Where can I find affordable homes in SoCal? Let us go house shopping in Compton and Inglewood. Welcome back Real Homes of Genius.

SoCal housing is a blender of crazy aspirations, delusional thinking, poor quality building, and a market built around incredible hype. A boom and bust machine. When we show homes in San Marino, Pasadena, and Arcadia people begin to realize what they are up against. The argument to buy seems to revolve around the “values will only go up†regardless of your specific ability to pay. Opportunity cost is rarely factored into the equation as if real estate was the only investment out there. There is a flood of big money coming in and this is somehow reason enough to push you into a property that will stretch your family’s budget into a position of crying out for mercy. A few people have e-mailed me with their actual budgets and I find it near comical that some people think that they somehow can afford to buy in Newport Coast, Beverly Hills, or Manhattan Beach with the incomes that I’m seeing. They are shopping with a Burger King budget and expect to somehow buy a very expensive sushi dinner. Instead of telling people that they are lusting at homes like a hormonal teenager, I will give you two cities in L.A. County where the “dream†of homeownership is very doable. It is also a useful example of how the housing mania has filtered into Real Homes of Genius territory.

The American Dream in Compton

Some argue that gentrification is happening in all parts of L.A. County. Okay, if this is the case then every area is the next “prime†market. If you are looking to buy you might have a taste for Pasadena or Santa Monica, but in reality you might be only able to afford something in Compton.

To show you how expansive this housing mania is, prices went up in the last year everywhere. In other words, the speculation is running rampant across the country and not only in prime areas. Let us take a look at a “reasonably†priced home in Compton:

617 W Plum St, Compton, CA 90222

3 beds, 1 bath, 928 square feet

Built:Â Â Â Â Â 1923

This is another spectacular 1 bathroom home located in the heart of L.A. County. This place is 928 square feet and has nice bars over the windows to add for that HGTV aesthetic effect. Will we ever see the housing flipping shows with their nicely groomed hosts in this neck of the woods? You might be asking, “hey, I’m sold! How much is this place already?†I know, I know, but let us read the ad first:

“Standard Sale, Remodeled 2 years ago features 3 bedrooms and 1 bath laminated flooring living-room tile in the kitchen with laundry room garage for two cars, and a long driveway for 3 cars nice backyard.â€

Standard sale? As opposed to a foreclosure? This place can be all for you and your family if you are willing to shell out $259,000. Take a look at the price history here:

This home sold in 2013 for $175,000. So all of a sudden one year later the value of it went up $84,000 or 48 percent. Yes, perfectly reasonable pricing going on here. The more reasonable price was set back in 2012 at $100,000. This might be the perfect L.A. County home for you. Our next stop is Inglewood.

552 Hyde Park Pl, Inglewood, CA 90302

1 bed, 1 bath, 512 square feet

Built:Â Â Â Â Â 1921

Bam! Super in-depth perspective photography. Someone is using their NatGeo photo taking skills here. Look at how well kept that drive way is. Looks like a Nascar pit-stop. This place is listed at 512 square feet and built during the Roaring 20s. Let us look at the ad:

“Property is zoned INR3YY and great for a builder/developer. A copy of Plans for 2- New homes are in the Addendum. For property zoned INR3YY, refer to the City of Inglewood Planning Dept. for building info. of additional units. The assesor shows the property as a 1 Bedroom and 1 bath. Property is located near 405 fwy, airport and Ladera shopping. PLEASE DO NOT DISTURB TENANTS. Seller will consider all offers….â€

In other words, you better have developer cash to tear down this place and build multi-family units since everyone is going to get rich on rentals now. To show you how out of sync people are with prices, take a look at some action here:

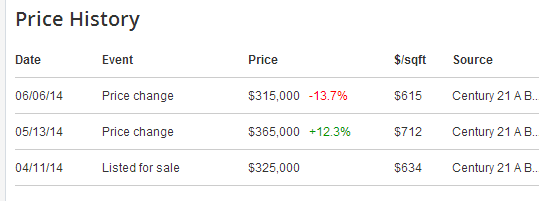

Back in April, they listed the place for $325,000. They must have got some interested because they then pushed the list price up to $365,000 in May. That obviously was too high for this majestic place and the price is now “only†$315,000. You can find much better properties for $500 in Detroit but of course, this is the great and glorious L.A. County and Inglewood is the next La Jolla.

See, you can have a reasonably priced property in L.A. County in today’s zany market. Don’t be too picky when you have a weak household budget. Shift your expectations. I mean $315,000 for 500 square feet in Inglewood is a great deal right? All of this is perfectly sane and reasonable and of course, never forget these mantras:

-Real estate never goes down

-SoCal housing only goes up

-Never a bad time to buy

-If you hold out long enough, everything goes up

-Incomes don’t matter

-#alwaysbebuying

Welcome to the wonderful and wacky world of SoCal real estate. Don’t say that we only show prime properties in locations for the elite. We also like providing you with options and reminding you that Real Homes of Genius are alive and well in this market.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

110 Responses to “Where can I find affordable homes in SoCal? Let us go house shopping in Compton and Inglewood. Welcome back Real Homes of Genius.”

I would never purchase a home anywhere near these homes. You are talking dangerous. Gang infested. Living in those areas is a threat to your life.

buy in a tough neighborhood or rent for less in a good neighborhood…fortunately I have options and doing the latter. Owning is a little overrated at this time if you don’t have $$$ for SoCal.

My niece is a real estate agent and she has to quit her job because she having nervous breakdowns. There is more schizophrenia in this town than anyone can possibly imagine. Hardly surprising that ‘home pricing’ would reflect that same kind of schizophrenia.

Hi Polo

Being a Realtor is not as easy as some people think. In any market, Buyers and sellers will have their concerns. As my dad used to say “Get those commissions out of your eyes and do the job right”

Realtors are legally a fiduciary. You should base your business on that concept and build your database from happy clients

As Rick James would say…”Crack is a hell of a drug….” Seems like most SoCal home seller have been smoking it just a tad too much…

Actually, it’s “Cocaine is a helluva drug.”

