The Muddle Years – Why the California economy is destined for years of slow growth and declining home values. 10 charts showing California still deep in recession and no state budget as we enter September.

California now enters September with no budget in place and a $19 billion budget deficit. As we edge closer to issuing coveted IOUs, the spin cycle is out in full force. A report was issued showing that CEOs at the 50 firms that laid off the most workers since the recession started earned an average of $12 million. I guess the recovery will depend on who you are asking. Here in California, looking at income data is a good indicator on how the “rest of us†are doing. The state of California depends heavily on personal income taxes. Nearly half the state budget revenue comes from this one source alone. Common sense would tell you that if more people were working, personal income tax collections would be up. That is not the case. You would also expect hiring to pick up and this is something California is not seeing either (with a 23 percent underemployment rate). The definition of recovery has gotten muddled in this deep recession, the deepest since the Great Depression. Let us look at 10 charts and try to examine what they mean for the future of California.

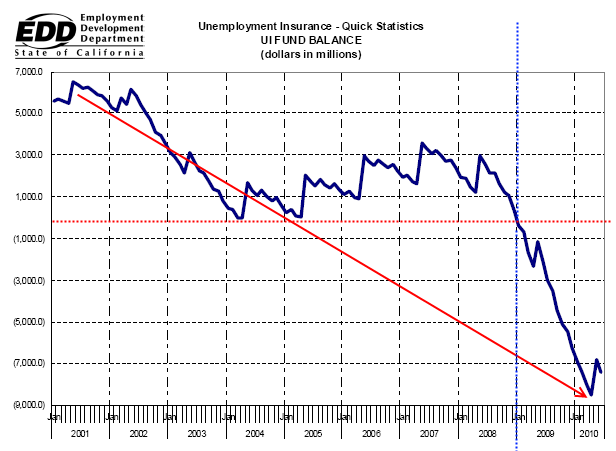

Chart 1 – Unemployment Insurance

The California Unemployment Insurance (UI) Fund has been on the decline since the early 2000s. Yet we didn’t tip over into the red until early 2009. Now, the state owes the Federal government a stunning $12 billion with interest. This is expected to top out at $15 billion by the end of the year. This money cannot be repaid from UI funds so it’ll be interesting to see how we pay this off. Maybe we can strategically default on this loan? One thing is certain here, many people are collecting and unable to find jobs. These people are looking for work and are definitely not in the market to buy a home or a car.

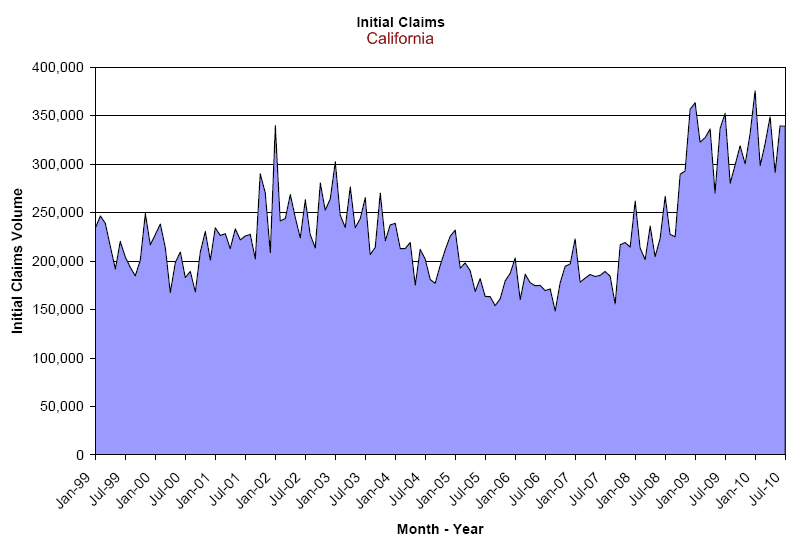

Chart 2 – Initial Claims Filed

Source:Â EDD

For all the talk of a recovery, initial unemployment claims remain elevated. In other words the economy is still doing very poorly when it comes to hiring people for actual work. This number needs to get under 225,000 to even resemble any sort of real recovery. We are far from that as you can see from the chart above.

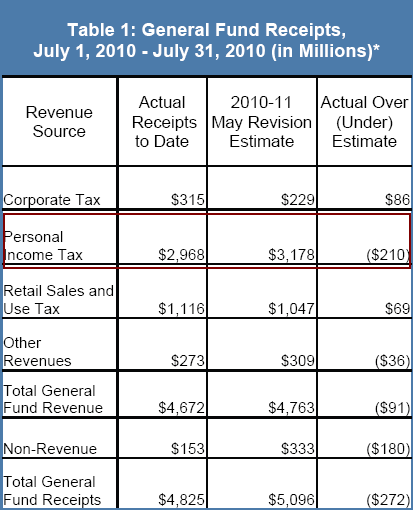

Chart 3 – Monthly Tax Collection

Source: State Controller’s Office

The State Controller’s Office issues a monthly report showing tax collections for the state. The latest release shows another drop in personal income collections. Even with the recent May budget revision, we are now coming in $210 million under expectations for the month. The fact that retail sales taxes are up should be no surprise because we actually hiked taxes up recently. The state budget in California is looking more and more unsustainable. On Tuesday, Democrats wanted to raise fees and shift around funds while Republicans want to cut. Both parties put their collective spin on this but bottom line is we need to increase taxes or cut spending. Both parties are part of the big plutocracy so they rather put on a bread and circus show and go on the road to raise more money for their November election campaigns. All this happening while the state flutters around. They had no problem passing a state home buyer tax credit on short notice but this is because big lobbying dollars from the finance, banking, and real estate industry bankroll many of these politicians.

