Foreclose the Dream: Record Breaking Foreclosures in 2008. California Foreclosures Rise Like a Phoenix now that Weak Foreclosure Legislation is Catching up.

Well the final tally is in and 2008 is a record year with foreclosure filings vaulting over 3 million for the first time ever. The little respite provided by the holiday Fannie Mae and Freddie Mac moratorium is now over and we are back to the reality parade of banking shenanigans, corporate fraud, and the circus which is our current global financial system. Many were stunned when foreclosure filings jumped over 2 million in 2007 only to be shattered by the 3 million in 2008. Keep in mind this is in light of trillions of dollars pumped into the crony capitalistic system which of course has kept up a certain few at the expense of the vast majority of the population.

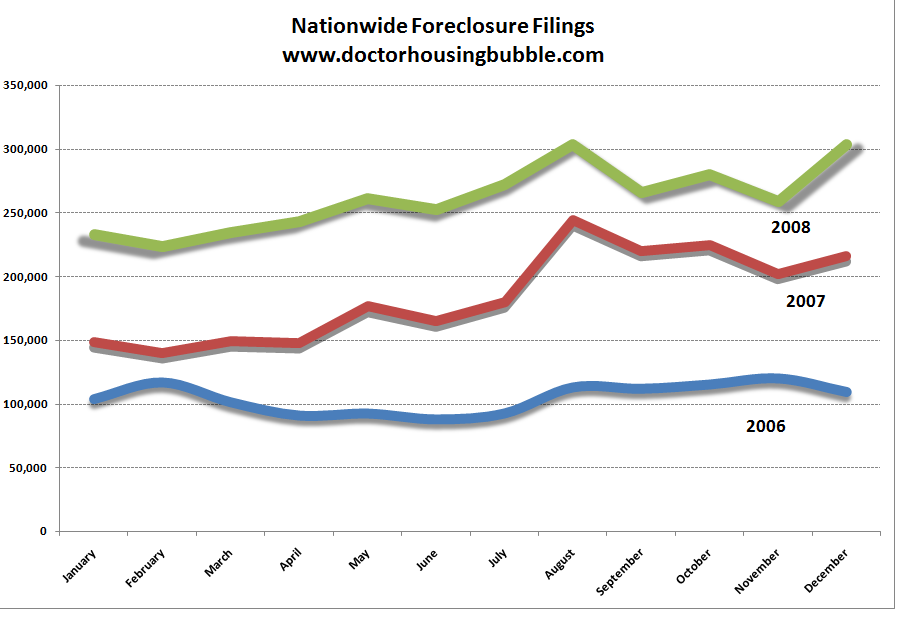

Since the data is finalized, I thought I’d spend some time reviewing the foreclosure situation for last year and where we are going this year. First, let us take a look at foreclosure filings nationwide:

Click for sharper image

You’ll notice the slight dip for the November data which was a ruse with all the TARP delusions and Fannie Mae and Freddie Mac “pause before you get smacked upside your head” program took effect. We are now back in full retreat mode. The monthly average of foreclosure filings has been steadily increasing as well:

Average monthly filings for 2006:Â Â Â Â Â 104,000

Average monthly filings for 2007:Â Â Â Â Â 174,000

Average monthly filings for 2008:Â Â Â Â Â 261,000

I’m going to keep a close eye on this for the first 2 quarters of 2009 because this will tell us if we are going to have a bitter second half of the year or a brutal second half. This second half recovery non-sense is absurd. If your name isn’t Bank of America, Citigroup, JP Morgan, or Goldman Sachs don’t expect any significant alterations to your financial life in the short-term. Bank of America is already back for more TARP funds:

“Bank of America Corp. was near an agreement with U.S. officials late Thursday that would provide it with $15 billion to $20 billion of fresh capital while backstopping $115 billion to $120 billion of Bank of America assets to help shore up the bank.”

Lovely. This is the equivalent of you buying a crappy used car knowing it was broken and expecting to sell it back to the dealer at full price with the dealer covering the repairs. Well at least Bank of America already has an appropriate name since we’ll probably own it soon. We are entering the realm of the absurd here while people are losing houses left and right. And one of the biggest reasons for the jump in foreclosures last month was California and the saga of the pilgrimage to pay option mortgage perdition.

