Squeezing the prudent middle class homeowner – how deadbeat debt borrowers and shady banks are siphoning the wallets of prudent Americans dry. Trying to get a million dollar home for free in Simi Valley.

At this point in the housing fiasco you would think that you have seen it all. But leave it to an 11 member Simi Valley Southern California family to make me want to drop kick my television out my window. I’ll get to that story later on. As things go forward it is clear that we are suffering from this skewed financial reward system. On the one side we have irresponsible bankers who have conducted the biggest wealth transfer in American history and were able to do this by stealing money from taxpayers. They made bad bets and created toxic mortgages and were bailed out by everyone else. And then on the other end, you have dead beat debtors who game the system. I’m not talking about a family in the Mid-west who bought a $100,000 home and through the bad economy lost a job and no longer is able to pay the mortgage. That is completely understandable. What I’m talking about is California homeowners who used their homes like ATMs and lived high on the hog leasing European luxury cars and taking lavish vacations all financed via debt. Now they expect a free lunch as well? The middle class that tries to play by the rules, which by the way is the majority, is paying for this circus on both ends.

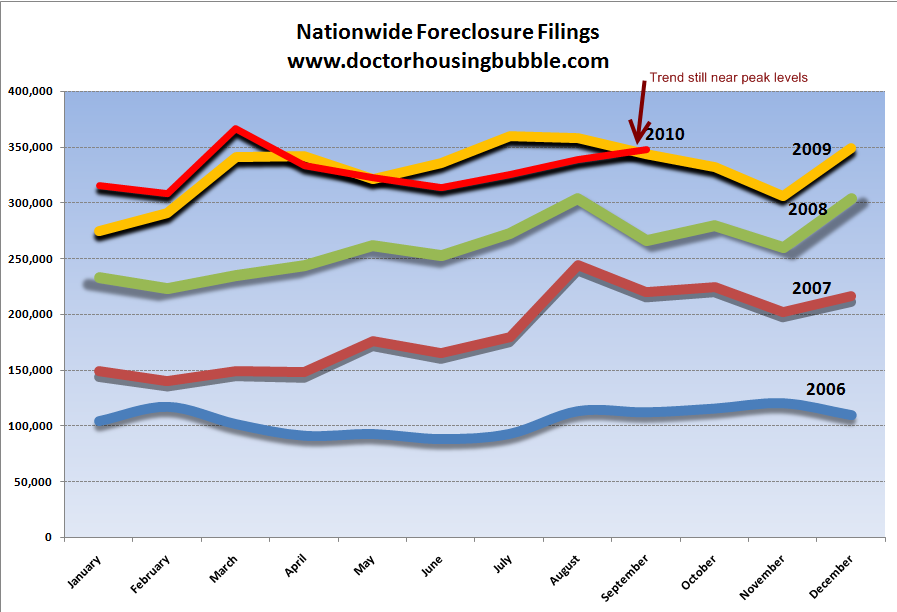

Let us first get the pulse of the current foreclosure crisis nationwide:

If the foreclosure process is coming to a halt it doesn’t show up here. I’m sure given the current fraudclosure problems we’ll see this tick lower in the next few months. But this is likely to be like HAMP where we will see a respite for a few months and then a sudden boost once things clear up. Let us get to the story that I saw on the tube yesterday:

“(Ventura County Star) An 11-member Simi Valley family who claimed they were wrongfully evicted after a foreclosure forced their way back into the house over the weekend in a move meant to block the new buyer from moving in.

Jim and Danielle Earl and their nine children used a locksmith to help retake possession Saturday, despite an investor who spent $697,000 to purchase the house at a foreclosure sale in January and remodeled and sold it to people ready to move in Tuesday. The two-story house in the 5800 block of Mustang Drive has nearly 4,000 square feet, six bedrooms and 4.5 baths.â€

This is not a poor or working class area by the way:

Home prices in this area range from $700,000 to the high $800,000s. The media broke this story but as we dig deeper into the actual paperwork, we find out a very interesting financial story:

“Pines argued his clients have a constitutional right to a jury trial.

The Earl family bought the Simi Valley house in 2001 for $539,000. In 2005 they refinanced with an $880,000 loan. In February, the trustee’s deed upon sale indicated unpaid debt with costs on the property just over $1 million.â€

Why in the world would they refinance? By my calculation they increased the debt on this place by $341,000. The median U.S. home price is $179,000! Is this your typical family? Not even close. Oh but it gets even better:

“That was what (they) claimed we owed at that time,†Danielle Earl said. “I don’t believe I owe anything at this point.â€

Pines said that while the debt hadn’t been paid off, the family’s claims for damages from their fraud allegations exceed the $1 million debt, meaning the Earls are now owed money.â€

That is right, this person who took up his debt load to nearly $1 million in a prime Southern California area in Ventura County now believes he owes nothing. Notice how these maximum leverage debtors have the same mentality as the banks? The system is completely muddled up. Not only do these people not owe anything anymore, they expect bailed out banks to pay them for damages! Since the banking system is now subsidized by you, the prudent taxpayer, you’ll also be bailing out this family. How does that make you feel?

This family clearly knows how to manage their finances:

“The couple has had financial troubles in the past, filing for Chapter 7 bankruptcy in 1994. This year they initiated two back-to-back voluntary Chapter 13 bankruptcy proceedings beginning in February, a few weeks after their house was sold. At trial, the judge said the bankruptcies appeared to be delaying tactics.

The Earls’ bankruptcy filings show they have assets of $500,000 to $1 million, and liabilities exceeding $1 million. Their listed creditors include the state tax board and the Internal Revenue Service.â€

Is this what we are now rewarding in our country? So while you pay your mortgage on time and live modestly or pay your rent, we have people trying to get out of hundreds of thousands of dollars in obligations on a McMansion. No wonder why it feels like the responsible middle class is being flushed out of the system.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

97 Responses to “Squeezing the prudent middle class homeowner – how deadbeat debt borrowers and shady banks are siphoning the wallets of prudent Americans dry. Trying to get a million dollar home for free in Simi Valley.”