Actually, Mr. James’ quote was referencing “cocaine,” which is germane to the blog if for some reason you’ve been remiss in checking out Dennis Weaver’s seminal, unintentionally campy, full-nostrilled performance as a nose-bleed, coke fiend realtor in, “Cocaine, One Man’s Seduction.”

James Spader plays Weaver’s straight-edge son, and Jeffrey Tambor contributes mightily as Weaver’s recovering white lines addict.

It’s the buyers that are suckers. I would pay, but not at these current prices. I don’t think I’m cheap, I just think it’s way over priced.

Sellers are finding out there are less “suckers” everyday. I Redfin favorite’d a nice room additiin house in North Upland a whike ago. Not a San Antonio Heights place, but a large track home taken up to 5 bedrooms. 2010 foreclosure sale 450K before the upgrades. Now listed at 950K. The additions are nice, but this guys deaming of 400K come up before fees. Now if the RE gains are so solid why is someone looking to cashout? After all rents up… inventory… Chinese pricing up everything… Blah, blah, blah…

Maybe the guy’s sensing peak stupid? Maybe he HELOC’d himself into trouble? Either way I think a lot of the 2009-2011 “lottery winners” aren’t as stable and happy as many hear suggest. EVERYONE is subject to this declining jobs/wages environment. That sweet 3.5% mortgage on a 2011 price trough house can still break you back if the checks stop coming and not everyone is willing to take on renters, second jobs, etc to hold on to the “dream”. There is no stability for any of us and the rentier class relying on the proles ability to spend 60% plus of their income on housing to keep the Ponzi going is wishful thinking.

Here’s the address if snyone is interested

2123 North Vallejo Way Upland, CA 91784

I agree with NihilistZero’s remark that “a lot of the 2009-2011 “lottery winners†aren’t as stable and happy as many hear suggest. EVERYONE is subject to this declining jobs/wages environment.” There are a minute number of jobs that will not be subject to a substantial decline in wages, though many do not realize this yet. Among those who have already purchased, there are many who know they are one job loss or even one paycheck away from losing their homes.

I’m interested in what will happen as the number of ordinary people capable of purchasing declines. I know some think this will trigger a crash. I wonder if instead we’ll see the end of the market in SoCal as we have come to think of it, meaning something in which ordinary people participate in. As the number of individual participants declines, the propaganda value of individual home-owning as a dream recedes to nothing.

So what could take it’s place? Someone here suggested big players selling back and forth to each other. That sounds right to me. Another possibility that I’m watching for is land grabs. For example, is anyone here following the estate recovery provision in the Affordable Care Act? Apparently CA is considering legislating against it, which is promising, but hasn’t happened yet, and it would still be in place elsewhere. If it stays in place, large numbers stand to lose their family homes. I recommend reading about it here: http://www.paulcraigroberts.org/2014/02/08/obamacare-final-payment-raiding-assets-low-income-poor-americans/

Teresa, I’ve been following the Estate Recovery provision for quite a few months now also. It passed the state senate (SB 1124, if you want to look it up) but Brown is being told not to sign it – sure, that jacka$$ will give anything to illegals, but something that might accidentally help the little guy, can’t have that! I think he either has to sign it or veto it within the next month, so we’ll see soon.

I fall right into that Estate Recovery trap, if I sign up for Medi-cal (my income is too low to get a subsidy, so there’s no choice) and I’m over 55 yrs old, so I’m screwed. I own my home outright and I’m not about to let the state steal it when I’m gone. If I have to, I’ll move to OR or WA, where they’ve already changed the law to exempt everything except long term care.

I’m so sick and tired of this state and the crooks running it – especially the head crook, Brown. “If it’s brown, flush it down” should have stayed the mantra and maybe this idiot wouldn’t have been reelected. Too late now…

Happy 4th 🙂 May we all live free and prosperous. — Housing TO TANK HARD in 2014!!!

Go Jim Go! Happy 4th of July!

I always said I would prefer to rent in a good area than buy in the ghetto.

I still stand by my mantra.

That is good advice, Lottie

I love it…the Compton house is getting listed an nearly the exact same price as back in 2006. And yet constantly in the news I hear about how we’re not in a bubble…this is simply a healthy housing market that is picking up steam!

And then I read stuff like this article. Incomes are down, and prices are nearly back at 2006 levels. How is this at all a healthy market?

http://www.trulia.com/trends/2014/06/bubble-watch-q2-2014/

If prices “keep going up!” and home are selling for the same as in 2006, taking inflation into consideration, prices have gone…..

Down.

You clearly didn’t read the article. Median incomes, adjusted for inflation, are down. Even with inflation…if home prices are nearly back to 2006 levels, how are home prices MORE affordable now than in 2006?

Bingo!

Do consider that in 2006 interest rates were 6%. Now they are 3-4%.

What?

Bubble rich areas are bubbling up once again, this is where all the action is. The cities in the article that are lesser known are more like 90% of the cities out there,they have not recovered from the last bust. Here in Orange County, and Los Angeles of course the bubble will pop again? Some cities will always bubble more than others. I don’t agree that anywhere in the country is “undervalued” unless you can see into the future.

Plainly the Inglewood property is deemed a straight land sale. The hut is a shack.

I’m perplexed that Inglewood land could possibly warrant such a price.

Perhaps the listing agent has a sense of humor.

@blert, Inglewood is walking distance to Culver City. A house like than in Culver City would be going for $700K (we’ll ignore the fact that Culver City is surrounded on 3 sides by ghettos/barrios/slums). During the previous housing bubble (circa 2005-2007), homes in Inglewood, just like the picture shown, were selling for $500K plus. No joke.

So the current listing price is a BARGAIN!!!!!! Buy now or be forever priced out of Inglewood. Prices will never go down. Home prices will go up 30% a year, every year, forever!!!!!!!

Home prices will never ever go down. According to Lord Blankfein, DFresh and QE Abyss, SoCal is different. Jobs don’t matter. Local incomes don’t matter. Fundamentals don’t matter. There are 400 hundred million Chinese with suitcases filled with gold bullion waiting to score one of these luscious beauties.

Buy now or be priced out forever!

Lord Blankfein here. I will occasionally check in with the blog to see how things are going. I think everybody realizes that housing will NOT tank hard anytime soon; thus, we are seeing all the sarcastic “housing to go up forever” comments from the bears.