We had a slight dip at the end of 2008 in California because of the SB 1137 legislation. This Einstein like legislation boiled down to this:

Lender: “Hello. Can I speak with Joe.”

Joe: “Yes. Speaking.”

Lender: “You are late on your payment. Can you please explain your situation to us?”

Joe: “Yeah. I got an option ARM which started out at $1,300 and is now up to $3,000. I can’t make that payment.”

Lender: “Okay. We’re going to give you like 30 more days and then we’ll kick you out.”

Joe: “Sounds like a plan. Can you reduce my principal?”

Lender: “No. But we can extend your terms to 50 years making you basically a renter in an expensive home. What do you say?”

Joe: “No thanks. Foreclosure it is.”

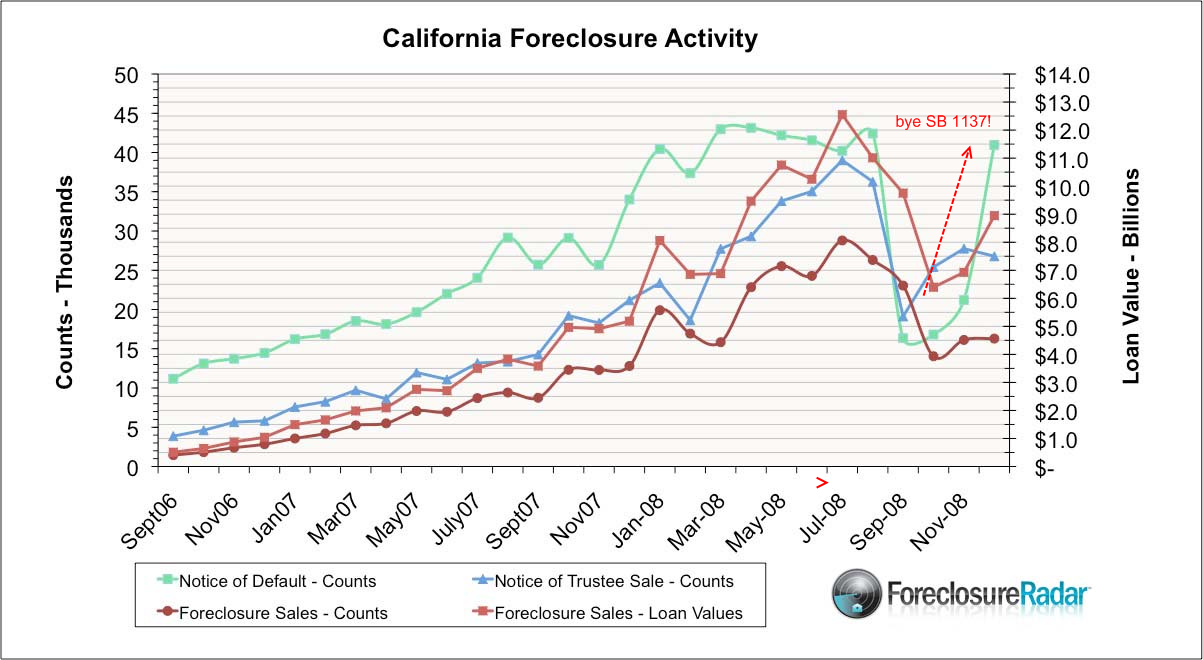

That is if the lender can even get a hold of the owner since one-third of people moonwalk away from homes without responding to the lender. Let us take a look at how well that SB 1137 did for California:

Source:Â ForeclosureRadar.com

Well that didn’t last. We are back at near record levels in one month. It was a complete waste of time and political posturing. I mean politicians love saying, “save a home, save the world” yet how many of these people speculated with toxic mortgages on overpriced homes chasing a pipe dream? Banks lent the money and deserve to implode. At this point here is my suggestion since I get some people e-mailing me about what to do:

(a) Pick a handful of banks and that is it. They’ll be the banks of the country. All others implode or fight for their own survival.

