What Should a Home Really Cost? Using Real Estate Valuation Methods to Arrive at a Sustainable Market Price for Homes. Three City Examples: Compton, Culver City, and Rancho Palos Verdes.

One central issue being avoided by many on Wall Street including politicians revolves around pricing homes to reflect sustainable fundamentals. What should a home cost? I know this question may seem too simplistic on the surface but really it is the fundamental issue surrounding the housing bubble. In reality this debt bubble bursting was a reflection of assets being valued much too high. In a classic economic sense this was a bubble. Yet in many bubbles including the Tulip Mania in Holland, once the bubble bursts the underlying speculative fervor pulls away from the good in question and prices collapse to the tune of 90 percent or higher. Yet homes do hold value. People will always need a place to live. It isn’t like a penny technology stock that once the mania burst, was completely worthless. Homes do have a market cost but what is it?

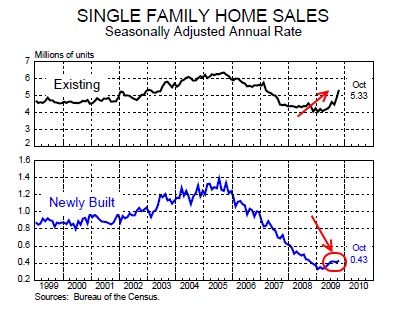

Those claiming that prices hit peaks based on “economics†were out to lunch during the boom. Prices right now also don’t reflect a true free market price because the government is virtually the only player in the mortgage market, has provided a very expensive tax subsidy for buying, and has allowed banks to work their crony accounting magic on what otherwise would be dubious assets. I happened to catch CNBC this morning before the new home sales report was out and they had a countdown clock going. About a minute before the numbers came out, they made sure to undershoot the expectation and of course, the sales report beat expectations. What a shocker. But let us look at this number closely:

I’ll get into the existing home sale jump in a second but that little jump in new home sales was the “giant†beating of expectations. In fact, let us zoom in closer:

At one point in the mania, we were selling on a seasonally adjusted annual rate 1.4 million new homes. Take the above data for what it is worth. We are simply returning to a new normal in new home sales. The existing home sale jump? Much of that is being pulled forward by the fact that nearly one third of all national home sales are foreclosure re-sales and prices have collapsed. In California that number is 40 percent but much of last year it was close to half. That jump isn’t a sign of market stability but a sign that many foreclosures are being sold at much lower prices. For an economy with less money, a lower price will increase demand.

So that brings us back to the issue of pricing a home. Various metrics are used in valuing homes. Some like to use replacement cost analysis. Others prefer to use a combination of methods. In reality there are three major methods:

-1>Â Â Â Â Â Cost

-2>Â Â Â Â Â Sales Comparison

-3>Â Â Â Â Income Capitalization

Take a wild guess which method was overused during the boom? If you said number two, you are absolutely correct. How does this method work? Basically it is the method most appraisers use. They look at three recent home sales in the immediate neighborhood of said home, they look at key characteristics, adjust for other data points, and then arrive at a square foot price for the home. Basically you are taking three recent home sales and arriving at a price for the current home. But you can see how poor of a metric this is in housing bubbles especially one unlike anything we have seen since say Florida in the 1920s, but on a national level. It becomes a game of musical chairs. Comparing three inflated homes and inflating a fourth is not an economically viable method in bubbles but that is how things played out. And that is largely how we got into this mess. Ironically, pricing a home has nothing to do with local area incomes but how much debt people could get their hands on. With money being given out to people with no income and cats with supposed MBAs, it wasn’t a stretch to get massive loans.

The cost approach is used more by home builders or for those buying land. You want to see your actual cost of replacing a home or building a new home. Many of the new homes in parts of the country where the economy has been pummeled are selling for replacement value or even less at times. Home builders are not in it to break even. They were in it to make big bucks when the margins were hot.

