Why Did the Housing Phenomenon Spread? 3 Key Reasons for a Social Epidemic: Housing Connectors; Mavens; and Salespeople.

In examining the housing bubble we need to acknowledge that certain people have a better understanding of the economics behind the housing market. Even though practically 100% of the population lives or rents a home, a very slim proportion actually understand the dynamics of the housing market enough to spread the gospel of housing wealth. From Malcom Gladwell’s principles and other sources of behavioral economics we realize that three principles players exist in spreading any social epidemic; and do not kid yourself because we are in an epidemic of biblical proportions. The key players are the housing connectors, the housing mavens, and the housing salespeople.

Housing Connectors

In every society we have key people who are massively connected in the community. They know everyone. From congressmen to doctors to your local supermarket manager. These people can spread information quickly because they have access to the ears of those who will listen. You can look at the massive growth in MySpace for example. Otherwise a very small and obscure website, a few techies spread the word to key people on college campuses and all of a sudden millions in the population have their face plastered on the internet for the public to see.

Those in the housing community known as the housing connectors are the hedge funds, the mortgage back security markets, and the Federal Reserve. The hedge funds played a massive role because they created a market in which trading mortgage backed securities (MBS) was possible. Not only was it possible it was profitable and in a world with low returns, hot money was seeking better yields. Then we have the Federal Reserve dropping rates after the September attacks:

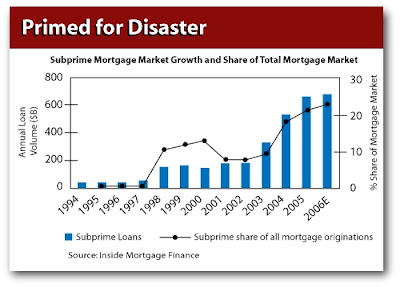

If you recall, we did have a very brief recession that was stifled by an absolutely irresponsible monetary policy that created multiple bubbles that we are now dealing with. The Federal Reserve not only dropped key interest rates, they encouraged folks to take riskier mortgages. Remember Alan Greenspan talking about ARMs? Good job AG, make a bubble before you hit the public speaking circuit. He would leave you to believe that this did not increase the amount of money flowing to risky mortgages. Take a look at the chart below:

The key thing to remember here is the access these connectors have to the public. They are the tip of the pyramid and have a podium to the public. When Alan Greenspan encouraged riskier mortgages he was essentially giving the MBS market a blessing that exotic mortgages were okay. Once this message was processed, Fannie Mae and Freddie Mac felt as if they had a government safety net protecting them in case anything would collapse; otherwise known as a lender of last resort label.

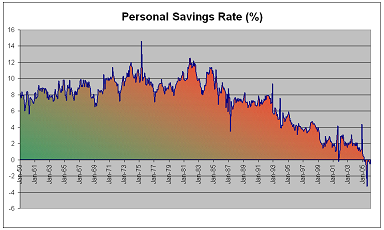

The problem with this logic is of course that encouraging unmitigated debt spending would cause inflation and even worse, the bubble we are currently in. Then we have Bush ushering in the patriotic movement that spending was as American as apple pie. What happens to the savings rate?

I like visuals because they colorfully highlight the credit mess we are in and vividly portray the direct correlation between all these actions. Since the economy was supported on credit spending and now that credit is tightening we will see a withdrawal effect and I have discussed this regarding the Duesenberry Effect. It is very hard to give someone massive access to credit and suddenly turn off the spigot; have you ever given a child a lollipop and suddenly taken it away? If you have, that’s pretty messed up but you will get an understanding of what will happen when the credit lollipop is taken away from the public.

Housing Mavens

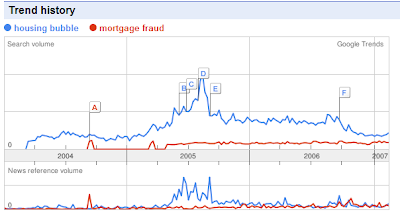

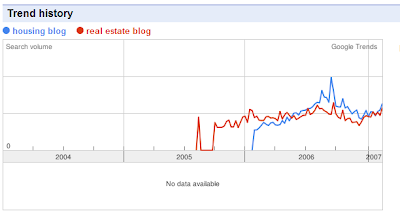

Those that have access to information and massive amounts of information are known as the housing mavens. They are information brokers. They spread information because they enjoy educating the public; people that fall into this group are housing/economy bloggers, housing bears, housing bulls, and economist. These people have many listeners but do not have the massive network of the connectors. However when Mavens talk, people listen. Initially, there may be some doubt from people catching on to the information but slowly the information traffic picks up. Let us take a look at searches in Google for the past couple of years:

