Real Home of Genius: Irvine California and the Home Equity Withdrawal Machine. FHA Approaching the Zero Bound.

The California housing market is slowly entering phase two with the Alt-A and option ARM train quickly barreling down the tracks. Attorney General Jerry Brown should be hearing back from some of the top option ARM lenders soon since he put a November 23rd deadline on his request for additional information. This information should give us deeper insight in to what option ARM lenders have been doing to remedy the approaching tsunami. It is likely that not much has been done. Wells Fargo is attempting to remedy the issue by converting Pick-a-Pay loans to interest only loans. It is yet to be seen how well this is going to workout or what other lenders are doing.

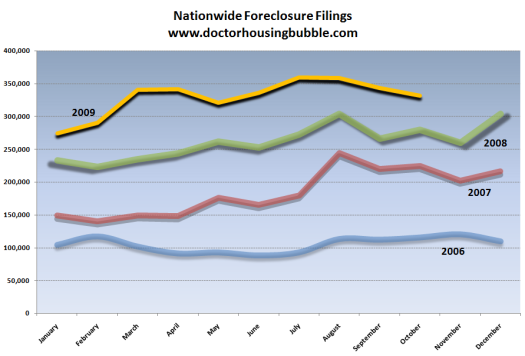

For all the recovery talk, housing is still seeing massive amounts of foreclosures. On Thursday we saw the 8th consecutive month of 300,000+ foreclosure filings:

In other words, homeowners are still losing homes at a record pace. The stock market might like this but the vast majority of Americans must be wondering why a stock market is up 60 percent when foreclosures are sky high, unemployment is still increasing, and the U.S. dollar is on a progressive state downward. The stock market is defying all rules of logic with high price to earnings ratios and ignoring market fundamentals. Yet in the last two decades, economic fundamentals were after thoughts with two enormous bubbles in technology and housing.

FHA Going Broke

FHA loans were never intended to become a giant part of the mortgage market. Don’t tell that to California. Take for example last month’s data that shows for Southern California, 36 percent of all homes purchased were financed with FHA insured loans. Since FHA only requires 3.5 percent down, FHA insured loans have replaced the Alt-A and option ARMs as the new leverage product for those with miniscule down payments. Surely this move has done wonders for the FHA right?

“(WaPo) As of Sept. 30, those reserves had an estimated value of $3.6 billion, a sharp drop from the $12.9 billion available a year earlier, the audit found. The current total represents 0.53 percent of all outstanding single-family-home loans insured by the FHA, well below the 2 percent portion set by law. This is the first time reserves have fallen under that threshold since 1994.

A year ago, the agency’s reserves equaled 3 percent of those loans.â€

Whoops. It must be stunning to find out that making low down payment loans in a recession is resulting in higher defaults. The only other examples we have of this are interest only loans, subprime, Alt-A, and option ARMs.  FHA was supposed to be different because they actually looked at W-2s? Of course the FHA doesn’t envision a scenario that we all now find to be obvious:

“Under the audit’s base scenario, the FHA can cover projected losses over 30 years and have $3.6 billion left in its reserves if home prices stabilize by the second half of 2010 and start rising about three years later. The agency’s reserves could even bounce back to the required 2 percent level by the end of fiscal 2012, the audit said.

But under the audit’s most pessimistic assumptions, the reserves would run dry in fiscal 2011, requiring a $1.6 billion cash infusion from the Treasury. This case assumes that home mortgage interest rates would plummet to about 2 percent and trigger a significant wave of refinancing. It also assumes that most of those borrowers would refinance out of FHA-backed loans, depriving the agency of insurance premiums. FHA officials said that scenario is unlikely.â€

The new strategy is more housing speculation! Wells Fargo is speculating that all those interest only loans will be in the green in a few years and the FHA is thinking that things will turn around by the middle of next year. I’m so glad that now instead of toxic mortgage lenders speculating on low down payment mortgages, we have the FHA playing this game. I described in detail why housing will be in a long winter and much of it goes beyond short-term tweaks to the system.

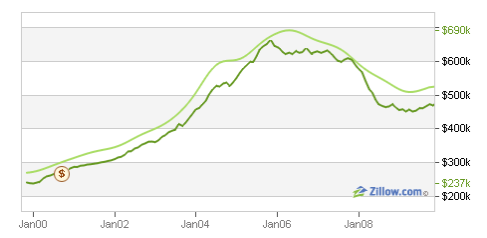

Another bust for the housing market is the home equity machine phenomenon. Never in our history have we seen so much money extracted from homes to fuel consumption. People forget that many of the options ARMs have 2nd mortgages attached to the home. Some people did not buy during the bubble yet put themselves in financial danger by refinancing their home like a piggybank. Today’s home is one of those examples.

Today we salute you Irvine with our Real Home of Genius Award.

