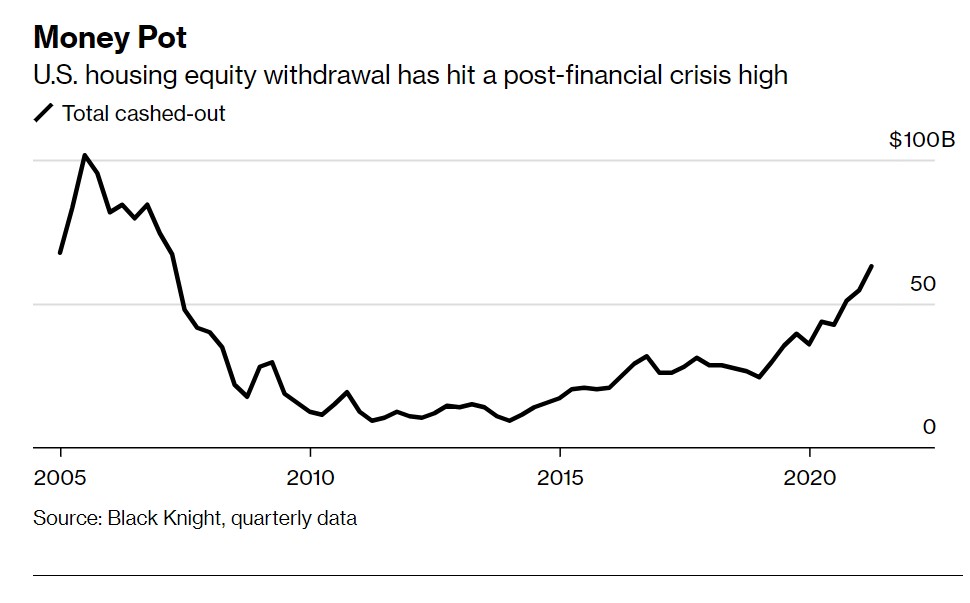

The Home Equity Machine is Back on the Menu: Equity Withdrawals Reach Post-Financial Crisis Highs

As we are seeing in the financial markets, inflation has a big impact on the way people behave. Too much money floating around is going to push the price of items up. Back in 2005 to 2007 it was incredible how many people viewed their homes as ATMs and tapped equity to fuel their lifestyles. Well guess what? Home equity withdrawals are back on the menu. In fact, the rate in which people are tapping their home equity is reaching levels last seen in the months before the housing market imploded. At this stage, it is pointless to save your money in a bank account. Banks are paying roughly zero percent on savings so people are chasing yields in everything from crypto, to real estate, to stocks. We have companies with no tangible products or revenue now being valued in the tens of billions of dollars because money is simply floating through an aggressively inflated system. The Fed is now trapped. Inflation is soaring but raising rates will correct the markets. What is a person to do? Well leave it to the average American to yank money out of their homes and spend on fun times.

HELOC Machine Is Back

The system feels like it is inching to another Minsky Moment. I wrote about this back in 2007 and this is what it is:

“A Minsky moment is a sudden, major collapse of asset values which marks the end of the growth phase of a cycle in credit markets or business activity.”

Will asset values collapse this time around? Well it depends on what a collapse means to you. Asset values are incredibly inflated and disconnected from any measurable metrics of historical values. Of course we get the “this time is different” argument over and over but when you have meme coins amassing billions of dollars (there are 15,000+ crypto currencies) or you have IPOs that make Theranos look like a sound company, you realize we are reaching the grift part of the cycle. The public views this, a few years late, so they join in the party right when they should be more conservative. So what happens is you get this sudden reversal of fortunes and this happens in most large bull runs (e.g., the dot com bust, the Great Recession, the first few months of Covid-19, etc.).

So here is what this looks like in practice:

Whoops. Cheap money and with incredibly low rates, Americans are tapping equity out of their homes. So do the math here. Say your home went up by $100,000 last year. You can tap your home for $50,000 for 3%. Inflation is over 6% so this is virtually “free” money. So people take this money out and buy things, remodel, or use it for anything else pushing the cost of items up as it competes with all the money in the system. Yet you still need to pay this back. There is no free lunch. Doing cocaine feels good in the short-term but at some point you crash – no shock that Fentanyl deaths for young Americans hit a record this last year sadly. So we have this system now where everything is increasing in cost because in the real world, there are only so many cars you can buy or so many turkeys to purchase. Sure, in the metaverse you can buy real estate and art with no restrictions but in reality, we are limited by the amount of supply and demand.

The more sophisticated (aka grifter class) is already ahead of game pitching toxic SPACs and crap-coins and the greater fools will rush in. Once again we are in the crony capitalism phase of the market. Corporate socialism for us, straight up aggressive capitalism for the masses. The Fed is basically making those with assets wealthier (the top 1 percent control more wealth than the entire US middle class combined). Inflation is a tax on the poor and middle class.

The HELOC trend is worrisome because for Joe and Karen, most of their wealth is in housing. So tapping money out of housing is typically not a smart move. This also shows a weird notion that the gains of the last two years are sustainable (they are not). The system has trillions of dollars in Covid relief, PPP for big businesses, stimulus checks, no regulation checks on toxic things like SPACs which usually enrich the founders while leaving others as bag holders, and you have people pushing stocks like GME and AMC up as a protest sign.

Why work when you can simply tap the $100,000 gains in equity each year? They typical US family makes $67,000 a year before taxes. So just imagine how it feels for them when someone sitting on their butt is making that much just by sitting in their home? So of course they are going to chase gains in weird places or tap equity out. By definition something that is unsustainable will come to an end. The end is usually not a clean one.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

169 Responses to “The Home Equity Machine is Back on the Menu: Equity Withdrawals Reach Post-Financial Crisis Highs”

Borrowing money for speculation was a big cause of the 1929 crash. But there wasn’t the degree of inflation we have today in the US because the money supply was pegged to gold. What disappeared was money out on credit, which is deflationary. Today, what you are borrowing isn’t linked to anything tangible, just a note from the government saying you have so many “dollars”, which is just a figure in a ledger.

I’ve heard a lot of ads touting getting money out of your home to finance investments or upgrades to your home. Both of those are better than using the money to buy rapidly depreciating toys or vacation trips. But if we have another deflationary economic crash like 2008, you are guaranteed a bigger loss than if you had just left well enough alone. I recommend hanging on to assets and avoiding debt that isn’t necessary to provide something you absolutely need.

These points are for the ages.

Borrowing money for speculation (aka leverage) is always adding risk to economy. Fiat money or gold. Fiat money is much more suited to modern world, this is why concept of using BTC as gold is already outdated.

What I do not know is liabilities of BTC holders (either direct borrowing to buy BTC or other debt). I still think that next liquidity crunch will trigger massive BTC sell off, unless BTC crowd somehow is not leveraged that much.

Yes, my coworker just borrowed against his home to purchase more crypto. He encouraged me to do the same.

2022 will be massive for the crypto market! I simply cannot wait 🙂 🙂

100k Bitcoin baby!

Vanguard rips crypto a new one.

https://investor.vanguard.com/investor-resources-education/article/cryptocurrencies-and-vanguard-what-we-think

When crypto was at 60K earlier last year, M said folks should buy because it’d hit 100K by year’s end. I think he even said 300K at one point. Not only did it not reach 100K, but it’s hardly above 40K just a few days into January.

“Yes, my coworker just borrowed against his home to purchase more crypto. He encouraged me to do the same.”

Crypto went utterly mainstream (as an “investment”, not a currency; that has yet to occur) a month or two ago. Charlie’s coworker borrowed against his house to purchase (gamble) crypto, my cousin traded a large swatch of his family’s retirement for crypto, everybody’s Mom and her Cousin Louie and his kids got on board the crypto [FOMO] bandwagon…

…which begs the question: Is *everybody* really going to get rich off Bitcoin? Of course not! It’s too late and for those who got in early, there’s still no guarantee it won’t tank. Sorry, but the latecomers are suckers drinking Kool-aid from people like M.

Get Rich Quick™ doesn’t work for the masses. It never has and never will.

My take on vanguard:

Roth IRA’s for crypto are showing an unprecedented demand. Take itrust capital for instance. No monthly fees and you can trade bitcoin, Ethereum, Cardano a number of other cryptos tax free. They are the largest crypto Roth IRA platform. I got an account there as well.

