The housing correction has started: The entire US market will face a correction in the next 12-months. 183 markets forecasted to fall up to 20%.

The market has hit a rather significant wall in the last few months as the Federal Reserve has decided that there is no longer any containing inflation from the public, no matter how much economist and financial wizards try to massage the data. The correction was largely inevitable as the US economy fell in love with artificially low rates that were injecting insane amounts of money into the economy because of the pandemic and even before it. There was so much money injected including wasteful spending on PPP loans from corporate welfare recipients that suddenly go on Twitter to lambast the “poor” for a few thousand dollars while they were taking millions in dollars in a raid under the cover of the pandemic. Remember the banking bailouts from the last crisis? Sounds very familiar from pointing fingers to “subprime mortgages” when there were larger reasons why the market imploded. Yet the repercussions today caused wild inflation and the Fed has no choice but to tighten debt and housing is going to take it on the chin for the short-term given housing is the biggest line item in the CPI. Even the conservative rating agency Moody’s is forecasting a market correction. Where is housing heading?

183 markets forecasted to drop by 20% or more

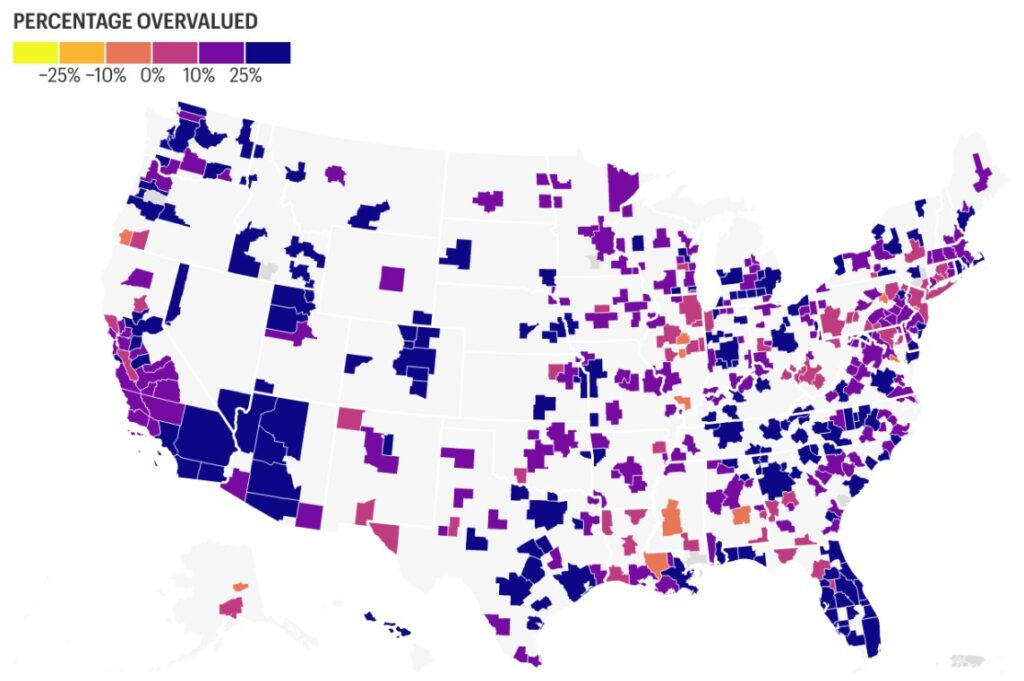

Moody’s recently highlighted 183 markets that are set to go down by 20% or more in the upcoming 12 to 24 months. Here is the map:

This is a significant correction. Take Orange County where the median price is now above $1 million for a crap shack. A 20% correction is going to wipe out at least $200,000. I’ve had the chance to speak with people that have been saving for a few years and working hard, professionals in many cases, and I know that losing $200,000 will sure get their attention. You also need to realize that all of the financial models were being built with 2.75% to 3.5% mortgage rates and those are now in the rearview mirror:

Do the math here. Let us assume a $1 million home with 20% down with a 3% mortgage rate and a 6% rate:

Purchase Price: $1,000,000

Down payment: $200,000

Mortgage: $800,000

PITI at 3%: $4,119

PITI at 6% $5,543 (35% increase in monthly payment)

So in a few short months, that monthly payment went up by 35%. As so many commenters like to point out, it is all about the monthly nut. So what home price do we need to get to arrive at our previous 3% monthly nut? That $1,000,000 home will need to be $738,000 to get to that previous PITI amount.

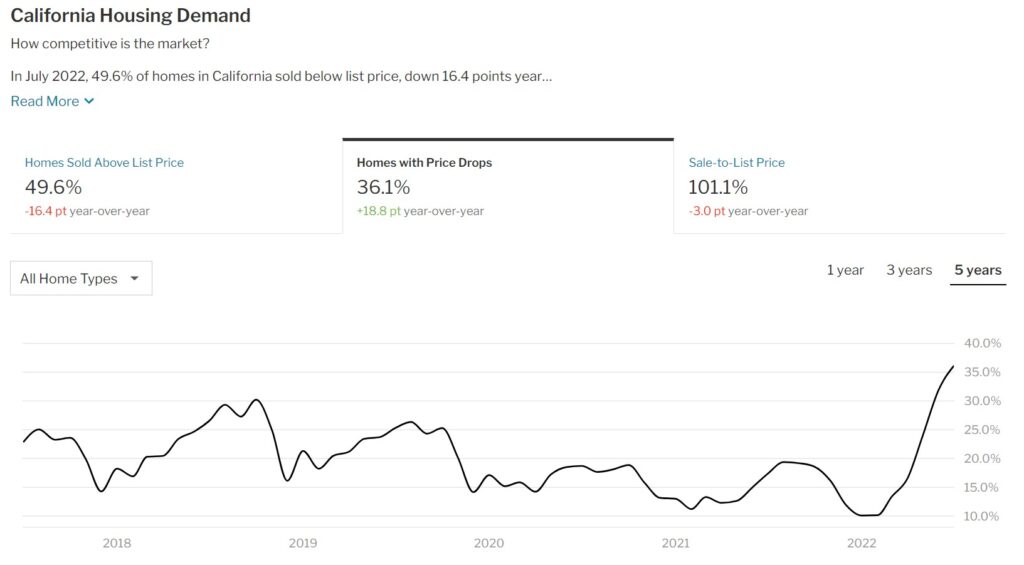

And even in California where real estate bulls drink maximum price appreciation Kool-Aid, price drops are at the highest level in half a decade:

So the correction is here. Will Moody’s be right in forecasting a 20% decline across many US markets? Time will tell but keep in mind that the last housing correction took 3 to 5 years to bottom out. We are merely in the first year of this correction.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

197 Responses to “The housing correction has started: The entire US market will face a correction in the next 12-months. 183 markets forecasted to fall up to 20%.”

Right on queue we are seeing record levels of inflation. It is clear the housing market is going to be in a rough spot for the next year or so.

Record levels of inventory? ROFL!!!

Can you give us one example?

Reality:

no forced selling. If a seller doesn’t get what he wants he take the home of the market.

Homeowners never had better equity/credit profiles than today.

Inventory not even back to 2019 levels.

Inflation is your friend when you own assets like real estate and your worst enemy when you rent.

Supply/Demand. Demand is falling faster than inventory as the housing market limps into the doldrums. A hike in interest rates will further dampen demand. The FED wants to reset housing along with everything else. And crypto is now in the sights of the WH with a proposed bill to regulate crypto. Might be time to rethink your investment strategy.

A lot of what you said is true M. However I have to disagree with your premise that if a seller doesn’t get what he wants he takes his home off the market. Some people move for jobs, some move for retirement, some need a bigger home/more bedrooms bc size of family increases by taking in relatives or maybe kids are at an age where can’t share a room anymore, some people will lose their jobs and sell their home and may have bought recently so don’t have equity and some folks will sell if prices start going down simply out of fear that prices will go down more. Home prices are based somewhat on local comps so it only takes a few folks to sell their homes at lower prices to bring all the other ones in the neighborhood down (just like your house went up based on comps/people selling their house for more).

Charly,

“ And crypto is now in the sights of the WH with a proposed bill to regulate crypto. Might be time to rethink your investment strategy.”

Music to my ears. I need peak panic and a crypto capitulation event to go in heavy.

When everyone thinks crypto is dead and will never recover, that’s when smart money buys again.

@heynow

“ Some people move for jobs, some move for retirement, some need a bigger home/more bedrooms”

Prices don’t fall if someone sells and buys again. A seller is usually a buyer. That won’t increase inventory.

People who bought at the peak and become unemployed can either sell at a small loss or rent out rooms. You don’t have massive numbers of people that are underwater.

