There will be Housing: How we’ve Returned to Selective Market Ignorance.

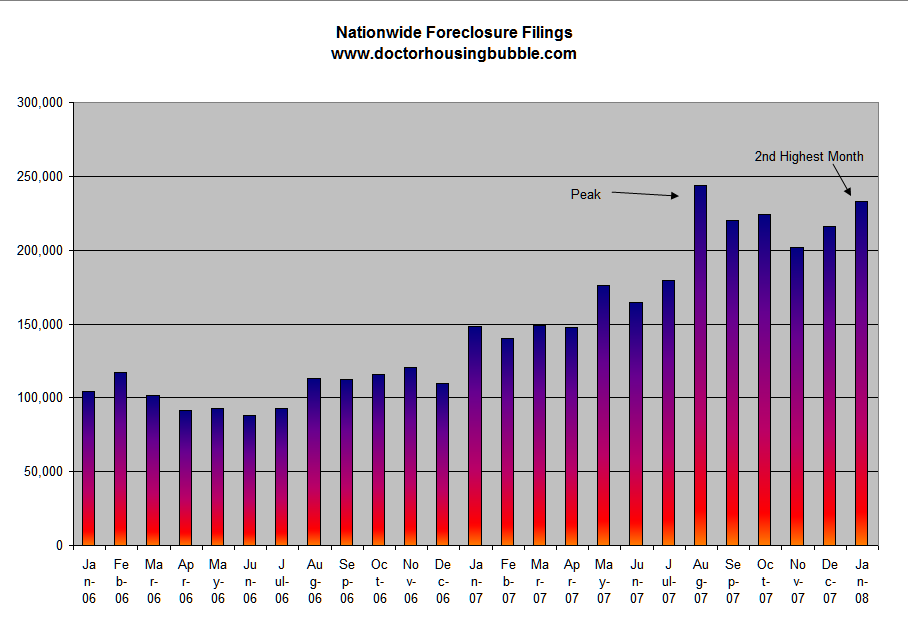

As we quickly approach our Wile E. Coyote moment in the market, we have once again returned to the selective attention desperation of early 2007. You know, the moment when we are rapidly chasing the road runner ignoring peril only to find ourselves suspended in air a few inches over a cliff. The market has been rallying since last week simply on the notion that there will be a bailout for monoline insurers. This so-called bailout has dominated all other financial news as the market desperately grasps for any sign of turning around. In fact, this week as the rating agencies proved yet again that AAA means absolutely nothing, the market took off flying on this false alphabet soup of delusion. In fact, one of the monoline insurers was given an award! Next we’ll be hearing that Enron won a prize in sound business practices. Here is the incredibly ironic thing of this all, the underlying asset backing up these players is real estate. Now logically you would think that a good measure for the soundness of these investments is real estate but instead, the market is using binoculars to look at bailouts as a sign of market health and not the collateralized obligations. Here is a newsflash, the fact that we are talking about bailouts every week does not signify a healthy market. In fact, market psychology seems to have drifted back to Q1 of 2007 when a few high profile subprime lenders went under and that was spun as an “isolated” event. Now we are trying to make it seem that the monoline insurers are only isolated events again and any sign of movement is enough to send the market rallying. First of all, let us look at national foreclosure numbers:

*click to enlarge market rally

So we just had our second worst month on record in January and the market is rallying because there is a potential bailout for insurers that are backing up lenders that are holding portfolios of these foreclosures? I can see the ACME anvil getting ready to drop. For the mom and pop investor, I’m not sure what to say. All fundamental indicators are pointing to more housing and credit pain yet the market rallies on seemingly knee-jerk news while the bigger story gets sidetracked. For those of you who don’t know, the century old Dow Jones Industrial Average just decided to make the following move a few days ago:

-Remove Altria and Honeywell International

-Added Bank of America and Chevron

Let us take a look at the one year performance of these companies:

Altria: -13%

Honeywell International: +23%

Bank of America: -18%

Chevron: +23%

In the end it is a technical wash. But what kind of move are they doing considering that BofA is mingling with Countrywide and asking for “epic” bailouts? Also, they are now pegging to peak oil with Chevron but how much job growth is really in these areas? Honeywell was dropped since it was one of the smaller industrials but again, this speaks to what I was talking about in Business Devours its Young. That is, more and more we are getting rid of our blue collar industries and becoming a nation that is a paper pushing house flipping oil hungry populace driving around in tanks on the 101 at 5 MPH in peak traffic. You may be wondering about the title of this post but we are now a housing and oil nation and as such, we are going into a housing led recession followed by peak oil. The selection of the two companies is very telling of what is now deemed as a big 30 company.