The income capitalization approach is the most accurate in giving you a fair market price for a larger area. Of course, you will always have areas like the Hamptons, Beverly Hills, or Newport Coast that really are micro markets and don’t adhere to overall trends. This is also the approach used by most real estate investors. After all, you need to make sure that your expenses are lower than your revenue otherwise you are losing money like any business. Now in California, people used the tulip method in that they thought that housing prices would always go up by double digits so when they sold next year, prices would be higher. That was the extent of their analysis. Much of the fire was fueled by Alt-A and option ARM loans and people not needing to verify their income. How it ever came to sound like a good idea to give people $500,000 mortgages with no verification will provide financial historians plenty of anecdotal evidence to cement this bubble in the chapters of financial folly.

We’ll be looking at three cities in California and try to arrive at a price point for local home prices. This is not a science and given the amount of government intervention, it is hard to predict where things will go. But logic will tell you that without jobs, prices can’t go up since government mortgages at least ask you to verify your income via W-2s. I was talking with someone who works with mortgages and he told me, “it takes so much longer now that we have to verify income and other documents. The government is getting tough!â€Â This kind of mentality shows you how far we have to go if actually verifying your income, the money that will pay the mortgage, is too much to ask for. If anything we need more stringent requirements like this:

I’ve pulled three cities in L.A. County that reflect completely different markets. Compton, a market dominated by subprime lending and a collapse in prices. Culver City, a market with an enormous amount of shadow inventory and with prices not too far from the peak. And Rancho Palos Verdes, a high income area.

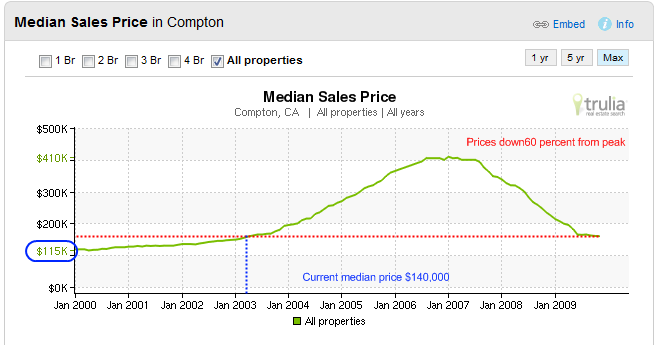

Compton

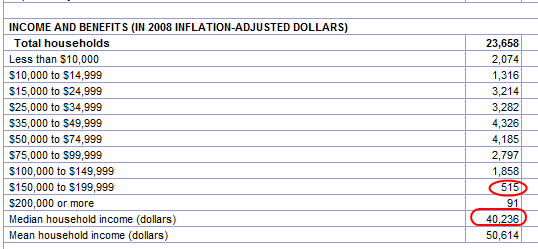

The above chart perfectly highlights the housing bubble. At the peak in 2007, the median home and condo price in Compton hit $410,000. This was an absolute insanity fueled bubble by subprime lending, fraud, and delusion that did not reflect market fundamentals. Some of these homes that sold for $410,000 would only rent for $1,200 to $1,400 a month. Take a look at income data from 2008 for Compton:

The median income is $40,000. So without a doubt, having the median home go for $410,000 or 10 times the gross income of a family was nuts. For a $410,000 home you need at least $100,000 a year. How many households made that in this area? Look at the chart above. Out of 23,658 households approximately 600 met this bottom line number. It is no wonder that the median home price is now down to $140,000, a drop of 60 percent and if we look at condos, the current median is at $110,000. In other words, we are inching closer to prices seen in 2000. This would make sense since California is in a massive budget deficit and incomes have not grown over the decade.

Are prices cheap in Compton? They may look that way if you simply look the median price. Yet valuation of real estate goes beyond the three above methods. Cheap real estate may actually go cheaper. What about employment in this market? Is it stable? Will wages hold up? Just ask Detroit how low home prices can go when an economy is destroyed.

