The Forbearance Tsunami: 4.7 million mortgages are now in forbearance with an unpaid principal of $1 trillion.

Let us clear something up regarding the last financial crisis with housing at the center of the market unraveling. The vast majority of the foreclosures that happened in the Great Recession occurred on standard 30-year fixed rate mortgages. There is this mythology that only subprime and NINJA (no income, no job, no asset) loans were the culprit of the entire collapse. This narrative fits into the crony capitalist mentality that somehow, only losers caused the crisis and that of course all of the suckers that got lured into a toxic mortgage somehow deserved losing their homes (while banks of course got bailed out with billions of tax payer dollars). A swift kick to the poor, and corporate welfare for the banks. It almost fits into this modern psychology of dis-information and revisionist history that we are now seeing. Â So it should be no shock to rational individuals that now, we suddenly have a whopping 4.7 million mortgages in forbearance (aka not paying their mortgage payment). This is not a good thing. The assumption is that people are going to start paying their mortgages back on time once the virus goes away but is that the case with so many jobs being lost? First, let us show you some data on the previous crisis for those that somehow forgot who lost their homes based on the type of mortgage on the property.

Foreclosure crisis during the Great Recession

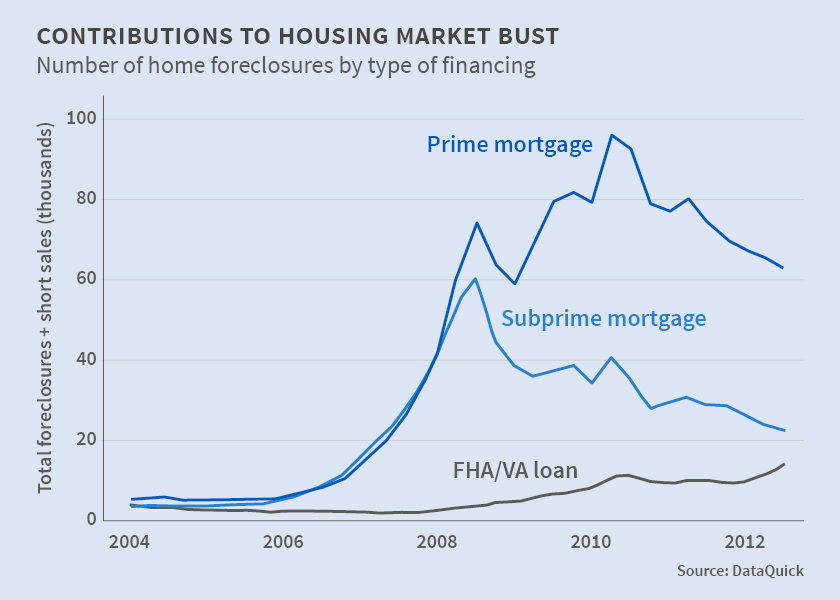

Here is some data from the National Bureau of Economic Research. What they found that while subprime borrowers did lose their homes first in the crisis, prime borrowers started dwarfing the subprime market through 2009 to 2012:

Why is that? First, the subprime borrowers lost their homes rather quickly but then those with standard mortgages still needed to make their mortgage payments and with no jobs or reduced incomes, they were unable to keep up as well. The chart above shows a very clear picture that while subprime mortgages caused a big problem, the impact was felt across many American households including those that took on mortgages under the “puritanical†guidelines that somehow are not brought up when looking back a decade ago. It should be noted that in every recession we face, you see a spike in foreclosures. And this is going to be a bad recession from the looks of it.

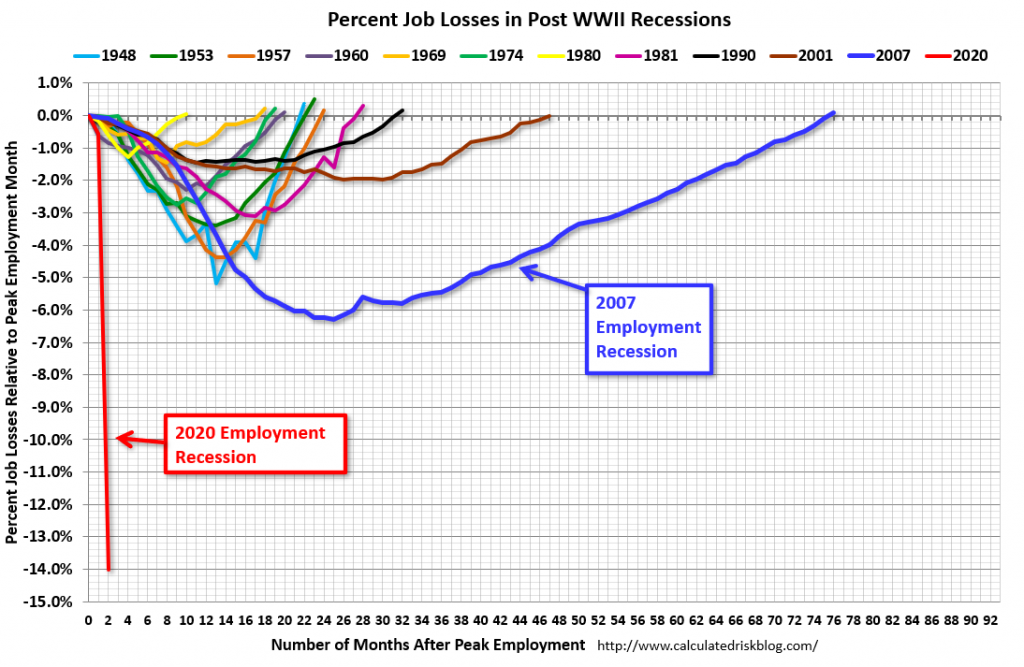

Now why is it important to understand this? First of all, the number of jobs lost in two months now has passed the number of jobs lost in the entire Great Recession. The fact that we now have 4.7 million Americans that have essentially paused their mortgage payments is startling. There are new guidelines in place that will allow these households to work with their servicers instead of doing an insane balloon payment in 3 or 6 months (how are you going to pay 6 months of backed up payments if you are having issues making one payment?). Fannie Mae, Freddie Mac, and the FHA are actually going to allow more creative options to pay your mortgage once the forbearance is over. Yet that is a big assumption that in 12-months, all of a sudden these 4.7 million household are going to be able to keep up with their regular payments assuming we recoup the insane numbers of jobs lost:

April saw a mind numbing 20.5 million jobs lost. That is the worst number of job losses in modern history. Yet somehow, housing is going to remain okay in this market where everything is getting hammered. The forbearance numbers simply reflect that this is not going to be a V-shaped recovery. People are struggling in this environment. Commercial real estate is getting smashed as well.

Let us add some more data. Between 2006 and 2014 (an eight-year window) 10 million Americans lost their homes to foreclosure. In a matter of two months, we now have nearly half of that figure of US households not making their mortgage payments.

This is going to have an impact on the housing market and like the Great Recession where subprime led the way initially, the downstream impacts from this hit to the system will be seen as the months go by.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

251 Responses to “The Forbearance Tsunami: 4.7 million mortgages are now in forbearance with an unpaid principal of $1 trillion.”

The loss of $1 Trillion in mortgage payments to the Banks makes them chew fingernails to the bone. They know many will never recover and as so they are digging their own grave. Forbearance breeds bankruptcy for the payer and the Payee

But according to some, not in CA, it’s different this time. From Bisnow on California. “Investors looking to snag distressed apartments and multifamily properties across Southern California during the coronavirus pandemic may have to wait a bit longer or go somewhere else. ‘There’s a perception out there that if I jump into the market today, I’m magically going to pay 20% less. That is not an unrealistic desire to want to do that,’ Universe Holdings CEO and Chairman Henry Manoucheri said.â€

“‘The fact is, there’s been very few transactions done since [the pandemic], and the adjustments I’ve seen is about a 5% number. The 20% number is not out there yet. There is still a huge disparity,’ he said. ‘Any seller used to the pricing four months ago is not going to sell unless they are really, really motivated.’â€

The San Francisco Chronicle in California. “In 2005, the owners of 2820 Scott Street bought the hundred-year-old property with the goal of turning it from a 30-room boarding house back into a single-family mansion. The multiyear renovation required an almost complete rebuild. In fact, the size could sometimes be a deterrent when showing it to buyers, according to listing agent Olivia Hsu Decker. ‘Some buyers used to complain that 2820 Scott has far more space than they would ever need,’ she said.â€

“The home has been on and off the market several times since 2016, at anywhere from $29.5 million to $27.5 million in 2019. They had a $25 million offer in escrow at the end of last year that fell through, she said, through no fault of the property. In the spring, when shelter-in-place restrictions went into effect, Decker said her owners could see the writing on the wall and quickly agreed to a price cut, chopping the price by a whopping $6.5 million to $21 million.â€

Stick a fork in it, Real Estate is toast.