Of course vanguard is not happy about the massive money outflow from their traditional platform to new players.

You can easily pick apart their article:

“Risk without reward. Unlike stocks and bonds, cryptocurrencies don’t pay dividends or cash payments, and therefore don’t offer any intrinsic value for the sizable amount of risk the investor takes on.

Who’s in charge here? As stated earlier, cryptocurrencies are largely unregulated without the backing of major governments or economies.”

Cryptos are regulated. Why else would there be a bitcoin spot etf?

Cryptos – if a long term investor like me reads that crypto is supposed to show risk but no reward I must question the credibility of that author. To give you an example: I accumulated Cardano and ETH for years. Cardano was trading for 2-10 cents per coin. It’s now over a dollar 🙂 that all happened within a few years.

don’t you figure that they’ll manage to absorb most of the money they lend against the equity in houses and then get the houses too?

I do. They’ll probably even get the public to clamor for everything they have wanted to force on the public, as usual.

The courageous student loan forgiveness movement lays the foundation for HELOC loan forgiveness. Freedom from debt oppression now!

Morning Blurtman , if you want to end your debt oppression only spend what you have in your pocket. Sit on your front porch while drinking sweet tea and watch the people wearing $200 dollar suits strutting down the sidewalk while wearing shoes with holes in the soles, and wearing recycled underwear .Stop trying to impress others who don’t really matter. We are all created equal, some more equal than others. Take a breather and reassess your own situation.

I don’t think the mobs will be able to force HELOCs to be forgiven.. but IF HELOC debt will be forgiven, then why not tap it?

PPP loans were built to be forgiven so tons of people took advantage of that and spent the money on more assets (second homes, investment properties, crypto, etc).

We have sat on way too much cash for far too long. I’m seeing people buying houses and doing nothing to them and flipping them three months after purchase for 200k more than they paid, realtors getting rich!

Thanks to the Brandon inflation, holding cash is the worst thing you can do right now. Buy something, anything. I don’t mean R/E necessarily, anything of value. Hell even a used car is a good investment these days. Whatever you do, for God’s sake don’t hold worthless USDs.

That’s what people did in the hyper inflation days in South America. Just buy a cello or anything.

Buy tools or something that will provide income in the coming days.

I new car is probably you best deal at this point.

That’s what people did in the hyper inflation days in South America. Just buy a cello or anything.

Buy tools or something that will provide income in the coming days.

A new car is probably you best deal at this point.

I’d rather be in Cash losing 5-6% per Year than 80% in Stock Market or 30% in RE Market.

Lol Sammy. When is that 80% market crash going to occur? 30% in RE? Let me guess, any day now?

The end to this speculative madness can’t come fast enough. I really hope the feds can’t intervene with funny money and bailouts for those who get caught short when the inevitable crash hits. But alas, I’m sure they will. Why are they so afraid to raise interest rates?

Real estate in Los Angeles is out of control , stratospheric prices, multiple

Offers for anything . The money is flowing and so many offers are non contingent and all cash ! Trillions of dollars in FAKE PPP loans , has created this urgency to stash the money – and “IF” these thieves are caught , ( they may have the loans forgiven) or they think they can sell the property , keep the profit and stay out of jail !! I’m seeing this every day . Sneaky bastards writing outrageous offers . Will it end ? Unless the idiot few raise the rates and start calling in these delinquent mortgages it won’t ! The runaway train is ruining our economy . We will continue to see real estate prices go way up in 2022 -with low interest rates ( under 5%) and low inventory , low foreclosures – we are headed for a hyper inflation year – no, it’s not going to get better . The administration needs to wake up and take control – other countries are starting to raise rates rather that destroy the currency . This is a nightmare !

But housing to bust for really real this time!

Deja Vu all over again…Been there and seen that before. I know the American society is based on spending instead of saving, but I would rather curb my appetite for the latest and greatest instead of only replacing items when that item is no longer serviceable. The only 3 people I want to impress – my spouse – my Banker – my Tax Preparer. Let others wonder why I don’t have the latest and greatest, but my older American car will get me to the mountains but not as quick as your whiz bang high dollar import, and we eat off the middle of the menu , but we do not toss and turn at night worrying how we are going to meet the minimum monthly payment just to keep the illusion going till the bitter end. Time to reassess our priorities.

We are consumption-based society…and do not self-deprecate, since it is not just American society but the entire world.

If absolutely everyone goes frugal, you will end up losing your job since your salary is being paid by someone’s consumption somewhere.

But premise is correct: Excessive borrowing will trigger liquidity crunch. And it will be BTCs over MSFT stock that will be sold first to cover the HELOC payments.

Ya, because every family that is living better than yours is up to their eyeballs in debt and are up late at night worrying about it. smh

“Why work when you can simply tap the $100,000 gains in equity each year? They typical US family makes $67,000 a year before taxes. ”

I think most people want a higher standard of living “now” as opposed to waiting. That may mean taking out equity money to improve or expand their current house or it may mean buying a bigger truck or boat than their neighbor.

Of course the problem is that it has to be paid back. In 2008, the value of the houses became less than the outstanding loans and income dropped due to job losses.

10M people foreclosed and ran like lemmings from their house boat anchor (but probably kept the new depreciating boat)

It could happen again. We’ve seen it all before.

Or the Fed could drive inflation higher. Houses would increase in value so there wouldn’t be any panic selling or foreclosing. Wages would go up lagging inflation the the story will continue happily forever (to the moon). Just like any good fairy tale. That 1M house in LA will become a 5M house in LA in no time with plenty of equity. There will never be a job loss recession again and typical household income in the US will shoot to 300K per year.

Buy now or forever miss out.

There’s probably somewhere in-between that is less happy and less painful. Trust the Fed!

But not like you did n 2008. They learned from that.

My Magic Eight Ball says “Reply hazy, try again.”. My palm reader says “You will have a long and happy life.” I won’t mention my crystal ball again. I miss it.

“My Magic Eight Ball says“

Good, cause your crystal ball was smashed by the great Northridge quake of ‘92.

Thanks for pointing this out, Rich.

You must be fairly young. The Northridge quake that destroyed my beloved crystal ball was in 1994. You wouldn’t have forgotten that if you were there.

The median HH income is $67K. A household can be 1 person or 10 people, it’s not “family” income, it’s HOUSEHOLD income.

A typical family, ie a traditional mom, dad, kids family is making a lot more than $67K. And those that are buying homes are making waaaaay more than $67K.

Can there be a collapse of RE with all this inflation?

Inflation leads to a false impression of real value for the general population. If inflation is 10% and the value of a property only goes up 5%, then you’ve lost money in terms of real value. Residential real estate tends to perform better than many assets in an inflationary environment because of its importance to daily life. But commercial real estate has problems because of the negative impact on business profits from inflation. Ultimately, destroying economy by destroying the currency impoverishes everyone to some extent, but those without real assets suffer the most. Look up “rentenmark”, a currency backed by real estate used in post-inflation Germany in the 1920s.

Maybe everything bubble will burst with the dollar.

Seasonal slump or crater city?

https://www.cnbc.com/2021/12/23/sales-of-newly-built-homes-tank-as-affordability-hits-buyers.html

Per the article “ Still, inventory of existing homes is at historic lows, keeping prices high for now.”

Massive money printing

Historic low inventory

Low interest rates

Inflation (significantly above previous years)

Good luck thinking/hoping that home prices will fall anytime soon

Making money in RE, for the most part, is not a get rich quick scheme. At least, that is how it was for me. However, as a young person I read a book where it says that most rich people made their money in RE; I am talking about self made millionaires, not those connected who make billions or those who inherit.

As a person with no money or inheritance or connections, I worked hard, lived frugal, saved as much as I could and started investing in RE. Decades later, I am also a self made multi millionaire with lots of RE investments. Comparative to Bill Gates I am poor but I have a very high standard of living. I am no longer frugal, I am working normal hours and I enjoy what I am doing. I am always fully invested in RE regardless of where the market is going. I keep cash only for emergencies. You have to be prepared at all times to face any direction in the market – don’t leverage too much! I liked fix payments and their total be kept always under 25% of my net income (which is very high).