>> strict lending standards caused only qualified buyers to purchase.

In a job loss recession you might see volume of forced selling but we are not there yet.

And your last point: people sell because of fear. I’ve known two clowns who did that. They sold to rent because somehow they thought to have a crystal ball. They can no longer afford to buy the same house they used to own. Selling and renting because you think you know what the market will do is the single most dumbest thing one can possibly do. You might not just lose financially but also your spouse.

M is correct.

Demand is relative. We are going from 50 people overbidding on a house to 5 people negotiating on a house. This is going back to normal. The problem will rise when nobody is bidding on a house.

If you have to sell now due to unforeseen circumstances or a move, housing prices have soared 30-40% in the last 2 years. If you bought before that and have to take a 5-10% cut in price, you have made at least 20% in leveraged money and have no right to whine because you didn’t gain 30-40%.

If you purchased a house as an investment in the last 6 months and want to sell, you will lose, guaranteed. A house is a place to live long term and not a short term investment. People have forgotten that important principle.

M. You’re ‘a seller is a buyer which keeps prices up’ theory doesn’t hold true in the real world unless that person buys in the same location. I lived in Austin and my neighbor a couple blocks away with a similar home as mine had to sell his house. I then had to sell my house a month or two later as I was moving up North so the price I could sell for was limited by his sales price. Then I guarantee anyone else that had to sell a month or two in my neighborhood would be limited by our sales prices. It doesn’t matter the reason why someone sells their home for a lower price then previously homes sold for in the neighborhood. As long as they do, that’s the new comps folks work off of and everyone else’s home in that neighborhood is now worth around what those comps are. Real estate is hyper local. Will housing prices crash? Very unlikely unless stock market craters like 50% and mass layoffs everywhere (but then Biden would likely say folks can stop paying mortgages and rent bc technically we’re still in an emergency n he has those powers). Will real estate go down 5-20% in individual markets. Probably.

“You’re ‘a seller is a buyer which keeps prices up’ theory doesn’t hold true in the real world unless that person buys in the same location. ”

It’s totally true.

For two people selling in Austin, 3 are trying to buy in Austin who come from California.

For 3 selling in California there are 10 buyers trying to buy in CA that come from Canada, Asia, or India or from other parts of the world.

It’s as simple as this:

Nobody sells their home to be homeless.

Those that think they are smarter than the market and sell to rent, lose out 9/10.

If anyone here thinks they can time the market, all you can do is wish them luck.

Where do you get your inventory data? Looking on Movoto, it’s kind of a mixed bag at the moment …

San Diego is not quite back to 2019 levels but it’s getting close. Palm Springs, Pasadena and Santa Monica inventory is pretty much back to 2019 levels. San Francisco, Sacramento and Los Angeles are both way above 2019 levels. There were 3023 homes for sale in the city of Los Angeles as of October 2022. That’s more inventory than almost every single month in 2019. But, then, on the other hand, inventory in some places like Santa Barbara, La Jolla and Laguna Beach are way below 2019 levels by a lot!

This is a planned inflationary spiral and not the fault of consumers.

https://theconservativetreehouse.com/blog/2022/09/18/cbs-economic-gaslighting-example-face-the-nation-pretends-not-to-know-joe-biden-energy-policy-driving-higher-prices/#more-237816

He said inflation, not inventory, ya’ll.

It’s been painful sitting out to wait for a crash that seemed to evaporate year after year as prices soared! The price correction is finally here.

By the way, something is wrong with the website. I had to trick my browser in order to land here. It was asking for permission to download and wouldn’t open the page.

It is about the monthly nut. If house payments have gone up 35% and raises due to inflation have not kept up, then housing is due for a fall.

However, if wages go up 35% with inflation, then I expect house prices to be flat.

Watch wage increases due to inflation and stock market gains to determine how income is affected. This will limit the fall in house prices. If things start crashing over 20% (on average in the US, it could be more locally) I expect the Fed will lower rates to lower the monthly nut and to prevent foreclosures (2008 repeat?).

We are not there yet so rates will continue to rise. Wages will continue to rise also but the Fed is trying to suppress this to control inflation. There will be a lag in wage increases.

As Jim Cramer has been saying: Everyone needs to get off their couches and rejoin the labor market so the supply of labor will increase and wages will stabilize or fall. ie go back to work for a cheaper wage than you would have received yesterday.

Thanks for fixing the hacking issue. I have been in withdrawal for the last 2 weeks. 🙂

I too had trouble getting in last week, but the Dr got it fixed. I’m in your corner about monthly payment being the decider for middle class houses. Poor areas have valuations based on rent generation, rich areas based on liquidity of assets needed to finance big purchases. The cost of a house can go up (monthly payment), and the value of the house can go down in “dollars” at the same time.

OK, I just read this from yesterday.

All rail workers will get a 25% raise. Plus some additional bonuses.

Housing will not crash if wages keep up with inflation. Housing will be flat. If the stock market and BTC starts going up, the housing price increase boom will continue.

If you are on Social Security or an inflation compensated pension, you will not be hurting. You can continue to pay your 1970’s $200/month mortgage and pocket some extra savings money. Joke, nobody on SS should have a mortgage if they bought a house for 20K in the 1970’s. They are living the dream of a paid-off house. Be like M and buy now so you can be living the dream in 2052.

That’s blue collar union workers. I’m a STEM worker, and I haven’t had more than one 4% raise in the last two years. I get a bigger raise from my social security check than I do from working.

A friend of mine is a broker in WLA Culver City. He said pullback started about 2-3 months ago. Open houses walk thrus way down, prices dropping a little.

For me, I bought 1800sqft home in 2012, im on a 3.25% fixed mortgage and my equity is about $700K. I I plan to stay in my home for about another decade and my mortgage is the same as a 1bedroom apartment.

Bring on the crash!

QE abyss

We ARE in a housing recession but that doesn’t mean prices will crash. Don’t take my word for it….just watch the market. A neighbor of mine wanted to sell but instead of reducing he just rented out the other house he’s supposed to move into (as a short term rental). After waiting for 6 month he finally found a buyer. The buyer was the only one that submitted an offer close to asking. But the buyer had all kinds of demands. He wanted the appliances and furniture. My neighbor said no. The buyer came back and accepted.

Tells you what I keep saying. There is no forced selling. If I have to move I will just rent out my current home. I would never sell this beauty unless someone pays 2M over market value. Never sell real estate in great locations. Accumulate and get rich is my strategy. Time and inflation is on your side.

A lot more inventory in my vicinity, some cuts in 5%-10% from original list prices and very few pending items. And this is in the neighborhood with 30 offers per just few month ago.

But, across the town, $750k condos are flying off the shelf.

I guess there is a real compression on top range due to significantly accelerated interest rates.

No movement. Nothing goes to pending. Not too many listings either. An increase in rental properties.

Wait till the derivative default leaks out of Germany starting September 24th!

It will trigger a bank-run and a bank holiday that will be INTERNATIONAL.

An event will follow in Japan that will shutter their stock market indefinitely.

Do NOT try to buy puts for this, they are making sure to close the trading windows and not honor their side of the contracts.

https://prophecyclub.sermon.net/main/main/22025522

Wait till the derivative default leaks out of Germany starting September 24th!

It will trigger a bank-run and a bank holiday that will be INTERNATIONAL.

An event will follow in Japan that will shutter their stock market indefinitely.

Do NOT try to buy puts for this, they are making sure to close the trading windows and not honor their side of the contracts.

where can I read about this derivative defaults and Germany?

Thanks

Gerald, it sounds like a quote from zerohedge. If you are not familiar w ZH. Basically, the sky is always falling. 365 days every year.

Europe and China are in a recession. It’s not the end of the world. It’s a buying opportunity. Similar to the US.

Personally, I am waiting for lower bitcoin and stock prices to go in with heavier DCA.

Yes,

I’ve seen this article on ZeroHedge, the QAnon page, and a link from the Trump supporter page.

lol lol lol ,

When does the bank run start? Did I miss it? /s

Gerald, what happened to the end of the world (bank run) date? Is it being postponed from sep 24 to October 24?

Folks, stay off zerohedge. There are better ways to waste your time.

Remember, PPP for businesses was to keep employees on payroll without any business revenue. A large portion of those funds did not line the pockets of business owners but went to payroll. The employees benefited from PPP more than businesses and they have gotten several other handouts as well. The consumer / employee has received much help during the pandemic. Now that that is stopping, folks have to pay rent, pay mortgage, student loans etc. This thing is coming to a screeching halt and will be painful. I will cringe when the politicians want to give more handouts to buy votes and complicate what the Fed is trying to do to demand/inflation. MMT is starting to come home to roost.