Culver City

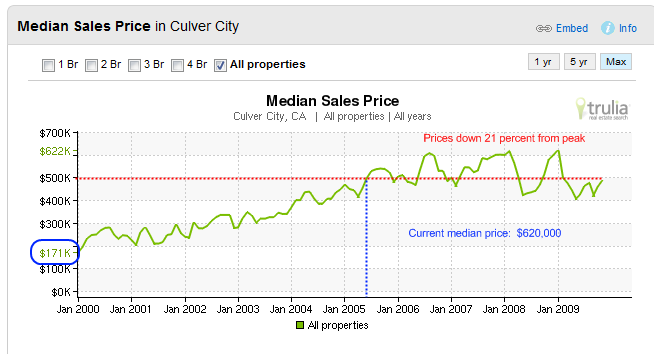

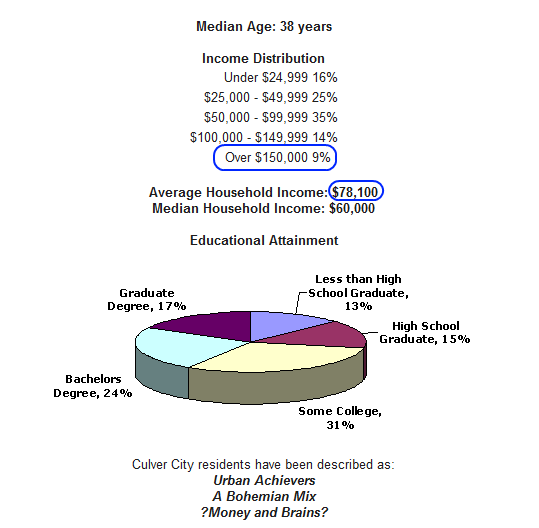

Where Compton prices are inching closer to 2000 price levels, Culver City prices are back to levels seen in 2005 and 2006. The above chart includes condos as well so that is why the median price is lower. The actual median home price in Culver City for last month’s data is $620,000. Overall including condos the median price is at $487,000 so it has fallen by 21 percent from the peak reached in 2007. Here in California, this is the next market segment to look at. Many think that these areas unlike the lower range of the market are immune to seeing prices decline. First, prices have declined. I tend to see the Alt-A and option ARM data and it looks like prices are still much too high. We’ll find out soon enough. But if we use the above metrics of looking at local incomes, employment trends, and home values prices are still in a bubble:

Source:Â Culver City

The $620,000 median home price puts the annual median gross income to home price ratio at over 10. Compton hit 10 but is now down to 3.5. Prices have a lot of adjusting. For a $620,000 home in Culver City, you need an income of over $200,000. Only 9 percent of residents make more than $150,000 a year.

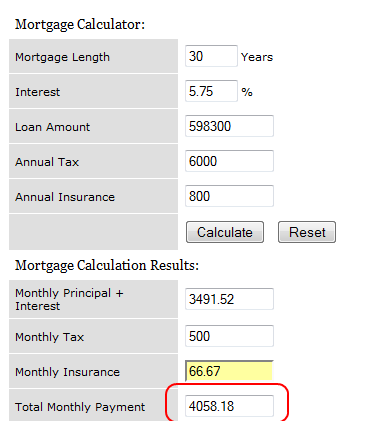

Say you buy this place with a mega FHA insured loan with 3.5 percent down. All you need is $21,700 down:

Your monthly payment is over $4,000 for a home you can probably lease for approximately $2,000. Something is off here. Either incomes are going to boom to justify the current price of homes, or home prices are going to decrease further. And as you can see from the charts above, prices are not going up.

