The making of a housing market – like a Hollywood set, housing inventory looks to be low only because that is what is being presented. Orange County foreclosure pipeline twice the size of non-distressed MLS inventory.

The decrease in nationwide inventory is an ongoing trend. Keeping supply constricted has clearly helped with pushing prices higher as demand is now competing for a smaller number of homes. A lower mortgage rate has also pushed the monthly payment amount lower thus allowing home buyers to purchase more home with stagnant income levels. The recent employment report should come as no surprise. The recent moves in the housing market are spurred on by record low interest rates and constrained inventory. Yet this should not be mistaken with an improving economy that is pushing prices higher which would be healthier. We have a limited horizon before the summer selling season comes to an end and the market is put to a bigger test in fall and winter. Looking at market data from a variety of perspectives shows that the market is far from being normal.

Orange Country Snapshot

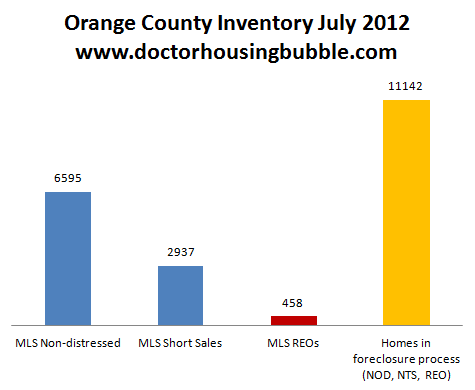

Orange County is seeing a solid jump in sales this year. We have seen a good amount of short sales hit the market recently. If we look at MLS inventory and last month sales we have approximately two months of inventory! This is back to the days of the mania. Yet this is only part of the story. Take a look at the total Orange County market:

Short sales are a big part of the visible MLS inventory making up roughly 30 percent of all inventory. Look at how tiny the REO listings are. But take a look at the yellow foreclosure pipeline. These are homes in the foreclosure process. This figure is nearly twice the size of the non-distressed visible inventory. These are households unable (or unwilling) to pay their mortgages in an expensive county. Does that seem healthy to you? Just because banks are selectively leaking out inventory does not mean the market is healthy.

It is an interesting observation on human behavior when you examine the thought process of those buying.

“Banks can do whatever they want and I need a home to start a family.â€Â

“These record low interest rates are making it tempting to buy.â€

It is fascinating that many do thoroughly understand what is occurring. That is, the market is like a Hollywood set and is fake. It is a façade yet the financial system that proclaims “free market†capitalism all the way through is more than willing to let a command-control housing market take place. The irony of this all is that many of the programs holding up the market (i.e., FHA insured loans, GSEs MBS, etc) at their core are set to keep housing affordable for Americans.

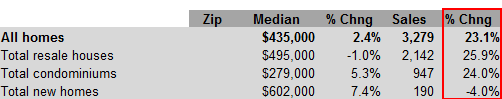

So what you see for example in Orange County is a surge in home sales:

Price gains are seen in condos and new home sales. Prices declined a bit in resale homes. The jump in sales from last year is solid.

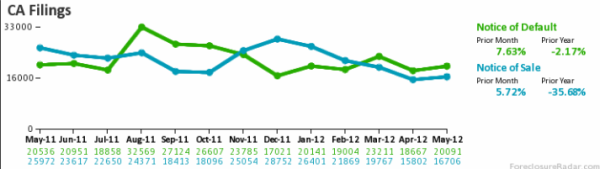

Foreclosure filings still occurring

In spite of home prices moving up and visible inventory going down, foreclosure filings are still occurring at an elevated level:

These are fresh filings entering the pipeline. These are filings that will go to the yellow column above. The good news is that year-over-year the number of filings has declined substantially. This is a positive for the market. At this rate we are years away from any semblance of a normal market.

What needs to be taken into context as well is the desire to modify loans and also, the jump in short sales. Banks seem to be willing to agree to short sales (if a place like Orange County has 30 percent of visible MLS inventory as short sales this is definitely a strategy that is being pursued). Short sales by definition will likely push prices lower in metrics like the Case-Shiller that look at repeat home sale.

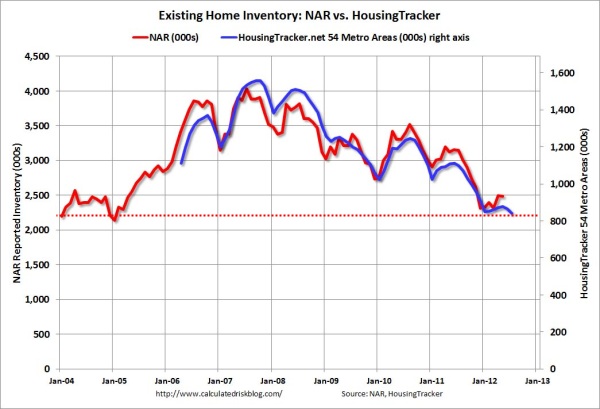

Nationwide inventory

The trend of lower inventory is occurring on a nationwide basis:

Inventory is back to levels last seen in 2005. The strategy of leaking out inventory in a controlled fashion while leveraging low mortgage rates seems to be the ongoing plan. If you speak with many investors in the trenches their investment strategy really is dependent on the moves the banks and government make. If you truly looked at the market as being transparent and open, you would likely jump in with both hands since visible supply is low and demand is still there. Yet you are contenting with a multitude of other factors:

-If the market is healthy, why are we seeing a large number of short sales?

-If supply is so low and demand is here, why are banks restricting inventory?