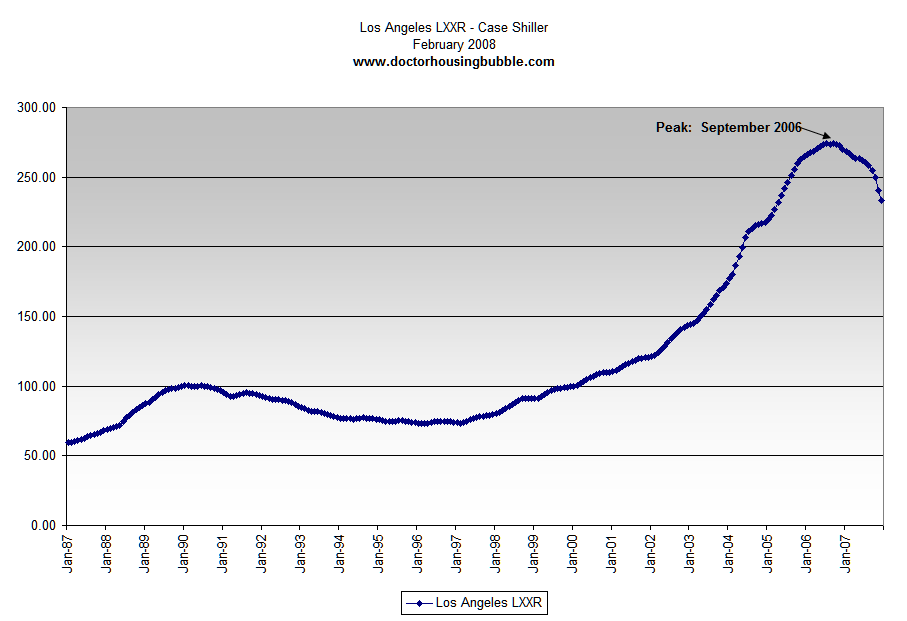

Case/Shiller – 2007 Worst Year Ever

As the market continues to fiddle while Rome burns, the Case/Shiller Index just came out with its worst yearly drop on record since it started keeping track of housing prices in its 20-year history. Prices in 20 of the top metro markets in this country are now down 9.1% for the year. Just for a comparison measure in the 1990-91 recession housing prices were down by 2.8%. So the velocity of this drop is 3 times as fast as the one we faced in the early 90s. Then again, we’ve never been in a global housing bubble so all rules are out the window. Take a look at the Case/Shiller numbers for Los Angeles:

We are now down 13.7 percent for the year. Of course, we already know from other data measures that Los Angeles is off by nearly $100,000 from its median peak. The biggest drops came from Miami (down 17.5 percent on a year over year basis) and Las Vegas (down 15.3 percent on a year over year basis). Don’t fret SoCal, we did take the bronze. These drops show no signs of slowing down. Even yesterday, the NAR came out with data showing a “stabilizing” market which of course is like saying the Titanic didn’t sink that badly because it went down in slow motion. Take a look at this write-up over at Calculated Risk discussing the numbers. What you’ll notice is no stabilizing and we are still at record inventory levels yet again, the “bailout” once again rallied the market. Oh yeah, and producers input prices are skyrocketing but who cares!

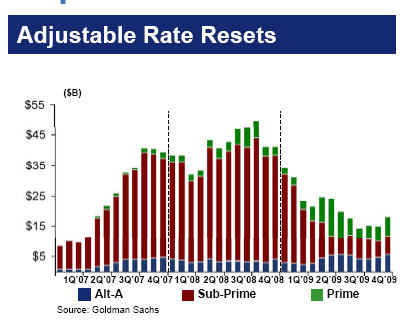

Need we remind you that March 2008 is going to be the month with the largest number of subprime resets thus far?:

Yes my friends, there will be bailouts.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

17 Responses to “There will be Housing: How we’ve Returned to Selective Market Ignorance.”

Hate to tell you, but the reset chart shows the March resets at the lowest level of the year – March is the third one in from the left (dotted line dividing ’07 from ’08 as base) in ’08, n’est pas? April slightly higher, then MAY is the largest number of resets so far.

Or am I reading the chart wrong?

I can’t wait to see the numbers at the end of this year. It looks like this will be the worst year for housing ever and the NAR is talking out of their A…es. Who in their right mind can trust what a Real Estate Agent has to say nowadays. Anybody who is pecimistic about the current situation needs to take a hard look at the data being offered. It is not the time to buy, prices are still sky high and have about 40% more to go before the market can stabilize. The sooner this happens the better because alot of Politicians, Economists, Corporations, and Government Agencies are beginning to make foolish decisions which will not be forgotten after this is all over.

Thanks for yet another thoughful and level headed overviiew. I have been following your writings now for a few months and I always feel a little wiser . Thank you.

One wee thing…try a few paragraph breaks. Makes for even greater reading.

Question for you Doctor. I often see the reset chart as two big humps. The largely subprime resets of 07-09 and then the largely prime/ alt-a resets of 2010-12. If are 80% of the folks that took out pay option ARMS pay the bare minimum (as I’ve read – maybe here), then wouldn’t that speed up the reset assumptions for the seond wave? (i.e. a 5 year ARM resets in 3.5 because LTV triggers kicked in).

My prediction? PAIN! (Thanks Clubber Lang.)

The monoline bailout has already occurred…and it didn’t cost a dime. Just a stroke of the pen over at S&P and Moody’s. A rating from any of the ratings agencies is meaningless now…there is no sheriff in town any longer.

