When Mortgage Fraud is Rewarded: Lessons from the Great Depression Part XVIII. Charity for Financial Deviants.

California is now 7 weeks late on bringing forward a budget. Having a late budget of course isn’t something new to the sunny state. However, should we pass Friday of next week with no budget we would break a world record for our state in terms of tardiness of a budget. There has been a bit of silence after the proposal of reducing 200,000 state workers to minimum wage. The Governator has taken it to the courts against State Controller John Chiang who is refusing to follow the order. In typical California fashion this will be settled in the courts Judge Judy style.

The Governator has benefited from the housing boom in California. Money was flowing in like beer at a frat party. Tax revenues from the housing boom made the state extremely rich during these times. Everyone was spending as if they had a Centurion American Express card and had an infinite stream of money. The Governor’s popularity hit a peak in May and August of 2004 around 65% dropped a bit in 2005 then rallied back up to 60%. Currently his approval rating is at:

The trend is also heading lower with grand plans of balancing the state budget via lottery tickets and also his new grand behind closed doors idea of giving money back to subprime lenders! This is why during good times, a rising sea lifts all ships but when things do get tough we see the true colors of a politician. As it turns out, Arnold simply benefited from being at the right place at the right time. Maybe his nostalgia for the subprime lenders to come back and bring in beaucoup money is helping him have a soft spot for these criminal enterprises:

“(LA Times) SACRAMENTO — — One reason California still has no state budget is a closed-door dispute over a tax proposal that could be a multimillion-dollar boon to banks that engage in subprime lending.

The proposal, according to legislative sources and industry lobbyists involved in the private budget talks, was brought to the table by the Schwarzenegger administration at the urging of lenders and other corporate interests. The proponents argued that it would help offset costs to businesses that could result from other tax changes under consideration.”

This is literally what our state has come to. We are now going to offer tax breaks for many of the perpetrators of the subprime lending enterprise. Instead of ransacking these places and putting head honchos on perp walks, we are now going to give them money when we as a state have none!

“The plan would allow many large financial companies that are currently enduring record losses to eventually receive tax breaks millions of dollars greater than are currently available to them. Subprime lenders would be among the largest beneficiaries because they experienced a large boom followed by a bust.

Businesses that have had more modest revenue swings might not benefit at all.

“This is all about bailing out the subprime lending industry,” said Jean Ross, executive director of the California Budget Project, a nonprofit that advocates for low-income Californians in the state budget process. “They will have checks written to them by the state of California if this goes through.”

Absolute idiotic plan. If this is the type of logic these people are using to solve the economic crisis in California this late in the game, we are screwed. No wonder why the Governator now has a popularity rating of 40%. In politics if you preside over good times whether you had a hand in the success or simply were a bystander, you get to ride the blue wave of momentum. It was fun after we beat on Gray Davis and “total recalled” him but now it looks like our budget is about to get terminated.

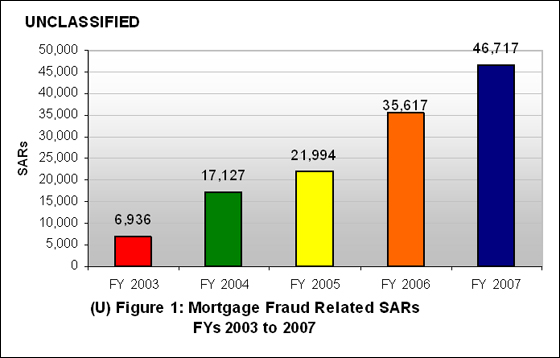

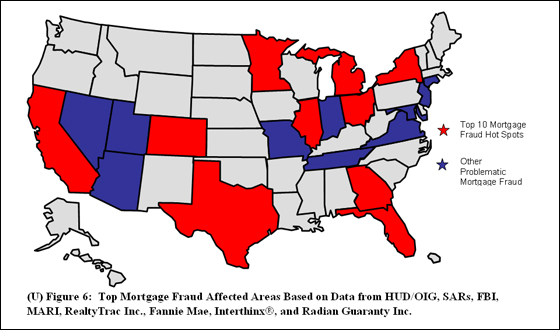

Rewarding criminal behavior isn’t a new phenomenon. In fact, there was so much fraud during the boom that the FBI put out a fascinating study looking at mortgage fraud last year. There finding of course puts California as one of the head perpetrators of fraud:

