The condo mania of Irvine – Beware of Mello-Roos and massive HOA fees in Irvine. Does an $840 monthly HOA due seem high for a 2 bedroom condo?

One thing is apparent with the buying process for condos in desirable Southern California areas. People are blinded by the “lower†costs since many have been programmed to insane prices for well over a decade. It has become an accepted mantra that real estate is simply high in certain areas without looking at the underlying information. Some areas warrant high prices because of high household incomes. Others are still inflated. It is no shock that nationwide prices went up yet sales moved lower even with another record low interest rate. This is the so-called solution to the shadow inventory problem. Crush household incomes, artificially constrain supply, and boost prices up. Yet you have government backed GSEs with an underlying mission of “affordability†for American home buyer. The proof is in the housing pudding. It is amazing how bad some people are at basic financial math but then again, this is what allowed the bubble to rage. This allure of lower sticker prices is being seen in condo sales in Irvine yet people do not take the entire picture into consideration.

Beware the HOAs fees of Irvine

Once upon a time in the boom days rising condo towers were built in Irvine. This craze was assuming that walkable amenities and prices would remain inflated for a very long duration. Those days never materialized even in Irvine. Today you are seeing massive price cuts even in a very desirable city like Irvine:

3141 Michelson 304 Irvine, CA 92612

2 bedroom, 2 bathroom, 1,500 square feet, Condo

This place is one of the high rise condos built during the peak of the mania (the year built is listed as 2006, near the apex). The place was done up with the artifacts of luxury:

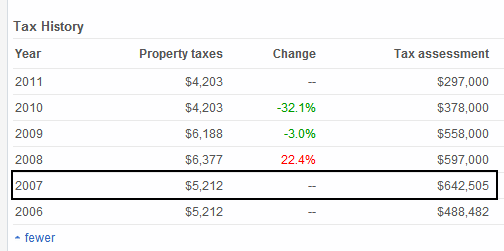

Not a bad place for New York City. But for Irvine? It was unsustainable. Take a look at the tax assessment:

At one point this place was assessed at $642,000! It went from $488,000 in 2006 to $642,000 in 2007. That isn’t a bubble. That is full on madness. This place currently has a pending offer at $300,000 which must seem like a steal compared to that peak assessed value of $642,000. But is this place a good deal? Let us run the numbers:

PITI:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1,632

For a 1,500 square foot 2 bedroom and 2 bath condo in Irvine $1,632 seems like a deal right? This is even cheaper than rental parity? You might be forgetting that wonderful HOA fee:

HOA dues (monthly):Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $840

You read the above correctly. The HOA dues are $840 per month bringing the total monthly carrying cost to $2,472. We are now above rental parity. The HOA fees are half of your overall PITI. And chew on this, even if you paid $300,000 in cash for this place you would still shell out over $1,000+ per month just for HOA dues, taxes, and insurance. They don’t tell you that in the brochure. I’ve seen so many people dive into condos ignoring the insane additional fees of these newer developments. This is rampant in Irvine as people go “oh my goodness! You can get a condo in the $200k to $300k range. Where do I sign?â€Â Many are going to get shocked when the bills start rolling in.

I’ve also seen this with many of the communities that carry Mello-Roos. To show you how little people understand about real estate, many for years have been using Mello-Roos as a deduction to their taxes even though this is not permissible. The Franchise Tax Board will now be cracking down on this because you know, the state budget is so flush with money right?

“(FTB) Assessments on real property owners, based other than on the assessed value of the property, may be deductible if they are levied for the general public welfare by a proper taxing authority at a like rate on owners of all properties in the taxing authority’s jurisdiction, and if the assessments are not for local benefits (unless for maintenance or interest charges).â€

In some places the additional assessments and taxes take the base rate of 1 percent in California up to 2 percent (that is a big deal when paying $500,000 for a place). Again, many are simply looking at the PITI and sticker prices and are going gaga with low interest rates forgetting that they are still paying a pretty penny but the price calibration is still off thanks to the bubble. The Fed has boxed itself in a corner. The market is now accustomed to low rates. Rates can’t even move up to the historical levels of 7 to 8 percent without imploding the entire financial edifice of the world. In essence, the confidence game has to continue for as long as they can play it out. How well is that game going for Japan now over two decades into their low interest rate game? Even at 0 percent you have to pull in some income. Is real estate booming just because rates are low? Of course not, because as we have seen with multiple reports, most Americans have seen their net worth and incomes collapse since the recession hit. A $80,000 Mercedes is still expensive even if they give you a 7-year loan at 0 percent.

