The Genesis of the Credit Bubble: Advertising, Deception, and $163 Billion in Subprime California Loans Resetting in 1 Year.

There is something to be said about creative marketing and the influence it has had on this credit bubble. Yes, it is one thing to go after the Federal Reserve, Wall Street, greedy speculators, or unscrupulous lenders since we tend to associate a sense of responsibility with them in creating this credit bubble. Yet not much has been examined about those that played on the psychological strings of the public and enticed them with dreams of golden brick roads and endless sunshine. The advertising behind the credit bubble has been amazing in its subtlety and deep in misguided financial advice. Let us take for example a current ad that has a woman talking about a Pay Option ARM mortgage.

The ad plays along this script:

“With my flexible mortgage, I have the option to pay what I can, when I can. I can pay:

[use ridiculously low negative amortization monthly payment here]

[use financially destructive interest only option here]

[use with no emphasis fixed interest rate here]

The next part of the ad shows us a quick clip that subliminally tells us a lot of how people perceive credit. It uses the difference between the negative amortization payment and the fixed payment and calls it, get this, your savings.”

Maybe some of you have seen this ad or some variant of it. Frankly, I’m astonished they are still marketing this stuff given the political negativity surrounding the current housing market. This is one of the few that is currently airing and I’m not sure how much longer it will be going for given the nature of these mortgages. Yet the striking point of the ad is the message that whatever you don’t pay today is the same as you actually saving for tomorrow. This in fact is not only factually incorrect but also financially destructive. Think about what a negative amortization loan does. If you are to elect to pay only the lowest payment option, you are in effect increasing your mortgage balance each month. This in the world of reality and mathematics has the effect of growing your balance, the opposite of saving.

Now keep in mind that many of these Pay Option ARM mortgages were taken on by “financially savvy” folks with good credit that would never be mixed in with those sub-primers. Yet there is just as much of a risk for these to default since practically every loan of this category given out in the past two years in the state is now underwater. The entire state of California is now facing multiple challenges that will put significant pressure on prices for the next few years. So even a 5 or 10 percent down payment is now wiped out. Needless to say all those no money down loans with second mortgages are just waiting to be walked away from; that is if the government doesn’t step in and starts picking them up in the great mortgage swap meet of 2008.

Another stunning message in the ad is the person talking said something to the effect, “this mortgage is great. One month I can pay the full payment and the other month I can pay the minimum. I can decide to pay whatever I like.” Yet another free lunch mentality. I’m sure you know of folks in your immediate circle of friends and confidants that have back breaking credit card debt and yet you hear them say, “but I only pay [insert minimum payment that does nothing to the balance here] a month!” And not only do they say this with a straight face, they are proud of it. Even the wording of the loan is Orwellian. Pay Option? How about I take option D and simply not pay at all. Seems like a lot of folks are electing to use that one. These loans should be called, “pray that housing keeps going up while I make the minimum payment so I can unload the property in this forever Ponzi scheme of housing before my mortgage recasts in 2 years” loans. A little truth in advertising there.

Everyone Makes $250,000

The media for some reason doesn’t like pointing out that American household incomes simply do not support home prices. The implication is the problem is the loans and not that wages simply do not reflect current housing prices. After all, if everyone was making $250,000 prices would be cheap today. Right now the topic du jour of course is the bailout of Bear Stearns. It’s almost as if Bear Stearns held some sort of capitalism kryptonite and if the box where to be open, the world would start trembling. Glad it only took $29 billion to right the entire global economy. I think we got a great deal on that one! Let us once again re-examine the income breakdown of American households:

| Lower threshold (annual gross income) | Exact Percentage of households |

| $65,000 | 34.72% |

| $80,000 | 25.60% |

| $91,202 | 20.00% |

| $100,000 | 17.80% |

| $118,200 | 10.00% |

| $166,200 | 5.00% |

| $200,000 | 2.67% |

| $250,000 | 1.50% |

| $1,600,000 | 0.12% |

One of the charges leveled a few years ago when I started posting was ironically a common message that stated, “you’ll be surprised how many households in California make $250,000.” I’m not sure if this figure was given in some late night lending infomercial but the number seemed to stick and was used often. Now that the tide is drifting out to the vast blue Pacific Ocean those people were right, I am surprised how many households make $250,000 in California. Clearly it isn’t enough since those people with Pay Option ARM mortgages only make the minimum payment at a rate of 70 percent. Now I’ll give it to many that there are many households in the coastal regions that are in the six-digit range but this doesn’t go far in high cost areas. Yet there is a difference from a household making $120,000 and a household making $250,000. I think the above statistics put a major cloud on the prospects for higher housing prices.

Now why is this data important? Well let us look at the data for the entire state of California to see what sub-prime mortgages are looking like:

| Share ARMs | 73.8% |

| Share current | 58.9% |

| Share 90 days delinquent | 8.2% |

| Share in foreclosure | 10.8% |

| Median combined LTV | 85% |

| Share low or no documentation | 47.5% |

| Share ARMs resetting in 12 mos. | 43.2% |

| Share late payment last 12 mos. | 50.1% |

Source: FirstAmerican CoreLogic, LoanPerformance Data via the New York Fed.

If we dig deeper into the data we get these astonishing numbers:

California housing units: 12,214,549

Number of sub-prime: 500,958

Average balance: $325,672

What this means is California alone currently has $163 billion in active sub-prime loans in which, 47.5% were done with low or no documentation. This doesn’t even examine the Pay Option ARM mortgages. What you’ll be happy to hear is most of these loans were originated at the height of the bubble:

| Origination Year | Number Originated |

| 2004 | 63,324 |

| 2005 | 137,458 |

| 2006 | 204,256 |

| 2007 | 66,120 |

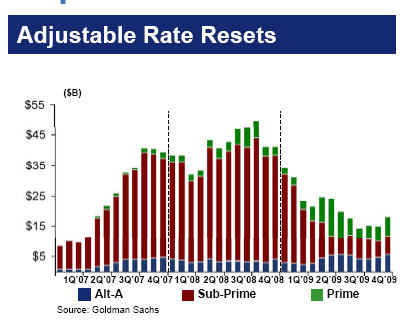

And the sub-prime loan of flavor in California was the 2/28 mortgage. Guess how many of those 2/28 loans will be resetting this year? How about 43.2 percent. Does that make this now infamous chart make more sense?

And guess how many folks actually took cash out of their homes on these toxic mortgages? How about 256,630 or over 50 percent of the entire sub-prime California mortgage pool. Don’t you just love the flexibility these mortgages offered like the creative advertising was telling us? Talk about a gigantic mess. As we discussed in a previous article the FHA $300 billion bailout proposal would most likely leave all these loans out on a vine since it is very likely that for the most part, these are underwater or very close to it given the date of origination and market conditions. That $29 billion to Bear Stearns doesn’t seem so large when the amount of California sub-prime loans is over 5 times as much. A billion here a billion there and soon we’re talking about pulling out the real American Express card. Put it on our tab and we’ll pay it later.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

49 Responses to “The Genesis of the Credit Bubble: Advertising, Deception, and $163 Billion in Subprime California Loans Resetting in 1 Year.”

Another awesome post.

One other thing that I think bears mentioning is that in the laundry list of toxic loans there is one particularly vile flavor that is certain to cause the most collateral damage: the Interest Only.