(b) Those that are picked are now owned by us. Screw it. If we are pumping money into them we dictate how they are run. As the people’s bank, we choose where the money goes.

(c) Bad assets get forced down either by cram-downs or mark to market. Bring all of it into the open. Those that make it, survive another day. Those that don’t, implode on their bad loans and should be gone.

(d) Ramp up FBI/DOJ prosecutions. Those that bet on this market and caused this bubble deserve to have their money yanked from them. Create a trust fund where all their wealth is taken into custody for the greater good. That should yield a few billion.

(e) Triage foreclosures. Someone making $30,000 will not make it in a $300,000 home. Foreclose. Someone making $70,000 will not be able to manage their $500,000 mortgage in California. Foreclose. Do this quickly and get it over with. All these other programs are only prolonging the pain. We have another viable option. It is called renting. Over 50 percent of the 10,000,000 people in L.A. County do this. We need to get away from this “American Dream” according to the real estate industry meaning everyone deserves a F-150 and a 3,000 square foot McMansion with a plasma in every room.

(f) Those banks that are standing cannot use funds to buy out other companies! Look at BofA buying out Merrill Lynch. Now they need more money. Banks that fail will be broken up in bankruptcy and sold off to the highest bidder, period. Otherwise you are going to get banks like Citi and Bank of America hoarding tax payer money to buy out failing banks. Totally inconsistent process which smells of cronyism. Banks being bailed out should run like utility companies.

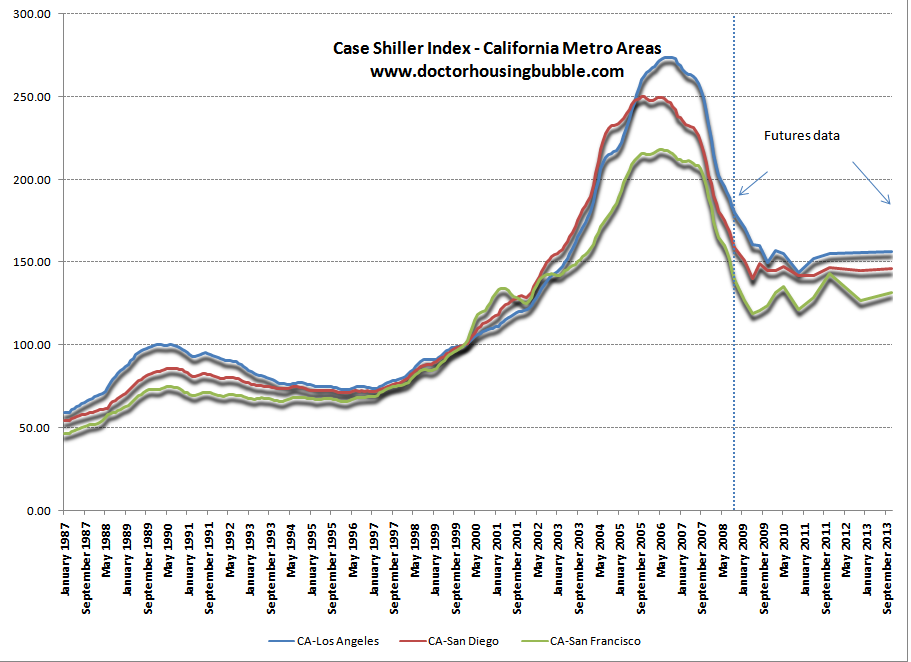

All the intervention and prices are still cratering:

If you have any doubt how useless SB 1137 was, take a look at these stats:

California Notice of Defaults

August 2008:Â Â Â Â Â Â Â Â Â Â Â Â Â Â 44,278

September 2008:Â Â Â Â Â Â Â Â 21,665

December 2008:Â Â Â Â Â Â Â Â Â 42,000

A total waste of time. California alone made up 26 percent of all nationwide foreclosure filings even though we are 12.1 percent of the entire nation’s population. How many foreclosure filings did California have in 2008? How about 837,665.

