The World in Depression: Lessons from the Great Depression: Part XXIV: Economic Crises Around the World in Synchronization.

To assume that the worldwide depression in banks and global equity markets started here in the United States dilutes the magnitude of our current predicament. The interconnectedness of our global markets makes good and bad ideas spread faster, with deeper and more profound implications than say a half century ago. I have been reading numerous articles and journals regarding the lost decade experienced in Japan that permeated throughout the 1990s and is still lingering today. The latest pieces I have gotten my hands on are Charles Kindleberger’s The World in Dpression 1929 – 1939 and a piece by Carmen Reinhart from the University of Maryland and Kenneth Rogoff from Harvard University, The Aftermath of Financial Crises presented at the American Economic Association meeting in San Francisco on January 3, 2009.

There are many deeper problems still swimming in the sewer that is our global banking system. The paper presented at the AEA meeting focuses on historical banking crises instead of minor recessions. It is safe to say that we are battling with a different kind of economic beast at the moment. The data presented in the paper is startling and has research from across the world. I understand that people initially are reluctant to use parallels with the Great Depression. Yet I believe this aversion to discussing the Great Depression earlier say in 2005, 2006, or even 2007 has caused us to stack this house of cards only higher and higher and the downfall will now be much more widely felt.

It is rather apparent that exploring Ben Bernanke’s view of the Great Depression is deeply rooted in neoclassical economics. This view that all ills can be solved by monetary policy and central banking is simply a misguided notion in such a complicated and global network of economies. The problem with Bernanke’s view of the world is that economic systems have some kind of inherent equilibrium. Yet I think this notion is false. That in the end, the market will balance everything out and that there is some ideal level for economies. That is to say that there is an ideal level of unemployment, an ideal level of inflation, an ideal price for most assets. Yet economic systems rely on humans who are inherently chaotic and do not follow orderly systems. Need we point to the current global battles going on to show that we do not always get along or follow nicely paved roads?

Going back to the paper presented earlier this month, it looks at banking crises and pulls data looking at housing and unemployment during the economic downturn. What this shows us is that this crisis can run deeper and has the potential of snow balling into something more pervasive if it isn’t handled properly. The unfortunate actions taken by our central bank and U.S. Treasury leave us wanting. It also leaves us with a bitter taste in our mouth and a blatant disregard to what history has taught us.

This is part XXXIV in our Lessons from the Great Depression series:

18. Charity for Financial Deviants.

19. The Silent Economic Depression

20. The Four Horsemen of the Economic Apocalypse

21. The Big Change

22. The Infection of Consumerism and Living Fake Lives.

23. The Worst Housing Crash in American History.

Where is the Bottom?

