The Real Cost of a Picket White Fence: 3 Housing Factors to Think About; Prices set at the margin, income discrepancies, and bubble euphoria.

After drinking water out of the bailout fire hydrant, I think most people are scrambling to get an idea of what is happening. An issue placed on the back burner by many politicians is suddenly garnering massive media playtime. Amazingly, Americans in a large percentage are against any bailout talks or consideration. The nationwide MSNBC and a local station KTLA ran unscientific polls asking the questions, “do you support a government bailout for the mortgage industry?†The answer was a resounding NO. In fact, from a brief review of these polls 95 percent of Americans are against any form of corporate welfare. They realize that deep down this is only a ploy for the government to subsidize maverick hedge funds, Wall Street circus acts, renegade brokers, and Vegas inspired buyer gambling. They want you to believe that they are doing it for the person on the street. How are they going to help out expensive counties such as Los Angeles where the median home price is $547,000? And what about those that have been foreclosed or are being foreclosed on? Don’t they deserve a retroactive bailout? Come to think of it, why don’t they give me money I invested in tech stocks back in 1999 that was wiped out since these companies had P/E ratios higher than Barry Bonds’ batting average. Or the money I lost in Vegas two months ago on blackjack (I suspect that the dealer was a former hedge fund manager since he asked if I wanted margin and wanted to flip a home in Henderson). A decade of conspicuous housing consumption has left the nation hanging on a thread looking for more bubbles to fuel their credit addiction. What other highflying act will allow American consumers, a large part of the economy, to continue their spending marathon? We’ve already seen that mortgage equity withdrawals had a lot to do with bolstering the economy over the past years. Unfortunately you can’t tap into your home equity line of credit if you are swimming underwater Jacque Cousteau style. See, like any Ponzi Scheme, those that get in early do well on the backs of those that come in late. And like any good Ponzi Scheme those coming in at the end are left holding the manure filled bag of worthless mortgage backed securities; it turns out a 600 square foot Real Home of Genius isn’t really worth $500,000.

Then we have the fear mongering by the politicians and the media. The new line that I’m hearing dished out is “well you wouldn’t want your entire neighborhood full of foreclosures eh?†Instead of drop kicking my monitor Jackie Chan style at this completely stupid and moronic assertion, I will show you that at any given time, only a very small percentage of all housing units are up for sale. So why all the brouhaha? Because housing prices are set at the margin; meaning, homes are priced by the units that are currently sitting on the market. And the fact of the matter is we’ve been operating on a one-trick pony economy where housing has kept us out of any recession and has provided the fuel to keep this SUV of spending going forward. But now that housing is depreciating we are realizing that yes, this economy is based on housing. Otherwise, who really cares that housing prices are trending downward? If we are such a diverse economy this one tiny sector shouldn’t mean so much; but it does because of the massive credit bubble we are living in.

So today we will examine 3 new factors that you should keep in the back of your mind since I have a feeling this housing mess won’t go away anytime soon. First, home prices are set at the margin so we will examine the actual numbers. Since politicians and the media like churning information and creating a fear cycle we will carefully look at housing supply in relation to units being sold. And again, anyone following this housing bubble isn’t surprised. In fact, it was predicted here a very long time ago. You may be saying, “but I feel safe because daddy Bernanke is here to save the day, he saw this coming.†Let us take a trip down memory lane:

“At this juncture . . . the impact on the broader economy and financial markets of the problems in the subprime markets seems likely to be contained,” Ben Bernanke Quote to Congress’ Joint Economic Committee. March 2007

“Given the fundamental factors in place that should support the demand for housing, we believe the effect of the troubles in the subprime sector on the broader housing market will likely be limited,†Bernanke said in May 2007.

“In particular, the further tightening of credit conditions, if sustained, would increase the risk that the current weakness in housing could be deeper or more prolonged than previously expected, with possible adverse effects on consumer spending and the economy more generally.†–August 31 Ben Bernanke

Wrong, wrong, and now you get it. Even the last statement is misleading because how did we go from “fundamental factors†being okay in May to “weakness in housing†in August? So given that the Fed Chairman didn’t see this coming even as early as May of this year, do you have confidence that these other yahoo politicians have the right policy decision in mind? We can discuss other policy mistakes regarding the current administration but that would require much more than this housing blog.

The second factor we will look at is income discrepancies. Current home prices are not in line with current family incomes. Unless you think making $14,000 and buying a $720,000 home is perfectly fine and makes economic sense. Finally we will examine the current market panic. Bubbles burst in typical fashion (see Manias, Panics, and Crashes) and this credit bubble will pop in the same way. We can pull the Band-Aid off fast or continue the absurd policies and allow for more guerilla mortgage products to enter the market.

