Wave Goodbye to the Bankrupt Joneses: Deconstructing the American Dream. The Shifting Financial and Societal Goals of a Country Mired in Debt.

The American dream signifies many things to many people. The dream has evolved over time. If we are to look at history and our fascination of the Western, the dream once meant the freedom to be a rugged individual in a country that had no boundary. You were on your own with the frontier. Yet that dream ended once the country was connected from coast to coast and with the Great Depression, many in society actually felt that some compact between citizen and the government would be helpful especially in distressing times. We oscillate as a society from moments where we desire zero government involvement to moments where the government seems to be the last resort. With our current economic crisis, many Americans are rethinking the makeup of the dream.

The component of the American dream regarding homeownership didn’t become a cornerstone until the end of the Great Depression. There was a long period from 1900 to 1940 where only 45 percent of households owned their home. This number had increased to 55 percent in 1950 and by 1960, it was at 62 percent. We finally brought the peak to a crescendo in the 2000s flirting with a 70 percent homeownership rate:

During the 1950s, we started seeing the rise of a strong and vibrant middle class. Some may argue that this was the balance between the right amount of consumption and debt. Americans were still saving a good portion of their disposable income. Debt was still not a big player outside of homes and automobiles. Yet early sitcoms showing the joys of suburban life in a hyper-perfect reality played a crucial role in defining how many Americans saw what the dream was made of. It also demonstrated the incredible power of the media.

Two must read articles have come out from the Rolling Stones and Vanity Fair examining the breakdown of the American Dream and our values as a society.

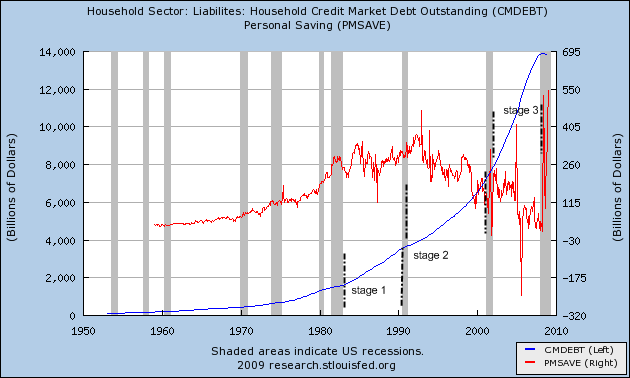

With the recent incredible involvement of the government through the Private-Public Investment Program we see how the dream is once again shifting towards seeing government as part of the solution. I’ll leave it up to you to debate whether this is right but we are moving from a free wheeling hands off crony capitalistic model that has led us up to this economic mess, to a system where the government is taking on a more active role. This economic tempest did not show up in the last few months. This has been built over 30 years starting in the 1980s. That is when the seeds of de-regulation started dripping into the conscience of Americans and all future planning was disregarded for the instant gratification culture that has taken us to this financial Grand Canyon. Little by little, like a drip of water turning into a pool, this economy developed under a culture where deficits didn’t matter, shopping was the key to economic vitality, and a public so comfortable with debt that they had no problem going zero down on $500,000 mortgages. A far cry from the distant shadows of the past. Let us look at the massive explosion of household debt over this time:

It is incredible to think that since 1980, each following decade has seen household debt double within 10 years. We went from a household debt of $1.3 trillion in 1980 to a stunning $13.9 trillion in 2008. Just to give you a sense, in 1980 GDP was at $2.9 trillion. Household debt was 44 percent of GDP. For 2008? Household debt is now equivalent to annual GDP. We can also see from the chart above that during this time the savings rate not only trended lower, but it actually went negative by billions of dollars. The recent shift is that the savings rate is now exploding towards the upside. Is this because many Americans have found that part of the American dream is savings? Sadly, that is not the case. I attribute most of this jump to a societal tipping point, where cultural and political landscapes are looking akin to the post Coolidge-Hoover world where we were leaving a decadent unsustainable era to a more prudent one. The era would have continued if it were not for the bubble bursting during 1929 and the decade of pain that followed. We are in a similar position with debt loads surpassing those of the 1920s.

We have traveled to the pinnacle of decadence fueled by debt spending and now it is time to go back to a more moderate means of living. Many people will have a hard time with this new American dream. The U.S. Treasury and Federal Reserve are doing everything they can to maintain a debt based economy but unfortunately that time has come to pass. Since when was the American dream to have a granite countertop in every kitchen, two large HDTV LCDs in every home, two cars not older than three years each, and a McMansion? When did this become the dream? What is even more unfortunate in the pursuit of this dream, Americans have sacrificed everything at the altar of debt. The days were debt was only used for big purchases like homes and cars was a far and distant planet, people were now using their credit cards to pay the monthly utility bill or taking cash advances to pay the rent.

One part of the American dream that should stay with us is that of education. With the G.I. Bill after World War II many young Americans had the chance to go to college, once a privilege of the wealthy and elite, and we suddenly had a large educated working class. From 1940 to 1965, the number of Americans with four-year degrees doubled. Yet in our instant gratification culture, we had high school graduates making $100,000+ a year selling toxic loans to Americans hungry to keep up with the Joneses. Why go to college when you can make the almighty dollar with only a high school diploma? As we now know, many of these people are now out of work in an environment that is quickly shifting its values. The jobs that are now currently available require specific job training. A college education in many cases is needed for jobs in engineering or fields in the sciences. And in states like California where the true unemployment rate is at 16 to 19 percent competition is now fierce. So part of the dream with education will be revisited. Yet here in California, the public education system with the University of California, California State University, and Community Colleges many of these institutions are scaling back classes and raising fees since the budget is impacting their bottom lines. As we are seeing, an education is a ticket out but that ticket has just become more expensive and harder to obtain in the face of our economic calamity.

