The Second Correction – 6 SoCal Homes from 6 SoCal Counties Showing the Continued California Housing Correction.

The median southern California home price increased by $3,500 in February but there is more information in the details. As we have stated many times before, you can have the median price go up for an entire region but see higher priced areas go down. Case and point? Los Angeles lost another $10,000 off the median price in February. Orange County lost $8,000. Ventura County dropped $10,000. The only two counties that went up in price were Riverside ($2,000) and San Diego ($17,000). When we parse the data, we find much distress inventory still out there. A recent report shows that 15 percent of all California mortgages are either 30 days late or in foreclosure, a record high. Yet here we are with little MLS inventory (slightly increasing however). Want to see what the banks are hiding in their balance sheet?

Today we are going to look at 6 homes from 6 Southern California counties. We’ll pick a mix of homes from an area that cover over 50% of California in terms of population. What we find is a breath taking array of toxic mortgages and major price discrepancies.

County #1 – Los Angeles

Sample City – Culver City

Here is a perfect case of an overpriced home that doesn’t show up anywhere in public data but is going to reflect a correction at some point. The above home is a 2 bedroom and 1 bath home. It is listed at 773 square feet. The last purchase on record is this:

09/08/2003: $305,000

It probably would have been fine if that was the end of the story. It is not:

This place now has a $608,000 first mortgage. I’m sure this is going to end pretty. How long can the bank sit back on this and will the current owner continue paying that hefty mortgage? The auction is scheduled for April of this year. Culver City has a lot of correcting to do.

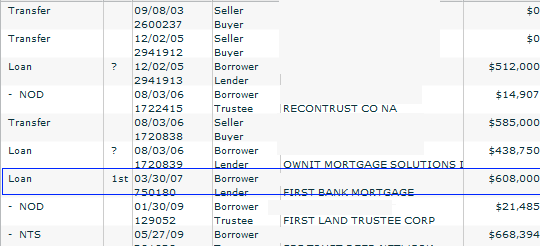

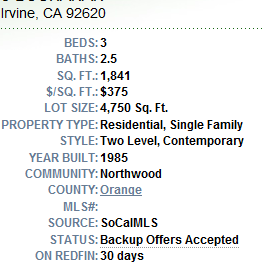

County #2 – Orange

Sample City – Irvine

Here is a home that was on the MLS for roughly two weeks and got an offer. The above home is a 3 bedrooms and 2.5 baths home. It is listed at 1,841 square feet. Here is the listing:

The list price is $689,950. But that isn’t where the action is at:

$1.256 million in loans and currently under contract with a current list price of $689,950. Sure looks like a correction to me!

County #3 – San Diego

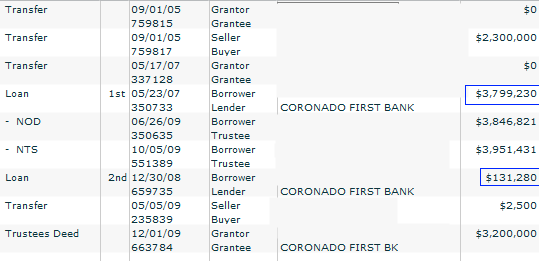

Sample City – Coronado

This is a prime home in a prime San Diego neighborhood. But even in the high end, banks are taking over places. The house is currently listed as bank owned but not listed on the MLS. The above home is listed as having 4 bedrooms and 3.5 baths with 3,515 square feet. A luxury home no doubt. But let us look at the loan history:

You think this place is going to sell for $3.2 million in this market? Hard to sell a home when it isn’t listed.

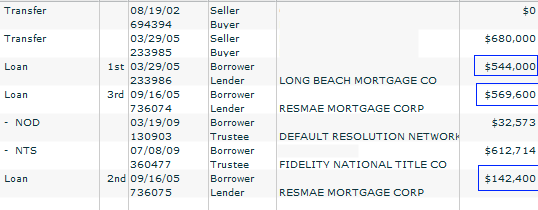

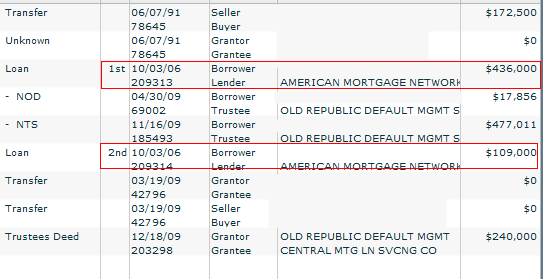

County #4 – Ventura

Sample City –Moorpark

The above home went way over its head. It is now a bank owned home. A 3 bedrooms and 2 baths home. Listed at 1,161 square feet. All yours for $259,900. Is this a discount?

