The Housing Correction is In Full Swing – Gear up For Years of Housing Challenges as Inventory Grows and Low-Rate Years are Over. 4 Charts Showing Housing Correction Just Started.

There are many Americans that are going to painfully realize that the Fed does not necessarily love housing. Their focus is the overall economy and when housing is juiced up by low rates, we realize that creating a housing bubble as a consequence of low rates has repercussions. One of those is that once the low-rate spigot is off, you have a bunch of industries that get slammed because of this, including those in the housing cheerleading section. Another industry is the mortgage sector and banks like Wells Fargo and other brokers have seen traffic completely dry up. New home buying is being impacted and builders are now needing to give incentives and cut prices. Potential buyers with the economy slowing and high rates are unable to squeeze into crap shacks at inflated bubblicious prices. Does this story sound familiar? It should because housing bubbles are simply a reflection of artificial rates and easy money – this can be with absurdly low rates as we saw this time around or subprime debt and lax lending in the Great Recession. Same book, different chapter. Let us look at some data first.

Housing bubble 2.0

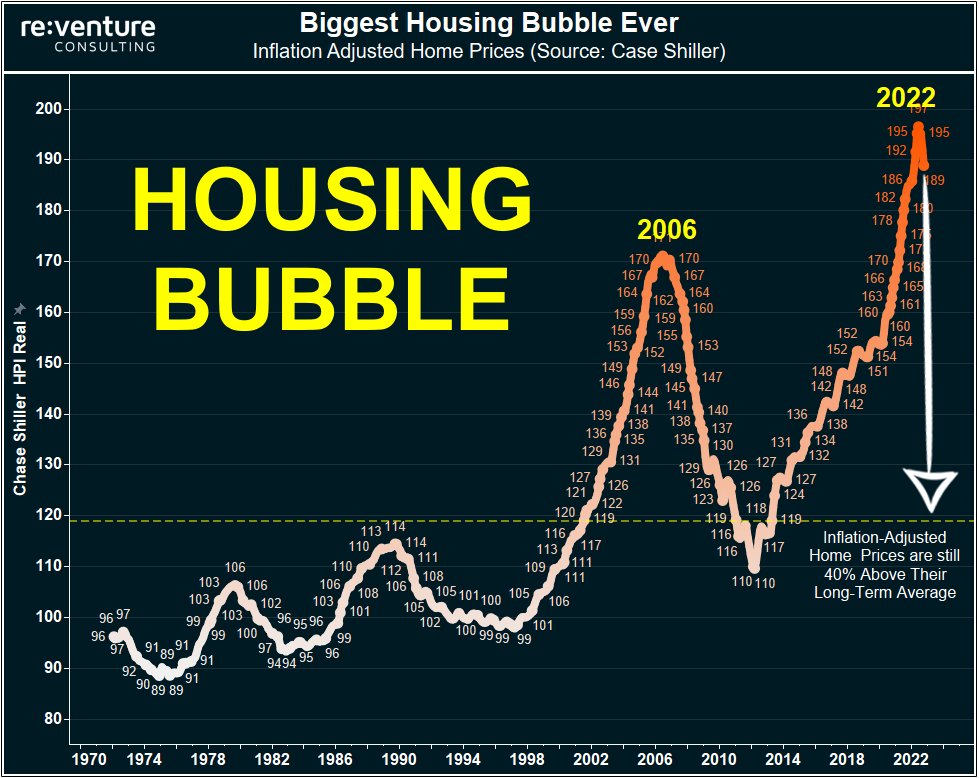

The housing correction is here. In many areas home prices are now correcting and price reductions are very common. Take a look at inflation adjusted home prices here:

Home prices are at their highest inflation adjust point in American history. “But the rates!” was the argument for a long-time. Well guess what? Rates are still historically low but all it took was 6 to 7 percent interest rates (still historically low) to implode all of this which suggests people were gambling with low mortgage rates to squeeze in. Great, you bought a $1 million woodshed at 2.5% and are super excited. Hope you enjoy that place and have the income to support that for 30-years because new buyers would buy your place at a 30 to 40 percent discount given rates and their incomes. You know, income that comes from actual jobs and not speculating in imaginary tokens or tech companies with insane valuations for an app that makes you look 30-years younger. The reality is, there is no shortcut – to look good in the meat world you need to workout and put in the effort consistently. I know a few plumbers and electricians that are doing fantastic since no avatar in the metaverse is going to fix your plugged up toilet in your crap shack.

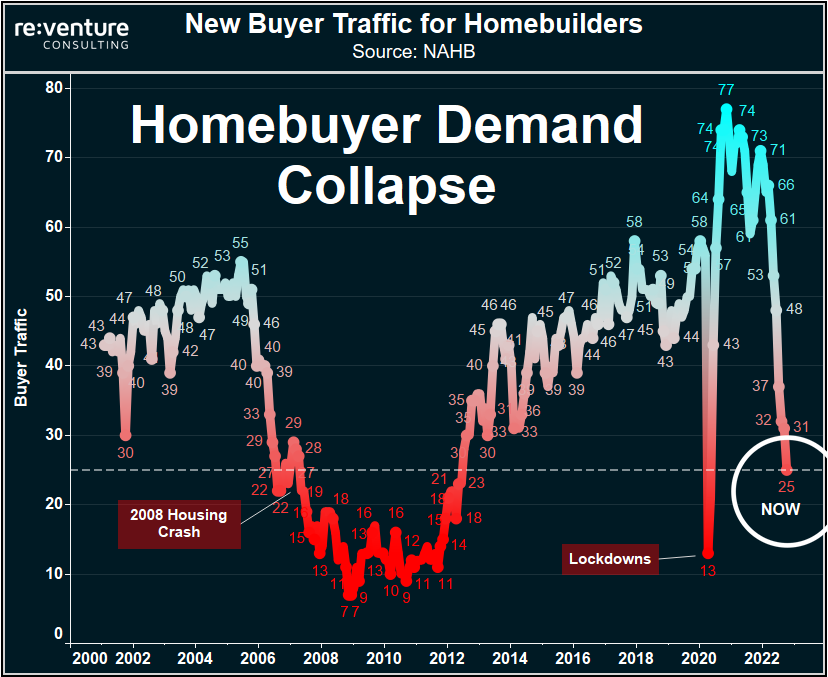

And this is exactly what is happening. So existing homeowners are in a “it is you, not me” situation for the short-term but home builders with new homes have a cold economic driven view of the market. And they know what is happening. Take a look at this:

We are at Great Recession levels of traffic and new home builders are offering incentives and now lowering prices. Many prefer incentives and massive bells and whistles to move inventory but now, they are cutting prices plus offering incentives which is exactly what happened during the last crisis. Builders do not have the luxury to be delusional like some homeowners that are psychologically addicted to tracking their “home gainz” on Zillow and pretending it was real – it is only real when you sell and have the cash in your bank account! Ask the crypto bros in FTX how real those “gainz” were. Easy come, easy go.

Prices are adjusting everywhere

In many areas prices are down year-over-year. Nationwide, we are seeing a clear trend of where we are going and in a few short months, we will once again have a negative year-over-year print (something that was said to never happen in housing but happened in the last Great Recession and in this Recession pending its trademark):

So do a little analysis here. Prices hit a momentum peak in 2006 and started trending down noticeably in 2007. Prices had sizable drops here until 2012 when the market started trending up slowly again. You need to understand that the Fed is focused on smashing inflation! The biggest component of the CPI is housing so guess what they are trying to do? Obviously, they will not say this publicly to offend the cult of “housing only goes up crowd” but they have no choice to do this or risk inflation getting even further out of control. Kiss those low rates goodbye.

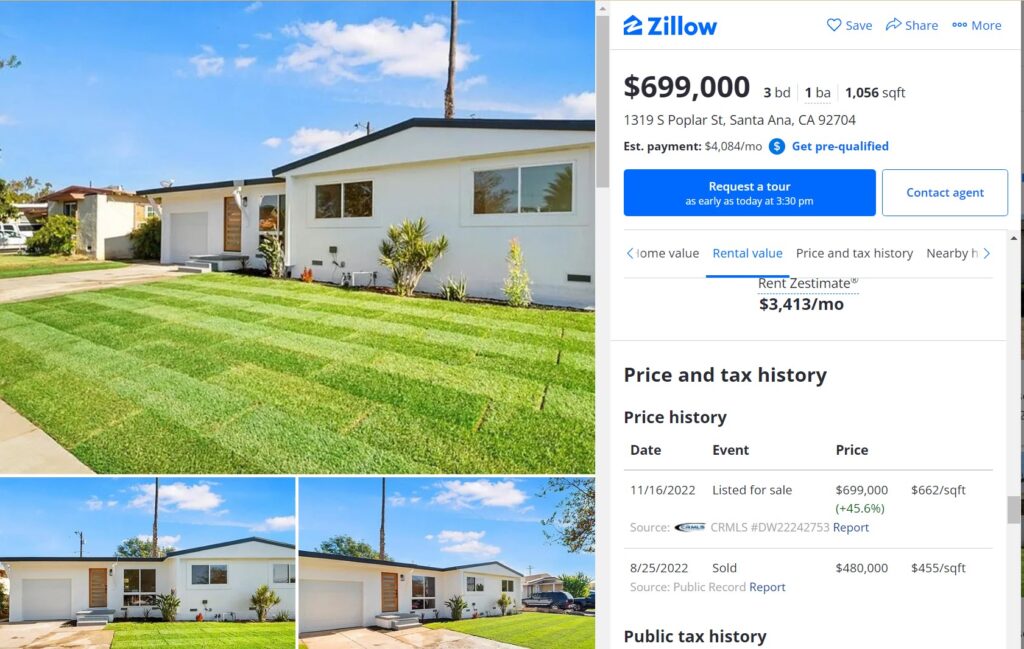

Housing shifts down in increments. Take a look at this SoCal flip as an example:

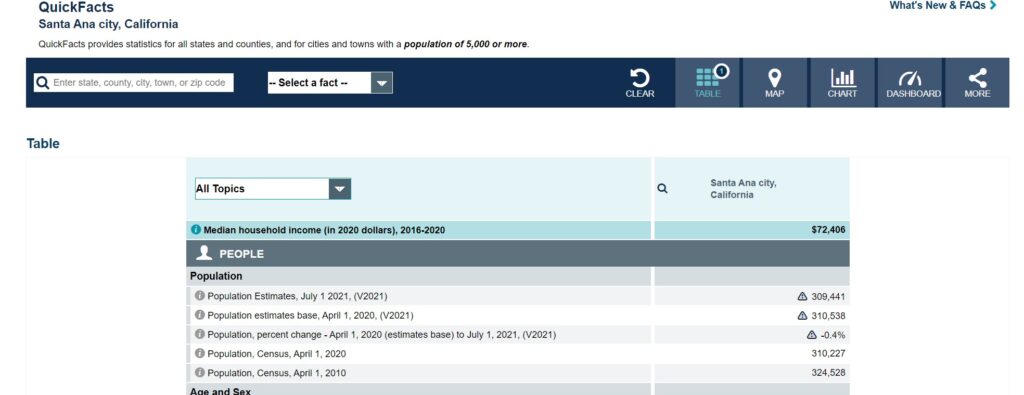

Someone bought this home in Santa Ana for $480,000 in August, not too long ago. So slap on a few cosmetic changes and how much value did you add? They added $219,000 in value just by fixing the lawn and doing some basic maintenance here! What is the median income of a family in Santa Ana?

Household income is roughly $72,000 so this little bit of work added 3 times the annual household income here. Totally makes sense folks! We got a long way to go before any bottom is to be had here.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

260 Responses to “The Housing Correction is In Full Swing – Gear up For Years of Housing Challenges as Inventory Grows and Low-Rate Years are Over. 4 Charts Showing Housing Correction Just Started.”

I’m still watching that flip in my neighborhood. Plus now I’m watching another nearby house I found out has a potentially illegal short term rental in their ADU. The authorities have limited new short term rentals, where they can throttle new ones easier than the state regulated ADUs.

The smart cities like Coronado limit rentals to 30 days or longer so they don’t end up nearly ruined like Dana Point where you have a real home with no real neighbors. ADU’s will be the straw that breaks the camel’s back in San Diego as far as enjoyment goes.

The overpriced flip next to me wouldn’t sell so they turned it into a rental. The estate sale behind me sold for a reasonable price. Investors don’t want to sell. Inheritors see that this is the time (though we don’t have a Prop 13 in TX).

Californians still clogging up our roads here in Texas. My wife now wants something bigger on more land. I’m ready for that too. Need to wait and see how low prices go first! Price drops are an advantage when going from less to more and you’re coming in with cash. That’s why the Californians are heading our way. 🙂

Turtle, you always come up with reasons why California is unattractive. Funny how you talk so much about California – particular San Diego – all the time. If you weren’t interested in CA & SD and if it were so shitty why talk about it – constantly?

Armpits like the Bay Area, Chicago, Portland, buffalo NY…..those are places nobody talks about. Because they are in fact armpits and undesirable. But San Diego?

“ADU’s will be the straw that breaks the camel’s back in San Diego as far as enjoyment goes.”

Do you know what ADU’s cost since Covid/inflation? I have a buddy who owns a huge BY that is just vacant. He lives in a great location with no HOA. Perfect for a ADU. There is a reason why he has not put up an ADU. The numbers don’t make sense. Btw., if CA would be so undesirable to live in, how come you expect it to be overcrowded?

I think CA is just right. rents are very high, RE prices are high. If it were lower I would be concerned about it becoming too crowded. I don’t mind CA being so elevated in price. My next rental will again be in AZ. It’s much easier to evict some loser who doesn’t pay rent in AZ compared to the eviction process in commiefornia.

Ugh, I’m cringing about the fact that I actually agree with M on this one. San Diego is hands down the best place you can live in the entire country.

Foobaa, I actually don’t remember a time you ever disagreed with me on something

Bitcoin to the moon.

Buy RE as soon as you can comfortably afford in (location, location, location)

And dollar cost avg into stocks

Don’t let emotions guide your trade

Stay off zerohedge and the nypost

Forget about politics and have sex all the time and while others waste time on voting

Don’t ever try to time the market and don’t listen to the majority

Not much more to know. All you need to get rich and retire wealthy/early.

Oh, and don’t live in crappy places like the Bay Area or Chicago.

The Supply Side of the Market:

Crashes happen when supply or inventory goes up. Inventory goes up when sellers lose their homes to foreclosure or extenuating circumstances prompt them to sell (moving out of state, lucrative job in another area etc). It’s highly unlikely that anyone that currently owns a home will default on their low monthly payments. Also, extenuating circumstances are an exception not the rule so that will have little to no effect on oversupply. Builders haven’t been building enough in the last few years to the point that these empty homes are significantly adding to the supply either.

The Demand Side of the Market:

Demand is absolutely clobbered and ground into a fine dust. Potential homebuyers saw a 50% increase in payments after these last rate increases pricing many out of the home that fit their needs. Lending hasn’t loosened up either which drives demand further down. Don’t get your hopes up though, falling demand is not enough to significantly affect prices. Housing is not a commodity with a shelf life like grain or petroleum and falling demand only causes crashes commodities where its a race against the clock and selling for something is better than nothing, especially when storage costs become a liability. Most homeowners currently occupy homes that rent for higher their mortgages. If sellers can’t the price they want, that’s fine. There’s nothing stopping them from renting it out until more qualified buyers enter the market through wage increases or decreasing rates. Owning a property today is not a liability like it was in 2006.

Final Verdict:

Slightly increasing supply and the lack of demand is sure to have a downward effect on prices but not enough to cause a full blown crash. The average mortgage is about 20% higher than comparable rent in my local market and when prices come down to rent parity, that is a strong buy signal. A increasingly common trend I’m seeing in the market is sellers incentivizing their listing through rate buy-downs. With so much equity, they can afford a $10K fee to buy down the buyers rate by 1%. This helps alleviate the symptoms that come with increasing rates. Don’t hold your breath for anything more a 20% drop under the most ideal conditions. Even then, a 20% drop in price at the current rate is not enough to dip payments below 2021 levels so all of the chicken littles and popcorn munchers in the comments section better not get too excited because it was still a better time to buy a home last year than at any point in this upcoming slump.

You forgot about all the baby boomers dying off and leaving their homes to their adult children. Most adult children want the cash and will sell the house. There will be a tremendous flood of homes on the market. The ones inheriting houses in several years from now will be so shocked at the value of the house that they may rent it instead if one or two kids. If three or more, they will not want to haggle over splitting rent.

Also, USA population is in steep decline. Birth rate is at 1.5! That’s the reason the are allowing the illegal alien invasion in USA. However, that still won’t replace the steady population loss here.

I heard about baby boomers dying off in droves since 5 years now. Maybe even longer. We have historic low inventory. Would be nice to see a few more listings. A healthy balanced market needs more inventory.

Baby boomers passing their homes off to their children is hardly a blip on the real estate radar. Im sure you can come up with a better contrarian argument. Try again but this time make it make sense please.

Actually, we don’t have a lot of data on why crashes happen in real estate, simply because they haven’t happened that often. The last housing bubble is probably the best indicator we have. It was widely thought the crash happened primarily because prices reached unsustainable levels. In other words, irrational exuberance was making people buy a home in the expectation prices would continue going up. Also, the fear, or regret, they may lose out if they didn’t buy. This bubble fever wasn’t helped by subprime lending and the downward spiral when credit markets seized up.

Inventory levels never recovered and continue to be low to this day. Lack of new builds are often cited as an explanation for this, but new homes only ever comprise a small percentage of total inventory. There have been a few attempts to explain why inventory is so low. One explanation is that high home prices and low inventory disincentivizes would-be sellers. If you can’t find a home to buy, you are not going to sell. Another explanation is again behavioral. Home owners believe equity is ‘locked in’. In other words, they believe unrealized gains are tangible and that prices unassailable.