You are just picking on these people. In our society, no one is responsible for bad decisions. Someone else must be at fault.

Mantra for the year 2010: “It’s all about ME!”

Quid pro quo – We have a society that is completely failing. But there is a solution.

Quid pro quo allows our elective representatives to receive donation from corporations and union bosses in exchange for concessions, wages and benefits.

If you want to change the culture of government and the culture entitlement class and stop the gaming of the system:

1. Require Arms length transactions, no more Quid pro quo, by elected representatives and corporate or union bosses;

2. Require Transparency, full public discloser and debate,

3. Require competitive bidding minimum 3 qualified bidders, or have contract put to a full vote of all registered voters not just the government workers or union card check to be able to vote.

Steve

Its either we change the culture of government and stop the gaming of the system and require oversight ( bank regulators just do your jobs) and liquidly in all our financial institutions and their instruments, loan contracts, insurance polices, and derivatives or we what for the bond holders to leave the party. Look at the Greeks, Irish and the Portuguese bond spreads.

the problem is that the banks didnt follow proper foreclosure rules but these people also didnt make their payments…….

Gypsy scum, nothing more. With all the previous bakruptcies and who knows what else, these are your typical deadbeat leeches on society, ALWAYS trying to game the system.

And 9 kids, jeeze! Why can’t these subhumans keep it in their pants and keep their legs closed! Like we don’t have enough selfish, self centered, irresponsible assholes with a ridiculous sense of entitlement on the planet! I bet they’ve also been getting welfare/WIC for the 9 kids the wife has squirted out. I hope the new homeowners drag them out and summarily execute the parents in the street! I’d call it justified if I was on that jury!

7 of the 9 kids are ‘foster childern’ so if you live in california you are paying for them, read the full story it will make your blood boil.

Why don’t you tell us how you really feel !! LOL

I think they are foster kids. More gaming the system.

BTW Dr. HB, you mentioned the luxury cars, as well as in a previous article how there’s no shortage of fire sale priced luxury cars for sale on craigslist in SoCal. I haven’t seen this at all in the L.A. section – is this just in the O.C./Inland Empire sections? I sure as hell wouldn’t mind picking up a top of the line, couple year old high end luxury car or cars for say $20-30K (like a Lexus LS460, BMW M, 6, or 7 series, X5 or X6 etc.). The only ones I’ve seen in the L.A. craigslist that are a good deal are too good to be true – those “pay through eBay motors and we will ship you the car” scams.

Not only that, but even if they have the car and the pink slip, who knows if these private sellers don’t have all kinds of leins or debts on the car.

Foolio, I am with you as much I don’t like to contradict DHB on small potatoes. The crises is not over, not at all, but the fact is actually the inventory of “European luxury cars†o Craigslist has evaporated practically. I don’t know what the morons are thinking, may be “yes, we are there yet!” . I know this because I sold my BMW about 6 months ago and it was painful market with many sellers and no buyers. Today make a search for 3-series BWM for particular year model and 4-5 adds. I don’t know what are they thinking, but this crises is not over by any means. My only explanation is total delusion and disorientation of the moronic populace is fueling turbooptimism, which keeps the wheels going

da-di-da,

Most of “the moronic populace” is clueless. The majority live in a delusional bubble, almost like that movie about the boy in a bubble.

I liken it to a deer in the headlights. Before that car hits the deer, the deer was perfectly peaceful, grazing on some grass, trotting through the forest and enjoying the moonlight flicker off a mountain lake. But as soon as those headlights appear, that peaceful mood turns into fear and then moments later, BAM…it’s game over.

That’s pretty much how I see this ridonkulous charade playing out.

Dr. HB is right about fire sales on luxury cars. Check autotrader in the LA area. No shortage of BMW’s or Mercedes. And while you’re not going to find a $100K 7-series for $20K, you CAN find a $120K Maserati Quattroporte – three years old and under 30,000 miles) for around $40K. I’d call that a fire sale.

I hate what the banks did with the shady paperwork shortcuts. BUT if you can’t afford your loan then you lose your house.

Take a look at this from CNN.

http://money.cnn.com/2010/10/14/pf/boomerang_kids_move_home/index.htm

So hard that a whopping 85% of college seniors planned to move back home with their parents after graduation last May, according to a poll by Twentysomething Inc., a marketing and research firm based in Philadelphia. That rate has steadily risen from 67% in 2006.

I think Dr. HB had a article about college debt and the impact of housing.

They’ve learned a lesson from today’s 30 something, who actually launched when expected, but now years later still can’t afford houses in CA. Why not just live with mommy and daddy until your 30 to afford that house?

Charge them with breaking and entering and contributing to the delinquency of 9 minors, and be done with it.

What a mess. It stands to reason , though. As the power structure is clearly cheating the people, the people start to figure out that they should join the power structure. When in Rome……

Given that 25% or more of home sales are foreclosures at this time, this should really bring home sales to standstill for the next few months. Fear will be running high for prospective buyers.

This imbroglio surely fills THIS prospective buyer with fear, I can tell you. I’m now terrified of buying.

I have until now intended to make a substantial down payment. But you know what?

Maybe it’s a better idea to just take the 3.5% down payment FHA loan and keep your cash stashed against the day some previous foreclosed owner, encouraged by allegations of foreclosure “fraud”, decides to break and enter, and take possession of “his” home after you’ve bought the place.

I find this sideshow maddening, and for the same obvious reasons as the Doc, but note that:

a) This family has had the scrutiny of one or more judges–granted, they were kal-ee-faux-nia judges, but, hey, that’s who you elected out there;

b) Sounds like the locksmith involved needs to suffer a suspended/revoked license, a day in court, and significant fines; I mean really, in an Age when you can pull up property records on a smart-phone, WTH?

c) I’m betting the taxing authorities involved will not be as lenient as the dopey judges have been.

d) That re-fi UP-move was a bubble classic, but the lender involved (and the Mortgage Bankers’ Ass’n in general), having already taken their bath, are certainly not going to let this legalistic “strategery” gain any credence or momentum.

