Westside Los Angeles: The Ultimate Prime and Stagnant Real Estate Market. Comparing March and May 2009 Data. Gear up for the Foreclosure Storm. $17.5 Million Foreclosures happen when you let WaMu and BofA Play Together. Digging into the Housing Shade of Palms.

The Westside of Los Angeles is the perfect region for real estate neurosis. Bubbles play on human nature’s manic tendencies and nothing is more volatile than real estate in the Westside of Los Angeles. I’ve written a couple of pieces highlighting homes in Culver City and Santa Monica and discussed why these regions are prime candidates for the destruction that the Alt-A and option ARM tsunami will unleash later in 2009 and 2010. Just to give you a perspective, in May only 219 homes sold in the Westside of Los Angeles while the entire county had 6,521 homes sold. The 29 zip codes that make up the Westside of L.A. make up only 3.3 percent of all total sales for the county but there are probably more per capita articles written on this region than any other. Call it the “MTV Cribs” obsession.

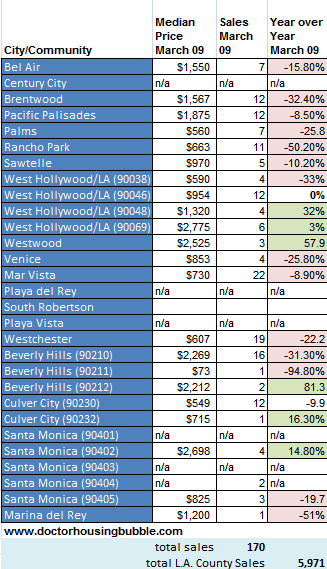

Now in this article, I want to examine data from March of 2009 and compare it to data from May of 2009. I will also pull up current MLS data and distressed property information to show how a silent tsunami is building up in these areas that many people seem to be in denial with. California with a $26.3 billion deficit and pumping out IOUs, yet some people still think that their region is locked in a tiny silo that protects their pseudo housing wealth. Some people are still in the mania phase of the bubble, (as hard as that it to believe). Let us first examine data from March:

This is important information. What you’ll see is that 14 zip codes are reporting year over year declines in their median price while only 6 are reporting an increase. Even in March, the Westside only made up 170 sales of the 5,971 sales in Los Angeles County. Let us now see what occurred in the period of two months:

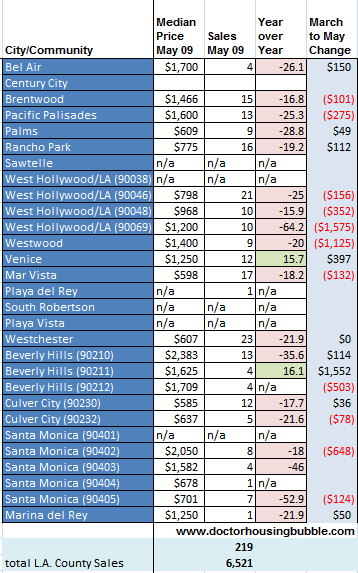

What you now see is more year over year price declines. In this latest data, you will see that for the Westside 18 zip codes are reporting year over year declines while only 2 zip codes show any increase. I’ve also included a comparison from March to May and you’ll see how extremely volatile this region is because of the tiny subset of sales. Sales did increase from March but that has to do with falling prices. Just look at Westwood for example. The median price fell by $1.125 million from March but this is only based on 9 homes sold. This also occurred in Beverly Hills (90212) where the median price fell by $503,000 in two months but is also based on 4 homes sold. Yet the overwhelming trend is to lower prices. What else would one expect in a region littered with Alt-A and option ARM products?

People sometimes need examples so we’ll take a look at a home not in the Westside, but in Southern California which exemplifies what is going on. The former New York Mets and Phillies baseball player Lenny Dykstra recently filed for bankruptcy protection. He had purchased Wayne Gretzy’s gorgeous Thousand Oaks home for $17.5 million. The home was recently on the market for $25 million then dropped to $16.5 million.

*Source:Â Zillow

“(ESPN) Walter Hackett, a lawyer for Dykstra, said the event triggering the bankruptcy filing was a planned foreclosure sale of a southern California residence that Dykstra bought from hockey legend Wayne Gretzky for $17.5 million in 2007.

