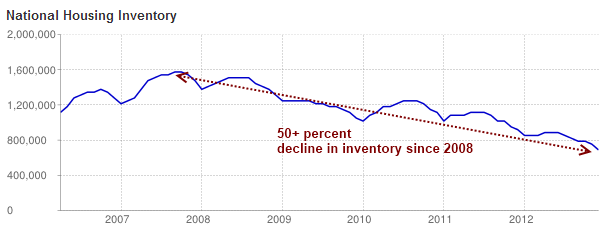

The disappearing housing inventory – US housing inventory down over 50 percent from 2008. 5 million Americans not paying their mortgage or are in the foreclosure process.

Supply and demand. A basic fundamental point of any course in introductory economics. With housing most people go with what they see. Distressed inventory is a silent issue because you really do not know how deep problems are in a certain area unlike a home that is listed for sale with a big red sign in the front lawn. Yet we know that over 10,000,000+ Americans are currently underwater on their mortgages and another 5,000,000+ have stopped paying their mortgage or are currently in the foreclosure process. What people see however, is prices going up, available inventory going down, and their ability to buy more house expand courtesy of mortgage rates. Today I want to focus on the inventory side of the equation because it has fallen dramatically in the last few years and is causing bidding wars in certain metro areas.

Housing inventory

The biggest asset most Americans have on their balance sheet is their home. The credit markets prior to the crash in 2008 were open to all people with toxic loans. So anyone with a pulse had the ability to buy. Today, the government is the mortgage market originating over 95 percent of all loans. FHA insured loans are a big part of this and only require a paltry 3.5 percent down payment. Inventory has fallen dramatically from the peak in 2008:

Source:Â Housing Tracker

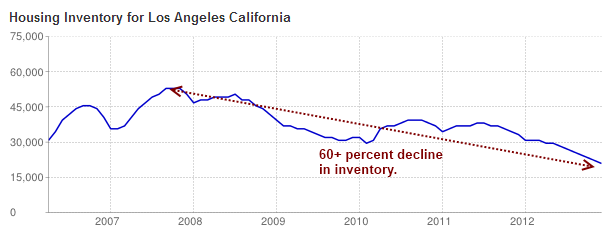

Nationwide, inventory is down a stunning 50 percent from 2008 as home sale demand has picked up. This is also occurring in select metro areas:

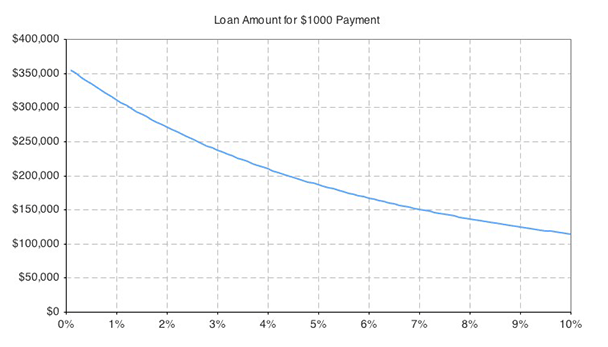

Inventory in Los Angeles is down over 60 percent in this same time period. Basic supply and demand will tell you that even with the same level of demand, prices would be pushed higher. Yet with housing, you can only purchase a property with actual real world income. Typically, this income has to come from local households but like in many places in California, you can have hot money coming in from other nations or states. The Fed and government fully understand this point and since it is much more difficult to target household income to increase, they simply pushed mortgage rates lower via a variety of mechanisms including QE3. The result is similar to this:

This is a very critical item to understand in why home prices surged in 2012. 6 percent rates were here not too long ago (2008) and rates were up to 5.5 percent in mid-2009. A 6 percent rate in historical context is incredibly low. So you see with the chart above, at 6 percent a $1,000 payment will get you a home at roughly $150,000. At 3 percent, it approaches $250,000. Yet household incomes remain stagnant. However that drop in interest rates suddenly boosted buying power dramatically.

