The Wall Street fascination with rentals: Is the big rush with investor buying locking up the supply of real estate? How retail buyers are priced out of the equation.

The flood of investors into the real estate market is no tiny trend. This has been a big force in the market for a few years now. Someone in the real estate industry commented in an e-mail that FHA buyers are viewed as the new subprime when it comes to the hierarchy of buying a new home. They didn’t mean this in a derogatory sense but meant that if they have an all cash offer with a quick close versus a loan with high leverage, chances are the all cash offer will win out. This is simply the case in this low supply market where the last thing people in the industry want to do is extend the process trying to close on a property only to see it fall out of escrow. With an all cash close, you can get the deal done rather quickly. We’ve never seen this level of institutional buying in the housing market for this prolonged of a period. What are the implications of Wall Street’s current fascination with rentals?

Locking up supply for years to come

There was an interesting piece discussing this trend with JPMorgan diving into the rental party:

“(Bloomberg) New York-based JPMorgan, whose private bank oversees $877 billion, started pooling investments from its clients in mid- 2012 into a partnership to purchase distressed properties, betting that prices will rise over the next several years and provide investors with income from renters along the way, said Lyon. The firm uses a third-party manager to find homes, buy and manage them, he said, declining to name the firm.

The goal is to sell the houses within three to four years in one of three ways: through an initial public offering of a real estate investment trust, a sale to an existing REIT or to an institutional buyer such as a pension fund, Lyon, who’s based in San Francisco, said. Clients will receive a share of any price appreciation depending on the size of their investment.â€

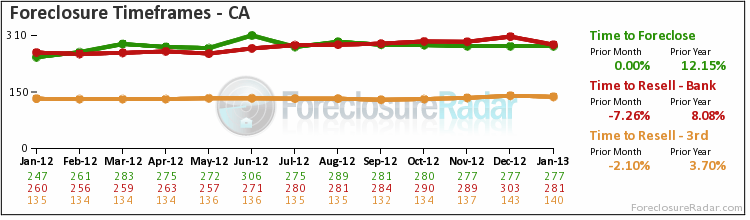

I find this interesting. First, we know that banks have prolonged the foreclosure process although it has somewhat improved in the last year as banks are selling into the current momentum. In California the average time to foreclose is 277 days (once the NOD is filed which is dragged out to begin with):

Then you have the current strategy of some of these big banks. JPMorgan for example plans on selling these properties to other big investors in three or four years. In other words, this is housing stock that is being taken off the market to retail buyers for a solid three to four years and then what? If other big money purchases the portfolio these properties are taken out of the supply chain for well over half a decade. We also realize that many buyers with FHA insured loans are being pushed aside for the investor buying crowd.

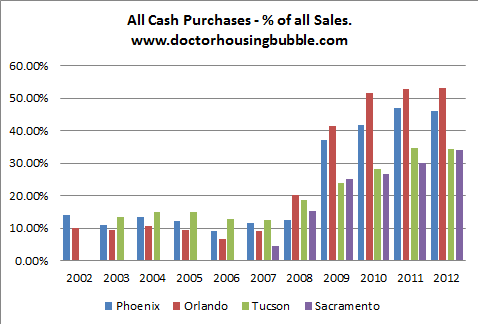

All cash buying is a big part of the market:

It is rather apparent what is going on and what we have been saying for a very long time is being seen by many:

“(DQ News) This fledgling housing recovery has momentum. Already, price hikes have caused some to question whether it’s sustainable, whether it’s a ‘bubble.’ Let’s not forget, though, that we’re still climbing out of a deep hole from the housing downturn. Regional home sales remain sub-par and prices in many areas are at least 30 to 40 percent below their peaks. That’s not to say we don’t see risks. Sharp price gains can attract speculation, which could lead to unsustainable, short-term gains in certain submarkets. A lot of today’s housing demand is fueled not by spectacular job growth and soaring consumer confidence, but by super-low mortgage rates and unusually high levels of investor and cash purchases. Take away any one of those elements and it will matter,†said John Walsh, DataQuick president.â€

