Real Homes of Genius: Today we Salute you Compton, El Monte, and Downey. Four Examples of Foreclosure Alley. The Hesitant California Housing Market.

This weekend, I was having a conversation with an investor colleague and they brought up a crucial observation regarding the California housing market. New home buyers are jumping in head first into the drained pool thanks to FHA insured loans and investors are picking up many homes side stepping banks, but the move up buyer and seller is now fear stricken. Do people sell their current home in this market and pay a higher price for a home in a more prime area even though prices are still inflated? Or do they wait and hope for lower prices and at the same time, see their own equity dwindle? The low end of the market, meaning sub-$250,000 is moving briskly thanks to FHA and investors. The other part of the market is at a high risk of distress with the Alt-A and option ARM wave recasting in full force in 2010 and 2012. We can discuss how this will play out, but make no mistake it will not be good.

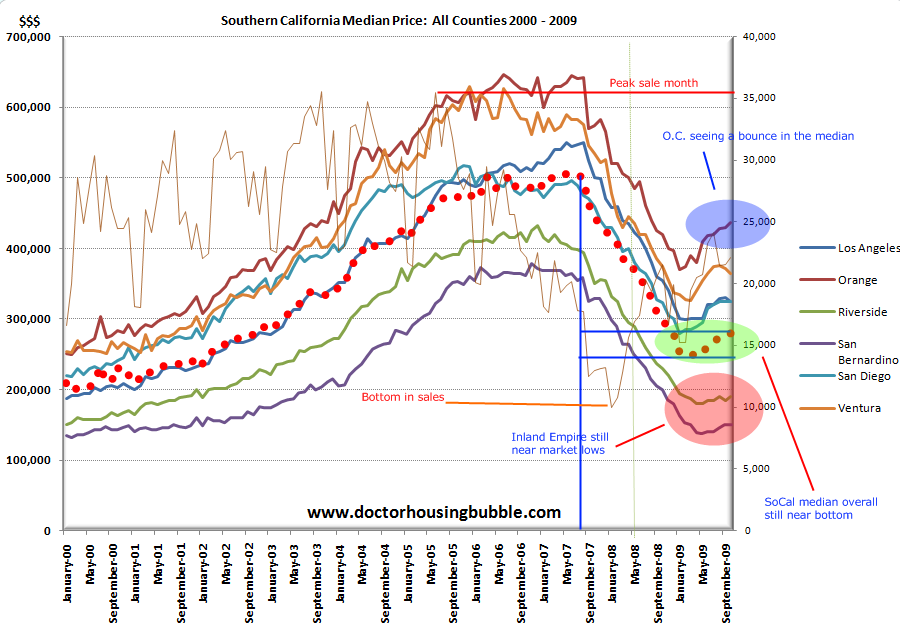

The market dynamics are fascinating. I put together a comprehensive chart examining Southern California breaking out counties:

So what is happening? The overall median price for the region is still near the trough. The hardest hit regions of Riverside and San Bernardino are still near the bottom. The slight uptick in these regions are based on first time homebuyers and investors. In many of these areas, buying is on par with renting. So that is one facet of the market. On the other end, you have a county like Orange bouncing from their bottom. Still a far cry from their peak but you are seeing more homes sell. A couple of patterns here. More lenders are willing to do bigger ticket short sales and this is moving prices up. It is fascinating that they are hovering around the $417,000 mark. The jumbo market is non-existent. It will be fascinating to see what it does at this point. Los Angeles has moved up slightly from the bottom.

