The worst may still be ahead for housing – 3 million homes foreclosed on in the last three years with another 5 to 7 million foreclosures in the pipeline. One third of homeowners believe they are underwater.

Ignoring a problem might bring temporary relief but ultimately a day of reckoning must occur. The underlying problems with housing have been swept under the rug for many years like dust trying to be ignored. Yet the dust is still there and it will ultimately need to be cleaned up. The housing market is simply in a temporary lull yet more troubles are ahead. Take for example the HAMP program that was designed to help 3 to 4 million homeowners. As of the first quarter of 2011 only 634,000 loans have been modified. Why was this program such a major failure? Simply put the program sought to fix an issue that was temporary in nature yet the reality was that the housing collapse is much more systemic than a temporary problem. It was a massive bubble embedded in our banking system. Perspective is important here. Over the last three years some 3 million loans have fallen to foreclosure. Yet some in the industry are projecting another 5 to 7 million foreclosures by the end of 2012. If we figure that foreclosure is the ultimate sign of housing failure then the worse may still be ahead for housing.

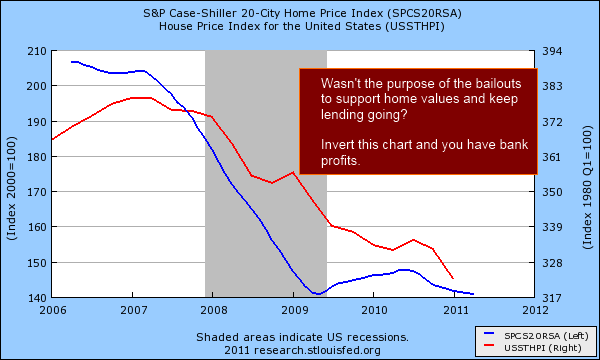

Home prices falling for five solid years

Home prices continue to move lower and are now bouncing in a short-term trough. For some parts of the country home prices are more justified with local area incomes but other markets like in California remain stubbornly in a bubble holding pattern. I think the psychology in bubble states keeps prices inflated even longer because people want to believe that somehow the rules of economics do not apply to their own area. Of course, home prices have fallen hard in many once untouchable markets yet many are still willing to bet that things will somehow miraculously turn around even though the economy is weak. What is even more surprising is the notion that with broke state governments and a broke Federal government that somehow taxes will not be going up. It is only a matter of time that taxes move up and in a state like California where property receives favorable treatment I would suspect that this will be on the table shortly. Taxes seem to be blistering high on everything but property in the state. Regardless of the politics money is running out and tough choices need to be made. So how do we envision price appreciation in property with this economic climate in mind?

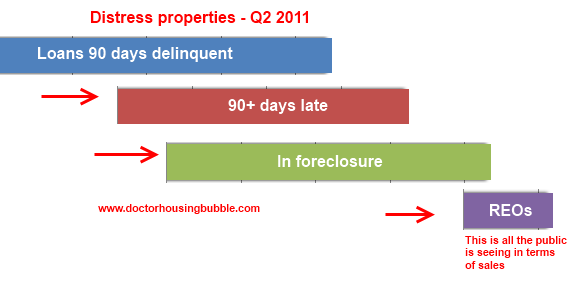

Loans currently in foreclosure

Over 2 million loans are currently in the foreclosure process. To envision 5 million more foreclosures in the next two years isn’t hard to imagine since nearly half of those homes are already in the process and only waiting to be finalized. It should be obvious to most of you that the banking bailouts were merely programs to protect financial institutions from facing reality. That was it. It was one giant bread and circus spectacle to fool the public into believing that somehow these bailouts were necessary in keeping home values inflated (instead they inflated the pocketbooks of bankers). Now the government is talking about renting out REOs as some kind of solution. We have gone back to square one except we have already spent most of the money on propping up the financial institutions that caused this mess. People are losing faith in the system especially with the insanity now going on with the debt ceiling. Apparently we have no problem dolling out trillions of dollars to banks so they don’t have to practice normal accounting procedures but when it comes to paying our bills we now have to tighten our fiscal belts? What an odd universe we live in at the moment.

Half of mortgage holders think they have equity

It would seem that homeowners have a better grasp on reality than those on Wall Street. Only half of homeowners actually believe that they have equity in their home:

“(DSNews) Less than half of homeowners – 49 percent – currently believe their home is worth more than the amount they still owe on their mortgage.

…One-third of homeowners believe they are underwater with their mortgage, and 18 percent of respondents said they weren’t sure.â€

I find this fascinating because it sheds useful information into the psychology of the current homeowner. If you believe you are underwater you are less likely to list your home for sale I would imagine unless you had to desperately sell and had the cash and desire to rid yourself of the property. I see this happening in cases of a job move or a divorce for example. Yet this reality now shows that the data is matching up with perceived notions of housing value. People are now more accurately valuing their property. This also is a likely explanation of the lack of move up buying in this market. I find it amazing that 18 percent of those surveyed simply have no idea whether they have equity in their property. Maybe this group simply does not care? Consider this another lingering symptom of the housing bubble mania. With a 20 percent down standard you can rest assured that most people would know if they had equity in their home.

