The incredibly high cost of construction and more open attacks against Prop 13. California housing takes a turn. Â

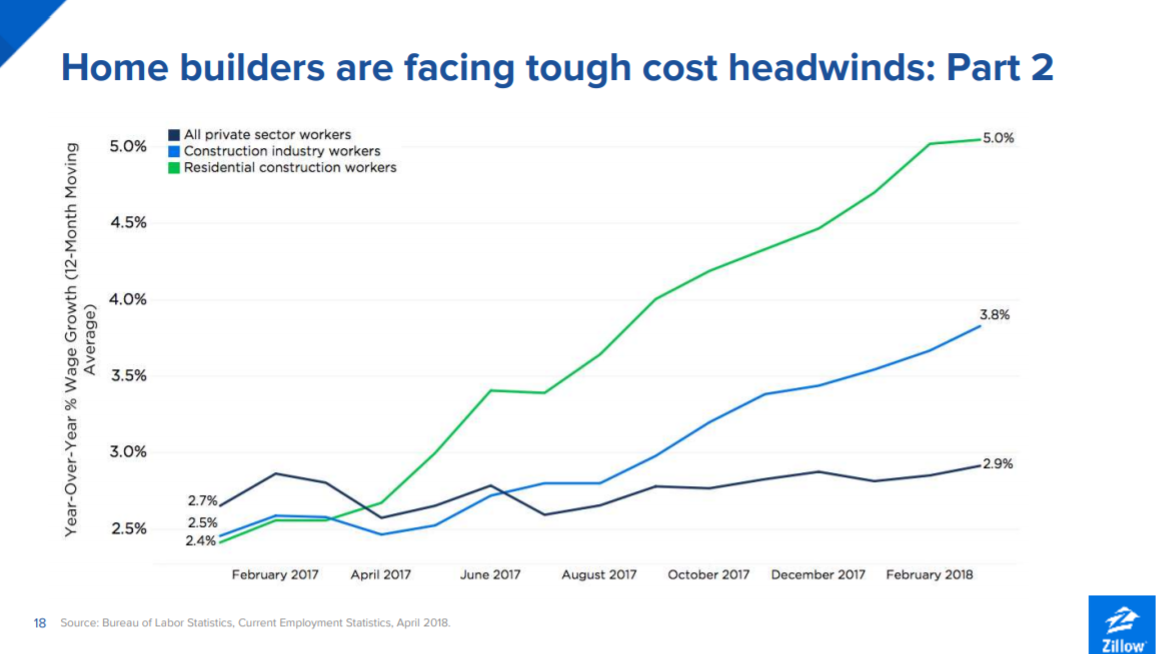

There is now a concerted attack on Prop 13 as people with two ounces of common sense realize that no, grandma isn’t being kicked out onto the streets because property taxes are going through the roof. In fact, there is now evidence highlighting what we all knew and that is Prop 13 is a gift to the “I got mine so screw you†generation. For example, the majority of people that inherit Prop 13 homes essentially use them as rental homes or second residences. The issue with this system is that say you buy a crap shack in San Francisco today, it is very likely that you will pay 5, 7, or even 10+ times the amount in property taxes as your neighbors. No one likes taxes. And what is odd is that states like Texas, a state that no one can argue is “liberal†has some of the highest property taxes in the country. People selectively choose which taxes they like and don’t like. Prop 13 sucks when you don’t own but then if you do buy, your incentive is to keep the rate as low as possible. And then you have the incredibly high cost of construction in California. So of course builders are only focused on high-end homes or rentals where they can make their money back.

Prop 13

The L.A. Times has a piece on Prop 13:

“(LA Times) In Los Angeles County, as many as 63% of homes inherited under the system were used as second residences or rental properties last year, according to the Times’ analysis. A similar trend was found in a dozen other coastal counties. Prime vacation spots in Sonoma and Santa Cruz have some of the highest concentration of homeowners receiving the benefit.

The inheritance tax break, The Times has found, has allowed hundreds of thousands — including celebrities, politicians, out-of-state professionals and some of California’s most prominent families — to avoid paying the higher taxes owed by newer homeowners. The tax break has deprived school districts, cities and counties of billions of dollars in revenue.â€

As homeownership gets more elusive in California, you can rest assured that Prop 13 will be under attack. And we are now seeing more press on this. And of course the cost of building homes in California is expensive because of NIMBYism and other factors. Take a look at this:

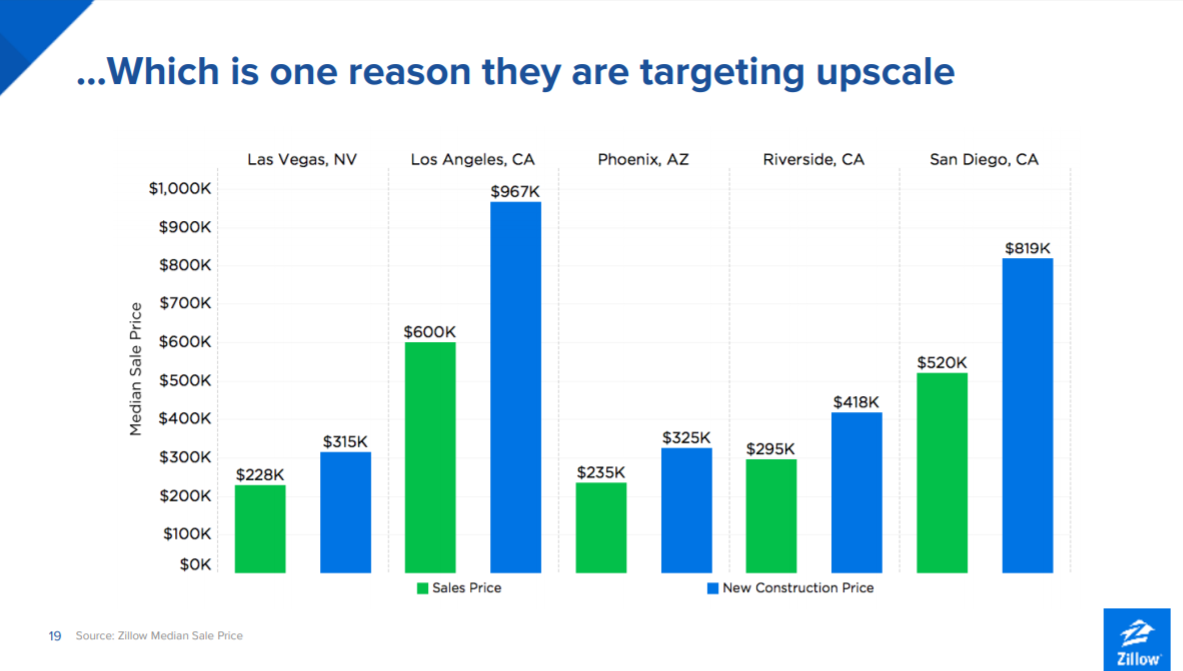

The actual cost of materials is going up but look at regional differences:

In Las Vegas and Phoenix building a new home might make sense. In Los Angeles or San Diego? Why would you do that if you are presented with the following cost constraints. We also have a need for higher density housing but of course NIMBYism makes this more difficult. And this is ironic because “free market†thinkers yap like little parrots regarding letting the market be free but love the following:

-Federal Reserve (which of course intervenes in the market)

-Prop 13 (which of course artificially keeps property taxes low in California relative to the nation)

-Mortgage interest deduction (government kicking some money back to you because of owning)

-Local and regional paperwork laws to make it hard to build new homes and construction

So much for a free market. So what we get are million dollar crap shacks and odd situations where neighbors can be living in very similar houses with massive differences in their tax bills. People want free lunches on all sides of the argument. There is a large push now attacking Prop 13 and this is something that has gotten louder over the last year.

In many high cost California areas, the majority of households are now renters. So expect this trend to continue.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

631 Responses to “The incredibly high cost of construction and more open attacks against Prop 13. California housing takes a turn.  ”

I have a friend who inherited her house (what a life she is having….no worries, no job, no car….the life of Riley) and her taxes are $1200 a year thanks to prop 13……I looked it up on Zillow. Central Anaheim. According to Zillow her assessed “value” of the home is about $70K….it was bought in the 60’s I believe and her grandparents set her up well.

Almost everyone I know is just waiting for mom, dad or the grand parents to die so they get the house……..these are older folks working menial jobs or acting as caregivers……it’s the only way to afford a home in socal.

