Most Angelinos struggle with monthly budget expenses: 57 percent of Angelinos don’t even make enough to have an adequate standard of living based on a recent EPI report.

There have been a few reports highlighting that the LA/OC housing market is the least affordable in the nation. A more recent analysis by the Economic Policy Institute (EPI) found that 57 percent of Angelinos fall below a basic budget presented. We’ll show the budget shortly but these kinds of reports highlight the growing divide in many metro areas around the country. Having across the board housing price increases and rent hikes come at a consequence when wages are stagnant. For the L.A. metro area, what we have seen is a big shift to rental households (L.A. County is a majority renting county). People may forget that the cost of living is high in the Southland even beyond housing. Many want to buy in a good school district and many are willing to dive into a crap shack for the kiddos. But many households wind up in the two-income trap; daycare, added healthcare costs, and ancillary school services to keep up with the neighbors. Housing in the form of mortgage payments and rents is eating up a larger portion of disposable income.

The challenges to keep up for families in the Southland

Most of the people that are eager to buy a crap shack either have a family or are planning on having one. Many single tech workers in the Bay Area are living in roommate situations and their budgets are fine. It is when the desire to have a family kicks in that you begin competing with the dual income professional households. Suddenly living in the hood doesn’t seem so appealing especially when you look into school API ratings. Most logic is thrown out the window once a kid is in the works. People usually will try to buy based on life events, not careful financial planning. People were having kids back in 2003 to 2007 when the bubble raged and nothing stopped when 2007 to 2011 brought the correction. And the same applies for the recent run from 2012 to the present. Timing. Speculation.

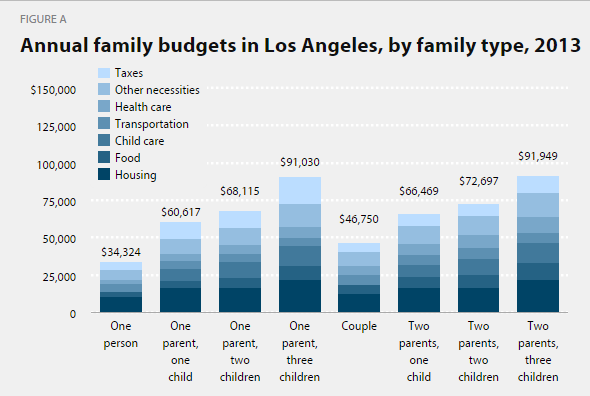

You will notice without the kids, for singles and couples the budget required to get by is modest:

Why do things suddenly get so out of hand once you throw little ones into the picture? Childcare is a big line item. The EPI has $8,137 per year allocated. It moves up to $10,641 for two kids per year. This is only one line item. You then have the added costs associated with healthcare here. For one person, the budget allocates $3,042 but for a couple with two kids, the costs jump to $9,185 per year.

Housing costs also jump. If you buy a crap shack in a poor performing school neighborhood, expect to shell out $12,000 to $15,000 more a year for private school. In SoCal you have some that are fully set on buying and don’t account for all these other expenses. Typically a cascade of spending happens once the family planning stage hits. I’ve seen couples living modestly in a nice apartment suddenly buying a home, a new SUV, brand new furniture, and massive spending when the baby arrives. It is as if they go into full on spending mode. Incomes haven’t changed but expenses sure have. The EPI report merely looks at what is being earned and what is needed to live an “adequate†life in Los Angeles. Sure, you can cut costs and go Taco Tuesday crazy. But daycare costs are fairly standard. Healthcare costs are also pretty standard. You can gamble on these but is it worth it?

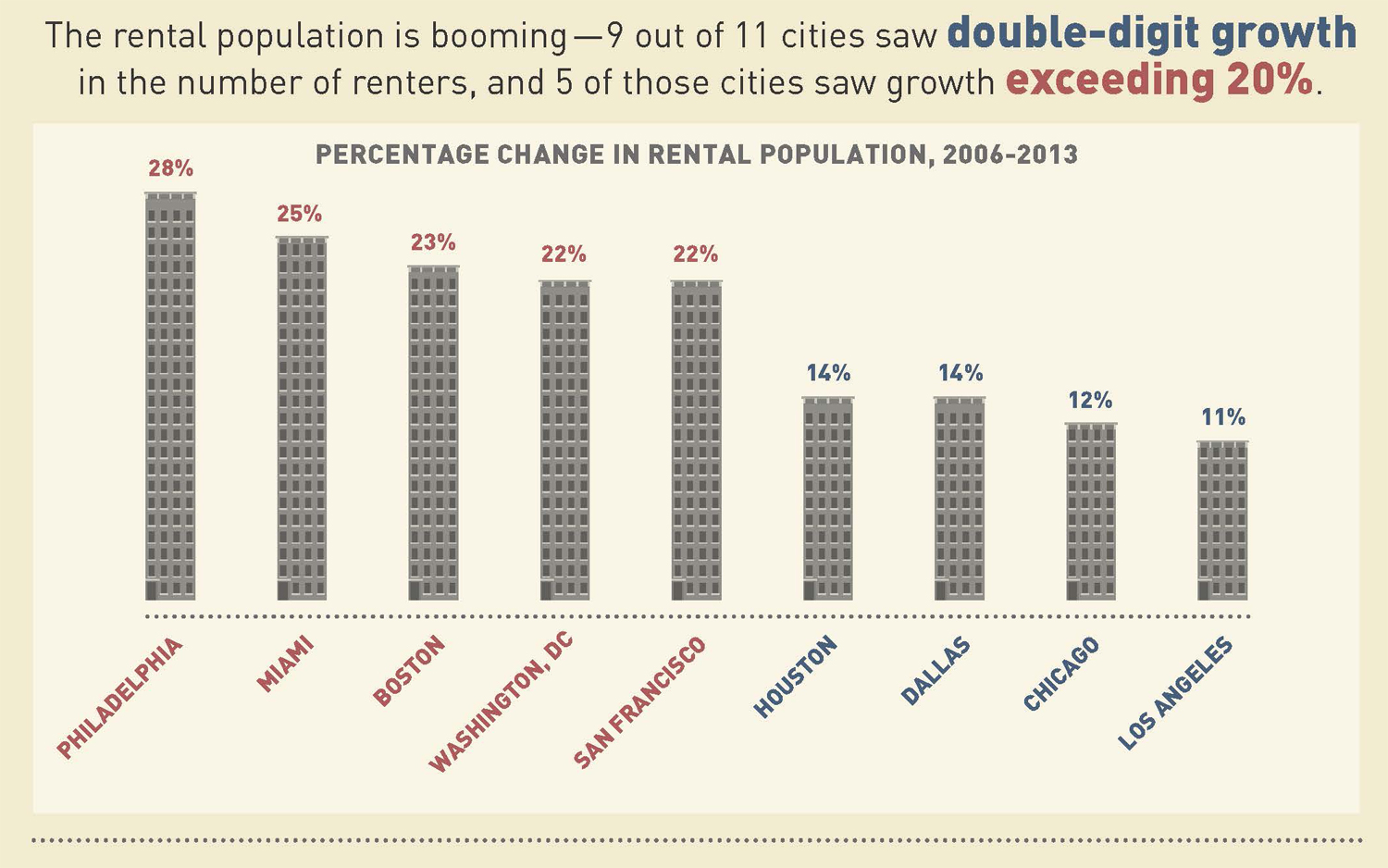

Because of the increase in costs brought on by low supply and investor demand, rental household growth has soared in Los Angeles:

Los Angeles isn’t the only market experiencing this kind of shift. When you break it down, a family with two kids will need to make $74,605 annually just to stay away from government assistance either through subsidies (i.e., giant tax breaks, etc) or other programs like food stamps or Section 8 housing in the L.A. area. The official poverty line is $23,550 so the EPI budget is rather robust given what families actually make. Good luck trying to buy a crap shack with $74,605 annually (by the way, this is much higher than the typical family makes in Los Angeles). According to the latest Census data the median household in L.A. County makes $55,000. Even in tough areas, home prices are high relative to incomes.