” A large portion of those funds did not line the pockets of business owners but went to payroll.”

*Only* if measured by *amount of loans*. >90% of top-100 loans (by dollars) went *all* to business owners while same companies fired thousands workers.

Literally *all profit* and never paid back either. As good as tens of millions of gift to company owners, per company.

Claim that workers benefitted isn’t of course based on anything. Some got to keep their job while small business owners bought houses and Ferraris with “loan” they didn’t need to pay back, just *claim* it went into salaries. No-one would check.

This according to the Federal Reserve Bank of St. Louis. For all those that believe housing inventory is in short supply:

Privately Owned Housing Units Authorized but Not Started

https://fred.stlouisfed.org/graph/?id=AUTHNOTT,

(Higher than the last bubble.)

Privately Owned Housing Units Under Construction

https://fred.stlouisfed.org/graph/?id=UNDCONTNSA,

(As Dr. Robert Shiller, of Yale, recently pointed out, it has never been higher.)

Nice to meet you, Chuck. Thanks for sharing the compelling data.

I have a few properties for sale in Phoenix so I think I am able to comment here. What we are seeing right now is a panic based equity selloff. People are trying to protect their profits and bottom line. The homes here were already overvalued to account for this market correction. If a home is overpriced by $100/sqft is it really a 20% dip in value? Not really, not in my eyes at least because that money was never realized. The market makers here are trying to float this “forced” selling narrative which is so far from the truth.

There’s so many variables here I can go on and on for days but watch the iBuyers in your area. They will pop up a 2-3 listings for each newly listed home to undercut them. I spoke to Opendoor and I was told they are taking any nearby listings and undercutting them by 90%. Heard it straight from them.

So you could say that some of these inventory increases are almost “artificial” in a sense. I challenge someone to categorized regular sellers from these iBuyers and you will be quite surprised house tight they have their foot on the housing markets.

Fed’s are in a bind. Raise interest rates, housing and stock markets tank, and government borrowing costs skyrocket. If they don’t raise interest rates, inflation continues and eats away at purchasing powers of Dollar. On top of that, oil is still very expensive, fertilizer shortage, and massive influx of illegals, that will drain the resources of cities across the country.

It does seem like they’ve run out of ammunition. They’re flat out saying hard times are to come at this point. They waited a year too long to get serious about raising interest rates. Been kicking the can down the road since the Great Recession but COVID really made them up their game and eventually the price had to be paid – by us. But I don’t even own a crystal ball. Things might be just fine. Carry on!

Lansner of the OC Register says that two different home price monitors say that CA is having bigger drops in home prices that other places in The US. A survey of 50 big markets for July (Black Knight) and 20 metro areas for the quarter that ended in June (Case-Shiller) showed that CA headman of the leading down markets. The Black Knight list had numbers 1, 3, 4, 5, 7 and 8 down markets in CA. Most of the other down markets were also in the West. Case-Shiller shows San Francisco at #2, San Diego at #3 and LA/OC at #4. The LA/OC dip was the first in 30 months. The other down markets were also in the West: Seattle, Portland and Phoenix. But this isn’t generating affordability because of inflation and rising rates. Black Knight says the average buyer now has to pay 36% of income toward the monthly payment. The 25 year average is 24%.

This data led led Lansner to lower his Bubble rating to 3 bubbles. One lower than the last one. It looks like consumer demand is backing off under the regime of rising rates. No relief for non-cash buyers here, though.

munch munch munch …….

San Diego, CA Housing Prices Crater 19% YOY As The Fenders Flap And Wheels Fall Off San Diego Housing Market

https://www.movoto.com/ca/92101/market-trends/

This is just the opening credits, Got Popcorn :))))) lmao

One of these days your dramatic statements are going to be correct.

But that’s still yet to be seen. Maybe next year will be the year!

Thanks for the data, Realist!

Woohoo! From this data, the medium list price is down to July 2022 levels.

Sadly, this data shows the median list price is still up 5% from May 2022.

Housing prices will be flat or slightly up during 2022.

Headline Look inside a NYC woman’s 80-square-foot, $650-per-month apartment

https://nypost.com/2022/09/20/look-inside-a-nyc-womans-80-square-foot-650-per-month-apartment/

Sweet price but no bathroom? LOL

Not sure why people earning less than seven figures annually want to live in NYC. There are about 20,000 other places where one can make it without living like a roach.

munch munch munch ;;;;;;;)

The Orange County Register in California. “‘The train kind of left the station as far as over-bidding on properties,’ said Gail Anderson, an agent with Inet Realty in Irvine. ‘For $750,000 properties, we were getting offers close to $900,000. That’s not happening anymore. … There no longer are multiple offers. … No more lines at open houses.’ ‘The market’s taking a downturn,’ said Juan Zarate, an agent for The Real Estate Shoppe in Murietta. ‘We’re seeing a slight increase in inventory, decrease in prices and a little more flexibility with sellers. … We’re in a different market than we were as little as six months ago.’”

“One example was a 112-year-old house Anderson sold in Anaheim on Aug. 31. A month after listing the home for $889,000, the owners had just one offer for $20,000 less than their asking price. ‘They ended up accepting that offer, and that’s what’s happening almost everywhere now,’ Anderson said.”

The Union Tribune in California. “San Diego County’s median home price fell for a third month in August, down 6 percent from its peak in the spring. ‘Buyers are taking their time. There’s no sense of urgency,’ said Jan Ryan, an RE/MAX agent based in Ramona. Ryan said she was recently able to sell a large single-family home in Ramona’s Black Canyon Estates for around $1 million — but it took 45 days and a $86,000 price cut. She said the home would have sold over a weekend last year as buyers seemed to be doing anything they could to get a property. Ryan said the slowdown is more subtle, not a noticeable crash. ‘It’s a soft landing,’ she said.”

The Los Angeles Times in California. “‘That maddening competition is gone,’ said Jeff Lazerson, president of brokerage Mortgage Grader, noting sellers are more open to low down payment offers they previously would have ignored. When it comes to individual counties, the median is down more than regionwide, ranging from 2.8% below the all-time high in Riverside County to 6.7% below the peak in Orange County.”

The San Francisco Chronicle in California. “Compass is undergoing a round of layoffs that will primarily affect its technology team. About 3,000 of the company’s 21,636 employees are based in the Bay Area, according to LinkedIn. It’s unclear how many employees will be affected by this round of layoffs, and Compass declined SFGATE’s request for comment. This is Compass’ second round of layoffs in recent months — the company laid off about 450 people in June, mainly due to ‘clear signals of slowing economic growth,’ a Compass spokesperson previously told SFGATE. Redfin also laid off hundreds of employees around that time, and Realtor.com laid off an undisclosed number of employees earlier this month as a result of slowing sales volume in the real estate market.”

Got popcorn, this movie is just getting started 🙂

You do “realize” that inventory is going down and prices are still up yoy. Or is that something they cut out of your movie?

I wonder how many bags of popcorn he’s opened in the last decade.

M, master of straw man arguments. Just bc something is up year over year doesn’t mean it’s currently not decreasing in value. Year over year is irrelevant for looking at current prices as it’s mostly backloaded (11/12 months are old data). My guess is you’ve never witnessed a down market either bc you’re two young or just purposefully playing a part on this chain. Again I don’t think housing will collapse but it’s certainly going down x% with no one knowing x and x being different depending on the market. The fed wants this is housing makes up a huge part of inflation data. Is housing more sticky, of course. Does the whole world say I’d rather rent my house out then sell it just bc that’s woukd gou would do or bc maybe it’s the smart move? Of course not.

Hey now,

What are you talking about? Yoy RE prices are up for literally every single month this year. Inventory is not skyrocketing. In fact, it’s going DOWN. Inventory levels are waay below 2019 levels. How is that old data? Prices simply cannot go down if inventory doesn’t increase tremendously. They call this a “lockdown”. Houses are extremely unaffordable. Sellers are not motivated to sell bc they don’t want to buy high w high rates and nobody sells to be homeless. And rents are high plus inventory is low. Talk to any realtor, lender or follow anyone who tracks housing data. Just bc you are in a housing recession doesn’t mean prices come down.

Btw., I’d love, love, love RE prices to come down. I want to buy more properties.

Same with stocks and crypto. I love that we are in bear markets and prices trend lower. I am DCA’ing in the market and holding back for a big move into the markets until we see some capitulation candles. Cash is king!