Dykstra is “in good spirits,” Hackett said in an interview. “He understands now that bankruptcy is truly a protective act. I do expect that Lenny is going to emerge from Chapter 11, and make those people whole who have legitimate claims.”

According to the bankruptcy petition, Dykstra’s largest unsecured creditors include units of JPMorgan Chase & Co., owed $12.9 million, and Bank of America Corp, owed a combined $4.2 million.

Hackett said Washington Mutual, now part of JPMorgan, was the main lender on the 2007 home purchase, and that the bank misled Dykstra about his ability to afford the property. The lawyer said the bank deserves nothing on its claim.

JPMorgan spokesman Tom Kelly said: “We don’t comment on individual cases, but we expect our customers to repay their legal obligations under their mortgages when possible.”

Bwahaha! $12.9 million plus $4.2 million comes out to $17.1 million! You mean to say on a $17.5 million dollar place Washington Mutual and Bank of American allowed virtually a zero down play? I was searching for the home in the MLS but it doesn’t seem to be there given the bankruptcy filing which will now forcibly sort things out. In April it was reported by Zillow that Sotheby’s International had the home listed at $25 million which obviously did not sell. The current Zestimate is $13.1 million. Apparently, multi-million dollar properties are not immune to the busting housing market. And if you want to see leverage, take a look at this:

“The 46-year-old has no more than $50,000 of assets and between $10 million and $50 million of liabilities, according to a petition filed Tuesday with the U.S. Bankruptcy Court in the Central District of California.”

Maximum leverage. I find it hard to believe that there is still a sizable contingent of anti-math folks that believe this entire global credit mess was created by subprime borrowers. They think that poor people in the inner city somehow led to $13.87 trillion in household wealth being wiped off the balance sheet. Try telling these people that some $1 trillion in subprime loans does not equal $13.87 trillion in wealth destruction. The reality is much of this is a distraction from their puppet masters on Wall Street and the true crony-banking machine.

Now moving back to the Westside you can rest assured the likes of WaMu, Countrywide, and IndyMac made plenty of maximum leverage loans that will end horribly in the next 6 to 18 months. Now let me give you a glimpse of the shadow market that is developing in the Westside.

Take for example the community of Palms. If you look at the March to May data, you will see a slight increase in the median price from $560,000 to $609,000 but this doesn’t tell you much since the increase in sales went from 7 to 9. It is a small sample size. However, if you look at the MLS there are currently 94 listed properties. Not bad right? Well that would probably be true if there weren’t 95 distressed properties! That is right, in the zip code of Palms with 94 listed MLS properties there are now 95 distressed properties. Westside L.A. immune? You can rest assured that the conversation in the summer of 2010 will be extremely different.

But let us keep our focus on Palms. With 95 distressed properties, you would assume that many would show up in the MLS right? Nope. Only 3 of these properties are listed as foreclosure or short sales even though 43 of the 95 distressed properties are bank owned or geared up for auction. Welcome to the shadow inventory world. The other 42 properties are in pre-foreclosure. But let us look at one of the places that is currently listed as a short sale:

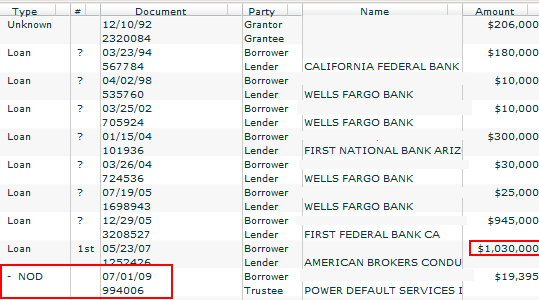

This is a nice 5-bedroom home with 3 bathrooms. It is definitely a good home for a higher income professional. Yet even these kind of homes are not immune to the housing bubble bursting. The home has been on the MLS for 67 days. It is currently a short sale but at this range, you don’t have a big client base like you would with some Real Homes of Genius. It is a larger home with 3,017 square feet and is listed as being built in 2005. This home has a last sale in 1992 for $206,000. But once again like the Culver City home example, it looks like this home was the ultimate California equity withdrawal machine:

This home was tapped out like a keg. Keep in mind the last sale occurred in 1992 for only $206,000 and somehow managed to end up with a $1,030,000 first mortgage on the place. Looking on the history you will see how notorious Wells Fargo was in this California housing bubble but also First Federal Bank, an option ARM specialist. The notice of default was filed on July of 2009 so this is a fairly new listing but given the enormous amount of notice of defaults being filed, we are going to have an epic Alt-A and option ARM wave hitting like a ton of bricks later in 2009 and into 2010. The public-private investment program better stay away from these California loans because you can rest assured these are the kind of loans that will be pushed into it.

As you can see, the current borrower is now behind by $19,395 and this of course will be growing each day the home doesn’t sell. And it isn’t selling:

Price Reduced: 06/02/09 — $1,199,000 to $1,099,000

Price Reduced: 06/11/09 — $1,099,000 to $999,000

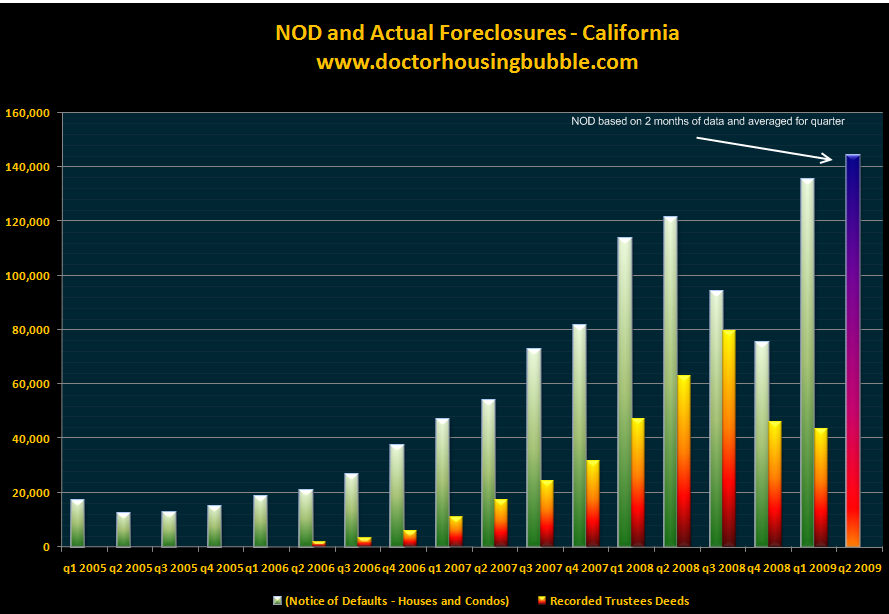

As you can see from the tiny number of sales in the Westside that there are still people buying in the Westside who still believe in the pagan god of real estate. Yet many will be stunned when the Alt-A and option ARM wave strikes. I have never seen such a massive pent up wave of problem real estate and this current pattern is very similar to what occurred in 2007 with the subprime bust. We all know what damage that is ravaging in the Inland Empire and Central Valley for example. Take a look at the NOD chart:

The home currently has a $1,030,000 first and is selling for $999,000. If it would sell today the loss would be:

$1,030,000 – $999,000 = -$31,000

-$59,940 (6% commission)

-$19,395 (missed payments)

Total loss = $110,335

The lender should count their lucky stars if this sale goes through at this price. Yet the homes that sold in Palms are for much less. From the latest 9 homes that sold the median price is $609,000.

The Westside is now standing in the direct pathway of the Alt-A and option ARM tsunami. It is much too late to get out of the way.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

32 Responses to “Westside Los Angeles: The Ultimate Prime and Stagnant Real Estate Market. Comparing March and May 2009 Data. Gear up for the Foreclosure Storm. $17.5 Million Foreclosures happen when you let WaMu and BofA Play Together. Digging into the Housing Shade of Palms.”

We’re still building suspense during the movie, ‘Planet of the Alt-Apes’ where the optional-armed gorillas have come to terminate the 9021X-men.

