Washington Mutual: WaMu up to Bat. 11 Bank Failures for 2008. 8,430 Still out There. Southern California Housing to Ben Bernanke: Do we Qualify for a Bailout?

If you haven’t noticed, Wall Street is having a bad week. It would seem that the reality on Main Street is finally catching up to the Wall Street casino. Many Americans are only starting to pay attention to the economy. Why is this happening? What went wrong? To be honest, the current financial system is a mixture of loan sharking and legitimizing a Ponzi scheme as a true and stable system. Think how idiotic some of the new financial innovations are. If you are wondering why A.I.G. was bailed out it is because it would expose the world to a balance sheet that is completely exposed with these new products. You can add Bears Stears, Fannie Mae and Freddie Mac, and AIG to the now growing list of bailouts.

Let us simplify one aspect of this economic mess. You sell an insurance policy to your friend that should Generic X company go into default, he will receive $1 million. Your friend fearful of shady Generic X corporation decides to invest in the place (moral hazard time!) and would have not ventured to do so if he did not have insurance. Feeling confident he invests and, life goes on. Well as it turns out, Generic X is a very funny institution. It turns out they were giving loans to burger flippers for nice $500,000 McMansions. Generic X suddenly goes into a tailspin and defaults since those housing loans are defaulting in massive numbers. Your friend gives you a ring to redeem his policy and the conversation goes as follows:

“Hey buddy. It looks like I’m going to need that $1 million since Generic X just bit the dust.”

“Hey buddy. It looks like I’m going to need that $1 million since Generic X just bit the dust.”

“Really? Wow. Didn’t see that coming. Funny story. Remember when I sold you that insurance? Well, as it turns out we weren’t really betting on Generic X failing so we never really had the money.”

“Really? Wow. Didn’t see that coming. Funny story. Remember when I sold you that insurance? Well, as it turns out we weren’t really betting on Generic X failing so we never really had the money.”

“Say what? But isn’t that why we bought insurance? To protect against a loss?”

“Say what? But isn’t that why we bought insurance? To protect against a loss?”

“Yeah. We sort of thought the same thing and bought insurance from Crapco Insurance and as it turns out, they were betting that Generic X wouldn’t fail either.”

“Yeah. We sort of thought the same thing and bought insurance from Crapco Insurance and as it turns out, they were betting that Generic X wouldn’t fail either.”

“So what am I suppose to do with this policy?”

“So what am I suppose to do with this policy?”

“I don’t know. But I heard the Fed is exchanging all kinds of things for Treasuries so you might want to give the head guy over there a call. I think his name is Ben Bernanke.”

“I don’t know. But I heard the Fed is exchanging all kinds of things for Treasuries so you might want to give the head guy over there a call. I think his name is Ben Bernanke.”

Call it what you want but this is a Ponzi scheme. Ponzi schemes pay old members with new member money acting as if they were really investing. Things go well so long as you can keep finding new members (i.e., housing prices keep going up). But once your momentum catches up with you (i.e., prices reveres) the entire system comes crashing down imploding on itself.

In this article we are going to talk about 3 major economic stories. Given the massive amount of news, anyone trying to make sense of the current economy and attempting to follow all the headlines must feel like drinking water out of a financial fire hydrant. We are going to examine WaMu and their current problems. We are also going to look at the banking system and problems that we will face. Finally, we’ll tackle the Southern California housing numbers that put a massive Viagraless exclamation mark to a summer selling season.

Whoo Hoo!

Washington Mutual, the nation’s largest thrift has now put itself up for sale with the help of Goldman Sachs. Has anyone taken a look at these two companies recently? You have to wonder if someone else needs to find someone to help in a sale:

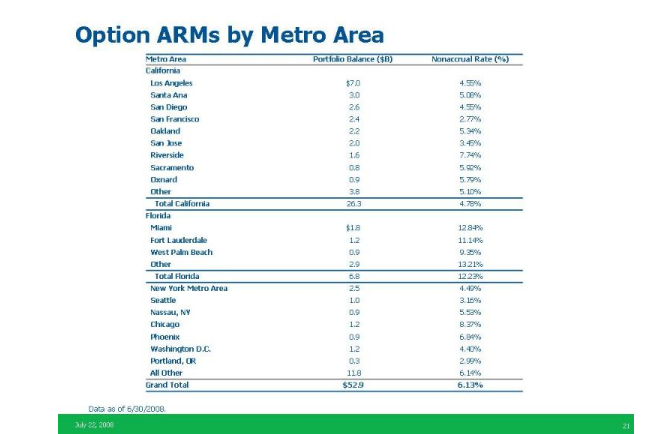

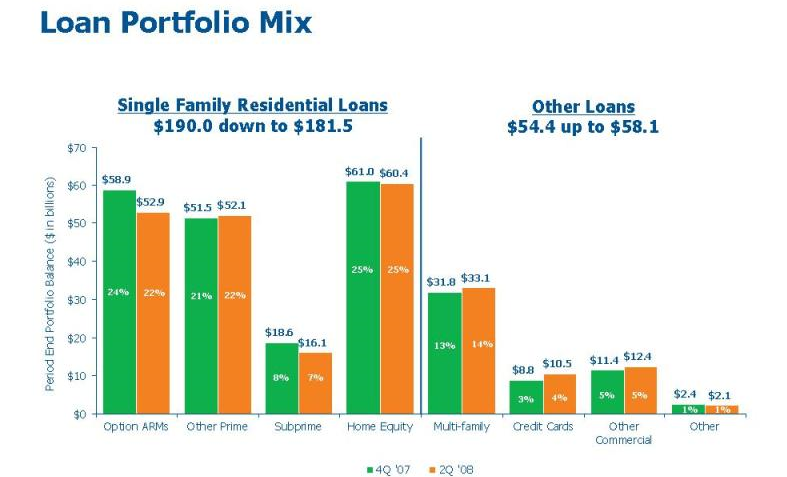

You may be thinking that WaMu with a $3.4 billion market cap is cheap. You want to know why people are balking at this sale? How about having $239 billion in outstanding loans with $52.9 billion in Option ARMs! The same toxic brew that is sitting here in California waiting to unleash the next leg in the housing market. We have $300 billion in option ARMs here in the state waiting to recast or hit anniversary dates on a state that has arguably one of the worst housing markets in the country. You want to know where those $52.9 billion in Option ARMs are sitting?

$26.3 billion are in California and $6.8 billion in Florida. Now you can understand why that $3.4 billion market cap isn’t so cheap anymore. In addition, WaMu has a ridiculously large home equity portfolio which is another negative:

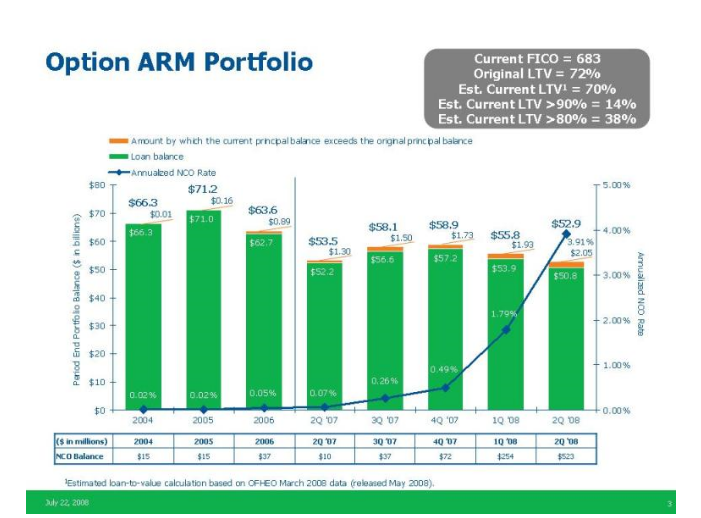

Yet another strike. But you may be thinking that those option ARMs are doing okay. Wrong:

The Option ARM portfolio is seeing exponential growth in defaults and late payments. Any company seeking to buy WaMu would be absolutely insane to do so with such high exposure to the most toxic of mortgages. The only way a sane deal would get done is if the Fed or U.S. Treasury somehow allow only the good to be sold off like the residential component while shipping this sludge onto the U.S. taxpayer. Take a look at some of the Real Homes of Genius in California, many that were purchased with exotic mortgages and ask yourself if you want your tax dollars at risk for this.

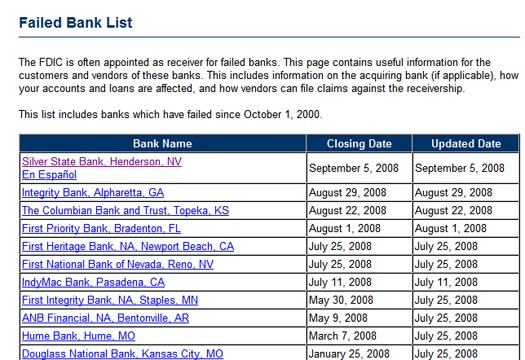

Make no mistake, a failure of WaMu would be enormous. IndyMac Bank, another model of responsible lending when it got taken over by the FDIC had $32 billion in total assets. This little bailout cost the FDIC $8.9 billion which ate up about 17% of their insurance fund. How much in assets does WaMu have? How about $309 billion with $239 billion of that being loans. Either way, someone is going to pay.

