Happy holidays everyone! Hope everyone is enjoying the end of the year festivities. There’s a feeling in the air that everyone is maxed out. I was out in the Inland Empire this past weekend and saw very nice brand new homes going for $200,000. Prices are starting to take major downturns here in California. I’ve been getting a lot more e-mails from readers showing me Real Homes of Genius throughout the state. In fact, I would venture to say that this housing fiasco has enveloped the entire state of California into a Real State of Genius. We featured 10 Southern California homes back in May and people still had doubts about a housing bubble. In today’s very special holiday report, we are going to show 10 homes throughout the state from Palo Alto, to Fresno, to Chula Vista that bring home this housing crisis. This should also show that this housing bubble is more than a subprime problem but a much larger and pervasive credit issue that will impact the entire economy. Listening to the radio this weekend, they had a realtor from Las Vegas pleading his case that the government needs to bring back “alternative financing†to prime the pump. Yes! What a splendid idea. Instead of admitting the glaring problem, let us pump this bubble to the next dimension. This is tantamount to giving a meth addict more meth when they are in the middle of rehab because they cannot bare the withdrawal pains. Oh yes, our society is addicted to credit and even the rhetoric of “injecting†more liquidity should make you think about the psychological ramifications of comparing the Fed to some sort of doctor. Maybe they are comparing their valiant effort to that of Dr. Kevorkian.

If you have any doubts that we are in a bubble here in California, after seeing these 10 homes maybe your opinion will change. We’ll profile homes in posh areas, to not so prime areas to demonstrate that this manic housing bubble infected rich and poor alike. Greed crosses all socio-economic barriers. California is the golden state and land of Hollywood. Perfect weather and tan bodies are everywhere; that is if you are within a 10 mile radius of the coastline. Yet homes that are nowhere near the coast and have bad weather went up in price just like prime properties. It would seem that being in California was justification enough for sky-high prices. Today we salute you California with our Real State of Genius Award.

#10 – San Francisco (Bayview)

Price: $445,000

Square Feet: 932

Details: 2 bedroom / 1 bath

Median Rent for Similar Unit: $1,750

It is hard to believe that there is a place more expensive than Southern California but there is. San Francisco and Marin County boast some of the most overpriced real estate known to humankind. We won’t turn this into a Tupac and Biggie thing, a who is more overpriced, the north or the south since we are both in another universe. After all, trying to distinguish between really crazy and really really crazy is an exercise in futility. As you can see from this enormous 932 square foot home, you’ll get more than you can handle at a stunning price of $445,000. Area rents for a similar place like this one will go for about $1,750 a month. You don’t need to be a rocket scientist to know what makes sense here. Let us move on to another Northern California overpriced area, Palo Alto.

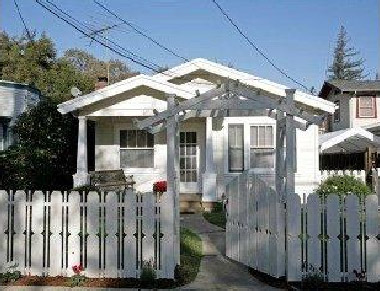

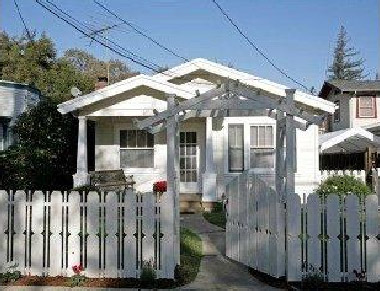

#9 Palo Alto

Price: $799,000

Square Feet: 692

Details: 2 bedroom / 1 bath

Median Rent for Similar Unit: $2,500

Palo Alto is home to Stanford University and anti-university logic housing prices. You would think that people here would refrain from bubblemania instead, they have taken it to another level. We won’t even talk about East Palo Alto but suffice it to say that people were paying for name, like paying for Nike over your Wal-Mart priced shoes. The only difference here is we are talking hundreds of thousands of dollars. If you thought the previous home was small and expensive, here we have a 692 square foot home for $799,000! This home is for those wanting to relive the glory days of living in your dorm except as an adult. The only difference here is you won’t graduate away from your mortgage.