Of course growing pressure to household budgets causes larger socio-economic challenges. There is demand for affordable housing but a lot of new housing construction is focusing on higher income households (even with more luxury rentals). Housing is very cyclical in the L.A. region – boom and bust. Some seem to think that we’ve reached a permanent plateau. That would make sense if price pressure was made up by regular households buying instead of investors and historically low inventory. As the EPI data shows, many are walking on a very fine line and even a modest recession is enough to send many over the edge. People suddenly take this as a sign of never buying a home. There is a big difference between careful consideration and shelling out $700,000 for a stucco box that looks like a child’s LEGO design. 20 percent down on your typical L.A. crap shack is going to range from $100,000 to $140,000. Given the above budget and incomes, it will take even a couple earning good money some time to save this up. And I mention this again, a single family home does not throw income off in retirement. Many are now locked into their baby boomer sarcophagus as their adult kids move back home. The kids want the California dream pitched by mommy and daddy but they are not making enough for a crap shack and many can’t even afford a rental. You have to sell to unlock that equity. And because of the above stats, most Angelinos are too broke to pay the asking price, hence the pathetic sales volume. So the number of rental households increases and the beat goes on.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

108 Responses to “Most Angelinos struggle with monthly budget expenses: 57 percent of Angelinos don’t even make enough to have an adequate standard of living based on a recent EPI report.”

Bad sign! Tech company mergers and acquisitions. They are now talking about M&A. Well, I’m no expert — but it means they’re maxed out. I remember Network Solutions couldn’t get profitable and grow it’s business in the 2000’s so it started to acquire as many companies as possible to show growth. The dotcom bubble blew up shortly thereafter.

http://www.businessinsider.com/get-ready-for-a-major-boom-in-technology-mergers-2015-4

I don’t think this is a bad sign, although I do believe we are definitely in a tech bubble when it comes to insane valuations for various reasons. Mergers & acquisitions return capital back to VC investors, which allow them to put more money into other startups as well as leverage to raise even more capital to invest. The dotcom bubble blowing up wasn’t caused by large companies making acquisitions, but rather it was the companies that could not get acquired, make enough revenue, or get additional capital that created a cascading effect. For example, Yahoo has been making plenty of acquisitions with nothing to show for it since its existence.

That’s the point, Jason. Where is the snapchat, twitter, youtube profitability? There is none. Their plan – sell more advertising to companies who want to sell products no one can really afford due to housing taking up much of their income. Case in point: go to Facebook. Look at the ads. They are all from startups or retargeting ads. Where are the BRANDS that carry companies to profitability with their advertising? Basically FB is reporting revenue from ads sold to startups that are burning through VCV capital. IU lived through the dotcom era. Yahoo, Netsol, and others started M&A when it became clear their business model wouldn’t deliver growth and profits — for the very reasons you so articulately laid out.

100% agree on those points. The problem now though IMO is that primarily due to our monetary policies, the barrier to create new startups and raise money is way too low, so one failed startup just gets replaced by another. Plus the existing startups that aren’t generating any revenue are raising ridiculous amounts of capital that give them insanely long runways (eg. Snapchat has raised $850m in 7 rounds over just 3 years). There will definitely be another tech bubble burst but I don’t think it will really start until some other dramatic event happens first (such as interest rates finally rising).

All really good points Jason. You know your stuff. Here is an example of why M&A in the tech industry is worrisome to me — and may take years to unwind —

“Nokia’s takeover of Alcatel-Lucent will help it better take on mobile leader Sweden’s Ericsson and low-cost powerhouse China’s Huawei [HWT.UL] amid weak growth prospects in the telecom gear industry.”

Key words “weak growth”. I doubt even Apple feels real secure with mobile hence the watch and repositioning of the brand as luxury. What do I know? These people are so sophisticated at the shell game they may keep it going far longer that one would think or they may even create the perception that this is a new reality. However, my savvy business friends seem to be convinced that it is a law of nature that what goes up too much — will come down.

Great observations here, as usual. Your comment about parents going into full spending mode after a child arrives is quite true. As I approach 30, many of my friends are going from living in smaller apartments and living pretty simply to feeling pressure to buy a home and max out their credit cards to create designer nurseries for their new little ones. Why as a culture do we believe that having more stuff is the recipe for good parenting and a decent, memorable childhood? Infants aren’t at a stage to appreciate a beautiful nursery, so who cares? It baffles me.

Then there’s the issue of child care. It adds up so quickly. You have to figure it’s at least $800/mo. per child, if you want decent child care. It’s probably more $$$ in L.A. than Denver, but still…it puts a dent in a family’s budget really fast.

That chart underestimates child care costs.

Childcare for 0 – 2 year olds center based program ranges from $1100- $1800 per month, with two children (twins or Irish twins) you get a 10% discount on the second child.

It drops by about 30-40% when the child hits 2 years old, so $650 – $1200 monthly. Then you still have to pay for afterschool care, camps, etc… when the kid gets to school age. Then the schools (yes, even public) have there hands out for an additional $2-3 K per child each year as well).

I have a 1st grader and a set of two year old twins- I pay $34,000 a year in child care (not including babysitting), only $5500 is pre-tax with my flex spend account.

Between that and my rent $2400×12 ($28,800 Annually) plus gas & elec, That is $65K roughly I need post tax ($86,000 Pre tax) dollars I need. I haven’t eaten, paid for insurance, cars, travel, or bought clothes yet!

LA is very very very expensive when you have children.

“LA is very very very expensive when you have children.”

Agreed that the costs for raising children to generally accepted standards in SoCal today are being underestimated by the chart. That the expense is so high is due to a natural feedback mechanism informing the participants that the system is seeking a balance through pushing back on births.

Where on earth are you spending that much on daycare? Most places charge $150 to $200 a week

Infant Care with extended care hours is minimum $270 a week (that would be with no food provided), start adding in food and amenities quickly becomes $400+ weekly. State law says a when children under 2 years of old are being cared for there can be no more than a 3 child to one care giver ratio. Drives up the costs quickly.

We we had children when we could afford it, the Twins kick us in the n#$*s.

What kind of extended hours are you dealing with – do you and your spouse not work 8-5?

Most people don’t need extended hours. For an infant, you should be able to find full-time care for $700-$1,000 a month. $34k per year sounds like a gold-plated plan to me – you could hire a live-in babysitter for that.

Kids are expensive for sure when both spouses need to work but if you get creative with maternity leave, extended family and discounts, you can drastically reduce the hit.

Those are pretty high child care costs. I have two children in all day care…they run me $750 a month each. I have a kid in elementary school…he costs about $250 a month for before and after school care. So about $1750 a month. Once all the kids are in public school…it really won’t be too bad.

Seems like a pretty simple math decision to me. You spend $86k on child care, then I assume you and your wife EACH make abundantly more than $86k? If not, then why are you working? Whoever is making less than $86k should just stay home take care of the kids and quality of life for everyone would be better. However, if you EACH make more than $86k abundantly, then you should be in such a good financial position that you shouldn’t be renting anyway.

I’m with Mr. SmithinKtown. My infant in a daycare near DTLA is $1250/month (when I researched, all comparable daycares in the area cost the same or more) and my 2 year toddler is in preschool at about $900/month. Husband and I both work full day jobs so this is not extended hours for us. I’m considering moving the baby to a nanny which would be $15/hour, so that would be roughly $2700/month just for the infant. Irregardless, we are definitely paying more in childcare each month than in rent. We are fortunate to earn enough to afford to pay this amount, but it does affect our savings for a future house. I do get jealous of those who have family around to help assist in childcare, since it is so expensive.

