The next generation of home buyers and our over investment in real estate: first time home buyers and move up buyers see their net worth crushed during the last few years.

In general, Americans are very poor when it comes to saving money. One of the stunning revelations that came out of the financial crisis was that the median household net worth fell from $126,400 in 2007 to $77,300 in 2010. What was even more interesting in the report put out by the Fed Consumer Survey was that median home equity fell from $110,000 to $75,000. Think about this for a second. Most of what Americans have in what we would consider as wealth is locked up in housing. In fact, non-housing equity wealth was $16,400 in 2007 and fell to a paltry $2,300 in 2010. Is it any wonder why so many Americans depend on Social Security deep into retirement as their main source of income? While the stock market has rallied dramatically from the lows reached in early 2009 the housing market is still far away from the peak. What is interesting is the lack of move up buyers in the current market. With such little inventory I’ve been seeing the first-time home buyers diving in simply with maximum leverage. Americans if given the chance would borrow a million dollars at zero percent (the big banks are doing this). What does the future hold for the next wave of young home buyers?

The current state of housing

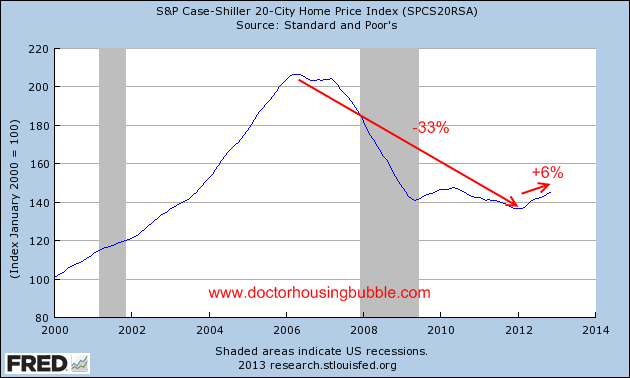

Home values fell by 33 percent from peak to trough. Since that point, they are up 6 percent:

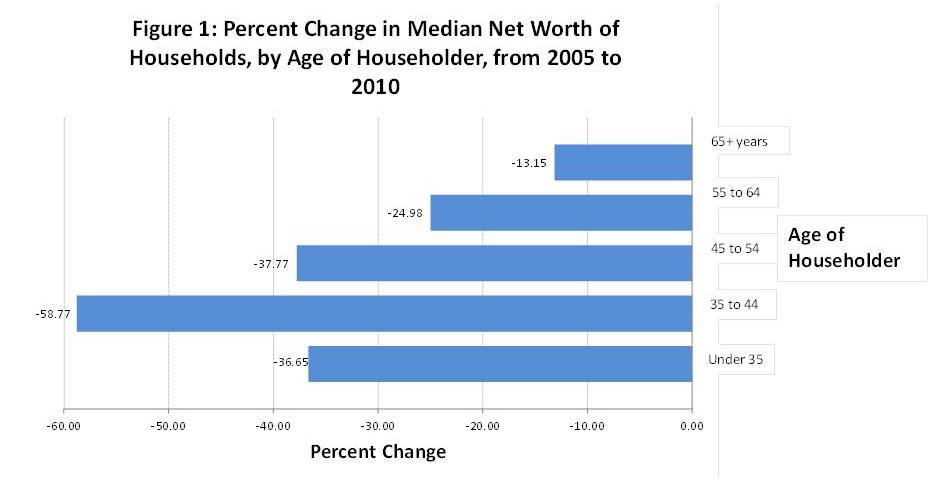

Since we know that the bulk of wealth for Americans is stored in housing, the net worth figures haven’t changed much since most families have a miniscule amount invested outside of real estate. The numbers are even more difficult to digest for younger Americans that are saddled with incredible levels of debt. The current crisis has taken a bigger toll on younger Americans. For example, the median net worth of householders under 35 was $5,402 in 2010. That doesn’t even cover the closing costs for most homes in the US forget about incredibly expensive metro areas. Take a look at changes in net worth during the crisis:

Source:Â Census

The two main groups of first time home buyers and move up buyers, those 35 and younger and those 35 to 44 were financially crushed during this recession. From looking at Census data measured with the Fed Consumer Survey, we know that Americans are storing a large portion of their wealth in real estate. It also helps to put into perspective why the government is eating billion dollar losses with the FHA since this is the only way many younger households can even contemplate owning a home.

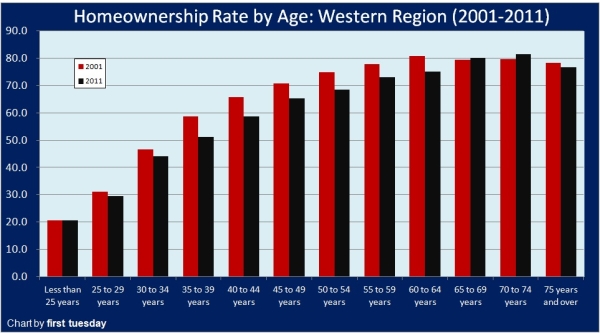

The trend with homeownership

This also helps to explain why homeownership has fallen for younger Americans while it has grown for older Americans. Take a look at this chart:

What this tells us is that we have an aging population that is long real estate. But given that so much money is locked up in real estate, many are going to depend simply on Social Security to get by in their later years. This is also a reason we see the retirement age being pushed up and many working into older years. But what does this say about housing for future generations?

The young are less affluent and have even less financial security when it comes to retirement. Even optimistic estimates project that Social Security payments will be cut significantly in the decades to come. Some seem to think that simply owning a home is the answer to your financial security. In fact, this seems to have been the status quo investment option for most Americans. Buy a home, and ride it out until you have equity like a forced savings account.