#8 Fresno

Price: $167,000

Square Feet: 1,170

Details: 4 bedroom / 2 baths

Median Rent for Similar Unit: $1,295

Our next city takes us to Fresno California. The birthplace of acclaimed rapper and procreator Kevin Federline, this city is exploding. The central plains of California are taking a major hit with the current housing market. Prices have adjusted and foreclosures are exploding. This home’s price is starting to have a more accurate reflection of local area rents. You would think that landscaping is necessary in the current market but not for these people. Here we have a 3D home since it seems to go on forever to the back. The harder hit areas need to adjust quickly because inventory is piling up like a plate of pancakes from Denny’s and people can’t hold out too long since this is subprime country. For example with San Francisco and Palo Alto, we still have delusional sellers with reserves thinking 2008 will somehow be a different year while folks in these cities have no reserves thus foreclosures are spiking much faster.

#7 Stockton

Price: $109,000

Square Feet: 976

Details: 2 bedroom / 1 bath

Median Rent for Similar Unit: $800

The next city boasts the infamous award of foreclosure capital USA. Stockton California and near areas have been a hub for subprime shenanigans including a young 24 year old poster child of housing greed and speculation. Stockton is being hit particularly hard since a lot of its local economy was based either directly or indirectly to real estate. This home has a fabulous pink with red trim and is a must for any value investor. Heck, for $109,000 you may not find a cheaper priced home in California. Given that a similar unit could be found for $800 a month, I’m not sure if a would-be Donald Trump investor will be buying this hot pink place.

#6 Paramount

Price: $374,900

Square Feet: 840

Details: 2 bedroom / 1 bath

Median Rent for Similar Unit: $1,500

Next we go South to Los Angeles County. The next city is home to the Zamboni and also a ice cold real estate market. In fact, we’ve profiled Paramount before the New York Times did an article on the bubblicious nature of the city. Suffice it to say that Paramount is another subprime city that is being hit very hard by the housing decline. Unlike Stockton or Fresno that are pricing homes according to the current market, we still have folks thinking the years of going down to your local mortgage broker and getting a no-doc exotic banana republic loan will come again. Little by little we are seeing this confidence being chipped away. This 840 square foot foreclosure demonstrates how absurd the bubble has gotten. A similar place would rent for $1,500 while the home is on the market for $374,900. What do you think the price would need to fall to before this home makes economic sense? That’s right, not the current price.

#5 Riverside

Price: $205,000

Square Feet: 1,070

Details: 3 bedroom / 1 bath

Median Rent for Similar Unit: $1,495

Next we move the Inland Empire, ground zero of the housing bubble bust. If you needed to look at a region that epitomizes the housing excess, you needn’t look any further than the Inland Empire of Southern California. Overbuilding, speculation, and fraud are no recipe for building a sustainable region. Simply put, speculators assumed that anything remotely close to L.A., Orange, and San Diego County would command high prices because people said so. Now that the bubble has burst this region has the highest foreclosures and inventory in the entire Southern California region. This bank owned property was initially listed at $250,000 but had no bites. After 3 months on the market you would think that interest would be high but again, even looking at local area rents could be misleading for a real estate investor since a large part of the local economy was based on housing, construction, and real estate financing. Since California is already in a recession aside from what the numbers tell us, what do you think is going to happen to rents when the employment market contracts?

#4 Santa Ana

Price: $420,000

Square Feet: 680

Details: 2 bedroom / 1 bath

Median Rent for Similar Unit: $1,480

Next we go to the Real OC, Santa Ana. You would think a place with 12.4 percent of Orange County’s residence would garner more fanfare but all you hear about is Newport Beach and Laguna Hills, which hold a very small part of Orange County’s 2.8 million inhabitants. Why look at facts and data when we can speculate into infinity!? This short sale is subject to bank approval but what are they going to do with so much inventory in the area? This home sold for $488,000 in March of 2006 which makes no sense given that local area rents for a similar place go for $1,480. Wow, that rental price is similar to the Riverside home except the delusion of being in the OC is keeping many of these places sky high in price. A $68,000 discount? Try a couple more hundred thousand. As you dig deeper you start to realize how incredible this housing bubble is.