Prices set at the margins

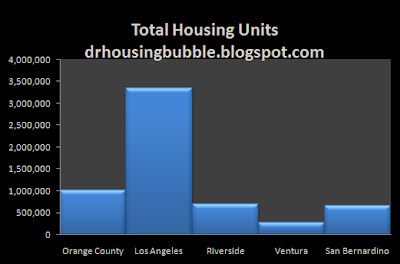

At any given point in time there is only a small fraction of homes on the market for sale. Drive down any street of the 88 cities in Los Angeles and you will see homes for sale, but not many. Unless you are driving in some home builder subdivision in Arizona or a condo high-rise in Florida, the majority of this country isn’t selling each and every single home on the block. But the media now has this fear mongering idea that if the market corrects, every person is going to be bumming cigarettes under the San Gabriel River. So instead of their verbal attacks on the public let us take a look at the actual numbers for Southern California:

*Data Source: Census.gov

There are approximately 6,000,000 housing units in Southern California. Keep in mind this includes apartments, rentals, and owner occupied homes. Now how many homes are for sale as of today in SoCal? How about 139,689 or to make it more tangible, only 2.33 percent of all available housing units in the area. Doesn’t seem like the entire neighborhood is going to hell in a hand basket as the media would like us to believe. And keep in mind that we are seeing record foreclosures and inventory here in Southern California and as of today, we are still only seeing 2.33 percent of all available units on the market for sale. See, not everyone bought into this housing bubble. Some people decided to rent. As I’ve pointed out the majority of households in Los Angeles County rent. Some people decided that they would rather save their money and wait the market out. Some are simply going to rent because they unfortunately cannot afford a home. This idea that everyone should own their home is dangerous and has also led us into this mortgage market debacle. If you are unable to buy a home without a shady zero down mortgage maybe you should wait until you can buy a home with more conventional financing. Others, bought before this entire bubble game started. So they are still sitting pretty on equity and have no plans of selling. There are also approximately 20 percent of people in Los Angeles that own their homes outright; many of these people are retired or nearing retirement and have no vision of flipping their homes. So the battle comes down to those that want to buy and those that want to sell right now. It looks like more and more people are wanting to sell and less and less people want to buy (or at least buy at current market prices). And why would you buy right now with prices decreasing each and every day? In addition, the prospect of you flipping and turning a profit now is as likely as finding Michael Vick at a PETA fundraiser as an honorary member.

Show me the Income!

Again the media likes to believe that everyone is earning $300,000 so a $547,000 median home price isn’t so far fetched. I’ve discussed this affluent façade in a previous article but let us take a quick look at income statistics for this country:

Household income (overall percent of US households over):

Income Percent of Households over:

$65,000 34.72%

$80,000 25.6%

$91,705 20.0%

$100,000 17.8%

$118,200 10%

$166,200 5%

$200,000 2.67%

$250,000 1.5%

$1,600,000 0.12%

So what does this tell us? In order for a family to comfortably afford a median priced home in Los Angeles County they would need to make $200,000. As you can see from the above data, only 2.67% of all households make this much. And I doubt any family making $200,000 will want to buy a Real Home of Genius as they would probably prefer to rent in a better neighborhood and invest the massive difference they are saving from buying a home. Are there tax benefits to owning? Of course. Many housing pundits want to use some voodoo economics to make you think spending $1 so you can get two quarters back is smart math. If you really need a tax break buy a rental property in a non-bubble city; you’ll get cash-flow, the benefit of owning real estate, and the feeling of owning a home if that is something that you desperately need. With all this talk, isn’t it fascinating that the media doesn’t state the obvious? That homes are massively overpriced! Incomes cannot support current prices without using mythical fantasy world exotic mortgages that seem to be a thing of yesteryear. 2/28 mortgages, option ARMS, negative amortization, stated (liar) income loans, and all variations of these dubious mortgages will come under the congressional microscope in months to come, just watch.

Smoking the Housing Bubble Peace Pipe

We’ve been living in a housing obsessed society. In fact, I’ll be happy in a few years where you will be able to go to a party and not have to listen to some wannabe Trump talk about his recent flip in the Valley and how he pocketed $50,000. The hardest part listening to this hogwash is knowing that they are part of this speculation bust that we are now seeing; deep down anyone that has a basic idea of finance and economics knew that this couldn’t go on forever. And here it stops in Q3 of 2007. In fact, I haven’t heard much of this talk in the last year. Yet in this housing bubble decade we have seen the media eat up the housing game and carry the party line. Take a look at some of the shows that have made the air in recent years:

Property Ladder

Discovery Home’s “Flip That House”

A&E’s “Flip This House,”

HGTV’s “Bought and Sold,”

Bravo’s “Flipping Out”

TLC’s “Real Estate Pros.”