For those buying in newer condo and home communities in SoCal, make sure you run the full numbers before buying, otherwise expect to get a much higher bill than you would expect.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

60 Responses to “The condo mania of Irvine – Beware of Mello-Roos and massive HOA fees in Irvine. Does an $840 monthly HOA due seem high for a 2 bedroom condo?”

so true .. if you ignore the high HOA, the current condo prices would be a great way for folks to own a property and get the benefits of homeownership ..

i would like to point out the obvious/apparent.. that $840 * 12months * 30years = $302,000!! as much as your the buying price of the condo…

btw, if you save $840 every month (put it away in a mutual fund, assuming 3% growth every year, at the end of 30years you will have almost $500,000.. question is, will your property be worth $800k or more at the end of 30 years?

and another way to look at it is .. in addition to the PITI, if i can pay an additional $840 per month (for HOA).. that’s additional buying power(assuming ..so your total condo price is ($300k + $x) for that condo .. the question is would you buy a condo for ($300 + $x) k or would you buy a single family house?

HOA dues are deeply misunderstood. At a condo I used to own, the HOA dues were $400 a month. But for $400 a month, that included landscaping, building cleaning, 24 hour 7 days a week security guards, basic cable, water, gas, sewer, repairs and maintenance to common areas, earthquake insurance, several heated pools, jacuzzis, and saunas, a world class gym and two hours of free monthly club house access. The club house could hold up to 200 guests and had a full kitchen.

The only thing that I had to cover was electricity, premium cable channels (which I did not use), and plumbing if I somehow clogged my own drains (which never happened).

And, then, of course, try to put a value on the relative care free existence you live for just writing that check every month, instead of all of the hassles and expense of owning a home with a pool.

Yeah but did those monthly club house hours roll over?

What does 2 hours of monthly clubhouse access mean? I have never heard of such a thing. You mean you pay all those unnecessary fees and you can’t use the clubhouse as much as you want? That is not a bargain.

HOA fees are fine for some, if you use what you are paying for. Do you really need someone parking your car ? How often do you use that pool, the tennis courts, the clubhouse ? And if your neighbors run water all night, guess what, you pay for it. Then of course, you DO NOT get a tax right off for HOA’ fees. Then come the special assessments, even if you are not in favor, you end up having to fork up thousands. HOA fees only go up, and you can’t control them.

And then you’re stuck in Orange Co! Fine if you are a Republican or a Tea Partier, I suppose. If someone put a gun to my head and said you have to move to OC, I would choose Laguna Beach.

San Clemente for me

For something like the 4th year in a row Irvine was the safest city in the United States. So it isn’t likely that anyone there will put a gun to your head and force you to move there. The “putting a gun to someone’s head” thing is no doubt more common where you live now. Feel free to stay there. Irvine also has some of the best schools in the state. No need to pay for a private school as you would if you lived in LAUSD. For those with children, that adds to the “affordability”. I don’t live in Irvine, but I don’t understand why people feel the need to trash a place that really has a lot to offer.

I wouldn’t be so quick to put LA schools down. Look at the API of the school my children attend in Cerritos compared to this one in Irvine.

Cerritos

http://schoolapi.com/school.aspx?school=Cerritos+Elementary&cds=19642126068274

Irvine

http://schoolapi.com/school.aspx?school=Oak+Creek+Elementary&cds=30736506120141

Jerry Roy, I hate to break your bubble. Cerritos is the Irvine of LA County. Predominately Asian population that puts extreme emphasis on eduation. That’s a huge reason why test scores are so high and schools are so highly rated…and real estate prices reflect this.

Step outside the Cerritos bubble and you sure as hell wouldn’t want your kids going to most any of the LAUSD schools. They’ll likely be going to school with many future drop outs, gang bangers, ESL kids, parents who don’t give a shit…all a recipe for FAIL!

Jerry Roy. I wasn’t aware that Cerritos has merged its schools with LAUSD. Perhaps I missed something.

@ Jerry Roy: I *would* be quick and sharply judgmental about LAUSD’s low quality. I work in LA and I’ve had the opportunity to converse with enough young new hires to know just how poorly educated they are. Actually, “poorly educated” is an entirely euphemistic way of stating it, since it implies some level of education once it’s all over. Fresh out of high school, most of them I’ve talked are barely able to hold a conversation. Go look up the car crash sound effect guy interview on youtube, and that’s about as articulate as these kids have been. I’ve actually been complimented by on my impressive arithmetic skills by a *college graduate* for being able to convert scaled readings to unit measurements (effectively multiplying by either 40, 100, or 200 depending on the instrument’s configuration) on the fly in my head. That’s hardly even math. That’s just counting!