Lower inventory, more buying power, higher prices

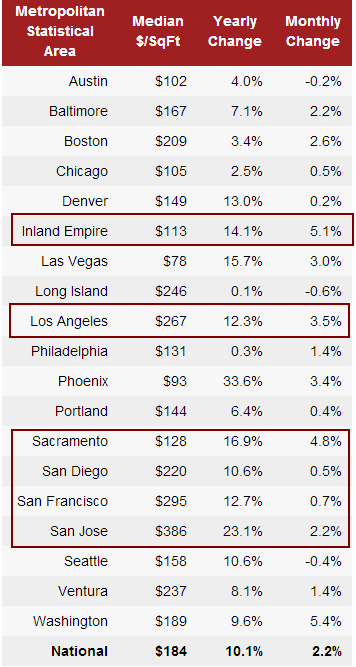

So it should come as no surprise that prices surged in 2012:

Source:Â Redfin

Nationally the price per square foot went up by 10 percent. In Los Angeles, it went up by 12.3 percent while in San Jose it soared a stunning 23 percent. Take a look at Phoenix however. The price per square foot went up 33 percent! We discussed Arizona incomes and the flood of investors into the area in a previous article.  Nearly half of sales in Phoenix and Las Vegas come from investors and hot money. Big funds from Wall Street are chasing yield all over the country and are willing to become large landlords.

You would think given this massive rise in home prices that home sales are near record levels. They are not. In fact, new home sales are still near the trough and are barely creeping out:

This chart probably would surprise most that overall existing home sales are back to levels last seen in 2006 or at a similar rate to what we had in 1999. The population is much larger since that time and back in 1999 the 30 year fixed mortgage rate was closer to 8 percent. What we are really seeing more than anything is the lack of supply on the market plus massively artificial interest rates. Is this healthy? The bulk of people only see two things when they look at the housing market:

-1. What is my monthly payment

-2. What homes are available for sale

The mania that is unfolding right now has nothing to do with underlying solid economic fundamentals. In fact, come what may with the fiscal cliff, we will be seeing a combination of cuts and tax increases. We’re reaching another debt ceiling and we still have big issues to contend with like the large number of baby boomers retiring and a much less affluent younger generation. How will this impact housing? Even for the above chart, how will new home sale construction look like? Many younger Americans have no desire for the giant 2,500 square foot McMansion model that seemed to go hand and hand with cheap energy. It is amazing how easily people forget history and the reality that 5,000,000 Americans have been foreclosed on (and we have millions more to go with 5,000,000 right now not paying their mortgage or are in the foreclosure process).

Supply has dwindled to incredibly low levels. Banks have altered the foreclosure process and this has had a short-term gain with a combination of low interest rates. Short of rates going lower or incomes moving up, we will see this momentum slow. Flippers and bidding wars are now back in the game. The lack of new home construction has caused what little inventory that is on the market to increase in price relative to the changes in the interest rate. How much more power does the Fed have in pushing rates lower than where they are today?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

49 Responses to “The disappearing housing inventory – US housing inventory down over 50 percent from 2008. 5 million Americans not paying their mortgage or are in the foreclosure process.”

I’ve now heard rates under 3%!! This is an all-time record low in the history of the US.

A 3%, 30 year mortgage on a $355K loan is $1,500/month. $2,000/month payment will get you a 475K loan. $2,500 gets you close to $600K. So, I’d say the $500K an under home prices are having the greatest sales pressure because they are closest to a lot of rent payments.

You still have to have a home to buy to get the rate. Without that, it’s just theory.

CAE, you hit the nail on the head. Borrowing money right now is ultra cheap. As you mentioned you can borrow almost 500K for 30 years at around $2000/month. This is why anything decent in the 650K and under price range is seeing such fierce competition. As people are realizing, you need to live somewhere and rents seem to be continually going up…so buying anywhere close to rental parity makes sense. I know we’ll hear the argument that “rates have to go up and prices will have to go down.” That may be true, but what timeframe? 1 year, 5 years, 10 years. Are people really willing to wait another decade in hopes of a normal market returning? Most are not.

This housing market sucks, but it is what it is. Good luck everybody and happy new year!