In 2018, when rates started to creep up, inventory increased markedly. This shows that home owners feared price declines and wanted to offload to realize gains. More recently, that hasn’t happened despite much higher rate increases, and this has baffled pundits. It could be the shock of large rate increases created paralysis. However, we are seeing both an increase in inventory (partly due to slower turnover), and price declines. The Bay area has seen 20% declines in median price from its May 2022 peak, according to Redfin. If declines continue at that rate over a 12 month period, it will be considered a crash.

At the moment, we are seeing in an increase in DOMs (days on market), smaller list to sales ratios, indicating a cooling in buyer fever, and I expect foreclosure will ramp up as negative equity impact buyers who got caught up in the Covid bubble. It is downhill from here for residential real estate, as rates will continue to erode buying capacity and sellers capitulate to a self-adjusting market. It is of course impossible to predict to degree of declines with any accuracy, but we know the Fed is implicitly targeting real estate, and won’t stop until inflation is back to target. This won’t happen unless home inflation comes home to roost. In fact, Powell even warned buyers now would not be a good time to buy.

In the previous thread, M said: “Is anyone surprised that those people don’t advance or are opposed to crypto? They would t even know how to buy it store their precious BTC.”

Like a typical troll, M ignores remarks that don’t fit his narrative.

As I’ve said in the past, PayPal sells crypto. Anyone with PayPal can buy crypto with the press of a button. It’s easy.

Buying crypto is not arcane or esoteric, and requires no “financial expertise.”

They sell it at at the freaking Coinstar machine in Walmart. It went mainstream last winter. The biggest and last victims.

Nobody wants crypto any more. It’s over until Uncle Sam goes digital and there won’t be any opportunity for speculation when that happens as it will be died to fiat money. But they probably no longer see a threat from crypto and so that won’t happen for a long time.

Music to me ears “ Nobody wants crypto any more.”

Bottoms occur during apathy not when moon boys still talk about it. Dump it baby so I can buy back at much lower prices!

Coinstar should also dispense Beanie Babies. That would give educated investors the opportunity to diversify.

Beanie babies don’t have intr

More music for M.

Headline: Bitcoin Mining Giant Core Scientific Ended October With $32M in Cash: Core Scientific reiterated it could run out of cash before the end of the year as lawsuits are piling up.

https://www.coindesk.com/business/2022/11/22/bitcoin-mining-giant-core-scientific-ended-october-with-32m-in-cash/

Core Scientific (CORZ), the world’s largest publicly listed miner by computing power, ended October with $32.2 million in cash and 62 BTC ($975,000) and reiterated that it may run out of money before the end of the year.

The company first warned of bankruptcy risk about a month ago, sending its shares plummeting about 80% on Nasdaq. The miner had 1,051 BTC and $29.5 million in cash at the end of September.

Core Scientific is one of several miners struggling to keep afloat as rising energy prices increase costs, and a stubbornly low bitcoin price slashes revenue.

Compute North filed for Chapter 11 bankruptcy in late September, and Iris Energy has received a notice of default on its loans. Argo Blockchain (ARBK) and Greenidge Generation (GREE) have also said they are strapped for cash.

“We anticipate that existing cash resources will be depleted by the end of 2022 or sooner,” Core Scientific said in its third-quarter earnings report, filed with the U.S. Securities and Exchange Commission on Tuesday.

“Depending on our assumptions regarding the timing and ability to achieve more normalized levels of operating revenue, the estimates of amounts of required liquidity vary significantly. Similarly, it is very difficult to predict when or if bitcoin prices will recover or energy costs will abate.” …

Intrinsic value and more importantly, beanie babies don’t show higher highs and higher lows over a ten year time frame. Buying bitcoin at the lows is a sure way to make money. Not financial advice of course but its a smart idea to listen to savvy investors like me.

Beanie Babies have more intrinsic value than does crypto.

If both plummet in value to zero, you can still use a Beanie Baby to mop up a spill. I don’t know what you could do with crypto.

“I don’t understand it”

That goes without saying though, son of landlord.

Nobody expects you to understand technology. You still have a landline. You carry your phone in a faraday bag. You still have cable and you pay close to 1k in hoa’s.

I mean, come on. I don’t think you would even know how to buy or store crypto!

M: “I don’t understand it”

That goes without saying though, son of landlord.

Huh? That’s not an accurate quote. If you’re gonna use quote marks, quote me correctly.

M: You still have cable and you pay close to 1k in hoa’s.

As I often said (and you choose to ignore) every Millennial in my building has cable. We have no choice. It’s included in the HOA fees.

M: Nobody expects you to understand technology.”

I’ve been using computers since the 1980s. Been on the internet since the 1990s. Built my first website, of many, in 2000.

“Technology,” like crypto, ain’t that hard to understand. You’re not special.

M: “I don’t think you would even know how to buy or store crypto!”

You know that’s not true. As I said (and you choose to ignore), anyone can buy crypto on PayPal. It’s easy. You’re not special.

M: “you pay close to 1k in hoa’s.”

As I said in the past (and you choose to ignore), my HOA fees include gas, water, electricity, and wi-fi internet.

I assume you also pay for those things?

Also includes over a dozen security cameras (outside entrances, garage levels, elevators, mail room, lobby etc.) And 24/7 doormen, on site manager, and three full time maintenance workers.

Perchance you also pay for security (cameras, ADT, etc.).

And yes, my HOA fees also include cable TV, pool and sauna room.

Son of landlord,

Wait, You pay more than 1k in hoa?

And, do you have enough funds saved to buy a whole bitcoin yet?

I’ll help you to move the bitcoin to a cold storage when you are ready.

Because I am a nice guy and you need to make sure it’s stored safely.

How much do you pay every month for gas, water, electricity, security cameras, ADT, earthquake insurance, homeowners liability, and wifi internet (all included in my HOA).

What difference if you pay separately (as M does) or as part of an HOA?

Sorry to jump into this extremely amusing debate between SOAL and M.

I’m more like SOAL. If I ever purchase Crypto, I would never store it in some unregulated shady exchange like LTX. I’d be like SOAL and have my wallet triply backed up with a high level of S/W security. Given SOAL’s level of security, I suspect he would do the same.

I regret not buying Crypto from 2013 to 2020 when I could have earned 2X to 10,000X ROI on this bubble. Crypto still has value to all of the criminals and terrorists out there.

IMHO, it is still a good investment when the ROI is at least 2X in 2-3 years.

The Fat Lady hasn’t finished singing yet. Excuse my dated Silent Generation non-PC quote.

Holy cow SOL, so it is true!

Instead of paying 2k per month for hoa for useless cable and a landline you could have saved the money to buy your first whole Bitcoin?!!!!

That’s a shocking revelation! How are you going to recover from this financial misstep?

bitcoin increases in value tremendously. Just a few years ago a Bitcoin was only 3k!!

A landline and cable just cost you money and provide no value. Landlines haven’t been used in decades. Cable is probably equally useless. With streaming apps you get better quality and less ads for a fraction of the price.

A smart investor would have ditched the landline and cut the cord years ago and bought Bitcoin instead. Too bad you didn’t listen SOL.

Instead you still read zerohedge and carry your flip phone in a faraday bag? ????

M lies again.

M: Instead of paying 2k per month for hoa …

You just made that up.

I never said I paid 2k a month. And you know it.

As I said, my “nearly 1k a month” includes gas, electricity, water, earthquake insurance, liability insurance, security cameras, wifi internet and much else.

How much do YOU pay for all that? More than I do?

Troll.

???? no sol, I don’t pay for cable and a landline at all. Not even for a faraday bag.

M: no sol, I don’t pay for cable and a landline at all.

That was NOT my question.

Once again, the troll misquotes me.

I’ll repeat my question:

As I said, my “nearly 1k a month” includes gas, electricity, water, earthquake insurance, liability insurance, security cameras, wifi internet and much else.

How much do YOU pay for all that?

You see? I didn’t ask about cable or landlines.

Don’t tell me you don’t pay for water, gas, electricity, wifi internet, homeowners liability insurance, and possibly earthquake insurance and security (RING, ADT, etc.).

So how much DO you pay per month for the above? More than me?

Thanks for the question SOL.

I def don’t pay for

A flip phone

A faraday bag

A landline and

Cable

Maybe 10 years ago I would have paid for that in my twenties.

Minus the faraday bag. Still don’t know why you wrap yourself in a faraday bag. Do people sometimes ask you why are you wearing this?

I also pay much less than 2k for my hoa. Way, way less. I think most people do.

The rent zestimate of $3,413 is 57% of household income ????

People are nuts paying nearly 10X their annual income. The bank allows this?

It’s a recipe for disaster come recession. We were paying 1.5X our income buying right before the last recession and it made things hard for us. I cannot imagine having paid 10%. We’d probably have drained half our retirement at that time.

Hopefully it’s not true Uncle Sam doesn’t care about housing. And hopefully the Fed knows what they’re doing. Juicing the economy + people’s FOMO is a bad combo.