A couple things of note:

Dow over 17K (all time high as of last close)

30 year fixed (0 points) at 4.29% (per bankrate dot com)

Unemployment rate 6.1% (who cares if it’s fake)

Money still flowing into desirable CA prime areas

Take all these points and add in supply and demand, rental parity, house horny lusters, Prop 13 bandits, etc and I don’t think there is any tanking in sight.

Housing to tank hard in 2010?

Housing to tank hard in 2011?

Housing to tank hard in 2012?

Housing to tank hard in 2013?

Housing to tank hard in 2014?

You get the drift…

It is different here. Unlike flyover country, you simply just can’t build 10K new homes in all the surrounding vacant dirt to fill demand. In highly desirable prime areas, home prices are forever disconnected from median incomes (see DFresh below for clarification).

When will Jim Taylor update his prediction to “housing to tank hard in 2015?”

@ernst not earnest

My main premise is anyone who purchased in LA during 2010-2012 will probably not see a major erosion in their home prices when the price drop comes. When the price drop comes are most of you really going to buy? Seems most on this blog are in a rentier class who wont buy unless WLA, Culver City return to $500K. Really guys, what are you expecting to happen?

@ernst

show me a post where I have said any of these comments:

“Home prices will never ever go down”. “Jobs don’t matter”. “Local incomes don’t matter”. “Fundamentals don’t matter”. “There are 400 hundred million Chinese with suitcases filled with gold bullion waiting to score one of these luscious beauties” “Buy now or be priced out forever!”

BTW havent you figured out “SoCal IS different” otherwise why be on this blog.

Blofeld: >> Culver City is surrounded on 3 sides by ghettos/barrios/slums <<

But which way is that trending? CC was considered crappy in the 1990s, and it's since gentrified. So, is the gentrification spreading to the areas surrounding CC? Or will the ghetto take back CC?

“It is different here. Unlike flyover country, you simply just can’t build 10K new homes in all the surrounding vacant dirt to fill demand. In highly desirable prime areas, home prices are forever disconnected from median incomes (see DFresh below for clarification).”

This place is different and everyone wants to live here, except when it’s not, like all of the prior periods where prices dropped – even in “highly desirable prime” locations. Perhaps this time is different forever… perhaps this time, finally, forever.

It’s not different here in the most fundamental regard that price drops, even large ones, can and do happen here, even in prime. Of course there are detailed variances between regions – which no one disputes – that apply, but that’s not what’s being debated. Just like every time someone brings up “prime” in an attempt to put up smoke and mirrors, no one is disputing the differences between prime and non-prime, there are commonalities across the board that we’re paying attention to.

Keep preaching the gospel and spreading the good word! The pews aren’t filling up quite like they used to and the good Lord could use the money.

“My main premise is anyone who purchased in LA during 2010-2012 will probably not see a major erosion in their home prices when the price drop comes.”

This is a big part of the disconnect here. Nobody but you really gives much of a shit how your 2010-2012 bet turns out. If you didn’t have some concern about it, you probably wouldn’t be reading a housing bubble blog, much less trying to talk up the horse you have in the race.

I don’t mean to target you specifically but we got it, ok? Good grief. Some of you bought in that timeframe and feel that it was a great play on the timing. Who cares if you’re right or wrong about that – it’s not very relevant to anyone looking to purchase today or tomorrow – aside from a potential future lesson on timing for which it’s too early to tell at the moment.

I like your humor, Ernst

“Incomes don’t matter.”

Yes, for this place they don’t, since as Blert points out it’s clearly a tear-down and will do great as a cheapo multi-unit rental.

Wake up, doc. You’re starting to sound like What?’s hysterically ironic realtor shill alter ego.

Your comment makes sense if every property for sale in LA was a teardown waiting for investors to put a multi-unit building to be built in its place.

I guess price would depend on how many rental units can be built. In an earlier post you mentioned sprinklers now have to be installed, a buyer might might not know that. With smoke detectors, irritated tenants would rip them out. I wonder what kind damage will occur when sprinklers go on when Cheech & Chong want to find out what they are?

Always be buying, I like that one. So glad you’re working on the real homes of genius, season two.

Can you imagine dealing with the ghetto bullshit that likely goes on in those neighborhoods? But hey, some folks like “diversity.”

There are nice pockets in both cities with very nice houses that would make nice homes. I would be very careful to conclude all things are bad in cities like Compton and Inglewood. In general though, it’s not the perfect place like Rolling Hills and the rest of PV.

“There are nice pockets in both cities with very nice houses that would make nice homes.”

Surrounded by mostly ghetto. No thanks. It takes more than some nice pockets to make a shirt worth wearing.

Speaking of being tired of the BS, wouldn’t it be easier to cut the BS and just use whatever racial slur you have in mind rather than putting diversity in quotation marks?

Your comment exposes your perspective – some sort of racial bent, apparently. I’ll leave the race baiting to folks such as yourself.

Doc is showing us extremes on both sides; e.g. Venice or Compton, etc. For those who want to start doing their homework now for the time when prices drop; I suggest looking into the areas such as: Outside of Culver City proper but just east of the border. Outside of Beverlywood proper but just to the east. [That is if you wish to be within a reasonable distance of the beach]. Otherwise to be near the beach you are looking at Inglewood (east of Westchester), Lawndale or Gardena (east of Manhattan Beach, Redondo Beach) for low prices. If you dont care about being near the beach or the westside then there may be pockets also that are in between the lousy part of Hollyweird and Hancock Park, perhaps pockets of Koreatown also. As a lifelong resident of LA, I dont see any other choice you have (to be near the beach) If you really dont care about being near the beach, then start at the Inland Empire and work your way into flyover country.

Lawndale might work (cash flow as a landlord) during the next price decline, but I’ve give it another 25 years before it tilts into gentrification. One thing it has going for it is as an incorporated city, it’s free from the reigns of LA.

Gentrify it will, doubt not.

You’re not taking into consideration population declines amongst educated people, wealthy people with assets. The vast majority of population increase in the US is from immigrants and children of immigrants – mostly Latino from Mexico and Central America. These folks don’t have much inherited wealth or high incomes. They are the wave of the future, and I don’t think they will be able to afford high-priced homes. I do not think the numbers of other groups will be large enough to gentrify the huge swaths of LA not already gentrified.