“Many younger Americans have no desire for the giant 2,500 square foot McMansion model…” Just curious if most people around the country still consider this kind of square footage to be anything like a McMansion – type home. Outside of exclusive and pricey areas, that kind of living space would appear to be closer to the norm today, whereas anything exceeding 4,000 square feet would more likely be an outlier of sorts.

We live in 1400 square feet. With two kids. We’d KILL for 2500.

Thanks for responding – but what I wanted to know was if anyone lives in homes of less than 1,800 square feet, what locations are they living in currently? I understand if this is a SoCa phenomenon, but outside of some areas like SF and the NY metro area, that might seem a tad on the small side for many folks.

Dmac

We owned a 4,000 sq ft McMansion 5+4, 3 FPs, Built in Fridge, Circular Staircase beauty w/ a view from 6 rooms (Ventura County). Now we live in a 1900 sq ft one-story cash & close. We are the happiest we’ve ever been. It’s the home, not the sq ft imho.

First we have to consider the definition of “McMansion”, what it means in southern california, and what it means “around the country”.

To preface my remarks, I will qualify by saying that none of my observations probably bear much relevance to Southern California Housing… which I consider to be a housing in petri dish sort of scenario! 😉 (ie: I really think some areas, like socal, are quite bizarre in nature – and don’t really relate to the rest of the country in various ways depending on what you’re comparing it to.)

But you expressed interest in hearing from “most people around the country”.

I really hope I’m not “most people” – because that sounds awful! lol

But I’m definitely from an area very different from Southern California….

I live in northeastern quadrant of Pennsylvania, and so that’s where my experience & observations come from – which includes the Scranton/Wilkes-Barre area, Allentown, and the Poconos, and the northern tier (where the Marcellus shale gas boom & related housing & rent bubble is going on).

To me a McMansion is the kind of house that looks like a cookie cutter house, and it’s usually a large house built on a rather smaller plot of land than would’ve been common before the housing boom years around here.

They are notably distinguishable as being built during the housing boom. They just have that look.

Sometimes they’re just a block or 2 of them, shoved awkwardly into older neighborhoods.

But they are mostly found in clusters in developments that were, of course, developed during the bubble.

(They kind of look like low income housing projects – just that the houses are a LOT bigger.)

And it’s not a true mansion, though they may be quite large in sqft. They are not the true mansions you might find that were built in the 1800s iron boom in the city of Scranton with sprawling verandas & servant quarters, and not the mansions built around Lake Wallenpaupack and other parts of the Pocono Mountains.

Even though some of the true mansions might be similar in square footage to the McMansions, or even smaller. They are quite different in quality & setting & the people who buy them.

Worse, in northeastern pa, what the developers would do is go & clear a tract of land… so all around acres away would be beautiful scenery & trees. But in the McMansion development – no trees at all – they were clear cut, and just these big houses in a big clearing, practically on top of each other with bare yards between… because nobody ever lived there long enough or with enough money to actually make the place nice or replant any shrubbery let alone trees.

There’s no way people who could afford a nice house would choose to live in these places when there are other houses they can find that are much nicer… maybe a bit smaller, unless they have a ton of kids maybe.

Those McMansions were doomed from the start. It was all a house of cards completely. There were never the jobs & economic growth in this area during the boom to warrant that sort of thing – beyond the swelling housing prices.

In my opinion, that’s the epitome of the definition of McMansion.

A crappy huge house built & bought for no other reason than that there was a housing bubble.

Perhaps it’s different in southern california because at least people were trying to buy houses there for a purpose – because they had decent paying jobs in southern California.

That really wasn’t the case here, even during the boom years.

At any rate, I don’t know if this was the “around” broader picture you were looking for. But I thought maybe you’d be interested in a bit of perspective.

As for sqft that is “average” or “normal” or what would qualify something as a MANSION (be it McMansion or a real mansion?)…

Well how could we even say after all the construction that happened during a bubble?

I watched that horrid documentary about that ridiculous time share guy & his outrageously ridiculous mansion in Florida that’s 80,000sqft.