#3 Santa Monica

Price: $749,000

Square Feet: 635

Details: 2 bedroom / 1 bath

Median Rent for Similar Unit: $2,500

For those of you not from Southern California, Santa Monica is prime. Great location and one of the best cities in Los Angeles County. That doesn’t mean that we don’t have any Real Homes of Genius in the area. With this magnificent 635 square foot mansion, you will be the envy of all the people flocking to the thirty-mile zone. For this extraordinary privilege you will pay $1,179 per square foot! Bwahaha! Even in the current housing market we still have people thinking housing is going to rebound even when a similar rental would go for $2,500 to $3,000. Who would buy this place? A buy and hold investor will not buy this place. A flipper may buy this place but they would need to knock it down and build on the land. But by the time the new home is ready to flip the market will be even deeper in the dark with less buyers and more inventory.

#2 Chula Vista

Price: $344,500

Square Feet: 1,284

Details: 3 bedroom / 2 baths

Median Rent for Similar Unit: $1,700

Next we head to the Southern part of the state to Chula Vista, which in Spanish means “beautiful view.†Another prime location of bubble speculation and halo effect bubble pricing. That is, since Chula Vista is in San Diego County therefore it should be massively overpriced. Plus, you are paying a premium for an exotic name. This place is the perfect example of buying at a peak in any bubble. This home sold for $460,000 in March and now, only a few short months after is discounted by a stunning $115,500. In other words this home is down 25 percent from it peak in nine months. Yet looking at local area rents it still has further to go. From border to the north, California is one overpriced state. And you wonder how Washington Mutual and Countrywide are going to do next year since they both hold a large percentage of their mortgages in California real estate.

#1 Compton

Price: $290,000

Square Feet: 1,234

Details: 3 bedroom / 1 bath

Median Rent for Similar Unit: $1,500

Finally we come back to Los Angeles County with a property in Compton. Compton which is adjacent to another city on the list, Paramount witnessed the same bubble phenomenon. Prices sky rocketed with a glut of subprime loans. Now, homes are coming back down to Earth in a dramatic fashion. This 1,234 square foot home is going to have a hard time finding a buyer without a resurrection of subprime financing. Now after looking at the data and homes, do you think the pundits have it right that we should open up the financing gates once again? Even areas with poor schools and locations were commanding amazing prices just because they were in California.

Conclusion

The ranking on this list doesn’t signify which area is in a larger bubble because all areas in California are in a bubble. That is a pretty bold statement given the sheer size of the state but without a doubt, California boomed with the credit bubble and will burst in equal proportion to it. There is no stopping a state so dependent and obsessed with housing; now with tighter financing, less demand, booming inventories, and economic malaise the housing correction has only started in the state. In a culture fixated with quick riches and instant gratification, how will we grabble with a housing bust that has the potential of lasting 3, 4, or even 5 years?

Today we salute you California with our Real State of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

30 Responses to “Special Edition: Real State of Genius: Today we Salute you California with Our Real Home of Genius Award! 10 Homes throughout the Golden Bubble State.”

looking at the pictures and then the price tags, most of them look ridiculous. prices in asia look so much more reasonable now after this list.

Dr HBB,

Why are you posting those exceptionally cheap houses as examples?

I need to protest because the houses listed here for NorCal is probably the cheapest one you can find listed in MLS.

And the #1 Compton house is a steal! Just go to check out any East Palo Alto/Oakland/Richmond/San Jose (King & Story Rd)/San Francisco (south) listed in MLS (the crime hot spots in NorCal), I highly doubt that you can find even a 500 sq house listed under $400k. You will find a fair amount of old fourplex/converted apartment/condo.