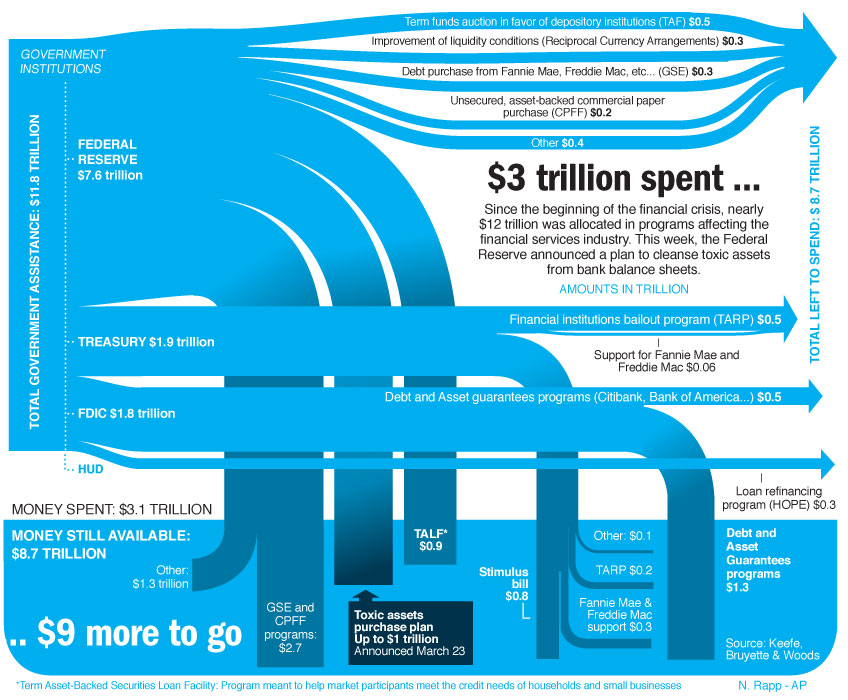

It is hard to compete with a trend. On Thursday the GDP finalized numbers for Q4 of 2008 were released and showed the economy contracted by 6.3 percent. Unemployment claims are at record highs. Yet the market continues on its unrelenting bounce from its early March lows. In fact, we are now in an official “bull market” considering we are up 20 percent from the lows. However, people jumping back in somehow believe the Fed and massive government actions will somehow bring back the free spending days again. It isn’t a surprise the market is up, we have used up $3.1 trillion to the cause! You better expect something. Nicholas Rapp has a great visual on where all this spending is going:

Source:Â Nicholas Rapp

I appreciate Nick letting me use this graphic since visually it helps to show the amazing amount of money being injected into the markets. We have committed nearly $12 trillion, almost the size of our annual GDP to the cause. This is unsustainable. To think that the Federal Reserve and U.S. Treasury think interest rates can remain low and still attract more scarce global capital is mathematically unsustainable. In fact, the first day of quantitative easing saw a weak auction where the rates actually moved up! We do not have an unlimited supply of goodwill here. Where we do use the money, it should be targeted yet we are spending on everything and anything thinking there will be no repercussions and most of the money is going to the financial sector, which is bloated and needs to contract. This is the same early 1980s mentality that led to the following 1990s tech bubble, and 2000s real estate bubble. Are we now creating a treasuries bubble?

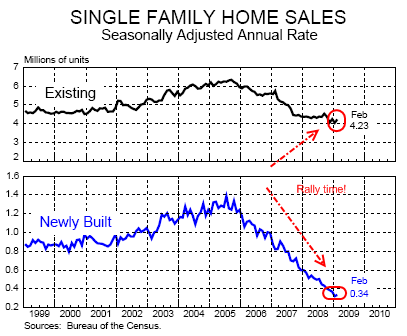

Earlier in the week, the media was running the great news about the jump in existing and new home sales (the cornerstone of the American dream). Let us take a look at that chart:

Well the reason existing home sales “shot up” was that nearly 50 percent of all homes sold are foreclosure resales at rock bottom prices. In fact, the median price of a home sold in February of 2009 was $165,400 nationwide. Compare that to the median for 2006 of $221,900. That is a 25 percent drop and we are still moving lower. Make no mistake, we may be reaching a bottom in regards to home sales. Yet the other bottom will be in home prices, which will come much later. And the way prices are measured will be deceiving to many in the next few years. Currently, many of the organic sold homes still find Pollyanna sellers thinking they’ll get higher prices. Many of these folks are coming to terms with the market and discounting prices. Yet these prices are higher than the rock bottom foreclosure resale prices. So once these homes start flooding the market when psychology breaks, you will see the median price going up. We have yet to see that. In fact, seeing a trend in the median price upward will be the sign of a true bottom. And I think most of us are looking at a price bottom, not a home sale bottom.

