The worst performing cities of Los Angeles County – Top 10 cities with annual price declines for 2011. The fundamental attribution error when applying a nationwide housing bottom to your bubble niche market.

People have a hard time understanding that the world is not made up by black and white answers and that goes equally for how the economy evolves and responds to bubbles bursting. Some don’t even want to acknowledge that we are now half a decade into this bubble popping like believing the Earth is flat. What I find interesting is that some are commingling a bottom in national median home prices and applying this national trend to tiny niche markets that are clearly in bubbles even today. Yes, it takes a lot of time to parse out data for micro-markets but not paying attention to the details is what led us into this epic financial disaster in the first place. Most of this can be explained by the fundamental attribution error. In other words, the bubble has burst for everyone else but not for me contrary to the data. So yes, the nationwide median home price of roughly $150,000 might be finding a bottom when household incomes are roughly $50,000. This can even apply to the Inland Empire here in Southern California. But for other areas this is absolutely not the case. Now that we have annual data for 2011 the results might shock people.

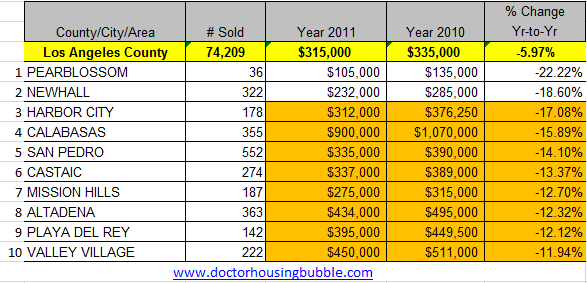

Los Angeles County worst performing cities

The benefit of having a year’s worth of data is that you sand out any temporary blips on the radar. What we find in Los Angeles County is that many areas are still seeing prices fall:

Calabasas saw the biggest nominal hit of the top 10 percentage drop cities seeing their median home price dropping by $170,000 from 2010 to 2011. In other words, the correction is still hitting. Now imagine that you put down 10 percent and bought in 2010 for that $1,070,000 price. You can now kiss that down payment goodbye. So much for the talks of a housing bottom in prime markets. If you look at the areas with the biggest price drops for the year, you’ll notice that most are above the median price for the county.  In other words, these are your mid-tier to prime regions. This is the point. While some areas may be finding bottoms nationally there are plenty of bubble markets in California that still have a way to go before having any semblance of a bottom.

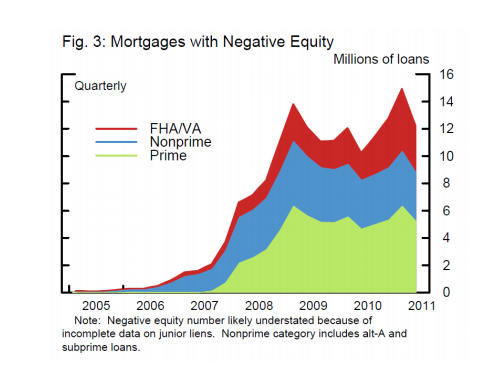

All the people that dove in with FHA insured loans in 2010 and bought in these markets with the 3.5 percent down payment are now fully wiped out and part of the 12,000,000 Americans that are now underwater:

And this is what people are failing to understand that many recent buyers in bubble markets are now newly minted underwater homeowners. Many of those underwater in a market like Las Vegas for example are those who bought near or during the apex of the national bubble. Yet the markets above are merely a reflection of the second round correction that is hitting mid-tier and upper-tier areas.

