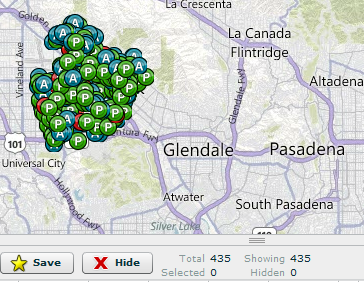

The surge of distressed properties in Burbank California – 435 shadow inventory properties when only 39 make it to the MLS. Foreclosure filings surge in California as Bank of America starts up the shadow inventory clearing machine.

Burbank is a city I would categorize as falling in the Goldilocks position of being just right for a solid correction. The hype around a city like Burbank is now unable to sustain lofty prices of 2006 and 2007. Burbank is definitely a mid-tier city although many would try to pawn it off as a prime location in the league of Bel-Air. As many of you now are fully aware the shadow inventory in California is enormous. Last month notice of default filings soared in large part because Bank of America restarted their foreclosure engines. A large part of these were with inflated markets in California. The data in Burbank is stunning and a big difference between today and say the last bubble nearly 20 years ago is that you have a better sense of what is going down behind the scenes. Banks would like you to believe that the entire inventory available is open on the MLS, transparent for the world to see. For Burbank nothing could be further from the truth.

The California surge in foreclosures

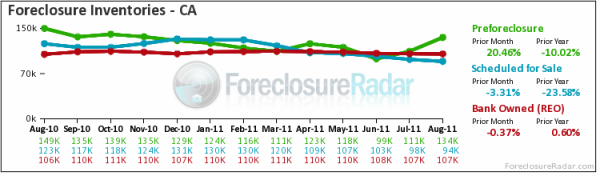

The first step in the foreclosure process is a bank filing a notice of default. Last month notice of defaults soared by 20 percent for California:

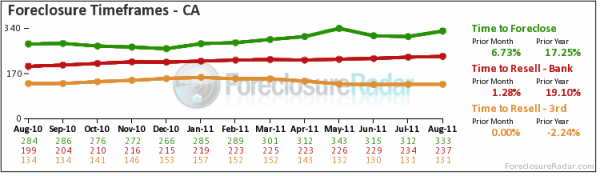

A large part of this is coming from Bank of America. This bank is the largest servicer of mortgages in the U.S. and now with its ownership of toxic mortgage superstar Countrywide Financial, Bank of America is going to be extremely busy in California. At a certain point banks need to act and start losing money on not moving on a foreclosure process. The timeline is already at record levels:

The average time to foreclose is 333 days and this is once the process starts! We already know because of the shadow inventory that many banks don’t even start for many months, even years. That does however seem to be changing. So with that said, let us look at our first home in Burbank:

608 EAST ANGELENO AVENUE, Burbank, CA 91501

Listed   04/27/11

Beds     1

Full Baths            1

Partial Baths      0

Property Type  SFR

Sq. Ft.  600

$/Sq. Ft.              $492

Lot Size 2,050 Sq. Ft.

Year Built            1922

This home is a 1 bedroom and 1 bath home listed at 600 square feet. That is correct, 600 square feet. The home has an interesting inside:

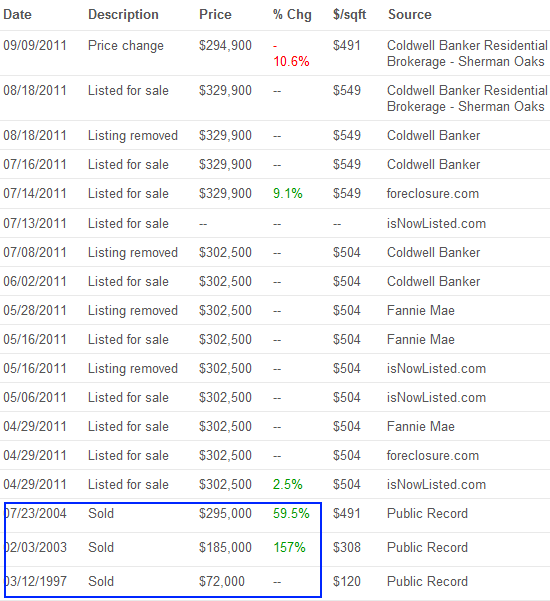

What can you expect from 600 square feet? Let us take a look at some price history here:

Looks like someone is chasing the market down here in Burbank. Take a look at the pre-bubble housing price of $72,000 in 1997. It is likely the value of this home is closer to the 1997 level rather than the current price. At this point this seller has chased the market down to the previous sales price of $295,000. They are reluctant to come to terms of the new housing market so they are willing to take a $100 loss! Think about it. Someone paid almost $300,000 for this 600 square foot place! Yet here they are in late 2011 asking for that same amount. Who will be the lucky winner to step up and purchase this place?