8,430 Commercial Banks – Many are Unsound

According to the FDIC as of August 22, 2008 there were 8,430 FDIC-insured commercial banks in the United States. As of this year, 11 have already failed:

Keep in mind that the list of troubled banks put out by the FDIC jumped to 117 from 90 this past quarter. Even by their own admission, they stated that they did not see IndyMac Bank coming and this one failure cost more than all the other 10 combined! Given that many of these banks lent money out in a similar fashion as WaMu did, it is almost a certainty that many more will be failing. Why? Well once you see the Southern California housing numbers you will understand why.

The financial sector for a very long time was only about 5 percent of the economy. Now, it is estimated to be about 25 percent. I’ve argued that since 2000 over 30 percent of all job growth was somehow related to real estate. Many of these bank failures will add to further unemployment. WaMu alone has 43,000+ employees. Lehman Brothers had 26,000. What do you think this is going to do to the unemployment numbers? Just take a quick look at some of the banking and financial stocks and you’ll quickly realized that many of these people will not be absorbed into the economy. Good high paying jobs. Yes, much of it depended on the casino like world of Wall Street and the delusional accolades of the housing bubble but this still doesn’t answer the employment question.

Many of these banks are capital impaired. They have “assets” in the form of loans but in terms of capital, are very poor. They have been overly generous in estimating the value of their assets and that is one reason why the bankruptcy of Lehman Brothers has caused so much chaos. They dared to look at the Medusa balance sheet and as it turns out, they did turn into stone. Their worst fears were confirmed. Why do you think they are doing everything to keep this from happening again? There are now talks that Morgan Stanley is in chatting it up with Wachovia. They are doing everything to keep the books closed because we all know what we will find once they are opened up.

Southern California Housing – Pathetic

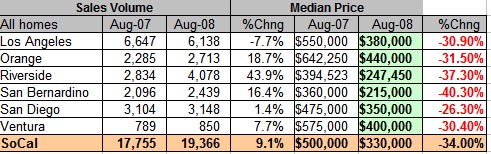

Only one word can describe the summer selling season for Southern California. Pathetic. First let us take a look at the raw numbers:

The median price for a Southern California home is now $330,000. That is off from $500,000 which was reached only one year ago. That is, $170,000 has been lopped off for the entire region in the space of one year. And this was during the high volume summer season! What is going to happen with the slower fall and winter season and we start seeing a much larger number of option ARMs recast into ridiculous payments?

If you look at the sales numbers, you can see that the Inland Empire once again dominated the entire sales activity. San Bernardino and Riverside made up 33% of all Southern California sales in August. Foreclosure sales made up 45.5% of all sales. I know many are going to want to argue that the median price is not a fair reflection since only lower priced distressed properties are pulling the figure lower. Well when 50% of the sales are distressed properties the market becomes distressed properties.

Sales have jumped up because people are trying to spot a bottom. Some investors still think that in no time, we’ll be back to the glory days of this decade and they’ll be able to flip these homes. Have they not been watching what is unfolding on Wall Street? All you are hearing now is REGULATION. Meaning, easy access to credit so you can buy homes with zero down are gone.

These numbers are nothing to clamor about and the slight uptick in sales is attributed to the summer selling season and bottom callers jumping in thinking this is it. This is not it. I stick by my 10 reasons why California will not see a price bottom until May of 2011. Everything that is unfolding on Wall Street simply reinforces my thesis. Let us say prices do bottom out, who is going to buy the place? California now has one of the nation’s highest unemployment rate and since you have to now verify your income, that $330,000 is actually too high for the median household income of the region which comes in at about $55,000 to $60,000. $330,000 is still 5 to 6 times the median household income.

I’ve talked to a few people recently and psychologically this is going to be a culture shock. They know no world where credit is difficult to obtain. It is a shock that they are receiving letters from their lenders telling them that their home equity line of credit has been shut down. This is the new reality. As I discussed in a previous article, the world markets are getting pummeled following our lead. In Russia they shut down the stock exchange! Globally there is $75 trillion in real estate, $53 trillion in total GDP, and $675 trillion in derivatives. You do the math.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

20 Responses to “Washington Mutual: WaMu up to Bat. 11 Bank Failures for 2008. 8,430 Still out There. Southern California Housing to Ben Bernanke: Do we Qualify for a Bailout?”

The transition back to the historic mortgage norm of 20% down and no more than 4x income will be painful. Once we get there, it is a better sustainable situation for the US economy and will (hopefully) drive investment away from housing and back into productive use.

Wamu could be compared to A Rod of the Yankees against the Pink Sox right now, he will strike out. In this case the outcome isn’t booing, it’s going to be a finantial disaster with no way out.

People are thinking, how the hell are we going to stop this from spredding? Answer, you have to let these banks & corporate entities fail. Otherwise the cancer that is the fanantial system will be even more deadly to all of us. Propping up companies allows the toomers to matastisize into something far more dangerous. Main street & the world have finally woken up to the scam that is Wall street, but it maybe to late to treat the toomers that have grown because they have reached into all fasits of life around the globe.