My peace of mind comes first – I can not put a price on that; after all, that is the only reason I invested in the first place. In the end, the turtle wins the race with the rabbit!…I learned that from a billionaire 🙂

Great advice! Live and invest within your means, and don’t leverage with a HELOC.

Happy New Year!

Merry Christmas to all of you!

My 2022 outlook:

Crypto to rise higher but to peak eventually

Housing to keep climbing (due to housing shortage, high demand and low interest rates)

M buys his first investment property in Arizona

Stocks will go much higher

Inflation to remain high

I’m guessing that the frequency of posts on your blog is about to increase a lot given that it’s obvious to anyone paying attention that this economy is about to implode. We survived 2008, but what I see coming down the pike is likely to make 2008 look like a Sunday picnic. The worst of the worst is going to happen to those who, as you alluded to, aren’t paying attention and coming in to the game a few years too late. The election year will do it’s usual magic to keep things moving forward, but they can’t keep this charade up for long. We’ve become a banana republic.

I bought a home in 2012 here in LA near Culver City for $470K at a time when most of the posters here said I was ‘catching a falling knife’ haha.

Consider me old-school, like my blue collar father – I would never put myself in a position to get HELOC money. My mortgage is $1650 a month for a 1800 sqft home on 7000sqft land.

1 bedroom apartments at LaCienega and Jefferson in the new Cumulous Project and Arc Resdences are leasing for $3K per month. My mortgage, insurance, utilities and taxes are less than that.

generic homes now on my block are selling for $1.2M. Unreal.

If housing goes into serious crash, I can survive with a low mortgage.

No doubt, but probably 1/2 to 2/3 of that appreciation in your hood since you bought is due to people who are in no where near as good a position as you. They might even be airbnb moguls, crypto addicts or NFT gurus, skating on very thin ice. I read their comments all over the web and they appear to invest in things with as much thought/analysis as those who got caught up in the pet rock/beanie baby/sports card crazes. Its a mass psychosis that pairs well with the giant psyop that is covid-19.

Actually, for the past 8 years, I have personally taken an interest in the people who have moved into the neighborhood of Baldwin Vista since I moved in – most are well-to-do coupled and families in Film, TV and IT who were renting on the Westside or West Hollywood. They want to own a home and still be close to Culver City, Santa Monica and Hollywood.

Baldwin Vista is the closest and safest area you can get to the beach and still pay only $1M – $1.2M for a 1600-2000 sq ft home on 7,000 sqft land.

(even dumps in Culver City are now $1.5M)

Think about what you said – even dumps go for 1.5M. Even for high earning couples, thats decades of toil on top of the insane taxes, traffic, cost of living, crime, homelessness, etc for a dump. I’m guessing those dumps are old and run down. Age wont make that any better. They could move elsewhere and have a much better quality of living. I did it myself 15 years ago. People are kidding themselves that Culver City is desirable. I lived in socal for years, CC was considered nothing decades ago.

People talk up the weather – many places are better. They talk about the ocean – same. And the reality is they probably never go into the ocean there, too cold. And that whole surf and ski on the same day? Never happens. Its all mass psychosis. I’m guessing most of these “affluent” neighbors have never lived abroad or maybe never even traveled abroad. If they did they might realize there are incredible places all over this planet where the cost of living is a fraction of what it is in the oppressive grind of CA.

Merry Christmas to all of you, democrats and republican!…:-)

My prediction for the new year – stocks will go down, at least in the first half of the year; residential RE might have a small correction, but not like in 2008, Cryptos will go down, at least in the first half of the year (it might go up on the second part).

All that being said, the main factors influencing the market are political and politicians change their minds all the time; it is also an election year. The economy is no longer going based on fundamentals, but based on the whims of the Central Committee of the Politburo.

Do not discredit your good ideas with this “politburo” crap

David Stockman calls the Fed the “monetary Politburo “, seems accurate to me!

The difference between the American Federal bureaucracy and the eastern European politburos that Flyover lived under is that we still have a somewhat independent judiciary, some independent state governments that are resisting, a bit of a legislative stalemate at the Federal level (by a thread), and we have a somewhat free economy with non-state owned businesses, some of which don’t support centralization. The soul of the bureaucracy has been socialist since the Obama era transformation. In other words, they still don’t have the power to send Flyover to the gulag.

Happy New Year to All.

Here are my predictions:

1) The Fed(The Central Committee of the Banking Politburo) will raise rates in Q1-Q2

This will cause a steep drop in stocks (10-20%) similar to the last time the Politburo raised rates in 2018. Unlike 2018, the Politburo will hold the rates and allow the stock market to recover during the rest of the year and not increase rates until it is stable. The Politburo will not raise rates but will continue backing off of QE and will stop purchasing mortgage backed securities which will drive mortgage rates to 4-5%. (Hang on to your current 2.5% loan)

2) Inflation will drop to 4-5% as supply chains free up. The “free” Covid money will be spent and rent and mortgage forbearance will be settled in the courts.

3) Housing lags the stock market, but with less equity for down payments, higher mortgage rates, and increased inflation, price growth will be mostly flat or 3-5%. There will not be a crash if the Politburo does not make the same mistakes of 2008.

People will be more likely to sell their homes as they move back to working from an office and the fear of Covid decreases.

Employment demand is still high and wage growth is increasing.

4) Crypto – Anything that goes up 8X in 2 years is bound for tragedy at some point.

Disclaimer:

A massive Ebola outbreak, WW III, an asteroid collision, or a massive quake causing CA to slide into the ocean would likely affect these predictions.

I’ve been thinking and partially hoping that real estate would crash or go back to the price levels of 2009 and 10’ even though I have been buying real estate each year for the past 8 years. This market is ridiculous but I’m still buying because it’s better than holding cash or other investments. People think we are at the bottom for low rates but what’s to keep the fed/government, especially when Fannie and Freddie are still under government conservatorship, from going to 1% mortgages or 40 or 50 year terms like other countries. Nothing! Next big market scare/downturn and that’s what’s coming. Housing will never go back to the levels seem in 2008 so take action and get into the market.

I’ve been thinking and partially hoping that real estate would crash or go back to the price levels of 2009 and 10’ even though I have been buying real estate each year for the past 8 years. This market is ridiculous but I’m still buying because it’s better than holding cash or other investments. People think we are at the bottom for low rates but what’s to keep the fed/government, especially when Fannie and Freddie are still under government conservatorship, from going to 1% mortgages or 40 or 50 year terms like other countries. Nothing! Next big market scare/downturn and that’s what’s coming. Housing will never go back to the levels seem in 2008 so take action and get into the market.

Millions are refusing the vaxx mandate. Exp. those professionals with house paid off and perhaps investments. They’re tapping into their equity for cash, to support their fam in the same boat, until this horrific Orwellian samdemic nightmare comes to an end.

It’s as simple as that.

that’s great insight, Anna. One that I hadnt thought about it and it does make sense.

Whoever is doing heloc to live off just to avoid a vaccine mandate is a fool deserving to part with his money.

Thats a very high price to pay for a questionable principle.

Smart vaccine avoiders would simple move temporarily

The Brandon admin has destroyed the USD with its spending. If you aren’t in real estate right now (or stocks or some other asset), you are losing money literally every hour of every day. I just raised rent by 14% for one of my rentals.

What does Mr Landlord always say? Renting long term is financial suicide. This goes doubly so in an era of double digit inflation.

And a belated Merry Christmas to one and all here.

As usual, Mr. Landlord is correct. Even before the Brandon record inflation hit, I was always pounding the table that buying a home locks in your payment. This protects you from future rising home or rental prices and especially from inflation. Inflation in a normal world was always around 3%, which adds up over a decade. Do a decade of 6-8% percent inflation and you will see a doubling of asset values. This is why sitting on the sidelines NOT owning assets is truly financial suicide.

The only figured locked in the mortgage payment. All other expenses will increase with taxes being the highest increase. Yes, you already knew this.

@Charlie, have you ever heard of Prop 13. I suggest you read up on it. Even one more reason why CA RE is so sticky, many people never sell strictly due to the property taxes they are paying. Due to Prop 13, property taxes only can go up 2% per year max even if Brandon inflation runs 10%. Buying a home here in CA is locking in your payment for the long run. I beat this topic to death during the last decade, go read the archives if you want.