The Apprentice

And the list goes on. Everyone suddenly had housing religion. But the good thing about bubbles is after the pop, slowly the talk dissipates. Remember the technology bubble? For years this was all the talk and anything with a dot com was worth putting your entire retirement funds into. How much talk have we had about these once high flying companies after 2001? Not much. I think by 2009 we’ll be more concerned about cleaning up the mess of 2 back-to-back bubbles, that is if we don’t see another bubble after this one. And yes, housing is very different from stocks. But what do you think funded this game? Mortgage backed securities. Where did these MBS trade? Hopefully you realize that not everything is linear but following the interconnectedness of this credit bubble you can understand why we are truly in an epic once in a lifetime housing bubble.

Do you think politicians and the media are handling this housing bubble burst correctly?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

31 Responses to “The Real Cost of a Picket White Fence: 3 Housing Factors to Think About; Prices set at the margin, income discrepancies, and bubble euphoria.”

I actually think the media are the government are doing a fine job on this. The media are pumping the story on high volume which is required to get any penetration with the masses.

Remember most folks that get any news barely retain it and chances are the a sub-primer isn’t all that bright to begin with so even if there was a bail out program they probably couldn’t fill out the forms.

The standard procedure of DC politics appears to be:

#1 – Deny the problem exists to buy time

#2 – See #1 if asked a question about the problem

#3 – When you can no longer deny it exists, talk around the problem

#4 – Admit it exists but downplay the significance

#5 – Come up with a “plan”

#6 – Explain how the “other guys” are blocking your plan

#7 – Blame the “other guys” for delaying your plan to the point that it couldn’t succeed because it was too late.

#8 – Smile for the camera!!!

So we are on Step #5.. I would expect to see step #6 in about 60 days.

“And keep in mind that we are seeing record foreclosures and inventory here in Southern California and as of today, we are still only seeing 2.33 percent of all available units on the market for sale.”

Around 8% of houses in LA County, 12% of houses in Orange County, and 18% of houses in Riverside County were resold at the peak. That’s counting only existing home sales since January 2005 to this day, not including new home sales and cash-out refinancings. These houses were predominantly financed using ARMs and interest-only loans with very low combined loan-to-value ratio. It’s safe to say that most of these owners already owe banks more than they can get by selling their houses.

If these homeowners will start defaulting on their mortgages en masse (and they will if housing market correction gets nearly severe enough as it should be) – your 2.33 percent of all units for sale will easily triple just from all REOs coming on the market.

Remember – there’s very little downside to foreclosing (your nose isn’t cut off, you don’t go to debtors prison, in fact, in most cases, bank can’t even take your car and your savings account!) so we’ll eventually see a shift in mass psychology that foreclosing on a $100,000 upside-down mortgage is the right thing to do.

@Dr HB

If voters are angry, who will they throw out of power? Voting for the other party that gets as much in campaign funding as the first party? Until the financial barriers to entry are removed from campaigning, we’ll be stuck with shills for special interests who look and/or sound good on camera.

Really good point on the 2.33% of homes are for sale. One forgets that when listening to the ‘state of fear’ coverage. It’s like hearing about the Fed ‘printing money non-stop’ but by looking at the numbers, noticing that the Fed has not made any permanent liquidity injections since May. Thanks for cutting through the housing BS.

I dislike the bailout plan proposed by Bush, and dislike Hillary’s idea even more. A tax forgiveness for cancelled debt removes the financial pain from foreclosing. A lot of people want money for nothing and reward with no downside risk. Hopefully, Bernanke does not bail these millionaire hedge fund investors out and regulation comes to the mortgage/housing industry.

Do you feel that consolidation of the mortgage lending industry will lead to a more regulated industry? I worry about large banks controlling a fragmented mortgage lending industry.

The first commenter nailed it with “most folks that get any news barely retain it”. Big Brother is not watching us, he’s distracting us. Think of how no one is really discussing the dynastic swapping that will probably occur in ’08, Bush-Clinton-Bush-Clinton.

Have a good Labor Day.

Two great comments.

If the pain of foreclosure is removed by removing the tax consequences from the short sale, it will have the opposite effect the bailout advocates are aiming for, in that it will trigger more defaults, not fewer.