^^

But I would say that 2500sqft in northeastern pennsylvania would be considered a large house. Be it a mansion or a McMansion, or just an old farm house with an addition added… it’s ample. I don’t know what the average size is for the area for new house construction. But I’d say that 2000sqft would be considered “nice size”, and that most people who live in houses, live in houses that are 1500sqft or less, and were built more than 30 years ago. (I myself live in a 900sqft house built around 1920.)

I think your definition of McMansion is the same as in So. Cal. I saw them going up in San Diego. Large tract homes, really. Around 2,000 to 3,000 s.f. Postage stamp yards. No style to them and cheapo construction, even though they looked nice.

I much prefer houses built in the 70’s for quality overall, versus the 90’s. A remodel to the 70’s home can give you a really nice house that I believe will last many more years than the 90’s and 2000’s cookie cutter houses.

I think the “Mc” in McMansion is like equating the homes to McDonald’s. You know, not really a mansion, like McDonald’s is not really good food.

The Fed has the advantage of time. The Fed can simply hold the rates where they are for the next 10, 15, or 20 years–slowly out living each generation with current inflation.

Therefore, those that are waiting it out hoping for a rise in interest rates will wither on the sidelines in their rental living arrangement. The American Dream will be lost for them.

If by “dream” you mean the nightmare of being stuck in a 30-year contract in an uncertain job market with next to no chance for appreciation in real dollars, then I’m sure those waiting it out are happy in their position 🙂

Sometimes being a tenant can really suck goo.gl/Lio0Y I’d rather slip my “rent” in the mail than have someone knock on the door to collect it. Just a preference.

Nothing is wrong with waiting. Will it ever make sense for some to buy? Probably not. For others, it almost always will. I think waiting makes perfect sense, especially if you are saving money while you wait. If you aren’t able to save while you wait, you should think about how many years you want to work. After all money is one thing and time is another. Time is finite. Don’t buy more than you can reasonably afford and don’t buy for appreciation.

Remember though, that in a leveraged investment like a house you don’t need an appreciation in “real” dollars to make money. If I finance 80% of my house and the dollar falls in value by 50% my house hasn’t appreciated at all in real dollars, but has doubled in “value” in nominal dollars.

While few here like to admit it the likelihood of further dollar devaluation makes housing a pretty decent inflation hedge. The only question is whether nominal inflation due to dollar devaluation will trump or be overcome by potential home price declines when (if) federal intervention disappears. Looking to Japan I think I know the answer to this one.

Thanks for the concerned RE agent trolling on this blog – hope those fat commission checks keep coming your way.

Thanks for gettingitright. Buynoworbepricedout. Whoohoo 2006 lives. Happy New Year.

lol

Thought you would like this….

http://www.forbes.com/sites/zillow/2013/01/03/korean-singer-psy-buys-gangam-style-condo/?utm_campaign=forbestwittersf&utm_source=twitter&utm_medium=socialhttp://www.forbes.com/sites/zillow/2013/01/03/korean-singer-psy-buys-gangam-style-condo/?utm_campaign=forbestwittersf&utm_source=twitter&utm_medium=social

Apparently 2776sqft is gangnam size for a condo in southern California.

haha

@gettingitright, sorry but I hate to break the news to you but the Fed cannot hold down interest rates indefinitely. Thinking that the Fed can hold down interest rates forever is like the debt ridden household thinking that they can keep applying for new credit cards to roll their debt over. This works short term but eventually the limit is reached and all hell breaks loose.

This. gettingitright couldn’t be getting it more wrong that the Fed has some sort of immortal position in a world of global power balancing.

I used to think this and it makes logical sense, but boy the Fed (and the financial industry) keeps coming up with new schemes. No rules anymor, IMO.

get locked into a 30 year at low rates, watch rates increase as the perceived value of your home collapses.

Yup. Buying high with cheap margin is still buying high.

If Mcmansions were out of style, then can you sell houses in South Orange County, the capital of Mcmansions.

True, about the younger generation in Ca which is more minority. Both Santa Ana and Anaheim have the most people in their 20’s among Orange County cities. But many are more likely to be renters. Inner city Anaheim and Santa Ana are around 69 percent renters. These 20’s good be recent iegal or illegal immigants or children of the above or Mexicans have relatives that have been in California prior to 1980. Some homes are under 300,000 or under 350,000 or lower and some are three bedroom.