A shift in the American dream is occurring. During the Great Depression the notion of thrift and staying away from debt ran deep in our culture. This past decade saw the ultimate climax of the opposite. Not only did we shun thrift but also debt was a method of keeping up with the Joneses. Yet this massive pursuit of “things” and “stuff” did not make us happier. How can that be? We had the highest per capita ever, the majority owned their homes, many people had not only one but also two nice cars, most everyone had a television, people were living longer, yet happiness was not there? We had forgotten of the common good. Interestingly enough in 2006 CNN conducted a poll finding 54 percent of Americans thought the American dream was achievable. In 1995 a Business Week/Harris poll found that two-thirds thought the dream would be harder to achieve in the next 10 years. And that is the problem. Each successive generation was under the model of perma-growth and naturally, everyone wants to think that the future is better. Yet we have had periods in our history where things retrograde (Dark Ages anyone?). When the dream was only achievable through debt, many people were willing to risk it all just to have a piece of the delicious financial apple pie. How many times during the bubble did you get mailings to refinance your home and take money out for a vacation you deserved? Or how many credit cards did you get saying that you should go out and buy those expensive shoes because you are worth it? There is the problem. Much of this past decade was so shortsighted and focused on the “me” culture that here “we” are in this global mess.

The L.A. Times featured an article with another UCLA forecast predicting a gloomy 2009 and 2010 for California. Basically they are saying unemployment will reach close to 12 percent in the state and problems are going to be around for sometime. Looks like they are saying 2011 may be a bottom. Sounds similar to my 10 reasons why California won’t hit a bottom until 2011 that was published on August of 2008. Even if academics are late to the game, things will be tough for an extended period because this is not temporary dip; this is a forcible redefinition of the American dream. We have no choice. We have reached unsustainable debt levels. We need only look at Japan to see how a country deep in fiscal stimulus was stuck for over two decades in neutral.

The American dream came to a head with shows like Laguna Beach, The Hills, Flip this House, and other shows obsessed with money and how difficult the lives of these people were. It was either you had all the money in the world and were bored out of your mind, or you had to flip a home every month and become a millionaire in a few years. That is the problem. It was never enough. It did not matter if you had the “perfect” home or “perfect” family because someone next to you (or through the media) has something better. It doesn’t matter that you have the Lexus because your neighbor just got a Mercedes. Yet under the hood of this all, people were going more and more into debt. How can you be happy if your goal is a moving target and you can never ring the bell of achievement? People worked 80-hour weeks never seeing their family to have the McMansion, the car, and sending their kids off to the prestigious public school where every other parent is running on fumes as well. And for what? To send your kid to an Ivy League for a degree in business so they can run a hedge fund? The common good hopefully will come back. We don’t have a choice. It won’t be seamless and there will be bumps. Few have lots to lose but many have much to gain.

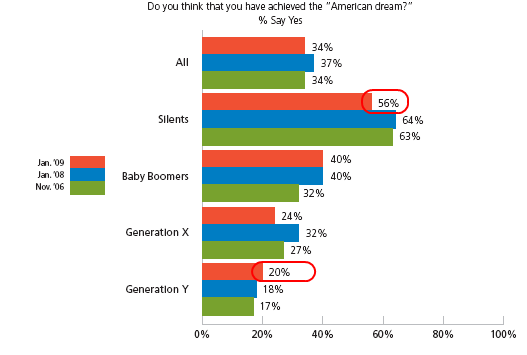

Metlife conducted a fascinating study looking at the American dream. Much of what we have been discussing shows up in this survey:

It is interesting to note that only Generation Y has seen a slight increase in their view of achieving the American dream. And this has occurred during the most turbulent economic times since the Great Depression. It would also make sense however, that the older you are, the more time you have had to achieve the American dream so the number increases for each age group. But overall, the notion that the dream is achievable has scaled back.

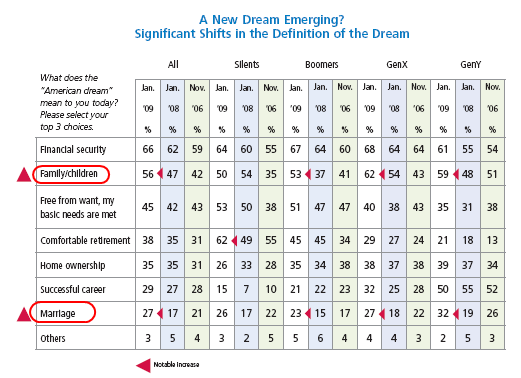

But as the dream shifts and money evaporates from the system like a hot summer rain hitting the pavement, the idea of the American dream is evolving just like it did during the Great Depression:

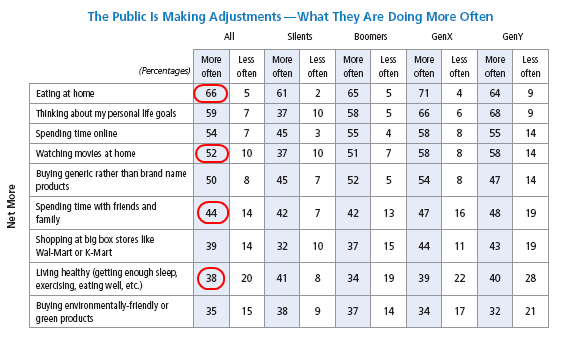

Interestingly enough two major areas with change over the past year are “family/children” and “marriage.” You can expect that this trend will even be stronger for 2010 as many people need to revert to things that do not involve debt or excessive money. In addition, for all those people thinking the public does not know what is going on, they do and are making shifts accordingly:

What you are seeing is a shift to doing things with family, friends, and staying at home. Eating at home for example is a major trend. And this trend may not reverse when things get better. Think of the sitcom 1950s era where it was essential to have a nice meal around the table. Now I’m not saying we’re going the Leave it to Beaver way but people are going to realize that there is something nice about spending time with those you share a common bond with and sometimes, it doesn’t require being in a posh restaurant.

