California housing market squeezes middle class home buyers and renters – 8 charts recapping the 2012 housing market for the state.

Earlier this week I woke up to a couple of e-mails of readers unfortunately confronting much higher rents. “My landlord suddenly hiked up the rents by 10 percent!â€Â This seems to be a common trend for 2012. Especially in locations with investor and flipper activity, many are realizing that they can yield higher rental rates or simply sell the house in the current environment. As the housing bubble burst, more and more Californians became renters thus increasing the supply of those looking for units available for lease. In LA and OC rental construction has been nearly non-existent so supply is limited. Many are simply confronting higher rents in the face of stagnant incomes. Some stories talked about how owners were increasing rents by up to 20 percent in key areas. Yet I have heard very little stories like this for the Inland Empire or the Central Valley. Let us look at the trends that hit in 2012 for California real estate.

The decline of homeownership

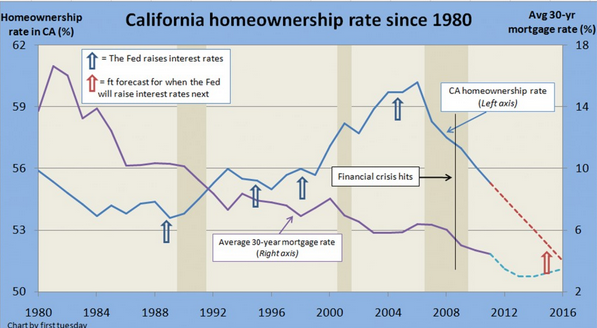

The California homeownership rate peaked right along with the housing bubble:

The current homeownership rate is now back to levels last seen in the mid-1990s (right back where inflation adjusted incomes are landing). As discussed in an earlier article, many middle class Californians have left the state from 2000 to 2010. What you have is foreign money coming in and also, at least since the bubble burst, Wall Street investors coming in buying property. Most of the population gain was not because of domestic migration in the last decade which is interesting.

To compensate for this, the Fed has pushed mortgage rates to record low levels to sustain high home prices. The core reasoning here of course is to help banks offload inflated properties to the market. Clearly high home prices do not benefit a society with stagnant incomes and misallocated capital from other more important and productive sectors of our economy. I noted this many years ago when you had physicists and engineers running off to Wall Street to trade derivatives (still is still going on) and working class Americans suddenly putting on a suit and hocking mortgages back to each other (this industry has been chopped largely because the government is the only mortgage player in town today).

REO as resales

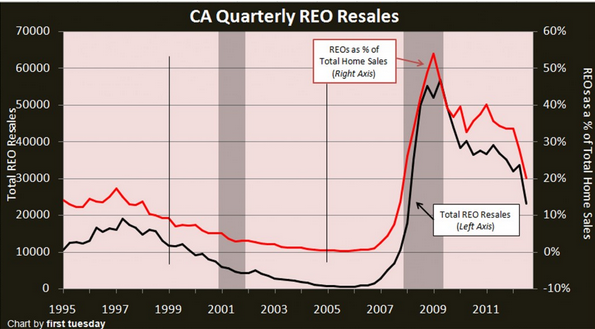

Another key change is the number of REO re-sales. This has sharply decreased in the last couple of years:

Where in 2009 over 50 percent of all sales were REOs that number is now down to roughly 20 percent. This is certainly higher than the 5 to 7 percent “normal range†but it is moving in that direction. This has also contributed to the median price surging because REOs typically sell for sharper discounts.

Rental prices sharply up

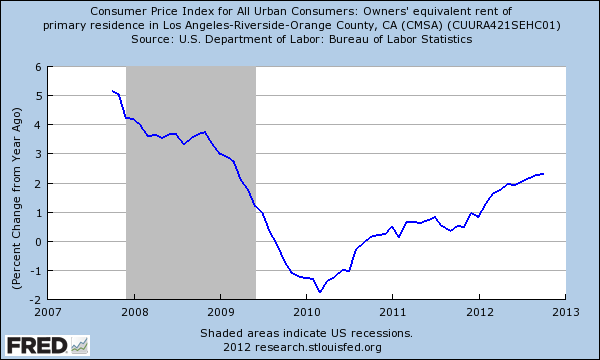

With very little supply of rentals, rent prices started moving up in 2011 and up sharply in 2012:

Rents are now increasing at 2 percent year-over-year while household incomes are stagnant. So this also ties in with why many middle class Californians have left. People are left with the choice of contributing more of their disposable income to rental housing, buying, or leaving. Over the last decade at least with domestic data, many have left.