A mindset dies hard–perception masks truth until it can no longer. Looks like we’re gearing up for another simu-loss package:

Bail-out Cal, Nev, MI, FL, AZ…

Autos, ramified GM tributaries, more mega-profits for GS, JPM, Exxon, Wallmart.

I saw a couple of coming attraction burfore Planet of Alt-Apes: ‘Massacre on Main Street’ and ‘It Was a Wonderful Life’.

Any happy news in the crystal ball of Professor Marvel’s, Doc?

One of the things going on in the San Francisco Bay Area, is that owners who purchased years ago are holding tough on asking prices.

If you bought in 1992 at $200,000. and “value” is now $700,000., you have NO incentive to drop your asking price. House payments( if there are any left)

would not be that great of a burden. You can hold out for what you think it is worth.

Of course, a year from now, things could (probably will be) worse, so this is only a game for those who have no pressing need to sell.

PMI – Home Prices Could Be Lower in 2011

Fifteen areas in the country have a 99 percent probability of lower prices in 2011 including:

Miami, Fort Lauderdale, West Palm Beach, Orlando, Tampa, Jacksonville, Riverside, Los Angeles, Santa Ana, Sacramento, San Diego, Las Vegas, Phoenix, Providence and Detroit.

Dykstra’s story appears to be a classic one of alcoholism-fueled grandiosity. An arrest early in his career with a .179 blood alcohol level after crashing his car is no ordinary DUI. To get the BAL elevated to such a point requires 12 shots of 80-proof liquor in the space of four hours for a 200-pound person. It happens to be Henri Paul’s BAL when he crashed the car in which he and Princess Diana died. It’s also far beyond what practically any non-addict can function at, must less drive a car; most are on their faces by the time they’re at a .12 to .15.

Alcoholics suffer from distortions of perception and memory. They think they can accomplish superhuman feats. In their manic phase (it resembles bipolar disorder) they truly believe nothing they do is or can go wrong. The sense of invincibility is, in fact, a signal symptom of alcoholism. Why else would Henri Paul drive at 90 mph in a 30 mph zone in a tunnel with giant pillars? Why would Dykstra purchase a $17 million home with $16.whatever in loans? When we shake our heads and ask, “What the hell is he or she thinking?” we need to look for alcohol or other-drug addiction.

I wrote “The Mortgage Mess, the Real Estate Bubble and Alcoholism” as the Top Story in my August 2007 Addiction Report (at http://preventragedy.com/pages/TAR/032.aug07.html). Dykstra provides yet more evidence for the assertion I made in that article: that alcoholism-fueled egomania is a prerequisite for turning bubbles into monsters.

Great great post.

The westside is going to implode like a black hole.

Granted, in the end, the westside prices will still exceed other areas, but not so disproportionately like they do now.

Yuppies got loans they had no business getting 5 years ago, with everyone looking the other way. Now when that 32-year old advertising freelancer has no clients, the monthly $15K checks stop coming in, and the “oh crap!” panic sets in. Savings? Of course not! Otherwise how else could I afford my 2009 BMW M3?!?! I need that car, ME BIG SELF-MADE ENTREPRENEUR.

Nope. You were sucking on the teat of irrational exuberance. Look around you. Record unemployment. Rising taxes. Vacancies everywhere, tons of rental properties on the market. Businesses fleeing California. Tight credit. Years of inventory on the market.

IT’S GOING TO BE A BLOODBATH ON THE WESTSIDE. If you bought a home on the westside in the last 7 years that you can’t afford, your credit rating and your lifestyle are about to be annihilated.

I’ve said it a few times but the NOD chart doesn’t really even show how bad things really are. I’m pretty sure if they were truly doing NODs at 90 days delinquent we would have 2-3x more NODs right now than what is actually showing. Prices in the inland empire are already lower than what it costs to rent a place. I expect that when this hits the real peak prices inland will be somewhere around .75-.80 the cost of rent. Either that or rents will have to go down 20-30%.