“Some argue that gentrification is happening in all parts of L.A. County.”

Nobody is arguing this. The windmills you’re now tilting towards are disappearing along the curvature of the earth, doc.

All it takes is a few hipster artisan restaurants/stores to open up around the corner due to cheap commercial rents, then the whole neighborhood will explode.

“Incomes don’t matter.”

Nobody is saying this, either. What some are saying is that median incomes no longer are an accurate measure of whether a “household” can afford to purchase a home in prime SoCal neighborhoods.

* Prop 13 lottery winners skewing the numbers down

* Off-the-books, cash-and-carry business owners skewing the numbers down

* People renting out rooms and guest houses skewing the numbers down

* Foreign cash buyers skewing the numbers down

* Multi-unit dwellers skewing the numbers down

* Manipulated inventory skewing the numbers down

You do realize that your own “feudal nation” and “median incomes matter” mantras are contradictory, don’t you?

DFresh

November 25, 2013 at 7:38 pm

“Don’t mistake “local incomes†with “available money.†Believe me, local incomes don’t matter for desirable CA real estate and there’s plenty of money…”

—

Dr Housing Bubble

Gentrification of Southern California: Price-to-Income charts and mortgage payments as a percent of income. Are some spots in SoCal becoming like New York?

“Incomes do matter for a couple of reasons. First, these will determine going rents and half of Los Angeles County rents. Many of the current purchases for all cash are from investors looking to rent places out.”

—

Doc, it would be nice if you put a date line on your posts. And don’t forget, just like incomes, interest rates don’t matter either.

“If you hold out long enough, everything goes up.”

That has ALWAYS held true for SoCal; and you’ve only had to “wait” a few years at worst.

Next!

Unless one is forced to move when the chips are down. Good thing that #never happens.

That picture of the Compton property doesn’t do it justice. Check out the street view in google maps to fully appreciate this gem.

I remember visiting a friend who bought a condo in an ‘ok’ part of Inglewood in the last run up. These were the things I noticed: a preponderance of small dog sh1t on every bit of lawn distributed evenly everywhere (no one curbs their pets). A random pile of rags/clothing sitting in the street. A 40-something african american fellow dressed all in blue driving a blue lexus. Still not nearly as bad as Compton; that early 90’s movie Boyz N the Hood had two gentlemen from Crenshaw scared of going into Compton….Crenshaw is actually fairly decent with a smattering of elderly Chinese and Japanese folks here and there in homes bought in the time before racial desegregation and the dissolution of racial covenanting in greater LA.

My girlfriend works in the hispanic neighborhoods (Bell Gardens, Huntington Park, Cudahy, etc) and in addition to some of the characteristics of the Inglewood area she notices plenty of loose dogs on the streets and the perpetual front yard sales!

Exo…What?

“the last run up”

Haven’t you heard the good word? This is the last run up. It’s #different this time.

Los Angeles is Tijuana with higher taxes. And it’s only going to get worse. I can’t believe the prices people are willing to pay to live in these ghetto neighborhoods. It really is unbelievable.

“I can’t believe the prices people are willing to pay to live in these ghetto neighborhoods.”

But, people are, while other ghetto neighborhoods (like in parts of Detroit), homes are sitting unsold for $5,000.

Why do you think that is the case?

Wheelin’ Dealin: >> Los Angeles is Tijuana with higher taxes. And it’s only going to get worse. <<

It'll only get worse for the Middle Class. The rich areas are getting richer. L.A. is evolving into a Third World city.

Uber-rich areas with private security patrols, within multi-gated areas. (I've read that houses in Hidden Hills and Beverly Park have gated areas within gated areas.)

And outside of those multi-gated and patroled areas — a sun-baked, weedy basin of crapshacks, slave-wage workers, and welfare recipients.

But they can’t stay behind those gates forever. They have beautiful new cars and they have to come out and get on that freeway sometime. The freeways are the great equalizers. We are all stuck there together, and their money and new cars won’t get them to their destination any faster than we poor schmucks.

I love knowing when I’m stuck in traffic, Spielberg is probably also stuck. I don’t think he’s taking a helicopter to work.

If using the word “pay”, you actually mean “borrow” at max leverage on a government backstopped mortgage, then yes, I believe it. That moral hazard is more extreme in SoCal than most other parts of the country certainly wouldn’t be #different than what we’ve seen before.

This home is an excellent value. Especially compared to Beverly Hills and San Marino.

You can run a number of home business here that would be under a critical eye in other snobby cities. Such as a grow house, whore house, gang banger headquarters, etc. Drug money will pay for this home in a few months in cash.

The best deals in SoCal are found in what I call the “second city inland”. Lawndale, Hawthorne, Lennox, Inglewood etc. very mild weather, but not nearly as expensive as the beach cities. We picked up a 2150 sq ft house in a great neighborhood for $350k. We had to remodel, but it was not a wreck when we bought it. My 7 year goes to an excellent and safe school and is in the best dual immersion program in the South Bay. Hawthorne and Lennox have some of the best High Schools in the country (Math and Science). They blow the drug infested High School of Manhattan Beach out of the water.

David, don’t think in the present tense. You must view these neighborhoods as the hazy Polaroid’s from the OG’s on this board…way too expensive (and racially diverse) relative to similarly sized homes in Texas. You’re crazy for getting less white and less per sq/ft than you could get in Phoenix.

LA is one giant slum pit, and the fact that it’s ranked as among the top 4 most powerful city brands in the world (along with Paris, NYC and London) means nothing in this global, mobile, 0.01% driven economy.

http://www.theguardian.com/cities/datablog/2014/may/06/world-cities-most-powerful-brands-get-the-data

Good thing this place is #different and everyone wants to live here.

Things can change. In some of your earlier snark you mentioned Detroit. In 1950 you would have been laughed at if you’d suggested that 20 years later Detroit would have been on a serious down slide and that 60 years later they would practically give away homes in Detroit.

