Is student debt hindering young people from buying homes or is it low incomes? Both mortgage and rental payments consuming a larger portion of income.

Young people are having a very difficult go at enjoying the spoils of the recent housing market. In places like California, 2.3 million adults are living at home with their parents, many unable to scrounge up enough for a rental let alone the ability to go out on their own to purchase a property. I’ve seen the argument chastising student debt as the main reason why young people are unable to purchase a property. That is likely to be one part of a larger symptom. The bigger issue is you have a younger population that is less affluent. It was already difficult enough for young buyers to purchase a home prior to the investor led boom of 2013. You would think that a housing boom would coincide with a steady growth in household formation but it has not. Sales volume is still relatively low given the increase in prices. What you have is a market being driven up by a sheer belief that prices are going to go up even higher (i.e., flippers, investors, etc). Yet we now see inventory starting to increase because of ludicrous prices being asked in certain areas. Some big name investors are now openly talking about housing being a poor investment at these prices. Frankly, current prices in many cities across the country are simply too much for the incomes of young Americans. Is student debt the main reason why young people are opting not to buy or is there something bigger going on?

Mortgage debt and wages – leveraging up

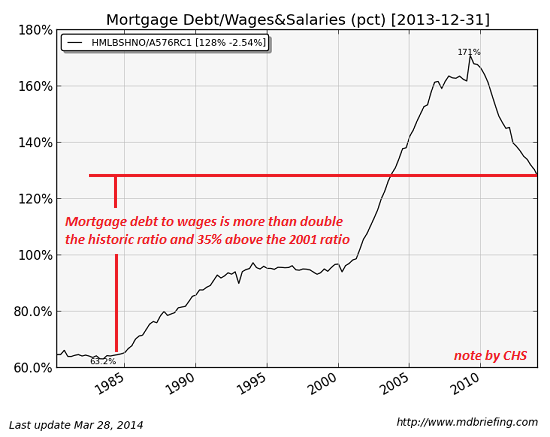

First, it is important to note that people are leveraging to the hilt to purchase in the market today. Of those venturing out, many are taking on massive commitments in an economy that is changing at a radically fast pace. For those looking to buy, mortgage debt is the name of the game and we see households fully leveraged.

The below chart is interesting because it looks at total mortgage debt versus total wages paid out in the United States:

Basically we have more mortgage debt outstanding than we have in annual wages and salaries. The above chart highlights a society fully addicted to debt. This is why in places like SoCal you have ARM usage skyrocketing because incomes are lagging and house horny buyers trying to squeeze into any home are leveraging every penny they have.

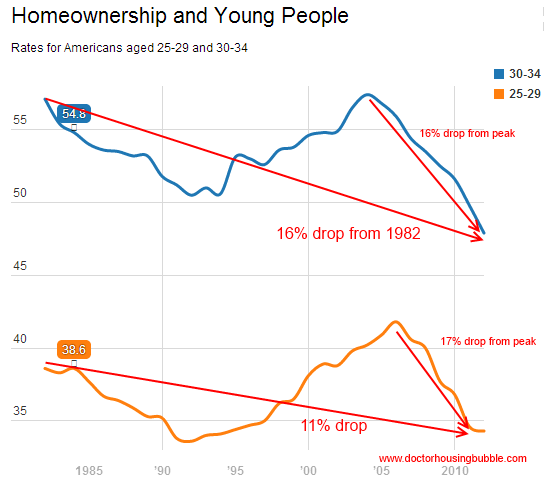

In spite of the recent increase in prices, the homeownership rate of young Americans has followed a very clear trajectory:

The only reason we saw the rate increase and peak out in 2005 was because of all the nonsense loans and no income idiocy that was permeating the market at the time. This was the pinnacle of the flip this house TV days where people were buying in ghettos and basically slapping on some paint then selling the place to some poor sucker taking on a ticking time bomb of a loan. The music ended and you can see what that did to the homeownership rate above.

Now that incomes are being checked, unfortunately young buyers are not coming back not because of lack of desire. No, these house horny buyers would take on a $1 million loan on a $50,000 income if you gave them the chance. What is happening is that incomes for young Americans are simply weak. I’ve noticed in many parts of SoCal people crowding in with roommates and noticing more cars at certain homes in many cities ranging from prime areas to lower income areas. Of course, in many cases, these are not roommates but adults moving back home with mom and dad.

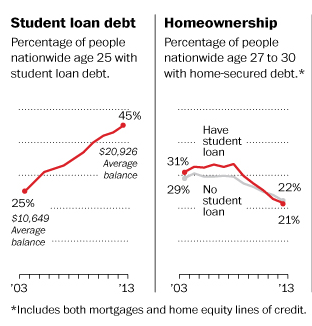

Student debt doesn’t seem to be the main culprit

Some are linking student debt to the reason why homeownership is falling for the young:

I highly doubt this is the main issue here. You’ll notice that the homeownership rate for younger buyers has been falling steadily since 2005, during the peak of the “make up your income†days. Sure, student debt balances are moving higher and we do have a crazy amount of student debt in the market. But thanks to the way you can pay debts back, most can go on “income based†repayment plans and cut their payments down to a very low level. Heck, in SoCal young people have no problem taking on a juicy car payment so student debt is not the primary reason why these young buyers are unable to purchase a crap shack for $600,000 that has mega deferred maintenance. Income is the main reason. In many areas investors have pulled back aggressively because with rents, you actually have to pay with monthly net income from local families (no way to leverage to hell and back your rental payment).

Debt is the name of the game. For the young however, they are unable to access debt to levels of large investors and have very little ability to compete with big money buyers from abroad. Many would like to buy where their parents bought but they have beer budgets with champagne tastes. I’ve had a few e-mails from young professionals with healthy incomes buying in areas like Pasadena mentioning the “lower manners†of their older neighbors (those that bought ages ago). Apparently they don’t like seeing them coming home from Wal-Mart in their beater car or the fact that they have a limited college education. It also angers them that they are paying 5 to 10 times more in property taxes thanks to Prop 13. I’m sure this is merely the growing pains of gentrifying a market out.

Low sales volume

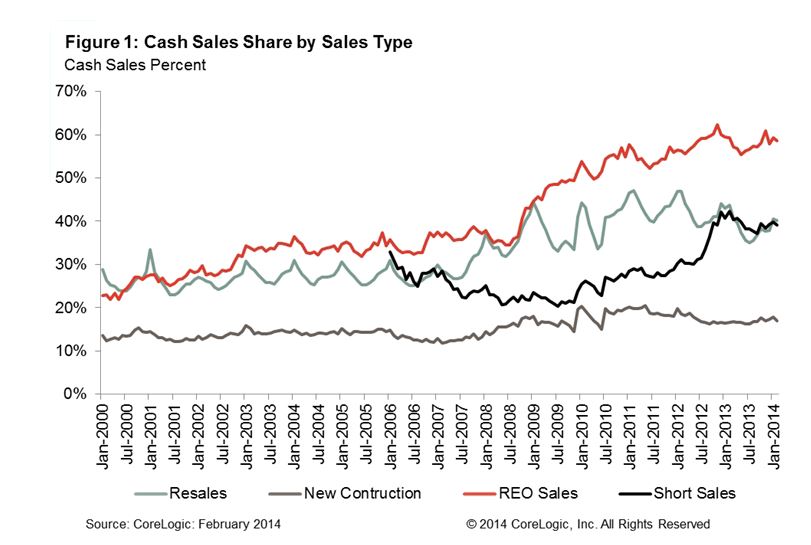

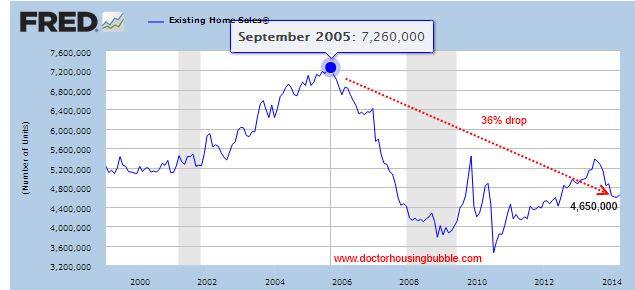

If the house horny mania was truly organic, you would expect to see sales volume zooming up:

No coincidence that the peak in home sales also hit in 2005. Of course many have lost these properties in the 7,000,000+ foreclosures that have hit since 2005. A large portion of these properties were slowly transferred over to the new owners, the investors:

Cash sales picked up steam in 2007 and have yet to let up. Since investors are now slowly edging back, you are seeing inventories rise and the interesting increase of ARM usage at a time when mortgage rates are near all-time lows. Many young buyers don’t have two pennies to rub together after all daily expenses are paid out.

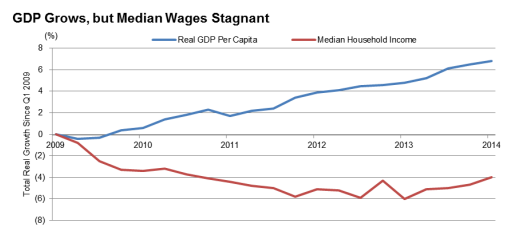

Readers disagree on many items but one thing that can’t be disagreed upon is the shrinking middle class. Take a look at this chart:

Source:Â Fitch Ratings

GDP is going up overall but household income has weakened. In certain markets, hot money is flowing in so those looking to buy will need to go into massive debt if they would like to play the game today. The housing market is now as volatile as the stock market. Keep in mind we have yet to see even a minor pullback in the stock market since 2009 so a lot of ancillary hot money from the markets is flowing from there to real estate. There are bigger forces at work here but having a large, underemployed, massively indebted, and young frustrated population is probably not good for the country in the long-term.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

147 Responses to “Is student debt hindering young people from buying homes or is it low incomes? Both mortgage and rental payments consuming a larger portion of income.”

“As the housing recovery now moves in fits and still-weak starts, the super-pricey segment is sizzling. Sales of the most expensive 1 percent of homes in the U.S. are up 21 percent this year, according to a report from Redfin, a Seattle-based real estate brokerage. Sales in the remaining 99 percent are down 7.6 percent.

“There are haves and have nots, and the haves are the ones out buying,” Redfin CEO Glenn Kelman said…”

http://www.cnbc.com/id/101707665

Makes sense since 2% of the Earth ‘ s population totals 140 million they no Longer have any use for the remaining 98%. watch any TV commercials lately? They all have fabulous lives fabulous homes fabulous cars clothes food, the family sits down and eat meals together, and the food is all healthy and delicious in beautiful kitchens with perfect immaculate stainless steel appliances etc who are they marketing to? Certainly isn’t the bottom 98%! Because we don’t live like that. In a fantasy world without mark to market, they don’t need us. They can Live quite well off the Money stolen off the backs of the rest of us, derivatized decades into the future but the cash has already been taken up front whether it ever is paid back or not, so wtf do they care?

Exactly. In the retail world, it is accepted that there are only two markets now: luxury or discount mass retailers like $1 stores. Yet even the discount stores are under stress–just look at the collapse of big box stores like Wal-Mart, etc. If you were a retailer which market would you choose?

What people seem to miss is that there is nothing that says there has to be goods and services on the market for your price point. There doesn’t have to be clothing stores for the middle class, for example. They could all go away. There don’t have to be single family residences for the middle class, either. The future may look radically different than we expect. That holds for the housing bulls and well as us bears.

I am in the mortgage industry and I’ve worked with people that had student debt…and had the student refinanced the debt into one payment and had the monthly payment in deferment while applying for a mortgage and even though the student doesn’t have job history, the amount of time going to college is considered…job history which includes the new job in their line of work they went to school for. I bought a house, I had 12k in student loan debt…refinanced my home and paid off the debt with my equity in my mortgage. The idea…sometimes is to buy a house that you can move up in value….and create equity. It might not be your dream home however; it get you used to making a mortgage payment you can afford. I recommend any student that wants to start out…buy a small condominium…or a small house..it might not be your choice area…however; use it as equity to payoff debt and buy another house.

“I recommend any student that wants to start out…buy a small condominium…or a small house..it might not be your choice area…however; use it as equity to payoff debt and buy another house.”

Now where did I hear this before???

I know just the place.

http://www.redfin.com/CA/Los-Angeles/4431-Don-Ricardo-Dr-90008/unit-18/home/6878708

You’d be providing this last spec..oops, buyer their equity and then you can turn around and sell it to someone else for your equity after getting used to a few payments. What’s great is that your equity will outpace inflation because they’re not making any more land so you gotta buy now or be priced out forever…. you know, get in on a free ride.

Hahahaha. Yes, I remember when I was told that and foolishly listened. I was 24, gainfully employed, bought a condo, and 7 years later, it is worth 100k less than purchase price. I would never advise someone to purchase a home on the basis that they will build equity. NEVER. Hahahaha.

I totally agree: buying a condo in an area I didn’t really like at 27 prepared me for ultimately buying a house in a great neighborhood 22 years later. See, the condo dropped in value so much that I lost my shirt, had it foreclosed, and then rented an apartment for many years, and by the age of 49, after nursing my wounds and saving a lot of money (while constantly hearing that I was “throwing my money away” on rent), I had the means to take advantage of a brief period of affordability a few years ago.

So, buying that crappy condo in 1989 burned me badly enough to make some very good decisions in the 2000s. I’d rather have spent $100 on a few personal finance books instead of the $85K I lost in that stupid condo, but I don’t always make the best choices.

Sometimes my attempts at irony are misconstrued: what I’m saying is that one should question the sanity of committing multiple years’ worth of salary for something they’d have to admit they don’t actually want, The bright spot about burning a finger while touching the hot stove is that you subsequently know not to jump into a blast furnace, though you could also heed the advice of people saying, “hey, don’t jump into that blast furnace.”

This post is a joke, right?

Look for year-over-year real estate price comparisons to fall sharply over the next several months. Last May, June and July is when the market took off — this May, June and July will not look great. Investors already know this, that’s why they’re cutting back their purchases. Young buyers can’t afford homes at these prices. Get ready to hit the panic button.

Investors are not in the game and that is just fine, sellers don’t want to make investors money they want a normal buyer and a fair offer. Sellers are not in the mood of giving anything away, they are in a postion to wait it out and they are.

So a normal 3% to 6% reduction is okay with most , more the that forgrt it, sellers are in a peddle your offers to a desperate seller, which there are slowly being less and less of.

Okay, I am convinced that there are two different robbies. We really need for you two to come to some kind of agreement where each of you two will use a different handle because it is becoming too difficult to tell you two apart (that’s a lot of to’s/two’s/too’s, I hope I got them right or is it write or is it rite or is it wright?)…

BTW how will TPTB know who to credit for the great insight?

I will reply to myself I’m the original, I have no control over imposters, I have my doctrine of investing or buying anything, the time is right when the time is right for you and your fianical position.