In fact, looking at only 4 states, California, Florida, Arizona, and Nevada these states accounted for 51 percent of all foreclosure activity. You don’t think Bank of America is going to need more dough once those toxic loans from Countrywide start going sour?

The future of foreclosures is easy to predict. We are going to have a more problematic year in 2009 than the record breaking 2008. Why? First, we now have a major wave of pay option ARM recasts with virtually all of the recasts going into default. I’d estimate at least 80 percent will default if not more. How can we predict this? Easy. Most of this toxic crap is in California and Florida where the housing market has been destroyed. Any sane person would walkaway. It is pointless to stay aboard the Titanic as it sinks. Homes in California won’t bottom out until 2011 and I have given you 10 reasons why. When I came out with that assessment, people had their doubts but more and more it is looking like a likely scenario. And how can it not be? The math does not lie and the math tells us we have a lot more pain to face. Our budget is an utter joke. Just wait until tax returns are filed in the next few months. The state is facing massive budget deficits. Where is the money going to come from? You lay off people, you push the unemployment rate higher and we already have the 3rd highest unemployment rate in the country. You tax people, there will be less money to spend. The piper is here. Time to pay up. The house of cards has imploded.

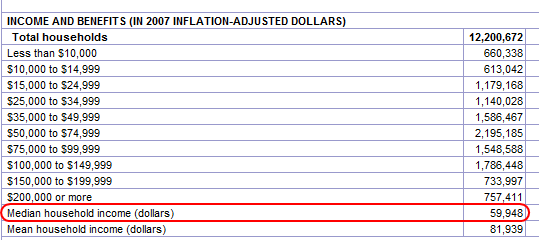

Keep in mind that the median income for a family in California is $59,948:

The current median home price in California is $258,000 a ratio of 4.3 to income. Guess what? That is still too high. Given our states economic problems a ratio of 3 is more realistic putting the statewide median price at approximately $180,000. Those numbers don’t sound so far fetched anymore given we are committing the same policy mistakes that led Japan down the road to their lost decade (two actually) and saw their real estate values implode by 70 percent. The peak median price for California was $484,000 reached on May 2007. A 70 percent decline puts us at $145,200. Given what is happening, that doesn’t seem out of the realm of possibility. Keep in mind, we are already down 46.6% from the peak. Does anyone really see prices jumping up in 2009? And if your answer is no, how can you expect a society so dependent on housing values and the financial sector to go up when these 2 areas are collapsing without seeing housing prices fall further?

The numbers just don’t add up. Sadly, all those trillions put into the system and foreclosures are still skyrocketing and the market is still crashing. Guess who that money was really for?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

36 Responses to “Foreclose the Dream: Record Breaking Foreclosures in 2008. California Foreclosures Rise Like a Phoenix now that Weak Foreclosure Legislation is Catching up.”

I think a price/income ratio of 3 is still too high for the long term and certainly for this economy. The long-term ratio is below three to begin with. Let’s look at the problem.

Median income in 2007 is $60k but it is dropping and will probably decline to $57k in 2009. Using a few different ratios, we get some frightening numbers:

4.3: $245,000 (5% drop from now)

3.0: $168,000 (35% drop from now)

2.8: $159,600 (38% drop from now)

2.5: $140,000 (46% drop from now)

The 4.3 ratio is obviously unsustainable. This is not because I hate California, am short REITs, want Lereah to burn (more) in hell, or I am a moron. It’s simply economics. People simply cannot afford to pay that much of their income for a house. So let’s ignore the 4.3

3.0 is optimistic for the short to medium term. The same might be said of 2.8 since there is not much difference between the two anyway. This range of 2.8 to 3 represents the long-term ratio of household income to price so you might optimistically expect house prices to make a bottom there.

If you expect that, you are channeling Lereah, are bad at math, or are an overly optimistic homeowner. There is nothing short of therapy to cure the first problem and time to cure the last. The math problem is something I can address.