What is interesting is the shift in psychology with housing. You will always pay for shelter. That is a given whether you rent or own. This isn’t some kind of new variable. The assumption also, is that many people are not investing in other vehicles. Clearly as a nation we are incredibly heavy on real estate as a part of our overall wealth portfolio (for those that have any wealth). It also highlights how poor we are when it comes to saving but also how quickly people are to go into massive debt. I’m seeing flippers unloading properties to younger buyers that are going deep into debt with FHA insured loans.

Over the very long-run, real estate is basically a hedge on inflation. Not exactly the stellar investment some make it out to be. I’ve seen some investors buying places for $400,000 with all cash and getting $2,000 a month in rent. Run the numbers here:

$24,000 / $400,000 =Â Â 6% return on gross rents

As we discussed in a previous article, about 40 to 50 percent of your gross rents are going to get eaten up by taxes, insurance, vacancies, repairs, and other items outside of the principal and interest. And there is work to being a landlord yet Wall Street is diving in head over fist for essentially a 3 percent yield on some properties.

Young Americans are competing with these larger forces if they want to buy. Many markets in the US are actually very favorable to young buyers. Large parts of California are not. I’m seeing folks making barely $100,000 talking about buying $600,000 or $700,000 homes. Younger dual-income families see this as the way things have always been but this is a recent phenomenon. The current market is being driven by all-cash buyers, investors, and over leveraged buyers.

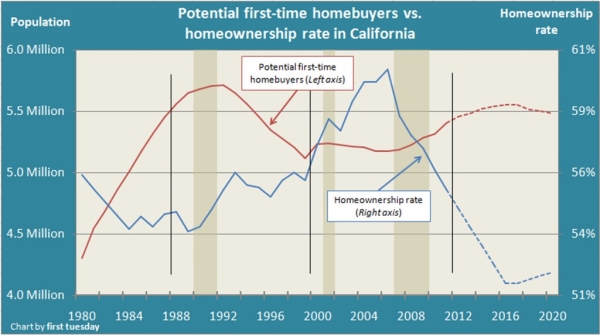

Homeownership in California

It is no surprise then, that the homeownership rate in California is expected to fall probably into 2016:

The biggest issues I see with younger buyers is:

-Lack of savings

-Big debt from education

-Tighter incomes

-Less of a desire for McMansions

I think the last point is critical. Even with the jump in current housing starts, a good portion of the starts are for multi-unit developments. In other words, rentals or condos but mostly rentals. Cheaper alternatives to single family homes. These are people building homes for the future. It’ll be interesting to see what happens once the investor hot money begins to recede from this current market.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

86 Responses to “The next generation of home buyers and our over investment in real estate: first time home buyers and move up buyers see their net worth crushed during the last few years.”

I missed to boat in 2000 when i was 29. Still waiting to buy our first house. As much as I want to I can’t justify buying a 400K fixer in a neighborhood where homes were valued @ 125K in 2000. Not sure how long we’ll have to wait or if I’ll ever get to own a home, but fighting over overpriced scraps is not for me.

Same here. I’m getting married in August and have had older family members inquire if we’re going to buy a house soon, which only leads me to rant on about what the SoCal market actually looks like, and why we’ll never be able to buy even a decent fixer at this point (unless we went all cash).

I’m in the same boat. I wish I’d had my act together just a few years earlier to have been able to buy before 2000. (Alas, I was still struggling through college at that time.) At current California prices, I don’t see the point in buying a house anymore.

Time is your friend. Too many people in the L.A. area are in a rush to buy a SFR. If they truly understood the Federal Reserve and the banking laws, then they would understand that the shadow inventory is not going to start showing up until 2016.

U.S. banking laws allow banks to hold on to foreclosures for a maximum of 10 years. The Federal Reserve now allows banks to rent out foreclosures (REOs). Plus if banks have trouble renting out an REO, they can go to the Federal Reserve and borrow at close to zero percent interest (ZIRP). The combination of these three means that inventory will be manipulated and abysmally low for the next three to seven years in SoCal. The smart buyer will recognize this and not buy into this highly manipulated market.

“U.S. banking laws allow banks to hold on to foreclosures for a maximum of 10 years.”

What laws? These people live under the rule of law? Please. They’ll just stuff some money into some pockets in D.C. near the deadline, and, poof, suddenly the law is changed and they can hold on to foreclosures for 20 years!

This is why I can’t take the inflation scare mongers seriously. Many beat the drum (mostly gold bugs) that the world will be Weimar soon, when I think it will be Japan. There is just so much de leveraging that has to happen, and the Fed is hoping beyond hope that they can ignite some more growth by propping up housing. It’s sad to see history repeated so soon. Thing is, they’re succeeding in some markets, with some chasing yields and driving home prices back up to bubble levels. Frustrating to watch. So much money, so many resources spent to make housing even more expensive. We know how it will end. We just saw it crash. Why would it not fail if people are so much poorer this time around?

Oh well, I saved my money, and avoided the bubble, so I have plenty for rent if that’s what I have to deal with. I’m certainly not going to buy unless I get transferred to Florida or Reno or Phoenix, but, that ain’t happening. It’s not going to be pretty, watching the Boomers slowly slide into poverty, and spending whatever meager sums they have to maintain a large home (forced savings, indeed) until the bitter end. Thank goodness for cheap immigrant landscaping, so they can keep appearances up from the road.

+1

I like to imagine all those flippers having epiphanies and deciding to use their winnings to go back to school and study something that would actually contribute to society and the economy, instead of doubling down.

> I’m certainly not going to buy unless I get transferred to Florida or Reno or

> Phoenix, but, that ain’t happening. It’s not going to be pretty, watching the

> Boomers slowly slide into poverty, and spending whatever meager sums they

> have to maintain a large home

It’s a shame. If there was more downsizing, a lot of kids would have a better place to live.

Looks like Sarah and Dmac missed the bottom in 2012 because they mistakenly thought housing prices were going to drop like a rock.

They could locked in and taken advantage of cheaper home ownership vs. rentals in 2012. Now the deal passed them by. I can see why they’re angry.