Rhiannon, you can have your cesspool third world toilet sanctuary city of Los Angeles all to yourself. If someone put a gun to my head and forced me to live there, I would take the gun and empty it on myself. 🙂

I agree, and can’t wait to leave, after my personal business in finished. LA is ranked worst in so many qualities of life, and standards, it’s pathetic. It’s also very sad, as SoCal was a premier destination for much of the 20th century. No longer.

And don’t let cheerleaders like Rhiannon fool you, they know the emptiness inside as well. Hanging on to this “illusion” is all they have left, and they all trade lies with each other similar to Real Housewives of ~~~.

I called the Dow at 14k and pulled out, bought gold at $480, didn’t get caught in a bubble mentality home, and was educated at some of the finest institutions a much stronger 1990’s USA offered. I was recruited by a Fortune 100 company, only to learn the rat race the hard way. All while the scoffers like Rhiannon choose to thumb their nose, when in reality now we all know the real losers are. Those are the ones in a sociopathic psuedoreality thinking they are/can/will “pull one off in life” by achieving a bankers dream – owning a mortgage in SoCal.

Unless SoCal caters to me, which it still may, no thanks. I’ll go to where the statistics are in favor not only for business, but for quality of life and race as well.

West hollywood will miss you if you move to Laguna…

Well you certainly wouldn’t want to be in Santa Ana in the OC. Gang central.

Did you really need to geet political? Really? As if Republicans show their voter’s registration card and get a discount.

But what about condo living in DTLA? I’ve seen places going for 200k and 220 HOAs fees? Is this a deal/steal (stdeal?) DTLA is not that bad. Any data for DTLA?

DTLA could possibly be a good long term investment, assuming LA’s master plan continues unabated. They built LA Live, are attempting to push Skid Row out, and Hollywood is trying to get the green light to build many highrises. There is a potential for that general area of LA to be more like NYC in 20 years, but who knows how it will play out.

5 Housing Markets Where Renting Beats Owning

Among all states, California has the most counties where renting is more affordable than owning. In San Francisco, the gap between average monthly rents and mortgage payments is the largest nationwide, with homeowners paying $1,259 more each month than renters, according to Marcus & Millichap. Last year, median-income households in the San Francisco metro area had just 66% of the income they needed to purchase a typical single-family home, according to the NAR.

In Central Richmond in San Francisco, rents for single-family three-bedroom-plus homes start at $4,800. Similar homes for sale have asking prices that start at about $1.2 million and property taxes starting around $6,800. Assuming a 20% down payment and an interest rate of 4.34% on a 30-year mortgage (the typical down payment and average rate on large loans, according to HSH Associates), monthly loan and tax payments total $5,345.

Hawaii’s state capital has the least affordable home prices in comparison to income in the country: Median household income is just 39% of what residents need in order to buy a median-priced home, according to the NAR.

Ah , Central Richmond in San Fran. For amoment I thought Richmond in East Bay. Richmond and West Oakland are very affordable. West Oakland has a very short commute to S.F and close to east bay job centers. of course the nights can be filled with the sound of gunshots. But apart from that…

For what it’s worth – current rents for this kind of place appear to be between 2750 and 3200, but the lower floor units will be at the low end, so you might be able to rent this place for as low as 2700:

http://orangecounty.craigslist.org/apa/3078338724.html

Don’t forget that the HOA is probably having a hard time collecting fees from owners who are squatting. I wonder how many of those condos are actually empty, or have non-paying tenants. Can anyone say, “Special Assessment”?

Certainly do not forget that. I am leaving a condo complex in Ventura County in a few weeks. I am fortunately a renter. While here I have realized what a risk condos are. I have heard at least 1/3 or more of the owners stopped paying their HOA dues leaving the rest to make up the difference. So they are paying over $600 a month plus special assessments for this dump. They highest priced unit is only about $250000 and most of tenant occupied. AS a result the place is falling apart even though they did extensive work. Maintenance has been cut back. Management staff cut to one person and trash is often tumbling on the ground. No one can keep track of who is living where because there are so many empty units.

Don’t you have trouble selling to a buyer getting an FHA mortgage (sadly most of them it seems these days) if your condo association can’t show that a very high percentage, something like 95% of the unit owners are up to date with their HOA’s?

O yeah I want to live in a building like that in earthquake country. Hello?