I am angry. I’ve been renting for the past three years because home prices are inflated. Personally, I do want to own, but the market has to adjust for owning to make sense.

I’m angry because the prudents being punished, while the imprudents living for free. And knowing the government, credit scores won’t even matter much in the future. If bulk of people have poor credit, the system will be lenient, make exceptions for them, to give them a competitive edge. I’m angry because it seems so helpless. All I hear are people pointing out problems, but no solutions. Some say just vote for the right people. Really? We voted for Obama, whose strength was economics. Whether or not he’s at fault, the system is still deeply flawed. I think anyone voted into office would just cave to the lobbyists.

Anyway, I thought of a solution, and please read here, http://bankwalkoffwallstreet.blogspot.com, and give me some feedback. I want to hear SOLUTIONS people!!

Obama’s strength was economics?!? FLOL, if that’s his strength, I’d hate to see his weaknesses (although we already have seen plenty of the great “0”s weaknesses and failings).

lol ahahahaha lol eheheh ahaha… you cracked me up Foolio….

I think Obama is the most incompetent President ever, but when he speaks…. he looks the most competent…. This guy fooled me.

Using a teleprompter while addressing a grade school… yeah, that’s competent.

Replacing the corporate banks for an independent run ‘by the people for the people’ won’t get very far. Not many people are willing to entrust money in a bank that is backed by nothing more than a group of people who simply hate the banks. There’s no insurance against theft, misuse, loss, etc, and there will be costs to provide the new banks services. Furthermore, who is to say the leaders of the new ‘peoples bank of America’ will not turn their backs and take advantage of a situation? I wouldn’t put my money there. I’m better off putting my money in gold or alternative currencies, which would also serve your purpose of getting my money out of the banks (in America at least).

Quite frankly, there is no workable solution that will rid our world of greedy people who take advantage of power. History repeats itself, and those who try to live responsibly just have to live with this factor. There will be good times where good wins over evil, only to be taken over as a result of complacency.

You, who desire a solution can do one of two things. You can challenge the system and be a hero in similar fashion to Mark Pittman. The heroes of this decade won’t be soldiers, but those who challenge and conquer the Fed. They are the modern day Goliath. Or you can go one step further in your prudence and hedge yourself with natural resources or other assets that will support you if society implodes upon itself someday.

Certainly, you are right in being angry. You are right in your desire to take action, but I cannot agree with your plan. It takes a special kind of strategy to take down cunning. Can’t replace thugs to guard your money with normal people, if you catch my drift

Great post DHB.

Today I,m going to pay my property taxes. Taxes that are running sky high because some idiot selected an idiot from a much larger pool of idiots to come over and asses the value of my home !

The idiots across the street from me are excited because their property tax assesment has shown a steady increase. Property values in my zip code have been on a steady increase through the collapse. My neighbors had no idea that one day their home would be worth so much.

They are headed to the bank today to show the new assessment to the loan officer. They hope to borrow that money to pay the property taxes and take a vacation.

I protested my property tax assessment this year when again it went up ! I exclaimed to my assessor that property values in 90210 are tanking. How could values in 99654 be on the rise. His reply “What is 90210 ?”

And this man claims to know something about residential real estate ?

I’d bet my borough property assessor is a blood relation to the Earl’s

I’m getting real tired of Idiots.

Clearly you don’t quite get all the nuances of property assessment. Unless your assessment was previously reduced due to a decline in value, there’s flat no way the assessment went up this year. In fact, 2010/2011 marks the first time since Prop 13 passed that the standard indexing (max increase 2% per year) went down — by .237%. That’s what we call not a good economic indicator. If your assessment had been reduced due to a decline in value in the past, the Fair Market Value assessment can fluctuate — sometimes wildly — between that prior assessment and the FMV as of January 1, 2010, but it can never exceed the factored Prop 13 value.

99654 is Wasilla Alaska. I don’t live in California. Prop 13 is California. I’m in Alaska.

I live in Alaska too, but in Anchorage. The Borough tax assessors gave me a song and dance about how the square footage of a comparable home (from 2-3 years ago) was on the rise and that if you contest their judgment then they “might” reassess the entire home to look for any improvements or reasons to increase the taxable value to their “target”…i.e. “don’t screw with us and we won’t screw with you”

How come only idiot are elected?

Six of those nine children are foster kids, I read some where. Just another way to get some extra $$.

Well this just cinches it. I have come to the conclusion that the 2 best career options at this point in time are: 1) banker 2) locksmith –

take note young people who haven’t decided on a career-path yet.

3) Baby Factory 4) Dumbass

The current owner needs to call the police and have them arrested for at the least, trespassing, and also for B&E. And they need to be escorted off the property so that the current owner can take possession of their property. All they need to do is show the deed or finance papers to the judge, to show proof of “ownership” of that home.

I agree this is all so very maddening, I could just scream at the abuse of taxpayer money! Despite 9 kids, this couple who has played loose with the rules for YEARS, needs to live in Section 8 housing or move to somewhere they can afford to rent.

And they need to serve a little time for their actions, to reinforce to others that its not “OK” to enter a home forcefully like a common criminal, despite how they went about it.

The Simi Valley sucks!! It is contaminated with radiation from the Santa Susana nuclear meltdown in the 1950’s and linked to higher cancer rates.

http://www.msnbc.msn.com/id/39003284/ns/us_news-environment

Not that Simi Valley’s any prize, but the whole “nuke horror” of SSFL has been way overblown. 10’s of thousands of folks have worked there in the 50 years since and they’re hardly dropping like flies. Heck, I worked up there for 10 years and the site is like a pristine nature preserve these days.

Anyway, a bigger issue than the 1 meltdown 51 years ago is the 30-40 years when toxic solvents were just dumped everywhere without regulation – not just at SSFL, but at every other Aerospace industry site in the San Fernando Valley. The whole damn region has a toxic history of which the nuke accident at SSFL, while it makes a sexy headline, is only the smallest part.