Completely agree. Most “real estate expert” estimates for 2021 are in the +1% to -5% neighborhood. Heads in the sand.

While I agree with you in principal, that particular property is a white elephant. It’s too dated to be the showplace of a tech gazillionaire and not inviting enough to be a family home. It’s more suited to be a consulate or school. Whoever buys this ‘bargain’ will have to think twice if they think they’re going to make money on it.

The renter profile is getting hit the hardest: People with 2 part time jobs or low paying full time jobs. The vast majority of those people weren’t buying houses anytime soon. Keep in mind that for many of those people it’s more “lucrative†to stay at home due to the additional $600 a week on top of unemployment payments.

The Heroes act still has to go through the senate and it’s likely that the benefits will be extended.

The Forbearance terms and conditions vary from lender to lender. Often, it means that the owed payments are added to the end of the loan. Nobody is paying 3-6 months of owed payments in a lump sum back anytime soon.

In the meantime the SoCal housing market is starting to heat up.

Covid-19 causes historic low inventory levels. In 2007 you had 115k of active listings. Today it’s 31k. And interest rates are historically low with 3.00% for 30years. The FED said it will provide the liquidity needed. “No limit†– Powell, May 2020

I have been enjoying working from home in my beautiful house during these interesting times.

Pls give me call when housing is starting to fall by 5-10% as I am interested in buying an investment property.

Why would we bother calling you?

Haha… you are so lucky! We were supposed to be house-hunting right now, but of course, with no work? The underwriter threw out our loan app. So we get to shelter in place in a 400sf apartment. But yeah – I hope that this is a blessing in disguise for potential buyers. We almost ended up homeless three years ago when our former landlord flipped the house we rented from them for years. We’ve saved, saved, saved. And now everything is tabled, tabled, tabled.

Same here M, when it drops 20%,we will buy our last home before we retire.

M,

You are very fortunate, but the rest of us have to work for a living.

Your exactly right about it being more “lucrative” for many to stay at home due to the additional 600 from unemployment. When the media speak of “nurses” they are generally referring to RN’s (registered nurses). A step down on the totem pole, there are LVN’s (licensed vocational nurses) and one more step down the totem pole are CNA’s (certified nursing assistants)….what many people dont realize, is that the average LVN wage in Socal is $18-24 hour, while the average CNA wage, is minimum wage, or perhaps a dollar or two more. These are essential healthcare workers were talking about here, and neither of them are paid a living wage…. for LVNs and CNAs its also more lucrative to stay at home. It really is a no brainer, work and risk you and your families health for less, or dont work for more?!?! So you can toss your essential healthcare workers into the list of the vast majority that were not going to buy a house anytime soon. For myself, I am enjoying this whole covid19 thing. I have plenty of free time and more money in the bank. This virus is bringing to light many problems in our country, such as our for profit healthcare system, overprices housing, and over worked and underpaid employees. what are our essential healthcare workers worth to our country? apparently the same as someone flipping burgers at IN N OUT, as they are paid about the same…and our CNA’s are valued about as much as a walmart employee as they are both paid min wage…..the reality is, a hospital needs a CNA just as much as it needs its Doctors….the place cannot be ran without either. I truly hope an outcome of this pandemic is our essential healthcare workers being paid what they deserve. Oh yeah, these underpaid healthcare workers are also burdened with huge student loans they are unable to pay back with their wages. God bless america, its capitalist system, and for profit healthcare system………dont even get me started on why we didnt have enough gloves masks or ventilators. It was supply and demand, not shortage. The companies were selling to the highest bidder, just like on ebay, just as coumo had said.

@Kent: “Flyover is worried about California being a bankrupt state, yet ignores Trump increasing the national debt $4 trillion dollars in a few months time. You’re so fake.”

Kent,

There two problems with your statement:

1. It is the House of Representatives who has the power of the purse (you can check the Constitution for a refreshment course). The leader of the House is Pelosi and if you did not know she is a Democrat and she has a majority in the House. The president can ONLY say Yes or No. What president EVER will say no to spending in an election year?! That being said I do not agree with the spending and Trump, although he is a republican (in name only), he is not a Conservative (social or fiscal). So, yes, I do worry about all this spending, because it is going to be you and I along with future generations who will pay for this in less services, higher inflation and more taxes. Now, Pelosi said she wants to spend another 3 Trillions of dollars after she just spent 4 Trillions. At least for now, I am surprised that Trump and McConnell told her to take a hike. I am sure it is just for now and soon they will cave in. Remember! It is the House who has the power of the purse, not the president. The president can not make laws and he can not spend anything without the House.

2. A very BIG difference between CA and the federal government, like I said before, it is the power to create money out of nothing by the federal government. Even if they have that power according to the Constitution, they delegated it to the FED.

So, what I said above, are facts. Is it anything fake in what I said?

You are missing a few steps,. The president is the first one to submit a budget. Then the house considers it. And you completely left out the Republican-controlled senate and their role and the fact that right now it’s pretty much impossible to override a veto by the President.

Nobody pays attention to the President’s budget proposal. The House drafts their own, passes it and sends it to the Senate who changes it dramatically and then it goes to reconciliation and they produce a new copy that does not resemble either.

Not that I care 2 sh*ts for either of them , but how will local governments collect their monthly rents … er, property taxes….?? ..and the property insurance companies collecting their monthly shakedown…??

oh, the humanity..!!!

This forbearance of both mortgages and consumer debt has kicked the can further down the road. The SFH market in the southbay remains robust. Homes priced well selling quickly and even the overpriced crap shacks selling eventually at maybe 10% under list. I am seeing an uptick of former Airbnb units hit the rental market though. Real estate agent/friend sold a tear-down in Westchester (near LAX) with 14 offers over asking last weekend. So that leads me to believe that developers still think there’s gas in the tank. Locally high paying tech layoffs haven’t hit [yet]. Like the illogical stock market I think we won’t see a decline in SoCal real estate for another 12 mos unless we see a lot of local layoffs or the continued stifling of small business due to covid. We aren’t done folks.

Optimism and bullish sentiment is always the highest at tops, except for RE industry shills. For them “it’s ALWAYS a ‘good time to buy!'”

And it actually is. You can’t go wrong with buying in SoCal for the long term.

The best time to buy a home to live in was yesterday. The second best time is today.

But only if you can comfortably afford it. Don’t buy too much house.

Keep money on the sidelines for a rental when deals are available.

Buying a home in SoCal is a must. Renting long term doesn’t get you anywhere.

When is it not a good time to get a commission check, I mean buy a house?

Flyover – I would dial down the smarty pants tone if you’re going to embarrass yourself with a “refreshment course.†I’d like some lemonade myself.

What did Flyover state that would be embarrassing? Everything he stated was factually accurate, excepting opinions (which are just that, and are not facts one way or the other).

A lot of what is going to happen in the RE market depends on how long our communist governors keep the economy still. At some point, regardless of what the FED is doing, the derivative market (weapons of mass destruction) is going to explode and destroy along with it the bond market, the stock market and RE market.

They are playing with fire, but according to our Bob, they have our best interests at heart. It is nice to believe that, but he is the first and only one I ever met who believes that politicians have his best interest at heart. It must be nice to live in such a blissful world!…

“but according to our Bob, they have our best interests at heart.”

No politician wants to end up like Tsar Nicholas or Marie Antoinette.

However, the Democrats in the House passed a Coronavirus Relief Bill that would actually help renters and mortgage holders. The Republican Senate and Trump said they would not pass it and veto it.

The Republicans are telling the voters that they already bailed out the corporations and the stock market and everyone else can just “Go out to your local crowded bakery and if you don’t get sick or die, Eat Cake”

We have seen this before and it didn’t end well for those in charge.

Bob: “We have seen this before and it didn’t end well for those in charge.”