A house needs to cost about $200K based on the incomes of 99% of the people I talk with……okay, so yeah I do know one guy that’s a dentist and he’s doing well.

The sad part will be when the Millenials finally find out their parents took out reverse mortgages and they get squat.

womp…womp

Its pretty darn hard to get a reverse mortgage now…maybe some of the mortgage brokers on this blog can weigh in?

Reversed mortgage ….muhhahaah

Keep dreaming

This is true, reversed are administered by FHA and do have a lot of newly enacted restrictions.

Recently the loan to value was cut and there is an income analysis that must be done to verify the borrower can carry the taxes, insurance and other non mortgage debts. It has definitely taken a large bite out of the reverse market.

The people you talk to obviously do not represent the real puchasing power out there

clearly. But do we know for sure where all that purchasing power is really coming from? I’m having a hard time understanding how it’s all from incomes and when the next correction comes i’ll be interesting to see how this plays out.

my guess is, same game, different players……

It does not matter. Even/when crarsh/correction plays out -> these same people won’t be able to afford just the same as they are now.

People think that crash will improve affordability…it is lack of general affordability that that might drive price reduction (aka no loans, no jobs, etc…)

Great news from the east coast. Sharp drop in prices for luxury apartments.

https://www.zerohedge.com/news/2018-08-20/luxury-apartment-sales-plummet-new-york-sellers-capitulate

West coast is next?

Also, if you are so hung-up on someone who got it easy through inheritance (and you are jealous), you can just pretend she got a lump sump (and also got it easy).

So, is this about prop-13 un-fairness? or general life un-fairness? (someone got it easier than you)??

LOL, Jealous? You think that’s what my comments are about? What happened to Americans? I’m not jealous of the fortune of others…….I will grant you that it is annoying watching these people piss it all away though.

Oh, and as another friend has mentioned to me (she inherited 2 houses) she is “house rich and cash poor” just like the first person I mentioned. Both people I mentioned here have nothing BUT those houses.

This IS about prop 13 and I pointed out examples on how it’s being used or dare I say abused.

P.S. Okay so I thought about it, I am not jealous of their house rich status BUT I am jealous of all the free time these people have……..neither of them have jobs and are quite possibly dysfunctional. The first girl has never had a job since I’ve known her (survives by having roommates) and the 2nd one can’t seem to keep one.

p.p.s. And I wonder how you’ll make this all about me ……… again.

Hey, interesting — jealous is the spin being put on not wanting to subsidize other people. Surge is twisting the truth of things here. Long time Prop 13 beneficiaries are being subsidized and want to keep their handout, so they’ll make up anything in a desperate attempt to promote a false narrative just like Millennial does with price crash agitprop. This has absolutely nothing to do with the fake spin word of jealous. They know this gravy train is coming to an end sooner rather than later.

interesting~

Of course, you’re jealous. You say so yourself:

“I am jealous of all the free time these people have……..neither of them have jobs and are quite possibly dysfunctional. The first girl has never had a job since I’ve known her (survives by having roommates) and the 2nd one can’t seem to keep one.”

This is all the doing of democrats. From uncontrolled immigration into citizen black neighborhhods. From useless government over reach in rent control. From overreach in permit fees up to 30% in some cases. The democrats zombie votes are to blame!

There are a lot of Dems that take the Wall St. handouts, but the Republicans are the true masters of the dark arts of being bribed by the financial elite. It was the Bush tax cuts that created the situation where rich people had too much $$$ and nothing to invest in regarding the real economy so they resorted to speculation and real estate investment instruments since RE always seemed safe. Without that elite liquidity bubble there would have been no demand for mortgage backed garbage and thus Countrywide’s ‘The Hustle’ where there borrowing test consisted solely of fogging up a mirror placed under one’s nose. Federal loans were only like 1 of 200 mortgage originations before the crash, so no it wasn’t Dems giving poor people government loans that caused this.

What should have happened was we should have let the banks fail and let anyone with a mortgage from such subsequently own their home free and clear afterward.

What should have happened was we should have let the banks fail and let anyone with a mortgage from such subsequently own their home free and clear afterwar

NOT!

That would be grossly unfair to people who’d paid off their mortgages.

We should not have bailed out the banks. Instead, the banks should have foreclosed on all who had defaulted on their mortgages, immediately, instead of letting them live there for years, rent free. The courts should have facilitated the foreclosures.

The banks rely on the houses as collateral for the loans. That’s what collateral is for. The banks should have repossessed that collateral, and nothing else. No bail outs.

Why all of sudden hate people that by luck inherited property. Anyone of us would love to be in their shoes. I can just tell you would be blowing your money on cars and fun if you had the same chance. And instead of saving for a second home to leave your kids you would be riding in a cool car. Yes the prices are high but that is due to extreme demand. There are better, cheaper places in the US to live if you cant afford CA. If you cant make it here, I would say move where you can. By the way, I did not get a free house from my parents. I lived in a 300sqft guest house for 8 years driving a 1993 paid off accord to come up with the large down payment. People nowadays feel almost entitled to everything without sacrifices. Either scale down spending or go back to college and make more money otherwise you will be a renter for life.

“People nowadays feel almost entitled to everything without sacrifices”

and that is exactly who I am/was talking about. I have no problems with people that earn what they have but these losers out here sitting on their collective asses waiting on their parents to die isn’t right. BUT what pisses me off is they act like the fucking earned it and deserve it

I had one of those inherited homes and sold it! People make this sound so great, but the folks better have had the means to keep those homes well maintained and updated. First, my Dad was ill for many years, then my Mom’s health declined. They did the minimum to their house overs 20 years, as their focus was on health issues. I did what I could when I was there to visit. It would have taken a total gutting, and several hundred thousand to do it all, and by the time I inherited the house, I was looking at my own retirement … drain my savings to renovate or sell for a huge amount! Easy decision as I had a relative who also inherited, did the renovation, and now has drained a large chunk of his savings to do so …

If you do your own work you will make buku bucks. But hire the roofing, not worth dying over.

Housing To Tank Hard Soon!!

I would probably believe it if you weren’t the one who said it.

keep dreaming Jim!!

Stay away from the weed

There’s no point in repealing prop 13 the same way there’s no reason to raise any tax in California. Those up in Sacramento will just find a way to spend it foolishly as they always do. In addition to lowering all state taxes I would suggest bringing everyone’s property taxes down and firing at least a third of our state government employees. Everyone will save (except the folks who just went on welfare).

I completely agree with you. Abolishing 13 isn’t going to lower anyone’s taxes. All it’s going to do is raise everyone’s taxes, and give the government even more money to waste. What new buyers don’t look at is that 13 will protect THEM down the road as well.

It is not as simple as repealing prop 13. We need to install a better tax control on government. I am a big supported of the dollar caped solution. No primary residence shall pay more than $X,000.00 per year, with the ability for it to rise no more than 2% per year. Remove all the transferring and inherited benefits as well.

Those under the cap will remain until they hit the cap. Those above will see a tax reduction.

It will cause prices to drop significantly which benefits us who want to get into the market for a reasonable price. More people will have to sell if their taxes go up. That’s a good thing because these people have been paying next to nothing while the younger ones have to foot the bill.

So Karin, you would be okay with equalizing property tax if it is done in a state budget neutral way? I mean: upping the tax for those who pay close to nothing, while simultaneously lowering the tax for those who pay a lot now? If so, you may be on the same page as Millenial after all.

Nice story by the way, the ten men going for a beer! I would say: split the bill like 10 dollar each, independent of who earns more or who lives longer in his property… What say you?

i like Henk Poell. I hope he posts more.

If anyone thinks that eliminating Prop. 13 will even the playing field, they weren’t in Jerry Kiddo’s State back when Prop 13. was passed…

All it will do is incrrease the Rentier’s percentage of RE holdings, as any middle class left owning property will be driven out of the state due to runaway property tax increases (NJ anyone?).

Gotta love how millennials continue to blame all their problems on those that came before, and continue to elect rhetorically proglodyte apparatchiks to tilt at the imaginary bourgeoisie…

Henk~

You obviously don’t read many (or any) of my posts. I don’t think property owners should pay any property tax whatsoever. Property taxes make us renters in our own homes. If we don’t pay those taxes, they come and take our houses. We didn’t have property taxes until maybe 60 years ago in this country; did you know that? In fact, the government was formerly able to support itself primarily on tariffs, and in addition, did not have the massive debt that it has today. Did you ever notice how the more we pay in taxes, the more in debt our governments become? That’s because the people that run this country, from the local to the national level, are entitled vampires that live on sucking the blood out of us. Let me repeat: our tax money is not being spent for the ‘greater good’, as they continually tell us in order to extract more and more assets from us. It is being stolen by the politicos and their crony allies.