“I just raised rent by 14% for one of my rentals.” – Merry Christmas! I’m sure all of the readers who are renting will respect your advice after increasing your rent double the current inflation rate. Brandon made you do it? It sounds like Scrooge is to blame.

“The Brandon admin has destroyed the USD with its spending” – We are still running under the last Trump budget so this does not make sense. We’ll see once we have the first Biden budget.

I do agree that not owning a house for the long term is financial suicide. As long as you are not forced to foreclose like the 10M who lost their homes in 2008.

Merry Christmas and Happy New Year!

Raising the rent 14% under the current circumstances isn’t unreasonable if the area is one with a shortage of units and a surplus of prospective renters who are worth renting to. That is 7% above inflation. Last year, we didn’t raise the rent on our tenants because we felt that we might have difficulty getting as good tenants as we currently have. A bird in the hand is as good as two in the bush. After all the money we sunk into our rentals this last year, I’d need 14% to pay for it, but I don’t think we’ll go that far because of the smaller supply of good tenants where our rentals are. We have to decide in the next three months if we are going to rent it out for another year or put the houses up on the market this spring. I think we’re going to keep them as rentals because I don’t have anywhere I’d like to move the money and we can’t avoid taxes anyway unless I can find a 1031 in the state where the houses are that I like better.

Oops! The kind of real estate vehicles that you can do an exchange into are not REITs but are Delaware Statutory Trusts (oh I love your state Joe B.! The friend of tax avoiders) or tenants in Common arrangements.

“will respect your advice after increasing your rent double the current inflation rate.”

I am sure you do not believe the official CPI – nobody does. I think Mr Landlord increased the rent below the REAL inflation rate. All the tradesmen rates doing maintenance and all property taxes and insurance rates increased more than 14%. In most states it is not like CA where you have Prop. 13. Property taxes increased based on market values not the bogus CPI.

I am just stating the obvious; I am sure you already know that.

Bob,

Happy New Year!!

First off, nobody “lost” their home. They failed to meet their contractual obligation with a lender.

Yeah I raised 14%, thanks your your Brandon. It’s funny you’re blaming me for something your Brandon is doing. I’m only reacting to the market that is currently in near hyperinflation mode. If your Brandon weren’t a feeble old frail dementia patient, I’d be raising it by a more typical 3-5%.

And yes I feel bad for renters who are subjected to this. But at the same time I am not running a charity.

I partially retract my Scrooge comment above.

Raising rent 14% in a 7% inflationary environment could be justified if

1) The rent hasn’t been raised in years and the going rent for the neighborhood has increased 14% over many years.

2) Massive improvements have been made to the rental. As Mr Landlord pointed out that you can’t lose money on an investment. This isn’t a charity, it is a business.

Otherwise, a landlord could be accused of price gouging and extreme greed. I don’t know Mr Landlord well enough, but I do know extreme greed usually causes Socialist governments to be elected which enact rent control and other laws that severely punish landlords. Greedy landlords are very short-sighted.

The Trump excessive deficit budget in 2021 (greater deficit than even Obama’s largest budget) was his desperate attempt to get re-elected despite having approval ratings below 50% during his entire Presidency. Some fools believe that despite having approval ratings so low, that he actually won the election. Some even blame Brandon for Trump’s budget.

As far as inflation, I see many point to Shadowstats as a reference to the true inflation.

Since Shadowstats has been estimating inflation for 10 years, many point out that if you actually believed them, that a cup of coffee today would be over $1,000. This is a great example of cognitive dissonance.

Sorry Bob, you can not pay skilled labor for maintenance with a cup of coffee. Anybody who tried to hire skilled labor lately know for a fact that their price increases are more like 100% not 14%. The materials went up even more than that. Since most states do not have Prop 13, property taxes went up more than 14% per year. If I remember correctly, Mr Landlord does not have his rental properties in CA; therefore, his increase in rent is below his increase in cost – you can not accuse him of greed. If you want to talk about greed, pick up on the FED and politicians who printed trillions and split them among themselves – I didn’t see any of it.

In terms of polls and approval rating I don’t remember a president with lower approval ratings than Brandon. Even the liberal media who always cheer for him doesn’t mater what (a luxury Trump never had) run out of excuses for his approval rating tanking; I don’t even want to talk about the approval rating for the VP.

I like prognosticators who are willing to put the results for their predictions for the year in print or on-line. Columnist Lazerson has his 2022 predictions and the results of his 2021 predictions in today’s OC Register. Here are the results of his 2021 predictions:

1) 15 year fixed below 1% : actual low = 2.1%

2) Local 30 year fixed below 1.5% with points: actual 2.65 with points.

3) 30 Yr Jumbo below 2% with points: actual 2.65 with points.

4) Freddie Mac 30 yr fixed average = 2.65%: actual 2.95.

5) Wall Street prime remains at 3.25%: Correct!

6) Average Freddie mac rates rise in Q4 2021: Correct.

7) California Eviction / Foreclosure Moratoriums lifted Oct 1: Correct (except for an application from tenants who completed an emergency assistance application have through next March 31 which is a special case).

8) SoCal median home price up 10%: actual >15%.

9) SoCal Home sales flat: Wrong.

10) A first time home buyer tax credit of $10000 will be enacted: Wrong.

I’ll discuss his 2022 predictions later.

Columnist Lazerson (OC Register) 2022 predictions for RE and rates:

1) Globally, shutdowns and lockdowns continue for coronavirus. (pretty much a gimme… my note on his prediction)

2) Continuation of coronavirus will lead to flat mortgage rates and higher home prices (location not specified… my note on his prediction)

3) The 30 yr Freddie Mac mortgage rate will average 3.375%.

4) The 15 yr Freddie Mac rate will average 2.625%

5) The median home price for LA, Orange, SB & Riverside will increase by 8%.

6) Region’s home sales will be flat compared to 2021.

7) CA home sales volume will increase by 5%.

8) The prime rate will increase to 4% from the current 3.25%.

9) Nationally, total mortgage fundings (purchase, refinance and cash out refinance) will drop by 25% compared to 2021.

10) The FHA will decrease the mortgage insurance premium for most mortgages. The up-front MIP will drop to 1.25% of the loan amount from 1.75%. The monthly mortgage insurance premium will drop to 0.55% from 0.85%.

11) The federal government won’t have any new COVID-19 mortgage forbearance programs, and no new eviction moratoriums in CA.

I already posted the results for his 2021 predictions. We’ll see next Christmas how he did for 2022.

Lazerson has great articles.

He seems to have predicted a Doomsday 2021 last year and was very far off.

ie

1) 15 year fixed below 1% : actual low = 2.1% – very close to 2020’s 2.4%

For 2022, his predictions are more conservative. ie rates will rise.

This one I think will be accurate with the current admin but will cause more irresponsible lending since they have already raised the mortgage limits. I think it is dangerous.

“10) The FHA will decrease the mortgage insurance premium for most mortgages. The up-front MIP will drop to 1.25% of the loan amount from 1.75%. The monthly mortgage insurance premium will drop to 0.55% from 0.85%.”

I think his 8% increase prediction of median home prices may be high (I think the higher rates will cause a flattening or dip in the stock market and I don’t think wages will increase by 8% to compensate). We saw what happened 3 years ago in 2018 when the Fed tried to raise rates. I think stock equity gains are driving the housing market now.

Long time lurker, first time poster. Cyber event/ bank holiday coming, probably right before or after mid-terms. Cash is going away, we’re halfway there now. Martial law to follow in metro areas. Law enforcement, first responses, food and rolling blackouts will be sporadic everywhere else. People forget the virus is synthetic, long term presentation unknown as well as “vaccines”. Be thankful for what you have now and try to be kind and helpful to others. I live debt free on coastal Oregon. If the Juan De Fuca subduction zone doesn’t fail I should be fine. I’m old and will accept what happens.

Good luck to us all

I own rental properties in the coastal northwest. I’m making money on them now, even after sinking a lot of money into improving the water systems (one well hookup to an old well and one pump house rebuild with a new purification system). The area is in a REA Co-op for power. Power outages are rare as the local lines are underground, but some lines feeding the area are not. Bad storms have caused long power outages. Rates are low with hydropower being the source. Earthquakes and tsunamis haven’t been a problem (we’re too far inland for tsunamis). I’m not worried about any major fault including the San Andreas. They have a long history, and I have earthquake insurance here in SoCal. That is in God’s hands, not Biden’s.