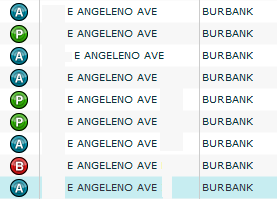

What many potential buyers don’t know is how mired this street is with shadow inventory. The MLS lists one distressed property on this street. It is a bit different in reality:

Turns out another nine properties are already in the foreclosure process. What will happen when these sell now that some banks are picking up their foreclosure process? Banks have also gotten more motivated moving short sales:

1227 N BEACHWOOD DR, Burbank, CA 91506

Listed   03/01/11

Beds     4

Full Baths            3

Partial Baths      0

Property Type  SFR

Sq. Ft.  2,167

$/Sq. Ft.              $231

Lot Size 6,525 Sq. Ft.

Year Built            1940

This home is obviously larger than the last home. This is a 4 bedrooms and 3 bathrooms home. This is a B of A short sale. In other words, banks are realizing getting anything close to peak values even in mid-tier California cities is largely a lost cause. And big banks have a front row seat to new potential buyers. Do you think they are seeing a lack of large income coming in for these places? Sure, there are delusional debt pirates with no savings trying to buy places with toxic mortgages but once those income statements pop out, banks realize that they themselves will be chasing the market lower. Banks are the biggest crooks in this system so if they could unload this excess inventory to more suckers they would in a heartbeat. Let us look at the ad for this place:

“Bank approved short sale @ 510k. Fantastic 4 bedroom, 3 bathroom property. (unpermitted however, we have the county inspector’s simple list of items that buyer will need in order to pass final permit inspection). If property shows as “active”, then it’s still active. This property is very spacious at 2,167sqft. This home was rebuilt from the studs upward, in 2005. This two story beauty boast high ceilings and a big kitchen. Recessed lighting. Master bedroom has spa tub and walk-in closet. Short sale through bank of america. Short sale will be processed through bank of america’s equator system. (making this a faster short sale approval process). Seller is a licensed broker.”

Here is the inside of the home:

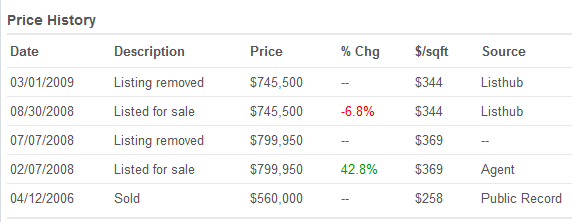

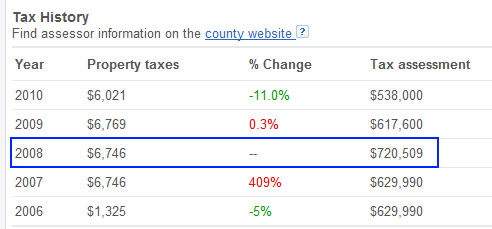

Not bad for a starter. Yet everyone is realizing that peak prices are no longer here:

Someone actually tried to sell this place for $800,000! Not going to happen even in 2008. They chased the market down a bit until reality hit. Today it is listed at $510,000. The local tax assessment also got sucked in by the bubble in 2008:

Even taxes are chasing the market down. The bottom line is that even at the current list price this home is still inflated. The shadow inventory is finally being moved in Burbank and this is likely to be the case for the next couple of years:

Burbank

MLS:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 312

Listed as foreclosure:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 39

Shadow inventory:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 435

Just think about the above data. 312 homes are listed on the MLS with 39 of those being distressed properties. However, the shadow inventory for the city is up to 435 properties!   Shadow inventory is suppose to be a tiny part of any healthy housing market and that is why I still think we are years away from any semblance of a normal market. Cities like Burbank are only entering stage two of a multi-stage correction process. Although I’m sure many are eager to repeat the lessons missed from our recent bubble.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

69 Responses to “The surge of distressed properties in Burbank California – 435 shadow inventory properties when only 39 make it to the MLS. Foreclosure filings surge in California as Bank of America starts up the shadow inventory clearing machine.”

Now that Bank of America is making its near last cuts, (does anyone know the totality of all their layoffs?), focus is now on international business. So they are cutting line and jumping ship. Are they sill allow to used the world America in their business name?

Maybe the word America in their name is apt.

I love this part of the second featured house description “unpermitted however, we have the county inspector’s simple list of items that buyer will need in order to pass final permit inspection.” I wonder how expensive that simple list is?