If I have to take the pulse of or burden of all the talking heads on making buying decisions then I wouldn’t be where I’m today, financial independents.

“the time is right when the time is right for you and your fianical position.”

Statements like that are meaningless to someone looking for clues and answers. We’ve had this discussion before in the comments forum here. Of course “the time is right when the time is right” and it doesn’t tell anyone anything that they don’t already know.

Sorry but I’m compelled to call out these types of responses for the cop-outs that they are.

You mean financial independence?

Lynn – actually he means “independents” because you can’t write off “independence”…

“they are in a postion to wait it out”

Until they aren’t. That’s the rub, Bub.

I don’t understand about the median wage being down under Obama. The media says how great the economy is under Obama. I thought that everybody was happy with Obama like my friends at the café in Brentwood. This comes as a complete surprise to me.

No one is happy with Obama, thank god all the Bush boys are out of the presidential seats for now…you are stupid to think anything would be better with any candidate from either party.

Housing TO Tanik Hard in 2014!!!!@

Sorry Jim, it will go up in 2014 by at least double digits. I seeeee 30% rise 2014!!!

What? Why are you always on another planet with your responses? No, housing will not go up 30% 2014…the only thing you ” see” is a need to try to garner attention for yourself.

That is my prediction and I stand behind it.

Homeownership to Tank Hard!!@!

Wrong, not enough evidence to justify

Which one of the three are wrong?

RE Agents to gin & tonic hard in 2015!!!

Cue responses that wealthy foreigners with buckets of money will save home prices in prime areas in 3..2..1

So buy now or be priced out forever because there’s an endless supply of those people who will always be buying and selling to each other at ever higher prices. Always.

And don’t forget that everyone wants to live here, this time it’s different, this place is different, they aren’t making any more land, and it’s a great time to buy… Because none of these things were applicable in previous downturns, but they apply now.

Welcome to the dark side my friend! Now that wasn’t so bad. Yes you will feel unclean at first but I find that I can distract myself by repeatedly washing my hands until they bleed…

It makes perfect sense. Send the jobs abroad. Pay them less. And eventually they will come here and buy the houses for more.

@Tired of the BS,

Local incomes do not matter. Median household incomes of $70K (plus or minus $2k) per year do not matter in places like Burbank/Glendale/Pasadena/Culver City/Torrance. This time is different. Prices will continue to go up 30% a year, every year forever!!!!!! Economics do not matter. Jobs do not matter. Incomes do not matter. Those who did not buy will soon be living in tent cities and cardboard boxes. This time is different.

Exactly!!!

Median household incomes of $70K (plus or minus $2k) per year do not matter in places like Burbank/Glendale/Pasadena/Culver City/Torrance.

# # #

That is correct, sir. The median hh income in Torrance is probably around $70k and yet 3/1 900 sq ft NE Torrance crap shacks are selling for $450k. Even after a 20% down payment, this $70k buyer would not qualify for an FHA or conventional loan with that LTV. Yet, this is the market. So, local median hh incomes DO NOT matter for Torrance.

Rich foreigners coming to L.A. is not a myth — it is fact. And it’s not just rich Chinese. The rich include Persian Jews (see Tarzana and Beverly Hills), Israelis, Russians, Brits, Germans, Italians, Spaniards, Greeks, South Africans, Saudis, Indians, Aussies, etc.

And no, this time is NOT different. That’s why I doubt L.A. housing will tank. It might dip for a while, but not tank.

It’s long been true that rich folk from socialist and/or corrupt foreign countries come to hide their wealth in the U.S. Even John Lennon came to the U.S. to escape Britain’s high taxes.

Things may be bad for America’s middle class, but if you have money, this is the place to be. Rule of law (mostly) to preserve your assets, lower taxes than in most countries, the best health care money can buy (if you can afford it), easy immigration.

Foreign money will pump up the prime areas in L.A. (And in Manhattan, London, Vancouver, and a few other Western, mostly Anglo, cities.)

You forgot rich Canadians!!! I worked for a Canadian company and nothing pisses them off more than to be forgotten…

“Rich foreigners coming to L.A. is not a myth — it is fact.”

But is that in dispute? I feel that most of us would agree that’s been happening for nearly as long as L.A. has existed.

This “it’s not a myth” seems to be a bit of a strawman. It’s well known that for decades, every large American city has had its share of playing host and home to wealthy foreigners.

“And no, this time is NOT different. That’s why I doubt L.A. housing will tank. It might dip for a while, but not tank.”

I think you are suggesting that this time is different. As I pointed out that the foreign buyer phenomenon is not new (perhaps the scope has varied) and since fundamental inputs applied in the past, one of those would no longer be applicable for there to be a meaningful conclusion. That would be different.

There also seems to be a matter of semantics. One man’s tank is another man’s dip. Ask ten different people what it means and you get ten different ideas. The primary point I believe Doc has been stressing over years of postings is that you can’t count on SoCal RE to always go up – that’s the takeaway I think most of us are working with.

“Foreign money will pump up the prime areas in L.A. (And in Manhattan, London, Vancouver, and a few other Western, mostly Anglo, cities.)”

What’s the message supposed to be for someone looking to buy a home to live in? I go through the possibilities time after time and always deduce down to buy now or be priced out forever because “foreign money will pump up the prime areas in L.A.”

This “foreigners with buckets of money” meme only tells us something we already know. It’s like knowing a symptom without understanding the disease. It seems that important details are being glossed over which might inform us as to the current scope of the issue and potential scenarios as to how things play out down the road.

I don’t expect anyone to have the answers – I certainly don’t have them – but how helpful is it to the debate to simply state something obvious and general while inferring that it’s a big mystery?

Tired, the “disease” is the never-before-seen combination of:

* rise in global capitalism, much of it coming from the 3rd world, creating a flood of “risk on” 1 percenters looking for safety for their largesses

* low interest rates caused by post-financial shock of 2008 and chronic disinflation, thus creating massive asset chasing

These global trends coupled with the commensurate 30 year decline of the American middle-class has created a surge in demand for previously “middle class” areas of SoCal that is now being filled by all sorts of people with either wealth (House horny U.S. 10 percenters, foreigners, cash businesspeople, investors, etc.) or lifestyle flexibility (adult children living at home, house hotels, cat-food eating prop 13’ers, etc.).

I have a 25 year old niece that has a bachelor’s degree in English from UCLA and she graduated with a master’s degree in education from Azusa Pacific about a year ago. She hasn’t been able to find a full time job. She’s still living at home with her parents in Rolling Hills Estates and she has been working part-time as an park aid at the Palos Verdes Parks and Recreation Department. She doesn’t have any student loans because her Dad was able to pay the tuition bills. Unless she finds a very well paying job or unless she marries well, she’ll probably never be able to buy a home in in an area on the Westside that she would want to live in. She’ll probably end up inheriting her parent’s house (which is paid for).

How many foreign countries has she visited so far? Does she describe herself as ‘well travelled’? Or a ‘foodie’?

A true “foodie” IS “well traveled”!!!

When a 25 year old has that education and can’t get a decent jod that is crazy.

Folks that belies the problem, corporate America can’t see a value in a young educated person , what a road to disaster for this nation?

“corporate America can’t see a value in a young educated person”

Proof that robbie has no idea how corporate america works…

I will give you points on grammar though! Or was it the other robbie that has bad grammar? I sometimes can’t tell you apart…

Her father was dumb to pay for a useless major. It amazes me how stupid working class parents are, but then again, they are working class, and we certainly do need them to do the work. At the café in Brentwood, the waiters are college grads too.

the working class built this country! There’s a difference from being dumb and being lied to. The working class people have been lied to big time so your comment is dumb.