Do you live to work or do you work to live? If you work to live, maybe this isn’t the right place for you I mean $2700 a month so that you can rent? Why not do what people in the rest of the country do – they move to a town where wages are probably lower but the cost of living is exponentially lower. I remember being in my 20’s making six figures but couldn’t buy a house but my buddies living in the midwest making half as much as i did owning MULTIPLE properties and eventually becoming wealthy due to stacking up assets and investments. That’s when it dawned on me that I was looking at the salary at face value in $$ but it means nothing when weighing it against the cost of living. For a single person it makes sense because living anywhere can be done frugally when you’re just one person. A family cannot do the same.

it’s more cost effective for my sister to be a stay at home mom because it would cost more for childcare then what she would earn in a job since she is not a STEM employee. plus her baby would be more well adjusted

I’m in the same boat. If I choose to work full-time after having children, my parents can help a little bit, but we’d still pay HALF of my take-home pay (after taxes and insurance are deducted) just for me to go back to work five days a week. It makes more sense for some parents to stay home at least part-time because the benefits of working the extra hours are totally negated by the cost of childcare. I’ve heard that it also makes more sense to keep kids out of a daycare facility, if possible, because children tend to get sick more often, passing it to their parents and forcing mom and dad to miss a lot of work anyway.

“Infants aren’t at a stage to appreciate a beautiful nursery, so who cares? It baffles me.”

It’s because having children continues to become less about what the child means to the world and more about the parent’s continued existence in many cases.

Having children is sort of the ultimate selfish act. Not that being selfish is inherently bad, but it helps to have proper perspective. In an age where the requirement for exponential increase in human population is being outmoded by technological advance, most are unable to parse the actual need for children with the basic biological drive to reproduce.

Of course, the largest beneficiaries of the current status quo must have increasing real population levels to fuel the “growth” model they so desperately need. The consumerism inherent in the nursery example you gave feeds right into it.

People have called me selfish for not wanting children. Selfish for not sharing what little wealth I have. Ah Yeahhhhh. I don’t make 6 figures. I can’t afford the lifestyle I want for my family. I don’t wanna lower my standard of living and live like a Mexican

Technology has not outmoded the need to reproduce. What are you envisioning – some immortality serum that eliminates the need to have children to keep the human race going?

As long as people age and die, there will be a need for young people to replace them.

And there is a social need that goes well beyond biological urges. I believe having children is one of the most effective psychological motivators to push the average young Joe from the default inclination of near total consumption to capital formation. It is the desire to see future generations (usually your own) prosper that elongates time preference.

Keynes’ inflation-enabling shrug – in the long run we’re all dead – has a mighty counter in committed parenthood.

The phrase I used “is being outmoded” is not the same as “outmoded the need” as if it was suggested that the need will be completely eliminated.

This has nothing to do with what could be envisioned and everything to do with what is occurring, which is that the natural environment is pushing back on the human birth rate in order to achieve a balance.

Immortality is beside the point. Technological advances increasingly continue to confer benefits to the human species which lessons the need for population multiplication in order to maintain the species, therefore the replacement rate slows as exponentially inverse to exponential increase.

The idea that reproducing slows down one’s consumption doesn’t negate the point due to increased consumption by offspring, especially so in an exponentially increasing population. The same is said for time preference, as it confers no net benefit in the aggregate.

Siggy: “which lessons the need for population multiplication”

It’s “lessens” and not “lessons.”

Lessen — to decrease

Lesson — a unit of instruction

@ Siggy – the birth rate has slowed to well below the replacement rate among most developed countries. I can see how automation, longer life spans and immigration have mitigated some of the damage, but I think you are crediting postive (technology) and neutral (the natural environment) factors for what is actually a self-destructive cultural phenomenon.

And reproduction doesn’t just slow down consumption, it increases production. Married men & women with kids make substantially more than their unmarried, childless peers. And I’d wager they have higher savings rates too, though I haven’t seen a study that tackles that question directly.

And while children obviously increase consumption, the capital set aside for them isn’t just lying under the mattress awaiting future consumption – it’s available for use in increasing productivity. Time preference does not disappear in the aggregate.

It would seem to me that an aging population that outnumbers its youth creates a greater consumption imbalance anyways, as the current social security and medicare dilemmas indicate.

— It’s “lessens†and not “lessons.â€

So there was a spelling error, big deal (and my computer’s autocorrect may have done that anyhow). Anything regarding the topic at hand you care to discuss?

“@ Siggy – the birth rate has slowed to well below the replacement rate among most developed countries. I can see how automation, longer life spans and immigration have mitigated some of the damage, but I think you are crediting postive (technology) and neutral (the natural environment) factors for what is actually a self-destructive cultural phenomenon.

And reproduction doesn’t just slow down consumption, it increases production. Married men & women with kids make substantially more than their unmarried, childless peers. And I’d wager they have higher savings rates too, though I haven’t seen a study that tackles that question directly.

And while children obviously increase consumption, the capital set aside for them isn’t just lying under the mattress awaiting future consumption – it’s available for use in increasing productivity. Time preference does not disappear in the aggregate.

It would seem to me that an aging population that outnumbers its youth creates a greater consumption imbalance anyways, as the current social security and medicare dilemmas indicate.”

Anyone can argue the subjective moral merits but the reality is that less preference for having children is becoming increasingly commonplace for debatable reasons. What parenting or marriage may or may not bring to the table is irrelevant to stating the observation of what is actually occurring.

“People have called me selfish for not wanting children. Selfish for not sharing what little wealth I have. Ah Yeahhhhh. I don’t make 6 figures. I can’t afford the lifestyle I want for my family. I don’t wanna lower my standard of living and live like a Mexican.”

After reading of people’s circumstances here, living like a Mexican seems pretty good! Family members who have know your child since they were born willing to babysit for a fraction of these prices. The money saved can go to yearly passes at Disneyland. A school trip to Sacramento. And a trip to visit relatives in Texas. Two blue collar parents can easily bring in $120,000 and buy a nice place in Pico Rivera or West Covina when prices aren’t sky high like today. I feel sorry for all the East Coast immigrants who come here with what seems to be a quasi-liberal and classist world view. I’m glad I grew up in an ethnically diverse and mostly immigrant part of Los Angeles where having a (Mexican) friend with a Honda Civic was the best thing ever because it meant no more bus pass. Cheers.

This housing market is really pissing me off! I sold my house in the San Francisco Bay Area last year after buying it in 2012. Made a decent profit of 150K. Kept it for 2 years to avoid capital gains. My wife and I sold it to move to a more kid friendly city with more flat land. We soon discovered crapshack after crapshack that was way over priced and then had 5 idiots over bidding for said crapshack! We decided to rent instead of overpaying for a home we really didn’t like anyways. We prayed the housing market would start the same descent which happened in 2007.

We’ve been here almost 8 months now and it seems home prices keep going up. My wife and I make 250K combined and can’t even fathom buying a house we like in any decent area of the Bay Area. With rent, childcare costs (nanny for baby and preschool for 3 year old), food, gas, etc we can hardly save much. If we bought one of these overpriced crapshacks we would be stretched so thin it wouldn’t even be funny.

All I can wonder is who the hell is buying all these tiny houses for 1.5 million – 2.5 million?? Its getting sickening listening to all my friends talk about how much money their houses have gone up in such a short time, while I am renting. In my parents neighborhood in the suburbs, a 4000 sq ft home sold last year for 1.8 million which seemed like a lot. She just told me another house that is the same model just listed for 2.5 million and there are buyers lined up?!?!? WTF?!?!?!

