The echo housing bubble across the United States – Rising home prices in the face of stagnant household incomes. How the Fed is manipulating the monthly payment to keep home prices inflated.

The Case Shiller data is showing a steady increase in home prices across the United States. The headline figures are clear but rarely make the connection that much of this gain is coming on the back of unprecedented Federal Reserve intervention. Data is clear that household income is not making any significant gains. These gains are coming largely from added leverage produced by lower mortgage rates. We’ll go into the details on this but you will see how a tiny drop in mortgage rates can supercharge home prices especially in a market where inventory is tightly managed as the year comes to a close. The Case Shiller is a better measure of home prices because it looks at repeat home sales. Yet even here we are seeing signs of bubble like activity in a handful of markets. An echo housing bubble is a possibility in many markets.

Echo housing bubbles

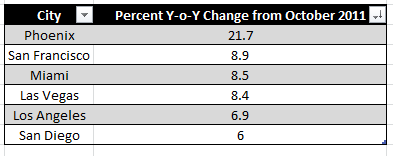

The Case Shiller figures reveal some strong gains in certain areas. Let us take a look:

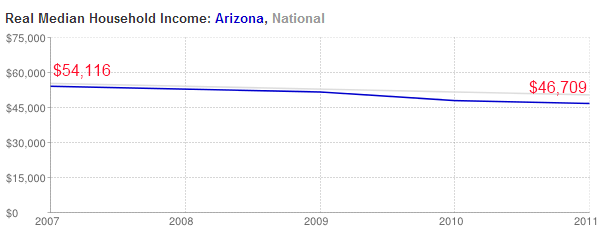

Phoenix is an interesting case because since the bubble first burst, it has been a market dominated by investor money. The first boom was brought on by easy money in the initial round of the housing bubble. Prices collapsed but big investor money has flowed into the market pushing home prices up 21 percent in the last year as measured by the Case Shiller. This is interesting because Arizona household income is actually down 13 percent from the peak in 2007:

So doesn’t it seem odd that home prices suddenly shot up 21 percent in the last year when incomes have actually gone down? Of course much of the activity is coming from investment funds and investors. About 40 percent of all buyers in Phoenix last month were investors. Other places like Miami and Las Vegas are seeing similar trends. That is, local households have seen their income fall yet home prices are now rising sharply courtesy of external forces. The Fed with low interest rates has pushed big money to flow out of the banks to chase yield in real estate. It is ironic that Wall Street that typically looked down on being a landlord is now very much in the game.

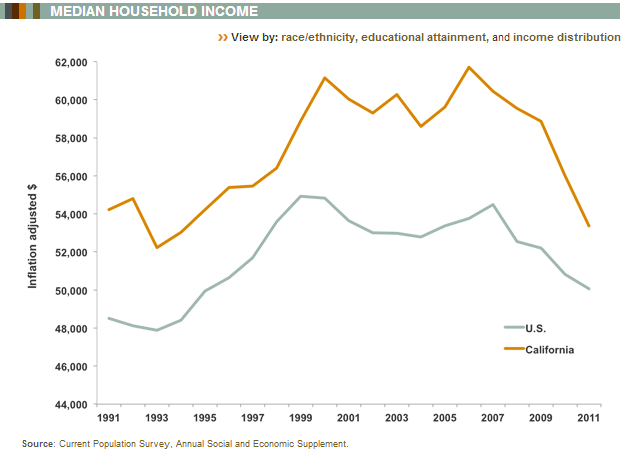

You’ll also notice big jumps in California home prices. Again, the push is coming from all other sources except strong household income growth. There are those naïve and wedded to this new housing bubble that they are using the same denial tactics used during the first housing bubble. Some have even claimed incomes are going up! Let us look at the data:

That does not look like rising household incomes. Yet a good number of buyers are foreign buyers; in some markets like in California many are from China. So these figures do not hamper their buying ability. Wall Street money is still chasing yield and we have our hipster flippers back at it once again. Yet these rapid gains in price are unsustainable without real household income gains. Even the 4.3 percent gain across the US is merely a reflection of the tight inventory and Fed pressure on the 30 year fixed rate mortgage. But the Fed is now pushing at a $3 trillion balance sheet and we are already seeing leakage into other financed markets like higher education where easy access to debt is making costs soar. So what about the future home buyers that are now saddled with massive college debt? Interestingly enough college debt is much more expensive than mortgage debt which is an indication of our current priorities as a nation. After all, if we are targeting specific sectors for specialized low rate privileges why not target a sector that will education our future citizens? Then again, why not allow every American direct access to zero percent loans for anything they would like to purchase? This is the kind of logic some people will use to justify artificial low rates.