That means that capitulation will happen faster.

Maybe it’s just best to get it all over with as quickly as possible, but even changing the tax situation is really sort of a “bailout”, though I doubt it makes much difference overall. Most of these buyers will be confronting bankruptcy no matter what.

The FED is not going to stop deflation. Remember, that FED is a private bank that has owners. It does not want to see itself destroyed.

More on this here:

http://www.financialsense.com/fsu/editorials/nystrom/2007/0831.html

I’ve seen a lot more for-sale signs popping up around here lately. Which, er, still means not more than one every few blocks. Still a sharp uptick though.

If a few “renegade” sellers started pricing based on what would be affordable to some reasonable percentage of income levels in their area (assuming good downpayment etc., none of this newfangled stuff), what would the effect of that be?

I don’t understand it. People on this post, and others like it appear quite bright, understand they can’t have something for nothing and seem for the most part to have earned their own way.

Where are these other people that think the gravy train can last forever? Replace education for the fast buck? Now they think the government should bail them out?

Son of Brock Landers,

Kevin Phillips has been talking about the dynasty building since at least 2004 when his book, “American Dynasty,” was published.

But, but, but Greenspan told me that an ARM was a good thing! Bwhahaha!

Credit card fallout is next. I’m canceling all of my cards and getting a Platinum MC from my credit union.

I fully expect all of these cards to start changing terms and to start charging annual fees to folks who pay in full every month.

Actually I’ve starting doing payoffs every 2 weeks via the internet since they like moving the due dates around so much.

You think things are bad now? Wait until Christmas when every 6th person in line is being declined.

I want to be the only guy in the line with cash while someone is being declined and yell out.. “Hey that commercial said using credit cards was faster than cash! Get this line moving!”

Here is a nomination for real home of genius:

http://vcrdsmls.rapmls.com/scripts/mgrqispi.dll?APPNAME=vcrdsmls&PRGNAME=MLSPropertyDetail&ARGUMENTS=-N503660005,-N297875,-N,-A,-N6056968

Pic 3 and 4:

http://prmedia.rapmls.com/vcrdsmls/listingpics/bigphoto/071/70012671_03.jpg?tsp=20070816152651

Is that someone sleeping in the middle of the floor in the MLs photos? Yep.

When did San Diego stop being part of SoCal?

A potential way to bypass a bailout of the hedge funds / lenders would be for Congress to enact legislation eliminating prepayment penalties, and most importantly, forgiving those on existing loans. It could be done selectively, however given the hatchet not scalpel that Congress typically wields, it won’t be.

Elimination of the PPP would make the financial hit of a recourse 1099 to a foreclosed borrower slightly less painful.

It would hit the lenders square in the general ledger. Many would be required to restate income projections, as these typically are booked as revenue. Some correspondent / wholesale lenders could attempt to pursue recapture against mortgage brokers, but that would be like squeezing blood from a turnip, so the remaining lenders would write down the value of their portfolio. And the lenders with retail divisions with large portfolios of PPP laden loans – say, Countrywide – would have no broker to chase.

There would be significant adjustments to how risk will be underwritten by lenders, plus other fallout. But – it constitues assistance to the homeowner while neither forgiving them of debt or responsibility, and also provides no bailout to the lenders / hedge funds who helped create the mess.

To Jimmy, I went to the house featured in your link.

What a piece of crap. You can see what pride the owner takes in the place and the realtor takes in selling it by photographing the place when it’s a total stye and there’s even the young teen stretched out on the floor.

I’m always amazed at the way some real estate agents “stage” the house for listing photos that will be posted online for everyone to see. Remember, people have a lot of houses and condos to wade through when they are looking to buy. I use the photos to eliminate the places I don’t like- am grateful for this because it saves me and the agent both from wasting our time on a tour of a place that there was never a chance I would like.

When your agent photographs your place for the online listing, get all the crap off the countertop and the 1300 magnets and kid’s drawings and shopping lists and bills off the fridge cabinet fronts, and GET THE LAUNDRY BASKET OUT OF THE LIVING ROOM and the shirts and jackets off the backs of chairs, and pack away all the clutter, including decorative bric-a-brac and doilies and fake flowers and stacks of magazines and CDs, and get ratty old furniture out of view. Best to strip the rooms down as much as possible, get the place professionally cleaned, and paint it.

Do these people really want to sell this place? The only decent thing about it is the pool.

“They are trying to remove the only recourse in this entire process. If the debt is forgiven, this flipper had zero risk in this entire process. Let me put this question out to everyone, who ends up paying for the loss here?”