M-let’s makes this easier for you by example. And let’s pretend there’s just 6 months in a year. House/stock/crypto/any asset goes up 2% in month 1, 1% in 2, 2% in 3, 1% in 4, 1% in 5 and then goes down 1% in 6. The asset is up by over the 6 month period but it is still an asset that is losing value. Then the next month when you read the 6 month, it’s now 1% at 1, 2% at 2, 1% at 3, 1% in 4, then down 1% in 5 and again down 2% in 6. Again the asset is still up over 6 months, yet down the last two months. It takes time for a yearly stat (in this example 6 month for ease) to reflect what’s actually happening in the short term, especially when that yearly stat is higher than the norm like it has been. Another quick example so I don’t have to do this with you again. If I bought a stock or crypto a year ago at $50 and it goes up to a $100 after 6 months and is now at $75 today, the stock/crypto is still currently declining, no? Also why are you comparing inventory vs 2019 when someone says it’s increasing? You should be comparing it vs where it was a few months ago. We all know inventory is low historically. The point is it’s considerably higher than a few months ago so when you mix that fact in with higher rates the market shifts. Will it crash, again no. But it’s going down (go read recent CNBC article showing actual house Prices (not inventory or sales) went down last month. And yes I understand the concept of sales going down is not the same as sales price going down so please don’t use that straw man argument. I lived in LA from 08-13 so I understand it’s a very unique real estate market but to think it’s definitely immune is silly. Will LA crash, nope bc weather too perfect and too many folks buy with cash and trade houses like NY does stocks but I wouldn’t call it immune from price declines. Probably 5-15% but IMO not more than 10%.

M-one last point. You mention buying more of an asset when it goes down and I agree that’s the best time to buy. That being said it doesn’t happen in reality for most folks as most people wind up ascribing to not wanting to catch a falling knife. So once things start going down most people don’t buy bc they think it will continue to go down. Do you buy when things are down 10%, 15%, 20%? It’s not to easy in practice even though it seems like a simple concept in one’s head.

M I’d love, love, love RE prices to come down. I want to buy more properties. Same with stocks and crypto. I love that we are in bear markets and prices trend lower. … Cash is king!

Not if inflation is ravaging your cash.

If real estate, crytpo, and stocks all go down, but your cash’s value also goes down because of inflation, then, well, how are you ahead?

Or am I missing something that only a real estate, finance, and crypto “expert” of your exalted level can see?

You love to see house prices rise. You love to see house prices plummet. You’re all over the map.

SOL, you have a proven track record of being wrong 9/10 times.

Here an example:

“ Cash is king!

Not if inflation is ravaging your cash”

Cash is absolutely king in this high inflationary environment.

It’s sad that I have to explain it but thats why they call me an expert I guess.

Cash is king because the alternatives are worse. If you invest your cash into stocks, crypto or RE now, you will likely lose much more than 8% annually. That’s why cash is king.

Cash is also king because you want to have investable cash when stocks, re and crypto bottoms. If you would have actively read/comprehended what people write on this blog for years you should know this.

And Of course I like both, lower prices and higher prices. During times of higher prices you take profit and during times of lower prices you buy more. Also sad that I have to explain that but what can I expect from someone who still has a landline. Lol

HeyNow, I actually agree w what you say. I replied to “realist” and shared REAL facts because I feel bad that he’s eating his stale popcorn since years now.

I am comparing the current market to 2019 because since then we are in a very imbalanced market. Our inventory is historically low as we all know (should know). Prices, despite the fact that they are extremely unaffordable, cannot go down significantly if inventory doesn’t rise. If inventory continues to be that low and prices yoy are not even declining than this is all a big ol’ nothingburger.

We hear every year on this blog that prices will crash because of Covid, forbearance, interest rates, global recession, (fill in the blank), etc.

Wake me up when we have a job-loss recession and I will get off the couch to buy some more properties.

There are 6 month CD’s at 4% right now so YES cash is king if you’re looking to buy assets like stocks or real estate which are no longer inflating. They’re eroding, which is fantastic for savers looking to scoop up some deals in the not so distant future. Now cash for groceries? Yes, that’ s a raw deal. We all know that but this is a real estate blog.

“Will LA crash, nope bc weather too perfect and too many folks buy with cash and trade houses like NY does stocks but I wouldn’t call it immune from price declines. Probably 5-15% but IMO not more than 10%.”

That would make absolutely zero impact with where interest rates are now. Maybe you’re right (who knows) but SoCal had even better weather in 2008 – 2012 and it tanked 40%. Right, it was a bit cooler and sometimes even rained! Also no feces on the sidewalks and less feces in the saltwater.

SoCal will always be expensive because of weather and dreadful regulations but it’s no more insulated from cash than any other part of the country. In fact, last time it tanked, it tanked harder than most of the country. The highs and lows swing far in California. It’s a dramatic state. That’s part of it’s charm.

Turtle-I was in LA in those years and almost bought a house back then (should have) but there was not a ton of good stuff on the market in West Hollywood at the time. House on a busy road or next to a taco shack or a house where a flipper ran out of money. Don’t always agree with M but the housing market is not nearly the same with lending standards and hairdressers on NINJA loans with 0% down not owning 3 houses. Adjustable rate mortgages are still years away from resetting and many folks have bigger equity cushions even if their house goes down 20%. Rents were also down then as when I rented I got a big discount. Airbnb wasn’t popular/used widely. Private equity was in the game but not as deep as they are now. Online companies weren’t buying as much real estate. I get the whole what goes down ca. go down again, but fundamentals are not comparable. It’s gonna take a deep and decently long recession with pretty high unemployment to have LA housing go down 25% IMO. Phoenix, vegas, parts of Utah and Idaho, inland and other parts of CA higher odds for bigger downturns. Again everyone is guessing but don’t hold your breath on nicer parts of LA.

Turtle and M have good points.

I believe Cash is King now.

If I have 100K in cash in an 8% inflationary environment now. What would I do with it?

Keep it in “Cash” with IBonds paying 9.6% and the rest in 6 month-1year yields of over 4%?

Or continue to invest in the housing market or stock market and likely lose 10-20% in value over the next year? When the year is up, I can decide if I want to jump back into the housing or stock market with my cash and buy at a huge discount.

I’d pick cash even though I am still losing to inflation. I will decide when my Treasuries mature in a year on what to do next. Housing prices move slowly. It took 4 years to bottom in 2012 after the 2008 crash. There is plenty of time to hold cash and be ready.

Even though inflation is 8%, you cannot find CDs with even half that rate. 3.5% at best.

And that is before taxes.

There is no safe mechanism to protect your money in cash. Well you can try goods but good luck with liquidity.

Whatever you are not making on the cash not invested is your price for high liquidity and thus opportunity to enter market at the right price.

If you are looking to make big, bold moves, then having sufficient liquidity is imperative. That’s how really rich people buy big things at a discount during bad times. Like I’ve said before, poor neighborhood prices are based on rental income, middle neighborhood prices are based on household incomes and monthly payment and rich neighborhood prices are based on liquidity of the wealthy.

A coming housing recession is being blasted from all corners of MSM, SM and online communities. Don’t discount the affect this will have on the market. This is one of those variables that is far more influential than 2008. Those that need to buy are far out numbered by those that want to buy but can or have to wait a little longer.

“ A coming housing recession is being blasted from all corners of MSM, SM and online communities. Don’t discount the affect this will have on the market. This is one of those variables that is far more influential than 2008.”

Such ignorance. First of all we are in a housing recession already. Secondly, this could not be more different than 2008. Housing peaked in 2006 and inventory went higher and higher while defaults were rising. Whoever had a pulse was able to purchase property.

Today: homeowners have the highest equity ever recorded in history. Lending standards are a far cry from 2005-2007. We are not even at 2019 inventory levels. No crash in sight

If we were at the tail end of the rate hikes, you could make an argument that we’ve escaped a crash, but the fact is that the economy/RE market hasn’t had time to fully digest the rate hikes which just started six months ago, let alone the additional hikes we’ll see in the coming months. The stock market usually precedes moves in RE and look where that is. I’m with the popcorn eating crowd…the next six months should be interesting.

“Today: homeowners have the highest equity ever recorded in history”

This might be true “today” but some poor folks are already underwater. Equity will easily be eroded as asking prices continue to get knocked down.

Fixed it for ya: “Tomorrow: homeowners may or may not have any equity”

Some thought they were locking in lowest rates ever but sadly only locked in a high price.

M, I agree with you. The current housing climate is NOT like 2008. I don’t necessarily agree with all the media trash either but there is a majority that will. My comment about media influence IS one of the differences now v 2008. An aspect that may result in a quicker correction.

Maybe take more time to understand someone’s comment before posting some useless knee-jerk reaction. Or not. My PSA obligation has been met for the year. Carry on.