Bottom line, banks are trying to maximize profits via re-writing accounting rules and using massive government bailouts to their benefit. Short sales do better than foreclosures. Constricting supply obviously will push prices higher. The Fed owns trillions of dollars in MBS and we are left with a record low mortgage rate. The market is looking for lower priced housing while the financial system is determined to do everything to keep prices inflated. Financial scandals are hitting left and right and no solid reform are ushered forward.

Moving in with mom and dad

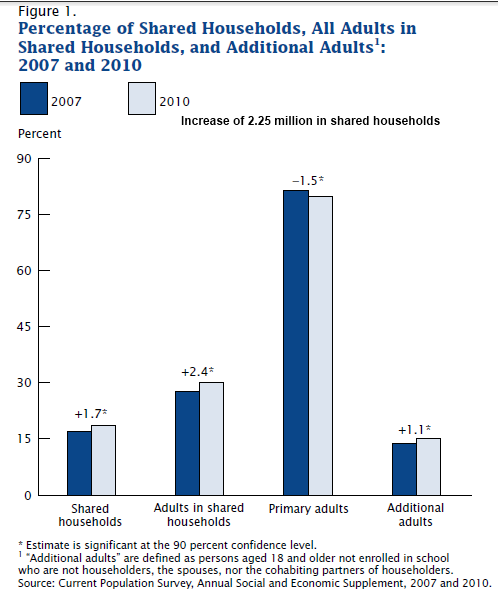

The increase in prices and sales is a short-term trend unless the overall economy gains traction. What will be important to see play out over the next decade is how younger Americans will perceive housing. This will be a less affluent generation. Many are already massively in debt for their pursuits of a college degree. Since the recession hit, many have moved back home with parents:

2.25 million adults have moved back home for a variety of reasons since the recession hit. You wonder if this generation is willing to dive into massive debt to purchase a home simply because a mortgage rate is low. How many will qualify if they have lower wages, a bigger student debt obligation, car loans, and other forms of debt?

What is more likely is that demand for rentals in the short-term will be stronger and we are seeing this with increases in rent nationwide. You also see many of these people unable to qualify for mortgages in a tighter lending environment. The typical pattern goes:

Live at home >> go to college >> rent >> buy a home

In the past it was easier to go into the workforce as a blue collar worker and still qualify to purchase a home. Yet many Americans are now competing for lower paying service sector work so college or vocational training is the only route to a stable lifestyle and what one would consider middle class. Couple this with the massive baby boomer wave of retirements and we are certainly entering a different time.      Â

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

82 Responses to “The making of a housing market – like a Hollywood set, housing inventory looks to be low only because that is what is being presented. Orange County foreclosure pipeline twice the size of non-distressed MLS inventory.”

In 2013 you have to question the Short Sale strategy. If Congress doesn’t extend the Mortgage Debt Relief Act, all of those who do short sales will be on the hook with the IRS for their principal forgiveness.

Not true. Anyone in CA who has not re-fied can short sell without any tax implication because the loans are non-recourse. In addition, anyone who meets the IRS’ definition of “insolvent” can short sell with full recourse loans and face no Federal tax implications.

Incorrect the non recourse does not relate to tax consequences. After Dec 2012 You will be issued a 1099 and be liable for the tax. This will bankrupt the majority of short sellers.

Sorry but you are wrong on this, plain and simple. Non-recourse loans by their very nature do not allow the pursuit of any assets to satisfy the loan – the lender can only take back the property. As there is no legal entitlement to pursue money from the borrower beyond taking the property, there simply is no “debt” that survives a short sale or foreclosure, and therefore no cancellation of debt exists that can be taxed. This is not part of the Mortage Debt Relief Act – this is a pre-existing and free-standing provision in the Federal tax code.

IRS Publication 4681 is very clear on these issues, which also include the insolvency exception that gets many underwater borrowers with recourse loans off the hook for debt cancellation tax.

My recommendation to everyone is to read the tax code and if you don’t understand it go see a tax attorney (who will tell you what I just told above).

Wrong!

http://www.irs.gov/individuals/article/0,,id=179414,00.html/

Straight from the horses mouth!

The following are the most commonly asked questions and answers about The Mortgage Forgiveness Debt Relief Act and debt cancellation:

What is Cancellation of Debt?

If you borrow money from a commercial lender and the lender later cancels or forgives the debt, you may have to include the cancelled amount in income for tax purposes, depending on the circumstances. When you borrowed the money you were not required to include the loan proceeds in income because you had an obligation to repay the lender. When that obligation is subsequently forgiven, the amount you received as loan proceeds is normally reportable as income because you no longer have an obligation to repay the lender. The lender is usually required to report the amount of the canceled debt to you and the IRS on a Form 1099-C, Cancellation of Debt.

Here’s a very simplified example. You borrow $10,000 and default on the loan after paying back $2,000. If the lender is unable to collect the remaining debt from you, there is a cancellation of debt of $8,000, which generally is taxable income to you.

Is Cancellation of Debt income always taxable?

Not always. There are some exceptions. The most common situations when cancellation of debt income is not taxable involve:

Qualified principal residence indebtedness: This is the exception created by the Mortgage Debt Relief Act of 2007 and applies to most homeowners.

Bankruptcy: Debts discharged through bankruptcy are not considered taxable income.

Insolvency: If you are insolvent when the debt is cancelled, some or all of the cancelled debt may not be taxable to you. You are insolvent when your total debts are more than the fair market value of your total assets.

Certain farm debts: If you incurred the debt directly in operation of a farm, more than half your income from the prior three years was from farming, and the loan was owed to a person or agency regularly engaged in lending, your cancelled debt is generally not considered taxable income.