“(FBI) Mortgage fraud continues to be an escalating problem in the United States. Although no central repository collects all mortgage fraud complaints, Suspicious Activity Reports (SARs) from financial institutions indicated an increase in mortgage fraud reporting. SARs increased 31-percent to 46,717 during Fiscal Year (FY) 2007. The total dollar loss attributed to mortgage fraud is unknown. However, 7 percent of SARs filed during FY 2007 indicated a specific dollar loss, which totaled more than $813 million.’

“Subprime mortgage issues remain a key factor in influencing mortgage fraud directly and indirectly. The subprime share of outstanding loans has more than a doubled since 2003 putting a greater share of loans at higher risk of failure. Additionally, during 2007 there were more than 2.2 million foreclosure filings reported on approximately 1.29 million properties nationally, up 75 percent from 2006. The declining housing market affects many in the mortgage industry who are paid by commission. During declining markets, mortgage fraud perpetrators may take advantage of industry personnel attempting to generate loans to maintain current standards of living.”

Given that subprime was a direct and indirect cause of this fraud according to the FBI, why would we be rewarding companies that facilitated this fraudulent lending? This makes no sense and when the California budget does finally arrive, I am certain that people are going to be digging through it like a California gold miner.

This article is going to look at the fraud and fraudsters during the Great Depression just to give you a taste of our own dubious economic proposals in getting the economy back on track. According to some politicians there is nothing to get back on track since we are already on a good path. This article is part XVIII in our Lessons from the Great Depression series:

14. Bank Failures.

16. Items That Sold in the Credit Bubble.

17. The All Hat and No Cattle Nation

I’ve just finished reading John Kenneth Galbraith’s excellent book The Great Crash of 1929 that gives a historical account of the events that led up to the Great Depression and also the aftermath. What you can’t help to realize while reading the book is how the same charlatans of the past always seem to rear their heads in similar fashion:

“That we are having a major speculative splurge as this is written is obvious to anyone not captured by vacuous optimism. There is now far more money flowing into the stock markets than there is intelligence to guide it. There are many more mutual funds than there are financially acute, historically aware men and women to manage them. I am not given to prediction; one’s foresight is forgotten, only one’s errors are well remembered. But there is here a basic recurrent process. It comes with rising prices, whether of stocks, real estate, works of art or anything else. This increase attracts attention and buyers, which produces the further effect of even higher prices. Expectations are thus justified by the very action that sends prices up. The process continues; optimism with its market effect is the order of the day. Prices go up even more. Then, for reasons that will endlessly be debated, come the end. The descent is always more sudden than the increase; a balloon that has been punctured does not deflate in an orderly way.

To repeat, I make no prediction; I only observe that this phenomenon has manifested itself many times since 1637, when Dutch speculators saw tulip bulbs as their magic road to wealth, and 1720, when John Law brought presumptive wealth and then sudden poverty to Paris through the pursuit of gold, to this day undiscovered, in Louisiana. In these years aslso the great South Sea Bubble spread financial devastation in Britain.”

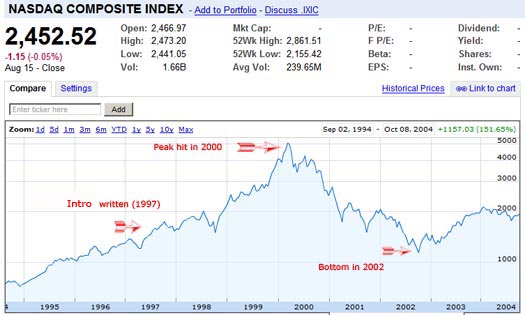

This is a foreword on the book republished in 1997 during the dotcom bubble. The actual book content was written in 1955. Mr. Galbraith goes on to talk about the additional bubbles in the United States and of course, as most predictions his views on the current bubble were a few years early:

Clearly Mr. Galbraith has much more history with bubbles and realizes the danger in making predictions too early. He recognized that in 1997 we were in a major bubble. The bubble didn’t peak until 3 years later only to hit a bottom an additional 2 years later. Yet this gives us a keen insight into the history of previous bubbles like those fueled during the 1920s. Public sentiment takes time to unwind and bubbles sometimes reward fraudsters and sometimes these fraudsters actually become the status quo bringing things into the mainstream:

“Through 1925 the pursuit of effortless riches brought people to Florida in satisfactorily increasing numbers. More land was subdivided each week. What was loosely called seashore became five, ten, or fifteen miles from the nearest brine. Suburbs became an astonishing distance from town. As the speculation spread northward, an enterprising Bostonian, Mr. Charles Ponzi, developed a subdivision “near Jacksonville.” It was approximately sixty-five miles west of the city. (In other respects Ponzi believed in good, compact neighborhoods ; he sold twenty-three lots to the acre.) In instances where the subdivision was close to town, as in the case of Manhattan Estates, which were “not more than three fourths of a mile from the prosperous and fast-growing city of Nettie,” the city, as was so of Nettie, did not exist. The congestion of traffic into the state became so severe that in the autumn of 1925 the railroads were forced to proclaim an embargo on less essential freight, which included building materials for developing the subdivisions. Values rose wonderfully. Within forty miles of Miami “inside” lots sold at from $8,000 to $20,000; waterfront lots brought from $15,000 to $25,000, and more or less bona fide seashore sites brought $20,000 to $75,000.”

This Mr. Ponzi of course is the man who gave name to the “Ponzi scheme” that many use today. He laid the groundwork for many of the criminals today in the housing industry. Yet during the boom he wasn’t seen as a criminal but a player in the Florida real estate bubble. Here’s a nice picture of the gentleman:

During the boom he was making money hand over fist although if people thought about the economics behind the entire bubble, they would have seen how absurd it was. Of course only until a bubble bursts and people start losing money do they begin questioning the ethics or motives behind a quick and rapid rise in money. I think Mr. Galbraith hits on a particular point of any bubble that is important. The idea of “effortless” riches. That is getting money with the least amount of work. This idea is so powerful that when enough time passes by with no economic crisis, enterprising men and women devise ideas to accelerate the process of acquiring money. Some of the ideas are genuine and some border on the criminal. In our current bubble with mortgage backed securities, CDOs, CDO squared, SIVS, subprime, pay option ARMS, and no money down loans the ideas bordered on the margin of bank robbery.

Think about what just occurred in the last decade. Any person with the desire to do so was able to purchase a home with no money down. That is, you were able to take possession of a home, say a $500,000 home with no money down and be responsible for the accompanying $500,000 mortgage as well. No one seemed to care because after all, you were going to flip it next year for $600,000. Such is the delusion that runs deep in the veins of a bubble. I wrote an article last year talking about the Florida Real bubble in the 1920s which looked at a book Only Yesterday from Fredrick Lewis Allen that lays out the entire rise and collapse of that bubble.

Bubbles do burst in fantastic fashion. They end quickly and violently just like California losing 38% of its median home value in one year for a state with 36,000,000 people. Florida burst and the end came quickly. Yet people are reluctant to believe the end is actually here because they are beholden to the mass delusion of the entire game:

“This reluctance to concede that the end has come is also in accordance with the classic pattern. The end had come in Florida. In 1925 bank clearings in Miami were $1,066,528,000; by 1928 they were down to $143,364,000. Farmers who had sold their land at a handsome price and had condemned themselves as it later sold for double, treble, quadruple the original price, now on occasion got it back through a whole chain of subsequent defaults. Sometimes it was equipped with eloquently named streets and with sidewalks, street lamps, and taxes and assessments amounting to several times its current value.”

Just look at the massive drop in bank clearings for Miami in three years. The game comes to a drastic end yet it is hard to believe for those who thought they were “investing” but were nothing more than gambling on housing. During the boom times however the stock market soared. Those on Wall Street were revered and simply having a name on your ticket was enough to make it all better.