You notice a couple of interesting things from the query. First, housing bubble searches peaked in the summer of 2005, which for the nation is about accurate. Then we see a trailing off effect. Many coastal readers are thinking this bubble is over but keep in mind not everyone lives in

From the above, you can see that many folks started searching for housing blogs starting at the peak of the housing bubble. This interesting growth for alternative media is what is driving a quicker and much more pronounced decline in the housing market. Information travels at the speed of light and people are looking for alternative pieces of media. The benefit of this is that people have options of what they hear. Many mainstream media pieces have been driven by bloggers and housing mavens such as Redfin, who was featured on a 60 Minutes piece arguing against the sacred 6% commission.

Housing Salespeople

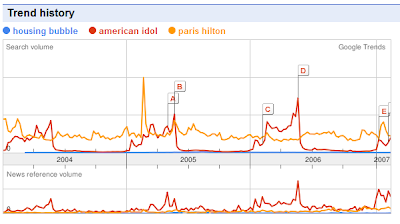

As you may have noticed not everyone cares about the housing bubble. People care more about Paris Hilton or even American Idol. Take a look below:

It is not fair to assume that everyone is interested in this market even though we have folks earning minimum wage buying $720,000 homes. Given that housing isn’t at the forefront of everyone’s mind, how did the American public become captivated into this frenzy? The final actor in this play are the salespeople. These are the agents, brokers, gurus, and housing pundits that pushed this market beyond any economic fundamentals. I am reminded of a quote from Walter Bagehot:

“The reason why so few good books are written is that so few people who can write know anything.â€

When you read Rich Dad Poor Dad or any bathroom literature you are given vague ideas of how to pursue wealth. It makes you feel good. Certainly it is more uplifting than reading Manias, Panics, and Crashes but at what cost? We are certainly bound to repeat history if we do not learn from the past. And this hyper-bubble is another lesson in psychology that human nature, for whatever reasons will always remain with us. Greed is a profound desire and many of the salespeople, via charm, persuasion, or any of their other tools was able to convince people that a $500,000 box is worth every shiny penny.

The fact that we have so many people in the sales ranks is another testament of the growth of the housing bubble. In fact, we have a bubble in those peddling the bubble; those that are agents and brokers. When the market declines and housing takes a hit these jobs will go away. They are the prototypical cyclical job. Unfortunately we have a tremendous amount of people in this industry. In addition, the mere assumption that these jobs are extremely high paying, we will lose a lot of consumption when people are laid off or cannot find work. Many will need to go back to school to learn a new trade or take a massive pay cut. They will no longer be in the work force or fully productive.

So there you have it. The three market brokers of the housing bubble and why it spread as it did. Not everyone was equally responsible but from the top like the Federal Reserve to the absolute bottom of graduate students buying outrageously priced homes, this bubble is one for the ages.

Subscribe to Dr. Housing Bubble’s Blog to get more housing content and your full dose of Real Homes of Genius.

Subscribe to feed

Subscribe to feed

11 Responses to “Why Did the Housing Phenomenon Spread? 3 Key Reasons for a Social Epidemic: Housing Connectors; Mavens; and Salespeople.”

Good job, sir. You actually seem to know the subject very well. Maybe you should write a book!

When presenting your case of the unholy trinity (you do address the buyers & fraudsters, so maybe it’s quadrilateral quackery), the subtext appears to me to be that while there was no explicit conspiracy, there seems to be some sort of implicit collusion. Witting or unwitting, that is not yet clear.

It’s possible that one begat the other, without any undue influence. Presumably the natural flow which greed took affect, once people in these positions grok to the “new order.”

As an aside, I can give some people a little slack for just getting caught up in the magic of the moment- people who bought for appreciation and extended themselves in doing so. Sad about them.

But those individuals that refi’d more than once or twice (seven or nine times?), “bought” new “homes” from developers and sat on their hands awaiting their bonus for being prescient; the loan officers who took advantage (they can never say ‘no’ that would be against the American Way, no?); the packaging of MBS and CDO then hiding the bad loans amongst the good; the agents (“boosters”) who got their vig for just being there and putting forth little and occasionally sinister effort; and more. What would we expect happen, they are only human.