Or check out burbed.com. You will find million dollar toilet/investment/teardown opps there.

Okay, I just backdrafted raisin brans through my nose (ouch!) when I saw that Santa Monica house! I wouldn’t let my dog pee in that yard!!! $749,000! Holy Crap! Wouldn’t you need 4 or 5 sitcom stars to cover that mortgage? And with only 635 sq. ft (smaller than most garages), they’d need to sleep in shifts on bunk beds. Why would anyone ever ever ever live in California?

The entire state is primed for an economic meltdown of epic proportions.

Will 2008 be Cali’s “Great Depression”? The sad part is if CA tanks, the other 47 states will tumble like dominoes after it.

Hey, it’s not so bad to live in CA … *IF* you RENT.

You think the other states might be in trouble if CA tanks? Well, if CA were an independent nation it would have the 10th largest economy in the world, so maybe.

692 Sq Ft works out to about 26 feet square. Unless you’re sleeping standing up, how do you fit two bedrooms and an bath in there? I assume there’s some sort of kitchen.

Maybe “bedroom” is simply CA code for “closet”. That’s my guess.

This just goes on and on. Where does one start? I think it would be prudent to think defensively about one’s own individual economic situation going forward. The best case scenario outcome for this debacle will hurt us all and the worst case is unthinkable. The next two to three years will hold many life changing events for everyone except the very rich. I hate doom and gloom, but taking some defensive actions now may ease the coming pain. Saving and not making expensive purchases will help. Unfortunately, cutting back on spending exacerbates an already weak economy depending on consumer purchases. Its a catch 22 going forward and it will be interesting to see what sector of the economy takes the lead. One thing for sure, I’ll bet its not real estate! People who have good jobs and can afford their existing mortgages will do fine. Those who are highly leveraged via mortgages or credit card debt will go under. Its that simple; and so it goes…

Here is another great find to show everybody what we are going to see in 2008-2009.

5253 Deeboyar Ave, Lakewood CA, 90712

Homes.com Price for sale = 320,000

Zillow Zestimate = 594,752

Sold 02/14/2006: $558,000

Price drop of 43% of the sold price.

Price drop of 47% of the Zestimate.

Zestimates are losing their value faster than the dollar. It’s hard to imagine how the NRA is predicting a recovery in 2008 with prices still 50% away from historic economic fundamentals. What data are they looking at?

I dispute the $1750 rent on the San Francisco house. You can get two bedrooms in an average neighborhood in San Francisco for that, and Bayview is the worst neighborhood. You’d have to be on crack to pay $1750 to live there.

I am not too familiar with the SoCal real estate market and I must admit that I am no expert when it comes to this industry. But Listing #7 and #8 seem to be pretty good rental investments as they both can probably generate pretty decent returns on captitals. Specifically, I am talking about the one in Fresno and the other in Stockton. I am just curious as to why these two houses are on the “Genius” list.

Its NOT just California or Florida. We are on the Great Lakes, big time summer tourist area but the closest city with more than 15000 people is 4-5 hours away and median income is around $44,000 in the county. The delusional wanna-be ‘real estate moguls’ wail ” but but but everyone wants to have a summer house here that they can only use for 2-3 months a year……”

Your Idiot – #7 Stockton Price: $109,000 Square Feet: 976 Details: 2 bedroom / 1 bath Median Rent for Similar Unit: $800

Our Idiot Here: $160,000 (owner’s wish price for flipping – I explained reality and found her a tenant) Square Feet: 727 Details: 2 bedroom/ 1 bath

Median Rent for Similar Unit: $700

Your Idiot – #1 Compton Price: $290,000 Square Feet: 1,234 Details: 3 bedroom /1 bath Median Rent for Similar Unit: $1,500

Our Idiot Here: $284,000 Square Feet 1350 Details: 3 bedroom/2 bath

Median rent for similar unit: $750 –800

Our idiots are less than 5 blocks apart in the same tiny town.

