Trifecta of keeping the housing bubble inflated in pocket markets –Senate votes to reinstate big loan limits, pushes visas for wealthy foreign home buyers, and artificially slams rates lower to hammer savers.

It should be abundantly clear and obvious that the government and Wall Street want nothing more than to keep home prices inflated and are sticking out a giant middle finger to the majority of Americans. You might have missed the glorious news that our stunningly cunning Senate decided to reinstate the heightened loan limits for Fannie Mae, Freddie Mac, and the FHA (aka the entire stinking mortgage market). Of course the lobbying arms of the housing industry went gaga for this policy even though it keeps prices further inflated in bubble states like California and New York. Good job politicians, I’m sure the checks from the FIRE industry will come in just in time for the 2012 election! Since our politicians care so deeply about working Americans, they are also examining a push at giving residential visas to foreigners looking to buy at least $500,000 in real estate. Forget about the fact that the median home in the U.S. costs more like $170,000 to $180,000. Then we have the Federal Reserve artificially keeping mortgage rates at historic lows and you hit the trifecta of housing welfare for expensive bubble ridden states while the overall economy falters.

Senate sells out again to the FIRE industry

Showing that the Republicans and Democrats are largely two sides of the same soiled coin, the Senate went off the reservation and reinstated the higher loan limits:

“(Housing Wire) The Senate voted 60-38 Thursday night to reinstall the elevated conforming loan limits on mortgages guaranteed by the government.

The higher limits expired Sept. 30. Sens. Johnny Isakson (R-Ga.) and Robert Menendez (D-N.J.) introduced an amendment to H.R. 2112, a minibus spending bill. The Senate approved the amendment Thursday, and the Senate will take up the full bill after the recess, according to Isakson’s office.â€

Only recently the Federal Reserve, the same folks pumping up this bubble found that allowing the loan limit to drop would only impact 1.3 percent of all purchases! Do you really need any more information as to who the government is really working for? At this point, the financial industry has the government in a deep capture that is simply amazing. The fact that this was passed on a 60-38 vote margin shows how bought out the Senate really is.

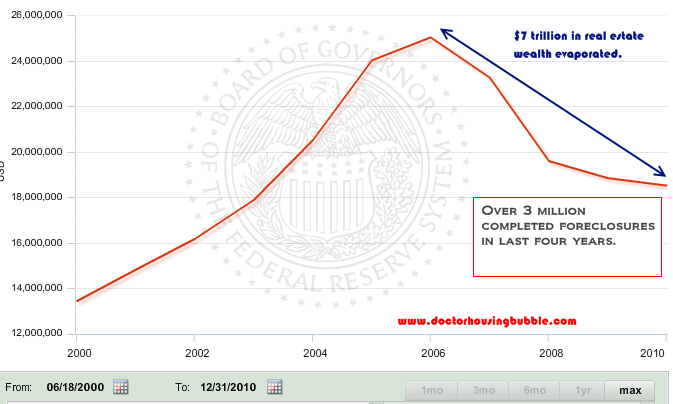

Success of bailouts? How about $7 trillion in lost real estate equity and 3 million foreclosures

After trillions of dollars in bailouts this is what most home owners have to show for it:

Since the housing bubble popped some $7 trillion in real estate wealth has evaporated. Part of this is a reflection that many potential buyers can only afford lower priced homes but also a reflection of the bubble bursting. So why in the world are we passing higher loan limits of $729,750 when the typical household makes $50,000 a year in the U.S.? Never mind that tiny detail, since the crash hit over 3 million foreclosures have concluded and this is in spite of banks creating a shadow inventory of between 4 and 6 million properties. It is also the case that banks are dragging their feet on higher priced properties.

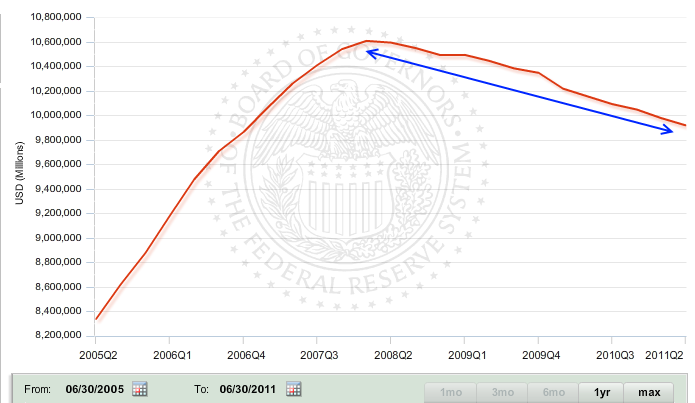

The pretending is going on with the mortgage side of the equation:

While the $7 trillion drop represents a fall of close to 30 percent from the peak in equity, mortgage debt has decline by roughly 5 percent. In other words the game of pretend continues.

More bi-partisan selling out for wealthy foreigners

Picture this, we are in the late 1800s and early 1900s and millions are immigrating through Ellis Island. The only difference is that we are now checking to see who is coming in with suitcases full of dollars. We have another bi-partisan sham job at hand here:

“Times Union — Sen. Chuck Schumer is proposing a bill that would grant three-year residential visas to foreign nationals who buy homes in the United States.

The Democratic New York senator describes his bill, which is co-sponsored by Sen. Mike Lee, a Republican from Utah, as a way to help the sluggish housing market by boosting demand. Foreign nationals would have to spend at least $500,000 on residential real estate, including at least $250,000 for a primary residence.

“Our housing market will never begin a true recovery as long as our housing stock so greatly exceeds demand,” Schumer said, adding that the effort “won’t cost the government a nickel.”

There would be plenty of demand if the government and banks wouldn’t keep prices artificially high! Instead of these sell outs working for their banking masters why don’t they sit the housing market on the shelf and focus on setting up an environment to create jobs instead of bowing down to their banking overlords? What utter nonsense and I seriously feel like we are in some Alice in Wonderland scenario. This will spur more speculation in bubble markets since I doubt that foreigners are going to flock to Cleveland or Detroit with their suitcases of cash. We have the TSA basically feeling up our citizens and for those with cash we are offering them a golden ticket? What in the world? This is such an absurd policy. What about being smarter and offering visas to scientists and innovators that can actually create jobs for other Americans? Instead we offering more financial shelters for those that can afford it and penalizing local households that will now need to contend with buckets of global money?

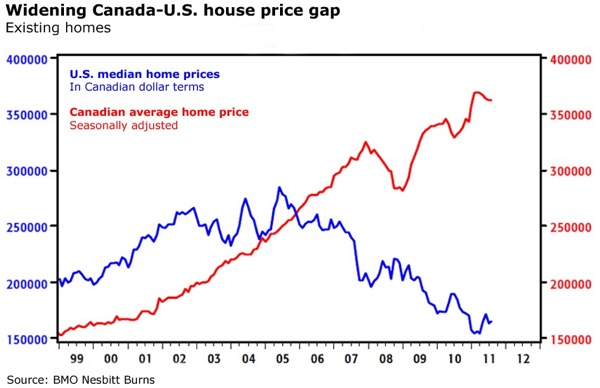

If you really want to see what happens when you do a boneheaded policy like this just look to our neighbors in the north:

Source:Â The Globe

Here is an interesting on the ground perspective in regards to purchases in Canada:

“How many are rich foreigners? 20-25%

How many are poor foreigners (i.e. high ration financing)? Zeroâ€

Can anyone from Canada comment on this? I’m curious to hear how this has played out with locals since it definitely looks to be in a bubble and given our sold out government, might also be part of our future.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

131 Responses to “Trifecta of keeping the housing bubble inflated in pocket markets –Senate votes to reinstate big loan limits, pushes visas for wealthy foreign home buyers, and artificially slams rates lower to hammer savers.”

(D) & (R) Duopoly: Screwin’ honest, prudent citizenry since 1913!