A particular example: an ex of mine in the Bay Area upgraded from a condo to a duplex back in August of ’05. I spoke with her at random a couple months ago and asked how the housing market was up there, etc. and the subject of her loan came up. I inquired as to what type she had taken on 3 years ago and her response was “you know, a normal one”.

Long story short she sent me her loan docs and turns out she had a 3/27 IO ARM. Her interest rate would reset on 8/08 to 12 mo. Libor + 225 BPs, had a teaser of 5.375% to start, total amount financed 380K.

6 months later she decided she wanted “some things” so took out a 50K HELOC at about 9% and went on a spending spree. She soon thereafter was laid off and out of work for 6 months, so she lived off credit cards for that time, piling on another 25K in debt, all of this at 17-20%.

So, our discussion quickly led to the fact that she owed 430K on her house (had been paying interest only on the first, had maxed out the second) and another 25K on the cards for total debt of $455,000. She had zero equity in the house and, since her loan was due to reset in August, she was about to feel the real pain of “reset” on an Interest Only loan: YOU HAVE TO START REPAYING THE PRINCIPAL!!!

In my mind this is the thing that is going to sink 95% these loans. You could take interest rates to zero and it is not going to help people like this chick. Her new nut on the first is going to go up a minimum of $450 a month, and guess what? The house isn’t worth the balance of the first, let alone the second, she still has all that credit card debt and she could rent a place a block away for $900 a month. Even if she could (she can’t), why in the world would she stay?

Oh, I know what you’re wondering. This chick must be loaded, right? I mean, nobody just gives a half a million dollars to someone unless that person is a baller, right?

Think again. She is an administrative asisstant and makes maybe 65K a year.

Yeah, I’d say those loans are just about worthless.

I started reading this blog about two weeks ago, DrHB, and I have to compliment you on your mix of useful information and snark. Some of those Real Homes of Genius are comedy gold!

I live in the east bay area, and I’m here to tell you that the bubble has burst with a vengeance in my part of the world. You can scarsely stand anywhere in Contra Costa or Alameda Counties and throw a rock that *doesn’t* hit a NOD, NOF or REO property. Even seemingly untouchable San Francisco is starting to feel the irresistable pull of reality.

As for me, I relocated here two years ago, saw what’s what and rented. No worries, mate!

Long time reader – first time poster.

Did anyone who took out these toxic mortgages for $500K ever plug the numbers into an amortization calculator and see that the total principle+interest payments over 30 years was nearly their entire gross income for the same period? Did anyone who purchased these houses with 100% LTV ever expect to repay the loan with nothing but their income? I live in flyover country where our home prices never rose to these levels for simple tract houses and condos. Where I live 500K wont by the Biltmore, but it buys a lot more than a stucco tract house. I’m still trying to get my head around all of this.

I’ve read your commenst with interest for a while but am increasingly coming to the conclusion your agenda is as much of the media – to fear monger – to present the negative part of the story only – and not the full picture

First – to be clear – there certainly IS a real problem – and there are unscrupulous lenders – always has been, always will be. Nothing forces anyone to take out one of these loans.

Now to your comments – you make comments about income – which I presume is to attempt to point out affordability – although you never really say what your point was.

So what about affordability in California?

The NAHB/Wells Fargo Housing Opportunity Index (HOI) tracks this number. The 4th Qtr 2007 median income across all Calif Cities they tracked is $64,200. The median home price during same period is $ 412,000. With 5% down, a 5.875% 30 year fixed rate loan, and a hoousing pmt at 28% of income the median income could afford appx 65% of the median home price.

However if a simple 2-1 buydown was used on the same 30 year fixed rate loan – so payment was 3.875% yr 1, 4.875% yr 2, and 5.875% yr 3 thru 30 – a median income would qualify for 81% of the median home price. Again – this is a fixed rate fully amortizing loan with no negative amortization

No, a median income earner can not afford a median price home in some of california – but statewide they come close.

And in many markets a median income CAN afford that area’s median priced home – or more. Using the temporary 2-1 buydown this shows the percent of median price home a median income can afford:

Yuba City, CA 109%

Oakland-Fremont-Hayward, CA ^^^ 93%

Stockton, CA 100%

Chico, CA 119%

Sacramento–Arden-Arcade–Roseville, CA 115%

El Centro, CA 98%

San Jose-Sunnyvale-Santa Clara, CA 81%

Fresno, CA 102%

Modesto, CA 105%

Madera, CA 106%

San Diego-Carlsbad-San Marcos, CA 88%

Santa Rosa-Petaluma, CA 90%

Riverside-San Bernardino-Ontario, CA 95%

Santa Cruz-Watsonville, CA 71%

Santa Barbara-Santa Maria-Goleta, CA 85%

Oxnard-Thousand Oaks-Ventura, CA 85%

San Luis Obispo-Paso Robles, CA 72%

Merced, CA 93%

Santa Ana-Anaheim-Irvine, CA ^^^ 77%

San Francisco-San mateo-Redwood City, CA ^^^ 60%

Los Angeles-Long Beach-Glendale, CA ^^^ 70%

Salinas, CA 73%

Napa, CA 73%

In many markets, using a 30 year fixed rate loan, with a 2-1 temp buydown, with no negative amortization, a household making median income can afford a median price home – or more. In appx half of the markest a median income can afford 90%of median home price – or more. And in 16 of 23 markets a median income can afford a home 80% of more than median home price.

This is the most affordable Calif has been in very long time. Because of its costs and desirability along with limited supply and high demand, Calif will never be an “affordable” state but it is far more affordable today than many portray.

Great Blog!

Looking around I’ve noticed discrepancies in mortgage reset charts.

The chart in this blog shows a y scale with a maximum value of about $45B.

A chart from Credit Suesse (Oct 2007) shows a peak value of about $35B

http://calculatedrisk.blogspot.com/2007/10/imf-mortgage-reset-chart.html

(This is a 20% difference from the above chart)

An older chart from Credit Suesse shows a peak value around $45B in line with the above chart. It makes sense that over time some of these loans will be removed from the books. (Sorry I no longer have the link)

I’m just wondering how often these charts are updated and if data from the older charts are often used and don’t reflect the current reset volumes resulting in a more pessimistic outlook.

It’s hard to know without information about when the data was compiled.

Keep up the great work! I look forward to the next installment.

Jeff

About 1 year ago the wife and I went to the bank to switch our home equity ARM to a fixed rate. We were the only ones doing that according to the loan officer.

Shifting a bit, Washington is like wa wa, were they not the ones that stopped tax deductions on car loan interest? Thus steering the public into using home equity.

I am in no hurry to put extra cash into my principle when my neighbors might be allowed to walk, you can bet a whole lot of others are thinking the same way.

Matt’s ex’s situation sounds unfortunately typical. A guy I work with is slowly being driven to his knees by a 600K mortgage he got in 06–since then they’ve had an unexpected baby and his wife’s back went haywire so she can’t work. He mentioned his mortgage resets this year–I know it was a 0 down. Very grim.

The sheer number of people involved in this situation is breath taking.

I kind of expect we will see an increase in people going postal.

And then there is your implication that the remaining subprime loans are some kind of huge ticking time bomb.

Which is also largely untrue.

Why?

Because you seem to buy into the media hype without doing an analysis or review of the facts and details.