I wish we can speed up the housing bust. I have no feelings for the Junior Trumps that came around and started bidding up all the houses. These stupid assholes kept me from upgrading to a bigger house. I’m so glad I didn’t buy last year. I am stepping back (as all buyers should) and letting this thing play out. I can wait another year or two and squeeze the sellers. It’s just like a short squeeze in the stock market. How much pain can they take?

It’s just like the mid 90’s. Pretty soon we’ll be seeing prices drop 30-40% from where they are today.

Groovy to have ya back Doc!! (I was starting to go through withdrawl) I hope all had a cheerful Christmas. Whilst I was reading this latest blog, my husband was looking over my shoulder and commented at the prices; “Are they nuts?” To which I responded; “It’s CA”. He said; “I don’t care, that’s crazy. Why don’t you look up something more interesting like…” (which all I’ll say was of a sexual nature)…..(you have to know his sense of humor)…..which I found kinda ironic, considering how screwed many have or will end up.

Usually we consider an increase in prices as something undesirable—inflation. Housing seems to be an exception where an increase in price is called “appreciation.†I think this results from the notion that a house is an investment item and not a consumption item. We want our investments to appreciate, but we don’t want our consumables to cost more. The consumer price index (CPI) put out by the Bureau of Labor Statistics (BLS) does not include residential real estate in the market basket of goods they track. The use rents and imputed rents as a surrogate for housing costs. Thus you don’t see the run up in real estate prices over the last ten years reflected in the CPI. BLS also does a few other funny things. BLS shifted from using an average to a geometric average, and make what they call “hedonic†adjustments to prices in there market basket. A hedonic adjustment is supposed to account for an increase in quality. In reality these adjustments provide an opportunity to fiddle the CPI to reduce the apparent rate of inflation. The government has good reasons to make inflation look smaller than it really is because Social Security benefits are adjusted for inflation along with the interest on I-bonds and the principal on TIPS. This brings us back to housing prices. Does easy credit really explain the housing bubble? Why is the bubble global in nature? Perhaps the bubble has something to do with a debased currency.

I think the consensus is how unbelievable prices are throughout the state. Anyway you slice and dice the data, whether you look at the DataQuick numbers, the Case-Shiller Index, or the OFHEO numbers prices are coming down quickly. The only problem at looking at the national numbers in an aggregate format is they don’t capture the magnitude of housing TnT in California and other hyperexpensive areas. Even though folks are calling for a 30 percent drop nationally when all things are said and done, (remember that even one year ago anyone saying this was labeled absurd) it doesn’t capture the fact that some areas have already had 20 to 30 percent drops in only a few months ala California. We have stubborn hold outs still moving up and some areas are simply crumbling with $100,000 evaporating in less than a year. Again this shows how paper equity gains are not really gains until you cash out; sort of like leaving your winnings at a poker table in Vegas. If you keep gambling eventually the house is going to win.

Kenny Rogers has the perfect advice for investing, gambling, RE speculating, or any kind of ploys to make money:

“You got to know when to hold em, know when to fold em,

Know when to walk away and know when to run.

You never count your money when youre sittin at the table.

Therell be time enough for countin when the dealins done.”

I’ve lived in several places in the country including Socal and Norcal and as an outsider to CA you quickly figure out that everything is nuts. Only in CA can you find houses that you wouldn’t even enter for fear of your life (that is if you weren’t scarred enough to stay in your car) that were prices like mansions are everywhere else in the country. And I hate to tell the Socal people that their weather isn’t that wonderful. I lived there for 5 years and the weather seemed to shift from three states: hot, foggy, fire.

Dave

Maybe the NRA (real estate) will merge with the NRA (guns) and then they can force people to buy homes at gunpoint.

Drive-by mortgages!

It may not be so insane here in Chicago as in SoCal, but we have the same problem with massive inventories, steeply declining sales, and massively overpriced homes and condos priced at levels where the mortgage payment will be at least twice the rent for a comparable, given 20% down on a 30 year fixed.