The case might be that it was all a setup to pit serf against serf and let the old boiler room adage “if they’re stupid enough to fall for it” be the this bubble’s motto. After all, they were only following their bliss.

So yeah, plenty of blame to go around.

Great blog BTW.

Great post, Dr. HB!! You always call it dead on and straightforward. Some of you bloggers should get together and write a scathing book about this industry and bubble.

I heard a rep from NAR on XM radio (which I am sure was really a disguised commercial) saying that there is still more demand than homes, the market is still strong, sub-prime will not affect anything, appreciation is still happening, now is the time to buy or be priced out forever, blah blah blah…

Total propeganda that will sure lure some more asses to their seats. I was laughing through the whole thing!!

I guess I’m more cynical than most: I think this bubble (and the series of other asset bubbles that followed) are no accident, but a result of intentional design.

It’s unfathomable to believe that Alan Greenspan DOESN’T know what an asset bubble is: it’s covered in Economics 101! He wrote theses on the topic back in the 1960’s! I know he says that you can’t recognize a bubble until after it bursts, but I find that as laughable as claiming the Earth is flat.

Therefore, when AG ‘blessed’ the creative loan devices that adequately assessed the risk of sub-prime loans a few years ago, it’s clear he was simply endorsing their wider implementation. Same when AG said earlier this year that the sub-prime meltdown would not be an issue IF housing prices only rose ANOTHER 10%! If that’s not the musings of an architect who’s mourning his design coming to end-of-life, then I don’t know what is….

We’re in an economy that is dependent on getting hyped up via artificial stimulation: following 9/11, the Bush admin used EVERY economic trick in the book to prevent the economy from going into a recession. They pulled out ALL the stops: lowered capital gains taxes, lowered taxes and interest rates, increased deficit spending on Afghanistan/Iraq, reduced regulation of business, revamped bankruptcy laws, etc. If there was a trick to be done to stimulate the economy, it was used.

As economist Christopher Thornberg jokes, Alan Greenspan and baseball player Mark Maguire are both suspected of artifically boosting performance!

But why did they do this? Al Qaeda and other extremists want to defeat the West via financial warfare (hence why the WTC has been a desirable target, first attacked in 1990 with a failed truck-bombing). If the 9/11 strike had sent the economy into a recessive tail-spin (and it nearly DID), that would be a HUGE victory for the terrorists.

So suddenly the patriotic thing for all citizens was to go out and spend, spend, spend. Unlike World War II where the population was asked to CONSERVE for the war effort, suddenly we were asked to CONSUME to help this effort. Ironic, eh? And what better expensive item to buy than a HOUSE? There’s very few credit cards that have $750k credit limits!

People were fighting the ‘war against terror’ with their credit cards at the local malls and realtor office, and it certainly helped stave off a recession (or arguably, will only make the day of reckoning much worse: the bigger the asset bubble, the more painful the correction).

So now that the housing market is officially DOA, where’s the excess liquidity going? Wall Street? As if people already forgot about the dot-com bubble collapse! Let’s not forget that SOME people made tons of $$$ riding the real estate bubble wave, at the expense of many others who got saddled with mortgages for over-priced homes.

Some economists believe we’re in a permanent bubble economy, where citizens are forced to chase after a series of asset bubbles to hope to catch the bubble de jour to get that enticement of passive income.

Unfortunately, I think our government realizes that they’ll be unable to provide for even the social security payments due for a retiring baby boomer generation, so it’s becoming every man for himself.

Adam smith sez:

Some economists believe we’re in a permanent bubble economy, where citizens are forced to chase after a series of asset bubbles to hope to catch the bubble de jour to get that enticement of passive income.

If it isn’t clear from my earlier comment, I am not an economist. But even I squirm when I see how pronounced the bigger fish syndrome has become.

When we were a company that actually produced something (besides towers of paper) tangible, there was a strong work ethic and tremendous pride in being an American.

Now of course we eat our young and stupid for breakfast, as if that’s an American ^H^H^H^H^H^H^H admirable thing to do.

I think, Adam, you have your finger pointing in the right direction toward the problem. The question (rhetorical) is what to do about it?

How I wished there was an answer.