Tax payment should not be a requirement for keeping something that is supposed to be “yours.” Conditional ownership is not really ownership at all. Either you have it or you don’t. If we do not own a stake in the property we live in, then you fork over power to government agencies who can throw you out and make you “homeless.” That’s tyranny. This issue is one of the major areas of concern for why the real estate bubble was such a problem and continues to be as we try to recover from it many years after the fact. Once a piece of property is paid entirely, no agency should be able to strip it from you after the fact.

My question for you, then: how is my stand on property taxes similar to Millie’s in ANY way? Go back and read my posts on this topic. Millie and I agree on nothing regarding property taxes. As for your claim that I would be okay with equalizing property taxes if it’s done in a state budget neutral way, where did I even come close to indicating that? You sure know how to twist things, as I cannot even remotely see where that comes from.

To Millenial~

Of course you like Henk Poell. He has his head in the same place you do.

Karin, another A+++ explanation about property taxes. I kept saying the same thing for years. It is amazing how many indoctrinated people are out there to fight against property rights. The crooked politicians laugh all the way to the bank! They deceived everyone that it is for the “greater good” without specifying that it is for their OWN “greater good”.

Lord B.@ “There are problems with kids in wealthy areas, but I’d rather deal with these problems then send my kid to a ghetto school where you are surrounded by gang bangers, low lives, non english speakers, etc. The chances of somebody thriving in that environment is very low…”

Lord, but the MSM and all the liberals in CA tell us constantly how much better is to have multiculturalism and how much more we are enriched by diversity. And here you state the obvious without being PC. Who needs those flyover places in the country with no multiculturalism and diversity???!!!!…..

Millie,

Unlike the others here, I agree with your assessment of Prop 13. Where I don’t agree with you is in the fact that you direct your righteous anger towards eliminating Prop. 13 instead of changing it. You miss direct your anger.

I agree with Karin, that there should not be any tax if there is no income – I call that confiscation of property and it is a feature of bolshevism/communism/collectivism. Whoever supports that is evil and want to benefit from the theft or is a plain idiot. There is no rational and excuse for property taxes. Even Switzerland, a far more civilized country than US, with better roads and schools than S. Cal has capped the prop. taxes at $1,500/yr. That is maximum; it is scaled down based on value and income. It is true that they don’t have multiculturalism and they are not so enriched by diversity like those in S. Cal., but that was their choice. The voters in CA made it clear that they want multiculturalism and diversity by electing politicians who do just that – their choice.

Again, supporting politicians who want property taxes is giving up your rights to your politicians and their cronies/buddies.

The whole debate should not be around Prop. 13. The whole debate should be around property rights and no taxation for unrealized income. The whole debate is about the government right to confiscate/nationalize private property, because that is the definition of property tax. Instead of debating how fast the government should nationalize private property, we should debate where in the Constitution the government has the right to nationalize and tax property. Otherwise, the whole discourse is summed up in – should we nationalize in few months like the Bolsheviks, few years like Illinois and NJ, or a little bit slower like in CA.

If the debate would be focused on the right issue, there would be no need of Prop. 13.

If people would have more disposable income (no prop. taxes), they will be more spending and more sales taxes. Sales taxes and income taxes should be enough for any decent government to take care of schools and roads, like Switzerland proves very well for anyone visiting there. It is a matter of spending, not taxation.

Karen, read your reply, in which you state again that you’re very much opposed to property tax. Next, you avoid to make a real statement regarding the main question I have for you namely: “given the existence of property tax, being good or bad or ugly or even extremely rotten, would you support having John and Jack both pay $2000, instead of today’s $100 and $3900, if they have equal houses and living situation?”. So it is not about this tax being appropriate, just about how it is divided. Would you care to give us your answer?

Now about your property tax / govt spending concerns: I agree with you that governments should step back and downsize. Lower taxes are good, libertarians are right about that. Personally, I think that if you tax, it should be in proportion to the benefits you get from the government spending it. So, a road/car/fuel tax that goes up with the weight of the car may cover infrastructure spending. Import tax should cover harbor authorities. And surely, the more property you own the more benefit you have from a bunch of government services – a homeless guy does not care if the police protects houses. So I would say a property tax is appropriate. Income tax is, IMHO, more debatable. After all, how much extra money is the state or nation really spending on your high salary?

Sincerely,

Henk Poell

Yep, most agree with my prop13 assessment. Only those that benefit from the current scam do not agree. They want to keep their subsidies. Karin is different.

As far as higher taxes goes….every country has fairer property tax laws than California.

California is broke. I don’t see a tax cut. What needs to happen first is that we stop the wealthy and some boomers getting a freebie. Once everybody pays their fair share we will all be on the same page.

“Yep, most agree with my prop13 assessment.”

Then why is it still in the constitution?

Change doesn’t happen overnight. That’d Be too easy. Prop13 will repealed just a matter of time. Same with the RE crash. Just a matter of patience and discipline!

Flyover~

Thank you. You and I are in sync on quite a few issues on this blog. Good to see someone else who is awake to reality.

Henk~

I avoided nothing in my answer. I do not believe that my property should be taxed, period. I already pay more than my fair share in income taxes, which represents money that is actually streaming in – unlike what I receive from a property that I live in. My house doesn’t give me money to pay property taxes unless I sell it, at which point I cease owing property taxes anyway. Regarding my income, if I make more, I pay more – unless I’m an inside crony, of course, and get a waiver.

As for how I would allocate under the present system, I do believe in protection against having to pay unlimited taxes on your property. I know many older folks that would have lost their houses without the Prop. 13 cap. Pre-Prop. 13, you qualify under one income, but due to raging inflation manipulated into the currency by the big bankers that run the Federal Reserve, your house’s value on paper goes up multiples, and you get taxed way beyond what you originally signed on for, and often way beyond what you income can support. And your house produces no additional income to pay for it. For many, the only way to pay the taxes owed was to sell the house. And then what? A lot of retirees are on fixed incomes, and in the last decade plus, interest income from the banks is practically zero. Do you expect an 80-year-old guy to get a job to pay those taxes? No. But if YOU come along and can afford to buy at the most recent very high price, that means that you can qualify to pay the mortgage and the property taxes. Under 13, you then have a cap on how much your taxes go up as well, just like the 80-year-old retiree. Remember, you’re making today’s income, not the fixed income of someone that finished their career 40 years before you got yours started.

Don’t you get that?

What you’re advocating for is to give more money to a wasteful and criminal government, who never spends our tax money on us anyway, other than a few token gestures. I worked for the State Department of Transportation in California for 30 years, up until last year. It was like watching sausage being made. Knowing how my money was being misspent was like having my face rubbed into a giant turd every day I went to work. I am not kidding. And our State government is like Mahatma Ghandi next to places like Illinois.

Thank you Karen for clarifying your position. As I read it, you want to keep the tax for 80-year old people low, as one cannot expect him or her to start working again. For the government to get enough property tax (yes, they waste too much of it but that’s not the issue when it comes to the distribution question) they have to double it for other people. So according to you, millennials have to subsidize the elderly.

Hey wait a sec… isn’t that your 10 guys getting a beer story all over again? The moral of that story you told here was about how unfair it is to let the same people pay for others each and every time, and the others not being fair to the ones paying it all… But when it comes to your situation, where you are being subsidized, your arguments magically reverse! Well it’s your opinion, you’re entitled to it, but I really don’t see any sense of fairness in it. If the guys in the beer story do not have the cash to pay, they should not drink, and if people don’t have the money for the upkeep of a house they should move to some less expensive place. No matter if the upkeep is maintenance, tax or anything else.

Something else from the anti-tax front: splitting the tax very unevenly makes it easier for governments to up it… Did you realize that? All the people who are basically exempt from it will tend to support the government every time the tax goes up. Why not? Even if half the money is wasted, some of it might pay for some services. Divide and rule, supported by the likes of you.

Sincerely,

Henk Poell

Henk~

None of what you wrote makes any sense, nor does it connect soundly with what I wrote. You obviously didn’t understand my points. I was going to address your comments, but it would be a waste of my time as it’s obvious you wouldn’t make an attempt to understand this either.

You also didn’t get my story about the 10 drinkers. To quote the ending:

“For those who understand, no explanation is needed. For those who do not understand, no explanation is possible.”

I believe Henk is saying that your beer example obviously makes sense.