How the hell can there be so many buyers for 2.5 million dollar homes? Is everyone getting rich off company stock options except me?? The mortgage payment on a 2.5 million dollar home is crazy. What am I missing?

Then I think about all the first time home buyers, who are in their mid 20-30’s. If they are making 250K combined (which is a decent household income), how can they ever buy a home in the San Francisco Bay Area if the starting price for a crapshack is 1 million?

I feel your pain. Your story is nearly identical to mine, except I’m in LA.

BAY AREA SLAVE,KTOWN, & WARREN CELL

I feel your pain and anger. We live in east Ventura County. We sold our luxury hilltop view home and the bubble made us renters for years. We have a medical vicissitude and a forced retirement (Husband). We saved and hoarded all our dough, and could not afford an $800K fixer. We had to wait out the market, even being able to do a cash & close. Property Tax liability was beyond our reach at the nosebleed prices. F…ing absurdly priced homes, that needed everything.

In 2012 the market finally made a little sense (but still $150K over what we purchased was worth). We had to gut it. We own a piano and higher end furnishing, so we had to move into a fairly “move-in ready” cr*pshack. We paid almost the same price for 1/2 the sq ft, and our luxury home was new construction in 1998, not a circa 1960’s pos.

I am so livid about the last 12 years, I could scream. The banksters, the REIC, and the politicians are money hungry pigs. We could be traveling, if we didn’t have to overpay.

We’re older and are now political atheists. This country is a mere shadow of its’ former self.

Hey Keepin it Real, My eastern Ventura County experience is kinda the flip side of yours.

Bought a 1200sf starter crapshack in ’91 and, even for just my wife and me with no kids, felt pretty damned cramped by the early 2000’s. Decided to buy a bigger place in 2003 and then Bubble 1.0 took off and we sat it out. Had some decent opportunities to buy after the crash in the 2011-2014 time frame, but by then we had gotten close enough to retirement (and comfortable with our neighborhood) that we just said “F* it” and decided to put our money into a comfy 2nd home out of state.

So in summary we did OK financially, but the cost of being careful not to jump into the SoCal housing mania is that we’ll NEVER buy that big hunk of suburban splendor we once lusted after. That’s the reality for many here to consider. Life circumstances eventually change and if you wait for long enough it may simply mean you’ll never buy the place you want in this area.

Was that the right choice for us? Hard to say. We saved/invested aggressively for many years and now have lots of savings, a payed off mortgage and minimal housing costs allowing us to retire early. But we still struggle with limited room for storage and guests and would have gotten a lot of use out of bigger house had we bought one years ago. Only you can choose which side of the trade off makes the most sense for you.

@BayAreaSlave:

Ha, join the club. We don’t make nearly $250k, but we are renting currently after moving out of our owned condo for space purposes. Although we still own the condo (it’s rented), we thought we would only be renting ourselves for a few months to a year, the time it would take us to find something we would want to buy. This was early 2013. You know the story after that- prices got ridiculous. So we’re stuck renting, too, unless we want to move into our old condo (which I don’t) or overpay for something we don’t even like. If you keep your expenses reasonable, it would seem you should be able to save a bare minimum of $75k per year with two kids ($100k+ if you’re really about saving). If you can’t save at least $75k/yr while making $250k/yr, then there’s probably room for some serious budgeting there.

@Keeping It Real:

You had a fairly new house built in 1998 that you apparently liked and you sold it? Ok…. Even with a medical issue and a forced retirement, if you had a bunch of cash lying around that could have been used to pay for the house, that just doesn’t make sense.

Just a little patience, yaaahhh, just a little patience, yaaaahhh

Guns and Roses…listen to it….it will help…

Sometimes cons take a long time to figure out….Maddoff, Libor and FX rigging etc…

this is a con run by the fed, banks, PE, FASB, ratings, govt. etc…

now inflation is needed to sustain it…watch for this meme…

Buying a home where water may not flow is insane….let the hopium buyers buy…drugs where out…

why worry about what others say, what they have etc…

“•Americans’ retirement know-how rates an ‘F’

Pamela Sandy, CEO and founder of Confiance, a financial advisory firm, points to other causes as well. Her clients are contending with such things as student loans, the cost of child care and the need to help family members. “Do I think people are just out there being frivolous? It is damn expensive to live in the country today, and it’s damn expensive to raise kids, and that’s just the bottom line,” she said.”

http://www.nbcnews.com/business/retirement/one-third-high-earners-are-living-paycheck-paycheck-n342726

BayAreaSlave: I’m guessing you probably bought a 850k home in 2012 and flipped it for about 1m in 2 years and that’s how you cleared $150k?

Just think there are other people that may have purchased in 2000 or 2010 and are cashing out for much more than $150k profit and are also using that to move-up.

$250k / year buying a $1m home seems do-able. $250k/yr + $500k equity makes a 1.5m dollar do-able as well.

With your extra $150k you’re pricing out new home buyers without equity just as other people are pricing you out of the next level up.

You made a big mistake in CA… never try to time the peak of the housing market. Once you are in and have the equity just feel fortunate you are paying less than rent per month.

I’ve seen many friends get burned doing this over the years… and very very few time it right.

Bay Area sees 100% up cycles for 6-8 years… then 2-3 years down 10% during recessions… it’s just not worth playing that casino game.

Trying to time the market in California is totally unadvisable. There may have been a handful of lucky people who sold in 2007 and bought again in 2011. In the grand scheme of things, they probably didn’t make much money if any when factoring in the costs involved (selling, moving, renting, buying, moving, loss of Prop 13 basis, etc). If you are anywhere close to rental parity, it makes sense to buy. In the year 2030, your 2015 rental parity payment is going to be looking great.

“If you are anywhere close to rental parity, it makes sense to buy.”

Duh! Who wouldn’t buy then?! The problem is that many or most prices in So Cal are out of whack with rental parity.

The same couldn’t be said a few years ago. Many properties were at or below rental parity. Almost everybody had a chance to buy until the frenzy ensued. I remember looking at properties in the summer/fall of 2011. Great houses in nice neighborhoods, prices 30% below what you see today and houses would sit for 2 or 3 months before selling. The buyers were in total control, but that changed in a blink of an eye. Nobody could have predicted these events. In hindsight, the lesson is buy when at or below rental parity in socal.

…and the rental parity meme is always predicated on nominal figures.

“just feel fortunate you are paying less than rent per month”

what planet are you on? or are you smoking some good OG? i am renting the house i’m in right now for about 1/3 the price it would cost to buy.

and to all the rest, I’ve been wondering the same thing, where are all the people getting all this money to buy these insanely priced homes???????????????? it’s madness!!

To ‘interesting’ – good for you. Let’s sit it out, in some comfort, and wait for the house price crash.

Below is a very good entry.. a key-reference-point I keep coming back to, by Doc from January 2015… I’m like “The Memory Man” when it comes to Doc’s entries. I wait for the stage there are fewer buyers, banks have just about righted themselves, smoothed out their overall position, to position themselves for future correction, then fresh volume lending, against prime houses.

Main point I know, banks don’t make any money when other investors/owners hold the majority of the equity without mortgage debt.

_____

Doc: […]Volume is low because the qualified pool of buyers is low. You have a small amount of inventory on the market and those itching to commit to a 30-year mortgage have to contend with the ugly options available. Wall Street was largely interested in turning homes into rentals. Given current prices and local area incomes, that play got weak in 2013 with massive movements out in 2014. After all, rent can only be hiked to a point where local area incomes can support the payment. This is net income and not leverage based buying where interest rates can inflate the underlying cost of an item like housing.

http://www.doctorhousingbubble.com/mortgage-applications-decade-lows-mortgage-rates-2015/

You wonder who’s buying those expensive homes and putting down huge cash or all cash? It’s mostly people who made huge money in the ultra hot Chinese market, have snuck their cash out of the country, and are now seeking safe haven in US real estate.