I agree with you. When Trump said a month ago that he is the “Emperor”, Newsom was incensed and said that according to the constitution, in CA he is the one in charge. Since indeed he is the one in charge, I don’t see how this can end well for him.

Louis XVI and Nicholas II were initially sidelined by Lafayette and Kerensky. Both of the replacements were overthrown by violent brutal radicals who killed the royals. Lafayette and Kerensky both escaped. Lafayette had some protection from his American connections. Kerensky eventually wound up in America. Lafayette eventually was able to resume his political career in France after the Napoleonic era, but Kerensky died in exile.

Marie Antoinette’s family were a big deal (Royal family Austria-Hungary), and she had a lot of influence over her husband. But he, not her, was the ruler of France before he fell out of power. Her death made the Austrians angry with Lafayette as he had weakened the French monarchy before fleeing to Belgium, and the Austrians held him prisoner (along with the Prussians in a series of prisoner transfers). His American friends stood by him and with help from Napoleon he was released.

I see no similarity between Trump and any of the Royals you mentioned. But you have a narrative you want to push, so you pick figures from the past that have a bad reputation of the sort you want to exploit. (I personally would’ve compared him to Huey Long if I were holding your political position… he was murdered, too, and was one hell of a talker.) Trump will either be re-elected, or replaced by a doddering old clown, and go into retirement … public like Obama or private like W is his choice.

JoeR,

Thanks for the history lesson.

The point is that Tsar Nicholas and Marie Antoinette ignored the masses and figuratively told them to “Eat Cake” and die. Essentially to save the wealthy class.

That is what the Senate and Trump are telling renters and mortgage holders. The only group that seems to care are the Democrats in the House.

We have seen this before. Trump and the Republicans should read your history on Nicholas and Marie.

Again Marie Antoinette WASN’T the head of the French government. She was an unpopular foreign Queen whose supposed extravagance was a rallying point of the opposition. And the real lesson was that in both cases, a popular democratic revolution was hijacked by murderous radicals who began reigns of terror. Lafayette and Kerensky were way more likely to actually help the people of France and Russia than Robespierre and Lenin. So do you want a radical revolution that totally destroys our economy a la Venezuela? Or do you want to help elect Joe Biden, who is a grafter of the first order who merely wants to skim a bit off the top for his friends and relations and send Federal money to crony politicians and crony capitalists. I wish we had a different choice in November, but there hasn’t been a serious third party threat since 1912 where the third party finished second.

The delusions of the SoCal real estate market have infected other areas of the country now . I’m from Denver and this is from an article written a week ago in a local paper.

The volume of properties available makes sense when viewed from a historic perspective, Smith contends: “People are going on about how we’re going to have a crash like in 2008” during what became known as the Great Recession, he notes. “But the circumstances are entirely different. What happened in 2008 was the result of bad mortgages, which are not being written anymore because of controls implemented as a result of the crash — and also there was overbuilding in 2008, whereas now not enough homes are being built.”

The economic downturn “could be felt in the luxury market,” he acknowledges. “The million-dollar homes may suffer a little bit, but not much. Although rich people have a lot of liquidity, it’s mostly in stocks, and it’s not a good time to sell stocks when the market’s depressed. But the lower-middle class, the middle class and the upper-middle class, to the extent they can afford a home, are still a strong market. Millennials need homes and baby boomers need to downsize. I’m totally convinced of that.”

Yes bad mortgages were the cause of the last recession but that’s all fixed now! Not to worry oh and also millennials and middle class folks are a strong market…uh huh.

Not sure what your are smoking , but pass it down. No jobs, no money, no buyers. It is amazing that some greedy property owners keep raising rents despite the fact their mortgage payments have dropped year over year along with interest rates . I have one rental in Huntington Beach . Same renter 15 years. I could get 4K in rent if I wanted but have not raised rent because I have refinanced and pass the savings to my renter.

Sandy, your best tenant, M, just moved out.

Will you raise the rent now?

I can understand holding rents to a lower level when you have a great tenant.

If that tenant leaves, what will you do? There is more risk now unless you personally know the tenant or they are family.

If you don’t keep rents in line with the market, you are exposing your business to grave risks. AB1482 limits rent increases – I assume you’re an individual owner, so it doesn’t affect you. But the proposed measure for November (local rent control for small landlords) may affect you, and may prohibit increasing rent between tenants (no vacancy decontrol). And if that doesn’t, some other communist measure from California regime might.

In short, one way or the other, you may be unable to raise rent sufficiently exactly when the inflation picks up, and all your costs (including living expenses) shoot up.

You can trail the market rate by $100 or $200 or whatever, but you should always be close to it. Because the choice may be soon taken away from you.

Of course, that will cause many small landlords in CA to sell. This will reduce the affordable housing when needed most. Another testament to stupid, communist California government (People’s Republic of California), led by Comrade Newsom.

If you don’t keep rents in line with the market, you are exposing your business to grave risks. AB1482 limits rent increases – I assume you’re an individual owner, so it does not affect you. But the proposed measure for November (local rent control for small landlords) may affect you, and may prohibit increasing rent between tenants (no vacancy decontrol). And if that doesn’t, some other communist measure from California regime might.

In short, one way or the other, you may be unable to raise rent sufficiently exactly when the inflation picks up, and all your costs (including living expenses) shoot up.

You can trail the market rate by $100 or $200 or whatever, but you should always be close to it. Because the choice may be soon taken away from you.

Of course, that will cause many small landlords in CA to sell. This will reduce the affordable housing when needed most. Another testament to stupid, communist California government (People’s Republic of California), led by Comrade Newsom.

If you do not keep rents in line with the market, you are exposing your business to grave risks. AB1482 limits rent increases – I assume you are an individual owner, so it does not affect you. But the proposed measure for November (local rent control for small landlords) may affect you, and may prohibit increasing rent between tenants (no vacancy decontrol). And if that does not,, some other communist measure from California regime might.

In short, one way or the other, you may be unable to raise rent sufficiently exactly when the inflation picks up, and all your costs (including living expenses) shoot up.

You can trail the market rate by $100 or $200 or whatever, but you should always be close to it. Because the choice may be soon taken away from you.

Of course, that will cause many small landlords in CA to sell. This will reduce the affordable housing when needed most. Another testament to stupid, communist California government (Peoples Republic of California), led by Comrade Newsom.

Flyover, you make my heart sing, always. Thank you so much for your informative posts.

You know it’s bad when Newsom is begging for Federal bailout, threatening to reduce firefighters while giving illegals stimulus checks.

When will prices start to drop?

Once inventory skyrockets you should get ready.

When you have historic low inventory and historic low rates it’s impossible for prices to drop significantly. The quality houses priced well sell like hot cakes here in SoCal.

M I think your somewhat delusional. Prices on SFR’s Tend to stick and won’t come down right away. While I agree with you 100% that inventory is low and there won’t be price adjustment anytime soon (give it another year), I think everyone needs to look at the ripple effect that’s going to occur. As I mentioned in one of my postings the key to understanding where the market is going to go is to review the commercial real estate market. The good Dr. wrote a sentence about it. It is going to get a beat down like you’ve never seen before. Why is going to get a beat down? Because business’s are not going to be reopening. How do I know this you ask because I work in the commercial market!!!No reopening no jobs simply put! No hard science behind that logic. City’s, counties and state employees are going to lose there jobs and or have pay cuts. The California budget is a mess!!!

Yes, Bootz, but Governor Newsom has Bob interest at heart in everything he is doing. He is bankrupting the state, puts millions out of work, wants to keep a first class medical system in a third world economy, all because he has Bob interest at heart. If only one life can be saved (Bob’s) who cares about millions who will become homeless and tens of thousands will commit suicide?!!! Who cares about millions who will lose their houses and cars to the bank if few precious lives will be saved and millions lost because they will have no job, no medical insurance and no place to sleep. At least the National Guard will bring food at food banks.

The beating will continue until morale improves – that is November 4.

Flyover, please don’t include me in your political rants! Let’s just stick the subject matter!!!

Flyover, are you fighting for the Proletariat masses?

M, you just caused me to slide off my chair. Here’s what you said:

” also thought of having a live-in nanny when my current one moves out. An Older woman who would get a low rent but would clean my house, buy groceries and maybe take over gardening. Will see what happens.”

REALLY???? Do you honestly think some older woman, or anyone else, should be a nanny, and clean your house, do your grocery shopping, and even weed the garden, in return for nothing more than reduced rent? Any of these, except, perhaps, the “little bit of gardening” or the grocery shopping, is a full time job that rates a full time paycheck.

