IndyMac Bank: Bank Failure, Long Lines, and a Real Home of Genius. Another Reason why IndyMac Bank Failed.

It has been one week since Pasadena based IndyMac Bank was taken over by the FDIC. After the market closed on Friday, the FDIC had assumed control over the troubled institution which was the second largest bank failure in history with assets totaling $32 billion. Initially, since it had been a very long time since a bank of this size had collapsed, many did not know what to expect. Uncertainty was fueled over the weekend when people were unable to access their accounts. On their website, a FDIC page was posted telling customers that the bank was now under full control of the FDIC.

As the institution opened on Monday, uncertainty turned into nervousness. Report after report discussed how people were withdrawing their money from the bank, even those who had insured deposits under the $100,000 FDIC limit. The mass influx of people overwhelmed the resources of the institution and many had to return the subsequent day.

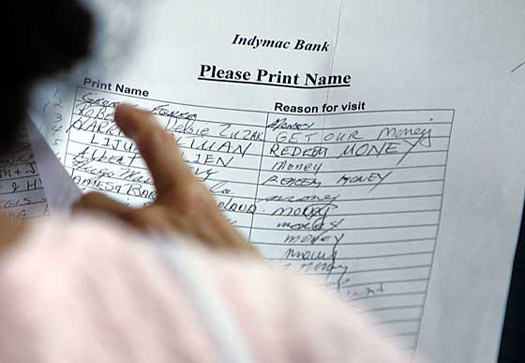

At this point, people started worrying more about simply getting their money out. Bank lines and lists started to make their rounds in various locations:

*Source: OC Register Eugene Garcia

In some locations customers waited hours only to be told that they were unable to get their funds out. The heat and uncertainty turned into anger and frustration. Miscommunications occurred where lists were not approved officially from the FDIC so it was uncertain if they would be honored the next day. This did not bode well for many customers some who had been waiting from 1:30AM.

It is clear that the majority of customers from various reports were taking out their money even though the PR machine was fully saying, “this is the strongest bank in the country currently” – if that is the case, why was it taken over on a Friday afternoon without telling customers before hand even giving a slight warning? Yes, against policy rules. Also, I’m sure those with $100,000 plus would have something else to say about that security.

As the week progressed and customers made their way with FDIC cashiers checks out, it turned out that some reports were stating that there may be some delay with other institutions honoring the checks coming from the institution. Clearly this caused more uncertainty with customers who further withdrew more funds. Amazingly some of the other institutions putting extreme holds on some of these checks are only weeks away from a similar position and they too are insured with the FDIC. Is this how they would want their customers to be treated in the future? From what it appears and legitimately so, many of these other institutions are on the lookout for fraud given the circumstances. Unintended consequences.

At one location, the police were called out to settle customers down. Now of course this isn’t exactly the way to manage good PR. You’re threatening arrest on customers who want their money because your bank collapsed? They want their money because it did collapse! I’m surprised that some people say, “well this is irrational panic and people just need to calm down.” Actually, what is irrational is the mortgages this institution got involved in which led to its predictable demise. Today we have a very special Real Home of Genius Award for IndyMac Bank with a home right in its home city of Pasadena. Today we salute you IndyMac Bank with our Real Home of Genius Award.

IndyMac Bank and the Temple of Doomed Mortgages

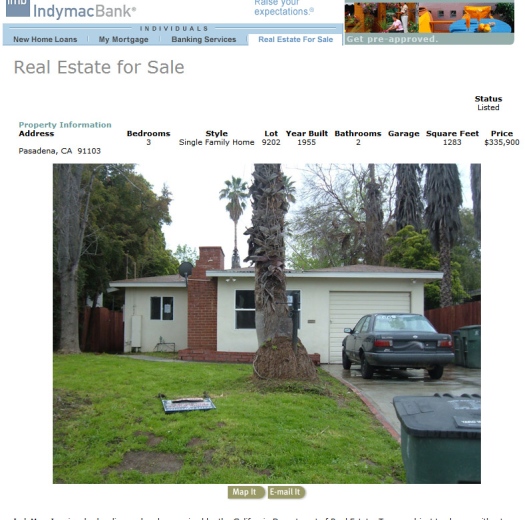

Today’s home leads us to Pasadena California. This home has 3 bedrooms and 2 baths which is your typical bread and butter starter home. It sits on 1,283 square feet of patchy green grass. You would think that when you are selling a home, you would at least remove the kicked down sales sign from the lawn and the green garbage can before taking a picture but this is how collapsed banks do business. Hey, collapsing just doesn’t happen overnight! It happens over the weekend and once you see the history of this one example, you’ll begin to understand why banks like IndyMac are doomed in the upcoming months.