Where future foreclosures are coming from

Here is the drawn to scale pipeline of future foreclosures. We have roughly 6 million mortgages in some state of distress or foreclosure. As you can see from the chart above the REO category is a tiny fraction of the other problem properties gearing up to hit the market. Again, this relates to our argument that ignoring problems does not solve them. The banks felt that after five years of nonsense that somehow, another bubble would hit and home values would be back on their way up. Well guess what? That has not materialized because incomes are falling or stagnant! Watch the mainstream press and you will never hear a figure given for the median household income. Even on those “professional†housing shows you get a home value but you never get the breakdown of household income even though this is by far the most important factor in purchasing a home. Of course they don’t want to open up that can of worms because they want everyone to continue spending mindlessly and keeping the gig going especially in housing.

This mess is going to drag painfully out. Just look at how the synergy between politicians and investment banks work to keep the public in the dark. 3 million finalized foreclosures in the last three years with another 5 to 7 million coming up in the next two years yet somehow things are on the mend. What kind of math are these people using? Probably the same math they are using to deal with the debt ceiling.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

73 Responses to “The worst may still be ahead for housing – 3 million homes foreclosed on in the last three years with another 5 to 7 million foreclosures in the pipeline. One third of homeowners believe they are underwater.”

A house down the street from us had an open house, and my wife and I walked through just to be nosy. 439K for 900 sqft 3/1 in Burbank. Now by current Burbank standards this house is reasonable. Guess what. That’s why the place was packed with people looking at it. Unbelievable. That box will probably sell in short order. I guess there are plenty of buyers out there??? What’s going on? Didn’t anyone get the memo. Get rich quick on real estare is

(estate) is over!!

PIMCO says that in Orange Country, they do not foresee prices going up. Which means that for the indefinite future, prices will not go up, so people will rent instead of invest in housing. PIMCO states that the income does not support prices going up with 20% down and 28% of income, the new lending rules, and lower govt loan amounts.

And to add to the post above the reduction of the mortgage interest tax deduction, conforming & FHA loan limit decreases, and credit downgrades of Fannie and Freddie. There is no upside.

In order for the unemployment number to remain level, we have to create around 175,000 new jobs every month, due to increase in the U.S. population (around 2,500,000 a year.)

Last month, the number of jobs created was around 15,000. The layoffs from Borders books and Cisco alone, will exceed that amount.

correct, do not forget the birth/death model that padd’s the BLS’s numbers.

Jobs and revenues, why can’t the admistration, put 2 and 2 together. When you have nation that 40-90% of monthly net income goes to shelter costs you eliminate those funds from being saved and/or spent into cirulation. 3 million home, how many vacant, but yet the biggest sector in housing is new multi unit buildings….Do we really need more shelter? just comical.

And another 2,000 from RIMM. Hewlett Packard gave some indication a couple months ago that they may be laying off, too. I expect others will as well.

With 50,000 factories or 10 percent of the total factories being sent overseas ib the past 10 years it doesn’t look good for employment any time soon.

Hey Doc! How about a quick & dirty analysis of Thousand Oaks? My husband and I have been renting in the area for a year but he is getting more anxious to buy and less convinced that prices are still inflated (or maybe just less convinced that they’ll actually come down substantially in the next year). It seems homeowners out here think their 2400 sq ft cookie cutter home is worth $750K and I’m not sure why. (Because the schools are good and the area is “great for families”? c’mon now people, is that really enough?). The newer homes in Newbury Park (built w/in the last 10 years) are even more expensive and aren’t even close to 2003 price levels. We have this fantasy of putting 20 – 30% down and getting a 10 yr loan on a house that costs $600K or less but lately that seems unlikely. Median income here is pretty high – around $100K. So are we delusional, Doc, or are the sellers?

Love your post & keep up the good work.

schools are only good because of 750,000 home vlaues and the property tax revenues that come along with those foolish shelter costs.

IMHO, T.O. and the surriounding areas have a high concentration of public service employees from Ventura and LA county. in addition, hollywood flim industry, all have been very much non effected by the down turn. keep renting, if you feel the need to buy look for rental homes in markets that have adjusted downward and that cashflow.

All I can say is, “have patience”. I understand the urge to purchase a house and be able to say, “Yeah, we bought this house.” “It’s ours, har har har”. You have the thoughts of being able to have people over to YOUR house. etc etc etc. I know the feeling because I did that in 2006 (“strategic walk” in 2009, call it what you want).

Instead of thinking of all of the “plus” sides to owning, above all, trust your gut and trust the facts. Your post has a lot of indications that tell me you really feel uneasy about this whole housing market. Don’t fool yourself into thinking, “Oh my gosh, it’s never going to come down! We’ll never own a home and show everyone that we’ve really “made it”. Instead, we’re just poor renters that can’t afford a home like everyone else… woe is me!”. If it doesn’t make financial sense to you, then don’t tie up 20-30% of your money for the novelty that will wear off when you realize no one else really cares that you “bought” a house. Remember, you need at least 10% price appreciation if you want to sell and “break-even”, not to mention new costs of purchasing another home. Moving from house to house as an owner is much more expensive than moving as a renter.

I’m not trying to dissuade you, but it is very important to really consider everything instead of just focusing on some short-term ego-boost. Don’t argue stability, either. I’m sure any landlord would be very happy to have a long-term tenant if you decide to stay for 10 years.

Closing thoughts: Leave the risk to the landowner for the next 5-10 years. What do you have to lose? At worst, another housing bubble (I just laughed out loud). At best, there is an earthquake and everyone takes a 30% hit on their housing prices, plus another 30% when those that are already underwater decide to walk, as well.

DON’T BUY IN THESE DAYS, PEOPLE!!!

My closing remark about not buying… doesn’t apply to every situation. I got a little carried away. 🙂 I know there are places in the U.S., and even in California, where it does make sense.

