Real Homes of Genius: Today we Salute you Beverly Hills. When the 90210 Simply Isn’t Enough.

Today we get the stunning announcement that unemployment “surged” from 5 percent to 5.5 percent in one month. Of course, given the way the government calculates its shoddy employment numbers this is only shocking to folks that believe in the absurd government Kool-Aid. The reality of the current market arena is we are floating in a sort of no-man’s-land where Wall Street and Washington simply do not have an idea of how trying things are on the streets of America. I’m sure many politicians get their ideas of certain cities from YouTube or the regular tube and think that the OC is all like Newport Coast or Laguna Hills and conveniently leave out Santa Ana, Stanton, Westminster, and Anaheim which make a more accurate representation.

The current shift that is occurring is rather stunning. You need to remember that right now is usually the best seasonal time for real estate. Remember only a few months ago all the optimistic hogwash being put out by the housing complex that somehow California was going to bounce back? Really hard to jump back in at any price when California has the 3rd highest unemployment rate of all states. And the recent trend of distress with prime mortgages is simply reflecting the general malaise in our economy.

I was hearing on the radio yesterday an ad saying, “oil has peaked! The recent trend back down to $122 is a perfect time to get in [X company]! Don’t wait! Act now.” The irony is the ad was produced probably on the $122 day, jumped up yesterday, and today is now back near the all time high of $135. That is how quick things are changing. Now let us give you some raw numbers so you can sink your teeth in:

Inventory steadily is going lower and short sales are going up. How can that be? What we are seeing is the psychological component of real estate playing out in full force. Here are three quick observations that we can derive from the data:

1. Distress sales are going up. Banks with REOs are having to place homes on the market at a time when prices are free falling.

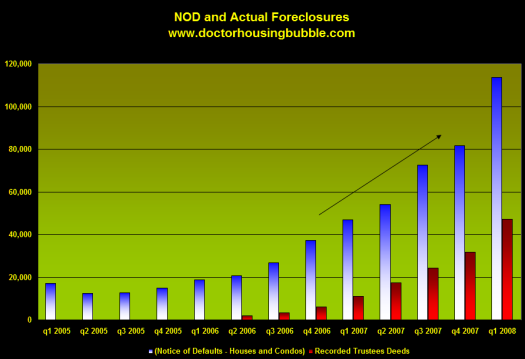

2. Those teetering on the edge represented by notice of defaults:

Demonstrate that we have a steady pipeline for the near future of distressed properties. The rise in short-sale numbers only reflects this reality.

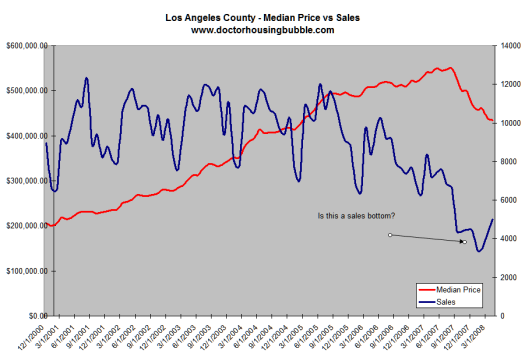

3. Those that do have some equity and want higher prices are simply removing their homes from the market. This group is most likely the reason why overall inventory is falling. Sales are not the reason:

4. The quick realization that prices were at an all time bubble are forcing the market to correct at a devastating pace. Homes are expensive at any price if unemployment is rising and good jobs are being lost. The employment report today demonstrates that. In a symbiotic relationship, the jobs that are being lost are very dependent on housing being good but housing can’t be good without those jobs. Welcome Catch-22 for housing.

And now we enter the next stage of the housing crisis when folks that were supposedly prime realize that they weren’t. Not sure if anyone caught the piece on NPR yesterday about folks cutting back on their groceries. They interviewed a couple of families about the rising cost of food. One family with a lower income was struggling simply to make ends meet and was even buying old boxes of cereal for $1 which at times, wasn’t exactly edible. The other case which ties into today’s article, was an affluent woman and what she said simply struck me. She was talking about how she only buys organic and spends about $300 per week on groceries. However, she was now having a hard time paying that bill. She went on and to paraphrase said something to the effect of, “well we have a home on the lake, a vacation home in another state, and live in a relatively affluent neighborhood so I guess we are upper-middle class?” Yes, the inflexion at the end isn’t necessary. But you better hope that your household income can support all that is going out to maintain that image.