I had a few hours to kill yesterday and looked at several open houses in Huntington Beach, where I eventually want to buy. I was mystified that some sellers want top dollar for their fixer when you can buy a newly remodeled property for the same amount of money. I saw several of these houses where the selling agent basically said you need to take this house down to the studs and start from scratch. Well if I’m going to do that, I will need a monster discount on the sale. They didn’t know how to respond to that other than this house is special…neighborhood, location, etc. We still have a ways to go.

Check out this from Mish and some of the comments. A tidal wave of foreclosures may finally be coming:

http://globaleconomicanalysis.blogspot.com/2011/09/more-on-coming-wave-of-foreclosures.html

This is an important piece. Previously, we had discussed the uncertainty that MERS threw into the purchase of properties in California. The 9th Circuit Court has deemed that MERS is legal in California.

Don’t you love how the Bankers own this State?

So all the pundits who were crowing about how foreclosures have slowed down are about to be shown that, yes, it was because the Banks were holding them back; and not because things were getting better.

And as I’ve been saying, no, we haven’t seen the bottom in Real Estate. We’re not any where close, yet.

I went to “Mish’s” website, poked around a bit, mostly all money matters, but then hit a few articles where his opinions shone forth. I have no interest in seeing the site again.

@Swiller

me too

Ironic that you chose the tag line of the old laugh-in show from the 60’s: Beautiful Downtown Burbank, which was poking at Burbank not being first tier, but someplace close enough and cheap enough for a lot of the entertainment business.

Even Lehigh Acres, FL was exhumed during this bubble, and still quite a few good deals there. I guess Meredith Whitney woke the giant zombie BOA and the Fed quit buying all their worthless paper. Look for this process to go on for years–not just Burbank, but Country Wide…

I would love to see the shadow inventory analysis for Santa Barbara and Montecito where i am trolling. Thanks for all your work.

Zillow shows REO property not for sale on there neighborhood or zip code maps. These will show up as red dots without prices or actual address but have the street so it doesn’t take much to find them. Again these would be bank owned rather then short sales or pre forclosure but gives one an idea of what the banks will be putting on the market near term.

Anyone know the best way to check on the number of foreclosures coming in a particular area? Dr HB is great at this, but he’s an expert and I am not. I can get the number of NOD’s, etc, for an area, but I don’t know how to estimate when these homes will actually hit the market.

I’m looking to buy in an area in northern San Diego that was built and sold in 2004-2006. Back then, they mostly sold for $600K to $900K, and that means a lot of middle and upper middle class folks who overextended and are now $200K to $300K underwater. I’m assuming they started defaulting in 2008-2010, and these homes are now coming on the market and will continue coming in waves for the next couple of years.

I’m trying to model all this, but it ain’t easy. Wondering if anyone has any ideas.

Thanks!

Burbank is about a hundred thousand people; but large parts of it are teetering on the edge of significant racial tipping points (asian, hispanic). Burbank’s median home price five years ago was about 650,000 at the peak, and now, about $450,000. (gross values, not adjusted to net market value by deducting selling costs from either figure). Call it a round $200,000 loss per home in all Burbank; there are only about 17000 homes in Burbank, though. That means this city’s homeowners and bank lenders lost 3,400,000,000 of equity (fluff that it was). Not bad for a smallish city by LA standards. Lower prices and foreclosures/short sales may mean further deterioration of the neighborhoods (upkeep, economic status, down payment invested, renters). The high proportion of rentals, many reasonably priced, only further weakens the past identity and history of Burbank, for better, or for worse. Good luck buying there.

Racial tipping points? Yeah because everyone knows that only white neighborhoods are worth living in. As an Asian myself, I can’t wait to move to an all white area, I just hope I don’t bring down the property values of my own home as a result. I should probably divorce my Latina wife first though, she might bring the wrong element into the neighborhood.

Do I have to be the referree here? As a bi-racial white-Asian person, I prefer to live in a white neighborhood over any others. White neighborhoods are generally cleaner, quieter, and lack funky ethnic traditions (ie. bbqing in the front yard/driveway, funky food smells wafting from offending homes, bad drivers on neighborhood streets, etc).

Asia: Big continent. So are you russian, or mongolian?

You are not an asian. It is obvious from your comment. You are a poser, so get lost you poser. American and foreign Asians buyers move into and buy into high quality low crime cities with good schools and good economics, and prefer centralized locations like Burbank or Arcadia or Fullerton or Torrance or the Palos Verdes Penninsula, rather than outlying areas. Even more so, Asians could care less about whiteness or whatever else you fraudulently mention, you race baiting fraud. Asians seek family and economic value.