Keep in mind this is being said in a release where the SoCal median home price is up a whopping 23.5 percent on a year over year basis and home sales are up over 10 percent. Another aspect of the investor pool yanking supply from the market includes unique loans to high net worth clients:

“While buying single-family homes to rent is among “the smarter ways to invest going forward,†Pastolove advises wealthy clients to buy the properties to rent themselves if they are able. Morgan Stanley isn’t purchasing homes or managing them; instead it’s making loans to high-net-worth customers at rates lower than a typical mortgage, and using their investment portfolios as collateral. That provides people the capital to purchase investment properties, he said.â€

In other words, wealthy investors are using their investments as collateral for cheap loans to go out in the market and scoop up homes with what appears to be an all cash purchase. In reality, they are leveraging their investments to purchase real estate. Others are using funds to buy and flip.

Total housing inventory is very low. However, we have noticed some month-to-month increase nationwide but this is minimal. Year-over-year inventory is down well over 23 percent. As was stated above, much of the current push is coming from big money investors and people leveraging up with low interest rates. It would be great if household incomes justified this kind of increase in values instead of massive rate manipulation and hungry yield chasing funds. There is a mania going on because we are seeing multiple offer situations, contingencies removed, presentations to win over sellers, big bids over asking price, and the sense of “if I don’t buy today, I’ll be priced out tomorrow.â€

So if you are out in this market, make sure to bring a briefcase full of cash. Sounds like a rational housing market, right?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

50 Responses to “The Wall Street fascination with rentals: Is the big rush with investor buying locking up the supply of real estate? How retail buyers are priced out of the equation.”

Holy Sheet. That all-cash chart is something else.

Also, check out this article if you get a chance (don’t remember if I got it from here originally but it was certainly an eye-opener): http://www.vcstar.com/news/2013/jan/25/big-investment-firm-continues-to-buy-homes-in/#ixzz2J8ha1cus

I get the feeling this won’t end well for anybody.

I can’t see this ending well myself either. I wrote about this back in 2009 when I was explaining how this housing debacle was created and who caused it to begin with and how this was going to be the great transfer of wealth. when I use the word wealth I certainly am NOT referring to the fiat currency I am referring to the real assets the things that actually have real value like housing. So, when the banks own all of the real underlying assets then the people will truly be debt slaves. it’s so frustrating to have seen this coming in 2009 started a website, I created a guide it was free, I just wanted people to know what was happening and instead people watch the news and blame the subprime borrowers. Living in the matrix not seeing the truth. thank God for this website where people are aware of what’s going on. if you go to the Federal Reserve’s websiteyou can read the details of the selling of the sell off of the REO’S only to the large institutional investors like JP Morgan Goldman Sachs etcetera etcetera. they must keep these homes for 10 years I think it is but then they can extend it for an additional period of time. it’s been awhile since I read the details I can’t recall if it was 5 and 5 years or 10 and 10 years, but check it out.

Lynn Chase

Thank you for such a great post. We paid cash for our final primary in Sept of 2012 in So Ca . Then we did one of the many to come cash infusions to bring the interior up, with the exterior as our next infusion, when we have the dough.

I though tpaying cash meant something. We delayed gratification, waited out the insane bubble, did without new cars (and we need one replaced) and actually did without vacations, eating out, and new clothing. That’s how life is suppose to work for us average folks. I know life isn’t fair, but this country is DOA.

Did anyone read Matt Tabbai’s article on HBSC and their money laundering, and how they got off for a $B= penalty. Terrorist groups and Drug Cartel as clients. The DOJ said the world’s banking system would have collapsed if they held the big shots responsible. Oh cry me a river.

Folks normal or not… you can’t fight market forces.

I learned something at an early age… it’s called Law of Diffusion of Innovation. In short… This “law” breaks down the market physiology of “adopters”. Right now… the people who are making money are the early adopters and innovators.

A famous quote from Malcom Gladwell… he said “The tipping point is that magic moment when an idea, trend, or social behavior crosses a threshold, tips, and spreads like wildfire.†We aren’t at the “tipping point”.

I did write a manifesto talking about these changes and how people can capitalize on this market.

Investors and humans in general are quick to forget. As Mark Twain said… “History doesn’t repeat itself but it rhymes”.