Sounds very familiar to the “don’t miss the bottom” calls from 2009. While there may not be a catastrophic drop, the next few years will likely offer plenty of bottoms to pick from as the market staggers along sideways.

Shut the pug up, troll

So, basically you and others are upset. I would be too. However when I knew we were heading below rental parity, I bought. April 2012- on the basis that the banks and other investors would support at around that price point. Will prices go down?

I was squarely in the housing bear camp, until I bought. Now all I see are the housing bears hoping, praying, and wishing for another chance. Let me clue you in for a second. Ask yourself a simple question, did demographics or middle class equity or wealth cause the recent increase in prices?

If not, what makes you think they could cause a decrease in prices? It’s a rigged market folks, we have no control other than to try to catch the waves when they are good.

@pugtv — I don’t generally like to jump down someone’s throat but, this: “missed the bottom”….is an absolutely fruitcake comment.

It begs the simple question: Have we seen the bottom, pug? Are you sure?

If pugtv is the word play I see he’s sure it’s bottom and all gravy now because he is the “property wars” producer. See pug is a slang term for fighter (pugilist) and tv, well we all know what tv is.

In any case it was a heck of a snarky comment.

I think we have seen the bottom. There may be some frothiness in some areas due to investors. Bond yields are low. A 6% return is actually pretty good (much less net, of course) compared to bonds, which currently don’t keep up with inflation. Should stocks become fashionable again, I expect some capital to head that way, but I don’t expect housing to crater, unless employment does a Detroit. There is little reason to expect that to happen in California.

THe recession is well over for the private sector. Employment has been lagging because while the private sector has been adding plenty of jobs, government has been shedding them at a rate nearly enough to cancel out. (Consider what government downsizing really means, the next time you hear it.) However, government is about done with the downsizing. California has balanced its budget. The US government will get through the sequester. After that we will be pretty much out of manufactured crises.

If the endless stream of crises and uncertainty that keeps scaring people ends, what will happen?

Investment. Growth. Employment.

…and of course more people will feel secure enough to buy a home.

They’ll get another chance. Artificial asset inflation through QE infinity is working but will not work forever (as I’m sure some at the FED are hoping). The hubris of those who feel otherwise reminds me of AAPL shareholders back in September of last year when (almost) everyone felt that AAPL was going to $1,000. QE will end the same. It’s a matter of when and not if. But if you are in a house and area that you love then the sinusoidal value of your home should not matter.

Mostly a lie which manages to bypass almost every fact and points to only one: Prices haven’t dropped much.

If you claim that you foresaw massive FED intervention and removing of regulation, I’ll say you lie.

Therefore believing in markets was a correct choice at that time and markets said that bubble is burst, it’s time to drop the prices. A lot.

33% (which happened) is nothing compared to amount they should have dropped and that was prevented by FED.

Almost alone, SEC helped a lot too: Every major crime made by major banks is waivered into oblivion and not even published. Almost 100 waivers exist by now and those are not made about small sums like millions: It’s always hundreds of millions or billions.

In other words: SEC is allowing financial crime, in large scale. That was quite hard to foresee, too.

There’s nothing worse than a Troll – other than a particularly ignorant one. No, Trolly, I didn’t buy this year because we had just completed a cross – country move to the West Coast. Most folks have to rent for at least a year in a new location in order to be able to understand the market at present and what neighborhoods you’ll want to live in for the future – but then people like yourself are of course naturally insane with rage because you’ve just bought and are now holding a dead asset that you can’t unload. Keep crying all the way back down to the bottom – your tears of bitterness taste so sweet.

So, the one area I haven’t seen anyone touch on is how the younger generations in many areas were crushed because of condo ownership. And, of course, because most of the housing data hand waves away the condos, that aspect of move up buyers seems to be totally ignored by pretty much everyone in the housing market. If you were 30 and bought a starter condo in 2003, hoping to accrue over a decade or so, you probably got crushed and were lucky to be able to even get out. I’ve seen no one even talking about this group.

Of course, the Case Shiller data doesn’t even count the condo market, so I’d love to see some real research showing how many people are either trapped or had their credit wrecked by being stuck in a place and having to stay or foreclose/short sale & lose all their money in the process.

While I don’t know their full stories, I know of two families who are stuck in condos and can’t get out. One family has two kids in a small 2 bed condo in a rowdy party neighborhood. The other has three kids in a two bedroom condo. Lucky for them the second room in big enough they can fit a full bed, a bunk bed and a crib. They at least have some sort of plan to get out. His parents are going to buy their condo off them at some point as an investment property. I guess they are just waiting for him to have more stable work and for her to return to work after having three kids.

We have decided to get another rental and not buy now. Their situations worry me and don’t want to get stuck. We’ve also decided that long term US is not for us. Politics and economics are a big concern for us here and we’ve decided we’ll probably go back to one of our boring little countries. You know it’s really really nuts here, right? LOL. I love ya’s but you’re all nuts!

Well, that’s the rub re: investment opportunities. First, you have to see if the building is slowly going rental. FHA/HUD financing was upped post bubble pop, but you’ve still got the < 20% barrier for getting funding. The building goes more than 20% rental, and EVERYONE is trapped, as basically be becomes rent or sell for cash.

The second issue is that of sales. In a few Chicago neighborhoods, prices fell so far so fast, you couldn't even get banks to touch them for mortgages. The laws concerning limits on points/percentages at close meant that units that fell under $100k, the banks can't make enough at close to be worth it. Thus, they again, become cash only policies.

To add insult to injury….if you have a strong board and bylaws that cap rentals, you effectively ruin yourself because no one can rent, prices have dropped that no one can sell, and everyone is stuck. So it's a real Catch-22. Let everyone rent, and you create a bunch of people who may not be able to cover their mortgages with rent (or even want to be a landlord), don't let everyone rent, and you discount the only part of the market that might actually buy a condo these days.

Hey, tapis, may I ask which countries you’re referring to? Just curious.

