The current status of foreclosure activity: Pre-foreclosures up 200,000+ from one year ago and examining inflation in regards to housing prices.

Foreclosures are still relatively high but what makes things appear to be better comes from a couple of fronts. First, foreclosures are being purchased at a faster rate by investors and some are doing this at the courthouse steps under a Nevada sun or rolling storms of Florida. So many do not make the MLS where the public can view them. The low supply has definitely pushed prices higher. What is interesting is the jump in pre-foreclosures. Part of this has to do with moratoriums that occurred over the last few years in a handful of states. It looks like banks are now deciding to move on more properties given that the market is now prime for this. Low supply and higher prices will make it a more lucrative venture to move on some of the pending foreclosures. This is a reason pre-foreclosure activity, the first step in the foreclosure process is up by 200,000+ from last year. It is useful to also look at home prices in relation to inflation. Let us first examine the foreclosure situation.

The rise in pre-foreclosure

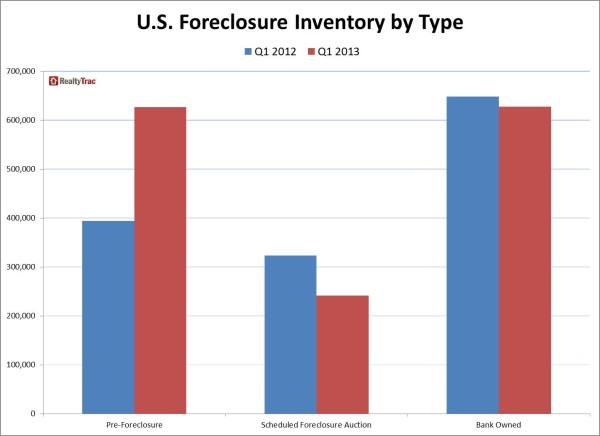

There has been a big jump in pre-foreclosure activity:

In the last year, the notice of default category has soared by over 200,000+ properties bringing the current total to 600,000+. So why the big jump if the housing market is in full recovery? Part of it stems from banks now moving on foreclosures and the moratorium laws that came into place a few years ago. Yet many investors are likely to yank many of these properties even before they hit the MLS. One common misconception is that all investors are buying for rentals. That is not true. In places like California good luck getting a good return on a rental. But as a flip? That is where the action is at. We’ve highlighted flipping action in hipster areas like Silerlake and other hotspots.

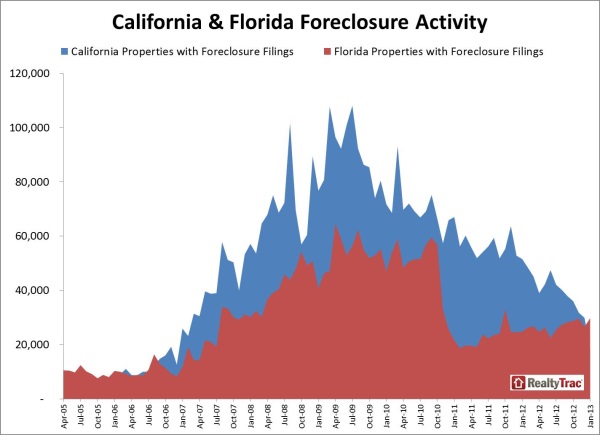

Looking at the foreclosure data more closely, you can also see why a state like California is seeing big price jumps:

At one point, California had about 40,000 more properties with a foreclosure filing than Florida. Today, Florida has taken the lead and just remember the population of Florida is half the size of California. Florida goes by judicial law when it comes to foreclosure. The above isn’t all necessarily a good sign since a big drop has come from the Homeowner Bill of Rights in California that has made the process tougher. In a supply constrained market this has only added to pushing prices higher.