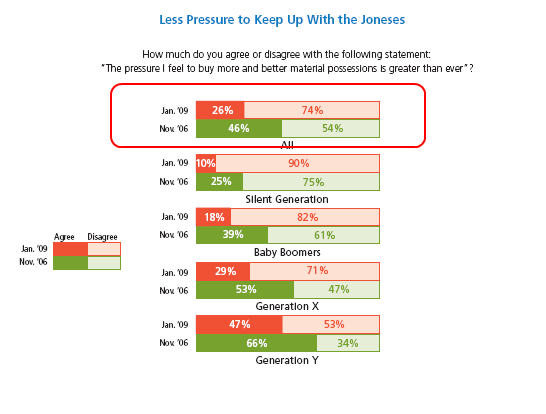

And given all this, you would expect that people are feeling less pressure about keeping up with the Joneses since in many cases the Joneses are going broke:

This is a dramatic shift in less than 3 years. 74 percent say they don’t feel the pressure when in 2006 this number was 54 percent. Yet what is to be a sign of the future, many Americans are on the verge of financial troubles:

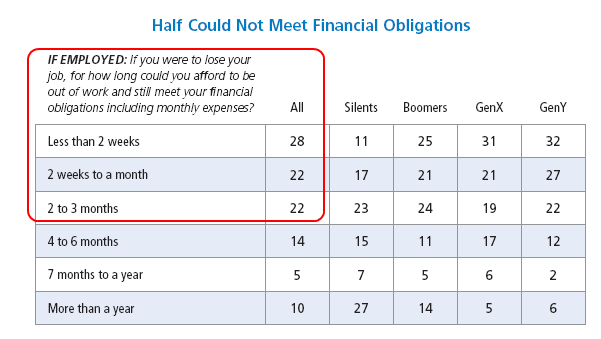

50 percent of Americans would not be able to meet their financial obligations after 1 month without a job and 72 percent after 3 months. So much for having those 6 months of savings. And where was this savings going to come from? Look at the above chart and you’ll see that the only reason we had a semblance of economic growth over the past decade was because of explosions in debt. Yet these are also societal trends and that is why you are seeing the personal savings rate jump up. Don’t expect this trend to reverse anytime soon. If you train a society that “you are on your own” and don’t expect handouts, the fact that the system is currently setup to serve only the extremely wealthy through bailouts, most Americans now realize that the only bailout they are going to get is through their own prudence. While many have seen their stock portfolios shrink by 50 percent they see rich CEOs who have ruined companies get million dollar bonuses. What do you think that does to the psyche of a society? They will not trust the economic system and government for a very long time because it has failed them. It will take many years and time to repair this trust.

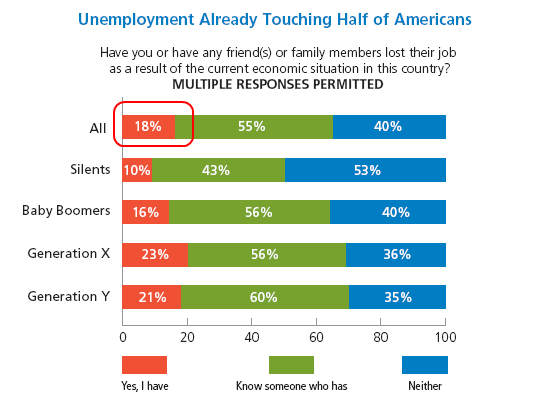

As I have said many times, the 8.1 percent headline unemployment rate is a joke. This survey shows this:

18 percent of those surveyed stated that they have lost their job because of this recession. 55 percent say they know someone that has lost a job.

The American dream is being redefined. What we will find is that we have a country with many dreams competing for the same airtime. I think most would agree that education is a cornerstone to the dream. Homeownership should be a part of it as well so long as people don’t go into massive debt for this. And that is the problem. The massive debt culture. This is starting to change in small baby steps. I went from receiving possibly 40 credit card offers a week to now maybe 5 or 6. The refinancing offers now just trickle in. We will come out of this but if you expect to have things as if we were reliving the early 2000s, you are going to be sorely disappointed for a dream that is no longer available.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

32 Responses to “Wave Goodbye to the Bankrupt Joneses: Deconstructing the American Dream. The Shifting Financial and Societal Goals of a Country Mired in Debt.”

What is fascinating in this is the United Kingdom. I live in London and the economic crisis has not hit here yet. People are spending like crazy, mostly on debt or equity withdrawal from their homes. The British seem to believe they are racially supperior to everyone else in the world and the economic crisis will not affect them. They also believe that the world has to march to the order of London’s City, and that will mean the British will always be given an advantage. So the slappers keep slirping their white wines, the shaven-headed, fat-bellied white guys still go out and start fights and think they are owed a job despite behaving like foul-mouthed pigs with no education. Gotta love the British!