Rental Vacancy down

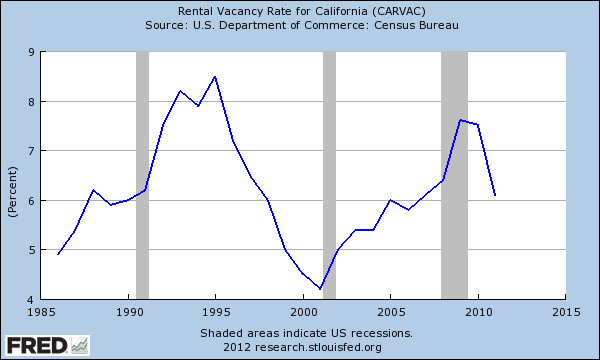

As demand for rentals has picked up, rental vacancy rates are sharply lower:

Also, in the last couple of years Wall Street investors are buying large blocks of homes in more depressed areas and converting them to rentals. This might also be another reason why rental prices in the Inland Empire are more stable. These investors took these REOs and actually added to rental supply. In key areas of LA and OC many are buying (foreign) and flipping. This doesn’t actually increase supply but lowers it.

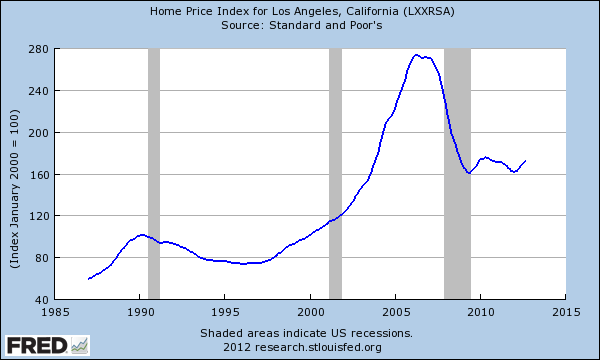

Home prices overall

Although it would seem that prices are simply flying upwards, the trend is modestly up when we look at things in perspective:

The above includes Orange County as well. These are large and diverse counties. Keep in mind the move up is coming with maximum leverage FHA loans and historically low rates.

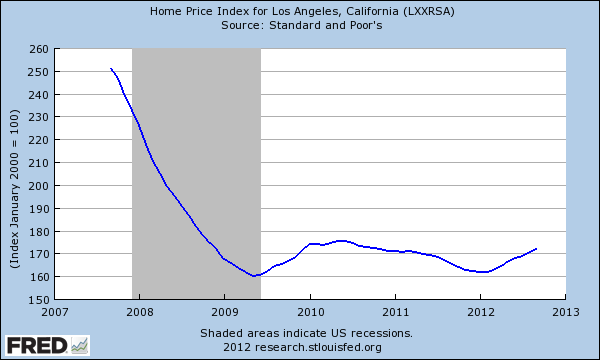

Last five years for home prices

In the last five years the LA/OC repeat sales index saw this:

You can see the tax credit boost of 2009 into 2010, it waned into 2011 and now prices are up because of record low interest rates. Nowhere along this path did we see household incomes move solidly up.

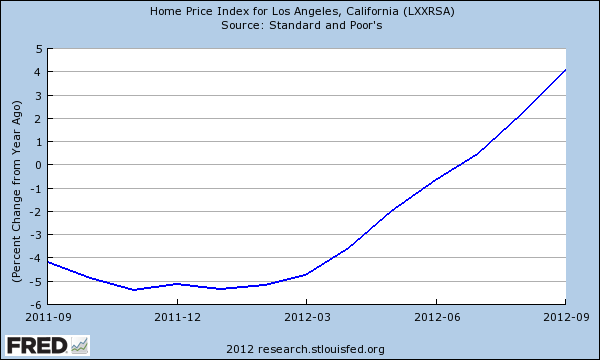

Home prices move up in 2012

The result of lower interest rates, foreign demand, and maximum leverage loans caused this to happen:

Home prices are now moving up at a rate of 4 percent per year. Home prices are still down 36 percent from the peak but are now up 6.8 percent from the trough.

