The Trillion Dollar Question: Looking at the Exact Items That will Cause $1 Trillion in Write-down Losses.

It is becoming rather apparent that the economy is now of the cusp of flying out of control. The Federal Reserve under the tenure of Alan Greenspan always carried an aurora of power that whenever things got silly in the market, the maestro Greenspan would quickly take center stage in D.C. and calm the markets. No one really understood what he was saying most of the time but the markets usually responded to his words. Yet Greenspan was essentially the Wizard of Oz, keeping the Ponzi scheme going until the very verge of the market implosion. No one really believes that the entire credit market meltdown is Ben Bernanke’s fault. Yet many do believe that Greenspan and Bernanke are essentially cut from the same cloth.

The economy is under pressure given that this June has been the worst month for the markets since 1930, during the Great Depression. There is a major significance to this aside from the psychological association to one of the worst financial moments in our country’s history. The major reason this plays on the overall market psyche is that it is hard to keep bamboozling the public into believing all is well and we are not in a recession when the following is occurring:

-$140/bbl oil and $4+ Gas at the Pump

-Rising Grocery Costs

-Healthcare costs sky rocketing

-Home prices crashing across the country

-Credit card defaults rising

-Unemployment rising for consecutive months

-An unpopular war

We can go on, but now you have a sense why consumer confidence is at a multi-decade low. The popularity of the President and the current Congress are at historical lows. The past week was significant as well since the market briefly flirted with Bear market territory. That is, we are nearly 20% off from the peaks reached in early October of 2007. Now whether reaching the number is important, we are only a few points off and we are going to be entering earnings season in July given that the first quarter comes to an end on Monday.

If early indications of earnings are any sign, this is going to be a brutal earnings season. So far, we have seen write-downs totaling approximately $391 billion. These write-downs have come from the following sectors:

Banks: $234.19

Mortgage Finance: $25.24

Broker-dealers: $86.29

Insurers & Reinsures: $45.10

*Source not updated for write-downs from last week

The tipping point reached by the market last week is we had the announcement of further write-downs from companies here at home but also, across the globe. We’ve heard rough estimates here and there that this was it and we were nearing a bottom. That these write-downs marked the end and we would soon be recovering. That is absolutely not the case. We have $500 billion in toxic Pay Option ARM mortgages starring us squarely in face getting ready to start recasting in the upcoming months. Many of these loans are in the hardest hit states such as California where housing is down over 30 percent from the highs reached last year. Should employment sink further, we can expect delinquency in auto and credit card loans to soar.

There is a fantastic book by Charles Morris called the Trillion Dollar Meltdown which I just finished reading this past week. It is an easy read given the subject matter at hand. Mr. Morris discusses the genesis of the credit problems and since it came to publish before the hysterics of 2008, has been on the money ever since so there is little reason to believe what is outlined won’t come to fruition. He also gives a bit of history of the S&L problems and the LTCM issues which amazingly seem very similar to what is occurring today. The only problem is today’s issues are multiple times larger and more problematic. I would recommend anyone interested in learning about the CDO, CMBS, CLO, CDS, or any other credit instrument to understand truly the underpinning of the credit crisis read this book.

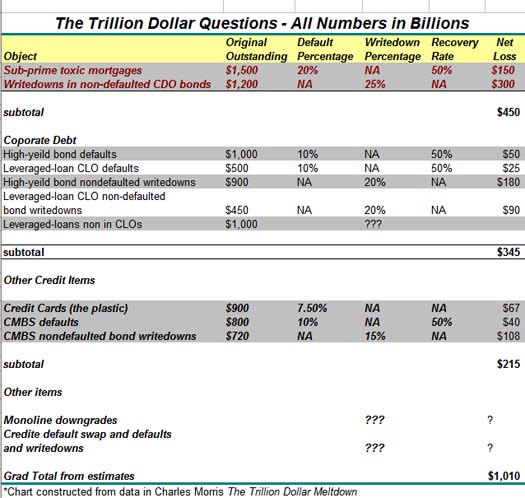

From data produced in the book, I have reconstructed a chart showing that the $391 billion in write-downs is only one-third of what we have to expect. Here is the chart:

Keep in mind that in the above chart, it is hard to estimate how much will be lost from markets with little transparency such as the CDS and derivatives markets. Given that the notional value of derivatives is a mind numbing $596 trillion, this has the potential of slamming the brakes on the global market. Much of this is traded over the counter with very little transparency. In fact, the entire Bear Stearns bailout was done to protect the collateral damage from these archaic instruments of destruction. The above $1 trillion in write-downs does not include these items.

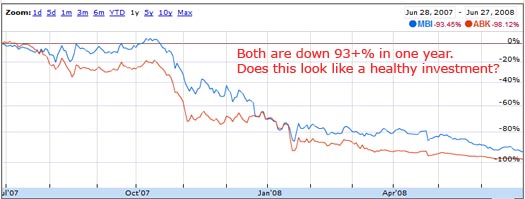

Also, the above chart does not factor in the monoline annihilation that is going on. We already know that MBIA and Ambac are now fighting for their survival:

Both Ambac and MBIA are struggling for survival being down a stunning 93+% in one year. This is not the sign of a thriving company. So the $1 trillion is simply an estimate on the potential of further write-downs and given the health of our economy, I can see these numbers ballooning much higher. We have yet to see the commercial side of real estate take a major hit which if the economy contracts further will get slammed into the ground.

This is not the time to pass government legislation allowing lenders to transfer junk from that $1 trillion list above, and put it on the books of the public. We have already seen over $3 trillion in housing equity evaporate into thin air although I would caution to call any bubble gains real equity.