Buying a home now, unless you are super wealthy (and even then it is a crap shoot), is a sure bet that you will live bent over on Worry Lane with a lot more government gangsters having access to your wallet. Rent and stay nimble, its a herd thinning and Uncle Sammy left the country long ago.

The Scamerican dream is the Scamerican nightmare, but it is not just the housing sector, it is the entire economy. People refuse to look at the root problem, that governments at all levels have been hijacked and are immoral and murderous at all levels. We have been bombarded with a new menticide but we still live in the old. Failure to see the shift from good old fashioned Vanilla Greed for Profit (Evilism) to Pernicious Greed for Destruction (Xtrevilism) is a major stumbling block, I’m a long time activist and less optimistic each day. I have never seen people so cowed, fearful, and on their knees before.

If you get it you can vent on the poll. Stay strong, work to end intentionally created homelessness and you will see improvement.

http://saintaugdog.com/sadarticles/murderissue.html

Warren.

Most party loyalists (Ds,Rs, and Independents, like to mentally mast*rbate in the well thought out propaganda. The Banks & Lobbyists own this country. The BIS owns the Fed Reserve.

We just got a VERY SMALL car loan. 1.49% APR. People think that’s great. Scary dumb people breath in this world. When I mention it’s a symptom, not a good thing, I get “the look”. As someone on another Blog says “free candy cr*p’in unicorns for everyone”. I’m a lady, but I like truthiness.

Come on, Doctor, we’ve seen you time and time again reference a 20% down payment like it’s the industry standard. I know it used to be. But today, how many SF home purchasers actually show up with a 20% down payment?

Given that all cash purchases is still greater than 25% in SF Bay Area, I think the number of sales with less than 20% down is small.

20% is actually a small down payment in SF and LA.

Try winning a bidding war with a low down payment

When I stand at the top of Palos Verdes and look out over the L.A. Basin, there are times that I can’t help but think that I’m looking at the next Detroit. The various governments are disconnected and focused more on feel-good leftist and P.C. posturings than the hard work of actually taking care of what they have whilst planning ahead pragmatically to construct the infrastructure that will necessary in a timely and cost-efficient manner. Businesses are fleeing overall, and service industries don’t make you rich. The “Haves” look at taxes, regulations and the price of housing and then begin to consider other states. (Or they game the system by declaring, say, Nevada as a primary residence.) This is all helped along as crime oozes ever closer to the supposedly “safe” beach cities. (A recent rape in Manhattan Beach and attempted rapes in Redondo come to mind here.)

Really, the whole thing is semi-rotten, and all it needs is a good kick to cause a collapse or reset. Take away the water – already happening – the power and gasoline, add a good earthquake or several, and then watch what happens. It will be the L.A. riots all over again, only this time by a factor of 100 as there is no cultural cohesion and the majority population is seemingly the have-nots and takers that Bill Bonner refers to as “Zombies.” No money, no jobs, no sense of involvement in system and a disarmed population equals ‘Devils Night’ writ very, very large.

Wish it wasn’t the case, but that’s where it’s heading: a reset if you’re lucky, and a collapse if you’re not.

______________________

@Tolucatom and Jason

Consolidation within any industry or retail segment is always a sign of trouble. It’s done with debt, and ever increasing debt loads are a straight line to bankruptcy. Look at the history of M&As and you’ll see the company always ends up in the courts.

Just a thought.

VicB3

Excellent post. Thank you.

Yes, that’s what I was trying to say but didn’t stop to think about the debt aspect. Thx.

Great post

for that wonderland you so much pray for is only few hours away by plane.take for example Kansas,Florida, Texas, Arizona, Mississippi, Louisiana, Arkansas i know i’m forgetting some of the states whose politics would be much in your favor.but then again standing on top of PV is really not so bad.

One of the things that occurred to me lately with LA in particular is if you take away the entertainment industry and the huge amount of money that brings in there isn’t much left industry wise. LA itself isn’t all that appealing – certainly not with the overpopulation, traffic, and general third world feel every few blocks. If aliens took away the self proclaimed cultural elites in the blink of an eye it would be quite a different place, with much less money circulating/chasing ostentatious nonsense.

Glad I live thousands of miles away from that hell hole.

Junior, Los Angeles is a tale of two cities. The third world shithole you talk about exists and truly sucks, this is the majority of the city. Then you have the wealthy areas close to the beach. Mansions, beautiful women, perfect weather, etc. If you can afford that part of town…it sure is hard to beat.

“ostentatious nonsense”

“Mansions, beautiful women, perfect weather, etc. If you can afford that part of town…it sure is hard to beat.”

Case in point.

Sorry guys, I am going to have to disagree with you here. The climate, scenic natural beauty, lifestyle, etc in certain parts of California is unmatched anywhere. This is the premium you are paying for. You can certainly disagree, but you are in the minority.

respectfully disagree. LA is becoming less of a pure entertainment hub over time as it diversifies.

It’s completely subjective. The idea of being in the minority or majority on this issue is a red herring.

You should just stick to whining in the basement. If you tried looking up the facts, LA is the THIRD LARGEST ECONOMIC GDP CITY IN THE *** WORLD ***, yet you suspect that it’s ALL entertainment driving almost 1 TRILLION in yearly GDP? Really? Are you in first semester community college that drove you to that much wisdom? Los Angeles by itself has a larger GDP than MOST COUNTRIES and is the same GDP as the ENTIRE FRIGGIN COUNTRY of ITALY and LARGER than ALL OF SAUDI ARABIA!!! LA is the LARGEST MANUFACTURING CITY IN THE ENTIRE COUNTRY. Yet you think it’s ENTERTAINMENT? That is literally the single most ignorant thing I’ve ever heard on any internet thread ever. Congratulations, you take the cake buddy.

I’m not saying California doesn’t have beautiful areas or doesn’t have nice weather, but I personally think the vast vast majority of LA isn’t one of those beautiful areas. The few nice places in LA are like a hollywood set – a facade which would quickly blow away without water from elsewhere. If you think otherwise, you haven’t been to Australia, Cote D’Azur, Hawaii, or a myriad of other places or perhaps have rose colored glasses that only work in the golden (shower) state.

Also, in regards to the entertainment industry being less concentrated in LA than years previous, I have read that as well but I think for residence purposes the majority involved with the industry still maintain a home there. I think its probably necessary for marketing oneself and making those connections/deals to further one’s career. You have a critical mass of industry types that requires one to be in that area, much like silicon valley for internet start ups.

10% of the LA population is in manufacturing, which is low skilled, low wage jobs like those found in the garment district – something to occupy the third world populace. Junior is correct, take away the entertainment industry and 2/3 of your vaunted GDP evaporates overnight.

Comparing LA to Italy? Italy makes things people the world over desire – art, food, fashion, cars. Enjoy your traffic jams, pollution and overcrowding.

Once upon a time there were lots of small towns and cities all across the US. “Fly over country” was where most people lived. New York, Chicago and a few other places became big cities and skyscrapers were built because if you wanted to do business you had to be in the Central Business District so people could physically meet and documents be physically delivered by bicycle couriers. It took 50 hours to get from Chicago to SF or LA by rail and air travel was expensive, exotic and not really that safe in the era of the DC-7 and Lockheed Constellation. The physical remoteness of the West Coast limited population growth and it took WW2 and the interstate highway system to turn LA into a megalopolis though San Francisco stayed a more provincial town for a quarter century more.