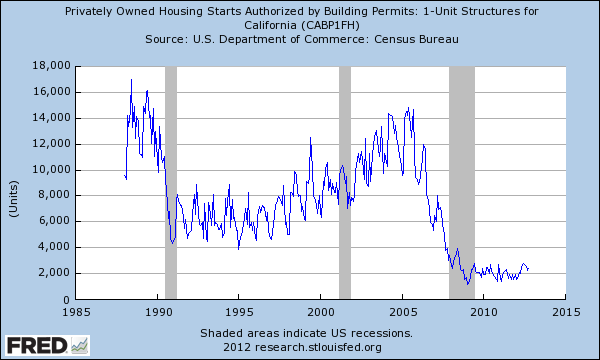

Housing starts low

You would think this new resurgence would cause housing starts to surge. To the contrary, we are still near the lows of the crisis:

So you have no new supply coming online and you have these groups competing with one another:

-Foreign money (targeted to key markets like Irvine, Pasadena, etc)

-Wall Street money (distressed properties to rent and higher end properties to flip)

-Individual flippers (largely focused in hipster areas to make a quick buck)

-Middle class homeowners (largely using big loans to leverage up)

-Renters (competing with lack of new supply and higher rents)

At the core, household incomes are not going up. The Fed is largely concerned with boosting the housing market not to help homeowners, but to provide banks an exit for their toxic loans during the bubble. They do still exist with over 5,000,000 distressed homes still lingering (the Fed balance sheet is also close to $3 trillion and we have little idea what is in there). Let us not forget that 5,000,000 Americans have already experienced foreclosure. The bill will come due however. As we mentioned, it is now much more expensive to go with the popular FHA insured loan product and it looks like MIP will become permanent in 2013. The mortgage interest deduction is now being openly discussed and certainly, it would make sense to cap this out since why are most middle class Americans subsidizing say a Bill Gates with a million dollar mortgage when they, with their say $100,000 mortgage are not even going above the standard deduction? We are even hearing rumblings about Prop 13. Remember that chart above? California is largely returning to a 50/50 renter state.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

63 Responses to “California housing market squeezes middle class home buyers and renters – 8 charts recapping the 2012 housing market for the state.”

An easier way to fix this is to legislate a permanent and inexhaustable supply of foreign buyers, “investors/flippers”, and hot money.

That would make the influence of increased family formation and higher family wealth driving value moot.

this is dire news for the middle class.

I don’t feel California is worth it anymore to buy a house. Unless you are comfortable buying a house well into the millions or living in squalor.

But I’m sure the realtors will disagree with me.

If you can move from California, I’d recommend it. Not only are many areas rundown and dingy, but it’s become a police state too.

UGH – so glad I’m leaving. (I’m not originally from here.)

That is for sure. I moved to S.Diego in 1999 for Portland, it was kind of cultural shock.

In Portland, you had a vast city with defined “poor area”, the rest of the metro area varies from okay to fabulous. Here in San Diego most of the metro area would meet my definition as “poor area”. Except don’t try to buy in one of the poor areas here in S.D., you might not be able to afford it!

You ain’t akiddin’ about San Diego, lol. I lived there the 2nd half of the 90’s, most of time in the relatively run down beach neighborhood of Ocean Beach. Rented a tiny studio cottage.

The last year I was there I moved to T.J. and rented a mansion, in a relatively safe section, near the Tijuana airport, for $500/month. It is a hassle crossing the border every day, but I went to work in the shipyards at 6:00 am, so it wasn’t too bad.

The San Diego shipyards are a microcosm of why wages are stagnant in the USA. Why pay a welder or pipefitter $30/hr, plus another $30 in benefits, when you can pay guys crossing the border every day about $30 total (wages AND benefits COMBINED)?

There’s no way out. We’re addicted to cheap stuff coming from outside the USA, so wages CAN’T rise here, since we’re competing with the global economy at every turn. The only temporary solution is keep forcing mortgage rates lower, and hope that some miracle presents itself some day.