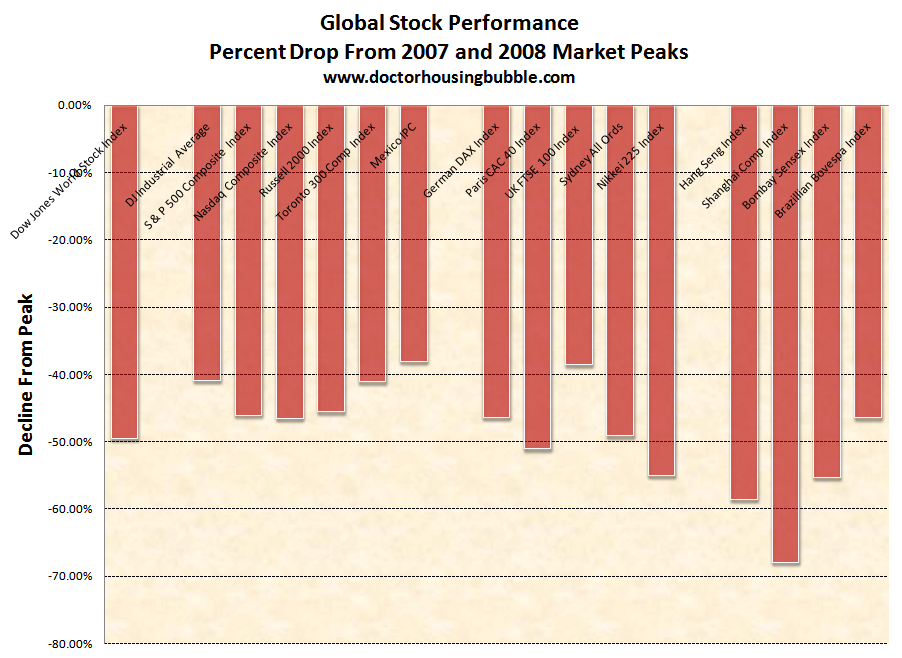

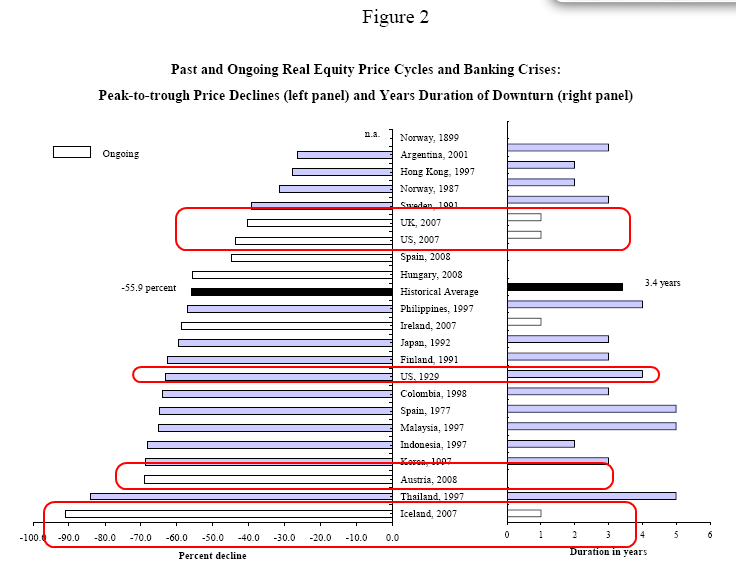

As we approach 2009 with a solemn humility that markets can be chaotic, it is important to first assess the damage to the global equity markets:

*Click for larger image

Virtually every major equity market in the world is down from its 2007 or 2008 peak by 40 percent. Many are down by 50 percent and some are down 60 percent. Make no mistake, this is a global crash. Yet looking at historical data this seems to be on par with many banking crises in our past. What the paper found is equity prices fall on average 55 percent over a downturn of roughly three and a half years. So assuming this crisis is like those in the past, the above declines seem about right. Yet we are talking about averages. Given the persisting problems, this would assume our crisis is closer to the end than the beginning.

It was interesting to hear a poll on MSNBC that 57 percent of Americans believe this crisis will last 1 to 3 years. So much for the notion going around regarding a second half recovery in 2009. Most people are already bracing for a longer economic downturn. Let us look at some data presented in the paper:

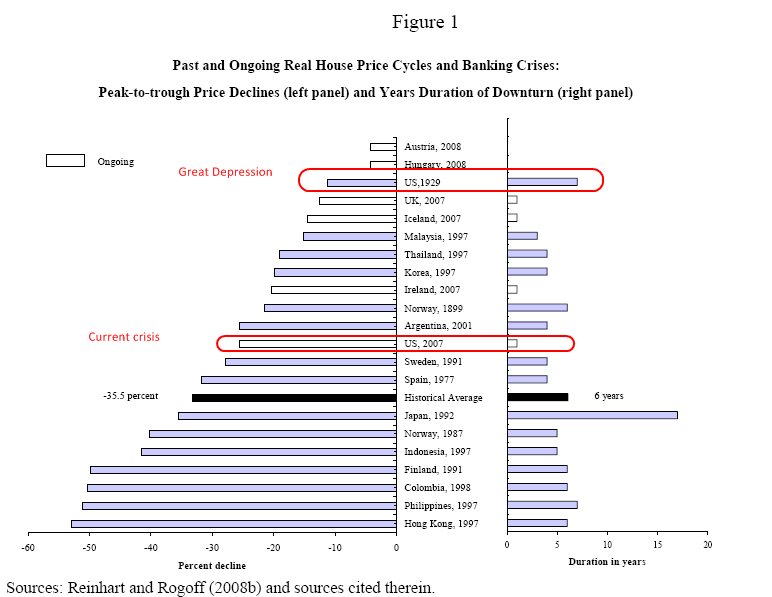

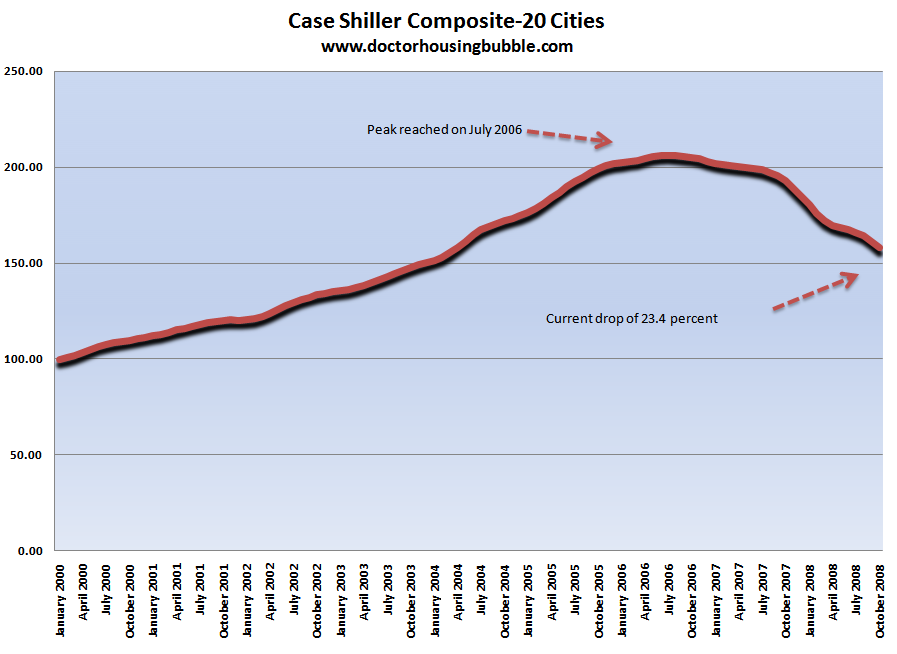

Incredibly, this housing crisis is already worse than that of the Great Depression. It is also the case that during the start of the Great Depression homeownership in the country was slightly over 40 percent while at the peak of our recent real estate bubble, homeownership nearly touched 70 percent (we are now back down from that level). The research found that on average, real estate housing price declines average 35.5 percent and last 6 years. Let us look at the most recent Case-Shiller data:

First, the peak was only reached in July of 2006 which means we still have until 2012 for this thing to run its course if we are to follow the historical average. In addition, we have 12 percent more to go in terms of price drops. Yet by any standard and measure this has been the biggest coordinated real estate bubble the world has ever seen so merely reaching the historical average would be fortunate. My estimate is that we will fall much lower on the downside. If you look on the chart above, Hong Kong fell over 50 percent which is something resembling the state of California which is already down 46 percent. I still believe California will not see a bottom until 2011 and this recent budget hot air blowing simply shows how bad conditions are getting.

I think it would be useful to put this into context from a passage from Kindleberger’s book:

“Samuelson’s emphasis on the fortuitous character of the depression is not entirely satisfactory. Financial crises have occurred with great regularity, or at least they did in the nineteenth century and prior to the end of the Second World War: 1816, 1825, 1836, 1847, 1875, 1866, 1873, 1890, 1907, 1929, 1937. A number of these turned into great depressions. The great depression of 1873 to 1896, sometimes regarded by economic historians as the great depression, was perhaps different in origin, characteristics, and effects, so that on these scores one can regard the period from 1929 to 1939 as unique. Going further back, however, produces the uniformities that the social scientist searches for. Like the First World War, the Napoleonic Wars were followed by a short, sharp deflation in 1816, comparable to that of 1920-21, and a period of monetary adjustment culminating in the restoration of the pound to par in 1819 and 1821. Then came a spurt of foreign lending from 1821 to 1825, followed by a stock market crash in 1826 and a depression. If one subtracts 100 plus three to five years from the major economic events of the 1920s and 1930s, interesting parallels emerge. The 1826 depression was not perhaps as deep or widespread as that of 1929 or as those of 1837 and 1848 that followed it. But the timing is disconcertingly similar.”

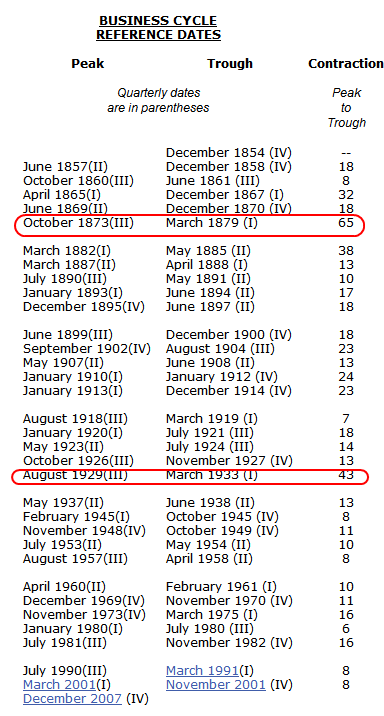

The point of course is that economic shocks occur quite frequently. If we look at history after the 1929 – 1939 Great Depression, it would look rather tame in comparison. Yet I think that is where the mistake is being made. Let us look at a chart showing United States’ recessions dating back to 1854:

First, the Great Depression lasted 43 months officially on its first stint (1929 – 1933), then fell back in 1937 and 1938 for another 13 months. However, if you look at the earlier Great Depression usually referred to as the Long Depression, this lasted 65 months. You’ll also notice that since 1933, the longest duration of economic contraction has been 16 months. We are already on month 14. Do you really see things jumping up by April of this year? If you don’t, then we are talking about the longest contraction since the Great Depression.

I would also argue that the recent relatively light recessions have lined us up for a mega economic contraction. First, we have been cooking the books on unemployment and inflation for nearly 2 decades. We have jumped from one epic bubble in the 1990s with the technology boom to the real estate bubble of the 2000s. So for nearly 2 decades, we have operated in a world where the data understated the true nature of what is really going on. First, most of our growth has come at the cost of stunning credit expansion. This credit expansion made up for our loss in productivity and gave us a false sense of growth. Also, the last recession was simply averted by Alan Greenspan dropping rates in a deregulated climate and created a recipe for disaster in a world where business ethics simply did not exist.

If you think the Great Depression stock market was horrible, we already have two nations past that level:

Austria and Iceland are already seeing a much deeper crash in their equity markets than the U.S. did during the Great Depression. Also, it is early in the game since these occurred recently. The average peak to trough found in the research is 3.4 years. Assuming our domestic peak of August of 2007, just to stay with the average we are talking about late 2010 or early 2011 for our bottom.