“The shadow inventory is finally being moved in Burbank” This is good. Burbank is a leader again, this time in moving the inventory out of the shadows and into the light. Once the goofy dogs are cleaned up, then Tune Town will raise again(at least that is what Roger Rabbit told me). “Although I’m sure many are eager to repeat the lessons missed from our recent bubble.” That is also good news for sellers. PT Barnun had it right.

In Burbank, about half the listings expire because the price is not high enough. The other half usually go through escrow at least once and about half that go through are cash buyers. The Realtors really have to work hard these days.

Look at all the comments here from supposedly more educated folks who still want to buy in third world CA. PT Barnum sure did have it right. The only thing stopping these properties from selling is bubble financing.

The only thing I like more than a chain link fence is a rusted chain link fence.

Funniest thing I read all morning! So true.

Thanks man. I have my moments.

Thanks Dr. for talking about my fair city. I am a RN, and my wife works for a major studio here yet we can’t afford (under realistic financial principles) to buy a home here. We look at stuff in the 400K range and it’s complete garbage, either total fixers, or tiny homes or condos. If a couple like us rents vs buys, who is going to support the idiocy of these prices? We make close to 150K with no debt. We are going to keep renting a house that would probably be listed at 550K under current market conditions.

The entertainment industry isn’t as strong as it used to be, and the aerospace Industry that this town was built on is gone. Where are all these high paying “middle class jobs” to support these prices going to come from? It’s just a matter of time till this city capitulates. The crash of Europe, and eventually China along with the inability for Congress to compromise will only exacerbate the decent. LOL at those 600K real homes of genius.

Dude, I feel your pain about the entertainment industry. Jobs got cut back in 2007 and never returned. Very few lilly pads to jump to if you don’t like your current gig. Since it’s an in-demand industry, employers know they can pay peanuts and still have people lined up to work for them.

For sure! Studios aren’t going to produce nearly as many movies as they used to. Santa Fe, Vancouver, are prime locations for the biz now. Outsourcing for special effects is rampant now (CGI). California is not an easy place to do business. Only going to get worse as Jerry raises taxes and “fees” to cut the deficit.

Sorry about the ignorant prejudicial comments of IndyLew. They have no place here, or anywhere for that matter!

I think it would be nice to live in Santa Fe. I’m going there next week 🙂

If only we had more intelligent home investors like CC.

CC you need to talk to the right person. With 150K in income, I can get you into your $550K place. Go on Zillow for your favorite home address, and play with the figures and you can get in. With 20% down on $550K, the payments are $2089 a month. You should have saved up $110K, but let us say that you are a Dave Ramsey fixer upper couple and can only afford 4% down ($22K) then your payments are $2507. Don’t forget the great tax deductions that I can get you. Don’t dispair, we can do it!

Dear John,

Where to begin… First off anyone who knows Dave Ramsey knows he would not advocate your stupidity. Second, just because I could use creative financing to get into a house 100K out of my price range ( income times 3 equals 450K ) doesn’t meen I should. Third, are you going to bail me out when that dream house you enslave me to is underwater 20+ percent in the next two years. The idiocy you advocate is the main reason this blog exists! Go smoke so more crack and find another sucker, and ruin their financial future.

CC:

I’m pretty sure John was being sarcastic. Stick by your guns though because you are right.

The hut on 608 looks to be part of six hut set the lot was broken up to give each hut a seperate address. talk about bad zone planning, that street has no parking all the high rises have underground parking but most are one spot and most have atleast two cars.

Just like a can of sardines.

Any insight on Northern CA – specifically the SF Peninsula? Anecdotal evidence seems to say prices are going up (after a decline in 2008-09) because of lots of jobs and more demand as people from outside the area move here for work. Is the dynamic here just fundamentally different than other metro regions in the CA and the U.S.?

Maybe this is true in Silicon Valley. But not the east bay and contra costa county. They’re starting to head south again.

U better hurry-up and buy now, or you’ll be priced-out forever!!

“John CPA JD

September 18, 2011 at 4:54 pm

“The shadow inventory is finally being moved in Burbank†This is good. Burbank is a leader again, this time in moving the inventory out of the shadows and into the light.”

It’s kind of *unclear* to me how the city of Burbank has anything to do with BoA finally waving the white foreclosure flag while it is financially unraveling.

What is really stunning is the shaft one receives from Prop 13…from the sellers $1325/year property tax bill to the increase of 409% to $6746…yikes.

Like they used to say before that kind of crap was outlawed until Jarvis resurrected it’s corpse: “Welcome, Stranger!”