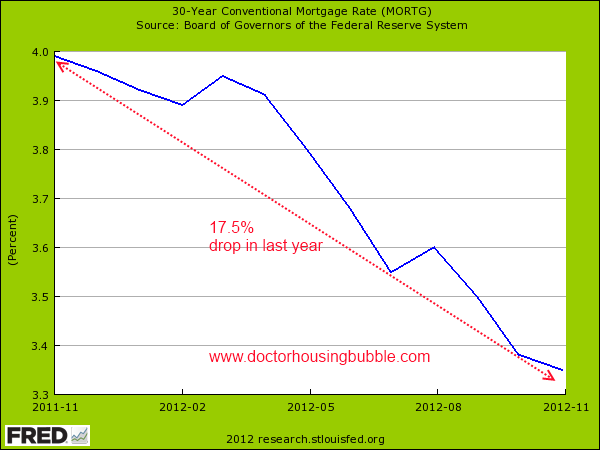

It might help to illustrate what has happened in the last year with an already low mortgage rate:

In the last year, the Fed has pushed rates from 4 percent to 3.3 percent. Big deal you might say but look at what it does in terms of price:

$500,000 mortgage @ 4%

PI = $2,387

$500,000 mortgage @ 3.3%

PI = $2,189

$545,000 mortgage @ 3.3%

PI = $2,387

In other words, the person qualifying for only $2,387 a month last year can now take on $45,000 more for the same monthly payment. People blindly think this is coming for free or have a religious like veneration of the Fed. Keep in mind the Fed is the reason we had the first housing bubble by not doing their job of monitoring member banks and stoking the flames of the mania by lowering rates. In the rubble of 5 million foreclosures, some seem to forget history. The Fed will now have to do everything it can to keep rates low but look at our current government and the current fiscal issues they are unable to resolve. Step back for a second and think reasonably here. We are spending more than we are taking in. That is simply a fact. If we enjoy the current level of services, guess what? You need to pay for it. If we don’t, then we need to cut. Seems reasonable enough but of course, the government is largely controlled by big interests and wants it both ways. That is why we are here only a few days away from the New Year with no plan on the table. It is likely a last second plan will emerge but will be a half-baked can kicking exercise that we have grown accustomed to.

Anyone bothering to read the details of what is being discussed realizes that once sacred items like the mortgage interest deduction or Prop 13 are now fully on the table. At the very least, major modifications will be coming down the road. I recently was seeing talk about doing away with 401k tax benefits. When you have many that are struggling the smoke and mirrors of increasing housing prices is simply a way of keeping banks from dealing with the ramifications from the housing bubble bursting in the first place. Who is really benefitting here? I’ve gotten countless e-mails from people being outbid for homes that they would like to purchase to live in and start a family because a flipper or a big Wall Street fund is seeking a better yield got their first. This is a modern problem in our housing market. Remember Paulson on his knees begging Congress for the banking bailouts to help the working and middle class? So much for that because many of these same banks are offloading properties to other financial institutions so they can jack prices up and rent them out or flip them to Americans that actually bailed out the financial sector in the first place. Higher home prices do very little good if incomes are not rising. That was lesson number one from the first housing bubble.