I live in an area with a lot of hispanics. Back during the Rodney King riots, there was a guy in our neighborhood telling people that they were coming down to our neighborhood from the cheaper apartments a mile away to loot. My Wife told him off, saying it was nonsense. It never came close to happening. (Of course, about 20% of the families on our block were well off hispanics.) The cops out here in suburban Orange County have done a good job with gang control. Democrat controlled cities are going to lose population if the idiots aren’t replaced with pro police union politicians.

HI Gaz

If you have some sources to read about these topics, let me know. I sense it will also happen sometime soon. ie: I dont think FB going dark for a few hours was an accident, I think it was a test balloon for more internet outages.

Thanks

It is funny how the same group of folks can say that government/people in charge are completely incompetent and at the same time point to extremely sophisticated technical conspiracy conducted by the same group. Accidents are not allowed.

Surge, there is no contradiction when you are talking about thousands of people – incompetence and evil can go hand in hand. For example, I file AOC and Maxine Water in the “incompetent category” and I file Pelosi and Schumer in the “evil category”. The later are capable to handle very complex situations in their favor, but that is the extent of it – they don’t do it for the good of the country.

It’s freaking hard to figure out what I want as a rental investment.

Looking at the greater phoenix area. Ideally a single story, north of phoenix.

I love Scottsdale but boy did that area increase in price. The west side of phoenix has good values and maybe I can’t go wrong there.

Looking everyday and crunching numbers all day long. Going back to phoenix to explore the area.

Luckily our generation has crypto otherwise we would be in trouble. Imagine you go to phoenix without 250-300k as a downpayment?! I could pay in cash but I need to be heavily exposed in crypto as I think 2022 will be massive.

Just in case, be prepared for massive BTC losses. Diversify your BTC wealth gains (you are doing this with RE). It might still appreciate but even if the the year might be massive, but king is naked – there is utter failure to show a hint of reason why it will go to 100k (which does not mean it won’t).

Stimulus ending, liquidity shocks here and there, disillusionment – all this contribute to slow but significant decline in BTC/USD.

Hey, maybe you’re right. Maybe up is the only way to go! Insanity truly does appear to be the new norm. Phoenix is probably less vulnerable than Vegas. And Scottsdale less so than most of Maricopa simply because it is affluent. And such strong business there. As long as inflation runs out of control, asset owners win. That’s the idea, anyway. Can’t wait to earn 15% on a CD like in the Carter years! That must’ve been a thrill.

Then there was the 14% mortgage rate we paid on a house in 1980 (with the second that had a lower rate so we could buy with 10% down). Ultimately we wound up with a house that they say is worth maybe $800K paid free and clear. Our initial investment including money borrowed would be $265000 in 2021 dollars according to the Dollar Times inflation calculator.

Bob got mad at me for raising rent by 14% as if I am some evil landlord. Bob is so out of touch with reality it’s embarrassing. This is what happens when you have a Brandon running things. But no mean tweets, so all is well, right Bob?

“The national median rent rose to $1,302 in September, up 15% from a year ago, according to a report from Apartment List, a rental listing site. … Since January, the national median rent has increased by 16.4%. From 2017 to 2019, a more typical rent increase during those months was 3.4%, according to the report.

CNN

Sep 30, 2021

Wow!…And you quoted his favorite media – Communist National Network

As I said above, even the liberal media has a hard time defending Brandon’s incompetence. No wonder his approval rating is circling the drain; even the democrats hate him at this point. Actually Brandon’s base was affected the most due to inflation – their standard of living took a big cut. They were better off financially under Trump. After taxes, they buy way less than before, under Trump.

M,

$40,000.00 told you to wait. Time to add a few more bits and ride the wave.

Wait to do what?! I have been dollar cost avg since years. My first Bitcoin was bought in 2017 and it was at 4K back then…..

So 40k is pretty awesome for me. However, I believe bitcoin will go to 100k this year.

Right now is a great time for people to buy if they want some crypto exposure. Mark my words and thank me later.

M,

Bail out !

Will add back in on 30,000. See you at the bottom.

You want me to sell my precious bitcoin at 42k????? No way 🙂

I might give them Away for a price of 100-150k per coin. Now is a time to buy as they are heavily discounted and because everyone thinks they will get cheaper!

That is the problem that bears have. They always wait for lower prices but fail to buy the dips and boom bitcoin pops and they missed the rocket launch. ???? ????

Weak hands are being shaken out of the crypto market. Mainly new investors who think they can get rich quick.

I have said for years that dollar cost averaging and holding is the best strategy to get wealthy in crypto.

The stock market continues to print new All time highs. If you enjoy 2x gains but dont like 40% dips on the way than crypto is not for you. If that’s you, then stick with the stock market. Besides, you have to be diversified between stocks, crypto and RE.

Crypto is great for someone like me who thinks long term. As many said before, crypto is here to stay and so many industries and large players are getting into it. We are still early and 2022 will be a massive year for crypto. 100k bitcoin will soon be a reality. Soon doesn’t mean next month. My outlook on investments is always long term. I expect to hit 100k Bitcoin within this year.

You said that last year.

Nobody has a stinking’ clue what will happen.

So stay diversified, my friends!

(And remember, don’t gamble your house on crypto!)

I have 1% of my wealth in Ethereum. Better than the lotto, maybe not much better. 🙂

Very happy to hear that. Ethereum is an excellent investment – long term!!

I am also big into ETH and ADA (Cardano). And BTC, and DOT and link and Matic 🙂

My other shitcoins are for sale (sell orders) they are gone during the next alt coin cycle.

“Weak hands are being shaken out…” another financial cliche by those who have no idea what they are doing.

my hunch is a lot of play money put in crypto are flowing out for whatever reason (buy stuff, renovation, need for inflated downpayments for home). With so much inflation, why would anyone put money into useless asset (BTC) vs. buying up more real assets (home, renovation, car, stocks).

You answered your own question.

BTC is an excellent hedge against inflation

Thanks Brandon! Stocks, RE and Crypto will do great during these high inflation years!

Inflation rises to 7% and BTC drops 35% is a hedge against inflation?

The best hedge against inflation during this cycle are 7.1% I Bonds. Insured and guaranteed to pay 7.1% for 6 months.

The second best hedge against inflation is your mortgaged house at a 2.5% mortgage rate with a predicted home price increase of 3-5% this year. Using the 5X short term BTC gains was an excellent diversification strategy. Long term, your house will hedge against exorbitant rent increases from Mr Landlord and after 10 years will be an excellent long term investment.

Last is any entrenched value company stock paying 3-6% dividends. ie CocaCola, Oil and gas, paper. They will get hit with rising interest rates but in 2008, they recovered fastest. If they don’t go bankrupt like General Moters, United Airlines, major banks did in 2008,

Bob,

“ Inflation rises to 7% and BTC drops 35% is a hedge against inflation?”

The answer is yes! Bitcoin is up 141% in the last 12month while annual inflation runs at 7%. Holy crap. Inflation hedge is an understatement:)

I’d cal it best thing since sliced bread. Everyone and their mom should have some % of their wealth invested in Bitcoin. Thank goodness they have Roth IRA options for crypto now! A great way for Millie’s like me to generate tax free wealth from bitcoin and retire early. Got to add a few more rentals to my portfolio as well. I don’t want to work for 30years. Let inflation and Time in the market (not to be confused with timing the market) work for you!

Bitcoin down 25% in a month

https://jacobinmag.com/2022/01/cryptocurrency-scam-blockchain-bitcoin-economy-decentralization

That’s good! It means the cycle prolongs! This is a fantastic buying opportunity!

The average U.S. household with debt now owes $155,622, or more than $15 trillion altogether, including debt from credit cards, mortgages, home equity lines of credit, auto loans, student loans and other household obligations — up 6.2% from a year ago.

Percentage change for total U.S. household debt between 2020 and 2021

Mortgages 8.2%

Any type of debt 6.2%

Auto Loans 6.1%

Student Loans 2.5%

Credit cards ?13.9%

https://www.cnbc.com/2022/01/11/amid-rising-prices-us-households-fall-deeper-in-debt.html

Wonder of credit card debt was reduced using HELOCs.

Doesn’t tell me much. You show the percentage change yoy. Great. What I want to know, out of the 155k debt how much debt is for the mortgage? I assume the majority. If so, that’s great debt!