I live in Thousand Oaks, and saw this on the news, very upsetting that they were allowed back into a home someone else now owns. I feel really sorry for the people that were supposed to move into their new home today. I hope the police kicked out this family, but according to the news, it’s a civil matter. It’s pretty criminal. Have to see how it plays out, I hope they let everyone know.

The worry also is more losers are going to start trying to do this, and it’s really going be crazy times. For now we will continue to rent until this nightmare finishes up.

Interesting what you can find out about someone on the Internet.

Father is a “stay at home Dad”. 6 of the children are foster, so they get paid by the government to take care of them.

Wife is part owner of a tiny business with father and brother.

Probably use the business for “tax deductions”, afterall doesn’t seem these guys pay their taxes either.

This story is unfortunate because it hides a bigger issue. Due to the half assed nationalization of the Title system (Mortgage Electronic Registration System), everyone is having a hard time figuring out which bank actually holds the paper and who holds the title. There are many more people in states being wrongfully evicted where a judge has the option of presiding over foreclosure (California is not one of them).

You are referencing Judicial Foreclosure, not used in CA. The wrongful foreclosure’s you are refering to: please show me one that the owner has made their payments/taxes/HOA and insurance payments and still lost their home to foreclosure. Show me just one and I will buy into the storeis of the flawed system we have. Because someone signs 10,000 documents a month at GMAC might be incredibly stupid and irresponsible but it did not cause Mr. and Mrs Homeowner to loose their home. Not paying the mortgage is the cause!

There’s a kind of poetic justice going on here. Considering just how crooked the mortgage industry has been for the last five or ten years it’s nice to see someone apply the advice of one of our intelligence agencies: Admit nothing – deny everything – make counter charges.

Corporate America is about to discover that when there are no rules – there are no rules.

When the government unilaterally/retroactively negates the penalties (foreclosure) as agreed to on the original mortgage agreements, rules and laws cease to have credibility anyhow.

You’re siding with the wrong forces. The vast majority of mortgage holders are playing by the rules–see DHB’s blog entry earlier this week.

The banks aren’t getting reamed, they’re getting bailed out. The passive voice there begs the question–“BY WHOM?”

By YOU AND I. (If you are prudent. I know I’ve been.) WE are getting the tetanic handcuffs shackling our wrists to our ankles.

And enough of this postmodern/PC moral equivalence/Sixties Rebellion horse goo for the love of lefse! Just because the banks get away with murder doesn’t make it right for me to come to your house with my chainsaw and turn you into splatulicious artwork.

Similarly, larceny by the gangbanksters doesn’t justify others doing it. I’d go so far as to say these deadbeats are showing Which Side They Are On, and the side is the banksters’. In other words they came, they scammed, and they are still scamming.

And you and I are paying for it.

If you don’t understand this, then you really need to go back and re-read every DHB entry starting with TARP and since then. These deadbeats aren’t “milking the system” or “getting even with the banksters.” They are nailing you and me and all prudent owners even harder to the bloody perch.

The deadbeats and loansharks get plenty of press, including from bloggers WHO SHOULD KNOW BETTER. Now, who speaks for the prudent borrowers, and the prudent lenders?

Seems like this could be cleared up very easily. The bank that foreclosed on the Earls needs to go to the courthouse tomorrow WITH THE NOTE to prove that they have stading to foreclose. This critical step was apparently skipped the first time around. They then need to endorse the note over to the new owners. This critical step also seems to have been skipped the first time. File both property transfers with the county and pay the registration fees. The new owners can then have the Earls kicked out on their freeloading butts.

I think the problem is that morality has become an empty slogan. If the bankers -I include people like Greenspan in that- can be so wrong and almost bring the country to its knees and still face no consequences and still get their private jets and their million dollar bonus, then others are going to do the same. Now there will always be the honest set, but in today’s world it almost seems like the honest ones wind up being the fools.

Well at least we sleep well at night and for those renting like me-we do have true freedom. Who wants to deal with all that.

a couple of things are happening here..

the Earls’s are rightly testing the system;

the new seller’s and the buyers are now forced to test the system;

that’s why the cops did nothing;

any refernce to foster children in the previous post is extraneous & irrelevant;

this is a new paradigm and only the beginning;

either the courts or new(quick) legislation will change the landscape

I don’t know much about that family, but here’s my guess:

1. I think that family have kids to collect money.

2. This family likes to look big, but really is tiny.

3. I’m pissed off because they didn’t get punish enough.

4. I feel sorry for the kids.

5. I’m really pissed, but I can think of a way to punish them without hurting the kids.

6. There are many good people who deserve better than this family.

Wow, this website is awesome…. very very informative. Kudos!

I have a friend who bought two +500k homes and not on his own credit nor SSN. I believe they both were pick’n pays with Countrywide. Needless to say, he stoped making his mortgage payments on both and has been squatting in the first for over 3 years and renting out the second to his relatives/squatters… for 3 years! He has also been collecting unemployment and food stamps. He’s been saving the money he earns under the table from an unreported job, saving what would have been his mortage payment and keeping the rent from the second home he rents out to his in-laws. He’s been able to do this becuase he has a realtor friend who knows how to deal with the banks and the courts and continue to delay foreclosure and he has no intent on changing the course. He claims he has enough money saved up to buy another house cash down and will do so if he finally has to be removed from the premises. Kudos for him and too bad for the banks… I guess, reluctantly.

But here is where the resentment comes…. I have not bought a home mostly for the reason that my work requires that I have to relocate frequently. So I have been renting for the last 7 years. I now do have a family with children and see the need to settle down in one city now that the girls have started preschool. I have very good credit (780 last I checked as does my wife 766 mid-FICO’s) and carry almost no debt (just pay off all my credit cards every month)… auto loans, student loans all paid off. I am now just waiting for housing to bottom ( I am anally risk adverse and even frugal). I hope to be able to buy a house with 50% down… but the way this is going I may be able to just wait longer, save more, and just buy it out without a mortgage or even buy more than I really need and carry a mortgage.