If someone is receiving the same beer or service, then they should all pay equal amounts for the same beer and service.

By that argument, Prop 13 is not fair since the older homeowners pay much less than the newer homeowners.

Karin’s other argument is that we all pay too much. It would be like the bar charging $20 per beer to fix the leaking roof or a broken driveway. The older people have been paying for beer much longer so they should only pay $10/beer.

The bar manager was the smartest, he was a Republican and borrowed millions against the bar and gave each of his customers $10/beer in bar credits and he went on golf trips to his resort at Mar Lago and deducted the entire amount from his taxes.

Bob~

You don’t remotely get any of my points either. I would explain them yet again (for maybe the 20th time), but if you haven’t understood what I’ve been saying by now, I doubt my further explanation will register with you.

I find myself posting (or even reading) on this blog less and less. There are some pretty sharp bloggers on here, but they are in the minority.

Karin, Please explain again for us dull people. 🙂

If this helps, I agree with you about Prop 13 and why it should be kept for senior citizens or people on fixed incomes.

Unfortunately, I think this makes you a closet Socialist. Sorry.

If this makes you uncomfortable, please explain.

Karin, Please explain again for us dull people. 🙂

If this helps, I agree with you about Prop 13 and why it should be kept for senior citizens or people on fixed incomes.

Unfortunately, I think this makes you a closet Socialist. Sorry.

If this makes you uncomfortable, please explain.

Karin,

I believe I understand you perfectly. You simply want to avoid paying more tax. Very human behavior. And as you are probably above average intelligence, you do not say: “I I I me me me wanna keep paying lower tax then the rest” as it would display a certain egoism… So you say: “instead of upping my tax, it should be lower for everyone”, which sounds very sweet and social. And in the end it is never going to happen, so your reasoning protects both your financial interests and social appearance.

I’m from Europe so the outcome doesn’t effect me, but… something always draws me to this website 🙂

Hey, Bob, “Those up in Sacramento” that are the problem are the legislators that you in Inferior California elect and send up here to ruin everything. Get the pole out of your own eye before you complain about the good folks of Sacramento. (And stop stealing our water!)

I do agree that the pols that you and your neighbors send up to the state capitol would piss away any extra money they can squeeze out of Prop 13, plus use a good portion of it to put the Golden State deeper into debt.

As for Dr. Housing Bubble’s gripes about Prop 13, of course grandma isn’t losing her home today–she’s protected by what’s left of Prop 13! (Duh.)

Prop 13 was intended to resolve a problem that began in the 1950s yet the legislature (remember, they’re the people the voters of Inferior California have stuck us all with) fiddled around and refused to fix it. Instead, for decades that legislature would toss the voters a quickie

Band-Aid patchbribe to head off a more comprehensive fix brought to the voters by citizen initiative.The situation came to a head in the mid- to late-1970s. Yes, I was alive back then and I knew young adults back then whose grandmothers had literally lost their homes because the taxes on their homes had skyrocketed so much that their annual property tax assessment was higher than the original purchase price of their home! I can’t honestly call such literally confiscatory tax rates ‘fair’. I don’t know how Dr. Housing Bubble can.

When I voted for Prop 13, I knew that it wasn’t a perfect solution to the inflationary crisis of the 1970s and ’80s but it was the best proposal on offer. (Does anyone else remember then-Assembly Speaker Willie Brown–an immigrant from Texas, BTW–saying that if Prop 13 failed, he would take it as a signal from the voters that we don’t feel we are being taxed too much?) I figured that 30 or so years down the road, Prop 13 would itself require reform or replacement but I was willing to leave that problem to the voters of 30 years later.

Instead of comprehensive property tax reform to address the appearance of unfairness that has built up in Prop 13, the Democrats that Inferior California has sent up to the statehouse have simply been greedily eating away at Prop 13’s protections, all to feed their hunger for Other People’s Money. (When was the last time you heard your preacher expound on the sin of coveting–whether it be thy neighbor’s goods or thy neighbor’s spouse? Yeah, I can’t remember either.)

Anyway, Dr. Feel Good’s rant here isn’t a serious argument for comprehensive tax reform in California, including reform of property taxes. Dr. Feel Good is ranting that the fortunate who moved to the Golden State earlier are advantaged over those who blew into town yesterday. Or that the successfully frugal homebuyer is advantaged over her less frugal counterpart. Or that those who bought in communities that became very attractive later were fortunate to do so. Envy is a deadly sin, is it not? California has enough sins from her sinners already, Dr. Housing Bubble, don’t add more.

According to Zillow: “Essentially, it’s a sellers’ market if the local inventory is sufficient for less than five months’ worth of sales.” In Orange Co., where I live, there is currently a 57 days supply of homes for sale below $750,000 and a 76 days supply for homes for sale between $750.000 and a million dollars. Both are well below Zillow’s definiton of a buyers’ market being over a 152 day supply. Real estate bears will have to wait and hokpe because there is no sign of a crash at the moment.

We need to keep Prop 13. It is more important than ever now that SALT deductions are limited to $10,000. I can’t believe how stupid many of those posting at this site are. They are begging to pay more than 1% in property taxes. “Please tax my home at more than 1%,’ they demand, “because that would be fairer.”

Prop13 is the biggest scam in history. It’s purpose is to screw the younger generations by putting the tax burden solely on them. Older folks pay next to nothing. Plus older people benefitted from the bubble. Younger people did not. Prop 13 needs to repealed. People love government subsidies and freebies as long it’s only beneficial to them. It’s like the good Dr said….Screw everyone because I got mine. Typical mentality of the boomer generations. End prop13 and the bubble ends tomorrow. Have them pay their fair share….it’s way overdue!

Prop13 is the biggest scam in history. It’s purpose is to screw the younger generations by putting the tax burden solely on them.

Why do you post lies? You KNOW that younger generations benefit. They benefit when they inherit their folks’ houses.

You KNOW this because YOU expect to inherit. You said so many times.

You ARE just a troll, aren’t you? You post stuff that you know is false. Stuff which you wouldn’t support if your life story (as you represent it) is true.

“End prop13 and the bubble ends tomorrow.”

So there’s no bubble in the northeast where taxes are 2%+ of current value?

Not sure what my inheritance has to do with the fact that millennials have to pay 8-12 times more than some older folks? Prop13 has to go and older people have to start paying their fair share.

Maybe Our Millennial is an idealist who believes in equity for all.

Prop 13 is not “an equity for all” amendment.

1) Inheriting your parent’s (or grandparent’s) tax base from the 1960’s or 1970’s is not equitable.

2) Having a 2% cap on tax increases is not equitable for all. Even Social Security has a inflation indexed increase. When in the 1980’s under Reagan, people were getting 14% increases in wages and Social Security. Yet their Prop 13 taxes were capped at 2%. When retirees on Social Security are making out like bandits, that means the government subsidy is unfair to all. Prop 13 should follow the US government inflation rate covered by Social Security.

3) Corporate taxes are also covered. Many companies live longer than people. If they can’t make it in a free market unless at the expense of our schools, fire, police, then they shouldn’t exist.

So unfair! As our current President would say.

Those old people have been paying property taxes for decades, Millennial.

When are YOU going to start paying your fair share ?

Millie, read my reply to Gary.

Funny thing about Prop 13 – it didn’t exempt parcel taxes that the voters pass. In the last 24 years taxes on our home have doubled – from $1,840 per year to over $3,600. Even with the Prop 13’s limited 1% annual increase, our property taxes have been going up 3% per year.

Tenants aren’t “exempt” from Prop 13 either, unless some rent control ordinance provides the “jackpot” of limited rent increases for ever. In which case, the property will become a deferred maintenance nightmare.

We pay a lot of money in property taxes for lousy public schools. We don’t have any children going through the system. Perhaps addressing the cost of educating children, in addition to the corrupt public pensions which are a total ripoff of the tax paying public.

Begin with responsible management of public funds, cut government spending. Prosecute corruption. Public employee unions are responsible for massive bribing of elected representatives – but campaign reform is hardly a topic anyone can talk about.

Yeah, Millie, and if you ever buy a house, you’ll appreciate the protection Prop 13 gives you 20 years down the road. You don’t think long term. Plus, if Prop 13 is eliminated, you won’t be paying less in taxes. Your neighbor will just be paying the same as you, giving politicians more money to steal or waste. And based on recent history, those higher tax revenues aren’t going to go into useful infrastructure unless it benefits politicians and their friends, like the high speed rail in California.