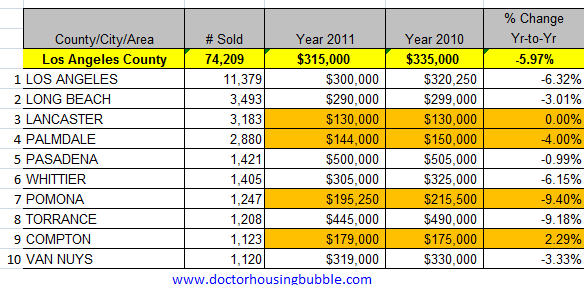

You might be surprised what other areas show up on the list:

Median price fall from 2010 to 2011

Malibu:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â -6.43%

Agoura Hills:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â -6.25%

San Marino:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â -7.69%

Woodland Hills:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â -5.56%

Manhattan Beach:Â Â Â Â Â Â Â Â Â Â -5.00%

Woodland Hills and Agoura Hills are mid-tier areas, not prime like Malibu, San Marino, or Manhattan Beach. So much for that talk of a bottom. Factor in the typical selling costs of 5 to 6 percent and many of those that bought in the above markets in 2010 are now underwater. Now how about we look at the top selling cities in 2011?

8 of the top 10 selling locations in Los Angeles County are near $300,000 or substantially lower including the lower priced markets of Palmdale and Lancaster. This isn’t new and this trend has been going on for years now. Some of those with massive cognitive dissonance are simply examining the national trend or looking at markets in the Central Valley or the Inland Empire and applying it to their mid-tier cities. What the above data is showing is that your city and area is not as prime as you may think it is. Otherwise, how did prices fall strongly into 2011 with comically low interest rates and a Fed and government that is practically trying to give homes away for free? Household incomes are not as strong as one would expect. You see this in mid-tier cities where most households do well nationally, but have sub or par $100k incomes yet think they are pulling in $250k and higher and live that way. The poser force is strong in Southern California.

To call a bottom overall and then apply it to pocket markets is nonsense. Sure, if we are talking about a national median price of $150,000 we may be at a bottom assuming interest rates stay this low and most households keep on pulling in that $50,000 income (3 times annual household income to home price is a historical average anyway). Try running those numbers on many of the California bubble cities and you’ll find an entirely different picture.

I forgot how delusional people could be until I posted an article on Canada and their housing bubble and all of a sudden, it was a trip back into time to 2006 and 2007. Bubbles by definition are driven by herding and psychological energy, not fundamental economics. They are nothing more than financial sugar highs and end badly. This isn’t new. History is replete with bubbles from Tulips, 1920s Florida Real Estate, South Sea Bubble, tech stocks, and many others.

So what are some simple lessons we can dig out from this bubble pop five years later?

-Lower priced areas may be finding a bottom (i.e., Inland Empire, Central Valley etc)

-Areas where the median price is higher than the regional median price still are seeing prices falling (likely because more shadow inventory is coming online and being priced to sell)

-Delusional people will always be around whether it is in the heart of a mania or even in the face of a bubble bursting right in front of them

Mark Twain was right in that history doesn’t repeat itself, but it does rhyme.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

45 Responses to “The worst performing cities of Los Angeles County – Top 10 cities with annual price declines for 2011. The fundamental attribution error when applying a nationwide housing bottom to your bubble niche market.”

Most people alive today have no personal memory of what we’re now living through. So this will take time to sink in. But, I think we’re getting fairly close. Maybe another year? Maybe two? Not more.

I’m out in Hawaii now… in a decent but not great area. A Fannie foreclosure (some good nickname should be here) just sold down the street for 529,000$. Now, that is getting pretty close to par for renting at 2500$/month. OK, it’s a flesh wound compared to a few years ago.

However, you consider the downside risk if we have a big cutback in military spending, that drives real estate. A lot of guys are renting off base here and potential for rents to crash is high.

Also demographics look pretty nasty out here. You have a boat load of old people ready to kick the bucket. I doubt the number of people that want to retire to an expensive location is very high at this point.

Things that will drag it out here. Low, low, low property tax rates. Holding cost is quite low. We also get very substantial pressure from Chinese and Japanese looking to buy in. They also will sit on a bad investment like no one else in the universe.

Anyhow, the 20+ year grind down continues.

Sales on the big island have hit a brick wall–down about 70% vs. a year ago. Prices inevitably follow. Higher fuel prices mean higher air fares mean fewer travelers mean fewer flights mean less demand. . .

I haven’t been following Oahu much, because prices are too high and it’s too crowded, but the same logic applies. Where prices have been falling most are high-crime areas some distance from Honolulu (Ewa Beach, for example).