The tide is sucking out before the tunami hits. It is the quiet before the storm. With prices down 15-25% on the Westside, this summer should be brisk in sales. But no, people are on the sidelines waiting for sellers to capitulate. The ALT-A/Prime foreclosure wave is in sight now. Just this week, a property in the exclusive Santa Monica zip code 90402 sold at a 42% discount from it’s last 2006 sales price. Even better, it was an REO, that indicates banks know what’s coming and are gearing up their inventories (Shadow and otherwise). Can you imagine what happens when the traditional summer selling season ends in August?.

Cowabunga!!!

http://www.westsideremeltdown.blogspot.com

The mortgage financing structure is based on option mortgage products providing the mortgage debt holder (homeowner) the option to sell the property before the contract expires or keep making agreed payments until the contract period ends.

This type of option contracts create speculative markets based on an asset that must always be trending up in value or the incentive is to default since the option to sell before the expiration is worthless.

Our current RE market based on this system is crashing since it is impossible for the market to continue treading up and when as in the current economic conditions create a deflating asset then option mortgage holders find it in their economic interest to default since their primary reason for taking out the mortgage was always speculative rather then longterm home ownership.

Lot’s of knowledgeable folks chiming in these days (not me, I’m no RE pro). There’s a lot of damage when the Tsunami comes in, but even more when the water runs back out and takes houses and people out to sea. Man-made disasters are worse than natural ones because they could have been avoided. Fortunately Wall Street is protected from all this–in fact, they are probably picking up choppers and jets on the cheap to perpetuate their criminally-secured oppulence. Sorry founding fathers, we let them turn this fine nation into a third-world mess: One nation, under Goldman. Planet of the Alt-Apes? Forget it, the reviews suck. Any surprise that mob movies are in vogue right now?

Robert Cramer; right on about the bay area. Two people I know have three houses that are so far underwater the only logical solution is to walk, recourse be damned. But they are clinging to hope, which I believe is typical of the SF bay area mindset. Things will get very interesting next summer.

In response to the good Doctor’s post, notes to self:

– Prepare to remove all money from bank

– Continue converting fiat paper to tangible assets

Cheers!

on the flipside has anyone walked around westwood village recently? almost like 50% of the commercial space in this prime area is vacant. Some places have been vacant for years since I worked in the area. Crazy….

If only this information could be read by everyone in this country on a regular basis. In addition to the Doc’s spot-on reports I learn even more by reading the comments.

I watch Cramer several times per week and he is STILL telling everybody that housing is beginning to show positive signs…….

I didn’t know Lenny Dykstra was an alcoholic but I did read a few years back that he was actively trading stocks and options using the money he had earned from his playing days and owned a car wash in Corona. I guess all that’s down the tubes now, huh?

I live in Palms and I’ve seen the ridiculous prices and mentality that these sellers have. I am just hoarding cash for the next two years and will hopefully have enough to put down a 30-40% downpayment on one of these houses in Mar Vista or Rancho Park. I don’t think it’s beyond reason to think that some of these houses priced currently at 800-900k will bottom out at around 550k or so.

Love your comment. Many witty and pithy comments appear here, but yours stands out. “planet of the alt-apes”, that is great.

I appreciate the information on this blog. I too would like to think that these vastly inflated housing prices on the Los Angeles Westside (and even in better parts of the San Fernando Valley) will collapse down to reasonable levels, but I have my serious doubts. There are simply too many parties who have an interest in keeping prices high. The owners, obviously. The government, whose bailout and modification schemes may be ineffective to a great degree, but which have been taken advantage of by at least some owners. The banks, which are apparently letting a number of defaulting borrowers sit in their houses, rather than foreclose and have to fire-sale the property.

I have been looking to buy on the Westside for five years. At the height of the bubble, I knew it was an impossible task. But even now, I am seeing house listings at what are, given the economic situation, ludicrous prices. $1.5 million for old, small houses in Santa Monica. $1.9 million for average houses in Pacific Palisades which are 45 minutes off the freeway. The owners either have enough money, enough equity (remember that the value of these houses is still well over pre-bubble prices), or enough patience to just sit there. The only way that these prices will collapse is if their owners face serious financial difficulty. And even so, unless the banks are willing to foreclose, and reduce these prices to saleable levels (rather than hold on to them for indefinite periods, refusing to capitulate on prices), nothing much will happen.