I mean could be recent legal or illegal immirgants,

True, some areas see prices rising but with incomes stagnant, layoffs rising and the jobless rates increasing in real terms, it’s difficult to see this “recovery” as anything but a tiny blip on a long recessionary road. Regarding the “low inventory,” I see many empty houses with no ‘For Sale’ signs out front. In fact, several that were languishing on the market for months have been removed from listings. Many of these ‘ghost houses’ show broken fences or other deterioration that go unattended.

This zero down, or almost zero down environment saturated with Flippers and speculators in a near zero interest market is not a healthy situation.

Ben – are these homes located in the areas commonly discussed on this blog?

Even in the lower priced Inland Empire, including better and lesser neighborhoods, most of the new listings I see popping up are foreclosures. Who’d a thunk that? Certainly not the pundits in the main stream touting the reecovereey.

I appreciate the data you provide Dr. I wish that you would do more by making sense of the data in terms of the possible outcomes given the current trends. If you bought a home in 2009 and still have your job… you may have refinanced and cut your payment in half by now. A good thing for someone staying put with a secure job.

Same for flippers who bought and renovated… by selling into a tight market, they have been enjoying a good income. In terms of the interest rate… and the potential for inflation… I see homeownership dicey for those who may need to move for a job or may lose their job. Incomes would have to keep pace with the inflation in order to make the principal payoff in what is likely to be a higher interest rate environment. As for the shadow inventory…it has been successful to hold back the flush and keeping more people from being underwater. Totally manipulated but maybe the best approach. Who is in charge? The banks only own about 25% of the non performing notes, 25% in private equity and the balance 50% are owned by the GSE’s. Depending on the volume…. notes being sold at discount to hedge funds would suggest the country is once again being sold to Wall Street. What I fear the big boys overlook is that the middle class squeeze is only successful to the degree that you have a middle class. Cutting out the local businesses involved in Real Estate takes the money out of those communities. From mortgage brokers, agents, escrow, local contractors, yes flippers who make a home that could not be financed to a home that can. They buy goods at Home Depot and also small investor mom& pop property owners and managers. If RE has always been such a big part of our economy, it seems a risky venture to sidestep it. From MERS to selling discounted notes to Hedge Funds, you sidestep the local economies. Their hope has to be that other industries will grow and make up the difference. With a controlled housing market, it is conceivable that the average renter will be paying upwards of 50% of their income for housing. That will result in a negative spiral for the rest of the economy. What am I missing?

You’re missing the possibility that rents could fall. Your mortgage payment short of a miracle that rates go negative wont fall.

Are rents in a bubble? I’m seeing some bizarre asking prices for rentals. And if everyone is rushing from rentals into buying because of FHA etc why would rents be going up? Granted it ain’t scientific but I was looking at a rental on trulia or zillow and it was $600 more than a year ago. What’s going on there?

<<>>

Paragraphing

Good one Navigator.

Yes, inventory is the big question now. Everyone knows it is being manipulated and you have to ask yourself why? Because the Fed knows it would collapse dramatically if it hadn’t intervened. The real problem is having no real exit plan. They are the ultimate lenders of last resort. Unfortunately they will run out of fools to sell to while HOPING everything works out, as they kick the can. Nice trick, but reality wins out in the end. The forces that caused the 2008 housing collapse have only gotten stronger and will indeed end up collapsing housing even worse than in 2007. The housing cycle never really capitulated and ultimately it will. History always repeats itself. Oh, “but this time it!s different! Yeah right.

Banks still leaking out short sales and many properties are being sold at 2003 prices everywhere on the Westside of LA. 250 over the last 3.5 months to be exact.

http://Www.westsideremeltdown.blogspot.com

If the population of the West side of LA is 500,000 that is a rate of sale of about 1.2 of 1000th of a percent of the population. Does this sound like a healthy market to you?

I also wonder what percentage of total houses on the west side this is. How if that percentage is even triple what the percent of sales per population is does it translate to the median value of all the housing inventory. To me it seems like a weak economic model.