We are still far from ever reaching a peak sales month like the few months we cracked the 35,000 mark. Sales are also being dominated by foreclosures re-sales and first time buyers. Some data on last month sales:

SoCal Data – October 2009:

Foreclosure re-sales –  40.6%

FHA Insured loans -Â Â Â Â Â Â Â Â 38.3%Â (two years ago this number was 2 percent)

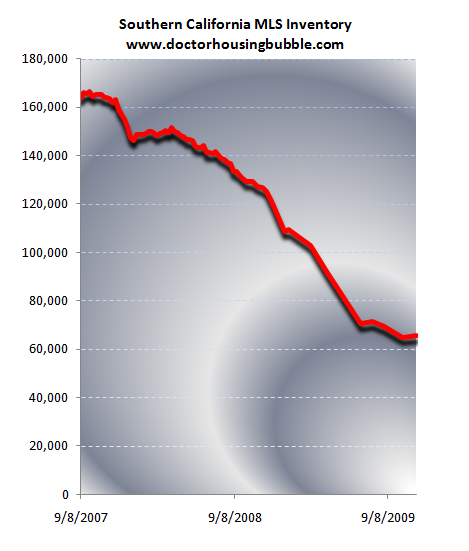

It is hard to extrapolate any normal market trends from this because the market is anything but normal. We have HAMP trial mods and most are in California. You can bet your money that the majority will not stay permanent and will add more inventory in 2010 once they fall out of HAMP (the government will probably make another program to modify failed HAMP mods called RE-HAMP). The numbers are fluff on the front-end. Expect this to hit at the same time as the recast wave. As we now know, banks can game the system but that doesn’t mean that the market is going to boom or even stabilize. Take for example the MLS inventory trend:

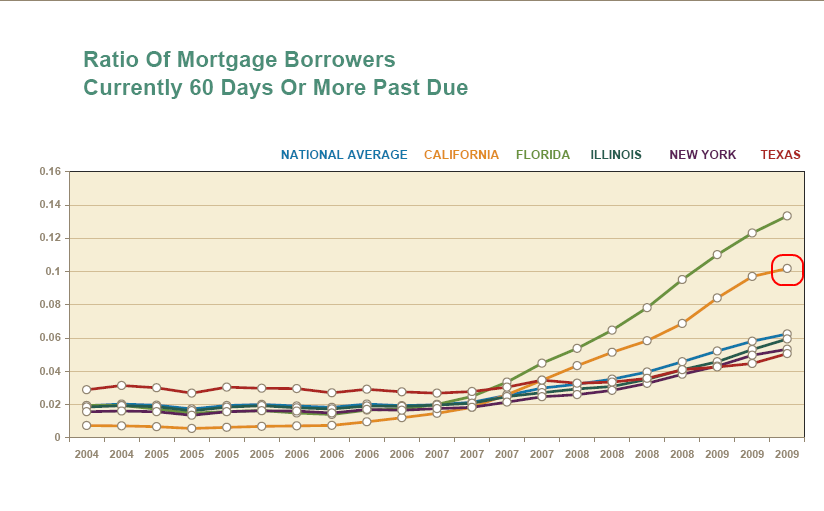

Since September of 2007, the MLS inventory has fallen dramatically. Good news right? Not exactly. Because most of the inventory is now part of the shadow inventory. Nearly half of all sales are foreclosure resales so many of these homes don’t even make the public list. So we now have to adapt to the new reality of the market. If you have any doubt about this, just take a look at recent distress data put out by TransUnion:

Over 10 percent of all California mortgage borrowers are 60+ days late! This is uncharted territory. Clearly there is little dispute that growing foreclosures is not a good thing. California having the second largest average mortgage balance of $354,000 puts an enormous amount of money at risk. How distressing is this data? Let us break it down further:

California homes with a mortgage:Â Â Â Â Â Â Â Â Â Â 5,290,000

10 percent 60+ days late             =            529,000 homes

Current Seasonally Adjust Annual Rate of Home Sales   =           530,520

In other words, we have a year of distress inventory and who really knows where this is at. Some of it is REO. Some of it is in HAMP. A lot of it is sitting pathetically idle in the balance sheet of banks in a form of toxic mortgage stalemate. People aren’t paying and banks aren’t moving. Everyone is now waiting for a bailout thanks to moral hazard central. The only data where it shows up is in the distress data of the 60+ days late because it certainly isn’t showing up in the MLS.