It kind of drives a spike into the heart of the long-term investor buying these up as rentals for at least 5-6 years…or more. Those “Futures” markets gambling prices will rise mid-2012: they must see a world war on the horizon…and SoCal opening old munition’s factories…because Bubba, there ain’t no other game in town to sustain jobs capable of swallowing this inventory….goodness…$294,000 for an 89 year old 600 sq,ft. home…what would the rent have to be to break even for an investor, including the PTI? No way, Jose.

What’s wth the prop-13 haters??? Dr. please do a column on prop-13. I think many folks are severely mis-guided.

I think people are finally “waking up” about Prop 13. What started out as a grand idea to save all those granny’s from losing their homes from taxes, allowed corporations to forms trusts, and in that trust, names can be changed, but the property is not re-assessed at current valuation.

So Sir Richard of Balboa, starts his business with a trust, buys property, and that land valuation will only go up 1% per year as long as the trust is in place, it doesn’t matter who is at the helm, or who is getting paid, the property never changed hands. It’s called corporate welfare.

Surfaddict, generally the only people who really like Prop 13 are the ones getting the good financial deal from it. It totally screws over younger buyers and keeps desirable areas of CA inflated because it limits supply…people will stay in a house that is no longer ideal just to save on the property taxes.

It’s not unusual to hear stories of new buyers paying 5x to 10x as much in taxes as their long time neighbor. How the hell is this fair? And they can gift these ’70s era tax rates to their offspring…again, how the hell is this fair? And it totally skews the rental market also, when you have someone paying virtually zero property tax, they can rent at below market rates.

Get the corporate welfare removed and if you really want to keep grandma in the house then let Prop 13 kick in when she is of federal retirement age.

Your ignorance is boundless!!!

Dr. Housing said, “Even [property] taxes are chasing the market down. ”

What is going to happen to the ability of these cities to provide essential (or non-essential, but desirable) services, if property tax revenue continues to decline? Surely they are not counting on the state or federal governments to open up their checkbooks to make up the difference, right?

As government workers are canned to help the entity (local, state, or federal) meet budget, the unemployment rate rises, further stressing the community. I see a reinforcing feedback loop here, that would tend to depress housing prices, even more so than the already dreary metrics of Dr. Housing would suggest, if that is possible.

Jason, I appreciate your concern about the state and local government’s tax revenue. farange is concerned about Prop 13. You folks fail to see the great service that my friends at B of A(formerly the Bank of Italy) are doing. The deadbeats living in the shadow inventory are not paying property taxes. When the homes are sold by the bank, the back taxes get paid and the new property tax assessed level is higher than the folks that bought the home in 1998 and before(old Prop 13 assessed tax value)and took out home equity loans and had such a good time living the rich life.

There is a lot of built in tax revenue in the shadow inventory for the state and local governments. When this inventory starts moving, then the money will flow into the coffers of the local government to give the school teachers and etc pay increases.

With all due respect, John-CPA-JD, you probably have it backwards. The people that bought during the bubble are the most stressed, and will be forced out first. So homes that are on the books, for real estate tax purposes, at $600,000, will soon officially worth half that.

In the unlikely event that an individual city, here or there, happens upon a financial windfall, do you honestly believe the city officials will publicly announce a pay raise for city employees? If you really believe that, I suggest that you put every dime you have in the stocks of companies that sell tar and feathers.

As to the other poster that asked about which services are essential, it doesn’t matter. As budgets decline, cities usually cut the thing that is easiest to cut, the size of the workforce. And the largest group of employees is usually police and fire.

Define essential…

I will: NOTHING There is absolutley NOTHING the city “provides” that I can do without. It is mosly just a scam to write parking tickets, issue building permits, etc. I don’t need a fire dept, if my place burns, my homeowneres insurance will pay for it. If invader breaks into my house to rape my daughter, by the time the cops get there its too late. I PAY for trash, water, elec. Gas tax & registration fees are SUPPOSED to pay for roads….ha ha!! public schools are a joke, I have to de-program the nonsense they “teach my kids..and who wants to swim in the public pool that charges $4 anyhow??

I was charge a $60.00 ticket 5 years ago for entering the Nancy Hoover Pool overlook. The gates were open, but the sign said don’t enter after dusk. Had a long day, and just wanted to relax by looking at the lights of the city I live in and love. The Ranger service came through and just nailed everyone and sped out of there. I assume that all of the gates “accidentally” left open and they were capitalizing on the “opportunity”.

8 years ago I received a fixer ticket for a headlight out. In Colorado this is not a court appearance issue. Since I missed the court date it ended up costing me $590.00.

Yes, I realize both of these incidents were due to my lack of properly following the directions, but this state REALLY capitalizes on these lame offenses. You can be sure I won’t be making any parking violations for the next 10 years of this market drag! Then again, they’ll get my money somehow.