The Fed is picking winners and losers. One lesson you quickly learn in real estate is you do not have a win until you close escrow and a check is in your hands. Like all those that had paper gains in the first bubble, many tapped equity out and many did not sell at the peak. Why? It is hard to time manipulated markets but also, many wanted to sell and cash out and buy a larger (more expensive) place. In higher cost areas it is rare to see someone buy and then downsize. So this time around, unless you stay put for longer than the average five to seven years, you better hope the magic tricks of the Fed are still going on deep into the future. Seven years ago we were still in the mania of the first housing bubble and five years ago we were barely entering the recession. A lot will happen in that next timeframe but human behavior will not change in such a short duration. In the mean time, enjoy the echo housing bubble.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

65 Responses to “The echo housing bubble across the United States – Rising home prices in the face of stagnant household incomes. How the Fed is manipulating the monthly payment to keep home prices inflated.”

Hi Dr.,

Really enjoy your posts and analysis. Any chance you would want to start tweeting on Twitter?

And it continues…

http://www.latimes.com/news/opinion/commentary/la-oe-pinto-home-ownership-fha-20121227,0,4564498.story

pffft. fha pef-fha. this guy’s out PUMPING hay while it shines:

Scott: The stink of 2007 to 2011 will be a thing of the past and a “normal†real estate market will be warmly welcomed.

http://lansner.ocregister.com/2012/12/28/broker-sees-turnaround-year-for-housing/168558/

Whoa….the rubber is meeting the road….skidmarks on the runway of reality

at the La La Land airport.

The truth about really low interest rates is that you must be the first to utilize the money to realize the gains. So those buying homes in the last 6 months at 3.4% will see strong prices rises in 2013. But, wait until the end of 2013 or 2014 and you’ll probably be the sucker left holding the bag.

Rates will probably go a little lower and that may extend this prices rise for a while longer. But stagnate and lower real incomes coupled with tougher lender underwriting will probably keep a lid any real bubble action in real estate.

I would also add that if median prices go up another $50K, many of the underwater homes out there will go neutral to positive. This may put more inventory on the market as people that have been underwater for 4 years just want an opportunity to get out while the getting is good. Others may stay put thinking that a new bubble is on the rise. But at least this potential inventory will not be subject to the banksters and Wall street theives control.

Who can buy the houses then though?

Perhaps it is a coincidence, since LA is such a melting pot, however, many of the open houses I go to in West LA and the Westside, there seems to be a noticeable amount of Asians as prospective buyers. They show up 3 or 4 of them together, speaking in their native tongue to each other, with 1 of them asking the listing agent questions in English and translating to their entourage. Nothing wrong with this, but since it is at open houses outside of the traditional Asian communities it could be one aspect of the hot market this year.

I live in the Asian bastion of Walnut. They were caught upside down in the housing market too. Asians are not great when it comes to original thinking in investing. They are very ‘me too’ which can be VERY costly.

Asians are probably the only ones who can afford the stupidly inflated prices. I hate the FED. Wait til the bond market crashes and they are forced to raise interest rates. prices will tank and we’ll be back to square one. If those stupid bastards had not interfered and simply allowed nature to take its’ course, the economy would probably have found some balance by now and all of the repos would already have been sold, etc.

They buy up all of that bad mortgage paper to help out the idiot fat cat bankers who should have been executed for treason.

Yes, and the first group I’d put in front of a firing squad is Alan Greenspan, et.al.

The Fed is presumed to be there to protect the nation’s economy.

WRONG.

It is there to protect the interests of the oligarchy. Period.

I’m on the same page with you Travis, responsible people get the shaft for scamming bankers. My wife and i were looking to buy in the inland empire, these prices are crazy we said and didn’t buy, as Real estate agents told us we would be priced out forever.

We are now getting .09 on our savings due to the greed of the bankers. It’s punish the people who had the good sense and acted responsibly . I want to see us go over the fiscal cliff, best thing that could ever happen to this country.

It could be foreign buyers for their kids who are going to school at UCLA. They did that are Irvine for their kids that go to school at Irivne. There was a piece in the Orange County Register where they will buy a 4 bedroom house for one child that is going to college in the US.

The guy who owns on of the Guangzhou factores I deal with sent his son to Santa Monica City College. He paid cash for a car and will soon buy him a house in Culver City.

This is true for all wealthy people. I sold a beach condo to a white guy who wanted it for his son to live in while attending college. $700K. Thanks dad.