As you note the vast majority of those subprimes are 2/28 ARMS. These loans are typically based on 6 month LIBOR index plus appx 6% margin. They typically have appx 2.5% cap per adjustment.

When originated in 2006, the loans that will reset in 2008 had typcial first year rates of appx 8%. The index at time was a bit over 5% – which put the fully indexed rate when originated at a bit over 11% – making the 8% start rate relatively reasonable.

As these loan are coming up for reset now the current 6 month LIBOR is appx 2.8% – add a 6% margin and the current reset rate is appx 8.8% – almost no change – about $75 a month on a $200,000 mortgage.

The simple fact is that RESETS on theses subprime loans are no longer the reason for defaults.

This same situation is an even bigger benefit to all the subprimes that reset in previous years.

2005 Subprimes were the worst for interest rate increases at first adjustment. They also had appx 8% start rates when originated. And same terms as above. When they adjusted first time in 2007 the 6 mo LIBOR was still generally around 5% – add a 6% margun and the fully indexed rate was appx 11%. For these loan the cap kicked in – original rate of 8% plus 2.5% cap = 10.5% new rate.

These loans are the ones that caused the current increase in subprime defaults. That said, even with the big payment increases the current dfault rate is still just 5.27% for subprimes. Far below the subprime foreclosure rates in 2001 – 2003 which approached 10%.

The media ignored tehse facts. That 94+% of all subprime borrowers are NOT in foreclosure despite the big increases in payments they have managed to find a way to hang on. And they are now getting significant relief. Not from any govt bailout etc – but simply from the terms of their loans.

These 2/28’s reset every year tyically after initial 2 yr period. And as the loans that reset in 2007 to 10.5% are coming up on this years reset they are getting big relief. Again current index is appx 2.8% – plus 6% margin = 8.8% new rate … these owners will see their poayments DROP by pretty much same amount as it increased last year.

Which will undo the hardship and burden putting them back almost to the original teaser rate they started with. Once again the subprime mortgage payment will no longer be the reason for default and/or foreclosure on these loans.

By the end of 2008 all of the subprime loans – except very small number originated in 2007 – will have reset to current rate and be at mid 8% range. This includes essentially all of the 2006 and earlier vintage subprime 2/28 ARM loans .

If the subprime ARM resets in the woirst year – 2005’s that reset in 2007 – have not caused higher than a 5.27% foeclosure rate – and with the vast majority of all subprime ARMS resetting to well under 9% thi year – there ios little credible evidence that foreclosure rates will skyrocket as claimed by so many

Yet the finacial sector has written down (Bloomberg story this week) $282 BILLION in subprime investments. Many to a 100% loss expectation status. Which is completely irrational and unsupported by any credible facts.

What is the real loss exposure to lender on subprime loans? Actually not that hard to figure out. There is appx $1.072 trillion in subprime loans out there out of appx $11 trillion in total US mortages. If a whopping 25% of all subprimes were foreclosed – a completely unrealistic number – and each of those loans the lender lost 30% of their mortage amount – the TOTAL loss for all would be appx $80 billion dollars.

The total risk of loss to lenders would be less than 8% of the total subpime loans outstanding – and well less than 1% of all US mortages. Well within the risk priced into these subprime mortgages.

So what then happens to the $282 bllion in writedowns? Just as the lenders were reqd to writedown – mark to market – these assets they will be required to write them “up” – one analyst predicts at least a 25% return to the sector on JUST these writeups alone.

Making the majority of this media induced “crisis” completely unsupported by the facts.

So Mr Housing Bubble … the alamist commentary and sky is falling fear mongering are the biggest reason behind the confidence crisis – no, not credit crisis – we are undergoing. The media screaming the end is here – supported by blogs such as this – have been responsible – largely without basis in real fact – for one of the greatest losses of wealth in our nations history ….

If you are going to comment I encourage you to conside the consequences – and as such fully research your comments – and then opresent all of the facts in perspective.

The reality is that despite the media telling us daily that we are on the edge of a precipice – with reports of foreclosures “up 300%” etc – that for SUBPRIME loans alone nearly 95% of all owners are NOT in foreclosure – and for ALL mortages – INCLUDING subprime loans – more than 99% of ALL US mnortgages are NOT in foreclosure

Those are absolute facts. If the media was reporting those numbers we would not have the situation we have today – whih is largely unsupported by inderlying fundamentals or facts.

That’s why we call them put-option ARMs.

This is really destructive.

The ads in itself maybe not create so much damage but coupled with what these people see their relatives and friends doing(‘investing’ and refinancing and buying their luxuries) these ads just validate what their feeling and hence, do what everybody is doing.

I hope they do something to change this.

ASG

There are two kinds of statistics: lies and damn lies.

I’ll concede that everything you have said is true and you know what? You still have a HUGE problem: the tightening of lending standards.

Had these not been relaxed starting in 2001 there is absolutely no way the pricing increases we have seen could have occured. And now that lenders are starting to look at things like “can this guy actually pay the loan back?” and “what sort of down payment has he saved?” prices are going to come down. The cost of credit has gone up (aside from the absolute interest rate) in the form of bigger down payments and fixed rate P&I 30 yr loans.

And why say that this blog is some sort of hypebole machine? You sound like maybe you are in the real estate/mortgage market given your bias, and that’s fine, but your arguments will likely find few proponents here. Your example in your first post is perhaps the least disingenuous:

No, a median income earner can not afford a median price home in some of california – but statewide they come close.

You then take another 300 words to explain how they can “come close” (is that like being a little pregnant?) but what it all boils down to is that people’s real incomes are going to determine how much house they can afford once again and prices should come down at least another 15-25%, maybe more.

Imagine it this way: what do you think the median house price would be nationwide if mortgages were illegal and eveyone had to pay cash?

What would it be if everyone could get a 1000 year Interest Only loan?

‘Nuff said.

If 256,630 people took cash out of there home, it’s a safe bet that 90% or more won’t be paying it back given we’re subprime. Doing some rededial math…

256,000 x $10,000 = $2,560,000,000 $2.56B

256,000 x $100,000 = $25,600,000,000 $25.6B

The total loss is probably somewhere in between. And this doesn’t include the total loss of the home, ifself. Yep, people sure were on a g**-d*** spending spree.

We are not in a crisis. We are in the midst of a major price correction and a financial market cleansing phase. I had a friend who’s real estate agent advised him to buy a place he could not afford with a fixed mortgage during the peak. The real estate agent’s exact words were “What’s the worst that could happen? You just go back to renting.” I believe these words convinced alot of renters who couldn’t afford a home to take the risk, outbid people who might have been able to afford the list price, and catch the knife. I don’t understand what the big deal is about people losing a home they can’t afford. If they return to renting their quality of life gets better because they will no longer be under the financial distress of paying an absurd mortgage. I look forward to prices of homes becoming realistic again (Income x 3) and putting all the current events behind us.

So, Mr. ASG, you sure spent a lot of time on your comments. You said:

“If the media was reporting those numbers we would not have the situation we have today – whih is largely unsupported by inderlying fundamentals or facts.”

Total BS, Mr. ASG. (That and you can’t spell) You claim the media is the cause of this??? That sounds like the tripe coming out of D.C.

People lose homes because they CANT PAY. Not because of an article on TV or the internet.