I just checked on Trulia. They indicate that Honolulu sales are down 60% year-on-year.

Don’t count on Oriental money to bail out Hawaii. China and Japan have troubles of their own.

Is this Dr. HB or Bernanke making these statements:

* BERNANKE: HOUSING MAY NO LONGER BE VIEWED AS SECURE INVESTMENT

* BERNANKE SAYS HOUSING IMPEDING FED EFFORT TO SPUR U.S. ECONOMY

* BERNANKE SAYS HOUSING SECTOR SUFFERS FROM `SERIOUS IMBALANCES’

* BERNANKE SAYS HOUSING IMPEDING FED EFFORT TO SPUR U.S. ECONOMY

* BERNANKE SPEAKS ABOUT HOUSING MARKETS IN ORLANDO, FLORIDA

* BERNANKE: TIGHT MORTGAGE CREDIT WON’T BE EASED QUICKLY, EASILY

Link: Ben Bernanke FTMFW Quote Of The Day

.

I guess Ben is starting to read Dr. HB and understand the housing market reality.

Oh, forgot to mention. A major southland driver of incomes, Aerospace, is headed for another big big slowdown. I think the salaries got inflated by the last tech bubble and never really pulled back. So, everyone is over paid and expensive, many with minimal skills outside of the big four (Lockmart, NGC, Boeing, Raytheon).. you know the kind (or in Hawaiian de kine), power point engineer that has “managed programs” for a while. Not to mention the personally dysfunctional types that have some obscure technical skill. They are not going to be finding jobs for a while and will be paid a lot less when they finally find something.

So, this is part of why satellite and fighter programs are so freaking over budget. Those guys just have not faced real cutbacks. Most of those guys should just pass across the board 30% to 50% paycuts.

My old department is shedding a few more people but could easily lose >50% and not seriously impede programs, though they would work to make it an issue.

This is true. I work for one of the Aerospace companies in So Cal. My employer is quietly laying off employees. From what I see and hear, they are mostly laying off boomer type employees – close to retirement age, high salary, probably expensive medical costs. Some of those employees not old enough to retire instead of getting laid off won’t be able to collect the full pension $ because they won’t be reitiring as an active employee – huge pension cost savings for the company.

I think all of defense is under pressure. If I look at Colt I see them suddenly paying attention to the civilian market for their rifles (AR-15 and M4 variants), dropping price heavily, removing restricted rollmarks that are legally meaningless and left over from the Clinton ban era, and pushing rifles with a lot more non-stock options and even CA legal configurations. Colt hasn’t given two XXXXs about the civilian market in a long-time, looks like their are taking their military/Colt Defense line running at capacity and pushing now significant excess into civilian channels. Good time to be a buyer though.

0% pay-increases this year, and we said thank-you.

Doc you should do a piece on the Santa Barbara market. It’s fallen 40% from the peak but it’s still nuts up here, up more than 50% from 2000. Worthy of “real homes of genius.”

Yeah, the Beemer mentality is hard to shake off. One reason SB has held on is that there was very little new housing built during the boom, so there are fewer people with huge mortgages. But with 150 properties over a million on the market, there does seem to be a ten-year supply.

Up 50% from 2000… So what it is 2012! That works out to about 4% gains per year… It is like the bubble never happened!

I rent in prime Pasadena for 2400. With 100k down my mortgage for this home would be circa 4000/mo. This area is bubblicious. The guy that rented this home before me bought up the street. He came over for some mail and confided to me that he made the biggest mistake of his life. He has a 750k mortgage (100k down, probably circa 4000/mo) in order to “own” what he was happily renting for 2400. This relatively smart entreprenuerial guy clearly places huge value on “ownership.” He has now realized that his lifestyle has changed very little, if anything, for the 100k in savings down and extra 1500/mo. I’m now month to month. If I want to check things out in Portland, OR, I just give notice and leave. If “homeownership” is mere “loanownership” to you, join the legions of conscientious renters that are not stuck to property (yet subsidize our “loanowner” loving government/fed that regulates monetary policy/wall street banks that actually own the fed – a PRIVATE institution).

