The American Household Balance Sheet. Lessons from the Great Depression Part XXVII: Household Net Worth Drop in Great Depression 11 Percent. Current Net Worth Drop of $13.8 Trillion Equivalent to 21 Percent Drop.

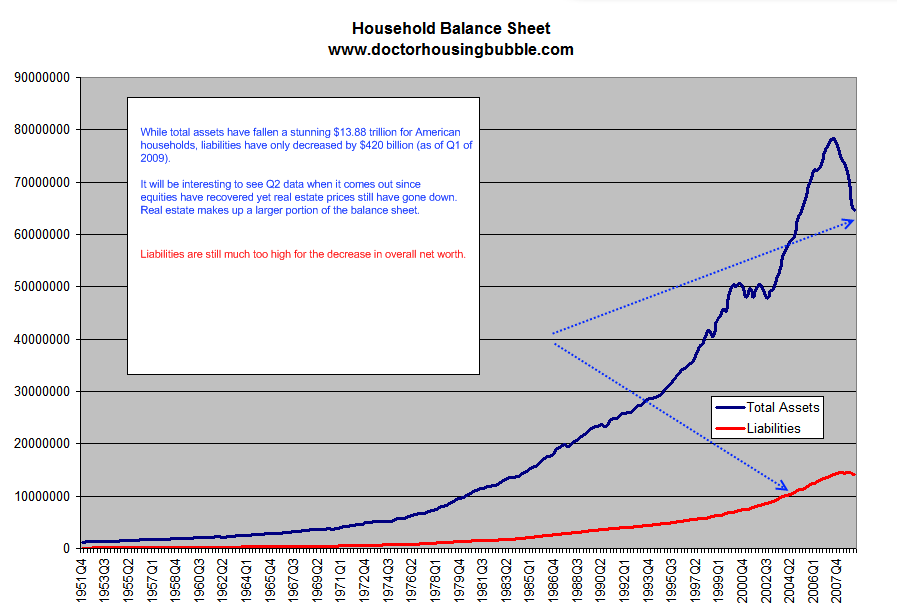

$78 trillion. In the third quarter of 2007 American households controlled $78 trillion in various assets including real estate, equities, pensions, and other forms of wealth. Adding in the liability side of the equation, Americans in the peak year of 2007 had a net worth of $64.2 trillion. A sizeable portion of that net worth has evaporated. In fact, that $64.2 trillion is now valued at $50.3 trillion. A 21 percent cut to the American household balance sheet. Now much of this has come because of the housing bubble bursting and the subsequent stock market crash. Even in the Great Depression, household wealth did not evaporate so quickly.

I’ve been digging through research papers trying to find accurate measures of household balance sheets during the Great Depression to try to develop a reference point for our current bubble. The trouble of course is that much of our new toxic instruments like Alt-A mortgages and massive amounts of commercial real estate debt really didn’t have a big impact during the Great Depression. At the time, it is estimated that some 1 million Americans were invested in the stock market. The homeownership rate was rather stable during the early half of the century:

This goes in stark contrast to our bubble peak when homeownership neared 70 percent while the majority of Americans are now involved in the stock market either directly or through a pension fund. Yet looking at research conducted on the American balance sheet during the Great Depression, we find that this current bust has caused more wealth destruction.

This is part XXVII in our Lessons from the Great Depression series:

21. The Big Change

22. The Infection of Consumerism and Living Fake Lives.

23. The Worst Housing Crash in American History.

24. Economic Crises Around the World in Synchronization.

25. Reconstruction Finance Corporation II

26. Pecora Commission Where Art Thou?

It is hard to grasp such a large drop in net worth. Let us chart this out:

*Click for sharper image

The growth in American household assets has been rather unrelenting since the 1950s. We had a hiccup earlier in the decade with the tech bust but we were back on track in a very short time. However, since the peak the asset side of the equation has imploded. We also see on the chart above the increase in liabilities. As in most busts including the Great Depression, assets adjusted quicker than liabilities. While asset prices have come down $13.8 trillion the liability side of the equation has only decreased by $420 billion. How is this disconnect remedied? By massive amounts of defaults and foreclosures since the instrument that caused the bubble was real estate and the debt tied to it.

Now I know that during the Great Depression, the safety net was largely non-existent. There was no FDIC. No Social Security. No large pension funds. So for the most part, people were on their own. It is no surprise then that the unemployment rate peaked at 25 percent with 14 million unemployed Americans.