Another thing totally ignored in all the facts presented is that the cost of living is going SKY HIGH. Don’t you think that contributes to people losing homes?

ASG, It is wise to critically analyze the data before marrying oneself to the conclusions based on surface evaluation. For example, of the supposed high percentage income segments, the 77% group, what is the number of non-home owners, or existing home owners that ‘need’ to up-size or relocate? I would say that if you looked at the number of renters, the upper income ones are either very well educated and understand that this price decline will drag on for 5+ more years and they will keep on renting and investing their money in real investments that show a positive return over this time span, or they are not the so well heeled renters that have no possible way to buy at what are still outlandishly high prices. You see it takes a real person, a buyer, to purchase a house and not an average, median, or typical income person, but real people that have access to a fair amount of cash from which to enter into a contract for a purchase. We are heading into, or as I believe already in a recession that will not end this year at all, and most of your “average” intellect folks can see this and are in no rush to buy a property only to have it fall another 30-50% before this is all over. House ownership is a big scheme with spin doctors from the realtors to the financial pundits all spouting off what a great investment it is and that it never goes down. A house is where you live and should never be the only asset you have for retirement as you can now see. Of course, we can expect to see some increases in prices over longer periods of time as a result of the devaluing of the currency that is so well done by your friendly FED, but do a search on the real rate of return on housing and you will see it barely keeps up with inflation, and it is not a very liquid asset like stocks or other tangible investments as you can now clearly see. None of this is news to anyone who studied the historic cycles of asset classes over time, but for those who don’t know, they are getting a very expensive education in risk and diversification. Oh well, it’s only money…and who needs to retire anyway, work is fun right?

Count the number of times the word loan is used in all these articles, this and others. Ask yourselves, What is it really you are borrowing? You never see the money being lent. Does it exist? It is well known that banks create money out of thin air, or as I prefer to say, by the stroke of a banker’s pen. They extend credit but it is not requisite that what they lend consists 100% of the deposits of other people. If at all it is a small % a hypothetical reserve requirement. Everyone will have to understand that we’ve been playing a game of “pretend the money exists.” If you get what I’m saying you’ll understand that these aren’t loans. These are agreements to play a game of pay back with interest over 30 years the credit extended to me. You put your credit at risk to write a check that would otherwise come back NSF but in exchange for a lien that titles the house to the bank, the bank rigs the system so that your check clears. Default, and while there is some expense, like $50,000 in legal, the bank can own the house. Now, isn’t that like getting a house for near nothing? And isn’t that as if the homedebtor gave the house for free to the bank? I admit there could be numerous errors with my thinking and all are invited to tell me where the errors are. But I don’t think so. So I ask, is it right to allow banks to extend credit when it is not backed substantially by something real owned by somone else and can be created by stroke of the pen? You might as well have your currency be backed by seawater, or sand. The whole point of money is its scarcity. When the counterfeitter runs 100’s off his color laserjet, it’s a crime. When the private banks extend credit, they no less make 100’s of debt on account for people to borrow, it’s allowed, so far, but how it it different other than for one a physical bill is produced (which takes some effort), and the other, is a ledger entry (which doesn’t)? And if banks are counterfeitting by extending credit, why do they deserve the right to place a morgage lien on the property? This is how real wealth is transferred from the people to the elites. Get some idiot to make a promise he cannot keep, then take the collateral. Except where was the counter-collateral? If the money didn’t exist before, there’s no value. It’s a void contract. If money is lent, it should be money owned by other people and the banks should be brokers, nothing more. And in the case of a rare forclosure, the bank could forclose as agent of the true lenders, the depositors, but the latter would be first in line for the proceeds of the liquidation, not the bank. Offered for your consideration. Does any of that make sense or is it all nonsense?

ASG, you are only half right. http://globaleconomicanalysis.blogspot.com/2008/04/closer-look-at-arms-reset-problem.html

Check out Mish’s analysis. People who got 3-year adjustables (3/27s, 3/1s, etc) in 2005-2006 range are going to be better off in terms of payment. But people who got 5/1s and 5/25s are going to have increased payments.

Some of your facts are completely irrelevant. Your 95% and your 99% figures sound meaningful, but by themselves they aren’t. You also have to consider that only a very small number of houses, let’s say 5% sell from year to year. Those 5% set the market for the other 95% of the houses. So an increasing number of defaults is very relevant even at the margins. I’m just making up numbers here, but if 0.25% of houses normally go into default, that could be a 20:1 ratio of houses sold to houses defaulted (5:0.25), assuming 5% are sold every year. If that default ratio goes up to 0.5%, then the ratio goes to 10.5:1 (5.25% to 0.5%). If foreclosures go up 300%, as you said, then the foreclosure rate goes to 1.0%, and the sale rate goes to 5.75% — then the ratio is 5.75:1. Don’t you think such a dramatic change in ratios would make a huge difference? I don’t know what the actual numbers are, but the ratios are being changed at these magnitudes.

The underlying fundamentals say housing prices must fall. Housing prices are way out of line with income and historically the prices have been more closely allied to income. That’s what’s causing housing prices to drop, regardless of all the subprime/Alt-A Wall Street crap.

ASG, I don’t really read the media spun crap. Here’s actual data for you. 25+% of one Washington Mutual Alt-A loan portfolio is at 60+ days delinquent:

http://globaleconomicanalysis.blogspot.com/2008/04/wa-mu-alt-pool-deteriorates-further.html

60+ days delinquent = 60 days + 90 days + foreclosure + REO. Note that 13.35% of houses are in foreclosure proceedings and 4.44% are already owned by the bank. These are Alt-A loans — that is the level above subprime, but below prime.

This portfolio was considered 92% AAA, but is obviously not, especially since only about 11% were full doc. Do you think these numbers are media hype? Just because you CAPITALIZE words every few lines doesn’t mean you have a valid point.

To all reading ASG.

Why we even respond to this poor man. He is probably in a bar on a second shot crying for the good old days. I start reading his spin and stopped. Why should I listen to a Realwhore anyway.

ASG MUST be a realtor or store-front mortgage broker

****(1) “The NAHB/Wells Fargo Housing Opportunity Index (HOI) tracks this number. The 4th Qtr 2007 median income across all Calif Cities they tracked is $64,200.â€

*** I haven’t since such flat out bogus bullhockey in YEARS. Guess someone didn’t tell him or his sources that it is not nice to tell lies, The 2007 income data is not in yet completely. (I’m talking about the RELIABLE sources.) Median HOUSEHOLD income in California, according to the data gather in 2007 for 2006 was $56,645. Seriously doubt that incomes went up 13.3% in one year. Citing FAMILY household income ($62K) as the median for ALL households is simply flat wrong and untrue.

***(2) “The median home price during same period is $ 412,000. With 5% down, a 5.875% 30 year fixed rate loan, and a hoousing pmt at 28% of income the median income could afford appx 65% of the median home price.â€

****Geez, this person NEVER quits. Good lending practice says not more than 28% of gross income for principal, interest, TAXES and INSURANCE. And 30 year rates have been at or over 6% for quite awhile. Allowing 1% of value for real estate taxes, and $53/$100000 of insured value with a 30 year loan at 6% and 10% down (although how many buyers with a median income of $56,645 have $41,000 in their piggybank is highly questionable) gives a payment of $2449 for principal and interest (51% of gross) and with taxes ($343) & insurance ($218), it would be a total of $3010 (63.75% of gross income.) This poster is NUTS! Even using the FAMILY household median income, the principal and interest alone would be 45% of income. Liar liar pants on fire.