Rancho Palos Verdes

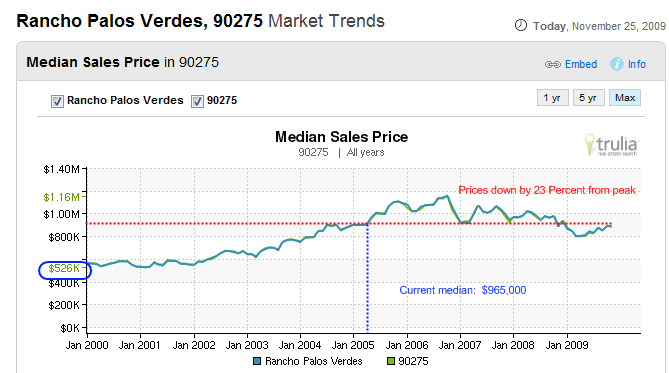

Even an elite market like Rancho PV is down by 23 percent from its peak. The current median home price is $965,000. Not a bad jump from the $526,000 point back in 2000. Yet markets like RPV cater to a unique buyer for the most part. During the boom, many over leveraged with Alt-A and option ARMs and they will wash out over the next few years. But there are many with money that will pay to live in Rancho PV but not enough to keep prices at their bubble peak. How hard this hits home prices is really the next question. Those who think there will be no impact are simply in denial. Look at all the data and metrics gathered. Prices in many areas are too high. Even the high end is feeling the pain. But some think they’ll be buying RPV homes at Compton prices and others think Culver City is going to see another boom in prices. Both cases are not going to happen. But prices will come down to reflect new economic realties.

Conclusion

So what should a home cost? I like using a hybrid of valuation methods. First, what are local rents going for? What is your true cost of ownership after factoring every imaginable tax gift from the government? Is the local economy strong? Homeownership will always be a bit more expensive then renting because of the benefits. But if you look at Culver City and see a mortgage payment of $4,000 on a home that will rent for $2,000 something is going to give in the next year or two. That is the current state of the housing market in California. And this makes logical sense because when too much of your income goes to housing, you have no buffer for economic shocks. A 23 percent unemployment and underemployment rate in California does fall under the category of economic shock.

If we look at historical trends, home values usually stay within a tight range of annual income with a multiple of 3 to 3.5. That is, if a local area family income is $50,000 then home prices can range from $150,000 to $175,000. The lower end of the market like Compton is closer to that range. Culver City? Not so much. But that is the next phase of this bubble. You didn’t expect a decade long bubble to correct completely in only two years did you?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

29 Responses to “What Should a Home Really Cost? Using Real Estate Valuation Methods to Arrive at a Sustainable Market Price for Homes. Three City Examples: Compton, Culver City, and Rancho Palos Verdes.”

“You didn’t expect a decade long bubble to correct completely in only two years did you?” I did not expect the government to spend trillions to delay the inevitable by a couple of years….but now I expect them to spend even more.

At least two mistakes were made.

One, a common one, is to compare median household income against median [single-family] house value, even if there are significantly fewer houses than households. In Culver City, there are 16,535 households and only 7,087 single-family houses available for them. Obviously they can’t all live in houses, so the comparison is relatively pointless. We could look at the median income of top 7,087 households instead is probably in the 130-140k range.

Secondly, rent vs. buy calculation is highly biased against buying. You are using a 3.5 percent down loan with a 5.75% interest rate, even though many families with six-digit incomes have been on the fence, saving, since 2003 or longer, and many of them have enough saved for 20% down, currently sitting in a bank account yielding 1.5% before tax. Tax deductions are ignored, as well as payments towards principal. Even the allegation that a median house in Culver City could be leased for $2000 appears to be a stretch. As of this moment, there’s a total of one detached houses available for lease in Culver City under $2000 on Craigslist ( ath a few that say they are in C.C., but they don’t specify addresses).

I’ve tracked CA realestate prices from 1960 to 2009 and the one and strongest correlation to price movement is the unemployment level. Anything over 7%, sends prices lower. When unemployment is 5.5% or less, realestate tends to increase in price strongly. And that was the old way of calculating unemployment. So at 23% real unemployment, we got a lot of downside left in this market.

Thanks Dr. HB. You make the long wait for a fair-valued house in Southern California a little easier. With all the government manipulation of the market right now, we just need to sit back and be patient, or else overpay.

An excellent read: http://tiny.cc/pPwDZ

Excellent blog. Dubai’s economy tanked today. I wonder if this is the event that will uncover the emperor’s clothing, or will it take some other event. It fascinates me that we printed enormous amounts of money. The economy perked up. Why not! The trouble of course it that nothing changed. Governments all over the planet did the easy part. They turned on the presses. They failed to do the hard part in making structural changes, like separating depository banks from investment houses. This will end in tears.

Jim

Happy Thanksgiving Doc, and thank you for this great blog, which is a true service to the community.