The severity of this crisis will shift the field of economics. First, I think the Milton Friedman school of monetary thought has taken a major hit. Sure, the argument can be made that during the Great Depression the Federal Reserve did not act as aggressively as possible. This was debated for decades. We had our first real chance to put Bernanke’s theory to the test. It failed horribly. First, a mistake made which I think is made with most neoclassical economist is they believe in the notion of some ideal equilibrium level. It simply does not exist. This would presuppose that there is an ideal level to be at. For example, should a Goldman Sachs trader make $1 million a year or $20,000 a year? Ideally the market would set this price but when you have the central bank in bed with the government, the salary is whatever the crony capitalist say it is. That is not equilibrium. That is a plutocracy and we are now in the field of political science, not economics.

Never have we seen such an incredible and unprecedented action taken by the Federal Reserve. They have failed. This year we are going to put the neo-Keynesian school of thought to the test with another spectacular action on the fiscal stimulus side. Will this work? I’m not sure. Look, as much as I criticize Bernanke for his ideologue view of monetary policy I would love to have been proven wrong and seen everyone making beacoup money (all of us and not just those in the finance sector), real estate at stable levels, and all of us able to afford the fruits of our labor. But again, the world doesn’t work that way. That theory is now proven wrong in the theatre of life.

I’m sure the vast majority of us want to see the country succeed. If fiscal stimulus does the trick then I’m sure few would argue. But even if we look at the fiscal stimulus of the Great Depression, what we see is that it did improve the lot of many Americans, added some needed regulations to the market, and gave us some of the social safety nets that we currently have. Yet we now live in a very different world. Those same safety nets are now a looming problem with baby boomers starting to retire in force and our workforce stagnating. Families simply aren’t having the number of kids that those in the early 1900s did. The fact that we aren’t even discussing Social Security or Medicare should tell you how severe this current crisis is. Let us assume we tackle this problem. Then what? We will need to confront the massive debt of our country at some point. This is already being acknowledged yet we are also told that we are going to run massive deficits in the short run.

The fact that we are now battling with deflation tells us that we are probably going to have a Japan like recession or worse, something like the Great Depression. Why are we to believe otherwise? We are committing the same actions. Are we trying to make our U.S. dollar, the currency of our country strong? Absolutely not. Ben Bernanke and the U.S. Treasury are trying forcefully by holding rates at near zero to devalue our dollar. Take a look at this chart looking at the CPI:

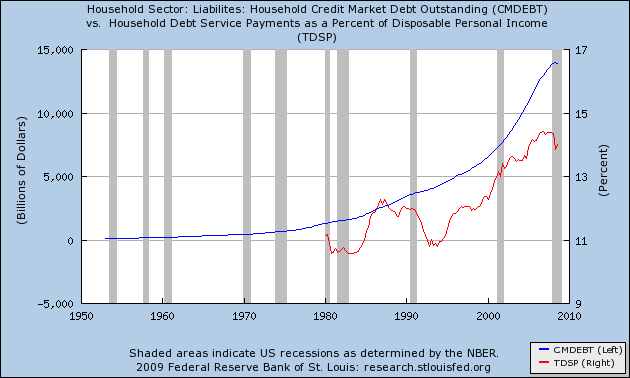

We are very likely going to see a year over year decline with inflation (aka, deflation). It is hard to see how we get inflation because that supposes that the government has some mechanism of forcing wages up. They don’t. Unions have very little power in our country today. Take a look at what is happening in California for example. Starting February 1st 2009 the Governor has placed thousands of state employees on furloughs that will run until June of 2010. This includes 2 days off a month. Sounds good right? Well that is a 10 percent pay cut. So as you can see, we are not seeing prices rise. In Bernanke’s ideal world, the flooding of the system with liquidity and now actual capital to the banks, was to get people back on that hamster wheel and going out to spend again. The notion was that prices would once again go up because people would start bidding on these items again. But there is one small problem. Americans are already tapped out on debt! They need actual real wages to go up. Take a look at the explosion in debt:

American households are still burdened with a historically high amount of debt. So it is hard to see how deflation doesn’t occur. As most Americans know it, inflation or deflation is associated with the price of assets or goods. This is normally the ancillary impact of changes in the money supply. Yet looking at the CPI, this is a basket of goods and their price so I think it is fair to look at the price of goods as a sign of inflation or deflation. First, let me give you an anecdotal taste of deflation. The liquidation of Circuit City and the job losses of 34,000 people. I was driving to the store today and saw street spinners highlighting the 30 percent off at the local Circuit City. The fact that they are slashing prices and moving everything out is typical of deflation. We can expect more of this. In fact, the prices of many items were cheaper. Initially, this may seem like a blessing but deflation is equally damaging to an economy.