****28% of the median household income of $56K for principal, interest, taxes and insurance is $1321. That is around a $175,000 mortgage – NOT a $370,000 mortgage.

*** 28% of the median family household income of $62K for principal, interest, taxes and insurance is $1446. That is around a $200,000 mortgagae.

****(3) “ That 94+% of all subprime borrowers are NOT in foreclosureâ€

***NO – according to the MBA last December or so around 16-18% of them were in foreclosure. (Geezz…if you are going to lie, don’t lie about something that can be checked – even the WSJ ran that chart that was released by the MBA.) And those who are defaulting are typically defaulting even BEFORE the reset. http://www.frbsf.org/news/speeches/2008/0403.html All those slime bag mortgage brokers are the cause that people were ‘qualified’ for loans where the mortgage alone (excluding taxes and interest) were 40, 50 or more % of gross income (Just like this poster wants to do when the median household income is $56 K and this twit thinks a $2449 a month for principal and interest alone is just fine at 52% if gross income or where the median family household would be at 47% of gross income.)

****(4) more than 99% of ALL US mnortgages are NOT in foreclosure Those are absolute facts.

****According to who? Someone in a hashish induced dream? The foreclosure rate varies some BUT nationally it is well over 2.5-3+% and rapidly rising. This person needs to go back and learn how to read repots and do math. The Mortgage Bankers Assoc is not smoking what ever he is smoking – they have much much higher rates using their real world numbers.

****(5) And people are NOT losing their homes because of what they read in the news. They are losing their homes BECAUSE THEY DO NOT HAVE THE INCOME TO PAY THE LOAN with principal and interest Typically they couldn’t afford those homes even with a 30 year fixed rate because they believed slimey lying brokers and realtors who made insane loans and sold them the houses, and for many, even if they only had to pay the principal they couldn’t afford it.

@AnnScott et al

Hallelujah, and testify! LOL.

If we were over at CR or on the OC Register blogs we could make fun of his acronym “ASG” = asinine stupid guy, another sorry gasbag, etc., but let’s give him credit. Oops – nobody is extending credit these days, are they?

ASG – step back from the koolaid. Some of your points might even have some merit, if you choose to better research your data. You’d likely need to re-formulate your conclusions, however, if you did correlate data to the ideas.

This one, for instance (referred to in Mish’s article): the lower Fed Funds and Discount rates have caused lower LIBOR and other ARM rates, which in turn mean that resets are not as difficult as they would have been when the debacle gained steam last March. Mish concedes this point. You neglected to note that the 2/28 reset was changing from interest-only (I/O) to fully amortized, however, which means that ‘almost no change’ to the rate AFTER RESET WOULD have a substantive change to the payment.

Let’s do the math, shall we? For a $391,400 loan (95% of your mythical $412k house, pick a different figure if you want) at 6% start I/O, the payment is $1957. At 8% PI, payment is now $2922 and change at the reset. At 8.8% it’s $3139 and change. Before taxes, insurance, and, um, this little thing called mortgage insurance that’s required anytime the loan balance exceeds 80% LTV. You may have heard of it? Not that any of the MI companies can actually pay the lender for losses right now, but the concept is there, anyways… In any event – a nearly $1000 payment difference per month just on the mortgage is rather significant to most people earning $62k, or $56k, or whatever K you want to pick up to probably $500k per annum.

Argue if you will about median buyers ability to buy, or blame the media, or bemoan the lack of coordinated statistics and which ones should be used. Go ahead. Just be very careful about bringing up figures that can be independently verified – there are a lot of p*ed off people who read these blogs who will your sh*t OUT.

And, if I may add, why are we all so p*’ed off? To sum, because logic, common sense, decency, and reasonableness got tossed aside during the bull(sh*t) run earlier this decade, and now as taxpayers we’re all paying the price.

Full disclosure – I was a mortgage broker for 16 years and now am not. I couldn’t sell the OA crap and so didn’t do that well between 03 and 07 – I kept stupidly insisting that prospects understand the financial ramifications of the make-believe loans. Cost me referrals from re-litters and some ticked off buyers who would have none of my ‘doom and gloom’ factual excel spreadsheets. Oh well – I just never tried to convince some prospect to buy based on median this and average that. ASG – you should become accustomed to tailoring your specific prospect’s needs with their financial ability to pay on a 30 yr fixed, and with the prospect of impending future market value declines. If you can’t do that, don’t be surprised when you get flamed for bringing that pseudo-statistical crap on this (or other) boards.

The last time I saw these numbers posted on this site (the income percentiles) someone wrote in the comments about how they made $200,000/yr and was renting because they couldn’t afford to buy. Commentors said, “oh, man, you could/can/should/ought to buy a house!” I wonder if I point out that I make a bunch of money and am in the 4%-ish of income earners, if I’d get the same reaction today, when it’s so clearly throwing money away?

I am a proud renter. I had a house once. Leaves kept falling in the swimming pool. The grass kept growing and needed to be landscaped. And the roof needed to be replaced sometime in the near future. I had squirrels burrowing into my 8-foot tall custom cedar privacy fence because it was hollow on the inside to hide the stakes on both sides. Owning a home, from my perspective was a big pain in the neck. But I’m technically single and I travel extensively for work and fun. So homeownership just wasn’t for me.

In a few years if I’m married and have kids, then the story will be different. I just hope by then things return to normal by then. But I’m not sure this is just a market adjustment. I believe all great civilizations fall. Just ask the Romans or Mayans. I think this could be the beginning of the end for us in the U.S.

Like nocaster, I am more a reader than a poster but I would like to this opportunity to thank all posters for your views/judgements. Although a very small percentage make my blood boil (ASG) the majority are an eye opener and a true learning experience (AnnScott, Exit). Most importantly, thank you DHB for your time/skill/dedication to this site and your new quarterly newsletter. It’s greatly appreciated!!

@exit – We really should have some pity on ASG. I’m a retired lawyer (litigator in federal court specializing in commercial law and labor law) with another degree in economics (specialty in micro and pricing.) You have the real world experience.(You would LOVE my local bank – they have trouble spelling ARM and probably have never seen the loan docs for an OA. They too actively discourages their customers from even considering such things.) Really too shabby of us to launch into a battle of wits with an unarmed man (or woman.)

****I have been watching the WaMu pool on Mish’s blog in fascinated horror. Yikes!

**** I was fooling around with affordable caluclations and have begun to question whether 28% of gross income is too high. I took a real world budget and worked backwards since food, utilties and other necessary expenses can not be restricted to a % of gross income no matter what since those things keep going up and up in cost.. I assumed married couple with 1 child. I included utilties (gas $100, electric $65, water & sewer $75, trash $20, cable & ISP $120, phone $50), food ($675 – seems high to me I’m told that people usually spend that much), car insurance (2 cars $120), car maintenance ($100), 1 car payment (Ford Focus around $500), household misc (cleaning stuff. light bulbs, etc – $75), gasoline (both work so $385), personal care (haircuts, clothing etc- $150) and $200 for the ‘whatever’ (computer repiars, things kids need for school etc) and assumed credit card(s) with $9000 and 29% interest (average balance carried by US households) so the payment would be $197 (interest + 1% balance.) No vacations, no toys, no plasma TVs, no cell phone per person, no ‘extras.’ Then I used the median priced house of $195,000, 10% down, 30 years at 6% with a PITI of around $1318 (not including PMI.)