No soup for you renter scum in the mortgage fraud settlement. Next!

I can only assume you are joking since the settlement with the big 5 is a complete JOKE! No soup for anyone but the Skanks I mean Banks!

@Lynn Chase:

What do you mean? President Obama took to the podium a couple of hours after the deal’s announcement to declare that it will “speed relief to the hardest-hit homeowners.”

Relief to the hardest hit homeowners. So boxers and cage fighters who own homes will finally be helped. But not renters. Not folks who own their homes. And not folks who are kicked, smacked, or hit just a little bit. You’ve got to have been hit HARD. THWACK! BOFFO!

No one is even pretending to help renters. And while you may think that folks who could afford to make a reduced principal mortgage payment could also afford to rent, owning a home is our God given right. It’s what separates us from those Godless communists. It is why we fought the Iraq terrorists who attached us on 9/11. Get real, you clueless liberal! Change has arrived!

Very intelligent post pasaden8r. I don’t understand taking the risk of buying a house in CA now…fundamentals look poor to me. CA in fiscal ruin, higher taxes a real possibility, job market for career, full time living wage jobs is abysmal. Recent college grads compete for $10/hr jobs, often carrying lots of student loan debt. Too many Californians dependent on govt assistance, high cost of living, schools/universities overcrowded, deteriorating. Be mobile, and agile in this job market. You got that right!

Ah, but the weather…to many it trumps everything else, and will save us all! Eye roll, nothing like SoCal weather! Not to mention the restaurants! Nothing else matters!

.

On your list you forgot “being in close proximity to Trader Joe’s.” 🙂

I think this was one of the absurd reasons why a previous poster justified paying obscene prices here in Socal. Take your Trader Joe’s and shove it! I would have no problem living in middle America eating hot dogs and mac and cheese and actually living a normal life (ie, not spending two thirds of my paycheck to “own” in a decent area). We Don’t Make Those Drinks No More, you listed all the reasons why California is in a death spiral. And people think things will be back to where they used to be in the near future. Let them have their cake!!!

Film and tv industry is doing better than ever! Lots of people at home watching TV… Cheap entertainment equals higher ratings.

Also im enjoying a much better LA commute with less cars on the road…. If you got a good job and a house with 3% mortgage i would say things are pretty sweet.

Caliowner, I’m not sure about the film industry doing well when people need to pay $12 / ticket. I’m sure the TV industry is doing well. What do expect when you have a huge segment of the population that is obese, ignorant and lazy. Sitting at home collecting ___________ (welfare, disability, unemployment, etc) while watching American Idol and Dancing with the Stars is the cornerstone of any advanced society.

400 AD: Give them Bread and Circus.

2012 AD: Give them EBT and American Idol.

This will end the same way my friend!

He/your neighbor could move quickly to OR if he likes too, by becoming a landlord. Oops, the rent won’t cover the mortgage!! Another fool that didn’t think 2 steps ahead. I bet he is poor chess player as well….

Some other economic indicators that point to the fact that the bottom is still falling away from us.

Gasoline sales down 21% comparing july 2011 vs july 2008(the peak) so people are driving 1/5th less often, so less jobs to commute to, less consumption of consumer goods, less vacation travel.

Baltic Dry Index down to 1986 levels, despite 25 years of inflation, it now costs the same to ship a ton of goods, as it did in 1986. These means lots of empty ships available and a whole lot less shipping, hence less commerce, hence less production.

Air Freight is still dropping, the number of tons of air freight in 2011 is declining significantly, JAL was down by 45% year over year. The only thing up is the stock markets, and it is well known that the European Central Bank has poured over 300 billion dollars into stocks in the last 3 months.

My theory is the U.S. economy will be pumped up as much as possible until after the November election, and then the other shoe will drop. The banks will begin large scale foreclosures, since they have the robosigning amnesty, and we could see riots in the summer of 2012, in American cities and certainly in 2013 when things will be much worse.

The scale of the problems suggest no real recovery until early to middle part of the next decade. Nothing has been fixed in the financial sector, so a collapse will spread rapidly through finance and banking. If I didn’t own my house outright, I think I’d be renting so I could move where the employment is going to be.