Non-recourse loans: A non-recourse loan is a loan for which the lender’s only remedy in case of default is to repossess the property being financed or used as collateral. That is, the lender cannot pursue you personally in case of default. Forgiveness of a non-recourse loan resulting from a foreclosure does not result in cancellation of debt income. However, it may result in other tax consequences.

These exceptions are discussed in detail in Publication 4681.

Well if the act expires, and you question the short sale strategy, what is left for homeowner to do? Loan mod? Nope, those are usually denied.

Homeowners will be trapped.

Thoughts.

I don’t live in SoCal, but I see some similar tactics by agents, lenders, and banks in our local residential market. Since March, RE agents have taken steps to limit publicly available information essentially scrubbing all transaction and sales summary details from the newspapers. On radio shows and in print, agents talk-up the lack of inventory, “stable and rising” prices, and “once in a lifetime” opportunities for investors. To me this smells like collusion in an attempt to take control of what is obviously a bad situation. Is it legal? I guess anything goes these days and if the Public gets screwed, so what?

One loud-mouth agent even has an “Ask Dave” column where he solicits questions from RE “investors” and dispenses self-serving answers that no registered financial advisor could get away with. IMO we are witnessing another RE bubble/fiasco in the making, fueled again by stupidity, greed, and an unholy alliance between RE agents, brokers, and banks.

Jon,

What collusion? I became a principal real estate broker in 1992. In 2003 I warned my first Buyer about the housing bubble. By 2004 I was getting pretty pissed at how dumb everyone seemed. Americans generally know more about how their computer works than they do about their economy. Mention fiat money and eyes will glaze over. How about Austrian economics vs Keynesian. This is so econ 101 but people are utterly clueless. By 2005 there were bankers, mortgage and real estate brokers telling anyone who’d listen that we were in a very dangerous housing bubble. Our politicians and our media ignored us. I can’t tell you how many people I warned including MY own Sellers and Buyers.

You know. the funniest thing was most of people I warned simply didn’t believe me because I was not ‘important enough and am without economic credentials’ and bought or over-priced their homes anyway! T

he collusion if it exists was one of ignorant denial.

Now here’s a big tip for you. America’s economy is GOING to fail. If you want to buy any real estate then be smart NOW! Buy at least 5 acres and any kind of home you can afford to go with it. Be rural. The property should have a good year round water supply and plenty of fuel (wood). You’ll want to be able to feed yourself and defend yourself there. Tural Oregon west of the Cascades is very good.

OK, do you think people will listen to me this time?

I seriuously doubt it. But I’m telling you Jon, I’m right again. I read plenty, and I know I’m right.

Real estate agents don’t know any more than the average Joe does, and they are not influential at all, so your comment is way off base. You can look negatively at agents for selling homes in these times, but no one is twisting any buyer’s arms to buy.

Yet another cute, overpriced house in my ‘hood that will sell quickly. Suckers abound…

http://www.redfin.com/CA/South-Pasadena/1724-Monterey-Rd-91030/home/7006570

there is a saying in the finance world, there is a sucker born every second ..

Rhiannon,

I agree, many “cute” homes in Pasadena are definitely overpriced. I once went to an open house for a small bungalow in Madison Heights that was built in the 1920’s, had only 1000 sq feet and a one car garage with musty smelling drywall slapped on the sides touted as an “artist space”. I doubt the space was permitted, not to mention it looked to be in terrible shape. All interior fixtures looked like the originals. The asking price? $700k.

City of South Pasadena is even pricier…

It’s just what the market will bear… No one is blindly jumping into housing anymore.

It may be “overpriced” to you… But it’s called capitalism.. (even if it isn’t very transparent like the Dr. spoke). The banks OWN all these homes.. They can hold onto them as long as the government keeps feeding them free money. Which i don’t see ending with an Obama or Romney presidency. Do you really think Romney will stop feeding the beast?

It’s time to accept we are in a rigged and propped up system and start playing the game by the “new rules” our government and banks have set for us.

The alternative would be short-term chaos… Everyone that bought a home in the last 10-15 years would lose it.. And all the renters would then swap places with them at much lower prices.

It would be a chaotic few years where banks would literally have to be nationalized in order to keep them open. Otherwise everyone’ s ATMs would stop working tomorrow if banks had to sell all there homes at fire sale prices.

It’s very similar to our federal deficit… We can’t pay it off.. without a long massive depression. The same with housing.. banks would all go bankrupt and all your money in the bank would be lost… unless you keep in under a mattress.

This is wrong on so many levels. Have you not paid attention to what has happened over the past five years? The banks do not OWN the mortgages, they SERVICE the mortgages. The OWNERS of the mortgages are the GSE’s which are OWNED by the federal government, MBO’s which the Fed and Treasury has bought trillions of dollars worth from the banks. The Fed/Treasury OWNES trillions of dollars worth of the MBO’s mortgages. The majority of mortgages are directly or indirectly OWNED by the federal government. The banks collect service fees will little to no exposure while quietly getting the “toxic†loans off of their balance sheet. Oh, and the federal government OWNES AIG which is on the hook for insuring the “toxic†MBS that are still outstanding. This is not your father’s banking system of taking in savings and loaning it out to home buyers. That ship sailed long ago…

To What!?,

Ok, how does this change anything if the FED really owns the mortgages or not. Either way we are destined for a long, slow stagnant decline at worst. The only fire sale homes will hit the market at this point is in a very controlled manner. We actually both agree there is no light at the end of the tunnel currently.

I just think a fire sale and liquidation of all real estate, what many on this site agree is the solution… Would cause far too much short term chaos for our govt to effectively manage. Also unintended consequences of a liquidation would be high crime, riots, and potential financial collapse.