*****To cover all those expenses, the household would need a gross income of around $66,000 (Top 31.69% of households) The PITI would be 24% of gross income.

****If the household were to save an amount equal to 10% of their net income, they need close to $75,000. (Top 26.66% of households) The PITI would be 21% if gross income.

****Maybe 28-31% works for households in the top 20% or more of income but I really don’t see it working for the other 80% of households.

I think that the core of the mess is essentially deregulation. One cannot really expect corporations, whose purpose is to make money, to behave ethically. Regulations ensure that these entities behave in a way that is compatible with the good of society. Advertising makes things worse, obviously, but why shouldn’t big mortgage companies advertise for something that creates a huge profit for them, if it’s legal? I think we should blame the legislators on this, not the advertisers. They had either a conflict of interest, or they were incompetent in not being able to see this mess developing, or both.

I have a simple question for everyone: “Why was this debacle allowed to happen”?

Dr HB saw it coming. I too saw it coming, and many of you here also saw this coming.

Greenspan, federal regulators, bankers, etc. They too must have seen this coming.

Why was this housing debacle allowed to happen?

In re to ASG

We are here to discuss the reality of a recession, a housing market

that has gone insane and although we all have our opinions

To claim that simply talking about it and pointing out the facts

of life is the actual reason that we are in a recession and have

a mortgage crisis is just plain stupid.

Our discussion will not stop anybody from defaulting on their

mortgage just because we said he would.

Simple fact is these people are defaulting because they can no

longer pay. Even the ones that had no personal hardship and loss of

income can no longer just spend, spend and spend. Between the

mortgage resets and the fact that their Credit Card limits are dropping

there is still the problem with the cost of living.

In my business I see the misery on a daily basis. People that have

to try 3 different credit cards before one of them finally approves for

the $10 of gas they are trying to buy so they can make it to work at all.

They raid their coin collections and use them for change.

They think twice about getting their cup of coffee in the morning.

Jobs have gotten so scarce that the local paper only had 3 help

wanted ads in their weekend edition.

All around me Retailers are cutting back on labor. Oh they don’t

lay off, oh no, let’s just cut the hours. The poor cashier that barely

can make a living on 40 hours a week now all the sudden finds herself

with 24 hours a week. She is not a statistic for the Unemployment

record – just someone that can’t make a living anymore.

At the same time everything from donuts to beer all the sudden costs

more. Donuts go up because wheat is traded at record levels since

investors are pulling out of wall street and trying to find another reliable

commodity to trade. Well guess what – when alot of people start buying

a commodity just to make money – the price goes up. Yesterday it

was housing related investments (mortgages) and today it is Wheat,

Oil, Gold, etc. Same game – just a different colored egg.

If we had as much influence as ASG claims please let’s get these

investors to concentrate on a different commodity than Wheat and Oil

Please…. how about “Pet Rocks or Beany Babies”?

I hear they were pretty cheap to make and could be sold at huge

profits.

OK, not going to even bother digging through stats, ASG. I truly appreciate opposing opinions and points of view. BUT, did the media cause Bear to falter? Is the media the cause of institutions lining up for fed loans? Is the media the cause of massive foreclosures? Countrywide? Sure, they would be fine if not for sites like this one.

No. As AnnScott pointed out, the issue is that many people cannot pay their insane mortgages. The borrowers were stupid and the lenders greedy. Plain and simple.

Median homes are affordable for the majority of median earners? These median priced homes are/were in f’ing COMPTON!

As CompaJD has stated … This is not a crisis, rather a much needed correction.

It’s not rocket science. It’s not a new paradigm. It’s common sense and plain arithmetic. Nothing more.

To respond to ASG:

In 2006 40% of all home purchase mortgages had a piggyback loan. So while the primary loan may reset for a year to the current low LIBOR rates the second loan will float with LIBOR, and that isn’t likely to stay this low throughout the year. Also most HELOCS are floating and not fixed. The central bankers will have a very difficult time trying to keep yields low for an extended period of time. To put it another way, they can’t prop up both the bond and stock markets at the same time, one of them has to give.

Like this comment? [yes] [no] (Score: 1 by 1 vote)

Great comments here. I appreciate both sides of the argument on this issue. Unfortunately, there seems to be a heavy bias leaning toward one side of the issue. As some of the commentators have stated, the problem boils down to income. To say a family on $64,000 can “afford†a $412,000 is technically accurate. But it is also feasible for someone on minimum wage to lease a Lexus. Yes, 75 percent of your income will go to the car but if we are to use “afford†as simply meaning you have the money to pay for it, we all can afford many things. Or to paraphrase Chris Rock, “you can drive with your feet, but doesn’t mean it’s a good idea.â€

I’ve heard this “95 percent†of sub-prime loans are not in foreclosure argument a few times. Did you look at the above data from the New York Fed for California? Already over 10 percent of sub-prime loans are in foreclosure. And California has only started seeing negative year over year median price drops since late in 2007. Just because something hasn’t happened doesn’t mean it will not. The trend is to higher rates of foreclosure. Even in 2006, it was evident that sales were dropping and this was a leading indicator telling us where prices would be going as well. Didn’t happen over night but it eventually arrives.

In regards to why nothing was done. Well, things were done. I, as I’m sure many of you wrote letters to certain representatives, talked with friends/family, and also did not buy into the hype but the fact is that our society is a consumerist nation. As long as there is a collective winning feeling fueled by credit, even if the prize is a façade, people will want to keep the pretense going. Think of the stimulus checks coming next month. They are inherently being billed as a spending rebate. In fact, they are crossing their fingers and praying you’ll blow that $600 on consumer goods. Is any leading politician actually saying that maybe we need to tighten our belts a bit for the next few years? Instead of encouraging you to save or spend the money paying down debt, they want the credit cycle to continue. But guess what? The credit party is over:

“Seventy percent of consumers who have received their 2007 income tax refund are using it to pay off credit cards and bills, the first time in 20 years that figure has topped 50 percent, according to Beemer. People who may have never seen the inside of a Wal-Mart are now buying groceries there, he said.â€

Bloomberg Article

Why save at your local bank when savings rates are 1 percent and CDs are 3 percent and inflation is at 4.8%? If the Fed wanted us to save, all they need to do is jack up rates and the money will start flowing into Treasuries and folks will be encouraged to save and avoid more expensive credit. Whether they say it or not, they want everyone to keep spending regardless of their income and some people have bought into this religion.

@JohnH

Why? A good, simple question with a fairly simple answer. Except it’s not really that simple, is it? Sociological implications of fiscal policy that encourages consumption over production, political policy that teaches jingoism over diplomacy, a tax code that favors capital gains over labor.

Ultimately, though, IMO it boils down to speed. We Americans have been taught that speed trumps deliberation. Fast food – but instead we get fatter and unhealthier, and lose the communal sense of going to market, making, and sharing a meal. Fast track to wealth – instead leading us into the present debt debacle. Fast on the freeway – more gas spent, higher gas prices, and ensuing conflicts over petroleum resources – all to get home five minutes sooner to do what? Watch some TV show and shut out conversation with the spouse or kid while wolfing down some high in saturated fat fries – with a diet soft drink, natch.