What irrates me is that I have been a saving and waiting for the right time (I had seen the bubble brewing)and city to settle into, and now someone like my friend and more people like him who have been saving as they have been squatting and reaping rental benefits and now will also be able to buy even though they are bearing no responsibility for the mess they previously got themselves into. Furthermore, with foreclosure delays… he could continue to squat collect more rent and save tons more than me! And now that BoA-Countywide has delayed foreclosures again…. he will definitely stash more in the mattress!!!!!!!!!!!!!

Don’t get me wrong, I appreciate my friend (not sure if I should keep him as one), but this seems wrong and I think it is the responsible homeowner that is getting screwed and (some of) the irresponsible ones are benefiting. I don’t mean to make blanket statements for I know people who lost their homes and have endured much suffering. In my friend’s case, he is just beating the system at taxpayer (our) expense.

Interesting story.

Your “friend” (I don’t like dishonest friends because it’s only a matter of time before they screw you too) may like to think he’s getting away with something, but in the end, he won’t.

Here’s my line of thinking which stems back to when I used to be an insurance claims adjuster.

“Give them enough rope to hang themselves” is something a supervisor would say when I had a questionable claim. We couldn’t use the word “fraudulent” …only “questionable”.

We would like to let the insured believe that they were getting away with something by playing it slow and stupid. We would send out forms called a “proof of loss” that asked for all kinds of seemingly unrelated information. That form had to be signed, notarized and then MAILED in. Some times they would try to drop it off at the office and they would be told that it HAD to be mailed. They would ask why and we would basically just shrug our shoulders and say “Dunno…it’s just policy. I don’t make the rules” or something along those lines.

The reason that they would have to mail it is that defrauding an insurance company is NOTHING compared to mail fraud. And as soon as you send a notarized “lie” through the mail…you’re screwed (or so I was told). We would never let them on to what was going on in the “investigation”, and in the end, the guillotine would come down.

These debtors think their gaming the “system”, but in reality, it’s nothing that the “system” hasn’t seen before. So, ask your “friend” if he has had to mail any NOTARIZED forms/statements/etc. back to the bank. If so….they have him right where they want him.

Nice! Another way scamsters are caught is when they file for bankruptcy to try to get their credit card debt discharged. All the credit card company lawyers have to do is compare the debtor’s schedule of assets and liabilities, and other information they have to disclose, with the credit card application. If there’s a discrepancy, the company can claim the debtor committed fraud, and the debt should be nondischargeable. When you think of how many people lied on their mortgage application, it makes you wonder if the same thing can’t happen to them.

Good luck. Chances are, these people will stay rent free for few more months. But nothing more will happen to them except being kicked out. I’ve seen out right frauds that involved hundreds of thousands of dollars that were never recovered and perpetrators never prosecuted. The system is over loaded with cases and most cases will never see the light of the day in court.

It doesn’t pay to be prudent anymore. The socialization of loss is now approaching far greater circles than few well connected and influential banks. Now the small time operators are getting in on the game. Capitalism is no more in USA, communism is taking over.

Red, a few years ago the blog The Simple Dollar had some excellent thoughts on how prudent and frugal people could act/react when facing sad truths about whether on not to keep imprudent and wasteful friends. I was going through that myself at the time with several long-standing friendships that couldn’t accept my own refusal to waste and exploit (that was at the height of all the mania).

You might find those useful as you work through your own feelings/issues around keeping your financial process clarity ahead of your “lust of result.” I would say to you:

Stay your course.

Ahhh, young grasshopper…you should know that man who fart in church, sit in own pew. Your buddy, just like the family in this story, will get theirs eventually.

Bu Bu But think of the Chillllllldrennnn.

Perhaps we should send them a nice housewarming gift?

And just in case you were wondering which house is theirs…

http://www.zillow.com/homedetails/5893-Mustang-Dr-Simi-Valley-CA-93063/16445727_zpid/

^^^ FLOL, from the property description:

“This beautiful 6 bedroom Shadowhawk is move in ready for your large or extended family TODAY!!”

I guess the Earl brood took that literally…

My gosh, we are in fine form here.

I mean that in a good way.

So the question is, are there any GOOD ways to “work the system”? I’d say yes. One way is understanding how debt works, and managing it prudently. But the returns on that aren’t enough for the gimme-gimme crowd.

Here’s what makes me shudder like a bucket of leeches dumped inside my Jockeys (to go back to Foolio’s observation about things kept in pants):

Between this household and OctoMoo, there are 23 future new households who grew up believing that the way you get ahead in life isn’t through working, saving, and building mature, patient, adult alliances….but through flipping, scamming, begging, litigation, and headlines.

They are learning this sense of drama and entitlement from their parental units.

The damage here will extend 50-80 years into the future just in personal terms. And even more downstream. If you ever wonder what MZBs are going to look like, gaze deeply at photos of the Earls’ and 8Moo’s progeny. If they feel this entitled to you and I paying their way now, imagine what they’ll be demanding as the edge of the Olduvai Cliff crumbles further.

If I were the new owner, I would kick down the door and go into “my house” with a tire iron, lead pipe and deed in hand. The cops would have to do something because this is no longer a civil matter. These people are sheisters who are taking advantage of the system. As we’ve found out, the system sucks but thiese deadbeats definitely contributed to its demise. This country has completey and totally unraveled from top to bottom.

Take a deep breath. Reread some of the above posts about notarization, mailing, etc.. Note where Compass Rose made a remark about patient and mature. The cops may appear to be doing nothing but that officer sitting in his patrol car is a witness. When the DA concludes his investigation of those facts they may well knock on the door at, oh say 5AM. We have all seen the video clip of that knock and how the slow response leads to a huge pipe battering the door. If that happens and after that happens the new home owner will have a civil claim for damages against the Earls. This of course does not mean they will collect but stranger things have happened. It is also possible that they have legal protection in the purchase wherein the investor will owe them recompense for the time they have been out of their home. The wheels of justice grind slowly and sometimes they grind accurately. I would expect that in this case.

Thanks for doing the investigaive reporting; you were able to find a good example of what is so detremential about real estate investing today.

It’s too bad, the family actually believes that they have a right to the home, and committed a break-in to reclaim the property.