Since the 1960’s and 70’s, vast areas of the US interior have become depopulated as deindustrialization has emptied out middling interior cities though immigration has masked this to some extent. Buffalo and Flint may have lost their industry but they have plenty of third world immigrants willing to create an economy of sorts based on… more immigration and economic arbitrage between the first and third worlds ( which also powers much of the economy of Miami, LA and New York). It isn’t sustainable of course as the real estate market is making clear.

Years ago, at UC Berkeley, I took an economics class that discussed the underlying factors in urban real estate. One of the more fascinating topics were western ‘boom towns’. Our professor pointed out that the wealth these towns generated could be disposed of in three ways. It could be exported, sequestered or inflated away and all three processes often happened in the West. The Comstock Lode made mining millionaires who exported the wealth back to San Francisco or sequestered it into short lived mansions in Nevada or it was inflated away in whorehouses and saloons in the mining camps. We are experiencing something like that today as the FIRE economy sucks the wealth out of Los Angeles real estate and will leave a dying boom town behind.

I’ve been reading this blog for 7 years now. I started reading in 2007 and actually avoided buying at the time because of it. Thanks (I think). Fast forward to 2014 and I finally bought a condo in Studio City. I certainly didn’t get bottom of the market prices but the markets up a bit in the last year I suppose. What put me over the edge was the cost of rent. My rent on a one bedroom apartment went to $1800 a month from $1250 in two years. The match worked all of a sudden and I’m happy at the very least to know Im locked in and dont have to worry about my rent going higher and higher. I feel for those people with families who cant even sniff a decent neighborhood. I think the best thing to do is just move out of state.

Your costs are still subject to the whims of the world. Assessments, repairs, replacement costs, transaction costs, taxes, and so on…

When the day comes to sell, you’ll be selling into the same market realities that you’ll be seeking a replacement from.

“When the day comes to sell, you’ll be selling into the same market realities that you’ll be seeking a replacement from.”

Not necessarily… There is the option of buying a new home when the market has tanked and retaining your existing home as a rental. Being a landlord isn’t for everyone, but it certainly is an option to avoid being subject to the circumstance you mention.

“Not necessarily… There is the option of buying a new home when the market has tanked and retaining your existing home as a rental. Being a landlord isn’t for everyone, but it certainly is an option to avoid being subject to the circumstance you mention.”

I was referring to the scenario of selling into and purchasing back into an environment having a higher price level with the assumption that comparable real rents always go up. My point being that there is no such thing as a “lock-in” vs renting when purchasing because not all costs are fixed, including replacement cost.

Retaining the original as a rental and purchasing a replacement in a lower market price level environment still doesn’t avoid the circumstance of non-fixed costs.

But examining that scenario further…

If comparable real rents go down, said “lock-in” is immediately invalidated.

If comparable real rents go up, it’s offset by the degree of loss from the original cost basis of the property after accounting for net operating profit or loss over the holding period. In other words, if the goal is to avoid a loss when selling due to a market “tank” then this can be a useful strategy, although the “lock-in” conferred by this is likely not of the variety which most people would consider advantageous.

It makes more sense to wait for purchasing when the market price level is lower and then one wouldn’t be “locked-in” to having to be a landlord.

Siggy, I really like most of your posts. But I think you’re over-complicating things here. In a nutshell, it’s very simple:

Step 1: Buy house.

Step 2: Save for new house

Step 3: Buy another house, retain original as rental

Step 4: Enjoy your paid-off (and/or significantly appreciated) house courtesy of your tenants. Sell whenever is advantageous for you.

Obviously, you would need to ensure you have a positive monthly cash flow on the rental, or else you’re losing money. If you get a good tenant (which isn’t all that difficult if you screen tenants well), the tenant is effectively paying off the mortgage for you. Yes, rents could decrease (unlikely to any large extent in So Cal), and you might have an unexpected expense at some point. But overall, this is a very simple strategy that will make you money over time, while affording you the ability to time the market if you wish. I don’t know about everyone else, but that is advantageous to me. Like I said, being a landlord isn’t for everyone, but it’s an option. It’s worked out well just fine for me so far (the landlord part anyway; we were too naïve to buy an additional place in 2011 and 2012 despite multiple opportunities; we won’t make that mistake again).

Responder, we’re debating the concept of the “lock-in”, no? What you’re referring to is a strategy that doesn’t eliminate non-fixed costs. That’s what OP was conferring – that by purchasing, one can “lock-in” to the safety of fixed living expense versus leasing.

I was really only debating the statement, “when the day comes to sell, you’ll be selling into the same market realities that you’ll be seeking a replacement from†more or less independent of the lock-in concept.

was really only debating the statement, “when the day comes to sell, you’ll be selling into the same market realities that you’ll be seeking a replacement from†more or less independent of the lock-in concept.

Okay I see where you’re coming from although hardly anyone wants to be an accidental landlord by choice. Been there, it’s still a turd sandwich.

“…hardly anyone wants to be an accidental landlord by choice. Been there, it’s still a turd sandwich.”

For me, it’s not accidental at all. I plan on keeping all of the houses I purchase and renting them out when I move on to the next place. If I get sick of being a landlord, I will either hire a property management company or sell the rental. As long as the rental income covers the mortgage or better, it’s not really costing much other than some time/frustration here and there. Perhaps there’s opportunity cost, but you could argue for/against that all day.

A combination of real estate, investments and cash seems like a nice mix to finance retirement in 20-30 years (hopefully less).

I’m glad Doc has addressed a trend in the comments of recent weeks/months re suggestions of “permanent plateau / could be paying down a mortgage instead of dead-money rent.”

As the saying goes… “It’s the price we pay for our instrument. We save when the economy is good and make our asset purchases when it’s bad.” Together with need to afford a repairs/a life/raise a family, rather than just overreach to buy a house/mortgage at any high price.

_____

As the EPI data shows, many are walking on a very fine line and even a modest recession is enough to send many over the edge. People suddenly take this as a sign of never buying a home. There is a big difference between careful consideration and shelling out $700,000 for a stucco box that looks like a child’s LEGO design.

Years ago in college I took a class that dealt with urban economics. One of the fascinating topics was the economics of ‘boom towns’ in the West. The professor pointed out that the wealth these towns generated was either ‘exported’, sequestered or inflated away.

Recalling this lesson today one can see that coastal California is very much like a 19th century boomtown with its wealth slowly being squandered exactlyin the same fashion as the mining towns of Nevada. Much of the real estate ‘wealth’ is being exported to the global “FIRE” industry. Some of the rest is being ‘sequestered’ in luxury mansions owned by those at the top of the financial pyramid and, just like the saloons and whorehouses of Virginia City, the rest is being ‘inflated away’ as the cost of local goods and services soar.

Los Angeles isn’t that different than Minot, North Dakota, where Bakken oil allows local workers to make $100,000 salaries but if local hamburger flippers make $15-20 per hour and a single wide mobile home costs $2000 per month to rent are they any better off than if they made $50,000 per year somewhere else.

Possibly – because if you make $100k and expenses are $50k, you bank 1 year of expense a year ($50k). If you were in a cheaper area making $80k and expenses are $40k, you also bank 1 year of expense a year ($40k). However, if you save for 4 years then move to the cheaper area, you now have 5 years of expenses saved up ($200k) versus the local’s 4 years ($160k). The person making more will find it more affordable visiting outside his/her local area. Making more gives you more optionality provided you pull in the same net amount after expenses.

that’s because the big banks are securitizing the rent rolls. They are securitizing them and then I’m sure hedging their bets against them just like they did with the housing market back during the last bubble prior to the collapse of 2008. The banks have already made their 30% broker fees off the derivatized securitized debt that extends out god knows how long? And when it pops the taxpayers will bail them out cuz they’re just too big to fail and jail.