Inflation and housing

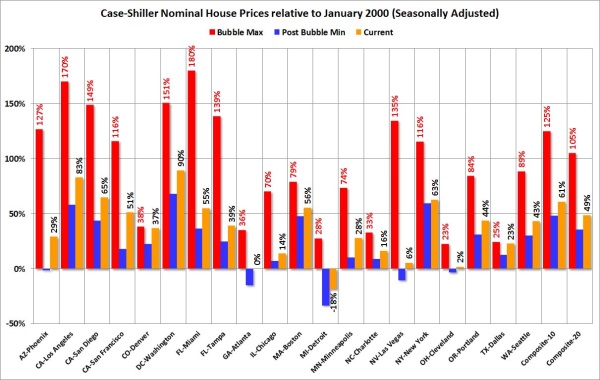

Professor Robert Shiller has argued that over a very long period of time, housing generally tracks the overall rate of inflation. From 2000 on, the overall US inflation rate has moved up by 35 percent. So let us take a look at various regions and where they stand relative to the overall inflation rate:

Source:Â Calculated Risk

It looks like Charlotte is under the inflation rate and so is Las Vegas for example which is only up by 6 percent relative to 2000. You can see that the bubbliest area is Washington DC. Of course Los Angeles (including OC) and San Francisco are up there as well way above the rate of inflation. The rate of inflation in California is very close to the nationwide rate of inflation. The rate of inflation during this same time for California was 38 percent.

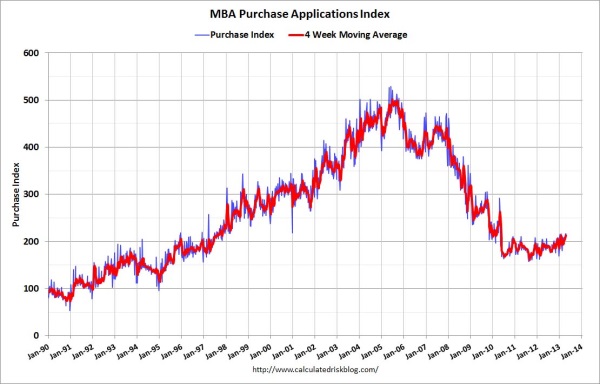

So it is interesting to see where prices now currently stand in relation to the overall inflation rate.  Low interest rates would impact every region equally. Yet investors and hot money are targeting certain markets in droves. The idea is that regular buyers are a big part of the market recovery but they are not as indicated by the number of purchase applications:

The volume of purchase applications is nearly the same as it was in the late 1990s. Nothing remotely close to the peak days in 2004 and 2005. Of course this is coming from virtually a third of buyers being investors. In some markets like in Arizona the number of investors is even higher.

It is hard to say whether that jump in pre-foreclosure activity is going to add more supply on the market. We already are seeing inventory increase nationwide but in certain markets like those in California, inventory is still near record lows. One thing is certain and that is banks realize that prices are rising so it might be tantalizing to get rid of some of those properties and thus add some supply to the market. Yet this is something more likely to happen nationwide and as we all know, real estate is a segmented system. The fact that bidding wars are occurring is stunning. I just had a talk with someone that mentioned to me, “real estate is back and this time I’m not missing out especially with such low interest rates†in relation to the California housing market. What can you say to someone with that kind of conviction? I just wished them luck as they enter the market to compete with hungry cash loaded investors. With such a limited supply in desirable areas, competition is fierce.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

51 Responses to “The current status of foreclosure activity: Pre-foreclosures up 200,000+ from one year ago and examining inflation in regards to housing prices.”

http://www.labusinessjournal.com/news/2013/may/03/colony-american-homes-files-ipo/

8,200+ homes, 1 billion in expenditures. 10M in revenue thus far (really?)

If we see a significant jump in inventory, and this IPO falls flat, I think we have the makings of that first domino to fall.

In my mind going long this type of investment is much like going long a 30 year bond at a historic low in interest rates. Seems like a horrible investment but, I am the same idiot who thought mid 2004 was a good time to sell my California house.

Makes my skin crawl. Especially the choice words of “unique opportunity.”

What is that 10M? a tenth of a percent of their investment? Perhaps this IPO is a way to short the investment rental home sector. If you can’t get the cash out of renters then get it out of pension funds and guarantee your salary so you can skim your golden parachute as the company goes down the tubes.