The Irvine Home Equity Machine

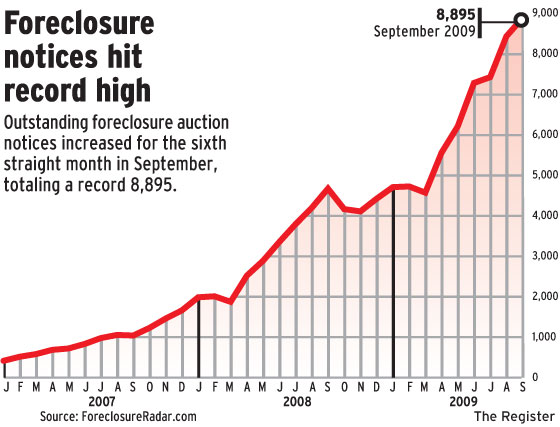

Orange County has seen the median home price stabilize in 2009 yet this is based on higher priced homes selling at lower prices and the shift in home sales volume. In fact, foreclosures are at an all time record high:

Source:Â Matthew Padilla at the O.C. Register

Clearly the above isn’t good news. Yet if look into the data we see that 1st time homebuyers spurred by the tax credit and investors looking for quick gains are a large part of the current market. Today’s home takes us to the city of Irvine. This home is the perfect example of a home equity machine:

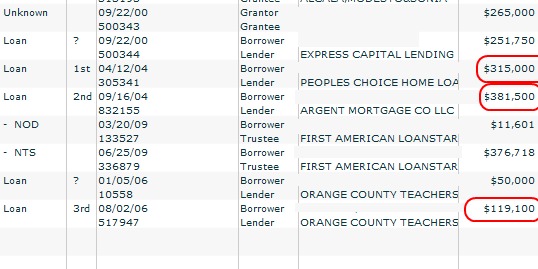

The above is a nice 3 bedroom and 2 baths home that is listed at 1,116 square feet. This is what you would consider a starter home for a working professional couple. The home is currently listed for sale at $420,000. If we look at sales history we see the last recorded sale back in 2000 for $265,000:

Sale History:

9/22/2000:Â Â Â Â Â Â $265,000

So this is a happy ending here right? We have someone that bought the home for $265,000 and is looking to sell for $420,000. They missed selling at the peak but that is okay. Not a bad profit of $155,000 without factoring in sales commission or any additional costs. But that is where the conventional side of the story ends. California was home to the HELOC ATM machine. This home was anything but conventional:

Welcome to the OC folks. So a home purchased in 2000 for $265,000 by 2004 had:

First mortgage:Â $315,000

Second mortgage:Â Â Â Â Â Â Â Â $381,500

Yes, a second bigger than a first. But the story didn’t end there. In 2006 they took out a third mortgage with the Orange County Teachers Federal Credit Union for $119,100. So in total by August of 2006 this home had $815,600 in loans! And not once during the decade did this home sell aside from the 2000 purchase which makes this even more incredible.

And get this. The Case-Shiller data when this home sells (if it sells above $265,000) will register a nice price gain. Yet the reality is some lenders are going to eat some major losses here. That is why it is important to look at all the factors involved here.

When talking to people that didn’t grow up in the U.S. about home equity refinancing they cannot believe something like this would happen. It doesn’t compute that people were able to use their home finance vacations, cars, granite countertops, or gold plated toilets. This was a very unique domestic issue. Sure, many countries had major housing bubbles but very few have examples of home equity withdrawal machines like the above case in California. And this is only one example of thousands.

Today we salute you Irvine with our Real Home of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

17 Responses to “Real Home of Genius: Irvine California and the Home Equity Withdrawal Machine. FHA Approaching the Zero Bound.”

Real home of genius? You tell me that this owner was able to take a $200-$400 K asset and sell it to a bank for $800K. This tells me that the owner is smart…the fool here is the taxpayer who will pay him for it…

What a great example of why foreigners are snapping up the desirable properties for cash or almost all cash all over the country. It reminds me of when my friend sold his nice house in Pasadena in the late 80’s and moved out to Rancho Cucamonga, bought a cheaper house so he could buy a new BMW and a boat. Now the Pasadena house is still worth almost a million and the Rancho house is worth less than 400K. Just plain foolish! The worse part is that now we are stuck with cheap dollars that won’t buy quality.

The Case-Shiller index is probably one of the best measures of house prices, yet dr.hb pointed out a great flaw. If the price of the house declined by a lot from the peak, but it was purchased over 10 years ago, Case-Shiller will show a price appreciation. Very deceptive.

I wonder how many loans will default given by the OC Teachers Federal Credit Union. I thought credit unions were conservative with loaning money but even they fell into the frenzy.

Here in Southern California, in the last housing cycle, FHAs were the closest thing we had to 100% financing and subprime. In 1991, at the bank I was with at that time, we originated/bought/securitized FHA loans in the amount of about a $1 billion in the previous year (which was the peak of the housing prices in that cycle.) So, a year later, we had severe delinquencies. They sent me out to look at them and report (I worked for an East coast bank; I was based here.)

I had my print out (dot-matrix printed on those attached/perforated sheets) and driving around it was easy to figure out: prices dropped and people walked. No equity and they could rent for cheaper.