$545,000 in loans and currently selling for $259,900. Â So much for that trickle out theory of keeping prices propped up.

County #5 – Riverside

Sample City – Riverside

Few places in California have taken it so hard like the Inland Empire. The above home sports the typical boarded up window look which is becoming common place in many cities. The above home is a 2 bedrooms and 1 bath home listed at 786 square feet. Let us look at some sales history:

Sold 10/19/2007: Â Â Â Â Â Â $290,000

Current list price is $59,900. I wonder what a sale at that price will do to neighborhood comps? Sure seems like prices are going up everywhere across SoCal.

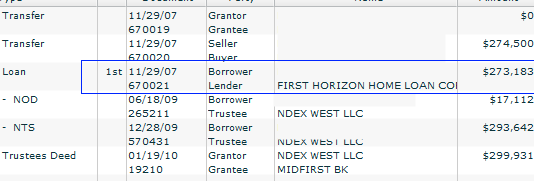

County #6 – San Bernardino

Sample City – Hesperia

San Bernardino is the other county making up the Inland Empire. Hesperia is actually seeing many home sales. Investors are being drawn by the wicked low prices. Last month in SoCal 29.3 percent of all sales were all cash (aka lots of investors). But there is a reason for low prices. The economy is devastated in these markets.  Some are betting on flipping these places and others are trying to gather up cheap rentals. Go on any rental website and you’ll see the market flooded with rentals. Plus, why would you rent when you can buy for these prices in these areas? All you need is 3.5 percent down with FHA insured financing.

The above home is a 3 bedrooms and 2 baths home that was recently built in 2007. The home is listed at 1,364 square feet. Let us look at some sales history:

11/29/2007: Â Â Â Â Â Â $274,500

So it looks like someone bought this place new. Let us look at the note history:

The place is currently listed for sale at $99,000.

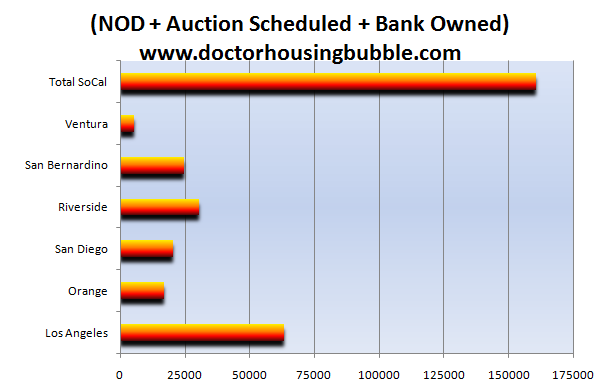

Southern California has over 160,000+ of these homes:

Repeat the above 6 cases thousands of times over and tell me if we have a healthy housing market?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

34 Responses to “The Second Correction – 6 SoCal Homes from 6 SoCal Counties Showing the Continued California Housing Correction.”

#2 is probably a glitch in the ForeclosureRadar database. The 544k loan was most likely paid off when the 569k loan was taken out.

And yet daily in the LA Times we read that real estate is going up and real estate is moving!

Well stated, but one house per county is not enough of a sample size. I understand your point though.

The worst part here is that there are already many apartment rentals due to the high unemployment and then now you have investors buying foreclosed houses 100% cash and then trying to rent them, further adding to the rental inventory which will further drive down rents throughout the So. Cal. region.

I can’t wait for the tax credit and the mortgage paper purchase by Fed. I hope that will speed up the price adjustment. Our family has been looking by a house in Torrance since last year but price hasn’t come down enough for us. Many in Torrance area seem to think worst is over and the price is there to stay. Anyone familiar with housing market in Torrance care to comment on it?

CNBC: “keep fueling the housing recovery or are federal agencies running out of money?”