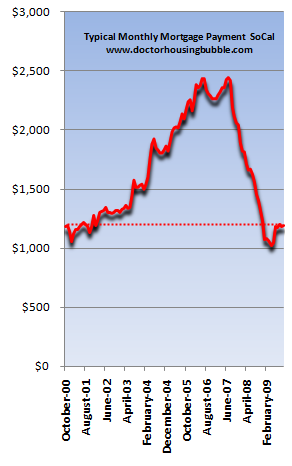

Another chart showing the new reality of the California housing market is the monthly nut metric. Don’t expect to find this in any economics books but this is another good measure of how much debt the current buyer is willing to take on:

At the peak, the typical California home buyer was willing to take on an insane $2,500 principal and interest charge. Actually, this data is completely misleading because this was based on crazy mortgages including option ARMs which didn’t even include principal! Or even all of the interest for that matter. Now, with FHA insured loans being the bulk of the mortgage market people are committing to a typical payment of $1,196. Try finding something that fits into that data in the Westside. Of course the market is correcting. But some people are obsessed with niche areas that they miss the larger trend. I get the sense that some people want to buy a Beverly Hills mansion for $200,000. Not going to happen. Yet the reality based market is adjusting as the above data is showing.

Since people seem to forget why the market is taking such a big hit, let us take a trip down foreclosure alley. Today we salute Compton, El Monte, and Downey with our Real Homes of Genius Award.

Foreclosure Alley

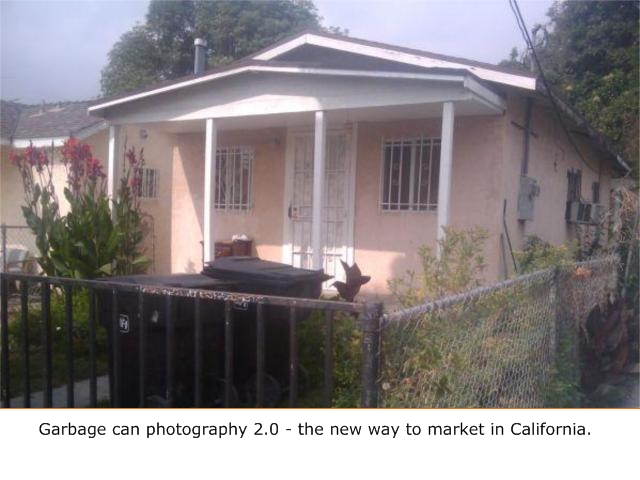

Our first home takes us to Compton California. Compton has been devastated by the subprime mortgage fallout. This home is no exception:

Ah yes! The very common garbage can photography technique. Banks are so motivated to move inventory that they don’t even bother to move trash bins out of the way to market the home. I’m glad banks are trying to get the most bang for their taxpayer bailout buck. The above home is a 2 bedroom and 1 bath home listed at 576 square feet. Let us look at the sales history here:

| 06/18/1996: | $32,000 |

| 01/13/1998: | $105,000 |

| 07/20/2000: | $72,000 |

| 07/21/2003: | $140,000 |

| 02/24/2005: | $208,000 |

This home is currently listed for sale at $54,400. Lost decade for this home. Can it reach the double lost decade figure? A 74 percent price cut would make anything seem possible. What do you think this home is going to do once it sells at a low price? Lower comps. The backlog of distress inventory assures us downward pressure on prices in future data measures.

Let us move on to home number two:

Are we buying a home or vegetation? Thanks banks for taking the time to take quality pictures! You were more than happy to make loans on these places and you can’t spend some time on taking a few quality shots? Last time I checked eBay has some quality digital cameras for $200 or less. I’m sure you can use some of the trillion in bailouts to purchase some decent photo equipment. Just saying. This home has an interesting history:

| 08/07/1998: | $46,000 |

| 11/06/1998: | $113,000 |

| 11/01/2005: | $290,000 |

The homes is currently listed at $85,000.  A 1 bedroom and 1 bath home listed at 910 square feet. Let us look at the ad description:

“Great opportunity for investor or owner/occupant. This property has great potential and is priced right for a quick sale. Surprisingly spacious with great utility. Requires significant repairs.â€

You’d probably get $700 a month for this place as a rental. Great investment right? Well you need to factor in those “repairs†and also, many areas have higher vacancy rates because unemployment is sky high. Many novice real estate investors right now are jumping in having no clue how volatile being a property manager can be. They look at the rent, multiply it by 12 and subtract their principal and interest payment and suddenly it looks fantastic. It isn’t that simple. But hey, this is California housing math! Why let little details get in the way like the 22 percent underemployment rate?