Surfaddict,

How much do you think your insurance will cost or if you’ll be able to get covered at all, if there ceases to be any sort of fire department in your vicinity? This doesn’t have to be a city service, there have been well reasoned proposals for how this could be a private business but there needs to be something or no insurer would have anything to do with it, especially in a tinderbox like most of Southern California.

The cops may not get to your house in time to stop an intruder but how many such persons are languishing in jail because they got nailed for something else and thus their home invasion activities are curtailed? Policing isn’t perfect anywhere but it beats the hell out of no police at all. (OTOH, one of the major reasons my brother now lives in Nevada instead of California is the likely treatment he’d receive if he shot an intruder in his home. He’d expect to be arrested in CA while in NV the cops might compliment him on his performance.)

It doesn’t have to be a government operation but we do need some things and they’re better contracted as a community to get a better price. This is a very limited category of services, though, and many have lost sight of that as government just grows and grows.

..What is going to happen to the ability of these cities to provide essential…services?.

In a word, Bankruptcy.

A few municipalities may skate on by, but what other recourse (long term) do they have?

What’s never mentioned in the Press is that a huge part of the budgets are used to fund absolutely ridiculous retirements and pensions. These were passed out like candy during the boom, and now everyone wants to keep these hush-hush.

So when you see services curtailed, it’s only in part because of lower revenue. The main reason is to keep paying out these absolutely crazy pensions. While Prop 13 may need reform, the existing Pensions and retirement benefits do too.

Cut these back, and you’ll have more money for actual services.

Doc, you’ve done studies on the impact of student loans and their relationship with potential home-buyers, but I would like to see a study of the money that goes out for Pensions in California, and how that impacts the state revenues and values of real estate.

Questor:

You do not have a clue as to what you are talking about. Faux noose talking points much? Govt pensions were not created nor handed out like candy during the bubble. Govt pensions go back I would hazard to at least two or three times as long as you have lived. They are and were negotiated with unions. Most employees pay a portion of income into the pension, the city pays the rest and the money is held and invested – in the stock market. Market scammers, think the people who got bailed out by the Feds induced these pension trusts to invest in REITs. Additionally most govt employees are exempted from social security but are then hit with reduced social security pensions for “windfall gains” even with pensions as low or lower than 20K. Not so the private sector (think bankers with 200K incomes) who have paid into both SS and 401s, etc. They get to double dip. Who was that Senator or Congressman in the news complaining about Obama’s jobs plan causing him distress on his 600K income excluding his govt salary (free med for life by the way)? You need to pay attention, get the facts and your eyes will be burned open. Geez, read DR HB’s new post it is about this very issue of the middle class getting hammered by this bubble.

Sorry, Wydeeyed, You’re the one without a clue or facts to back up your silly ignorant rant.

Have you ever seen what firefighters get? I’ve got a friend who retired recently due to a back injury after 5 years on the job. She gets a very large portion of her previous salary, and that’s just after 5 years. You might also try reading the newspapers sometime. If you had, you’d find that the scam with firefighters is to claim an injury early, just to scoop up the benefits.

Oh, and she still gets to keep those, even when she returns to work full time.

That’s just one example. There are many more, with City workers. In case you missed the headlines lately, you’ll see that cities across the State are cutting benefits for new workers.

The difference between us is that I can back up my claims with data. Here you go:

http://www.mercurynews.com/bay-area-news/ci_16244872?source=rss

Check google’s cache. The SJMN appears not to handle it’s past articles too well. But here’s a snippet:

San Jose voters weigh pension changes, public safety costs

By John Woolfolk

jwoolfolk@mercurynews.com

Posted: 10/04/2010 12:00:00 AM PDT

“With pension costs skyrocketing and city coffers depleted, “People need to understand that there’s a direct link between the cost of our employees and our ability to deliver services,” Reed said. ”

This is a theme that’s repeated throughout the State. And yes, they were passed out like candy during the boom years. That’s why we’re having problems now. Again, this has been repeatedly in the news since the crash.

You sound like someone on one of these. My condolences. When the State’s inability to carry its debt load catches up to it, these are going to be trimmed big time. No other choice there, sorry to say. And yes, I do mean existing pensions, regardless of what was promised.

OT. Dr. what impact does the dollar value have on housing. For example back in 2001 the dollar was worth 1.07 today slightly less then .80. So a home purchased in 2001 for one million now sells for 800K, the combination of deflation and lower priced dollar would seem to be a double hit for the seller; your take?

Question. I may not have thought this through well enough, so you guys tell me what I’m missing.