Jeff Coga

p.s. I did write a manifesto that made #1 on Amazon Kindle a few weeks back (now in the top 100)

Check it out here ==>

http://www.amazon.com/Flipping-Houses-Wall-Street-ebook/dp/B00B98CPUA/

All part of Zimbabwe Ben’s plan.

Screw the poor and enrich the bankers.

As long as The Bernanke is at the controls in command central, how can anyone lose?

—

On a different note, some beautiful pictures of Morro Bay taken from a 2 million dollar starter in Los Osos.

Be sure to see the rainbow over Morro Bay.

Once a sleepy, very small bedroom community, only now talking about a sewage system.

…a mosquito’s heaven atop impermeable clay.

Courtesy of a tireless Enviro who we sold our farm to, who carefully Collects his urine, then calls for a sewage pumping service.

We need skeptics, not septics at this time.

…previously known as Inventor of The DickMobile

…he had a great handout brochure aping Road and Track/Car and Driver jargon.

Somewhere I have a photo of my dearly departed wife standing next to it on what once was our pasture.

Interesting times, indeed, in CA.

Feudalism is back!

Wall Street will provide the financial vehicle for investors to be able to invest in whatever they want, be it rental RE or strip clubs.

I think investors are wrong to think that RE is ‘coming back’. RE can and will crash just like any other investment. When it does, the housing market will totally be destroyed, unlike anything seen in 2008.

Housing is not about meeting consumer needs. It’s just another wall street needle sucking life out of those of us who still work and produce things. It’s time to ID properties scooped up by the banksters and set them on fire. Nothing less will stop this madness and allow an actual market in which consumers can participate to emerge.

re: setting them on fire….I’d never actually do that but it sure is comforting to know I’m not the only one with thoughts like that.

But I’ll bet the a$$wipes hope that happens, as I’m sure they’ve anticipated the level of frustration and most likely have some sort of “insurance” that would put that money right in there pocket again.

Perhaps people should move into these places and be tenants from Hell.

?

I like the renter from hell senario

Sorry, I meant “their”.

“The goal is to sell the houses within three to four years in one of three ways: through an initial public offering of a real estate investment trust, a sale to an existing REIT or to an institutional buyer such as a pension fund, Lyon, who’s based in San Francisco, said.”

Notice that they have no intention of taking the 8% cost to market the homes individually. All their exit strategies involve a bulk sale of the position.

Also, I laugh every time I see an article using the word “recovery” as though prices at the bubble top represented proper valuations. The fact is that society could not carry the housing stock at those prices, hence the methods of subterranian interest rates and strangled inventory trying to hold up the walls of the temple of fraud – Run as market pressures, like Samson, will bring this house down on all who occupy it. JPMorgan is putting its clients into a bubble top – not itself – sound familiar?

with CNBC as your “pumper” as you “dumper.” Very similar if not identical to Goldman’s prop desk…vs what it says to the public. “Consistently the opposite of what they’re doing” but with real media…ahem…”bias.” under this scenario you would want to go long zero coupon Treasuries as “in order to create this magnitude of cash you have to be short something massive.” That would be Treasuries…which of course have done nothing but rally “ever since THAT big short was put on.” Not saying this scenario i’ve laid out is fact here…but it has “history as a sure footed guide.” with no economic recovery to speak of…well i imagine “only the Government think’s they’re the big winner here.”

I just spoke with my a friend yesterday who said that him and his wife have decided to short sell their home. They bought it in 2007 for $760,000. The home could probably sell for around $600,000 in this market but my friend doesn’t care how much he sells the home for because no matter what the price of the short sale, he won’t make any money off of it.

The listing agent he hired said he would be the home for $475,000 cash and advised my friend to stop making payments on the home because he could live their rent free for the next 6 months at least.

To summarize, the home won’t hit the market because the sellers agent has agreed to buy the home for DIRT cheap, and is shielding himself by having his wife pay for the property. In exchange, my friend will live in his home for 6-8 months rent free before the paperwork is complete.

No wonder the inventory is so low in Orange County these days. Agents are buying the properties for their friends and families before they even hit the market.