This will create a powerful incentive for banks and lenders not to give money to these flippers. First mortgages will start requiring 20% down and second mortgages will either disappear or start asking for some sort of mortgage insurance.

Doc –

I concur that the national discussion won’t move this way since the bank(er) lobbyists will oppose that revenue stream elimination. Still, it’s worth a shot. You have a forum – you want to propose it?

However, to be clear I don’t propose waiving the 1099 – just that a person who was foreclosed on shouldn’t be penalized for a loan fee paid to a broker. Losing a home to FC is still penal even to flippers, who might be subject to the 1099 for the principal loss the lender suffers, as well as the credit report hit.

Additionally, it would make the refi process much less onerous and allow more people to qualify, since the lower refinanced loan balance would carry a lower LTV, a lower payment, and possibly allow it to fit under the conforming loan cap.

As far as elimininating 2nd mortgages, I disagree with the premise that more regulation will solve the problem. Higher rates attached to a 2nd were SUPPOSED to be the hedge – the lenders were to have invested some of that return in insurance to hedge against loss. Evidently many just used a derivative to offload risk without truly underwriting it – that is, they didn’t take the lower yield that results from buying insurance or establishing a rainy day fund against loss. If a 2nd trust deed lender wants to take the risk, and will NOT be bailed out – then that’s the market. One piece of legislation is needed, though – forbid corporate welfare.

Finally, it would require a scalpel to determine which borrowers were truly bamboozled, and which just greedily jumping onto the bandwagon for those $400k loans at 32 cents a month. Congress doesn’t have a scalpel, it has a men’s restroom in the Minn airport – sorry, I digress. It would be quite difficult for Congressmen to bypass the lobbyist pork offered when they set about defining who is a bamboozlee.

Dr.HB do I miss something in this whole mortgage mess but whatever happened to PMI?? I remember buying my first house years ago with FHA and I had to pay PMI. Hmmm.. just curious! Wasn’t PMI supposed to cover mortgage lenders in case of default??

@steve,

Seems like we are following that script. The blame game is starting and there is plenty to go around. Isn’t it fitting that the solution by the government to all this is to add more government? We already have agencies that were supposed to oversee things like this and prevent this mess from happening. The last thing we need is more layers; what is needed is actual enforcement of the laws on the books. Yet no one cared when everyone was making profits hand over fist.

“I want to be the only guy in the line with cash while someone is being declined and yell out.. “Hey that commercial said using credit cards was faster than cash! Get this line moving!” Bwahaha. Maybe you should get a cash speedpass.

@sd scientist,

You bring up a good point. I’m not sure if people will see it as okay but you are right that the stigma of foreclosure or bankruptcy doesn’t mean much in today’s society. This is one of the reasons so many people are opposed to any talk of bailout because it is the only repercussion left. Then we are hearing talk that the administration is trying to push for debt forgiveness on short-sales and foreclosures. Then there is no risk in speculating. Look at it this way:

-Buy a home in 2006 to flip here in SoCal for $600,000

-I get this home on a zero down mortgage

-I put the home up for sale and realize no one wants to buy the place at $650,000

-We examine prices and realize it is only going to sell for $550,000

-If the lender approves a short-sale, I will still need to pay taxes on the forgiven debt portion (only risk in this whole thing)

They are trying to remove the only recourse in this entire process. If the debt is forgiven, this flipper had zero risk in this entire process. Let me put this question out to everyone, who ends up paying for the loss here?

@son of brock landers,

You are absolutely right. Just like the example I gave to sd scientist, what is the actual risk then if we forgive the debt? You can make the case for people who were mislead into buying or refinancing a home with a wacky $150,000 to $200,000 mortgage balance. We already have ways to help these folks. Use government secured mortgages that have lower rates and are more flexible. Cut out the pre-payment penalty and this will push some recourse on the lenders.

The bailout can’t be used as a populist term. Here in SoCal, with median prices for basic starter homes from $550,000 to $600,000, many vehemently disagree with a bailout. Maybe in other areas things are different since prices vary throughout the country.

@the north coast,

Absolutely. With zero down and debt forgiveness, there is no risk for the multitude of flippers. There was a study showing that the highest growth in defaults is happening in the 2nd home market. Guess who the majority of these folks are?

@eestiseebimull,

Deflation in housing prices for many metro areas is the only way things are going to get back in line. Incomes aren’t going to catch up that quickly.

@feonixrift,

I think we are a long way from any normal real estate market. We are going to have at least one-year of perma-bulls wanting to do everything and anything to get this game back up. If you listen to their rhetoric, they look at the current market as a minor blip on their continued golden era of real estate. Until this psychology is broken, we are in for an uphill battle.