@joe a couple of the other former British colonies.

Just wanted to say I don’t take offense & wouldn’t blame you… Boring sounds nice!! ha ha ha

Hi madopal,

While i don’t know the overall picture, I can tell you my condo story:

Bought in 2005. Came from the east coast. Just thought things were more expensive in LA, and the realtor told me no different. Had dial up internet at the time, so no Zillow or market following for me.

Went in 255K on a 980 sq.ft. 1 bed/1.5bath, two story townhouse in a good neighborhood. Previous owners were getting a divorce, so they HGTVed the place up with a jacuzzi bath, walk in tiled shower, new tile and cabinets for the kitchen, pergo flooring downstairs, etc. They had previously gone into escrow at 275 or 280K, but the deal fell through, so I thought I was getting in on the cheap.

I didn’t want to spend more than 180K on a starter place. The realtor strategically demoralized me by showing me a 180K condo in a trashy, gang-ridden neighborhood, then a series of small, 1 bed condos in the 250 to 350K range.

Around 2006 and 2007, watched another unit like mine (but not HGTVed up) sell for 330K after 5 days on the market. Watched a unit in my complex that was 2 bed/2.5 bath sell for 500K to a young lady whose brand new Land Rover held a personalized vehicle license plate: ‘STARTRANR’ or some such nonsense.

Then stuff went bust. I watched it happen and did not sell. Didn’t think it would be as bad as it was. Plus the only thing worse than equity loss is renting a box with paper thin walls and people jumping up and down on a floor above you. I originally put 50K down. Incrementally, I was paying the principle down: 5K here, 7K there; at one point, whilst thinking about refinancing, I dropped 25K in. Wish I would have dropped it in the SPY in retrospect, but had to get out the interest only ARM loan the realtor and her broker friend had pushed on me (‘You’re not gonna stay in the place forever, right? Appreciation will make up the difference..’).

Watched the star trainer lady go bust. Watched the 330K guy go bust, then die. Watched my net worth shrink about 100K (mostly due to loss of equity in my CA condo, but also lost a lot on an east coast beach condo that I bought in 2001). Including opportunity cost, interest, and appreciation, my net worth has probably shrunk 150K+. If you include the pretend equity at the height of the the bubble, I’ve ‘lost’ more than that.

If I had just shown up a few years earlier, I could have bought the same place for 130 to 150K. I would have had the thing paid off here in a few years. Most of my condo neighbors bought in the 1990’s for prices of 60K to 100K. (They don’t mind the exorbitant HOA hikes, secondary to the zero interest rate policy that keeps funds from appreciating in the bank, and secondary to control freaks on the HOA board that enjoy playing with large sums of money, etc…).

So am I gonna be a move up buyer? Nope. I’m gonna rent this place out. In a few years I’m gonna go live rent free in a 3 bed, rental property my father owns in full. Do that for a few years to regain part of my net worth. I’ve also been teaching myself woodworking, and am going to trim my condo out with custom frames, wainscot, etc. to make it look more enticing, if I ever I do need to sell my place.

Oh, and the 330K condo in my complex? It was purchased at auction, but has since gone delinquent (perhaps a HELOC after purchase?), and is sitting on the market for 160K. I feel sorry for whoever buys it, as the lady next to it has a dog that she puts on the back porch that loudly barks all night long.

“Plus the only thing worse than equity loss is renting a box with paper thin walls and people jumping up and down on a floor above you”

So it’s better to lose 100k and then put a ton of money into your “owned” box before you attempt to sell it/ rent it out?

BTW…you can’t live “rent free” in a rental owned by your father. He must claim it as a gift and it goes against the lifetime gift tax exclusion (or the $14,000 per year he can give you without filing a gift tax return).

Thank you for sharing this story. These are some of the real circumstances that people need to be aware of. Unfortunately most will have to learn the hard way.

@ Where’d User Name Go — That was a useful story to read, thanks for sharing that.

Your quote, “to control freaks on the HOA board that enjoy playing with large sums of money, etc)” OMG, let me second that quote!!

I live in Charlotte, NC and sold a townhome here last summer after being on the Board for over 2 years (owned the condo 5 years). Let me tell you what I witnessed and struggled against the entire time from that Board — self-dealing from the community money pot (not direct cash but justification of repairs/upgrades for their own units that were outside the scope of the Bylaws), favoritism toward certain homeowners, continual budget-fudging, dismissiveness toward anyone who posed questions, pie-in-the-sky ideas about what constitutes value (they did not understand something long documented….that when you remodel, you average approx 75-80 cents on the dollar back of $$ spent when the property sells. Remodeling will not provide an increased return on the investment! Btw, I’m not saying, ‘never remodel’….rather, I’m saying, ‘tread carefully if you care about spending money WELL’.)

It was an absolute freak show. But, wait….is this some mysterious pool of crazy people I had the misfortune of involving myself with? Uhmm, these are the same people that populate your workplace, your family, your friendship pool, etc. Yep! Most Board members are non-businesspeople so already they have wishy-washy and undisciplined ideas about money. Simply put, HOA’s are a mini form of government and they behave the same way. Power and access corrupt people.

Two Action Items: 1)do yourself a HUGE favor and spend the time reviewing a few years of budgets and balance sheets for any condo you’re considering buying. AND, don’t forget to ask for *in writing and with written response* how many special assessments have occurred in the last 10 years AND whether any are under consideration. If they balk at providing that level of detail, I would consider it a BIG flag. 2) Do an internet search using keywords: abusive condo boards — and let your jaw drop at what you find.

This data is relevant to this “young people screwed” topic: http://www.zillowblog.com/2012-08-30/under-40-and-underwater-a-list-of-the-top-100-u-s-metros/

Last August, but, hasn’t changed that much.