Great Post!

Seems like I’m noticing a new trend arising… I call it the “help me too…”

As I was reading all the questions for Obama on the White House page, all I saw were questions like, how can you help me “help me pay for my house”, “help me get a new job”, “help me get this.. that…”

I think now people can’t borrow what the jones have so they want help getting it.

I thiink this seems like a natural progression from the previous stage of the american dream

I think we need to go back and “Ask not what your country can do for you; ask what you can do for your country”

“two major areas with change over the past year are “family/children†and “marriage.†You can expect that this trend will even be stronger for 2010 as many people need to revert to things that do not involve debt or excessive money.”

Most hilarious bit I’ve read all day, but it’s only 7a.m.

Great post. Yes, the words “you deserve” are still being used in commercials for home imorovements, travel, and automobiles. Part of this is expectations.

My parents rarely took a vacation. Now , every college student on spring break thinks they “deserve” a trip to Aruba, Cancun, or Florida.If you start doing this in college, what will they expect when they get out into the real world?

If you have kids, the best thing you can do for them is give them a dose of economic reality, and not indulge every whim.

You are correct to lay much of the blame for our current economic mess at the feet of the aptly named “crony capitalism.” What is incorrect, however, is to call it “hands off” crony capitalism.

Fannie and Freddie were and are anything but financial institutions where government took a “hands off” approach. The Community Reinvestment Act transformed those institutions from a conduit to the “American Dream,” the merits of which are certainly debatable, to a governmentally tailored American Dream. Neither party is blameless as both underwrote bankers’ risk so that each could argue that they were bringing social justice.

There are other examples in other industres, such as the “Food Safety Administration”–who could argue against food safety? Unless of course you’re a small family farmer who sells produce in a famer’s market that would then come under new federal regulations. Sounds like this food safety thing might be quite the boon to agro-business at the expense of small farmers.

And who could argue against “green” technologies? Only that when government artifically elevates one competitor over another, for every winner there is at least one loser, much like realtors and mortgage brokers benefited from Fannie and Freddie, never mind what it did to those in the rental industry.

We have never been a “hands off” nation when it comes to the economy. Generous subsidies in the earliest days of rail, are evidence of that. But now, more so than ever, government picks winners and brushes losers under the rug. So long as the chosen winners win, I suppose that works–unless you’re already one of the designated winners. But eventually the artificial hand can’t conceal unconcealable economic truths, and that’s when everybody loses. We’re seeing that flagrantly in evidence in the housing market today.

Glenn Reynolds has correctly stated the problem before: when the best invesment that a business can make is to hire a lobbyist rather than to invest in the business itself, the economy is screwed. Crony capitalism is indeed the source of much, if not most of the problem, but “hands off” it is not.

Dr HB,

Excellent post.

Back to basics… what a concept for the sheeple!?!?!

I hope individual fiscal prudence is the new ‘keeping up with the Joneses’.

But, I fear it won’t last forever… greed will rise again, and that, coupled with a lack of common sense… fast forward to 2012 and there’ll be new hype about a new bubble.

Hi,

The statement that stands out most is that we are having a government bubble. I wrote about this back in October.

http://www.insightwriter.com/2008/10/30/money-bubble-arising/

Bubble after bubble after bubble… When will it end?

Im starting to think being stuck in neutral may not be a bad thing after all.

Jeremy

Some interesting commentary here:

http://www.youtube.com/watch?v=EQGOC5Jkrg0

Some of our best minds had already seen this problem brewing as far back as 1969!

That makes some sense, but I’m not seeing it much. I don’t see any behavioral differences now that gas is back to $2/g. There’s talk about it, but not much action from where I sit. We’re like a huge herd of cows. The predators are picking off the vulnerable from the herd, but unless you can hear their demise or see a cow near you go down, it’s a long line at Starbucks and a new outfit and shoes, and stuff your face at the trough–yes, super-size that angry whopper.

Bob K,

Testify! Couldn’t have put it better myself. I understand that Bush II made over 10 legislative attempts to reign in the Franny debt-bomb, but was defeated by an hostile Congress.

That does not in any way condone the economics of the Republicans – Bush was effectively asleep at the switch, however, I believe it was Clinton I’s repeal of Glass Steagall in 1999 that led directly to this mess.

We have never had (in anyone’s lifetime) exposure to “crony capitalism” and true free market forces. I believe that “crony capitalism” in an unrestricted free market would fail dismally.

Dr HB rightly points out the failure of the regulatory agencies, and the influence of lobbyists, but as soon as you start imposing regulations and agencies, you are destroying the concept of a “free” market.

It shames me to think that the most “free” market in the world today could well be the PRC!

http://www.portfolio.com/news-markets/national-news/portfolio/2008/11/11/The-End-of-Wall-Streets-Boom

Thanks for another great post DHB.

I still disagree with your prediction of a bottom in 2011. Please tell me, what is going to raise the economy back up in CA ? A Black Swan? Empty houses left by boomers, no more liar loans, and soon to come the end of the shell game that makes millionaires out of public servants.

~

Wish I could remember where, but I read an article where some of the big cities back east have plans to abandon whole blocks of houses. Raise them so they don’t need now scarce fire and police resources. Wonder how many of them have granite countertops?