At the root of the problem is the repeal of the Glass Steagall Act that permitted slice and dice securitization with CDO financialization. And the AICPA and the SEC came out with FASB 157 which entitled the banks to mark real estate properties to manager’s best estimate rather than to mark them to market, and thus maintain delinquent home mortgages on their books at terrifically inflated and unreal prices; and has entitled people to live payment free in their mortgaged properties.

There is indeed a mortgage and banking cartel with the GSEs, Freddie Mac and Fannie Mae at the top; the beneficiaries of the cartel, are for the most part the nicer neighborhoods, that is the middle and upper class neighborhoods, where the Bank or mortgage company owns not only the first loan, but the second and all others as well, and is unwilling to kick the squatters out because the bank would take a terrific loss through foreclosure, having often to place the home in REO status, as most buyers are willing to pay only equivalent rent prices for the property.

Do you understand WHY banks are creating fabricated documents? Because it’s fraud covering up fraud. Our note was never transferred to the securitized trust that the bank sold off to investors. Though they had an agreement whic said that they did. Because they didn’t do this, they could sell a mortgage to investors more than once. Our mortgage was placed into 2 different trusts. Do you know what THAT means? Wells Fargo was paid twice for our mortgage by investors. Unfortunately, those investors lost out. So why would you want to give back a house to Wells Fargo so that they can get paid on it by investors a 3rd time? They never put up a dime in the lending process and only made money through servicing.

I don’t think it’s fair to blame the middle class for pulling out equity in their home to make improvements or buy a boat. The PROBLEM was that the banks fraudulantly propped up the appraisals on the homes. So homeowners THOUGHT they had this equity, when in fact they didn’t.

Because of these fraudulant appraisals, people were sold homes that were worth on average $250,000 less during the height of the boom in California. Take a couple who put $70,000.00 down on their new house as an investment only to find out that the appraisal was fraudulant.

Because the banks never transferred title to the trust by the cut off date, and they screwed up the titles on all of the homes that went into securities, these illegal foreclosures have GOT to stop before another person buys a home that has screwed up title. I don’t know how the hell they’re going to fix it, because there really isn’t a fix.

I’m glad these people have taken their home back for which the debt obligation was paid for by a third party (the investors who were bailed out). The bank should have worked with them because their loan was fraudulant from the start.

The banks deceived BOTH the investors AND the borrowers. So, it’s fraud covering up fraud folks, not just a technicality in the paperwork…and it can never legally be fixed.

You can thank the greedy banks for that. Let them fail.

The one part or your post that bothers me is your comment about homeowners taking equity for improvements or boats. It seems to ignore the bottom line that in order to use that money you have to pay it back. That has to come from somewhere and obviously it come from equity in a home you are living in ergo you must sell the home or make payments from income. It is a financially unsound decision to take equity that cannot be backed up with income. Prudent real estate investors get income from equity but Joe and Jane six pack do not.

Two wrongs don’t make a right. The profligate spender and speculative buyer gambled and lost. Some prudent were hurt but vast majority of those who bought at the peak were no money down, so they have no real claim to the house.

It is simple: you don’t pay, you don’t stay. Instead of making an half-ass argument justifying bad home squatter behavior, think what would make it right. The home needs to be foreclosed, the bank should turn over the house to investors to split the remaining funds. I say wipe out the bad banks, bad investors, and bad people. Clear the garbage from the current system and start over with the prudent banks, prudent investors, and prudent people.

By the way…we are not in default, but the bank has screwed up our title which we now have to pay to fix.

Do you know why title companies will no longer insure buyers on properties that have been securitized? Because THEY know that the banks have fraudulantly skrewed up title.

I know many average people who pay their bills and live within their means, who are really, really angry. Angry about losing jobs and businesses while people face little consequence for poor behavior. Politicians focused on their own agenda and financial benefit, and the special interests that elect them, unconcerned about the needs of constituents. People present false docs for employment; when exposed, no punishment…they’re victims. Any consequences for Meg’s maid? Maybe she’ll be offered a reality show. Banks bailed out. Wall Street rallies while people struggle to put food on the table. People default on mortgages and become indignant…we like this house, the kids love it, so what if we can’t afford the payments! We’re staying! We owe nothing! If those that play by the rules continue to be seen as a silent majority of suckers who just take it, what will eventually happen to our society?

This is all true and eventually the whole system crumbles just get ready to pack your bags when the time comes

I don’t live in the area, so I’ll need to take a pass here, but who is planning to go to Simi this weekend and protest? You know the address. Why not take action – peaceful action – but do something of significance here. Would be nice to see people picketing this behavior, get a couple of news helicopters circling around, you know a typical LA Media Circus ™ and make something happen.

They will eventually get foreclosed on and forced to move–the bank just has to file the legal paperwork properly, LIKE EVERYBODY ELSE HAS TO DO. Of course, that will cost the banks money, but that is the risk you take when you make loans to people who shouldn’t be getting them, and then try to take legal shortcuts because you have adopted a “too big to have to follow the law” mentality.

I agree the banks should follow the law and these scumbags are taking advantage of it. I guess everyone gets theirs one day

Sanford Weill spent $31 million on his home in Napa after taking tax bailout money. Got to love those Citi-group criminals. Jesus hates bankers, hookers and gays are OK.

I feel sorry for these people as human beings who have lost their house, however, they are irresponsible jerks who have been living high off the hog and spending money very recklessly. And to now say they owe nothing is despicable.

It’s sad that the children have to lose their home, however, to buy a house for $539,000 and refinance it to $880,000 dollars is the epitome of irresponsiblility. And now when they are unable to pay – play the deadbeat, victim role.

As strongly as I feel that these people are deadbeats, the banks too have engaged in massive criminal behavior and should be punished and forced to shut their doors. We need a responsible, fair and honest banking system in this country.