Not this wealthy person…maybe wealthy/lucky morons. I know a few…

“Seems reasonable enough but of course, the government is largely controlled by big interests and wants it both ways…”

If I may, I would like to add a tiny edit to this statement – “…but of course, the government is largely controlled by big interests and wants it both ways, as well as the majority of US voters.” The voters want their cake and eat it too, as evidenced by the recent election – the folks voted for this, and now they’re going to get it…all of it, like it or not. Math is relentless and math doesn’t care for sentiment nor feelings – so everyone better pucker up and get ready.

Agree. Everyone wants tax increases on someone else and spending cuts that won’t affect them. Talked with gov retiree blaming Obama when Obamacare is to pay for gov retirees ever-increasing medical costs. Everyone wants the perks of runaway debt but not the consequences. The cheap Chinese imports but not the lost jobs. The housing dream but not the financial ruin.

Ben is befuddled. He says it’s unfortunate.

http://www.bloomberg.com/news/2012-12-24/fed-flummoxed-by-mortgage-yield-gap-refusing-to-shrink-economy.html

Come on Ben, wake up.

RM charge offs now at 1.99 percent and delinquencies (100 largest banks) now at 12.13 percent (highest since 3rd quarter of 2010).

.

http://www.federalreserve.gov/releases/chargeoff/chgtop100sa.htm

http://www.federalreserve.gov/releases/chargeoff/deltop100sa.htm

Ben, have you checked bank Net Interest Margins?

http://imgur.com/uCH2M

How about the bank loan loss/total loan ratio?

http://imgur.com/VCkbb

We all know what comes next. Raise reserves or tighten lending.

NEWS FLASH!

SACRAMENTO LEGISLATURE MOVES QUICKLY TO GUT PROP 13

The Democrat super majority in Sacramento is moving to remove the prop 13 property tax protections for commercial properties in California. This means that residential properties 5 units or more and commercial and industrial property could face rising to sky rocketing property tax bills.

The thing renters need to know is that land lords of residential properties will just pass the tax increases on to their tenants by raising the rent. Residential rents have been increasing in the last few years and land lords and property management companies know they can raise rents even higher.

^Retail and Industrial businesses will either have to pay or close, many businesses have been hanging by a thread for years now, this tax increase could be the the final straw.

The thing that the supporters of repealing prop 13 need to understand is that this repeal will end up being a major tax on renters, and renters will be hit the hardest.

Bingo, beware of the law of unintended consequences. Huge property tax increases could be passed on to renters, more jobs evaporate as businesses liquidate or shutter CA properties, shuffling jobs to more tax friendly locales. Heck, even that Disney annual pass could double, or triple. But it feels so good to “stick it to the man”!

Yes, the commercial aspect of Prop 13 looks to be on the chopping block. I was at a party recently and two people there told of the CA Franchise Tax Board coming after them. It was astounding the stories they told….frozen bank accounts and threats. Watch out, CA state govt wants more money and is on the war path to get it.

Wrong-o, Greggers — rents won’t go up by how much the taxes go up, as rents are much more tied to what the market can/will bear. There aren’t any easy/no-down FHA loans for your 12 month lease.

What will happen? Lots of landlords will cease being landlords and have to find real sources of income.

Yes, having been a landlord, I would say it is about the most honest “market” we have in the US. The prices are tied, very strongly, to the amount of available cash that people actually have to spend on any given month. Try raising your rent prices because you have a certain cost go up and see what happens. Notice what the food business has done to packaging sizes to fight costs and sales revue hits…

You could argue that a tax increase would hit everyone, but will it? I’ve been in an area where we’ve had two parcel tax increases in 4 years amounting to about $400/year in increases and I’ve not heard nor seen anyone raising rents.

I’m not sure that the added property taxes can’t cause rents to rise.

Rents have been increasing this last few years, and I have to admit that I’m dumb founded as to why. I mean we all know that incomes have not been rising, and we are starting the 5th year of this recession.

I was renting a house up until a year ago. 18 months ago my landlord raised my rent, $50 per month to $1900. I told him that my income had not risen and I told him that if he went ahead with the rent increase I would look for another place.

After I moved he rented the place for $2000.00

I’ve been told by several realtors that rents have increased because people who have been in loan modification haven’t been paying anything for several years and when it’s finally time to move they are flush with cash and they don’t quibble over $2500 for a rental house.