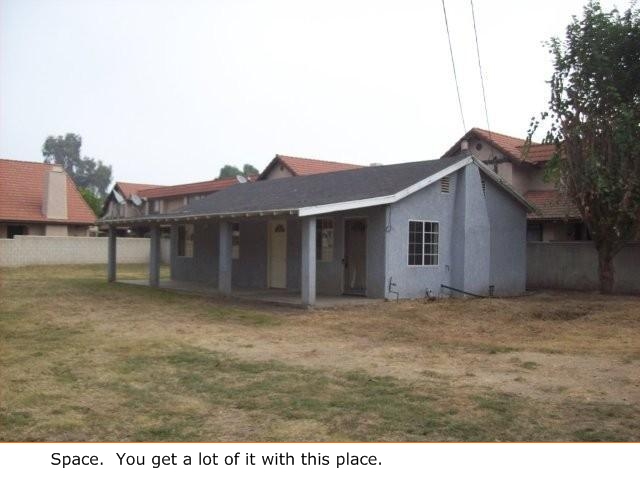

The third home takes us to El Monte:

This home is a 1 bedroom and 1 bath home listed at 760 square feet. It looks bigger because of the yellow grass and the size of the lot. But it might be hard sleeping on the lawn. Feel sorry? Let us look at some sales history:

| 02/25/2005: | $410,000 |

| 12/01/2005: | $530,000 |

| 09/24/2007: | $515,000 |

The person who bought in 2005 just lucked out. They lost some money but hey, not like the recent buyer. The current list price is $206,900. Keep in mind that $500,000 in many other parts of the country would buy you a castle like mansion and here, it gets you 760 square feet with yellow grass. Real Home of Genius indeed. Who is the next lucky buyer?

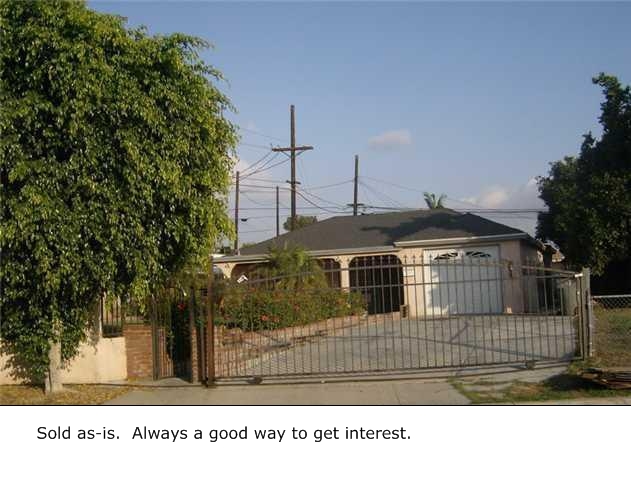

Our final home takes us to Downey:

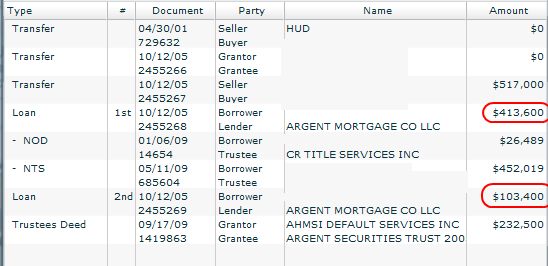

This home is a 4 bedroom and 2 baths home. It is listed at 1,372 square feet.   So what caused this home to go into foreclosure? Many reasons including the home equity machine:

Ah yes. 100 percent financing for a $517,000 home. Of course, this didn’t end well. Zero down for this place. The ending is very common. The current list price is $274,900. Chalk one up to the California dream gone insane.