Rolling Hills Estates = Working Class

Huh?

R.H.E. and working class parted company a long time ago.

The niece and the brother would have been better served sending her to USC to major in “Alumni Husbandry”, the coeds there have a much better track record in that field of study.

Lynn,

What does the fact that “the working class built this country” have to do with one person’s poor choice of a university degree? Want to make good money – go get a STEM degree… I have no sympathy for anybody that gets a liberal arts degree and racks up 25k, 50k, 100k in debt in doing so. That was never a good stategy to “get ahead” in the U.S. of A.

-Jeff

Depends what your major is. I have a friend who’s son is at Cal Poly – major is Economics, his last year 14-15. He already has job offers lined up from HP, Anthem Blue Cross and some other good companies. He interned with HP last year and they offered him a part time job, fully remote. $35 an hour. Hasn’t even graduated yet.

Ashly, I have that same degree (UCLA English) as that girl, and it’s not as worthless as you suggest. I went to law school and have never had a day of unemployment since I got my JD. And I’ve had lots of different jobs, not one of which that I got fired/laid off from. It was always me getting another cool job. So your generalizing is pretty lame. Hiring is about people, not necessarily where you went, your major, etc. I have a friend whose kid got into medical school recently after majoring in music.

Bay Area Renter, funny, one of my waiters at the Brentwood café also has a law degree from a 2nd tier school. He makes interesting conversation. Apparently the law firms are not hiring much with this alleged economic downturn(first Q1 down 1%, if Q2 down , then economist will say recession). He does make good money from the tips, he tells me.

The law degreed waiter isn’t looking in the right places. I’m sure banks are plenty busy with real estate-related litigation, especially in SoCal.

Your niece would have had a great job by now if she’d gotten a Bachelor’s degree in Spanish instead of English. Half of the LA County population is Latino. Dual language grads are in high demand for all SoCal school districts. That demand will only grow, as will the compensation.

Nope, special ed is the way to go. California has mandated that overwhelming amounts of resources in public education be focused on the least quantifiable of results. In the budgetary world Special Ed is Teflon coated.

This is not a slight on the less fortunate, only a critique of how .gov is the worst way imaginable for doing anything of value. Everyone deserves an education, having the .gov do it for you is not in every-ones best interest.

DUH. An English degree? And then wasted $$$ on a master’s in education before she even got a job teaching? Would you expect any less?

She’s going to remain broke until the rich ‘rents kick her down. Fortunately for her, she has them to fall back on.

this is very common, and has been for several years now. I know people with juris doctorates working at McDonalds. Why do you think they’re asking for a raise? Cuz those are the jobs that we have now and people need to raise a family and pay for everything with those jobs. My job, I make double minimum wage and it costs 1 weeks worth of work just to pay for my gas insurance and maintenance on my car every month. 1 week just to cover my transportation costs to get to the job I have no children and barely make it. How could someone feed their family much less buy a house on these wages? Btw- i previously had my own business, sold it, and had everything i worked for since i started working at age 12, stolen in the last housing collapse. you do realize that through the mark to fantasy Wall Street Casino accounting, the equity was stolen from the brokerage banks the day all these borrowers closed escrow right? Everyone does understand how this was done already right? If not you have some research to do.This all comes down to monetary policies. All of it. Housing, gold prices, student loans, virtually any equity commodity or what have you, is all manipulated by the powers that be. Until we correct the underlying monetary policies we will continue into our feudal society that is being built around us. The 99% are irrelevant when you have mark to fantasy.

Lynn: “i previously had my own business, sold it, and had everything i worked for since i started working at age 12, stolen in the last housing collapse. <<

That's because you were a house flipper.

We've heard your tale of woe before. You'd said that you had "several" houses in the Las Vegas area, which you lost when the bubble burst.

Your own statements indicate that your were house flipping.

Like lots of middle class folk, you imagined that you were the next Donald Trump. You played with the big boys at the housing casino. You gambled your nest egg and lost.

I have no sympathy for house flippers. They're part of the problem.

Yes. I recall your ‘busines’s to Lynn. You wanted to sell properties on at a higher price to the Greater Fool. Turns out you were the Greatest Fool, from the story you gave.

Business > money > stolen > Las Vegas = LOL

She is still much better off than most. Zero student debt, nice place to live, and a $1M+ housing lotto ticket that should fund her retirement someday, unless her parents cash it in first.

we want to buy a house here in orange county,but you can not get anything decent for under 700k…..and you are saying prices just will go up….its insane…..better go back to russia

There are lots of affordable homes in Orange County. The problem is these homes are in areas where there are no jobs or these homes are located in areas that no one wants to live in.

Karian…Forget getting a decent home in Orange County or just about anywhere else in CA. for under 750k. The fact is the horse left the ranch long ago in CA real estate, there is no way the markert is going to collaspe to a affordable price for the borderline buyers.

Only a castropihic event can bring housing back to earth in CA and of course the place won’t be inhabitable for many years. My suggestion, if you can move to bordering states and leave, Russsia is not a option for you.

Wow,

Catastrophe. Why are sales down 15% YoY in Orange County? Catastrophe?

Why is inventory up 50% YoY? Catastrophe?

You are right, another recession will never happen.

You are right, after endless money printing the yield on the 10 year treasury will never exceed 3.5%

You are right, there is an endless supply of investors buying houses hoping to fill them with…never mind, CA’s population ain’t growing.

“Wow,

Catastrophe. Why are sales down 15% YoY in Orange County? Catastrophe?

Why is inventory up 50% YoY? Catastrophe?

You are right, another recession will never happen.

You are right, after endless money printing the yield on the 10 year treasury will never exceed 3.5%

You are right, there is an endless supply of investors buying houses hoping to fill them with…never mind, CA’s population ain’t growing.”

Lies!!! All lies I tell ya!!!

Pssst ak… Janet is watching… ixnay on the antray or your ankbay will onfiscatecay your oneymay… 😉

Yes! We are in “recovery” and we thank our great leader for it!!!

no one know what will happen…..but what we know that greed was always a problem for humans

Doctor, Doctor, Doctor, I sense a hatred of adjustable rate mortgages. We need to go back to your childhood and dig deep into your subconscious to root out the cause of this deep seeded hate…

It really is pathetic that TPTB did nothing to offer some advantage to those seeking house formation (first time buyers). I know in some countries in Europe for example flipping homes is illegal or a first time home buyer takes priority over a get rich quick transaction. It may sound like ‘socialism’ (which we as Americans know so little about) but after spending several months in some of these countries with free educations, free health care, strong protections for workers, 4-6 weeks paid vacation, high minimum wages and where flipping homes is illegal – they have quite a nice life. Of course places where socialiazed democracy works there are not as many billionaires or millionaires but also no homeless, little poverty, little crime and no one going bankrupt due to student loans or medical bills or overleveraged mortgage. Geez Louise many Europeans have a quality of life unlike America today.

Those are some pretty serious rose colored glasses if you think Nirvana can be found in neo-socialist Europe. What’s wrong with house flippers? You could have bought instead of them. They bought (at a price the market could bear and supported) because they saw a value, and profit, that could be driven by improving the property and remarketing it to those with less imagination and time than money. This is good business. If you don’t like it don’t buy it – before or after.