“He was a director to General Motors, an ally of the Du Ponts and soon to be Chairman of the Democratic National Committee by choice of Al Smith. A contemporary student of the market, Professor Charles Amos Dice of Ohio State University, thought this latter appointment a particular indication of the new prestige of Wall Street and the esteem in which it was held by the American people. “Today,” he observed, “the shrewd, worldly-wise candidate of one of the great political parties chooses one of the outstanding operators in the stock market…as a goodwill creator and popular vote getter.”

Isn’t it ironic that U.S. Secretary of the Treasury is a former Goldman Sachs boy who is placed at such a high level by the current administration? It goes to show that politics from both parties follow very similar paths in history. Yet fear of course is what guides most people as the bull market kept raging in 1928:

“People remained unperturbed when, on September 17, Roger W. Babson told an audience in Wellesley, Massachusetts, that “if Smith should be elected with a Democratic Congress we are almost certain to have a resulting business depression in 1929.” He also said that “the election of Hoover and a Republican Congress should result in continued prosperity for 1929.”

We all know how that turned out. Even Andrew Mellon during this time was saying, “there is no cause for worry. The high tide of prosperity will continue.” Such was the administration at the time. Only difference here, the bubble burst a year too early to play that game and people have been hurting for a few years. The Governator here in California benefited from the housing boom that only burst last year. You need to remember that even in 2007, prices in California were up on a year over year basis. When I think of all the inane comments about “see, prices are still going up” I just can’t help to think how delusional and arrogant many of these people were. They are the equivalent of Charles Ponzi in 1925 Florida selling real estate to those that never even planned on living in the lots. He sold a dream that only criminal money ideas being washed into legality can bring forth. Everyone was getting rich.

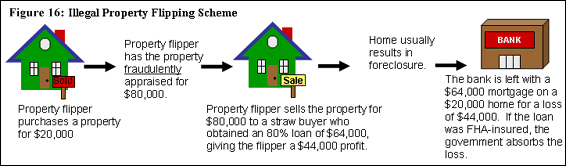

The FBI study has a nice graphic about an illegal property flipping scheme:

The only way something like this can happen is collusion and criminal mindsets from all parties. The problem is the sliding scale of ethics here. First, a buyer needs to with his own free will sign to buy the home. An agent, has to be shady enough to put someone into a home that is massively overpriced. This overpriced home has to be appraised by an equally shady appraiser. The next step is have a broker who really doesn’t give a crap whether the home is “worth” the price since they’ll package the loan off and send it to Wall Street. Wall Street doesn’t care because they’ll sell the notes as a combined package to some unsuspecting investor chasing higher yields. The government doesn’t care since they get tax cuts all the way through the process. This permeated all the way to the top and no one really has clean hands except those that did not participate.

This step would have been averted if local lenders were forced to own a piece of the pie. That is really it. There are many ways to “solve” this problem but making local lenders responsible for the note would at least force some due diligence. After all, if you were lending this amount of money wouldn’t you spend a day investigating the property and doing a bit of research? This is what is happening right now and why the market is slowing down. Sorry to inconvenience you with the need to verify income and actually see if a home is appraised accurately. The criminal mindset is still hungry for the easy money of yesteryear. They won’t be coming back. If you feel so strongly about this system, why don’t you lend the money directly to the buyer? There are places like Prosper that offer peer to peer lending many times to subprime borrowers. That way, you can be the subprime lender with your own money if you feel so strongly about this system.

Of course, the Governator’s move with his council hungry for more real estate returns is yearning for the money of the decade long boom. Sometimes those in authority don’t want the boom to end or to recreate it:

“Some of those in positions of authority wanted the boom to continue. They were making money out of it, and they had an intimation of the personal disaster which awaited them when the boom came to an end. But there were also some who saw, however dimly, that a wild speculation was in progress and that something should be done. For these people, however, every proposal to act raised the same intractable problem. The consequences of successful action seemed almost as terrible as the consequences of inaction, and they could be more horrible for those who took action.

