

I know that I’m not the sharpest crayon in the box but this make-a-no-sense to me. Lucy, please ‘splain yourself.

Maybe once commercial RE tanks hard, they govt will allow the banks to hide the losses they’d take on these assets as well and allos for businesses to stay in their offices for pennies on the dollar as well. What a joke. Our govt / financial system is getting more ridiculou by the day. I sure hope China puts the brakes on buying our debt, so we will actually be forced back into operating responsibly. FAWK!!!!

Buy Now. Buy Now. Buy Now.

http://www.mixpo.com/videoad/J77BZx9FQ4mi43IGq9Wenw/Daniel-Penrod-visits-Lansner-on-Real

Shadow Inventory, That is inventory taken back by the banks but not on market, is largely a myth. There is a certain “float” of home in pre-list phase. Some on market and a very very small percentage that are being held off market for various reasons.

Shadow inventory is the massive number of homes in default and not being foreclosed on.

I think people need to reclassufy there thinking regarding shadow inventory because if you think the banks are sitting on a large inventory of foreclosed homes you could easily prove it by matching public records data to MLS records , you just have to give the servicers a reasonable time period (a few months) for the pre-list phase and then you can see the REO numbers that aren’t marketed go down so low it really doesn’t matter much. If there is a half month to a month of shadow inventory sitting off market it really isnt going to do much when it comes on market.

I address shadow inventory in this post:

http://effectivedemand.blogspot.com/2009/08/bursting-bubble-shadow-inventory-does.html

The simplest graphic showing that REO inventory is being drawn down and not building is this one I created using Dataquick data:

http://img43.imageshack.us/img43/4752/dqshadowinventoryq209.jpg

For Dr. HB first graphic in this post it simply shows exactly what I am saying. The banks holding off foreclosing, NTS spiking, REOs dropping, fewer properties coming on market and so inventory is being drawn down.

Shadow inventory is a lot of fun to pretend it exists but the myth doesn’t match the reality.

Immigration may save California from a total bust on house prices.

The US allows one million legal immigrants, per year. About 1/3 of those, end up in Ca. Another 400,000 illegal immigrants come in per year, about 25% end up in Ca.

With a population increase of 5,000,000. in the next decade- well, they have to live somewhere.

Locked and loaded !!

time to get our guns out and reform the banking industry… 1776 style…’right beside you Joe Mama.

As someone who is in the middle of a foreclosure I have to say is this real? I’ve heard bits and pieces about the banks renting properties back to foreclosed homeowners, but so far I’ve had 0 luck when asking the bank about it. The numbers in your scenario are really not all that bad. What about an instance in a place like Temecula where prices have fallen much further. You bought a house for $400,000 and its now worth $150,000 (My situation). You put nothing down with an 80/20 loan so you are $250,000 upside down on the place(62%). Would they rent it back to you for $1000 with the option to buy it for $200,000 in 3 years? This sounds to good to be true and if they do you can bet that a lot more people would intentionally default. For my own situation I hope this is what they do, but it is completely unfair to people who have been more responsible.

Your graphic at the top say NOD at 90 days which we known is not the real story right now. Last payment was made Dec. 1st 08 and I still have no NOD. I know others who haven’t made payments for 1 full year and have no NOD. That being said I know others who had an NOD at 90-120 days. Actually the people I know who are well past 90 days are all former countrywide customers. Bank of America seems to only file a notice of intent and I’m assuming they still have to file an official NOD with the county. I looked up my name on the Riverside Recorders web site and definitely no NOD. My neighbor who stopped paying a couple months after I did had one file in early July. This rent back to people with the option to buy after 3 years seems real unfair to people who have already been foreclosed on as well.

As mentioned in DHB’s previous posts, the banks have no choice but to be most concerned about cash flow. It doesn’t really matter how they get from Point A to Point B on their balance sheet anymore, or if the legitimate buyers/suckers/victims/smart money investors/stupid money investors come from the U.S, China or Uzbekistan. The rent-back scenario seems like a “plausible” story for now that may make sense in the calm of the eye of the foreclosure hurricane. The real estate industry seem to operate in a 3-month window and they have to sell this junk somehow. Things could look much different in 3 months. Using basic logic, I doubt if the rent backs will make sense if foreclosure rates dramatically increase, as they are expected to do. This leads to some obvious questions. How many of these people being “rescued” by rent backs are those who were either directly or indirectly making big temporary incomes from the RE industry itself and have no hope of returning to those former incomes? What’s the average drop in income on an individual basis for this easy money crowd? A 50% decrease per stressed household might be a logical guess. How much can they afford to pay for rent? Is that really attractive to an investor?

Our government is SO corrupt. I’ve saved for years and still can’t buy in a decent area on a teacher’s salary.

And from what you are stating here, the prices may never reach the level where I will be able to get in.

Government by the rich for the rich…

Seriously…. the problem is too big. Banks just aren’t equipped to be in the business of being landlords. Kicking the can down the road will result in a long painful deflation of house prices.