Ther have been lots of incentives offered over the years to tempt buyers from lower down payments, certainty of lower taxes with Prop 13 caps, ARMs, interest deductions and more. We don’t need more incentives. We need more higher paying career jobs to offer the Millenials.

We have shipped the manufacturing overseas with our tax code, we have eliminated housing and commercial construction jobs for most youth by bringing in Hispanics to do those jobs (hey we can pay them less and they don’t dare complain.) Now the tech industry jobs left here in this country (mostly software coders) are being replaced by imported Indian and Asian immigrants.

What exactly do you think these newly minted graduates are supposed to do? There are a few teaching jobs, sales and the retail positions they can fight over.

If you think government can “help”us more, take a look at an income demographics map of the Chicago area. In the last 20 years the Middle Class has disappeared. There is the poor and there are the rich enclaves. How much more help do you think they want from Washington DC?

I think California is headed that way too. We have chronicled that well for the last many years.

Fensterlips wrote:

> What’s wrong with house flippers? You could have bought instead of them. They bought (at a price the market could bear and supported) because they saw a value, and profit, that could be driven by improving the property and remarketing it to those with less imagination and time than money. This is good business. If you don’t like it don’t buy it – before or after.

….

If that were all there was to it and we competed on a level playing field I’d have no problem with flippers. Unfortunately almost all of those “great deals” that everyone supposedly had access to were restricted to buyers with some kind of inside connection. Regular “retail” home buyers like most of us of us on this blog only saw those “deals” after all the value was sucked out of them by flippers with an inside track. No wonder we feel a trifle annoyed with flippers in general.

“They bought (at a price the market could bear and supported) because they saw a value, and profit, that could be driven by improving the property and remarketing it to those with less imagination and time than money.”

They purchased (at a price the taxpayer-backed leverage creation machine supported) because they saw an arbitrage play, that could be driven by putting lipstick on a pig and remarketing it to the financially imprudent.

There, fixed it for ya.

American philosophy: live to work.

European philosophy: work to live.

Very different ways of viewing work/life relationships. Extreme consumerism in America has brought us to this point. Everything is about the rat race and keeping up with the Jones’.

In America we flip homes because we can…don’t begrudge others making a living. You choose a 9-5, I choose otherwise. I take the risk, what’s wrong with that? I think flippers improve a neighborhood unlike foreclosures. No one has to buy a flip home…they choose to. Not everyone has the vision or the patience for remodeling. It is a service that others will pay for… thank you very much for the multiple offers!

“In America we flip homes because we can…”

I thought we flipped housed in Merika to get on the TEEVEE. I heard that’s where the real money is…

“In America we flip homes because we can…don’t begrudge others making a living.”

Loan sharks are just “making a living” as well, and their actions are judged accordingly.

“You choose a 9-5, I choose otherwise. I take the risk, what’s wrong with that?”

If someone’s 9-5 involved swindling folks out of their money, there are going to be negative judgments. Also, no one is claiming there’s anything wrong with risk taking so that’s not even on the table.

“I think flippers improve a neighborhood unlike foreclosures.”

And credit card companies will advertise that they are improving people’s lives.

“No one has to buy a flip home…they choose to.”

This is a non-sequitur. The issue is that flippers are the dealers of the imprudent purchaser’s crack. That flippers contribute activity which impacts the price level for non-participants is the problem – flipping doesn’t exist in a vacuum. They are a financialization-enabled scourge on the marketplace.

“Not everyone has the vision or the patience for remodeling. It is a service that others will pay for… thank you very much for the multiple offers!”

What’s to stop a purchaser from contracting out the work on their own immediately after the sale? Ah, that’s right, it’s the ability to roll-in the costs into mortgage leverage. The finance and flipping industry are cartel buddies in this scheme just like the grower and the dealer.

Multiple offers, that’s about as impressive as how this flip finally went pending after 200 days sitting on the market with over a dozen price drops. http://www.redfin.com/CA/Los-Angeles/2125-Vallejo-St-90031/home/6945511

Christie: “In America we flip homes because we can…don’t begrudge others making a living. You choose a 9-5, I choose otherwise. I take the risk, what’s wrong with that?”

Tell that to Lynn Chase. She flipped houses in Las Vegas and got burned. She’s been blaming Wall Street, the bankers, and the feds ever since.

Successful speculators brag about being risk-takers. Unsuccessful speculators cry for government bail-outs. Which, if they’re rich and powerful, they get.

Yes, you like your life of leisure Christine. Keep flipping.

Yeah. I know a bunch of former Swedish and Finnish exchange students from my high school days. Nearly every one of them has started his or her own business. So have most of their siblings. They don’t have to sweat health care and education costs, so it frees them up to be more entrepreneurial. Most Americans prefer to be debt serfs who believe they are free. So, they fight any form of social insurance. It’s a product of the dominant Scots-Irish and Calvinist Protestant cultural legacy of the U.S.

Growing student debt is almost certain to have some effect on home sales. Is there much overlap between average ages when student debt is paid down, and the average age of FTBs? You’d expect at least home buying to be delayed a few years. Tighter credit and high prices probably have more to do with it.

“Growing student debt is almost certain to have some effect on home sales.”

I don’t see the connection. How does student debt affect the banks and fund managers ability to sell SFR among themselves?

What? To keep housing going like past historical trends you need new homebuyers to enter the market along with regular buyers. First time home buyers are not entering the market like past years and this will no doubt have an impact on housing moving forward. It is just a piece of the puzzle, it shows that new buyers are not coming into the fold like the past. First time home buyers do not have the jobs/income to buy homes and they have student loan debt. This is impacting new housing formation.

“To keep housing going like past historical trends you need new homebuyers to enter the market along with regular buyers.”

“new homebuyers to enter the market” = Chinese

“regular buyers” = banks and fund managers

I think we can stretch another 20 or 30 years with this equation…

Switzerland has no minimum wage.

Their unemployment rate is 3.9 percent.

Not entirely true:

http://www.therichest.com/business/the-top-10-countries-with-the-highest-minimum-wages/

Their tax rates tend to be higher too.

I saw and entire documentary about how Switzerland subsidizes small, organic dairy farms just to maintain Alpine quaintness for tourism.

When searching to buy a home in SoCal around 2010 I saw a lot of homes where 7+ people were living in 3-4 bed rooms. A couple homes I was surprised people were loving in a converted garage. Hell, if you pitched a tent in the backyard I’m pretty sure you could charge rent there too!

San Francisco is another good example. Housing is so unaffordable people are living with way more roommates than is comfortable just to get by.

Something has to give. This economy and housing market is laughable

Howard Johnson ( love their pancakes back when) any how, you mention how people are living together because of the housing crisis and economy. I was told in a past post to look for clues. I can tell you people living together in one house has been going on since 1776. NYC had so many people living in one room starving artist , actors you name it, and all those folks said the same thing I can’t afford anything. It is 2014 same cry except now we have 315 million people so it looks on the surface worst.

BTW… Our restaurants where we live can’t get a reservation on the weekend, went to a auto dealer with my nephew Sat. couldn’t get a sales consultant to busy, I guess to me it means things aren’t so bad as one projects.

Of course if I go over to the University I will see lots of young people in a one house?

“I was told in a past post to look for clues.”

No one told you that. You don’t do hyperbole very well.

the house next door is a good example. The owner is an architect who is several hundred thousand under water. What started as a family of four has no less than 8 people live there right now. One living in an un-permitted dwelling in the yard. Four new cars on the street in front of the house every night. Welcome to the new normal.