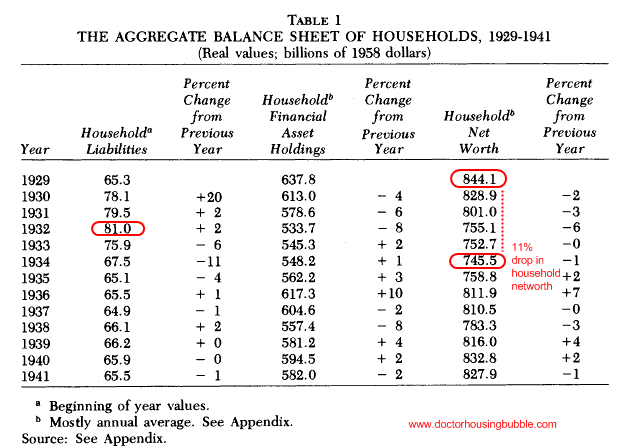

It is hard to believe that we now have 14.7 million unemployed Americans with another 11.2 million either working part-time for economic reasons or some who have given up looking for work. Yet the pain isn’t as visible as soup lines or men standing outside of manufacturing plants looking for work. Unemployment benefits are done electronically through the internet and in some states, funds are disbursed through debit cards. Yet on a percent basis, Americans have lost more household wealth in this crisis than in the Great Depression. Let us look at the balance sheet from the Great Depression American household:

*Source:Â Frederic Mishkin – The Journal of Economic History (Dec., 1978)

I struggled to find this data and even the author in the above work had difficulty constructing the data set. Much of this is largely due to the poor record keeping done prior to the Great Depression. As we can see from the above chart, the household net worth peaked in 1929 and didn’t hit a bottom until 1934. From peak to trough, the amount loss was 11 percent. Now why the lag? For the most part, much of the wealth of the American household wasn’t in stocks contrary to popular belief. Of course, the stock market rocked the economy and led to job losses which in turn hurt the balance sheet but many Americans did not have their money linked up in stocks. The lag and hits came with many of the bank failures and subsequent foreclosures. The most visible historical memory is the stock market crash with photos of anxious crowds gathering outside of Wall Street.

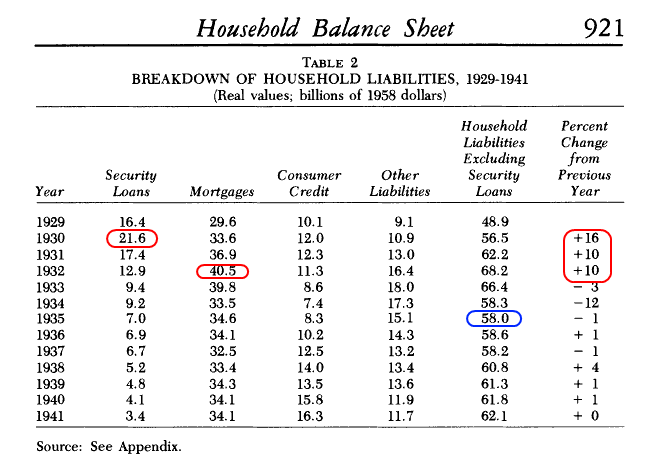

It is interesting to note that the patterns of bubbles are rather similar. That is, liabilities keep on increasing even after the peak. Let us look at the liability side of things:

Mortgages were not a gigantic part of the balance sheet. Much of this had to do with mortgages being constructed with a 5 to 10 year term and a balloon payment at the end. Let us take the peak year of 1929 for example. While household net worth (in 1958 dollars – we are focused more on percent changes) was $844 billion mortgage debt was $29.6 billion, or 3.5 percent of net worth. Let us look at our peak data. Net worth peaked at $64.2 trillion and mortgage debt was $10.5 trillion, or 16.3 percent. Now this would make sense since homeownership is much higher than during the Great Depression but it also shows how dependent we were to the housing industry. In fact, that is why the government and Wall Street are so concerned about maintaining high home prices even though in many parts of the country they are still unaffordable. We are approaching the bust in differing ways. Take a look at a paper written in 1933 during the Great Depression addressing various government programs:

It is strange to see a government initiative during the bust seeking affordable housing. How things have changed. Most of the current legislation and programs seek to maintain high home prices (i.e., loan modifications, bailouts, etc). Since much of the American balance sheet is tied to real estate when the housing industry busted, much of the bubble wealth also came crashing down. At the peak real estate made up $24 trillion of the $64 trillion in household net worth. That is a large portion. It’ll be fascinating to look at the Q2 data since housing prices have been coming down but the stock market has rebounded. Real Estate is still a larger segment so I would expect the net worth figure to decrease for the quarter.