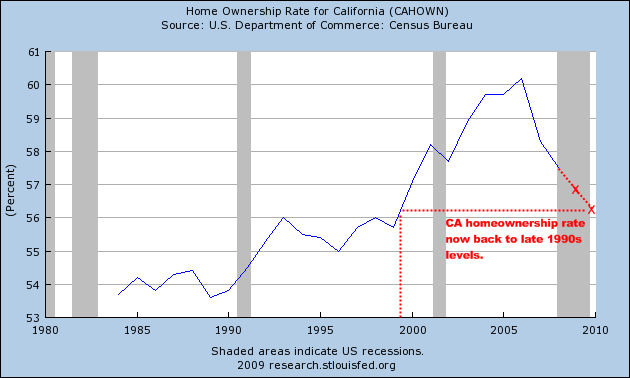

Chart 4 – Homeownership Rate

Don’t look now but we’ve now erased over a decade of homeownership gains in the state. Given the large amount of toxic waste mortgages, I wouldn’t be surprised if we have a few more quarters of this rate going down. If things were really doing well, don’t you think this rate would be going up because people would be buying homes? Or at the very least, people would be paying their mortgage and keeping the rate steady. That is clearly not the case.

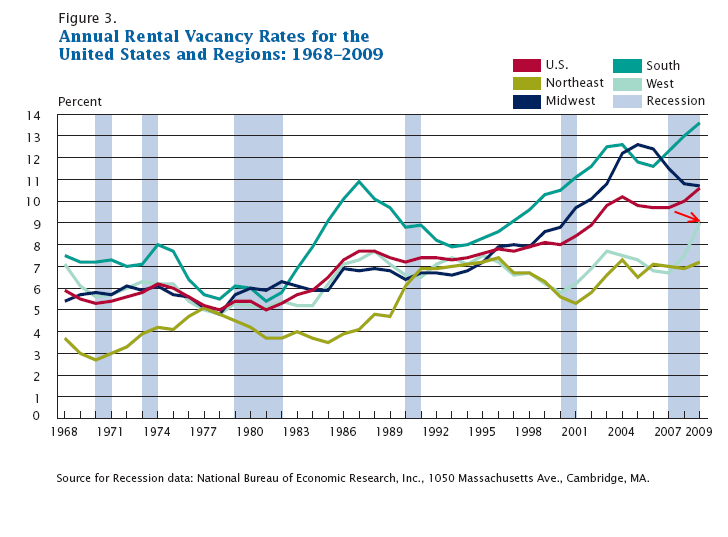

Chart 5 – Rental Vacancy Rate

Another reason why we will muddle through is because short-term policies on pumping the home buying spree have caused a glut in rental real estate. Rental prices have fallen in California for over a year now. There are good deals to be had. So now, all those vacant homes and people trying to sell homes will contend with excellent rental deals as well. Look at the above trend for the west. The rental vacancy rate is at an all-time high which means lower prices and more supply on the market. Of course, policy makers were only concerned with short-term gains. Short-term gains are actually what fueled the toxic mortgage craze of the last decade in the state. Very few people bought with the idea of staying in their community for more than 5 years. It was all about buying and moving up the property ladder until you owned the biggest McMansion on Stanford, Harvard, or whatever university name avenue. Now that we are running on fumes, the idea of the “American Dream†has now shifted.

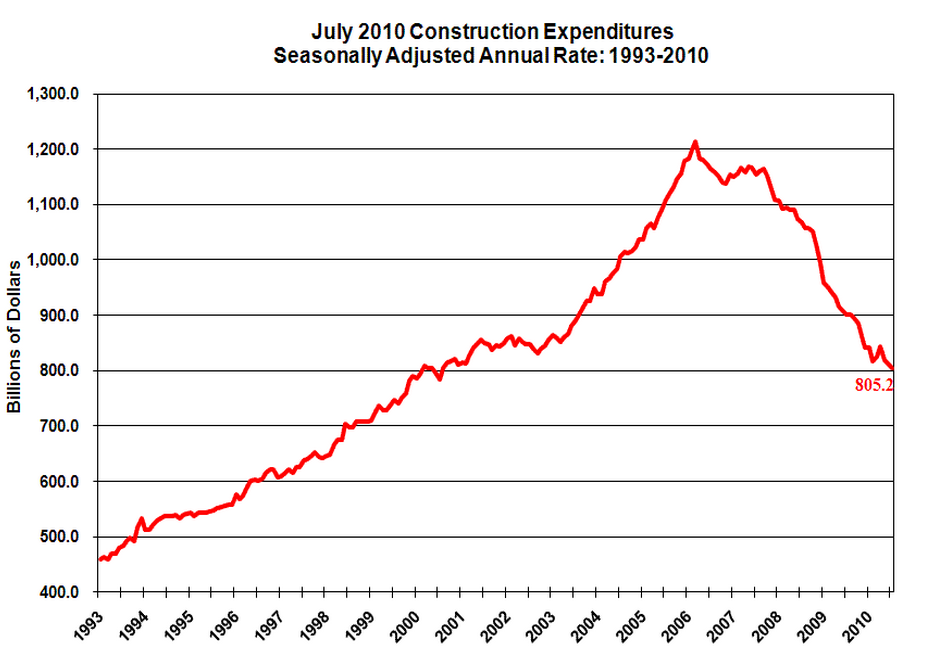

Chart 6 – Construction Spending

I’ve seen the argument made that people should buy in high priced areas because “you know construction prices†won’t be coming down anytime soon. Really? Look at the above chart. Construction spending has collapsed and with it, the cost of building. Right now, there is a glut of houses, condos, and commercial real estate that there is little reason to build. Yet those in higher priced areas continue to live in their bubble. The correction is already there and will accelerate over the next year.

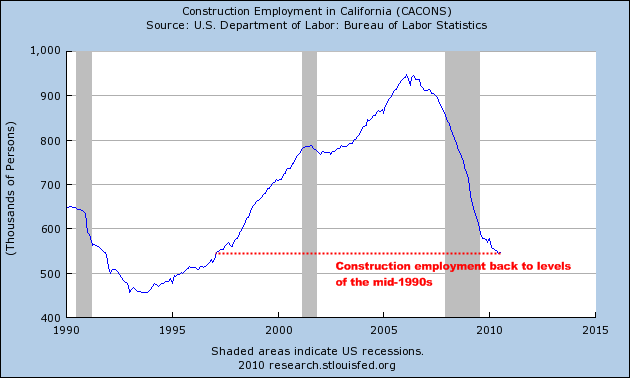

Just look at construction employment for California:

I’m sure you have many contractors who would do the job for 10, 20, 30, or even 40 percent off their peak level prices instead of being out of work.