The 4 bedroom house next door to us in Sacramento is an example. It was owned by a nice family who lost it to foreclosure. It was bought by an investor from the SF Bay area who turned it into a rental. He rented it to a Hispanic family who only speak Spanish. Now there are at least four other Hispanic families living there also. They park their numerous vehicles on the front lawn and along the street. The house now has an overgrown yard full of weeds and looks like a ghetto house that you’d see in South Central LA.

I often read that rents and housing prices are affected most by incomes. Your post is a small example how this isn’t the case. Rents and housing prices are affected most by supply and demand.

If rents are too expensive then you sacrifice space/privacy and start dwelling with family or roommates. Multi-generational living will become more and more common as housing prices keep going up.

In many many other metropolitan cities where housing is scarce, rents and housing prices have far outpaced incomes. I’m not sure why anybody believes cities in the US should be immune. I guess they believe “it’s different here”

Europeans are strongly signalling that rates will drop further:

http://www.marketwatch.com/story/ecb-comfortable-with-range-of-measures-mersch-2014-05-28

Any guesses as to what the Americans will do (hint: NOT raise them). The Central Banks of the world have painted themselves into a corner and we the citizens are all screwed. This is a global problem. Unless we have a Black Swan type of event (massive war in Ukraine?), low rates are here to stay for a very long time. We are all screwed.

ECB rate was cut from 0.5% to 0.25% a few months ago as I recall it. I don’t think they’ll get away with QE, or not at least sort of QE US and UK has seen. They keep denying it, but it’s deflation in my view, in Europe (and in the West). Hey just because base rate is low, don’t confuse it with borrowing rates, higher criteria to qualify for debt, and lackluster demand for debt.

Another hint:

http://money.cnn.com/2014/05/29/investing/gdp-economy/index.html

Great to see this excuse finally being trotted out by Larry Summers , the Wall Street Journal and the MSM as if it is a distinct issue holding back the real estate market.

My first blog post ever last year was called “Student Loans and Unemployment are Holding Back the Economy and Real Estate”

QE has solidified economic losers, by driving up home prices without any underlying improvement in the economy and shut out an entire generation from economic opportunity and home ownership.

Good News everyone!!! Out long national nightmare is over!!!!

Steven Pitchersky, of Rancho Mirage, Calif., was sentenced to 51 months in federal prison for a scheme to defraud TARP recipient GMAC Inc. (since rebranded as Ally Financial Inc.) that resulted in losses to the company of approximately $5.3 million, announced the Special Inspector General for the Troubled Asset Relief Program.

Read the news release here. http://www.sigtarp.gov/Press%20Releases/Pitchersky_Sentencing_Press_Release.pdf

After all these years your government has managed to find someone to pin the whole thing on.

And you folks were worried that our .gov was a bitter disappointment.

That is great news! Now we can finally move forward and enjoy our economic “recovery”!!!

What? There has been a recovery if you have not noticed. It does not mean that we won’t be back in the hospital at some point on life support, but for now we are in “recovery”.

Christie, You are making my point!!!

Christie thinks that artificial manipulation by the Fed and FedGov (suspension of mark to market accounting rules, free money to banks, TARP, cash for clunkers, QE, ZIRP, et al.) translates into a “recovery.” No, all it did was save the bankers’ bacon and we are feeling what “trickle down” feels like. As soon as the spigot is turned off (i.e., when they realize that tens of trillions of dollars of debt isn’t manageable), we will finally hit rock bottom and THEN we can start to recover. But of course you apparently don’t understand this. It’s too obvious and too simplistic, I know. Hidden in plain sight by the 1 percenters.

What? is my new Internet crush.

Believe what you want AK, go ahead dream of a collapse so you can buy cheap, sir I been studying trends and the capitalist system all my long years, there is always sales down. sales up.

If you live by that rule of buying and selling you need to live in a stale socialist society where everything is a flat line?

BS what clues and answers? I been posting forever, when you are ready to buy then find the property you want check public records on the history of the property and the seller. That you gives you a “CLUE” if this property is worth the asking price, the answer is to ask yourself does this purchase make sense for me now and in the future.

Why in the heck make it so darn hard, what you want is to get a clue when it all comes to a crashing halt so you can buy a property and to that I say, it isn’t going to happen, it happen in 2008 and that was your chance to buy?

I bought and sold my investments in 2012-2013, want another hint, when the administration is thrown out you can bet your bottom dollar business is going to rebound huge and that overpriced house today will be a bargain in late 2015- 2016!

Remember this is the guy who pleaded with folks on a money blog to buy stocks at 7500 and was told it is going down to 300, everybody was after me, the shill stockbroker, today it is over 16,500.

“…business is going to rebound huge…”

Dow and S&P 500 at all time highs. US Real estate near all time highs in many areas and continues to rise. Official government statistics show unemployment tumbling. Durable goods up. Consumer sentiment up. Inflation down. Sounds like we are already “rebounding huge”…

What?

S&P is down 1/4 percent today…buying opportunity of a life-time!

GDP will be NEGATIVE. Two quarters of that means RECESSION.

“GDP will be NEGATIVE. Two quarters of that means RECESSION.”

I have a perfectly rational, logical and sensible response to this…

wait for it….

IT WAS THE WEATHER’S FAULT!!!!

(Fine Print)

Read fine print at your own risk. Reading fine print can cause blindness and or loss of denial bliss. Please ignore the fact that imports were up in Q1 (weather apparently has no negative impact on imported goods). This message has been brought to you by the National Association of Shills (NAS)

My name is What? and I support this message, Thank you…

Comments made on the Doctor Housing Bubble site are strictly the opinions of the commentator and do not represent the views or opinions of the Doctor, Blue Host or any rational thinking person.

Clues and answers to trends and patterns. A bigger picture than some given property. It appears this is a bit over your head.

“If you live by that rule of buying and selling you need to live in a stale socialist society where everything is a flat line?”

Hello??? Testing… one… two… three… testing… is this thing on???

fensterlips, when it comes to housing, Europe is more free-market than the U.S. In Europe the government does not guaranty mortgages; there is no mortgage interest tax deduction (in the U.S. someone who can afford a $1.1 million mortgage gets to deduct the interest — ridiculous); no FHA; no first time buyer tax credit; after the 2008 financial meltdown most European countries punished the banks, not the homeowners; etc., etc., etc.

We like to think of ourselves as free market and Europe as neo-socialist. Not true. I’ll take the U.S. over Europe any day. But when it comes to housing, let’s call it what it is: We’re addicted to government support and tax subsidies. Addicted. In the extreme. It’s socialism dressed up as free market. Wake up.

There’s no question the government heavily subsidizes home ownership, but that doesn’t mean it’s “socialism.” Socialism refers to public ownership of the means of production. A public utility may fall within the realm of socialism, as does public transportation.

Government subsidy of private home ownership, OTOH, really is not socialism in any meaningful way, particularly the tax subsidies. Unless you want to make an argument specifically about the role of Fannie/Freddie as a covert means for the government to have all your base belong to them, but you have to work for that case. You can’t just assert that anything the gov’t does that you don’t like is socialism.

Bipartisan – I think we are reinforcing a similar point. Acouple other posters reinforced, or perhaps inadvertantly made my point – A Political Scientist & Tired of the BS.

I don’t want a government that when it finds a few drunk drivers – rounds up all of the cars. We have some bad actors in the flipping department. They have a truck full of paint and sod as well as friends at the bank. They buy cheap properties, throw some paint on them and put down a new lawn. Tada! a $300K profit.