This place is listed on the IndyMac website at a sales price of $335,900 which for anyone in Southern California who knows about Pasadena, seems like a steal. Maybe it was a good deal a few years ago but not anymore. In today’s market, qualified buyers are actually demanding a decent product for the amount they’ll shell out. No longer can you get a toxic banana republic loan to fund your flipping or delusional real estate mogul dreams.

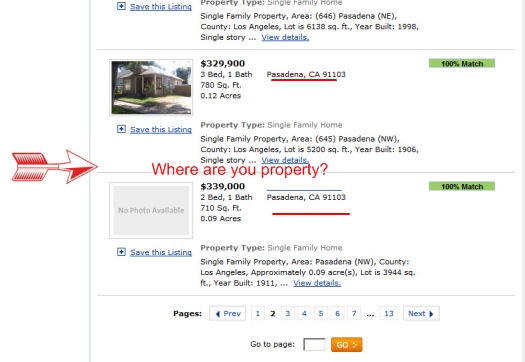

Yet now we are going to see how disorganized California real estate has recently become. There is this phenomenon where real estate owned properties are for some reason not showing up on public MLS real estate sites. Whether lenders are overwhelmed or simply do not care, this issue is not clear. What is clear with many of these toxic Pay Option ARM mortgages is that there is a fleet of owners right now in California that are one, two, three, or four months away from their payments skyrocketing 50 percent and above. With the median price of homes dropping by 30% across California, these homes are simply waiting to be foreclosed on. Yet the irony here is that these loans actually look profitable to many of the current note holders. Unlike subprime were people with very poor credit were given absurd mortgages and of course defaulted very quickly, these loans tend to go incognito for a much longer time. If you have a two or three year window were you are deferring interest and even some of your principal yet pay on time, all looks well on the balance sheet.

A large number of these borrowers are “good” credit folks who used up their home equity like an ATM and now are simply sitting waiting for that recast anniversary. These places are flat out doomed and with $500 billion recasting shortly, many of these lenders are simply waiting for their FDIC turn. This brief rally on Wall Street is a suckers rally. Jump in at your own peril.

If you think this REO idea is off, just look at this property. We can go to the Realtor.com website and search this Pasadena zipcode and take a look below:

*Source: Realtor.com

Oh where art thou? Shouldn’t $335,900 be in the middle here? Yes sir! But nowhere to be found. Big deal you may say right? Well if lenders aren’t reporting their inventory correctly it artificially makes the overall sale to inventory ratio look healthier than it really is. My gut tells me there is a lot of REO and defaulted property hidden from the public view right now simply because of NTS, NOD, and REO data being reported from other agencies. Once recasts hit fully, the zombies will come out of the ground hungry for capital.

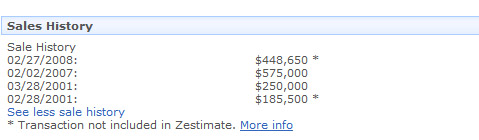

Yet if you want to know why these institutions failed, let us look at some of the pricing action:

*Source: Zillow.com

This place sold on February of 2007 for $575,000! How absurd is that? If a prime area like Pasadena can see a home drop 40% in slightly over a year, what about the loans they made in more troubled areas like the Inland Empire? Given that it was picked up in February of 2008 for roughly 80% of the peak price, I imagine that the lender simply took back the home. It was probably under an 80/20 which was so typical in California. Yet it has been sitting on the books for nearly 5 months and once it sells (if it sells for the current price) their will be a write-down. And once this brief euphoria is over, the overall stock market will punish these stocks again. They are all operating as if a bailout will be given to all. Nope. Unfortunately they only have the time and pseudo resources to go after the big boys of Fannie Mae and Freddie Mac.

Is it any wonder why IndyMac collapsed? These kind of loans should have never seen the light of day. Today we salute you IndyMac Bank with our Real Home of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

16 Responses to “IndyMac Bank: Bank Failure, Long Lines, and a Real Home of Genius. Another Reason why IndyMac Bank Failed.”

Whoever approved the loan back in 2007 for $575,000 should have fraud charges brought against them, then hung up to dry in front of the county court house.

And that is not a house; that’s a garden shed with A/C.

We have already had this situatuion in the UK when We had the first run on a bank for 200 years. The TV was showing people queueing all night to get in to

Northern Rock.