Jeff, thanks for that postscript. There are in fact people for whom buying will work just fine…but in the present situation I would not easily assume I were one of them.

I was running some numbers on how much we’ve saved, and banked, by living this past decade within walking distance of where we earn our income, and buying only 12 gallons of fossil energy each month, TOTAL (no natural gas or oil or coal for the house either). We chose to put a good portion of that into improving the house’s energy efficiency. We don’t seem to need the stuff that others do–hot tubs, wine rooms, fleet of cars, cruises, etc.

We won’t see that money probably, in the permagrowth Greenspanomics sense so many got used to. But after renting for 25 years (each of us), we both were ready to live somewhere that we got to decide certain things. Like to turn a master bedroom into a woodworking shop, and a mess of frakkin’ lawn into native vegetation, and a place to store three years of firewood and grow as many vegetables as we wanted to. Or not.

We stuck to our fundamentals in 2001 and bought a house in line with them despite RealTorz and banksters trying to tempt us into million-dollar waterfront places. We expected to be here for the long run and never expected to “sell it for more than we paid” even though there was a massive price run up 16 weeks after our signing the mortgage (60%; 40% down payment). Even at that, I felt we overpaid by about 5%, and in retrospect I would have driven a slightly harder bargain than the 15% I got the sale price reduced by because we were in no hurry and the seller was getting antsy, being in over his head.

In all this time I have always expected the “value” of this house to retreat to that 2001 sale price, and even lower. But we don’t have to sell, thank the gods, at present…and so. As Laura notes down below, that really is what a lot of people are facing. They know they are going to HAVE to sell, and they will come out seriously behind. So how do we all make the best of a bad situation…. But that’s exactly what my grandparents and parents said life was like in the Depression. It’s not always growth uber alles.

I see DHB constantly pointing to the need for a mental shift, so that people assess the facts AS THEY EXIST in each person’s situation. He honed right in–yet again–on what happens when people “have to sell” because of a job loss, job change, or whatever. THAT is the killer, that questionable stability thing, and I think it’s emotionally hard on people, because we’ve been taught since the 1950s/1960s that our lives should be a continually, routinely unfolding series of things you do and buy, in order to get to the next upgraded step/purchase. Also, !!!things must never get smaller!!!

So potential buyers, do be careful. It’s not enough to figure the numbers on the mortgage, taxes, carrying costs. And we all know what bullshit “How much house can you afford” is/was. Now one has to assess whether or not they’re in a steady situation or not…and really, none of us knows that.

So if one is going to make a commitment that will cost out only over 10, 15, or 30 years–if it costs out at all in the conventional OR the NewThink manner–one had better be clear about all that. And if you’re not clear, or don’t wish to be, then be prepared for some shocks later. Be aware of how well you ride out shocks like that; some people are undone by them, others bob on the chop like seagulls. “Preparing for the worst” isn’t limited to canned goods in the basement, and a zombie gun in the closet.

If I were in the exact same situation we were in 2000 and 2001, even though prices are lower locally than they were at that time and our income is higher, I would NOT buy here at present…though people are doing it every day and the Inflatable Suburbs Barracks houses have come down hugely in price in the past 3 years. And when I do searches in the greater Seattle area (“Pugetopolis”) I’m amazed by how many things I find for $150K and less. This was not the case 3-10 years ago. Still, I wouldn’t buy now except under a very restricted set of conditions…and in all honesty, I’m not even sure what they’d be.

The other cost factor that is often overlooked is maintenance. In addition to your time, it also costs money. These costs are chronically underestimated by RE owners and investors.

“Renting in VC”

if you are in a comfortable rental, ride it out at least thru this Fall. Good rentals are getting harder to find, especially with good, stabile Landlords. If your rent is fair, there shouldn’t be a problem finding someone to take over if you find the right deal. Too many beautifull New homes in Newbury Park on tiny lots at too high of asking price. Something has to give soon. We are getting kicked of of great rental… Good Luck to you.

Prices have come down in T.O. In my neighborhood of 1200-1400 sqft “starter homes” prices have dropped from an absurd $600-650K down to a merely ridiculous $400-450K (should be ~$300K to get down to 2001 pricing). Unfortunately it seems that much of the low hanging fruit (really desperate, distressed sellers) has already passed through the system. What’s left in “affluent” areas like Thousand Oaks is a bunch of sellers who can afford to wait – either delaying a move or carrying their old home as “accidental landlords” while they wait probably for years for price recovery.

I agree with DHBs basic premise that these prices are ultimately unsustainable in real terms, but if enough folks have enough money to wait for a decade then nominal price inflation (i.e. dollar devaluation) may just give them their wish.

Sadly, I believe more and more that we are indulging in wishful thinking around here. Prices may never fall much more in “desirable” areas. Instead price appreciation may just be grindingly slow for the next 10-20 years. Investors lose, frugal buyers looking for bargains lose. Homeowners lose too (through opportunity cost as they’re obliged to hold on for longer than they’d like), but lose less than we all believe they should.

There’s really no two ways about it. Prices do not make sense with current incomes. The result will be that these two metrics must move toward alignment. If prices are made sticky, then a healthy market will not resume until wages have risen to sensical levels. Given the stagnancy of wages over the past 20-30 years, one has to wonder just what social and political conditions will be born from the current economic wasteland we’re traversing. Instability in one often spreads to the others, and the course we’re on is not headed toward any significant recovery in the foreseeable future.