When are AMERICANS going to say enough is enough?!?

I think it’s becoming more evident everyday that those two moronic parties are essentially the same. They are nothing but puppets for their true elite bankster, Wall St. scum masters. It’s only a matter of time before the average citizen wakes up and says enough is enough. From having followed politics pretty closely the last 15 or so years, I view politicians right up there with murderers, rapists and child molesters.

Gerald Celente (a trend analyst and WS thinker- not an a-hole) coined the term “Political Atheist”. My husband and I became one, and are now very objective.

This country isn’t the USA anymore.

All we want is an affordable home to grow older and wiser in. Is that too much to ask?

We are trying to. Come down to Wall St.

Life in the U.S. is getting “interesting”. Competing with the global poor for wages and competing with the global rich for housing.

yeah…thgere is no depth your pols will not sink to to screw you guys over and save your fraudulent , corrupt FIRE folks from its natural deflationary bust and bankruptcy.

Its tragic…the world has lost America as a moral force…and from an international perspective that is the true dire consequence of Le Credit Crunch

“Life in the U.S. is getting “interestingâ€. Competing with the global poor for wages and competing with the global rich for housing.” -Jr

Probably the best quotation I’ve read in awhile! Seems like the more tricks and gimmicks they use to try boost the economy the worse things are going to get when the crap hits the fan.

:bow: :bow: BUMPER STICKER!

Thanks, Congress. Keep protectng the rich. It does not matter if you are Democrat or Republican.

Congress should surprise us and do something the complete opposite for a change. At the same time they passed this legislation to help the rich, they should have instituted a property surcharge tax of 1%.

surcharge tax of 1% on them.

“…the government and Wall Street want nothing more than to keep home prices inflated and are sticking out a giant middle finger to the majority of Americans.”

Keeping home pricese inflated? Yep. Giving the bird? Beg to differ.

Since the majority of Americans “own” their home (@67%), I think WS and DC are rather doing everything they can to appease the majority of Americans….and by appease I mean buy favor (e.g., votes). The 67% do not want their property values to go down.

I agree with this view. Its like the mortgage interest deduction and other forms of “Homeowner Welfare.”

Homeowners have been granted prima dona status (for vote buying) for several decades now. I don’t expect anything to change anytime soon.

~Misstrial

Sorry, IMO this view is way off.

First, only about 1/3 of those cited above actually own their homes. That is not a majority. The rest own a mortgage, and not a home. That’s not a majority either, by itself. And about a 1/3 of those are underwater (and probably near 50% now, the way the market is betting). That portion doesn’t even have any equity in their homes, which puts them in the category of a renter, really, and not a homeowner. Though they may be delusional about it.

Secondly, Wall Street and Washington did extend a giant middle finger to America when the Feds bailed out the Banks. They also stuck us with the bill. All against the wishes of most Americans at the time (80% at the time).

I can’t think of a greater way to tell the American people to f*** off. Of course, a lot of Americans turned around and voted for their Incumbent afterwards, and will do so again. Which tells you something about most Americans, including those reading this if you voted for someone who passed the bailout bill.

I’ll happily give up the mortgage interest tax deduction as soon as people who breed new carbon units give up the expectation that it’s in my interest to pay for the full-service 13-year government day care services outlets laughably called “schools.”

I’m a reasonable person. I’ll settle for having a say into whether a particular guy should be allowed to emit viable gametes. You know, the ones that trigger pregnancies.

@Compass Rose — Did you say that out loud?

Now, I’m not sure I’ve done enough research on this to actually know anything, but it appears as if TARP has been mostly paid off.

Banks repaid 99% of TARP

As much as I loathe the banks and gov’t for getting us into this debacle, it appears as if the bailout worked? If this is true, then it appears as if not much is changing in the way to prevent it from happening again though.

Damn, this meme is really gaining steam. I’m seeing it more and more. First of all, TARP, is not the bailouts in total. It is a small slice of the total funds disbursed — of which over 1.5 trillion remains outstanding and 14 trillion remains at risk. The bailouts are an ongoing deal if you consider that the TBTF banks are able to stand in the middle between the Fed and Treasury and essentially collect a debit thanks to their access to the Fed discount window. They are also able to lend the money they borrow from the Fed for nearly 0% and lend it out at 12-18% via credit card balances.

Furthermore, there is the never discussed opportunity cost of the TARP bailouts which were supposedly paid back. Ed Kane, and old school economist from the Institute for New Economic Thinking recently suggested that the banks should be paying over 300 billion a year in in Systemic Risk Insurance, but they pay nothing.

As an aside, nobody ever considers what amounts to a tax on savers thanks to ZIRP. Some estimates put this at 350 billion dollars a year.

According to a recent AP article: “About 11 million U.S. homeowners – about 23 percent of Americans with a mortgage – are underwater.”

When the above is considered more people have an interest in seeing housing prices settling down to intrinsic value rather than be subjected to banker-induced price-puffery.

When people realize they have effectively no equity, they invariably favor lower-priced homes and that group is moving firmly into the majority.

Politicians want higher home prices because they receive more in property tax. It’s that simple. Homeowners seem to think that higher home prices make them “richer”. It’s the furthest thing from the truth.

Well the easiest answer here is to band together as a community to fight like hell for strong wages, rather than the exploitation of labor and consumers, and skimming and offshoring of resulting profits.

Then you can have sustainable housing prices, a sustainable tax base, and get together to determine sustainable expectations about government services–which should be socialized, which should be privatized.

In my view, that’s what most people would like to see. But there’s always the ones who think the American Dream is scamming any system for all they can get from it. And the ones who bow down at their feet with true beta primate enthusiasm.

I think you hit the nail on the head. The 67% lottery winners (aka home owners) want to collect their winnings and are looking to the government to help them collect. It is also true that the banks extend and pretend activity does help their management extend their ability to collect bonuses. But the truth is, banks no longer do actual banking (i.e. give savers 5% interest for their money and lend to viable borrowers for 8% – 9% interest). This model breaks down when interest rates are at or near inflation. The government is the only lender these days and the banks are simply an agent collecting transaction fees. I believe we have seen nothing short of panic from our “leaders” over the last few years. I think we can pretty much all agree that all of these tactics will only put off the inevitable correction. It is apparent that home owners, bankers, property tax collecting local governments, real estate agents, FDIC, etc. have a vested interest in this extend and pretend aka soft landing which affects the activity of our elected officials.

Questor,

There was a reason for the quotes around “own.” I think others got that.

And, your math doesn’t add up. You say 1/3 own their home free and clear and 1/3 have a mortgage. Let’s see, that’s, what, 2/3? Additionally, you claim 1/3 is underwater (actually it’s more like 28% as of May, 2011). With that group, the devil in the details is by what amount. DHB has demonstrated that the MORE someone is underwater the more likely they are to strategic default. So, what do you think someone who is underwater by 5-10% is wishing more…..for home prices to crash so they can walk and start over or that they get propped up so they don’t feel like a loser for buying at the wrong time?

@Dfresh:

I did not say “1/3 own their home free and clear and 1/3 have a mortgage.”. It’s 2/3 that have a mortgage. I would presume you made a typo. Take 2/3 and multiply it by the 67% you quoted. That’s 40% of “All Americans” which have a mortgage.

The Doctor’s original point was that Wall Street and Washington were “keeping housing inflated”. Followed by telling the average American to piss off. They are doing the latter by trying to stick the average American with more debt. Directly, via higher loan limits, and indirectly via taxpayer funded bailouts for the Banks. You still owe the latter, even when your house is paid off.

Let me put this simply. If someone swipes your Credit Card, and goes on a spending spree, they are extending a giant middle finger to you. And with this type of Credit Card, there is no way to repudiate the debt. Well, at least not without crashing the system. You still owe the money, and believe me, you are going to pay that money, in more ways than one.

Hopefully that analogy makes things more clear.