I just bought a rental investment and will add 100’s of thousands to my debt once it closes (summer time frame). So what? By the time it closes, it will probably add 30k of equity to my wealth. Someone’s giving me a 3.5% loan during 7% inflation per year! And I get to pocket the appreciation for the entire house value by just putting 25% down! Thank you very much! Debt has to be put in relation to your net worth. If you tell me you have 6M of mortgage debt, it could be you are worth millions (net) or you are close to bankruptcy.

Showing a percentage change without the surrounding figures is even more meaningless.

The personal details and opinions you share in the blog are meaningless. Sorry you fail to see the significance of these details. Now tell me about crypto again…

That’s okay Charlie! We are seasoned investors here on this blog and always look at the holistic picture. Percentage changes without surrounding figures don’t impress us. It’s like just reading headlines and using the headline as a basis for a statement. Next time just do more research. Good luck and pls feel free to ask questions!

Headline: California Considers Doubling Its Taxes:

https://taxfoundation.org/california-health-care-tax-proposal/

A proposed constitutional amendment (ACA 11) in California would increase taxes by $12,250 per household, roughly doubling the state’s already high tax collections, to fund a first-in-the-nation single-payer health-care system.

The top marginal rate on wage income would soar to 18.05 percent — nationally, the median top marginal rate is 5.3 percent — and the state would adopt a new 2.3 percent gross receipts tax (GRT), at a rate more than three times that of the country’s highest current pure GRT.

All told, the new tax package is intended to raise an additional $163 billion per year, which is more than California raised in total tax revenue any year prior to the pandemic. …

I am sure Bob Seen it All will be so happy to pay more and more taxes to support an unending stream of illegals pouring over our non existing southern border. If we don’t let countless millions to come in, then people will elect a dictator like Stalin, or something like that….Oh! I forgot we already have a dictator in White House bossing around the whole economy without legislative approval. Good thing we still have somehow level headed justices (nominated by Trump at Supreme Court) to stop our bully – Brandon.

“California faces a downside risk in the form of a continuing exodus of taxpayers”

Exodus tax, mileage tax and now this. What a frinkin greedy state. This will only drive more to leave. Myself included. Then there will be more legislation to recover lost revenue. When does it end?

Ideally, this should be implemented at the Federal level like all other 1st World countries.

Unlike some, I like to live in a 1st World country.

I doubt CA will pass this, but if they did it will be the ONLY state in the US, where capitalist companies will not have to shoulder high health insurance costs for their employees.

I would think that companies would flock to CA to take advantage of this.

Retirees not on Medicare would also be able to move to CA to take advantage of this low-cost healthcare.

Uninsured ER visits would drop and healthcare costs would plummet in CA.

More people would live longer with proper health coverage. Pro-life!

It looks like Bob never had to use government provided “Health Care”. It doesn’t matter where it was implemented, it was a total disaster. I used to be the “beneficiary” of that, but I escaped that “worker’s paradise”.

You may want to study the VA system. Try to extrapolate that to a far larger group of people and to an unending stream of illegals and all I can say is “Good luck with your newly acquired health care”… Maybe it is time that you should also “benefit” from that. You haven’t sen all before. It is time for you to see more.

It will get get even worse when the government goes broke printing constantly and losing the reserve status of the currency. Then you can say that you’ve seen it all.

Bob, I pay over $15,000 a year for my health insurance. (With no pre-existing health problems.)

I pay an additional $2,000 a year for my annual checkup.

That’s because my physician refuses to accept insurance after Obamacare was enacted. Yes, I could go to a doctor within my insurer’s plan, but I prefer my physician because he’s top tier, and offers top tier, personal, unhurried service. He’s good enough that he can afford to forgo insurance.

Plus, I pay for my own dental and eye exams.

So now you’re saying that if I pay for other people’s insurance as well, then my overall cost will go down? Just like in Cuba, Venezuela, and the former USSR?

Again, all of the world’s 1st World countries have socialized medical coverage.

We will be on Medicare when we reach 65.

People are flocking to Canada to buy cheaper prescription medicine.

People are flying to countries in Asia and Mexico to obtain complex medical procedures at a low cost.

The US has the most expensive medical costs in the world.

I don’t know why people don’t see this. Brainwashed, I guess.

Again, all of the world’s 1st World countries have socialized medical coverage.

We will be on Medicare when we reach 65.

People are flocking to Canada to buy cheaper prescription medicine.

People are flying to countries in Asia and Mexico to obtain complex medical procedures at a low cost.

The US has the most expensive medical costs in the world.

I don’t know why people don’t see this. Brainwashed, I guess.

Bob, I knew a Canadian woman who loved her free health care — until she had to use it. She required a dental procedure, and was put on a waiting list.

After two years (when her condition got bad enough, I guess) the Canadian health care system flew her to the U.S. to have the procedure done.

Not enough dentists in Canada to meet all the demand for free dental, I guess.

Bob,

What if I told you that France, Germany, Netherlands and Switzerland all have private health care systems? You’d be shocked of course. That’s because you and your fellow leftists have this weird idea that in all 1st world countries everyone gets FREEEEEEEE health care. Well yeah maybe they do, technically. But like anything that the govt gives to you for “free”, it is garbage. Public systems come with months if not years wait times and sub-par treatment by doctors who probably wouldn’t be allowed to practice vet care in America.

That’s why anyone who can, pays extra to get good care, provided by private providers with top doctors.

And the same will happen in CA. The illegals will get garbage “free” care. While anyone with a decent income will opt for private care.

You guys never learn. Socialism doesn’t work. Never has, never will.

Son,

There are something like 7 million Canadians (about 25% of the total country’s population) within a few hours drive of Buffalo or Detroit. For those of you recently graduated from a public school, Buffalo and Detroit are border cities with Canada,

And in both those cities, there is a thriving medical industry catering to Canadians. For routine care, the “free” system in Canada is fine. But as soon as anything major is needed, tens of thousands of people cross the border to get it taken care of every year. The option is a) wait a year for the “free” operation or b) pay $25K for it in Buffalo and have it done next week. And for most people, $25K is a small price to pay to avoid a year of constant pain and suffering.

Nothing in this world is free. With health care, “free” = higher taxes (gas in Canada for example is $6-7 a gallon) and awful service. People like Bob never understand this.

Bob, countries like Germany have private health insurance. But only for those that can afford it. The avg joe is on socialized health care. I bet you would choose private insurance once you see how crappy the socialized health care is.

It’s good for a headline (we are the only first world country without socialized health cared) but that’s about it. Do you want to pay more taxes for bad health care? I don’t. Ask any avg joe German how they like their socialized health care.

You are all welcome to look up my statements above on Google.

If you look up “Countries with the best health care” it shows the US was 30th last year.

Just below Mexico. I think we can do better than Mexico.

M may be correct, you can get better health care in Germany beyond the socialized version if you have money. Germany ranks 17th on the list.

US health spending is significantly higher than that of countries with socialized medical car (both overall and per head). While I am not clear whether it is good, bad or even matters, one cannot deny there is significant financial inefficiency by not having a single payer system option. Lots of money is spent on litigation related expenses as well as R&D.

However, a good indicator of overall US health system is covid19 deaths. Much death/sickness higher rates compared with similar industrialized nations (where average age is even higher). This shows utter failure of preventive medicine.

this is beaten to death.

Rank 30 out of 89 isn’t that bad. We can’t be nummer one in every discipline. I am doing our taxes right now….. I rather stick with the current health care system. A change to socialized medicine might mean that my taxes go up even further but the quality of my healthcare decreases (very likely).

Seattle eviction moratorium extended another 30 days, to February 14:

https://mynorthwest.com/3309546/mayor-harrell-extends-seattle-eviction-moratorium-another-30-days/

The city-level moratorium on residential and commercial evictions was initially set to expire on Sept. 30, 2021. Then-Mayor Jenny Durkan later extended it to Jan. 15 in the wake of the delta variant-fueled surge in COVID-19 cases. …

Citing a recent rise in COVID-19 cases, Harrell said he believes another extension is a necessary step toward providing relief for renters in the near-term. …

In addition to the extension — which will now have the eviction moratorium extend through Feb. 14 — Harrell is also forming an “interdepartmental team” to manage the distribution of rental aid to both tenants and small landlords …

Phoenix-holy cow

It’s boom….going to the moon time.