Don’t forget that the state also found bids for the OC Fairgrounds coming in far short of what they hoped for. The “California is supposed to be expensive” mentality isn’t being reflected in the market.

I’ve looking at the Torrance market for quite a while. It doesn’t seem like reality has set in yet for people trying to sell…and even with the inflated prices there are people buying!! Guess we’ll just have to wait for reality to smack them across the head…which hopefully will be soon!!!

With 3,000 to 3,500 TAXPAYERS leaving the state every WEEK, not to mention unemployment over 12%, both prices and rents have to decline.

Fortunately for me, my main customer is in Texas and they need my knowledge and skills.

I’ll wait awhile before buying, thanks to Dr. Housing Bubble!

And all this time I thought the Upper Middle Class areas were immune to price corrections. Damn it. You know I kind of regret not buying in 2001-2007.

Imagine right now I could be living mortgage/rent free, in a great neighborhood, driving a new Lexus, and have over 300K in cash. I wonder how many prudent savers/renters feel like suckers for not following the herd during the mania. I feel sick to my stomach knowing that the failed risk takers have it better than those who chose to make wiser decisions during the bubble.

Whatever an $12 an hour job will service mortgage wise, is what home prices will fall to. About $18,000 to $24,000. With gold prices set to soar, in 2 to 3 years you should be able to buy a nice home for an ounce of gold.

Compa, I felt as you do until I considered the future ramifications of their lunacy and irresponsibility, for these borrowers who are living “rent free” in those houses. The bill for their equity-extraction shopping sprees and free rent in luxury housing is going to be much heavier than you could ever think.

Aside from the fact that their credit is shot and, given a foreclosure blot on their records, will take 10 years to repair, they are going to have a hard time finding good rentals when they have to move at last.

Maybe they can sell all that crap they bought with the equity-extraction dough, the jet skis and fur coats and cars and electronics and other “butter”, but they’d be lucky to get 10 cents on the dollar for this rapidly-obsolescing garbage. And of course the tummie tucks and boob jobs are non-salable.

Worst of all, there will be tax consequences, or so I believe. I don’t do taxes, so will somebody on this board tell me this: if you bought your place for, say, $200K and you extract $300K in equity when it is at $500K, do you owe income taxes on the money extracted. I have heard that you DO, and the IRS is short these days, tax revenues are falling as jobs are lost and spending is falling,and their goombas will be in no mood to be merciful, especially since they get bounties for hunting down major scofflaws. What if you are now jobless, or you only made $65K a year to begin with, and you get a tax bill for $200K plus accumulated penalties and interest? You had better be prepared to grovel a lot. Don’t fight it, nobody fights the IRS and wins. It is like lying down in front of a train. While private-sector creditors can whack your little paycheck for just so much, the IRS can take the clothes off your back and they will, too.

Yeah, I’m glad I’m not one of these borrowers, and you should be, too.

@CompaJD:

Same here. But whatever, at least its nice outside. Can’t dwell on the negative too much you know.

CompaJD.

You are not alone in the way you feel. The responsible people are bailing out the irresponsible people. Nice, isn’t it?

Well, considering how much in advertising dollars the LA Times gets from Coldwell Banker, Prudential, Teles, Nourmand, and all the rest and of course the NAR and the MLS in the Saturday and Sunday (paid advertising) Real Estate sections, it’s no surprise that they are so RAH RAH! over Real Estate. Of course, they have to show the truth in the monthly Year over Year zip code numbers, and that shows the true reality of the situation – double digit losses for the the year, and losses almost every month (YoY).