Another reason why we need to get corporate money out of politics.

Our democracy is at stake.

Hear hear. Campaign finance reform. The time is now.

Silly woman. McCain-Feingold was passed and signed into law by George Dubble-Yoo Bush himself.

+1

Unlimited Corporate campaign financing is a bastardization of free speech.

Americans are never going to be united enough to make a real change. We have Republicans enticing the poor to vote against their own economic interests thinking that they might get a tax break making 40K a year. That they will not be bothered when the EPA is dismantled because what’s a little cancer among friends. Then you got the democrats trying to tell us that the government is the answer, never-mind the fact that we are broke, and spending like drunken sailors. These people want you to vote against you economic interest (tax burden) to save the banks, and investors. Occupy Wall Street has no coherent message and is useless. Most middle class voters are not well informed enough nor do they vet their candidates beyond a few slogans at election time. In other words we are going to have to fully crash, and be brought to our knees before we are even close to ready as a country to fix anything. The only arsenal at our disposal as individuals is to seek the truth, and make prudent decisions for our family. Turn off the stupid noise. I remember when we thought Japan would buy up the US…how did that turn out? A strong middle class is the only thing which will save this country. Any efforts directed otherwise will fail as we have already seen. We have double dipped, and there is no end in site no matter how many rich Chinese come here and buy property with government backed jumbo loans.

Perfectly said.

***Standing Ovation***

Very well stated.

Hey, CC–you’re missing the crucial point. Cancer contributes to GDP. And it’s going to do so even more as the “health” “care” industry is increasingly structured as the next bubble scheme.

All those honest working Americans who still have savings? Time for millions of total cashectomies!

There will be a bond /gold bubble before the health care bubble pops.

I call B.S. that the Wall St. occupiers have no cohesive message. It’s just not simplified to the point where people can pigeon hole it. Tell you what, have the country continue the direction it is going and the people in the streets will give a very definitive statement…through violence.

I wish the Dr. would post a picture I have from Irvine that had a huge banner “Re-instate the Glass-Steagel Act”, hardly uninformed people. Turn off the dam TV and go out to the people and ask them WTF they are there for, you will learn the truth then and not some b.s. perpetrated by the same a-holes who control the money supply.

If all you read is newspapers and magazines, you would be better served to not read AT ALL.

I don’t know how many times I’ve read in this blog, “People should be out in the streets!” Whatever the case, it is GREAT to see Americans in the street exercising their rights and their voice.

I don’t think Democrats stand of a platform of government being the answer to everything – that’s just media hype. The government of the USA is one that should reflect the will of the people and is the arm of the Constitution that provides for this. Government is the instrument with which we can exercise our power. Compare this to feudal societies or totalitarian regimes. IMO, in theory, we have a pretty good system.

The problem arises from the right wing that wants to move us back toward a feudalistic system where only the wealthiest and most connected members of society have any say in the life of our country.

This is exactly what the OWS protestors are fighting against. The MSM only reports the drum circles and hippie elements, but these people are using tactics that people have used since our country was founded to effect change. They want what we all want, a level playing field so each and every American can do what Americans do best – invent, create, innovate and succeed.

No other nation that has ever existed is as creative and innovative as the US, but without institutions like a firm middle-class and education, we will never see middle-class people create the industries that drive the world forward. EG, Steve Jobs was raised in a middle-class household, with access to good education, and based on this foundation, he was able to create new categories for computing technology that have changed how we communicate and create. The thing is, you can never tell where innovation is going to come from – it could come from the poor immigrant, the rich kid, the middle-class, or anywhere in between. By keeping our economic policy tilted toward the rich, we disenfranchise 99% of the population from being able to have the resources they need to become the next great American successes.

Unemployment will not be helped by anything these idiots in Congress do, and they know it. Without jobs that pay a decent wage, the whole country is just going to keep seeing most asset values headed south. Especially those assets that take a lot of leverage, like housing.

We are already overrun with scientists and engineers. As in Steinbeck’s Grapes of Wrath when the Joads were picking up fliers claiming lots of picking jobs and no mention of the thousands applying for each picking job, the science and engineering professions have been overwhelmed by both the millions of people coming here on foreign work visas and the millions of students and expired visa holders who overstayed their visas to undercut American wages. Chuck Shumer is well known as a favorite of the labor dumpers.

http://www.youtube.com/watch?v=TCbFEgFajGU

http://www.programmersguild.org/

I can attest to this. I received a B.S. in Mathematics & Computer Science in May–from a state university, NOT ITT, DeVry or a “career school”–and all I’ve been able to find is low-level, clerical temp work at $10.00/hour. This despite the fact that I was an adult student with years of work experience.

Unfortunately, I didn’t have tech experience. I have been told, by multiple sources, that my only hope of getting a tech job is to spend YEARS working ILLEGAL unpaid “internships” in the hopes that someone will eventually throw me a bone.

“Booming tech market” and “shortage of tech workers,” my bum. I got this degree because I bought into that hype, and I will never forgive myself for it.

your problem is that you got a degree in mostly math and software theory, with probably not too much emphasis on the latest web 2.0 software technologies and integrated web design, which is where everything is going these days…

a degree doesnt mean much unless you have the necessary skills to design in the latest software platforms…

i would take specialized classes in order to add “EXPERT” status in the software program section of your resume…

that is what employers at the apples/microsofts/googles want to see…

and unfortunately you are competing with millions of asians and indians who have been hammering away at this stuff for years…

good luck

I work at one of those companies. I wish universities taught classes in what we need but I don’t think they do. A lot of the “inexperienced” people that we end up hiring either just finished a Ph.D. (science or engineering), did an internship with us and do well, or work on some open source projects of interest to the company for a few years and become known to the engineers within the company and knowledgeable about a subject area. The rest are typicallly people with 5/10 years solid industry experience. I think we would hire really smart kids straight out of college, but we’d probably have to be blown away by them — Rhodes scholar level or similar. We just don’t get any applicants like that. Most recent B.A. / B.S. that I talk to can barely program.

When you do get your interview, you had better know, really know, C or C++ as your primary development language. It doesn’t hurt to know a thing or two about hardware too.

There was an article in my paper today welcoming our new police dispatcher to the city – she possesses both a BA and a Master’s Degree – Years ago I was once offered this postion on my High School diploma alone. What gives?

Maybe the question you should really be asking is ‘why is the US having to import its knowledge base, rather than producing it itself?’

I understand the frustration at seeing decent jobs going to furriners. But until our politicians – at both State and Federal level – stop cutting education budgets to give tax breaks to the rich and corporations, then you’re going to have to import more than you produce at home.

A lot of the really smart domestic kids are going into finance, because the pay scales are so out of balance with the rest of the economy. I don’t think it is healthy.

I think you need to look more deeply into what has occurred. Norm Matloff is an expert in this area.

http://www.sooty.ca/trends/IT-Glut.pdf

This might be a little off subject – but then again maybe they are a big part of the problem regarding the subject matter and we are the solution – Think about it.

Warren Buffett, in a recent interview with CNBC, offers one of the best quotes about the debt ceiling:

“I could end the deficit in 5 minutes,” he told CNBC. “You just pass a law that says that anytime there is a deficit of more than 3% of GDP, all sitting members of Congress are ineligible for re-election.

The 26th amendment (granting the right to vote for 18 year-olds) took only 3 months & 8 days to be ratified! Why? Simple! The people demanded it. That was in 1971…before computers, e-mail, cell phones, etc. Of the 27 amendments to the Constitution, seven (7) took 1 year or less to become the law of the land…all because of public pressure.

Warren Buffet is asking each addressee to forward this email to a minimum of twenty people on their address list; in turn ask each of those to do likewise.

In three days, most people in The United States of America will have the message. This is one idea that really should be passed around.

*Congressional Reform Act of 2011*

1. No Tenure / No Pension. A Congressman collects a salary while in office and receives no pay when they are out of office.