For an economy like ours so dependent on spending and consumption, deflation will make this into a depression. Just think about it. Why would you buy a home today if you knew it would be cheaper tomorrow? Why would you buy a car today if you were worried about your employment? That is the issue with deflation. Bernanke’s mistake was that he thought he had the power to induce inflation which he clearly cannot. The consumer psychology has changed. Even if people had access to credit (which they don’t) it is wrong to assume they will spend it again. The gig is up.

The size of the fiscal stimulus may cause some short-term stability in prices in some sectors but the magnitude of this problem is much larger than that. I simply do not see how a world in a depression like atmosphere will see prices coming up in the next few years. Even the historical data doesn’t show that. Yet I am hopeful things will get better. In fact, the last few months show the savings rate going up. Hopefully people take this new found austerity in stride and remember that life isn’t only about that gigantic McMansion with granite countertops courtesy of a back breaking mortgage. When we reach the bottom of this, if anyone tries to talk about how great and infallible real estate is, just try remembering this worldwide depression to temper your expectations.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Â

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

31 Responses to “The World in Depression: Lessons from the Great Depression: Part XXIV: Economic Crises Around the World in Synchronization.”

Great stuff again Doc,

I guess the urgency of this latest piece’s lack of sarcasm paints an even more dour picture of the dust-bowl that our economic landscape is becoming. We should be able to survive, but Americans have become so soft and are so quick to complain. We still think the purpose of society is to fulfill our constant stream of whims and delusions. The 1929-1939 (unofficial, but that’s the truth) depression produced a stout populace that learned how to produce more, ask for less, and keep whim and delusions at bay.

Maybe this will produce tighter families, less divorce (too expensive in a depression) kids dreaming of a better life by educating themselves rather than grand-theft auto marathons as a lifestyle.

What doesn’t kill us can make us stronger. Of course, future generations, assuming there are, will again one day be foolishly arrogant and assume they have gained new insight to the financial mechanisms of the world, and that the past malaise (2007-201?) could have been averted by negative interest rates and bigger bailouts.

Great post, as always.

It would be interesting to know what the growth was between the recessions in your chart to see where we ended up compared with 1873. I just did a quick back of the envelope run assuming a 10% annual growth, and if 10-73 equals 100, by December 1914 we are still at less than 23.

All I know is this….the news is staggering. If in my mind, I know if I wait a week or a month or even a year the price of an asset is going down then why would I buy it until there was stability.

I am scared which is in my opinion a natural reaction to this financial mess. If you’re are not scared then you just dont understand the magnitude of the problem. I still see they are selling homes in Hollywood with 1200 square feet living space for 1.2 million. If I loaned you the money for a home like that then you better be putting enough money down to support a that home at a year 2000 price because when this is all said and done that is all that is will be worth. Tell me what the price of a Hollywood Bungalow cost in the year 2000.

Put your rain gear on people, we are all in for a storm……..

I think the “why would you buy today if you knew it would be cheaper tomorrow” argument is bogus. If that was true no one would’ve bought computers, media players and even cars ever. Those have always been cheaper tomorrow. No, the reason is the step back from spending too much too easy, the “oops, let’s be more careful now”. People aren’t buying houses not because they’re cheaper tomorrow but because they’re overpriced today.

Cheers for the good work Dr.

Dr.

Brilliant as usual.

You’re starting to sound like Peter Schiff.

(That’s a good thing!)

Hey Doc this reads like YOUR work:

http://www.powerlineblog.com/archives/2009/01/022586.php

Gee it’s a nice format- enjoy your day-

I am going to be repetitive about this. What is needed is principal relief from the

government, not lower interest payments. The notion comes from the ancient concept of jubilee. Rather than force everyone into bankruptcy, the government can cancel some amount betwee $100,000 or $500,000 of every citizen’s consumer+mortgage debt.

Puttingg money into the hands of the middleman banks is just a money sink and will not inflate the economy. The bankers and loan people just eat in bonuses and salaries. Bankrupt the banks, take them over, and cancel the loans. Let’s do a reset/reboot like with a computer. The current path is going nowhere and will result in years of misery.

Worst of all, it will not result in the change in behavior needed by the banks to limit loans to those that do not need them. Home loans and credit have been the tools of social engineering (a home and garage for every car owner) ala Fannie and Freddie, and as such their responsibility should be borne by the government.

Incredible post as always Dr HB. This one happens to be the most alarming though. it is obvious now, that we are in a global crash, unparalleled in history. This unfortunately is our fate, as the excess of the FIRE economies throughout the world are in their last phases. As painful as it will be, we will come out the other side, but, it will take time. 2010, 2011 are optimistic, as we are dealing with a bubble of epic proportions. It amazes me how everyone thinks their piece of the pie will be saved. I don’t think so. All of us will feel pain from this, as 2009 makes it evident.

Are people on the Westside that delusional, that they can’t see the bigger picture? This is Hollywood though, and people love a good fantasy.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

Again I’ll be the lone voice crying in the wilderness and point out that if you take the number of the unemployed in America and then subtract the number of jobs illegals are taking (which would then be available if they weren’t) viola you have no “unemployment crisis”.