Additionally, we have other, possibly larger, problems as a result of the speculative rampage, namely thousands of shoddily constructed homes and condos, along with scores of illegal conversions. City oversight of builders went completely by the board, and formerly high Chicago building standards were relaxed to accommodate politically plugged-in developers, who have foisted hundreds of badly constructed or rehabbed projects on the city.

Many buyers of newly rehabbed condos that presumably passed city inspection, and also passed the buyer’s inspection, received notices from the city that their building was in violation a few months or years after the purchase. Why? Because the building did not meet codes but was rubberstamped through the system prior to sale by the city, thanks to the developer’s status as a major political contributor.

There was unspeakable corruption from top to bottom, from the developers and city officials responsible for code enforcement, clear through appraisers, lenders,and inspectors.

Residents of building of $1,000,000 condos in Bucktown were forced to hastily vacate a building that was literally coming apart at the seams- residents noticed that the floors were beginning to separate from the walls, with gaps of 6″ after a few months of occupancy. They were informed by an engineer that for their safety they had to vacate the place immediately, that very day. This case will be in the courts for a long time while the owners must continue to pay on their mortgages while living wherever they can afford after making $4000+ payments for a dwelling they can’t live in and can ‘t sell.

Another condo near me is an illegal conversion, and the residents only recently discovered that they don’t even really own the overpriced, unimproved former rental dumps. Worse, the developer, who still effectively owns the units, did not pay his assessments for over a year, and as a result these people went without heat and water in the middle of a Chicago winter because he did not do his job as head of the condo board and did not pay the utility bills. In the meantime, the “owners” are fighting in court to get him to pay the condo conversion expenses he supposedly paid but did not because the conversion was totally fraudulent. This particular illegal conversion is an unbelievable legal quagmire and will play out in the courts for many years, as the lower-middle-income owners are forced to ante up for massive legal expenses pursuant to establishing ownership of the units. Meanwhile, three-quarters of the units sit vacant.

Our situation is repeated in communities across the country, even though they are not as “bubbly” as CA or Florida, nor as depressed as Michigan or Ohio. We will be twenty years cleaning up the multiple messes in finance, construction, and neighborhood destruction left behind by this greatest of all binges of financial lunacy in the history of the world.

What a collection of DUMPS! I doubt I would be willing to pay more than 50K for the best of the Lot.

Compton is one of the highest crime areas in the country. You couldn’t PAY ME enough to live there.

What drives a lot of the home prices is that a house ISN’T in Compton or Lynwood or wherever. In other words, it’s the notion that a given neighbourhood is occupied by “people like us.” Consequently, even though the houses in, say, Hermosa Beach are overpriced for the size (although I’ve seen way too many stylish and very well constructed bungalows torn down to build Mc-Tuscans – money DOES tend to mar), what drives the price is that it’s not like that area “over there,” refering to the various ethnic enclaves a mere one or two miles to the East, be they Korean, Afgan (yes!), Chinese (yuck.), Indian, or esp. gang-ridden Hispanic. (North Redondo is where you get murdered in the parking lot of the Galleria, no joke.) The same can be said about West Los Angeles where the “East Coast Persons” of “Eastern European Ancestory” – connect the dots – seem to ruin everything that they touch.

By comparison, and using Hermosa again – and without going onto a rant about the fraud of multiculturalism – the beach areas are relatively – relatively – tight knit and safe. (Before somebody screams, I’m not talking about race, but about worldview. No racism here, so don’t start.) That, combined with its small size with unique features – only 1.5 square miles, close-in shops, markets, and services, its walkstreets, and its narrow, traffic calming roadways, and a consequent responsive city government – is what drives the price of say, a one bedroom bungalow on a half-lot to the high six to low seven figures.

Ditto Manhattan Beach, parts of South Redondo, PVE, and so on.

In other words, it’s not just house size or income that figures in California, but the people who live in it.

Perhaps an unpalateable truth to some, but true nonetheless, so there you have it.