“Some thought they were locking in lowest rates ever but sadly only locked in a high price.”

Who cares? Rates and price determine affordability. As long as an owner can make their house payments and lives in a house that costs him less than a comparable market rent…..that is winning big time. Housing – like everything else, is a out monthly payments. Over time, house prices alway trend higher. Nobody cares about a correction in between.

Unless we see a severe job-loss recession this is all a big nothing burger.

Folks, I believe we are headed for an inflationary crash. For extra credit, Dr. HB readers need to research RE during the Weimar Republic of Germany to get a more ‘correct’ sense of what will happen in the US — not just Cali.

Nobody has a clue what will happen. I’ve been wrong more times than I can count. It’s best to just stick to your plan for retirement and be prepared for anything along the way. That is, have some dry powder just in case, but don’t do anything stupid like sell your house and go sell and rent because you think you’re the one with a working crystal ball. Also, don’t live in California if you can help it. 😉

“Dr. HB readers need to research RE during the Weimar Republic of Germany”

I have, and Weimar inflation was at 1000+% during that time. The government continued to print money causing inflation to spiral. We are at 8-10% now.

The Fed is doing the opposite. QT and increasing interest rates. The exact opposite of Weimar.

They should have continued QT and interest rate increases in 2019 but a certain President loved artificially low interest rates to pump up his ego and browbeat the Fed with threats to continue it.

Finally we have a Fed and President that will do the same as Volcker and Reagan to return the free market.

Finally we have a president who is printing close to a trillion dollars (after printing another 4 trillion 1.5 years ago) to “fight” the fire of inflation – fighting the fire with gasoline – that will surely quench it!….No wonder that the inflation keeps increasing despite multiple 0.75% increases!….thanks to “Inflation Acceleration Act”.

Flyover, you are correct.

The current President is still inflating the deficit (and inflation) with government spending. It is lower than the last President’s deficit spending so that’s an improvement. The Fed is going in the right direction and has stopped printing money.

The last President was a complete and utter disaster!!! He outspent Obama with deficits AND browbeat the Fed into printing more money in 2019. All while claiming the best economy ever. What in the heck happened to the fiscally conservative Republicans I used to vote for? The current President is a tremendous improvement though he needs to stop government spending and act like a legacy(In name only) Republican and not like the new ones.

Related to housing, the current President waited too long to to turn the Fed and raise rates. it took him a year. During that year. housing inflated another 20% on top of the previous President’s “greatest economy ever” 20% rise.

Bob The last President was a complete and utter disaster!!! He outspent Obama with deficits AND browbeat the Fed into printing more money in 2019. All while claiming the best economy ever. What in the heck happened to the fiscally conservative Republicans I used to vote for?

If you recall, those trillions in increased spending were to fund our “Covid response”: Unemployment extensions, stimulus checks and subsidies to individuals, businesses and hospitals, plus all that money to buy “free” vaccines from Big Pharma.

The progressive were whining that it wasn’t enough, though typically, they now blame Trump for giving them what they wanted.

Not ashamed to say, I’m still unvaxxed for Covid. No clot shot for me.

Somebody wake me up when price drops are YOY instead of month to month. I truly thought COVID and the lockdowns would destroy the markets. Boy was I wrong.

I’ll open my popcorn when we are down 20% YOY across the board nationally on sale prices, no sooner.

Exactly, this is a housing lockdown. High rates, high prices, low

Demand, no inventory. Sales deteriorate, sellers take houses off the market because they don’t want to buy into this market, so they rather stay put. And nowadays you can do many jobs remotely. If someone really has to move they can rent out their house at a profit and rent a place themselves for the short term.

Wake me up if high paying jobs are lost and housing declines yoy.

Basically “nobody” wants to lower their price and “nobody” wants to buy. I’m looking at the house next to me and the house behind me that have both been for sale for months without a price drop.

Redfin says my home value is down 4% while Redfin says the neighborhood is “Very Competitive”. So, which is it? Their algorithms apparently don’t work well in this bizarre market. It’s a freaking stalemate.

I don’t see how hands will be forced without massive job losses and so far that’s not happening. With interest rates at 7% or 8% and possibly higher, prices would have to come down by a TON for the payments to look attractive again.

Turtle,

In the last few years, many (not all) houses were apparently bought with “cash”. That cash in many instances came form HELOCs. Most of those had variable interest and it went from around 3% to 7% in few short months. If interest will continue to go up (most likely due to the fact that relative to inflation rate they are lower) it will cause lots of financial pain to hold on those properties.

The higher interest will soon cause some great casualties like Lehman Brothers; in this case it might be Credit Swiss. At that point, the financial system worldwide can freeze. I don’t know the future, but what I say has a high probability and it did happened before. The bond market is three times the size of the stock market. This increase in rate is going to blow up the bond market. This time I see a breakdown overseas before it can happen in US. Throw into the mix China and Russia and US using finance as weapons of war and anything is possible.

@Flyover I agree, anything is possible! If only we had crystal balls.

Flyover, if someone buys a home cash pulled from HELOC, that person must have at least 2 houses paid-off of equal value.

This is still a profile of very solid financial position.

Surge, if you pull money from the HELOC on the first house, then, that first house is no longer paid off – you owe whatever number of hundreds of thousands borrowed against it. The second house might be or might not be paid off, depending on how expensive it was. Definitely, you don’t end up with two paid off houses.

Headline: Typical mortgage payments soar $337 in just SIX WEEKS as interest rates near 7%: Homes are lingering on the market – forcing desperate sellers to lower asking prices at pace with 2015

https://www.dailymail.co.uk/news/article-11271411/Typical-mortgage-payment-soared-337-just-six-weeks-rates-hit-7.html

The average US homeowner saw their monthly mortgage payment rise by 15 percent or $337, according to a shocking new report from Redfin.

The report goes on to say that the rising mortgage rates of around seven percent are the highest since July 2007 shortly before crash that triggered the great recession.

This is causing potential homebuyers to get cold feet and decide not to buy in the current market.

In addition, homes are remaining on the market for longer which is resulting in owners dropping prices at the highest level since 2015.

Not since January have pending sales been at the current low level while the amount of homes selling for below market rates is at its highest level since 2020. While new listings are down 14 percent from the same time in 2021.

Redfin’s Jason Aleem is quoted in the report as saying: ‘It’s imperative for home sellers to react quickly and aggressively as the market turns.’

He continued: ‘This means adjusting your pricing immediately if you want to be competitive and attract offers from a smaller pool of qualified homebuyers. If your home isn’t the ‘belle of the ball’ in your neighborhood, you’re going to need to cut the price to sell it.’ …

People are getting squeezed all around thanks to inflation / higher rates and also disasters.

– I have friends whose house payment went up $500/mo in two years between property tax and insurance. They’re living month to month and almost to the point of being forced to sell.

– My health insurance went up 29% this year and my MIL’s up 25%. That’s thousands of dollars out of the annual budget.

– I bought a $7 box of cereal at Sprouts the other day, for Pete’s sake!

There’s no way Biden gets re-elected. Fair or not, he’s Jimmy Carter 2.0. Am I right?

It is not unhealthy to be squeezed on all fronts. Builds resilience and character

Surge,

Ha!

I sort of agree. If you squeeze me enough, I might fit into my high school jeans again.

Other than that, I don’t like squeezing.

Maybe Jerome Powell can use that to assuage the masses.

The last annual inflation rate I found in a search was 8.3% (through August). Over the last year, the gold ETF GLD is down 6% and the S&P 500 index is down 16% (both in dollars). But the dollar index against other currencies (DXY) is UP 20%!

With all of our problems, we’re not the biggest S-Show in the world after all. So the dollar might buy more RE in markets with sliding currencies like the Euro. One potential lurking problem is that US exports could suffer if the dollar rises too much against other currencies.

Looking forward to experiencing 15% on a CD.

5 yr CDS at brokerages are at 4.4% now with the aforementioned 8.3% inflation rate. That’s more than 1% higher than at my credit union. Paul Volcker is dead. Don’t hold your breath

munch munch munch :))))))))

The San Diego Union Tribune in California. “The prevalence of corporate buyers in the local housing market may be leveling off. Median home prices in August decreased for the third month in a row to $799,000, according to CoreLogic. While down from the all-time high of $850,000 in May. ‘It seems like it may be coming to an end now,’ Thomas Malone, the CoreLogic economist, said of the investor surge in the market. Investors can be more sensitive to interest rate increases and more hesitant to jump in, he said.”

Got Popcorn

Month to month changes always happen. Up, down, up down. They’re not tremendously meaningful. Let me have some of your popcorn when we see year over year drops. That’s taking a step back to see what’s really going on. Nothing will surprise me this time.