Next week is my escrow and moving out of Westlake Village / TO.

I bought my house 2003 when Bush delcare war on Iraq.

My wife and I have jobs near LA. So we decide to sell and move.

Our house is 30 years old. 2400 sq ft with 7k lot.

Very similar house sold for $665k last April. We listed $659k.

some one offered $589k, which was passed.

every 2 to 3 weeks we reduced $10k.

Second offer was $600k, which was raised to $620k.

We remodeled minimum $15k, realtor $30k, roofing & termite $6k.

We made only $50k. But we enjoyed living the house.

We tried 91011 area for 6 months without success.

Even full price and sometimes more.

Since we are lack of time, we rented for same size for $4k per month.

I plan to buy next year.

If you don’t mind relatively old house (30 years), I would like to recommend back of TO post office, Octagon shape area, where I lived 8 years.

Good luck for your house or renting!

A $600K house with 25% down is a $450K debt, along with taxes (going up, from Prop 13 grandfathered levels, to 8x for the new sucker) and maintenance.

If you HAVE $150K + closing costs, keep renting, buy silver and look for jobs in a free State. You have a good down payment (or 100% down, no payments for a modest dwelling) in much of the reasonable parts of the USA.

Losing $150K in cash-money in the housing casino would be tragic. That much money is a minor fortune in much of the world.

Best wishes.

3 million foreclosures in 3 years or 1 million a year seems to be as fast as the banks are able move. If there will be at least another 5-7 million more foreclosures, then it will take another 5-7 years.

One could argue that that the bottom in RE could be near….but I dont see any chance of rising prices for many, many years to come.

Anybody else getting a spam letter from Ron Phipps, National Assoc. of Realators? I’ve gotten two telling me about the new Qualified Residential Mortgage law coming out and his advice on writing my congressman in opposition. He even makes it easy for you. You just have to click on a button and a screen pops up, you fill in basic info like name and email, then you click on send and the form letter opposing the QRM law which, get this, requires banks to demand 20% down payments on future loans. I’ve been sent several of these so I guess the NRA wants lots of form letters flooding the congress.

Maybe it’s time the Dr. or other action group set up an email system in support of the QRM. Anybody know much about this new legislation?

Agreed Kurt, I was just thinking about this today. I’m certainly going to write my representative to make sure the FHA conforming loan limits are allowed to expire. The Dr. or patrick.net, or somebody else that aggregates a lot of potential home buyers needs to help organize an effort to influence congress. I’m sure they are getting tons of letters from realtors, lenders, home builders, etc. about the QRM measures, conforming loan limits expiration, and mortgage interest deduction elimination, in a very organized campaign. Unfortunately we are letting everyone that has an interest in keeping prices high and unaffordable, speak for us. We need to let them know collectively that the average borrower is interested in lower home prices, not easier access to credit and large amounts of debt.

I agree, we’ve taken enough of a beating in too many ways to just sit on the sidelines and watch the circus continue. It’s time to take action!

The truth is ,most people who bought from 2003 – 2009 are now underwater. This accounts for so many Zombie listings on the market. There are very few homes on that are ABLE to sell, because they do have some equity. As prices continue to drop, more and more will be underwater. Invariably, we will have more strategic defaults and more bad bank “assets” or, actually liabilites. The charade by banks will become more evident and fewer people will risk buying a home. Until ALL the inventory comes to market, the declines will continue slowly and painfully.

http://www.santamonicameltdownthe90402.blogspot.com

http://www.westsideremeltdown.blogspot.com

Just to clarify…

If 1/3 of “all home owners” are underwater, and 1/3 of all homes are owned free an clear…

Then that would mean, 1/2 of houses with a mortgage are underwater.

To further clarify, according to my calculations, there is only about 6% equity left, on average, for those who actually have equity because 1/3 of homeowners are free and clear. So, if we get a national median price reduction of 5-10% in the next year, which many people fully expect, then we’ll actually be at a point where the average homeowner does NOT HAVE ANY equity whatsoever. Pretty amazing and pretty scary.

Clearly it’s a very dangerous time to consider buying in many, if not most, markets, so be careful out there! I, for one, plan to wait a number of years, build more equity, and then possibly buy free and clear (or at least close to it) once price stabilize in the next 5-10 years. Until then, it’s going to be one painful slow-motion train wreck for everyone on the sidelines to watch…

Good luck to everyone,

Investor J

http://www.meetup.com/FIBICashFlowInvestors/

http://www.meetup.com/investing-363/

Thanks for posting that; it’s pretty insightful. No one that I know of is looking at the thought that the standard view of homeownership is being underwater. And that we might be there as soon as next year.

To further clarify, the 1/3 of all homes that don’t have a mortgage, owned free and clear, are mainly 75 year old (or older) clunkers. Not houses that were built 30 years ago and were recently paid off.

In a lot of small towns and in large swaths of run down cities you won’t see hardly any homes that were recently constructed. A lot of older homes in and around Detroit are being sold for $15,000. I assume they are being given away and the $15000 covers a few adminstrative costs.

$15000 sounds like a bargain, but these houses need a lot of work, and there aren’t any jobs nearby, so how are you gonna live, unless you are receiving a pension of some kind.

@Allen White

1Million per year by foreclosure, but some of the pipeline will certainly be burnt off in other ways… such as short sales prior to foreclosure… I think it will take 3 years to burn through the supply.