I agree with you that this particular family is milking the system. I do want to point out though a couple of things. I purchased a home in 2002 for 345,000.00 I have horses and the entire backyard was dirt so when the appraisal of my home went up to 850,000.00 (according to the bank) I refied in 2006 and took out $100,000.00. I put up a barn, landscaped, put in a pool, and jacuzzi, painted my house. Thought I was improving the property. I had well over 100,000.00 of my own money into the house prior to doing the refi, as I had put 20% down, plus made my mortgage payments for 4 years so even with the new, higher mortgage, I still had about $400,000.00 to $500,000.00 in “equity” left in my home (according to the bank). Well here at ground zero Las Vegas, my house is now valued at 270,000.00. less than when I bought it with a dirt backyard in 2002! My husband became unemployed, I became unemployed, suffered family illness and death, and basically lost everything I ever worked for in my entire life. I am no longer able to go back to the profession that helped me make the money I saved to put down on this house. I took money from the equity based on the information given to me by the bank that never disclosed one thing about the fact that they were pre selling non existant, yet unsigned Notes via MBS’s and falsly inflated home values etc. Had I known that I may have made different financial decisions. I even accounted for the fact things might drop and factored in to my decision a drop of up to 35% which would have still left equity in the home. I don’t think anyone could have anticipated a near 75% drop in value! check out http://www.economicsurvivalguide.org It explains in even more detail about the whole banks/money scheme. The housing fraud is just the tip of the fraudulent iceburg. Start peeling back the onion and see the truth.

Sorry to read of your dire circumstances, however by 2006, there were several well-known and established bloggers warning of the housing bubble. There was Nouriel Roubini, Robt Shiller, Peter Shiff warning of the fake home “values.”

At that time, I was looking to buy property but chose not to based upon their warnings.

And it wasn’t just them – even on places like the Housing Forum on Craigslist posters were posting links to online articles in major news sources regarding the housing bubble. Patrick.net has been around since 2005 and was well known among real estate agents.

There were many videos on YouTube warning of impending disaster and real estate agent spin to get people to buy.

So, its a bit disingenuous to suggest that you were a victim when all you state that you did regarding financial research was to depend upon the opinion of one person at your lender’s office.

In addition, you do not state who the person(s) were that led you to think about “falsely inflated home values.” Realtors overestimating maybe?

As an investor, I perform A LOT of research on companies prior to investing, sometime taking several months and relying on two money managers at separate companies and several financial websites prior to “pulling the trigger.”

You obviously put a lot of your money into this property, yet I’m not reading about the research you did prior to doing so. In fact, it appears you were basing your financial future on the assumption that “real estate only goes up.”

Sorry to say at this late date, but if you’d looked into demographic trending patterns (readily available on the internet through the persons and websites mentioned above in 2005) you would have seen that the Boomer demographic was approaching retirement age and would be downsizing soon.

This huge demographic would certainly leave a tremendous footprint on home values and sales prices since it was determined at that time (2005 or so) that home sales would outnumber home buyers available and that prices would have to fall dramatically in order for younger buyers (such as myself) to be able to afford a home purchase.

As much as I sympathize with your situation, you chose a very expensive hobby – horses – to indulge in. I am aware of the costliness of keeping horses since my uncle used to own racehorses (3) and their care and upkeep is huge.

You built a barn. Was it air conditioned? Have plumbing for hot & cold running water? A restroom? Tack? Feed is expensive. What were your costs for feed and vet care?

You see, this requires a big income – you need to be a millionaire, really to afford all of this including a pool, spa, and house painting.

Were you a real estate agent or mortgage broker?

Sorry about your current distress, life happens and the important thing is to prepare for it. Maybe its too late for this advice and I hope it doesn’t sound trite to you at this late stage, however, many Americans are unwilling to just blame the banks for the present economic disaster. They had help from the mortgage lending industry, Wall Street, NAR, local real estate agents, and government agencies that failed to supervise and contain what was going on.

Many Americans also put the blame on Main Street buyers who took loan money that they assumed would be paid by someone else upon the sale of the property. These Main Street “loanowners” saw a property they wanted, felt entitled to living at a certain level and borrowed money not willing to sit down with paper and pencil to determine if they could actually afford to buy.

The property ponzi scheme could just not go on forever.

If you cant pay get the fock out, I dont feel sorry for any of them…Go rent, they just looking for a hand out!!!

Update – maybe the courts are good for something after all…

http://www.vcstar.com/news/2010/oct/15/court-orders-simi-family-to-vacate-foreclosed/

Thank you for the link.

Also in the Comment section someone was kind enough to post this link to the investment company’s side of the story.

http://5893mustang.com/Default.htm

Yup. I’ve been reading a lot about the mess with titles and improper foreclosures lately and a couple of well written articles have said that the law *strongly* protects the buyer of a home that was presumably legally foreclosed on. The party which feels the foreclosure was wrong is supposed to get redress from the bank not the new buyers. The Earls are taking action against the new buyers.

Did anyone notice the Attorney said “I Picked Them Because” he is an amublance chaser of the worst kind. I bet he sent out hundreds or thousands of letters to anyone on the foreclosure list and waited for just this low life to appear. Second the locksmith should loose his license as he had absolutley no right to break into this home. Last, who really believes that the media will tell the truth on this story in a follow up?

CJ

I really do mean this with all due respect and the best of intentions. Just because loose is not flagged by spell check does not mean it is right. Grammatically you want to say ‘lose’. Loose is a word related to nuts or a horse who has escaped from the barn. I see this so commonly on the internet and mainly with that word so it seems to be a misunderstanding rather than a lack of typing skill. Your ideas are appreciated but it hurts my ears to read loose for lose about as much as it does to read “the reason why is such and such”. It is actually correct to say the reason is. Why is understood and unnecessary in the sentence. Please keep sharing with us. and if you could pass it on so we can lose loose.

Free aneurysms at the link. Countrywide mortgage. Let us pray Mozilo bunks with Bernie.

http://thecivillibertarian.blogspot.com/

Good News: The squatters have been kicked out by a Judge and have a week from Monday to leave!

http://www.vcstar.com/news/2010/oct/15/court-orders-simi-family-to-vacate-foreclosed/

And get this, they’re still defying the judge by saying they’ll move right back in after they’re forced to leave! Hopefully they’ll wind up in jail for contempt of court. Talk about stupid!