LA has a much nicer climate than most places in the U.S. But I live in central Massachusetts and I could probably get to a beach nearly as quickly as one can from a lot of cities and towns in the LA metro area.

A lot of peripheral and significant supporting industries have diminished in or left the LA area. That should be a real concern. And it will likely end up as very foolish to interpret mistaken predictions of the timing of a real estate crash to mean it’ll never come.

Not sure that I get your point Dfresh. I get the sarcasm, although written sarcasm is not easily conveyed online. The bottom line is that the house that we bought in 2012 for $350k, sold new for $285k in 1989. Interest rates in 1989 were 10%. The original house payment was probably $2.7k/mo. That is in 1989 dollara. Our payment is $1/mo less than that. Comparable rents for our place is $1k/mo more than our payment.

Now, according to Zillow the place we got for $350k is now worth $500k+. The realtor who sold us the place said the same. But that only means it is rent neutral which sounds about right. The second city inland locations are not quite the deals they were 2 years ago, but compared to the beach cities, they are still pretty good.

I’d buy a burial plot and set up house in it before I bought in Lawndale.

Which is exactly why prices are still pretty good here. For us, we like the lifestyle. A magnificent new community center a half block away offering Dance, singing, martial arts, art and other classes at about $7/class. A beautiful new library offering tons of stuff for kids including free bilingual tutoring (daughter in best bilingual program in South Bay). Good neighbors who have lived in the neighborhood for 20+ years on all sides. All that and still just a 10 minute drive to the beach and great climate and a reasonable price.

As usual I agree with Blankfein. Prices are back to 2008 / 2009 levels assuming we didn’t have the CDO crash yet unit sales remain low,a huge proportion of deals are cash and traditional lenders are not lending to anyone who doesn’t have a sterling personal balance sheet. Once mortgages start getting written again the market will accelerate even more. Forgive the caps but they are for emphasis. PEOPLE WILL BORROW MONEY IF GIVEN THE OPPORTUNITY REGARDLESS OF AFFORDABILITY. Additionally you throw a calculated bet into the mix via the chance to make a mint via house price upside, and personal factors ( I need to house my family….what kind of a person can’t do that?) it gets emotional and visceral. There may be slight hiccups and plateaus but SoCal real estate is going to keep going up. What drove the market in ’08 peaks was loose lending standards. If any of you believe banks wont loosen up again you’re crack addled like Rick James. You have 200 years plus of US bank history to prove it. Wait for the crash and collect your 1% bank yield. Good luck.

First and foremost, Compton is a big city, there are a bad neighborhoods, OK neighborhoods and nice neighborhoods. Take for an instance, this year, a house in a nice area sold for 525,000 a mini mansion (average 300,000). On the other hand, in the bad area, a house could be selling for 220,000. Compton has also many gated communities as-well. Compton has always had middle-class neighborhoods even during the rough decades. Currently, Compton residents elected a new mayor, who has said she will clean up Compton. This year in Compton we had Chipotle, Jamba Juice, a Starbucks (4th in Compton), PetSmart, Marshalls, Ulta Beauty, Menchies Yogurt (opening soon) open in Compton. Also, there are plans for new townhomes and single homes communities (over 125). Compton also offers one of the best First Time Home Buyers Program in the LA area.

Compton is my town. The Mexicans are coming in and driving out the Blacks, who were the long time residents. We don’t take kindly to this. Some of the boyz vent their displeasure in a way that most of the readers of this blog would not approve, but fortunately, they are not too good of a shot, so not many people get killed on the drive bys. Look at the city how it is changing. Compton, which was once mostly white (former President George H.W. Bush lived there in 1949) and then became mostly black, is now mostly Hispanic. About 65 percent of the people in this city of fewer than 100,000 are Hispanic and only 35 percent are black, according to the 2010 census. Some say Hispanics now make up more than 70 percent. Fortunately, on the city government, it is still majority Black because a lot of the Hispanics are illegal and usually don’t vote because we ask them for their ID when they come into vote.

Tyrone iii, you sound bitter. This board is about housing, not your hatred towards Mexicans. You ass. It’s not like “blacks” had Compton looking like Beverly Hills before those beaners moved in. You are that guy that makes people feel uncomfortable when they go to african American establishments. I’ve heard many african Americans talk mess right behind me when I visit (not all). “What are they doing here”. I like BBQ brisket just as much as the next man and I love to support local business no matter who the owners are. I’ve worked in watts 14 years and all my friends are my co-workers who are educated african Americans, who don’t think like you. Heck, my wedding was split 70-30 like you said. Anyways, back to topic. Compton has nice areas and awful areas. Some pockets have long time residents that take care of their “blocks”. Make a wrong turn and you might be in trouble. I live in huntington park, yes that city going nuts when Mexico wins a World Cup game. However, those people going nuts aren’t all hp folks. They come from south central, Compton, watts, and as far as the inland empire. And yes, it pisses me off that I can’t leave or enter my city when this happens. I’m a homeowner who bought in 2008. I over paid a bit at 240k, however I just added a single family unit to my home for 65k. When I’m done paying my loan off my mortgage will be 400 bucks after my renter pays most of the bill. I will save up and move in 3 years. Have a plan people, I’m 2 years into my 5 year plan, and I’ll buy a home when I want to, not when “the time is right”. It won’t be to Compton neither. Twitter @thinkmikefly

You hit the nail on the head Ty. And it’s not just Compton: this is happening all over Los Angeles. Between illegal immigration and the birth rate, the Hispanic growth rate is being clocked at about 3500 per week. So. With this growth rate, how long will Santa Monica remain “Santa Monica”? West LA? Torrance? People can delude themselves into thinking they can rent up their way out of this but the writing is on the wall. You cannot stuff all the poor and illegals into Compton, Inglewood and So. Los Angeles. Not at that growth rate. I grew up here and I don’t recognize it sometimes.

Those of us who see the handwriting on the wall are getting the hell out.

Have you people been to Compton? It’s the urban jungle. Sure you can still buy a home there for a reasonable amount of $$$, but why would you? To build a armed compound? There is something to be said for having quality of life.