Yesterday’s LA Times reported on a woman who, losing a $55K job, went for welfare/food stamps and was enraged that her savings and unemployment disqualified her. She was miffed because her unemployment wasn’t as much as she was earning in her job, and how was she supposed to live on less?

~

So, um, like, if you lose your job, your taxpaying neighbors should cough up as much money as you earned before? The implicit thinking being that if you ever earned $X in a job, you are guaranteed that forever through some combination of tax slaves and rainbow-farting unicorns?

~

The LAT reporter framed the story around an apparent foregone conclusion that if you save for a rainy day, and the skies go grey then open up, you shouldn’t have to actually spend any of that money. If it rains, y’all buy my galoshes. And the LAT reporter framed this as “helping the middle class.” Why should really poor people get all the welfare? (Well, for one thing, that safety net is there for them precisely because they don’t have savings, unemployment, etc.) So I read the story as more war on the poor. “You all don’t need that stuff, WE need it, because we’re accustomed to more!”

~

What stymied me even more was that the woman is over 40 and single with two toddlers. So I’m reading and thinking, she chose to start two new lives in her late 30s, alone. One income, two kids, starting well in middle age. Didn’t this include the maturity to look ahead to the possibility of difficult times, and the need to prepare for that financially? What were here goals for saving beforehand? You go and have two kids alone/in socioeconomic isolation and don’t figure you could be out of a job at some point, for whatever reasons? Did she always figure that her savings are for HER, not to spend on, say, her kids if times get rough? Or that times would never get rough? Or what?

~

Just what are people thinking about paying their own way through life? Or about making choices based on socioeconomic realities? A lot of people are facing the costs of their choices, but instead of rethinking, retrenching, getting creative…they’re honking DADDY GIMME GIMME GIMME. Our DHB is right–the big boys get daddy’s bailout. For the rest of us, there’s just our own ability to look ahead and prepare in a mature, level-headed way for when things stop being bubblicious.

~

But how many people have the perspective, skills, and ability to bail themselves out of unavoidable and inevitable life trouble, as afflicts all of us? Or even to make an effort in that direction?

~

I was raised in a family that easily traces its generations back to the American Revolution, and even before that. I was raised in the notion that “The American Dream” meant being beholden to no gods, no masters. I.e., no daddies. The American Dream is the Constitutionally ensured liberty to be an adult, responsible for one’s own destiny, free to work for one’s own path. No daddies in the sky, in the church, in the government, in the palace. Just one’s own freedom, with all the responsibility that comes with that.

~

I have always been a very liberal and progressive person socially and politically. But I have to wonder. What has happened in this Age of Horus version of the USA, where everyone has become a helpless whiny child looking for bling, things, and hope…not from working and saving, but from scamming? What has happened to the idea of being an adult, taking responsibility for one’s choices and their outcomes, refusing to be fearful in times of great change? What has happened to the idea that age 40 is supposed to mark the onset of elderhood, and life leadership, rather than dependency?

~

I blame my profession–the media, communications, publishing–for the youth culture that keeps people constantly stirred up in adolescent frenzies of insecurity-driven acquisition lust. It’s profitable. But the media also simply reflect something larger: the culture of nannyism and gold medals for turning up–everybody’s special! everybody’s indigo!–that is preparing many people for nothing but life on the dole.

~

To tie this whole long message together, this concerns me, because one day someone will show up promising to be their daddy–Papa Joe, Chairman Mao, Uncle Adolf, Rev. Jones, whoever. And people will climb over themselves to be saved from adulthood and themselves.

~

rose

~

Freedom of choice is what you’ve got.

Freedom from choice is what you want.

–DEVO

rose-

you are an ass.

take your holier than thou anger & direct it to the banksters who refuse to take responsibility for their actions and are being bailed out to the tune of trillions….

you are focusing on this lady who, as i saw it, is asking why she needs to be homeless & destitute to receive assistance? please, spare me the “taking responsibility for one’s life” speech. First off, she was working, so she paid into unemployment insurance-she’s not just “living off the dole”. Secondly, do you even know how much private family health insurance is? Granted, it is less than Cobra, but if you have to get by on unemployment, pay for health insurance, and the basic costs of living while you are looking for a job in this market-you will quickly deplete your “rainy day” savings.

So you think it’s better that she depletes her savings, sells all the assets she can, until she is destitute enough to qualify?

People like you make me sick.

DHB: The amount of money spent on college education in the states is as big a waste as what was spent on McMansions near Las Vegas. This is not an answer.

Most of the middle class students aren’t motivated enough to be worth spending taxpayer or even foundation money on. Then those that are motivated enough choose professions that should in NO CASE be subsidized by the state: Lawyer, MBA, Environmentalist, and all the sundry baby sitting majors like communications, journalism, etc. etc.

The truth is that our youth have already been brainwashed by the time they graduate from high-school, by their teachers and by their peers.

Our children (those in the middle of the bell curve) need skills that allow them to get a job and earn a living, not 4-8 years of state subsidized baby sitting. When the graduate for high school (or sooner) most of our youth need to start in job training and work with adults who set an example. We need to prevent our youth from growing up in a youth hip-hop bubble, isolated from reality, and taught by marxists and people who never have to hold a real job.