Residential foreclosures are up 57% with Case-Schiller reporting 2007 housing losses far greater than previously reported, commercial real estate is headed downhill and picking up speed, the FDIC is openly talking about preparations for multiple bank failures this year, consumer confidence is the lowest in years, inflation is rearing its ugly head with the PPI at a 12% annualized rate last month and commodities like oil and wheat going rapidly north, the dollar just hit $1.50 to the Euro–lowest ever, the long bond and mortgage rates are climbing, and bankrupties are skyrocketing.

All this in the news today, and the market is up 115 on the day??!!

This makes me cranky, because keeping all my money in the mattress makes it lumpy and I can’t sleep well.

I think we are headed for something only our nonagenarians have seen before. In fact it might make what they went through look somewhat tame.

This whole story gets more out of hand every day. My dad read a story that stated prices for housing PRICES went up in NYC, White Plains & northern NJ. WOW!

Leaving aside the fate of the American blue collar worker ( or is he now the Mexican blue collar worker in America) and the fate of the stock market, I think we can all agree the latest news from the housing and banking sectors of our economy is bad, very bad. As Dr. Housing Bubble noted, having your insurer call up and ask for a loan to continue your insurance policy is does not leave you feeling like you are in ‘good hands’ but that’s the reality of it. We are entering the ‘checks in the mail’ time. When the art of juggling becomes more than entertainment. You have to keep all the financial balls in the air because if you don’t they don’t just drop one at a time, they all come crashing down and your act is finished! Well, being a big bank doesn’t mean you can’t juggle, in fact, it means you have to keep more balls in the air. You have the first mortgage, the second mortgage, the HELOC, the construction loan, the bank regulator and the depositor all flying from hand to hand and to keep all of this synchronized it takes all of your concentration yet, to your horror, AMBAC or MBIA suddenly are knocking at your door and insisting you open it for them. By yourself you can’t and it would finish your juggling act to try it alone but, you’ve got other banks doing the same juggling act as you and rather than try and juggle another ball by yourself everyone agrees to take on this new ball together passing it from one to the other. How long can this go on? Will the balls turn into knives or can the jugglers finish their act to great applause. I don’t know but it is one helluva show they are putting on.

Just read an article over at OC Register about furniture stores; sales are way down and they are going out of business. And Yahoo Finance has been showing poor earnings across the board. All I can say is, batten down the hatches!

I think the Case/Shiller chart shows there are going to be more drops in the future. The people buying today in the “stabilizing” market are going to be the ones walking away tomorrow.

Any tips on how newbies like myself can “batten down the hatches”..? I have some savings, and I currently rent. Beyond that, I don’t know what else I should do, partly because I’m not sure what’s going to happen over the next five years.

Dr. HSB…you’ve probably seen this already, and i apoligize if i missed your commentary on it, but if not…what are your thoughts regarding NAR prez take on raising the loan limits: http://www.realtor.org/about_nar/presidents_report/_video/president_s_podcast_video_february_2008.html?fbr=1203012969531

Maybe someone can clarify this for me. I’m looking at the LIBOR rate chart, on which it is my understanding that these resets will be based on, and as of February it looks to be dropping. So…although I know great damage has been done already, does this mean the re-sets, or at least increases, will stop now?

I found that there is a tendency to keep the myths alive in spite of reality. Regardless of what reality shows you, believe in what you are told. They myth makers go to great length to make sure that their myths are not tarnished.

Here is an example of myth repair: http://youtube.com/watch?v=fQKNvPn3V-8

Whether a pageant or economics the public must buy in. How can AAA ratings be maintain when it has shown that it’s not deserved.

@ Jen

Don’t buy what you don’t need. Invest in a couple of good cook books and eat at home. Squeeze more time out of your car by maintaining it properly (inflated tires, oil changes, etc.), and plan errand trips in bunches to minimize travel time and wear and tear, carpool when available. Give up cable TV and join Netflix and the library instead, and join book clubs. Read up on ETF’s that invest out of the US (see Minyanville.com, for example, on some ideas). Generally, don’t believe the hype of stuff pitched on TV and you’ll be better able to resist temptation to buy stuff you don’t need.

@M Daughtrey

The LIBOR resets will be slowed by lower overall rates. There was a spike in LIBOR after the credit freeze-up in August, even after the Fed dropped rates. It’s come down, but not nearly as much as you’d think given the amount of $$ pumped in. This slowing will mean borrowers with LIBOR based Option Arm loans may have an extra month or a few months before they hit the reset cap. That’s it – it doesn’t stave it off problems unless and until said borrowers have enough funds to pay OFF the negatively amortized portion, and then principal, to a figure that will keep the reset date at bay. And even if they do – most Option ARMS have 5 year triggers (Wachovia has 10) – so the day of reckoning for a payment reset is staved off at best by a couple years, maybe 18 months.

Values won’t increase enough by then to permit refinancing.

I sat on a throne of Blood. Once again, I will reign!

@ Exit

Thanks! :^)

Leave a Reply