Nancy Pelosi sez it’s all about jobs jobs jobs but NOONE nationally or at our state level has mentioned this ‘lil tidbit-

Arizona clamped down on hiring illegals and they all just went to other states like ours who allow them to be hired with impunity.

Now I know LOTS and LOTS of illegals and some of them are awfully nice folks but America is supposed to work for AMERICANS after all AMERICANS are who have made the sacrifices and fought the wars that enabled this country to become what it did-

Since when was national sovereignty such a villified concept?

PrintFaster…

We can always vote in Hugo Chavez or someone like him. Only he – and others like him – can waive a magic wand and declare debts absolved. However, what follows is a complete collapse (much worse than what we are going through) in the economy as investment completely dries up. Forever…

All the FED and Treasury are trying to do is initiate inflation. We can fight inflation. We can only fight deflation through inflation. Folks, we should be setting ourselves for a period of deflation followed by very dangerous inflation.

Additionally, we should be setting ourselves for dramatic cutbacks in our demands on government at ALL levels. Is not the public sector the worse of the worse. The public sector has been running deficits even when things were booming. We (the imperial, not the individual) wanted those deficits. Yum, yum…

There are already articles about government moving to seriously reduce services.

I am ok with that.

The dates for the slump that began in October 1873 are hopelessly skewed and should not be part of your sample. By 1875 the United States had RETURNED to the gold standard after abandoning it during the Civil War. The very sketchy price and income data available from the 1870s have to be adjusted for the effects of The Specie Resumption Act. The economy did not “recover” to the levels of 1873 until the end of the decade because prices were no longer discounting continued monetary inflation. Grain and pig iron production, railroad freight miles and worker incomes adjusted for declining prices from increased productivity (the same process that has been rewarding customers at Wal-Mart for the past decade) literally exploded during the decade. Even conventional Keynesian historians like the Romers concede that the 3+ decades from the resumption of the gold standard to the Panic of 1907 were the period of the most dramatic rise in agricultural and industrial production AND productivity in the history of the United States. It was that boom in real incomes that brought the wave of emigration from Europe to the Americas (not just the United States). The present circumstances are quite different.

In the typical American fashion, we will finally do the right thing, once we have exhausted all other possible methods.

First, I think the Milton Friedman school of monetary thought has taken a major hit. Sure, the argument can be made that during the Great Depression the Federal Reserve did not act as aggressively as possible.

It depends on how the hit is interpreted. Decades ago, Friedman’s opinoin was disputed by Murray Rothbard who claimed that the Fed did all it could reasonably be expected to do as far as monetarization is concerned – the fed can’t simply replace all private credit with government cash. The only thing the Fed didn’t try at the time was insuring deposits – which would’ve required printing dollars and would’ve required ending the silver standard as well. We are living through NOW what Friedman says should have happened THEN, and we still are only speculating at the effects. And we have a lot more forms of credit in the system today than existing in 1929-1933: credit cards and HELOCs, bank shares traded publicly, insurance companies demutualized, student loans, etc.

What Friedman failed to imagine is what would happen to trust and interest rates. The Fed can create cash to kingdom come if it wants, but who’s’ going to lend money at a fixed rate when they have no idea when the Fed’s money creation is going to stop? If money is being created on a whim, interest rates will either skyrocket to accommodate for the uncertainty (why lend at 8% when money supply expands at 16% – the loan will cost the lender money even when the loan is paid) or the loans won’t take place. Who’s going to borrow at high rates when the money creation could stop at any time? All Friedman’s idea could do AT BEST is pay 15-20 cents on the dollar for bank deposits at defunct banks. Which would slow the deflation but not reverse it.

Eventually the fed WILL replace all the lost credit with cash, but there’s no way they can time it without hurting sectors of the economy. The best they can do is drag the money creation out over a series of 10-20 years to stop periodic shocks but the fed can’t do anything about the initial shock which will last a minimum of 2 years. After the initial shock, things might feel normal for a while until the aftershocks take place.

hat the government has some mechanism of forcing wages up. They don’t. Unions have very little power in our country today.

Even if unions DID have power it wouldn’t make a difference. In the 30’s, wages remained high – for those that got wages. Wages PER CAPITA fell.

Comment by Mich

I think the “why would you buy today if you knew it would be cheaper tomorrow†argument is bogus. If that was true no one would’ve bought [….}and even cars ever. Those have always been cheaper tomorrow.

____

HUH??? Cars have always been ‘cheaper tomorrow”‘? In 1974 or so the small-medium size moderate price sedan cost 27% of the median household income. In 2008, the same small-medium size moderate price sedan is aroun $24,000 and costs 50% of the median household income. Then take my semi-custom pickup – odd thing 1 T body on a 1 1/2 T frame with the 11/2 T rear end, axles, heavy-duty towing set up etc. Only around 3000 of them were built. 21 years ago it cost $20,000. I priced replacing it with one built to the same specifications (semi-custom order) about 7 years ago. The quote was “starting at $65,000 and going up depending upon options” – and I’m still not sure if that quote included the engine! Cheaper???? When the base price was 325% higher than 14 years before?