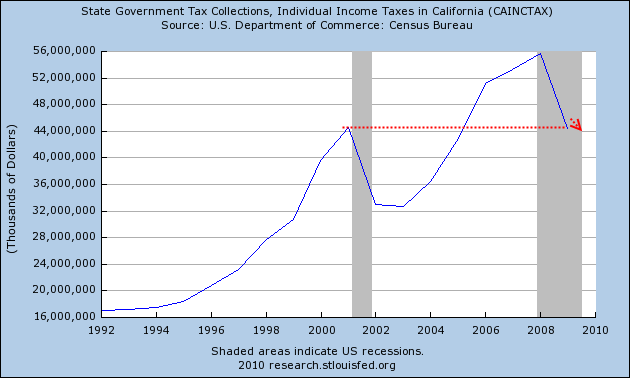

Chart 7 – Personal Income Tax Trend

This chart should be called a story of two bubbles. We are now back to state income tax revenues from the previous peak with the tech bubble. Unless we can find another bubble, the state will now need to adjust. As we have said, this can only be achieved through two methods – tax hikes or cuts. It certainly isn’t coming from a better real economy at the moment. So the options are limited. Either option however is bad for the state economy and housing. You know those sacred property taxes in California? Local counties not being reimbursed by the state are finding out the new ways to get around this:

“(CA County News) In order to generate an additional $17 million from property taxes, L.A. County leaders agreed to raise the property tax rate for Measure B slightly so that more funds could cover the costs of emergency and trauma care. As a result, property owners will be paying a little more each year so that the large budget deficit of the Department of Health Services will be relieved. Legally the county can only raise the rate by about 27-hundredths of a cent.â€

In Bell, with their fun loving politicians the state controller blocked an illegal property tax hike:

“SACRAMENTO – Today State Controller John Chiang notified Los Angeles County that for years the City of Bell has charged higher property tax rates than allowed by State law.

The overcharges were discovered during the initial phase of the Controller’s audit into the City of Bell’s finances. Property owners in the city paid an estimated $3 million in extra taxes during the past three years.

“While my investigation into the City of Bell continues, these unlawful taxes must stop immediately,†said Chiang. “Homeowners and property owners should not pay the price for this poor fiscal management.â€

As I said years ago, don’t think that property taxes are some kind of third rail of politics. Right now California politicians have a popularity rating in the single digits. What do they have to lose?

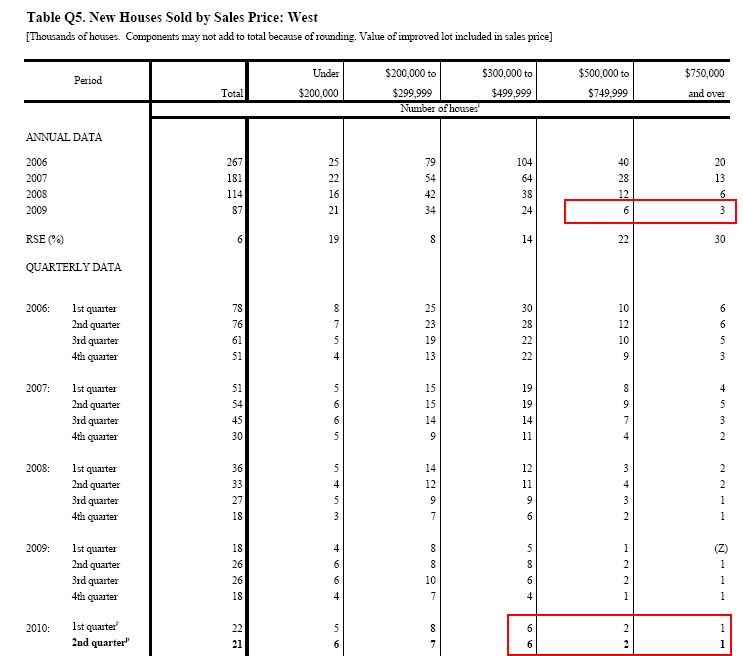

Chart 8 – New Home Sales

The amount of high priced sales has collapsed with the housing bubble. California is dominated by expensive homes in many niche markets. The amount of sales has come to a screeching halt for many areas in this segment. Some areas will always have strong buyers but it isn’t likely to be where 99 percent of the public currently lives. The above chart reflects this change in home sale dynamics. Why would this trend reverse? Unless incomes can suddenly pickup with employment gains then an argument can be made in favor of this. Do the above charts show this trend emerging?

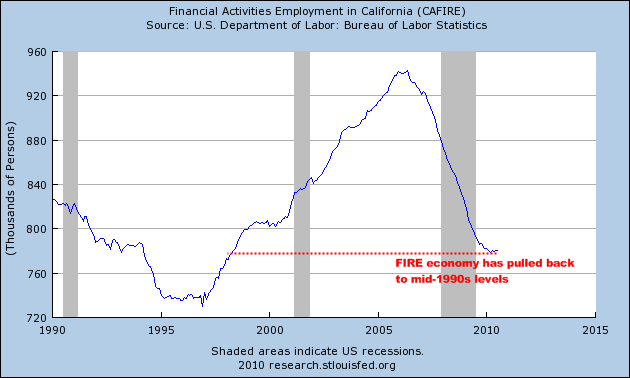

Chart 9 – FIRE Economy

Just like the tech bubble of the 1990s the real estate bubble of the 2000s fueled the state with tons of bubble wealth. These were high paying jobs with tons of taxes being collected not only from the personal income tax side, but also on the conspicuous consumption side. So the state loved this bubble in a multitude of ways:

-Higher property taxes due to inflated assessments

-Big personal income tax payments from brokers, bankers, agents, etc.

-Massive boost in sales tax income from big ticket items

It was a win-win at least from those in this industry and the state. But look at the above chart. Employment in the FIRE economy is back to levels of the late 1990s. Unless a new housing bubble emerges there is little reason to believe this industry is coming back to anything like the bubble days.