These are homes currently selling and we have thousands more. What do you think is going to happen to median prices when they sell in their local areas? Today we salute you Compton, El Monte, and Downey with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

15 Responses to “Real Homes of Genius: Today we Salute you Compton, El Monte, and Downey. Four Examples of Foreclosure Alley. The Hesitant California Housing Market.”

In the bus. section in the Union Trib. for the last few days headlines reads, real estate is moving up. Do you think “they” read about the unemployment rate before they put this in the paper???

More bad news for California…

California’s projected deficit: $21 billion:

http://www.latimes.com/news/local/la-me-budget-deficit18-2009nov18,0,7647152.story

two of those listings look like buildings in a 1950’s motel complex. but the one with the gate! wow does the gate have an garage door opener on it, or is it safe to get out and open it manually? and those 4 power poles wont affect the view from the veranda, or will they? and will my beemer fit in that garage?

Home rescue plan delaying, not solving crisis

To help pay his mortgage, Latta has slashed his bills by hunting for food in the wooded hills around his town of Albany in southern Ohio, and growing his own vegetables. He has resorted to selling pumpkins and firewood to make cash.

In March, Latta heard about Obama’s Home Affordable Modification Program, or HAMP, that allows mortgage payments to be reduced to 31 percent of a homeowner’s income.

The plan was launched as a central plank of Washington’s efforts to stem foreclosures.

Latta applied for a loan modification but was rejected. His bank said his income from selling pumpkins and firewood — a net of $906 in 2008 — was too high. (!)

Dr. H.B –

awesome as always! I know that most people here are focused on the westside but I was wondering/hoping that you could do a couple real home of genius for the SFV. It had been a while since I scanned the r.e. websites for the Valley and I was shoked that prices are still all over the place – it’s still crazy out there folks. Hunker down, it’s gonna be a long cold winter.

thanks again for all the great info!

“I get the sense that some people want to buy a Beverly Hills mansion for $200,000. Not going to happen. ”

Doc,

I hate to criticize you in any way as you do a great service of providing information yet I have to take issue with the above statement.

I read the comments regarding “niche” areas too and they are all pretty much the same as my thoughts. And that is, homes within 10 miles of the coast, (for me, I am speaking of San Diego) that are in a decent neighborhood , not only failed to drop by more than 10 to 15% from the peak but they are now rocketing and these days even if you wanted to it is nearly impossible to find one of those “rockets” in decent condition.

My old house in 92104 is just a couple blocks from a Hispanic area. The street it sits on has no parking due to the apartment complexes near by. It is also 2000 feet from being directly under the flight path for the airport.

I bought in 1999 for 289K, today, if it were for sale, it would fetch 750Kish.

I would gladly pay what I sold it for in 2004 but it is looking less and less likely.

I don’t see Riverside or SB going up anytime in the foreseeable future. You see hundreds of vacant homes around here everywhere. For every home you see already vacant there are probably another 5 in some state of foreclosure. It is roughly the same price to buy/rent out here, but I think everyone who was going to buy has done so. It doesn’t seem like investors are snatching up the homes out here yet as I’ve had 10+ homes within a block of me vacant for 4-6 months.

“I get the sense that some people want to buy a Beverly Hills mansion for $200,000. ”

Most homes in my neighborhood are three bedroom one bath shacks built in the 1930s. Where do you think prices will bottom here? (90048)

Doug N

>>

The way you quoted that article is misleading. Read it again.

>>

The income of the man in the story is NOT ‘only’ $960 a year as implied by your selective quotes. In fact the man has a pension – probably around $1750-1800 a month.

>>

In fact I found the article suspiciously vague as to exactly what his income is. The is a reference to the mortgage being 93% of his pension but it does NOT say, for example, that the mortgage is 93% of his entire income.