In any event, I doubt that the Earl’s will be able to talk a locksmith into picking the home’s door locks any time soon.

And now that the local police have been informed of the prior eviction of these people, they will probably arrest them at break-in without delay.

Also the property owner (Conejo) is looking into obtaining a Restraining Order against attorney Micheal Pine. I would also ask the court to restrain Jim and Danielle Earl as well.

The only people mourning the enforcement of the Writ of Possession are the anarchists.

That is excellent news. These deadbeats can rent a property that will “suit their needs.” Their gravy train is came off the tracks.

One more thing, they even left behind the family dog when they moved out the first time. Nice people, hmm.

Here’s a statement from the new owners of the house where they give their side of the story:

http://5893mustang.com/

Can we please realize in some cases homeowners are actually begging the banks to take their homes and finish the foreclosure process, but the banks are refusing because they want to push the losses back forever. Some people just want to start over renting and work on the process of cleaning their credit history, but the banks won’t let them. I’m in a situation where I actually did move out of my house and I told the bank it was unoccupied, but they still won’t take the place. Meanwhile I still have to upkeep the place, because legally my name is still on the property. Some of you say people should move, but don’t realize when the banks refuse to take their properties it still leaves them on the hook for all the liability associated with the property.

Oh God, what is this country becoming?!

Is the property located in a deed-restricted community or HOA?

If so, check your Purchase Agreement and CC&Rs. There may be clauses in those docs that require *you* to maintain the property or assume liability per Association rules even in the event of abandonment or foreclosure.

Another reason to have a real estate attorney representing you at signing.

And meanwhile other people wish for the opportunity to buy a more affordable home but can’t because prices are artificially being held up by deliberate withholding of homes from the market. Something is so very very wrong economically when useful goods can’t flow to people who wish to use them that it just indicts the whole thing. I mean really if this kind of farce was going on in the old soviet union it would be used as an example of everything that was wrong with communism. Meanwhile back in the U.S.S.A.

That is exactly right. The government is protecting the money interest in the name of “financial stability”. This is kind of propaganda that I could only imagine happening in communist or totalitarian regimes. The whole process is so broken down that it takes a huge bubble to show how much capitalism has degenerated to in America. Capitalism is about efficient use of capital, and the current system only promotes efficient use of capital to save the banks and shysters. The stuff going on right now in America would make Hugo Chavez proud.

people need to take a stand against the government, this is how (only way) things will change. things will not change by electing “new” people, the “new” people in office are just as corrupt as the ones voted out. politicians are so out of touch with reality and they all have back door deals to benefit themselves. the american way…me, myself and I.

I would like to know where child protective service is?

There’s a BB player who bought a $1.5 million house in Rocklin Ca. He makes $10 million/yr. He’s a deadbeat too. These people need to be stripped of everything and set free naked.

With 6 or 7 teenaged foster kids, plus the associated food stamps, free school lunches, clothing vouchers, free Christmas gifts, etc., that foster children are entitled to, this family should actually be able to afford the payments on a $750,000 house if they had a decent downpayment, didn’t refinance, and weren’t spending lavishly on any other aspect of their lifestyle. The payments that foster parents receive for an older child, nearly all of whom have been diagnosed as having some special need of some kind, can easily be a couple of thousand PER CHILD, and the payments are TAX FREE.

And Tricia is right — where IS Child Protective Services??? If these people had 9 biological kids and were pulling this stunt, CPS would be there in a heartbeat to scoop up the “abused n’ neglected” children. But once the children are re-classified as foster children, CPS is no longer in such a hurry to disrupt their home life. It will be interesting to see if any of the bio parents of the foster children use the information in this story to try to re-establish contact with their kids.

Yeah, I hate CPS.

that wouldn’t fly here in oklahoma. as the new homeowners most here would have blasted the first person through the door. do you feel lucky mr. locksmith? go ahead, make my day.

DG,

Someone with ties inside banking asserted that some banks are using document problems as a convenient excuse to delay foreclosures

The Bad Old Days:

Pressure at Mortgage Firm Led To Mass Approval of Bad Loans

Monday, May 7, 2007; A01

Maggie Hardiman cringed as she heard the salesmen knocking the sides of desks with a baseball bat as they walked through her office. Bang! Bang!

” ‘You cut my [expletive] deal!’ ” she recalls one man yelling at her. ” ‘You can’t do that.’ ” Bang! The bat whacked the top of her desk. As an appraiser for a company called New Century Financial, Hardiman was supposed to weed out bad mortgage applications. Most of the mortgage applications Hardiman reviewed had problems, she said.

But “you didn’t want to turn away a loan because all hell would break loose,” she recounted in interviews. When she did, her bosses often overruled her and found another appraiser to sign off on it.

—

Shares in the Irvine, Calif., company rose from $5 in early 2001 to $66 at the end of 2004, cementing its status as a Wall Street favorite. Last year it issued $51.6 billion in loans, more than any other specialized subprime mortgage lender.

Great website and critique of this situation.

I see now that the Earl family about to be evicted. Their attorney needs to be disbarred for advising his clients to commit criminal acts.

http://www.vcstar.com/news/2010/oct/15/court-orders-simi-family-to-vacate-foreclosed/#comments

Here’s a better link to my previous message:

http://www.vcstar.com/news/2010/oct/15/court-orders-simi-family-to-vacate-foreclosed

Doc, A neighboorhood in Camarillo where I want to buy has lowered its price of the house I want to buy by $75,000 in the last three months. It was a 1416 sq ft single story house which was originally offered at $450,000, someone offered $350,000 and was declined. I didn’t bother because I wanted to offer less. Shortly thereafter, lowered price to $398,999. BofA wanted close to the $400K asking. And within one month of the offer, all this foreclosure news and now offering $375,999. I wonder if BofA is now rethinking it should have taken the the $350,000 offer. A 50% decline for that house in that neighboorhood would be around $300K. I think it will end lower around $275K when housing comes to a bottom. Overcorrection will occur.

Leave a Reply