Home prices will continue to decline for the next 7 years and demographics say flat demand after that.

Great post! Totally agree, and only want to add that the 300 billion from the EU Central Banks came from the 16 Trillion the Federal Reserve secretly has given to the EU Central Banks and foreign countries.

http://www.dailypaul.com/188540/audit-teh-federal-reserve-reveals-16-trillion-in-secret-bailouts

http://www.tax-freedom.com/Federal-Reserve-Robbery.htm

Remember that the $16 trillion was created out of thin air. Also it was hush money.

@ jimmy Kay:

“Baltic Dry Index down to 1986 levels, despite 25 years of inflation, it now costs the same to ship a ton of goods, as it did in 1986. These means lots of empty ships available and a whole lot less shipping, hence less commerce, hence less production.” Astute observation, jimmy. It’s been (BDI declines) ongoing since at least 2009.

As I was saying before….watch California R.E. steadily decline until it reaches the Reagan-era R.E. bubble start date of 1985….because, wages are and have been stagnant, manufacturing has gone to Asia, tariffs are an alien word no one knows in D.C., and even in 1985, while living in Fremont in my first home I bought and not rented…they were building homes at prices I could not fathom the average working Californian to be able to afford. Behind my property, Kaufman-Broad bought up a tract of land that was an old tile factory (right next to RR tracks, still blowing whistle at 3:00am every morning), placed homes in 8000 sq ft lots (obtained a “variance since 1/4 acre was the previous minimal lot size), and buyers swarmed in and bought lots, before the houses were even built, and as soon as they were…put a sea of “for sale” signs up at 40% increase over purchase price…I heard many were buyers from Hong Kong, which was being turned back over to ROC then. But how many times can circumstances like that occur? Not many.

I got lucky. I almost waited too long, tried to time the peak (1990)…and my house (which was 50 years old on 1/3 acre) sat while the market was tanking. I sold my home at almost bubble peak, to an ethnic Indian (Sikh) doctor from Santa Cruz, that bought it to place his elderly folks in, because their Sikh temple was a 3 minute walk away. How many times can those circumstances occur? Not many.

Unless and until I see policy changes from D.C. and Sacramento taking focus off of the bogus “Terror/Security” paradigm enriching crony “privatized” contractors, and focusing on rebuilding our manufacturing base and extolling the benefits and virtues of agriculture (California’s REAL ASSET) as a profession/occupation, while restricting the use of migrant farm workers and encouraging our youth to seek these jobs while making the wages livable….things will simply continue to decay.

That’s a fact. It boggles my mind that the US has an IPO that makes a billionaire out of some kid that designs a website so you can “like” something…as if we were all 3rd graders….and call it “technology.” Have you ever watched an interview with Zuckerberg? He sounds like a 3rd grader.

It boggles my mind that financial (non) regulation by Congress (which I thought was their almost entire reason for existing) allows for a corporation like Apple (I went to high school with Jobs, and consider his success a wonderful thing…but…) to move manufacturing overseas to China, and build up a cash position of $87 billion dollars…and not see the word TARIFF in their dreams. And I don’t mean to pick on just Apple, this is a nation-wide scandal.

Watch and see….the bottom will be 1985 R.E. prices in California before this bottom is reached. Unless what I stated above comes to pass: Tariffs and focus on agriculture and manufacturing, again, and dismantling the war machine budget.

Even the 80s in California were fueled by Reagan’s bloated “Defense” budget deficit (borrowing) spending….That is simply not sustainable in a world the rejects the US Dollar as the Reserve currency…which is already under way. Go ahead: invade and occupy Iran…steal their assets….but then WHO? America is running out of defenseless enemies to attack…asset-rich defenseless “enemies” to attack…THEN WHAT?? YOU ARE NEXT, CITIZEN. What do you think the real meaning of the recent NDAA focus is? What little you have left: they want.

farang is viewing things from a fog-free peak; his/her assessment of the state of the State and the absolutely intransigence and self-aggrandizing delusions of the U.S. Congress (D.C.=Hollywood for Ugly People, and just as removed) are symptomatic of a rudderless ship, spinning about at the behest of too many oarsmen (the cabal of Citizens United empowered, corporate lobbyists and special interests), ever so enamored of a perceived ranking on the pseudo-social-fau-lebrity scale that they don’t see the crumbling of the columns. As Ozymandias always warns, Hubris always prevails, and empires always fall, .