@ Not

So the “solution” is to continue the madness? If the insolvent banks were allowed to fold in 2008, we would have suffered 6-12 months of ugliness. Yes, the government would have had to print a couple of trillion to protect depositors and pension funds, but the bad debts would be gone, and new banks established.

We now have zombie banks, a zombie housing market, and the federal government hooked like a pathetic heroin junkie on ZIRP, with Ben Bernanke as the dealer. I have no idea how it will end, but I suspect it will not end well for the average Joe. A history of the French Revolution might offer a hint to where we’re headed.

We could easily pay off the debt with almost no problem at all.

Obama has the authority to mint platinum coins and could mint $16 Trillion easily. We “printed” that and gave it to the banks already with only a minimal level of inflation and could do it again.

I don’t expect the housing debacle to be fixed by any actions in government. Democracies (even representative democracies like ours) are very stable because mad swings in direction are unlikely to be supported by a majority at any one time. The downside is that we’re also reactive versus proactive. We cannot convince a majority that we should take action or shared sacrifice when everyone votes for his or her own interests. Nobody can promise exactly what will happen if we kick the can, but we know that we’ll face minor chaos if the market is allowed to level out naturally – everyone in government will be voted out at the next election. Who is the person willing to sacrifice his or her lucrative political career to be proactive on something that may not happen?

The only viable solution I see is letting the air out of the balloon slowly – popping it is just too risky. From the banker’s perspective, they have nothing to lose by holding back inventory. All the risk arrives with the market completely tanking. So what to do?

1. Wait and rent. Could be waiting a really long time. 2. Buy an overpriced place. Kick yourself in 5 years when prices are about the same or less. 3. Sit and complain.

I say at least make a conscious choice, rather than #3 where a choice is made for you. We’re over a barrel anyway, we might as well select the barrel.

I’m with Jimmy. First, a majority of the nation is in OK shape in terms of RE situation in terms of median income and median RE prices. (Coastal areas, primarily are the only ones still grossly overvalued). A pop would have had dire unintended consequences, plus to his main point, politicians aren’t wired like that…they simply want reelection. And, it’s a sure thing that they’d have been kicked out if there would have been a short term crash/cleanse. So, here we are, predictably kicking the can down the road 5 years after the crash.

Apart from that, a nuance to his rent versus buy scenario…

Many people (like myself) are renting in a sub-par situation and trying to stash cash quickly as possible for the next opportunity to buy in the $400-$600k range. I’ve been thinking more and more of renting a much nicer place, say “fuck it” with waiting all this out, and lose my hedge that things will turn up in a year or so (we’re all talking desirable Coastal So Cal, are we not?). I’ve got two kids, 6 and 9, and they’re growing up fast. Things might not get sane for another 10 years!

Jimmy, I think you hit the nail on the head. Anybody on the fence should ask themselves the following questions:

1. Do you think home prices will still come down by 10 or 20%? I don’t.

2. Do you think interest rates will go up to historic norms anytime soon? I don’t.

3. Do you think the PTB can keep manipulation going well into the future? I do.

4. Do you think rents will be rising in the near future? I do.

Based on that, if you can find a place near rental parity and borrow sub 4% money…it might be time to get off the fence. For people who have patiently waited the last 5 years, are you prepared to wait ANOTHER 5 years for potentially lower home prices?

I think this whole situation sucks, but it is what it is. The PTB hold all the cards, we’re just pawns in the game. Like I mentioned below, I’m actively looking and planning on being in a house before the end of the year.

That first sentence of yours is utter bull. Sounds like realtor self serving crap. No one is blindly jumping into the market? Look at those houses at high six figures in S. Pasadena. Anyone who can afford those homes should be able to buy much better quality real estate. Those are average homes priced in the top 4% of income. Blindness is clearly rampant if folks are throwing cash at that trash.

That is one very cute vintage house but it is laughably overpriced. Additionally, the baths were redone in a manner completely out of character with the house, and in a faddy style that will look sadly dated in a decade, while old 20s vintage baths still look cute if they’re in good condition.

$450K would be more like it. But then, I’m in Chicago and really don’t know your market.

Here’s another one, pending sale. People snap up these places because of the school dist. test scores at SPSD. People are nuts, as I always say!

http://www.redfin.com/CA/South-Pasadena/805-Garfield-Ave-91030/home/7006372

Wow…can you spell s-t-a-g-e-d?

Thanks Doc. You’re like a lighthouse in rough weather. You help us keep our bearings by pondering stubborn facts.

Give this one a head scratch. Maybe the reason the banks are opting for short sales is that, in addition to sustaining a smaller loss – maybe they’re making these short sellers take on a note for part of the deficiency. Maybe they’re doing that to let you out of your plywood prison when you don’t qualify for hardship which is what used to be required on a short sale; e.g. loss of job, death of principal mortgagor etc. For people who have a problem taking the “walk away” route (maybe their employment won’t accept a foreclosure on their credit) they are paying a ransom in the form of a personal deficiency note.

Is anyone tracking this?

By the way Doc, thank you for all the work you do. You are a great friend to have in interesting times 😉 You are the best bar none!

Parts of OC are like an episode of a Real Housewives fantasy; I’ve come across many people living a high end lifestyle, although few seem to have real “jobs” or hard income professions, many “entrepreneurs” and “consultants”, often they’re attention junkies…eventually delinquencies, short sales, foreclosures, evictions, etc. come to light, but somehow, usually within a year or two, these types are BACK, bigger and badder than ever, as if nothing ever happened, appearing refreshed after recent plastic surgery, driving an expensive car, once again living in pricey digs. I wonder, where does the seemingly endless money or credit come from? I’ve seen it happen over and over again over the years, not sure how its done. Reminds me of cockroaches…spray ’em, kill ’em with fire, they’ll be back, bigger than ever.