There are four Starbucks and a Chipotle there now, it’s #different this time! By now or be priced out forever.

i think gardena is the nicest ghetto area in LA. the lausd high school makes it ghetto but the many japanese and korean businesses (restaurants) in gardena makes it livable IF you have no children and live south of redondo beach blvd

America has 18 million empty houses all of which added to GDP. WASTE.

ZIRP continues to add to this waste. This is what kills capitalism: greed driving waste. Higher interest rates on time would have cured all of this and avoided this massive overbuilding WASTE.

Apparently America has 6 empty houses for every homeless person. Still, we protect the rich from losing money they have stolen from us; and we view the poor people of America as a threat to our livelihood. Because they are…losers. Hell yes, love the winners. Admire the winners. Reject the losers.

We’re spending trillions on the rich all over the world. I don’t hear many complaints. QE is money for the rich, taxmoney for the rich. But $700 a month for a family without a job brings out the viciousness out there.

The housing market is interesting because it is so much a function of government intervention. Going back a ways, the housing market was boosted by wealthy buying multiple homes for tax write offs until it was curtailed in the early 2000s. Fannie Mae and Freddie Mac then decided to push the excess onto the masses with artificially low rates and easy money losing loans. We can see what happened.

Today they are using banks to hold the excess supply giving them the ability to artificially misprice the property in their portfolio so they can hold it forever. Fannie and Freddie, despite talking about tighter standards, have not implemented much if any and other agencies are offering those who can’t afford houses low interest low to no down loans again. In reality, nothing much has changed save that other government agencies are taking the lead in offering artificially bad loans to people who can’t afford it and Fannie and Freddie are outright backed by the Federal government. In the meantime, banks eager to keep their construction companies afloat increase the numbers of new homes/multi-family homes in the market and hold onto their loser property since the accounting standards board lets them keep artificial values on their books unless it is bid on at a lower price than they record.

I assure you, the next big downturn will collapse this house of cards just like before and Fannie and Freddie will burn a deeper hole in the governments pocket forcing them to take even more taxes from the public that is backing this horrific game of socialized housing bubble making.

Everyone ( including housing bulls on this forum ) knows the end will be ugly, but it keeps politicians in office and players making money off of it until it disintegrates again. Then the mayhem will be too great and they will hide under a rock before trying the same trick yet again.

Wisdom of OZ: >>America has 6 empty houses for every homeless person. <<

That's a non sequitur. Expensive housing has little to do with homelessness. I live in Santa Monica and see the homeless every day. They're overwhelmingly druggies, alcoholics, lunatics, or some combination. Putting them into a house won't solve their problems.

“Housing bull” is too narrow of a descriptor. I’m as stupefied as anyone here about the price action for SoCal in the last 14 years or so.

For the bears there’s ZIRP, mark-to-market acctg shenanigans, shotgun pan-gvmtal pro-housing interventions, twitchy Wall Streeters playing the yield roulette, clueless foreigners with suitcases of gold, etc., which explains the insanity…take these unsustainable “patches” away and we go back to the good old days of median incomes explaining all in SoCal, just like it does for most of the country.

For the bulls there’s rising 0.01% domestically, SoCal as one of a limited number of global destinations, the emergence of the global real estate market, global capitalism minting third-world millionaires looking for security, hunkered down prop 13’ers limiting inventory, supply (land)/demand (people), the LA “brand,” the LA climate, undocumented residents co-inhabiting roach motel-style, etc., all of which are long-term trends that show no signs of abating (or, in the case of the weather, a constant).

In a way, this board has been a proxy for the disappearance of the American middle class. And, just like with many things, California serves as a microcosm for all to see this happening in 2x time.

If that’s the case, that we’re really arguing about whether the American middle class is just experiencing a temporary case of walking pneumonia or it is going the way of the Velociraptor, then I’m afraid to say that you’re right, I am a housing bull.

“SoCal as one of a limited number of global destinations”

This place is different and everyone wants to live here because there is hardly anywhere else is the world worth living to anyone that matters.

“This place is different and everyone wants to live here because there is hardly anywhere else is the world worth living to anyone that matters.”

Methinks thou protest too much. You might be priced out of the area you really want to buy in LA, but you still matter.

Nice ad hominem attempt, but the debate isn’t about me, it’s about the claims being made here.

@ Lord blankfein

so the Dow at 17k and the 4.9 apr will assure that the housing wont tank? Could you explain oh Lord cause I’m very interested how those facts correlate.

Because everyone who was stuffing money into the stock market during the last huge pullback has doubled that money. And today’s low interest rates means you can qualify for 20% more house than in ’06. And the RE market has bounced back to peak prices which means a big spike in tax-free equity to roll into your next property.

I think some of you need to face the facts that housing is not that expensive for tons of people who have made back all their prior equity lost in the crash and have made big dough in the stock market, and now have way low interest rates as well. What an awesome combo! Just another example of how sitting on the sidelines, be it stocks or real estate, can really hurt you.

It is amazing how many people are pushing an extended housing market uptrend with little fundamental logic to hold it together. It seems much like the last major downturn except rather than housing its the stock market this time that will triger the slide. People have yet to learn the appearance of government support always ends up overextending gains and results in fantastic crashes later. Later is becoming closer and closer. Watch out out there and don’t believe the hype. Don’t extend your risk and buy into this bull this late in the game.

QE has been nothing but an utter failure because the creation of money without cost or recourse for anything but the government has nothing to do with economics or capitalism. It is by its nature a tool for ripping off the many to enrich the few. I’m amazed America puts up with it and more amazed with cheerleaders calling for more QE.

I think we are late in the game already and are only held up by government and central bank action on top of government and central bank action.

This recovery is certainly abnormal and because of it the fallout is liable to be abnormal as well. It is not when as much as how big a decline will be. As long as government and the central bank continues to over-expand their balance sheets in a late recovery rather than prepare for a downturn, I wouldn’t want to bet or be close to the economy when inevitably it does go into another downturn. If there is a downturn this year it will probably be Q4 and more likely a downturn will happen next year. It’s not an if, it’s a when.

We are looking at a new page in history where the government and Federal Reserve are almost powerless if another downturn happens this or next year.

Good Luck.

“Because everyone who was stuffing money into the stock market during the last huge pullback has doubled that money.”

I wasn’t yet aware that everyone has cashed their winnings out of the casino. Thanks for the info.