You are right on, on this scam. We have had the same thing happen to us twice, as in a short the seller calls the shots, he can simply tell his friend what your offer is and they will beat it by a few thousand, thus taking the highest and best offer. The false agents simply don’t care as it’s only the banks money, that we the taxpayers have made good on.

Same thing in my hood. The guy down the street one day had a realty sign in the front lawn, he told me that it was a short sale, and that the realty guy’s partner immediately put in a low cash offer on it. Sure enough 6-8 months later, it sells and the price is exactly what he said the offer was.

@ Paul and @ Tillamook,

You guys should report these people to the attorney general. If you know about fraud and don’t do that, it’s likely that this kind of thing will keep going on.

Some of the agents are teamed up with money guys with cash and contractors to flip those properties for quick profit. Real estate transaction is complicated, and it requires a team in which an real agent is a critical part with an access of the inventory. These are the same flippers talked about a lot here. The easy ones are gone, and it is harder to flip unless the price of the property is low enough for a profit.

I don’t believe Wall Street is interested in rentals, they are interested in returns, however they can get it. If there is a revenue stream in rental, they will get it by hiring people to manage them. This kind of buying is only concentrated in a few selected markets, not nationwide at present. The stock market is at multiyear high, and I am afraid what we seen in real estate market in CA is the next at national level. Where do you think the money Bernanke printed in the last five years will go? Ray Dalio says the cash will be moving to “stuff” this year, real estate is a big “stuff”.

Patrick, recommend referring this matter to the authorities. Suspect that this real estate agent is “flopping” the property.

Likelihood is that the cash offer is a ruse. Instead the real estate agent has probably teamed up with a lender to open up a hidden escrow and has lined up an unsuspecting buyer who is offering more than the $475,000 offer. The real estate agent will pocket the difference. This needs to be reported to the authorities and CAR.

I hope your friend knows he has to pay income tax now on the difference of what is owed on the home and what it sells for…

No the seller does not have to pay taxes on the forgiven debt, Congress extended the forgiveness during the midnight hour budget deal.

The rentiers (primarily the 1%) are taking over the world. What they can’t buy, they want to privatize so they can buy it. Their goal is soak up all the wealth of the world from interest on debt or fees and rent which produce nothing. Investments which actually produce something that people need or want is too risky for them. The best investment they can make is buying politicians so they can write laws which allow them to remove any impediments to taking over the world and making a debt or rent slave of anyone that is not part of their small greedy cabal. We are no longer the country of producers we once were. We are being financialized.

I think it was Adam Smith that cautioned against what he called ‘The masters of mankind and their vile maxim’, which is ‘all for us, and nothing for anybody else’.

California has always been the leader in creative real estate transactions, but keep in mind that investors and/or bank business partners are at times shell shocked by unexpected repairs, properties taxes and HOA fees, which over time will eat into their profits, acquisition cost maybe low, but holding on to properties can result in some major loses while marketing to a qualified buyer. Japan’s real estate rings a bell regarding long turn property valuations, it did not happen, why, full time job losses and employment opportunities, I think we can expect much the same here. You gotta have high value jobs to live in California’s major metro areas, we can’t all be real estate brokers and financial whiz kids.

I think you suffer from the same disability that I suffer from, the disability of life perspective. There indeed was a time not too long ago when the cost of repairs was an overwhelming metric of weather to buy or not to buy.

In the age of monetary printing to the tune of trillions a year, while prices on many consumer goods remains stagnant, the value of houses can surge in one year to pay the maintenance costs for 10 or 20 years!

It is really strange that not only has the rules of Capitalism changed before our very eyes in the last 5 years, but the “capitalistic” markets seem to be thrilled by the fact that you cannot count on the rules of the game to guide our decisions.

“…the value of houses can surge in one year to pay the maintenance costs for 10 or 20 years!”

Only matters if you cash out or can raise rents accordingly. The first is possible. The second is nigh impossible in this economy.

Are home prices in So Cal reasonable?

From an investor perspective – If one can make a decent positive return, by buying, holding and renting out, then the prices are reasonable.

From a home owner perspective (who intends to occupy the home) – If the overall cost of buying is much cheaper than renting (for the same exact home), then prices are reasonable.