>>

If he only made $960 a year with firewood and pumpkins he is doing something wrong. A bundle of firewood (basically about 5-6 chunks 4-5″ in diameter and aboutn 18″ long) goes for $4 up here near a US National Park. I have paid $50(20 years ago) – $100 (5 years ago) for a pickup load of wood which is the equivalent of a 1/2 cord. The chainsaw and gas to run it don’t cost that much. And the pumpkins are stick the seeds in the ground. Not a high cost operation.

>>

The way you quote the article gives the idea that all he has is $960. In view of all info in the article, the article itself isn’t clear whether it was “$960 a MONTH in 2008” or “$960 for all of 2008” that he made from wood and pumpkins.

>>

Since the man is not in foreclosure (per the article) and has thus been paying the $1600 a month mortgage, is not starving (and growing veggies and doing some hunting might make up 10-20% of all food needed), appears to be paying his child support albeit ‘struggling’ to do so and has the pension as well as fire/pumpkin income, it sounds like there is some other income from odd jobs or something.

>>

Badly written article. The way you quoted it added to the muddle.

Martin_

You are right about some select areas. I sold my house in Altadena in 2003 for 400K. I would be delighted if could buy it back today for 500K.

Doug, this is why most small rural producers I know are keeping as much as they reasonably can off the books. Barter is the way to go with this stuff…though I have no doubt that both political parties will eventually joint to try to tax that as well.

~

On-books approaches pull the producer into a miasm of regulations, taxes, and punitive outcomes such as the one mentioned in the Reuters piece. These are all designed to reward huge operations and literally outlaw small ones, and frequently have been planned and pushed into being by corporate powers and the politicians who serve them. I’ve watched with dismay as this has happened to certified organic farming, and most very small organic growers I know are no longer certified. They can’t afford to pay $500 or $1,000 a year when they are producing only about that much.

~

There is no reliable way to get ahead at a micro scale with hunting and farming, no formula for that. It too has become a lottery. This person succeeds by selling yuppie chow to Alice Waters. That person succeeds by finding a bunch of New Agers who will pay $15 a gallon for unpasteurized milk. And so on. But any of these operations are at best hobby or sideline farms. Anyone hanging on to land is doing so by the skin of their teeth.

~

In the decades where I worked with the remaining small farmers in my region (many of whom have since been driven out), their common plaint was that everything they wanted to do was illegal. They had better, more sustainable ideas, but every way they turned there was a government entity or agency telling them they couldn’t do it that way. And a passel of fat economists telling them it “wasn’t efficient.” “Efficiency” only meant “at a mega-industrial scale.” The efficiencies of small, local operations were completely ignored, as were the virtues of keeping money circulating locally rather than sending it to some far away corporation that turned local ecosystems into waste lands, extracted all the profit, and undercut local laws.

~

I would show these frustrated small operators how it wasn’t just the economics that got ramped up into a mega scale with factory farming the sine qua non both at the research (Land Grant) and industrial levels. It was also the entire network of regulations and policies, reflecting a global New World Order in which only corporations can own and use land, mostly owing to their ability to float huge cadres of vicious, high priced lawyers. And where many layers of power infiltrate a person’s daily life and can interfere at any time.

~

What this has in common with DHB’s RHG this time is that when small and humble lifestyles are outlawed and marginalized, then the best anyone can hope for is to a) win the lottery or b) be a serf. There is no longer any effective type of “home ownership” in this nation. Even those of us who have purchased our lien from the bank/lender are renting our homes from powerful municipalities who can tax us at whim and will, and frequently without representation. We cannot say no to these taxes; they are framed as “bond issues,” or they simply change the mil rate because they have statutory authority to do so. Say no, and your real landlord–government–takes your home away. So the current government socialization of home ownership is no surprise to me. It is the logical outcome of the path we’ve been on at least since 1980.