End prop13 and the CALIFORNIA bubble ends tomorrow.

Corporate taxes are also covered. Many companies live longer than people. If they can’t make it in a free market unless at the expense of our schools, fire, police, then they shouldn’t exist.

Prop 13 companies don’t make it “at the expense of” schools, fire, and police. The latter don’t have any right to anyone’s tax dollars. It’s “We, The People”‘s decision how much we wish to pay teachers, firefighters, and police.

As for myself, I think teachers, firefighters, and police (and all govt employees) are way overpaid. Especially with their lucrative overtime and health & pension plans.

I’d me more willing to slash Prop 13 benefits, if there was a concurrent slashing of govt employee pay and benefits. Maybe cut all health and pension plans by 50% (at the very least).

Karin,

I mostly agree with you except when it comes to prop13.

I do not want to subsidize someone else’ freebie. I don’t want to pay multiple times more in property taxes than the guy next to me. We should be paying the same.

I do not care what politicians do with our tax money. Politicians can’t be trusted as we all know.

My property taxes (if I buy now) are already sky high. Thinking about the situation in twenty or thirty years doesnt help to resolve the current issues. The issue is that new buyers (mainly millennials) have to pay multiple times of what older people pay-for the same house/same services.

Why can’t we all pay .5 percent of market value instead of 1.1? Increase the taxes for people who enjoyed the freebies for decades and lower taxes for new buyers.

The problem with that is that boomers are an entitled, selfish generation. They are spoiled and think they deserve these freebies in paying next to nothing in property taxes.

Millenial,

If you decreased property taxes from 1.1% to 0.5% the vast majority of current owners would be paying far less in property taxes than current.

Just do a simple calculation on people who bought in 1990 and have owned for almost 30 years. In fact if you actually get the crash you want those people will be paying more in property taxes than you. Not only that but they paid property taxes for 30 years and built the community you will be buying in…. while you did jack crap.

Trust me on this, you want Prop 13. Most people own a home for 5 years or less. The Prop 13 inequities are really very minute when you look at the big picture. The key for you when you buy is to make sure Property taxes can not go up at will. I have lived places where this is the case. There are areas of the country where house prices have inflated dramatically despite 2-3% property taxes. If you eliminate Prop 13 watch out for the unintended consequences. I can promise you it won’t work out the way you think to your benefit.

Tank in sight,

WAIT WHAT???

“If you decreased property taxes from 1.1% to 0.5% the vast majority of current owners would be paying far less in property taxes than current.”

the vast majority? Dude, do you know how many people living in million dollar homes pay next to nothing? Here a guy from my family: lives in a multi-million dollar home and pays less than 2500 dollars in prop taxes. He inherited it.

if he pays 0.5% of current market value it wont break him. I PROMISE YOU THAT.

0.5% of 3 million dollar is 15,000 dollars in taxes. He gets an absolute freebie as of now. 15k is not even that much and this guy would not even feel it but its a lot more than 2500. Plus it would lower the taxes for new buyers like myself. For that 700k condo i would only pay around 4k. This is how easy and simple you can fix this mess. The millionaire will finally pay closer to what he should and younger buyers would get a break. Just how it should be.

And I dont care if poorer people pay less…..if you have it equal for everybody (0.5% of current market value) a LOT of people who received freebies finally start paying something! If you think that paying 0.5% in property taxes means the vast majority pays less than you should support my proposal, no? Arent you for lower taxes??

Older folks were once young folks too. They paid 1% of the purchase price in the first year, 1.02% in the next year, 1.04%, 1.08%…. It is a fair system, like accumulating seniority over time.

Millenial,

You are talking about a very small percentage of people, less than 2%.

However one thing we can both agree on is that inheriting property taxes is wrong.

If you actually looked at people who bought in 1990 who still own the home (which is extremely rare)…. you would see they pay about 80%-90% of current market and paid it for 30 years at 2% per year increases. If you get you crash you will pay less than them. They built the community you will be buying in.

Why should property taxes increase more than inflation? Trust me you don’t wan the unintended consequences of eliminating prop 13. Just look at the areas in the country with inflated property taxes and 2-3% property taxes. I can assure you if they eliminated prop 13, taxes would not be 0.5%… but sign me up LOL

Doug,

“They paid 1% of the purchase price in the first year, 1.02% in the next year, 1.04%, 1.08%…. It is a fair system, like accumulating seniority over time.”

Yes…..they paid 1.1% of a very cheap purchase price. We have to pay 1.1% of current inflated, bubble prices….which translates into several thousands of dollars more a year in property taxes…for much less house!

Tank,

“If you actually looked at people who bought in 1990 who still own the home (which is extremely rare)…. you would see they pay about 80%-90% of current market and paid it for 30 years at 2% per year increases.â€

Show us an example!! My bet is you won’t

Socialists aren’t very good with math. Or logic. Their only concern is making sure that anyone more succesful in life than they are is punished.

This is the mentality of a Democrat today: I can give you $100 and your neighbor $200 or I can give each of you $50. They’d rathe lose out on $50 as long as their neighbor loses out on $150.

Socialists like being subsidized by others. Prop 13 is a subsidy program. You’ve got it backwards.

And there is no basis to your example. Under what scenario would the benefits of $100/$200 be reduced to $50/$50? Liberals may have problem with math, but this seems no more than pulling numbers out of one posterior to reach some pre-determined conclusion.

Dan,

Look at tax cuts as the best example. The typical leftist middle class worker got $2K back in taxes. But he hated the tax cuts because evil Mr. Rich White Guy got $50K back. The leftist would rather have $2K less money if it means the rich guy has $50K less.

Socialism does create equality. Everyone is equally poor and miserable. Well not everyone. The leaders of socialist countries always make out like bandits. Fidel was worth billions when he died as was Hugo Chavez. But you know, they are all for helping the little guys and girls LOL!

Well, I’m not a socialist, and I’m really good at math. I just posted this above, but it’s worth repeating. I checked the math, and it’s correct:

The true meaning of socialism and why capitalism wins everytime it’s tried (taxes)

Suppose that every day, ten men go out for beer and the bill for all ten comes to $100… If they paid their bill the way we pay our taxes, it would go something like this. The first four men (the poorest) would pay nothing. The fifth would pay $1. The sixth would pay $3. The seventh would pay $7. The eighth would pay $12. The ninth would pay $18. The tenth man (the richest) would pay $59. So, that’s what they decided to do. The ten men drank in the bar every day and seemed quite happy with the arrangement, until one day, the owner threw them a curve ball. “Since you are all such good customers,†he said, “I’m going to reduce the cost of your daily beer by $20â€. Drinks for the ten men would now cost just $80. The group still wanted to pay their bill the way we pay our taxes. So the first four men were unaffected. They would still drink for free. But what about the other six men? How could they divide the $20 windfall so that everyone would get his fair share? They realized that $20 divided by six is $3.33. But if they subtracted that from every body’s share, then the fifth man and the sixth man would each end up being paid to drink his beer. So, the bar owner suggested that it would be fair to reduce each man’s bill by a higher percentage the poorer he was, to follow the principle of the tax system they had been using, and he proceeded to work out the amounts he suggested that each should now pay. And so the fifth man, like the first four, now paid nothing (100% saving). The sixth now paid $2 instead of $3 (33% saving). The seventh now paid $5 instead of $7 (28% saving). The eighth now paid $9 instead of $12 (25% saving). The ninth now paid $14 instead of $18 (22% saving). The tenth now paid $49 instead of $59 (16% saving). Each of the six was better off than before. And the first four continued to drink for free. But, once outside the bar, the men began to compare their savings. “I only got a dollar out of the $20 saving,†declared the sixth man. He pointed to the tenth man, “but he got $10!†“Yeah, that’s right,†exclaimed the fifth man. “I only saved a dollar too. It’s unfair that he got ten times more benefit than me!†“That’s true!†shouted the seventh man. “Why should he get $10 back, when I got only $2? The wealthy get all the breaks!†“Wait a minute,†yelled the first four men in unison, “we didn’t get anything at all. This new tax system exploits the poor!†The nine men surrounded the tenth and beat him up. The next night the tenth man didn’t show up for drinks, so the nine sat down and had their beers without him. But when it came time to pay the bill, they discovered something important. They didn’t have enough money between all of them for even half of the bill! And that, boys and girls, journalists and government ministers, is how our tax system works. The people who already pay the highest taxes will naturally get the most benefit from a tax reduction. Tax them too much, attack them for being wealthy, and they just may not show up anymore. In fact, they might start drinking overseas, where the atmosphere is somewhat friendlier. David R. Kamerschen, Ph.D Professor of Economics. For those who understand, no explanation is needed. For those who do not understand, no explanation is possible.