Homeowners have been paying 6-7X their annual income in S. CA since the housing boom in late 1980’s. I was one of them just out of college. I was fortunate to receive raises and drastic refi interest reductions from 10.5% down to 3% since then. Currently, wage inflation is raging helping any working fixed rate mortgage holder.

Based on a quick Google check, the US government owns and backs about 80% of conventional loans. Freddie & Fannie (62%), FHA (10%), VA (10%).

The taxpayer (and political careers) are on the hook for these loans. All of the Fed MBS’s are backed by the taxpayer.

The Fed represents the banks. Compared to 2008, the banks hold very few home loans. Since 2008, banks originated the loans, collected the fees, and sold them to Freddie or Fannie (The taxpayer).

The banks also have other loans, commercial and personal (credit card).

In summary, the Fed doesn’t care about what housing prices do since this time, since the banks hold very few home loans. Taxpayers and politicians care.

However, if the Fed crashes the housing market and cause a deep long recession, the taxpayer will cover the mortgages, but the banks will likely be hurt badly with their other loans.

For this reason, I think housing will drop 20-30% (back to 2020 levels) before the Fed steps in prevent a deep recession to save the banks. The homeowners who purchase since 2020 with 3% mortgages and inflation based wage increases will be underwater but likely not hurting unless they lose their jobs in a recession.

Most home sellers are also buyers. When you sell you have to buy something else right? With a majority of homeowners locked into sub 5% rates, buyer credit scores and incomes being healthier than ever, it’s tough to imagine a scenario of forced selling. For employed homeowners to sit the family down and say “housing market is crashing, we need to sell now and go rent a comparable house for more!!” Is tough to imagine. If rates stay high I think we will be in a mortgage rate lockdown scenario. The real crash is in transaction volume. Check on your realtor/mortgage broker friends, could be tough for a while.

>>Most home sellers are also buyers<<

Exactly, nobody sells to be homeless. Only a crash bro would believe this fairytale. Inventory won’t rise.

Nobody gives up a 3% mortgage to buy back in at 6.5%.

Housing is about the monthly payment not just about the home price. If my beautiful home on SoCal goes down in value and someone wants to buy it I say: if you pay 2million usd over market value I sell. If that buyer says you are silly I reply: maybe you are silly for thinking I would ever sell this treasure! I bought in Q1 2020 and have a below 3% mortgage interest rate. I’ll never sell this house!!

Kj,

“Most home sellers are also buyers.”

I completely agree with this for primary homeowners (except for homeowners trying to time the market and sell high, rent, wait for a crash and then buy low. My 3 co-workers who tried this broke even at best in 2008-2014).

Flippers, second house owners, AirBnB speculators, and corporate rental owners are the real question.

They won’t buy again until the market drops or rents rise. They likely will sell if the market fall picks up momentum. This positive feedback loop might drop the market rapidly as the speculators try to all dump their losing investments. What % of house owners fall into this category?

The question is: What percentage of house owners fall into the speculative category?

By 2011, Phoenix Real Estate prices dropped more than 50%. The snowbird renters disappeared and the speculator lemmings all tried to unload their losing house investments. At the bottom in 2012, another co-worker was trying to sell me the 50% off investment opportunity in Phoenix houses. They learned from 2008 and sold at a huge profit in 2019 as the speculative bubble inflated again.

Note I said house owners instead of homeowners. House owners are often speculators that rely on increased value or higher rents to keep their house investment. If this falls, they will dump the house faster than they dumped their crypto and prices will fall.

M will become humble. Probably not a bear since he will still have his 2020 primary home paying much less on his mortgage than going rental rates. However, he won’t panic or sell since the price will be the same as what he bought it and he has an extremely low mortgage rate.

If RE prices in Phoenix fall 50% (which they won’t). But let’s say they do, why would an investor like me sell? Rents barely every fall significantly. Instead of selling I would try to buy more RE in AZ.

RE is not like stocks. Investors don’t sell their RE, they accumulate more. 2008 was an Outlier. You had NINJA loans back then. Those days are looong gone. Todays RE investors don’t care if the book value falls. As long as renters exist in this country who are paying off our RE investments, we are just fine.

And we won’t run out of renters! Inflation is hurting renters. They won’t be able to save for a downpayment and probably keep renting until they die.

Many people sold their RE investments during 2008-2012.

They were so overextended with unprofitable rentals that they had to. Or they foreclosed. A few who survived during 2008-2012 have posted on this blog onthe nightmare they experienced.

The Good Dr posted many great posts during this time on the foreclosures.

Don’t overextend to the point of having to walk away.

Maybe this time is different with 20% down and ultra-low rates.

Great, you bought a $1 million woodshed at 2.5% and are super excited. Hope you enjoy that place and have the income to support that for 30-years because new buyers would buy your place at a 30 to 40 percent discount given rates and their incomes. You know, income that comes from actual jobs and not speculating in imaginary tokens or tech companies with insane valuations for an app that makes you look 30-years younger. The reality is, there is no shortcut – to look good in the meat world you need to workout and put in the effort consistently. I know a few plumbers and electricians that are doing fantastic since no avatar in the metaverse is going to fix your plugged up toilet in your crap shack.

I’m dying!!! ????????????????????

Working for a 30 years is very overrated.

You want to get to a point where you can put money aside and invest in a multi bagger. Crypto is an excellent vehicle to increase your wealth. Same with stocks and real estate. The next crypto bubble will offer life changing gains.

‘inflation fueled wages’ is really weird concept: Only CEOs have their wages raised in par (or faster) than inflation. Everyone else gets the same salary as in 1990s, +- few percent. While actual inflation rages at 10% *per year* (see shadowstats.com inflation charts).

Add rising property taxes to that and it is very likely that a large number of current home ‘owners’ can’t afford to pay their mortgage and will lose their home.

Add rising interest rates and you get a very large crash when the bubble bursts. Which suits to FED very well, it is a private bank and it cares *only* about bank profits.

At crash banks are the only ones having cash so they’ll ‘aquire’ huge amounts of homes, basically for free, sit on them couple of years and slowly sell them with huge profit. Just like in the previous crash.

If it goes pear shaped, FED will save the banks. no problems. Just like last time: Zero risks, potentially trillions in profits.

‘inflation fueled wages’

Agreed. The only income we have with inflation adjustment is Social Security, and it lags true inflation. I’ve been getting zero or way less than inflation raises for the last three years.

‘rising property taxes’

Prop 13 in CA and a similar measure in OR have prevented major increases there for us. In fact, OR property tax went down this year due to falling prices there. (I checked the two bills… 2021 vs 2022.)

“At crash banks are the only ones having cash so they’ll ‘aquire’ huge amounts of homes, basically for free…”

The little guy can get in on the game if they have been patient. Living below ones means, delaying gratification and all that. Financial counterculture, if you will.

sorry, turtle, but that saved latte mindset is typically making you fall behind, not get ahead

Like the famous story with the Turtle and the Hare, the turtle was behind most of the race but eventually won because the Hare impulsively ran off to buy Bitcoin at its peak while the turtle followed Bogle’s advice.

The race isn’t over yet.

The issue with turtle and a hare tale is that sometime turtle is so slow, the hare gets all the chicks. The turtle can be so patient it might die before it does anything fun.

Tract homes in northern San Diego are now closing about -15% from peak spring ’22 prices. We are in the early stages of the inevitable devaluation of real estate. The bidding war era is over and buyers have less and less $$ to roll from their old home equity into a new home as values are going down everywhere. Interest rates are way up. The job market is slowly flipping from employees with all the leverage to a balanced market, and will eventually completely flip to employers will all the leverage again. This will take a few years.

Inflation is not transitory and is higher than govt. figures allege. It will not abate soon. Purchasing power is way down. Wage inflation is not keeping pace and will eventually stagnate. In fact go ahead and talk to your friends in the mortgage and RE industry about income these days. It’s a huge part of the SoCal economy that is drying up.

There is really rough water ahead. There are too many moving parts to predict a bottom date with much accuracy, other than to say that this will be a multi-year process due to transaction velocity being far slower than for instance the stock market. I estimate 2025-26 bottom with values down about 40% from peak. This is for San Diego and is an average. I have been in the RE/construction/lending related industry since ’91.

I’m bullish for SoCal coastal RE long term and always have been, but I saw many get wrecked in prior eras. Not just in RE but in other asset classes/investments. Arrogant know-it-alls, young inexperienced people with no frame of reference, and people in denial are usually the ones I see taking a beating. I promise you this will repeat itself this cycle and these types of people are going to get caught off guard and lose alot of money and i mean ALOT.

No chance North SD Country drops 40%. Too much doom and gloom here, go to bubbleinfo.com to get an accurate accounting of market conditions here in North County Coastal SD. House inventory is extremely low, people are not giving away these houses, especially with locked in low interest rates.

Jim at bubbleinfo has good data. Fact is the recent closed sales are averaging out at about -15% in the area for comps. I’m calling for another -25% from now over the next 2-3 years. We’ll see. Jim also links to outside data and has a good vid of Palacios calling for essentially reversion almost all the way back down to pre-pandemic values by ’24, with support for the proposition.