Todays engineering far surpasses earthquake danger.

As for politics, for honest American conservatism, you can’t beat Phoenix. Arizona bound!!! Liberalism and CA is a clear failure.

Yeah, they said that about Cal Arts too. It was earthquake safe, built on rollers, supposed to be the emergency center for the community. It was trashed during Northridge. Buildings that were steel reinforced and up to modern code were condemned. But those wooden homes from the 30s? Still there. Wouldn’t want to live in anything more than two stories high here.

Have fun in Arizona. I’m sure you’ll be happier there and the weather is nicer. I’ll be surfing 😉

LOL. Arizona has a massive budget deficit , as does Texas. CA has been open about it and dealing with it. But Texas couldn’t even come to terms with how much deficit they owed.

That and they want to control every aspect of your private life-so much for small government conservatism. Having worked in Saudi Arabia for a project-no thanks-me love America/CA.

Only differenc between republicans and dems is that dems are like the Kardashians-open about it. Repubs are like Bristol Palin and Newt Gingrich-do the same behaviour but condemn everyone else for their transgressions and make millions out of playing holier than thou.

Could we all get off the false dichotomy express, please?

Cheering much for either team is foolish.

For those of you unfamiliar with these Irvine highrises, they are known as the NKT (North Korean Towers). Anybody who drove by these places at night noticed there where little if any lights in these buildings for years. Similar to satellite photos of Asia at night showing the void of life and light in North Korea.

The timing was awful for this project and it just didn’t make sense from any perspective. Irvine is not some densely populated metropolis where high rise living is needed/desired. When you take the 405 South, look on the right side when you pass Jamboree Road and you’ll see these monuments that represent everything that went wrong during the housing bubble!

Girl by the whirlpool

Lookin’ for a new fool

Don’t follow leaders

Watch the parkin’ meters.

NKT – North Korean Towers – that’s awesome!

Tough to get walkable amenities in sprawling Irvine. Nothing feels more quaint than crossing an 8 lane boulevard with cars racing by at 65 mph. The attempt at amenities in Irvine are strip centers with national chains selling food, trinkets, and tanning.

Rhiannon is right – Laguna Beach is probably the best place in OC.

I live in a very similar 1,300 sq ft two-bedroom two-bath condop in Greenwich village in NYC. similar apt ment recently sold for $2,100,000 with $2,700 monthly maintenance. Price is about where it was in 2007.

High rise living makes sense in NYC, not in Irvine. I would guess you don’t even need a car in NYC due to public transportation and proximity to everything. Unfortunately the same can’t be said for Irvine. I guess you could always take the OCTA bus for date night or when you want to go to the beach. 🙂 They should convert these entire buildings to apartments or maybe a homeless shelter.

Wait till the next stage of the crash, Lance. Think the rest of the country will stand for all the NY based big banks getting hundreds of billions of TARP funds, again, while everyone else has to eat cake? What will happen to the price of those condos then? Oh, prices will drop everywhere else, too. But in NY and DC, the places that most benefitted from the bailouts and then the ridiculous surge in gov’t debt, it will be a freefall. And most of the other 300 million americans will enjoy seeing it.

I remember when they were building those condos in Irvine. It being so close to john wayne airport and earth quake country seems pretty scary. Im guessing here, but these towers are in close proximity to UCI. I’d think it houses wealthy students from other countries. I’ve heard they come toward the end of High School and then head right into our UC system as Ca residents? Word has it, parents would send the high school student by themselves, purchasing them a home in the desired school district and these kids would tend to their own needs. Who knows, sounds too crazy to be true. Nice diggs for anyone, much better than the pit I lived in as a student.

Foreign students come here on an F1 visa. No matter how long they are here, they do not qualify for resident rates-unless they manage to get a green card . Some do get scholarships.

@Lance I understand how the selling price can get so high, I do not understand how an HOA can get that out of control. Any insight?

One other thing about condo buying that buyers ALWAYS shrug off. That is the financial state of the homeowners association, specifically the replacement reserves. I find it maddening how little real estate agents are aware of this (but, of course, you don’t need a college degree to be a real estate agent). When asked the question, they always say “sure, the association is financially sound.” I ask, and “how do you know they are financially sound?” Their answer is always….”because they have a lot of money in the bank” BRILLIANT!

I know of one condo complex in Century City that is about to vote in a $40,000 per unit special assessment to fix water intrusion issues. How would you like to be the poor schmuck that just bought a unit there, only to find out that you are going to be shelling out a $40,000 payment to the association.