Dr Landlord,

You sound like Marie Antoinette. She said “Let Them Eat Cake” while she was eating caviar and filet minion.

That didn’t end well. She was beheaded by the 99% who were tired of eating cake while the 1% kept raising their rents.

Like in a game of Monopoly, true capitalism doesn’t work and is a dismal failure since eventually there is only a 1% and the rest are homeless and starve to death(ie are out of the game). In true Capitalism and Monopoly, there is only one “winner” and most everyone else has starved to death (ie out of the game)

You sound like Marie Antoinette. She said “Let Them Eat Cake†while she was eating caviar and filet minion.

No, she didn’t. That story is apocryphal. And like many people today, you don’t even understand the point of that fable.

That fable, which arose after the Revolution, wasn’t meant to suggest that Marie was cruel or callous. (Think about it –What’s so hard-hearted about consigning people to eat cake, an expensive treat?) That fable is meant to illustrate the entire ruling class’s cluelessness, not their cruelty.

The aristocracy was blindsided by the French Revolution. Most never saw it coming.

As the fable goes, Marie asked one of her courtesans why the Parisian mobs were (yet again) rioting. The courtesan replied that it was because flour was so expensive, the people could not afford bread. So Marie replied, “Well, let them eat cake.”

She wasn’t being callous. She was trying to be helpful. But she was so insulated from reality, she not only didn’t know that cake was more expensive than bread. She didn’t even know that cake (like bread) was made from flour. All she knew was that when she asked for cake, a servant brought it from … somewhere.

There’s no evidence that Marie Antoinette really was this ignorant. But the story does illustrate how the ruling class’s bubble lifestyle blinded them to harsh daily realities, until the Revolution unexpectedly burst that bubble.

Millie~

WHAT freebies are long-term taxpayers getting. I already pay a very high income tax, sales tax, and on and on. My property taxes (back when I owned a house) were not spent on any benefits I or anyone else got. The roads were falling apart, the schools were indoctrination programs (and I had no children in them anyway), bus service (for which we had 4 parcel taxes voted in in the 7 years I owned my house) was nearly non-existent in my area, etc. WHAT FREEBIES ARE YOU TALKING ABOUT?

Son of a Landlord,

Thanks for the background on Marie and it is exactly what I mean.

The rich person gets $1M in spendable income while the poor person gets 2K.

The Rich person looks at the poor person and says “You should be grateful for the 2K and never mind my 1M”.

Meanwhile, the poor person is making 20K per year with a 2K per month rent bill. Does the 2K help? Sure, but the rich person is extremely arrogant in thinking this solves the poor person’s problem. So the poor person runs up their credit cards to pay the bills and that is where we are today.

The last time this happened in the US, FDR was elected for 16 years and we became a Socialist Nation.

That does remind me of a joke.

Trump, Bernie, and a Libertarian are sitting around a table with a plate of 5 cookies. Trump immediately grabs 4 cookies and tells the Libertarian. “You better watch out or that Socialist Bernie will take your cookie.”

Karin,

“WHAT FREEBIES”

I agree that taxes are very high in California. I never asked for higher taxes. I am asking for a fairer allocation. Here is what I mean by freebies:

Long-term tax payers pay next to nothing in property taxes while new buyers (you and I) have to pay 1.1% of the inflated purchase price. The guy next to us, who bought a long time ago for a much lower price has locked in property taxes. Both, he and I are locked in. Our Property taxes will not increase by more than 2% each year.

Obviously, the base is what makes a difference in thousands of dollars between me and him. His base was a cheap purchase price a long time ago. My base is the inflated house price today. He has no incentive to move because he doesn’t want to lose this great benefit. I wouldn’t want that either.

We have situations in California where someone is living in a multi-million dollar home and pays next to nothing in property taxes (a couple thousand dollars is next to nothing compared what a new buyer would have to pay). How can that be? Well, inheritance or someone bought a very long time ago.

Why can we not cap the property taxes for new buyers? 4k max. for instance?

Or Why can we not reduce the percentage of property taxes? Instead of 1.1 do 0.5%.

Most of us know about the debt burden in California (e.g. unfunded pensions), most of us know what property taxes are used for (schools, infrastructure, staff salaries, etc), Most of us know that lower taxes is not what California can afford. Yes, they waste it, you have corruption and stupidity etc.

Bottom line is nobody wants to pay more taxes and California is not going to lower taxes. Prop13 is allocated in a way the that screws those that are buying now and benefits those that bought a long time ago. I mentioned it many, many times and will continue to do so. You have many posters here who even brag about how low their Prop13 taxes are and how enormous their RE market value is.

I have a family member who owns a multi million dollar home and pays less than 2500 dollars in taxes. If i buy a condo (much smaller, HOA’s, less favorable location) i pay MUCH MORE IN TAXES than the guy sitting in his multi-million dollar home. Say i buy a 700k Condo. My property taxes are 8,030. Why should I pay 3 times more in property taxes for much less house???

It has nothing to do with jealously.

It has nothing to do with socialism or communism or Bernie Sanders, or Obama or snowflakes or liberals or weed.

It has to do with common sense and fairness.

Prop 13 greatly benefits a few and sucks the money from people who are struggling to buy their first home. Its so painfully obvious.

There can easily be a better solution to make it fairer. However, we still have lots of boomers who fight against it and the rich of course. Because they love when others subsidize their low property taxes. What gives me hope is the army of renters, millennials and the recent outrage over prop13. We have historic low ownership rates. It just needs to be marketed the right way and it will be repealed. Its just a matter of time.

Millennial~

Let’s skip all the old arguments against and for Prop 13, and get down to the real problem, one that no one has even hinted at so far on this blog. The real problem is inflation, aka debasement of our currency, all done by the banking families that own the Federal Reserve. The last tie our dollar had to anything of value was gold, and that tie was severed in 1971 by Richard Nixon, whereby he declared that not even foreign nations could redeem dollars for U.S. gold anymore. It was after that that inflation went hog wild. It was after that that the U.S. real estate market went into perpetual boom-bust cycles. It was after that that the homeless population started growing, until we come to today where every city and town in America has a homeless problem, mostly due to the high cost of housing.

After I bought my first house in 1998, the comps on my house went up over $5,000 per month, for every month I owned it for the next 7 years. Everyone else’s house price went up too. We had a young guy from Palestine in our department, and one day he commented on the ecstasy of everyone that owned property. Regarding how values were shooting through the roof, he said, “But if everyone looked around, so is everyone else’s house.”

And this, Millennial, is the point. The only time you have the money made from the house’s rise in value to pay the taxes is when you sell it. Then you think you’re rich, until you try to buy another house. That’s when you find that it’s not that the house got more valuable, but that your dollar has lost a lot of its previous purchasing power. The real solution is stabilization of our currency, and not taxing people that are barely hanging on (and I’m talking primarily about older folks on fixed incomes) until they lose the roof over their head, after which they will barely be able to afford a condo.

As Thomas Jefferson once said:

“I believe that banking institutions are more dangerous to our liberties than standing armies. If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their fathers conquered.”

“The issuing power of currency shall be taken from the banks and restored to the people, to whom it properly belongs.”

avi~

Prop 13 only subsidizes our government.

It’s the politics of envy. If the poorer taxpayers save money under a tax law, but richer taxpayers save more than they do, they complain about the law because it benefits the rich more than it does them, and they therefore want the law abolished. They don’t look at the fact that they are saving on taxes as well.