A bubble can easily be punctured. But to incise it with a needle so that it subsides gradually is a task of no small delicacy. Among those who sensed what was happening in 1929, there was some hope but no confidence that the boom could be made to subside.”

I highly recommend you read the book if you have not done so. Mr. Galbraith in The Great Crash of 1929 offers an excellent historical read that has many lessons for our own time. If you want to get active contact your representatives:

Contact your local House of Representative member:

https://forms.house.gov/wyr/welcome.shtml

Contact your Senator:

http://www.senate.gov/general/contact_information/senators_cfm.cfm

Contact your California Legislature:

http://www.leginfo.ca.gov/yourleg.html

Let them know how you feel about what a great idea it is for the Governator to give tax breaks to those who benefited the most via subprime mortgage lending. Many are up for reelection this November and rest assured, much of this is going to be made public and those that support such idiotic ideas should and will be voted out. Make no mistake, in California where we have 7.3% unemployment (a 12 year high), a budget impasse that will go in the record books, and a housing market that is down 38% in one year, the economy is the number one issue. Time to get active and let them know that you are aware of history and that these kind of crony capitalist moves and welfare for the financial criminals will not go in silence.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

14 Responses to “When Mortgage Fraud is Rewarded: Lessons from the Great Depression Part XVIII. Charity for Financial Deviants.”

When you add the CA governor’s bailout plan AND all the state and local programs to assist buried borrowers to monies being allocated by the housing assistance bill just passed, AND the numerous injections of money by the Fed as well as the Shotgun Marraiges of failed lenders to still intact banks, it becomes clear that the total cost of the bailout will be many TRILLIONS of dollars.

I’m in no position to do a comprehensive accounting of every federal, state, and local tax-funded program, but it appears that the public will be on the hook for an amount of money at least equal to the Federal debt, if not more.

At least non-players did not have to bail out NASDAQ tech wreck losers. This current debacle will cause those of us who have waited patiently on the curb while the rampage ran its course, to wait several more years to buy our places…..should we be so fortunate as to still be employed and have our cash reserves intact. That’s not guaranteed… there will be massive collateral damage from this, and it’s happening already, as tens of thousands of possibly innocent people get laid off or suffer steep business reversals. Don’t look to the lenders to help out, either, for credit has never been so tight. Many factories are unable to fill standing orders because they can’t get a loan of a few hundred thou to buy necessary equipment, because the money was lent to some minimum wage earner to buy a mini-mansion back in the days of Easily Manufactured Money.

Wow. Guargantuan post Dr.HB. We are screwed here in California. Only saving grace, is the downturn appears to be accelerating and perhaps it will be quick. The Governator needs to be “totally recalled”.

The Westside of LA is now demonstrating real declines in real estate. Just yesterday, I noticed that land values had dropped over 12% in the West Hollywood/Mid City 90048 (Fairfax) in just over 2 months. Financing has all but dried up here unless you have loads of cash. The banks must be flush with properties and don’t want anymore. My guess is the flood gates of shadow inventory may open soon. As you have mentioned, the list of problems gets longer and longer here in California.

California does appear to be in the pre-stages of another Great Depression. It’s time to do some reading on 1929.

http://www.westsideremeltdown.blogspot.com

90048? Really?

Keep us on track Doc. Good post.

>

Talking among friends I often hear someone say it is a good time to buy. “Hold them for 10 years and be rich!”. Who’s going to maintain them, pay taxes on them, pay utilities etc. during this time? Who is going to protect your interests when HUD moves a crack family into a foreclosed house next door? This bubble is done; wonders are what is next.

>

You are still missing the fuel issue. Heating and cooling may not be much in the Inland Empire but gasoline is. The market is celebrating the reduction in oil prices. It is still over $100.00 a barrel!!! Virtually everything we consume is made from the stuff. Prices are higher than the 78 embargo. Anyone remember that one… Volker and 18% mortages rates ! Here, take a look http://www.forbes.com/home/2008/05/13/oil-prices-1861-today-real-vs-nominal_flash2.html

Yes, 100 block of S.Edinburgh to be exact.