These are borderline thieves and need to go away. Most flippers I’ve met are construction business folks that buy something needing a lot of work. They put their time, skills and money into the venture and then sell hoping to made a few bucks. It’s a risk. The house could have nightmares and the market could go sideways.

My main point is I want less government involvement from top to bottom. We need strict laws to protect people. There are plenty of bad actors from ’08 I would love to see in jail or worse – not rewarded but our government has become crony capitalist. They “help” the banks. They “help” their friend the flipper looking for an edge up. I think they mean well (giving an undeserved benefit of the doubt) but everything they touch ends up in trouble. Their “help” is inflationary, tends to end up with biases towards “friends” and doesn’t have the controls a profit and loss statement would bring.

I would like to see stronger laws but less government (22 million government employees! Really!) and zero crony capitalism. Well, I can dream…..

It seems the graas is greener, in my travels where wages are high and everything is fairly affordable nobody seemed happy in these countrIes. Everyone ask me about America, when I told them were one of my homes were they said we have seen it on the Internet wish we could live there. I always ask why do you want to leave this life, nice they say buy America is still where you dream everyday of owning something and the selling it to better yourselve

Thanks Robert….i know i was kidding about the Russia….left Russia in 1996,you buy me a house there,i am not gonna live there…..whats good state to move,i am salesperson,sell cars,my wife is accountant….have 2 kids.

All depends on you and your wife’s eye and hair color. If you are both blond with blue/green eyes, then I would say Arizona. If you are both brown haired with brown eyes, then Florida. All other combinations should move to Texas. I hope this was helpful! Have a great day and welcome to your new home country.

The great state of De Nile is popular these days, I know a lot of people who have gone there. Some folks think I was a native from there. But I don’t think so.

What everyone should do is convince all of the sane level headed folks that “get it” and populate these blogs, to move in-masse to Wyoming, take over the federal elected offices and raise heck. It would only take 300,000 give or take.

Russia…Good for you, I have employed and done business with many Russians, you guys love a great time.

A friend just called and told me that the commercial building he bought in downtown L.A. for 275K ten years ago, he just turned down an offer of 1.8M. He says he will sell for 3.2M, Ha.

I know the bubble is popping in residential but I’m not sure about commercial. He now lives in the building which is within blocks of several world-class restaurants. When he bought the building it was pure ghetto. Homeless everywhere. A few new restaurants and voila!

Be prepared for an attack on your anecdote being the result of crack-smoking gold-covered Red Chinese riding unicorns on pink clouds.

“…crack-smoking gold-covered Red Chinese riding unicorns on pink clouds.”

Come on DFresh!!! its crack-smoking gold-covered Red Chinese riding unicorns on candy flavored rainbows not pink clouds!!! Rookie move… Come on, you really need to up your game. Remember, we are being watched…

Hooters is world-“famous” not world-“class”. But anyways always sell old DTLA buildings before the next earthquake makes it a tear down.

You missed it: Latinos generally hate Blacks and are driving LA’s gang-bangers east to Atlanta.

This (reverse WWII) migration was first spotted during the 1970 US Census. It has accelerated away ever since.

I’ve been told that Watts is now pretty much a Latino community. When Maxine Waters retires, she will be replaced by a Latino politician. Her seniority has saved her seat for her.

In a similar vein the Sacramento ghetto was emptied over the last fifteen years. Prices took off and Section 8 rentals collapsed. These renters were replaced by illegal immigrant Russians. (Moscovites, to boot)

(Rancho Cordova is known as little Moscow, in some circles.)

Such gentrification or even semi-gentrification causes land values to EXPLODE.

And so an investing gambit is born: buy commercially zoned properties that figure to benefit by the Latino/ Russian/ Chinese displacement of native Black Americans from the general LA scene.

From this point forward, the reverse migration may well pick up steam, as few Black parents would want their kids attending an LA Unified School District campus where Latinos seriously out number (and out gun) the Crips or the Bloods.

Further, Federal benefits to the poor go a lot further in Georgia than in LA.

Once rents start to move, really move, Section 8 no longer has any appeal for landlords. That’s what happened in Sacramento in the early oughts. (03-07)

Something like that has already occurred in San Jose.

Yeah, small arms crossfire is a great rent suppressor.

After the housing market burst in Sacramento, investors bought up foreclosed houses on the cheap. Section 8 has a renewed interest by landlords. Low income families have been fleeing the SF Bay Area for Sacramento to escape soaring housing prices and rents. Sacramento has become one big Section 8 government ghetto. The predominant language in most of Sacramento is no longer English.

You missed it! Buy now or be priced out before prices EXPLODE!

Ok,help me understand this…..some of you are saying that homes,will always go up,and this time is deferen….and i even hear ,30% each year…..(by the way its all over the web right now about housing market that is stalling)…so then home that are selling right now for 750k,in few years will be about 1,3 mil.with average incomes 120k per house hold.

Did i get it right?

“.some of you are saying that homes,will always go up,and this time is deferen….and i even hear ,30% each year”

nobody here is saying that except ‘What?’ and he’s just being sarcastic.

I believe I am really more sardonic than sarcastic. There is a difference you know!!!

What? I guess the difference is in the eye of the beholder?

# # #

According to Longman Dictionary of contemporary English:

Sardonic: showing that you do not have a good opinion of someone or something, and feel that you are better than them

He looked at her with sardonic amusement.

Sarcastic: saying things that are the opposite of what you mean, in order to make an unkind joke or to show that you are annoyed

I’ll stick with sardonic, sarcastic is soo 2013…

“…by the way its all over the web right now about housing market that is stalling…”

Okay comrade, can I call you comrade? Let me explain how it works in a democratic free market capitalist system.

This is just the result of propaganda seeded through the government controlled media/press to ensure that the central planers are still in control. What we have come to understand is that the central planners are testing their levers and strings to make sure everything is working as expected. No need to panic because they will soon move the levers and or strings in such a way that it will make the centrally planned economy get back to work for the greater good… I hope I cleared that up for you!

Do not listen to What? He uses this blog to amuse himself with sarcasm and baseless conclusions. Real estate is stalling. More inventory is coming online. Real estate is not dropping as of yet just plodding along. If you are trying to “buy right” anytime you buy within rent parody is the right time here in So Cal. Rents level out but never drop. Look at zillow at the 10 year chart and if you buy pre 2005/2006 prices I think you will be fine long term. Don’t buy if you are buying at all time new highs. Bubbles usually over correct at first then reset at pre bubble prices. When you buy real estate higher than the last high that is when you are in very risky territory. You have to really know the market and understand what will keep moving prices up like the SF area. Even in San Francisco and Silicon Valley the crash happened there too but took off again very quickly. Lots of demand in those markets because of the high paying jobs.

RENTAL PARROTY! BAWK, BAWK RENTAL PARROTY!

___

/___\

@____

/|\__/

/ |

/ )|

/__/V

” V |

| |

m m

The rental parrot strikes again!

But hey, when parroting rental parity, why not toss a smoke bomb for good measure…

Rents never drop? You missed it entirely. Ask any experienced landlord and they will assure that rents can move in two directions.

It’s always a great idea to take buying advice from a flipper – no conflict of interest there!

“parody” indeed!