Here’s a perfect example of what I’m talking about:

The true meaning of socialism and why capitalism wins everytime it’s tried (taxes)

Suppose that every day, ten men go out for beer and the bill for all ten comes to $100… If they paid their bill the way we pay our taxes, it would go something like this. The first four men (the poorest) would pay nothing. The fifth would pay $1. The sixth would pay $3. The seventh would pay $7. The eighth would pay $12. The ninth would pay $18. The tenth man (the richest) would pay $59. So, that’s what they decided to do. The ten men drank in the bar every day and seemed quite happy with the arrangement, until one day, the owner threw them a curve ball. “Since you are all such good customers,†he said, “I’m going to reduce the cost of your daily beer by $20â€. Drinks for the ten men would now cost just $80. The group still wanted to pay their bill the way we pay our taxes. So the first four men were unaffected. They would still drink for free. But what about the other six men? How could they divide the $20 windfall so that everyone would get his fair share? They realized that $20 divided by six is $3.33. But if they subtracted that from every body’s share, then the fifth man and the sixth man would each end up being paid to drink his beer. So, the bar owner suggested that it would be fair to reduce each man’s bill by a higher percentage the poorer he was, to follow the principle of the tax system they had been using, and he proceeded to work out the amounts he suggested that each should now pay. And so the fifth man, like the first four, now paid nothing (100% saving). The sixth now paid $2 instead of $3 (33% saving). The seventh now paid $5 instead of $7 (28% saving). The eighth now paid $9 instead of $12 (25% saving). The ninth now paid $14 instead of $18 (22% saving). The tenth now paid $49 instead of $59 (16% saving). Each of the six was better off than before. And the first four continued to drink for free. But, once outside the bar, the men began to compare their savings. “I only got a dollar out of the $20 saving,†declared the sixth man. He pointed to the tenth man, “but he got $10!†“Yeah, that’s right,†exclaimed the fifth man. “I only saved a dollar too. It’s unfair that he got ten times more benefit than me!†“That’s true!†shouted the seventh man. “Why should he get $10 back, when I got only $2? The wealthy get all the breaks!†“Wait a minute,†yelled the first four men in unison, “we didn’t get anything at all. This new tax system exploits the poor!†The nine men surrounded the tenth and beat him up. The next night the tenth man didn’t show up for drinks, so the nine sat down and had their beers without him. But when it came time to pay the bill, they discovered something important. They didn’t have enough money between all of them for even half of the bill! And that, boys and girls, journalists and government ministers, is how our tax system works. The people who already pay the highest taxes will naturally get the most benefit from a tax reduction. Tax them too much, attack them for being wealthy, and they just may not show up anymore. In fact, they might start drinking overseas, where the atmosphere is somewhat friendlier. David R. Kamerschen, Ph.D Professor of Economics. For those who understand, no explanation is needed. For those who do not understand, no explanation is possible.

Ahem, that last line is directed to you, Millie.

Karin,

my response never showed up…i’ll try again.

short version…..the message of your post makes sense but it has little to do with prop13.

In your beer example everyone gets the same beer. The rich pay more.

In prop13’s case, many rich people and many boomers (not all) pay a very small percentage of their current property value in taxes. New buyers pay 1.1% of the highly inflated purchase price (often several thousands of dollar more than the guy next door, for the same house). The rich/many boomers get a benefit that we all have to subsidize. The rich keep RE in their dynasties and the offspring inherits the locked in property taxes.

You cant have someone in a little condo pay multiple times more in property taxes compared to someone living in a multi-million dollar house. But thats the current state.

Its socialism for the ones that dont need it. But it can easily be changed….just educated the millennials and renter nation. The moment they understand this scam it will be gone.

I just posted this under the previous topic, but it is much more apropos to this topic, and since it was the last post for the July topic, it can also be one of the first for the August topic.

There is a very interesting article in today’s OC Register by Jeff Collins about accessory dwelling units (ADUs). In 2017 state laws took effect that made it easier to build these small add-ons. Almost 5000 such permits were issued by municipalities in 2017, which is a 60% increase over the previous year. LA and Orange Counties had a 122% increase. And in 2018, the permits are up 78% over the first half year compared to 2017, with LA/OC up 125%! The boom is less evident in the I.E. where housing is cheaper.

Some people are adding them for elderly parents, but others are building them as rentals. One fellow in the SF valley got into trouble when the inspectors found an un-permitted rec room in the garage. He spent $5K to remove it and is awaiting a new inspection to remove the city lien on his property.

The big concern among neighbors seems to be parking for rental units. I think we can foresee cities adding increased parking spaces to the requirements for ADUs unless there is something in the new state laws that block this.

I love more ADUs!

Who cares about more cars….we need more supply of housing! Way more!

Is that you, Milli?

This ADU news was posted in the previous thread, and you pretty much posted the same response.

Are you now trolling under multiple handles?

“Who cares about more cars…” I do. Do we need more parking impacted neighborhoods?

“Is that you, Milli?”

I’d bet money on it. Looks like he posted under several different names toward the end of the last thread.

Even though Millie says he has all the time in the world to wait this bubble out, I don’t think that is the case. I’m sure pressure to buy is starting to show itself. We’ve had several of these bear bloggers in the past (post all day long under multiple handles) and then they just go away one day. Likely after swallowing their pride and buying a house.

Lord,

What pressure are you referring to? I pay a very small percentage of my gross income for rent. I get paid to wait. I would lose if the market goes up in a straight line but people with a half brain know that markets move in cycles.

If you think I buy anytime soon you are dead wrong. I have to say though, some price drops I have seen lately are remarkable. People trying to cash out before/duuring summer are now lowering prices by a significant percentage. Have seen a nice home in the high 800’s that is now on there for 700 (after three months of no offers according to the realtard). Not that I believe him but that is a huuuuge drop. Also, realtards are willing to write low ball offers now, something they weren’t willing to do a while ago.

We’ll see…. if you think I am disappearing anytime soon you are dreaming. Next year is going to be interesting. Rates are rising, we are due for a recession and the tax reform will kick in.

Millie, for every person like you with an unlimited time horizon there are probably 20 people with pressure to buy. Spousal pressure, family pressure, safety and security for kids, etc. Most people with kids wouldn’t even think about getting a cheap rental in a part of town with bad schools. And there it starts. If you want to live in an area that is safe, good public schools, close to job centers…you will pay dearly whether you buy or rent, it is that simple. And that is why certain areas have such sticky prices.

Lord, you are correct.

Utilizing a cheap rental to save lots of money doesn’t work for everybody.

No secret here, I stated many times I am not the avg. Joe. But that doesn’t mean you have to buy! Why cant “they” just rent a nice place?

Your BUY PRESSURE statement is misleading (purposefully).

From a financial perspective it doesn’t even make sense, that’s why you avoid the numbers. You are going for the emotional aspect, because that’s what is driving the decision to buy for many people.

Let’s look at it in more detail:

You mentioned “spousal pressure”

I agree, if you marry someone with expensive taste you are screwed (Either way). But that was your choice. In most cases, having money in the bank goes long ways though. Just show the well-stocked bank account and/or rent a nicer place.

You mentioned “family pressure”

Your parents?

Sure. They want you to buy because they might not understand prices can also fall. When they bought a long time ago prices were cheap and it paid off nicely.

But all of us here know that prices can fall and will fall.

Your in-laws?

Absolutely, your in-laws want financial security for their daughter. They might even judge you by the size/quality of the house you buy for their daughter.

That can be a 15 min conversation though. If you show them evidence of your funds in your bank account it can do wonders to reassure them.

Safety for your kids:

That’s dumb. The rent I pay is dirt cheap but hat doesn’t mean its unsafe here. I don’t have to explain that? Are richer kids all saints and don’t bully you kid in school or beat it up? Can an instructor/coach at your sports club, school or someone in your family not be a pedophile? What about break-ins. Do you think its more likely someone will break into a cheap rental versus a nice house? What’s there to steal in a low-income neighborhood?

Again, if you want to live in a nicer area, just rent in a nicer area. You still save a lot compared to buying. If you feel pressured to buy (renting money from the bank) instead of renting from a private landlord, maybe you are too weak to hold your ground. Most of the time, you argue with numbers. Just show a rent vs. buy calculation and consider the new tax laws (24k standard deduction for married couples and 10K cap (SALT)). Numbers don’t lie.

Lord, you are correct.

Utilizing a cheap rental to save lots of money doesn’t work for everybody.

No secret here, I stated many times I am not the avg. Joe. Why cant “they” just rent a nice place instead of buying?

Your BUY PRESSURE statement is misleading (purposefully).

From a financial perspective it doesn’t even make sense, that’s why you avoid the numbers. You are going for the emotional aspect, because that’s what is driving the decision to buy for many people.

Let’s look at it in more detail:

You mentioned “spousal pressure”

I agree, if you marry someone with expensive taste you are screwed (Either way). But that was your choice. In most cases, having money in the bank goes long ways though. Just show the well-stocked bank account and/or rent a nicer place.

You mentioned “family pressure”

Your parents?

Sure. They want you to buy because they might not understand prices can also fall. When they bought a long time ago prices were cheap and it paid off nicely.

But all of us here know that prices can fall and will fall.

Your in-laws?

Absolutely, your in-laws want financial security for their daughter. They might even judge you by the size/quality of the house you buy for their daughter.