>>>

LetUsHavePeace

Uh huh……. gold is only a symbol for the value of goods, services, labor etc. GO reread the very simple explaination in The Wealth of Nations. The obsession with gold is a hangover from the 16th-18th centuries and the discredited method of determining national wealth called ‘mercantilism.’ Since the amount of gold in existence is limited, using it as the monetary unit of exchange (called ‘money’) creates a restriction on the value of additional goods which are produced. If all the gold is worth 10 bushels of wheat, then if the farmer grows 11 bushels, 1/10th of the goldis no longer worth one bushel of wheat is now worth 1.1 bushels of wheat so the farmer has no reason to do the work to produce the 11th bushel. He gets no more for his work.

I don’t know what to say.

Tried to buy currency today, its incredibly hard. I’m not trying to whine, it seems I learned all the right things to do way to late. So now its like…I’m watching destruction happen to me before I can do anything about it. Sux man…..I’m just lucky I have no debt ( beyond 5000 in student loans). But I don’t have my degree either.

I’m getting to the point where I’m deciding , for my sanity and educational attainment, to ignore what’s going on around me ( although I should do SOMETHING). I don’t think this is wise but, my grades are suffering. And I can’t do anything anyway BUT study for exams and hope for a better tomorrow. Continue to learn Chinese, speak Spanish and learn CPR. Get my Drivers License.

ugh…ANY idea’s out there?

@Another College Student

Don’t despair. Depression and deflation are not the end of the world. The rich always have money, continue to buy, and become more rich because they can buy distressed assets for pennies on the dollar and become more rich later, if those assets don’t become worthless. Even in the 1930’s depression, 70% of workers had jobs, and their money went further. Catering to the wealthy still works fine in a depression. Just don’t figure you can pursue the status quo–probably not a lot of careers in investment banking any time soon, but demand for accounting is and always will be strong. Engineering and Science, we’re still importing talent. My company hired 4 people today (we’re not F500, so 4’s a big deal) and have had no layoffs yet. Listen to where the government wants the throw money–green energy and the like. Should be many opportunities to make a good and rewarding career. Life’s always been difficult, and it is not going to get easier, but any of us older folks would love to be young again right now and go through the struggles of youth again. The big problem is when you are young, you feel sorry for the suffering of the masses, but as you get older you justify your complacency and distance yourself from it. In another 10 years you can probably walk right by the salvation army post and not drop a dime and not even care, although I hope that you don’t. Be optimistic, because there’s not much point to the dark side.

I saw that a bank-owned home nearby was being rehabbed. New roof, new landscaping, lots of work. It’s been going on for the past week. All the workers are hispanic, most certainly illegal, but the contractor is white.

Which makes me think that if the TARP funds had gone through in its original form, and they actually bought toxic assets, homes and such, and put money into refurbishing them, why would the contractors act any differently? Would they not still hire illegal workers, thereby increasing their profits while providing little or no employment for American workers? I don’t see that the equation changes when the formula remains the same, illegal workers cost less, and probably complain less.

Got Ammo?

That was weird…

a commenter on international website http://voxday.blogspot.com just used the phrase “Real Homes of Genius”.

Is the good Doctor going viral?

Hope you got a tm on that rascal-

Your only mistake is mistaking prices (a side effect) with inflation or deflation. Prices are the result of free market forces such as supply and demand, which can be influenced by money supply. Prices themselves to not indicate inflation or deflation.

The actual definition for inflation is an INCREASE IN THE MONEY SUPPLY.

If you look at Gov’t statistics, the money supply has gone exponential in the past few months, even in the face of declining asset prices. In order to truely have deflation, we would need a DECREASE in the money supply. This we definately are NOT seeing.

An exponential rise in the money supply ensures a future hyperinflation event even in the face of current deflationary pressures. Perhaps a case study on the Weimar experience would be benificial for this site.

Printfaster, No go on the principal reduction, aint gonna happen. 1/3 of Americans rent. Of the 2/3 who own 40% actually do own and have no mortgage. Millions and million more “owners” have resonable non-speculative, non-bubble mortgages, lets say another 40%.

So we have 33% renting, that leaves 67% who “own”. 40% own outright and another 40% were smart. That leaves just 20% of the 67% “ownership” population who fall in the housing gambler catagory and want a pricipal reduction funded with 100% of the population’s tax dollars.

The rest of us are not having it 🙂

Looks like Ambrose has picked up the theme of Jubilee:

http://www.telegraph.co.uk/finance/comment/ambroseevans_pritchard/4285187/Biblical-debt-jubilee-may-be-the-only-answer.html

@Mich:

Ummmm, yeah homes are overpriced. And so are cars and computers and many many big ticket items. Personally I have not bought a home and have been waiting for almost five years now, because a. homes were overpriced and the market was in a bubble and now b. because they will be cheaper tomorrow. Why catch a falling knife? So yeah, People are not buying because it’s smarter to wait right now. And that is exactly the attitude that people took as the Japanese housing bubble burst….why buy when it will be cheaper tomorrow?