Hey Jason,

I always wondered if it was feasible to do what you’re doing with the whole live cheap across the border thing. Is it difficult to get a visa simply to live there?

On another note, any guess as to what will happen to the SoCal ports/economy once the Ensenada port is in full swing with truck/rail line infrastructure built to transport goods north?

Agree. Can’t wait to leave but stuck here for a few years while tying up some loose ends. This place is a joke if you’re a middle class working stiff who didn’t get a decent piece of land a few decades ago.

My favorite are the self absorbed appeasers who’d rather stick their heads in the sand and say “leave, we won’t miss you” or make up excuses for why it’s better to settle for less here.

My cynicism is turning in your direction Joe.

Despite a huge income hit and lack of easily accessible clean surf, OR and WA are looking like affordable places to live and raise a family outside of the consumerist curtain of SoCal.

South Pasadena is great, I’m staying put!

Hi Rhiannon-

Well we bought an adorable one-story 1900 sq ft 4+2 w/ a pool. It’s a cool “L” shaped home on a smallish lot. With the shape of the house and all the sliders we don’t feel it. It is almost ready to move into Dec 2oth. We have remodeled with just our bed and a minimalist lifestyle.

We went with chocolate cabinets, granite and natural quartz, lots of “me” (leaves and naeato glass in the fixtures) and went very earth tones and no carpet. Dust mop and we’re done!

I feel so blessed, and all with no debt. We own the pink slip! I wish we could afford So Pasadena. Love your area. You’re one lucky gal. We are in east Ventura County.

We lived very modestly and struggled to get a home again after selling. Prices were absurd, and we waited it out.

Merry Christmas and Happy Healthy New Year to all you smart delightful DHB folks.

Oh, and rising prices stink. Property Taxes are expensive enough.

Hey Mad as H, congrats on your home! Much cooler up where you are, that’s for sure!

Seems like Rhiannon and I are the only ones still living the dream! I got a great deal on a huge house in San Pedro, which I love, back in September. Super happy, I love CA and all there is to do. All of this “flight” to the other parts of the country is nothing new when demographics change. CA has never been cheap, but it’s fabulous, terrible govt and all. Personally I think environment is worth a premium, our weather is fabulous, beaches are beautiful and there is an endless supply of things to do… Beats some track house in BFE hands down.

If that’s what you need to tell yourself.

Meanwhile, in the parallel universe of real observation, SoCal isn’t the only place with things to do – good grief. There’s nothing fabulous about terrible government. The majority of this world has a different climate and they’re not all dying to be here, give it a break already.

This place could be paved with streets of gold and it still wouldn’t amount to an attractive long-term region to live in if a good income can’t secure a reasonable domicile within reasonable risk parameters. That’s why we’re here on this forum.

I don’t think anyone here ever asked for cheap housing in SoCal and those of us who have examined the historical fundamentals understand that it has been reasonable here at other points in time. Again, no one has asked for perfect. There comes a point where the hassle to affordability factor reaches critical levels for many and that must be dandy to be indifferent to it when you have yours.

By the way, those L.A. beaches are either overcrowded, dirty, or both.

Hi Candace, I’ve been here allll 48 yrs of my life. I’ve traveled the world and I’m always grateful to return to SoCal. My parents moved here from Illinois after WWII and never regretted it 🙂

Rhi-

Who would have regretted moving here right after WWII? Less populated, less polluted and plenty of reasonable plots of land. It was a great place to raise a family and once firmly entrenched anywhere it becomes harder for most to relocate far away. Rarely does anyone regret getting in while the gettin’ is good.

New arrivals and younger generations who aren’t inheriting a house here have a starkly different set of variables to contend with today.

With a super majority now in control in Sacramento, is it possible we get a reform to Proposition 13?

Prop 13 needs to be put out to pasture. The ideal of Prop 13 is what we need, not the monster we got.

A couple of guys in Sacto are already working on it. Mostly to get the corporate part changed so that they don’t get the Prop 13 break anymore.

I am sure that removing the cap on commercial property taxes will incite many long-term California-based companies to pack up and leave the state. It is inevitable.