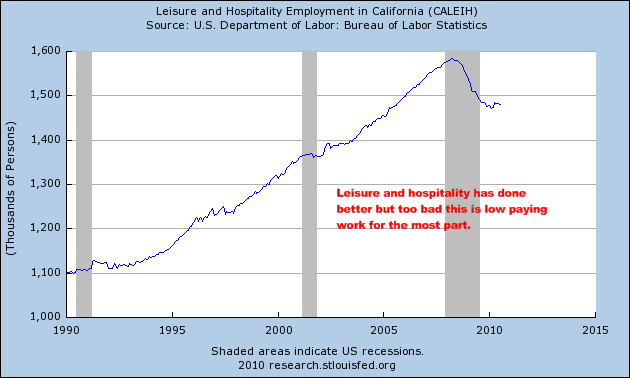

Chart 10 – Leisure and Hospitality

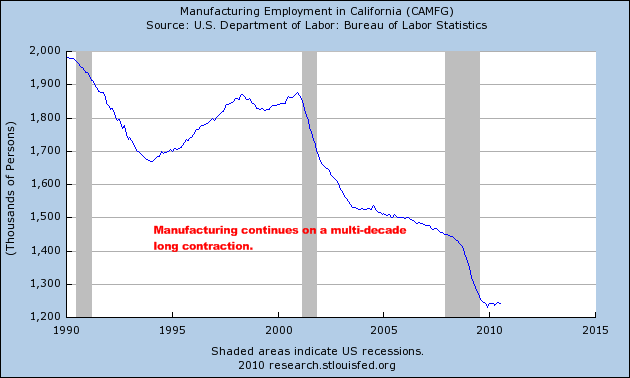

One of the brighter notes is that leisure and hospitality employment didn’t decline as badly as other sectors during this recession. On the other side of the coin this industry typically doesn’t pay solid wages. We have 4 out of 10 Americans working in the low paying service sector jobs so maybe this is part of a bigger trend. After all, those blue collar manufacturing jobs are now long gone:

California also has a large aerospace engineering sector and other companies that cater to military spending. Official combat operations are now over for Iraq. Do you think the demand for billion dollar equipment is going to still be high? This isn’t exactly a sector where you can export to other nations since the public might have a tiny problem with that.

Either way, it seems pretty clear when looking at this data that we are in for a long correction. Housing certainly doesn’t seem to have any support for higher prices. On the contrary, it would seem that the momentum now is toward lower prices. I made a prediction awhile back about 2011 being the bottom for California. At the time, we were bailing out the big GSEs and trying to gather ourselves. Home prices for California have fallen since that time and there were many rumblings back then that it was a bottom. Much has changed since then.

And since that time two years ago Fannie Mae and Freddie Mac continue to be giant trash bins of taxpayer money. Banks keep their mouth closed on this issue because 95 percent of their loan volume is government backed. Either way, the median price for a California home is likely to go lower. The state government is one giant mess and has only managed to be functional for the past two decades because of giant bubbles that masked their inability to govern. So now, rubber is hitting the road and taxes and cuts seem to be the only solution. Don’t expect any action until November however as we muddle into this election season.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

64 Responses to “The Muddle Years – Why the California economy is destined for years of slow growth and declining home values. 10 charts showing California still deep in recession and no state budget as we enter September.”

Thanks Doc. Your summaries of actual economic data consistently display a grasp of what is really happening vs what is being spun/propagandized/sold in the “media”. It is a;ways refreshing to see a presentation of the facts vs. a presentation of “opinion”. Like a glacier – reality will inexorably crush those who ignore it.

Propaganda in the media is not as widespread as many of the “black helicopter” crowd have come to believe. Much of the news is spot-on and relevant.

The media are corporate owned and paid for hacks. They spout propaganda to the uneducated masses in order to try to keep the status quo. Only fools believe what the media has to say.

Yeah, like their ‘coverage’ of the oil gusher in the Gulf.

It’s fun to blame it all on the corrupt media. So you are saying an honest person is not eligible to work in the ‘media?’ I do believe something is amiss though. There are lots of journalists and pundits that I want to believe and respect out there and they are confirming DHB’s analysis. Why?? DHB seems to be spot on but I find it hard to believe the “media conspiracy” could really be talking in such unison.

It is a more generalized American principle; criticizing the American mythology of self-perpetuating progress and unearned improvement is not tolerated and cannot breach our populace’s barrier of cognitive dissonance. Towing the line of believing that all is well in the face of the contrary in order to hopefully scathe by by the skin of our teeth is a seemingly exclusively American characteristic.

The same ignorance that is now at work self-censoring reality and the consequences of our society’s most fundamental stupidity; is the one that got us into the current mess, where people could not fathom anything but perpetual and exponential home-value increases on a monthly basis.

American society is mentally ill on a large, general scale in that we cannot face reality and thus prefer to substitute a narrative that fits our self-image of god blessed, masters of the universe, who nothing bad can ever possibly happen to. We are a people who are equivalent to the privileged, wealthy, famous, trust-fund baby, who is so proud of himself for being successful; not having earned anything himself and only squandering opportunities and resources unseen and unfathomable to most other people.

The question is, can we burn through our resource assets long enough to live high on the hog until I die; or is the party over and we are going to end up like the multi-million dollar lottery winner or the heir to an empire that now live in squalor?

I have an inkling that we have enough resources to burn through before things get bad, but one day, one generation will witness the breakup of the USA and the devastation of the current generations’ actions. Congratulate yourselves, you have squandered America’s resources and given them to the Aristocracy; all because you are stupid and cannot step out of your fantasy of undeserved grandeur.

I’m surprised the deficit is still 19B. I thought that’s what it was 3 months ago and it should grow every month until there is a solution. You’re probably right that we’ll see more taxes and massive cuts in services. Like you said, CA greatly benefitted from the last two big bubbles. Unfortunately, we are now out of bubbles and reality time and that it’s going to be ugly. I hope every turd politician gets thrown out of office in November. A class of third graders wouldn’t have done as much damage as those embeciles in Sacramento have done.

California real estate values will continue to decline thanks to even more government intervention. HUD in it’s infinate wisdom is now selling off much of their REO inventory at a 20% discount to Municipalities (City and County Governments) under the Neighborhood Stabilization Program who will then pay thousands of dollars to repair and rehab those properties, you guessed it with Grant Money from the taxpayers, and resell them again at a discount to low to moderate income families. This will not go a long way to improving values anytime soon.