Dear Dr Housing Bubble,

Thank you for outlining the importance of the relationship between household incomes and house prices. You state that housing should range between 3.0 to 3.5 times incomes but this is a little high for normal markets (such as Texas and most of the heartland), where to rate as affordable, housing markets should not exceed 3.0 times household incomes. To allow this to happen, new housing stock must be allowed to be constructed on the fringes (which are the only inflation / supply vent) at around 2.5 times incomes.

I trust my recent article “Housing Bubbles: Why are Americans ignoring reality” available via the US New Geography and Australian On Line Opinion websites, is of some assistance in further explaining these matters.

My colleague and co author of the Annual Demographia International Housing Affordability Survey http://www.demographia.com , Wendell Cox , has also written a recent article asking (available on the New Geography website) suggesting that a bubble is getting underway again in California – simply because the land use regulatory environment does not allow the construction of new affordable housing where people wish to live.

We only have to see the appalling new residential permitting rates in California at 1 / 1000 population – which I believe are the worst anywhere in the world. Speculators in California would be well aware of this Im sure. The US overall would only be permitting around 307,000 annually, if it waas permitting at the California rate.

Once again – many thanks for a most informative article.

Hugh Pavletich

http://www.PerformanceUrbanPlanning.org

Christchurch

New Zealand

IF the point of housing is to have a house to live in then rent is a good comparison, for in both cases you get a place to live. Yes I might put in the tax benefits, but then put in a couple of percent a year for repairs and replacments (roofs do wear out, note that in many places after a house is 40 years old the insurance company will require re-wiring and re-plumbing, there is painting and the like) add this back into the payment and it does go up a good bit, particularly as many of the houses covered in this blog are not exactly new. So if one were to save for upkeep and repair, it would be between 500 and 1000 per month on the Culver City house, sort of wiping out the tax advantages.

So to justify the house purchase one needs to expect investment returns, on the house or it is just plain stupid to 2000 or more more a month for investment returns when you can get between 3 and 4 % tax free on long CA muni bonds.

Lest we forget the lesson of how numbers are being manipulated, bent, stretched, or falsified in the current state of delusion, we should be wary of the latest new home sales numbers. Here is a quote from a recent article:

“Sales of new single-family houses rose 6.2% in October to a seasonally adjusted annual rate of 430,000, according to estimates released Wednesday from the Census Bureau and the Department of Housing and Urban Development. The gains suggested concerns over the expiration of the federal tax-credit for first-time homebuyers were misplaced. However, the increase was driven entirely by a 23.2% surge in the South versus declines in the other three regions, suggesting the possibility of a quirk in the data.”

The truth will set you free Comrades!

Late to the party, but one thing that made the “three comparable values” appraisal style even weaker was that often the mortgage broker had already instructed the appraiser as to the value the appraiser needed to find in order to make the deal happen.

While it’s useful to say “look, the most this guy can qualify for is $300,000, can we make sure we’re not wasting the buyer’s time?” what ended up happening just as often was the broker saying “you need to hit a value of x amount if I’m going to keep sending you business.” So not only was the approach dubious to begin with, it was then cooked beyond recognition in many situations.

Comment by Nameless

November 26th, 2009 at 2:07 am

At least two mistakes were made.

One, a common one, is to compare median household income against median [single-family] house value, even if there are significantly fewer houses than households. In Culver City, there are 16,535 households and only 7,087 single-family houses available for them. Obviously they can’t all live in houses, so the comparison is relatively

>>

__________

You are wrong. All those households have to live somewhere. They may buy the house or they may rent the house. The price of a house MUST reflect what it would bring in rent. (And don’t forget all the condos….not a true SFR and probably not reflected in your numbers.)

>>

Whether you buy the property or rent the property, the amount paid is the fair market value for shelter. Period.