2. Congress (past, present & future) participates in Social Security. All funds in the Congressional retirement fund move to the Social Security

system immediately. All future funds flow into the Social Security system, and Congress participates with the American people. It may not be used for

any other purpose.

3. Congress can purchase their own retirement plan, just as all Americans do.

4. Congress will no longer vote themselves a pay raise. Congressional pay will rise by the lower of CPI or 3%.

5. Congress loses their current health care system and participates in the same health care system as the American people.

6. Congress must equally abide by all laws they impose on the American

people.

7. All contracts with past and present Congressmen are void effective 1/1/12.

The American people did not make this contract with Congressmen. Congressmen made all these contracts for themselves. Serving in Congress is an honor,

not a career. The Founding Fathers envisioned citizen legislators, so ours should serve their term(s), then go home and back to work.

If each person contacts a minimum of twenty people then it will only take three days for most people (in the U.S.) to receive the message. Maybe it is time.

THIS IS HOW YOU FIX CONGRESS!!!!!

Great stuff we as americans need to think together, if not we will all perish together.

Please don’t repeat this chain letter – there is no such thing as a Congressional Reform Act of 2011. The facts in this are all wrong (do a quick web search on this for simple facts).

So Mr. Corn Capital Billionaire is saying that we should give politicians incentives to hold down GDP, so they can get re-elected?

Hell, I thought that was already happening.

Just like the numbers from Bureau of Labor Statistics, I’m sure that congress would find creative accountants and economists to instantly make the debt 3% of GDP.

How come Occupy Wall Street gets the publicity for their non-focused gripes, and not Dr. Housing Bubble with utterly brilliant posts like this?

The point on jobs is exact: bringing in rich foreigners brings no jobs unless one likes to “trickle down” to the local expensive furnishings and gardeners providers. The Dr. likes to focus on California, and there’s this: raising prices in Southern California’s hottest markets will only further UNemploy people, as it blocks out employers of real people who want to locate there or stay there. With 12% unemployment and 25% underemployment/part time, one can assume that about 6% of California workers and their families and their support structure from teachers to retail clerks, will leave the state to find better prospects elsewhere. That’s mostly younger families many of whom are prime candidates to buy a home; and that continuing price dropping will give other prime home buying candidate young families even less motivation to get snared into buying and getting stuck with immobility. California needs to lose about three million workers with their families, directly who in ordinary times would already have moved to some other state to reduce California’s unemployment rate to less than six percent, almost all of them in the high median to low income ranges families. Rich foreigners/out of state US residents buying premium properties (which occurs a lot now in California) will only further screw getting living costs for home owning families down. The rich out of other areas, buy into California without adding meaningful jobs (this is actually going on now in Miami, incidentally, where something like 25% of sales are exactly to rich foreigners who seem to have no trouble staying in or getting to this country under present visa laws).

Indy, perhaps you should exercise your democratis RIGHTS and go out there and talk to the people Occupying. You would find that many are very intelligent, and DO KNOW what is going on. They had a GIANT banner at the Occupy Irvine that said “Restore the Glass-Steagel Act”.

Perhaps the 99% should turn off the propaganda (which is controlled by the same interests pulling this financial thievery) and go research why those people are out there.

As a 2 year old only knows what you tell him, so goes the american people who watch TV and read the newspapers and do not use critical logical reasoning. Aye, watch what happens to this country, blood will flow.

“IndyLew

October 26, 2011 at 4:28 am

How come Occupy Wall Street gets the publicity for their non-focused gripes, and not Dr. Housing Bubble with utterly brilliant posts like this?

Didn’t know Fox News parrots could type. The OWS and the good Doctor are singing the same tune: regulate and investigate the banking fraud, and end their power over our economic health. Their message is focused: you just aren’t paying attention.

Amen

There would be plenty of demand if the government and banks wouldn’t keep prices artificially high!

It’s so obvious to everyone that this is going on just for the benefit of the banks. That’s what angers me so much about this mess. A lowering of property prices would benefit everyone and would help get the country back on track.

Then they pretend they’ve never taken Econ 101 and scratch their heads and say: “we just don’t know why their is more supply than demand”. Because you won’t let prices FALL to equalize it. The playing dumb act is really not fooling anyone anymore.

I’m not Canadian, but it is pretty much common knowledge that in the years leading up to Hong Kong’s repatriation to China, from the UK in 1997, that Hong Kong money has been pouring into Vancouver. It continues to today. And it will probably continue further, until China’s housing bubble, currently topping out, comes crashing down and the Chinese economy has at least a soft landing, if not a hard one.

Also, high oil prices are boosting the Calgary and Edmonton economies. I wonder what that graph would look like without those three cities.

A lot of the money is also pouring into Toronto.

I think we’re missing something here. It’s not that the Senate is catering to the rich. They are rich! Most are well beyond millionaires, and own two or three homes that I’m assuming will be protected by this move. That would explain the lopsided vote.

Doesn’t this have to pass a vote in the more, ahem, middle class House?

Here’s a response to Sen Schumer. If pieces of the American dream are now up for bid in the global market, why stop at just a niceish house and legal residency? We could really make a dent in the budget deficit by auctioning off public offices! For, let’s say, $5 Billion in cash you get full citizenship AND Chuck Schumer’s seat in the US Senate! After all, you can’t possible come up with worse legislation than this. Act now and we’ll throw in a beautiful 4 bedroom colonial in Scarsdale at no extra charge. Operators are standing by…

Doc,

Over the years you have convinced me, I’ll be with the Occupy Irvine this Saturday. Enough is enough.

I went down to LA city hall and dropped off fifteen cases of water for the people who are on the front lines. On Nov. 5 I will close my savings account take out most of the $ from my checkings account and deposit the funds into a credit union. I’m only keeping the regular bank accounts open because of convenience.

They f*ed us..

99%!

I plan to head downtown this weekend too, to drop off supplies. Yes! Get ye to a credit union. I left WF this year and I do not miss those fees!

Alas, we are the 99%….

I bet a good chunk of the 1% is not part of the “1%” that OWS is thinking of. The cutoff is around $308k /year, certainly a healthy sum! However, some pretty everyday professionals like doctors, engineers, consultants and lawyers can find themselves at that mark. You can bet that the low end of the 1% are paying the highest tax rates of all.

The 1% the OWS means is probably the 1% in terms of *wealth* not *income*.

All democratic senators, except for Webb, who did not vote, voted for this. What gives with this? All 38 no votes were Republican senators. The other 9 Republicans voted with dems. RINO types. This was an amendment to a larger bill which I think next step is conference committee.

That new immigration visa is disgusting. It’s like the previous millionaire business operator’s visa. Now the global rich will buy their way into America again, but even cheaper. They’ll buy a house, and a rental unit or two, and bring their kids over to go an inexpensive state university. They’ll attain residence in a year or two, so, they won’t pay out of state fees, meaning they save a hundred thousand dollars or more in the long run. Maybe they’ll go live in the Inland Empire, and go to UCR.

They’ll also be collecting rent on a house or duplex, probably from some Americans who had ruined their credit and now is forced into the rental market.

I’m sure these immigrants are decent people – but Americans really need the help more than these foreigners.

BTW – I know you all are thinking “Chinese” but trust me on this – they will be mostly business owners from all over the world. The big attraction is our universities and access to the US market.

This is off the subject, but one DHB has touched on in numerous articles. This morning Obama announced a plan to reduce the cap on student loan payments from 15% of income to 10%. Also announced is a plan to limit loan payments to 20 years. Any balance remaining after 20 years would be forgiven. This is WELFARE from tax paying Americans to the educational elitists in this country. The schools can charge whatever the hell they want for tuition and tell the students to not worry about it, it will be forgiven in 20 years. Why the hell are we working? We should all be starting our own versions of University of Phoenix and National University.

OMG, Taz…. why not just be economic with words and stick with “get off my lawn”?