Green jobs and industries are coming to help out! Have hope! The sustainable development movement is backed by the UN and has a lot of financial support. Be patient, though — changing the infrastucture of our economy will take time. Just be patient…

Sign me up for anything backed by the UN. Are you effing kidding me. These green jobs are nothing but a hoax. For every green job gained, you will lose many “non green” jobs. This sorry excuse for a state can’t afford to lose one more job (other than government jobs).

Many”green” industries and employment would not exist without government subsidies. The ROI on them usually indicates a very long payback period (if any), and is based on many assumptions about the future. Comparing the investment with other investments, it’s a loser.

I love the comments that basically say that no subsidized jobs can possibly be any good.

Yep, just like that computer industry, whose creation was heavily subsidized basically since the end of WW II, and which continues to be subsidized (perhaps less so) through the present. And the aerospace industry – big loser, that. And, y’know, agriculture is basically a bad idea, because it’s so heavily subsidized. Let’s not forget roads — if the Romans hadn’t gotten us addicted to socialist government roads, we’d be much better off. Why, just look how much better things turned out for the Etruscans.

OK, sure, subsidies do distort markets, but unbridled laissez-fair capitalism ain’t no panacea either.

If you lost many non-green jobs for every green job, don’t you think we would have had ‘green power’ long ago. Wind turbines require tons of maintenance, solar is nice but stricly small scale. The only ‘green’ energy is nuclear power. But corporate greed will manage to destroy that in 5 or so years, as they continue to “continuously improve” which is nuclear speak for cut staff, misdirect independent oversight, and maximize profit until something happens.

The problem with government subsided jobs is that someone *without* a subsidized job must eventually be taxed to pay for them. This logic is somehow easier to escape for those with government jobs, or subsidized government jobs. What we need is sustainability, not more debt creation.

The “haves” in California are government workers. They keep their jobs (maybe no raises for a few years- big deal!), keep their generous pensions and free medical insurance, and will get annual inflation raises after retirement.

The “have nots” are the other 75% of workers, who work in the private sector.

Layoffs, dramatic cuts in salary, little or no pension.

What a great system!!

I’ll call bullsh1t on the whining of public jobs. You lump everyone together, yet will still vote to fund POLICE and FIREMAN, THAT’S where you are getting raped, but everyone is willing to bow down to the big unions. Don’t belive me,,,here’s a place to start…take a look at the TITLE and pay.

http://transparentnevada.com/salaries/

And for the repugnantcans who vilify the defacrats….take a look at this data:

http://www.businessinsider.com/us-wealth-inequality-2010-7#republican-tax-cuts-have-significantly-increased-the-wealth-gap-9

Personally, I believe this man, and I agree with his assessment of what is coming for you and I.

http://www.businessinsider.com/gerald-celente-greatest-depression

irrelavent. The entire economy comes crashing down-both private and public sector. Its going to get ugly. You haven’t seen anything yet. No worker will be safe.

We need socialism to balance this equation out a little. Why not follow in the footsteps of Europe to help resolve this? A European Union and a single currency — types of things that might help us here in the US.

Hear Here!

The U.S. already has a single currency, the dollar.

Yeah, I was scratching my head on that one too. Maybe we could drink beer and wine like the do in Europe?

Can’t wait for Nov. 2nd.. Bman- we’ve been having about as close to socialism as you are ever going to get in the US of A. How has it worked out for you? Stimulus, massive incentives to buy houses and cars, the state buying a gigantic corporation, a law to more or less nationalize health care over the next few years… Seems that the general public is definitely not feeling all of these “solutions”… but we will see what happens Nov. 2nd

Get a brain, or do some research. The U.S. tax revenue as a percent of GDP is about 28% and it is 52nd on the list of all countries. Most of Europe is in the 40’s and China surprisingly is 17% (if you can believe their numbers). The facts show that big business is “killing” the working class in this country. According to official statistics, GDP increased 57% since 1998 and the number of employed increased3% or 3.5 million. Million the population increased 40 million. The top 1%’s share of total income has increased dramatically. Although Obama hasn’t really addressed this problem, you know the Republicans will totally ignore it.

BMAN: I thought your previous comment about green jobs was sarcasm! But after this comment about European Socialism I was wrong. You truly are a kool-aid drinker. Green jobs? The world’s economy runs on: 1) 30% oil; 2) 30% coal and 3) 20% natural gas. How are you gonna replace that when less than 5% comes from supposed green sources-not in your lifetime, your kids lifetime, their kids lifetime, etc. Your going to need a major miracle discovery. The world has moved from a wood energy based economy, to a coal energy based economy, to a oil energy based economy, and now maybe moving toward a nuclear based energy economy. Green energy in the future no way. Regarding European socialism, how come they are all privatizing now. The Euro almost collapsed this year due to the Greek crises. And it does not look good for the future. If Spain(the collapsed poster boy for the Green Economy), Portugal and Italy don’t get their spending under control, Germany will bolt from the European market and government. German people will not put up with supporting other countries who won’t rein in their silly spending. Just like California, which has lost a substantial part of it’s economy due to silly government actions, rules and the idiotic green movement. The Dr.’s analysis of the California’s economy is spot on. What revenues are in the future for California? Not much! Taxes likely will go up-which will push people to move to other states. California has pretty much gutted it’s manufacturing base due to governmental rules-look at the Dr.’s chart above. Once people move in mass, spending will need to be cut and then we will have a decade of tax increases and spending cuts visited on California’s population annually. Not a very pretty picture for the tarnished Golden State.

European socialism is death on innovation and job-building.

And while we don’t hear much about it here, their economies are in trouble as well. Trouble is, all those social programs are supported by taxing the population so heavily that it’s very difficult to start a business, and those who DO make big money immediately switch citizenship to other countries with lower taxes (which means their home country loses big-time tax revenue).

It also means that the UK has a huge class of able-bodied people who barely work at all in their lifetimes, perfectly happy to sit on their bums collecting welfare checks. We need too encourage people to start companies and create jobs, not reward them for being lazy!