Laura is correct. Milli is describing a live-in maid.

A live-in maid usually gets a reduced salary, in exchange for free room and board (i.e., Milli would have to feed her as well).

It seems that when Milli is not breaking into his neighbor’s pool, he’s trying to stiff low-wage workers of an honest day’s pay. And he called Boomers greedy.

Laura Louzader: Let’s just hope he’s trolling as per usual. Sadly, there obviously are plenty of people like that in the world that have zero problem exploiting others under the thinly veiled guise of doing them a favor.

Guys, I don’t want to take advantage of an older lady renting from me. If she wants to clean I can pay her either via Venmo, check or bitcoin. Or I deduct it from her rent.

If she goes grocery shopping and picks up a few extra things for my wife and myself in exchange of below market rent, i think that’s fair.

Alright, here is a question for our perma bears.

When is the forbearance tsunami going to hit the SoCal coast?

Can’t be anytime soon since demand is up 41% in the last two weeks.

The housing market was strong going into this covid thing. Now you see what it means when you have qualified buyers and super low demand. Market is heating up quickly. I wouldn’t have expected that.

The demand curve Looks like a big V. The expected market time is an upside down V.

San Diego, expected market time at 60days! Knock, knock! who’s there? Sellers market! Who? Hot sellers market!

The biggest problem I see with your recent purchase is that your ‘granny flat’ which will contain no granny, but a tenant that will live inside your home. This stranger (I mean tenant) will have friends, family, lovers which he or she will also want to bring inside your home. Hopefully your wife won’t mind.

This all could have been easily avoided if you had simply followed your own advice and waited for the correction to occur. You could have bought a bigger, better home with a ‘detached guesthouse’ for extra income and your own privacy, and for much less money. No mysterious strangers in your kitchen or laundry room. I don’t consider myself a real estate expert like you, but even I wouldn’t have made such a rookie mistake.

I predict that Milli will eventually announce that he’s found a dream tenant. Rich, low maintenance, never complains, pays above-market rent, and always pays it ahead of time. Plus, this dream tenant is almost never home, no wear and tear on the unit, because he travels a great deal. Just direct deposits his fat rental checks into Milli’s bank account, ahead of time.

Rofl Rick!!

My stranger in the house knows she can’t have sleepovers or she will get a spanking.

I do like she’s paying nearly a third of my mortgage but I agree, I need to add to my RE portfolio and buy a fixer SFH as an investment.

While poor people like Rick have to wait until the market corrects to buy, people like me will buy an investment property if the market corrects.

My purchase was a boss move. Got really lucky with rates going down significantly while I had already locked in my price.

son of a landlord, I think the much more likely scenario is that M’s tenant (who is rich as you stated) will become best friends with M and his wife. Then the tenant will have an unfortunate demise, and leave her fortune to M. M will then be able to realize his dream of becoming a real estate landlord/mogul and will live happily ever after. And he’ll still have the time to share the new with all of us!

Son of Landlord,

I don’t Ask for a high rent. It was more important to me that the tenant has good credit, no pets and appears to be clean. I took a hard look at her car etc. I admit it isn’t ideal to have a tenant in your house. We have extra rooms and could rent those out too but I think I would prefer buying a fixer upper as a rental.

I also thought of having a live-in nanny when my current one moves out. An Older woman who would get a low rent but would clean my house, buy groceries and maybe take over gardening. Will see what happens.

M, you can’t prevent a tenant from having pets. After a tenant moves in, if she suddenly needs an “emotional support animal,” she has a legal right to it, regardless of what the lease says. It’s easy to get animals certified as “emotional support animals,” and legally, you have no right to challenge her on it.

Pray it’s only an “emotional support cat.” I don’t know if the law protects “emotional support camels,” but I’ve heard of all sorts of “emotional support” wildlife brought aboard planes, from hogs to miniature ponies.

My father had all rental checks sent to his P.O. Box. He was determined that his tenants not know where we lived.

Plus, our house had two phone lines. Once was the “office phone,” which he only answered during office hours. He didn’t want tenants to know that the “office phone” was actually in his house. Otherwise, they’d have been phoning 24.7.

He also had supers to deal with the tenants on a day to day basis.

A wise landlord keeps an eye on the tenants, but makes sure they can’t keep an eye on him.

I told her no pets and she said she doesn’t have any.

If she has emotional problems she’s a goner. I will just say I kick you out because my mother in law must move in or some other BS reason.

Honestly, I really like animals and if she wants to get a little baby tiger Or liger (hybrid offspring of a lion and tiger) I would probably okay with it.

Serious question, M. Have you been screened for bipolar disorder?

No, why?

Because I used to be a bear and became now a proud homeowner in SoCal and RE bull?

Why remain stagnant and not evolve?

He is a millenial…they are schizophrenic because we built them like that. Millenials are the worst generation (and dumbest) since the fall of the roman empire.

Two plus two, you sound jealous. Does it bother you if millennials can afford nice houses?

M was a troll created by one of the REIC shill here to make ridiculous predictions like 50 to 70% crash before he buys. However, once this prediction comes true they now switch him to a housing bull who just happens to buy at top peak of housing bubble 2.0.

You’re right, M. It won’t be any time soon. It will be in 1 – 2 years. Forbearance is not indefinite and real estate is slow to react. Not every borrower will qualify for loan modification and some will be unable to resume regular payments due to employment trouble. Many will sell to escape with cash while others foreclose.

The only other outcome I can imagine is a miracle in the job market. “San Diego County’s estimated unemployment rose to a record-high 28.7% this week, according to a report by SANDAG.” The most optimistic predictions are for a recovery to the point of 10% by year’s end. The best case scenario is as terrible as worst point of the Great Recession.

I know the federal government is trying their “best” to “help” but history shows that they are anything but all-powerful. I don’t expect your old predictions of 50% – 70% to materialize but I think 30% in SoCal is possible in time.

When is the forbearance tsunami going to hit the SoCal coast?

As of right now possibly almost a year away due to Government legislation. The short sales should start in early August when the extra government unemployment checks stop but they could always extend them.

When the non bank lenders start to declare bankruptcy you will know we are getting close.

so cal housing may tank hard this time. I know a friend working as a financial advisor. he has been receiving calls from landlords inquiring the market. they are worried they wont be able to make their mortgage payments due to layoff, pay cut or other income reduction. even though they are not selling today. whether they have to go to foreclosure process is unforeseen. best luck to them.

WOW!!

Purchase application data…..if you are a perma bear please sit down before you read this.

33% increase since the covid low!! That means YoY you are down by just 1.5% in purchase applications. As a perma bear you will have a very tough time telling yourself that there is no demand!

Speaking of no demand. Guess what the expected market time is for houses in the 500-700 range for San Diego as of last week?

36 days! 36 DAYS!

May I remind you that below 60 days expected market time we refer to a HOT sellers market.

36 DAYS….That means those homes sell like ice cold lemonade during a brutal, hot summer day.

M,

More likely it will be crashing after the US election in November.

Sure, it will crash very very hard. Brutally hard. Starting December!

In the meantime we hit a new record high in home

Prices!!!!:

https://www.barrons.com/amp/articles/the-median-home-price-reached-an-all-time-high-during-the-coronavirus-heres-why-51590075593

Milli, the article you link says in its first paragraph:

Low inventory in the residential real estate market drove the median sales price of existing homes to an all-time high in April, according to the National Association of Realtors’ April Existing Home Sales report …

YOU are citing the National Association of Realtors as a valid source?

Yet you told us — spammed us, you posted it so frequently — that all realtors were liars. You often mocked the National Association of Realtors and any “RE cheerleader” who dared cite the NAR’s reports.

Has your opinion changed on that TOO? Do you now claim that the NAR is a sterling source of real estate information?

(I’m not saying I accept or disregard the NAR, just noting yet another sudden turnaround on your part.)

M, you must be really young guy and don’t remember how it played out last time ( 2008) . The uptick you see in the median price is due tio change in th emix of properties it is the last breath of the market before the plunge. What is hapening high end / luxery mutimilion properties still get sold and the low end of the market in abrupt stop. This may skew median price with 10% and up. It hapened exactly the same last time . In LA beach sities in 2009 median was still rising when in Las Vegas and Phoenix was full catastrophy beware. I am hoping to buy rental in Vegas but next year …

Son of landlord

“ Has your opinion changed on that TOO? â€

It absolutely has! I think there are good realtors out and and a few not so good ones.