This quote from the offering made me think that they are shifting the American dream of home ownership to the 1%….. “We believe current market conditions present a unique opportunity to consolidate the ownership of single-family homes in the United States at distressed prices, rent them to tenants, manage and position the assets for revenue growth, stability and capital appreciation, and thereby achieve attractive rates of return, .. and – Serfdom for the 99%.

Yes, sure seems like a unique opportunity to transfer ownership to the 1%. Argh!

I think buying needs to wait until there are no more bidding wars, which will be when inventory is at a level where supply equals demand.

“…manage and position the assets for revenue growth, stability and capital appreciation, and thereby achieve attractive rates of return,â€

Good luck with that plan! I’d bet on Dow 30,000 before this scheme.

These robo-landlords like to obfuscate. Let’s see, how do we walk the tightrope of luring investors while not looking exploitative of the common folk. Like this:

“We believe current market conditions present a unique opportunity to consolidate the ownership of single-family homes in the United States at distressed prices, rent them to tenants, manage and position the assets for revenue growth, stability and capital appreciation, and thereby achieve attractive rates of return,” the REIT said in its filing.

Translation: We’re going to snatch the American Dream away from the serfs by using the all-cash window so no seller will even consider the “subject to appraisal” offers that common folk submit. Then… yes then we’ll corner the market and jack up rents er I mean “manage and position the assets for revenue growth.” Hehe. They’re houses silly, what do you think revenue growth means?

It would serve them right if they made so many people renters that their portfolio gets slammed with rent control left and right. haha Maybe these investors are the ones getting hoodwinked. Here kitty kitty, come over here and get great “revenue growth.” Put all your eggs over here in this basket kitty, kitty. “SMACK!” You just got rent-controlled Simon Legree. You know what’s going to happen when interest rates go up kitty kitty and your revenue is locked down by law. Sorry kitty kitty – but who could have seen that coming? The revenge of the common folk.

“notice of default category has soared by over 200,000”

does this mean the 1,000,000 or so squatters finally have to move?

do not count CA out of FC’s. 1. Keep your home California is program sponsored by Federal dollars. the program gives all or partial mortgage payment to homeowners. 2. offerings of $4,000 to $30,000 to short sale your home. 3. huge amount of modifcation that strech payments out over 40 years, soon these homeowners will wake up too the nitemare of how much am i going to pay over 40y on a asset worth xyz amount. when ever you here this good news from main stream media look for the minipulation.

I am a realtor and I am seeing houses that sold last year in the $220,000-$250,000 range now selling in the $300,000-$329,000 range. That is a 30% rise in one year.

After the 1989 crash, my father taught me that no markets can rise that fast and sustain themselves. I saw it in the bubble market of 2003-2006 and sold all of my investment properties at the end of 2005.

Well, kiddies, it is happening again. Life is about timing. Unless you bought an investment property that is bringing you a good return, It s now time to sell and keep your cash for the next downfall.

Always remember that the difference between lettuce and garbage is timing

Bill, I guess that means you are in process of selling your house? Please do tell.

Here is a hypothical scenario for homeowners:

A. Sell your property today and live in a rental for the next 3 years and then repurchase same property for 25% less.

B. Stay in current property and absorb 25% loss.

I would go with Option B all the way and I imagine most homeowners would too. The loss in real terms would probably only be about 10%. Selling and buying is expensive and a hassle. And just the thought of having to move and endure the uncertainty of rental hell for another three years is out of the question. And this is likely a worst case scenario, I personally don’t see prices down 25% three years from now.

Lord,

My home is paid for, but then it is my principle residence which is totally different from an investment property.

If you just bought a home last couple of years, stay there and don’t worry about it. If you are currently looking for a home to live in, be motivated by location, lifestyle and what you can afford, not what it is worth.

If you are buying for investment, know your numbers. Any investment property that you have to feed is a losing proposition.

If you are currently renting and looking for your dream home, plan it out and don’t get caught up in the emotions of the marketplace. Instead of going for an FHA loan, where the PMI is extremely high and won’t go away, keep saving your money. You would be better to have 10% down and go for an 80-10-10 loan with no PMI.