Interesting title -“The worse may still be ahead for housing…”. I do think there is a good possiblility that this will end up being true, especially in overpriced areas. I like in a town on the California coast. Most of the homes here are very old and many of them need a lot of work, yet the starting prices for these homes is in the high $500K’s. It’s crazy.

It angers me greatly how the government and the banks are artificially propping up home prices. Anyone doubt this ? – Barack O-man admitted this in his 2010 State of the Union Address. When their efforts fail – and they will – housing will drop a lot and find its free market equilibrium. These insanely high prices, which benefit BANKS and GOVERNMENTS (higher payments and higher taxes) make the homeowners poorer. And the O-man admitted to this shameful policy in his speech (he worded it very slyly though).

Here are O-man’s exact words: “That’s why we’re working to lift the value of a family’s single largest investment — their home. ” Sounds good doesn’t it? Maybe he could have worded it like this instead “We’re working to make homes more difficult to afford for homebuyers,” or “We’re working to keep the housing bubble, aka massive scheme, alive.” or “We want more money to go to the bankers, and less money to stay in your pocket.”

It’s not the job of the goverment to artificilly manipulate the markets. It’s not their job. It only makes things worse!

They’re from the gubberment and they’re here to help

*insert pause here*

Bwahahahahaaaa!

On another note – look at this real estate woman tell about the property taxes of a newer home in the Sacramento area – what a damned rip off. On many newer homes you have to pay your regular taxes, plus Mello Roos (as a friend of mine calls it a “scam tax.”). On one nice home in the Sacramento area, I saw the MONTHLY homeowners association fee of $220/month. I thought, what the hell do you get for $220/month???? Answer: NOTHING!

It’s a shame how they have made “homeownerships” a business of ripping people off and absolutely taking working class people to the cleaners.

Agree with a lot of what was said. Between HOAs and Melaroos taxes even if the home has a good price you will still end up paying a large amount of your income for ownership because of these 2 factors. Maybe your mortgage is only $1000 per month, but suddenly you add in $200 HOA and $300 Mellaroos and your house payment just went to $1500. The worst part of it all is that you can’t really buy any home built in the past 10 years without paying these in California.

As to the 18% who “don’t know” if they have equity or not, my guess is that most of them are either slightly underwater, or have a small amount of equity. It seems reasonable enough to me that many people would be in a position that they wouldn’t be able to say for sure whether they were in a negative or positive situation unless they actually put their house up for sale and then found out one way or another.

The remainder of the 18% who “don’t know” are simply in denial. They are just NOT going to think about their own situation, they will cross that bridge when they come to it. They don’t want to believe that they have made a dumb financial decision, so they shove the whole, horrible problem out of their minds.

There must be MILLIONS of families who know that their situation is hopeless and that they will have to dump the house, but they are trying to hang on until Suzie graduates from high school, or the older daughter’s wedding is over, etc. I’ll bet that there are plenty of families who have “done the math” and figured out the approximate month that they can stop making payments and still be assured of keeping possession of the house until Suzie’s graduation.

You are SOOOO right! Worst of all, they are borrowing from family, taking out of 401k and have stopped saving anything for Suzie’s college education. All so they can maintain the facade a year or two longer.

It is so tragic and sad. No good options.

Well, here is what the Fed says:… (see bold text – LOL-LOL)

No US home building rebound until 2014 – Fed paper

(Reuters) – U.S. home building likely won’t return to normal levels until 2014, and then only if housing prices rebound and foreclosures drop sharply, research from the San Francisco Federal Reserve Bank showed.

Continued weakness in the housing market is dragging on the U.S. economy, which is losing ground under the weight of 9.2 percent unemployment and declining consumer confidence.

DONT KNOW WHAT IM HEARING BUT IN 1965 BEFORE FRACTIONAL RESERVE LENDINGS PRINTED UP 40 TO 100 DEBT DOLLARS THAT COMPETED EQUALLY AT A HOUSE BID/BUY PROCESS WITH EVERY DOLLAR OF SAVINGS FOR EVERY DOLLAR OF BORROWING IN HOUSE TRANSACTIONS THE AVERAGE HOUSE COST 8700 AND THE AVERAGE YEARLY WAGE FOR AN INDIVIDUAL WAS 8700, AND TODAY THE AVERAGE WAGE IS 24,000…??????????????????????????? CAnt be this many floundering fish..with votes..??????????? my places are not “:average” they are special, just like evewrybody else”s>>????????????????????????????

The current Depression/Recession was caused by a failure of private debt, not public Federal Reserve Debt.

Private debt, otherwise know as “Credit Default Swaps” far exceed dollars printed on a “non-gold standard”. Which is meaningless.

Public debt, out of control dollar printing presses did NOT cause this crisis.

Private banks, issuing private debt (CDSs) did.

You should be against private debt, not public debt.

This interests me. I understand how debt can increase money supply. The CDS market is eye-wateringly enormous. A collapse there has the potential to eviscerate entire economies. As such wouldn’t a prudent government put limits on credit default swaps? Doesn’t the government bear some responsibilty here?

The only thing Federal about the Federal Reserve is in its name. The Federal Reserve Bank is a PRIVATE bank owned by private citizens who are stealing from the american citizens. It was set up by an act of congress in 1913, private citizens were given the right to issue currency in the name of the United States. They are only out for themselves and their bankster friends. It is Crony Capitalism at its finest.

Please stop shouting.

I have become addicted to this blog.

My husband and I got bitten by the homeownership bug, although we have always been diehard renters, since we’re from New York and buying wasn’t on our radar like it was for a few of our friends. Now those friends are short selling for hundreds of thousands of dollars less. It’s hard to see. Tragic, really.