This town is expanding/building everywhere!

Just signed the contract for my first rental property!!!!!!!

Single story, 4b/2b, new construction, 25% down. Low 400’s

Beautiful upgrades. Will be completed by summer and by that time I expect I already gained lots of equity.

Let’s have another year of 25% home price gains!!!! Let’s go baby!!! Thanks Brandon for the inflation!!! Inflation is my best friend right now!!!

Millie, Brandon inflation is great if you are an asset holder. It is complete destruction if you are on the sidelines with no assets. We had a home go on the market down the street. Due to covid, people must sign up for time slots to view the home. Despite having a prearranged time, there was a parade of cars lined up for hours just to see the house. This housing market is insane. Owning for the long term tunes all this noise out, that is one of the most important lessons people need to grasp going forward. Even 5 years ago on this blog, people were convinced the market can’t go any higher…look at it now!

So true. I have a cousin who saved 100k and was waiting for the market to crash. Just like me (I was saving/investing for years and hoped for a severe market crash).

That cousin feels like the rug was pulled out from under her.

Today, she can afford less house than 4 years ago because house prices have outpaced what she can save each month. How frustrating when you feel like you go backwards while all asset holders celebrate.

You can’t time the market/you don’t know what will happen. You can just buy a property when you can comfortably afford it and let the market/inflation do the rest over the next decades. It’s that simply. People told me this over and over and it took me a long time to finally get it.

Inflation is a neutral monetary effect (amplified short term by supply issues + money inflows). Some people might be greatly impacted by it (the ones without assets). Some might benefit (with leveraged discretionary investment). But impact and benefit will be capped by economics.

If you think about why we are even discussing this…all these efforts (investments, rental property, primary homes) are fundamentally to get a step closer to financial independency…aka no need to work when you are old and have no teeth (or maybe little earlier).

While inflation might make you feel that your assets are working for you, everything is also getting more expensive for assets holders (insurance, taxes, maintenance).

For un-leveraged money flows:

If you are thinking you are doing great by raising rent for your tenants, just know that all those people are raising their prices for your healthcare, food, restaurants, services, etc…. It’s not a judgment it’s just a reflection that increases in rent are offset by overall inflation everywhere.

For all your leveraged assets (investment property on mortgages, etc…) – this is where your gains can help you outpace inflation. However, you have to realize you are playing a leveraged game and ultimately it remains a gamble.

Inflation at best is monetary state and at worst a bit of wealth transfer from group to group. There is no overall wealth creation (except for business loans)

Statistically, you are staying with inflation no matter what you do as a median. Stdev is where money is made or lost.

Surge

I buy a new construction now and lock in the price while the house is being built.

By later summer the house is done (hopefully) and has gained already equity (early phase purchase + high inflation in lumber/other materials).

In summer I will close on the deal and a lender is giving me a 3.5% conventional loan as an investor while (hopefully). While inflation runs at 7%.

Yeah inflation means I pay more for food and gas. It also means the house value appreciates which I pocket even though I only put 25% down.

Brandon’s inflation is my best friend.

Say my down payment is 100k on a 400k house and the house appreciates 15% annually. I gain 60k on a 100k investment in just one year while the renter pays my mortgage. Holy cow, I want more rentals!!!!

Inflation is the most regressive forms of taxation (stealth). The only people truly benefitting are the 0.01%. -the owners of the largest banks who hold about 2/3 of the US RE titles – they keep liabilities the same while the asset column increases in value.

The rest of the people stay the same or lose more or less. The more assets they have, the less they lose or stay the same. The poor foot the bill.

It is a monetary phenomenon and it is used as a tool for wealth transfer from the producers to the parasitic class – banks and politicians.

“You can just buy a property when you can comfortably afford it”

Or… in your case M, when that free inheritance money comes through.

Great plan for all of us to follow. Lol.

Rich: Or… in your case M, when that free inheritance money comes through.

Great plan for all of us to follow. Lol.

In fairness, Rich, in addition to his sudden inheritance, M also made at least a million in Crypto.

M (Sept 17, 2021): On paper I am already a crypto millionaire”

Source: https://www.doctorhousingbubble.com/more-housing-inventory-is-coming-850000-borrowers-will-exit-forbearance-between-august-and-october/#comments

That’s right! There is another payout coming. I guess I have to buy another rental. Maybe Nashville TN!! I would also love a vacation home in Sedona! So much I want to buy 🙂

Flyover,

We much rather have inflation than deflation, right?

Our renters pay more, stocks, salaries, our house values go up, up and up. Oh and crypto 🙂

“Just signed the contract for my first rental property!!!!!!!”

Our little baby Millie is all groweds up!

A single tear of joy streams down Mr L’s cheek.

Thank you Mr L 🙂 cheers my friend! I can finally call myself a landlord as well 🙂

Congratulations!

Buy and hold RE for the long term. You can’t go wrong. Even in Phoenix.

After falling 51% from 2006 to 2008 in Phoenix, the owners who held on are now up 30% from the 2006 peak.

Just don’t panic if there is a 50% downturn. HODL that rental!

Thank you Bob 🙂

One of the few housing humpers that I trust, Logan here in SoCal.

Long winded but lots of interesting graphs.

https://www.youtube.com/watch?v=63-FVr7Lj5o

Headline: Student loan company Navient to forgive $1.7 BILLION in debt owed by 66,000 borrowers after 39 states reach settlement over predatory lending

https://www.dailymail.co.uk/news/article-10399537/Navient-settles-predatory-student-loan-claims-1-85B.html

They made poor financial decision. Overpaid for their education and over-leveraged.

What do you propose they do? Infinite servitude to serve the debt? Debt-prison?

Debt-forgiveness (or bankrupcy) has proven itself to be a beneficial option to the society overall.

I though Hancock Park was supposed to be a desirable neighborhood.

Headline: 24-year-old employee stabbed to death inside Hancock Park store in ‘random’ attack

https://www.foxla.com/news/24-year-old-employee-stabbed-to-death-inside-hancock-park-store-in-random-attack

This was not a robbery. The suspect and employee apparently did not know each other.

“There is no known motive at this time,” the LAPD wrote.

The suspect looks like a BLM supporter. Perhaps randomly punishing a store employee for her “white privilege”?

In the article it says “The suspect is described as a male Black, unknown age, tall, thin, wearing a dark hoodie, sunglasses, a white N-95 mask, dark skinny jeans, dark shoes and carrying a dark back pack,” the LAPD wrote in a press release Friday. “Based on evidence discovered by detectives, the suspect is believed to be homeless.” From the picture in the link, the young lady is a pretty woman. I’d say the guy in question is probably a mentally ill drifter, and he gets set off by pretty young women who are out of his league. Mary Katharine Ham had a funny take on hotness as a curse in response to AOC’s comments on her own looks provoking jealousy:

https://www.mediaite.com/tv/cnn-contributor-pillories-aoc-over-sexual-frustrations-tweet-plight-of-the-super-hot-has-long-been-ignored/

its a bit misleading to call that area Hancock Park. It is in an area of Hollywood. Calling it

Hancock Park is a high end residential area, its not the commercial strip along LaBrea Ave.

Ive lived in LA my whole life. most likely suspect is simply a psycopathic homeless man, not a so called BLMer haha.

Besides the truch of the BLM riots is this: 90% were nonviolent protesters, the other 10% were criminals joining into the protests as a disguise for their smash and grabs.

Gated community no guarantee of safety.

Headline: Burglars hit the home of Lori Loughlin and Mossimo Giannulli in LA and made off with million bucks in jewelry

https://www.dailymail.co.uk/news/article-10405779/Burglars-hit-home-Lori-Loughlin-Mossimo-Giannulli-LA-took-1million-jewelry.html

Burglary appears to have occurred within Hidden Hills, a gated city. Hidden Hills has been described as “gated communities within gated communities.”

The cops floated a theory that the bandits are part of a South American group that travels to different areas across the US to hit high-priced homes, TMZ reported.

The trouble is, many of the super-rich have large (and often poorly paid) staffs. Maids, landscapers, pool boys, cooks, nannies, etc. So you have lots of poorly paid servants entering these communities, casing the houses. Sometimes passing the info on to a friend of a relative, who then does the burglary.