Is that so? How come Germany is kicking arse again with exports? Everybody loves talking America this and that. Fact is, USGov spends more per capita than any other nation, although China will pass us when their overheated economy crashes in the future (doesn’t Asia do this same crap every ten years or so? Grow out of their diapers too quickly?). Taking care of people can make them more productive. Working people to death just burns them out. Our system of socialism that rewards criminal behavior and punishes prudence, encourages foreigners to bring the elders here to draw SSI, that’s when socialism fails–when it diverts from productive entities and underwrites counter-productivity. Dropping money out of helicopters, it’s unguided dilution of capital. We need houses people can afford and the nation can afford–not perpetual expansion and havok on families.

I work for one of the few companies left in California that still makes stuff and we’re doing extremely well. Early bookings are at record levels and shop sentiment is high. Whether or not we can fulfill those bookings will be the issue, as some factories are still struggling to ramp up production and there are some parts shortages. If we can, spring 2012 may be our best season yet.

What do we make? Outdoor clothing and gear. Think The North Face. Jackets, backpacks, sleeping bags, that sort of thing. We’re not exactly a billion dollar military contractor and our employees are probably not paid like, say, engineers in the tech industry, but we’re certainly better than the low service sector.

I really have no idea why this is the case. I mean, how our retailers can think people will dump $400 on a rain jacket at this place in time is beyond me. It seems pretty disposable. But apparently they do, and in record numbers. (Can someone explain this?)

So there are some rays of sunshine in this thunderstorm, and we’re not the only ones. What little manufacturing we have seems to be doing well. Agilent, an offshoot of Hewlett Packard and the largest private employer up here in the North Bay, also recently posted profits that exceeded expectations.

Perhaps if there is any recovery to be had, it is with us, in manufacturing. Maybe we need to get back to making stuff, as opposed to speculating on stuff that isn’t really there.

Perhaps people think they’re going to be LIVING in those tents and need those jackets to keep warm!

Or perhaps a return to camping is still a cheaper alternative to hotels, cruises, and other expensive vacations that people were taking constantly during the bubble.

I sure hope not!

And the latter is what we think, as well. People are spending less of their vacation time at resorts and more of their vacation time camping, because, well, camping is cheap.

Our gear, however, is not. As I said, a rain jacket can set you back $400, but you won’t have to replace it for 15 years, if ever. Compare that to a $100 rain jacket that you have to replace every other year, and the $400 jacket makes better economic sense. I’d like to think consumers are this savvy and maybe this is another reason why we are doing so well, but I won’t keep my hopes up. I would, however, be interested to see if this is the case elsewhere, if perhaps there is movement away from the “cheaper is better” culture that has infected us for so long, and a movement toward a consumer culture that actually makes sense. If one side effect of the recession is that the average consumer has gotten smarter, that can only be a good thing.

Again, I’d like to think this is true, but I won’t keep my hopes up.

The State of CA “borrowed” and continues to “borrow” $B from the federal govt just to cover unemployment benefit payments since the state fund dried-up over a year ago. Not mentioned in the budget. Nor are other costs and financial obligations. As strong the govt empoyees unions are, the math doesnt work and the voting populace is going to get really annoyed at rising taxes and declining services. Somethings got to give and pretty soon.

Green jobs. haha, you guys crack me up.

At least green energy investments are trying to invest in something real, the infrastructure we really do need for the 21st century. This is so much better than so many things we have thrown money at to no avail (like TARP, cash for clunkers, etc.). It is pretty sad when China is so far ahead of us in things like solar technology.

I don’t know if it will create huge amounts of jobs, but it is necessary regardless. Or we could just pretend that cheap oil will last forever.

OT But cool:

Check it out: Plastic Trash turned back into oil

http://www.flixxy.com/convert-plastic-to-oil.htm

“I made a prediction awhile back about 2011 being the bottom for California. ” What is your current prediciton Dr. Housing Bubble? 2012?

“Maybe we can strategically default on this loan?” LOL!

(sigh)

As someone who asked for an application at a retail store today as the nice lady I had been talking with exclaimed “What? Here? But you have a MASTERS!” I can tell you- the job market still sucks. Yes, I have a masters, but my field is public health and non-profits…and guess who’s bankrupt right now? I’m frustrated, but lucky- my husband still has a job that can support us both.

As for what Petrin says- yeah, I think we SHOULD get back to making things instead of buying crap. Anyone here read Cory Doctrow’s book “Makers”?

It’s an excellent book about how “desktop manufacturing” can re-ignite our economy and bring back jobs, IF we make it easier for the little guy to start a business and don’t allow large corporations to use the legal system to smother them to prevent them from becoming competition.

Really, I’ve been looking into how to start a business here in CA, and I am horrified by how much money it takes to simply insure that one angry litigious customer can’t ruin your entire life with one lawsuit. $800 to start an LLC, with insane further fees and confusing laws. We need to start making it easy to start a business. I would really like to see small business classes and incubators attached to our high schools, and start-up funds given like scholarships to kids with the most promising business models. This would give the kids who are motivated but not

“college material” a chance to make jobs and a living right away.

And I think, Petrin, that your stuff is selling because the “high end” folks who are skipping on the big foreign vacations are going camping, and even though they are spending 1/2 the amount they would have before, their idea of “cheap” is still oh, say, a $400 raincoat! 😉

Susan- you forgot state tax, federal tax, city tax on gross revenues, state tax on corporate gross revenues, city business license, county tax on equipment(computers, copy paper,etc.)state corp. licenses, and a few that I can’t remember.

NEVER start a business in CA.

Great Analysis as always

Oil can what?

“you know construction prices†won’t be coming down anytime soon. ”

Which is untrue for reasons you said, but also these people forget that cost of construction is a _minor part_ of the sale price of any house, ie. less than half, even for a new house.

Ray- You forgot unemployment insurance, social security payments for each employee, state disability tax, and property tax if you own your building.

Most people have no idea that ciities have a tax on business income. As a business owner, you are lucky if you get to keep 40 cents for every dollar of revenue, before you pay your own personal income tax.