Perhaps we (Americans) wanted this dream of home and security and a full stomach, all with clean hands, and a “service” economy was the end point.

Well, one out of three isn’t good- unless it’s a batting average in a competitive league.

And whose hands are clean?

numpty mchoon,

Welcome on board to the housing rollercoaster. In terms of who started this there is no question that those with the loudest voices and political clout, those in the real estate syndicate, had an incentive to push real estate as the investment entrée of the day. I am reminded of the quote from Upton Sinclair:

“It is difficult to get a man to understand something when his salary depends upon his not understanding it.â€

Take a look at the top Political Action Committees. Notice that the top three have something to do with Real Estate?

They don’t vote strictly for Republican or Democrat, they are for the bottom line. They hedge their bets by betting on both parties with a slight bias toward those who’ll make them more. Conspiracy? Maybe not. Self-Interest? Absolutely.

Socalwatcher,

Thank you. Each and everyday our voices are getting louder. Suddenly the housing bubble isn’t some made up Dr. Seuss story being followed by fringe bubblelistas wearing tin foil hats. This is serious business, enough that 60 Minutes dedicated a whole piece to attacking the sacred 6% commission and did a good job at it. Ironic how the previous bubble in technology is helping kill this bubble in real estate via Redfin, ZipRealty, Zillow, or many of the do it yourself website. When was the last time you used a travel agent?

Adam Smith,

You bring up many good points. I think your assessment is spot on. I am reminded of a fact in psychology that many more depressed people have a better grasp on what is real (i.e., famines, injustice, pain, etc) than those who are normal. If we are to focus on all the realities of the world we wouldn’t want to live. That is why it is important to have hope and the fortitude to address what is wrong with our economy and fix it. No point in sticking our head in the sand and blissfully ignoring the impending economic doom.

Those in the housing camp would love for this bubble to continue ad nauseum. I can only pause and reflect that Countrywide announced yesterday they will be hiring 2,000 more people and issuing a 50 year subprime mortgage and reverse mortgages. Un-freakin-believable. With these kind of tactics why stick your head in the ground? It’ll cost you $20,000 for that 10 square feet over 30 years on interest only.

Hi Dr. HB,

I can only pause and reflect that Countrywide announced yesterday they will be hiring 2,000 more people and issuing a 50 year subprime mortgage and reverse mortgages. Un-freakin-believable.

As you know, predatory lending has been extremely profitable for decades, and mortgage lending is just an extension of that well-established trend: what better way to get consumers on the hook for a lifetime of home debtorship than to issue a 50-year loan? I’m reminded of the strangehold of a Boa Constrictor: slow and steady does it, and the exhalation of the victim are when the snake tightens it’s grip.

For when you look at the difference in the monthly “nut” for a 30 yr vs 50 yr loan, it’s amazing how much more interest you’ll pay in the 50 yr loan, PLUS you’ll not even enjoy much of a decrease in loan payments each month! Truly a sucker loan…

FWIW, PBS ran a special series about 4 years ago entitled “The Secret History of the Credit Card” that was very revealing of how extending credit to the masses (especially those least likely to repay) is extremely profitable.

Even though it’s a few years old, this article is worth a read:

http://tinyurl.com/3akc96

Notice the appearance of First Lady Hillary Clinton in 1998: she knew the extent of the problem of predatory lending, but later caved to special interests and campaign contributors when push came to shove! Notice credit card issuer MBNA being the largest contributor to Bush’s campaign.

Also notice how the article predicted problems with sub-prime loans (“loan to own”, so named as the lender expected the borrower to default) years before we got in this mess….

My take is that none of the so-called sub-prime meltdown was an accident, but was a squeeze-play by conventional bankers on the “smaller” start-ups (like New Century). The newbies had figured how to side-step the conventional lenders to enter the lending game, channeling money from Wall Street to borrowers.

OF course, the “upstarts” had to be countered as a threat to the business model of the existing players (does this remind anyone of NAR trying to kill redfin?).

So here we are in 2007, with predatory lending as standard operating procedure: the bigger lenders like CW (CountryWide) now feel they can safely service a market segment vacated after the failures of New Century, etc, as bigger players like CW feel they have sufficient reserves.

So my conclusion was the big lenders were watching, trying to gauge just how tightly consumers could be squeezed (what the market could bear), without actually killing the victim: they don’t want to kill the goose that laid the golden egg! Hence why they’re now pulling back to reduce the number of foreclosures, etc.