San Diego thought it was special in ’07 before the 40% crash, and they think they’re special again. Not so.

I live in north county San Diego and we have very low inventory. There are open houses but sellers just wait it out or take it off the market. Time is on your side if you are a homeowner.

Even if home prices dropped 40%.. they would bounce HARD off that bottom like in 2011-2012… No one that bought a house in 2013-2014 is crying right now. Also those that sold in 2006-2007 and didn’t buy back in in 2011 missed out as well. The pandemic home price increases was artificial… just like the big tech stock gains in late 2020-2021. Just like used car prices will crash.

” I promise you this will repeat itself this cycle and these types of people are going to get caught off guard and lose alot of money and i mean ALOT.”

I know many who took a beating (only on paper) for their primary home from 2008-2014.

They just continued to live their lives in their home in perfect weather while going to the beach every day. Today, they have their houses paid off and at the moment have huge equity in their houses so if they grow tired of perfect weather, they can easily move.

I know a few who panicked and sold or walked away at a loss in 2009. Many are still struggling and trying to get back in to the housing market or have moved out of coastal CA.

I think the key is don’t panic sell and don’t overextend.

munch munch munch…..

Better hope and pray those magic coins come back in style, housing sure aint :0

A report from the Union Tribune in California. “San Diego County’s home price has now dropped five months in a row. The median home price was $775,000 in October, said CoreLogic on Tuesday. It reached an all-time high of $850,000 in May. Jan Ryan, an RE/MAX agent based in Ramona, said she typically has four to six homes in escrow at any given time. Now she has none. Ryan said she is seeing many potential buyers struggling financially with higher interest rates, and many sellers are having a hard time accepting that sales prices are lower now.”

“Here’s how the San Diego County price changed by home type in October: Resale single-family home: Median of $842,000, with 1,392 sales. It is down from a peak of $950,000 in April. Newly built: Median of $840,000, with 203 sales. This figure combines single-family homes, townhouses and condos. Down from the peak of $890,500 in August. Almost all of Southern California saw price drops from September to October. Riverside County had the biggest drop, down 2.7 percent for a median of $545,000.”

The Daily Democrat in California. “Buying a home in Woodland is becoming less attainable for young adults and other prospective owners as mortgage rates rise to their highest level in decades. Ryan Lundquist, who runs a Sacramento appraisal blog, agrees that Woodland is much more affordable than Davis. The median home price in Woodland is around $570,000. That same-sized median-priced house in Davis is around $890,000, according to Realtor.com.”

“Lundquist said the market started to see a drastic change this past spring. ‘Honeymoon market – that ended in April,’ Lundquist said. ‘We are in a different arena right now where prices have been going down. The market is starting to lose steam in a lot of places in the Sacramento region…It was almost like when mortgage rates went below 3%. It was like a steroid for the market. Buyer demand went crazy.’”

Got popcorn 🙂

Why pay for a quickly depreciating asset when the Big Fat Bastard will pay your mortgage for you?

Thank you Big Fat Bastard for paying my mortgage! I am now living rent free in my house and in your head!

I really like the inflation vs home price chart the Good Dr used above.

It shows that today, if housing prices fall 36%, they will intersect with the inflation baseline for houses. The last time this happened was in 2012 at the bottom of the last bubble. That is when home prices were a great bargain and investors and primary home buyers jumped back into the housing market. Housing prices tracked inflation again in 2012. As they should in a non-speculative market.

This time is slightly different. Unlike last time, when inflation was negative in 2008, the inflation line today is rapidly rising 8-10% per year.

Within a year, if inflation rises 10% and housing prices fall 25%, house prices will intersect the inflation line again and the bottom will be reached. I would wait until that point to purchase a house. Housing prices will be back to 2020 levels but wage inflation will give people more buying power.

“wage inflation will give people more buying power”

Where is this wage inflation? Maybe union workers in jobs that have a stranglehold on some critical work and some management or sales jobs. And government-mandated increases for low wage workers who can hardly afford necessities let alone a house. Social Security is going up faster for me than wages (I get both).

Here is an article on federal workers’ wages. Doesn’t look like they have been keeping up with inflation either:

https://www.govexec.com/pay-benefits/2022/03/biden-proposed-raise-federal-workers-2023/363666/

Current inflation is supposedly almost 8%. The drop from Summer’s rate is mostly due to artificially lowered gas prices from the latest Teapot Dome scandal.

JoeR,

As you said, most of the wage inflation is in the lower and middle class. Social Security, government jobs, and all of the career wages being floated higher by the increased minimum wage. I think this is the majority of the US.

I agree that unless you changed jobs for higher pay in the last 2 years, tech wages have not increased. The exception is highly specialized jobs. However, if you were lucky enough to work for a company whose stock increased 10X over 2 years, you had a massive increase in yearly pay. If you are now in a company whose stock plummeted 70%, you saw that “raise” evaporate. Most co-workers who changed jobs in the last 2 years had raises that were paid in RSUs/Stocks. Most of these raises are now less than originally anticipated due to declining company stock values.

I suspect the median wage has increased over the last 2 years but will lag inflation just like what happened in the 1980’s.

Any increase in wages will help soften any declines in the housing market. This is different than 2008 when inflation was negative for a year. It is more like the 1980’s when COLA and inflation based wages were paid. The housing market did decline slightly but increased wages balanced it. Of course, there was not a huge bubble back then so this time is different.

I am employed as a contractor for a unionized company that supports the federal government / DoD. We’ve been in negotiations for a new contract since early last year.

Things slowed down for a minute initially when we pulled out of Afghanistan along with covid. But now with the Ukraine situation, they are making bank and labor is critically short. There was some kind of a rumored offer recently for a 20% retro raise / bonus and 5% a year increase for the next three years which the union shot down real quick.

We know the real inflation numbers and this isn’t going to let up anytime soon. And who knows what the state of the economy will be when the next contract is up. We’re looking for somewhere around a 50% increase in wages/benefits over the next three years. In the meantime, guys are making huge paychecks working unlimited overtime.

Working in the life science industry. Covid was basically a money printing machine for us. Bonuses and additional payouts that were unheard of. Covid money is drying up a bit so things are reverting back to normal business conditions.

House prices are holding up pretty well? Looks like the crash bros are disappointed again and have to hope for a crash next year. 🙂

For the Newbies, I repost why I disbelieve M’s tall tale of buying a house from an alleged inheritance. His timing of events — from bear, to inheritance, to housing purchase, to completion of construction, to move-in — are too quick.

(Unlike M, I quote him accurately, and provide links for verification.)

All the below dates are from 2020.

Jan 31 — Still a bear. Advises against buying.

Feb 11 — Claims to have inherited money.

Feb 19 — Claims to have bought a house. (Fastest probate in history.)

April 16 — Discusses commute time from the new house, which is beautiful, brand new. (Apparently already moved in.)

May 20 — Claims to have a tenant.

June 27 — Now claims he bought the house while it was under construction. House was so incomplete, he saw the materials that went into it. Considering the short time between the inheritance, the purchase, and the move in, this was the fastest probate AND fastest construction in history.

Relevant quotes:

Millennial (Jan 31): “there is an incredible amount of inventory on the market and much, much more to come. Just obvious that sales and prices fall accordingly. … Boomers need to start paying their fair share. They barely pay any property taxes.”

————–

Millennial (Feb 11): “I inherited from a boomer. A lot. Thinking of buying property. ? I have a very nice house in mind.”

—————

Millennial (Feb 19): “Just signed. … Love it here already.”

—————

M: (April 16): “Commute to my tech job isnt bad (25min). … [house] is brand new, no headaches and it looks beautiful as you can imagine.”

—————-

M: (May 20): “My stranger in the house knows she can’t have sleepovers or she will get a spanking. I do like she’s paying nearly a third of my mortgage …”

——————

Millennial (June 27): “… the top line materials were used. We watched it being built which is a cool experience itself.”

———-

Sources for the quotes:

http://www.doctorhousingbubble.com/the-cure-to-the-housing-shortage-may-be-retirement-homes-the-coming-tsunami-of-homes-over-the-next-decade-may-come-from-an-unlikely-source/

http://www.doctorhousingbubble.com/why-are-californians-moving-out-in-droves-to-texas-a-trend-that-goes-beyond-one-year-a-two-city-example/

http://www.doctorhousingbubble.com/the-forbearance-tsunami-4-7-million-mortgages-are-now-in-forbearance-with-an-unpaid-principal-of-1-trillion/

http://www.doctorhousingbubble.com/covid-19-and-the-impact-on-housing-socal-home-sales-hit-an-all-time-low-in-may-and-4-76-million-americans-are-now-actively-not-paying-their-mortgage/

Thank you! Do you see anything wrong with my statements?

Son,

I find M to be entertaining. I agree some times and am amused sometimes. I wouldn’t spend 10 seconds let alone a couple of hours going through his old posts. The flipped stand on buying actually made sense with the specter of inflation rising, and crypto is also a big part of his posts which doesn’t figure in your research.