None of us lives forever, and those stupid kids whining about being in financial servitude for their working lives are the people who will replace us eventually.

You want to see a glaring example of why America is Not Number One anymore? Its because our educated workforce is starting their professional life with an average debt of @25k, that the govt can pursue for payment and no recourse to bankruptcy.

So, rather than buying stuff and paying a mortgage, they’re spending the first years of their professional life paying off their education.

20 years is still 20 years and 10% is still a sizable chunk out of your pay.

How much student loan did you take on to get through school?

speedingpullet – You just don’t get it. If you read DHB regularly, you just don’t understand what you’ve been reading. The problem with the amount of student loan debt is directly correlated to the massive rise in the cost of college education, which is directly correlated to the massive increase in government involvement in easy access to unlimited student loan debt. Like the Housing Bubble, the Student Loan Bubble is unsustainable. Easy and unlimited student loan debt is enabling colleges/universities to obtain unfair massive profits by skyrocketing costs to students that will eventually be picked up by taxpayers. If you don’t like the message coming from me, just wait, there will likely be an upcoming DHB post on this very topic and the point of view will very likely be more like mine than yours.

I took out $0 in student loans. As an undergrad I worked part-time at night, paid what I could afford as I went and put the rest on credit cards. When in an MBA program, I paid as I went along, while at the same time working full-time, married, with a mortgage and car payments. Today students aren’t able to do the same as I did because government involvement in easy student lending has allowed the cost of college to get out of control. However, going to college is a choice, not a right. Knowing that costs are out of control because of the easy student loan situation and going to college anyway is the responsibility of the student. Those that looked at the cost of college and instead chose to drive a truck, go into a trade apprenticeship, join the military, etc shouldn’t have to pay the bills of those who chose to go to school. As for student loan debt not being discharged in bankruptcy, I agree with you on that point, but students today take out loans knowing that is the situation. Buyer beware.

Would we rather have poor, uneducated immigrants flooding across the border and soaking up free social services and not paying significant taxes? Come on, Dr. – if rich foreigners want to come and pay off some of our collective mortgage debt, should we say “no” in the name of theoretically lowering home prices?

The idea of inviting rich people from abroad to our country to help us out is one of the best things I have heard all year – not as good as the plan to withdraw all troups from Iraq, but pretty good!

Are you f***ing nuts? We need NONE OF THE ABOVE! We don’t need poor uneducated immigrants illegally flooding across our borders and we don’t need rich foreigners coming in to prop up the bubble housing market. Let the damn market fall where it may. The government needs to get the hell out of the housing business. This mess wasn’t caused by government inaction, it was caused in large part by government action.

It is just another pathetic attempt to move chairs on the deck of the Titanic…

LOL. Well put! Thanks for the laugh. I was getting so fired up reading this. I needed the laugh.

hell, they’re going below deck and making the hole bigger.

This country needs to work for it’s citizens, not for illegal leaches and wealthy foreigners.

Jay is a GIANT IDIOT.

These rich Asian immigrants DO NOT pay taxes, they own their own all cash businesses and CHEAT TAXES.

They also exploit the infrastructure and health care systems and leave all the WAGE SLAVES to pick up their tabs…

Plus 10-15 will pool their cash together and live in the same house, which therefore not makes them rich at all but just leaves more of them in our country to open up more dry cleaners, nail salons, quik-E marts, etc… Just what we need to save the country.

JAY gets the award for biggest IDIOTIC post of the internet for the day, good job Chief!

While I respectfully disagree with Jay’s view, I have to say that you shoot yourself in the foot with an ad hominem attack. Aside from invalidating whatever else you were going to say, it also turns people off. I think one can do much better than that here.

But the rich foreigners (did I say “Asian”? I think maybe you said “Asian”, hmmm) would be forced to pay massive property tax if they were required to spend 5000K on real estate, wouldn’t they? Point being – if we are going to have immigration, and we should and lots of it, I would rather it be wealthy, educated immigrants than illegals crossing the border and working for subsistence under the table. That is the only point I was making and I’m surprised anyone found it controversial, much less the launching point for a personal attack.

“if we are going to have immigration, and we should and lots of it”

Why, exactly?

I want to read very specific reasons because mass movements of individuals across borders have historically been called ‘conquest’ and multiculturalism has a poor track record to date. Multiculturalism appears possible only with an extremely powerful central government, which requires an ever-increasing tax base to sustain it. Are you willing to pay higher taxes? Are immigrants?

In fact, all the trendlines point in the opposite direction, with multicultural states breaking up into their constituent nations.

The most awesomest part of that super awesome refinance plan for underwater loan owners is the fact that it creates two mortgage markets. One for regular people buying or refinancing who have to play by the rules, and one for morons who over-borrowed or paid too much and who can now easily sign up for a new low interest loan up to 125% under water. Sooooooper awesome!!!

Windy City, you gave me a good laugh. Thank you!

Regarding the protesters, I beg to differ with those who say the demonstrations are useless. In the sixties, mass protests eventually made a huge difference. We now have no draft, for example. Eighteen-year-olds can vote. It takes time, but this kind of public display can eventually have an effect. Perhaps the “good” senators who are ignoring the protesters at their peril are too young to remember. The president certainly is.

@Paula:

Regarding the 60’s protests, one East Coast Professor (Yale, IIRC) recently made the claim that the protests of the 60’s were the most significant event of the 20th Century. That’s a big claim, but he had an interesting view. He’s a Professor of Sociology, and is taking a broad view of things. Of note was his point that the protests were world-wide. Also of note is the time scale that he was looking at, and that those were the warm up for what was to follow over the decades later on. In particular, of today.

Just FYI. I didn’t fully follow his thinking, and I’m sure I’m not communicating it fully. Nonetheless, it was an interesting idea from a professional in that area, and thought that I’d pass it along.

A Yale professor of Sociology believes that the mass media-created and -flogged constructed-Boomer-demographic spectacles called “the protests” were the most important event of the 20th century?

Rillayyyyy? Not, like, Hitler’s conquest of most of Europe, or Stalin’s and Mao’s little wet dreams of running the world? Not, oh, say, the movement from electric to electronic mass communications, or the explosion of population from 1 billion at the century’s beginning to 6+ billion at its end? Not, ya know, nuclear fucking bombs?

There you go, Questor–our national mental clusterfuck in a nutshell: mediated events prized by postmodern pseudo-scientists in the tenured Ivy League access class are way more important than anything that affected the vast majority of us who had absolutely nothing to do with those outbreaks of Situationist spectacle, but were instead doing things like battling deindustrialization.

Yes, the Democratic Party protects its rich donors, the “Westside” folks, Hollywood, and Wall Street. You know who they are. Just accept the fact that the rich folk have always run the world and they always will.

Come April, remember to pay your income tax like a good wage slave while you know that the self employed pay nothing and get government benefits(you know who you are in Glendale).

Just for the record. Fifty Democrats, eight Republicans and Independents Joe Lieberman (Connecticut) and Bernie Sanders (Vermont) approved the measure. Thirty-eight Republicans opposed it. The GOP(Tea Party) controlled House is against it as well as Obama. Go figure.

From what I have seen in the San Gabriel Valley, foreigners are already welcome (as long as they have the ducats).

$500k gets a VISA? Nice work Chuck. Simply awesome – America – buy your slice today.

Save the banks. Screw the working class.

Thanks for keeping the anger alive and prescient. Any regular on the Blog is a step ahead of the mass media drones as far as the residential housing market is concerned.

I too agree with Jay…whats wrong in that. We Americans cant pay off the debt…if they help us in paying a part of it then what is wrong in that. Trust me there are many rich business men who can buy cash properties n thus save the state.

ken:

Iimmigrants are not going to pick up the tab for a bunch of stupid old white people who forgot to have children. They will shelter income and happily avail themselves of every goodie from Uncle Sugar that the natives have. And, immigrants get old and sick too.