@oilwelldoctor,

You’ll find the majority of people are absolutely opposed to any bailout. They want to help people within reasonable means; but they have very little sympathy for the flipper in high priced areas that was trying to make a quick buck.

@screamin,

Remember that? How smart does that statement look in hindsight? Of course he’ll probably say something along the lines of “well if people used them wisely and carefully assessed the market, we would be okay.†Yup, goes to show that many economist are not well versed in mass psychology even though they are experts in the numbers.

@jimmy,

I simply do not get this. You are selling an overpriced place and you don’t have the time to stage some pictures? My guess is we will start seeing better and better photography in the next few years as the market tightens up. Anyone going to buy stock in digital camera manufacturers?

@bryan,

Never. Still part of it just not included in this analysis. If anything, San Diego is getting hit harder. A few weeks ago an auction was held and places were selling for 67 cents to the dollar.

@exit,

You know I agree with this analysis yet it doesn’t seem like we are pushing this way. What is already in the pipeline is debt forgiveness, Fed relaxing credit, and government offering refinancing options. See, this will help many people that rightfully deserve some help if they were duped into an extremely high interest rate that only benefited the lender. However, there are people that were looking for a quick profit in incredibly expensive areas and I’m not sure people are willing to bailout flippers. So the argument I suppose needs to be framed like that; homeowners that got bamboozled into risky mortgages, if there balance is under conforming caps, should be helped with government loans that already exist. Anyone else needs to face up to the 1099 and pay up. Some may not be able to pay since the income from the 1099 may kick them up to a higher bracket.

How ironic that some of these people that went stated income and lied about their income may actually be paying as if they did earn that amount because of the added income from a short-sale or foreclosure.

Great comments all.

Too bad that the time and energy you put into this blog can’t be utilized more productively to actually create change!

In the time it took each of you to write your comment, you could have called your elected representatives, and/or sent the same comments to publications that reach an audience other than “the choir”. Or, perhaps sent out mass emails to all your contacts to ask each of them to write/call their elected officials, etc, etc.

These actions really CAN make a difference! There are millions of Americans who have been hurt by this ridiculous bubble (and I ain’t talkin about the flippers!) – and I think it is time to ORGANIZE! WE must get folks to let Ben and the pols know that we won’t stand by as they take this situation from bad to worse! In short order Ben will lower the Fed funds rate, Congress will approve looser standards for FHA, higher limits for Fannie and Freddie, etc., etc. Not to mention the myriad bailout proposals. NONE of these are in the best LONG-TERM interests of our economy or society. High home prices do NOT work for the average American!

Wouldn’t you rather actually make an impact that – just maybe – could change the course of this mess into something that works for you? Or, are you truly happy to spend your time and energy commiserating about how screwed up things are likely to stay?

I have LOTS of ideas about how we could turn this thing around, but as this is my first post on this blog, I will keep it brief. If you agree with any of my sentiments, and feel inclined to help get things rolling – please speak up.

Thanks!

fedup

The FED is not going to stop deflation. Remember, that FED is a private bank that has owners. It does not want to see itself destroyed.

More on this here:

http://www.financialsense.com/fsu/editorials/nystrom/20

I think the “FED” is an instrument of the ruling class and they really don’t care what happens to the average American. Furthermore, it can be shown that the FED has done everything to erode the middle class in the US ever since its inception when its backers covertly passed the legislation to make it law.

The problem in this whole mess is that the FED has an agenda that is contrary to its stated purpose. Once more of us can figure this out, the problem can then be addressed head on. But people need to realize the true history of the FED and the international bankers that installed their invisible government over us back in 1913.

As for the current housing crisis, the only solution is for buyers to demand lower prices from those selling. Heck “market conditions” will take care of that regardless now. But what’s most troubling is that many, many people that would otherwise have had a chance to buy a home will now be shut out. One of the purposed of central banks is to create class divides of haves and have-nots that are subservient to the upper class. You can chalk this up as a victory for the FED and it’s owners leading us on a quick path to debt slavery.

fedup… why do you assume such things. I have been on the phone, wrote emails and letters the last 4 years to HUD, The FBI, AG of my state, my representative, my senators on a weekly basis.. NOBODY CARES, even with complete documentation involving mortgage fraud, so called shyster and liar loans and all the other nice stuff going on for years.