Bubblehead,

Wasn’t the peak in 2005 not 2008?

In 2007/2008, inventory in SoCal was at 115k active listings. Today it’s at 31k.

I am also waiting for lower prices to buy a rental. And I am not a fan of median home prices either. However, the lower priced homes are selling very fast in SoCal. The high end houses are sitting longer. It’s the opposite of what you are saying. Provide some data pls.

The housing bulls vs. housing bears debate is very entertaining. In the few years of following this blog, bears have became bulls and bulls switched to bears.

While admittedly bias, I’ll provide my opinion. Bad things happen to housing during job-loss recessions. Saying that the current recession we have entered qualifies as a job-loss recession is a severe understatement. This is only the beginning. It has been a well documented that even IF the economy would open up tomorrow, approximately 1/3 to 1/2 of the jobs lost will not return. This does not only concern low income households. Price reductions in housing take a long time to peculate through the system.

Even if the FED went negative on rates, the pool of qualified buyers has and will continue to significantly shrink. Who cares what the interest rate is if you can’t get a loan. While some will buy with cash, lets not fool ourselves. Most RE purchases require loans (10%, 20%, etc.)

A question for Mr. M – if everything is as peachy as you seem to now believe (hilarious by the way), why are all the major financial institutions significantly altering lending standards? They now require significantly higher FICO scores, 20% down payment, triple checking income, even requesting last two pay check stubs before escrow closes (in case someone lost a job, been furloughed, or took a pay cut since initially been approved), eliminating HELOCs (can’t appraise a property based on old comps), etc…

I am not an expert, but here are my predictions for Los Angeles (Southern Cali) housing…

1. By the end of summer 2020 significant amount of supply will hit the market.

2. By the end of 2020, housing prices will fall by approximately 10-15% (Mr. M…your chance to buy that rental property you’ve been typing about).

3. By spring 2021 (hottest time for housing), it will become clear that prices need to come down more, as unemployment will still be in the teens.

I think it is safe to predict by the time everything is set and done, Los Angeles (Southern Cali) prices will take a 1/3 haircut at the bottom. If COVID produces a second-wave and if the stock market re-tests or creates new lows…all bets are off.

It all comes down to jobs in the end.

Analyzer,

By end of 2020 we see 15% drops in SoCal prices? Alright!

So then you agree with me that purchase application data (forward looking indicator) and inventory data need to change dramatically soon right? We all know that lower sales volume isn’t enough to crash a market. You need skyrocketing inventory for that to happen. Right now, expected market time indicates we are in a sellers market. Some local markets are at the brink of being a hot sellers market. That needs to quickly change if you want to see significant drops in prices!

Less demand doesn’t mean prices drop. You have seen how covid caused demand to drop like a rock. It recovered as of the last few weeks but let’s put that aside.

What happened during the demand drop? Sellers pulled back listings.

In 2007 you had 115k active listings in SoCal. Last year it was 41k and 1-2 weeks ago it was 31k for sale.

People under estimate what it means to have a housing shortage. We live in a time where only those that are financially sound can make a purchase. Those qualified buyers don’t have to abandon the farm at large discounts at the first sign of trouble.

Take a look at my neighborhood ( new, large, beautiful homes): the people who bought have money and have high paying careers (doctors, executives, supervisors, financial analysts, VP’s, etc) or the couple has middle class jobs (police officers, fire fighters, nurses etc) and somehow came up with a large down payment or they sold a previous home and Paid almost all cash. People are at home/outside during this time and they talk (and have a drink or two in their BY or front lawns).

None of those people has talked about being worried what the market will do and getting ready to sell. They seem to enjoy working from home during this time and take more walks during this beautiful weather.

This is roughly what I forecast for my own financial planning purposes. We both could be wrong though, if the Fed succeeds floating the stock market and real estate with all of the printed money. The one thing that scares the crap out of powers that be is the crash in asset prices. The financial system cannot handle it, the rich people cannot handle it, the government cannot handle it, the pension funds cannot handle it. So THEY will do everything they can to float asset prices, even if through inflation and through associated drop in the standard of living for working people. With zero interest rates institutional investors can keep assets off the market for a long time, artificially suppressing supply. The Fed can finance the whole charade for a while.

I personally would like to see real estate prices come down to affordable levels and I think there is a good chance that they will this time, which would be a good a thing for ordinary working people in the long run. But if the bankers manage to avoid the crash this time, I might throw in the towel and buy, if I don’t see downward movement in real estate prices by spring 2021. Incidentally, that is when my current lease expires.

Good analysis. It’s truly sad that the “powers that be” have manipulated the markets so much to disallow price corrections. I don’t know what kind of economy we have anymore.

@Thorbert: “I don’t know what economy we have anymore “

It is called “central planned economy “, where the FED acts as the Central Committee picking winners and losers. An economy where prices are marked to fantasy and contracts mean nothing definitely is no longer a capitalist market economy.

“I personally would like to see real estate prices come down to affordable levels and I think there is a good chance that they will this time,”

Me too.

There are 2 ways this can happen.

1) Short-term: A tremendous crash like in 2008.

2) Long-term: A persistent rise in inflation and wages like the 1970 and 1980’s

Some stretched and took option number 2 in 1987. That “outrageously expensive” 200K house in 1987 (40K when it was new in 1972) when they were making 30K/year was worth 800K in 2018. It did drop to 500K in 2010 with a 30% drop. Now it is worth about 700K with a 12% crash. Mortgage payments on the house after 33 years are now nothing. Even if there was still a mortgage, it would be under 1K/month with the low current rates. Prop 13 taxes are now 300/month. The neighbor house is renting for 4K/month. The benefits of long term house holding.

With all of the Fed “free” money sloshing around, I expect inflation to help anyone owning a home. It may help in the short-term for renters, but a fixed rate mortgage helps anyone in the long term.

Ever since I lived in S. CA, housing has NEVER dropped to an affordable level. However, it has when you count long-term inflation.

@ Seen It All Before, Bob

I don’t disagree with you that owning wins over renting over long-term. That’s not what I am hesitating about. The question is: do I enter ownership now or do I wait for a price correction, which is long overdue?

In 2019, I had finally saved enough for a nice enough house in San Diego burbs, my income was finally enough to buy responsibly, my kids were both entering public school system, career stability etc. etc. So I started looking into ownership. That’s when I did my research and arrived at the conclusion that this looked like an asset bubble. This is when I found this blog too. So I decided to wait and see if I could save hundred thousand bucks or so by renting for couple of years longer. That simple.

The whole notion that us “perma bears” or “crash boys” are advocating for never owning is bull. We just don’t think the asset prices will hold for much longer and don’t want to be the ones making the speculators rich.

I am renting a nice-enough 4 bedroom house that I would not mind owning. My rent is $3,000. It would cost me roughly $800K to own the house with monthly property interest, taxes, and insurance EXCEEDING my current rent. I am not even factoring in maintenance and lost investment income on the down payment for simplicity. So I don’t feel like I am losing money by trying to time the market better.

It is starting to look like this approach will work well for me more and more. I will reassess my position in Spring of 2021.

@San Diego CPA – you and I are in the exact same boat. Well said.

San Diego CPA, and Throbert.

My crystal ball is broken. I bought my current house in 1993 so the 2008 crash didn’t faze me 15 years later since enough equity was built during the 15 years that it would not have affected me even if I had to sell. No pressure for me at that time. I know co-workers who bought in 2006 and half held on and are now doing well, the other half who foreclosed are not doing well. You can’t get into a good position unless you own for long term. Renters think short term. It was a good time to rent in 2010 at the bottom of the crash. However it is a bad time to rent at the top and for the long term. There is no end to rent even when you are long retired and are 100 years old. A mortgage is done in 30 years max.

Should you wait for a market correction? Since we saw this in 2008 when Our Millennial was just getting out of diapers, I think it is likely to happen again. I can’t tell you when (darn broken crystal ball). Buy low and sell high has been a time-tested tradition.

However, given the long term investment in a house, buying now has never failed anyone who has held the house for 20 or 30 years. Never failed, ever, ever, ever….

Except for a meteor hit or earthquake. I guess if you bought in downtown Detroit in the 1970’s you likely only broke even today.