Here’s another nightmare scenario…

What if interest rates do increase and house prices do come down. Won’t these cash investors CREAM everyone in their path? If with cash they are already pushing aside everyone at higher prices, they will run away with the leakage of all future distressed inventory.

I also hate hearing everyone comparing prices to the peak and expecting everything is a deal that is down from that.

Under your scenario, these fat cat investors (there are few of them compared to the masses) will be absorbed (spent out) by the surplus (distressed inventory) of homes that will reappear on the market place in the early phase of a sane real estate market recovery.

As stability returns to the real estate market (in a later phase) predictability will encourage home builders to also enter the market place–the bubble will have been deflated and the dollar value of homes will be just right.

Where will you be job wise (having ability to make monthly payments) and savings wise (having 20 percent down) when the time is ripe for a home purchase?

Doc, happy new year! We come to read the articles, argue whether the price is going up or down. One thing we have to admit is nobody has a crystal ball, but everyone has to live under a roof. So, happy new year to all.

The banks are controling the inventory. It costs them nothing to hold the foreclosure process off, we the people are paying the banks to keep people who are not paying in their homes. With the suspension of the Marke to Market rule the banks can still have a nice looking balance sheet. Meanwhile with a shortage of inventory, and a surplus of buyers the prices are rising, just what the banks wanted, helps the banks with short sale prices and when the prices are right they will start releasing the foreclosures again. BTY DYK, that if your home’s value is less than the balance on your 1st mortgage you can ditch all the other jr. liens you have on the property. Once your home value becomes lower than the 1st, the rest of the loans are unsecured.

Wow. That’s quite the hefty profit these flippers are after. Who is buying these flipped houses? It can’t be people with kids. Paying half a million dollars to live in a school area that is a 6 (I guess it is a superior school for Santa Ana) with 1000 other kids. 1000 kids! In a k-5 school. Half a million. Who looks at this and thinks this is a good idea?

http://www.trulia.com/property/3104940205-1514-W-21st-St-Santa-Ana-CA-92706

And on a frivolous design note. Why do these flippers use the same color scheme for their flips? I rarely see a flip where the kitchen isn’t that ugly Home Depot dark wood and speckled granite. Surely Home Depot has other colours? These flippers really are living in 2004.

My raging desire to buy has well and truly been stuffed out in the past week or two… Insanity.

Well my family investigated the new normal real estate market and it is anything but NORMAL.It appears the added liquidity the FED and the Banksters have been able to corner the market like the Hunt Brothers did with Silver. The only difference is the FED and Bankster’s can get away with it!!!!!

!. Our Realtor is pumping prices by sending us to houses that all ready have offers on them, wanting us to put in a back up offer.

2. Sending us prospects that are over our top $. Trying to push prices even higher.

3. Zillow is completely useless as many homes are listed incorrectly and leave out many not on the market or very old listings.

4. The Real estate web sites are also out of date and only use the old listing to lure people in to create artificial demand.

5, Have caught my Realtor in several mic communications, (lies)

6. Don’t trust this market ..it is artificial and buyers should step back and wait this out even if it means prices get pump more as it will all end badly..

Hi Les. Sorry to hear about your situation with a broker. I am a prospective buyer and was able to connect with a broker who mostly represents buyers and that I trust. Having a broker represent you as a buyer does has its benefits. For example, he links me to his ‘listingbook’ website so I can see all the active properties with no old listings (you are correct that the websites such as Trulia and Zillow are unreliable). My broker is able to get me in to a half a dozen homes in one day and I dont have to call a half a dozen brokers to try to arrange this. Also, the listing agent has a fiduciary responsibility to the seller, and I find it hard to believe a listing broker can fairly fight for a buyer. Another topic which I find strange – when I was calling on real estate signs trying to go see houses for sale, I found that listing agents rarely answer their phone and rarely returned calls. For the life of me, as a prospective buyer I cant understand why listing brokers are so flakey. Maybe they are busy, I dont know. Also, the broker who represents me is able to sniff out information that a listing broker would never tell a potential buyer. In any case, I am now in escrow on a home in LA and my offer was the lowest of 3 offers, however, my offer was accepted by the seller due to some coaching on the part of my broker. I too am cautious but with a 3.5% interest rate, and a tax deduction of approx $900 per month and the ability to live in an area the rest of my life, I see the value of buying (and also my current $1800 per month rent going towards equity rather than my landlords bank account). Good luck!