What an epic crash!

Headline: Remote work wipes $453b off office real estate

https://www.theregister.com/2022/10/03/remote_work_real_estate_values/

The surge in remote work, and a decline in demand for office space, during the COVID-19 pandemic has apparently wiped an estimated $453 billion off commercial real-estate value. That’s not good news for investors and pension funds relying on the value of these buildings.

The US National Bureau of Economic Research (NBER) – a nonprofit, non-government org – came up with the figure, and is predicting what it calls an “office real estate apocalypse.” While it focused its work on New York City, data from 105 office markets throughout America between 2000 and 2022 was included in a report this fall.

Prior to the coronavirus outbreak, 95 percent of office space was occupied in the US, according to the bureau. By the end of March 2020, occupancy dropped to 10 percent, it said. As of only a couple weeks ago, the NBER said office occupancy is still only at 47 percent.

Around the US, that resulted in a 17.5 percent decrease in lease revenue between January 2020, and May 2022, …

I suppose some of these office towers will be converted into condos, co-ops, and apartments. That should affect residential home prices and rents.

munch munch munch …..

The Orange County Register in California. “The summer’s collapse in Orange County homebuying pushed the median selling price below $1 million and cut the number of seven-figure neighborhoods by six from springtime. The countywide median for August fell to $984,000, the first time it’s been under $1 million since March and down 6.6% from May’s peak of $1.054 million. Since the spring’s peak, drops out of million-dollar status were found in Anaheim 92807, Anaheim 92808, Foothill Ranch 92610, Garden Grove 92845, Huntington Beach 92647, Irvine 92614, Ladera Ranch 92694, Mission Viejo 92691, and Orange 92867. Meanwhile, the median jumped above $1 million in three neighborhoods: Laguna Hills 92653, Midway City 92655, Orange 92866.”

“The pandemic starkly changed the home-price landscape so what was only two year sago relatively rare — a million-dollar ZIP — is now Orange County’s norm. Low mortgage rates and limited inventory created a feeding frenzy during the pandemic era’s first two years. But times have changed. The buying binge is over as lofty pricing and sharply rising mortgage rates scare off house hunters and investors.”

Got Popcorn :)))))

Golden handcuffs for all of them. Good luck y’all.

Nearly three-quarters of pandemic homebuyers have regrets

https://finance.yahoo.com/news/just-cant-wait-nearly-three-210000181.html

Such a BS article. Lol

The story is mainly about one condo purchase.

“ The previous homeowners were embroiled in a conflict with the HOA and one of the stipulations of the resulting lawsuit was that the future owner of the lot wouldn’t have access to designated parking either.

“So now, all my neighbors feel very icky about me because of some drama that they had with the previous owner and my lot,” adds Kingsman.”

Big deal. Just rent out the condo in the future and buy a SFH.

I bought during the pandemic. SOL and others on this blog cheered when I bought: he bought the peak!! Market gonna crash!! Covid!!

Years later I look back to the best purchase i’ve ever made in my life: our first home

It appreciated tremendously, I am locked in for the next 28years at below 3%. My mortgage for a large SFH is cheaper than renting a condo.

Maybe what happens with buyers who recently purchased is the this: renters get jealous and tell them they will lose their equity. Don’t listen to others is my advice.

Buy when you can comfortably afford it. It’s a long term investment and a forced savings plan. Likely the best purchase you will ever make. It worked out so well for me I bought a second home as an investment property.

M: SOL and others on this blog cheered when I bought: he bought the peak!!

M lies again.

I never “cheered” his alleged home purchase. From the start, I doubted that his story.

M, please post a link to where I “cheered.”

Sol, thanks for the laugh!!

You “doubted” ?? ???? rofl

Someone carrying his phone in a faraday bag due to paranoia doubts me? As if that would mean anything. People should be suspicious of someone who tells them it’s a good idea to hang on to your landline. Maybe that was a thing in 1980 but we are in 2022 for crying out loud.

I bet SOL will hang on to his landline and his faraday bag for the next 5+ years. Once he stops the nonsense I might be able to take him a bit seriously.

And M, please stop trolling.

Agree or disagree, but don’t lie about what others have said. Lying is so childish.

Your immature trolling is one reason I have difficulty accepting your claim of being a thirtysomething, married, professional homeowner and landlord.

You just sound so bratty.

Sol, thanks for the laugh!!

You “doubted” ?? ???? rofl

Someone carrying his phone in a faraday bag due to paranoia doubts me? As if that would mean anything. People should be suspicious of someone who tells them it’s a good idea to hang on to your landline. Maybe that was a thing in 1980 but we are in 2022 for crying out loud.

I bet SOL will hang on to his landline and his faraday bag for the next 5+ years. Once he stops the nonsense I might be able to take him a bit seriously.

Maybe he meant “jeered”.

Sol, thanks for the laugh!!

You “doubted” ?? ???? rofl

Someone carrying his phone in a faraday bag due to paranoia doubts me? As if that would mean anything. People should be suspicious of someone who tells them it’s a good idea to hang on to your landline. Maybe that was a thing in 1980 but we are in 2022 for crying out loud.

I bet SOL will hang on to his landline and his faraday bag for the next 5+ years. Once he stops the nonsense I might be able to take him a bit seriously.

M, posting the identical comment three times does not make it more convincing.

It just makes you look like a troll.

I’d have regrets too if I blew every dime I had and half my income for the rest of my working life on a seven figure “cottage” draped in utility lines, across the street from an auto shop.

All the leaves are brown

And the sky is grey

I’ve been for a walk

On a winter’s day

I’d be safe and warm

If I was in L.A.

California dreamin’

On such a winter’s day

Turtle, and yet, California dreaming just does not let go of you.

But as Mama Cass pointed out:

1) You’d be safe and warm without high heating and cooling costs.

2) You’d be walking/biking to the beach every day in perfect weather.

3) You could die after living a long life in that house experiencing bliss.

4) You could get your car fixed across the street.

Come to the California Dark Side. 🙂

@Surge I’m flattered you think I could write such a fine song

If I wanted to be in California, I’d be there already. A lot would need to change on that end.

Unemployment dropped to 3.5%.

Expect the unexpected,

Turtle

I suspect that is a bogus number revised upwards after the elections. It looks like the FED has to do some serious QT since the interest raised so far did nothing. In Argentina is 75% and the inflation even higher. The FED has to mop the trillions they printed in the last few years!…

The Fed is awfully shortsighted these days.

Restaurants are packed

Concerts are packed

Airports are packed.

Everyone who wants to work is working,

Everyone got a raise. – Not me yet but our stock is still up.

When will this economic prosperity madness end?

Inflation is way higher than income increases (even using the bogus CPI published) – that means less purchasing power than 2 years ago for everything that people buy.

This is a fact, not just my opinion. They also showed that debt on credit cards went way higher than before; that means people use credit cards to cover the decreased purchasing power of their disposable income.

Crime went up in all big cities. Stocks are in meltdown. They will continue to go lower as the PE no longer makes sense at higher and higher interest. Everything points down and it is going from bad to worse. I hope you enjoy your gasoline prices and all the price increases. The 401k became 201k. This is just the warm up for what’s coming.

Flyover, you have a memory span of a fly. 401k are not becoming 201k. They are becoming 401k again from 801k from late last year.

Provinciality of some people amazes me. (and this has nothing to do with living in non urban areas).

Flyover,

“Everything points down and it is going from bad to worse.”

Everything is great now with massive spending of the free cash handed out by the last President. Everyone is employed and getting raises. The party is still raging in the bars, restaurants, airports, apartments, and concerts until the last cash is gone.

Inflation is draining all of the free cash sloshing around at a faster rate. (I went out this weekend. $15 beers????. I had one to be polite. My drunken bar mate blew $100 with tips without food)

Once the cash is gone (the punchbowl is empty), the party will wind down.

It will be a doozy of a hangover after a 5 year drunken party.

You and I may be some of the few who stayed sober during the last 5 years. My excuse is that I am too old to party.

I think even the life of this party, M, may be seeing the eventual end. At least I hope he does.

However, like in college, after multiple 50 cent beers, I picked myself up the next morning and life went on without any major catastrophe. I rode my bike to class because I couldn’t afford $1.30/gallon for gas on a $3/hr job.