Based on history and uncertainty, I would put the downpayment in a low cost index ETF and hitch a ride back up in the stock market while Covid goes away. CPAs will likely do better with investment advice than me. 🙂 Housing lags stocks.

After Covid hopefully starts to dwindle in early winter, look at houses during the non-panic peak season. Never buy when bidding wars are happening. They are so ridiculously full of emotion without any rational thought.

Even if you buy at a peak, like M, you will do well after 10-20 years. Just know when to hold them and when not to fold them (ie panic). Keep 6 months mortgage payments in reserve cash savings and there will be no need to panic.

My 2 cents on being old enough to be lucky. However, buying a 200K house with 30K income, was very stressful in 1987. It all turned out OK in the long run.

BTW, if your rent is 3K/month, the mortgage on 640K (20% down, 3.5% 30year) is 2870/month with 1K per month going to principal. With 1K likely going to TI, you are actually paying about the same as rent. Well, as long as the roof isn’t leaking.

Therein lies the problem. No matter how long the Fed eases it, there will come a day of reckoning when buying securities peters out and interest rates increase forcing all assets to adjust to a new normal.

We have never been here before with so much corporate and individual debt. We have never had this low long term interest rates for as many years as we have seen. We have to believe that this can go on forever but that makes no sense. Is this worse than 2007? We shall see. One thing for certain is the new normal for our economy will look nothing like the past few years. When buyers cannot qualify for a mortgage, there will be a correction which will cascade into price concessions from sellers in time regardless of how little inventory exists. It always does.

markets are different everywhere, Orange County CA has an inventory problem, not a demand problem. So many of these statements are not based on analytics and are just ridiculous. The 57% of the food service industry that’s unemployed is not the market here. It’s all about affordability and over 50% of the country has more than 50% equity in their property. Equity is at an all-time high and people haven’t used their homes as ATM machines; the average homeowner nationwide has $173,000 in equity and in OC it’s higher than that. Demand in our market exceed good saleable supply and would love to see anybody in forebarance add that to the listing inventory we desparately need. What’s been going on in May is completely different than what was happening in April. Also price point dependent, the over $2.0 market has slowed, the under $1.0 market is on fire. In the last two weeks we’ve written 4 offers up to $1.7 million and multi-offers on all properties, a total of 19 offers on those 4 properties that were priced at market, not below. Once Supply exceeds demand, then maybe what you are hoping for will happen, but right now, we are not seeing it, not even close. The real question is what will happen after all the PPP money runs out and will people who actually can afford buying homes in OC lose their jobs. People in Forebarance most likely have equity and can always sell, the real issue is when Supply exceeds the demand and we are only seeing that in the much higher price range. Perhaps that will push prices down across the board, but still nothing in the analytics showing that yet. I’ve never been a crystal ball gazer. Of course, if you say the market is going to crash soon every year, then eventually you will be right, good luck with that.

Dean OC: Why are you asserting that the job losses have/will primarily only affect low-wage workers? For instance, Souplantation is closing for good. Yeah, most of their workers were lower-wage workers at the restaurants and food prep facilities, but they also had accountants, management, HR staff, IT people, etc. All of those people are now without jobs, too. PPP wont do anything for them since the business is closing. Same with small business owners of restaurants, etc. that will close for good. And then there’s the reduced demand for services all of these places used (food delivery, outside accountants, software systems, etc.). The former small business restaurant owners can try starting a new restaurant, but good luck with that in the new economy. I think there’s a very good chance that there will be a cascading effect that will eventually impact people from many avenues of employment (certainly not just low wage workers).

In summary, I think it would be remiss (to say the least) to assume that there wont be at least some negative effect on house prices from the pandemic (or plandemic, if you will).

Excellent post, Responder. I keep reading on here how all these “low wage earners” aren’t buying homes so it’s not going to affect the economy. BS! Lots of high wage earners are tied to various industries.

I have many friends who will/are being affected. One of my friends is an executive chef for a high-end restaurant. He also runs a catering business on the side, mainly for weddings. His wife is a hair stylist and owns two salons. They are in trouble to say the least.

While the person waiting tables is probably not buying a home in OC, he along with millions of other low wage earners spend their money on goods and services. They will not be buying cars or taking a flight anywhere soon.

Speaking of cars, I read Hertz is preparing for BK and just cancelled 90% of their new car orders. A lot of people will lose their jobs along with some decent manufacturing jobs still left in this country.

Responder – I wonder why people keep repeating that too. Low wage earners are disproportionately affected but that doesn’t mean professionals are unaffected. M likes to talk about San Diego…

“…unemployment in Logan Heights was the highest at 37.5 percent. It was followed by College Area at 32.8 percent and San Ysidro at 32.4 percent. The least affected areas were Sorrento Valley at 22 percent, Scripps Ranch at 21.6 percent and Del Mar at 21.5 percent.”

https://www.sandiegouniontribune.com/business/economy/story/2020-05-06/san-diego-county-unemployment-estimated-at-27

Logan Heights is the bottom of the barrel. Del Mar is tip top and least affected, yet still experiencing 20% unemployment. Folks in Del Mar are wealthy. Not worried about them. But your accountant in Scripps Ranch? There’s real concern there.

The fact that a literal shack in Logan Heights is the “best deal” around at $500K tells you SoCal is due for a correction and it certainly looks like COVID-19 is this cycle’s catalyst.

Turtle,

San Diego is in a hot Sellers market for below 700.

Just because people think 500k is to much for a certain house doesn’t mean the market corrects. The supply problem is key. We are knee deep in a recession and prices grew 7.4% yoy.

Do you know what hot sellers market means for San Diego? There are bidding wars for homes in the 500-700’s. The expected market time is 36 days!

Great post Dean! I agree. Our perma bears have to wait a bit longer. San Diego data is pretty hot at the moment with homes below 700k selling within 36days of expected market time.

Real Estate to TANK HARD in 2021

Real Estate to TANK HARD in 2021 -The Orange County Register in California. “Home sales plummeted in Southern California in April, the first full month caught in the grip of the coronavirus lockdown, new housing figures released Tuesday show. Tighter lending standards also made it much harder for homebuyers to get financing last month. Non-traditional loans vanished, minimum FICO scores were raised and jumbo loans used to buy higher-cost homes grew scarce. ‘Buyers were less able to secure loans during this time,’ said Taylor Marr, lead economist for Redfin. ‘LA, in particular, has a higher-than-average share of homes that (require) jumbo loans.’â€

“Additionally, buyers fearful of future price drops paused their search process or withdrew their offers. About 40% of buyers withdrew offers in April, said CoreLogic Deputy Chief Economist Selma Hepp.â€

From Realtor.com. “The vacation home rental market, dominated by such players as Airbnb, VRBO, and HomeAway, has taken a huge hit. Many homeowners who had relied on rental income have been forced to either try to sell their homes or completely revamp their business model to stay afloat. ‘One of the things we’re seeing is a remarkable collapse of the short-term rental market, particularly in cities. The viability of running dedicated Airbnb operations is not looking good right now,’ says professor David Wachsmuth, who studies home-sharing platforms at McGill University’s School of Urban Planning.â€

“A pair of nightlife hot spots saw the biggest increases in furnished short-term rentals in the United States: Nashville, TN, with a whopping 185% leap, and Austin, TX, with 160%. The number of furnished rentals being offered for longer stays in New Orleans shot up 48%—sixth highest in the U.S.—though, it probably would’ve been far higher had local governments not banned nearly all short-term rentals six months ago.â€

“‘It’s causing [rental] prices to fall in areas that had a lot of short-term rentals,’ says Brett Richman, broker and owner of Nola Homes Co. ‘Landlords are heading for dark times. They’re used to getting, like, $5,000 a month and now are looking for tenants for $1,200 per month.’â€

Watch for FAKE NEWS saying Real Estate is Headed Higher.

The house near me that was updated as having an offer within three days of listing has me thinking about brokers and their tricks. The house has an offer before the sign went up in front (actually, I don’t think the sign has gone up at all!). Neighbors who are communicating through social media with the owner tell me that he dropped his price by over $20K at the behest of the broker. I think that the broker already had a client hooked up at the price he wanted to ask. So with only on-line listing, there isn’t a lot of traffic going through. But a neighbor tells us that the people who made the current offer did get a tour. The neighbor thinks that it is a family and not a landlord who is making the offer from what they witnessed. We’ll see. (See previous thread for more details.)