Happy Healthy New Years everybody.

When we closed escrow in late Sept 2012

we got a $20K discount on an overpriced fixer. Three months later we moved in , after a boat load of dough sunk into the interior. Next year we’ll save and do the exterior. We are grateful for our mortgage free home, and a great place to grow old in. Prices are out of whack for a decade now, and we think it’s treason to the hard working citizens. 10 years of our lives got eaten in this engineered nightmare, and it just pisses us off.

Let’s raise a glass to 2013. We’re alive and healthy!

(I saw an article that Mozillo didn’t know stated from verified income. Oy Vey… he’s one evil pos. Throw him in jail and throw away the keys.)

Just a quick fact-check:

I know Economics 101 suggests they *should*, but in actual practice when purchase prices fall in “prime” markets like LA Westside and Manhattan (NYC), do rents *ever* fall as a result? My gut says “no”, and in fact my impression is that the additional rental demand posed by the post-foreclosure crowd has actually *increased* rental rates.

What’s the consensus?

Thanks,

Jay

The banks are holding foreclosures off the market! Why is that so difficult to believe. We now have 20 million vacant homes in the US!!!

Daniel said:

“For the life of me, as a prospective buyer I cant understand why listing brokers are so flakey. Maybe they are busy, I dont know.”

—

My guess is the “profession” naturally attracts flakes.

Way back in 1981, we had a couple of acreages on the market in San Luis Obispo County.

One had a hundred year old all redwood farmhouse which I had painstakingly dismantled, sandblasted, (to remove multiple layers of paint hiding the inch and a quarter thick redwood planks – some 18 inches wide) and rebuilt.

The listing realtor, who lived ten miles away from the property, planned on not even personally being present to show the property to the folks who subsequently immediately made an all-cash offer!

I paid her a visit, and she acted stunned about why I appeared upset w/her:

I replied w/a full-throated:

“Do your F…… Job!”

(which brought a stunned silence to the office)

She showed up, we sold the property, and when we had a buyer for the second piece of property (also listed by her) show up, I paid a visit to the buyer’s realtor and arranged a deal which halved her commission.

She was morally outraged at this high crime, and acted like this was unthinkable, much less doable.

I reminded her that her contract w/us was almost ready to expire, and she could take it, or take nothing.

She took it.

I had already established what her true job description should have been.

(starts w/”W”)

…with the second sale I came closer to finding the true price of her “services.”

2500 sq ft is a McMansion ? what world do you live in ? not even close …

Here’s what I see.

The U.S. is in the best situation to kick the can of any nation or enterprise. This is due primarily to being the reserve currency, having the largest most diversified economy and the military with nukes doesn’t hurt.

Right now the GSEs are bankrupt hiding their insolvency through connection with the government. As long as this is allowed, they can trickle out inventory to balance against a bubble or a crash. If their bankrupty requires liquidation – look out below!

Given this, the question is how long will the government and therefore the GSEs be allowed to kick the can. My bet now is at least as long as Japan (e.g. 20+ years).

Congress will appease some folks with the appearance of cuts and entitlement cuts and the easy money will be allowed to continue. Most thought this would have flushed already, but so far they’ve been able to keep.

If they can get unemployment flat – even at 8 or even 10%, the charade can continue with slightly higher taxation and a few entitlement cuts. I see no forcing mechanism that prevents them from balancing easy money, housing inventory, taxation and cutting to indefinitely string this along.

Since I want to actually live in the home, the facts that rents are higher and growing means getting fixed payment on an asset likely to be flat or appreciate in nominal terms would be a good deal.

Housing will fall back to 30% of 2007 prices.

“Housing will fall back to 30% of 2007 prices.”

Didn’t that already happen in 2012?

Leave a Reply