Wouldn’t the banks be pushing for a bigger stimulus from the feds that would put money in people’s pockets and give them more buying power? Seems logical to me, and with all their influence, seems like that could actually happen if they were to try. Seems to me that a large stimulus–much larger than the first one–would help everyone. More jobs, more consumer spending, more home buying, fewer defaults, fewer foreclosures, healthier bank balance sheets.

Ideology aside (anti-government spending for the sake of being anti-government is not a valid argument), what’s wrong with that?

The idea of a jobs stimulus is not to “put more money in peoples pockets”.

Bob the grocery clerk , or Mary school teacher won’t get one cent from a jobs stimulus. However Bobs cousin might be able to find a job just as Marys Uncle may now find a job, but those jobs still don’t pay enough to afford California bubble prices.

The net result is business owners may be better off and certainly the economy in general but the average person isn’t going to have anything extra.

Nothing is free. You either borrow for the stimulus (transfer of wealth from the future) or you print the money to pay for it (transfer of wealth from those who save to those in debt). The first can only be done as long as somebody will loan you the money (think Greece), and the second can only be done as long as the savers have wealth to take (think Weimar Republic). As long as your GDP grows faster than your debt, deficits are sustainable, but if it doesn’t, things can get ugly in a hurry.

Okay, Lockjaw, so let’s say you borrow the money by issuing Treasury bonds, which at today’s rates don’t cost the government nearly as much as they “normally” do. Then you put people to work, maybe the way they did in the 30s, and collect taxes on their income. Those people also spend their money, putting more cash into the system. The GDP grows as a result.

I understand that the success or failure of such an approach depends a lot on the exact numbers. So is the reason the banks aren’t urging Obama to do this because the numbers don’t work out? (I know I’m oversimplifying this, but I really would like to know why the banks aren’t pushing something like a large federal stimulus like the WPA, CCC, etc.)

Martin, I understand that some people wouldn’t get more money under a stimulus, but it seems to me that putting unemployed people to work has got to put more money into the system and start to lift all boats. Even if that were to happen, I understand that California real estate prices are still way too high. But surely such a stimulus would keep a lot of people from defaulting. (Again, the exact numbers are critical; I understand that.) I’m not suggesting that a stimulus would be a panacea, but it does seem to me to be one of the few things that could actually make a difference.

Or is what the banks really want a return to 2004? Do they think that will make everything okay?

Paula,

Nobody sane is pushing for such Depression-era programs because they flat-out didn’t work. As one of the major designers of the New Deal said in 1939, “We have tried spending money. We are spending more than we have ever spent before and it does not work.â€

There was a genuine concern about uprising and revolts, especially after the Bonus Army incident. (Something that is all too often overlooked in discussions of the Depression.) The makework programs were known by the non-fools to be useless as a means to restore the economy. It was a matter of keeping the peasants in line.

Don’t be silly. The Banks are going to need that money for their next bail out. They’ve learned that they can gamble away to their hearts content, and stick the taxpayer with the losses.

None of what caused the crash of 2008 has been reformed, and no one has gone to jail. So you can expect history to repeat itself here. And that money will be needed for the Banks; and especially the Banker bonuses.

So what you’re saying, Questor, is that my idea is sensible but that the banks aren’t. Have I got that right? If so, I get it. I don’t like it, but I get it.

@Paula:

Yes, it some sense. But what makes no sense whatsoever is for the Banks to be pushing for it. This would be completely contrary to what they’ve been doing for decades. Based upon their actions alone, it is clear that they want to own everything and everyone. And I do mean everything. This entire Country, as well as others.

They have gone a long way towards achieving these goals. Do understand that Banks have taken possession of Countries before. Check out the history of Newfoundland, which was a completely separate political region from Canada, but lost their political independence due to too much debt before the Great Depression.

So no, helping the middle class is absolutely contrary to their goals and how they operate.

Ask Japan how that worked out for them…

The banks are certainly for another stimulus. The problem is that the last 2 stimulus attempts failed, and asking for more stimulus aggressively a 3rd time will just cause a bigger stir among the public that has yet to see any significant amount of stimulus passed from government to bank to consumer. If anything, the banks require another stimulus to try to stay solvent, and even then for some banks, that will still be a remote possibility (e.g. B of A)

Also, take into consideration the possible effects of another stimulus. The weakened dollar will drive further inflation in food/energy costs. Cost of oil will increase, and if that stimulus never gets our economy going (which it probably wont), the rising costs that get inherently passed to the consumer will slow us down further.

You might suggest raising up some stimulus with treasury bonds, but there is only so much demand for T-bonds, not to mention the US has already maxed out it’s own credit card (you can google up our debt ceiling issues).