You might get a better deal if you just waited a couple of years more

A lot of people are trying to relate an investment property with a principle residence. They are two different animals and you should know the difference. Read “Rich Dad, Poor Dad”, that will explain the difference

Thanks for the reply Bill. I was confused from your first post. Trying to time the market by selling a principle residence right now is ultra risky. Who knows what the future holds. At least with a house, you’ll have a place to live…

Selling your residence gets you up to $250K ($500K for a couple) , TAX FREE, if you’ve occupied it for 2 or more years. Tell me where you can get a tax free gain like that in our country?! If you gamed this correctly in popular CA areas, you’ve made out quite well.

We’re likely going to list our principal residence next month (Tustin, CA). It’s a townhouse and isn’t ideal for our growing family for much longer. We won’t likely make a gain on the sale, but prices in our neighborhood are 30% off of the bottom, and we’re hoping to sell it for near what we paid. We’ll then rent for a couple years and determine where we want to live. Hopefully higher rates will knock prices down a bit in the interim…

long-time lurker here. I was just offered an above comp price for my out-ot-town vacation rental property, and its the only house i own. My house is not for sale but the folks that stayed there for the weekend (they are from Canada) fell head over heels in love. I never thought i would sell this little gem in Carmel Valley, but i am thinking of accepting the offer and selling, keeping the profit, and waiting for this mini-bubble to burst so I can buy where I actually live – Sierra Madre. Any thoughts? HELP!?

oh, and i rent in sierra madre and LOVE my rental – way below market rent and super landlord

Hi Pammy

You have to weigh how much return your investment property is bringing for you next to having a nice home in Sierra Madre

Sierra Madre is pretty pricey and with the low inventory, you will be paying top dollar for a place to live. Just a note, I used to live in Sierra Madre Village in the 60’s when it was a hippie enclave. I remember the 1969 floods well.

A difficult thing to do is find a good investment property. If your investment property is netting you a 10% return on your equity after taxes, DON’T SELL IT. Unless you have other good sources of income and you want a nice house in Sierra Madre.

When I was living there, the first violin spider in the United States was found in Sierra Madre and some local artist made a statue to it in the local park.

Although, Sierra Madre is a very good choice on a cool place to live

Hi Pammy,

I was thinking some more about your Carmel Property. If you have a lot of equity, It might be a good idea to take it while the market is hot. Although Carmel is another cool town and you might be in a location that will hold it’s value better than others. The ideal scenario is to let it run if it is going crazy but we know that markets do not go in a straight line

This really should be discussed with your accountant. However, if you were lucky enough to not be claiming this property on your income tax as an investment, but a principle residence, then if you sell it, you can take up to $250,000 if you are single and $500,000 if you are married TAX FREE and be way ahead of the game.

If you have been claiming the property as an investment, then you will be paying capital gains tax

The idea of selling when the market is hot and waiting for it to cool down and then buy in Sierra Madre is a good idea. But let your accountant give you their opinion so you make a balanced decision that is not all based on emotion.

You seem to have some very good tastes: you own in Carmel and want to buy in Sierra Madre. That is the California dream that movies are made about

Bill – thank you so much for all your good information. We do have a call into our accountant, but after a LOONG walk up the canyon with hubbie yesterday, we decided that offer had to be a lot better before we sell our little carmel valley gem. We do love Sierra Madre so much, and frankly i just don’t think i could live anywhere else in So Cal. I’m a San Francisco native, so moving here was hard enough, but we fell in love with SM! we will probably try to buy a little fixer here after this bubble burst, who knows – anyway, nice to hear from a fellow SM lover.

Bill, Liked your reply. First time buyers, looking to buy in West LA. Not sure if we should take the plunge and buy a condo. And them move to a house in a few years time. I see so many pre foreclosues on Zillow but our realtor is asking us to offer the maximum! Not sure what is the right way to go. This market is driving me crazy.