A prop 13 repeal, even just a commercial repeal, would mean business would leave. If businesses leave the state, workers will leave and our ghetto apartment rent will go down! If the residential prop 13 were to disappear, maybe we could afford a nice little place to live… sorry, I got caught up California Dreamin for a moment.

(Aerospace engineer, very few places we can work. We look for a new job away from SoCal every day.)

Great, let those old businesses leave – opens many doors for new businesses. Today it’s hard to compete as a new business if the old ones have huge prop-13 advantages. Levels the playing field a bit… Yes, I know, there’s out-of-state competition, but for some things it’s still better to be local – there’s simply no reason for prop-13 for commercial properties. It’s a hand-out to the establishment.

Also, commercial property values will drop, again good for business since the majority of businesses are leasing today.

A commercial repeal would hit some residential units. Multi-family residential with 5 or more units is commercial property in California.

The taxes are capped at 1% – too high but better than what would happen without Prop 13. The state makes plenty from the current rates, they just need more money to cover promises they cannot keep and for their out of control spending on the wrong things. If the tax goes up on rentals, it will be passed along in higher rents.

CB

I’m on board. Thank God for Prop 13, but all these wish my house would appreciate idiots seem to be ok with high proerty taxes. Our PT is our only housing expense (other than insurance, utilities, maintenance) and we prefer they adjust down. This home is our toe-tag home. Florida and some other states have nose bleed high property taxes. No thanks.

“So this also ties in with why many middle class Californians have left. People are left with the choice of contributing more of their disposable income to rental housing, buying, or leaving. Over the last decade at least with domestic data, many have left.”

According to other sources, this conclusion is not accurate – no one willingly leaves CA, everyone knows that.

@ Dmac

Here are some facts instead of your ludicrous statement that no one willingly leaves California. http://anythingvoluntary.com/?p=1211

Regarding the middle class, the housing costs in California have been destroying the middle class for decades and the economic crisis has accelerated the destruction. The trend is toward very wealthy enclaves, multi-generational “middle class” housing with at least three mediocre paychecks to pay the mortgage, and large and growing areas of apartheid grinding, gang infested poverty. Take your pick.

If you think real estate taxes (Prop 13) are not going to be hit to pay for services for all the new non-tax paying citizens then you deserve to live in California.

Correct. Prop 13 will be the first thing the Democrat controlled State Assembly go after early next year. Then watch the housing market in this state really collapse !!

I was being sarcastic, Jeff – you seem to be the only person who missed the obvious. Please read my earlier posts here and maybe you’ll eventually catch the drift.

My wife and I will be leaving in two years, as soon as she retires.

If 0bama hasn’t totally destroyed the US by then, we should be able to make a decent profit on the house we bought in 2002, and with prices in the area we’re looking at being so low, we might not have any mortgage at all.

Yeah, Obama has really been bad for housing prices, no inventory and rising prices are the proof!……….BUT NOT REALLY!

Now if you want to blame Obama’s policies for recreating the bubble, I would agree, but you can’t take a shot at him for crashing the economy, if anything he is doing his best to recreate bubble dynamics…….and that is the real worry.

Um, do you read this blog? The only reason you house is increasing in value is because of the jacked up policies of the Fed right now. Hopefully, you can get out before it collapses — like it should have before Obama “wrecked” the economy. I don’t agree with the current policies, but I would be kissing Obama’s feet right now if I was trying to unload housing assets.

I’m a recovered Republican. Voted for Bush 43 and regret it. Now a political atheist, I’ve concluded the R&D are a two- headed snake. The bubble dynamics started when Glass-Steagal was overturned. Blaming Obama is ridiculous. This economy has been structually broken for decades. A two headed snake. Nuff said.

We got trapped in an apt during this nightmare (storage for belongings). Sold our home and saw $20k A MONTH JUMPS.

Delinquent mortgages are slowly getting processed. There’s an estimated 500K more homes that need to go through foreclosure or short sale in the next 5 years. These will probably become renters when they finally leave their house. So the rental market should remain steady to growing. All the hedge funds are buying up SoCal $200K homes to turn into rentals for the coming years. So more supply is headed our way as well.