My Wife says the family that made the offer is coming around during the day, and that they are relatively young with young kids. They expect to close within a month from now. I’ll check the RE websites for further progress as the time goes by.

The Wife of the new family told my Wife that they had made 6 offers on other houses before they got this one. They had sold a condo and were renting. Guess in that price range there is demand now in Orange County.

There is a house listed as a comp about a mile away in a less desirable neighborhood, 100 sq ft smaller house and 2000 sq ft smaller lot (although it is about 20 years newer) that is going for about $40K less and is 20 days on the market with no contingency offers yet. I think our new neighbors may have gotten themselves a good buy.

If only most of the folks would understand that all mortgages are fraudulent. There is no money to pay any bills.you can only discharge debts. paying a mortgage note with debt instruments from fed reserve is just prolonging national debt.Anyone who ever took out a loan never got a loan because there is no money of account. HJR 192 allows remedy. When folks sign a promissory note they in fact create new money and they are the lenders not the banks. Its a massive fraud .Greatest fraud in and scam in history.

Huh? Are you referring to federal reserve lending (to banks) and fractional reserve banking?

Regardless of whether or not what you stated has any legitimacy, everyone more or less plays by the same rules when getting a loan from a bank. You demonstrate to the bank that you will be likely to pay the loan back, and the bank issues the loan. I think anyone with half a brain knows that the principal for the loan is created out of thin air because of fractional reserve banking.

Sounds like a big scam to me. I’m sure the smart ones will avoid getting conned and rent forever. That’s always been the best option in socal.

Lol Lord B! Nailed it!

CA Real Estate is Toast -Existing Home Sales Continue Collapse To 9-Year Lows

https://www.zerohedge.com/personal-finance/existing-home-sales-continue-collapse-9-year-lows

I feel very sorry for our crash boys.

When will these bears learn?

https://www.cnbc.com/amp/2020/05/21/april-home-sales-drop-18percent-as-inventory-decline-pushes-prices-to-record-high.html

“ That drop in inventory pushed prices to a new record high. The median price of an existing home sold in April rose 7.4% annually to $286,800. That record does not account for inflation, but is a nominal record-high.â€

I bought RE and stocks at the perfect time. Huge win with locking in 30y at such a low rate.

I don’t have to say much about stocks, we all look at the same V shape chart.

I know, I know, it all crashes in Q4 2020. And if not, it will def crash in Q1 2021, and if not it will 100% crash in Q2 2021. Or 2022 or 2030.

The median price does not make sense in a skewed market.

Most of the low end buyers are gone and few transactions taking place are on higher end thus skewing the median price.

The more accurate index would be case shiller but it lags quite a lot thus making it useless for now.

Last time, in 2008, housing took 4 years to find the bottom. what do you expect when this crisis is just 2 months old ?

You need to wait for at-least a year for things to turn around either way

What do you call low end? It depends on the location, right?

In San Diego, homes priced between 500-700 have an expected market time of 36days. That’s a hot sellers market.

For OC, anything below 1M is selling quickly.

Fixer uppers in the greater area (SoCal) sell very fast as long as they are in a good location and the comps indicate there is a good margin to be made.

If you want to compare this to 2008, then let me ask you when will inventory skyrocket?

In 2007, SoCal had 115k active listings. Last year we had 41k and now it’s 31k.

I know, I know. Tsunamis of foreclosures. Okay, so, if you are in forbearance and your owed payments are added to the end of the loan, why would you need to foreclose?

I am not saying this recession won’t have a negative impact to the housing market but the data is not showing any sign of inventory levels improving (rising) significantly.

If there are significant drops in the next few years I am in line to buy a fixer upper close to the beach.

I’m going to leave this here.

https://www.cnbc.com/amp/2020/05/21/april-home-sales-drop-18percent-as-inventory-decline-pushes-prices-to-record-high.html

If we don’t get a supply glut or higher interest rates, we’re not going to get a price drop. Interest rates are going nowhere but down and the supply is so so low even IF the forbearance debacle materialized (it won’t), the prices are still going to hold. I’ve been 100% on the money in everything real estate including the crash of 2008 (just so you know I’m not a housing “cheerleader”). I call it like I see it! All facts, no speculation! 😎

I’m going to leave this right here. The crash is just beginning. Prices sky rocket before they crash twice as hard. Ever hear of a dead cat bounce? Probably not, because you’re a millennial who lives in your Mother’s basement. Prices will crash big time because when people are broke and unemployment is now 30% in Del Mar. A rich enclave. This is just the beginning of a huge correction that will make 2008 look like a record high for real estate.

*A millennial that lives in his mother’s basement that made a 6 figure return in 2 months trading homebuilder stocks. (That’s a bit more accurate).

“Dead cat bounce” I nearly spit out my coffee reading that!!!

“This is just the beginning of a huge correction that will make 2008 look like a record high for real estate.”

Honestly man, I wish you were right. I’d rather be wrong and even wealthier than right and not as wealthy. Unfortunately, investing is not emotional game and no matter how many times I wish the market would crash so I can scoop up more RE, it’s just not going to happen. I have to rely on a little known effective strategy called “facts” to help me make wise decisions. The “facts” are that interest rates are low and heading lower. Inventory is low and if it doubles, it’s still quite low. Existing demand taking into account the record unemployment twice satisfies the market. And inflation is going to rapidly take off because that poor money printing machine has never worked harder in its life :(. All of these factors contribute to stable, if not, increasing RE prices. At the worst, a 5% decline (I’ll take it, better than nothing) but I wouldn’t bet on that.

I should charge you for this advice but I’ve been having a stellar financial year so far so you’re welcome.

New age delusion,

Can you send us the link to your 30% unemployment in Del Mar?

In every article about San Diego county I am seeing that rich areas are not as impacted.

This is a common theme:

“ The analysis shows areas where low-income workers live to be the hardest hit.â€

How can you possibly know what lies ahead for housing? While what you stated is obviously true (interest rates will likely decrease and there is low supply CURRENTLY), there has been a substantial economic disruption and it remains to be seen how many home owners will be significantly impacted by this. Neither you, me, nor anyone really knows where this is going to end up. Maybe things will go back to normal pretty quickly and most professionals will keep their jobs. Or, maybe things wont go back to normal any time soon and professionals will start losing their jobs (and therefore their houses), particularly those who are significantly leveraged. Sometimes you just don’t know the answer, and this is one of those times. Comparatively speaking, I think the crash of 2008 was a much easier and more straight forward prediction than trying to predict what will happen in 2020.

How can I possibly know? That’s a great question.

You stated that the uncertainty lies in whether or not professionals lose or keep their jobs and I agree that is certain. But that’s not my focus. I’m not looking at the decline in demand, I’m looking at the existing demand taking into account that uncertainty. For every one professional that loses their job, there are two that didn’t lose their jobs ready to buy that foreclosed property. The current state of the RE market is so tight that if demand halves and supply doubles, it will STILL fare well. When supply exceeds demand and/or interest go up, then you get downward pricing. None of those two factors are likely to materialize. So with that said, I’m 120% on the money on this one. Believe it or not, this one is easier to call than 2008.

There will be disruptions in the RE market over the next 12 to 18 months, no doubt. But the severity and outcome remain to be seen. The bond market is dislocated right now, 30 year mortgages should be @ 2%. Germany is around 1.7%.

2% 30 year mortgages are coming down the pipe and that will alleviate any price reductions. The same theories as always still hold true. People have to live somewhere, and buying for 10+ years is always a winning proposition.

Yes things suck, but they have sucked before too. People thought it was over during the Great Depression. And the Great Recession. So on and so on. As long as warm bodies continue to inhabit the planet, the economy will always chug along as always. And as long as the USA still has Aircraft Carriers and controls Oil, we won’t do too bad.

Exactly. Can’t wait to refi at a lower rate and grab that free money.

When I bought my house, rates were in the 3.75-4% range.

People were talking about the “low rateâ€. By the time the house was built Rates came down to the low 3’s.

It almost seems unfair somehow that I can just refi in the near future at no cost for below 3% 🙂

While rents go up over time my house payment can only go lower. Add inflation to this (your salary will likely go up over time) and buying in SoCal for the long run is a no brainer.