Philosophically speaking, your idea ‘can’ work, but it requires various ideal conditions (aka the right context), and practically speaking, they don’t really apply during times of severe economic hardship. The underlying problems that exist during such times tend to swallow up whatever stimulus that comes, and in the case that the stimulus keeps coming, it lends itself to some very dire political, financial and social consequences.

For one thing it is only a temporary fix and after they spend their money, it’s gone and there’s nothing there to replace it with. And I’m sure that at this point, many will hoard their stimulus money, much like the banks.

I think this idea would have worked brilliantly for the first stimulus package, but by now many people have learned it’s better to save than squander.

So, how does a first time home buyer take advantage of this and buy a home in Burbank?

Take your time. Save your money. When CC (a consistent dhb poster) buys, then you know it is time to buy.

CC,

I feel your pain.. my wife and i are in a similar position.. except we just bought in early summer. But we were tired off putting our life on hold… wanted a house with a yard and pool and could afford it. So we bought a “fixer” for $400K in Woodland Hills… with 10% down so our mortgage… so $360K mortgage for a 4 bed /2 bath with a pool on a .25 acre lot very private lot… cul-de-sac home. Our payments after tax deductions and equity… will be about what we paid to rent a 2bed/2bath apartment in Sherman Oaks, CA. Do i think i we deserved, base on my income, to have less of a fixer… sure… and i might be proven wrong when in 2 years i see we could have gotten more for our money.

But on a $150K combined income.. you can make that fixer a dream home with 1 year of savings. Unless you go out to eat 5 times a week and vacation abroad every year… and fly first class… You should be able to afford a $360K mortgage at 4% interest rates and still save like $30K a year minimum.

I partly bought because of fear of inflation… since my rent has been raised every single year since 2002.. I was sick of moving and negotiating with landlords every year… Also renting a house is a lot harder to do then you make it seem. I don’t know too many homes in Burbank that rent for less than owning…. and don’t require MASSIVE deposits that you probably won’t ever get back…. I’m talking $5000K down just to RENT a home.

I appreciate your honest posts Kevin. Woodland Hills is on our possible list… That 101 is just a sticky wicket.

Granada Hills and Porter Ranch… are actually a more pleasant commute than Woodland Hills depending on where you work… You can take the 118 (always clear).. to the 5 South to 170 south… or 118 to 405 south… so you have some options to get places…

Got a good buddy in Woodland Hills. Nice town. Thought about Granada Hills too. Well regarded Charter HS. The wife wants to live in Burbank so that work and the kid are near in case of emergency, and I cant say I blame her. It gives me comfort to know she could get to him in 10 min. tops, when with my commute it would be an hour plus. I still can’t fathom paying 400K for a 2/1 800 Sqft. box that needs a whole lot of work. That’s what you get at that price. I can only imagine the people who live in these homes who bought during the bubble at 600K, and are now loathing their house. No room, and no equity cash outs to build on to it. Maybe John CPA JD has a plan for them. I’m going to wait. If you guys think about it…If this blog can encourage people to make sensible housing decisions, we are helping people to be free from oppressive debt enslavement. If enough people don’t buy till prices are within reason, then, prices will be within reason. They psyched us into this frenzy, that I myself felt. I was thinking I screwed up and missed out forever. Thanks guys and of course Dr. for helping me come to my senses .

As for renting, yes I am paying over 2 grand, and no I didn’t have to put a huge down, but isn’t this better than buying, and being immediately under water, with a continuing depreciating asset? I pay zero property tax, zero maintenance. I would rather move out of this house to a apartment again if need be than buy some piece of crap in an act of desperation.

Kevin you did what was best for your family, but Burbank prices are a JOKE!!!! Could never get that much house at that price here, would be in the 750K range.

The recovery is all about the job market. The just released UCLA forecast states:“Employment growth in 2011 and 2012 will push unemployment down marginally,†wrote UCLA senior economist Jerry Nickelsburg. “Therefore, we do not expect it to reach single digits until 2014.â€The one hopeful note for Orange County and other coastal counties is that Nickelsburg thinks jobs are likely to come back faster here due to higher concentrations of high tech, innovation and knowledge-based activities.

The downside is that recovery in the inland communities will drag on for years. He said those areas may not see a return to pre-recession job levels until 2017 or 2018 — or even longer. In otherwords the housing recovery will vary by region.

Senior economist David Shulman argues basically that the economy is so far down, it can’t really fall that much more. “Even if housing starts drop to new lows, this sector of the economy has shriveled so much that it would only have a modest impact on economic activity.†In other words, having housing starts drop from 2 million units a year to 600,000 had a much bigger impact than if they fall from 600,000 to 300,000 now, he said.

Leave a Reply