The story went on and she mentioned that she no longer shopped at the organic store; the organic store which she mentioned is the only food she would eat. Welcome to the new reality. People are going to get a slow and painful education between needs and wants.

Today we salute you Beverly Hills with our Real Homes of Genius Award.

Beverly Hills, 90210 Distress

The 90210 area code is getting a lot of mention in the last few days with the story of Ed McMahon going into default for $4.8 million with a Countrywide loan. Yet he isn’t the only one realizing that a posh zip code is not going to move a home without a qualified buyer. When Hollywood is impacted, you can rest assured that you’ll be hearing about it on the media.

Today’s home is a 3 bedroom 2 bath home in Beverly Hills. A nice home and by looking at the specs, would be a starter home in any neighborhood in the U.S. Yet this isn’t any area. This is the 90210 don’t you know? The ad tells us that this place is not a short sale or a bank owned property which makes us suspect if we dig deeper into the data. Let us first look at the sales history:

Sale History

10/17/2006: $1,350,000

12/19/2003: $825,000

07/16/2003: $775,000

Nothing odd about this. A pricey area that saw extraordinary appreciation during the boom. Like I mentioned before, leverage is a very heavy sword and cuts both ways. 10 percent on $100,000 doesn’t seem like much but use that same percent on $1 million and we’re talking real money. Let us look at the current pricing action on this place:

Price Reduced: 05/01/08 — $1,128,000 to $1,049,000

Price Reduced: 06/04/08 — $1,049,000 to $999,000

Now we can only arrive at two conclusions here. If this isn’t a short sale, then the buyer in 2006 must have put enough money down to have an equity cushion. In this case $300,000+. But is this really what is going on? It is hard to say without having further information but all we know is that it was purchased in 2006 for $1.35 million and is currently listed at $999,999 (essentially $1 million).

California is going to have a few challenging years. This coming recession is going to change the way people approach finances and perceive the Golden State. Today we salute you Beverly Hills with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

4 Responses to “Real Homes of Genius: Today we Salute you Beverly Hills. When the 90210 Simply Isn’t Enough.”

Dr. HB:

I agree that “People are going to get a slow and painful education between needs and wants.” There were some pople on a talk show who signed up to learn about saving money. An objective observer had to come in and show them that they waste more food (and $$ on food) in a few months than some poor people in this country spend all year.

They load up on groceries every week, pilings the SUV high. They cook separate meals for everyone in the family. No one ate leftovers. The kids would eat a few bowls of cereal from a box, and then leave it to go bad.

Multiply this a thousand times and you get a clue about home morally bankrupt and truly fucking in denial we are as Americans.

I booked a trip on the California Zephyr ( Amtrak) last week for Christmas. Gotta book early if you wanna a roomette. Now, after today’s stock market action I wonder if I won’t have the whole car to myself and will I look out my window and see hobos on freight trains by Christmas. They say generals always prepare to fight the last war and are inevitably caught off guard when the next one comes. So too, it seems are our financial commanders. While they installed ‘circuit breakers’ on the stock exchanges and created a Plunge Protection Team ( which might be out in force on Monday) after the 1987 stock market plunge and the crisis of LTCM in the 1990’s who’d have thought they needed a ‘commodity bubble force’ to battle the one sided market in oil or a ‘real estate bubble/plunge

protection team’ to guard against the other crisis rocking our economy? All the agencies we set up to guard against another 1929 worked wonderfully for almost

80 years but now the ‘next war’ appears to have arrived and we must scramble once again to find a way to defend ourselves against an onslaught from novel financial threats.

Nothing novel about these financial threats…

If your house burns down once every 80 years and you put in sprinklers in 1928, did the sprinklers actually do anything useful for last 80 years?

The fire is lit… The next bubble to pop is faith in Uncle Ben…

Everything is FINE!! We are GOING TO BE O.K.!!!

Pay no attention to that man behind the green curtain.

Everything is beautiful, in its own way,

the stocks will rise, and it’ll be a sunny dayyyyyy!

Ha Ha! Suckers!!!

Leave a Reply