Welcome to 2008, everyone. I live in Michigan…we’ve had conditions like this for two years now. You talk about CA “leading the recession” for the other 47? Hah! You must mean the other 46, because we’re so far ahead of you on the slide down it isn’t even funny. Enjoy the ride, Californians…it is going to get much, much worse!

I’m enjoying the ride — by renting, saving my money and staying out of debt. I knew that prices would eventually go back down and all, but didn’t think it would be such a major national debacle. Things are going to get bad pretty much everywhere, so out-of-staters, don’t be so snide. Your house values will decline too.

P.S. That Compton place is a steal! LOL

I’m here in Nor-Cal,how far down will the market fall ? Big question.I’m looking to buy right now but I’m afraid of paying too much as the market slides.Looked at a 4/2 1450 nice neighborhood for 570k and in this”out of touch with reality” area that seems cheap.That house was up to 775k not to long ago.

I don’t see a major problem with #9. A 6-6.5% 30Y fixed mortgage with 20% down (typical for the old days and any responsible person these days) would be paying about $2800, after tax-benefits. Similar rent is $2500. Rents are only going up with so many people displaced from real estate. Its not a GOOD deal, but not a bubble if in fact similar rents are $2500.

Jo Jo,

Truth is, I rent a 2500 sq foot House (4 bed/3 full baths) in Hermosa Beach (one of the prime beach communities in So Cal) for $2200/mo. It’s a beautiful home, and I can walk to the beach. What a joke to pay $2500 for a 692 sq foot shack in Santa Monica…it’s all the same sand and the same ocean! The problem is, most transplants come to Cali and get hypmotized by the glamor and glitter of it all, then seem to lose thier senses. Why you would ever buy this house is besides me. In the end, there’s gonna be some half-off bargains from San Ysidro to Redding after this senseless runnup deflates! Just look at the data!

P.S.

Those that don’t study history are doomed to repeat it. (Global Recession in the mid-70s, Cali Real Estate Demise in the 90s, Florida Real Estate crash of 1927, etc.)

I may not be able to sleep tonight after reading this post. I knew CA had it bad, but this is rank. Even so, I really can’t see charging $200K for that doghouse in Riverside. These people need to wake up.

I live in Buffalo, New York.

FYI : We are doing great during this recession/depression/collapse. Real estate prices have NOT fallen in Buffalo.

The average house here sells for about $110,000.

which is a 3 bedroom, 1&1/2 bath, with a decent sized yard.

Also : there are NO TRAFFIC JAMS HERE.

We are 10 minutes from the Canadian border.

AND OUR WEATHER IS MUCH BETTER THAN CALIFORNIA, FLORIDA, OR TEXAS. We have 4 nice seasons, and never have a hurricane, flood, wildfire or earthquake. Oh, and also we have the largest fresh water supply on earth.

Move to Buffalo.

It is the best.

Thanks

Alex

If you were familiar with SoCal real estate than you would know that most people don’t chose to live in most of the city’s presented here. I have lived in Orange County, Inland Empire and now LA county. You have to be so careful when looking to rent. Most of the locations presented in Southern California in this article are not areas people want to live in. Stockton, Compton and Santa Ana are city’s that depending on your ethnicity – you don’t live there. And I’m not picking on one race over another. I have many friends of many different racial backgrounds and they all will tell you who they wouldn’t live around. Another thing, the rental prices may look good to you for the areas but to get the rent paid you are going to end up with multiple people living there and at the very least you will have heavy wear and tear on the property. Like I said, I’m a renter but have been very involved in helping friend manage their rental properties and have seen the best and worst that renter will do. One tenant didn’t pay their electric and water and ended up stealing water and electricity for months, I know this because I watched them steal water pumps and go into their electrical boxes and rig the electricity. They also threatened other neighbors with violence. The crazy thing is that the neighborhood this happened in wasn’t like anything like any of the properties mentioned here. The homes were in a newer community – less than 10 years old and they were much larger, nicer homes. It can happen anywhere, I understand….

Leave a Reply