That old refrain to ‘stop and smell the roses’ has never been more applicable. Too many people wanted to get rich quick and so threw sense out the window, cheered on by the 6%’ers, by the Fed, by the tax code, by advertisers.

Enough schadenfreude. Right – simple answer. Back on track. Why? Perhaps Gordon Gecko – greed is good. Short memories. And maybe – of those that did remember, so many of us believed ‘it’s different this time’, and that we’d outsmarted the historical and economic forces that pointed out the folly – this time. Turns out, not so much.

Math is NOT MONEY ,Money is NOT Math,never trust the people that have all the paperwork done in advance and sit back and challenge the whole world to bet with them. If you are sitting at the table with 10 people playing cards for money and in 2 minutes can’t figure out who the sucker is,….IT’S YOU !

GOLD & SILVER are REAL money and we will see commodities continue to increase accordingly. It’s Not an event when real money and commodities increase,it’s the process of reversing the BAD money driving out the good. It’s a good train Precious Metals, get on and ride. The pay will be great and you’ll love the work 🙂

Well

I am going to save regardless of what they say.

I want to buy a farm(seriously not a joke)

I believe many in authority were aware of the lax regulations that allowed this financial mess to happen however, since money was being made by all involved, a blind eye was turned to the problem until the situation reached crisis proportion.

Now, the guilty the innocent and the ignorant are all being swept into bottomless whirlpool of debt.

This is the most affordable houses have been in a very long time? Are you on drugs? The year over year price increase has been NUTS since 1997. Houses in California have a long way to fall before they are in line with historic levels. And fall they will.

The article isn’t fear mongering…its reporting the truth. I was a mortgage lender until a year ago. I got out because, quite honestly, I couldn’t sleep at night. We sold the Payoption ARM through Countrywide nearly exclusively. To the tune of $45,000,000 a month.

Only a bare handful of the borrowers understood how the loan worked. Most of them simply cannot afford anything but the minimum payment, and only took the loan because their broker told them the value of the property would go up faster than the min. payments ate up their equity. Now that values are falling those people are underwater, and they are going to walk in droves.

Dr HBB

Funny you should mention those ads….. just in the past couple of weeks, I’ve noticed Wachovia airing those ‘Pick a Payment’ ads.

To thier credit, they do mention (in the millisecond-long fine print) some of the pitfalls of paying I/O, but you’d need TiVO’s ‘slow’ feature to actually read it.

Still – wtf?

I’ve never seen Wachovia running ads like that before. Guess they’re desperate for business or something.

BusinessWeek had an article today about the mortgage insurer ACA and how this worked ( or didn’t). Next to it was a picture of Stan O’Neil the boss at Merrill

Lynch. The deal went something like this. As long as the mortgages you bought were ‘insured’ Merrill could claim as profits the difference between the spread between the cost of borrowing money, the cost of the insurance and the yield on the mortgages. So if Merrill borrowed money at 6%, bought insurance for 0.5% and bought 8% mortgages it was making money. Basically free money. The more you borrowed the more the company made, the more you made. Thus all the leverage on Wall St. The thing is guys like Mr. O’Neil were sophisticated financiers. They knew at both ends of the scheme this was an impossibility. An endless chain of subprime mortgages was not AAA debt and, in the case of ACA (the insurer was rated only A) was not real insurance. IOW, a fraud was being perpetrated and it was global in its reach. The Sydney Morning Herald has a story of small Australian town councils losing millions of dollars because their financial managers were sold ( I won’t say bought) US MBS. How did the town manager of Cronulla Beach, Australia come into possession of Wamu issued loans on homes in Merced, California? A regional German bank find itself holding millions worth of loans on slum properties in Cleveland, Ohio? A Japanese pension fund owning the mortgage on the house of an illegal alien from Honduras

working as a busboy at the Bellagio Casino in Las Vegas? We’ve had a number of ‘confessions’ from mortgage brokers and even speculators right here on Doctor

Housing Bubble’s small corner of the internet. Am I to believe that no one, not a single executive from any of the big money center banks or even the large US regional banks, had any idea of what was going on? No one at the Federal Reserve Banks ( plural), the OTS, the Treasury of the United States of America. I find this beyond belief. Some people in high places need to be questioned and their interlocutors need to be US Attorneys. Will we have anyone take up this challenge?

when will everyone stop blaming the loan programs, IO, teaser rates, etc, and start blaming the greedy borrowers who didn’t care what it cost or what the future resets where, but just wanted their home or cash or both and damm the future? If a borrower has the bad luck to lose his job, have unexpected kids, get sick, or any number of reasons why their income goes down or the expenses up, it wouldn’t matter if they had a 2/28 IO arm reseting, or a 30 yr fixed P&I payment at 5.5%, they would still be late on their mortgage or going into foreclosure.

Everyone drank the punch and everyone has to suffer now. Dishonest & greedy brokers, dishonest and greedy borrowers, dishonest and greedy lenders, etc. Nobody thought this market would turn, and when it did, many had their pants down unready and unprepared. Nobody ever looked and planned for the worst case scenario, which is happening now.

BTW, i am a mortgage borker and a recent 1st time home buyer. I used to get calls all the tiem from CA clients wanted 100% stated/stated deals, so they could get in a house of their dreams. Most of these people could put down 5-10%, but why shuld they, in their words, when money was so cheap to borrow. They all said they would refi in 6 months to a year when their hosue was worth 10%-20% more and that CA prices never go down. Heck, I didn’t buy my house til i could put at least 20% down, and based my expenses and mortagge on 70% of my previous year’s income, JUST IN CASE, the market turned, which it did, and my income went down (actually it is the same, thank g-d).

Greed is what killed this market, and time for people to take responsibility for their actions and that is everyone fron the banks and borrowers.

What a table full of misleading statistics. With a “2-1 temp buydown”…

Sure. But how would that make sense for anybody, unless

they had a temporarily reduced income. And they knew for sure when

their income was going to be restored to its rightful higher level.

Same unsustainable nonsense that got us into trouble to begin with.

May as well calculate the percentage of households that could

afford median-priced homes if the tooth fairy put $200,000 under

their pillows.

ASG – Two things

1) Your CA Affordability Math above – Lenders don’t qualify at the temporary bought down rate, they qualify at the full rate post BD and for good reason. In years 3 – 30, the BD rate is irrelevant, borrowers must be able to pay the full rate unless they plan to flip the house for profit before year 3 comes. We know where that ends up. Using a bought down rate to compute affordibility metrics is bogus.

2) The problem with the 2/28 is two fold – One they reset from their low initial fixed rate to an index plus margin adjustable, typicall 6 or 12 month libor plus margin. SInce Bernanke has gone on a tear LIBOR has dropped to the point where the reset in and of itself will not be excessively problematic. But – Two – Typically thr I/O term ends on many subprime loans when the loan resetys meaning the payemnt will go up no matter where LIBOR is since the payment is going from I/O to Full Am.