The foreclosed former loan owner can get a new mortgage in 2 years. I knew a few people who short sold, and two years later rebought. I know of rent back tenants (in foreclosed homes we bought and rented) who have left their foreclosed homes with brandy-new mortgages in hand for the place down the road. It boggles my mind, but the foreclosed don’t stay renters for long.

Being from Wisconsin, my daughter and son in law have talked about moving to southern California because of the weather. From what I read here, the advice of many would be don’t!

Go on deptofnumbers.com and check out affordability by metro area. I live in the Bay Area, and what I do is own cheap homes in Rockford, Illinois, and rent them out, then use that rent to pay my rent here. So, instead of buying a $1M home, you can rent a $1M home and pay for it with the rents from 2-3 $100K homes in Rockford. It’s called arbitrage, and I think more people will do it. That way you have an equity interest in real estate, and you’ve freed up $700K to invest in other things. Plus, if your job requires you to move, you don’t have to find a buyer for your house.

I had been looking at this option as well. Why over-pay for a rental parity SFR in So Cal when you can just rent it?

My attempts in AZ last year proved futile as the REO dregs had already been bought at the court-house steps for cash and flipped for 100%. Now, it’s a lot harder to find a decent ROI in AZ. I haven’t looked country-wide, yet. Currently putting my investment $ into dividend-paying stocks. Thanks for the link.

I believe that’s a viable option, as long as you don’t mind being an absentee landlord and/or have a company to handle the inevitable tenant situations that develop. I had to rent out my condo for a year and a half when a work move was mandatory and I couldn’t sell the place without a substantial loss. My place was new when I bought it, but I still had some nervous moments when the tenants kept me busy with endless complaints about a chipped drywall here and a crack in the bathroom tile there. I would’ve felt more comfortable if I had been living in the same vicinity, no question. A lot of the homes being snapped up by the investment consortiums have management in place to handle the maintenance issues – far different reality when it’s just you doing all of the work.

Curtis, I am a California native ( 62 years old) who lives in So. Cal. I can tell you absolutely not to move here !! I am planning to leave sometime next year. It has become a tax-ravaged nightmare and populated more and more by low lifes. This is because the decent people are fleeing as fast as they can.

@peter wolf: We just moved to OC. We are renting from a Vietnamese engineer. He bought the house from a couple who I think you would probably describe as decent native Californians. They have fled to Arizona. I wish he could have redirected his mail because we’re tired of getting his gun magazines and catalogs. But you’re right. They were decent people. We’re from countries considered by some as socialist with high taxes. Which is ridiculous. But whatever. We moved here for a well paying job. The company is owned and run by Koreans. I lived there 10 years ago and appreciate their culture. A kid in our kids class just moved here too. The parents and other family members started a business in OC this year and expect to employ 100 people in a years time. High tech stuff. They’re from India. While it is a slug here there are also many opportunities. You get where I’m going, right? I got more stories if ya want more. Or you can just look at the charts

http://www.doctorhousingbubble.com/middle-class-california-dream-what-is-middle-class-for-california-incomes-real-estate-prices-migration/

We’re not that fortunate that we have foreign riches to bring with us but we have brought our cheap government subsidized higher educations and exposure to other cultures. If you feel you need to flee and hide in an enclave to live out your life then that’s what you gotta do. Just be happy about it, dude.

And Curtis Edmark your daughter shouldn’t move here if she is doing it just for the weather. She should absolutely come if she is highly educated and has a job lined up.

Whereabouts do you live exactly?

drjim talks about Obama destroying America in the same sentance as he says he will sell his home with enough proceeds to pay cash and have no mortgage when he moves—sounds like absolute destruction of America to me

First of all, it’s sentence not sentance. Secondly, drjim never claimed as to where he will be moving. He could easily sell his California home and buy 2 homes in Buxton Maine if he and his wife choose to and still pocket some extra cash. Everyone knows that home prices for the majority of the country are much lower per square footage than that of Southern California.