I agree with KennyB, but for different reasons. What are all these scientists and engineers going to do with their new degrees? Where are the jobs? Outsourced to India or China, undercut by H1B visa holders, and Johny BS or Suze PhD is left holding the debt. No, college is a BAD idea until the jobs environment, college cost, H1B immigration and economic situation stabilize. Our children would be much better served to learn the criminal arts, since this is what is clearly rewarded in our society: How to get away with crime, how to defraud the state, how to profit in the black market etc.

er excuse me but i thought your american dream was something to do with self sufficiency, self development, belief in democracy, justice and truth. generousity and charity to those never met and those met. the marshall plan, the resurgence of japan, the digging europe out of the yugoslavia debacle including saving the muslims in kosovo and attempting to face up to tyrany at the cost of not only dollars but american lives.

whilst wishing frank williams and his cars well i don’t recognise his london and suggest that most brits as well as americans ask that our government attempts to do the morally right thing.

bit difficult as we know dealing with the transfer of work and money across the world based on ability and value, the increasing mobility of the poorest, the increasing ability of the worst elements throughout the world to hurt us and those we befriend.

now i understand it was all about financial security, so did you really all want to be swiss, really?

summer-

you are an ass.

Where does it stop? It’s easy to blame the big bad bankers. But no one forced these loans on people. You really have no criticism for the auto mechanic who bought a $400k home? I guess thats all the big bad bankers fault too. And for the newly unemployed $55k/year asking for food stamps?? “why she needs to be homeless & destitute to receive assistance?” I’ll tell you why, because govt assistance is reserved for people who are homeless & destitute (crazy, I know) not someone who is making a ton more than people who are “homeless & destitute”

Unbelievable this me me me attitude.

@Winter-

In some cases, although not forced upon people, people were more or less tricked into them. Did they sign – yes. But with promises never meant to be kept, with purposely confusing terms and with the naive false belief they could trust the professionals with whom they were doing business.

~

I would say the me, me, me attitude does bother me but I see it in different places sometimes. What about the us, us, us? Isn’t part of what we can do for our country right now is helping those less fortunate? I would consider this woman temporary less fortunate and would much rather have my tax money (and charity money) going to people like her than bailing out those who have profited from bringing the system down.

I have made a lot of common sense decisons lately. However, with Washington changing the rules daily, my common sense decisions are beginning to look like a fools bet.

I know everyone says housing HAS to go down to realistic levels, specifically in San Diego, but with inventory decreasing, trillions of cash on the sidelines looking for a place to go, it is a little worrisome. It may not matter that 99% of the people can’t afford a house, if the 1% with the trillions are investing in hundreds of houses.

I was just in S.D. 2 weeks ago, I left in mid 2004, I had sold my house there. I am now wanting to go back. What I saw in S.D. was shocking. It appears to me houses are about the same as they were when I left and now multiple offers are coming in!

Unfortunately, for most people, it is all about the payment. It has become crystal clear that this government will drive 30 year rates down to 1% before it will allow housing to continue dropping.

I have made my bed and now I must lie in it. I can only hope that all this manipulation fails and my original common sense bets pay off. The markets have reacted to the announcement of a new freshly minted trillion dollars with a yawn. If the market place has no problem with the government printing presses going 24 hours a day, I am screwed.

Martin

Thank you Rose for your rare insight. Unfortunatlety, many individauls are still experiencing shock and denial from this buried reality (even those that read this blog).

Dr. HB-

Great post. The only thing I would add is that the true debt bubble began in 1971 when we left the gold standard and the demise of the U.S. Dollar as the reserve currency of the world is what’s at stake. When the government abrogates all responsibility at balancing its budget by entrenching deficit spending using fiat currency backed by nothing, its citizens learn to follow mommy into debt hell.

Since the not-so-hidden inflation tax eats away at everyone’s standard of living, perpetual debt is the only way for the middle and lower class to maintain their financial standard of living on the spinning hampster wheel until the great credit contraction arrives. Now that the depression has arrived, credit has dried up and unemployment is soaring, debt loads have become unbearable and keeping up with the Jones’s is no longer an option. Most people are better off defaulting on their debt than paying it back (and many won’t have a choice anyway).

The dept people go into make sought after expensive things more expensive. If financing was not offered for education, automobiles, or homes these items would be less expensive. There used to be a time when people went to work to pay there way through college. Work would help pay for purchases. Now people just get loans and they post the cost.

If we did not have so much credit things would be be more affordable for those that wish to pay as they go.

winter & rose-

you’re (an) idiot(s)….where did you come up with I am siding with gamblers who bought crap they couldn’t afford? I most definitely have no love for the the americans in collusion with “let’s keep this party going attitude & damn the future-housing prices only go up”….what I take issue with are the people who were responsible, saved their money while watching this mess unfold, get laid off as an innocent bystander and are now forced to deplete everything-quickly. mostly because they need to pay for healthcare LIKE RESPONSIBLE PARENTS DO. So- you would rather this woman forgo healthcare & just show up at the emergency room? what’s your solution? just let em all spiral into homelessness while we throw trillions to prop up the deadbeat loans…ahem “legacy assets”….great plan.

I’m a small biz owner & I am all for capitalism as long as the playing field is fair. I am also someone who enjoys empowering people & detests people walking around acting like victims, but it is increasingly evident that there are different games being played here that some people have NO CONTROL OVER & some companies that are NOT PLAYING BY THE RULES.

but hey, as long as YOU can aspire to an AIG-like bonus & your life is honky dory, everything is cool. you go ahead and keep drinking that koolaid. cause really, it’s all about you, right?

you need to dig deeper & focus your anger beyond MSM’s “it’s all sub-prime’s fault”. DHB is a good start….

rose:

Yet again, people trying to have it both ways, case and point

“you’re (an) idiot(s)” Can’t even decide on singular vs. plural.