>>

(And save the buy-and-get-a-tax-break nonsense. You only get a substantial break during the firs few years of a mortgage and how much depends upon your top marginal bracket. Repairs and maintainence wipe that ‘tax savings’ out pretty bloody fast. Ever paid for a flooded basement because a water heater burst? I have and I guarantee that fixing that mess was not a few hundred dollars. Then there is painting, replacing the roof every 10 or 15 years, the AC/furnance needs repaired or replaced, a wiring circuit goes and in oms the electrician, the garage door opener quits and the assembly has to be replaced, the lawn maintence and on and on and on….. Rent the place and it someone else’s head. Buy it and get used to writing checks for $2000 -10,000 regularly. )

>>

There will be properties of varying size and of varying cost in any area. Has to be – unless the upper upper bracket care to go without fire, police, clerks in the stores, teachers etc. No one is going to commute 1-2 hours for a low wage job; nor are those like teachers or senior police officers going to stick around if they can never afford to live in the area.

>>

You use the median income because all price (rent or mortgage) represents is the cost of shelter. Same thing as buying vs leasing a car.

Dr. HB you are the voice of reason in this sea of delusions. It is becoming painfully obvious housing prices are to high, as the “Main Street” recession grinds on. We are in different times now, and foriegn countries will not risk shouldering our debt anymore. It doesn’t matter how much sunshine we have, California is plain broke. That means less money for everyone and a crumbling infrastructure. We have reached a peak and it will take a long time and some painful lessons before we make it back. Not too many people can deny it now. Even the Westside is feeling it. Prime lots, North of Montana in Santa Monica are now approaching 50% off.

http://www.santamonicameltdownthe90402.blogspot.com

I wondered how the Dubai default would affect the markets, opened down triple digits, however I just heard a guy on CNBC say “buying opportunity”. I wondered how long it would be before those magic words were uttered. So it looks like everything is just fine. Keep moving folks, there’s nothing to see here.

AnnS:

You are correct, people have to live somewhere. However, if you’re renting an apartment in Santa Monica, it doesn’t mean that you will be looking to buy your first home in that area.

Another example: plenty of college students (dragging down the median income) and young people can live in Irvine with rental options from $1000 – $2500 per month. However, those same people wouldn’t necessarily be buying a SFR in Irvine. It’s not to say that the city isn’t overpriced, it’s just to say that using the median income of every household is an incorrect approach.

The other issue here is that you guys need to look into what a median is. It’s not even an average (mean). It’s the middle number in a list of numbers.

By the media income measure, an avg. house in Newport Coast would cost $750,000. That’s just silly when the construction cost alone of many of the homes in the area would exceed that amount. What’s more likely is that the buyers of homes are from out of the area and are wealthy. There are several apartment complexes and they impact the median income number (lower it) but they aren’t potential buyers of the homes so they don’t factor in the housing demand in the area.

In the past two decades, a few trends have impacted the median income to median household ratio. The rich and upper classes have really pulled away from the middle class in terms of income. People are much more mobile than they used to be and they don’t grow up, work, and live their lives in the same city as much as they used to.

The question is Quick Commentor, why would the rich and people who work very hard to earn a high wage would want to pay excessive amounts of money for property that is otherwise mediocre. Most houses in Culver City are cheap post world war 2 pre-fab bungalows.

As someone who is a fairly high earner I simply refuse to over-pay.

There are a lot more SFHs for rent in Culver City then one house, though they are north of $2k, they are cheaper to rent then buy! Craigslist is not the only source for rentals.

Quick Commenter–

Were it not for the economic disaster of the last several months, your argument would be sound; as things stand, however, your post reads as a monetarist apology.

Nameless & Quick Commentor,

I agree with your point about the market for SFR being distinct from the overall market for housing in a given area, especially where a large portion of the population rents and a large portion of the units available is in rental buildings where people would never want own a property. It seems right to look at the median income of the households that will OCCUPY the housing. Whether its by purchase or rental, the value WILL be determined by the income of the people living there.

And there does seem to be a bigger and bigger gap between those that can afford and those that can’t. Those that can seem increasingly to want to live in certain areas, so they bid them up. It’s a town within a town, and it’s right to look at the median income there, not in the whole.

However, looking at that income breakdown, it makes no sense to suggest that the median of the small town is at $150,000 when only 23% bring home more than $100K. I don’t know what the right number would be… but it looks more like $100K than $150K to my non-math-oriented eyes.

So you still end up with ridiculous multiples that require onerous sacrifice for the buyers. Why would they make that sacrifice? I won’t. Would you?