Another College Student –

This too shall pass.

Be financially responsible, start saving for retirement NOW, don’t get caught up in this ‘gotta have it/keeping up with the Joneses’ mentality.

Marry a spouse who is NOT a spender.

If you plan to stay in the same state, get private healthcare insurance now, so you aren’t at the mercy of a job in 15 years just to have coverage.

Think positive, you’ll find a job and enjoy your life.

You’ll be fine, you have the parachute of youth.

Certainly, discretionary items may experience price deflation. Flat screen plasma televisions and barbie dolls are not necessary for survival (unless you’re my daughter). What will be interesting to watch is, as they say, the price of bananas.

Wow, talk about the Obama bounce! Nasdaq lost almost 6%, Dow off 332, solidly crashed through 8000. Guess that wasn’t the freaking bottom, was it? Don’t listen to Warren Buffet–the paradigm has changed. He made a fortune on the way up but is just as clueless as everyone else right now, and just cost millions of honest Americans a few more billion (WB can’t be wrong!). He needs to read DHB and quit drinking the cruel-aid. Maybe he’s been watching Creymurr? Where have you gone, Louis Rukeyser…Buyah my aft!

Maybe Chaney didn’t see it coming–probably too busy watching snuff films–but most intelligent people have honestly seen this coming for years. Deficits do matter. People and nations still reap what they sow. Why not let Cameroon print 12 trillion cameo’s or whatever their currency is? One fiat’s as likely to be renege as the next.

Still this depression was as unavoidable as the sunset. The vacation’s over, back to the 1200 sq ft with Formica counter tops and linoleum floors. So what? People lived without Hummers and 63″ LCD’s for thousands of years. We can do it again. Maybe folks will learn to appreciate a library full of books they can read for free. Or play bridge with their while listening to music–human interaction. It’s really not the end of the world…it’s a new beginning.

@polo: Thx for kudos on TARP cipher, now we know the real plan: (“Taxpayer Annihilation and Rape Program â€)

Dr. Bubble classically confuses deflation with falling ASSET prices. Asset prices are falling because they were irrational as we all know, if I was able to sell T-shirts for $70 to crazy people and then the price came back down to $20 this would not be deflation. DEFLATION is the decrease is money ie the decrease in available dollars in the money supply. This is a class misunderstanding by Keynesian economists. By the way, Keynesian monetary policy CAUSED ALL OF THIS. The only answer and only sound economic thought is the AUSTRIAN SCHOOL. Conversely, INFLATION is not the increase in prices. INFLATION is the increase in the supply of dollars (money) and therefore more dollars chase the same amount of goods once everyone realizes dollars are not worth as much they charge more dollars and bingo! What we need is sound money, the kind we had for 200 years under the Gold standar.

THanks for another good post Doctor.

I don’t buy the “deflation is bad” argument. I will wait to buy? What? Will I go hungry and naked? Live without shelter? The price of gasoline/heating oil dropping is a bad thing? Bureacrats can’t regulate deflation, that is why they don’t like it.

What makes you think housing will imporve in the forseeable future? What is going to bring our standard of living back up to the post-bust? FIRE?

Time will tell, but even if successful, I suspect Obama’s jobs will be directed toward the masses and will be relatively low pay.

Keep up the good work.

Ryan,

Keynesian monetary policy didn’t cause the mess. I suspect Keynes would have been screeming bloody murder at having his name associated with the stupidity that governments have been pulling. You see with Keynes, the actions taken had to run countercyclical to the business cycle ie. governments spend more when time are bad and less when times are good. He did not advocate spend more and more and more.

The Austrian School is not without guilt in this mess either. The laissez-faire approach to mortgage underwriting, where banks were freely able to overleverage themselves lending money to people who couldn’t pay it back, was certainly part of the problem. A lack of regulation on the RE industries’ ability to make whatever claims they want, and create an illusion of agency when they are little more than salespeople shouldn’t be overlook either. I’m not a big fan of government intervention, but when it’s needed it’s needed.

You should also keep in mind that when you consider money supply, you have to consider all sources of money. It just not what the CBs print but how much it is leveraged up. If you have a leveraged investment account, then you are creating money and thus pushing asset prices higher. Since this is not measured, using money supply to define inflation/deflation doesn’t work well.

See AnnS’s comment above about gold too.

@DAve: Again I’ll be the lone voice crying in the wilderness and point out that if you take the number of the unemployed in America and then subtract the number of jobs illegals are taking (which would then be available if they weren’t) viola you have no “unemployment crisisâ€.

If only it were that simple. You’re assuming that all those jobs would still be there if they had to pay the higher wages that American workers demand. But of course they wouldn’t be, because companies faced with higher costs would hire fewer people — either by automating or simply by downscaling operations. We had a small-scale version of that here in Washington, where some crops rotted in the fields because no workers were available to harvest them due to stricter border enforcement.

This isn’t to say that I think illegal immigration is a good thing, but it’s a very complicated issue, and any solution has to address the needs of industries that rely on cheap labor.

Leave a Reply