Few days ago I talk to an old co student of mine from a high school in province town in Eastern European county, who happens to be living now in Moorpark, CA. He is married to a Taiwanese girl which family business seemingly is real estates speculations. They are buying some condos in Las Vegas, according to him “now is the timeâ€. It may be time for Vegas (although I doubt about it, that is over even there.) But I almost swallowed my tongue when he stated that prices around there in Moorpark are down only a little bit and “that is itâ€. I didn’t want to jump into fight because I didn’t know the area and it was not polite to start arguing with somebody you haven’t seen for 20+ years. Later I check it in redfin.com and saw few houses for sale at half price form 2006 madness evaluation… Now when I read the doctor blog. Wha-ha-ha! O-ho-ho! I cannot stop laughing, because Moorpark is an example how bad it could have been the fate of all those “investing†in RE in the 2002-2007. For example Westside and Orange Co which is still hatching its eggs… Even in the hardest hit areas people believe they somehow got away with the harsh reality of their stupid decisions. When will those people “decide†that there is something very wrong with their way of getting business decisions (about when to buy RE for example)? When people will grow up? What is that in California that is taking the minds away of people from around the world when they land in the middle of this historic mess? Why is this unabated optimism for the ultimate outcome of the greatest RE bubble of all times? Where is coming from that “it is gonna be All rightâ€? It is not gonna be All right!

I hear a lot of foreign nationals with dollars to spend(get rid of) are buying and selling in arbitrage market situations. I suppose the Chinese have lots of money to spend. Better to take a hit on a good quality property than to loose all to anticipated dollar inflation or some other blowout situation. This could prop up the market to some degree.

Ventura county, home prices have acted more like the Inland Empire, they fell fast and hard. I’m a knife catcher who picked up a REO early in the crisis. It wasn’t the bottom, but I got a good tenant, and the rent payments have kept up with the decline in value. I’m no worse off than if I had shoved the cash under the mattress.

I spoke with my neighbor yesterday, he was one of those who refinanced every 6 months. He used to tell me about the “free money” he was getting, I thought he was a fool. Now he claims that he got a modification…his payments are now much less than it would cost to rent a similar home, and he gets to keep all of that “free money”. I guess that he wasn’t so foolish after all.

The first article provides solid information on the tax consequences. Money extracted for cars, boats, vacations, etc., will not be forgiven.

————————————————————————————————————-

‘Some tax issues to consider on mortgage write-downs’

http://www.washingtonpost.com/wp-dyn/content/article/2010/03/11/AR2010031104516.html

Kenneth R. Harney Saturday, March 13, 2010 E1/E2

—————————————————————————————————————

‘Short sales to the rescue?’

Tracey L. Longo Saturday, March 13, 2010 E1/E2

http://www.washingtonpost.com/wp-dyn/content/article/2010/03/11/AR2010031104518.html

For those with underwater mortgages, new rules could expedite an often cumbersome process

————————————————————————————————————-

‘Short-Sale Debt Could Follow You’

http://www.washingtonpost.com/wp-dyn/content/article/2009/09/24/AR2009092405361.html

Saturday, September 26, 2009 Benny L. Kass is a Washington lawyer.

Regarding the house in Riverside with the current asking price of $59,900. When it sells, it will definitely bring down the comps, but , just by looking at the picture of boarded up windows, it seems that this house needs a lot of work. A comparable house in that neighborhood that is in good condition would probably be worth over $100,000. But if the comps come down, the value of the houses that are in good conditions will also come down. I feel bad for the people who maintain their homes in good conditions. They are harmed by the people who destroyed this house.

Laura, President Bush signed an amnesty bill in 2007 that removes the tax penalties on forgiven debt until 2012:

http://en.wikipedia.org/wiki/Mortgage_Forgiveness_Debt_Relief_Act_of_2007

State income taxes might apply depending on the state and type of loan recourse/non-recourse.

Why be bitter? You too can rush out and go buy a house and then default on it. Go ahead and see how lovely life is when you have a 500 credit score, possible recourse loans, and a tax bill to boot at the end of your run. Sounds like those people are really enjoying life!!!

The ones who don’t declare BK, will find life not so rosy after it’s all said and done, but hey, it sounds as if you have regrets and are jealous of the people defaulting, so by all means, get on in there and start “gaming the system”, I can guarantee you it’s not all you make it up to be, but I do so heartily encourage you to join the ranks! BUY BUY BUY! Live for FREE!

Did you know “Moorpark” backwards spells “Kraproom”?

Debt relief forgiveness act is good until 2012. Don’t get too happy someone else will get raped by the IRS (and they won’t in this case, thanks GW), your turn will come soon enough.