Hi Waiting,

Your realtor is right. If you want to buy a house in today’s market, you have to be very aggressive with your pricing. Don’t be swayed by Zillow, their information is inaccurate, be aware of actual listings and what they are selling for.

The real question is why do you want to buy? You should be motivated by looking for a home to raise your family, in a neighborhood you like and can afford. If you are thinking that you have to buy now because prices are going up, that is the wrong way to think.

I recently closed a sale with a first time buyer that I was dealing with for over two years. And they went through the typical process of a first time buyer: We have to have this size home to make us happy, we have to have these amenities, maybe we should buy a condo now and a home later.

I am a patient realtor and I sell by education. We finally bought a smaller house in a great neighborhood and they could not be happier. The house had a large lot and it had the potential to add on later.

West LA can get a little pricey. During the bubble, I sold a townhome down there for $895,000. The best advice is to know your markets, follow Dr Housing Bubble and don’t let your money burn a hole in your pocket. It is very costly to buy the townhome now, sell it later and then buy a house. Start looking for different neighborhoods where you can afford a house and would want to live there.

Remember that today’s market is not a normal market and it is easy to get caught up in the emotions of the marketplace. Keep saving your money, keep educating yourself as to the different neighborhoods and take Dr Housing Bubble seriously. Things are meant to be and it will all fall into place

Well I just don’t understand one thing. Why are people still buying. Don’t they understand that it is a bubble. Last time it was difficult to see but this time around every one knows that market was back to 2006 pricing in a yr. inventory is next to zero n price rise is artificial…can anybody pls help me to understand this…

Hi Ken,

I used to think the same way. “What is the matter with everyone? Can’t they see that the economy is in the toilet and there is no economic reasons for prices to rise so fast and so quick?”

The reality is that most people do not see it. Most people’s whole real estate mentality is based upon a three year period (2003-2006) where the market was like a casino that paid off handsomely. I even hear realtors say “It looks like the market is back”.

What market??? You mean the bubble, that was an abnormal crazy market created by government intervention? You mean that market?

People do not and will not understand how markets work. They are like sheep and they follow the crowds. Trust your own intuition and don’t worry about anyone else. They would not hear you if you told them anyway

Purely anecdotal but all of the buyers I know in L.A. are thirtysomething first timers.

Purely anecdotal, but ALL the sales I see, as a probate attorney in Los Angeles, are going to investors who have no intention of living in the houses.

A few months ago a realtor friend of mine had 34 offers on a house and 33 were from investors. Doing the practical thing, they sold to an all-cash investor.

Unfortunately, the practical thing for a seller is the terrible thing for the society.

Very hard for 30 something buyers who are taking a loan to compete in this market.

From my perspective (being a 30-something) very few people I know are in the market to buy at this time. The ones who bought anything did so in 2011, and the rest of the homeowners I know are still heavily underwater after the first bubble.

It’s rarely a topic of conversation for any of us because it’s too depressing to think about (not so much for the guys, but certainly for the ladies).

My guess?

Most people are also afraid of this being a bubble. But they’re assuming it’ll burst in 2015 when interest rates rise. After that, prices will rise again slowly as the economy recovers. In 2020, 30-year rates will be around 6% again and home prices will be back to 2014 levels.

In those 7-years, families will have built up equity in their home and can move again if they choose to.

I think us SoCal-ers are becoming way less picky about home choice and just want to get into something stable. So we jump into this crazy bidding process just to have something to call home for 7 years. We can ride out ups & downs in prices. We’ve gotten a little tougher.

im a first timer 30 year old, just saving. have a large down payment saved but i am still remaining picky. im hoping zirp and qe dont devalue the dollar too much before this housing bubble with no fundamentals behind it bursts.

im not going to buy a 525k house in santa ana. the prices people are asking for these days on every listing across orange county are seriously laughable.

Is “tougher” what they call settling for less these days?

@Ken said: “…Why are people still buying. Don’t they understand that it is a bubble…”

Answer: No.

When people purchase a home it’s based on their seat of the pants gut feeling and the monthly nut (mortgage payment).