I believe NONE of this (the price run-up, the increasing use of dangerous loan terms, etc.) was an accident, but expected as the end-game: by all accounts, it’s all going according to the plan.

I am reminded of a fact in psychology that many more depressed people have a better grasp on what is real (i.e., famines, injustice, pain, etc) than those who are normal.

Just as an aside: remember how President Bush was amazed to see a bar-code laser scanner at the grocery store check-out a few years ago? His existence has been so detached from a normal existence (e.g. going to the grocery store) that a laser scanner seemed novel to him.

This is the type of person who is directing policy concerning the lives of Americans…

Being overly realistic and seeing things for what they truly are instead of idealizing everything is one of the factors in clinical depression.

Think about it: Seeing stripes on a zebra as stripes on a zebra is called being depressed. Living in lala land and seeing things not for they really are, but for what you want them to be is called normal. With the attitude of SoCal people, does this ring a bell?

“Everyone wants to live in SoCal!”

“Housing in SoCal NEVER goes down!”

“I will get whatever selling price I want for my house!”

And so on. That is why Southern Californians have this reputation because they are seen as living in the clouds by the rest of the country.

Thus, through the wonders of Television and media, everybody sees this mystical world called California and try to emulate it.

I agree with the theory that this whole scenario by banks and lenders was planned. Figure this: get everyone locked in to debt for long periods of time. Then, you have GUARANTEED profits of enormous proportions for many many years to come because they get so over their head that they are locked in. What a wonderful plan! America does indeed eat the stupid for breakfast.

I also agree that the subprime meltdown is similar to Chernobyl in error. Shut off the spigot, everything overheated and KABOOOOOM!

Glad I have no debt, cash in the bank and discipline after making my mistakes…

tsocalwatcher said: “Being overly realistic and seeing things for what they truly are instead of idealizing everything is one of the factors in clinical depression. ”

LOL! As someone with clinical depression and looking for a home in the ridiculously-overpriced Baltimore Co., MD, area, I got a chuckle out of that comment. 🙂

It’s been a depressing process, and I mean that literally. So much for irrational exuberance….

Think about it: Seeing stripes on a zebra as stripes on a zebra is called being depressed. Living in lala land and seeing things not for they really are, but for what you want them to be is called normal. With the attitude of SoCal people, does this ring a bell?

I think, socalwatcher, that you are on to something here.

The herd mentality as practiced here means driving a statment to work, sleeping in a lifestyle environment, exercising with state-of-the-art, eating upscale, and being seen with trendoids so they TOO can be identified as such.

As a person who has struggled with depression his entire (long, long) life, I think I can say with a certain amount of exactitude that it isn’t me that’s off, it’s…. them. The rest of the louts who make believe but whose lives are lived in something of a bubble that they strive very hard to steer away from sharp objects.

I say, call a spade a spade (erm, that’s not politically incorrect is it)(who cares, it’s that sort of thinking that got us here in the first place).

By Ged, Dr. HB, I love yer blog.

PS I really despise word verification. Why can’t it be more legible? I’ve attempted six times to get this !#$&$ right, and my vision isn’t faulty. It’s a pet peeve, I know, and a necessary evil, but I’m too lazy to start a Blogger account (I am WordPress man).

I am not an economist (but I play one on TV). I have yet to read anyone placing any large amount of blame for the bubble fiasco on the tax code. I’m pointing the finger at home mortgage deductions, depreciation and credits for rental improvements, and possibly most important, Section 1031. That particular part of the code lets the flippers skip out on tax payments provided that they plough the bloated gains back into real estate. These were the folks parked out in front of condo sales offices at 4:00 in the morning, sweating under a desperate 45 day deadline to throw their bucks at slapped up particle board or face getting hammered by Uncle Sam. Overpay $10, $20 or $50K for a souped up doghouse? Beats giving the bucks to the govt. with no chance of getting it back. Watch late night TV and notice how many real estate, get rich quick infomercials there are…, this plague of mom-and-pop speculators has got to stop. I hope they get hammered.

Stimulate demand, no matter how well-intentioned the original legislation might be, and you stimulate price. I think Adam Smith had that figured it out awhile ago. I don’t look at the recent high percentage of home ownership in this country as a sign pride and confidence but rather an indication of how terrified young buyers were of being priced out forever.

Leave a Reply