I know a couple who bought a condo in 2006 for 725,000. They lost their place to foreclosure last year. It was purchased at auction for 530,000 in Dec last year. Well, it is on the market again for 1,000 less than paid for in 2006. Of course it is fair for some inside tracking, RE Investor to profit first before resale. Next. .

http://www.calculatedriskblog.com/2013/02/dataquick-january-home-sales-in-socal.html

DataQuick: January Home Sales in SoCal highest in Six Years

One of the housing markets I follow closely is southern California. I highlighted a couple of key points in this article: 1) Activity is picking up, especially in the move-up markets, 2) there should be a “supply response” to more activity and rising prices (I expect more supply to come on the market), and 3) foreclosure resales are at the lowest level since 2007.

Read more at http://www.calculatedriskblog.com/2013/02/dataquick-january-home-sales-in-socal.html#PAbkfo7KKGpixUxs.99

Having been involved in managing properties for over a decade, I want to confirm that your rough numbers (6% return on gross rents, 50% in taxes, repairs, vacancies, insurance) parallel my experience. Anyone seeeing numbers that indicate some marvelous cash cow is looking at an outlier and extremely careful due diligence would be in order. I think the 50% number is worse for most landlords who lack scale fewer than 50,or so, units. The way to make the long term number work is steady re-investment (i.e. not taking the 3% out of the business) and creation of pride of ownership property on which rents are raised and a waiting list created.

That, or catering to the Section 8 crowd, and make no investment beyond clean up and use of second hand stuff for upgrades.

Most people are better off building a diversified REIT portfolio including timber and resource REITS.

Even Section 8 is not doing well for invididual investors, not from lack of tenants, but from how slow government pays. According to a friend who owned a few Section 8 building in downtown LA (she sold them to some REIT) government is consistently 3-6 months behind.

This Is Housing Bubble 2.0: David Stockman

http://finance.yahoo.com/blogs/daily-ticker/housing-bubble-2-0-david-stockman-133026817.html

Traditional occupant owned real estate is very likely to be a very poor choice to be tied down to with a long term mortgage. For one, your house comes with a very large bull’s eye painted on it for the taxing authorities. Real estate taxes will increase dramatically. Secondly, the cost of commuting is definitely going up. Unfortunately, most nice neighborhoods are not plentiful sources of employment. Thirdly, the larger the house, the higher the operating costs, which will also be higher. California urban sprawl, whether it be light or heavy, is a fundamentally flawed experiment that cannot be sustained in a high energy cost environment. We are already there with oil at a $100 a barrel. And, you can forget about 3% or 4% economic growth as well.

I agree. I’m early 30’s and only see owning a house as a ball and chain. It just ties you down and doesn’t allow for much flexibility. The job market is very volatile and will only get worse. Plus, if (but more likely when) we enter into a hyperinflationary environment, ‘good’ neighborhoods may decay over the long run. I’d much rather rent, invest my savings, and retire early while laughing at the Joneses who are trapped in mediocrity because they bought into the American home ownership wet-dream. Of course I will probably buy small lots of rural farmland so that I do have some productive assets.

I think hyperinflation is a reason to buy and not to rent. If one day we will have to pay $1,000,000 for a loaf of bread (German Post WW1 Inflation) I am sure a house will cost more that that, or even the rent for a month. If you buy the house now on a mortgage, you can pay it off on a one day wage during hyperinflation.

Real estate taxes will only rise dramatically if Prop 13 is overturned. I’m all for that happening. The current tax system is grossly unfair! However, I don’t see it as likely. As long as Prop 13 is in effect, tax rates can only increase at 1%, which is less than inflation.

Some young people expect their old parents to give them money for a down payment. Gov. Rick Perry says for you California people to come on down and get a mansion for $300,000. Go to zillow and look what you get for your money. (Pastor Bob tells me not to lie, the AC summer bills are high and so is the heating bills in Dallas, not to mention the 3% property taxes, but no income tax)

As Mish said, in every modern case of hyperinflation the decision to inflate was a political one, NOT an economic one. In almost every case hyperinflation followed a war or a coup or some massive political change such as the end of the Soviet empire or the rise of a dictator or a populist-socialist takeover, and other political unrest.

Those calling for hyperinflation are extremely misguided. It is not going to happen in any timeframe worth discussing.

On the political side, no country is going to force war reparations on the US. The US is not going to peg its currency to another, the Fed is not going to print $50 trillion (and it would not matter anyway unless Congress spent that much), government is not going to confiscate land to the point of causing massive human and capital flight, etc. etc.

Moreover, the US’s gold holding, the fact the US has the largest capital and bond markets in the world coupled with ease in starting a business vs. nearly anyplace else in the world, absolutely 100% precludes a hyperinflationary outcome for the foreseeable future.

The hyperinflation model is absolute complete silliness.

So PapaNow, you are saying that even though the Fed is purchasing $45 billion per month of Treasuries and now has purchased $1 trillion worth, and even though it has back stopped the too big to fail banks to the tune of trillions that none of that matters? Who will buy the $45 trillion in treasuries each month if the Fed doesn’t? What happens if interest rates increase when the government owes $16 trillion dollars? For example if interest rates increase to 10%, the US treasury must pay $1.6 trillion interest per year. Where does that money come from? Even if interest goes to only 5% that means $800 billion in interest payments each year. Only possible solutions: increase taxes, increase the money supply (aka inflation) or both. Inflation is only not inevitable if interest rates stay at 0.0% or 0.25% forever, or if the US debt is paid off before interest rates go up substantially. To pay off the debt, the US must substantially increase it’s revenue, and reduce it’s expenses. Good luck with either of those scenarios.

Oops I meant who will buy the $45 billioin each month, not trillion. Typo sorry.

Tim with all due respect, that is only what is seen on the surface and it’s all the smoke and mirrors to keep this zombie economy going. $45 Billion is pennies to the Fed. The total amount of global currency, fake and real, can not be counted but is estimated at $600 Trillion. Yes, with a “T”. All the leverage, swaps, CDO’s, credit cards, you name it…all adds up. And America, being in the top, has a good percentage of that and it far surpasses $16 Trillion.