It is as if the government, the bankers, the homeowners all are waiting for a second wave of suckers to relieve them of all their mistakes, to buy up these properties at only slightly discounted prices, paying 20% down with standard mortgages. All the people who got nothing out of the bubble, who now see their savings accounts earning 1% a month while those in charge try to reinflate the bubble. And if there aren’t enough of these suckers, some new policies (principal reduction? Direct payments to homeowners?) will be done to keep most of the current occupants afloat so that they do not have to drastically reduce prices. I hope I’m wrong, but this seems to be the intention.

The next Resident Evil movie will be called “Raccoon City 90210”

Call me crazy but I’m looking for a 2-3 br house for under 500k in Culver City or thereabouts, and with enough patience I believe it will be achievable, as I am in no hurry. But for the longest time now, I grab the open house listings and go through them going “no, no, no, no, no,…okay done”. All still woefully overpriced. Hey tsunami, hit already!! But until then renting is just fine.

Nice properties all over the state will drop. But not that much where the supply is low. There are many people with cash ready to snap something up. Most cash buyers or large down payment buyers will be Asian, Iranian, Indian, etc. I have seen this in my city. They have no connection with the American credit crunch, consuming life style. If you are looking for that great deal, don’t be surprised if one of these people snap it up before you. And, if prices get so low that a house in Malibu is up for 300K, I don’t think anybody will want to live in this state!

What is the site the loan information came from? I’m referring to the ultimate California equity withdrawal machine image.

Time News had a quote of the day:

“The credit pendulum is stuck at ‘stupid.’:

* by LOU S. BARNES,

* owner of a Colorado mortgage bank, criticizing new loan requirements that he says have forced him to deny mortgages to qualified applicants

Too many people are tragically unaware of the horrendous calamity which is unfolding. We are still in the very early phases of a general systemic collapse for which there is no known cure. Very disturbing to read of folks thinking of buying when “prices are right”. Crime will be beyond belief. Unemployment, thanks to the Cap N’ Trade policies which will terminate 2.5million jobs per year, will surpass 50%. A shocking “Fascist turn” complete with martial law and curfews will be an unavoidable desperate attempt to prevent utter collapse. People are so naive… they don’t have a clue “what time it is”.

http://seekingalpha.com/article/148232-no-one-saw-this-economic-crisis-coming?source=email

Nice explanation of the FIRE model and how it has become the economic determinant in the US. That and we make a bunch of that plastic that wraps junk you buy in the stores…

Glad you like the Alt-Apes thing, Laura. What I lack in real-estate knowledge, I try to make up for in sarcasm. (aka Sabin Figaro) I’m just an engineer and in the midst of all the CNBC-B.S. DHB was like the one-eyed man in the land of the blind. This guy makes sense and does the research, shows the charts and figures. Most of the MSM clowns just tell you they think this or that, like they’re some expert on some topic and we’re supposed to believe them cuz they say so. Science doesn’t work like that. Show me the data. Tell me why.

@Jason

Crazy? maybe. Ignorant and reckless? more like it. DHB and a number of pros have explained with a million facts and figures why 2011 will be the soonest RE bottoms. Is your income dependent on the remnants of the FIRE bubble? Do you care if you pay 500k (you have 100k for a down payment?) and your house is worth 400k next year? If you can read all this, figure out Cramer is full of siht and a blatant lair, know that Culver City will be the Capital of Atlantis in 16 months, 300 Billion in Alt-A and Opt-Arms are your neighbors, and your state is paying the garbage man with IOU’s; go right ahead. Send in a picture for instant Real-Home of Genius consideration. Make sure to arrange the garbage cans for the photo…I’d renew that subscription to the Lenny Dykstra investment newsletter too. Booya Jason (you are just kidding, right?)