Re. the 1099C issue, I don’t think you guys are looking at this the right way. IMO the real issue is an underlying unfairness in the treatment of capital gains and losses, specifically, that losses are limited to a paltry $3k/year while gains are taxed fully and immediately. So someone with a big gain followed by a big loss is forced to pay fully for the big gain and then recoup the tax on the loss over the course of many years. Someone with $100k in losses may have to wait 30 years to net out the taxes. This frankly isn’t fair, and the $3k limit, which hasn’t been adjusted for inflation in decades, is absurdly low.

So what does this have to do with short sales? Well if I understand it right, it’s the same sort of unfairness that trapped many people when the stock bubble burst and they were forced to pay huge AMT on gains they no longer had, and yet could only deduct the losses over the rest of their lifetimes. Suppose that someone buys a house for $500k and finances 100% of it. The house drops to $400k and the person agrees to a short sale. If we are to consider that this person was given $100k in income, it seems that we should also agree that this person lost the $100k in the short sale. Net net, it’s a wash, or it should be if the $100k loss were deductible in the year it was incurred. The party that really has a net loss here is the lender who ate the $100k drop. The party that really has the gain is the original seller who pocketed the $500k. The FB is neither up nor down on the two transactions (ignoring RE taxes, interest, fees, etc.) so it doesn’t seem fair to make him/her pay tax.

Doug,

I think the difference is that the speculator / homeowner who bought with 100% financing was taking the risk that values would increase, and fully expected to “earn” the capital appreciation – and if held for 2 years, the gain would be for the most part tax- and scott-free.

So as Doc points out, why should a speculator get to take all the risk out of the equation by getting bailed out if s/he suffers a loss? The speculator had to ID the property, go thru the loan process and sign the loan docs – plenty of time to assess risk.

This doesn’t address your comment about the “unfairness” of the deferred write off of loss. Bear in mind, if this was a primary residence being lost, NO cap gain loss can be recorded – that only applies for investments (rental properties). So if you’d propose to amend the tax code, that aspect might be fairly addressed – primary residences lost to FC might get some relief from either the 1099 or being able to deduct the loss.

However, for the speculator who sought to gain on the investment, and who lost? Sorry – risk is part of the equation – so IMO no change to the code should be made.

They gambled. They lost.

Classic Ponzi scheme – there might have been 3 people ahead of them who made money, and the last person is left holding the bag.

@the north coast,

Appearance is so important in selling a home. I’m not sure why people don’t spend $200 and get a professional photographer to take a few shots of a $400,000 to $500,000 home. I think it is a symptom of the market where people would buy sight unseen simply because of the mass euphoria. It will change as the market tightens up.

@sd scientist,

That is why we are seeing the jumbo market being hammered. The assumed protection that lenders thought was there was false. Once this perception subsides, many lenders that are still in the game are becoming stricter on their lending standards (as they should).

@exit,

It is great that people on this site and other places have already contacted their representatives. Here is a great link at Patrick.net letting you know what you can do if you haven’t done something already:

Stop the Subprime Bailout

It gives a good overview of what people can do to take action.

It isn’t more regulation that I’m proposing, but enforcement of current regulations. We already have too many laws and regulations; what needs to be done is enforcement of standards in the industry.

You bring up a good point that politicians speak in populist terms. That is, we don’t have the time to take a scalpel at this debacle but have the time to focus on the minutia of other topics. In a way, I think that is why the argument is framed as a dichotomous option:

Yes Bailout

No Bailout

As we are discussing the issue is much more complex then a yes or no answer.

@liberal,

There are many ways around this. 80/10/10 or 80/20 or even lenders capitalizing the added cost into the loan with higher points and rates. Either way, PMI isn’t protection for the buyer but for the lender and technically will cover 20 to 25 percent in many cases should a foreclosure occur. The problem occurs in pricing this with jumbo non-conventional loans. The MBS market created ceilings that went beyond the FHA limits. That is why we are constantly hearing moral hazard talk. What is the risk? FHA loans can help since they have the assurance of the government but what about the non-conventional loans which in the last 3 years, is pretty much every loan in California? The market is realizing that prices will decline by large percentages.

Keep speaking up to your representatives. This will be a major issue in 2008 and it is important that people let their voice be heard. Look at it this way, even in early 2006 people doubted a housing bubble. We are in a very different world now and more people will be listening (because it is now hitting them where it hurts, in the wallet).

@fedup,

We are all open to your ideas and would like to hear what you have to say.

Many people on this and other blogs have already contacted their representatives (link above). I’ve gotten many letters of people telling me that they were on the verge of buying in 2006 and didn’t because of the information they got from this and other blogs. The mainstream media message of 2006 was “we are having slight difficulties in the market but everything will be fine.†People went to other media outlets for a different perspective. This may not show up in the official statistics but how many families on the fence of buying a home in 2006 didn’t because of reading alternative media outlets?