Just think if a two bedroom apt. would go from $1500 a month to $1700 a month, how that would effect rental prices of single family dwellings. That could easily push rents on SFR. up $200 per month as well.

Like I said I’m at a loss how rents have increased in the last few years, what with the recession and all, but rents have increased.

Greg is right on. Most Commercial leases are triple net so the taxes are passed on to the lessees. They then pass on the costs to the consumers of their products. And everyone thought we could just sock it to the big boys since “they can afford it”. Guess what? We’re all going to have to afford it.

We got lucky, picked up a few multis in the past few years. Thinking about listing one property, maybe next week. Hope its the right decision. Seems the air is getting thin, getting that 2005 feeling again. Are we back in new unchartered waters. Who knows anymore? We’ll see.

This situation is really depressing. So much for ‘free market capitalism’. What a pack of liars.

It is funny how often in the last election both parties waxed poetic about saving the middle class, but we can see quite clearly that exactly the opposite is happening and has been happening for decades. Clearly the real goal is a feudal state.

There are no more populist politicians.

Fed needs to stop lowering the interest rate so that the real estate market can finally naturally adjust itself back to normal. This lowering in interest rates makes home prices artificially rise but keeps monthly payment the same. I wonder what will happens when Feds finally do raise interest rates. Home prices will then need to drop as a result so that monthly payment stays constant. That will cause homes to go under water again. Damn, the Fed is digging a deeper and deeper hole that they won’t be able to get out of.

We bought a house in the South Bay in September. House payment is $800 less than rent. Plus a third of payment going toward equity due to low interest rates. House prices could go done 5% per year and buying is still better than renting. Of course, it cost us 6 figures to get into the house, but I have a Chinese wife, she saves. Plus, our money was earning no interest in the bank. I asked our realtor what percentage of his clients that are closing deals are Asian (or mixed Asian like our family) and he said 50%-75%.

David, I also bought in the South Bay a few months ago. I had several reasons for buying, but the key reason was that it was cheaper to own versus renting. Additionally, I don’t think the powers that be will change course regarding housing anytime soon. The house I bought had over five offers (all with six figure downs), obviously there is still plenty of money chasing real estate. I do NOT see rents going down in the desirable areas, so buying at rental parity will be a pretty safe bet from here on out.

Will rates rise in the future? Likely, but not much anytime soon. Will home prices go down in the future? Maybe, not much in the desirable areas. If my net monthly out lay for a 3/2 SFR 1 mile from the beach is equivalent to renting a 1 bedroom apartment I could really care less. Most homeowners in my neighborhood are fully aware of this also, they absolutely won’t sell unless they have to. This will likely keep prices elevated…all my 2 cents of course.

Where in the South Bay, one mile from the beach can you buy a 3/2 SFR for a monthly outlay that is less than renting a 1 bedroom apartment in the same area? Sounds unrealistic. Is it only because you put down a lot more than 20% on the purchase?

To be honest, we did not buy in any desirable location. We opened escrow 3 times in Redondo Beach and they fell through each time due to house problems. Ended up spending a couple of grand in inspections. Thought about a couple of east Manhattan Beach places, but did not like the life style. The reason to buy east Manhattan Beach is the schools and we were just going to have to commute ours to Lawndale for the dual immersion program. We ended up paying $350k for a 2100 sq ft house in a great location. Had to put $50k in remodeling before we moved in, but it still is much cheaper than renting. Houses a couple of blocks away in much worse locations and much smaller are renting for $2300/month.

I love this word I always see/hear being parroted…desirable. Talk about marketing! With the right marketing, I am convinced you could re-frame the exact same area as undesirable.

On the fence. Look at N. Redondo for a semi reasonable price in the South Bay. That Hermosa or S. Redondo ZIP will set you back another 200K. To answer your question, I put about 30% down on my place. When taking taxes into account and paying down principal…it’s cheaper than renting my previous 1 bedroom apartment located just down the street. I just don’t see rents going down in the “desirable” areas for various reasons. The low inventory of the housing market certainly isn’t helping one bit. Good luck.