The LONG TERM household income to house price ratio runs around 2.8 to 3, a ratio which goes back a long, long time. It has nothing to do with making new land, granite countertops, or floor area. It has everything to do with affordability. So, there is no real estate agent argument to make this ratio go away. Even today’s low interest rates don’t help since they will rise later and make prices drop even more!

so, the math part. The long term ratio is not a bottom; it is an average. Consequently, in order to respect the average and maintain it over time, for every month and increment spent above the average (e.g. six years of prices at 5 times income), the market must spend the same time and increment BELOW the average. So, as an example, if we spent five years with median house prices 4 times median income, we must spend five years with house prices at 2 time income to balance out the math to an average of 3 times income.

Well, my friends, we have spent a pretty decent amount of time with this ratio at an obscenely high level. We will now spend a long time with this ratio at a very low level. That is why I believe the ratio will go as low as 2.5 if not lower. It will need to stay there for a good, long time as well.

This is A GOOD THING. This is as good as the supermarket lowering the price of milk to fifty cents a gallon, or GM selling cars for six grand. Lower prices are GOOD. If you don’t think so, please allow me to do all your shopping for you and I will make you the happiest person on Earth (and me the richest).

Since median house prices continued to drop while SB1137 was in effect, arguably banks lose more money in the foreclosure process by being forced to wait to foreclose. Why doesn’t that incremental loss constitute a taking under imminent domain law for which the state must re-imburse the banks?

Great post, though all of them are. This one I’m taking to the high school classroom I consult with (in a residential treatment program for adjudicated boys) because it so clearly presents the situation. Thanks for your great blog.

$300,000,000 in Option ARMs ready to expolde in California, beginning this year. And, already we are the market leader in foreclosures. 2009, will mark the year, it’s not “just subprime” any more. Alt – A and Prime loans, will have serious default problems. The Westside, especially the highest end, like Santa Monica, Beverly Hills, Palisades, Malibu, Venice, Brentwood etc…. will have a year to remember, as they make up for lost time in price declines.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

The giveaway of taxpayer funds was simple thievery. Of course this theft will help nobody but the bankers and Wall St. types.

They keep dropping money from the sky, debasing the currency for no good reason…it’s as if the FED thinks they are playing with Monopoly money.

The thing that I keep wondering about is the fact that the money elite knows no shame. I’ve had times when I’ve been out of work and could have gotten unemployment money but felt bad about taking it. And this is a pittance compared to the massive thievery that these rich pricks are pulling off.

I almost wish that I didn’t know about this stuff. It just makes me angry as hell for no good reason; they don’t listen to our opinions anyway.

F.Y.I.

I work at the largest community college in CA. All faculty and staff just received an email 2 days ago stating that in addition to at least a 10% cut in class offerings in Fall’09 we will be cutting 50% of course offerings for summer’09. (We were told that we were in better shape than most surrounding community colleges who canceled their entire winter’09 sessions and were contiplating canceling their entire summer’09 sessions.)

The campus I work at had a 5% increase in enrollment Fall’08.

There will be many students who can not find classes (who probably are depending on going to school full-time since they can not find full-time or maybe even part-time work) and there will be many instructors/staff unemployed very soon!! What is sad is that many students are very unaware of what is about to “rock their world”. I am wondering how they are going to adjust??

RL I wonder how the state employees and vendors are going to react to the IOU’s that could be going out in FEB. I also hear the state tax refunds will be IOU’s as well. Can the IOU’s be sent in to pay your mortgage?

dosvidanya

as u will have seen on the web news, circuit city is no more.

the death of the borrow-from-china, buy-chinese-crappy-electronics phony economy we had for the last 20 years is proceeding. b/c the home ‘owners’ glutted on refi money who raced out to the plasma-TV store are now dying on the side of the road in front of our very eyes.

this is like being an indian with a job, walking past flea-specked, dying beggars en route to work.

is there anything savvy shoppers want from those stores as they liquidate?

So how do you folks feel about Grey Davis now? I’m in Texas and we have plenty of problems such as the idiot that took shrug’s place here who is called “Goodhair” Perry and reminds me of old Grey is why I mention it.

But as I recall, you kicked him (Grey) out after the ENRON (one our former Houston exemplars) company raped you over electric rates and you had a big deficit.

Well, now your deficit makes that one look like a kids piggy bank. So are you gonna dump the governator? Fair’s fair.