So again, with all that floating around, unless they actively release more CREDIT to the masses with ease (like the 2003-2007 housing bubble) for everyone to pounce on even more, I don’t see hyperinflation and I believe my argument.

It’s $85 Billion a month, not $45!

All it’s doing is plugging holes……

Considering the Fed is conducting a grand experiment it is very difficult to predict the outcome. With any experiment there are unforeseen outcomes. Hyperinflation is one of them, but considering the US is off the gold standard it might not occur.

The Fed’s also buying $40 billion a month of MBS, but what’s another $1 trillion/year of fabricated fiat? Let’s get our dream pad in Riverside!

Gordon, what’s wrong with Riverside? Redfin Wood Streets or Hawarden Hills. There are many many good neighborhoods in Riverside and their downtown is transforming into one of the best in SoCal.

Nothing’s wrong with Riverside, just randomly chose a bubble-affected city that has crashed hard

Hey Papa, I agree. Talking about hyperinflation in the same sentence as whether or not to purchase a home now sounds like extreme doomsdayer mentality. There are of course people who have purchased old missile silos in the midwest and plan to live in them when doomsday hits. But did they buy at the right time 🙂

we’re all doomsayers! what a bunch of idiots we were a few years back! Jesus, I missed out on the opportunity of a lifetime up in Palmdale back in ’06!

I agree with Dirtbagger in that real risk related to home purchase in today’s environment is deflation rather than inflation in any form: hyper or not…… Given that most homeowners are levered without recourse, one actually hopes for inflation as returns are magnified. Deflation is a real risk and that is why FED is printing thru QE. Not sure why people talk about potential inflation scenario and “saving” today in the same breath……

@Gordon Hi Gordon. Buying in Palmdale in 2006… anyway, my point was not whether or not it is the right time to buy (ie buying in Palmdale (or anywhere else) in 2006 was not a good time to buy). But my point was that if someone is using the possibility or excuse of hyperinflation as a reason not to buy a house is ‘doomsday’ thinking. Granted there are other reasons not to buy, hyperinflation is not one of them.

As for hyperinflation being an illegitimate excuse whether to buy a house, I would agree with you.

While everyone is discussing 2000, I’d like to take this moment to remind you all that you are 13 years older. I’m not trying to be a jerk but what’s the point of all the hemming and hawing and dreaming about homeownership if you are never going to do it? No one can predict AT ALL 20 years from now, tomorrow could be the first day of a massive baby boom for all you know and there could be millions of potential – debt free buyers – in 20-25 years…you don’t know! All you do know is that the clock is ticking away and someone is spending a lot of cash to snap up houses. If history has taught us anything it’s that those with money and power will stop at nothing to keep it, this is probably some elaborate scheme to buy time by artificially inflating things…until they think of another scam, it’s all part of their game.

Oh and regarding the TX comment….no real talent wants to live in that state, it’s got a terrible reputation as being hot, racist, ugly and environmentally unfriendly, not to mention the constant threats of succession. There is a reason that CA can command the taxes they do, because real talent, those with a choice, WANT to live in CA. They can ship all the po-dunk jobs to TX, but the creative and innovative jobs, the ones that truly matter, will stay here.

Candace, your smug attitude is the precise reason people are leaving. I myself am one of the most talented in this state, in Photonics. We are well funded yet the company sheds jobs to TX, where many are moving because of the COL and tax benefits. Dallas and Austin are the meccas right now.

Do I prefer TX? No. Will I move there? No. I’ll go back to St. Louis in a heartbeat. But don’t for a minute think you have any justification saying CA is the only place with talent. If that’s the case, why is NYC still bigger than LA or SF? Boo-yah. And to top that off I wasn’t even educated in CA, they recruited me here.

CA the only place with talent? Maybe in graffiti. Give us a break and shame on you.

Agreed. I’ve lived in the L.A. area for nearly 15 years, and, although my small business caters to the entertainment industry, the nature of my business has changed, so I can run it from anywhere. We rent a home in Studio City, and we were hoping to buy in about a year, but this market seems outrageous, so we’re seriously considering moving to the nicest old neighborhood in Indianapolis (I’m originally from IN.)

Here in the Studio City hills, a 900 sq. ft. 2/1 around the corner from us just came onto the market for over $600K. For $400K in Indy, you get a turn-key, 3500 sq. ft. Tudor near-mansion from the ’20s down the street from Peyton Manning’s house in a beautiful, old, wooded neighborhood with one of the best magnet schools in the country nearby.

California has its perks, but how much is it worth it to us to stay here? The houses in Indy that we’re looking at for $400K would easily be $1.5-$2 million in an equivalent L.A. neighborhood. It would be one thing if it was something like a third more to live in L.A. vs. Indy, but it’s more like 3x-4x…and we rarely even go to the beach!

Papa, don’t get sucked in by what appears to be a troll…speaks of superior talent in California, but ponders Texas “succession”? I think it’s great!

Candance,

I assume you live in Stockton.

LOL @ Candace.

Perhaps you should use more CAPS to try to get your worn out point across.

Thank you for “taking the moment to remind us all”

duly noted.

Candace, of all the posters here that I’ve noticed, you get it! As Yogi Berra once said, “The future ain’t what it used to be.” Plus, I agree about CA…..there just is something special which I don’t think exists anywhere…..really, a spiritual thing……a person can be or do pretty much anything they want…….it is all about creativity……..Mark Zuckerberg moved FB to CA…to me that says it all.

@Joseph – I’ve been an East Coaster all my life (but I love the West and may move there at some point).

I think I have the phrase you may be looking for to describe the West — pioneer spirit. It is real. I notice and feel it every time I’m out there. It’s awesome.

I live in the Southeast and it is the opposite. Very rooted, traditional, fearful, easily threatened, boring….would more describe the disposition here. It’s sad, really. A lot of wasted human potential.