As far as to whether or not Obama is destroying America, time will eventually settle that argument. It should be noted, however, that Obama is continuing with policy that he explicitly spoke up against back in 2006. http://www.zerohedge.com/news/2012-12-05/who-said-it

The ‘right people’ bought the media, bought the politicians, stacked the courts, wrote the laws, repealed the regulations, cut their own taxes, scammed the financial system, printed trillions, gave everything to themselves, and now they will spend their ill gotten gains on real property so they and theirs can collect rent and live without working in perpetuity. I predict they will end like the lords of days gone by. Fat, stupid, ugly, diseased and hiding from the masses.

Have you also seen that despite sky-high taxes in this state, Sacramento is already in store for an $800 million + shortfall next year?? This is what happens when Democrats run a state for the last 40 years and have drive away industry after industry through ever higher taxes and anti-business legislation. This is why the entire business press in this country despises California. And this is why our tax base is shrinking. Yet we continue to re-elect, decade after decade, these same old, worn-out Democrats. Some of them are now over 80 years old.

love southern California!

I’m having some difficulty determining if the market is going to reach equilibrium soon. I tend to think prices are going to drop again, but not if the banks can sit on REOs forever; they can unwind properties over the next 10, 20 years ? Meanwhile said properties are decaying.

The only logic I can think of is that the factors like interest, leverage, inventory already seem to be at their extreme values already = price has no where to go but down. In some areas within commute distance of the Bay Area, but not in it, -50% or -70% available inventory = only +10% or +20% price increase, which seems really weak to me.

I wonder if the only real option is to go to a bank with cash in hand and look at their REO list and buy it that way ? That doesn’t help most regular folks though. The stuff that gets listed on MLS, I was told, pretty much always has the multi-bids. So if the bank just wants to clear its books, maybe REO is the way to go, but it requires a lot more effort than FHA on an MLS property (and any all cash bids out there).

I think I’d have 100k of cash in hand within 4 years to buy a property if I wanted, but I’m not really in a rush to buy anytime soon and I think the idea of renting properties elsewhere at a higher CAP rate and just renting your primary residence makes more sense if you don’t want to commit to inflated local prices. I’ve been looking at multi family units in Reno but the few that are listed are in bad shape. I wouldn’t touch anything until inventory levels go back up anyway (price normalization), I just hope that’s going to happen within around 5 years.

This Bubblette is definitely not anything like before. Properties further from the coast have dropped in the last 3 years here in S.D.. Maybe the median has rose but what you get for your money has improved. An example……….

In 92120 in early 2010 a 3/2 bath 2Ksq. house with view in need of remodel but structurally sound, with freeway noise went rather quickly for 550K. Today in the same zip you get the same similar house remodeled for about 530K, without the freeway noise.

What is also different is condos in the best neighborhoods are selling for 2001 and 2002 prices. In bubble #1 everything went up, Condos, mobile homes, desert areas.

Will the bubblette stand up to a double dip? We will see.

http://www.creditwritedowns.com/2012/05/chart-of-the-day-us-real-personal-income-growth.html

This income chart is foreboding……………

HI Maximus – I dont think anyone knows the market is going to reach equilibrium soon…. Prices are not going down everywhere. Pockets of LA where I am looking have risen about 6% Year over Year from last year and good 3bd 2ba (most desirable amount of bedrooms) homes are sold within a week with several offers (again, assuming a decent floorplan, 3bd 2ba) in a decent neighborhood. I wonder if it is the same for people who have reported in the last that places like Burbank or Glendale, that good properties also get half a dozen full price (or more) offers?

For all of your rant about how overpriced the Ca. homes are… now your readers are faced with a 10% hike. Had they bought a home with the help of an evil real estate agent, they would be enjoying the lowest interest rate ever for a home they can paint any color they like, improve or not improve and their monthly payment would not be hiked today, next month or next year! Oh! and not to mention, should they stay in the home (cause ya gotta live somewhere) over time, they would increase their equity until eventually they own it outright!!! Wow, what a concept!

Right, because leveraging at a low cost automatically justifies overpaying for something.

*rolls eyes*

Joe, I’m with you

By the way, the only part of the monthly payment that wouldn’t increase is principal and interest. Taxes, insurance and maintenance costs are likely to increase. The politicians are hard at work attempting to deconstruct prop 13 so that should be real fun for those joining the herd.