We have been looking at homes (mostly because I am a lookie loo and just like getting a peek), and recently we did see one we fell in love with in La Crescenta. There were multiple offers for it at $400K. It’s an REO. Adorable. A little out of our price range, so we didn’t even bother throwing our hat in. The bank apparently went back to the offerers and gave them a chance to make their last, best offers.

What do you think, readers of this blog? Does this indicate that with prices dipping just back into the range of affordability, perhaps the frenzy will begin again, since there are so many families like mine who did not buy during the bubble, are tired of living in apartments with kids, and are now seeing opportunity where there was none before? La Crescenta has great schools and this was a good starter house for a relatively good price (in that area), and I think it just created a little bidding war. And I’m wondering if this type of activity will stabilize prices when more REOs hit the market from the shadow inventory. People might just be, like us, super duper tired of waiting for a house.

We were almost there, but ultimately we didn’t want to live in a place that looked like it would someday slide down the hill (reading the history of La Crescenta/La Canada/Montrose kind of wigged me out a bit–too many mudslides). And…it was about $50K too rich for our blood.

Thoughts? Be gentle. I am new to the game.

There are actually quite a few homes we could afford in Lake Balboa or Northridge. Nice places. Okay schools. Not bad at all, around $320K. And that makes me wonder if things are turning, shadow inventory and all. Or at least stabilizing. Because when a person like me, who has never owned and stayed out of the bubble, sees a house that looks reasonable, it’s like water after walking through the desert. And I wonder if there are more like me.

What you’re seeing are the last echos of the Feds trying to artificially stimulate the economy. They’ve added about 12% to the GDP, and when that goes, the GDP takes a huge hit. Think of what a negative 10% GDP will be like to the economy. A huge spike in unemployment, a big drop in consumer confidence, and less home buying. And another round of companies going out of business.

It’s sort of like the bubble that the Fed blew in 2009/2010 with the phony tax credit. Many of those buyers are underwater now. So too will many of today’s buyers be. Some within months of purchasing; many within a year.

The Fed has no choice now but to do QE 3 in order to try and kick the can down the road a little farther. But they’ll get less bang for the buck once again. Eventually they’ll run out of options, and we’ll be looking like Greece is today.

Just sit tight. Today’s buyers are simply removing themselves from the competition when prices do their next round of price declines. It’s Darwinian evolution in action.

Hi Julie,

I too am hooked on the blog. My wife and I were quite close to buying last December, but thanks to this blog we got our emotion out of the buying and are happily stashing our cash away until we think we’re ready and we wait out the market a bit more. We put in 3 offers in the Northridge/Granada Hills area and we lost them all due to a few reasons.

Home 1) stubborn standard sale – elderly person moved and just would not close a 15K gap. This house was recently removed from the market.

Home 2) Sweet bank owned deal! We were outbid by about 20K and from what I can tell, that house is now under water.

Home 3) Short Sale. We were narrowly outbid but are in backup…

Since December we’ve of course seen values decline, and better markets open up. (Like Sherman Oaks and Burbank). I honestly can’t see buying a home for at least another year which I expect at least lateral movement of home prices, but upward movement of my own savings. Additionally, I’m glad we did not buy as my work is definitely not solid ground. There are also just too many bad things going on in the world at local (California State issues) national (U.S. issues to many to list) western world (floundering major Euro Countries) and Mid East (Arab Spring). I just think it’s much too volatile to buy real estate at the moment.

You appear to have a wide range to work with. DHB had a writeup I think in the past couple of weeks that had housing declines in location based bubble chart. Further flung areas have declined the most. My take away was that better investments might be found in areas further out from “desirable” areas (Santa Monica, Studio City, South Bay). I still feel like the surrounding Northridge area still has a bit to fall though as I see it doing so still. I’m on the edge of my seat waiting to see what happens this fall though.

Hi Julie.

The decision between renting and “percentage ownership”, i.e., buying, is based broadly on two categories of reasons: 1) financial and 2) intangible-private-emotional.

The first has been amply covered in the blogosphere, this site being an excellent example. (Thank you, DHB!) The overriding message is “Stay put, if you can. Do not buy, and sock money away”, as the prices will probably not go up in the near future. Worse, they could go further down.

As someone pointed above, moving from a house (to which one is tied to, via mortgage) is more expensive that moving, as a renter. This rule apples, “to the average buyer”.

Then, there is the other category of reasons. They are private and specific to you. Is the house near the residence of a family member? Do you plan on staying put many years? Is it near solid, long-term employment? Not just your employment; in general, since you may want to sell it down the road to someone employed.

The thing to remember is that the experience derived from purchasing a home in the past (as lived by many previous generations) is probably nowadays much diminished, given the current financial turmoil, uncertainties and underwater statistics.

I have experienced living in a place that I “owned” [if one ignores the hundreds of payments left to make after moving in]. Part of the good feeling was knowing that, most likely, the equity was going up. Looking back, another factor was a mix of phantasy and vanity. (Ah, well. Youth.)

Today, like you, I am a renter, looking to buy. But I will wade in much more carefully than I did in the past, given the (un)employment scene and all the shenanigans witnessed by all.

Best of luck to you!

Actually, to correct myself, when I say “starter house,” I really mean “first house that you will most likely live in forever (unless said house slides down a hill), since prices won’t go up.”