These people buying into this bubble do not pop open a spreadsheet and do a what-if interest rates go back to their historical level of 9%? What if the Federal Reserve loses control of inflation and interest rates go to levels last seen in 1982, i.e. 17% on a thirty year mortgage?

Warren Buffett (Berkshire Hathaway, one of history’s most successful investors) and bond king Bill Gross (Pimco) are staying out of real estate this should be a major warning sign to those piling into real estate.

“Warren Buffett (Berkshire Hathaway, one of history’s most successful investors) and bond king Bill Gross (Pimco) are staying out of real estate this should be a major warning sign to those piling into real estateâ€.

The major warning sign should have come when brokerage houses were recommending to clients they put a portion of their money into rental properties. Once the masses are on board – it’s too late. The smart money was moving into real estate in 2008 (when everyone was running from real estate). Now, smart money is moving out of real estate.

@thenumbersneverlie

It appears the worst is yet to come.

http://dailycaller.com/2013/05/05/housing-nominee-mel-watt-helped-create-the-subprime-crisis/#ixzz2SaG5grVB

“…Mel Watt, President Obama’s nominee for director of the Federal Housing Finance Agency, pushed government programs to help welfare recipients buy homes during the creation of the subprime mortgage bubble.

Watt, a 20-year Member of Congress from North Carolina’s 12th district, also had a hand in programs allowing borrowers with poor credit to buy homes with no down payment…”

Corrected link: http://dailycaller.com/2013/05/05/housing-nominee-mel-watt-helped-create-the-subprime-crisis/

What happens when the light volume of homes hit peak prices from 2007 on the Westside? Investors will dump and run, that’s what. Then what are you going to be left with?High prices, a miniscule amount of real buyers and nowhere to go but up on interest rates.

Caveat Emptor.

http://www.westsideremeltdown.blogspot.com

Ken,

It’s simple: People are morons who let their emotions dictate their actions. People know that smoking causes cancer yet they still smoke. It’s the condition of being human.

Even Warren Buffett is worried about the Fed’s actions:

http://finance.fortune.cnn.com/2013/05/04/buffett-worries-about-feds-huge-experiment/

I just visited my son in Central Texas and my daughter in Houston. Tons of houses are hitting the market and so far it looks as if the ones that are selling are about 20-30% off the list price. I think sellers are getting desperate as they lose money in their 0.01% savings and need cash to live on but there may be other reasons sellers are finally throwing in the towel and settling for more realistic prices. After all, wages are stagnant or dropping and these re-sales cannot get the zero-down loans the new builders can hand out like candy to anyone who can fog a mirror.

I think you are mistaken about the market in Houston. Houston is actually more than one market. There is the relatively-dense urban core and then there are the far-flung suburbs, which are often adjacent to raw land.

In the core, the market is hot – lots of listings, lots of new development, prices rising, inventory down. Employment picture improving steadily, although I don’t know about wages.

Out in the suburbs is a different story. Homes in older subdivisions are harder to sell, because they can’t compete with the newer subdivisions a half-mile away. Houston has no natural barriers to growth. No rivers, no mountains, just the ocean forty miles away. If you want to build a new section of homes, just fire up your bulldozer and clear out the trees. Sometimes you don’t even need to do that, just move the cows out of the way.

From the (self-serving) Houston Realtors Association’s monthly housing market report:

HOUSTON — (April 16, 2013) — It’s hard to tell that the spring home buying season has begun because real estate transactions throughout Greater Houston never slowed during the traditionally quieter winter months. The addition of nearly 119,000 jobs over the past 12 months and the resulting need for housing, combined with continued low interest rates, helped make March Houston’s 22nd consecutive month of positive home sales.

“In reporting the addition of 118,700 net jobs during the past year, the U.S. Bureau of Labor Statistics ranked Houston No. 1 for job growth among the 20 most populous U.S. cities.”

I have no idea about central Texas. That’s a whole different ecosystem.

Update on newly remodeled home in SF Bay Area: Asking $999K

Two weeks on the market, tons of people walked through over two days of open house.

One offer for $40K above asking.

Asked the same amount last summer, pre-remodel, no offers at all.