Quick Commentor

November 27th, 2009 at 10:04 am

AnnS:

You are correct, people have to live somewhere. However, if you’re renting an apartment in Santa Monica, it doesn’t mean that you will be looking to buy your first home in that area.

Another example: plenty of college students (dragging down the median income) and young people can live in Irvine with rental options from $1000 – $2500 per month.

____

Those apartments have an equivalent purchase value as condos. That means that the price of those units to a buyer will still have to be in line with what they can earn in rent.

>>

That valuation will be reflected in the value of condos which are on the market. $1000 -2500 rent means a condo price of roughly $145,000 – 300,000.

>>

The median selling price – properly calculated – includes BOTH condos and single family stand-alone houses. A sale of real estate is a sale of real estate – doesn’t matter if it is a 100% interest in the dirt and a stand-alone 5000 sq ft house or a fractional interest in the dirt and a portion of the structure..

>>

The median price STILL has to reflect the median income. So all those condos (or potential condos) get included. And that means at the value which can be supported by the rents.

>>

You can not slice and dice the housing market prices by creating exclusions to torture the data to get your desire result and justification.

Doc, I hereby grant you several days off for the holidays.

Each of your posts is like a majore college thesis, and they come every several days. Do you ever sleep?

So relax. take some time off and enjoy yourself.

You’ve earned it.

Keep up the good work Dr. You would know better, but it seems to me that the average socal home is valued at $500k. When looking at average income, it doesn’t compute.

A house is only worth what someone is willing to pay for it. That is the first rule of real estate. The reason why prices skyrocketed in some areas was because of loose lending standards, easy credit, and speculative fever. This was a financing bubble, nothing more.

The difference between an appraiser and a broker is that the appraiser doesn’t have to sell the home. He works for the lender. His job is to justify the loan. So he looks for comparable prices, not comparable homes. This was at the heart of the bubble.

I write price opinions all the time. But what do I have to go on? Recent sales of similar homes in the immediate area, there is nothing else.

I also write historical price opinions for a mortgage insurance company, because they’re questioning the appraisal at the time of sale. I have yet to come across one that didn’t way overvalue the house.

If you want to know what a house will sell for or what you should pay for a house, ask a broker for a price opinion. Appraisals are worthless.

When factoring housing costs does anyone at all consider the fact that the cost of education and healthcare has more than doubled in the last couple decades? If the cost of these 2 have gone up so much and the cost of housing even after the bursting bubble is up where is the money to pay for these going to come from? Many people graduate from college with something close to a mortgage just in student loan debt. What are we paying less for now to make up for the fact that these 3 major expenses cost so much more? I believe food is actually somewhat less expensive(inflation adjusted), but I don’t think it comes remotely close to making up for the increase in these 3. All this being this case shouldn’t housing actually dip below the 50 year norm at some point?

Dubai is what we sometimes refer to in engineering as a worst-case-scenario. The incredible flow of money gives the illusion of endless prosperity, and I don’t believe that Dubai actually has any oil. So Cal is just another ponzi scheme that is almost played-out.

US as a whole is not far behind. The Goldmen can gaze out their Manhattan Penthouses to see the waste and destruction they have made. They can fly their private jets high enough so they can’t see all the corpses in the streets. 2008 will seem like an April shower compared to the Tempest brewing for 2010. PTB have thrown every stupid idea they can think of to mask the syptoms, but the root problem is debt is not wealth–it cannot be sustained.

Let’s see what happens when the Santa Monica Fire Department starts getting paid with IOU’s again…

Indeed, DG, I considered what you discussed as well: the cost of living increases seeming to squeeze out disposable income. Yes, it doesn’t add up. I thought perhaps that people were going without other consumer items to explain the increase in home sales, yet we still see everyone with a fairly new car driving around and shopping like mad. Somehow in this debt economy 2+2=9 and it just can’t remain this way. Sadly, as responsible financial persons, I feel as if our dollars are bailing out the irresponsible and in our cases 2+2=3 because we get so shafted paying for others’ cavalier spending. As a case and point, I find it amusing that college students typically vote for liberal tax-and-spend policies, yet balk vociferously when they are asked to shoulder more the cost of their educations. Welcome to Taxes 101.