Apparently, housing bears just don’t get that concept.

Except that when both housing prices and comparable rents are inflated by artifical constraints on inventory, as there are huge amounts of SFR rentals that will be hitting these markets in the next 6-24 months that will crush rental rates (in some areas by 50%), what do you think that will do for purchase demand combined with the fact that once interest rates start creeping up potential purchasers will lose 20% of their purchasing power for every 1% rate increase.

I don’t think interest rates will go up for a long, long, time. Not only will there be a massive hit on the bond market, the real estate market will also get crushed. As rates rise, the monthly payment increases causing values to fall as it prices out even more potential buyers. If the housing recovery is this pathetic with the lowest mortgage rates in history, what would happen if rates went back up to say even 5% on a 30 yr mortgage? Perhaps another 20% lower in asking price and causing even more people to be under water on their mortgage..hmmm. Kicking the can is the only solution until further notice. The banks and the Fed are on a circus tight rope and a snap anywhere on the rope brings down all the clowns no matter where they are standing.

“there are huge amounts of SFR rentals”

Really? How many (ball park estimate and cite source)?

You’re presenting a straw man argument.

I’m not aware of DHB or any commenters on this board promoting to the contrary of what you suggest is “reasonable”.

In case you hadn’t noticed yet, those are the only kind of “arguments” that poster has ever presented on this board.

Housing bears get the “concept” They know the game is rigged. They know how market manipulations always end in tears.

Your concepts between investor and renter seem to be contradictory. You need to buy low enough to rent out for a “decent” profit and the renter will rent because it’s not possible to purchase for the same cost of….. So if you can’t buy a house for little enough to match rent how do you make a profit renting it?

Housing has always been a transaction between owners. Your describing a used car business. I am well aware this is exactly what is going on in housing but it is destroying our economy and crushing many peoples lives.

what the heck will this do due rents? isn’t this in the end gonna create a glut of rentals? sounds good to me as i’ve not had a rent increase in years, 4 to be exact….and the thought of moving for lower rent is fine by me.

I just checked markets within 2 hour drive of my work – basically no affordable listings except mobile homes. I think… due to the overpriced markets I am just going to go minimal, I found a 25k mobile+lot (no space rent) about 1.5-2 hours from work. I can work from home about 25% of the time at least which helps, but my gas bill delta is still going to offset about 1/3 of the rent savings. Still, when all this blows up, cash is king and I want to save up for when that happens so I can take advantage. I do not want to be significantly invested in overpriced properties; with such little inventory I am 100% sure this is insanity. Even if this turns into a situation where prices never fall back down, then I will just go elsewhere. I’m sick of the Land of the Greedy Bastards and the Home of no Homes for Sale.

Nice 1200 sq ft, Open House Flip. Purchased in sept,2012 for 365,000. Now on sale for 769,000. The RE at the Open House smiled, as he stated that houses in that area were in the 400s, six monthes ago. To me, this new normal is anything BUT reasonable.

It’s all pretty simple……there is plenty of cash around (strong stock and bond markets, the US economic recovery has been going on for 3+ years, and unprecedented is the global economy – money/cash pouring in from all over the world. CASH is ALWAYS KING – plus, with interest rates so low, not much profit in lending.

Plus RE is always about location, location, location……and in the US are some great locations. Another important factor is rents have been strong in these great locations.

History NEVER repeats itself exactly….it is mathematically impossible.

Just when the masses in the US thought cash was obsolete and debt was the way to buy McMansions, etc……..they ended up just being suckered, when the patient people just waited and saved….it’s really an old story, as Ben Franklin said, “a penny saved is a penny earned…..now the “suckered” just don’t know what to do and just hope for complete disaster……so sad.

“now the “suckered†just don’t know what to do and just hope for complete disaster”

Wouldn’t the “suckered” want anything but disaster?

They hope for disaster because they envision buying something like a Malibu home for $50K or so.

The “sucker” is the client borrowing money from the big boys to buy real estate. Why do you think JPM, MS etc. are not buying outright? I can bet you that these loans are recourse, no walking away here.