Americans with their CONSTANT pro-immigration mantra are naive fools.

Americans with their CONSTANT pro-immigration mantra are naive fools.

Says someone who’s statistically likely to be the descendants of immigrants themselves…

Or maybe I’m a descendant of colonists from the south of England, which is a different thing entirely. But whether I am or whether I’m a Han Chinese who landed on the tarmac last week, that still doesn’t address the issues I raised in my post.

I must respectfully disagree with the good CPA above who says the self-employed pay nothing. My husband and I are self-employed, and we not only pay double the payroll deductions that employed people do, but a whole lot more for health insurance. Maybe you know some tricks we could use to change that?

don’t pay monthly health care insurance premiums, just go to the county hospital and get free taxpayer insurance whenever there is a serious concern…

works for a lot of people in this country

who can seriously afford $1K+ a month for health insurance when you are a baby boomer trying to start your own business?

The Milken Institute has released a study called the “Los Angeles Economy Project”, which reports that nearly 680,000 workers in the region work in the underground, cash-only economy. The Los Angeles Times freely admits that llegal immigration leads to companies that aren’t in “compliance with tax, wage and safety laws”. It leads to “unfair competition”, a “burden on public health systems”, and “worker mistreatment”. They note that “outlaw businesses… offer no compensation to injured employees and often pay below-minimum wage” and they are “unlikely to collect and pay sales taxes.” CALIFORNIA'S effort to root out the underground economy–where workers often are exploited and businesses evade taxes and other requirements–is a battle against a force that costs the state $6.5 billion annually.

In SoCal, we are going the way of Greece in so many ways.

I never ever thought I’d see the day when those food carts on the street would show up in Westlake Village and Thousand Oaks. The loud Mexican music blasting from a pick up in a nice neighborhood shopping center, made my husband comment that you can run but you can’t hide from the invasion. Lots of newer built stuff has gone section 8 around here. We have seen the illegals drive nice SUV’s and their offspring go to Westlake High for a while now. Amazing, isn’t it! Some of us crawled out of poverty and are very sad to see our country DOA. I’m knocking on doors before we buy a home. Neighbors make or break the neigborhood experience. Even once nice areas are turning “turd” world.

Please read the latest by one of the best journalists in the country, Matt Taibbi!

http://www.rollingstone.com/politics/blogs/taibblog/owss-beef-wall-street-isnt-winning-its-cheating-20111025

The Canada US house price chart is an average and cannot accutately reflect the extreme variations between the different market areas of Canada as the numbers are heavily distorted by the high volume Vancouver (and to a lesser extent Toronto) markets.

The Vancouver market is still to this day every bit as frantic as the LA market was at its peak as wealthy Asians continue to bid up the price of the most basic of housing to over $1 million per (http://www.cbc.ca/news/canada/british-columbia/story/2011/10/05/bc-west-vancouver-housing-royal-lepage.html). The Alberta economy remains quite strong but real estate prices there have remained relatvely flat or even slipped slightly over the past couple of years, as they have done in most other areas of BC outside of Vancouver. In fact, many other areas of Canada have had no price increases of significance for several years.

When the wheels fall off the Asian money train and the Vancouver market crashes, it will not significantly impact our banks, our government or the Canadian real estate market overall as we have all been expecting it to happen for several years.

If your Senate enacts the Wealthy Foreign Home Buyers program it will undoubtedly attract some of those who had considered buying in Vancouver and may even prop up prices in a few of the desireable areas in LA. But most areas will not be impacted at all.

Hi DHB,

Long-time reader, first time poster. I can second the comments provided in Bobbus’ post above. I have an aunt in Vancouver making a decent salary and she could never afford a home there. She has rented all her life and will continue to do so. Rich foreigners typically flock to Vancouver and Toronto, the big cities and as such inflate the real estate market. You got the oil boom holding prices high in Edmonton and Calgary but I don’t believe they are still increasing. In smaller cities like Ottawa, prices are pretty stable at this point with small increases over the past couple of years. I think unemployment plays a role as well, the national average 7.1% is a full 2% lower than the US average of 9.1 (Sept 11 figures).

Maybe in the grand scheme of things that 2% does not matter (you are the expert), but I have not witnessed first hand (yet!), the effect that less, good paying jobs would have on the market.

I know less about real estate than most that post here but I am just giving my perspective. As someone who is planning to move to the LA area for personal reasons in about a year, I began reading your blog about 6 months ago and have kept a close eye since then. Thanks a lot for the effort that goes into it.

Please, give me a break. I lived in Vancouver for 7 years, just recently returned to the states. When the Chinese economy falls off a cliff, the Vancouver RE machine will come unhinged with it and the market will indeed crash. Apparently we agree up to this point. What you don’t seem to realize is that virtually every Canadian mortgage is backed by the government. So the 5 major monopoly banks have virtually zero exposure and the government (tax payers) get stuck with the bill. Sure, perhaps most of the Asian money is buying up real estate with cash, but it drives ALL the prices up, the majority of which is still financed with government backed mortgages by regular joe Canadians trying to eek out a living in a very wage depressed city. No there will be a crash all right, and the government is wide open for full exposure. It will be a bloodbath when it does happen. Conversely, as far as immigration goes, I am generally all for it if the immigrants have to declare and pay taxes on their world wide income. In Canada, the Asians buy up the houses, and then leave their wife and kids to soak up the benefits Canada offers while dad stays in China to make the bucks. So next to zero in taxes are being paid by these immigrants all the while soaking the system. Yes, it is great for realtors, bankers, and many career politicians, zero benefit for the average joe. BTW, I moved to SF and the place looks positively cheap in comparison to Vancouver…..

@Buster

BC is in a massive bubble. I have friends up there who say that a 500K condo is an amazing deal, if you can find one. What’s funny is that in SF, which has a stronger, more diversified economy than Vancouver, you can get a place downtown for much less than you can in Vancouver or Victoria.

You’re right, the gov’t backs all the mortgages, so the tax payers will directly take the hit. Canadians always say that their banks aren’t as risky as American ones (smugly I might add). They’re right because Canadian banks transferred all the risk to the government. Healthy banks, insolvent government. Whoooooo!

Why is everyone freaking out about this? You make the case to let the limits drop because it only effects 1.5% of the population.. Then act like the world is ending because they aren’t dropped… It shouldn’t effect you … so what’s the big deal? It only effects 1.5% of the population apparently anyway…

“Why is everyone freaking out about this? … it only effects 1.5% of the population†Let’s list a few reasons:

1) It’s the thought that counts. This is but another blatant show of force from those who have purchased most of the Senate (i.e., all the Democrats but maybe one or two & all the “Independentsâ€, and some of the Republicans – i.e., the RINOs contingent). Therefore, it affects us all in that way, unless you don’t care about what is supposed to be a representative democracy being turned into a fascist/socialist joke.

2) Economically it doesn’t just impact 1.5%. Ever heard of the “broken window fallacy� Clearly you have not, or have chosen to purposely ignore it. Essentially, an economic analysis must take into account all costs and benefits not just some red herring portion. In this case you focus on a small fraction of the housing market and assume the is no bleeding over to other parts of that market or other markets for that matter; but seriously are you so naïve to think that that is the only thing being impacted by such a law? For example, and as others have pointed out, what are the additional costs of the ‘diversity’ this will bring? What about the costs of higher housing generally, lower wages generally, etc., etc. … In short, the economic impacts alone of something like this never just impact the intended market and/or group but we all (I mean real Americans) pay for it in 101 ways that are purposely ignored to aid in its passage.

3) I don’t want immigration policy to be open to the highest most unethical bidders. Also, see #s 1 & 2.