We have here an opportunity of epic proportions.

Using Sheriff Joe Arpio’s “Tent City” model (Maricopa County in Arizona) and the Old South’s “Chain Gain Model”, we could supply cheap farm labor to the Central Valley of California by arresting these realtors, loan agents, appraisers, etc. and using them to pick the crops.

We could then enforce the immigration laws!

We would have a cheap source of farm labor for at least the next seven years and revitalize California’s Central Valley!

Would we do this? No way. These crocks will all walk, very few will be arrested, and another bubble will appear for them to exploit.

Nice post Dr. bubble.

Investors From Europe Buy Real Estate In United States

Many investor from europe and the uk are buying real estate in the united states.

I’ve interviewed a real estate agent in california a week ago and he was telling me how much the market was bad until he started to work with investors from europe and the uk.

“They just have a lot of money” he said.

“I met them during a spring brake in europe. I said to my self there is no work anyway so I will go and travel a little bit.

I think it’s the best vacation I ever had and it’s still continuing , the only difference is that now I’m actually making money”.

Investors don’t need any green card, good credit, bad credit or visa.

They only need to put a least 35% of the purchase price as a down payment.

These investors will get a higher interest rate and if they will put 50% as a down payment they will probably get a much lower interest rate.

Today the euro is much higher then the dollar.

So if the american investors are excited about the foreclosures can you imagine the europeans?

For the europeans everything is much cheaper than for americans, because the value of the euro as oppose to the dollar.

Can a foreigner really get a loan in america?

Sure they can get a loan, just like an american investor can get a hard money loan without showing any credit information, they just need to show interest. interest for a mortgage lender is measured with money. banks or hard money lenders will loan you the money but you will have to put as a down payment a big chunk of your money. Than you will not going to loose the property you’ve purchased and get the banks in trouble.

Also there are many banks out there that are selling their Loans or notes to foreigners just because they need to take some loans off of their shelves, just the way you’re trying to avoid foreclosure or trying just to sell the house.

Banks today have to deal with so many issues like foreclosures, bankruptcies, notes and money in general.

Most banks that have loaned money to borrowers in the past 3 years are not protected or insured.

Three years ago the bank started to loan 1st and 2nd mortgages, 2nd mortgages are the cause of them not having mortgage insurance. So because they don’t have mortgage insurance they will loose their money if a foreclosure is placed.

So why did the banks offered borrowers 2nd mortgages?

Because it was easy to qualify and a lot of borrowers tried to avoid refinancing their 1st mortgage.

Banks just wanted to make money and more money and that’s what they did.

Now the banks are not willing to Loan 2nd mortgages anymore.

Read other articles I wrote to learn more about mortgage insurance.

Hey Nate, why don’t you pay the good doctor for peddling your toxic cr@p!!

As of August 18, 2008, EMC (formerly owned Bear Stearns, now a subsidiary of JP Morgan), no longer will permit the sale of individual Notes to investors. It’s blocks, or nothing. Found this out from an investor friend who was 9 weeks into a Note purchase from EMC and was to close this Thursday. Um, nope! At least, that’s what they told the individual investor. If it’s true, who knows?

The deal was going to wipe out an EMC 1st/ 2nd for some fairly big numbers (it’s in the OC), but someone decided it’d be better to just FC on the place. Amazing – they pulled nearly $ 3/4 million and no FC off the table in the hope / dream that they’ll book an additional $100k if they actually pursue the FC.

The buyer was not a furrner. I’m pretty sure they’re all in China at the Olympics right now. Wait! Maybe the DQ News release – all those 43% of houses that were once FC’s in CA were bought by furrners! That must be it! Stop the presses!

Or, not.

With all due respect, Doc, not *everyone* goes along with inflating bubbles. I’ve experienced a number of them in my life, starting in the 1980s (inflation of real estate out east), going through the ’90s in the Bay Area, and now into the Oughts with housing. In every one of these, the voices of the sane and prudent were drowned out by dreams–and sometimes actualities–of avarice.

So what happened to the mainstream presence of a genuine and powerful voice counter-weighting the Ponzians?