In my 32 years in the home loan business, I have found the single most important factor in loan performance is equity. Real down payment equity is what counts. What is happening with FHA financing in Southern California is crazy. The loans are too big, and they are being used too often with minimal down payments. This and the $8000 tax credit are keeping prices in some markets high, and preventing prices from dropping down to their real level of affordability.

If foreigners are really buying up properties right now they are fools. Properties are still too expensive and rents are falling. People are still losing jobs. No income, no rent, no mortgage payment, no customer.

‘Peoples Choice Home Loans’ must be the State owned lending arm of the ‘Peoples Republic of Kalefornea’.

I remember a ‘financial advisor’ telling me that the path to riches was to refinance my home loan to an Alt-A, pay the smallest payment (less than interest only), invest the remainder in a Pacific Life Variable Rate Annuity, and pay off the loan with the accumulated gains in just a few years.

What could possibly go wrong with that financial plan!!!

In fact, I think I still have the ‘plan’.

Better start reading :-}

Just curious but how do you get that printout of HELOC info on a property?

My girlfriend and I looked at properties (to buy a house) yesterday (took a day off to do it). We were shown 6 places in South Orange County (Dana Point, Laguna Niguel, San Clemente). The prices have come down substantially from 6 months ago. One condo with ocean view that was selling for 400K is now 300K, and the agent hinted that we can offer less… And since most were short sales, he also hinted that bank would move quicker now because they are in bad shape and need cash.

We were shocked by how stupid we would feel if we bought 6 months ago. We will now wait another 6 months to see what happens…

I never would have even had the nerve to try this … a refi to bring the monthly nut down is marginally acceptable but to take cash out by over a half million is bank robbery. I’m very impressed.

Foreigners are buying up real estate? Well if they are, then they are I-D-I-O-T-S. Big time idiots. Prices are still way too high, there is a huge shadow inventory, more foreclosures are on the way and rents are falling along with incomes. Plus we are in a deflationary environment.

Nimesh-

I concur, but they are doing it! The Chinese economy is strong, positive, and productive and it is not deflationary. Their economy is currently like ours was in the ’60’s with a 7%-9% GNP. In comparison, our economy is in the negative. They invest in infrastructure and industry, and we invest in fraudulent wars, corrupt banks and Wallstreet. There are a lot of rich people out there. It’s just that the wealth has been stolen from us and transferred to other parts of the world. The foreigners in my neighborhood lease back to their own or put a family member or friend on title. So I am told, it is much easier to become a citizen if one owns land in the U.S. What they do worry about is securing their cheap U.S. dollars. When a 800 square foot townhouse in Shanghi costs around a million dollars, some of their family come out here and buy something. Why are Asian banks are popping up like mushrooms around town here in the past year? There are waiting lists in Taiwan and Shangi for kids to attend the school system here in my city. It’s amazing.

Here is my prediction for real estate.

Since the Federal Government will wind up with all the bad mortgages in the USA as Freddie, Fannie, FHA, the banks and Credit Unions all go insolvent, there is a simple solution. Since we have shipped all our industry offshore, destoying the tax base, the Federal Government simply collects whatever rent they can get on all the bad homeloans. That will provide the new revenue stream to finance the government, it is section 8 on steroids. A whole new slew of Federal jobs to collect the rents, do repairs on the houses, provide insurance, etc. As the States all go insolvent the Fed bails them out and pays no local property tax on their holdings as part of that deal. The Fed gets to show all the houses they own as an “asset”, and all the bad debt goes off to a remote hanger at area 51. The privately owned houses slowly wind up in the hands of the Fed as the government institutes “Means Testing” requiring anyone owning property to pay back Social security and Medicare when they die. Oh yeah, and privately held property is still subject to local property taxes. Ditto for Commercial Real Estate. We will become the USSR not with a bang, but a whimper!

Illinois has moved up to the number 3 spot in number of foreclosures, only behind California and Nevada. We’re about to repeat your recent history here and the bloodbath is well underway. Turns out that we had exactly the same insanity here-the fraudulent mortgages, the loans massively outsized relative to income, the equity withdrawals. One local mortgage broker stated on his blog that the prices here need to drop another 40% to get back to the Case-Schiller trendline.

Thank you for this blog. You and other astute housing bloggers have saved me tens of thousands dollars. Places I made low ball offers on that were rejected have fallen far under the prices I offered and look to fall more.

While the upper end of FHAs are going to default, what about the lower end? If the rents are comparable to mortgage payments, and the resident is employed, where’s the motivation to walk? Rent money is spent money – it’s better to get a little equity in a declining asset (that’s probably near bottom) than to rent. Realistically, if I bought a tiny place in “the hood” which is kind of where I already live, I could tolerate losing around $20,000 a year in equity.

Where is the area that is called “High Desert” in the first chart?

Thanks again for your hard work.

Could someone please help!

I just can’t square a certain fact. Real estate prices in Southern California have been going up, at the same time we have record unemployment 12.7% in LA and default rates have been at record highs all year as well.

If any one can shed some light on these facts, please explain it to me I just do not understand.

Leave a Reply