@jimmy, Lynn & farang – thank you for your posts supported by facts. Any word of advice for an average guy like me (family with kids, both parents working) on how to prepare for the US financial sector melt down? We’ve paid off our house way ahead of the 30 year mortgage schedule, our cars are 10+ years old, have no debts, and have some rainy day money. It would be great for the bubbles to pop and things calm down to where an average person can make reasonable living with the money they make without getting in huge debts, on the other hand it sounds a bit scary to think about what would happen to my 401k and dollar de-valuation in general when the US $ gets rejected as the reserve currency. What a chaos will it be… I’d appreciate your recommendation please.

Hey, stop using my name!

By the way, you seem to be financially responsible. Take your own advice and not others…

Change your handle….lest people get us confused.

Charles Hugh Smith at oftwomindsblog has a very interesting and scary post of the massive decline in gasoline deliveries/usage in USA.

http://www.oftwominds.com/blogfeb12/gasoline-tanking02-12.html

Wake up Jimmy, look at the housing prices now for all these top 10 areas

Doc, what about West Hollywood and Hollywood real estate values. Everyone seems to think they are immune from the downturn, like they are in bubble. Rents at newer buildings are at 2600 for a single? Insane. Have you evaluated West Hollywood and Hollywood?

I live right next to this 180 unit monstrosity on LaBrea between Hollywood and Sunset which they finally managed to complete after six years, and there aren’t many lights on in the windows. They used to advertise on NPR for it “The Avenue”, but haven’t heard anything in a month. Hope it sits vacant so the traffic keeps as as light as possible..

I suppose it makes sense that people are confused because there is so much conflicting and irrational information we are bombarded with every day. We tend to lean toward what we want to hear. If you hear BS enough, it starts to sound credible.

Living in darkness on a steady diet of s*. Mushrooms or people ?

There’s no way of really knowing anything, not even that there’s no way of really knowing anything. Joseph Heller, Catch 22.

I’m shocked that the only top selling YOY green pricing area is Compton. Have drug sale incomes gone through the roof or is it investormania ??

That one is easy. Compton has great weather and is a reasonable drive to a whole bunch of jobs. All that has historically held it back is crime. However now the murder rate is a quarter of what it was twenty years ago ( http://articles.latimes.com/2011/jan/18/local/la-me-compton-crime-20110118 ). If there is any good investment in Southern California real estate it would be Compton.

how can we game the system (legally)? How do I buy a home below market value with little or nothing down and make money on the upswing or give it back if it all goes to s*? Orange county, CA area????

Sounds like greater fool to me…

Fannie Repos in OC at the site below. Some are 3.5% down, some give you 30K for refurb’ing.

The one I like best (ahem!), Costa Mesa: less than 1000 sq ft for 560, that previously sold for 773. No doubt because those dastardly bankers held a gun to the buyers head and demanded that they pay that much. Or was it the RE brokers’ fault? Or the mortgage brokers? Or Bernanke? I can’t keep it straight any more.

The other good one is the 2/2 Laguna Hills condo for 72. Cheap right? Laguna Hills for ~ 400/mo. Cheaper than rent! Umm, oh yeah–the HOA is $637/mo. AYFKM? 637 for HOA!? Oops, it is already under contract. ?Como se dice “moron”?

There are only over 200 of these smokin’ deals, so you better hurry.

I have also given you the Freddie MAC site link, only 48 homes on it.