Why would they not use their own money? They can leverage up way more than the clients. The simple answer is that they see money in fees and comissons, not assets. That is why they unloaded all those CDO as fast as they could. It is the same game, just with a little different twist. But the punch line is the same.

It’s all “pretty simple” for those so willing to drink the Kool – Aid, isn’t it?

“They hope for disaster because they envision buying something like a Malibu home for $50K or so.”

Most incoherent comment yet from this poster.

Yes it’s pretty simple.

We’re going to get out austerity too, with more debt, and less ability to cushion it with monetary excess.

Do you think the debt problems are being solved by central banks taking on more debt to protect debt and encourage more debt ?

Yes, you are more comfortable today. But what comes tomorrow, when we face the same meltdown we had in 2008 because of debt problems, and there is less and less ‘real’ money in the system to deal with it? Bernanke bought time; but it was a very expensive pricetag, 20% off the Dollar, to inflate prices and assets, keep the same bubble condition alive that destroyed the global economy. Is that how we cure cancer, we bulk up on carcinogens? Anyone who thinks we made it through the Dark Forest by not going through the Dark Forest is goiing to be shocked to find out there is an even Darker Forest between us and the next organic Growth Season.

The American Dream, the American Life-Style, is unsustainable. My father bought out house for about 30% of his salary. My mother took care of raising the family. We substituted this picture of health for one in which both parents have to work in order to afford housing. The Federal Reserve has to squat on interest rates to keep them from rising or there will be a huge housing default epidemic. Banks had to offer new mortgages that were destined to fail to sustain this way of life. This policy made the banks rich and made nearly all Americans debt-slaves. What kind of leadership is this? Bernanke continues to use his fake policies to try to sustain the unsustainable. Many Americans bought houses they could not afford and now are hanging by a thread, using food stamps, or buying food with credit cards. This is a catastrophe. Where is the soul of our leadership.

It appears that the American Dream now is on the side of the 10%; and the 90% are paying with their blood to keep prices inflated so the 10% can continue to get rich.

If this doesn’t end, America will have a civil war.

Oz, move to Texas, you can get a mansion for $350k. Texas is the land of the American Dream. California is a failed state. Come on over, GovRick Perry was just in the failed state of California inviting the refugees to come to Texas(no income tax state). If you are looking for welfare benefits, why, just stay in California along with all the other consumers of government benefits. Why in Glendale Ca, you have these folks who immigrated there and have their own off the books businesses(like 25% of people in L.A. county, part of the underground economy), and receive lots of government benefits when they drive their MB S600 and BMW 760LI because their tax returns show little income. California is really the land of suckers(pay income taxes so these free loaders get the gov benefits), but many of those who do pay income taxes are coming to Texas.

+1. Dude, you just perfectly described the entitled inhabitants of the hot, flat, ugly parts of L.A. I went to school at Texas Tech, so I know a little something about hot, flat and ugly!

I was checking starting 45m from my work (NorCal)… Gilroy nothing under $250k, but then something changed in the last few months… 75m from work… nothing under $200k now, I had to go out 2 hours from my work to find 100k houses which are currently inflated to 120-130k, and half only want CASH ! There are maybe 4-5 actionable properties at a time on the MLS and they are done in a week flat unless the property has issues or short sale; I ran into a person from my region who was also looking out there — 2 hour commutes just to find affordable prices, but how much are you really saving after cost of gas ?? Each city is losing inventory and the craze is spreading out from the saturated metro area. Someone compared the inventory a year ago and there were 110 houses listed and 55 sold, now it’s 48 listed and 45 sold or something like that, basically there is no free inventory and the spot market increases in price each time.

Here’s what I see in the Bay Area

– Many homes for rent, but prices too high for location

– Rents seem to be a couple 100 above what FHA financing would make mortgage

– Homes for sale are few and expensive, hardly anything worth buying

– Rents much higher than comparable mortgage costs

I don’t want to buy, just rent since I want to be mobile for career. High rents may force me to buy though since I can’t fathom spending 3K/month on rent to live in a ghetto.

What is it called when all or most land is owned by a very few landowners? The Junker system? Feudalism?

Leave a Reply