I assume you are talking about net revenue here. A 40% gross margin would be something only to be dreamt of in almost any business. If we talk after the cost of goods sold and selling general and admin expenses its a different matter. But then the cost of some of the taxes are really a cost of having the employee so that ss, unemployment and a business license tax are really part of SG&A expenses, as would be taxes on property owned. Anyone operating as a sole proprietor today instead of at least a subchapter S LLC has a fool for an accountant and a lawyer, anyway. (Subchapter s takes the federal tax difference between a sole proprietorship and a corp to zero)

“Can’t wait for Nov. 2nd.. Bman- we’ve been having about as close to socialism as you are ever going to get in the US of A.”

Maybe, you have the “market socialism” like here in EU: Losses are shared to everyone (=taxpayers) except those who are wealthy (who don’t pay practically any taxes), but profits are private (and used to buy lawmakers).

Worst sides of both systems like the rich wanted.

I think it’s sad that people have resorted to attacking state workers. The majority of all public workers salaries are a lot less than the average private sector job. In addition, most departments have lots of baby boomers retiring and they are not being replaced. They have one person doing the jobs of 3 people or more. Most agencies require you to pay money into retirement so its not just a free ride. In addition, private sector jobs used to give retirement packages and stopped so they can fatten their CEOs pockets at the expense of the people who are doing all the work. I think if people want to get upset they need to look in the direction of the people who are in charge which are the legislators, the ceos, and corporate execs, and city managers. Those are the people who are benefiting and not spreading the wealth. Sad that people turn on each other just like the people at the top want you to.

Anyhow, I love this site and the information is great. I’ve been telling my friends who bought at the height of the real estate frenzy to run and get out of the property while it’s the least painful time. Most still struggle to make that payment but I think people need to wake up. The banks are still up to their old tricks and the people who think that there’s any kind of integrity with regard to business with the banks are going to be sorry.

http://online.wsj.com/article/SB10001424052748703447004575449813071709510.html

Sad? No it is long overdue. State workers have taken advantage of their positions and voted themselves huge pay raises and pension benefits. It is time to take them to the woodshed. California has little choice now, it must privatize much of what state government used to do, and cut government with a chainsaw.

BS. Pure libertarian propaganda. Get a life you bitter loser.

Gael and Lynn, there will be state worker jobs cut by the tens of thousands in the near future whether you like it or not. The number of state workers has almost doubled in the last decade, has the population doubled? Now that a nasty recession has hit, we are hearing higher taxes, less services and the 800 lb gorilla which is compensation packages for the state workers. This is a topic for a different debate…state workers are completely OVER COMPENSATED here in CA. Many of these jobs can be privatized saving the tax payer much money. In the near future, you will be hearing that more and more. The current system is broke and can not sustain itself.

Exactly Lynn…They are plotting middle class versus middle class to get back into office!!

Overall, I have to agree, outside of some exceptions, state salaries are nowhere near the problem they are made out to be. If anything, good people on the state level are not paid nearly enough, while the lazies get a secure job that, although it does not pay well, is secure (which is worth gold in the USA).

The problem are the Federal and Department of Defense salaries. I have direct, soul-crushing, first-hand experience seeing the incompetent people who pull in six figure salaries who would have a hard time holding down a job as a fast food manager. I am not exaggerating and I wish the few credible, competent USA journalists would blow the lid off the issue; but I have a feeling that Military and Federal salaries are too abstract for journalists to be able to wrap their minds around, or for our functionally-dumb citizenry to sufficiently care.

I think people frustrated about creeping socialism in USA are completely out of touch with reality. We have system that is worse of both worlds. In the socialism (not the Chinese type) people had health insurance; education is free up to Master degree… In USA it does not look like socialism to me on its good side. On other side we have 2 million homeless ( but I mean real homeless, not that morons with foreclosed homes), and 3 million in jail (because that competitive economic conditions in the society is simply criminogenic), which is not the outcome of the capitalism in Europe, Japan or even Canada and Australia. Booooho socialism! Yeaaa! Again, why we need exactly this wild capitalism if produces few Bill Gates time to time and leaves behind 80% of the population? Good question , but it comes to one’s mind only when he is left in the cold, a?

Capitalism, albeit not perfect, is a manifestation of the one thing that truly changed the world…..Freedom. At their core, people who despise the idea of capitalism, have a deep seeded disdain for freedom, and all the benefits and problems that come with it.

Be afraid of those who want to replace “Capitalism” with something different, because what is different is in the opposite direction of Freedom, and usually pure evil.

It’s not that simple. Capitalism is not unique to any system of goverment. The problem most of us that do have difficulty with capitalism is that it favors corruption and cronyism and ultimately diverts resources from productive things, like manufacturing for export, to non-productive things like housing bubbles. There has to be a balance of incentives and consequences. If it’s completely unregulated, the spoils go to the best cheater…which is where we are now.

My problem is someone like Kudlow, who always sounds like an idiot no matter who his guest is, keeps spouting that free capitalism is the answer to all of the world’s problems. Until human nature evolves, we will continue to have our potential limited by the need-to-survive usurping all of our creative valents.

I wish people like you could comprehend that “Capitalism” is not some sort of modern or USA invention or concept. It is merely an extension, labeling, evolution, etc. of a basic concept of free agency, which has existed far before the USA in a waxing and waning nature over the course of human existence.

What some USA citizens falsely identify as Socialism (I wish they knew how stupid they sound when saying that) is actually a dangerous drift into Plutarchy, carrying the momentum to become self-perpetual. People who label everything that scares their pea-brained mind as Socialism have been methodically trained to associate something that could be generally beneficial to them in some sad pathological Pavlovian response; like the dog that starves because his metal food bowl was electrified a couple times and he is now scared of it. While the “everything is Socialism” crowd could have a share of America’s resources far exceeding anything they could even imagine; they choose to simply hand most of that wealth off to the Aristocracy, and waste more than their current share, to live a life of difficulty instead. Again, congratulate yourselves, you are so altruistic that you are willing to give most of your unrealized wealth to those who already have it. Too bad you don’t have the capacity to realize how much it is.

da-di-da

September 3, 2010 at 11:46 am

You guys slay me! Everything is free in socialism, wow, what are you smoking. Firstly, you can get into college only if you where accepted to a scholatic high school, which most people are not-that’s why they get trade school training. The waiting line for undergraduates is well in excess of 3 years and for graduates well over 3 years. Just recently, Germany has built its first new university in over 30 years. Do you know why, unions for professors who do not like the competition in the teaching profession. Da-di-da, you must really be a dreamer, wake up and get a bite of reality, geez!