😛

http://www.homepath.com/search.html?openHouse=&st=CA&cno=059&ci=&zip=&src_ref=&mlsid=&pi=&pa=&bdi=&bhi=&x=32&y=16

http://www.homesteps.com/cgi-bin/dynamic/propertysearch.cgi

I do not consider myself a greater fool, I will let you play that all the way to the bottom… I think a great man once said I don’t need the first 25% nor the last 25% I am happy with that middle 50%…

@Farang:

Almost with you. Almost. Conceivable, yes, that Californians invent, build and export nothing from here forward. Nothing new in the defense industry, in the tech industry, in the medical industry, etc. Then, yes, conceivable that the economy unwinds through the past 80 years back to what it was before WWII.

But, each time one of the periods of invention has passed starting with WWII (always accompanied by a host of world-is-ending manifestos with very good data and smart recommendations–remember Toffler’s “Future Shock,” or all that Gaia stuff, or how about the Soviet Threat [uh oh, we’re just about to be invaded by Central America!]) somehow another round of world-changing invention happens with California at the vanguard, and our relative incomes from all that great sturf we put on the market comes up to meet our spending habits.

I’m not saying you’re not dead on; just saying, it’s been said before. Hope this time is not different.

DC,

All that innovation was made possible by cheap energy and money flooding into the US after WW2. We were the best of the best, with the most stable political/social system on the face of the planet. Not to mention a brand spanking new reserve currency of the world. Of course we would thrive. It’s just the opposite now. We are losing Reserve currency status; energy is expensive; and we have an unstable political/social environment. Money is leaving us. With all the problems in Europe, the Euro is still higher than where it originally started against the USD. That’s a big statement of no-confidence in the US. Gave is over.

Energy can neither be destroyed nor created. Science is coming to the realization that energy is the same as matter – it can only be transformed. I for one do not find energy expensive. Yes I am quite conservative in my use of electricity and fuel (in this case natural gas for heat. My highest cost for gas this winter has been $40.00 and it dropped by 50% in the last month). What I do see as expensive is the cost of energy for transportation as gasoline is skyrocketing on a nominal basis. This is in my observation a direct result of our bedroom community life style. Oops can you say housing bubble. All that is an issue for another discussion one that should be the at the core of our national discourse. Back to energy. It is not more expensive in an inflationary end game scenario. It is simply that we keep using more and more of it for our increasingly electrified world. This computer and yours make a case in point. Don’t forget all the battery charged devices we now play with. But one poster said something above about invention and innovation. There is a boat load of innovation happening in internal combustion which will bring the $$ per mile down. Innovation is happening in batteries and in solar conversion. All it will take is one strong breakthrough and the cost of energy will tumble. Then game on. If said innovation comes from our fair state the world will beat paths to our door because the explosion in developing nations ain’t leaving and will need new sources of energy. I suggest you visit some science websites and keep an eye on what’s shakin’.

GE is moving its x-ray and imaging to China, only for now is ct/mr staying in the U.S. – that will eventually go as well. Once China has the technology infrastructure built up, it will be nearly impossible to manufacture anything high tech here in the USA.

Even with robots, if all your components are made half a world a way by slave labor that lives on site, it will be impossible to compete. Apple builds its i-stuff in China not because of the cheap labor, American labor would only cost about 40$ more per unit, its because they can control the supply chain and lock out the competition while moving rapid changes into new products, since the suppliers are located next door or within a mile radius.

Of course once China steals all their intellectual property and techniques, apple stock will crash, but live by the sword, die by the sword.

Corporations will run to widest material and labor arbitrage and care little if a product is made in country a or country b.

When Facebook is worth billions, you know America’s inventing days are in the rear view mirror.

X-ray and MRI machines? That’s bemoaning the exodus of 20 year old technology.

Who leads in robotic surgery devices? We do. Who leads in artificial limbs and nerve regeneration? We do. Who leads in cancer medication? We do. Who leads in robotic aircraft (soon to be coming to a police department near you)? We do. Who leads in nuclear power plants? We do. Who will finally invent the battery pack extending EV range to 300 miles? My money is on us. Will China take it over after 10 years? Probably, but by then we’ll be on so something else.

Chances are, this conversation will be a distant memory in 10 years, just like the fears and predictions of the 70’s were forgotten by 1985.

History…the cure for hysteria.

Leave a Reply