The arm reset is just one of many problems, lack of middle class jobs is even bigger and the Bush Administration trying to disguise it further implicates matters in the financial spectrum. We are in for huge turmoil I have never seen shopping malls so empty in my life, the only items people are shopping for are clearance items, that won’t keep them in business long, retailers are hurting badly and unemployment is more accurately at about 15% plus, unemployment benefits need to be extended quickly instead of cooking the numbers as to create confusion with the censured media who still doesn’t want to admit to a recession, unfortunately we are in midst of a depression, they wouldn’t know because they are fortunate to be employed, we know what’s going on out their, we can’t have a government making a mockery of the people they are suppose to serve, on the brink of financial havoc. The trickle effect will be catastrophic and everybody will be harmed.

Doctor Bubble, you bad boy. You made 247 banks go under!

http://ml-implode.com/?ref=drhousingbubble.blogspot.com

I knew someone had to be at fault. It couldn’t be the banks and their lax lending standards and undocumented income loans with gamed applications and total inability to pay attention to their own fundamentals.

Eh, it’s too sad to even joke about. Good post as always, Doc, you continue to improve and you were good before.

“…the value of the property would go up faster than the min. payments ate up their equity….”

Hails to history. Sounds like ’29 heading for ’09.

Course, one thing, though: 80 is not divisible by 7.

Tweak on….

It is unbelievable how many people STILL pull out the “but most people in California earn six figures” card. I recently had some idiot tell me that “high school dropouts can make $30,000.00/year at Foot Locker,” and insisted that anyone with an HS diploma and minimal skills can easily earn far more.

It all comes back to what you talk about in this post: A startling number of Americans are financially illiterate. They are oblivious to the fact that the median wage–even in “rich” California–is nowhere near six figures, and that retail clerks earn minimum wage, not $30,000.00/year. Since they cannot grasp these very simple concepts, it’s not surprising that they think they’re “saving money” with an option ARM, and do not see how credit cards are a trap.

Yup, welcome to California…

I wasn’t aware of the nonsense that was going on until around 2005 when

people around me all the sudden became homeowners. We are talking

about people that made $10 to $12 an hour and no they didn’t inherit

money to come up with the down payment. They were simply told

that they could – and so they did.

Needless to say that most of them are no longer homeowners. But not

a single one really understood the loan papers they signed.

Which is the real problem… I don’t think that everybody was in for this

because they saw $$$$ in front of their eyes and meant to buy property

to flip and resell at a huge profit. No, they were just everyday people

that were told that yes, they could realize the american dream and

buy a house.

They thought that their mortgage was a fixed 30 year when in reality

they had one of those bogus mortgages that reset within a year or two

with the downpayment attached as a second.

Me? I rent. – I am a realist and $400K for a house isn’t worth it.

Everybody thought I was nuts to stay out of it – but I prefer to be able

to sleep at night knowing that I have at least 6 months worth of cash

in my savings and a comfortable checking account balance that doesn’t

need to be checked every time I make a purchase.

I haven’t owned a credit card in ten years. My ATM/check card does just

fine. I bought both of my cars with cash. Used, of course but very reliable.

I don’t need the newest gimmick and absolutely hate Cell phones.

Large purchases (TV, Laptop, etc.) are “planned” meaning that I will

pay cash. I may not be fond of what my 401K or my IRA are doing right

now, but at least I have them. I find it amusing that the gold I own has

gone up in value but I wouldn’t think of selling it. Gold panning is a hobby

of mine although this year you can’t squeeze yourself into an open spot

at the rivers and creeks. Everybody is trying their luck at it – have fun

but don’t think you will get rich quick.

As far as I can see it will take at least 2 more years for the Real Estate

prices in CA to come down to where they need to be. Incidently by then

all the people who defaulted will have their Credit restored to them and

the game can begin again. Hopefully this time it will not end up in another

frenzy and people will realize that we buy houses to live in and raise a family

with the expectation to be in the house for a long time.

Of course we will need to attract alot of people. You should see how many

new housing projects have been built around here in the last couple of years.

It is absolutely amazing. These are huge, beautiful mansions with hardly

anybody living in the neighborhoods. From the looks of it everybody must

think that Californians make $200,000 a year. I am sure they are out

there but around me is just plain old middle class and the average Joe.

Greetings from Northern California and thank you for your comments and

stories. For a while there I was afraid that there was no common sense

left out there.

Reena

Re: Reena’s comment:

It’s great to see posts on this blog from people like Reena. We follow the same finanical mantra she does (with the exception that my wife and I have one credit card for emergencies only). It’s called “LIVING WITHIN YOUR MEANS AND NOT BEING STUPID WITH YOUR MONEY, FOLKS.”

2 years is a safe bet for a BIG Nor Cal (were we also live) correction. However, if the defaults continue to rise at an even faster pace (Sacramento Area in particular), the correction may come a bit earlier. I have said many times that once homes are back to the 3 x income, then we can talk about a recovery in the market. Which means, PONZI SCHEME GAME OVER. Hopefully the nation never sees another stupid episode like this in the future.

And for you Doc, keep the good posts coming. These posts always have humor in them. You should talk to Jay Leno and see if he would entertain the thought of you doing a stand up gig on one of his shows.

Ok, I understand the subprime mess, lax lending, reset schedule etc… but when I look at the longer history of the bubble, prices started rising more than the fundamentals would support in 1999. This is BEFORE lax lending, before Greenspan lowered rates, etc. Please tell me why then? Something is missing.

Check this one out:

PropertyForeclosure.com

for a whole $10 down this genius will show you how to flip

a house in less than 6 hours and resell it at profit to a hungry

investor that is willing to do the repairs….

And he has been teaching his methods to the public for

8 years… and why wait… buy his book, CD or online course

and you too can be rich without lifting a finger or ever using more

than $10 of your own money.

The sharks are still out there…

I don’t know when it exactly started. All I know is that around 2005

you couldn’t escape the advertisements on T.V. and Flip this House,

Trading Spaces and all the other “reality” real estate shows started

to replace the down to earth shows that taught you how to build

a bird house or fix your dripping faucet. All the sudden “hype, action

and how to make a fast buck” was hip on public television.

Of course these shows were just the peak of the ice berg and the

whole “buy cheap and sell for profit” thing had to have started alot

earlier. The nonsense did probably originate here in California.

Most likely southern California priced the middle class out of

the market. These people moved to the Bay Area. The Bay Area

went nuts during the tech hype of the 90’s. (this is why everybody

thinks that every Californian makes $200K a year) The Bay Area

aka the “Pit” can’t expand anymore and next think you know they

are knocking on the door of sleepy old northern California and buying

everything in sight at “bargain” prices. The next wave follows and the

first wave sells to the second wave, etc. etc. Inbetween was a slump

aka the 9/11 recession and then the lending standards dropped.

Just as we were in the middle of the second wave of Bay Area exodus

to the north it started getting interesting and what would have been

just a wave or two from the Bay turned into a different game.

Add to this an earthquake or two, the fact that wild fires don’t

care about the price of your mansion in Malibu, that the north gripes

about having to give up the water to the south and you can see why

Californians like to move alot.

🙂 Reena.

P.S. I do love it here – and remember people are people.

There are a lot of down to earth people here that work hard and

try to make a living just like everywhere else in this country.

I was wondering if anyone has actually tried the property foreclosure.com , I have read the testimonials and they are quite convincing not to mention the 12-month guarantee …I have never heard of a program that gives you 12 months to try their product !!!

Leave a Reply