California R.E. Crashing, Oil Prices High, Job Market in Decline, Bank Failures…. Worst aspect of all this: it turns out the “doom & gloom” crowd may have painted too rosy a picture. Things are stacking up WORSE than the worst forecasts from 12 months ago. If we are truly in a peak oil situation, this may be worse than the depression. May God have mercy on us all.

335,000 is still unaffordable for the median income family. The new Dataquick numbers came out for all SOCAL zip codes and boy do they look horribly good for all the renters out there. Alot of zip codes 50% below last years numbers in price. I am guessing we will need a couple more Banks to fail before we start getting Firesale prices on homes. The question is who’s next?

Link to Dataquick’s Data:

http://www.dqnews.com/Charts/Monthly-Charts/LA-Times-Charts/ZIPLAT.aspx

OT here. Sorry–

Can anybody tell me if the FDIC is limited in the amount of funds it has for failed banks? I remember hearing somewhere that beyond 50 Billion or something like that depositors were SOL. Fact or urban myth???

I bought a house in early 2004. Interest rates were so low, I thought even though at that time the prices were fluffy, the low interest rates made it worth it. Then I watched the market go out of control.

I know how much people make. I know that with a salary of $200,000, that family is making more than 95% of the people in the country, and I know that if you make $200,000 the most house you can really afford is about $800,000. And look around in places like Santa Monica and Venice even today and you’ll see there isn’t even an empty lot for sale for that price.

I sold my house in 2006, because I thought the whole thing was going to crumble and I wanted out before it did. Granted, I was about a year early. But better to be a year early than a year late.

The thing is, it doesn’t matter what I did. I saw this coming, but I’m still going to be paying for it. When the FDIC bails out all the stupid banks, and if the Fed has to step in and prop up Freddie and Fannie… we’re all paying for it. WE ARE BEING ROBBED BY A BUNCH OF IDIOTS.

Sure, I didn’t lose $100,000 on my house. But I’m still losing money in my 401(k) because the market has flipped out about the financial institution crisis, I’m losing money in the sense of inflation being caused in part by over-inflated housing prices (at a time when the credit crisis should be causing deflation), and I’m going to be robbed by the fed when they struggle to prop up the crashed system. No matter how smart or prescient a person can be, I can’t see how to get out of this sinking ship. I guess should have been banking with UBS where my money could be in some BS tax shelter somewhere in Lichtenstein like all the people who caused this problem in the first place.

Chris, I hate to inform you of this, but God is just pretend. The only mercy is going to come out of ourselves, each other, and a return to rationality…and kindness. I personally am addicted to Schadenfreude, and am having a field day, since I never got into all that speculation stuff myself. But I know I have to stop now, just as I cut my fossil energy use by 90 percent, and figure out how to help others do the same from a place of confidence, rather than resentment.

Another way to look at this is that the Baby Boomers carry such a megatonnage of guilt that they are courting doom. Not only were we the biggest, smartest, richest, and horniest generation…now we have to fall bigger and harder than anyone. Nyah nyah!! It’s the Woodstock of Crash!

You see, all our lives we heard about how our parents, The Greatest Generation, lived through the Depression, walked uphill both ways to school, blah blah blah. Never mind that the GG is taking SSI payouts well over what they ever paid into it (and we’re paying for their RV and golf lifestyles). Never mind that they had massive governmental handouts, and a world war to spur prosperity, and a whole big new planet full of resources to exploit with no consideration for anything other than making money and growing. Never mind that since the 1970s we have had to cut back on family/home/community time, and put more people into the workplace, for stagnating wages and a declining dollar value. Or that the basics of a simple life–home, a couple kids, community–now appear more like stakes in the heart of the planet than virtues.

My point, Chris, is that I think we’ll all be OK if people stop referring to the 1920s and 1930s. We are facing challenges and opportunities that no other humans ever have. What we do with this is up to us. Not god. It’s a huge evolution being asked of humans. It was asked of the GGers, but their response was to build the nuclear state and vote for Reagan. I think we can do better than that. I’m not sure we will, but I think we can.

mikke

Ive been looking at Norco in the inland empire recently and the high end appears to have had the largest price declines.