“a big spike in tax-free equity to roll into your next property.”

Also good to know that the government won’t be changing the tax rules moving forward because they #never do that.

Actually, there have been quite a few articles in various places such as here, at David Stockman’s web site

http://davidstockmanscontracorner.com/bubble-finance-at-work-how-the-share-repurchase-mania-is-gutting-growth-and-leaving-financial-wrecks-like-radio-shack/

about how the real driver of the stock market has been an insane level of corporations buying back their own stock. I think the statistic was that amount of money spent on corporate buybacks by the S&P 500 in 2013 was 95% of the total profits of those companies. This was done as the market approached and set new highs, meaning that these corporations neatly repeated the chump investor’s mistake of buying high. And they made this dumb mistake instead of putting money into capital expenditures and r&d. How do you think that will play out in the long run?

Everyone feels pretty good right now. Just wait baby boomers, you will take heavy loses on your stock portfolio, home equity. Chaos is coming, feel smug while you can. Buy like Falconator but get out while you can, a minute too late, is too late.

“about how the real driver of the stock market has been an insane level of corporations buying back their own stock. I think the statistic was that amount of money spent on corporate buybacks by the S&P 500 in 2013 was 95% of the total profits of those companies. This was done as the market approached and set new highs, meaning that these corporations neatly repeated the chump investor’s mistake of buying high. And they made this dumb mistake instead of putting money into capital expenditures and r&d. How do you think that will play out in the long run?”

The piece that you are missing is that buybacks plus dividends are over 100% which means that the companies are being gutted by management. Look at the P&L, the BS and the cash flow statements of these companies. The shares outstanding are falling, profits are still positive and a negative cash flow. I am not sure how long this can last.

Yes! I have been selling into this bull market all the way up. I may be oversold right now but I sleep like a baby…

Nobody has any skin in the game.

Everything is done with almost no equity involved.

Stock market goes to a billion when all of the corps buyback shares on borrowed funds. They know exactly how bad earnings are going, so they just buyback stocks to keep up appearances on the EPS front. Downgrade earnings all you want I can buy more of my stock to make up the difference.

The 1% borrow on their real cash equity to fund everything they do. None of the equity is touchable and sequestered in trusts mostly off shore.

They can let it go forever if they want. The end game is that same only the ones that have real equity/cash will be there in the end to buy it all back at the bottom.

I think the only true bubble in LA is the Clippers for the time being. $2 billion? now that is overpriced.

But I am pretty sure that Balmer has as little skin as possible in that scheme also.

54 million empty houses in China; 18 million empty houses in the US; 11 million empty houses in the EU. This is what happens when intrest rates stay too low for too long.

Housing market in the US is cancerous and this so called recovery is a scam designed by the Fed and big banks to lure more suckers and bankrupt a new class of people.

I love these comment sections. Having lived all over the country and now residing in the OC I have never encountered a segment of US society so out of touch with the real world be it economics, global/national politics, the environment etc. the only people flocking TO CA anymore are third world illegals, foreigners, and the wealthy. Add in the exceptional drought that is plaguing much of this state and it’s a recipe for societal and economic disaster!!!!! Housing is a TINY aspect of American prosperity. Do any of you have kids? Do any of you even care about the type of country and society they will be growing up in? The idyllic CA of the 80’s and 90’s is GONE! And so with it goes white middle class. Ever wonder why everybody wants to live in white middle class neighborhoods but then nobody understands why they are the way they are. My wife and I are the typical white middle upper middle class earners that made states like CA such an amazing place to live. LA is a dump. San Fran is a dump. Most of CA is unrecognizable nowadays. We are taking our incomes, our responsibility, our affinity to work hard, pay our taxes, raise our kids with a sense of right and wrong, etc, etc. and getting the hell out of this crappy, ultra liberal multicultural cesspool of a state. And it’s hardly because we can’t afford it. Quite the opposite. We don’t want to afford it. But hey I’m racist right??? LMAO!!!

OC is just a plastic dump. If you had real money, you’d be in Beverly Hills, Bel Air or Malibu.

I said we are MIDDLE CLASS genius not RICH. Thanks for proving my point!!!

Whether out of touch snobs like you or wannabe snobs like you realize it the middle class is what drives the economic engine of a first world industrialized nation. Enjoy your multimillion mansion while living in your banana republic while surrounded by the third world.

This whole string of threads sounds like a cross between a real estate training course & the film “Mean Girls.” It’s been this way for some time now & many posters should get some psycho therapy or at least chill as venting here has changed nothing. After all psycho therapy is the norm in in La la land, right? LOL

Find another handle.

Conquering Fool, What? is the “mean girl” of this housing blog. He likes to post stupid retorts that he finds humorous and comments under What? or other names. He comments all the time…he thinks each post deserves a comment from him. His comments are usually inflammatory but he thrives on that.

“Conquering Fool, What? is the “mean girl†of this housing blog. He likes to post stupid retorts that he finds humorous and comments under What? or other names. He comments all the time…he thinks each post deserves a comment from him. His comments are usually inflammatory but he thrives on that.”

First of all I only post under “What?”. Second of all the “What?” who made the OC comment is not me. So in reality you give me too much credit. Final thought for our simple friend. I call your BS and you get your feelings hurt. One should always be prepared to have their opinions challenged/questioned if they post them in a public forum.

Yeah, why can’t Murca be fer real Murcans?

America was a country for everyone that embraced freedom, liberty, responsibility, independence, limited government, etc. ad infinitum. Your cute little retort is supposed say what? You believe in giving your country away piece by piece and squandering generations of hard work and discipline so you can open your arms and your paycheck to every welfare king and queen and illegal in order to claim “diversity”? Open borders? No unified language? Yeah LAer…….sounds about right…..lol

Thankfully there are still beautiful places left in America where people can embrace what it means to be American, speak English, love free, and die with a little tucked away for future generations. It’s not SoCal.

We used to live in Orange County in the 80s’s and 90’s in the Huntington Beach area. It was indeed idyllic with a laid back beach culture. There were still empty lots along Beach Boulevard. We recently visited and it looked like a completely different place that we didn’t recognize–and some it wasn’t for the better. Most of the apartments off Beach Boulevard looked ghetto. The house we used to live in off of Garfield looked well maintained and zillow estimates the value to be around $800K which is about $50,000 more than for what we sold in for in 2004 before we left SoCal.