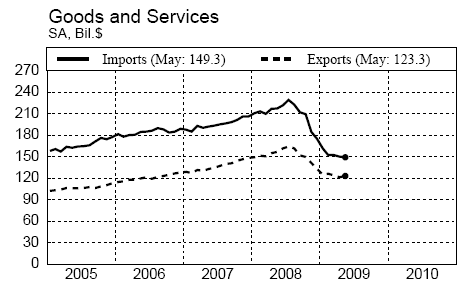

What becomes clear is that even though there is more overall prosperity in 2009 than in 1929, there has never been a time in history when so much wealth has been lost. Even the Great Depression did not see such large wealth destruction. We have more humane safety nets in 2009 but these are being strained. Many unemployment insurance benefits are reaching their end even with extended dates. What then for these people? Even though the freefall in unemployment may have stopped, companies are still not hiring. So what then? Trade is still hurting:

The American household balance sheet will only begin to feel some relief when companies begin hiring again. The balance sheet will only be helped when the liabilities side of the equation begins to reflect the real world value of the assets. There are many lessons to learn from the Great Depression. What those in Wall Street forget is that you have to create jobs to have a healthy economy. Without that, this is going to be a long and drawn out recession. Even Ben Bernanke had this to say:

“A lot of things happened, a lot came together, [and] created probably the worst financial crisis, certainly since the Great Depression and possibly even including the Great Depression,” Bernanke said at the start of a town-hall meeting in Kansas City.” – July 26, 2009

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

16 Responses to “The American Household Balance Sheet. Lessons from the Great Depression Part XXVII: Household Net Worth Drop in Great Depression 11 Percent. Current Net Worth Drop of $13.8 Trillion Equivalent to 21 Percent Drop.”

Thanks Doc,

Of course the Great Depression makes a good measuring stick but the obvious point is that we are witnessing the popping of the largest bubble ever devised by mankind. We are still in the early innings of this Great Deleveraging. A 21% drop might seem staggering but according to this news clip, we’ve only wiped out a few percentages of the total pie with much more to come:

http://www.cnn.com/video/#/video/bestoftv/2009/07/26/gps.recession.near.end.cnn

Where we will wind up at the end of the day is the complete annihilation of the middle class unless some kind of new reality dawns on ruling elites in Washington and Wall St (or an “awaking” of the sheeple). The crony capitalists have been at this now since the early ’80s (did you really think “trickle down” economics was designed to benefit the middle class?) and the Obama administration is being run by pawns of the elite. The reallocation of wealth to the top is nearing its conclusion. This class warfare has and will fundamentally change the nature of our society by undermining the very fundamental principles of the Puritans and other social and economic refugees who founded this great country.

As we are currently reexamining the Great Depression, so too shall future generations look back at the this period in time with great fascination. We are at a tipping point from which there may be no return without a complete breakdown in orderly society.

Be brave Comrades!

Quotes from Warren Buffet:

“It’s class warfare, my class is winning, but they shouldn’t be.”

CNN Interview, May 25 2005, in arguing the need to raise taxes on the rich.

“There’s class warfare, all right, but it’s my class, the rich class, that’s making war, and we’re winning.”

New York Times, November 26, 2006.

You mentioned the millions who will soon lose Unemployment benefits.

No surprise, it was mentioned on the Sunday morning news shows that Unemployment will be extended once again.

When it comes to any problem this nation faces, cost is no object. There are even people looking to the end of the 8K tax credit for home buying. What end? They are already talking about not only extending it but making it 25K!!!

When money grows on trees, what is to stop the U.S. from spending? Only one thing and that is the rest of the world waking up and refusing to accept money that is being created endlessly.

Until the rest of the world wakes up this Bologna will not end. Those who managed to save money will have it stolen via inflation. Anyone who thinks the government can print and print and print and print and think it is deflation that is the worry is doomed.

Deflation for maybe a couple years in housing, inflation in everything else is months away. Serious inflation in everything is less than 3 years away.

Unrelated to this article, but is there a conspiracy to make it look like housing prices are going up? I find many properties similar to mine for sale in the $160k-170k range yet according to zillow the value of my house in crease by $30,000 in the last 30 days. Much other data insists home values are on the rise, but I don’t see it. Even listed at $160k many of these houses still are not selling.

More words of wisdom: “Deleveraging is a Freight Train”

http://finance.yahoo.com/tech-ticker/article/294269/Govt.-Wasting-Time-%26-Money%3A-%22Deleveraging-Is-a-Freight-Train%2C%22-Boockvar-Says

Doc, I agree that alot of wealth has just vanished, but how much of that was “real” wealth. The vast majority of people who bought their homes before the bubble did NOT overpay for their houses. If they were smart and avoided the HELOC temptation, and paid off their house, the “loss” in the value of their home has been mainly psychological (assuming they didn’t fritter away their perceived appreciation on consumer purchases). It seems to be that the biggest losers are the people who bought at bubble prices, and the HELOC abusers. The only question is what percentage of the population are they?