“House-hunting? Hurry. Homes in California are moving faster” — I had to post this — do note the words “open house”. “Shil” Perhaps an insider joke and a message by someone at odds with the author?

http://www.latimes.com/business/la-fi-report-says-cal-markets-are-nations-fastest-20150414-story.html

“Real estate listings website Trulia crunched the numbers on how long home listings are staying on their site and found that only 43% of houses that were on the market in Los Angeles County in February were still up for sale in April.”

===

This statement needs much more clarification. Did these homes actually SELL? Listings get pulled for many reasons.

Some houses, townhouses, and even condos, are flying off the shelf on the Westside. Here are some properties that didn’t stay on the shelf long:

https://www.redfin.com/CA/Los-Angeles/1724-Armacost-Ave-90025/unit-A/home/74822149

And another one just like it: https://www.redfin.com/CA/Los-Angeles/1724-Armacost-Ave-90025/unit-B/home/74833347

https://www.redfin.com/CA/Santa-Monica/1253-11th-St-90401/unit-5/home/6773812

https://www.redfin.com/CA/Santa-Monica/948-16th-St-90403/unit-105/home/6772232

https://www.redfin.com/CA/Los-Angeles/1227-Granville-Ave-90025/unit-3/home/6759032

The Westside is HOT.

It’s so HOT that these properties aren’t having the same luck.

https://www.redfin.com/CA/Venice/915-Nowita-Pl-90291/home/6743360#property-history

https://www.redfin.com/CA/Los-Angeles/3782-Boise-Ave-90066/home/6747178#property-history

https://www.redfin.com/CA/Venice/645-Santa-Clara-Ave-90291/home/6742372#property-history

https://www.redfin.com/CA/Santa-Monica/1343-Palisades-Beach-Rd-90401/home/6779985#property-history

https://www.redfin.com/CA/Los-Angeles/4021-Marcasel-Ave-90066/home/6738292#property-history

https://www.redfin.com/CA/Los-Angeles/4254-Beethoven-St-90066/home/6736357#property-history

https://www.redfin.com/CA/Culver-City/5041-Purdue-Ave-90230/home/6728020#property-history

https://www.redfin.com/CA/Los-Angeles/3223-Cardiff-Ave-90034/home/6792708#property-history

HOT!

a million fucking dollars!!! epic facepalm!!!

The Westside is indeed HOT. The properties I list are all under a million dollars. Most of the properties you list are over a million. Sure, a property has to be reasonably priced. But if it is, it’ll sell.

One of your properties is priced under a million, but it’s East of the 405 freeway, and right next to it.

And one of the houses you list is currently “Accepting Backup Offers.” The one right on Santa Monica Beach, which asked for nearly $5.5 million. That’s a unique property that can naturally attract only a small pool of buyers.

Another quick sample, this time < $1MM, of varying type, west of the 405 and not right next to it…

Any other criteria you'd like to add? Perhaps some spell checking?

https://www.redfin.com/CA/Los-Angeles/12747-Venice-Blvd-90066/home/6747276#property-history

https://www.redfin.com/CA/Los-Angeles/12747-Venice-Blvd-90066/home/6747276#property-history

https://www.redfin.com/CA/Los-Angeles/12747-Venice-Blvd-90066/home/6747276#property-history

https://www.redfin.com/CA/Los-Angeles/12747-Venice-Blvd-90066/home/6747276#property-history

https://www.redfin.com/CA/Marina-Del-Rey/13600-Marina-Pointe-Dr-90292/unit-404/home/8105372#property-history

https://www.redfin.com/CA/Pacific-Palisades/17350-W-Sunset-Blvd-90272/unit-503/home/6843117#property-history

https://www.redfin.com/CA/Santa-Monica/832-Euclid-St-90403/unit-208/home/6772642#property-history

https://www.redfin.com/CA/Santa-Monica/2336-28th-St-90405/unit-A/home/6764672#property-history

https://www.redfin.com/CA/Marina-Del-Rey/13320-Beach-Ave-90292/unit-307/home/17225124#property-history

https://www.redfin.com/CA/Marina-Del-Rey/13700-Marina-Pointe-Dr-90292/unit-1214/home/8126678#property-history

https://www.redfin.com/CA/Los-Angeles/1154-S-Barrington-Ave-90049/unit-116/home/12289088#property-history

HOT!

Flying off the shelves!

Unfortunately, another set of ugly statistics that sets Los Angeles atop the heap of things to not be #1 in! Although L.A. is the most unaffordable city, it is not the only one with these problems. A relative just finally won a bidding war for a home in the Seattle area, where housing prices are also hitting the insane, Denver is in the same boat, and so are many other locations. I have that same ugly feeling now in Denver that I had driving around nice communities of Southern California in the early 2000’s. Then, it was all the swing sets going up in the backyards of high priced neighborhoods that made me think things were out of line … how could these young families afford these expensive homes … and now we know they couldn’t. Now, it is how quickly new homes priced in the $500k + are selling in Denver. My gut says few of these buyers are putting 20% down, and there will be a whole new glut of underwater mortgages and foreclosures coming!

@JN –

One only need look south of the DTC toward Castle Rock along the I-25 corridor to see 750k + homes coming on the market and stacking up like cord wood each and every week. I have been making periodic trips to the Denver area looking for an area to purchase in and have just come back to my simple apt. here in Chicago shaking my head more and more dismayed with each passing flight there. Prices are out of control – seems that a certain quiet panic has set in there.

I had heard from a builder there a while back that what is starting to happen in Denver is that folks who had been looking in very high priced areas in the center of town and in SE burbs can find something similar in size at 2/3 the cost if they drive further away by say 20 to 30 mins. I found that very telling – folks with dough looking to ‘save’ by buying further out thereby pushing prices up while inventory remains the same. And yet, even this is starting to dry up there.

I suspect as do you – given simple observations – I see it here in Chicago and mostly in the north and far west burbs – young families buying these 5, 6 700k homes – installing the swingset, driving the big ‘ol Escalade to and from soccer matches and I wonder – how do they afford this? Simple answer – they don’t. They figure they will fake it til they make it I guess. But then we know what happened just 7 short years ago.

The potemkin village facade on all this will collapse in a heap of dust – the question is when and what will be the black swan moment that causes it to happen?

The over-sized SUV thing is something I will never truly understand. I see working class people driving around huge lowered Tahoes and Yukons because it’s status thing. It’s kind of a ghetto “Look at me I have a huge car get outta my way I’m a baddass” sort of thing. These are people who make $12/hour. They replace them every 2 years. They justify it by saying that they have two whole kids and need a big car. My mom had a 1981 Honda Accord and got around fine in it with 3 kids. Escalades are another level of stupid. I remember everyone had these prior to 2007, and now they’re a funny anachronism. If the Escalade makes a comeback, we’ve re-entered idiot times.

I’m sorry you didn’t find anything in Colorado. We looked for almost 12 months last year and gave up. It’s really bad. Does everyone have a STEM career and 100k to put down on these places? I have a hard time believing it. I thought I was the only one who thought it was nuts, but I guess I’m not the only one. Best of luck to you, I hope it evens out soon.

You might be interested in checking out Dave Kranzler’s blog over at Investment Research Dynamics. I think he’s even posted in these comments a time or two. His outlook is quite skeptical on housing and he routinely mentions things he is seeing in his home market of Denver.

Now that I’m an old man, I cherish my childhood memories of how hard my mom and dad worked, and how poorly we lived. What kind of memories would I have if I had worn new clothes and rode in an Escalade like some kind of poseur prince? My early economic deprivation drove me to educate myself and develop my own successful software company.