I personally know of one person who hasn’t made mortgage payments since October of last year and is still living in the home. It’s just a joke.

I know someone in the Northern California area who stopped paying his mortgage MONTHS ago and the bank has not even contacted him. He contacted the bank and they told him they were backed up and would contact him in the future. The bank has not yet followed up with him. Meanwhile he went and bought another home and has already moved. At the same time he is renting out the home he stopped paying on… F—NG crazy. I’m working my job like an idiot and he is making money by renting out a “stolen” home. ABSOLUTELY F—NG CRAZY!!!! Don’t misunderstand me, I don’t blame him. He is just doing EXACTLY what the banks are doing in collusion with the federal gov’t . But when you see it in context of an individual you see how messed up it really is.

To – Don Black-

If you are a teacher, and can’t save enough to buy a home, try teaching in the Hayward, Ca school district.

starting salary $45,000.

Top salary $105,000.

I know two young teachers who bought homes in the San Francisco area in the last 2 years.

I just picked up a property in a new division here in CA and I would say that approx 80% of the new owners are chinese. The other 18% are indian. The last 2% mixed asian.

According to Dr. Michael Hudson in this interview on Guns and Butter, http://www.kpfa.org/archive/id/53994 the lenders make more money holding the properties in default than foreclosing OR shortselling OR modifying – This interview should be a real eye opener for anyone who is still unclear as to the nature of the global financial animal and what it is up to. Doctor, I would be VERY interested in your comments/response to the interview – Seems to me this is extremely critically important information that the vast majority of us are MISSING. I would love to see a post from you on this larger picture!!

DG made the following comment: You put nothing down with an 80/20 loan so you are $250,000 upside down on the place(62%).

Putting nothing down with an 80/20 loan does not make sense. 80/20 means, you put down 20%.

You did not really address the how many loans that are getting modified.

Why are you assuming 6% interest rate when they buy back in a couple of years? Rates are supposed to be going up.

The BIG banks will want the weak banks to die. They will get bigger that way. The small ones dying off will only re-group and come back again w/a different name.

Come on. This game is like Monopoly. Never ending.

For those of you looking for jobs, there are thousands of local government jobs paying $100,000 to $800,000. in Ca.

see.

http://www.contracostatimes.com/public-employee-salaries

Matt – and 80/20 loan means there were TWO loans taken out. One

for 80% of the puchase price and one for 20% of the purchase

price. The home owner has no actual equity.

Matt, it’s a nothing down situation if the 20% down payment was a loan too. It happened. A lot.

DG,

It seems as though your situation is very similar to what mine was, it just happened to me a bit sooner than you. I bought a new place in Murrieta in January of 2007 for $512,000. The property taxes were ~ $9000 a year. It was an 80/20 with the 20 having a ballon payment of ~ $100,000 due January of 2012. Not a very uncommon situation at the time. I contacted both lenders about a possible modification at least five times each prior to stoping payments on the house, all to no avail. I made my last payment on August 1 of 2008 and the house finally went to auction June 12 of this year. Sold at auction for $212,000 to an investor and apparantly sold to a new owner a couple of weeks ago for $298,000. I offered the bank $50,000 cash if they would reduce the principal to $300,000 (basically short sell the home to me for $300,000) and they laughed in my face. I think that after taking a $300,000 haircut on the deal, they may wish they could have a do-over on that offer.

I was able to save over $30,000 while waiting for foreclosure and now rent a very adequate home for $1500/month less than a mile from the other house. Although the credit hit sucks, I have to say that we are very pleased with our decision and feel sorry for our old neighbors who are “toughing it out” with their $3500 a month payments. It seems inevitable that virtually everyone in our old hood will realize the futility of trying to stay the course in their home and regret following up the first bad decision (buying the home in first place) with another even worse decision (doing everything possible to keep a famliy killing liability). I hope that however it plays out for you that you keep your eye on the big picture and think about how where you will be financially in five years if you stay in the home or if you leave and rent. Odds are, you would prefer the latter. Good luck.

Partyboy,

My 2nd loan also has the balloon payment written into it…. though mine was only $76,000…. not that it matters. I’ve tried to make similar deals with the bank to what you described though I don’t quite have 50k saved up yet. If constructed correctly a seamless short sale sounds like it could be a good deal for me. I’m curious did you get your loan from Countrywide in Temecula? I don’t see many toughing it out in my neighborhood as many of the homeowners who have not already foreclosed are in some state of foreclosure now. Did you have much trouble getting someone to rent to you? Any recommendations?

In Camarillo I personally know of 5 homes that sold for over $900,000.00 and the borrowers have not made a payment since January. That’s just what I know of in Camarillo. I also knew of a home that was bank owned and I called Realtytrac to ask why it did not show on their records and I was told that if a realtor or the bank asks that it be removed Realtytrac removes it. As for price increases, trustdeed sales that end with the property going back to the lender are recorded as a sale at the amount owed, which is giving a false price increase in some areas.

Leave a Reply