The interesting link of crypto and real estate for me is that both have a history of fraud, but the crypto fraud seems to be more front and center in the media. I think it is because the political crooks are involved and are using their buddy’s scam to promote “regulation” of crypto. Just like with Madoff, there were people going around pointing out the fraud but the chief regulator of securities markets was a buddy of the parents of one of the fraudsters (she). Madoff also had deep connections in the securities industry (“When the tide goes out you can see who’s swimming naked”: Warren Buffett). The public is being hoodwinked about digital currency, and the rulers want to emulate the dictators by instituting Fedcoin so they can track every transaction we make. I’d like to do the reverse. I’d like to bring back the $1000 bill. In the ’30s, you could pay for a car with one bill. Now with the largest bill in circulation (and inflation), you can pay for an oil change.

“The flipped stand on buying actually made sense with the specter of inflation rising, and crypto is also a big part of his posts which doesn’t figure in your research.”

IMHO, since M never mentioned the specter of inflation rising or the Fed lowering interest rates to irrational levels, he is more extremely lucky than he is a genius.

I guess he was also lucky to have a dear relative depart at a timely moment so he could have the cash to dive into crypto and the housing market. A fool and his cash are soon parted. So far, M looks more like a genius than a fool. Time will tell.

The game ain’t over until the fat lady sings.

I take this all back if it turns out that M is J Powell’s son with insider information. With insider information on the Fed lowering rates, I would have invested the same way.

|I don’t see anything wrong with this timeline except M flip-flopped from being a Bear to Bull in record time.

I was a bear in 2019 because I thought homes were overpriced by at least 15-20%. Massive 15-20% inflation over the last 3 years fixed this. I believe house prices today should be at the 2019-2020 levels.

M had the incredible foresight to predict the pandemic and Fed dropping rates to record lows which caused this 15-20% inflation. Or he just got lucky. Or maybe J Powell is his father telling him what would happen. M ran in when all other investors were running scared.

I was an executor for a trust and if the deceased had set up a trust, the funds do not have probate and are available immediately to the heirs.

However, the game isn’t over yet. Not all of us have J Powell giving us insider information.

Wasn’t it established a long time ago that the Millenial guy was not trustworthy because he was talking down real estate and saying don’t buy, but at the same time he had put a deposit down on a new build? LOL that is classic!

Yeah! I actually had enough money for a deposit for years. Just couldn’t get myself to pull the trigger. Once I received an inheritance, I was like, alright, now I am pushed over the edge. Can’t wait forever for a crash. Pull the trigger. That was the best thing ever! I never even think about a crash anymore! And if a crash comes, fabulous! I buy more real estate! Being a homeowner (and landlord) is a dream come true for me.

That’s why I always say, “time in the market beats timing the market”.

In other words buy when you can comfortably afford it!

What has renting for so long done for you Falcon? Your landlord just keeps increasing your rent. I am one of those landlords and in 2023 a rent increase is coming for my tenants.

Thank you inflation! Cha-Ching!

SOL, even though M is a complete fraud with an massive inferiority complex, you’re doing yourself a disservice by constantly entertaining him.

Damn man! Can’t you just let it go? This person “M” is just pushing your buttons/trolling the hell out of you. Regardless of who the liar really is or not, we have no way of knowing for sure, and all this is just a bunch of juvenile drek in the meantime.

“M” keeps putting it out there and you keep taking the bait, making yourself look more absurd with each retort.

You guys need to go get a room, and get out of the light.

Headline: NYC landlords could soon be denied criminal background checks for tenants

https://nypost.com/2022/11/26/nyc-landlords-could-soon-be-denied-criminal-background-checks-for-tenants/

A controversial bill prohibiting Big Apple landlords from performing criminal background checks on prospective tenants – even those convicted of murder and other heinous crimes – is on a fast track to becoming law.

At least 30 of the City Council’s 51 members have agreed to back the “Fair Chance for Housing Act,” which is set to go before the Council’s Committee on Civil Rights for its first public hearing on Dec. 8, records show….

And Mayor Eric Adams appears more than willing to sign it into law should the bill reach his desk.

“No one should be denied housing because they were once engaged with the criminal justice system, plain and simple,” Adams spokesman Charles Lutvack told The Post.

“We will work closely with our partners in the City Council to ensure this bill has maximum intended impact.” …

I have some experience in losses you can accrue by renting to an irresponsible tenant. We were lucky that it was only $5000 worth of damage, and the repairs upgraded the property by maybe 30-40% of the cost, so it has worked out OK for us. I know someone else who rented a house to people they shouldn’t have on the assurance from a friend of theirs that vouched for the tenant in question (who had a bad background) saying that he was OK now. That ended very badly. If you are not a rental management professional (especially if you do not live near your property) you should hire a property management firm to run it for you. Their fee can wind up saving you a lot of money. PS: Real estate sales agents are not necessarily qualified as property managers. We found that out the hard way. You want a company with a long track record in property management, period!

SOL, do you have any suggestions for people who own residential property in woke cities? What are the barriers to converting properties into co-ops or condos? Should you sell at a loss now or take your chances with the future? (Not that this is anything that relates to my situation of owning rural rental property. I’m just curious and you seem to keep up with this kind of thing.)

My late father made his fortune buying rent stabilized NYC apartments at bankruptcy sales, then converting them to co-ops.

It’s a long process, several years. It requires lawyers. Also, he filed a “Non-Eviction Conversion Plan,” which means that tenants can opt not to buy their units and retain their leases. Such plans are much easier to get approved than Eviction Plans.

It also means that each building ended up with two corporations. One managed the co-op units. The other owned the rental units.

Later, whenever a tenant moved out, my father would “warehouse” the unit. Keep it off the rental market, and sell it as a co-op when the market was right.

But I think it’s increasingly risky for a small landlord to buy a building in a woke jurisdiction. Large corporations can take a loss on units (economics of scale), but small landlords can be destroyed by enough bad tenants.

As we increasingly become a nation of renters, I expect “tenant protection” laws to likewise expand, especially in urban areas with high concentration of tenant voters.

That’s why I bought my sfh rental in Arizona.

No woke crap. And if the tenant doesnt pay you get him out in now time.

Nothing like commiefornia.

Life is too short…..it’s not worth getting gray hair over a non-paying tenant.

And, getting the backyard done (artificial turf, concrete, plants, rocks) in AZ is like a 1/4 of the cost compared to CA.

Gonna buy again in the phoenix area when rates come down.

“Nothing like commiefornia.” – says the guy who lives in “commiefornia” and loves it….

Future M responses to expect, in no particular order:

1) “That’s right cousin, I do love it. I love the ability to afford living here because my renter peons pay for it along with my awesome cushy job but even if I get fired, the cashflow from my rental is so good and the inheritance I’m about to receive from another dying relative will be so much that I won’t have to worry about working another single day in my life. I wouldn’t have it any other way. If you want to get rich quick or slowly, it’s super easy: all you have to do is follow my advice. I would start a Youtube channel to monetize it but I’d rather help others here get rich just like me. So please, if at all possible keep renting because it helps me get rich, not you.”

2) “Spot on. You took the words right out of my mouth. Buy low sell high. Don’t time the market, buy the dip. Keep going straight but take the next left turn…or maybe right. When life gives you lemons, make orange juice.”

3) “I love it when I make everyone jealous. Everyone looks at me and becomes jealous. I LOVE IT.”

Commiefornia, what would it be like without our far-left friends? Who would we make fun of at the dinner table?

I don’t think it’s that bad here. As long as you have a great paying job and a nice house. You don’t want to rent long term in a place like commiefornia.

There is no escape for someone as repetitive as M to eventually fall down into a very narrow camp.

Surge, thanks for the question. Never change a running, successful system. Rinse and repeat.

Waiting for lower crypto prices to buy in more. Same with stocks and RE.

In the meantime I enjoy the sunshine during winter in beautiful commiefornia!

Looks like a similar if not the same bill just passed in Alameda county:

https://www.theguardian.com/us-news/2022/dec/21/california-alameda-county-landlords-background-checks

Music to my cousin’s ears! Hopefully this comes to North SD county too sooner than later. And thanks for all the questions you didn’t ask but that he answered anyway.

Stay away from living in alameda county and the Bay Area. It’s the armpit of America in my humble opinion.

To my fellow Millie’s out there.

I am millennial myself and just like you (most likely) I had a very silly view of the real estate market. I used to be a perma bear hoping the market would crash.

I was so silly that I thought it would be a good thing to have higher property taxes because it would bring down RE values.

Let me tell you, the moment I bought my house and paid for property taxes I never let that thought come back to mind ever again. Instead, if you ask me now, I’d say I love my prop 13 taxes!

I used to believe that people treat their house like an investment and it became like the stock market (speculation).

A house payment is the cost of shelter. People don’t sell because they think it’s peak time now and they can time the market. Nobody sells a house to be homeless. So you gonna sell you house to rent? And tell your wife this is a good idea because YOU know you sell high and buy back low in a few years?! Give me a break.