Further justification for the HGTV mindset. How depressing.

It all depends on the remodel. There is the “decorator” paint, new cheap carpet/granite lipstick on pig jobs. Then there are “real” remodels…complete kitchen and bathroom renos, new windows/doors, new flooring, scraped ceiling, getting plumbing/electrical/roof/HVAC/insulation up to snufff. A remodel like this would costs tens of thousands of dollars, maybe even into the six figure range. This is something people generally don’t want to do while living in the house and people will pay a little extra for a move in ready product done right.

Hi Ken,

Like Bill said above, recent memories of the spectacular increase in prices of real estate in the 2000 to 2006 period have been highly influential in motivating many to purchase real estate as an “investment” currently.

I suspect this recent euphoria is probably short-lived, but who knows? I do want to say that the real estate market is not the only market showing signs

of this collective mindset. (“Buy before the price goes higher”) The art/fine antiques/collectible markets are exhibiting this exact type of behavior. I can only conclude that there is too much money floating around in the world with no place to go for a reasonable yield and safety.

Is this a Flip? 130K price increase in six months, description says “There are no remarks available” unsure if any work done. Sold for 461K in 2007? Unique Opportunity?

http://www.redfin.com/CA/Los-Angeles/727-W-56th-St-90037/home/6861730

Forget LA… Las Vegas is whats up….

http://wallstreetfool.com/2013/05/06/wall-street-takes-a-huge-gamble-on-las-vegas/

According to data quick, foreclosure starts here in so cal are actually DOWN to the lowest levels since 2005. The so called shadow inventory is a myth. Distres sales account for LESS than 10 percent of the market. I see the majority of trustee sales postpone then eventually cancel. If the banks are holding inventory I’m not sure the reason. Here in Rancho Cucamonga, the are a total of 5 REO properties on the market. This is a city of over 175,000 population, and 1733 licensed realtors, trying to sell 100 active listings! … And only 5 REO? If there was ever a time to unload shadow inventory … It’s NOW. But where is it? I submit it doesn’t exist. The sub prime inventory is long gone and the majority of the remaining underwaters will wait it out. A lot of these under waters are ARM loans. 05-07 Arms are actually great Loan’s now. Most 2.5 over cofi or 1yr CMT ect, and currently 3.5 or less. I think we are recovering from a reverse bubble where prices a coming back from unsustainable lows. Mabe the pendulum will swing back too far, but with 15 yr rates at 2.5 fixed, and 30 at 3.5… NOW is the time to buy.

Why do you think that those trustee sales are being postponed?

It’s because underwater loan owners are currently able to string the process along, in some cases for years. That’s a new set of rules. TPTB have been shitting their pants over the idea of mass foreclosures because they know just how fragile the house of cards is. If the system doesn’t get any more perverted, many of those will FC and there’s the shadow inventory – it would have been there all along, just not where you thought it was.

If TPTB are able to keep the shims in and rebuild without something major falling out of place, then perhaps your buy recommendation will prove good. The big question is, can they do it? That they would resort to these measures doesn’t give a lot of us much confidence.

Adios Raytheon. 170 jobs with average salary of 250K departing El Segundo, CA for McKinney, Texas.

http://www.calwatchdog.com/2013/05/07/raytheon-splits-california/?utm_source=twitterfeed&utm_medium=facebook

Housing prices continue to crank up in the 20 city index, at a fast pace….

http://www.businessinsider.com/corelogic-home-prices-2013-5

for how long though, nobody knows… 6 more months or 26 more months?…

If you cherry pick a trend line (simple linear regression) from 1990 to 1997 or 1998 on the MBA chart, then extend it over the graph, it would seem MBA purchases would be ‘more healthy’ at the 400 mark on the purchase index. Yet the area under the curve between the trend line and the bubble seems like it could end up being smaller than the AUC under the trend line and the post bubble dip. Sure, this is a symptom that we’re still screwed, the economy still sucks, etc., but in the off chance that we do start to meaningfully recover, it also almost implies there could be some upside potential.

Leave a Reply