So what can you expect for the next few months? You can expect further housing problems, more write-downs, and hopefully the government finally being honest and admitting that we are in a recession. The books are so cooked that is nearly impossible to be “officially” in a recession given how the government calculates data. By the time they admit any problems people are going to be paying $6 a gallon on gas and we’ll be hearing things like “worse than the Great Depression” although we are already hearing some of that. Do you happen to have a trillion in your wallet?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

12 Responses to “The Trillion Dollar Question: Looking at the Exact Items That will Cause $1 Trillion in Write-down Losses.”

Great post doc. You know I have been following you for a while and I want to say it has been a pleasure learning from you. I was just at a family party recently and it was amazing to see this reality/pessimist about our economy spread like a southern California wild fire. You average Jose is now talking about loosing his job, getting his hours cut, spending a little less, or just has a negative outlook in general. Exactly how you have pointed out numerous times.

I do have a question for you doc (or anyone else who would like to contribute). What is one to do is they have money in a savings account? Where is a safe place to put it? My wife and I have saved almost $100K and we feel we are being cheated by WAMU and their measly 3.5% online savings account. Should I pull it from WAMU since they are doing bad? We have never really invested in anything else so we are not sure what to do. Anything you or anyone can do to help is greatly appreciated.

Gold…the final bubble. One last gasp. Sure, gold bugs have been warning of the collapse for 35 years now. A bit premature, but accurate nonetheless. The delay was due to the size of the Middle Class wealth that had to be transferred to the “Chosen”. Now that the well has run dry, the reality will become apparent to the victims of this process. Expect civil unrest and major changes in the “Social Contract”. Better than Reality TV for sure!

Scary isn’t it? I just commented in Dr. HB previous thread that I find electric utilities to be an attractive investment because many pay a dividend equal to or higher than bank CD’s and their existing plant and equipment is worth a lot more than book value owing to higher steel, copper and other commodity prices. As electricity is essential to modern life it has even less demand elasticity than does

oil and people will pay their electric bill above all others save food. The other thing is that electricity demand, despite increasing rates, it likely to grow in the coming years as plug in electric cars hit the roads. A Norwegian company is set to begin sales next year in the US and the Chevy Volt will be available from 2010.

What this means to electric power generators is that instead of being essentially sellers of power from 6:00AM till 10:00PM they can sell power 24/7 as people charge these new electric cars at night. This will allow power companies to make better use of their generating and transmission facilities. Those companies like Exelon and Dominion who operate large fleets of nuclear power plants will really benefit as those nukes have a lot of spare generating capacity during off peak hours and don’t need fossil fuels to keep operating.

1 trillion $ is a floor and an optimistic forecast…

more realistically 2 or 3 trillion will be the total number…

when adding auto loans, credit cards etc….

and then we need to add the meltdown in Europe (UK, Spain, etc…)

$4 a gallon gas? Is it going back down? Driving through NW California, the lowest price is $4.759.

FZ6: I suggest you go to this site:

http://ml-implode.com/

type WAMU in the search window lower right side, read the articles, and pull your money.

I have a cd at Wachovia I am pulling at maturity, if not sooner, for the same reason. 3.5% is a good rate. It seems only dodgy banks and credit unions are offering liquid products at that kind of rate. I have the bulk of my savings at a credit union, in treasuries, and and in gold, with a small amount in dow and financial short index ETFs (link below). This does not constitute a guarantee of performance. I am sure a lot of people are investing more aggressively in precious metals, resources, and financial stock shorts, and making a great deal more money than I am.

http://moneycentral.msn.com/investor/partsub/funds/etfperformancetracker.aspx

We took our kids to Disneyland yesterday. It was the fewest people I’ve ever seen there, and it was a Sunday. Don’t know if there is a normal lag in attendance around this time of year though. We got to go on lots of rides….which of course made the wee ones quite happy. My son is sitting next to me right now saying “I want to go to disneyland again…” over and over and over…..

I went to Disneyland in May (Mothers Day) and mid June, there were short lines then too. Both Sundays. It was great, only the new rides had lines. It should have a lot more people….

With the cost of gas, parking & admission you are looking at least $200 down the toilet. With the econemy as of now I don’t think many people are saying “Hay! you cant make your morggage payment! What are you going to do now!” “We’re going to Disneyland!”

Government agencies currently insure deposits at banks and credit unions. If there are multiple failures at those institutions I wonder if we might be getting pennies on the dollar for our ‘insured’ deposits.

a lot of crazy things are all coming to roost right now……

Vegas was sort of a ghost town this weekend, and has now adopted the Tijuana shills out in front of the club trying to bring people in marketing tactic. Which I found suprising, and then scary since they haven’t dropped their entrance prices to the clubs or the room rates yet. At one bar, I sat next to a man arguing with his wife in regards to not playing the slots. His theory was, “Vegas is hurting, and it doesn’t take a brain surgeon to figure out that they are gonna dial up the machines to ultra tight”

This basically means nothing, but I always thought Vegas represented the real USA. and after this weekend, things don’t look good for Vegas…

The book seems a bit rushed (not surprising) and spends a little too much time on redundant commentary where a few charts would have explained things better. Since you have the data and tools, how about doing one better? For some future post, connect the bubbles over time and show how the money spigot from leveraged funds (mostly hedge and derivative funds) has moved from junk bonds to stocks, early CMO’s, back to stocks, then to CDO’s, and now leveraged commodity trading (a.k.a., oil speculation). Put each of those bubbles on a long time scale graph and I think you’ll find that they are almost continuous — just like passing an air hose from one balloon to another. The solution should be obvious, but it would put most of wall street out of work.

Leave a Reply