Zerohedge and YouTube had ruined me and I bought into the bubble-crash, rinse and repeat BS.

Luckily, I am much smarter now and enjoy living in our house. This blog helped me. I hope it helps you too.

Do you want to be that guy that eats popcorn for months if not years because that helps him to believe the market is about to crash or do you want to be that homeowner with a fixed monthly cost that doesn’t need to worry about ever-increasing rents? …. Popcorn is not part of a healthy diet.

Would you pay for your house at today’s price? If not, then why are you suggesting others to buy?

You were hoping for a crash during a period when there was no reason for it to: from 2012 to 2020, the economy was doing well, job plentiful, and interest was decent.

Pretty sure his about face had only to do with one thing: the inheritance. He’d probably still be pining for 50% – 70% if not for the gift. Just like Realist, but without all the baseless links.

And people spend money they didn’t work for differently than money they earned. Your boss gives you $100 to buy a prize for some office function. You blow it on a gigantic talking stuffed animal with a silly hat. Now ask yourself if you’d have made that decision if it was your own money.

I absolutely love my house and the area. I sometimes laugh when I think back of my the-market-is-going-to-crash days!

I can’t wait for rates to come down. I want to buy my second rental property!

thankful to be the right side of the fence now!

Do what I did and live frugal for a while and save money for a downpayment!

Buy as soon as you can comfortably afford it! Thank me later!

O O

I def recommend buying to everyone now. That means less competition for me when I buy my next rental in a year or so. It’s selfish but that’s called capitalism, baby!

not sure why you’re seeking the advice of a person who was only able to get into a house because his relatives died and gave him an inheritance.

Welcome to the blog foobar! Always nice to see newbies. What’s your take on the current market? And what’s wrong with inheriting money? Isn’t that part of life? Are you planning on taking your cash stash (i assume your are still renting and currently save for a downpayment by holding it in cash and a CD) to the afterlife?

Come on guys. I hope you realize there is no other value in giving any effort to dissecting M’s post other than sheer entertainment.

The OC Register (Lansner) reported the April to June average weekly wage for California ($1572) and it was the only state to show a drop year to year. Lansner ascribes that to the big jump in leisure and hospitality workers. That is obviously a group that isn’t able to get into the market for a house in most areas of California.

Another article which was an interview with a pro-housing growth non-profit organization’s head said that all areas of the country are experiencing new housing shortages with California having the worst underproduction. The increase in the underproduction has been larger in non-metropolitan America (small cities and rural) that in the metro areas by a factor of 3 to 2. That bodes well for my rural rental properties. The price of gas is the headwind while electric cars would be a tailwind due to lower electricity costs from REA co-ops (but only if the tenant was willing to pay for the charging station).

Headline: Distressed crypto firm BlockFi files for bankruptcy as fallout of FTX spreads: Lender with more than 100,000 creditors was set to be acquired by Sam Bankman-Fried’s firm

https://www.dailymail.co.uk/news/article-11477829/Cryptocurrency-lender-BlockFi-files-bankruptcy.html

Cryptocurrency lender BlockFi has filed for bankruptcy – blaming the ‘shocking events surrounding’ the collapse of FTX.

A filing said the company has more than 100,000 creditors and liabilities of up to $10 billion….

BlockFi’s products included wallets to store cryptocurrencies, a platform to trade them and also crypto-backed loans…

Headline How Big Tech layoffs could impact some of the priciest housing markets

https://www.msn.com/en-us/money/realestate/how-big-tech-layoffs-could-impact-some-of-the-priciest-housing-markets/ar-AA14BEPt

A series of layoffs at America’s major technology companies could put pressure on local housing markets amid a broader nationwide cooling.

These layoffs, brought on in part by a series of interest rate hikes from the Federal Reserve and a decline in revenues, could cause forced sales, damage buyer confidence and lead to smaller down payments — even from buyers who remain employed. …

munch munch munch ….

From crypto to housing, collapse of speculative wealth could refocus investment on real growth

Livin rent free in the small minds, housing down, magic coin down, par for the course for the weak minded.

https://r.search.yahoo.com/_ylt=AwrgzSaEVIZjvTIAyKlXNyoA;_ylu=Y29sbwNncTEEcG9zAzEEdnRpZANMT0NVSTA4OV8xBHNlYwNzcg–/RV=2/RE=1669776644/RO=10/RU=https%3a%2f%2fwww.cbc.ca%2fnews%2fbusiness%2fimaginary-crypto-tech-column-don-pittis-1.6645787/RK=2/RS=oaVWnuu0hlF6_PoHK_rsKQkNUKI-

Got popcorn 🙂

Well, at least CD’s are looking almost kind of good in the face of inflation.

San Diego down almost 8% from peak in May, says Wolf Richter. The YOY shrank to about 10% from, from what, like 30%? Every metro is down. My own metro in TX is down 4% from peak and the YOY is down to 16% from 32%.

San Diego was has had the biggest increase of all since 2000 (back when it was still “America’s Finest City”, maybe). Miami just took over that distinction. San Diego prices are dropping faster than all the other metros.

It’s pretty clear those idiot low rates caused the bubble to bubble up even more. On the converse, that seems to be unwinding pretty steadily. How low will it go? Let’s hope employment stays on track and that we don’t have a bad recession. The free money is still out there working a little magic.

Musk says the Fed must cut rates immediately to avoid a severe recession. This guy has been off lately. I guess when you have a bazillion dollars, inflation doesn’t matter whatsoever. $10 boxes of cereal mean nothing to a person in that position.

The housing correction is in full swing…this will take a few years and the bottom is 30% below us. Nothing will stop the decline over the next few years. Don’t waste your bullets on a dead body. Illegal Rentals and over-occupation with disastrous effects on infrastructure of house will cost a fortune to rebuild. What goes up, must come down.

30% would take prices back to a year or two ago. Practically a nothing burger.

I called it before Goldman Sachs! 🙂

The flip I mentioned on Nov 19 closed and it went for about 10 Grand less than the asking price (which relative to the prices nowadays is chump change). That means the flippers didn’t get their heads handed to them. In fact they probably made at least $50K. Soooo, Orange County is still holding up in this down market.

Headline: Gavin Newsom’s reparations task force considers $569 BILLION recommendation that could see all descendants of slaves in California receive $223,200 for ‘housing discrimination’ – in nation’s biggest ever restitution effort

https://www.dailymail.co.uk/news/article-11491263/California-reparations-committee-recommend-handing-223-200-descendant-slaves.html

A reparations committee in California has suggested that descendants of slaves in the state could be compensated $223,200 each for ‘housing discrimination’.

The nine-member Reparations Task Force was formed by California Governor Gavin Newsom as part of the country’s largest ever effort to address reparations for slavery.

A focus of the California task force has been ‘housing discrimination’ – and it has been estimated that it would cost around $569 billion to compensate the 2.5 million Black Californians, according to the New York Times.

That is more than California’s $512.8 billion expenditure in 2021 – which included funding for schools, hospitals, universities, highways, policing and corrections.

However, discussions are still underway, and panel is continuing to consider how payments should be made – some suggested tuition and housing grants or cash.

The task force has also identified four other causes for reparations: Mass incarceration, unjust property seizures, devaluation of Black businesses and health care.

$223,200 each? So a single mother with five kids would get $1,116,000?

Reparations for “mass incarceration”? You mean, reparations to gangbangers for jailing them?

And why assume that all “2.5 million black Californians” are “descendants of slaves”? Are not some of them post-Civil War African immigrants?

And if this goes through, what’s to stop a mass influx of “descendants of slaves” from moving to California to claim those reparations?

The taxation for funding that enormous amount, will wipe out middle class CA completely. Like with all other taxes in CA, the limousine coastal liberals will be spared. From the poor, which are most, there is nothing to take. That leaves the middle class the main target to fork the cost. Unlike Uncle Sam, CA can not print money, so more taxation it is. That can attract easily 2 more millions of blacks from other states to claim the free stuff. With that, CA is looking to more than a trillion in fresh new taxes on the back of the middle class.

CA does not have this money and unlike the FED, they can not print them; they can just tax them.

CA always spare the rich limousine coastal liberals from taxes because they are the donor class to the establishment and they write the tax laws with all the necessary loopholes. CA can not tax the poor, because they don’t have anything to tax.

The only tax donkey left is the middle class which will be taxed out of existence. When others from other states will hear about “free stuff”, they will also come till the taxes need to be raise by over one TRILLION. CA will be the first to experience the Democrat utopia – few overlords and all others EQUALLY poor. “They’ll own nothing and be happy”

John Kobylt of the John & Ken show on KFI said on the air that his Father was a slave. The Wikipedia article on the show includes his Father’s time as a Polish internee in a Nazi labor camp (5 years a slave). Millions of slaves perished in Nazi, Soviet and Chinese forced work camps under extremely brutal conditions.