It also has to do with location. I’m in Florida and just built. (Took 13 months) but finally in the house. Our neighborhood has 55% all cash buyers who are primarily retirees from the Northeast. This is unique because in 2008 in Florida about 75% of the neighborhoods were doing variable rate loans with almost nothing down. Easy to walk away. This time around almost 6 of 10 homes in our neighborhood are paid off and retirement spots. That will limit foreclosures and retirees usually don’t buy with intent to move in 3 years. The prices here have not gone down, they’ve just stabilized and aren’t jumping anymore. There will no doubt be a correction here at these interest rates but again, this place is unique because while there’s been supply issues everywhere, they were crazy here because not only were you bidding with a local Florida family trying to move from a condo to a house, you were bidding with tens of thousands of other folks moving here from all over the country. That in my opinion will shield the hot spot areas from getting crushed like they may otherwise would in places like Ohio, Pennsylvania or any host of states with declining transient populations. Also, a lot of the builders are getting creative. They are offering buyers 50,000 in “closing incentives” you can use them for closing or the builder will pay for your buy down rate or cover your PMI payments for 10 years, etc. They are doing all this so they don’t have to lower the actual sale price of the new house. It’s good for them not to set that precedent and it’s great for the neighborhood who just bought and would be infuriated if the builder started selling the same house for 75,000 less. I thought that was pretty clever. Who knows though how it will turn out. But I’m not overly concerned about the housing market imploding down here. Might feel different if I lived in Nebraska or something.

Well, I bet there’s a few price reduced properties in Fort Meyers.

Well, I bet there’s some proced reduced real-estate in Fort Meyers now!

Headline: Architect builds compact ‘infill’ house in a tiny parcel of land on his London street: Could this be the answer to Britain’s housing shortage?

https://www.dailymail.co.uk/property/article-11288245/Infill-houses-architect-built-compact-home-tiny-parcel-land-street.html

“… ‘infill’ houses — quirky little properties squeezed in the nooks and crannies of cities.

They have popped up between other houses, where garages once stood, or on underused hinterlands at the edge of clutches of housing.

So, when an architect finds himself the accidental owner of an odd slice of land in a break in a terrace of houses, what does he do with it?

Well, in Sandy Rendel’s case, he built Slot House, which is almost exactly the length and breadth of a London Underground carriage.

Two storeys high and just 2.8 m wide, the house in Peckham, south London, was completed in 2020 and shortlisted for the Royal Institution of British Architects Grand Designs house of the year award 2021….”

I expect more of this.

ADUs popping up in every nook and cranny. Parking will be heck but homeowners smell money and the government is backing them up.

As long as rent keeps rising, ADUs will continue to be built.

In our neighborhood, the HOA isn’t as liberal, so they are named grandmother or nanny suites. Even HOAs don’t hate grandma. Eventually grandma passes away into the great CA sunset and sons, daughters, cousins, grandkids, ex-sister-in-laws, 3rd uncles, etc all start moving in and paying rent. There goes the neighborhood for parking.

Prices are dropping in Scottsdale, AZ too, which I think will become an increasingly better value compared to suburb cities in California. Look at this house near a TPC golf course.

https://www.redfin.com/AZ/Scottsdale/7979-E-Princess-Dr-85255/unit-4/home/27739504

Look at the investment opportunity for this house! Price dropped to 825K!

Last sold 2 years ago for 592K. 50% ROI in 2 years!

M made the best decision EVER to buy in AZ 2 years ago.

Disclaimer: “Past performance is no guarantee of future results”

Thanks Bob! Our first rental (in AZ) is a winner so far and the renters have been good (paying on time). They did find lots of things in the new build that they wanted to have fixed. So I had to deal a lot with the builder to fix them. That’s part of being a landlord. It could be worse….luckily I don’t have to pay a dime for the repairs.

Seems Tiffany needs to augment her income by writing stories that hopefully convince everyone that home prices will be just fine. Wonder what her second literary piece will be. Thank you for your opinion anyway.

“For people in the market to buy or sell a home, the 24-hour news cycle can prove overwhelming. Is it a good time to buy or sell? Are we at the top of the market or should we wait for the market to adjust downward. How do we deal with rising mortgage rates?”

https://timesofsandiego.com/author/tiffany-torgan/

Tiffany is too much a happy optimist just like Realist is an unhappy pessimist.

We are all on the spectrum. Or somebody is lying.

However, I think she some good points for today’s market. However, the future is TBD.

1) Demand is still high with home buyers who have the income and savings. Just because there are only 2-3 buyers willing to pay list price for a house instead of 50 buyers overbidding on a house doesn’t mean that housing has crashed. With 2-3 buyers willing to pay list price, this market is still too hot for me to buy (Except for the long term. Like I did in 1987 with an 11% mortgage rate). Mortgage rate increases will help lower the demand to normal.

2) Supply on the market is still lower than 2019. 2019 was closer to a “normal” market. More home building or a job-loss recession with forced sales and foreclosures would “fix” this but with unemployment at 50 year record lows, that may take awhile.

Demand is higher than normal + Supply is still lower than normal = no crash yet.

We’ll see if Tiffany stays happy next year.

munch munch munch….

The Orange County Register. “Forty-three percent of California homes sold below their initial asking prices by the end of the summer, compared with just 15% last spring. ‘Buyers and sellers are adapting to the new realities of the market,’ said Bay Area real estate broker Otto Catrina, CAR’s 2022 president. ‘As sellers adjust their expectations, well-priced homes are still selling quickly. And for buyers, (there are) more homes for sale, less competition, and fewer homes selling above asking price.’”

CBS Los Angeles. “The California housing market has seen a noted decrease in sales, causing the listing prices of homes to experience a drastic drop. ‘Huge change,’ said John Moreno, a local real estate agent. ‘Everything just kind of shifted starting probably at the end of Spring, beginning of Summer.’ He admits that for the first time in a long time, he’s been forced to price things differently for his clients looking to make top dollar on their property. ‘Sometimes, that ruling is gonna require maybe putting a list price lower than we would have six weeks ago, two weeks ago even.’”

“In a recent report by Zillow, the average price of a home in Southern California has dropped 6% since May — the biggest drop since 2012. ‘With the interest rates going up, everybody kinda freaked out,’ Moreno said.”

Got Popcorn 🙂

Headline: Mortgage rates hit 20-year high of 6.92%: Amount banks are prepared to lend average buyer has fallen $100,000 since January to $343,000 (which would get you a trailer in LA)

https://www.dailymail.co.uk/news/article-11312113/Average-long-term-US-mortgage-rates-quarter-point.html

Average long-term U.S. mortgage rates reached their highest level in more than 20 years this week and are likely to climb even further as the Federal Reserve has all but promised more rate increases in its battle to tamp down persistent inflation.

Mortgage buyer Freddie Mac reported Thursday that the average key 30-year rate climbed to 6.92 percent from 6.66 percent last week. Some lenders are now even offering rates above 7 percent.

Last year at this time, the rate was 3.05 percent.

The average rate on 15-year, fixed-rate mortgages, popular among those looking to refinance their homes, meanwhile, rose to 6.09 percent from 5.9 percent last week — the first time it’s breached 6 percent since the housing market crash of 2008.

Rates have not been this high since April 2002, NASDAQ reports, with the 15-year rate hovering at just 2.3 percent last year. …

Active listings in SoCal today: 30,500 ish

3 year avg 41,100 ish.

Demand is also going down.

Low inventory + low demand + higher expected market time = no crash

Try again next year.

@realist, you are going to be ripe for the Guinness world records for being on a popcorn diet for a decade.

munch munch munch …

“For the first time in a decade, home prices in Southern California are definitively falling. After 10 years of largely uninterrupted gains, home values have turned negative, the result of rising mortgage rates that have squashed demand and caused sales to plummet. Few, if any, major real estate experts predict Southern California home prices will fall like they did during the Great Recession. But values are coming down in many corners of the country, because they have to, according to economists. In individual counties, price declines from the peak range from a 3.6% drop in Ventura County to a 6.7% decrease in Los Angeles County, according to Zillow.”

“According to John Burns Real Estate Consulting, prices in L.A. County are already down 3% from September 2021. Rick Palacios Jr., research director with the consulting firm, said one reason for greater drops in L.A. County could be the sagging stock market has hammered luxury sales in the more rarefied realms of the region, as people saw the money they planned to use for their down payments disappear. Although that’s not Great Recession level, ‘it’s nothing to sneeze at,’ he said. ‘These will probably be the most significant price declines seen outside from maybe a couple other instances in history.’

Got Popcorn 🙂

We’ve just seen the biggest one year jump in mortgage rates in over 40 years.

“Boy, that escalated quickly. I mean, that really got out of hand fast.”

– Ron Burgandy, #1 in San Diego

SD County Beach Advisories: https://www.sdcoastkeeper.org/beach-advisories

Please, somebody tell me what SoCal has worth paying a massive premium for in 2022 other than the weather? “It never rains, yay!” Okay, great… mega drought. Fantastic outlook for the future.