Couldn’t agree more, I can’t wait for the day when living like that simply won’t be POSSIBLE for those characters, no matter how much they desire to do it. I thought the 2008 Crash would be their last hurrah, but like you say, a lot of posers have somehow found a way to keep the mirage going. (Bank bailouts, still-easy credit) These clowns make the responsible folks look like stale farts or losers for not “knowing” how to play the game the right way and always being “behind”. I may die waiting for it, but I do look forward to that day.

thank you Dr. HB.

Looks like a nationally rigged market by the banks/Fed for the sole benefit of propping up existing loan portfolios from the bubble years.

@ Art. I think you are right. Why else? If these foreclosures are costing the banks so much as our president and his opponent say they would dump them by the tens of thousands and they are but only to the corporate investors who are able to buy them with pennies on the dollar. The system is so rigged and I need a place to live badly. No longer can I afford renting so I need to buy a small place. I finally figured that my only choice is an over 55 complex where the homes are very slow to sell. Guess the investors don’t want to mess with them. It is so depressing but I have to live somewhere. Those poor souls who think this Soviet “market” is natural and normal are about to be swindled – again. There must be places in the US where the market is more normal than anyplace on the coast of California – maybe areas like Portland or Boulder where they did not have a huge housing bubble. It feels more sane in those places. I could be wrong of course.

Any chance this frenzy might ease up a bit in the fall and winter?

No one knows. The seemingly bank/fed tactic of slow-release is just now beginning to get written about. Nobody knows what will happen next, or if this slow-release mechanism is going to last.

Many people still cannot sell due to being underwater and not being able to get approved for a short sell. In Nevada, folks are underwater by 50-70% – what kind of short sell prices could be approved on those situations?

It’s the wild-wild-west out there.

You say you can’t afford not to buy – what does that mean? Where are you and what’s your circumstance?

Having just moved from the North side of Chicago to inner Portland, let me tell you in no uncertain terms that the fix is in and is alive and well here in Stumptown. Inventory is being kept artificially low, REO sales have slowed to a trickle, not a word is heard about shadow inventory in the local MSM and now bidding wars are heating up, with no relevant macro economic data to support them. And the rents are of course skyrocketing right along with the big con – it’s ridiculous, and not sustainable.

I lived in Boulder from 2000-2009 and there was definitely a housing bubble then. A lot of Californians moved to Boulder during that time and helped to inflate the bubble.

Everyone is getting squeezed. Rental prices are going up, so you don’t want to rent. But buying is too expensive with the current market manipulations. That is, even if you could qualify for a mortgage. You just have to take it.

I don’t see a way out of this housing mess without a wholesale drop in American standard of living. There just aren’t enough jobs in this country – regardless of political affiliation. This is the cold cruel heart of capitalism. Wages are capped by what someone in another country is willing to accept to do your job.

I will say it once more. Artificially holding up housing IS the cause of the bad economy not the other way around.

I believe we have stipulated repeatedly that real wages have been stagnant at best over the past 10 to 20 years. The way that we have made up for it during the past bubble was extracting income from our over-valued housing asset. We can no longer extract income out of our over-valued house because most have little to no equity at best. We have had a double whammy of increased housing cost plus loss of a supplemental income stream. Now, we are stuck with high cost of housing crowding out other spending. I predict that we will not get REAL economic growth until one of two things happen, real increase in income (labor + ROI) or cost of housing aligns with the current income levels. Selling existing houses to one another creates little economic growth versus spending on new goods or services.

As to inflating our way out of this, it won’t work. We are in a global economy where many nations peg their currency to USD. Our labor is competing on the world market which will continue to hold the cost of US labor down. Currency devaluation is only going to make goods that we compete for on the world market (i.e. food & fuel) more expensive further crowding out other spending.

There is no easy fix no matter what the talking heads on the MSM say. My “prediction†is that we will continue to play out these theatrics to entice folks to purchase something they cannot afford. Each administration will kick the can in hopes that a new real estate frenzy will get our government the major holder of housing debt off the hook…

What?, I agree with everything you said. I think all these shenanigans keeping housing prices inflated will go on indefinitely. Five years ago, nobody would have thought all this nonsense would have been possible. Now the question becomes, “how long is everybody willing to wait for things to return to normal.” Two years, four years, ten years? Time counts for something in this world too.

I’m personally giving it until the end of the year until I throw in the towel. That is contingent on finding the right property in my price range. I see low interest rates here to stay for YEARS and that means we’ll likely have the same crap going on that we are seeing now. Low inventory, investor groups, FHA buyers, mulligan buyers, foreign buyers, greedy landlords, etc, etc.

This is getting frustrating to say the least!

This. My gut is telling me that we’re going to see low rates for a long time to come yet. The new normal.