I have the ability to be a “first time home buyer” but am still waiting until someone has the nuts to stop the generational-debt spending and make the stupid housing subsidies go away….I am willing to wait 3 or 4 more years for this but I’m starting to wonder how long they can keep the gravy flowing, which instead of helping out, is hurting people like me who want historical 3×1 LOWER PRICES, not $8k gimmicks that prop the prices up. If those asswipes in Congress (ex. Ron Paul, DeMint, etc.) go to giving away $25k in free money for the irresponsible, someone should go to DC with a giant wrecking ball and let’s start all over. I’ll get certified and operate it myself.

Are home prices in Japan affordable for the average salary? 3x annual income? Or are they still overpriced? I’m just wondering since so many keep comparing our governments reaction to the credit crisis as following Japan’s and their lost decade(s).

It has and will continue to fall on deaf ears. Stocks are in an unprecendented bubble this year only two years later (50% in 6 months could easily happen–has that ever happened?). This is the 5th super bubble since 1996. When will people learn? Never. All of the advanced societies, intellectually, throughout history have been destroyed by Mongols, Vandals, Conquistadors, etc. Only the foolish, bloodthirsty, greedy and violent have succeeded and we have descended from them. Don’t expect people to act logically and thoughtfully–we are emotional, foolish, greedy and egotistical. We will only do the right things when all other avenues have been exhausted. Don’t expect us use any better judgement about housing, because we have an even more emotional, foolish, greedy driver and that is the beautiful, young wife. We will do anything to try and make her happy. And fellas, sorry to tell you this, but she is also a diminishing asset, particularly if you think that buying her a dream house will make her love you more. But you will have to learn this for yourselves I’m afraid. Al Bundy is more likely than Donna Reed as a reality TV show…but Planet of the Alt-Apes is coming to a theater near you whether you like it or not…

@ Gman

If you think it’s just class, think again. Track down the history of the Khazars. Until you understand who stole our country you will never understand why their is a war. It’s not just about money. It is about annihilation. If you don’t know who the stooge is, you’re it…I’m afraid we’re it.

Thanks DHB for another good post. There is so much out there on the housing bust, that I don’t visit your site often enough. You were one of the few soothsayers. Keep up the good work!

Mish puts an interesting perspective on the inflation-deflation question here. As long as no one calls, the bubble prices can be bluffed. If they print a bunch of money but it sits in banks as reserves and does not go out as loans into the circulation, it is not inflationary. Maybe obvious to the casual observer, but I didn’t see it that way. Gas consumption is way down, but again fiat money is going into speculation on oil futures driving gas prices again. We give people money so they can screw us–ironic. We pay taxes to support overpriced food commodities–genius. We bail out the institutions that cause our housing prices to be too high–brilliant!

Is it just me or has the whole world lost it’s collective mind?

Alphonzo, you are right on, and the sad thing is nobody but us seems to care that the power elite get to screw the people coming and going, up and down, over and over, and to make it all that much sweeter, ON OUR OWN DIME! (and our Grandchildren’s) It’s just maddening, and (almost) no one cares. All the theft and looting is done in broad daylight these days, but If you try to explain to the sheeple how the scam works and has worked for a long time, they think you’re just a crazy tin-hat wearing fool. For some reason it is much easier for people to believe that Geithner and his wall-street/federal reserve kind really have our best interest in mind, than to believe that they could be criminally greedy and corrupt. Isn’t human nature and history easy enough to understand?

So what do you think the next turn in the market will be?

Here’s the thing.. If the stock market keeps rallying.. And the government offers a bigger $25K rebate next year… I don’t know if we EVER will see a true housing bottom at levels 2-3x income in desired areas of L.A. Well off people are making money hand over fist in this market.. I personally know a friend who bought a condo in 2006 market peak for $475K in the valley… (2bed/2bath). Overpaid.. yes… But he makes good money… and can easily afford it. He’s young and just started investing in the market 4 months ago.. So he’s up something ridiculous… Like $100,000… on the banks and casino stocks that are up like 10-15x… He’s now talking of buying a 3 bedroom HOME and selling the condo at a loss… Covering the difference with his recent stock earnings…

So i don’t know.. I know it’s a rare situation… But wealthy people are making a shitload of money in this market rally…If it was a stock market bottom.. Then the housing bottom wont’ be too far behind…

At this time of the year of 2009, December, is there anyone else wanting to comment on all those issue?

Sure, this time is a “government” induced bubble! But then, why must people talk about the “People” and the “Government” separately? Shouldn’t the “People” be the “Government” and vice versa? If a person can logically convince oneself on this issue with a very satisfactory peace of mind as a result, then everything else is so easy and peaceful, hahahahahahaha!

What is a revolution? Why does it happen? Is it about the “People” and the “Government”?

Leave a Reply