And the 80s and 90s saw double digit interest rates. Homes weren’t a casino they were a lifelong investment and way of life.

You come on over to Texas. Have some of my chili that is made with grass fed, free range, and happy steers(before the jackhammer knocks them silly). It is ok if you don’t like hunting and fishing, near Kerrville, we have some good birding territory and will even throw in “Kinky Friedman” for free.

>> LA is a dump. San Fran is a dump. Most of CA is unrecognizable nowadays. … this crappy, ultra liberal multicultural cesspool of a state. <<

You're describing New York City of the 1970s/1980s, during which time I lived there and rode the subway to high school, and later to NYU.

The subway was scary in the 1970s/1980s, especially when I rode it from Manhattan late at night.

Then in the 1990s, Mayor Rudy Guiliani changed NYC, making it cleaner and safer. Every year since I moved to L.A. in 1987, returned to visit NYC. Even when I ride the subways at 3 a.m. (from Manhattan to Queens), I feel safe.

NYC has continued its liberal economic policies, but it's far move liveable than 30-35 years ago. I think this is because it's another one of those international cities, where all the uber-rich want to live. They pump money into the city, keeping much of it safe and clean and liveable, despite all the problems created by the large underclass.

I think L.A. has a similar future. It IS an international city. Lots of rich Persians, Israelis, Russians, Chinese, Germans, Italians, Brits, Aussies, etc., coming here to hide their money from their more socialist governments. And there are a LOT of these rich folk.

Them and the rich natives have kept the Valley south of Ventura Boulevard liveable. So too the San Gabriel Valley area, and large areas of the Westside.

Plenty of poor folk in L.A. But plenty of international wealth too. I don't see that changing in my lifetime. L.A. is more like New York City than Detroit. All Detroit had was the auto industry. L.A. and NYC have much more.

Which is not to say I can afford the lifestyle I want in L.A. I'm stuck in a condo, and can only afford crapshacks in mid-tier areas. I'm more inclined to buy a nicer, yet cheaper, house in the Pacific Northwest.

Los Angeles has dumpy areas for sure.. But to call all of LA a dump is factually ignorant. I grew up in PA… go check out some backwoods parts of that state and then tell me LA is a dump! It’s crowded and overly congested sure.. But you do realize LA county includes the south bay beach cities… up to as far as Porter Ranch and LA Canada Flintridge…

Studio City, the westside.. even glendale and pasadena are still part of LA.

You focus on compton and south central and call all of Los Angeles a dump is a joke!

Awww sorry if offended your piece of paradise. You’re probably like every other wanna be LA/SoCaler who can’t REALLY afford to love in LA but will defend why it is so great to no end. Can you comfortably afford to live in the nice parts of LA? On one income? Etc. Point is LA is a dump politically, economically, and socially. And not only are some parts dumps they are third world Mexican ghettos!!!!

Sorry as a white middle class American I don’t want to surround myself with the thurs world or a bunch of rich elitist Persians, Indians, and least if all Chinese. Thanks for proving my point LA is a third world city. I’ll go raise my kids in Denver or Montana!!!!

Read “Sell Now – The End of the Housing Bubble” By John R. Talbot. Published in 2006.

Nobody listened to him them, but he was right.

Round 2 is coming, just a matter of WHEN.

Interestingly, John R. Talbott gave a buy recommendation a couple of years ago. It would be nice to know his thoughts on the present situation in markets such as SoCal.

I always find it amusing when people have to justify the place they live. “Inglewood ain’t so bad”, “Compton is getting better”, “Gentrification is taking hold”, etc. In reality, the majority of LA and surrounding areas are dumps and ghettos. Much of this can be blamed on prop 13 keeping people in their homes who generally can not afford it, and then passing it on to their kids who can not afford it. Add to that the influx of illegals and welfare recipients in Los Angeles that just take without contributing to the economy, and it’s easy to see that Los Angeles is doomed. I see suckers buying 2/1 crapshacks in scary neighborhoods for 500K and just shake my head in disbelief. Is this what it’s come to? Is this the American Dream?

The real fly in the ointment is not Prop 13 but the Prop 13 bait and switch props 90 and the others.

Old boomers can sell and move to another house and keep the old houses prop 13 tax rates. The Counties figure they can suffer with the revenue loss because these old farts will die off sooner than later and still have sales growth in housing.

The old lady in Compton can sell a crap shack to a gentrifier buy a single story condo in Riverside with hourly shuttle service to the hospital and live of the proceeds and still only pay $500 a year in property tax.

Your prop 13 stalemate only happens if all of them just put them into family trusts. That is what will kill property tax growth. If she dies in Compton, the kids just HELOC the hell out of it, rent it to undocumenteds for cash. Not pay taxes on the rents, still paying 1972 tax roll values, collect on all of the F.S.A. subsidies and live the good life a.k.a know as no longer counted in Unemployment Rate #3 in Culver City.

Do the right thing people! Send the old people to Palm Springs. Keep housing going forever!!!!

You’re not taking into consideration population declines amongst educated people, wealthy people with assets. The vast majority of population increase in the US is from immigrants and children of immigrants – mostly Latino from Mexico and Central America. These folks don’t have much inherited wealth or high incomes. They are the wave of the future, and I don’t think they will be able to afford high-priced homes. I do not think the numbers of other groups will be large enough to gentrify the huge swaths of LA not already gentrified.

The same dude is happening in your Texas as well, don’t come over to Texas. Stats, New Mexico 47 percent Hispanic, California 39 percent Hispanic and Texas 38 percent Hispanic. The same is happening there as well from white to Hispanic, sorry I suggest to go to Utah, Colorado. Utah 13 percent Hispanic and Colorado 22 percent Hispanic. Incomes in California and Texas will be definitely lower in 20 years a study by a demographer states so In fact California might be saved by the Asians but less of the Asians are interested in Texas not enough of middle class Hispanics and whites going to Texas to offset the children of poorer Hispanics being most of the population.

Leave a Reply