That can be a 15 min conversation though. If you show them evidence of your funds in your bank account it can do wonders to reassure them.

Safety for your kids:

That’s dumb. The rent I pay is dirt cheap but hat doesn’t mean its unsafe here. I don’t have to explain that? Are richer kids all saints and don’t bully you kid in school or beat it up? Can an instructor/coach at your sports club, school or someone in your family not be a pedophile? What about break-ins. Do you think its more likely someone will break into a cheap rental versus a nice house? What’s there to steal in a low-income neighborhood?

Again, if you want to live in a nicer area, just rent in a nicer area. You still save a lot compared to buying. If you feel pressured to buy (renting money from the bank) instead of renting from a private landlord, maybe you are too weak to hold your ground. Most of the time, you argue with numbers. Just show a rent vs. buy calculation and consider the new tax laws (24k standard deduction for married couples and 10K cap (SALT)). Numbers don’t lie.

“If you want to live in a nice area, just rent there.”

That’s the problem right there. Contrary to what you say, getting a cheap rental in a nice part of town is next to impossible. And if I am wrong, send some links as evidence. When people look at rental prices for 3/4 bedroom homes in nice areas, they soon realize buying isn’t that much more. There are problems with kids in wealthy areas, but I’d rather deal with these problems then send my kid to a ghetto school where you are surrounded by gang bangers, low lifes, non english speakers, etc. The chances of somebody thriving in that environment is very low…

Lord,

““If you want to live in a nice area, just rent there.â€

That’s the problem right there. Contrary to what you say, getting a cheap rental in a nice part of town is next to impossible.”

What is wrong with you? When or where did i say cheap rental in a nicer area???

Of course you pay more rent in a nicer area!? Thats why i dont rent there.

But renting in a nicer area is still WAY more inexpensive than RENTING MONEY FROM THE BANK (“buying”). That changes when we get a crash, which it looks like we are headed to.

You probably still dont get this. One more time….renting in a nicer area is still cheaper than buying in a nicer area…..during a bubble….in California…..no rental parity……buyer loses, renter who saves money wins when he buys during the crash…..not that hard? ….for some it is….

I posted it twice because as I explained, it was more relevant here, and it was at the tail end of last month’s blog. I agree with Millie about 10% of the time.. sometimes more sometimes less. I think Millie adds an important point of view as do you. If everyone who posted agreed with me, there would be no purpose in having this blog at all.

BTW I haven’t gone back to last month’s blog to see if there were any responses. Since I posted both on the same afternoon (before and after this thread appeared), I figured the action would be here.

It is possible for two people to share the views everyone. Geez.

Joe R. I researched building an ADU on my property in SoCal. We have a perfect setup for a rental property, but they way my town handled the new law was to make it easier to build an ADU only in the lowest density zone up in the hills where they are least likely to actually be built because of the proximity to bus routes requirement. In the medium density zoning where I live, they actually eliminated the possibility of ADU and increased the parking requirements for a second unit making it more difficult to convert to a multi-unit property. Each unit on the property now must have a 2-car garage! Meanwhile there are many properties in my neighborhood where a single unit doesn’t even have a 2-car garage, plus many un-permitted second units…

I kinda figured they’d use parking to get around this new law. Right again!

I’ve been fighting the City of Burbank for two years now. I originally wanted to demo my garage and attach it to the back of the house and add a master bedroom and bath. They made it damn near impossible. Then came the ADU’s so I had plans drawn up for the ADU to 740 sq. ft.. They turned that down said I can only have 500 sq. ft.. I’ve been waiting over six months now for the plans to get through plan check.

I have plenty of parking on my property. Burbank requires two spaces for each unit. Right now now I have three vehicles, a RV, and my toy trailer parked on my lot. When completed I’ll have two vehicles in the garage. And rest at the rear of the property.

I agree prop. 13 needs to be phased out over time. It really isn’t fair to young people.

Regarding Prop 13, ending it is NOT going to lower property taxes for young people. It’s only going to INCREASE taxes for longtime home owners. Also, new buyers (‘young people’) lose their future protection against out-of-control tax increases. Why doesn’t anyone on this board understand this?

Karin: Why doesn’t anyone on this board understand this?

Some do, but don’t care.

Milli will happily suffer more, provided that others suffer way more.

The nine most terrifying words in the English language are “I’m from the government, and I’m here to help.”

– Ronald Reagan

I know someone who moved out of their two bedroom Tudor revival bought in the late ’70s into a much larger ranch house (built maybe 10-20 years later) in a better neighborhood with the inherited Prop 13 tax break. I think the taxes are probably about the same, or maybe slightly more on the Ranch house. They leased the Tudor out on a long term lease before rents skyrocketed. Now they’re planning to move back to the Tudor, sell the Ranch and possibly buy something else nearer the beach in a County where you can transfer the Prop 13 benefit. We’ll see how that plays out.

People stop using “crash”. It did crash last time and you still missed out. Prices will drop but there won’t be a elf waving a banner saying Today Is The Ultimate Bottom.

Don’t you know that clicking your ruby red heels together three times while repeating on housing blogs over and over “there’s a crash just around the corner†will make it so?

Andy, in California it crashes every ten years. A severe crash is right around the corner. I did not miss out last time….it just finished school. That like saying you missed out in the 80s….no, I was just born. Millennials did not have a buying opportunity yet. It’s all about timing. Once we get a crash we buy of course. Has to be a biggie though 🙂

@Millenial

At least you got your crypto crash. 1 out of 2 isn’t bad.

Very true And thank goodness….imagine BTC would not have crashed…I wouldn’t be able to buy as much. Remember, buy low, sell high. Not the other way around!

Prop 13 won’t be repealed outright; they’ll end up using ballot initiatives to chip away at it to the point where the tax savings only apply when the home is a primary residence.

The big thing that is absolutely coming down the pipeline for SoCal (particularly the expensive coastal cities) is widespread rent control. Demographics guarantee it. The millions and millions of central and south Americans are going to continue to flood in, voting democrat. Dem politicians will go for easy wins with these (average 90 IQ) folks, and since they’ve already painted “the 1%”, white people, and capitalism as their boogeymen, it’ll be easy to keep pushing that window to include anyone with property to rent out…. and voila! Rent control. It’s an absolute, 100% guaranteed inevitability.

It won’t stop at just being only for owner occupied properties because people will lie. It’s going to eventually be made nearly impossible to get the prop 13 subsidy. It’ll be in name only and we’ll not only see its demise, but the other taxes which have been raised to accommodate it in the past won’t be lowered after the fact.

State and local governments are probably looking under every rock for any missing tax revenue or trying to find ways to change old laws just to keep the pensions going and other services in my opinion. When I read most homes in Cali are second homes. Means most of these people probably live out of state or different counties. Sure seems like a big imbalance in taxes and pensions and other bills.

You have it backwards. People withs second homes are ideal home owners. They pay taxes yet use very few, if any, tax provided resources. Those and seniors are what you want in your state/city from a tax payer / service user ratio. Seniors are great since they have no kids in school, don’t commute to a job (hence don’t contribute to traffic) and spend more than they save.

I might have it backwards. However, if the ideal home owners didn’t live in their towns or counties and putting money back into those towns where they got pensions or using their retirement savings in those locations they are slowly draining these locals tax revenue and assigning it somewhere else. Good for the other location. Not so good for the other towns.

Many local governments will likely be more dependent on keeping property taxes up and sales taxes to maintain pensions and other vital services, which are currently sending smoke signals.

https://www.ocregister.com/2018/04/23/the-realities-of-californias-pension-crisis/

“People with second homes are ideal home owners. They pay taxes yet use very few, if any, tax provided resources. Those and seniors are what you want in your state/city from a tax payer / service user ratio. Seniors are great since they have no kids in school, don’t commute to a job (hence don’t contribute to traffic) and spend more than they save.”

In the end it doesn’t really matter as each towns grow they will shrink and other small towns that saw zero tax revenue growth will see a turn around. Either way if towns are not managed right or don’t bring in the type of economic development or government services it will likely not last long. Second Home owners and Seniors may not hang around to support those city/county taxes. Prop 13 is just one of items once you decide to remove this it could potentially send a shock to the system and it may be wise to leave and wait for the dust to settle in my opinion.

Home of genuis: https://www.redfin.com/CA/Santa-Monica/3014-7th-St-90405/home/6778152

Price: $1,650,000.

Lot size: 2,482 sq ft.

Home size: 2 bed, 1 bath, 704 sq ft.

Built in 1909.