Part of me believes that this “show” going on right now is nothing but an orchestrated, last-ditch effort by the BWWS (Banks, Washington, Wall Street, Same Entity) to get as much of the exited-investor, desperate-buyer money as they can before the floor drops out below them – as they know it will – soon. I think there will be a good sized hit to prices around the end of the year, if for no other reason than seasonality (but there are other reasons as we know!). I already see inventory starting to back up again in some of the upper strata of CA housing. Sooner or later Supply/demand will cause some more of the price discovery/capitulation that we’ve seen in recent years…and whoever tells me that there isn’t a “domino-effect” down the housing spectrum is crazy. Only the EXTREME “RAP STAR” properties are truly detached from the pricing spectrum. From what I’ve noticed, houses from 2-3 Million on down are ALL attached at the hip pricing-wise. If the top shifts, everything below has to shift accordingly, with some understandable gradient changes, arguably near the bottom. An analogy would be if they started pricing Caddy’s like Chevy’s…who would then want the Chevy? The Chevy would have to take a commensurate hit in price to be able to keep selling. (Oh, I believe that’s coming too BTW, when the current generation of youths gets in to the car-buying mode but are too poor to spend a fortune on automobiles and no one is willing to gamble that much on a loan for them….at that point I forsee Gov’t backed auto loans to save the car makers’ profits, and maintain the American Credit Slave way of life.)

1) Banks/Washington/Wall Street = political power. Political power will be to continue to anesthetize (i.e., keeping prices elevated and the people distracted/pacified with programs) rather than let market forces take over and dictate prices.

2) There is now a permanent disconnect between the 1% and the rest of us. They are protected forever. They will not suffer. Our pain is not their pain.

Our government, oligarch banksters, and realtor pravda industry are in collusion to prop up this dead market with very low interest rates, keep problem inventory off the market, and constant media propaganda. Guess what. It will work for a short time only. Remember, if house prices continue to rebound, underwater houses that now all of a sudden have equity will quickly get listed for sale. All of a sudden you will have a lot of inventory on the market and that will put a ceiling on the rise in house prices and for certain cause the prices to come back down again to crash levels. Meanwhile, the dollar has a lot less purchasing power, obama is reelected, and the realtors get a few more dollars in commission.

http://www.huffingtonpost.com/2012/07/05/california-eminent-domain-underwater-mortgages_n_1651723.html

The length to which the government will go to reward the irresponsible and penalize the responsible and future generations is seemingly unlimited.

Is there any market now that’s not rigged?!

The problem is that the bears always have a new excuse. Inventory is down because people know prices have bottomed. Why sell when the massive shift in psychology has happened and prices have started to rise? Why sell when the monthly cost of a similar rental would be higher?

So you believe that supply/demand balance has been reached on fundamentals? That is the only real bottom.

Right now you have the government using the FHA and Agencies to totally support the market. Private lending is effectively gone. Super low interest rates will rise if the economy turns for the better (i.e. incomes rise and jobs return). You have a number of states that still have 1000+ day foreclosure timelines (looking at you NY/NJ areas). We also have banks sitting on massive inventory in an effort to manage prices via not over-saturating supply. Does that sound like a fundamental bottom?

That said, let’s just assume that the numbers work out and you are right. We still have to deal with YEARS of inventory coming to market which will cap prices as well as people who want to sell bringing properties to market on any uptick that can get them out at an equitable level.

Now let’s look at the “move-up” level homes that were not “moved-up” to on income but on 10-30 years of equity gains being rolled up. Bottom line is that there are far far more $500K to $3m homes than there are incomes capable of buying and supporting them – those houses tend to be older folks with more years in the RE game – many will want to sell and downsize at some point, others will need to move for work. Who will they sell to as the move-up buyer is completely gone until pricing starts to move up significantly (via incomes or real supply/demand) and we’ve already discussed the “cap” sitting on pricing via supply side. Let’s not even discuss the impact of higher taxes both property and income on pricing/affordability (the $250K Obama limit barely gets one into a $750K home on 3x income ratio) or the newer generations of home buyers saddled with low incomes and high student loan debt who have seen this mess unfold – not one of them thinks maxing themselves out on mortgage debt to buy as much house as they can afford is a good idea so income/price ratio is also likely to drop on demand in addition to underwriting standards being kept “real”.

These are all verified unavoidable headwinds. When I look for tailwinds (and I do look) there really isn’t anything substantial outside of low household formation which is being done out of necessity due to the poor economy and it seems the whole multi-family building craze is aiming to saturate anyway leaving single family homes stranded.

The bears have been pretty spot-on during this never-ending bubble. What have you been smoking?

How can you say that? Prices have been rising recently and inventory is way down. Looks like more price increases coming. Bulls are right on now.

Clearly, Mr. Bull, you have no conception of fundamental economics, in particular the concept of price discovery and how that has been skewed nearly unprecedented interest rates and the nationalization of the mortgage market among other things.

It’s a bull anything — it’s the same old same old with thicker smoke and better mirrors.

Hamsum – devil advocate here, but why does Mr. Bull need to know “fundamental economics”?

Case in point, certain markets have been manipulated for decades on end. Take DeBeers which has been manipulating the diamond market for 40+ years. Without their manipulation, diamond prices would be a small fraction of what they are now. Yet, anyone who decided to wait for “fundamentals” to prevail before they bought a diamond would be dead by now.

As for housing, we now have an entity far more powerful than debeers, with much lower carrying costs, manipulating the market. Thus, if DeBeers can manipulate for 40+ years with no end in sight, why cannot the US govt do the same here?

Note, im not saying this is “right” or what “should be”. Im just pointing out what is actually happening, much to the consternation of certain bears who wax rhapsodic about some ideal fundamental market which they may never see in their lifetime.

Carner — no offense, but your analogy suffers in that the two assets are vastly disproportional. Besides, try selling a diamond someday either to a pawn shop or a jeweller and let me know what you get. Cut diamonds have terrible resale value. I actually had a guy swear up and down to me that the sentimental value of a diamond made it worth it and the resale or actual intrinsic value (as in, I need to sell this to eat – what is it worth to someone who isn’t my wife) was meaningless. Diamonds are one of the most astonishing examples of how indelible really good marketing can be on the public psyche.