That is true for anyone who utilizes services, not just the super-rich. I don’t consider myself super-rich, but I have a gardener and a housekeeper.

Something tells me the pest exterminator guy probably didn’t dream of that career growing up until certain life events didn’t leave many alternatives.

The reality is anyone who has been robbed likely was visited by the perpetrator or has some has some connection to them.

OC Register columnist Lansner has his Bubble Watch series in today’s paper. This time, it’s on commercial real estate. His source is Green Street’s Commercial Property Price Index. All sectors showed a 24% gain last year, leading to a record high. The order of property types in order of biggest increase over the last 2 years is:

1) Self Storage.

2) Industrial

3) Lodging (i.e. hotels)

4) Strip malls

5) Apartments (Mr Landlord making unrealized capital gains!)

6) Malls

7) Individual Stores

8) Mobile Home Parks

9) Student Housing

10) Health Care

11) Office Space (an industry worst 4% decrease)

He gives commercial real estate a four bubble (out of five) rating. He feels that commercial real estate is driven by investors looking for income. He sees rising interest on bonds as a big risk for commercial real estate.

I think that will be true if interest rates on bonds rise to where they are more than the inflation rate, but as long as real return is negative, commercial real estate will shine (except for office space which is the victim of telecommuting).

Emprically, it has always been to be a contrarian to the average sentiment of the posters on this blog

I’ve never seen so many housing bulls on a housing bubble blog.

So far, they have been right. Until they aren’t. Like most of us had seen before in 2008.

Even the posters who clung on to the roller coaster from 2008 to the present have been become long-term bulls. The losers were the ones who jumped off the roller coaster and foreclosed and couldn’t buy another house for 7 years during the best time to buy a house.

Historically, it has been highly profitable to be a long term housing bull. Housing prices have never been this high.

It has been financial suicide to be a short term housing bull during certain times.

It has been financial suicide to be a long term housing bear.

A single bubble never lasts forever, but new bubbles are forever formed.

A bear gets worn out and turns into irrational bull right at the top of the market.

RE always wins long term (at least stays on par with inflation and debt reduced by rent income streams). But going into RE with high expectation for a short term can be a brutal mistake.

On this blog, M is a walking caricature on the impressionable investor.

Thanks so much surge! I do see myself as an example of what happens when you learn the most important lesson: Time in the market beats timing the market!

To win the game in crypto, RE and stocks you cut out the noise, dollar cost avg in and hold long term! Don’t overleverage yourself and do your research.

How do you dollar cost avg into RE? You don’t care if the masses tell you are buying the top of the market. You just keep buying rentals that at least break even and HODL.

So far, I can tell you that every time I buy a new house, people tell me it’s the top. Last time I gained over 300k in equity while buying the top. Lol

In just about 2 years or so. If that’s how buying the top turns out, sign me up for future deals 🙂

I’m currently putting 2% of my new contributions for my 401k into US stocks, 12% into foreign value stocks and the rest as money market. I haven’t rebalanced what I had in before except I got out of bonds a year ago. In the 70s, RE outperformed stocks. I’m not sure we are in the same sort of situation now, but it is one possibility. If there is a big stock market correction, I’ll increase stock contributions. I’ll wait to get back into bonds when returns on bonds are positive including inflation. Any recession and I want to look into RE even if (maybe especially if) interest rates go up. I don’t expect inflation to abate until this administration is gone. ( If inflation goes down to 4% and everybody cheers, that’s not good enough for me.)

So what if they’re not making any new land? You can now buy a condo on a cruise ship:

https://www.dailymail.co.uk/travel/travel_news/article-10411157/Live-cruise-ship-without-breaking-bank-residential-community-sea-vessel-revealed.html

Renderings were recently unveiled for a stunning floating condo called Somnio, which will offer ultra-luxury apartments starting at £8.1million.

But she’s by no means the only option for a cruise-ship-style life at sea. The Utopia and The World residential ships have already attracted buyers. But they too are expensive, with residences costing from $4.4million (£3.2million) in the case of Utopia and from $2million (£1.4million) for The World.

However, there is good news for those with shallower pockets who want to live on a cruise ship. MV Narrative, a ‘residential community at sea’, has one to four-bedroom apartments and studios starting at just $366,667 (£268,170). …

I suspect the association dues are higher than typical. Especially if it includes All-You-Can Eat buffets.

I hope none of the maintenance is deferred or it may result in a whole(hole?) new meaning of being underwater.

Opps, Housing has hit the iceberg, the sinking has begun lol

Yha better buy that house in metaveres, that would be right on Q for you home debters, all hands on deck, you are going down lmao

“a fool and his money are soon parted”

Hey BFB, is that you? We miss you at ZeroHedge.

Inflation is a driver for irrational exuberance. Lol

The young have the energy to be exuberant. Often, without experience, it is irrational.

Without mistakes, there is no experience. It is better to make mistakes while you are young.

Sure, Obi-Wan 🙂

Two articles in today’s OC Register.

Columnist Lansner says rising payments don’t sway SoCal homebuyers. Transactions up 20% in 2021. Payments are up 13%. So more houses sold with higher and higher monthly payments. He now has his bubble watch at four (out of five) bubbles. The near future of SoCal housing depends on how many people are keeping up with inflation in my opinion.

Columnist Lazerson looks at financing in the condo market. Fannie and Freddie are getting nervous about condo disasters like the Surfside FL condo tower collapse. Conventional financing especially in complexes with 5 or more units (!) will be much tougher to get. Deferred maintenance will be a no-no to F & F this year. Legal liability could go through the roof! The Fannie Mae form 1076 has gone from 5 to 8 pages as of Dec 21. 60-70% of all condo complexes are more than 30 years old. Fannie published a list of 82 “unavailable” condo projects in CA including Marina City Club in Marina Del Rey wish is way behind on maintenance (80-140 million dollars’ worth). Unit owners resistance to higher fees, and increased investor ownership, especially a single major owner, are a red flag in older units. Condo complex inspections are expensive, running into tens of thousands of dollars. Do your homework before buying one.

Good post.

BTW Marina City Club is not a total loss, but this first hip condo project in Marina Del Rey from back in the day, has lost its luster – more like an old folks home rather than the hip, swinger crowd from when it was built

https://patch.com/california/marinadelrey/no-safety-problems-marina-city-club-needs-repairs-report

Thanks for the link to the article on the Marina Del Rey property. Hip people from back in the day are now [SURPRISE] old!

Joe R, it’s interesting you mention the Marina City Club, as I’ve been following the news of that complex’s dangerously deteriorated condition with great interest for the past year. It is downright frightening how much its situation rhymes with that of the doomed Champlain Tower- it’s all there; the contaminated, spalling concrete in the 8-level parking garage beneath the deck with its 3 swim pools and 6 tennis courts, the decrepit, leaky plumbing, the deteriorated windows and balconies, and the refusal of the (affluent) owners to confront the situation, which didn’t exactly set up yesterday.

As a condo owner in a high maintenance older (93 years) building of great beauty myself, I wish I could talk to the owners. The $80 M to $140 M it may cost to bring this huge complex with its 6 condo towers, 600 condos, 100 rental units, and marina up to code may seem daunting, but that is for 700 luxury housing units with a huge array of communal amenities, so the cost per unit for the required repairs only averages out to $114, 285 to $200,000 per unit, with smaller units paying less and larger units paying more according to their percentage ownership of the complex. That may sound like a lot of money, but consider that these units range from $500,000 up to $2,000,000 or even more for the largest units, and it is really rather a small price to pay to bring your fine building up to code, especially when you consider that it is really just the cost of many years of deferred maintenance that would have been cheaper and easier to handle financially if it had been budgeted in all along. That is what my association does in order to make sure we have the money on hand to pay for the wall work that never ceases on a 1928 vintage building with a lavishly intricate terra cotta facade. We budget this work in yearly because if we did not address problems as they arose, the building would become a disaster and we’d be hit with a special that would severely stress our owners. So I’d suggest to Marina City Club owners that they put it in perspective and realize that they’d spend that much at least maintaining the structural elements on almost any single family dwelling over the time they’ve neglected their condo buildings, and that if they can afford $60,000 cars, meals out every other night at trendy restaurants, and designer handbags that cost $3,000, they should be able to handle the essential work on the building.