Rent “parody.” What a fitting malapropism! Christie, your arguments sound like those “Suzanne researched this!” NAR commercials. People buy houses and rarely hold them “for the long term.” Divorce rates are usually around 50 percent and houses often get sold during such events. People die and get fired, unexpectedly. The average time of ownership is still between 5 and 7 years, including people who hold onto them for their entire lives. And if you chart ups and downs in prices, only if you are lucky do you time it right (i.e., make money). There is no magical “hold onto it for 10 years and you will be good” timeline. Anyone who claims such is full of it.

Christie, what is rent ‘parody’? You mean parity perhaps?

Anecdotal info from a London prime landlord blog the other day, discussing getting money out of tenants: “A London agent told me 98% of London tenants are trash.”

_________

Christie said: “Do not listen to What? He uses this blog to amuse himself with sarcasm and baseless conclusions. Real estate is stalling. More inventory is coming online. Real estate is not dropping as of yet just plodding along. If you are trying to “buy right†anytime you buy within rent parody is the right time here in So Cal. Rents level out but never drop.

Sorry, BAR, I’m afraid you missed it as well. You see, foreigners with buckets of money are buying in masse and they will never sell because their kids need a place to live/residence for college, they need an asset to park their ill gotten gains, and prime SoCal RE never experiences significant price corrections. Yup, they are buying and holding forever. There will never be any events which will tempt them to let go of their grip. This time and each time hereafter really is different, but not different. Really!

After all, Suzanne researched this.

“If you are trying to “buy right†anytime you buy within rent parody is the right time here in So Cal.”

Definition of Parody = “an imitation of the style of a particular writer, artist, or genre with deliberate exaggeration for comic effect.”

I have to tip my hat to someone who is funnier than $h!t when they are trying to show a clown like me up by being “helpful”. God bless you Christie!

@From Russia with love,

Ummm, almost. Home prices will continue to increase at 30% a year, every year, forever!!! And home prices will never ever go down. Never!

Incomes, on the other hand, will decrease 1% to 2% a year, every year, which has been the case since 2007. It’s the new economy.

120k average income is very generous by the way…..i hear its about 78 k for house hold in SC

@From Russia with love,

Median household income in SoCal is $58K per year. Median home price $460K in SoCal. Home prices have been going up while incomes have been going down.

At the current delta in 10 years the median home price should be $6,500,000.00 in SoCal. And median household income should be down to $52K. I hope this makes sense. It’s the new math.

Median household income in SoCal is $58K per year. Median home price $460K in SoCal. Home prices have been going up while incomes have been going down.

At the current delta in 10 years the median home price should be $6,500,000.00 in SoCal. And median household income should be down to $52K. I hope this makes sense. It’s the new math.

LMAO. Brilliant thesis

So much to say. First of all, there are many foreign buyers in this market. The ones buying in California generally pay cash. Our bay area home is in escrow right now. I believe more than 150 people came to look at the home in the first few days. We got six offers and took the highest one where we thought the buyer could perform and close the deal. They put 500k down! These people are actually foreign buyers (I believe on a

H-1B visa). They didn’t bat an eyelash. It hasn’t closed yet but it looks strong at this time. My point is that these folks have helped to drive prices up. They are not solely responsible. The feds keep rates low and buy hoarded of bonds. Unfortunately, this strategy seems to benefit only those with money in the first place. I also believe Prop 13 gets a bad rap. Before it was passed the local and state government raised taxes every time they ran a budget deficit. Many retired people were literally taxed out of their homes. I would say that its insane to allow the government to raise taxes evenly across the board every time they need more money. The State of California has shown, time and again, an inability to live within their budget. This, in a state with the highest income taxes in the country! Don’t let the politics of jealousy cloud judgement. I will have to pay 1 1/4% on any new home we purchase in California. I do not begrudge my neighbor paying less taxes.

I honestly believe, as the Dr. states, that this market is reaching an inflection point.

How are these prices sustainable when our own adult working children cannot afford a starter home? Back in the 1970s Japanese investors invested heavily in Hawaii. Prices were sky high and locals were priced out of the market. Prices came tumbling down and many investors went bankrupt or lost their investments. History may not repeat itself here but something has to give.

The Dr. also aptly points out that there hasn’t been a real stock market correction since 2009. So true! Buying opportunities will arise but patience is the important commodity. Like Buffet and Graham said, “Buy when people are fearful and sell when people are euphoric”. I believe a buying opportunity lies ahead in the not so distant future. Don’t buy now!

We would agree that we want government to live within the means that the public will allow.

What we would disagree on is the idea that pushing down on one side of the waterbed won’t cause the other side to rise up so much that the bed remains dysfunctional and thereby doesn’t serve either side well. Meanwhile, the broken water tap that is overfilling the bed has been ignored the whole time.

Prop 13 is a failure because government is still spending beyond its means. All it did was to remove a feedback loop which informs government policy. Additional upward pressure has been put on all other areas of taxation and non-land deed holders subsidize deed holders.

You don’t have to begrudge your neighbor for paying less for the same level of government services you’re getting but that doesn’t make it equitable or just. I bet you wouldn’t be happy if they paid a fraction of what you do for the same utilities simply because they got in early. Of course you wouldn’t, because you would be subsidizing their usage.

It’s nice that grandma is paying less property taxes, but she’s paying more in the form of reduced services and other taxes. Other folks are paying even more than her. There’s no free ride.

Curt, you are correct across the board — except that the Japanese nationals went crazy during the 1980s mania not the 1970s decade. (BTW, Tokyo had capital controls on their citizens until the mid-1970s.

I can speak from experience, I was right in the middle of it.

Tired is as logically confused as his posting right here.

Tax revenue is an OPIATE to a spendist politician. Too much is NEVER enough.

Other than sales and excise taxes, there is never a correlation between those paying the freight and those riding free.

California’s problem is that the flood of dependent illegal immigrants is creating Cloward-Piven conditions for Sacramento.

Whereas those brainiacs thought that America would totally embrace their ideal of collectivism and redistributionism — the economic realities are quite different.

As Russia (1998) could tell you, when the system crashes, ALL of the dependants are cut off — de facto. In the case of Russia this took the form of crazed inflation that made Russia’s version of Social Security totally worthless. The elderly began to starve to death — and the problem was swiftly swept off to the grave yards of that nation.

Should America continue to permit Dream Act dependants to flood the nation two things will happen.

1) The Black American’s rank as the dominant minority will be lost to Latinos on a national scale. AA will come to mean promotion of Latinos who will soon show disparate impacts up and down the income ladder.

2) The growth of employment — across all racial and ethnic lines — will come to a halt. Again, this would be to mimic the experiences of Russia (1998) and other over taxed nations. Classic Rome and China blew up from such taxation — without losing any wars! They had no peer competitors and STILL blew up.

[In both cases, these classic empires vectored too much wealth to their armies and civil servants. Since neither class of citizen actually produces wealth directly, epic over spending was enough to implode the entire system.]

[Such travails always coincided with massive debasements of the currency — which was paper for China and specie for Rome.]

Many words leading to no conclusions, as usual. Absolute scattershot whilst flinging a personal label of “logically confused” as your posts tend to do. Perhaps your blog comments really are the wind beneath central banks’ wings.

My kid rents a place in downtown Denver and does not own a car. Walks or takes public transportation everywhere. Can rent a car if he needs one. He has NO student loans because I paid for his college. He DOES NOT want to own a house or a car. Big deal hear is not that he cannot, he does not WANT to. Has the marketeers and sales folks worried about that generation.

I look at the stupid hyperinflated asking prices and my mind always concludes: “Houses are for idiots.”

Leave a Reply