With all due respect to Hugh P. in NZ, your model for California–“develop the margins!”–is precisely the one that has been followed since the 1950s, and it is NOT sustainable…for the same reasons Dubai is hitting the wall. Starting with the quasi-religious belief that oil will always be cheap and abundant.

~

See Gail the Actuary’s thoughts on Dubai from today’s The Oil Drum:

http://www.theoildrum.com/node/6000

~

I can’t say how things cost out in New Zealand, but the fact is that California grew its “develop the margins!” based income over 50-60 years with a whole lot of externalized, deferred, or mounting but ignored costs. LA is the prime example of a city built on these sands.

~

But I’m open minded. Tell me how a broke state can build more highways, find and pipe more water, expect more people with no jobs to buy more houses (and the crap to fill them) in the frakkin SUBURBS…. And if you could add a bit about how to sustain this model in an era of peak oil, rising fossil energy prices, and even scarcer water, soil, and reliable hydrological cycles, that’d also be nice.

~

Suburbanization–with its vast hidden or externalized costs–is a large part of the problem. Not any solution. DHB’s view is the only rational solution: housing prices within the MOST EFFICIENT core areas of concentrated settlement must be allowed to settle back to 2.5x income, rather than continuing to flog the dying camel of “fringe” development.

~

On the Black Friday topic, financial press is full of “buying opportunity!” type rhetoric (I think it was at CBS Marketwatch that suggests we all bulk up on JP Morgan Chase and Wells Fargo).

~

I am thankful for Doctor Housing Bubble!

~

rose

AnnS:

I’m just trying to explain reality as of today whereas you’re trying to explain what reality SHOULD be. You can’t get overblown appraisals and for most people, it’s not easy to get a loan… yet, prices are where they are… still.

OK, so I get that there is certainly good odds that prices will drop further. But saying that prices have to be 3 to 3.5x income for ALL areas seems pretty unlikely.

Did you know that there are tours where foreigners drive around SoCal neighborhoods to buy up prime and cheap SoCal real estate? Did you know that given today’s rates, affordability is actually pretty good?

Outside of government incentives, there is no pressure for prices to increase but I think a very slow crawl down or sideways movement for years and years is more likely than another major downward leg.

Quick commenter is right that today’s reality does not reflect median price to income ratios. That said, the history of LA’s housing market, including places like Beverly Hills, reflects a steady median price to income relationship for the vast majority of the twentieth century. There were apartments, renters, desirable areas, and wealthy people during those times too.

The current median price to income ratios for most of LA are completely out-of-whack. If there were no means to secure a loan outside of traditional (20% down, 1/3 take home payment max) right now, I think there’d be a considerable return to the historical norm. If a bank won’t let you pay more than a third of your take home pay, and you have no other options, then prices will have to fall.

Currently, the condo market is perhaps the most absurd. $500,000 for a 2 bedroom apartment clone in West Hollywood with a $300-500 HOA payment. Rents for $1500-$1800.

Well maybe the people who are running the show are paying attention to some things we don’t know much about – and maybe Martin Armstrong is one of the people who knows something about what they know – which is why he is being detained – and now moved to a very dangerous high security prison … read his story on Nathan’s blog – and see if you don’t agree – something’s clearly on – http://economicedge.blogspot.com/2009/11/martin-armstong-forced-to-move-to-high.html

Any assistance to help keep Armstrong alive is greatly appreciated. and no we aren’t kidding about that, either.

A couple of comments about where the money is coming from. First smaller families which reduce food, medical clothing and education costs. Second smaller spending on food, possibly leading to the obesity epidemic as fast food substitutes for home cooked food. Third many other goods like appliances are no more expensive than they were 30 years ago in terms of hours worked to buy. Given that a child costs 250k or more to raise to 18 and likley now another 100-200k to get thru college, its clear that fewer kids mean more money to spend elsewhere. This is taking an economic point of view where a child is not viewed as a good investment anymore which changes the push with biology over children.

Leave a Reply