~

In Thucydides’ history of the Peloponnesian War, he observes (3.19.1) how the Athenians, fighting war and also facing the rebellion of Mytilene, decided to levy an eisphora on their allies in 428 BCE–a direct tax. Donald Kagan notes in his book on these warshow Thucydides mentions this precisely because such a levy was notable and unusual, and not just for the risk of alienating much-needed allies. “A direct tax had not been imposed in a very long time. Strange as it may seem to modern taxpayers…citizens of the Greek states hated the idea of direct taxation as a violation of their personal autonomy and an attack on the property on which their freedom rested.” The eisphora fell on the propertied classes, which included yeomen farmers who also served as hoplites.

~

Compare that to how Themistocles built the Athenian navy, 60 years before–a much more creative and insightful use of public and private funds and energies.

~

rose

So much for responsible people who struggle to do right and pay their bills, no matter what the cost. I have met two people here in Chicago who are struggling with unemployment and underemployment, and they, too, have been turned down for loan mods under the HAMP program, even though they are not buried very deep, could make it with their payments only slightly slightly adjusted, and are committed to staying in their homes and paying for them even though the places are worth substantially less than at the time of purchase.

Mr. Latta of Ohio can take this much comfort, though, even though it’s a cold, bitter comfort: he has clearly developed skills and coping abilities that will serve him well and give him a distinct edge as we head down the slope of fuel depletion. He sounds like a real coper, someone determined to do whatever it takes to stay alive and pay his way.

Back to Business

With F.H.A. Help, Easy Loans in Expensive Areas

http://www.nytimes.com/2009/11/20/business/20limits.html?pagewanted=1&_r=3&ref=todayspaper

AN FRANCISCO — In January, Mike Rowland was so broke that he had to raid his retirement savings to move here from Boston.

A week ago, he and a couple of buddies bought a two-unit apartment building for nearly a million dollars. They had only a little cash to bring to the table but, with the federal government insuring the transaction, a large down payment was not necessary.

“It was kind of crazy we could get this big a loan,†said Mr. Rowland, 27. “If a government official came out here, I would slap him a high-five.â€

In its efforts to prop up a shattered housing market, the government is greatly extending its traditional support of real estate, including guaranteeing the mortgages of middle-class and even upper-class buyers against default.

In 2007, the government did not insure a single mortgage in this city, one of the most expensive in the country. Buyers here, as well as in Manhattan, Santa Monica and every other wealthy area, were presumed to be able to handle the steep prices and correspondingly hefty down payments on their own.

Now the government is guaranteeing an average of six mortgages a week here. Real estate agents say the insurance is such a good deal that there will soon be many more.

Policy changes like the shift in insurance, while often introduced on a temporary basis, are becoming so popular that they could prove difficult to undo. With government finances already under great strain, the policy expansions are creating new risks for American taxpayers.

The Internal Revenue Service is giving tax rebates to first-time buyers, and soon to move-up buyers, in a program beset by accusations of fraud. And the government agency that issues mortgage insurance, the Federal Housing Administration, is underwriting loans at quadruple the rate of three years ago even as its reserves to cover defaults are dwindling. On Thursday, the Mortgage Bankers Association said more than one in six F.H.A. borrowers was behind on payments.

F.H.A. insurance was created for minority and low-income families who could not come up with the traditional down payment of 20 percent required by private lenders. Buyers receive loans from government-approved lenders and are required to document their income and assets. They must pay a substantial insurance premium of 1.75 percent of the loan. But in return, their down payment can be as low as 3.5 percent.

(more at link)

Something like 12% of homeowners in S.D. county are behind on their payments.

The question is how many of those people purposely missed payments so that they could then get their lenders to negotiate lower interest rates/ payments or whatever? The word is you must be behind on your mortgage payments or else no negotiation.

Dude! High Five! Seems one of the “partners” doesn’t even have a regular job. Gotta love that down payment, it shows a real commitment. Real estate is a no brainer, especially as foreclosures mount and unemployment rises. When and if Frank gets the higher FHA loan limits through on a permanent basis, it will be interesting to see the FHA loans that get approved and the properties and parties involved.

Seems we’re in deep, dark water, folks.

Leave a Reply