Finally, the stupidity and general raping just needs to end. The solution to too much debt isn’t more debt, the solution to too much government isn’t more government, the solution to too high housing prices isn’t higher housing prices, the solution to too much stupidity isn’t more stupidity, the solution to too much corruption isn’t more corruption, the solution to too few jobs isn’t to import more foreigners or outsource our jobs, the solution to so called “representatives†not representing our interests isn’t to not represent our interests less, etc., etc. … In short, the solution is not to make thing worse but to either stop the insanity or reverse the action we know isn’t working, and not to do more of it.

Do we not all see that these actions are sheer panic on the part of our “leaders� Actually, it scares me that we are on the verge of Armageddon and our leaders are coming up with these silly divisive “solutions†to the housing crisis. Although it is campaign season and all of this BS is probably candidates just trying to get their names in the news…

Doc, I have kept an eye on real estate in the Maritimes for 15 years. New Brunswick province and PEI in particular appear to have weirdly high real estate prices relative to wages. The causes are the same–too-easy loan terms, low wages pushing people toward doing something stupid to get something they can’t afford, and then of course demographics (the influx of retiring Americans from the NE US pushing up sale prices; the tax sticker shock for socialized health care, etc., comes later).

Vancouver, Toronto, Calgary, and Edmonton are officially recognized to be in bubbles.

Regular working Canadians are being squeezed just as regular working US citizens are, for all the same reasons.

A great place to start:

http://canadabubble.com/

Hi Paula what is meant by the self employed ‘pay nothing’, in terms of taxes is true. It pertains to the foreigners (Asian, Persians, etc) who come from ultra competitive merchant cultures who save everything, come here, set up shop (dry cleaner, liquor store, kiosk, t shirt printing, or buy out the old American man’s take-out food shop, etc) and run businesses and have figured out a way to cheat the IRS. They do well here, because the competition from their motherland is far greater than it is here. For example, the take-out food shops where the family lives upstairs and the kids are cleaning the floors, etc. Gotta give em credit for hard work but they tend towards cash businesses or otherwise under reporting on taxes. A few thousand a month income unreported goes a long way. I met a Korean man in the 1990’s who came here with very little money and soon had a successful garment mfgr shop in downtown LA, making millions a year. He told me he was shocked at how easy it was to make money in the US compared to his motherland, Korea. Mind you, that is the garment industry which we think it cut-throat and for him ‘easy to compete’.

Obviously tax cheats are also rewarded here. Hey, what a great idea for Obama. Maybe he can make a tax cheat bubble! Just import more third-worlders and create a tax subsidizing quasi-government agency called TaxyMae to bail them out when the IRS catches them.

America’s biggest import is third world village people who come here and use all of our government services and pay no taxes. The wage slave is the one who pays the taxes and keeps this country going.

The Democrats like the third world village people because they vote socialist. The GOP likes them because they work for cheap and the business man makes big profits now. Capitalism is always short term thinking. If it makes a profit now, they do it, even if it will result in their demise down the road.

Let’s face reality. Los Angeles is already a third world country along with SoCal(say goodbye to a price recovery in housing). It is only a matter of time until the third world spreads in America. If you like the be headings in Mexico, be patience, it will come here. Happy Halloween to all and good night.

I just visited Vancouver on business and noticed all the moderate homes in the area – e.g. 2 and 3 bedroom homes on small lots (around 5K or 6K sq.ft. of land) and asked the local taxi driver what those houses would sell for and he said: “It’s crazy… in the range of $1M – $1.5M..” So, for Vancouver that is high price, but in the same price range as a house in the northern Santa Monica area (Wilshire to Montana).

“Can anyone from Canada comment on this?” Well, I am from Vancouver and all you have to do is look at the RE market in the Lower Mainland (Greater Vancouver) and you will discover a few things:

The new, rich, immigrants set up a second or third home for their family and do not actually live here. Check the archives of the Vancouver Sun or Vancouver Province for the story on 20 rich kids that drove their fancy cars to shut down the highway so that they could race in broad daylight. And we are not talking Mustangs here… That is an example of the trickle down that occurs when you only allow rich people into your country.

Most all homes that date from the 1970s or earlier that are sold are running about $1M (with buyers) and are being bought and TORN DOWN. Under that scenario, MOST of the housing stock of the USA would be bulldozed. Forget all those fancy RE words like “craftsman” or “hardwood floors”. Oh, and let’s not forget the petitions to change the house numbers to multiples of “8” – check it out, it’s true.

But most importantly, prices here remain in a global bubble and while so many local experts are calling for an end to the bubble, it just isn’t happening. Essentially, immigrants (rich ones) are buying property in Vancouver and using the opportunity to then apply to move to the USA in the years ahead. However with the chump change of $500K being proposed, you are exactly right, the bubble areas that remain in California will continue for as long as the foreign money can come in.

Enjoy the ride.

Whatever happened to the “American Dream”? That is, affordable home ownership. At some point in the past ten or twenty years, the word “improvements” in the housing market sense started meaning housing becoming more unaffordable.

Now there are these two scumbag Republicans saying they’ll strengthen demand by bringing in rich foreigners (e.g., drug lords) to buy our houses and make them even more unaffordable. Whatever happened to protecting us from the terrorists? The terrorists have plenty of money and now they’ll be getting visas. Dirtbags.

Tad –

A correction – You are right that two scumbags proposed the legislation, however it was 1 Democrat scumbag and 1 Republican scumbag. You can look at some of the earlier comments to see the voting results, but if I remember correctly, 50 Dems, 8 Reps and 2 Inds voted for it, 39 reps voted against it, and 1 Dem abstained from voting.

Or maybe I’m a descendant of colonists from the south of England, which is a different thing entirely. But whether I am or whether I’m a Han Chinese who landed on the tarmac last week, that still doesn’t address the issues I raised in my post.

Why is it different whether you’re from the south of England, or from China? Your ancestors came over to make a better life for themselves. In exactly the same way that people are still doing today. Though I’d hazard a guess that they’re going to be disappointed as the good old US of A is currently sliding into the sewer.

You are wrong on at least several counts; for there are at least several implicit assumptions and/or flat out factually wrong observations:

1) A nation is not some random collection of foreigners. For example, ask the Han if China would be the same if it was populated only by Bushmen?

2) As an extension, the U.S. will become more like the third world as more third worlders are allowed, and in many cases like this one actually encouraged, to pore in and overwhelm the society and related people that occupy the space we used to call America.

3) As a wise man once said, “culture is not dropped from some culture fairyâ€. In short, it is the result of the people who live there. Thus, what makes Japan Japan is the Japanese, and what makes America America is not the Mexican illegals, or legals for that matter.

4) You seem blithely unaware of basic history and human nature.

I could go on, but the general point is that since its founding, it is incorrect to just assume you can import many people who have shown little or even no signs of acting like Americans and not expect the country will turn into the hellhole from which those newcomers came. The U.S. that third worlders want to move to is the one created by Europeans (and applying constitutional principles, which were created by primarily Englishman) not Bushmen or Han or any other group. That is a fact of history. Once you overwhelm that society/culture and allow invasion, whether invited or not, that place will become more like the hellhole of the invaders/interlopers (again, whether allowed in because of political correctness, or because they can buy a house). Again, that is a fact of history. Diversity is a weakness, not a strength, always has been and always will be.

Finally, a good part of the “mortgage meltdown†was allowing mostly “minorities†to borrow hundreds of thousands of dollars to buy houses they couldn’t afford, then assuming they would one day make incomes to be able to pay for those houses (especially in places like California, Florida, Arizona, Nevada, etc.). How’s that working out for you? And you want us to import more to prop up high end housing in places like Cailfornia and ignore the overall societal costs associated with it let alone the abject silliness of trying to use government policy to do so? It doesn’t take a genius to see that this is silly in more ways than one, but it is more likely a Democrat’s attempt to bring in more anti-US voters and some RINO’s attempt to seem politically correct. Count me out, and again, the solution to too high housing prices isn’t to push them ever higher; and the solution to the U.S. becoming a third world nation isn’t to import more third worlders. Wake up and read some history.