But what happens when rates go up? When the supermajority “fixes” prop 13? When educated and affluent people seeking lower taxes and stronger opportunity move east? When the continuing trends of government assistance reliance pushes payouts beyond revenue? When the public pensions go bust? When more cities bankrupt? Or when the state itself reaches a point where the massive budget deficits are simply unfixable?

Only bad, I presume, and I don’t intend to stick around to find out.

To buy a house in Pasadena in the rotten area we live, we would need to spend at least $2,300 a month, to live in a place the same quality as our $1500 a month rental. Add in lawn care, a $100 a month maintenance budget for problems that will arise, and suddenly buying makes no sense. I’d never take my savings and dump it into an over priced cardboard box in Pasadena, this decaying town, just for a lower monthly payment. FHA or the highway, and no seller will take an FHA buyer on a $500kish low end property round here. My east coast family thinks it is hilarious that $500k is low end out here. My mother cries when she sees where we have to live…

For all you California fans. The recent strike at the two largest ports in the US (that cost a billion a day), LA and Long Beach, by union featherbed clipboard holders who want to make more than PhDs, see below. When the Panama Canal is finished with its expansion, these two ports will lose more than half their cargo.

“The clerks, who make an average base salary of $87,000 a year, have some of the best-paying blue-collar jobs in the nation. When vacation, pension and other benefits are factored in, the employers said, their annual compensation package reached $165,000 a year.”

Jeff, the SoCal ports are nearing the end of sitting pretty. With new competition they will have to lower prices and standards. It’s only a short matter of time.

Yes, prop 13 will go and property taxes will be about the 2- 3% rate, but you get a deduction from your property tax for the amount of state income tax that you pay. That way the underground economy people will have to pay their income tax through the property tax.

At the federal level, we will get a VAT like the EU. We have to pay the bills from the party we had.

All due respect…when taxes go up for the homeowner…it includes landlords and they will raise your

rent to cover that increase…and you can pay to move…if you can find a betted deal… but have your rent increase there also. When finally ths economy moves again…the only way out of the enormous debt will be inflation. Guess what rents will do then.

Apples and oranges. Most rental units are not owned by single unit landlords. Different financial equations than your typical SFH FHA low down buyer of today.

By the way, with all of the new rentals coming online monthly rents will experience downward pressure. Your monthly principal payment won’t shrink short of re-amortizing or rates drop to zero. Good luck with that.

I have lived in this rent-controlled apartment since the earthquake. I pay about $1/square foot per month. I have been saving up my money but still can’t afford a home in Southern California.

California sucks. Move to Phoenix houses are 5 times cheaper there.

What is up with the people on here who brag about how great their homeownership experience is? Isn’t this blog for the disenfranchised of the California real estate market?

I finally gave up my goal of buying a home and found one to rent. I’ve been much happier ever since. I still want to buy a home one day, but it is pretty clear that that will have to wait.

I’m from Los Angeles (South Bay) and I’ve lived here my entire life. All I know is that up until about 2002 people who kept their credit good and had a reasonable middle-class income could buy a home in Southern California. Perhaps not beachfront or luxury property, but they could buy something. Unfortunately I was not established enough then to buy a home and missed out on the pre-bubble market. I’ll always be a little bitter about that.

My grandparents came here from another country in the 1960’s and became solid middle class homeowners within five years. My mother’s generation could actually live on minimum wage and had many opportunities to get ahead in life if they had the ambition. The older members of my generation all moved to Orange County and other outlying suburbs where new homes and neighborhoods were (oddly) more reasonably priced. People around my age turned to gentrifying older neighborhoods, and gaining from the ‘hip’ value. However, I have not seen, since I started looking in 2002, a single opportunity to buy that didn’t have a high downside associated with it (overpriced, terrible neighborhood, substandard condition of property) or an overly competitive bidding atmosphere.

I spent a lot of my life trying to get ahead with education, a career, and keeping my nose clean, almost exclusively out of my desire to buy a home. My reasons for wanting to be a homeowner are deeply personal rather than purely practical, so I cannot simply give up on that goal. The fact that my best efforts have yielded nothing more than being a lifelong renter kinda gets me down sometimes!

You are not alone 🙂

Leave a Reply