Your rent was probably goosed, though. Why doesn’t anyone seem to realize that rents are enjoying a spike because there is an unprecedented amount of credit-wrecked would-be buyers now looking for a haven, and that this is a temporary phenomenon? Gak!

BTW Equity is a funny concept. Until you sell the house or cash out via HELOC, it’s just the idea of wealth.

Most areas in the South Bay have goosed rents. We rented a place for 4 years. We negotiated a lower rent when we moved in by $300/month. We then negotiated a $250/month lower rent 2 years later. When the landlord wanted $250/month we decided to move. We wanted N Redondo, had 20% or 30% down and enough stable income for anything we wanted. The competition was tremendous though. The house we wanted most, we overbid and still lost to a cash deal. Another house, an average 3 on a lot for $600k had 30 offers. One thing we did learn is that in a sellers market, never use Redfin. Offers from Redfin agents are typically go to bottom of the pile.

On tge Prop 13 issue. There needs to be a clause that would prevent landlords from immediately raising rents. As for foriegn buyers, there needs to be a law that at least gives US residents first choice to buy a property to LIVE in. I talked to a Real Estate Broker yesterday in Newport Beach that seemed to be on a Manic High. She was talking about the activity in the Multi Million Dollar Market. She said it was mostly driven by Chinese investors. When CDM Village starts to resemble an Upscale Chinatown, they will have the last laugh. Greed,once again, seems to be a driving force on all fronts.

I don’t dispute Wall Street or foreign investors are buying property, but what is the hard evidence, i.e. something like public records, etc.

http://www.thenorrisgroup.com/blog/category/radio/

Listen to the last 5 or so interviews that Bruce Norris has done on his pod casts. They guy has complete credibility in the real estate investment market. He and many of his colleagues have been approached by the hedge funds from Wall Street to sell all their property.

I would favor also increasing assetments for younger property owens not sock it to businesses only. I would decrease income taxes and some sales tax but unforunately the Dems would just sock it to business and the Republicans would not go for my proposal of shifting taxes. Keeping 13 the way it has been increase income tax and made the state less competitive but Arnold could have suggested this. Instead prop 30 happen to charged higher taxes if you make over 250,000 and increase the sales tax.

What I mean is Brown would have just changed 13 for business and not residential while Arnold when he was governor could have suggested shifting the taxes from income to property.

From the Orange County Register Article, most of these foreign investors are buying to for investment or get their college kid a place to stay or live there once in a while when they are in the So Ca area. I doubt that Corona Del Mar would go much asian. Asians are different than hispanics. Hispanics usually want to stay here while that isn’t the case always with asians.

What niggles me is that those who see what is going on have few alternative courses of action, and just have to go along with it. Someone ought to start a new country called the Republic of Sanity, where sensible people lead independent sensible lives. Nothing utopian, or idealistic, just stripped of all the mayhem. Sensible tax policy, innovative, producing things we need, natural defenses, emphasis on good values such as education, and with a different form of currency.

Sounds a lot like Switzerland. Too bad they ain’t to big on immigration.

Limiting foreign immigration, especially from third world countries is what keeps Switzerland such a stable and sane place.

and what’s rarely mentioned about the Swiss is that their country remained unscathed by the war (they were officially neutral but basically allowed the Nazis free reign over their country), and that their banking laws of secrecy kept most of their ill – gotten gains under wraps for decades. Most estimates on the amounts still in their vaults from concentration camp victims number in the billions – this money has helped their economy and their citizens immeasurably over the past seven decades.

Jo,

That country used to be called the United States of America.

Sad, but true.

550,000 in LA isn’t going to buy much house or a decent neighborhood is it?