@Obamanation

My brief post didn’t fully communicate my intentions. Firstly I have NO intention of even thinking buying anything now or until the Alt-A Option ARM apocolypse has run its course. But I follow the open house listings ‘for a laugh’ if you will, and to see where things are going. I’ve been reading this blog almost since it first came out so am fully aware of all the info DHB has presented and I know that he’s been right on pretty much everything. It may be I never buy in LA as I’d rather rent and live by the coast than buy somewhere in the scorched earth of more easterly regions. Still, perhaps I needed a slap in the face, so your comment is appreciated!

All right folks,

Just read an article from May in the Healdsburg Housing Bubble. Granted its a few months old but it was a link from another article.

http://healdsburgbubble.blogspot.com/2009/05/reset-chart-from-credit-suisse-has.html

To summarize: #1 Wells Fargo Option Arm loans are mostly 10 year term loans versus 5 year (ie. the actual recasts are set for 2014-16, not the 2009-11, we’ve been thinking). #2 Chase may actually modifying Option Arms for another 5 year Option–ie. keeping consistent with Wells Fargo. Any truth to this?

No matter what happens, I do think there will be a fair number of homes in default throughout 09-11 because 1) loans to those that didn’t have the means to pay (the Alt A, non-stated income issue), 2) generally high unemployment (especially in CA) and 3) there are still a lot of houses that are worth substantially less than their mortgages.

However, if you couple Wells’ loan with 5 year extensions, a general lack of desire on behalf of banks to foreclose and a mandatory government bail out or 2 — we won’t be seeing the high level of carnage originally anticipated.

Any thoughts on this?

Sorry Jason, I know how much you want to put your family in a home that you own, but the risk is so high right now. I was born in LA but am afraid to go back. We are in uncharted territory–nobody knows how this is going to shake out, but it does not look promising no matter how you spin it.

For instance, yesterday, Merideth Whitney gave a dire forecast on the economy but said Goldman will profit from it, like they always do, so the whole market went on a tear.

From Patricia Sellers at Fortune:

‘She likes Goldman because she’s predicting “a tsunami of debt issuance†from federal, state, and local governments to shore woefully underfunded budgets. That, plus a surge in corporate debt issuance (to at least 60% of peak cycle levels, she says) will benefit Goldman, which along with Morgan Stanley (MS) is the last Wall Street giant standing. Survival of the fittest, precisely. The weak fall and the strong get stronger.

…

P.S. Whitney has sells on three stocks: Wells Fargo (WFC), Capital One (COF), and Citigroup (C).’

—-

We never really own anything in this world. Renting is OK. Enjoy your life and don’t worry if macro events beyond your control will ruin your dream.

“The westside won’t drop because foreigners, rich people, etc., etc…”

Whatever. Am I the only one who remembers the early 90s? There were rich people in LA back then too. Don’t catch a falling knife.

(See below, and it’s from a lender!!)

http://www.firstrepublic.com/lend/residential/prestigeindex/losangeles.html

Dr.

Can you shed soem light on the Orange County Area.

Every where else the p[rices seems to be donw, but not in OC.

What do see from the data around OC.

Apprecite all your posts and great insight in to the market

Foreclosures continue to climb in Silicon Valley:

http://www.mercurynews.com/localnewsheadlines/ci_12834550

@Whattado

That’s interesting. One caveat that DHB has pointed out is that people are defaulting and moonwalking long before the recast. Many of these homes are speculation and they can only hold them so long. If the values aren’t rising it’s like have an option on a stock. The option expires worthless and the contract goes to clearing. Another not-small number of homes were purchased by straw buyers, and they don’t make payments at all. Still many more folks are laid off in a depression environment and will lose their home if they can’t make payments eventually. And don’t think there will be bailouts for people. Only Goldmen and their counterparties get bailouts, Everymen just get downandouts.

Always interesting to read your thoughts about the US market, doc. I’m concerned about the house pricing situation here in Europe as well – interestingly it doesn’t appear to drop at all in our area, yet the number of unemployed are growing rapidly and the number of new job listings posted on our site have been decreasing noticeably. Here, too, the rates are ridiculously low and it feels like the governments are trying to put out the fires by pouring gasoline on it. Is it even possible to return to a normal interest rate anymore?

I agree 100% with Depression 2.0. What is coming will be unprecedented. Folks — please prepare. We are headed for a years-long depression.

Leave a Reply