Similarly, many existing condo buildings are now 30 yrs old +. I think that you will find that not only are these associations severly underfunded as far as their replacement reserve accounts are concerned, but there are pending repairs that can no longer be the effusive “kick the can down the road” type of expenditures.

When I was actively looking for a property, and my wife and I have been in and out of a few escrows in the last year, we always review the replacement reserve calculations. If I find that they are underfunded, I ask the seller’s agent for a credit against the purchase price. They look at me like I am nuts. Why? Because there are too many STUPID people willing to assume that liability for the underfunded balances that should be the seller’s responsibility in the first place. Shame on the buyer’s agents for not educating their clients about this. But, then again, they didn’t have to go to college either, right?

Before you close the deal you see the books back for ten years or whatever is available. Buyer beware. Another thing I did was to hang out in the area for awhile and talk to residents. They are always willing to complain to anyone who will listen. Americans are so strange. WE haggle over a small purchase but buy cars after driving it one or two blocks and buy houses without investigating everything. Don’t trust inspectors. If they are too honest the RE agents won’t give them business and you don’t know who is okay in a new area. It’s all a joke. The whole industry is crooked and stupid. I had a license in Marin County when ETHICS was the big thing so every year we had to spend a day in an ethic class. The class turned out ‘how to not get caught’.

Good Gawd, who wood buy a condo in this market? A person would have to have wood-eyes and a fir brain. Me, I got lead feet, no thnaks. Just showing my metal.

HOA’s are mostly for things a lot of us would not buy if it were our own home.

at $840/month. I would expect this kind of expense with a 3000 sq ft house.

Thought I’d share an example in my area…

http://www.redfin.com/CA/Valley-Village/5548-Radford-Ave-91607/home/5206971

My wife and I live on this street and thought we’d check it out. (We like the area) The carpets were horrible and smelled of pet! The main fireplace even had a big stone missing. There’s an apt. complex looming over the whole backyard. Nothing inside is special, things a tad bit grungy, and needs updating. On the market for 52 days and now it’s finally pending. Sold in 2001 for $269. Very curious to see what the sell price will be, but this is nutty to me. I have an apt. I’ve been in since Nov 96. Two bedroom/two bath for under $1000. Willing to put 20% down on a $400 maximum. It would have to be much nicer than this otherwise I’ll be renting for a while.

Papa to be,

Say it aint so, your not leaving. Your what Ca. needs more of. I guess if work and life style is better for you and family, it’s a no brainer. Seems like we keep loosing the good ones and shipping in boat loads of the families that use the system to their advantage and bring nothing to the table. I think were going to see a drop in housing this fall and winter season. Were still on the fence and actually seem to have better vision from up here, however sitting on a fence is quite uncomfortable, Im getting use to it. I love how one of the bloggers refers to Realtors as Realtards or Realturds. I agree with him, some are so lazy, the business is hard and requires a lot of work in todays market. Find a newbee who is willing to go the distance with you and get you what you deserve and love. If we do loose you to Az. they are lucky to get you, please keep posting! Keep us up to date with the market there!

Auntie M.

Ernst Blofeld,

What year was it your HOA included all the above mentioned in the HOA, 198_? Im wondering what year,what city and how many units?

It’s good to be alert to the extra costs (besides PITI) that come with buying a home. Here’s another item potential condo owners should consider: exactly how many of the units in the building are currently rented out? If renters are at 25 percent or more, there could be danger, heartbreak dead ahead because: lenders generally don’t want to lend money for units in condo buildings that appear to be turning into apartments with absentee owners. Why buy a condo when it’s turning into an apartment? It may be very difficult to sell when you need to move.

A well-managed condo limits the percentage of renters allowed in its official guiding documents known as CCRs (covenants, conditions, and restrictions). Next time at a condo open house, when the agent asks whether you have any questions, ask how many of the units are rented and how many are behind on paying their HOA fees.

Prediction of what follows: a puzzled look, “no one ever asks that question, I’ll have to check”… Such information should be on the tip of the agent’s tongue and a copy of the CCR should be on a table at the open house.

After looking at so many condos in LA over the past three years (total waste of time), realize that most building here at the crappiest California construction, not nearly enough reserves in the HOA and most have deferred maintenance. HOA fees only go up, not to mention the ongoing special assessments. Then you have to deal with all the other homeowners and their issues, and wondering if they understand rules and the english language. I would hate to be stuck in one….