I am in escrow on a home in Western LA, quite close to Culver City. The home had 3 offers (including mine, all 5% – 10% over asking the day after the first open house). The other 2 homes we looked at within a few blocks radius are also in escrow within a few days of the first open house. They too are both in escrow 5%-10% over asking price. What I am noticing is it seems the houses with good floorplans and solid maintenance in a quiet area (no freeway or major street) are in escrow after the first open house. Other homes, the cheap flippers or overpriced homes sit on the market for weeks if not months. Inventory appears to be down about 40% compared to when I was looking (but didnt make any offers) about 1 year ago. My broker said that many of the brokers, appraisers, loan agents he knows are very busy because the housing crash purged the market of shady characters and unscrupulous realtors…

interesting video – 1 out 10 homes in Cal being purchased by Chinese?

http://www.youtube.com/watch?v=kVSJOPG745M

When I actually sit down and pencil out these hedge funds becoming land-lords, the math absolutely does not add up. For example, let’s say a hedge fund buys 100 properties at $300,000 per unit. They pay cash and they can rent each unit out for $2,000 per month.

$300,000 x 100 = $30,000,000 (Total Cash Paid)

[($30,000,000) / ($2000 per month x 100 units)] = 150 months

150 months / 12 months per year = 12.5 years!!!

Their break-even point is 12.5 years away???

These investors are NOT interested in being land-lords. They are hedging themselves against inflation and will dump these properties when they’ve built up enough equity to a point that makes the investment attractive for them.

The other thing that I never hear people talk about is the Owner Occupancy Ratio. In order for a first time home buyer to qualify for a loan to purchase a condo, the complex must have an owner occupancy rate of GREATER than 51%. The herd mentality is to buy and flip, or buy and rent. First time homebuyers will no longer be able to buy condos as this ratio in many areas will be less than 50%. I suspect that many of the properties that are currently pending are due to the lender not providing financing unless the buyer can come up with at least 10% down.

There are so many things wrong with this housing bubble. 40% of homeowners with an active loan are underwater and will look to sell as soon as they are in the black, investors will look to sell quickly as to make a profit, the foreclosure pipeline still has 4 million + units, and the incredible amount of rents that are starting to populate my screen look like the freckles on Howdy Doody’s face.

The bond market is in a bubble and as soon as it pops, the Fed will be forced to increase rates. Once rates increase, the amount that homeowners can leverage will dramatically decrease as DHB has talked about.

I needed to post this in order to talk myself out of joining the herd. It was either this or call the hotline.

Investors are interested in cash flow. 2000/month x12= 24000 a year. That’s 8% on investment. All fees, taxes and maintenance are tax deductible. It’s like dividend paying stock. 8% is hard to find with zero interest rate. The house is not going anywhere. When they want to get out, they can simply sell it. Lump sum payment for future cash flow.

Unless, of course, the renters trash the place, which they quite often do.

Here’s how they work it:

“PE fund buys the house at a 7% +/- cap rate, paying $220k for a projected $15,200 annual cash flow.

PE fund expects to hold the asset for 2 years before converting to a REIT structure and selling shares to the public. PE fund gets $30,400 in cash flow from the property over the 2 year holding period (2 x 15,200 = 30,400).

PE fund then forms a REIT and sells shares to the public based upon a 5% capitalization rate on its cash flow, raising $304k (15,200 / .05 = 304,000). That is $84k more than the $220k they invested to buy the home.

Over the 2 year period, PE fund gets $30,400 in cash flow from operations, and another $304,000 from the equity reversion using the REIT exit strategy, for a total cash flow of $334,400. That is a total gain of $114,400 (334,400 – 220,000) over 2 years on their $220,000 initial investment. That is an annual yield of over 23% on their capital.

So, their bet (simplified) is that the public will pay $304,000 or more for shares of the REIT that actually owns an asset worth $220,000. Theoretically, the public should be willing to pay this premium for the benefits that the REIT structure provides… 1) diversification (the REIT will own thousands of homes across multiple markets), and 2) liquidity (shares of stock in the REIT can be traded instantly vs. the months it takes to sell an actual home).

So that is how it makes sense for them. And that example is unlevered! Imagine what this would look like if they added a debt component to the REIT capital structure (which they all do) which could nearly double their yield!” – SDCIA Forum website

I think of these as forces pushing on each other. All of those you mentioned are for lowered housing prices. To counter that, policy has to keep going more towards the extremes but once it hits the limit, we’ll see the next catastrophic phase. The forces propping up prices are growing weaker in effect as each increment of change (such as lowering interest rates) has less and less of an impact.