But, you can KEEP M. Zuckerberg. That guy is as narcissistic and dishonest as the day is long.

I have said it before and I will say it again. The continued high in Cali comes from the green corn. Buying in 2000 was good but anytime past that someone must have been smoking the green corn.

‘no good explanation for the plummet in default notices in California’ however the LAT article goes on to say it could be because of new laws protecting underwater homeowners from repossession…

http://www.latimes.com/business/money/la-fi-mo-southland-housing-20130213,0,5286697.story?track=rss

Boy are you lost…..there is a boom going on in CA, a legitimate boom….sure, there will eventually be a bubble…..CA has always been about booms and busts, going all the way back to gold rush days……but, just keeps on coming back stronger than ever……the current boom is more than just homes….an oil boom in Bakersfield, Tesla being Motor Trend Car of the Year, CA budget forecast to be in surplus in 2014, the largest drop in unemployment in 25 years, the Facebook IPO……………..I guess I just like to “read the signs” as in “Silver Linings Playbook.”

You consistently come up with more strawman arguments and completely irrelevant points to allegedly bolster your case. Your postings sound like canned presentations from the CA Governor’s office. And your point about the Facebook IPO? Hilarious, that’s one of the worst IPO’s to come out of the Valley in years, and it’s future performance looks abysmal.

Replace the Dumb with Dumber buyers! They must learn the cycle or California Real Estate! 7-12 years up & 7-12 years down. Must Sell@top & Must buy@bottom. Balls required for both!

Great read as always DHB. Here in SD this week houses in my area that were selling for 300 in 12/11 are on the market now for 400-420k. But you can’t get a loan for them and the filppers won’t touch them due to the lack of upside. So I remain in my crappy 1BDRM apartment with my with wife and 2 dogs……

On zerohedge I just read another report that might spell the end of 2.0, except here in California….

“Boomerang Foreclosures” Are Back As Bernanke’s Second Housing Bubble Begins To Pop. by Tyler Durden

http://www.zerohedge.com/news/2013-02-14/boomerang-foreclosures-are-back-bernankes-second-housing-bubble-begins-pop

Pretty sad when the Fed has to reinflate the housing bubble before it fully deflates. They must be scared shitless trying to put lipstick on this pig. Howeve,r jumping into the market at this point is a choice. Nobody is putting a gun to your head. If you can’t see who is buying in this type of market and what the state of the REAL economy is, then it’s your own fault. You better love the place your buying because we’re in unchartered territory with this latest artificially (government) induced real estate bubble.

The Risk vs Reward equation is stacked against you.

http://www.westsideremeltdown.blogspot.com

I don’t know. While I am from CA, am seriously thinking of moving to some place else. I have 100k + in liquid assets. Here that would just be a down payment, then I would owe the mortgage every month and not have much savings. Lord forbid I lose my job, I would be stuck with an expensive old shack. But a lower cost state, even if it is lower pay, I get to at least own half the house and pay mortgage in the hundreds and not thousands. I can build up my svaings again. Never thought I would consider this, but housing is just obscene-especially when compared to the late 90s-when everything else was booming.

No kidding. Like I just said above to PapaNow, I’m considering a move after living here half of my life. My wife and I only have one child (and we’re not having more,) we make over six figures, and it is still a struggle to buy in a nice neighborhood here, unless we decide to be house poor, which is apparently very popular here.

I’ve been following the market and this blog everyday for years, and I’m about fed up (no pun intended.)

That is what we did; taking job transfers out of CA and living in a lower cost state allowed us to save enough cash to buy three income properties (not in CA). Nothing fancy, but they are profitable. We have two kids; they were not traumatized by moving, embraced the adventure, experience. Now that they are adults I believe it has made them more flexible; less fearful of change and willing to try something new. No regrets. Just my 2 cents.

That wealth creation was bubble driven was on paper only. It wasn’t real wealth unless you liquidated your assets and realized that gain, and then downsized, which sometimes means lowering your living standards. The present/next generation (will) only knows a low interest environment, but as previous generations know that can all change. I feel sorry for them to the extent that the debt build up was irresponsible and will be up to them to pay down, but would have done things differently? Will FHA ever go? Will down payments return? Will current home prices see a fall off, when the government removes it’s supports? Things will probably revert to the norm, but there’s probably another decade of rot to fall out.

IMO – the housing bubble, dot com crash, etc. are just the unintended consequences of the on going credit bubble. At some point in time, the credit bubble will eventually deflate – the how and when are unpredictable. The FED is not oblivious to this excessive credit (having either willfully created it and/or allowed it to take place) and is trying to devise strategies to eventually remove excess credit with the smallest negative impact to the economy.

One of the major consequences of debt bubble deflation will be a greater scarcity of funds available for loans and certainly a much higher cost for these funds. Aging demographics , higher interest rates, and stagnant income growth seem to point to a modest growth in housing demand and in long term housing prices. Pehaps prices will mirror replacement costs. Buyers using their home as an investment vehicle rather than shelter are likely to be disappointed.

“The FED is not oblivious to this excessive credit (having either willfully created it and/or allowed it to take place) and is trying to devise strategies to eventually remove excess credit with the smallest negative impact to the economy.”

I really don’t believe that at all: Banks owning the FED are getting tremendously rich because of excessive credit and FED isn’t even trying to remove it, ever.

Instead FED is trying to keep that credit bubble inflated as long as possible, whatever the cost to the rest of the economy is, as long as the owners, the banksters, don’t suffer.

Economy as a whole doesn’t interest FED at all: They really don’t give a flying fuck.

Or, to be precise: they haven’t _done_ anything which points to that direction. Only talking and it’s quite obvious that those are lies to hide the true function.

Thomas,

Good analysis of the slimy Fed. But don’t forget they are now forcing the retail suckers to buy stocks for their “dividend” at the top to give them a good you know what on the way down. Yes, I am going to buy a stock with a 5% dividend and then watch it lose 30% of its value. Watch out for precious metals, the Fed is going to do a number on them as well.