Good point Bob Cohen,

I think once your wrapped up in a HOA community, your pretty much relying on everyone doing the right thing and it will all work out concept. The board on smaller communities can consist of residents, retired with memory loss, control freaks, village idiots, busy bodies, the worst are the ones who crave public attention and get a power high from being on the board. I suspect those ones were bullied in High School and we all resemble their attackers. I have lived in several HOA communities and the board consisted of one or a combination of the before mentioned. If the group is careless with the dues, which is almost a given. Who is paying for it? We do, the people that voted the idiots into office. Well, in my case to lazy to vote. Three communities later, all under HOA’s, I vow never again!

To Auntie M: I totally agree with you about the people who serve on the Board of Directors of the HOA’s and the different committees. They are all, for the most part, retired bullies who want to control the budget, the reserves, the paint pallet, the and the rules of the HOA. They are vicious and have no heart for folks who have temporarily lost their jobs or who are disabled. At one HOA where I have a rental, they are trying to take away the railings by the pools, saying that the disabled don’t need them because, “Well, let’s face it…..those people don’t go swimming anyway.”

Wrong!!! We need those railings for the senior citizens to balance and for small children as well. The HOA Board there is just stupid but the President is such a bully with a loud voice that I finally just gave up. I think the one I live in now is much worse. I wish we had a list to compare the best and worst HOA’s in Irvine.

I believe you place too much emphasis on college degrees.

Possession of a 4-year degree does not necessarily give your agent or other financial professional the level of knowledge needed to shepherd you through the complex process of evaluating a potential purchase, especially something more complex than the typical single-family house in a newer subdivision… any more than possession of a master’s degree in Finance and even the CFA designation is any proof that a “financial professional” has sufficient depth and breadth of knowledge to offer competent advice concerning the many complex and arcane financial instruments of the sort that have amplified leverage hundreds of times and destroyed our financial system.

You are wise to scrutinize the situation and learn what you need to know yourself, and not depend on some “expert” to spoon-feed you the information you need to avoid lethal traps and make an appropriate decision.

HOA’s are hell in a poor economy. Next………

I could not stand to live in Irvine. Sterile as a hospital operating room. Absolutely NO character. Traffic is horrible also. I wouldn’t buy a condo there if they paid ME.

LoL. I just added it up and my utilities (electricity, water, phone, cable) + HOA + trash + doing my own repairs + housekeeping expenses is a little less than just the HOA fees for the place above. Not saying it’s perfect–nothing ever is. I suppose if that $840 covers all the ordinary monthly expenses and some really nice amenities it could be worth it. However $1632 monthly for 1500 sq ft seems like a complete ripoff. Should be no more than $1000.

As a Canadian, I´m well aware of the prices of the condominiums. The most risky RE market in Canada is Toronto. And guess why? Because it is the American capital for condos. Our only difference is that we have not reached the peak in the prices. But it is definitely coming. Around 25 % of all condos are unsold or used as a speculative commodity by foreigners, banks and also stupid Canadians. They live the dream of ever rising prices. And as the author pointed out – nothing is free, nothing is cheap. Keep in mind this and you can financially survive in our society.

We outsource our jobs, keeping our salaries down, we sell our property to overseas investors (who hope to get green cards on this basis) who rip us off. So, we earn less, pay more. Not a recipe for success. We should look to Canada, the UK and other countries around the world and stop this madness. We now have people knocking on doors trying to find other people stuck with mortgages and in trouble so they can in effect steal their properties. We import Asian scams and lack of conscience. We are going to the dogs with our eyes wide open. Pity.

I love Irvine, but this is not a good time to buy anything in it, especially condos since the bank is controlling shadow inventory and they can only do that for so long. This country is not standing on its feet right now, all the numbers are fake and everything will collapse in 2013 or 2014. We can’t let the bank control the economy and lives by chasing after the few properties they slowly feed the market.

Dr. Bubble or anyone living in an HOA in Irvine, CA now: Can you tell me which is the worst HOA Community Organization (not NKT) around that has a greenbelt, pools, and tennis courts right now? I just bought a place here at Terraces near Michelson and Jordan and tried to plant some flowers and a plumaria tree in the front yard and got shot down by the Landscape Committee. They said that they will take me to court if I don’t pull it out within 15 days. They want to plant a crape myrtle instead. I think that the HOA Board is harassing me because I put up a security light on my garage. I hate this place and if I could, I would wear a sandwich board and parade up and down the main street stating, “Do not buy a house here in Terrace Community Association because the people are mean”. I wonder if they would call the police and run me off or if that would be violating my first amendment rights?

Leave a Reply