We would not buy as an investment. We need a house because we need a frickin’ yard. So I just wonder if the abundant inventory will be met by a slew of eager buyers and even things out a bit.

Thoughts?

Julie

I am curious which home you were looking at in la crescenta. We are also looking there for our first home.. I am 40 and wife 36 and daughter 7 yrs old… Looking for a good school district..we have been renting in burbank for past 11 yrs..

M Nair, it was 2929 Orange Ave. There were three offers. We really loved it but decided we didn’t have a shot.

We’re currently in Valley Village near a great school, so we’re fine. It’s a little frustrating to see just how much house you can buy right now north of us, but the schools get rated lower and lower the farther north you go in our area. For us the school thing is too big a priority to move near a potential bad one. I worked for LAUSD for many years, so I know just how bad some of the teachers really are.

I suggest you look at renting in South Pasadena. The elementary and middle schools are excellent although the HS is overrated in my opinion. I agree with some of the the other comments that a backyard for kids to play in is overrated. There are lots of kids sports like AYSO soccer, baseball etc and plenty of nice parks to play in. Additionally, I doubt very much that housing prices will go up any time soon and you may very well find, as we did, that one or more of your children belongs in a private school. Good luck.

I don’t know how old your children are, Julie, but by the age of 5 or 6 girls seem to prefer to play indoors, and by the age of 8 or 9, boys don’t want to be limited to a back yard, they want to roam the whole neighborhood. If they aren’t allowed to roam, then they too would prefer to stay indoors.

The house vs. apartment doesn’t mean as much to your children as you think it does, and I wouldn’t buy ANY house with potential sliding problems for ANY price. I don’t think insurance covers damage from sliding, or at least there would be a huge deductible.

Wait until California’s budget crisis really comes to a head. Aren’t prices out there already dropping by close to 1% per month? What would be the point of buying now? Think how depressing it would be if your house drops sharply in value right after you buy it, and nicer houses in the neighborhood begin to come available for significantly less than you have sunk into your house. My advice, in all sincerity, is to STOP looking at houses. It makes you dissatisfied with your present living arrangements and tempts you to make a really bad financial decision. Get a yearly pass to Disneyland and Knott’s Berry Farm, and take the kids to the beach. Forget about the yard, at least for a year or two.

My children were enrolled in the Newport Beach public schools for two years, and there were 37 kids per classroom. And yet Newport Beach was incredibly proud of its highly-rated school district. Your child’s SAT scores are fairly predictably linked to your child’s IQ score. The school district does NOT add much or subtract much. My recommendation would be to put the child in a reasonably decent school through the 4th grade, the best parochial school in the area for 5th through 8th grade, and then back to public school for high school. IMO, people worry too much about kindergarten and first grade and would be better off splurging to keep their children in a small, caring environment during the absolutely critical junior high years when all of their adult values lock into place.

The present trend is to give parents more and more choice as to where to send their children to school (charter schools, flexible school boundaries, etc.) Also, elementary schools can go downhill fast if a good principal is replaced by a rotten one. I’d be careful about paying a premium to be in a certain attendance zone. The lines can be re-drawn, or a local apartment complex can fill up with refugees, etc. It is VERY possible, IMO that the whole system of public school funding and attendance zones may be radically altered before your youngest child graduates from high school.

Take a deep breath and make a decision to stop house hunting for at least a year.

Good advice: stop looking at houses.

Also, you can utilize the NCLB law. Transfer your kids out of low-performing schools into a better performing school. Or, simply enroll your children into “open districts” such as HBCSD as long as there is room at their schools. Or enroll in “virtual” distance-learning/home school through OCDE.

For instance, many Costa Mesa (Mesa Verde tract) parents transfer out of NMUSD into next-door City of Huntington Beach’s (HBCSD) “distinguished” schools. The kids live in CM, but only need to drive about one mile to attend a better-performing new “home” school that their fellow CM neighbors attend as well. The kids see all their neighborhood friends both at school & at home, as well as most kids play on the same CM youth-sports teams such as AYSO soccer, baseball, NJB, etc…

So you can still achieve that “neighborhood school” vibe , just not in your assigned “home school” in your existing housing tract/district. There’s no need to spend the extra 100k for an overpriced HB house. BTW, home prices in South East HB don’t reflect who actually lives within the housing tracts (too many long-time retirees on fixed-incomes, accidental-landlords, & struggling two-income families where DAD got laid-off & makes a lot less money!) So it’s best to continue to save up right now, for when they all finally move on.

BTW, most private schools do not require their teachers to have a CA teaching-credential. However, HB’s Pegasus (Blue Ribbon) school is well worth the money because all of the staff have their CA teaching-credentials, as well as a master’s degree in education. There’s lots of CDM families from NMUSD attending Pegasus to avoid CDM Middle High School’s “hidden curriculum”.

Just rent a place with a yard, and you’ll be paying someone else to take the risk of a loss. You want to be out of debt right now, and to stay out of debt.

I was going to say the same thing, what’s wrong with just renting a house?