STOP CLOGGING UP OUR TEXAS FREEWAYS! Keep your increasingly warm summers.

Def the weather! Best weather!

Lots of high paying jobs too. Beautiful scenery and the Pacific Ocean.

But weather is prob the top one on the list. Can’t beat it. I can play pickleball all year long.

My dog doesn’t like rain. So it’s weather, weather and weather.

The high salary is just a cherry on the top. You can’t buy good weather with money. So I think a $1M premium is justified for weather alone.

Some people like bugs, humidity and cold weather. Imagine everyone would like sunny, mild weather with dry heat?! SoCal would be crowded!

Headline: Tenants And Advocates Want Permanent Federal Rental Assistance And Eviction Protections

https://www.youtube.com/watch?v=t209tb_Kkf4&t=506s

We had federal rent moratoriums during Covid. Now tenant activists want to make federal eviction protections (and rent control) permanent.

I don’t understand why RE bears are celebrating a housing decline that will never dip below late 2020/ early 2021 levels. Now they’re salivating at 7% interest rates to buy a $500k house that peaked $650k when they could’ve bought the same house with 3% rates for $525K not even a year ago. But hey, y’all saved $25K! Give yourselves a pat on the back and submit that long over due offer of yours! Hope you enjoy that $3300/month mortgage because having a $2400/month mortgage a year ago would’ve been financial suicide!

Real Estate bears (permanent ones) do these celebrations because they never buy real estate and they do not understand how economics of real estate work. They tend to think in cash, do not understand fiat money, value gold. Cali is a place to go for their criticism since RE estate / social gymnastics are very highly amplified.

Your example comparing 2022 vs 2021 is perfect example why their arguments fail 90% of the time. Not because RE is always up up up, but because their logic is flawed by their own biases/fears.

You’d think two smart fellers like yourselves would be able to share useful noggin nuggets instead of posting cornhole generalizations. Glad you found a forum that makes you feel good. Carry on.

@Surge

Its all good, I used to be misinformed and paid a huge price in opportunity costs. Luckily I wisened up around 2015 and never looked back. All it takes is a little research, a little number crunching and the rest is just noise.

@Charlie

If you want advice, feel free to look at my archived comments. My analysis has been eerily accurate and has not let me down. Nothing about this market is surprising to me to say the least. Grab yourself a pen and paper and make sure you take good notes. Carry on.

@Surge

Its all good, I used to be misinformed and paid a huge price in opportunity costs. Luckily I wisened up around 2015 and never looked back. All it takes is a little research, a little number crunching and the rest is just noise.

@Charlie

If you want advice, feel free to look at my archived comments. My analysis has been eerily accurate and has not let me down. Nothing about this market is surprising to me to say the least. Grab yourself a pen and paper and make sure you take good notes. Carry on.

@Surge

Its all good, I used to be misinformed and paid a huge price in opportunity costs. Luckily I wisened up around 2015 and never looked back. All it takes is a little research, a little number crunching and the rest is just noise.

@Charlie

If you want advice, feel free to look at my archived comments. My analysis has been eerily accurate and has not let me down. Nothing about this market is surprising to me to say the least. Grab yourself a pen and paper and make sure you take good notes. Carry on.

With mortgage rates over 7% people hunker down.

Hunkering down means, owners are not interested in giving up on their low locked in rate. My mortgage rate below %3 looks better and better by the day. I wouldn’t give that up unless a buyer offer 1-2M usd over market price. So for instance, if Zillow tells me that my SoCal house is worth 1.5M I would consider selling it for 3.5M in this current market. Why else give up on a historically low locked in rate?

No wonder there is no inventory.

“With mortgage rates over 7% people hunker down. ”

I am hunkering down with an under 3% loan. It is too expensive to move and take on a new 7% loan. I already have my forever home and from experience, the grass is never greener elsewhere.

I suspect most homeowners purchased before 2 years ago so they have 30-40% equity from the last 2 years. It would take a tremendous 50% crash to put people who purchased before 3 years under water.

Since I did the correct thing and bought for the long term, the only reasons I may consider selling:

1) I’m dead. – I won’t care at this point.

2) I lost my job. – I work remotely and there are still plenty of jobs available. Even if I have to take a pay cut, my mortgage is so cheap at 3%, I could take a job as a WalMart greeter and not lose my house. Never walk away from your house.

3) I plan getting a divorce and running off with a younger woman. – I won’t do that. Even if someone did, one of the parties could keep the house with the low mortgage. It would not make sense for someone not to keep it.

4) If someone offers me $3M for my house with no inspections. I may take it and retire.

I have to live somewhere and owning a house long term gives me the low interest and low payments to do it.

FYI, I said the same thing back in the 1990’s when I refi’d my 11% loan down to 8%.

8% seemed so cheap.

Or your wife divorces you after spending too much time trolling on housing blogs. I know, it will never happen to you. Just like most of the other 50% of couples thought when they said “I do”.

Don’t show her your comments on here. I can see her going to the judge and asking for you to buy her out based on your house worth $1.5-$2M more than appraised because of the rates and see how you feel. Looooooooooool

I barely spent any time here. My comments take a couple minutes to write.

But it’s true, divorce can happen to anyone. I could also just die by walking my dog on the nearby trails. Until these things happen I enjoy life and my 2.75% locked-in rate though! And the weather in SoCal. And our backyard and friends in the neighborhood. Speaking of friends, Halloween is coming up! Happy Halloween to the lucky ones who own a home and happy Halloween to all the renters who pay off our mortgages!

I think Whatever is trolling me.

Yes, the divorce rate is scary high so I agree that could happen for any reason. I’d like to know if the majority of the divorces involve a mortgage or kids. Or do they just self-destruct before that point.

In the case of kids, every divorce I have seen, someone taking care of the minor kids keeps the house. For years if necessary.

Based on celebrities like Trump, each of his many exes kept the house also.

Of course, if someone, not a celebrity, runs off with another person, that may be a different story.

I’d be interested in knowing how many home sales are driven by divorces that have to sell. I suspect it is not that much if a house is far underwater. Both would would have to split the loss.

Headline: US New Home Buyer Traffic DOWN -64% YoY (Bank Deposits DOWN The Most Since 1973)

https://confoundedinterest.net/2022/10/22/us-new-home-buyer-traffic-down-64-yoy-bank-deposits-down-the-most-since-1973/

Some possible explanations on bank deposits.

1) Inflation is eating away at the 100’s of k’s of cash sitting in people’s 0.1% interest bank accounts. People feel rich with 100K sitting in their savings accounts and are spending it until it is gone. This is what the Fed wants.

2) The smarter people have pulled their money out of their 0.1% bank accounts and maxed out on 9.6% Ibonds in a simple Treasury Direct account. The rest they are putting in 4.2% 6 month Treasuries and 4.5% 1 year treasuries which are still worse than inflation but much better than 0.1% bank accounts or negative 20% stock market investments. The smart people have safe cash in short term treasuries either waiting for the Fed to cave (Increasing stock prices) or for the Fed not to cave and housing prices drop 20-30%.

Really savy folks stack.?

E-Trade bank is now panicking on the lost savings.

They just sent a notice that their savings account interest rates are rising to 3.5%.

I suspect they have lost so much savings account money to Treasury Bills paying 4.5%.

The banks will see a drain on cash while CDs and Treasuries are paying much higher rates with no risk.

Headline: Maryland couple claim STRANGERS have moved into the $379,600 house they just bought and are now REFUSING to leave

https://www.dailymail.co.uk/news/article-11345947/Maryland-couple-claim-STRANGERS-moved-379-600-house-just-bought.html

A Maryland couple was startled to find that a group of random strangers had moved into the house they had just purchased for $379,600.

The couple signed a contract with US Bank to purchase the five-bedroom home at 10716 Dragoo Place in Clinton, Maryland on Thursday.

And to celebrate, WUSA reports, the wife drove past the property — where she saw a U-Haul in the driveway and people moving in.

She tried to confront them, the real estate agent told WUSA, but the new tenants showed her what they claimed was a lease for the property, and refused to leave.

The local rental blogs and Facebook blogs are loaded with fraud.

Criminals know which houses are vacant and post for-rent ads. They collect thousands in up-front deposits on vacant houses from desperate renters after showing the vacant house.

It isn’t until later when the real owners show up that it gets messy. By then the criminals have run off with the deposits and cannot be found. From what I’ve read, the renters lose thousands that they cannot afford.

I would avoid owning a vacant house for this reason. Have someone you trust live there

or I’d mount cameras and monitor the house while it was empty. In this case, the bank was negligent.