“where did you come up with I am siding with gamblers who bought crap they couldn’t afford?”

– When you call rose an ass and tell her to:

“take your holier than thou anger & direct it to the banksters who refuse to take responsibility for their actions and are being bailed out to the tune of trillions….”

“cause really, it’s all about you, right?”

Do I think it’s too much to give food stamps to someone who will be pulling down $1600 a month just to actively look for a job? Yes. There must be a limit to tax payer generosity both on the individual and corporate level.

“(people) get laid off as an innocent bystander” – I don’t understand this, you obviously think healthcare is a right (or at least should be) are you also saying that having a job should be a right too? Quite the capitalist you are.

Oh yeah, in keeping with the maturity level of this discussion:

You are an idiotic ass…

ok winter,

i dare you to support 2 kids, pay for their healthcare, your basic necessities, etc… on $1600 month….go on, show us how it’s done.

healthcare should be affordable & not at the whims of unregulated insurers who won’t define what “reasonable & customary” is when pointedly asked.

so what is your solution to this crisis? all these laid off people should…..slide into homelessness, preferably somewhere not near you? what say you to the people who were responsible, upstanding citizens that lost their jobs, but did not participate & are slowly circling the drain by depleting their rainy day savings?

you have no answer because asses don’t have brains.

To the apparently rising savings rate: Calculated Risk had a good thought on it that we don’t necessarily see changing behavior already. It could be equally possible that there were simply two groups of people, one who like to save and a second group who thought a HELOC is income earned by the house. The first group is saving as before (I am among them), but the second group has stopped their house equity spending, because they were forced to stop it by the banks. The result would be a rising savings rate. I think that the (necessary) change in behavior is still in the future and might take years to grow roots, like in the 30s.

Welcome to America, the World’s Scariest Emerging Market

Guess I’ll just be an unpublished contributor!

Record Drop in January Index of Home Prices

Record Drop in January Index of Home Prices

A widely watched 20-city index tumbled 19 percent from January 2008, the largest decline since the index started in 2000.

summer,

I’m sorry if $1600 isn’t enough to maintain a lifestyle but you still haven’t told me why it’s my responsibility to help you out of your bad times? Again, I must circle back to my original post and ask where does it stop? If $1600 isn’t enough then is $3000 enough (perhaps $5000/month since your scenario included 2 kids) At what point will the person receiving $3k/month decide it’s much easier staying at home getting $3k/month rather than wasting at minimum 40 hours a week to get the same? Since when is loosing your job or being unemployed supposed to be easy or a soft landing? Are we also considering raising the minimum wage to $15/hour cause there are people who are employed that make less than $1600/month. Should part time employees also be promised “enough” money?

While you’re at it and if you could think this far ahead, what would happen to the dollar if everybody was making at a minimum $70k a year? (hint: a new floor would be established)

And what is your definition of affordable healthcare? If $200/month kaiser rates are dropped to $10 (much more reasonable right?) then something has to give. most likely it results in a few more people laid off a bunch more salary reductions and this is my favorite part: approved treatments will dwindle. You will get what you pay for. You only want to pay $10/month for a doctor, well you’ll probably get $10 worth of care. Yes I know, heartless.

Lets see,

Don’t have an answer do you? because your brains are full of what one generally finds inside an ass.

winter-

YES people did “force” these loans on people, in the sense that bankers were assumed by the general public to be “professionals” with regards to money and therefore acting as a fiduciary on their behalf when recommending loan projects. How quaint, someone making a huge salary actually responsible for making sure the loans they write are LEGITIMATE!

Besides even if the auto mechanic took out this outrageous $400k loan some fascist banker offered him, he STILL lived up to the end of the contract he signed. The house was the COLLATERAL in that transaction and if the buyer can’t pay the bill his house is simply taken away. Right?? Those were the “terms” the banker set up after all. Joe Schmoe’s responsiblity ends there.

You honestly think in the ‘old days’ the bank would at all hesitate to take your house and decades worth of equity if it suited them in your personal time of crisis (e.g. horrible illness, job loss)?? Hello no. This time they just got too greedy and made such a sheer quantity of bad loans the tsunami wave rolling back at them now threatens their extinction. They are not ‘victims’ here. They are predatory scumbags who happened upon many willing victims during the boom years (and many innocent ones as well). They deserve no mercy and ARE TO BLAME for the global financial crisis now unfolding!

orange kitty-

I guess your meaning of “force” is different than the established definition. And you know this because you even put force in quotes. The truth is no one was forced to take the loan. People willingly suspended disbelief in “too good to be true” scenarios and got bit. I never said bankers were victims. People who took out loans that were too big are getting what they deserve and banks should be getting what they deserve too. Both people and bankers deserve no mercy but somehow our ire gets solely directed towards bankers incorrectly absolving people of their own blame and responsibility. That is simply dishonest. Whats really disheartening in this debate and you touched upon it is the anger seems to be directed towards those making a “huge salary” The lessons of history show us that class warfare is dangerous path to go down.

Leave a Reply