From a purely financial perspective, I feel pretty strongly that prices will come down more, and that there’s no hurry to “grab a house now because of the rush of people from the sidelines.” I have a friend who had the same “water in a desert” feeling 2 years ago and rushed to buy a junky condo, which of course has dropped dramatically in value since then. I understand the feeling because he’d spent a whole decade thinking he could never afford an area he liked, and then saw something that he could buy, and he wanted to jump on it before the chance disappeared. He could probably buy a house now in the same area for the price he paid for the condo. If he’s just happy to be in the area and doesn’t care that he overpaid, then it’s completely worth it, but you can see how it was a bad call from a financial standpoint. If you want to buy at the bottom, I think a buyer should 1) wait until after the 2012 presidential election so the manipulations subside, and 2) watch for the Time Magazine cover story that says, “is home ownership doomed forever?”, and that’s the point you buy. In the late 80’s So Cal housing bubble, I heard all the claims that housing would rise forever, then I heard that the early 90’s crash was temporary, then by 1993 or so, I saw desperate sellers everywhere, and houses in Santa Monica for $229,000 that lingered for months. The LA Times had a story about a person who put a big sign on his roof saying “please buy my house”. Obviously that was the time to buy: buy when it’s out of favor, not when it’s a mad rush.

On the flip side, I understand the feeling of wanting a house for the niceness of your own place that you can modify however you want. I’ve owned since 2000 and I do enjoy having a property, so I’m not completely negative on it.

What I have noticed is that any property that’s well-priced and nicely located is being snatched up in a day or two, whereas the junkers are sitting for months, so if you do want to buy, I’d say to drive the areas you like to watch for estate sales (a good indicator of an imminent sale), or a sign that’s just been put out, so you can bid on it quick. If you’re just browsing Redfin in the evening and checking the houses here and there, those are the ones that are probably overpriced.

As for being a renter instead of a buyer, I was a homeowner for 20 years until I sold my nice executive-level home in 2008. I wish I had sold it in 2007. We have been renting since January 2008. During the last 30 months or so the ‘value’ of property around us has dropped at least 30% which means that had we put 20% down and needed to sell for job relocation or whatever, we would be drowning underwater (don’t forget to factor in the exorbitant real estate commission when reselling). No upward pressure on house prices here. Sale prices are still slowly coming down to reality. Listings are stale and overpriced. No rush. Last week my landlord had to get our septic tank pumped for several hundred bucks. Nothing out of my pocket….

I should have said ’42 months’ instead of 30 months of steadily dropping prices.

Does Mello-Roos go on forever, or does it end after 20 years or some other period of time?

Mello roos end after a period of time. It can vary and 20 years is around the upper limit.

If you consider that up to 20% of a home’s equity is phantom equity, meaning that it is not available, because of selling costs, probably 50% of all mortgaged homes are underwater! What does that mean to the value of all those Trillions in mortgage backed securities, other derivatives and credit swaps? If I am not mistaken, if there is no equity behind a security, it is worthless. If banks were made to mark all their securities to market, their true value, they would be bankrupt!

Don’t forget about the property tax calculation & how it relates to home values especially on minissiple government operations. As property values drop, so do opperating budgets unless they increase the tax burden to make up any & all short falls.

The former is more likely since there’s a political aversion to raising any kind of tax for any reason thanks to the T party’s psycho babble.

I’m glad I’m already on the bottom. I live in WV, and my house is

36,000 and I pay $368 per month house payment. People who have

high mortgages have a long way to fall down and I feel sorry for them.

I pray the Lord will help everybody who is struggling.

The fictional man in the clouds….uh huh.

and political power was so alluring Jay Rockerfeller had to move into your “poor” neighborhood to get it..? just love the 42,000 dollar cash only model..?????????????????????

The mentality believing that asking prices should exceed their last sale or be no lower than that is still very much out there though. For example, I walked through a house this weekend, here are some more facts about this house.

was listed at 389k.

1. The bank foreclosed on the house after it was sold in 2006 was 640k.

2. It sold 6 months ago for 315k to a so called investor.

3. The house was a dump with gang like neighbors and graffiti nearby.

4. In 1996 this one sold for 185k.

Giving an annual appreciation from the mid 90’s close to inflation would have the homes in this area priced under 250k. The problem is they all sold from 1990-2002 for just around 200k but during the bubble the prices went to 600-800k!

There is a disconnect between reality and asking prices.

As if the buying public are like those fools on the HGTV shows.

MAJOR disconnect!

The bounce in the chart in 2009 is like a dead cat bounce.

The “old” model, and until recently the model in most of the country, was: (a) assume no appreciation higher than mean inflation, (b) increase the home value with sweat equity (e.g., add a room) sufficient to offset the loan mortgage interest, (c) after thirty years, be glad that you were “forced” to put 1/4 of your income into a fixed asset, (d) sell and live in a little apartment or with your kids during your golden years. Is that the new normal? If so, what’s everyone so worried about? Not getting rich?

Excellent point. For a decade in the US (25 years in CA) we have been told that homeownership is the easy way to financial independence. That is simply not true. Owning a business can make you money, because the business makes money. No house ever “made money” because no house ever produced anything. Sure if you bought on top of the proverbial oil well, the price may go up. The truly vast majority of houses don’t really appreciate unless there is market manipulation. Almost by definition manipulation has to end at some point. We have reached that point.

Houses have been a good vehicle for many as an enforced savings account. If used in that manner, then it can work just fine.

if loan-owners paid only 1/4 of net income to buy, then there would be no problem.

the problem is many are paying 1/2 or more of net income.

Reading these comments helps me appreciate my 14 X55 old trailer out here in the rural woods of MO. I paid 22,500 in 1990 for the trailer on ten acres, sold 3.5 acres for 17K back in 2007 and still have 6.5 acres and the home. Average income here is just under 30K yearly and if you get sick you are probably going to die but it is better than the situation in many places of America right now.

Is the right time to buy still in 2012?

Leave a Reply