WaMu is the next Dead Man Walking. Nobody is going to touch that one until the body is cold and hard. Masters of toxic loans in California. Wachovia Bank is on deck, Ninth inning, two outs, nobody on base.

http://www.westsideremeltdown.blogspot.com

One of the untold stories of this crisis is that with all of these bailouts, the common shareholders are being wiped out but the preferred shareholders and bond holders are going to get some or all of their money back. Guess who these folks are? Bank of China, Bank of Japan, Bank of Russia, etc. We are protecting the investment of foreign countries while socking the American tax payer. Yet another example of how the wealth of this country is being transfered oversees. It must be too mind blowing to think what would happen if we told them, sorry, no can pay.

~

This goes to my point in previous discussions that this is not a credit crisis, this is a solvency crisis. The Ponzi scheme ends with the US holding the empty bag.

I feel good telling my co-workers and my friends “I told you so.” But many of them still don’t get how serious the problem is. And many homeowners, even those people with Optional ARM, think the housing market has hit the bottom. I just can not believe these people. The biggest banks in the nation are either filing bankruptcy or being taken over by the government and still these pathetic homeowners believe they will be untouched. No, we Californians don’t deserve a bailout. Let them rot!

A relative of mine who has been dead for 7 years (RIP) was recently sent a mailer offering her a credit card through Wamu. Yea, um folks, I want my money in THAT bank! (sarcasm)

4x times income? How about 2.8x.

What scares me almost more than all the fed bailouts is that the American people do not understand who owns the Federal Reserve. We the people do not own our money or even the right to print it. We borrow from the Federal reserve (many european banks) It was during Woodrow WIlsons administration that Aldrich a friend of J.P Morgan and Rockafeller went to Europe to study Banking and find a system for us. It is obvious why some investors foreign banks will be getting thier money first, they own our money supply. Are we stupid enough to now let them buy not just our money but all of our property by bailing us out? I am not sure what it means to be an American any more. If the Fed bail out works more foreign banks profit. Why not hit rock bottom and get rid of the FED bring it in house let America profit form it’s own financial decisions? We can’t we no longer have the gold to back our money. Any wonder why gold shot up over a dollar an ounce? I must say this is a great site!

D-

blutown:

Not all the bond holders are in China, Japan, and Russia. While my money market account did not have any AIG or Lehman exposure, it was exposed to Fannie and Freddie. Had the government not made good on those notes, then the fallout would extend to nearly all money market accounts. Everyone would have broken a buck. The stampede to the exits would have killed everyone.

Dr. HB. I continue to be amazed by the strength of your intellect. Thank you for helping me to understand this crazy mess.

As someone who is wanting to purchase a house at the right time for my first home, I am in the situation where I am wondering if we keep bailing out the these financial institutions and devaluing the dollar by printing money, will inflation take over? Would this mean that home prices now (say, 20-30% off the peak) may be a good deal in terms of dollars, even though the dollar would be declining in real value?

Did anyone notice that some of the WAMU charts use the OFHEO data for property values? That data does not reflect current, realistic numbers. Perhaps someone should match WAMU’s numbers against Dataquick’s numbers and see how things really look.

dave:

What do you mean by the Fed being owned by foreign banks? Could you clarify please? Thanks

http://icanhascheezburger.files.wordpress.com/2008/05/funny-pictures-raccoon-subprime-mortgage.jpg

take your money out of any bank that gives you 3% interest and buy real estate. Period!

Why are US taxpayers paying to bailout AIG which is a global corporation with businesses in 130 countries? Why aren’t those other countries contributing to the bailout? And this RTC that the US government is going to pour tens of billions of dollars into (again taxpayer dollars that will not be going to social programs or to pay down our debt) isn’t that a moral hazard? If no one suffers from making bad bets, what have we learned?

Anyone know where Paulson’s dad is buried? I need to piss on his grave and yell at him for not using a condom.

On a lighter note, I love the avatars you use for your examples, Doctor. Humor is what seperates us from the animals and, for the time being, is what is helping me hold back tears of frustration.

Dr. HB: Did you ever, in your worst nightmares, envision the fed putting U.S. taxpayers at such risk?

So when will the first lawsuit be filed by a company that didn’t get a handout from the Feds when it asked for bail out money? I have the over/under at Oct. 16.

I am beside myself with anger. Okay, let hem bailout every financial institution in the frigging country at taxpayer expense if they want to but their businesses and share prices should go to Zero, their CEO’s should resign in disgrace and I want to see some key people in Jail, starting with Mozillo. I really hope R. Paul decides to run as a write-in candidate. Is it too late?

Leave a Reply