We’re seeing FHA insurance costs increasing to cover losses, as you said the bond market implosion is imminent and interest rates will have to go up, finally price increases from limited inventory will tend to be countered by selling pressure to get out for those underwater or to dump inventory before the next drop which is going to limit the upward potential of any move. The profit is being squeezed on new origination too and the risk is high – essentially the government is too relaxed (FHA insurance) and is now paying the cost on loans that should never have gone through while banks have to tighten their standards as well to dump the loans safely.

We might have another 1-2 years of manipulation but we’re seeing the cracks already appearing in the artificial forces holding up prices. Add the new buyers to the list that will go underwater in the next strong downward movement, this just makes it that much worse. Never mess with the momentum of a falling knife.

Maximus, I think you hit the nail on the head. I was listening to the Norris Group regarding packaging these properties into a REIT and are will to forego a cap-rate from 10% to a 7% cap-rate which causes a $200,000 property to be “valued” as a $280,000 property. Then they sell that REIT to the public with a 5% cap-rate which takes that same $200,000 property and turns it into a $400,000 property. BUT that doesn’t create a comp. These are properties in Orange County that are targeted to be bought by first time homebuyers.

But if you have average incomes back to 1996 levels, there will be zero buyers for these properties. The flood of flippers that have hit the market are playing musical chairs in search of the greater fool. Each time a home is flipped, the property by definition has to be listed at a higher price. This causes average prices to increase to a point where the final chairs are pulled and prices have to come back to levels that meet the first time home buyers ability to purchase.

I get the reasoning why inventories are low and home prices are up, I just don’t see this recovery as sustainable. The gap between incomes and home prices will either keep a cap on resales or on rent prices.

Couldn’t agree more, this housing “bubble” is nothing like the first one.

“It is always darkest before the dawn”

I remember when I sold my house in mid 2004, just before the peak, inventory was exceptionally low yet inventory came out of no where and it soon ballooned and banks didn’t have millions of foreclosures nor did we have millions of homeowners waiting for that day they can sell without bringing money to the table.

Good article. We are seeing this in Orange County. Record low inventories (which of course WE know why even though 95% of people don’t want to hear it) + the Feds interference = inflated prices. It’s almost as if people in OC have forgotten we’re in a recession. Still, real estate agents and brokers are smiling and praying the government keeps it up. Nobody thinks about the long term cost.

This listing made me laugh. Love the inclusion of the realtors creepy stalky first photo. He was in such a rush to list he couldn’t edit it out?:

http://www.redfin.com/CA/Santa-Ana/2609-Ponderosa-St-92705/home/4458024

Once a customer produced the proof of bank account, took a look, it had 6 million dollars, everyone was shocked.†And the wealthier mainland Chinese buyers like to buy in white areas, Newport Beach and Newport Coast are their first choices.

As for wealthy mainland Chinese businessmen moving into Pacific Coast white communities, real estate broker Liu Zhaojun said mainland China has foreign exchange controls, rich businessmen do not want to be too ostentatious and be noticed.

Real estate agent Li Caiyi said, the number of wealthy mainland Chinese businessmen buying homes in Newport Beach and Newport Coast area is increasing, even white real estate brokers know their buying potential and taking initiatives in approaching them and showing them houses.

More info on Newport Beach, this is probably why south of Irvine little asian growth in places like San Juan Cap, Dana Point or San Clemente since the Chinese want the cream of the crop.

End Game. What are the options? It’s all fiat money. Might as well be infinite as long as we’re too big to fail.

Currently 5,350,000​ homeowners are not paying their mortgage:

http://www.lpsvcs.com/LPSCorporateInformation/NewsRoom/Pages/20121221a.aspx

In Wheaton, IL there are so many big old homes for sale it’s unbelievable. They all need at least $100K in repairs just to make livable but the energy costs make it near impossible for anyone but the highest earners to afford to live in them. Brand new homes sit empty for 5 years as they break ground to build even more with nasty well water for Christ’s sake. The homes that do get sold nobody ever moves in. Rental signs on so many homes now but they get taken down after a few weeks and nobody moves in? The Fed has destroyed our country for good!

Leave a Reply