Well I sure have enjoyed all of the comments here and in the past weeks. I just wonder if anyone has herd of a compay called Titanium solutions? They are based in Salt Lake City. Their web page(www.utapulse.com) claims that there reason for exhistance is to assist home owners with education and options other than loosing their home. The real interesting issue to me here is that the have Alice Radgowski, a former employee from Citi Residential Lending, Inc (an operating subsidiary of Citibank) where she was vice president of home retention. Radgowski was also vice president of loss mitigation for Countrywide Financial Corp. Home loans. Maybe she felt due to the BofA buy out she would soon be in need of a job? In addition Fleisher also from Countrywide Home Loans where he was vice president of loss mittigation/home retention and even won an annual R.O.S.E. retreat award for achievemt of outstanding servicing with in the company’s loss mitigation division. I think this is just crazy, and I wonder what thier payt checks look liek at this new company are. I don’t believe that these folks should be let near a consumer…I believe that they are in this for themselvs and the money. I have herd that it is common pratice to let short sale properties go to trustee sale because the sub prime loan had MI insurance and the bank will collect more money from the MI insurance than a short sale. If this is true our banks and thier representatives deserve a award for acting and pretending to care. Again they are in it for themselves. I have also herd that Countrywide is buying back their own foreclosed properties for .10 cents on the dollar and then renting the properties, and plan to hold on to them for 2-4 years and then sell them. Hmmmmm, how is this in the best interest of the prospective home owner to refi and maybe…just maybe keep their home? Again they are in it for the money.

Can anyone confirm this stuff???

I have a 2nd mortgage loan with IndyMac Bank and they changed the terms on me to the point where I was paying $300 to $600 a month and the balance still would not go down! So I finally said the heck with it and stopped paying in 2007 and now look at what has happened to them. Dishonest business practices always bite people in the end.

I have noticed REOs in some neighborhoods disappearing from listings with no sales. In one neighborhood, the house was up for sale around 2 years, the listing went away and then the sign but no sale. I can think of two houses within 1/2 mile of me that the REO disappeared from the MLS with no sale.

The question above regarding regarding the 50 billion FDIC total funds, I asked that question to the FDIC man inside Indymac. He told me, get this, that the government would just print more money. He also stated that they would just start charging banks more for FDIC insurance. He then told me that the banks would pay for it not the customers. I thought to myself, yeah, the banks won’t pass that on to their customers?????

I’m sorry, I have to call BS on a baby boomer crying that they have it rough. The Greatest Generation probably gave you an inheritance, then you spent every nickel you earned, will reverse mortgage your way through retirement (no inheritance for your kids) and then bankrupt Social Security. How about the folks under you? I don’t know many people in the 40 year old age group harboring a delusion that we’ll get a penny of Social Security. But we’ll get record debt from the boomers. I want to puke when I see Dennis Hopper talking about blowing every last nickel in that retirement ad. Don’t grow up, man! Please.

Caveat: Many great boomers out there, many morons in my age group, etc.. etc. Just quit acting like a victim as a generation. It is tiring for everybody else.

Here’s the deal with the banks. Instead of having CPA’s ‘certify’ their accounting is honest CPA’s use incredibly complex rules to obsfucate what is really happening. Anyone care to recall Arthur Anderson PA and ENRON? You could take anyone of those people standing in line outside Indymac and let them inspect the loans that bank had made and I guarantee you they would have been more on top of what was going on at that bank than the FDIC was. They would have looked at a loan that was 90 days past due and said ” that loan is non performing’ but a banker would have said that is loan ‘held for investment’ or that they only count loans that are 120 days or 180 days overdue as ‘non performing’.

Its a sham and everyone knows it but forcing the banks to come clean would ruin them so the regulators wink and hope that lowering interest rates, allowing the banks to nickel and dime their depositors and good borrowers to death for a year or so that they will make enough money to cover their bad debts. It won’t work because they have made so many horrible loans that even Jesus would have been forced to pull out his whip and drive the money lenders from their temple once again!

In re to the question about IndyMac and how much of the FDIC’s fund

it will take:

Since this wasn’t a little fish (32 billion) it will take about 10% of

the FDIC’s reserves to cover.

So we have 9 more Indy’s the FDIC can cover and that’s it.

I just love the Internet – when is our government going to realize that

we can and do check out other sources of information.

It’s pretty sad when you constantly have to read between the lines

every time you turn on the tube and watch the news.

I was playing with my local area’s foreclosure and sales listings.

Strange when the number for all pending foreclosures and REO’s

is as high as the number of properties for sale.

Came across some real homes of genius. I swear there is one house

that looks more like a simple wooden shed but they still want 200 000

for it. I am going to watch just how long the “cottage” is going to be listed.

I don’t understand where the 30% drop in SoCal prices is located. As far as I can tell, it’s only the crappiest houses in the crappiest neighborhoods that are seeing any significant depreciation in value. Concerning Pasadena: most of the city is still in the $800k+ range for 2+1 condos. Houses that aren’t in gangland are $1M and up. I don’t understand who can still afford these.

Leave a Reply