@gael – So how do you want to pay for it all “you bitter” liberal “loser”? Raise taxes and watch more tax payers leave? How about an explanation or an argument instead of calling people you disagree with names. Why do people need to do this? It’s like some six year old calling another kid a pooh-pooh head. Oh you’re a big pooh-pooh head, waaahhh!

Grow up.

Here’s an article with ominous implications

http://www.reuters.com/article/idUSTRE6804A020100901

Here’s an excerpt from it:

The government-controlled company also said it may begin conducting reviews of loan files, processes and procedures used by the servicers, in another sign it is growing impatient with the firms that collect and distribute homeowners’ payments.

Mortgage servicers have come under intense scrutiny as they have struggled with record delinquencies and foreclosures. Their efforts to ease payments on loans to avert default have fallen short in many cases, playing some role in disappointing results of a federal program to refinance or modify mortgages.

“A compensatory fee not only compensates Fannie Mae for damages but also emphasizes the importance placed on a particular aspect of a servicer’s performance,” Fannie Mae said in an announcement to servicers.

“In some cases, a compensatory fee will relate to the action a servicer took, or failed to take, in handling a specific mortgage loan,” it said.

Fees will be applied in various instances, including failure to provide access to records and delays on completing foreclosures and selling foreclosed properties.

More aggressive action by mortgage servicers could help ease burdens on Fannie Mae, whose losses on loans it guarantees or owns forced it into regulator’s hands in September 2008. It has required some $86 billion in taxpayer funds since then.

Home sales, showing new signs of life two years after the credit crunch drove down home prices, must gain more ground before policy makers can “declare victory,†Housing and Urban Development Secretary Shaun Donovan said.

“It is too early to certainly declare victory,†Donovan said in an interview for Bloomberg Television’s “Political Capital with Al Hunt,†airing this weekend. He said prices picked up over the last year and Americans added $1.1 trillion in equity to their homes.

An index of pending home sales rose an unexpected 5.2 percent in July, the National Association of Realtors reported Sept. 2

The administration is putting more emphasis on affordable rental housing and less on homeownership as Obama and Congress work to stabilize home prices and rebuild the U.S. mortgage- finance system, Donovan said.

“We do need to rebalance our priorities,†Donovan said. “Part of that, frankly, is that we have a president who talks about rental housing and is focused on rental housing as an important part of the equation.â€

BETTY says, Obama appears to say that he won the war for housing prices, now he will help the renters. Such happy talk. Do you feel better now?

Blog’s really getting popular.

Maybe Cheney was right, Ronald Regean proved deficits don’t matter. Somebody else in the future will get the blame and you will be given a star on the Wall Street sidewalk of fame. So gov can print all the money it wants and get applause but you print $10 of your own and you go to prison. If printing money is the answer, why not give every city a printing press–then we could get the money out there even faster…give everyone food stamps…unemployment checks even if you work, it’s all fake money. You could take all the federal perverse notes in Manhattan to the treasury and not get one gram of gold. It’s all fake. Let’s just party like it’s 2012 and the world is coming to an end in November.

CAN THAT SECOND CHART BE CORRECT?

What is throwing me is that it shows INITIAL UNEMPLOYMENT CLAIMS for California averagIng at 350K; plus or minus.

For the last several months, the ENITRE United States has been averaging in the range of 470K; plus or minus.

This is that closely watched number that is released every Friday morning, and used to be benchmarked at 350K +/- to be considered healthy – THE NATIONAL TOTAL.

Could it be that California alone accounts for such a massive portion of the IU claims?

I can’t beleive it. Although if it is true, we we really do need to start to release economics data EX-California.

I personally have thought that the big four or five basket cases (CA, AZ, NV, FL, MI) have skewed the national data quite significantly.

Actually, I doubt anyone would dispute those five states are indeed derailing the US, but going back a step, IMO, the quas-independent state of Manhattan is the source of all of our ills. From there, the war on the American middle-class was waged and won. Many even say we did this to ourselves and blame it all on Barney Frank, Bush and Obama. We allowed ourselves to be brainwashed to believe a port-o-let in 90210 is worth a million if we add a granite urinal. We only have two choices–keep dreaming or wake up. Most of us have hit the snooze alarm, I’m afraid.

BoyWonder,

Take a look at Initial Unemployment Claims in Calif.

http://www.edd.ca.gov/about_edd/pdf/qsui-Claims_Filed.pdf

New Program for Buyers, With No Money Down

http://www.nytimes.com/2010/09/05/us/05mortgage.html?_r=1&hpw

Getting more & more interesting.

A check for 76 cents at closing. Fannie certainly learned her lesson. I agree, it’s all fake money so just keep printing. We’ve been on fake money for at least 37 years when Nixon got backed into a corner. I’m sure we can do this a few more years, but the end may be in sight.

Even if GDP shows improvement, don’t expect the employment situation to improve much. Since 1998 reported GDP has grown 57%(adjusted for inflation 29%) and the population has grown 40 million. Meanwhile, employment has increased 3.5 million or 3%. i.e employment has increased 1% for each 19% increase in GDP. Either the GDP numbers are bogus or all that growth is going into the pockets of the super wealthy. In any case, unless government policy changes to encourage employers to add about 2 million jobs per year (that’s 170,000 per month) in the U.S. and not abroad, the unemployment rate will not improve or will even get worse! That’s what the tea party should be focusing on. And you know that’s not traditionally where the Limbaughs and Hannities of the world put their focus.

“At their core, people who despise the idea of capitalism, have a deep seeded disdain for freedom, and all the benefits and problems that come with it.”

Slavery is capitalism at its finest: The have-nots are cattle, nothing more.

There’s freedom too, for those who own the slaves.

Capitalism is all about greed and legalized stealing. Somewhat regulated, but that’s the essence of it.

Leave a Reply