The historian Joel A. Rogers calculated that 388,000 slaves were transported directly from Africa to North America. He also calculated that slave ship mortality was 12-13%. And his figures for surviving slaves brought to the New World was 10.7 million. In 1860, there were 4.4 million Blacks of whom 3.9 million were slaves. This was 60+% of the total New World slave population at that time. The condition of slaves in the West Indies must have been horrendous. Of course the New World includes Brazil, which Wikipedia estimates brought 5.8 million slaves from Africa, apparently some after our Civil War. Brazil had 1.5 million slaves at the time of abolition plus 4.5 million free Blacks and Mulattoes. Again, very brutal conditions for newcomers, but more manumission of mixed race and multigenerational Brazilian Blacks.

The slave trade from Africa was outlawed in the US in 1807. Some small scale illegal slave trade went on, and of course, Spain and Portugal continued their trade. So meeting the demand for slaves in the newly established cotton plantations was met by producing new slaves in the border slave states (baby farming!) and then shipping them south when they were old enough to do plantation work. This practice ripped apart families which is definitely a form of cruelty.

Compare all this to Russia. The scope of serfdom in Imperial Russia was a massive number of people. From Wikipedia:

By the eighteenth century, the practice of selling serfs without land had become commonplace. Owners had absolute control over their serfs’ lives, and could buy, sell and trade them at will, giving them as much power over serfs as Americans had over chattel slaves, though owners did not always choose to exercise their powers over serfs to the fullest extent.

The official estimate is that 23 million Russians were privately owned, 18.3 million were in state ownership and another 900,000 serfs were under the Tsar’s patronage (udelnye krestiane) before the Great Emancipation of 1861.

One particular source of indignation in Europe was Kolokol published in London, England (1857–65) and Geneva (1865–67). It collected many cases of horrendous physical, emotional and sexual abuse of the serfs by the landowners.

But what about today’s World? endslaverynow.org estimates that there are 21 to 45 million people held as slaves today. In their forced labor section, there is mention of foreign workers held as forced workers, but no mention of Uighur slaves in Chinese camps or North Korea’s generational labor camps. SO, I think their numbers are probably on the low side. I think that the money would be better used to beef up human trafficking law enforcement in California. That is a current issue that would help all Californians (except for the organized criminals, of course!) and is a proper use of California taxpayer’s money.

If some version of this crazy handout happens you will see massive housing price increases. Houses going for 850 will suddenly go for 2.2

There is no other place to put that much money rapidly that is also a status symbol and adds value. Some will buy a RR but there aren’t enough of them to go around – nor that many deeply stupid people. Even drugs can’t sop up that many dollars. All of our squabbling about is this house worth 700 or 850 will be out the door and a memory as everyone fights over 2.2 or 2.5

I am a nurse, LVN, which stands for Licensed Vocational Nurse. I am not a RN which stands for Registered Nurse. LVNs make about half what RNs do. That may not be exactly accurate but RNs are paid much more than LVNs. Now that we have that cleared out of the way so I don’t have to deal with a douchebag telling me, a nurse/LVN how much I’m paid because their friend is a nurse and then quote RN salaries for Kaiser, as clearly they don’t know what they are talking about and unable to differentiate a LVN salary from a RN salary.

That being said, I am a nurse LVN in southern California with over 10 years of experience. I have to work 60 hours a week to net $1500 a week. People in my profession, licensed vocational nurses are priced out of the housing market. What kind of economy are we in when nurses (LVNs) can’t afford to buy a house! I’m 40 years old with 2 young children. Wife is stay at home mom as her going back to work wouldn’t cover daycare. I have been following this blog for about 10 years, read, but never comment. I agree with buying as soon as you can comfortably afford. I am still waiting for that day. Without a price drop that day will never come. The reality of the situation is it’s quite possible I’ll be forced to rent my entire life. And homeownership may be a thing of the past for the next generation to come, which is something people talk about being the end goal of the government or what not. As they are pushing forward with this new world order thing, own nothing and like it etc. Well see how things play out but I can assure you there are many more people in the same shoes as me out there. I don’t see any real change happening until the boomers have all died off and are no longer running the country as they are completely disconnected and in denial of the current situation the majority of people my generation are in. Unlike millennial, I won’t be getting any inheritance money, and have no family or relatives that I can just “move back home” with like they say the majority of millennials do. It’s been a long hard road to even get where I am currently.

The World Economic Forum (WEF) boss – Klaus Schwab – said openly “you’ll own nothing and be happy”. WEF and Klaus Schwab are globalists, like all Democrats any many RINOs. Since you know their goal and the goal to eliminate fossil fuels (they openly said so), you can say bye bye to home ownership or any ownership for that matter. The whole economy is based on fossil fuels and no amount of “green energy” will replace that. “Climate change” is the new trojan horse of the globalists to grab all power.

Increasing the money supply by 40% in 2 years to buy votes is not going to help you ever to buy a house or a car with cash. The result of that is massive inflation, much greater than stated officially. By increasing the money supply (the most regressive forms of taxation), everyone’s standard of living took a 40% cut unless you already owned real estate.

Voting the same globalists in power at every election expecting different results is the very definition of insanity. 90% of CA politicians are hard core globalists.

Nurse, how come you don’t move out of CA? No older family….so what’s holding you back? LVN opportunities everywhere!

I used to date a LPN in the 70s. She said it was short for Lowest Paid Nurse!

An on-line article from Bloomberg had some interesting information about the national real estate market.

First, Blackstone has a $69 Billion (currently I assume) Real Estate Income Trust. Yesterday, the fund announced that it is limiting withdrawals. Too bad if you didn’t cash out last week.

Wells Fargo is the largest home loan origination bank, and it is cutting hundreds more mortgage employees. Good luck finding a job in that field.

Housing prices nationally have dropped for the last 3 month, and the volume of rate lock mortgages has dropped by 61% in the month of October from the previous year. Also pending sales have fallen for 5 months in a row; all according to Black Knight Inc, a data analytics company.

Commercial real estate prices have slumped 13% from a peak this year (Green Street’s October price index), and financing is getting tight leading Brookfield Asset Management (a $725 Billion Canadian alternative investment firm) to warn of a struggle to refinance certain debt.

Starwood Capital backed Reverse Mortgage Funding has filed for Chapter 11 this week. Opendoor Technologies Inc which has been involved in home flipping has laid off 18% of its workforce and wrote off the value of property holdings by $573 million. Redfin has had two rounds of layoffs and shut down its iBuying business and Compass Inc has cut staff in its technology teams. Independent contractor real estate agents should also be feeling the pain nationally…sitting waiting for the phone to ring!

OUCH!

But yet in our low inventory Orange County area, we’re seeing houses still selling. All real estate is local, and the national picture is that interest rates are driving the collapse. High rents and housing shortages may keep Orange County from the same degree of collapse as nationally. But any massive job cuts in strategic SoCal industries will have to hurt. Meanwhile, We’re staying put.

Reality is setting in for millennials to generation Zers. I recently heard Charlie Munger (95 yrs. old. Berkshire-Hathaway) being interview. He was asked about bitcoin investing. He said, “Trading bitcoin was the same as trading turds”.

At the moment Real Estate is also looking pretty bad, but still has intrinsic value. The key is not to overpay. The last 10 million buyers have a problem. This time around I will be surprised if the FED bails out the entire market like they did in 2008. They still have that debt on their books to deal with. Should be fun going forward. The FED has painted this entire economy, and with it the rest of the world, into a corner. Too much QE, aka free money! Look for some major change going forward. I doubt these will be of a positive nature for the average investor or home owner. It’s only prudent to be prepared. CARRY NO DEBT! Be patient. Opportunity is in our future…..

OC Register’s Lansner has a list of LA/OC Zip Codes that were in the top 100 Zip Codes for home prices nationwide. 23 of the top 100 are in LA/OC. The numbers are for 2022 through October 19th. 90210 was #3 nationwide. OC’s highest was 92662 in Newport Beach at #9 ($4.7M). Newport Beach had six of the eight OC zips and Huntington Beach had one. The only listed OC Zip (#73) that is less than 10 miles from where I live is 92861…the little known Villa Park! No state other than CA and NY has more than 3 such zip codes.

Someone mentioned they were a Perma bear and it didn’t pan out so they bought real estate and is sitting pretty. If you read John hussman, his historic valuations of the market will show it’s been over valued for a long time. Everything reverts to its mean. The only reason the stock market has held up is because of low interest rates and this is how all these startups have continued to fund themselves. Has amzn made a dime? How much market cap did they just lose. If it wasn’t for them rolling over cheap debt and intentionally losing money to corner the market they would have never existed. Sorry to say but the game is over because the dollar being King is days gone by. I o w the Global Financial hegemony of the dollar is over. This is one of the reasons for the mass of inflation spike. The truth is in the book by Karl denninger called Leverage from 2012. All these corporations that have to roll over their debt will not make their yoy targets so evaluations cross the board are coming with multi-year lows. Last saying Medicare and Medicaid percentage of GDP is ramping to the point of no return. The new definition of a depression is upon us it’s just nobody sees it. Papering over it is not happening and this is why Powel at all cost has to get ahead of this inflationary nightmare. Look at Germany this last week inflation at 11 plus percent.