@JN hi JN. since the crash in 09, there have been no NINJA loans and hardly any move-up buyers. Even though qualifying for a loan has become somewhat easier in the last few years, (lower FICO) no one is lending to people who dont show solid finances. That alone will probably greatly mitigate the chances of a crash. The only crash in housing I see will be if and when there is a job loss recession. We all agree the economy is running on fumes but no job loss recession in the immediate future.

I believe we are at the forefront of a crash in the outlying lower-tier areas (Paramount, Lawndale, east Gardena, Hawthorne, Inglewood, Lynwood, South Gate, Downey, etc). It seems like 75% of the listings I looked at were: pre-foreclosure, foreclosure, foreclosed or auction. The lack of inventory masks this and keeps prices from falling in those areas.

When I looked at upper mid-tier and prime areas (West LA, Brentwood, Mar Vista), all I saw were normal (non-distressed but very expensive) listings.

You can still qualify for a lot of danger with a conventional loan. A few years ago, I got qualified for a $320k mortgage with a household income of $65k and a good portion of that income volatile. A couple bad breaks and I could have been facing a PITI payment exceeding 50% of my take-home pay.

True about Denver and Seattle prices are edging up. I saw OC in 6th placed for rents and LA and San Diego in 12th and 14th. In fact a lot of other places in the US will probably go up higher than LA, OC, or San Diego in the next decades since a lot of prop 13 people are dying off and people are leaving LA, OC, and San Diego while Seattle, Denver and other places are growing even Houston Texas a lower rental market grew 10 percent in rent even international immigration is dropping somewhat as countries like Mexico, China, India and so forth become more wealthy in the next decade..

What if you’re divorced, all your money goes to other people, but you can’t leave L.A. or else you will be leaving your kids behind???

🙁

I would be looking for an established (aka rich) woman. There are plenty of them in this city.

“The report, released Thursday by SunTrust, found that even among households with incomes of $75,000 or more, roughly a third live paycheck to paycheck at least some of the time, and one-fourth of those with incomes of $100,000 or more do the same.”

http://www.nbcnews.com/business/retirement/one-third-high-earners-are-living-paycheck-paycheck-n342726

I’ve related this tale before: A colleague of mine is a bit older and makes somewhat more than I. Similarly his wife and mine are in the same profession, but his wife makes more than mine. They live in a much nicer home (almost 3 times the size of ours) in a gated community.

They also had 3 kids who they put through private schools and expensive colleges. They pull in an easy $350K+ and yet have lived paycheck-to-paycheck for a good 10 years, and will have to make up for this by grinding through to 65 to save up enough to retire. It happens at all income levels.

“They pull in an easy $350K+”

what kind of career pays that well? i’m in engineering and i make good money…………if it was 1997 but not even close to 1/2 that. And I’ve not been able to raise prices for over 2 decades.

there is no future.

“What kind of career pays that well?” Dual income professionals. He’s in Aerospace, she’s in Medicine. Even though pensions are going away the Aerospace gig in LA can still pay very well. Most senior engineers with an advanced degree and 20+ years I know are making $150-200K. Add in a wife with a professional level income (over $100K) and you do the math. The example I chose with a $350K combined income is on the high end, but $250-300K combined household income is shockingly common among this set.

While I know this is far from the LA average, there are a LOT of these people (I have to commute with thousands of them every day). While this runs counter to the unaffordability narrative emphasized here these folks CAN afford to live here and there are enough of them to sustain at least some level of legitimate RE activity in LA and its higher end suburbs.

Man, I know people who are doctors and entertainment. Probably $300k/per annum. They have a house bought for $800k which is now market comped at $1.8. They have 3 kids and live paycheck to paycheck wondering if they can afford a vacation in Europe. Crazy, crazy, crazy. This is in super prime area of LA. It’s all hat and no cattle over here mostly. All they are doing is charging their way through life hoping the market holds up until they can sell the house and move into a condo or something.

@somepeoplecallmemaurice that sounds like bad math. If they make over $300k their bring home is about $200k or ~16.7k per month. If their mortgage was $800k their monthly is a measly $3700 a month principal only assume $4500 PITI would leave $12.2k LEFTOVER monthly income. I doubt they’d blink an eye on the ability to book a trip to Europe.

I find it interesting how so many people on this board continue to question how others are able to afford these $750k-$1mln residences. Answer: higher income, savings/equity, or leverage (lending standards are getting lower but not SO low such that one can put down nothing and get a $700k loan without the income to back it up).

If the rough math is one should stick to being within 3x household income, then $250-300k household income obviously makes sense. $150k is not exactly uncommon these days; why is this so hard to believe? $200+100, $150+150, $300… however you want to slice it. It’s completely believable. Remember this is SoCal, a very desirable place to live. If a couple each only makes $50k.. then forget about it. Ask yourself how many people rent versus buy in NYC?

@foobar. Doubt all you want Foobar. It’s a simple fact and a real situation I actually know about. In LA people spend more than they make, plain and simple and with a family things get expensive. Let’s say they stretched to get into that house early on before the dollars were really rolling in. Now they are in hole and taking equity out of the house. A couple of cars, some needed upgrades to the house, an mildly outsized lifestyle…it’s easy to do in prime LA and the next thing you know, you’re paycheck to paycheck, hoping your tax bill isn’t too bad and just hanging on until the kids are out of school and you can sell the house. I’m not talking hypotheticals here, I mean a real case. Half the other people on the street are in similar boats…interest only loans on $1.75M house etc.

Good article. If it’s not already clear, very few people in the U.S. are going to be retiring come 62 or 67. If you don’t already have all of your retirement earnings mapped out and understand the kind of money you’ll need in retirement, well then you may want to go do the math. And don’t assume your stock market picks are going to return 7% every year… Also adjust for inflation.

And rent just continues to climb, even in low income Sacramento metro area. There’s a huge apartment block in my neighborhood that has 1, 2 & 3 bed apartments. Abutts the local low-income apartment block, which is a dump. Rent for these has increased 40% in the past 5 years. I don’t know who is renting them. I live in the outer Eastern suburbs of Sacramento.

And they’ve just announced plans to build another 300 “lofts” in the area, average rent $1,700 for a 2 bed. This is a bedroom community, mostly families. I have no idea who they are marketing these “lofts” to.

This country is shooting itself in the foot. The more people have to pay for a roof over their head, the less they have to spend on ANYTHING else. Not just restaurants or other service industry items, but computers, cars, clothing, education, furniture, gym memberships etc. So eventually those businesses will close up, and their employees and small business owners (the ones paying 50% of their income to rent or mortgage) will be forced to move somewhere even cheaper. Or sell the overpriced crap house they mortgaged themselves to the hilt to buy.

Amen brother…it’s ridiculous. We are moving into unhealthy territory – have for a long time. LA already is like a Venezuela or Sao Paolo with a few rich people surrounded by 3rd world poverty.

More than likely those apartments are filled with state workers, lobbyists and Section 8 renters. Sacramento is mostly dependent on big government.

I work part time as a pharmacist. Here’s what I see on a daily basis: People pull up to the pharmacy drive through in a brand new Lexus, Mercedes, Hummer, &c. And they give me their prescription insurance card and it’s CA Medicaid or one of the Medicaid spin-off plans for either them or their kids. Same deal with tall, thin model-like women with small dogs in designer handbags: ‘Here’s my welfare card, how long’s this going to take? I have somewhere important to be….’

I think there is definitely a misconception about what people really make here in LA. Not everyone is making a six figure income. There is just not enough inventory. Population is pushing this city to its limits. Freeways are about to burst. We need a shakedown, large earthquake, or financial collapse to reset things here in sunny LA.

Leave a Reply