I have been looking for a home for a while. I have not seen any house I would consider living in that is priced less than $1.2 million as of January 2009. A lot of the houses I see in my neighborhood that are priced at $1.3 or $1.4 million need to come down by ABOUT A MILLION DOLLARS before they should sell. They’re not really large. They’re not especially nice. And though I’m close to Beverly Hills, it isn’t Beverly Hills. As far as I’m concerned, the houses around here are priced ABOUT A MILLION DOLLARS higher than they should be “worth” to anyone who makes enough money to pay $1.3 for a house.

______________________

Here’s examples for you of houses in my zip code that (IMHO) need to come down almost a million dollars in price:

______________________

http://www.redfin.com/CA/WEST-HOLLYWOOD/560-N-CROFT-Ave-90048/home/7104875

______________________

http://www.redfin.com/CA/WEST-HOLLYWOOD/8828-ROSEWOOD-Ave-90048/home/17463746

______________________

http://www.redfin.com/CA/WEST-HOLLYWOOD/335-HUNTLEY-Dr-90048/home/6817309

At least Gray Davis tried. He was recalled for incompetence.

Ahnold is a vicious predator. And noone’s complaining because our legislature’s even worse.

He was sold by our objective friends in the media as a Republican committed to restoring financial sanity in Sacramento. When he got there he showed himself to be even worse than Davis.

The idea of protecting freedom of the press was that they would act as an objective monitor of the government.

We became used to thinking of the media as our agents like we thought of the financial elite as watching over the economy for us. like we thought r.e. agents were working on our behalf. Not to say that some don’t still of course-

And now that the big newspapers will be bailed out do you think they won’t be even more slanted in their reporting about their saviors and their enemies?

Ahnold flies to Sacto. and back every day he works and then wants me to curtail MY lifestyle to fight global warming.

The ancient Jews wanted kings too…

There is a limit to how much houses prices are going to fall, they are not likely to fall so much that they will be cheaper than renting an equivalent place. And reaching the prices some people quote here would require that to happen or for rents to also drop (possible, but I haven’t seen much of it yet).

You’re right – the inflation adjusted value of that first one is about $500K. It seems like the price decline hasn’t caught up to more desirable areas in LA yet.

@In The Market:

Yeah, those same homes in that same neighborhood were about a million dollars less back in 1999. The schools are not exactly great either. And now lots of shops are going out of business and construction halted the neighborhood is getting to be a bit sketchy. For instance Payless Shoes and the huge retirement home behind it are now empty and homeless folks tend to congregate in the alleyway behind the empty buildings. Eat a Pita is gone and weeds are growing in the parking lot that has been tagged with lots of graffiti. I counted recently over 40 for rent signs between Hayworth and Gardener. Plus there have been a series of armed robberies lately. All this can be yours for 1.4 million…..

This economic collapse seems to be accelerating, no?

Housing, layoffs, more bank bailouts, hospitals closing…..not pretty.

I still have fond memories of getting rid of Gray Davis.

Getting rid of him was a great idea, the mistake was replacing him with someone else.

I feel your pain, dumps like the ones you been looking at go for about $640,000 in OC. But they should only be around$230,000. Our society is so out of touch with reality, that when you tell sellers that their homes are way over-priced they see you as being mentally unstable.

I’m sure it’s different in California. But in the large cities of the Northwest (Portland, Seattle,) the long-term average housing price until the 90’s was between 2 and 2.5 times average household income. Today, while the median household income is essentially unchanged since then, the NAR shows the current ratio as a whopping 6!

~

I have clients who are realtors and they say that, while this isn’t the worst market they’ve been through, it’s just as bad as the worst they’ve been through. The lively and happy clamor that used to permeate their offices has been replaced with sullen silence.

I live in WOodland Hills, CA 91364. This morning walking down my street I see a house (south of Ventura blvd, near Topanga Canyon) that has been foreclosed (or about to) with the front door, garage door, windows missing…. Later this afternoon a guy (who was paid by the loser owner) is standing out front literally chipping out the remaining windows. I call the police who come only to tell me that there is nothing that can be done because the owner has no problem with the destruction. The residence is going back to the bank.