This is quite interesting. As What? responded in an earlier post. The basic point is this.

1. The powers that be i.e. current administration wants the economy to at least

feel decent for most folks.

2. From #1, they tell banks to leak out inventory not flood it.

3. Banks do not own any loans anyway. They all belong to the FED, GSE’s etc. So effectively to the government.

4. FED can print money as needed to keep these defaulting loans going. I.e. pay

their property taxes and maintenance.

5. From #4 new money trickles into the economy. People who get first hand on it

are the local governments. So this is a secret slow bailout which will go on for a decade

or so till the budgets of counties and cities can be brought under control in line

with their tax revenues.

6. From #5, muni-bonds are best place to be since there is less chance

of default. Look at their 5 year charts, NMZ, HYD etc., soaring in value. Also, tax free yields in the range of 4% to 6%.

Now this makes some sense as to why the banks are only leaking the inventory.

Current powers want them to do just that.

Thanks DHB and What? for explaining that the banks do not own the loans.

This is a secret bailout of local taxing authorities. Whitney will have to eat crow.

7. The Fed’s ZIRP (zero interest rate policy). Banks borrow from the Fed at close to zero percent interest. Real inflation is 5%. Most of the delinquent mortgages are +5%. The Federal Reserve with their ZIRP is essentially paying the banks to withhold shadow inventory from the markets. This leads to artificially low housing volume. With ZIRP, banks can carry foreclosed mortgages on their books forever and there is no imminent need to release inventory except when the banks need to raise cash.

On the last post, it is Meredith Whitney.

Does anyone know how can I find out/research the shadow inventory in Chicago, IL? Your answer and guidance would be greatly appreciated. Thanks in advance.

After renting for five years, we just bought a house in the Bay Area. Why? Our landlord is selling the house we live in (I was happy to rent it, but didn’t want to buy it – landlord is delusional about the price). Rentals are super tight, mortgage rates are super low. We found a nice house and all in, we’ll be paying less than we were to rent, in a slightly nicer house. I wish nature had been allowed to take its course, and I could have bought the cute little 3/2 we ended up with for $400k. But we had to pay $800k for it, with a 3.875 30-year fixed, plus they paid half the closing costs…Mortgage is 2900 a month. Yeah, I wish rates were 10% and we could have just bought it for cash, but you can’t fight the Fed. Maybe the crash will someday be allowed to continue, and our house will be worth $400k, like it was in 1995. Or maybe even less. Or maybe they’ll crank up the printing presses again and it will be worth $5 million in 10 years. Who knows? In the meantime, we needed a place to live…

800k down too 400k. even with the slightest of that risk, i would not buy. worse case rent is $1000 increase per month, 12k per year, 120k losts over 1o year. still a long ways away from 400k loss plus interest.

brace-yourself-real-estate-prices-are-going-back-up. A NAR propaganda piece. Where are the jobs to service the high prices?

http://www.bloomberg.com/news/2012-07-08/brace-yourself-real-estate-prices-are-going-back-up.html

We lost a bidding war on a regular sale this weekend. We bid way over list, and held our nose. We think the listing office’s buyer won it. We refused to be extorted any higher. The house wasn’t even worth the list. We came to our senses with our “Highest & Best” offer, which is nothing more than a blind auction. We were being forced into a higher offer, and so were 4 other couples. Screw that.

It is the underwater home-moaners they are trying to help. They don’t want more no-pays. This market is full of corruption, collusion, and criminals.

The problem I see as a buyer, is that fall doesn’t look much better. I hope I’m wrong.

Elect-tile Dysfunction. 2012 Lots of goodies in the goodies bag

The start of the unraveling of the FHA market?

FHA’s mortgage delinquencies soar:

http://money.cnn.com/2012/07/09/real_estate/housing-delinquencies/index.htm

Dr. HB is all over this situation – this post from May: Will the FHA require a bailout?

The problem is that it won’t really do much for you bears. Prices have started to rise. A little trouble at FHA won’t matter, especially in the nicer areas where people don’t use FHA financing.

It’s not that people are bears or bulls – we are trying to be realists, that’s why I read Dr. Housing Bubble, among others. Why are YOU here? I purchased two homes for different reasons in the last 3 years, so, while I am “bearish” if you will, about certain situations, by looking at what’s real – I have always used down markets to take advantage of economic opportunities.

It’s not that people are bears or bulls – we are trying to be realists, that’s why I read Dr. Housing Bubble, among others. Why are YOU here? I purchased two homes for different reasons in the last 3 years, so, while I am “bearish” if you will, about certain situations, by looking at what’s real – I have always used down markets to take advantage of economic opportunities. There are others here who are looking to buy soon or have purchased during the bubble. So the bear/bull analogy doesn’t fit what we are doing here or why Dr. HB writes about the bubble.

Oc real estate boom

http://www.latimes.com/business/la-fi-oc-homes-20120620,0,205579.story

Toll Brothers is getting investment from a huge global private equity firm, Starwood. While Lennar has just about closed on a billion-dollar loan deal with China Development Bank. There is still tons of money out there it seems…

Check out the plummet in new car buying by those all the way up to 40, the bad statistics just keep rolling in…and some of the blame is that we don’t have a housing bubble to support more new car sales. Well, clearly the only way to get out of this mess is…tax cuts for the rich and free Swiss Bank accounts (for those in Romney’s class, Swiss and Grand Cayman, that he admits to so far). Incidentally, US manufacturing, what’s left, is largely defense industries direct and indirect paid for by a trillion dollar deficit and endless wars. Balance the budget, lose 20 million jobs of those on the public-but allegedly private-gravy train of government welfare to business and industry and oil and so on, all paying the lowest level of tax in modern US history and loaded with cash. Anyway, all the attention DrHB has paid to the young demographic and their student debt and lack of jobs and ability to marry…yep, now we see why!

http://www.edmunds.com/industry-center/commentary/whos-not-buying-new-cars.html

Dr HB, I enjoyed reading your blog for the last three years, I want to thank you from the bottom of my heart for all your hard work, you have no idea how hard is to find a reliable source of information about housing that is different from main stream media, you are indeed my hero..do you have any plans to write a similar blog for the stock market or for the broader economy in general? If any of the respected readers have any insights or reliable websites I highly appreciate your help.