It’s never no cost, even if you roll the costs into the new loan. The brokers are somehow allowed to call it “no cost” but there are always upfront money coming out of your pocket. Also, remember that you don’t get to choose the servicer of your loan. It almost always gets transferred and you may end up with a lender with obnoxious rules and terrible service, poor website, etc…

I agree, some of my friends are pretty pissed about the crap they have to deal with, with their lenders they got transferred to. Some lenders are terrible.

Regarding the no cost. Obviously, the costs are build into the loan but are you sure you ALWAYS have upfront costs? Just recently a friend told me she refinanced without cost upfront.

I’ll find Out soon when I try to refi. My rate is very good at the moment but I expect rates to go down further.

It is possible to have zero cost refi in exchange for a higher rate. I did that many times before. It is also possible to add the cost of the refi on the loan and still get a low rate. One way or another, the lender has to be paid – sometimes up front and sometimes that cost is spread.

Different options are good at one time or another, depending on the purpose of the refi. Sometimes, the purpose is not so much to lower the cost of the loan as it is to get some cash out of the equity.

Thanks Flyover!

Nothing To See Here, Other Then HOUSING Crush- Mortgage delinquencies surge by 1.6M in April, the biggest monthly jump ever

CA will be fine, just fine 🙂

https://www.usatoday.com/story/money/2020/05/21/coronavirus-mortgage-delinquencies-surge-1-6-m-april/5231835002/

Nope, nothing to see here, Real Estate in CA will be just fine :0… Here Comes The Wave: Loan Defaults Hit 6 Years High

https://www.zerohedge.com/markets/here-comes-wave-loan-defaults-hit-6-years-high

Better Buy Now or You’ll Be Priced Out FOREVER.

Realist,

Zerohedge? Come on man. Don’t waste your time with those doom

And gloomers.

There is money to be made in this kind of environment. The stocks I

Bought in March/April are up “biglyâ€.

Get on the train and buy some good stocks.

It’s easy to see there isn’t a RE crash anytime soon. And if the data doesn’t interest you, then take a look at the FED. The FED basically said there is no limit. They will throw everything they have against this.

Are you really betting against the US money printer?

Good luck with that.

Zerohedge? Are you really basing your economic decisions on this site?

I prefer the Calculated Risk blog for strong data and analysis.

Do yourself a giant favor and don’t follow any advice from the zerohedge nonsense. I like to call it zerocents, because that is what you will be left with. So who is still betting against the Fed? As I have umpteen times, the Fed holds ALL the cards and can engineer any outcome they want. We’ll soon have 2.x mortgage rates..that means people will be out buying in droves for the little supply that exists. Do not overthink this or be a market timer.

Can you comment on this excerpt from the exact article you just posted?

“Forbearance plans, by their very nature, are intended to assist homeowners through times of crisis until they can get back on track financially, and historically, they have proven to be broadly successful in doing so,” Walden said. “Given the sheer number of mortgage holders impacted, there remains a risk that some may progress into default and foreclosure further downstream.”

What I took away from it is forbearance is quite effective at preventing foreclosures and homes that do slip into foreclosure will enter into a market that is thirsty for inventory therefore you won’t get much downward (if any) price action. And seeing how from the same article that CA isn’t even in the top 5 affected states I can’t help but ask; should we really “stick a fork” in CA RE?

I have a question for the crash crowd: why do you think the housing market requires people/families with incomes to prop up prices? The stock market is doing reasonably well, and many of those companies (like Uber) have never made an operating profit. That money isn’t coming from mom and pop investors, it’s coming, basically, from the Fed.

Housing is just another asset class and, yes, there will be people losing their mortgages, but those houses will be purchased by corporations using 0% financing from the Fed. Why would prices decline if the Fed is providing 0% financing to big buyers? (And by decline, I mean more than 15-20%).

I see no evidence so far that American capitalism really needs those 40 million newly unemployed people for anything, they’ll just get shoved down with the rest of the under-class and things (prices) will be fine.

Eventually, of course, this will all end in complete collapse but, for the moment, I don’t see any reason to think America’s pseudo-capitalism is finished. Am I missing something?

Brixton77: Yours seems like a very rational analysis to me. The only caveat (in my mind anyway) is how long the government is willing to keep the music playing to continue the charade. How many trillions are they willing to print? Unfortunately, they’ll probably print ad infinitum. There’s too much at stake- the net worth of ultra wealthy, public pensions, etc.

San Diego is at an expected market time of 56 days now!!!!

This is getting scary! This is a sizzling hot Market.

What are you waiting for?? Call your realtor today!

Already have 🙂 proud SoCal homeowner here

That was months ago. What about today?? Get that investment property you always dreamed of!

If I were in the market to buy a home – to live in – this is a good time. Seriously. Not much competition (also not that much inventory). Do the math, 30y rates are in the low 3’s.

If you can comfortably afford it why wait.

In case prices drop in the next couple of years I would be happy to pick up a rental. But you can’t bet on it.

This is my first home. I don’t need to buy again right away. Don’t try to be a market timer.

Betting against this low inventory, low interest environment and time of money printing might not work out of those that wait too long.

My Dad told me that in the early ’20s he crossed Germany on a train. When they came into Germany, they were given ration coupons backed by foreign currency with which they could pay for food at the stations. Germans were standing in the stations begging for the coupons. I read that early in the inflationary spiral, con men would go out to farms and offer good prices in cash for farm products. When the farmers got to town, the money they had was nearly worthless. Oh, but we have modern monetary theory and a great big economy. We’re nothing like Germany, poor backward Germany.

We are a lot like Germany in the fact the masses were severely hurting.

They elected/appointed Chancellor Hitler to Make Germany Great Again.

You know the rest.

your exactly right. Us poor folk, such as your essential healthcare worker LVNs paid at 18 a hour here in socal can only hope and pray for UBI. Well be in the same shoes as when we were working, with the same amount of disposable income, which is zero, but we will gain is free time, as we will no longer have to work to be left in the same hopeless situation.

SoCal housing update

Expected market time was 105 days (huge impact due to Covid)

It made an impressive recovery and was at 76 days.

Guess where it is now? 67days for SoCal.

Say hello to a hot sellers market!

You ask why? Seems like people still like buying homes during this super low interest rate environment.

CA market is in the DEAD CAT BOUNCE stage and will be heading LOWER very soon. If you own a home, values will be dropping 20-30% by mid-2021. Supply is low because NOBODY wants to MOVE during the greatest Plandemic ever pulled off. The economy will be crapping the bed within 12 months, then the real fun starts. Unemployment will see record highs, along with record foreclosures, count on it. Never in our lifetime have we seen this, it is different this time.

Realist, I hope your crystal ball is in working order. Most seem to be broken and are usually 100% wrong. I would be doing cartwheels if your prediction of a 20-30% drop by next year is correct. If I could scoop up a beach close investment property valued at 1M today for 700K next year…I would be one happy camper. And not to mention we’ll likely have 2.x interest rates by then. Something tells me this won’t happen. But dreaming is free!

Well in Sacramento, California the real issue has been lack of inventory! That with demand is keeping prices SKY HIGH and homes are still selling in less than a month.

The Great Depression lasted from 1929 to 1939. There was another Great Depression from 1873 to 1896. Hopefully this time it is different but I am doubtful.

This is identical to the Spanish Flu in 1918/1919.

There was no recorded crash in housing during this time despite millions dying and cities shut down similar to now. There was a short recession in 1920-1921.

Today, this is also short term. We will recover a year earlier this time in early 2021 due to medical technology and vaccines.

The Great Depression was 10 years later than 1919. We still have time to prepare for the Big One.

Rents are decreasing in Los Angeles: https://patch.com/california/santamonica/rental-prices-fall-los-angeles-santa-monica-apartments

It took a pandemic to make it happen, but Los Angeles rental prices appear to be on the way down for the first time since the Great Recession, according to a new report from real estate data tracker CoStar.

Between the first week of February and today, rental prices in LA fell from $2.51 per square foot to $2.49 per square foot, on average. That amounts to a roughly $15 price reduction for a 750-square-foot one-bedroom apartment.

It might not seem like much, but it’s the first significant decline in rental prices recorded in the Los Angeles area since 2010, the report says. …

Milli always said, save money by renting, then buy during a crash. “Real estate experts like me know to buy low, sell high. That’s how you make money.

Instead, assuming his story is true, Milli did the opposite of his advice. He bought at the very peak, just before a crash in rents and housing prices.