There is another foreclosed house in a nearby street that has also been destroyed. The police said that this is a common occurrence and many of these abandoned houses have squatters living in them. My problem is that this particular house was already a foreclosed house earlier last year. Someone bought it and has lost it…. already…. What are the banks doing? They are still not making decent careful loans, because if they were this sort of stuff would not be happening.

I say, “NO more bailout money for these greedy banksâ€.

FYI, I am renting and am sitting on the sidelines waiting to buy a decent priced house, however this type of action makes me really nervouse about buying any time soon. Prices are going to come down at least 30% from where they are presently!!! Seriously, I am just dumbfounded by the utter lack of personal responsibility and morality. How someone can destroy a perfectly good house and get away with it is beyond me.

Well now I guess I’m not the only one who noticed:

http://www.vdare.com/walker/090112_crisis.htm

The only way the numbers add up is if the dollars inflate to meet the need, but deflation is foiling that in a stalemate. The spring tide is ebbing and there are a lot of blue whales on the beach, to paraphrase Sting…There’s an Alberta Clipper with this Kontradieff winter. Bob Pretcher made an excellent case for this being a Grand Supercycle with even more excess to unwind than the 20’s that led to the Great Depression of the 30’s. Manipulation of the markets didn’t help then and even with the schemes of unbelievable magnitude thrown at the problem today, they haven’t even acknowledged the roots of the problem. How can we fix liver cirrhosis with more tequila? Sorry for all the metaphors, but somehow real principles are ignored in the voodoo-economic matrix. We don’t even have a plan to go forward if we do get through this.

If you want a dirty hippie from California’s opinion, he mention of Grey Davis makes me want to say things that are inappropriate for a family blog. However I will attempt. Grey Davis should have demanded the legislature pass laws that would have put all of those guys in prison fro the next twenty years, and then… wait for it put those guys in state prison for the next twenty years. Instead like the good political operative that he was, he thought that the right thing to do was to fellate Enron harder. Couple of words come to mind, worthless, pathetic, spineless, looser.

PS: I reads this and almost fell off my chair. Guy wants to rent out a ~4000 sqft 4bd house in Bernal Heights in SF for $8000/mo.

http://sfbay.craigslist.org/sfc/apa/995523776.html

So whats that, the equivalent of a $12000/mo mortgage since a mortgage interest is paid for pretax?

Kelly–

Fair is fair? A course in logic emphasizing syllogistic and informal fallacies appears in order–please research causal oversimplification, ad Dictum simpliciter, false dilemma, and fallacies of distribution so that you may in your future posts spare the readers of this forum your clumsy and obvious trolling.

What’s that old saying?

“Eternal Vigilance” for those who now rail about crooked capitalism and corrupt legislatures!

We are caught in a downward vortex of greed, and ignorance on how our system works.

Now it’s all about JOBS! Without jobs we will plunge downward, debt relief legislation or not…..

JOBS, JOBS, JOBS!!

“Dovsvydania” is right!

Everyone squealed about Davis and lauded the sternum grater, but any jerk looks like a hot shot with a stolen credit card until he gets locked up. Julia Roberts in Pretty Woman summed up America in on sentence: “I want the fairy tale”

Ha ha Sierra

If it was REALLY all about jobs why would we make it so very easy for citizens of ANOTHER COUNTRY to compete with OUR citizens for the employment opportunities our state can still provide???

If we were to merely enforce our current laws regarding the employment of people who are legally ineligible to work in this state/nation what would our unemployment rate be then?

And have you heard ONE person other than me ever point out this simple and seemingly obvious truth?

Why is that do ya think???

The 2009 definition of a sucker is someone who wants what’s best for this country-

I see an awful lot of rust in California over the next decade or so…

The smarter and the richer folks are moving out.

The tax base is shrinking.

And, the only moron in government who actually managed to lose an ‘election’ was Grey Doofus. Name another ignorant lout in the state senate or assembly that actually lost. So, folks, we voted for the morons. Some blame the Terminator. He is a goober – but, only one of the many goobers in office.