Count me out, and again, the solution to too high housing prices isn’t to push them ever higher; Here’s where you make your error. Your enemies, ie., that republican and that democrat (yes I have taken to dropping the capitalization on dirt bags) don’t see high housing prices as a problem. I mean that literally, they do not see the high cost as trouble any more than they see young American men dieing in pointless wars as a problem. They see those things as good. To focus on the housing tho – their mindset is to ignore the problem, the real problem of over inflation, the tulip bulb is manna to them and not a disease. What I am basically saying is that they tulip mind set and the only thing they see is salvation in restoring the high prices of houses. In other words your truth is useless because Mao was right political power….. ferget the gun, wins. When Occupy finds your truth and it’s voice and grows like a well watered tulip we will move to your rightful solutions. And then the next lie will confront us….

Sorry mate, teal dear.

Other than:

Diversity is a weakness, not a strength, always has been and always will be.

Wow.

Ae you also concerned that there are people out there, plotting to steal your precious bodily fluids too?

I have no inoculation against that kind of crazy. You win, yay.

“Diversity is a weakness, not a strength, always has been and always will be.”

That statement is balls on the table stupid, and quite frankly un-American.

Republic- Outstanding post. The American culture and its roots is the one culture that forever changed the direction of humanity. It is now all but forgotten, if not outright villified.

The PC police does not want the truths you spoke of to be heard. You will now be villified.

Am i correct? you are very biased towards pro asian policies..

Newsflash, most americans CITIZENS do not like more of your kind coming here

Canada is in a bubble. Our west coast is completely delusional as is central Canada. This is the result of a minority conservative government searching for a majority. When they first came to power they introduced a zero down mortgage policy with the Canadian Mortgage and Housing Corporation taking all the risk from banks underwriting the mortgages. Next step was to allow 35 and 40 year mortgages, and then the desired housing bubble took off here just as it did to the south. People have been fooled into believing they are richer than they are. Hard to argue since every house up for sale has, until recently, been the subject of a bidding war. As is true of conservative governments everywhere they have ruined the states finances, by cutting taxes and spending like drunken sailors, all the while claiming fiscal prudence and tax fairness. They inherited surplus budgets and now we are far, far into the hole just as we were when the conservatives last were in power. All the nonsense about our banks and bank regulation is a crock, the government removed all the risk from mortgages, our central bank absorbed all the losses on our homegrown version of CDOs.

For a good take on the Canadian state of real-estate foolishness see greater fool.ca

In Canada, there is actually very little ‘foreign’ money coming in, but there is a giant lending bubble facilitated by the federal government in the form of the CMHC. CMHC is like Fannie Mae/Freddie Mac/Subprime on steroids. Downpayments are effectively 0%, there is no lending limit, and nearly everyone in Canada uses adjustable rate loans (ie: less than 5-year terms). The most popular loans actually adjust on an overnight basis.

The ‘foreign money’ story has mostly been concocted by the Realtors to stir up xenophobia in Canada, and to scare the locals into believing that they will be priced out forever. Canadians, on average, own less than 33% of their houses in terms of equity these days.

Very likely, coast to coast, there will be a 50-70% discounting of prices. Already in some cities in BC, particularly Kelowna, condo developers are offering product for 50% off.

Jason Emery, if there’s so much ‘money’ pouring into Vancouver, why the heck does the chart of Canada’s outstanding mortgage debt look pretty much identical to that of Canada’s housing prices? Foreign money coming in would imply a net de-leveraging, not an increase in the leverage ratio as you currently see. Face it, Canada is in the midst of a financing bubble, not a Chinese rush to move to Vancouver with money. Most new arrivals to Canada arrive virtually penniless, and they only live 10-15 to a house because they have to.

Hi Mark-All I know is that it is very easy to move huge blocks of money out of China and Hong Kong, despite currency controls. If it was a STRICTLY a ‘financing problem’ as you state, the Canadian housing price bubble would be at least somewhat uniform. It is not. See below. The Vancouver market bears no similarity to the rest of the country.

Check this link out. http://www.livingin-canada.com/house-prices-canada.html

In the 12 months ending February 2011, Vancouver home prices had increased 19.4% over the prior 12 months, to an average home price of $792,000.

There was about $940 billion in residential mortgage credit outstanding in Canada

in 2009. CMHC insured $473 billion worth of mortgages at the end of 2009 which @ 50.3% I just don’t think can be accurately described as “virtually every Canadian mortgage is backed by the government†. Google it BUSTER

As one who lived in Vancouver during it’s real estate market crash of 1981 – when it took until 1989 /90 for prices to recover I know what the normal ebb and flow of a real estate market should look like and we can all agree that the current Vancouver market is on “crack†and will eventually crash and burn.

I have listened to Chicken Little, Henny Penny and their associates predict a US style meltdown of the Canadian real estate market for almost 4 years but they clearly don’t understand why that will not happen. Remove special case Vancouver from the discussion and the vast majority of the remaining Canadian real estate market is acting just like a normal real estate market should act. Are condos being discounted up to 50% in Kelowna. Yes they are. They overbuilt and Alberta purchasers realized Arizona and Nevada foreclosure properties were a much better value. That’s what a normal market looks like. Have they overbuilt condos in Toronto. Yes they have – condo prices there will drop. I live in Kelowna – real estate prices in the Okanagan Valley have dropped 10 / 15% in the last 2 years. The same has happened in many other markets in Canada. Listing are up, sales volumes are down and you need to discount your price if you want to ( or have to) move your property. A soft but normal market.

The sky is falling………….don’t believe it.

Bobbus, its not necessary for the government to back literally 100% of the market. What matters is that, generally speaking, the government backs at least 50% of the market (your own figures) which are subject to high leverage and very weak overall borrower quality and capitalization. 20% LTV loans written to doctors, dentists, and engineers are not going to default short of nuclear war. What is important is where the risk of these Vancouver loans ultimately resides, and that is, with the CMHC.

Calling Vancouver’s market ‘normal’ when a SFH costs > 10X median household income isn’t ‘normal’ by any stretch of the imagination, and there is massive overbuilding in condos there.

Just wait until China pulls back. Canada will be dog meat.

“So why in the world are we passing higher loan limits of $729,750 when the typical household makes $50,000 a year in the U.S.?”

Because median household incomes are not the same everywhere in the US, and there are some markets, like the Bay Area where $729750 doesn’t buy very much. It’s a nationwide program, not a 47 out of 50 states program.

The Bay Area median income is less than $50,000, so your point is not well taken.

“We have the TSA basically feeling up our citizens and for those with cash we are offering them a golden ticket? ”

I believe this general thing would be the basic complaint of Occupy Wall Street. We should only be surprised that it took them this long to propose the idea.

I disagree with your view on the Visa proposal.

I am a Canadian citizen currently living in California on a work visa. 3 years ago I started a grew what is becoming a very successful real estate investing business. I can’t tell you how many people I have employed who would otherwise be out of work due to the housing crash….contrators, realtors, lenders, escrow/title companies to name a few. I would love a chance to stay in the USA to continue to work my business, but immigration makes it very difficult. A Visa such as the one proposed actually makes sense to me.

I agree that raising the limit on insured mortgage loans is insane. However, I want to address the issue of allowing foreigners to purchase homes. I believe that in order to obtain want amounts to a temporary visa is that a foreign person must satisfy two requirements: (1) the purchase price of the house must equal or greater than $500,000 and (2) the foreign person must live in the house as their principle residence at least 183 days out of every year. If the foreign person does not satisfy the 183 day requirement, then the visa can (and hopefully) will be pulled. Of course this could have the effect of solidifying and even increasing home values in those areas that would be affected. However, I believe that the main emphasis of this is that the foreign person will be required to file income tax returns in the United States and pay income taxes on their worldwide income.

Leave a Reply