According to housingtracker.net the inventory in LA increased 9.2% and median asking price is down 1.3% only for last week, for Orange county numbers are 9.8% and 1.5%. I think the new storm is brewing and after the “FED buy crap” program expires in few days and the last toxic breath of the $8000 buyers incentives dissipates in the fresh air of free market (whatever is left of it) tsunami will hit again. I don’t know an area of human experience where postponing and pretending works. How about when you have a toothache, does it go away when you are ignoring it? Is you car getting fixed without contribution to the dealers coffers? If your roof is leaking in one room, is it better avoiding that room and forgetting that problem altogether?

Is that debt forgiven if you did an equity extraction somewhere along the line?

Obviously the Fed and Gov are playing every card they have to prop this up–even taxes back to homebuilders? Trying to buy time before the numerous Ponzi schemes collapse. You may get your house at the price you want, but things may collapse soon too. We are so far into uncharted territory nobody knows how this plays out. The world is awash in worthless cash and foreigners are trying to get something tangible for their dollars before the music stops playing. It always ends in asset bubbles because productive investments take too long to pay off. (capitalism doesn’t really work by itself–man is too corrupt by nature) Big changes are coming, and the debtor planet is imploding. If we could see past the TV and the papers (all are broke and pander to ads, as mentioned above) and Kudlow, who will go to his grave thinking Reagan was an economic genius; you know there is now way to fix this–we just keep racing down this river till we hit the falls. Lassie can’t save us now.

Kid Charlemagne, good post. We are definitely in uncharted waters here. In my life, I have never been as fearful of the future as I am now. The political and economic decisions from the last few decades will haunt us for quite some time. Our kids and grandkids won’t enjoy the quality of life we did…that really sucks.

Anybody who thinks this is THE bottom is crazy. I realize the government will do everything they can to prop house prices up, but I don’t think it will work in the long run. There is too much inertia to overcome to fix this problem. Things just need to play out and most Americans won’t like it. The days of living high on the hog are over…welcome to the new reality.

Laura, in order for a home equity loan/line to be forgiven the defaulter would have to declare bankruptcy. Only loans used to buy, build or improve the home can be forgiven if the home is foreclosed.

Articles from LA Times

http://www.latimes.com/business/la-fi-cover-foreclose21-2010mar21,0,7144708.story

Realstate it all depends on the location. Last year, my father bought a recently remodel home in Compton for 68K, 3bed and 1bath, which on 2007 it sold for 365k. Near there they are building new condos. Compton is not that bad anymore, nice areas too, near LA and LB..Recently, there was a house for sale almost the same two houses away(a month of so), but this was recently remodel and with garage, that was in the market for 219k, now it appears as pending sale. At that time there were a lot of houses going for 50k or 60k in Compton, they were small and in the bad areas, when in the nice areas they were for 200ks. He decided to look for his third house last summer;however, it was hard to find one cheap and one that they would accept his offer. Out of like 10 property we went to see of 60k to 80k, he put the offers to 4 and 5k more what they were asking. He did not get none. Them I saw three back again on the market, remodel and everything for 200k, which they sold, 5k lower or 5k more what they were asking. Like there was one in the nice part of Compton, that were asking 75k and it sold for 75k, three months later, it appeared for sale for 200k and it sold for 190k. He sended the offer of 75,001k, but he didnt get it. But the weird thing it appears that all the houses sold for what they were asking, no more and they sold quick. Now, my uncle who lives in South Central he says that his houses are worth 110k and when he purchased them for 190k in Dec08..

Hell, Dorie, they might just as well declare bankruptcy… if, that is, they haven’t already done that within the past 7 years. I’m willing to bet that many of the people who borrowed this heedlessly and on stated income, probably already had one very checkered credit history. And anyway, somebody who makes $100K or less and has $700K in debt on a house worth maybe $350K today, is really bankrupt anyway and has no chance of either paying the debt or the taxes on the forgiven loans, so just do it. It doesn’t look any worse on your record than foreclosure.

The irresponsible people are the ones in our government! Vote out all Republicrats, vote in responsible independent politicians who will listen to you and not listten to special corporate interests!

Laura, yep, that seems to be the way to do it. If you have just one original purchase loan you simply let it go into foreclosure. If you’ve done a cash-out refinance or have a home equity loan or line of credit you declare bankruptcy to get out from under them all.

Leave a Reply