I blame us. We do not make the tough choices. We vote for simpletons who always say yes.

Why are we looking for state or federal help when they have proven themselves as incompetent as we have come to expect. The difference between a conservative and a liberal is that conservatives never had any confidence in the goobers; conversely,k liberals had confidence but think the goobers simply cannot manage things as brilliantly as they thought they could.

Get the LA Times helicopter video teams up in the air and watch the White Elephant Bronco (California) drive the dilapidated freeways. Watch the talking head wail about the children, the ponies, the heat, or whatever.

Game over!!!

Bottom line is until people realize the world has changed we won’t get through this. People still think we will go back to business as usual (was that the bottom?). I spoke with a woman a few months ago who was so proud her grandson was going to be a Georgetown lawyer. All our best minds are still striving to be parasites and predators, rather than contributing to the great American industrial machine. My dream job was to work at Cisco as a software engineer. I go there now as a subcontractor and I see much of the tech staff speaks accented English from Asia for the most part. F500’s pull talent from overseas while our best minds strive to game the system. No species can survive being cannibals. We haven’t learned a thing.

People think we can print prosperity, but look carefully below the surface. Foreigners aren’t buying our debt anymore. Three of the last four months are huge net out-flows of foreign capital. See what happens to the dollar at the next Treasury refunding auction.

I’m not sure how the next bailout goes, but at least Obama talks of chasing windmills for electricity, rather than for pennies from heaven to buy more Walmart crap. If we’re going to destroy the dollar, let’s at least get something for it. Maybe in 10 years the gov’t can get a few pennies on the dollar back for the Taxpayer Annihilation and Rape Program (TARP) assets and doomed bank preverted stocks they’ve been buying up, like killer mom’s at a Walmart opening.

Just want to say thank you again, Dr. HB, for your excellent blog articles in keeping up with this historic saga.

“Taxpayer Annihilation and Rape Program (TARP)”

LoL. 🙂

Hi Doc

My view is driving directly to principal relief from the

government. Take the ideas of the jubilee, and

cancel say $100,000 or $200,000 of consumer+mortgage

debt.

Forget putting money into the hands of the middleman

banks. They just eat in bonuses and salaries. Bankrupt

the banks and cancel the loans. Let’s do a reset/reboot.

The current path is going nowhere and will result in years

of misery.

I’m looking to buy in Carlsbad 92009. Historically (since the 1980s), the median house price has been around 5 times the family median income. If you assume everybody put down 20% since the 1980s then their mortgages were 4 times their household incomes. So they’re on a budget, but it’s doable………

But in 2007 median house prices were 9 times the family median income !!!

When the prices goes back down to 5 times the income I’m buying. I may lose some of my downpayment as the pendulum swings to the extreme, but probably not by much.

HI, Dr.

Since in California there are so many renters, I think we should compare the house price with “Mortgage Payers’ median income” , not the median household income and house price. Here, I assume the “mortgage payer/house owner” generally have higher income than renters. So the price/income ratio could be better than you thought.

Another point I want to make is, many second time home buyer during peak time could have a much higher down payment than you thought. Second time buyer usually sold there first house at a sinful price at peak, and put the profit as down for the new house. As far as I know, many of my friends sold first house during peak time, made at least 200 k, so their mortgage for million dollar new house is only 600 k.

Generally, I agree with you that real estate market is in big trouble now, but it might not be as bad as you thought. Let’s wait for the foreclosure number of the first quarter and see whether the Alta-A loan explode as expected.

What’s your opinion?

I completely agree with the fact that the price to income ratio in Southern California is still high despite the recent price correction. I think we still have more to go since the income does not correspond to the price of homes. I am not sure how long will the correction last, but one thing for sure is we will have another correction this year for sure. In that way, we will have a better price to income ratio and that will lead to a possible recovery in the housing market.

hi, in your link to 10 reasons california wont see a bottom, you stated that the median household income is $53,770. however, in this blog post, you mention the median ‘family’ income is $59,948. what’s the diff between family and household income? and if they are the same, does that mean households are earning 6K more than they have 5 months ago?

Leave a Reply