We will keep blogging and 2008 will be a very important election year.

@nesnyc,

The Fed, for some reason is seen as the balancer of all this. When things go bad, the government runs to the Fed and it is the Fed that is partly to blame for this mess. Have people forgotten that they dropped rates to 1 percent? This “stimulated†the economy but I’m not sure this is the stimulus they were looking for. If you make credit abundant and cheap and punish savers, guess what this will do? People will spend. Inject this into a society that has demonstrated its love for spending, and we create a massive credit spending machine. And now we are saddled with this debt.

The Fed’s ideal scenario would be a stagnant housing market with a stepwise tightening of credit and allowing inflation to adjust the kinks out. Yet we are beyond any baby steps. The only thing that will change this market is drastic reductions. Even during the Crash of 1929 in October, somehow bull market psychology saw the decline as only a temporary stop as opposed to a systematic problem. Take this quote from Lawerence Yun today:

“These temporary problems are primarily with jumbo loans, and there are continuing issues for subprime borrowers, but there are no serious problems for the majority of buyers who qualify for conventional financing or FHA-insured loans,” Yun said. “Some consumer concerns remain, but since mid-August the market has been stabilizing somewhat.”

Well guess that rules out every single property in California. Interesting how they view this as a temporary problem. It is much deeper than that and today’s housing report shows that:

From CNN: Record drop in pending home sales

Index that measures contracts being signed for existing home sales drops to lowest level since 9/11 attack.

Great info..i also post a new post about home buyers in my blog here Home Buyers

take a look

This forum have been very interesting to read and get an overall perspective on the current housing market.

One things I like too note is that I recalled when Ben Benanke was first being inducted as the head of the Federal Reserve he had to go before congress. He stated to congress that the US Goverment needed to do something about the massive debt, social security, medicare, savings and that Americans needed to stop consuming so much and save for tommorrow.

Any feedback on this subject is appreciated. (DR Housing Bubble)

This forum have been very interesting to read and get an overall perspective on the current housing market.

One things I like too note is that I recalled when Ben Benanke was first being inducted as the head of the Federal Reserve he had to go before congress. He stated to congress that the US Goverment needed to do something about the massive debt, social security, medicare, savings and that Americans needed to stop consuming so much and save for tommorrow.

Any feedback on this subject is appreciated. (DR Housing Bubble)

I really enjoy your posts. And the comments made by your readers are always insightful. I agree that getting rid of the 1099 consequence will make it easier for the speculators to walk away from their “flip”. I also agree with the reader that said credit card debt losses will be the next hit on the economy.

@insight,

It seems to be a common theme for those in the public eye to over promise and under deliver. The problem we are facing is a growing money supply even in the face of higher rates, which theoretically should slow growth down. Now that M3 isn’t published, who knows the actual figure and rate of the money supply growth. Even taking a cursory look at M2, raising the rates has not dampened the credit spending by many Americans. But with the recent open market activity, the Fed is reversing course. Initially they stated that the subprime market was contained. It is very apparent that this has the potential of bringing the economy into a recession.

Here is the issue. Anyone studying this market realizes there is a bubble in many metro areas. The bubble was fueled by lax lending standards and easy credit. Wealth created by this bubble was pumped into the economy. Consumption is two-thirds of the economy. So a decline in housing wealth will reverse everything for this primary reason; folks are now trying to buy homes on more conventional terms meaning incomes are starting to matter. As you’ve seen from the multiple examples here and elsewhere, incomes are incredibly disconnected from current market rates. Hence prices need to decrease or incomes need to explode in the next few months.

The government seems to have no problem running up massive deficits. Somehow they keep spending and pumping money out of thin air. No new taxes and no cuts so guess where the money comes from? Can it be a dollar worth 30 percent less? Or what about under reported inflation in housing, health care, and energy.

@chessnoid,

Glad to have you on board. We have a good community here. It is interesting to look at current stats on credit cards. It seems like many consumers are using credit cards as bridge loans. That is, something is happening either with mortgage payments or monthly cost that are requiring consumers to use their credit cards at a higher rate. It’ll be interesting to follow bankruptcy numbers in the next few months to see how deep this housing impact will hit consumer wallets.

That’s one huge list. Another useful list can be found at http://homes.relatedlistings.com

Happy listings!

IMO it’s a bit harsh to think that the benefit of eliminating the 1099 is primarily for flippers. They actually made up a small segment of the overall home buying market.

Leave a Reply