The Fed has sure done a number of precious metals the last 13 years or so

Has anyone else noticed how hard they have to work to keep this market juiced? 3.5% mortgage rates? Damn, this is taking the full concentration and resources of TPTB! But everday, they have to keep working harder and harder to provide the market with ever less juice than before. If they can keep it juiced until we all become homeowners, then they’ve won as we’ll all be invested into the lie as well.

The biggest issues I see with younger buyers is:-Lack of savings-Big debt from education-Tighter incomes-Less of a desire for McMansions…

How about the unwillingness of banks to finance? Maybe not an issue in California, but here in Florida we are very restricted to Cash when it comes to buy a Condominium. (Houses are more subject to be approved). I spoke to a mortgage banker, and he told me it is a gouvernmental regulation issue. Since prices are at a record low, it is almost a no brainer to buy and not to rent. (Condominiums from $35k!). If the banks finance those deals, the buyers will build significant wealth on their property, what would spike up the middle class. If (when) the banks start financing again, there will be an unreal appreciation in real estate, similar to the one we had in 2000-2006. My advise if you live in Florida: Buy!!

Of course, “Buy!”. I said that three years ago when Florida was tanking. No brainer, right? Boomers flocking down from the north in the zillions, right? Well, where are they? $35,000 condos, and they aren’t selling. Doesn’t that tell you something? First, the Boomers are underwater and in debt up north, with no ability to move anywhere, and the locals in Florida would have to rob five banks to come up with 35 grand in cash. Nobody has any money.

When I was 18, I realized I knew nothing about money. So I went down to my local public library, the money/economics/personal finance section was about ~25 books total, most of them from the ’20s through the ’70s. The most enlightening of all was “How to beat the salary trap” published in 1978, the year I was born. It can now be bought for $4 including shipping on Amazon. There were a couple books of the ‘get rich in real estate’ types, but that was a terribly small minority of mostly good, informative stuff.

The real lesson I got was that the only “good long-term investment” is your own education and skills. Real estate is a great money maker at times and a money loser in others. When a person is buying a house, the thing to look at is the lifestyle you want to live in the long term and your reasonably expected income. By reasonably expected income I mean how much can you expect to be earning a year from now if you lost your current job today. If you couldn’t afford the mortgage under those circumstances, consider a different property or a much larger down payment.

There’s still a lot of speculation in real estate, and much of it by people who really shouldn’t be speculating. For folks wanting a second home as an investment, best wishes. For folks looking at purchasing a primary residence as an investment, quit being dumb. Buying a home is buying a lifestyle first and foremost. Chances are you won’t be well positioned to buy at the bottom. And will you be able to sell, move, and get a better deal at the top? Almost certainly not.

I think it all comes down to inflation. Buying primary residence is not a risky thing in his market. Real Estate is an unique inflation secure investments (besides gold).

So if you think gas, food, and energy prices will decrease within the next 5 years, dont buy real estate, not even as an investment. If you think gas and food prices will go up, it is almost certain real estate prices will go up as well, unless the Feds kick up interest rates, as they did in the 80s to “milk the middle class” some more. I dont think they can get away with it this time, since it would spread extreme poverty to about 80% of Americans… but you never know!

This is by far the most extreme Federal Reserve we’ve ever seen. Granted we’re seeing asset prices rise but what I find troubling as do they are the employment numbers. Throw in 30 million citizens on food stamps and other entitlements that are growing rapidly and you come to the conclusion that we’re not fixing our problems.

JQ

At the end of November 2012 there were 48 million people on the SupplementalNutritionAssistanceProgram ( SNAP ). http://www.fns.usda.gov/pd/29SNAPcurrPP.htm

Markups, I am a CPA and based on my experience serving really wealth people, I have to tell you that you are wrong, and primary residences are not a sure anti-inflation investment, particularly when they are bought at overly high current prices that are totally out of line with people’s annual income. If you make $120K or less a year and you buy a 40 + year old house at $750K in So Cal, u are not smart in investing. Interest rate will rise again because there is just so much debt the gov’t can borrow to buy the bonds out there to suppress the interest rate at the current level. The USA is already heavily in debt, the next generation of citizens are going to have fewer job opportunities for high paying jobs like the baby boomers once had because of global competition and increase in technology that reduce the demand for labor to sustain productivity. A shrinking income tax base will put pressures on property tax for existing homeowners, and also reduce the USA’s ability to further borrow to buy bonds. Property taxes will hike and interest rate will hike, making home ownership more expensive. Home price will fall accordingly. It will even fall more when there is no eligible young buyer out there who can afford to buy these homes since they won’t have decent paying jobs. Home price will also drop more when baby boomers need to sell their houses to liquidate their equity they had tied down to their house for the last 40 years, to make up for the lacking of social security payments. Houses are only good investment, like everything else, when they are bought at a low price and when future demographics, and economic factors can support an increase in demand at the perceived price increase. The real estate bubble hadn’t really popped due to the Fed’s intervention, but pretty soon even the Fed will exhaust their credit, just like so many cities in So Cal already did, and the interest rate will shoot up…. Also, a house in Sol Cal can also be destroyed in the next big earthquake, which can hit anytime. Most home owners don’t buy earthquake insurance because it’s expensive. Most of the price in a house is related to depreciating components that run downs and lose value over time. The land where it sits is the only portion that is truly anti-inflation but even this is subject to property tax that increases with inflation. Putting over half a million bucks in an asset like houses, coupled with the reality of the future demographics and the economic factors, is a real risky investment. One thing I learnt from my very wealthy clients is, “Never treat your primary residence as an investment, treat it as any expense and monitor it that way…., also don’t go into a bidding war when you buy anything….”

Hard Times USA…

http://www.alternet.org/hard-times-usa/american-housing-market-set-screw-people-far-future

Stockman: Real Estate Bubble 2.0

Leave a Reply