If you want a “hint” (by no means the whole picture) of what the shadow inventory looks like, I like this site:

http://express.realquest.com/search.aspx?location=90501

Just plug in your desired zip code into the url, then hit “map view” once it loads. It’s quite interesting to see all the red, blue, and yellow dots versus the green “for sale” units. In a sane world they would all become foreclosure sales rather quickly, but it seems like they just sit there.

You failed to tell us that this is a subscription service.

In regards to the questions asked about Short Sales, Dec 2012, 1099’ing, et all…

I have to ask the simpler question, who cares about the “system”? Yes there are rules to follow but the bottom line is, someone who can not pay will simply not pay. It can lead to BK, collections, liens, whatever, but it doesn’t change the fact you can not get blood from a turnip.

So then what? The “system” is failing.

If i was a renter that didn’t care about my credit score, i would try to buy as much property as the government would allow (leverage up and go for multiple homes), then rent them out and stop paying all the mortgages. Imagine collecting rent on 3 houses for 3 years before the foreclosure kicked in. Expensive places like NY, where the bubble never popped, would be best because that maximizes rent money. Do I care if I buy a 500k shack that’s really worth 75k? No, because I don’t plan on paying the mortgages anyway, just collecting say 2k per month, per home for 36 months. Let the bank pay the property taxes too. It’s not a moral issue; it’s a strategic default – I maximize my profit at the expense of everyone else – the bank eventually gets their shack back per the paper work – we’re even-steven after 3 years. Maybe I’ll use the FHA thing – put a little down – stop paying the mortgage after a month – rent the thing out, err no – wait: i should acquire all my properties before halting the mortgage payments – that increases my probability of leveraging up more with additional properties. Just thinking out loud here…

Demand is being manipulated too, as we shoehorn more and more buyers into super low interest high leverage loans at several multiples annual salary.

I’m seeing stuff in the 90065 neighborhood selling and 670 a sq ft. We’re talking 500-700 sq ft cracker boxes perched on steep sloping lots in a gang infested area.

Yes, many Real estate agents started sending me emails asking me to buy now as it is the BOTTOM. Some of them said the same thing in 2010. I really like to kick their bottom. But there are some good real esatae agents too.

What you are pointing out is exactly what I have been observing in Canada for a longer time. Lies from banks, from Real Estate Boards and from politicians are maintaining the trust and lowering of the mortgage rates provides new customers, who are too stupid to care about the costs of their decision. Home Prices in Vancouver is a clear example how far this can go. And Doc, go check check Garth Turner pages. He is as smart as you.

Well, just don’t buy anything for the next 3 to 5 years.

Kids and family need the most room for about 5 to 8 yeras. Rent a house if you can get a good deal.

Thomas, once again…..you are on the spot! I could’t agree more! Also thank you DrHB! Always!

Things need to look better before the election. Banks have to play the game. O gets re-elected in Nov. he helps his buddies who run the banks who fund his campaign.It all turns to sh$t while he is a lame duck. 4 years later new guy comes in and blames last guy for the mess and promises that he has a better plan. We the sheeple should vote for candidates who are not republican or dem. How much worse would things be if we voted them all out? What if you owned a business and needed someone to run it and every timeyou chose a new CEO you used the same two headhunters and kept getting bad results? Surely we the sheeple are partly to blame by always voting for the two-headed beast. Bah bah bah

We are sheep. Sheep I tell you. Predictable and easily manipulated. If everyone voted 3rd party for every candidate for every election in 2012 it would throw off the machine. Why should politicians be concerned about people over the corporations and powerful groups that finance their campaigns? Campaigns are so predictable …almost a science. We the sheeple keep feeding from the same trough

In my experience whenever one acts based on the question “How much worse could it be?” one receives an answer.

The last 10 houses sold in 92104 will reflect a 30% increase over December of 2011.

It is a sad state of affairs.

My “ace in the hole” was 550K that I extracted from the housing bubble but with 3.5% rates and soon to be 2.5% rates, my leverage that I had is gone, especially since my income will only support a 200K mortgage assuming I will be paying 650 a month in property tax if I buy a 600 to 700K house.

If I jumped in before I get priced out forever and bought a piece of junk fixer for 650K, I would be broke and I wonder where the 50K every 10 years for maintenance would come from? Will the FED see to it that prices keep rising so that I can extract equity to do maintenance?

Sometimes I wish I was more like the Ignorant fools who don’t think about this stuff because the Ignorant have been the winners.

I keep reading that rents are going up. That’s not what I’m seeing from the ground level on the west side of L.A.

Either I’m completely missing something or there’s misinformation being spread around.

To all you people posting about the cute South Pas houses being snapped up. I have no idea who is buying these homes but the idea of just joe average family buying for the kids to go to school is ridiculous. These are plain and simple 2006 bubble prices on these houses that only the top 4% of earners in this nation can afford. Prior to our rigged real estate reality the homes these people bought were in La Canada, Montrose, San Marino. This market is pure insanity.

Leave a Reply