We all are aware of how print, broadcast, and Web news pandered to the financial and real estate and builders’ industries–which is part of why this blog is so important (well crafted contrarian information open to anyone who can afford Internet access).

I would include in the “fraud” category the media outlets that printed or broadcast anything the NAR and housing industry handed them. PR and advertising posing as news.

In an era where work, saving, and investing become the activities of suckers, it doesn’t help to have the media pounding the drumbeat that the only path to security is getting rich quick. As with the tech bubble, the people who get in earlier always need someone to buy them out. Until the whole thing falls apart. As far as I can tell the housing bubble was very systematically handed down the line till the least able bought the product. I personally believe that this was part of the systematic effort to wreck New Deal entities Fannie and Freddie, among other things, and to turn back the tide of democratization of home ownership by “liberating the hell out of it” (so to speak).

Thanks, Doc.

rose

The european market is coming down to earth too.

Just look at the U.K. and their “housing crash”

Unemployment in good old Europe is alot higher than here and

most women that have children must stay home because there

is virtually no day care available and children are signed up for

waiting list on preschool at the time of birth…

Most european countries have such a strict guild system that

forces a 3 year apprentice ship. Just try to change your job…

if you learned to be a plumber… than a plumber you shall be

for the rest of your life…

There is no such thing as jump in and swim… even slight variation of

an office job requires the completion of an apprentice ship.

Apprentices spend 3 years on minimal wages and are Europe’s cheap labor.

After you are done with your apprentice ship… good luck finding a permanent job. Your employer that taught you the skills for 3 years is most likely going to hire a new apprentice and now you have a certificate…. and still no job.

With any luck you get a job and if you are in a “guild” related occupation

you are now a journeyman… working once again to get your master degree.

You would be amazed it isn’t just the baker and shoemaker… oh no…

from electrician to auto mechanic specialized for one automaker only,

So, if you “learned” BMW it is esentially useless to apply at Mercedes Benz

You wouldn’t be qualified. While Europe has essentially more benefits for

their working and non-working population, it is strict, stiff and can not

accommodate the “free spirit” and adventure loving nature of some people.

I would rather be a workaholic in America with little safety net but no restrictions as to what I do for a living instead of being in a safe and sound cage in Europe doing a job I didn’t really want but was forced into because it was the only thing I could get an apprenticeship in.

Yes, John Kenneth Galbraith’s book “The Great Crash of 1929” is a great read. He followed this up with a very small book titled “A Short History of Financial Euphoria”. This book is lots of fun, and in Galbraith’s style, points out the absurdity of the whole mess in 1929, including various characters and their roles. There actually were a few astute economists, including Paul Warburg, who warned of financial disaster but were vilified by those who wanted the “Good Times” to roll on. Its interesting how history does not recognize those who may have warned of a coming financial disaster, but focuses on the crooks. There’s no doubt this bubble mania will reoccur, possibly in some other area of the economy, but will manifest itself the same way with the same results. Everyone likes a get rich quick scheme and so it goes……

UNBELIEVABLE IS ALL I CAN SAY!!

The market is down and individuals are actually out there getting into bidding wars with the prices. My husband and I have been looking for a home with a local realtor here is Fontana for the last couple of weeks and today we got a answer on a home we put a bid in for last week at 308(NOW I am talking the nice part of Fontana….92336 with a great school district….I still think 300k is pushing it but hey nice new home. We were advised that they would love for us to match the current bid that just came in at 320K are you KIDDING ME!!!

Realtors are holding on to offers waiting to see what the highest bid is going to be. My realtor had the nerve to tell me to be ready to dual with multiple offers on each property. I am so sorry to tell you but this is not 04,05 or 06 and This is not going to happen.

I guess my 2nd American dream will be just that A American Dream.

Hey here is a great Laugh

By the way Got a Home of Genius you should check into for Fontana

5777 Shea Court Fontana 92336

Sold on 6-20-08 for 274,300

Today asking price 330(wow and they have mutiple offers)

Everyone enjoy your day!!!!!

Leave a Reply